Exhibit 15.2

| GSK GSK will unite science, talent and technology to get Ahead of disease Together. We will prioritise innovation in vaccines and specialty medicines, maximising the increasing opportunities to prevent and treat disease. Step change in growth – Expected sales growth of more than 5% and adjusted operating profit growth of more than 10% on a compound basis 2021-26 – R&D focused on the science of the immune system, human genetics and advanced technologies – Positively impacting the health of more than 2.5 billion people over ten years – Leading ESG performance to be maintained  |

Haleon Haleon will be a global leader 100% focused on consumer health. It will have a clear purpose to deliver better everyday health with humanity, and a focused strategy to deliver sustainable above-market growth and attractive returns to shareholders. Strong prospects for growth – Exceptional portfolio of category-leading brands with attractive global footprint and competitive capabilities – Compelling strategy to outperform in a growing, £150 billion plus sector which is more relevant than ever – 4-6% annual organic sales growth in the medium term, sustainable moderate margin expansion and high cash conversion – Attractive growth profile with capacity to invest and deliver shareholder returns  |

| Contents |

||||||||||

| Strategic report |

93 |

168 | ||||||||

01 |

94 |

172 | ||||||||

02 |

95 |

|||||||||

03 |

96 |

|||||||||

05 |

252 | |||||||||

07 |

99 |

| ||||||||

10 |

102 |

Investor information |

||||||||

11 |

103 |

258 | ||||||||

12 |

104 |

263 | ||||||||

13 |

116 |

269 | ||||||||

17 |

117 |

|||||||||

29 |

|

272 | ||||||||

34 |

Remuneration report |

275 | ||||||||

41 |

120 |

288 | ||||||||

44 |

125 |

290 | ||||||||

46 |

143 |

291 | ||||||||

55 |

144 |

291 | ||||||||

| |

|

292 | ||||||||

| Corporate governance |

Financial statements |

294 | ||||||||

| 83 |

296 | |||||||||

| 89 |

154 |

299 | ||||||||

| 92 |

311 | |||||||||

– |

£34.1 billion Group turnover stable at AER, +5% CER |

– |

Pharmaceuticals £17.7 billion +4% AER, +10% CER; new and specialty medicines £10 billion +20% AER, +26% CER |

– |

Vaccines £6.8 billion -3% AER, +2% CER |

– |

COVID-19 solutions sales £1.4 billion |

– |

Consumer Healthcare £9.6 billion -4% AER, stable CER (+4% excluding brands divested/under review) |

– |

Total EPS 87.6p -24% AER, -13% CER |

– |

Adjusted EPS 113.2p -2% AER, +9% CER; contribution to growth from COVID-19 solutions +8% AER, +9% CER |

– |

Total operating profit £6.2 billion -20% AER, -9% CER |

– |

Adjusted operating profit £8.8 billion -1% AER, +9% CER |

– |

Dividend of 80p |

– |

Three major product approvals; 8 phase III starts; 22 vaccines and medicines in pivotal trials |

– |

Strong pipeline of 21 vaccines and 43 medicines, many of which offer potential best or first-in-class opportunities for patients |

– |

20+ deals executed securing access to novel clinical programmes including in immuno-oncology, immuno-neurology and flu, plus technologies that expand our capabilities in human genetics and artificial intelligence/machine learning (AI/ML) |

– |

New GSK investor update in June 2021 set out our new purpose, growth commitments and R&D catalysts. For detail see gsk.com |

– |

Consumer Healthcare capital markets day in February 2022 highlighted our strategic priorities, key growth drivers and detailed financial information. For detail see gsk.com |

