Exhibit 99.2

Exhibit 99.2

Management’s Discussion and Analysis

February 25, 2015

This discussion and analysis of Stantec Inc.’s operations, financial position, and cash flows for the year ended December 31, 2014, dated

February 25, 2015, should be read in conjunction with the Company’s 2014 audited consolidated financial statements and related notes for the year ended December 31, 2014. Our 2014 audited consolidated financial statements and related

notes are prepared in accordance with International Financial Reporting Standards (IFRS) as issued by the International Accounting Standards Board (IASB). All comparative share capital, earnings per share, dividends per share, and share-based

payment transaction information have been adjusted for amounts previously reported for the two-for-one share split that occurred on November 14, 2014. Unless otherwise indicated, all amounts shown in this report are in Canadian dollars.

Additional information regarding the Company, including our Annual Information Form, is available on SEDAR at www.sedar.com and on EDGAR at www.sec.gov. Such

additional information is not incorporated by reference unless otherwise specified and should not be deemed to be made part of this Management’s Discussion and Analysis.

Executive Summary

Core Business and

Strategy

| |

• |

|

We collaborate across disciplines and industries to bring buildings, energy and resource, and infrastructure projects to life. We provide professional consulting services in planning, engineering, architecture, interior

design, landscape architecture, surveying, environmental sciences, project management, and project economics. Our promise is to “design with community in mind.” |

| |

• |

|

Our business objective is to be a top 10 global design firm. We plan to achieve a compound average growth rate of 15% through a combination of organic and acquisition growth. |

| |

• |

|

To achieve our business objective, we focus on the following: using the strength of our local positioning to bring our world-class expertise to the communities in which we live and work; driving a client-focused culture

through cross-selling efforts, account management strategies, and strong local relationships; focusing on quality and creativity; positioning ourselves among the top-tier service providers in the sectors and geographic locations in which we operate;

and expanding our capabilities and geographic reach through strategic hires and the acquisition and integration of firms that share our vision and culture. |

|

|

|

|

|

| Management’s Discussion and Analysis

December 31, 2014 |

|

M-1 |

|

Stantec Inc. |

Key Performance Drivers and Capabilities

| |

• |

|

Our performance is driven by external factors in the infrastructure and facilities industry and by internal strategic drivers and capabilities that are articulated through our value statements: we put people first, we

are better together, we do what is right, and we are driven to achieve. |

Results

| |

• |

|

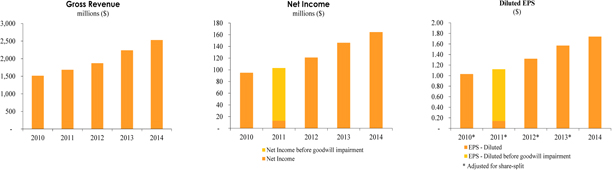

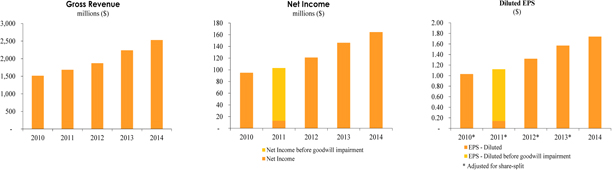

Continued profitability and organic growth. Our gross revenue grew 13.1% in 2014 compared to 2013. Of this gross revenue growth, 6.5% resulted from acquisitions and 3.9% from organic growth, particularly in our

Power, Water, and Community Development sectors. We achieved a 12.8% increase in our EBITDA and our diluted earnings per share increased 10.8% to $1.74 in 2014 compared to $1.57 in 2013. |

| |

• |

|

Growth through acquisition. Acquisitions completed in 2013 and 2014 contributed $144.6 million to the increase in our gross revenue in 2014 compared to 2013. We completed eight acquisitions in 2014 and five in