– |

1st in the pharmaceutical industry for Dow Jones Sustainability Index |

– |

1st in the Access to Medicine Index |

– |

Gold recognition in S&P’s Sustainability Yearbook |

– |

A- in CDP Climate Change |

|

Sir Jonathan Symonds |

Chair |

|

Emma Walmsley |

Chief Executive Officer |

Operating performance – 2021 |

|

|||||||||||

Turnover |

||||||||||||

2021 |

||||||||||||

£m |

Growth £% |

Growth CER% |

||||||||||

| Pharmaceuticals |

17,729 |

4 |

10 |

|||||||||

| Vaccines |

6,778 |

(3 |

) |

2 |

||||||||

| Consumer Healthcare |

9,607 |

(4 |

) |

– |

||||||||

| Group turnover |

34,114 |

– |

5 |

|||||||||

| Financial results |

|

|||||||||||

2021 |

||||||||||||

£m |

£% |

Growth CER% |

||||||||||

| Turnover |

34,114 |

– |

5 |

|||||||||

| Total operating profit |

6,201 |

(20 |

) |

(9 |

) | |||||||

| Total earnings per share |

87.6p |

(24 |

) |

(13 |

) | |||||||

| Adjusted operating profit |

8,806 |

(1 |

) |

9 |

||||||||

| Adjusted earnings per share |

113.2p |

(2 |

) |

9 |

||||||||

| Net cash from operating activities |

7,952 |

(6 |

) |

|||||||||

| Free cash flow |

4,437 |

(18 |

) |

|||||||||

| Adjusting items |

Total results £m |

Intangible asset amortisation £m |

Intangible asset impairment £m |

Major restructuring £m |

Transaction- related £m |

Divestments, significant legal and other items £m |

Separation costs £m |

Adjusted results £m |

||||||||||||||||||||||||

| Turnover |

34,114 |

34,114 |

||||||||||||||||||||||||||||||

| Cost of sales |

(11,603 |

) |

701 |

(33 |

) |

154 |

28 |

27 |

(10,726 |

) | ||||||||||||||||||||||

| Gross profit |

22,511 |

701 |

(33 |

) |

154 |

28 |

27 |

23,388 |

||||||||||||||||||||||||

| Selling, general and administration |

(10,975 |

) |

426 |

25 |

17 |

282 |

(10,225 |

) | ||||||||||||||||||||||||

| Research and development |

(5,278 |

) |

101 |

355 |

46 |

(4,776 |

) | |||||||||||||||||||||||||

| Royalty income |

419 |

419 |

||||||||||||||||||||||||||||||

| Other operating (expense)/income |

(476 |

) |

1,106 |

(662 |

) |

32 |

– |

|||||||||||||||||||||||||

| Operating profit |

6,201 |

802 |

322 |

626 |

1,159 |

(618 |

) |

314 |

8,806 |

|||||||||||||||||||||||

| Net finance costs |

(756 |

) |

2 |

1 |

(753 |

) | ||||||||||||||||||||||||||

| Share of after-tax profits of associates and joint ventures |

33 |

33 |

||||||||||||||||||||||||||||||

| Loss on disposal of interest in associates |

(36 |

) |

36 |

– |

||||||||||||||||||||||||||||

| Profit before taxation |

5,442 |

802 |

322 |

628 |

1,159 |

(581 |

) |

314 |

8,086 |

|||||||||||||||||||||||

| Taxation |

(346 |

) |

(159 |

) |

(81 |

) |

(114 |

) |

(196 |

) |

(470 |

) |

(49 |

) |

(1,415 |

) | ||||||||||||||||

| Tax rate |

6.4 |

% |

17.5 |

% | ||||||||||||||||||||||||||||

| Profit after taxation |

5,096 |

643 |

241 |

514 |

963 |

(1,051 |

) |

265 |

6,671 |

|||||||||||||||||||||||

| Profit attributable to non-controlling interests |

711 |

295 |

1,006 |

|||||||||||||||||||||||||||||

| Profit attributable to shareholders |

4,385 |

643 |

241 |

514 |

668 |

(1,051 |

) |

265 |

5,665 |

|||||||||||||||||||||||

| Earnings per share |

87.6 |

p |

12.9 |

p |

4.8 |

p |

10.3 |

p |

13.3 |

p |

(21.0 |

)p |

5.3 |

p |

113.2 |

p | ||||||||||||||||

2021 |

2020 |

|||||||||||||||||||||||

£m |

% of turnover |

£m |

% of turnover |

£% |

Growth CER% |

|||||||||||||||||||

| Turnover |

34,114 |

100 |

34,099 |

100 |

– |

5 |

||||||||||||||||||

| Cost of sales |

(10,726 |

) |

(31.4 |

) |

(10,191 |

) |

(29.9 |

) |

5 |

8 |

||||||||||||||

| Gross profit |

23,388 |

68.6 |

23,908 |

70.1 |

(2 |

) |

4 |

|||||||||||||||||

| Selling, general and administration |

(10,225 |

) |

(30.0 |

) |

(10,717 |

) |

(31.4 |

) |

(5 |

) |

(1 |

) | ||||||||||||

| Research and development |

(4,776 |

) |

(14.0 |

) |

(4,603 |

) |

(13.5 |

) |

4 |

8 |

||||||||||||||

| Royalty income |

419 |

1.2 |

318 |

0.9 |

32 |

32 |

||||||||||||||||||

| Operating profit |

8,806 |

25.8 |

8,906 |

26.1 |

(1 |

) |

9 |

|||||||||||||||||

| Net finance costs |

(753 |

) |

(844 |

) |

||||||||||||||||||||

| Share of after-tax profits of associates and joint ventures |

33 |

33 |

||||||||||||||||||||||

| Profit before taxation |

8,086 |

8,095 |

– |

11 |

||||||||||||||||||||

| Taxation |

(1,415 |

) |

(1,295 |

) |

||||||||||||||||||||

| Tax rate |

17.5 |

% |

16.0 |

% |

||||||||||||||||||||

| Profit after taxation |

6,671 |

6,800 |

(2 |

) |

9 |

|||||||||||||||||||

| Profit attributable to non-controlling interests |

1,006 |

1,031 |

||||||||||||||||||||||

| Profit attributable to shareholders |

5,665 |

5,769 |

||||||||||||||||||||||

| Earnings per share |

113.2 |

p |

115.9 |

p |

(2 |

) |

9 |

|||||||||||||||||

| Innovation We invest in scientific and technical excellence to develop and launch a pipeline of new products that meet the needs of our patients, payers and consumers. |

|

Performance We deliver growth by investing effectively in our business, developing our people and executing competitively. |

|

Trust We are a responsible company. We commit to use our science and technology to address health needs, make our products affordable and available and be a modern employer. | ||||

| 2021 objectives – Deliver Innovation sales with excellent commercial, R&D and supply chain execution in oncology, HIV and vaccines – Accelerate and strengthen pipeline with robust commercial input, including business development |

2021 objectives – Continue to prioritise spending to deliver growth and return on investment – Continue to deliver two-year programme to prepare GSK for separation into two new leading companies– Build a stronger, more diverse workforce for two new leading companies |

2021 objectives – Continue to deliver on-time, in-full supply of our products– Improve manager capability to motivate, focus, develop and care for people – Continue to deliver progress on Trust commitments | ||||||

| Progress – Received three major approvals in 2021: Apretude Jemperli Xevudy COVID-19 – Strong pipeline of 21 vaccines and 43 medicines, many of which offer potential best or first-in-class – 20+ deals executed securing access to novel clinical programmes including with iTeos in immuno-oncology, Alector in immuno-neurology and Vir Biotechnology in flu, plus technologies that expand our capabilities in human genetics and AI /ML |

Progress – Strong commercial execution across Pharmaceuticals, Vaccines and Consumer Healthcare – Pharmaceuticals £17.7 billion +4% AER, +10% CER with double-digit growth in new and specialty medicines +20% AER, +26% CER – Vaccines £6.8 billion -3% AER, +2% CER– Consumer Healthcare -4% AER, stable CER; -1% AER, +4% CER excluding divestments/brands under review– On track to deliver separation plans in mid-2022 |

Progress – Maintained sector-leading rankings in ESG indices, including the Dow Jones Sustainability Index, Access to Medicine Index and Antimicrobial Resistance Benchmark – Maintained supply and manufacturing without significant disruption throughout the pandemic – Made further progress to deliver on net zero impact on climate, and a net positive impact on nature by 2030 – Rolled out a new training programme to develop our managers to support them to be great managers and lead with care – Continued to prioritise diversity, with good progress made against our gender and ethnicity targets to improve representation in senior roles – WHO recommended wider use of our RTS,S vaccine for children in regions with moderate to high malaria transmission | ||||||

| 2022 priority objectives – Deliver Innovation sales with excellent commercial, R&D and supply chain execution – Further accelerate and strengthen pipeline with dedicated in-house expertise and robust commercial input, including optimised capital allocation and business development |

2022 priority objectives – Deliver more than 5% sales growth and more than 10% adjusted operating profit on a compound basis in the next five years – Continue to prioritise spending to deliver growth and return on investment – Deliver a successful demerger in mid-2022 |

2022 priority objectives – Deliver leading ESG performance and effective risk management with disciplined compliance |

| Culture As we move towards the creation of two new leading companies, we have been embedding a culture where we are all ambitious for patients, accountable for impact, and continue to do the right thing. We track our cultural change with a range of indicators, increasingly embedding assessments in HR processes, and the Board receives regular updates. See pages 99 and 102. Principal risks Our risk management framework is designed to support our long-term priorities. See pages 46 and 112. |

1 |

Innovation sales defined on page 12 |

Innovation |

2021 |

2020 |

2019 |

|||||||||

Innovation sales  |

||||||||||||

Pharmaceuticals and Vaccines – sales of products launched in the last five years |

£6.8bn |

1 |

£4.1bn |

2 |

£3.0bn |

2 | ||||||

Consumer Healthcare – sales from products which are new to a market in the last three years as a % of total sales |

10% |

11% |

12% |

|||||||||

Pipeline value and progress  |

n/r |

n/r |

n/r |

|||||||||

Performance |

2021 |

2020 |

2019 |

|||||||||

Group turnover  |

£34.1bn |

£34.1bn |

£33.8bn |

|||||||||

Profit  |

||||||||||||

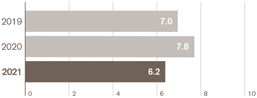

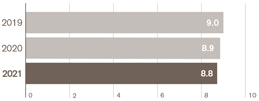

Total operating profit – down 20% AER, down 9% CER |

£6.2bn |

£7.8bn |

£7.0bn |

|||||||||

Adjusted operating profit – down 1% AER, up 9% CER |

£8.8bn |

£8.9bn |

£9.0bn |

|||||||||

Total operating margin |

18.2% |

22.8% |

20.6% |

|||||||||

Adjusted operating margin |

25.8% |

26.1% |

26.6% |

|||||||||

Free cash flow  |

£4.4bn |

£5.4bn |

£5.1bn |

|||||||||

Market share |

n/r |

n/r |

n/r |

|||||||||

| Top talent and succession plans for key roles succession plans in place |

n/r |

n/r |

n/r |

|||||||||

Trust |

2021 |

2020 |

2019 |

|||||||||

Employee feedback |

78% |

84% |

78% |

|||||||||

Supply service level on-time, in-full |

n/r |

n/r |

n/r |

|||||||||

| Corporate reputation globally and in top 13 markets |

n/r |

n/r |

n/r |

|||||||||

|

Linked to Executive LTI awards and annual bonus, see pages 120, 129 and 131 |

1 |

2021 includes products that have benefited from significant lifecycle innovation |

2 |

Comparative information reflects sales of those products that meet the definition for 2020 |

n/r |

Not reported externally due to commercial sensitivities |

1 |

IMF, World Economic Outlook: Recovery During a Pandemic, October 2021 |

2 |

IQVIA, The Global Use of Medicines 2022, January 2022 |

3 |

IQVIA, Global Medicine Spending and Usage Trends Outlook to 2025, April 2021 |

1 |

World Economic Forum, From zero COVID-19 vaccines to 11.2 billion in a year, 4 January 2022 |

2 |

Our World in Data, Coronavirus Vaccinations, as at 19 January 2022 |

3 |

IQVIA, Drug Expenditure Dynamics 1995-2020, October 2021 |

4 |

ABPI, Economic and Societal Impacts of Vaccination, 2020 |

5 |

H.R.5376—Build Back Better Act, 117th Congress, 2021-2022 |

6 |

PharmaExec.com, China 2021: The NRDL Readout, January 2022 |

For more on pricing see our ESG Performance Report

For more on pricing see our ESG Performance Report 1 |

Digital Health Global Market Report 2021 - COVID 19 Growth and Change, Research and Markets, March 2021 |

2 |

United Nations, World Population Prospects 2019 (Revised), 2019 |

3 |

Brookings, China’s influence on the global middle class, Homi Kharas and Meagan Dooley, October 2020 |

1 |

Lewis S & Maslin M, Five things you need to know about the Glasgow Climate Pact, World Economic Forum, 15 November 2020 |

2 |

Ritchie H and Roser M, CO2 emissions by fuel, Our World in Data, Last accessed 19 January 2022 |

| Pharmaceuticals and Vaccines highlights | ||

| – Strong pipeline of 21 vaccines and 43 medicines, many with the potential to be first or best-in-class – Approval in the US for Apretude – Xevudy COVID-19, approved or authorised for conditional/ temporary use in the US, UK, EU and over 12 other countries |

– Approval for Jemperli – Positive phase III data for daprodustat for patients with anaemia of chronic kidney disease – 20+ deals executed securing access to five novel clinical assets – Approximately 70% of our targets in research are genetically validated, and published scientific research shows that genetically validated targets are at least twice as likely to become medicines | |

– |

Benlysta |

– |

Nucala IL-5 biologic, which is now also approved in the US and Europe for severe eosinophilic asthma, hypereosinophilic syndrome, eosinophilic granulomatosis and polyangitis and chronic rhinosinusitis with nasal polyps. |

– |

Our shingles vaccine, Shingrix |

– |

Expansion of our clinical trial programme for Zejula |

– |

The contribution of Trelegy Ellipta Trelegy |

– |

COVID-19, for which we are working on both treatments and vaccines |

– |

RSV and respiratory conditions, through our efforts to develop RSV vaccines for the populations most at risk, as well as to develop future respiratory medicines |

– |

Hepatitis B, through our antisense oligonucleotide and vaccine technologies in development |

– |

Influenza, for which we are developing vaccines and antibodies |

| Phase III/Registration |

||||

| Bexsero |

Xevudy 1 (sotrovimab/VIR-7831) COVID-19 | |||

| COVID-19 (Medicago)1 vaccine 3 |

Blenrep 1 | |||

| COVID-19 (Sanofi)1 vaccine 3 |

Jemperli 1 (PD-1 antagonist) 1L endometrial cancer2 | |||

| COVID-19 (SK Bioscience)1 vaccine 3 |

letetresgene-autoleucel 1 (NY-ESO-1 2,6 | |||

| MenABCWY (1st gen) vaccine |

Zejula 1 | |||

| Menveo |

4527223 1 (AL001, anti-sortilin) frontotemporal dementia 2,7 | |||

| MMR (US) vaccine |

depemokimab 1 (LA anti-IL5 antagonist) asthma | |||

| Rotarix |

Nucala | |||

| RSV maternal 1, † vaccine |

otilimab 1 (aGM-CSF inhibitor) rheumatoid arthritis | |||

| RSV older adults 1 vaccine |

daprodustat (HIF-PHI) anaemia of chronic kidney disease | |||

| gepotidacin 1 (BTI inhibitor) uUTI and GC |

linerixibat (IBATi) cholestatic pruritus in primary biliary cholangitis | |||

| Phase II |

||||

| Malaria (fractional dose) 1 vaccine |

bepirovirsen 1 (HBV ASO) HBV | |||

| S. aureus 1 vaccine 4 |

3036656 1 (leucyl t-RNA inhibitor) tuberculosis | |||

| Shigella 1 vaccine |

3640254 (maturation inhibitor) HIV | |||

| Therapeutic HBV 1 vaccine 4 |

3810109 1 (broadly neutralising antibody) HIV | |||

| MenABCWY (2nd gen) vaccine 4 |

cobolimab 1 (TIM-3 antagonist) NSCLC | |||

| Varicella new strain vaccine |

||||

| Phase I |

||||

| C. difficile 1 vaccine |

3745417 (STING agonist) cancer | |||

| Klebsiella pneumoniae 1 vaccine |

3845097 1 (NY-ESO-1/TGFbR2 | |||

| SAM (COVID-19 model) vaccine |

3901961 1 (NY-ESO-1/CD8a | |||

| SAM (rabies model) vaccine |

4074386 1 (LAG3 antagonist) cancer | |||

| CMV vaccine |

4362676 1 (Mat2A inhibitor) cancer | |||

| BVL-GSK098 1 (ethionamide booster) tuberculosis |

4428859 1 (EOS - 448, TIGIT antagonist) cancer | |||

| VIR-2482 1 (neutralising monoclonal antibody) influenza 8 |

6097608 (CD96 antagonist) cancer | |||

| 2556286 1 (Mtb inhibitor) tuberculosis |

4527226 1 (AL101, anti-sortilin) neurodegenerative diseases | |||

| 3186899 1 (CRK-12 inhibitor) visceral leishmaniasis5 |

3858279 1 (anti-CCL17) osteoarthritis pain | |||

| 3494245 1 (proteasome inh) visceral leishmaniasis |

3915393 1 (TG2 inhibitor) celiac disease | |||

| 3882347 1 (FimH antagonist) uUTI |

1070806 (anti-IL18) atopic dermatitis | |||

| 3923868 (PI4k b |

3888130 1 (anti-IL7 ) multiple sclerosis | |||

| 4182137 1 (VIR-7832) COVID-19 4 |

4532990 1 (ARO-HSD siRNA) non-alcoholic steatohepatitis | |||

| 3739937 (maturation inhibitor) HIV |

2798745 1 (TRPV4 blocker) diabetic macular edema | |||

| cabotegravir (400 mg/ml formulation) HIV |

3884464 1 heart failure | |||

| 4004280 (capsid protein inhibitor) HIV |

||||

| 1 In-licence or other alliance relationship with third party. |

7 Phase III trial in patients with progranulin gene mutation |

NSCLC: non-small cell lung cancer; uUTI: uncomplicated urinary tract infection; GC: gonorrhea; SS: synovial sarcoma; MRCLS: myxoid/round cell liposarcoma | ||

| 2 Additional indications also under investigation |

8 GSK has exclusive option to co-develop post phase II | |||

| 3 GSK contributing pandemic adjuvant |

† Enrolment and vaccination stopped in February 2022. Further analysis to better understand safety data from these trials is ongoing | |||

| 4 In phase I/II trial | ||||

| 5 Transition activities underway to enable further progression by partner | ||||

| 6 In potentially registrational phase II trial |

Pharmaceuticals highlights |

Vaccines highlights | |

| – Total 2021 turnover £17.7 billion, +4% AER, +10% CER – Sales of new and specialty pharmaceuticals £10 billion +20% AER, +26% CER – Sales of Xevudy – Strong commercial execution of key growth products, including Trelegy Nucala – Better digital capabilities to support more effective engagement with healthcare professionals, higher productivity and a more efficient supply chain  Read more below Read more below |

– Total 2021 turnover £6.8 billion, -3% AER, +2% CER– COVID-19 pandemic sales for Vaccines £447 million including pandemic adjuvant sales of £444 million– Shingles: Shingrix – Meningitis: increased market share in the US for Bexsero Menveo – Maintained market share for key products despite significant disruption from COVID-19 – Excellent supply performance; our Shingrix – Accelerated our digital transformation, helping to drive data-driven decisions in manufacturing and supply  Read more on page 31 Read more on page 31 | |

See Group financial review on page 62 for more detail

See Group financial review on page 62 for more detail

| External benchmarking | ||

| We have maintained our acknowledged leadership in ESG, and this continues to be a key driver in our goal to deliver health impact and shareholder returns. Detailed below is how we perform in key ESG ratings that we are frequently asked about by investors. | ||

| – Dow Jones Sustainability Index (DJSI): |

– CDP: A- in Climate Change, B in Water, B in Forests (palm oil and timber) and Supplier Engagement Leader | |

| – S&P Global Sustainability Award: |

– Sustainalytics: | |

| – Access to Medicine Index (ATMI): |

– MSCI: – Vigeo Eiris: | |

| – FTSE4Good: |

||

| Using our science and technology to address health needs |

|

| Commitment |

Progress in 2021 | |

| New medical innovations Develop differentiated, high-quality and needed medicines, vaccines and consumer healthcare products to improve health |