2013.These acquisitions strengthened our presence in the North America. |

| |

• |

|

Strong balance sheet and liquidity. Our balance sheet remains strong. Cash flows from operations in the year supported acquisition growth and continued dividends. During the year, we extended the maturity date of

our existing $350 million revolving credit facility to August 31, 2018. As at December 31, 2014, $281.9 million of additional borrowing was available under our revolving credit facility for future acquisitions, working capital needs,

and general corporate purposes. |

| |

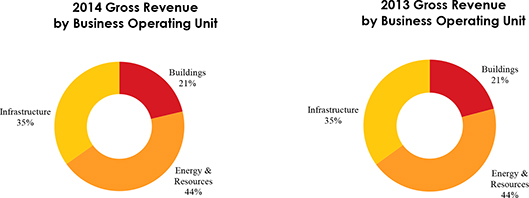

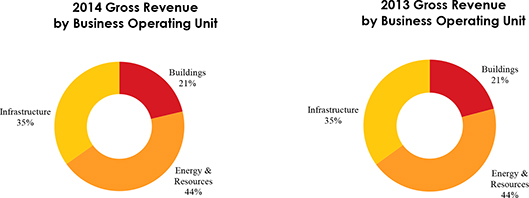

• |

|

Evolution to business operating units. In 2014, we realigned our organizational structure from five practice area units to three business operating units: Buildings, Energy & Resources, and

Infrastructure. |

Outlook

| |

• |

|

We believe that we will achieve a moderate increase of approximately 3% organic gross revenue growth in 2015 compared to 2014. For both our Canadian operations and our Energy & Resources business operating

unit, we anticipate a decline in organic growth in the first half of 2015 compared to 2014, followed by stable organic revenues in the second half of the year. We expect to achieve moderate full-year organic revenue growth in both our US and

International operations. Our Buildings and Infrastructure business operating units are also expected to achieve moderate organic revenue growth in 2015 over 2014. |

Risks

| |

• |

|

Various risk factors could cause our actual results to differ materially from those projected in the Outlook section and forward-looking statements of this report. The material, known risks are described in the

Risk Factors section of this report. We believe there will be increased activity in sectors and geographical regions that are linked to non-energy export markets led by the improving US economy. Economic pressures and uncertainties, volatility

in the Canadian/US exchange rate, volatility in energy and commodity prices, and public infrastructure funding may adversely impact our current outlook for 2015. |

|

|

|

|

|

| Management’s Discussion and Analysis

December 31, 2014 |

|

M-2 |

|

Stantec Inc. |

Core Business and Strategy

Core Business

The following discussion includes forward-looking

statements. For an outline of the material risks and assumptions associated with these statements, refer to the Cautionary Note Regarding Forward-Looking Statements at the end of this report.

We collaborate across disciplines and industries to bring buildings, energy and resource, and infrastructure projects to life. Our work—professional

consulting in planning, engineering, architecture, interior design, landscape architecture, surveying, environmental sciences, project management, and project economics— begins at the intersection of community, creativity, and client

relationships.

Our Company celebrated its 60th year of operations in 2014. Since 1954, our local

strength, knowledge, and relationships, coupled with our world-class expertise, have allowed us to go anywhere to meet our clients’ needs in more creative and personalized ways. With a long-term commitment to the people and places we serve,

Stantec has the unique ability to connect to projects on a personal level and advance the quality of life in communities across the globe.

Business Objective

Our business objective is to be a top 10 global design firm. Currently, we are a top 10 design firm in North America and a top 20 firm globally. We

continue to work diligently to improve this top-tier position. We believe that our continued growth will increase shareholder value and give our employees the opportunity to bring their talent and expertise to top clients with complex projects that

span multiple disciplines around the world. We plan to achieve a compound average growth rate of 15% through a combination of organic and acquisition growth.

Strategy

To establish a clear plan for achieving our business

objective—to be a top 10 global design firm—we have a strategic planning process that consists of three-year cycles between comprehensive strategic review years and interim execution years. In a comprehensive strategic review year we

develop our long-range (five-year) strategy. In the three interim execution years, we focus on implementing and executing that long-range strategy. Following the 2012 comprehensive strategic review year, 2013, 2014, and 2015 are execution years. In

2015, we will complete a comprehensive strategic review.