– 2021 saw three major approvals for medicines, eight phase III starts and have 64 vaccines and medicines in our pipeline. For more details, see the Innovation section on pages 17 to 28. | |

| Global health Improve global health impact through R&D for infectious diseases that affect children and young people in low-income countries, focusing on HIV, malaria and TB |

– Our commitment to improve global health impact through R&D for infectious diseases and access to medicines and vaccines has been recognised in the Access to Medicines Index (ATMI) where we have ranked number one for the last seven years, every year since its inception. – Our RTS,S/AS01e malaria vaccine is the first and only vaccine shown in long-term clinical trials to reduce malaria in children. In 2021, the WHO recommended broader deployment of the vaccine, to reduce illness and deaths in children in sub-Saharan Africa and other regions with moderate to high malaria transmission. This followed new data which showed that the vaccine, in combination with seasonal antimalarials, lowers clinical episodes of malaria, hospital admissions with severe malaria and deaths by around 70% compared to antimalarials alone. In December 2021, Gavi announced its decision to provide funding for the procurement and introduction of the vaccine into routine child immunisation programmes in Gavi eligible countries.– We made good progress in improving availability of age-appropriate HIV treatment options for children around the world. A generic dolutegravir dispersible tablet was made available in key sub-Saharan African countries, less than a year after US FDA approval of this treatment. This work was facilitated by our public-private partnership with the Clinton Health Access Initiative, Unitaid and two generic manufacturers: Mylan (now part of Viatris group) and Macleods.– Shigella is the second biggest cause of morbidity and mortality from diarrhoea worldwide after rotavirus, and no approved vaccine is widely available. In late 2021, the first subjects were vaccinated with our quadrivalent shigella vaccine candidate, in a first-time-in-human, – We have the richest pipeline focused on global health priority diseases in the industry, including ten medicines and vaccines currently in clinical development. – We launched a collaboration with Novartis in 2021, Project Africa Gradient, to support scientific research on the link between genetic diversity and patients’ response to malaria and tuberculosis drugs in three African regions. | |

| Health security Help the world to better prepare for future disease outbreaks with pandemic potential, and tackle antimicrobial resistance |

– We have taken a broad approach to developing COVID-19 solutions. To see how we have applied our science to finding COVID-19 innovations, see page 21.– We were one of five companies to sit on the Pandemic Preparedness Partnership Steering Group, convened by the UK Government in 2021, bringing together industry, international organisations and experts to advise G7 governments on how to speed up the response to a future pandemic. The Trinity Challenge, of which we were a founding member, also announced the winners of its inaugural competition to find innovative ways to better predict and prevent outbreaks of disease, using data and analytics. Winners included the VaccineLedger, which tracks vaccines from manufacture to patient, using blockchain technology. – Our commitment to preventing antimicrobial resistance (AMR) was recognised by the Access to Medicine Foundation’s AMR Benchmark, with GSK an industry leader for the third consecutive time in 2021. The benchmark highlighted in particular the diversity and depth of our R&D pipeline, particularly our AMR-relevant vaccines. | |

|

For full details of our progress against these commitments, please see our ESG Performance Report | |

| GSK Annual Report 2021 35 |

| Making our products affordable and available |

|

| Commitment |

Progress in 2021 | |

| Pricing Improve the health of millions of people each year by making our products available at responsible prices that are sustainable for our business |

– In developed markets, pricing of all our new products reflects the value they deliver to patients, healthcare systems and wider society compared to available alternatives, and supports our work to meet future healthcare needs. We offer patient support and, in the US during 2021, provided prescribed vaccines and medicines to more than 87,000 low-income uninsured, underinsured, and Medicare Part D patients through GSK and ViiV Healthcare’s Patient Assistance Programs Foundation.– For pricing in low income countries (LICs) and lower middle income countries (LMICs) we use innovative pricing structures to extend product reach. Our vaccines business has a tiered pricing model based on World Bank gross national income country classifications, and we do not file patents for our medicines or enforce historic patents in low-income countries LICs. | |

| Product reach Use access strategies to reach 800 million underserved people in lower income countries with our products by 2025 |

– Our access strategies continued to reach many more underserved people in lower income countries. We made good progress against our target in 2021, and have now reached over 323 million people with our products using access strategies. These strategies include our advanced market commitments to provide our vaccines to lower income countries through Gavi. Our partnership with Gavi includes supplying Cervarix Synflorix Rotarix | |

| – In 2021, we also made a commitment to supply Rotarix Synflorix | ||

| – ViiV Healthcare has voluntary licensing agreements with generic manufacturers. These have allowed at least 21.3 million people living with HIV across 119 LICs and LMICs access to a generic product containing dolutegravir by the end of 2021. | ||

| – We have donated over ten billion albendazole tablets, including 526.4 million in 2021, to support efforts to end lymphatic filariasis and control intestinal worms in school-age children. | ||

| Healthcare access Partner to improve disease prevention, awareness and access to healthcare services for 12 million people by 2025 |

– We have a number of partnerships with NGOs and multilateral organisations to improve disease prevention, awareness and access to healthcare services. By 2021, these programmes reached 13.9 million people. Over the next year we’re developing an ambitious global health strategy for GSK which will include setting a new target. – Our partnership with Save the Children increased its emergency preparedness and response capability, investing in data analytics and early-action protocols to provide efficient and timely healthcare in crises. Our partnerships with Save the Children, Amref Health Africa and CARE International have trained more than 108,000 front-line health workers since 2011. They reached over 17.3 million people with prevention and treatment for infectious diseases, plus providing maternal/child healthcare, vaccination, hygiene sanitation and nutrition. – ViiV Healthcare’s Positive Action programme aims to explore ways to support people-centred and community-led interventions to help meet the UN targets to end AIDS by 2030. In 2021, the programme reached approximately 274,000 people and funded 66 grants across 28 countries. | |

|

For full details of our progress against these commitments, please see our ESG Performance Report |

36 |

GSK Annual Report 2021 |

| Being a modern employer |

| |

| Commitment |

Progress in 2021 | |

| Engaged people Achieve and maintain a competitive employee engagement score by 2022 |

– In early 2022, we launched a new all-company survey focused on purpose, strategy, engagement and culture progress. Engagement remains high at 78% and above the general industry benchmark, settling back to 2019 levels after an extra boost during the early phases of the pandemic. | |

| Inclusion and diversity Accelerate our progress on inclusion and diversity, including aspirational targets for female and ethnically diverse representation in senior roles by the end of 2025, and recognition as a disability confident employer and in LGBT+ indices |

– Our aspiration is that women hold at least 45% of VP and SVP roles by the end of 2025. In 2021, women held 40% of roles at VP and above, up from 38% in 2020. The FTSE Women Leaders ranking showed that we are in the top 10% of FTSE 100 companies based on the proportion of women on our Board and in leadership positions 1 . We also published our fifth annual UK ‘gender pay gap’ report in 2021, which showed that we continue to outperform the national average.– Our aspiration is to have at least 30% ethnically diverse leaders in our roles at VP and above in the US and at least 18% in the UK, by the end of 2025. Our representation as at 31 December 2021 showed that we had 12.9% ethnically diverse leaders in VP and above roles in the UK, up from 11.1% in 2020. In the US, we had 27.1% ethnically diverse leaders in roles at VP and above, up from 23.2% in 2020. This progress is supported by our rigorous focus on equal employment opportunity. We have launched programmes such as Accelerating Difference – Ethnic Diversity, which supports the development of ethnically diverse employees, building on their strengths and addressing development gaps through individual and group coaching. From 2023 we will publish GSK’s ‘ethnicity pay gap’ data for the UK. | |

| – We have developed a three-year plan to increase our disability confidence. As part of this we have rolled out our workplace adjustments programme to our biggest markets, making it available to over 40% of our employee population so far. We also signed up to the International Labour Organization’s Global Business and Disability Network, to promote the inclusion of people with disabilities in workplaces. | ||

| – We continue to be recognised in global LGBT+ indices, including being designated as a Best Place to Work for LGBTQ+ Equality in the Human Rights Campaign Foundation’s 2021 Corporate Equality Index. | ||

| Health, wellbeing and development Be a leading company in how we support employee health, wellbeing and personal development |