In 2014, we focused on executing our strategy. Our purpose, promise, and values form the

foundation for our strategy. Our purpose is to create communities, and our promise is to design with community in mind. Our values are

| |

• |

|

We are driven to achieve |

For each action-oriented value statement, we identify annual initiatives relating to

human capital, learning and growth, clients, business processes, and operational and financial performance. (Our four value statements and initiatives are further described in the Key Performance Drivers and Capabilities section of this report.) We

seek to achieve our business objective by executing the following strategies:

| |

• |

|

Design. Focusing on professional consulting, we take on little or no construction risk |

|

|

|

|

|

| Management’s Discussion and Analysis

December 31, 2014 |

|

M-3 |

|

Stantec Inc. |

| |

• |

|

Community presence. Using the strength of our local position to bring our world-class expertise to the communities in which we live and work |

| |

• |

|

Local and global client focus. Driving a client-focused culture through cross-selling efforts, account management strategies, and strong local relationships |

| |

• |

|

Culture of excellence. Focusing on quality and creativity to provide value-added services through integrated quality management systems |

| |

• |

|

Top-tier positioning. Positioning ourselves among the top-tier service providers in the sectors and geographic locations in which we operate |

| |

• |

|

Expansion of capabilities and geographic reach. Expanding our capabilities and geographic reach through strategic hires and the acquisition and integration of firms that share our vision and culture

|

| |

• |

|

Diversification. Pursuing project and client diversification through a three-dimensional business model, thereby mitigating risk |

Business Model

Our business model is

a key element of our strategy. It is based on providing services across diverse geographic locations, business operating units, and all phases of the infrastructure and facilities project life cycle—planning, design, construction, maintenance,

and decommissioning.

Because of the diversity of our model, we can generally adapt to changes in market conditions by offsetting decreased demand for

services in one business operating unit or geographic location with increased demand for services in another. We believe this strategy allows us to mitigate risk while continuing to increase our revenue and earnings. Also, it allows us to provide

services to many clients and for many projects, ensuring that we do not rely on a few large projects for our revenue and that no single client or project accounts for more than 5% of our gross revenue.

Under the rules of IFRS, we have one reportable segment—Consulting Services—that is an aggregate of our operating segments. Our chief operating

decision maker (chief executive officer) assesses our Company’s performance based on financial information available from our operating segments, which are based on our regional geographic areas. In addition, we have business operating unit

leaders who provide strategic direction, mentoring, and technical support to operations across our geographic regions.

The following information outlines

the three main components of our business model: geographic diversification, business operating units, and life cycle solutions.

Geographic

Diversification

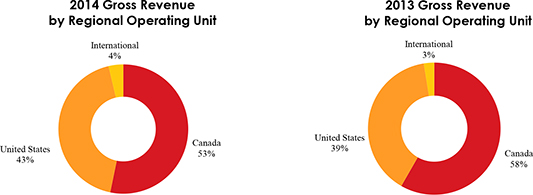

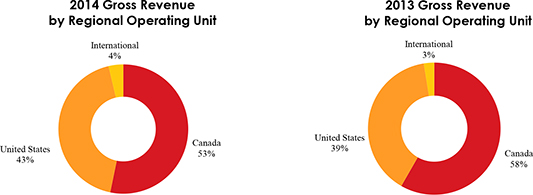

The first element of our business model is geographic diversification. We operate in three geographic regional operating

units—Canada, the United States, and International. Our International offices are in the Middle East, the United Kingdom, India, and the Caribbean. In 2014, we earned 53% of our gross revenue in Canada, 43% in the United States, and 4% in

International locations. Our aim is to leverage global expertise while focusing on our strong local presence.

Over the next three to five years, we

expect that the majority of our revenue growth will come from within North America and that this will occur through both organic growth and acquisitions. During this time, we will gradually increase our geographic reach in other markets suited for

and receptive to our services.

|

|

|

|

|

| Management’s Discussion and Analysis

December 31, 2014 |

|

M-4 |

|

Stantec Inc. |

Canada. At December 31, 2014, we had approximately 7,500 employees in Canada. We benefit from a

mature market position within each of our regions. Strategically, we view our opportunities as follows:

| |

• |

|

In western Canada, our primary growth areas include developing our significant multisector opportunities and continuing to develop our presence in oil and gas, power, mining, and commercial areas. To pursue clients, our

Environmental Services, Power, Mining, and Oil & Gas teams will continue to work collaboratively on business development. |

| |

• |

|

In Ontario, we continue to focus on augmenting our existing capabilities by emphasizing growth in our Transportation, Healthcare, Community Development, Water, and Power sectors, as well as in other areas.

|

| |

• |

|

The Dessau Inc. acquisition on January 16, 2015, added over 1,300 employees to our Company. Because of this, we believe we can now leverage opportunities in Quebec, particularly in resource and commercial

development, as a result of the significant investment planned and underway by the public sector in infrastructure and social facilities. |

| |

• |

|

In Atlantic Canada, we anticipate taking advantage of industrial and commercial opportunities for our Buildings business operating unit in two ways: by accessing our relationships in our Energy & Resources

business operating unit and by capitalizing on our significant local market presence. |

We believe that sustainable resource development is

important for the future of our Canadian operations. Our joint ventures and partnerships with Aboriginal groups, communities, and governments have given us a substantial local presence and a commanding presence in the North; we believe our presence

positions us well to capitalize on opportunities, particularly with oil and gas and mining clients. We will continue to pursue wins in public-private partnerships (P3) and emerging integrated project delivery (IPD) markets, particularly in our

Transportation and Healthcare sectors.

United States. We have approximately 6,400 employees in the United States, where economic growth is

improving. Due to acquisitions over the past five years, we are achieving critical mass and diversity across many sectors in many geographies. Strategically, we view our opportunities as follows:

| |

• |

|

We anticipate taking advantage of improved economic conditions in the transportation and community development sectors and the relative stability in the environmental services, buildings, and industrial buildings

sectors. |

| |

• |

|

We expect to build on our energy-related business because of the significant activity in shale, the strength of the power industry, and the need for infrastructure to support development. |

| |

• |

|

We expect to capitalize on infrastructure opportunities supported by certain state regulations promoting alternative project delivery (APD). |

| |

• |

|

We believe we can leverage our new acquisitions in the United States to diversify beyond our infrastructure roots and better position ourselves in the energy and resources and buildings markets. |

| |

• |

|

We believe we are well positioned in our Community Development sector to capture increased housing activities in Florida and California. |

| |

• |

|

We anticipate that trends like resiliency planning and storm preparation will continue. We also anticipate progress in areas such as healthcare and education, which are driven by population growth, supportive state

initiatives, and increased clarity in federal programs. |

|

|

|

|

|

| Management’s Discussion and Analysis

December 31, 2014 |

|

M-5 |

|

Stantec Inc. |

International. We have approximately 300 employees in our International operations. The majority of

revenue comes from our Buildings business operating unit and our Mining sector. During 2014, growth was positively impacted by hospital and institutional projects. However, the mining sector business is cyclical, so we expect that organic growth

will level off over the medium term.

To offset this trend, we will focus on growing organically in other sectors where we will concentrate activities in

areas where we currently have a presence. Like we do in our other locations, we expect to leverage our local position to drive cross-selling opportunities to clients in the United Kingdom and the Middle East.

Business Operating Units

Business operating unit

specialization is the second element of our business model. During 2014, we completed the realignment of our organizational structure from five practice area units to three specialized business operating units: Buildings, Energy &

Resources, and Infrastructure. We believe that this realignment ensures better support for our clients, stronger accountability for our leadership team, and more opportunities for cross selling, which, in turn, creates future growth and success. We

will accomplish these while maintaining the core elements of our strategy. In 2014, we earned 21% of our gross revenue in Buildings, 44% in Energy & Resources, and 35% in Infrastructure.