– GSK’s Leadership Team has continued to oversee our COVID-19 response, including the health, wellbeing and engagement of our employees in all our locations. We continuously monitor the impact of COVID-19 on our employees and as public health vaccination programmes continue, we’re helping to educate and raise awareness about them. Where there are no public health vaccination programmes available, we have committed to offer vaccinations at minimal cost to our employees and their eligible dependents. | |

| – We continued to make mental health training available for all our employees, and 66% of managers have completed it since it launched in 2019. We make confidential support available through our global Employee Assistance Programme, and we successfully piloted a new wellbeing programme focused on resilience strategies and energy management and will continue to implement a global rollout in 2022. | ||

| – We run health and safety training for our people, which covers how to identify and take measures to reduce workplace risks. In 2021, our reportable injury and illness rate remained at 0.16 per 100,000 hours worked and there were no fatalities. | ||

| – All our employees have access to our internal development portal – the Keep Growing Campus. This offers extensive development courses, videos and articles on a range of topics, including decision making, building change capability, coaching, influencing others and health and wellbeing. In 2021, our people completed 84,493 leadership and business courses. | ||

1 |

Data on employees by gender (including total employees, Board and management) is provided in our non-financial information statement on page 54 |

|

For full details of our progress against these commitments, please see our ESG Performance Report | |

| GSK Annual Report 2021 37 |

| Being a responsible business |

|

| Commitment |

Progress in 2021 | |

| Reliable supply Commit to quality, safety and reliable supply of our products for patients and consumers |

– It’s a priority to make sure there is a high-quality and reliable supply of our products for patients and consumers. This has continued to be of high importance throughout the pandemic, which has put increased strain on global supply chains. For more on how we manage continuity of supply, see pages 31 and 33. – Our quality management systems allow for continuous improvement, helping us to keep up high standards for product quality and safety. In 2021, we had 171 external regulatory inspections at our manufacturing sites and local operating companies – many conducted virtually because of the pandemic. We respond to all inspection findings, no matter how minor. We also ran 1,833 quality audits of suppliers, and 312 audits of clinical trials run by, or on behalf of, GSK to assess their quality and safety. Where we find areas to improve, we create improvement plans and track their progress. | |

| Ethics and values Operate an ethical, values- driven culture, in which any issues are responded to swiftly and transparently |

– Everyone at GSK has to complete training on what the company expects from them. In 2021, we renamed this mandatory employee code of conduct training ‘Working at GSK’ and improved the content to focus on risk and compliance, as well as diversity and creating an inclusive workplace. In 2021, 99.4% of employees and 92.9% of contract workers completed this training. – Anyone inside or outside GSK can raise concerns or speak to an independent third party through our Speak Up reporting channels, confidentially or anonymously, without fear of retaliation. We continue to take every concern raised seriously, and review every report to identify whether we need to investigate formally. If investigations show an employee has breached our policies, we take action. | |

| – In 2021, we changed the way we report disciplinary data and expanded the scope to include cases which were initiated in previous years. In 2021, 2,065 employees had concerns raised against them, with an additional 757 employees with concerns raised from prior year’s open cases. We disciplined 1,176 employees (298 of whom initially had concerns raised in previous years), an increase from 2020 primarily driven by late completion of mandatory training. Of these, 265 either left voluntarily or were dismissed, and 923 received a written warning. In other cases, we took action short of a written warning. At the end of 2021, we had 427 cases awaiting investigation or a disciplinary decision. | ||

| – During 2021, we undertook an independent assessment of our approach to managing human rights, to help us better understand how we can continue to improve how we manage our priority human rights areas. The assessment showed that there is good understanding of our human rights impacts and we will be reviewing and addressing the findings in the year to come. | ||

| – How our third parties act can have a direct impact on us meeting our priorities. It is important to manage our relationships with them well, including the way we choose, contract and monitor them. Our Third-Party Oversight (TPO) programme evaluates and mitigates the risks introduced through engaging third-parties to provide goods or services for GSK. We complete assessments for the portion of our third parties that may present greater potential risk, for example, interactions with government officials or annual transfers of value above certain pre-defined limits. In 2021, we ran more than 12,800 assessments of these higher risk third parties across more than 20 risk areas, identifying over 55% as high-risk in one or more areas. Most of these third parties are goods and services providers (70%), contract manufacturers and external suppliers (2%) or distributors and wholesalers (9%). We are evaluating our TPO programme to simplify the upfront assessment and broaden its focus to risk management throughout the third-party relationship, using user feedback and findings from our ongoing monitoring. | ||

|

For full details of our progress against these commitments, please see our ESG Performance Report |

38 |

GSK Annual Report 2021 |

| Being a responsible business continued | ||

| Commitment |

Progress in 2021 | |

Data and engagement |

– In 2021, we simplified our privacy notices and made them easier to access through a portal on all our websites. Privacy is a key part of the mandatory ‘Working at GSK’ annual training that all our people have to complete. This helps employees to understand that everyone at GSK is responsible for handling personal information in the right way. | |

| – Our patient panels give us insights and advice, as well as building trusting, long-term relationships with patients and carers that help us develop medicines that meet patients’ needs. In 2021, we ran panels in disease areas including cancer, rheumatoid arthritis and hepatitis B. | ||

| – As part of our commitment to data transparency for our clinical studies, we have published 2,776 clinical study reports and 6,239 summaries of results. We have listed 2,550 studies for data sharing via www.vivli.org and www.clinicalstudydatarequest.com. | ||

| – We want our clinical trials to be as representative and accessible as possible, reflecting the patient populations with the disease including age, race, ethnicity, sex and gender. Over the past five years, we have endeavoured to improve patient diversity in our clinical trials by implementing training and support to personnel at investigator sites including awareness training on conducting clinical trials in under served communities. In 2021, we formed a Global Demographics and Diversity team to coordinate our learning about epidemiology, burden of disease and health equity, and how they relate to age, sex, gender, race and ethnicity, so we can apply these lessons when planning our trials. | ||

Environment |

Climate | |

Have a net zero impact on climate and a net positive impact on nature by 2030 |

– To achieve our ambitious net zero goal we have set targets across our value chain carbon footprint. The targets have been accredited by the Science Based Targets Initiative as aligning to a 1.5 o C pathway. | |

| – In 2021, we reduced our operational carbon emissions (scope 1 and 2) by 15% compared to 2020, primarily through increased use of renewable energy 1 . In September 2021, we announced a £50 million investment in UK and US manufacturing sites to secure renewable power generation. This includes new wind turbines and a 20-year power purchase agreement to supply solar electricity for our Irvine facility in Scotland, and solar energy for our Oak Hill facility in New York. | ||

| – In 2020 (our latest available data), emissions from our suppliers, logistics and people using our products (scope 3) reduced by 8% reflecting the evolution of our product portfolio and reductions in business travel and commuting as a result of the pandemic. Our metered dose inhalers for asthma and COPD account for 40% of our carbon footprint so in 2021 we started an R&D programme to find a lower-impact propellant that could reduce emissions from them by about 90%. | ||

Nature | ||

| – Collaboration is an important part of our strategy and during the year we joined nine other global pharmaceutical companies to launch the Energize programme. This is the first collaboration of its kind to use the scale of a single industry’s global supply chain to drive greater use of renewable electricity. We were a Principal Partner of the UN Global Climate Change Conference (COP26) in Glasgow and we championed the need for action on climate and nature to protect health. We also joined the Health Systems Task Force of the Sustainable Markets Initiative to drive collective action in digital healthcare, supply chains and patient care pathways to accelerate the shift to net zero. | ||

| – We make our Climate-Related Financial Disclosure on pages 49 to 52 along with our energy and carbon emissions data. GSK’s carbon reduction pathway to become net zero by 2030 can be found on gsk.com. | ||