Within our three business operating units, we focus on the top 12 sectors that our clients operate in. By better understanding our clients’ goals, market

influences, and business drivers, we can offer multidisciplinary solutions to meet their needs.

Buildings. Most revenue in the Buildings business

operating unit consists of services in architecture, buildings engineering, project management, interior design, and functional planning for vertical infrastructure. The majority of our revenue is earned from private sector and institutional

clients, the remaining from public sector clients. We provide services in the following sectors:

| |

• |

|

Education & Institutional |

Energy & Resources. Most revenue in our Energy &

Resources business operating unit is composed of environmental services (these services are also provided to other business operating units), industrial engineering services, project management, and construction management services, primarily for

private sector clients. Services are provided in the following sectors:

Infrastructure. The majority of revenue in our Infrastructure business operating unit is from

design and engineering services, with a small portion from project and construction management. We provide services in the following sectors:

| |

• |

|

Transportation (Bridges, Roadways, and Transit & Rail) |

|

|

|

|

|

| Management’s Discussion and Analysis

December 31, 2014 |

|

M-6 |

|

Stantec Inc. |

For the most part, the Community Development sector serves private sector clients. Our Transportation and Water

sectors primarily serve public sector clients.

Life Cycle Solutions

The third element of our business model is providing professional services in all phases of the project life cycle: planning, design, construction,

maintenance, and decommissioning. This inclusive approach enables us to deliver services during periods of strong new capital project activity (design and construction), plus deliver services during periods of redevelopment or operational spending

activity (maintenance, integrity management, and remediation). We believe this strategy enables us to maintain long-term client relationships throughout the life of a project or an infrastructure asset.

Beginning with the planning and design stages, we provide conceptual and detailed design services, conduct feasibility studies, and prepare plans and

specifications. During the construction phase, we generally act as the owner’s representative and provide project management, construction management, surveying, and resident engineering services. We focus principally on fee-for-service work

and rarely act as the contractor or take on construction risk. During the maintenance phase that follows project completion, we provide ongoing professional services for integrity management, as well as maintenance and rehabilitation projects in

areas such as facilities and infrastructure management, facilities operations, and performance engineering. Finally, in the decommissioning phase, we provide solutions, recommendations, and remediation strategies for taking facilities out of active

service.

Key Performance Drivers and Capabilities

Our key performance drivers are defined by external forces and by internal factors that are articulated through our value statements: we put people first, we

are better together, we do what is right, and we are driven to achieve. The following discussion includes forward-looking statements. For an outline of the material risks and assumptions associated with these statements, refer to the Cautionary Note

Regarding Forward-Looking Statements at the end of this report.

Key External Drivers

Our core business is driven by a number of external industry factors that affect the demand for our services.

Buildings. In our Buildings business operating unit, economic outlook, unemployment rates, population growth, changing demographics in North America,

security, and aging infrastructure are the overarching drivers that impact the need for new facilities and renovations and expansions to existing buildings.

Our Buildings sectors and additional drivers that impact them follow:

| |

• |

|

Airports & Aviation – level of passenger traffic and security requirements (these influence the building and renovation of airport facilities) |

| |

• |

|

Commercial – consumer demand and market penetration relating to retail consumption and commercial workspace |

| |

• |

|

Education – population growth, public funding, technology, scientific advancement, and confidence in the economic turnaround |

|

|

|

|

|

| Management’s Discussion and Analysis

December 31, 2014 |

|

M-7 |

|

Stantec Inc. |

| |

• |

|

Healthcare – aging and growing population and government funding of capital projects (in particular, health reform supports capital spending in the United States) |

| |

• |

|

Industrial Buildings – strong manufacturing industry in North America and process improvements (these affect the need for industrial buildings and facilities) |