1 |

Energy and carbon emissions data is provided in our Climate-related financial disclosure on pages 49 to 52. |

|

For full details of our progress against these commitments, please see our ESG Performance Report | |

| GSK Annual Report 2021 39 |

| Being a responsible business continued | ||

| Commitment |

Progress in 2021 | |

| Environment continued |

– We are involved in developing standardised guidance on measuring our impact on nature through working with the Science Based Targets for Nature Initiative and the Taskforce on Nature-related Financial Disclosures (TNFD). We will achieve our net nature positive goal by reducing our environmental impacts across water, materials and biodiversity and investing in protecting and restoring nature. | |

| – In 2021, we reduced overall water use in our operations by 16% compared to 2020, and by 21% in sites in high water stress regions. 91% of our sites are now good water stewards, in line with the Alliance for Water Stewardship’s definition. During the year, we joined the Water Resilience Coalition (WRC), partnering to develop our approach to water neutrality in water- stressed regions and to deliver water resilience projects on the ground. Our Cape Town site in South Africa is the first in our network to embark on the journey towards water neutrality, and we are working with the WRC and local partners to address shared water challenges by clearing alien plant species and replanting local flora to create greater resilience in the basin. | ||

| – In 2021, we reduced the waste from our sites by 7% and recovered 43% of these materials through circular routes like reuse or recycling. Consumer Healthcare launched 40 million recycle-ready toothpaste tubes in over 20 markets. | ||

| – In 2021, we piloted our approach to biodiversity at our Stevenage site in the UK, working in partnership with Kew Gardens to deliver a 39% increase of biodiversity at the site. We aim to have measurable and effective biodiversity plans in place across all GSK sites by 2025. | ||

| – In 2021, we joined the public-private Lowering Emissions by Accelerating Forest Finance (LEAF) coalition which contributes high-quality emissions reductions by supporting countries to protect their tropical forests from deforestation. | ||

|

For full details of our progress against these commitments, please see our ESG Performance Report |

40 |

GSK Annual Report 2021 |

Consumer Healthcare |

| – Consumer Healthcare had 26 first-market launches for new innovations in 2021 |

– Committed to producing one billion recyclable toothpaste tubes by 2025 | |

| – Total 2021 turnover £9.6 billion -1% AER, +4% CER (excluding brands divested/under review) – E-commerce represented 8% of total sales – Delivered 3.7 billion consumer healthcare products |

– Significant investment in on-site solar power towards goal to source 100% of our electricity from renewable sources by 2025– Announced growth ambitions of 4-6% annual organic sales growth in the medium term, sustainable moderate margin expansion and high cash conversion | |

1 |

Therapeutic oral health segment |

2 |

Nicholas Hall’s DB6 Consumer Healthcare (OTC/VMS) Database, 2020 Store and E-commerce sales |

Consumer healthcare |

|

See Group financial review on page 65 for more detail |

Consumer healthcare |

– |

Go beyond |

– |

Do what matters most |

– |

Keep it human |

– |

Environmenta |

– |

Social |

– |

Governance |

| | ||

| Patients and consumers Insights from patients and consumers enable us to develop products that better meet their needs. How we engage Advisory boards, disease-specific patient panels and Patient Advocacy Leaders Summits to provide patient insights. Engagement and support for patient groups (disclosed on GSK.com), and initiatives that empower patients to get involved in medicine development. Market research including consumer sensory labs. |

What matters to patients and consumers Differentiated product innovation based on patient and consumer needs. Access to a reliable supply of high-quality products. Pricing of healthcare products, particularly out-of-pocket What we’re doing Strengthening our pipeline of innovative products. Maintaining high standards for product quality and safety. Continuing to take a value-based approach to pricing to balance reward for innovation with access and affordability. | |

| | ||

Investors |

What matters to investors | |

| We maintain regular and constructive dialogue with investors to communicate our strategy and performance in order to promote investor confidence and ensure our continued access to capital. How we engage Ongoing communications including the AGM, quarterly results calls, in-person and virtual roadshows and detailed company information online.One-to-one Biennial investors and analysts perception study. |

Sustainable performance for long-term shareholder value. Understanding how our R&D strategy is successfully developing our pipeline. Commitment to strong management of ESG issues. What we’re doing Creating two new leading companies through demerger in 2022. Good financial performance and transparent reporting. Business and R&D updates and events on key pipeline milestones. Driving leading-edge ESG performance and a culture of ambition, accountability and responsibility. | |

| | ||

Healthcare professionals and medical experts |

What matters to HCPs and medical experts | |

| We work with healthcare professionals (HCPs) and medical experts to understand the patients’ journey, partner to resolve unmet medical needs and make sure that our products are used safely and effectively. How we engage Scientific dialogue to increase understanding of disease management and patient experience. Providing high-quality, balanced information about our vaccines and medicines. Collaborating on clinical trials and research. |

Access to product and scientific information. Responsible sales and marketing practices. Safety, efficacy and differentiated innovation. What we’re doing Increasing the use of digital channels to deliver more personalised and effective sharing of information to HCPs. Ensuring we attract and retain the best talent and uphold responsible sales and marketing standards. Using HCP insights on disease management and patient experience to inform the development of our vaccines and medicines. | |

| | ||

| R&D partners and academia |

What matters to R&D partners and academia | |

| We partner with scientific institutions, national health systems, academia and industry partners to help us develop the most effective vaccines and medicines to meet unmet patient needs. How we engage Collaborating with outstanding scientists at academic institutions to accelerate discovery and development of new vaccines and medicines. Licensing advanced technology and potential vaccines and medicines from biotechs. Establishing joint ventures to strengthen innovation and improve efficiency. |

Finding the right partner to identify and accelerate a potential vaccine or medicine to reach the patients that need it. Pushing the science and technology as far as it can go to advance human health. Dissemination and advancement of scientific knowledge. What we’re doing Working with world-leading experts at biotechs, research institutes and universities to improve drug and vaccine discovery to increase the productivity of our R&D pipeline. Collaborating with a broad range of partners to support our R&D focus on the science of the immune system, human genetics and advanced technologies (see pages 17 to 27). Supporting the advancement of scientific knowledge with our long-standing commitment to sharing research see page 39. | |

| | ||

| | ||

Governments and regulators |

What matters to governments and regulators | |

| We work with governments and regulators to advocate for policies that encourage innovation and promote efficient management of healthcare spending. How we engage Meeting with regulatory bodies throughout the development process to ensure high-quality new products. Engaging with government health agencies to demonstrate the value of our products for patients and economies. Working with governments to protect and strengthen the operating environment for life sciences innovation and new medicine and vaccine launches. Participating in international efforts to address global health threats, such as the pandemic. |

Investment in innovation and life sciences. Scientific funding and collaboration. Medicines pricing and reimbursement. Public health threats – COVID-19 and antimicrobial resistance (AMR).Investment in preventive health and strengthening health systems. What we’re doing Engaging in US policy pricing/reimbursement debates and, with phRMA, commenting on legislative proposals for healthcare reform. Partnering across industry and governments to tackle AMR. Engaging with governments, including the US, UK and EU regarding production and procurement of COVID-19 vaccines and treatments. | |

| | ||

NGOs and multilateral organisations |

What matters to NGOs and multilateral organisations | |

| We work with partners to improve access to healthcare services and our products, and to advocate for the policy environment in which we can be successful and deliver on our ambitions for patients. How we engage Working with non-governmental organisations (NGOs) and partners to research and develop products to address global health challenges.Collaborating with NGOs and generic manufacturers to sustainably supply our products to lower income countries. Partnering to strengthen health systems in lower income countries and drive progress on global health priorities. |

Access to vaccines and medicines. UN SDGs and WHO targets for specific disease areas. Universal health coverage and the future of health systems. Financing for global health, including COVID-19 solutions.What we’re doing Focusing on our unique role as a global health partner to develop products where we have scientific expertise. Partnering with organisations that have complementary capabilities and reach to create sustainable models that share risk, including our partnership with Gavi to support access to vaccines in lower income countries. Leveraging our community investment programmes to support our scientific expertise and deliver greater impact for patients. | |

| | ||

Suppliers |

What matters to suppliers | |

| We work with thousands of suppliers, large and small, who provide goods and services that support us in delivering a reliable supply of high-quality, safe products for our patients and consumers. How we engage Regular direct engagement with suppliers to ensure they support GSK’s strategies and targets. Engaging with suppliers through our Third-Party Oversight programme and by conducting in-depth audits.Participating in forums such as the Pharmaceutical Supply Chain Initiative and the Consumer Goods Forum to improve supply chain sustainability. |

Prompt payment to agreed terms. Understanding GSK policies to ensure compliance. Opportunities to innovate and grow the relationship. What we’re doing Engaging with suppliers to develop improvement plans and track progress when we identify areas for improvement. Providing proactive support through our third-party EH&S team in countries where our priority suppliers are located. | |

| | ||

Our people |

What matters to our people | |

| We involve and listen to our people to increase employee engagement, drive business performance and retain talented people. How we engage Regular interactive broadcast events with the GLT and other senior leaders. Facilitating dialogue and collaboration through our internal communications platforms, Works Councils, Employee Forums and Employee Resource Groups. Providing feedback to managers via the global all-company survey and One80 questions. |

Our purpose and being able to see the difference we make. Having a great line manager. Feeling understood and valued. Being part of an inclusive and diverse workplace. What we’re doing Fostering a culture of accountability and ambition, underpinned by integrity and humanity. Launched new leadership programmes to help managers motivate, focus, care for and develop their teams. Campaigns and programmes to support safety, mental wellbeing and enable work-life balance. Driving our diversity and inclusion activities in support of new aspirational targets. | |

| | ||

COVID-19, see page 54. ARC report, see page 111. Internal control framework, see page 112. |

| 2021 Principal risks summary | ||||

| Risk |

Trend |

Assessment and mitigation activities | ||

Patient safety |

|

The macro risk level is stable but remains challenging. Public awareness of drug safety has increased following media coverage of the safety and efficacy of COVID-19 vaccines and therapies in 2021. Misinformation and negative characterisations of the industry have fuelled vaccine hesitancy. Highly publicised information security threats and data breaches require us to consider how we securely collect safety information from external sources. | ||

|

GSK’s risk exposure is stable. Our portfolio is evolving, with a greater focus on advanced therapy medicinal products that may require specialised pharmacovigilance. We need to carefully balance resources to execute routine pharmacovigilance while we manage change initiatives including the separation of the Consumer Healthcare business, the accelerated pace of drug development and the simplification of our safety processes. | |||

Product quality |

|

The macro risk has increased following COVID-19, with regulators resuming multiple on-site inspections to check that product quality expectations are met. There continues to be a focus on data governance and data integrity requirements, and on evaluation of products for the presence of nitrosamines. | ||

|

GSK’s risk exposure has increased, as we need to respond to the heightened inspectorate presence. We have launched inspection readiness programmes to ensure full preparedness. We have continued to invest in technology and digital platforms to further strengthen our controls around good data management practices. Governance and control strategies have been deployed for timely nitrosamine evaluations. All these mitigations will require focus and diligence as GSK undergoes significant organisational change. | |||

Financial controls and reporting |

|

The external environment remains challenging due to political uncertainty, proposed increases in the obligations of directors and auditors, increasing threats of cyber attacks (information security) and fraud, and increasing environmental disclosure requirements. | ||

|

GSK’s risk exposure has remained stable due to our ongoing focus on the resilience of personnel and the testing of our internal control framework. We implement optimal risk mitigation through transformational programmes, technology, centralised processes, and risk and control assessments, and maintain effective tax and treasury strategies. We continually strengthen our control frameworks and collaborate with external bodies on standard setting. | |||

Anti-bribery and corruption (ABAC) |

|

The macro risk level for bribery and corruption remained unchanged in 2021. We continued to see the ongoing impact of the pandemic on governments, people and businesses; rigorous anti-bribery and corruption standards aided by improved technology; and continued enforcement with focus on third-party intermediaries. | ||

|

GSK’s risk exposure is unchanged as we continuously improve our Anti Bribery and Corruption programme to ensure appropriate controls, training, capability building, awareness raising, strong monitoring and use of data analytics. | |||

Commercial practices |

|

COVID-19 consequences continue to impact the macro level. Competitive pressure has increased in many therapy areas and market segments. Future innovation requires successful launches of key medicines and products. Vaccination rates have been impacted by accessibility and political issues. Governments remain focused on initiatives to drive medicine and vaccine costs down for consumers. | ||

|

GSK’s risk exposure level remains stable due to our mature and robust control environment. We continue to evolve our commercial practices competitively. We have invested in new technologies that support virtual customer engagement. We maintain proportionate controls, training and monitoring for employees that engage with healthcare organisations and professionals. We train senior business leaders on delivering performance and managing risk. | |||

Non-promotional engagement |

|

The macro environment for non-promotional activities and scientific engagement with HCPs and patients is stable. It continues to be characterised by complex, dynamic disease areas and treatments with increased patient-centric focus, increasing diversity of engagement platforms, and the continued increase in virtual engagements since the pandemic. | ||

|

GSK’s risk exposure has remained stable. Our digital practices continued to develop and modernise, and we have applied our internal principles and policies, designed to mitigate risk, to this rapidly evolving environment. We have internal networks to foster collaboration and best practice sharing, as well as the identification of emerging risks associated with non-promotional activities, so we can conduct them in compliance with GSK’s values and policies, local laws and regulations. | |||

| Risk |

Trend |

Assessment and mitigation activities | ||

Privacy |

|

The macro risk continues to increase, with priority GSK markets such as the UK, EU, US, China and India instituting new privacy laws, and court rulings invalidating established international data transfer mechanisms that international companies had relied on. The increasing trend for data sovereignty initially targeting tech companies could affect healthcare companies in their ability to drive medical innovation and to effectively operate internationally. | ||

|

GSK’s risk exposure is increasing due to the impact of the unstable privacy regulatory environment preventing us from further standardising our privacy framework globally and due to the scale of the changes necessary to prepare for the creation of two new data-driven companies. | |||

Research practices |

|

The macro risk level is unchanged. We always need to continually assess how we do R&D in the context of our future ambition, our benchmarks, and the evolving global regulations and quality standards. This is particularly vital when expectations change or there are country-specific requirements (Human Genetic Resources Administration of China, Schrems II). | ||

|

GSK’s risk exposure is unchanged, as laws and regulations are continually evolving. When regulations change, the accountable R&D function develops an action plan which can include risk and impact assessments to determine how the internal control framework needs to change to meet the new requirements. R&D regularly scans the external environment through membership of professional organisations and consortiums, attendance at industry or agency-sponsored meetings and review of publicly posted regulatory/legal reports. | |||

Environment, health and safety (EHS) |

|

The macro risk level is unchanged as COVID-19 protocols have been embedded in our ways of working. Site staffing has moved from essential workers only to mostly full staffing. This has meant we have been able to resume more consistent management oversight and on-site global support through senior leaders, subject matter experts and audit teams. | ||

|

GSK’s risk exposure has levelled out due to consistent work practices related to COVID-19 control measures. However, organisational change continues to be a factor. We have placed continued focus on safety leadership training, embedding our Life Saving Rules, and adhering to our EHS standards. | |||

Environmental sustainability |

|

The macro risk level continues to increase. Investors, regulators and other stakeholders expect companies to understand and actively reduce the environmental footprint of their operations across their value chain, and to mitigate the impacts climate change could have on their operations and supply chains. | ||

|

GSK’s risk exposure is unchanged. We set ambitious new environmental sustainability goals at the end of 2020 and have established an enterprise transformation programme addressing climate, water, waste and biodiversity across our operations. We also increased the scope and depth of our Task Force on Climate-related Financial Disclosures (TCFD) analysis, and continued to monitor trends in physical, reputational and regulatory risks from climate change impacts. | |||

Information security |

|

The macro risk level continues to rise, as large multinationals increase their digital footprints and threats from hackers become more sophisticated. Risks identified as increasing during the pandemic have levelled off but continue to be an ongoing threat. At the same time, governments are tightening the regulatory frameworks, and we can expect enforcement to increase. | ||

|

GSK’s risk exposure has increased. The targeting of pharmaceutical and vaccine intellectual property, and of third-party service availability, has intensified. In response, our cyber security programme continues to improve our controls to increase our cyber threat intelligence capabilities and protect critical information and systems, including operational technology and networks. | |||

Supply continuity |

|

The macro risk level remains high due to the ongoing impact of the pandemic on product supply. There is also continuing potential for increasing protectionism, and Brexit uncertainty. Our COVID Issues Management Team is actively managing supply risk and mitigation on an ongoing basis. | ||

|

GSK’s risk exposure has stabilised. Our Procurement Task Force, a cross-functional group from Procurement and Supply Chain, is accountable for the identification and management of potential bottlenecks in the supply of components. | |||

Transformation and separation |

|

The macro risk level is unchanged and remains challenging as we set up two new companies in a highly competitive external labour market. | ||

|

GSK’s risk exposure level remains unchanged. Our transformation and separation projects have progressed as planned throughout 2021, with employee engagement remaining a priority. | |||

– |

The GSK Sustainability Council chaired by Regis Simard which includes leaders from business units and global functions, including manufacturing, R&D, procurement and facilities management, ethics and compliance and finance, who all play a key role in delivering our environmental strategy. The Council is supported by a dedicated Programme Steering Team, which is run by the Global Sustainability Team who also provide specialist expertise and advice to the business. |

– |

The Programme Steering Team who co-ordinate the sustainability programme and associated workstreams and have oversight for monitoring performance and progress of the enablers to deliver the sustainability programme. |

– |

The Capital Allocations Board (CAB) which includes the CFO and Group Financial Controller who review climate-related capital expenditure as part of their annual planning and capital allocation process. |

– |

The Finance Sustainability Network includes leaders from across Finance, Sustainability and Procurement and focuses on key financial enablers to deliver the sustainability programme. |

– |

business-as-usual 3-5°C of warming by 2100. |

– |

low-carbon future: assumes that the global temperature increase by 2100 is limited to well below 2°C by rapid changes in legislation and technology. |

1 |

https://www.gsk.com/media/7180/gsk-carbon-glidepath-010921.pdf 2” |

2 |

Scenarios are based on IPPC Representative Concentration Pathways 2.6, 4.5 and 8.5, the IEA World Energy Outlook 2018 New Policy Scenario, Current Policy Scenario and Sustainable Development Scenario; and data sets from WWF and WRI for water stress and flood risk modelling |

| Physical risk/ description |

Scenario |

Risk management |

Potential profit impact/ timeframe |

Metrics |

Targets | |||||

| Increasing levels of water stress which reduces the availability of water for our operations. GSK uses freshwater as the main source of water to manufacture medicines, vaccines, and consumer health products. If water availability was restricted at a factory then production operations would be interrupted. |

BAU and low carbon |

We have performed water stewardship risk assessments for all our manufacturing sites and we have identified ten sites in our current network that are currently in areas of high-water risk. We are developing plans for these sites to become water neutral by 2030 and will partner with other organisations to address shared water challenges. We are currently piloting this approach in our Cape Town site working with partners including WWF and the Water Resilience Coalition. The TCFD process has helped us develop a watch list of additional sites potentially under long-term threat and we will monitor changes to the risk levels and update our site water risk assessments appropriately. |

Low: <£100m/ Long: 3-10 years |

Sites that have achieved water stewardship* Water use in our operations Sites and supplier sites that have achieved water neutrality |

Achieve good water stewardship at 100% of our sites by 2025 Reduce overall water use in our operations by 20% by 2030 Be water neutral in our own operations and at key suppliers in water stressed regions by 2030 | |||||

| Increasing frequency of extreme weather events causing disruption. Extreme weather events such as flooding, storms etc can result in short-term interruptions to manufacturing and other operations. |

BAU and low carbon |

We have performed risk assessments for our manufacturing and other operations and have business continuity plans in place which are reviewed annually to respond to the impact of extreme weather events including adopting appropriate mitigation plans. The TCFD process has helped us identify a watch list of sites that are in places where the flood risk is expected to increase over time. However, the risk from flooding remains very low. GSK has a well-established loss prevention and risk engineering programme to identify a range of risks that could impact our sites and where flood risks exist, we have taken action to mitigate the risk. |

Low: <£100m/ Long: 3-10 years |

Sites that have business continuity plans |

100% of sites have a response to extreme weather events in their business continuity plans | |||||

| An increased number of very hot days (>35°C) resulting in reduced productivity. Extreme heat could result in heat stress affecting our staff. |

BAU |

GSK has operations in countries that already experience very hot temperatures periodically. We already control the temperature and humidity inside our buildings. As part of our EHS control framework, sites conduct risk assessments on very hot days including adaptations for outside work. |

Low: <£100m/ Long: 3-10 years |

Scope 1, 2 and 3 carbon emissions |

Net zero emissions across all operations by 2030 Net zero emissions across our full value chain by 2030) | |||||

* |

As defined by the Alliance for Water Stewardship |

| Transitional risk/ description |

Scenario |

How the risk is managed |

Potential profit impact/ timeframe |

Metrics |

Targets | |||||

| Regulations governing the use of high global warming potential (GWP) substances are being updated in the UK, EU and US. This could lead to increasing cost and restrictions on the use of the high GWP propellant (HFA134a) in our Metered Dose Inhaler (MDI) products. |

BAU and low carbon |

We have started an R&D programme to find a lower-impact propellant that could reduce emissions from our metered dose inhalers by about 90%. We already have a portfolio of Dry Powder Inhaler products that do not use propellants that are not impacted by this risk. We are monitoring the evolving regulations governing the use of fluorinated gases and will review our assessments in future declarations. |

Medium: £100m to £300m/ Long: 3-10 years |

Scope 3 carbon emissions |

Net zero emissions across all operations by 2030 Net zero emissions across our full value chain by 2030) | |||||

| There is uncertainty over future regulatory policy responses to address climate change that countries around the world will develop including carbon pricing. We anticipate that carbon pricing on operational carbon emissions will come into force in some regions in the medium to long term which could increase our operating costs. |

Low carbon |

We are transitioning to 100% renewable electricity by 2025 and are starting to investigate options for renewable heat technology to reduce our carbon emissions from energy. Our sales fleet aim to transition to electric vehicles by 2030, further reducing our scope 1 carbon emissions. Shadow carbon pricing has been embedded in the capital investment process at $100 per tonne and is driving conversations and decisions around carbon emissions at all levels of the organisation. |

Low: <£100m/ Long: 3-10 years |

Scope 1&2 carbon emissions |

Net zero emissions across all operations by 2030 | |||||

| Opportunities |

Scenario |

How the opportunity is managed |

Potential profit impact/ timeframe |

Metrics |

Targets | |||||

| At COP26 in November 2021, more than 50 countries around the world committed to provide low carbon healthcare systems. This could lead to increasing demand for low carbon vaccines and medicines. |

BAU and low carbon |

We are reducing our own scope 1 & 2 carbon emissions which in turn reduces the scope 3 footprint of our customers and suppliers. We have started a new Eco-design programme to reduce the impacts of all our products and packaging.GSK have certified and published the carbon footprints of our portfolio of respiratory inhalers and have launched our first carbon neutral inhaler in the UK. This enables healthcare providers and patients make informed choices. We have started an R&D programme to find a lower-impact propellant that could reduce emissions from our metered dose inhalers by about 90%. |

Low: <£100m/ Long: 3-10 years |

Scope 1, 2 and 3 carbon emissions Total waste and non-circular waste |

Net zero emissions across our full value chain by 2030 Zero operational waste, including eliminating single-use plastics by 2030 25% environmental impact reduction for our products and packaging by 2030 10% waste reduction from supply chain by 2030 | |||||

Carbon emissions ‘000 tonnes CO 2 |

2021 |

2020 |

2019 |

|||||||

| Scope 1 emissions (from energy) |

393 |

415 |

416 |

|||||||

| Scope 1 emissions (other 3 ) |

288 |

349 |

382 |

|||||||

| Scope 2 emissions (market-based) |

159 |

227 |

518 |

|||||||

| Scope 3 emissions 4 |

Available in 2022 report |

13,427 |

14,260 |

|||||||

| UK Scope 1 & 2 emissions |

130 |

141 |

195 |

|||||||

Energy |

2021 |

2020 |

2019 |

|||||||

| Scope 1 and 2 emissions from energy/sales revenue (tonnes CO 2 e/£m) |

15.1 |

18.8 |

27.7 |

|||||||

| Scope 1 and 2 emissions from energy/FTE (tonnes CO 2 e/FTE) |

6.1 |

6.8 |

9.4 |

|||||||

| Total energy used (GWh) |

3,596 |

3,858 |

4,079 |

|||||||

| UK energy used (GWh) |

850 |

945 |

975 |

|||||||

1 |