Energy & Resources. Our Energy & Resources business operating unit is driven primarily by the supply and demand for commodities in

the global economy and is affected by commodity prices. In recent years, strong demand for commodities from countries such as China, India, and Brazil has generally caused a rise in the prices of oil, gas, and mineral resources. However, the market

is cyclical and can cause dramatic fluctuations in supply and demand conditions, thereby affecting commodity prices. In periods of declining oil prices, upstream and downstream segments of the energy sector may delay or cancel investments in capital

projects. However, in the midstream sector, where we have significant expertise, clients may move forward with new, rehabilitated, or repurposed large capital infrastructure in periods of declining oil prices as these are significant multiyear

projects that are not as affected by short-term commodity fluctuations. Environmental regulations and stakeholder engagements also influence the development of energy and resources, especially in North America where assessment, compliance, and

monitoring are subject to increasingly stringent requirements.

Our Power sector is more of an infrastructure business, but economic activity also affects

power demand and therefore impacts this market to a degree. In addition, activity in our Power sector is influenced by regulations, the age of infrastructure, the location of supply and demand for transmission and distribution, and the level of

subsidization related to renewables.

Infrastructure. Our Infrastructure business operating unit is driven by population growth, urbanization, and

the continuous need to rehabilitate aging infrastructure. Government funding and environmental regulations impact this market as do changes in the housing market and special community initiatives. Also, government funding—whether at the

federal, state/provincial, or municipal level—generally determines capital spending and infrastructure project priorities. Increasingly, the private sector is influencing this market by engaging in project delivery approaches, such as P3s, and

projects with direct user fees, such as toll roads. Overall, this business operating unit relies heavily on local and regional clients and benefits from Stantec’s strong community presence.

Key Internal Drivers

We believe our actionable value statements

best reflect what unites Stantec and compels our people to come to work and do their best every day. Our performance depends on our ability to achieve excellence by putting people first, developing strong, long-lasting relationships with each other

and our clients, doing what is right, and being driven to achieve at every level. Our value system provides a framework for the strategic initiatives we implement to drive our performance and obtain our overall business objective to be a top 10

global design firm.

We Put People First

We continue to evolve by attracting talent and developing our people. This entails assessing and guiding current employees, engaging and developing leadership,

and ensuring we create an experience and work environment that retains talent. The total number of employees at our Company increased from close to 13,200 in 2013 to approximately 14,200 at the end of 2014. At December 31, 2014, our workforce

included approximately 8,500 professionals, 4,000 technical staff, and 1,700 support personnel. With the addition of Dessau Inc. on January 16, 2015, we have grown to over 15,500 employees.

|

|

|

|

|

| Management’s Discussion and Analysis

December 31, 2014 |

|

M-8 |

|

Stantec Inc. |

Employees

We strive to attract and retain the best employees in the field. To do this, we design our programs to be competitive and flexible, and to reward top

performance. This begins with providing comprehensive benefits programs, including a wellness culture where we provide tools and support to help employees and their families improve their health and well-being.

We have three career streams—business, technical, and project management—to provide employees with career development direction and growth

opportunities based on their primary area of interest. We have a comprehensive, blended learning environment for our employees that combines experiential on-the-job training, coaching and mentorship, improved tools and practices, and external

networks. Career stream and learning initiatives in 2014 included continuing to formalize our succession planning and launching an Emerging Leadership program that is consistent across all geographic regions.

In 2015, we plan to continue to enhance our leadership and training programs. In addition, we will focus on our Alternative Work Schedule and Global Mobility

programs to establish policies and practices to support our current and future business needs for a flexible and mobile workforce.

Our

Diversity & Inclusion Committee fosters a workplace that is supportive of the unique differences among our clients and employees. In 2014, we hired an external consultant to help develop a three- and five-year Diversity and Inclusion

(D&I) Plan. We will implement this plan in 2015, starting by formalizing a D&I Council.

In 2014, we continued with our Human Resources

realignment (initiated in 2013) to create a new service delivery model that will accommodate our current and future size based on forecasted growth. Our Human Resource structure will focus on three distinct service streams—shared services,

business partnerships, and centers of expertise.

We measure the success of our various initiatives through employee surveys, 360-degree feedback, and

exit interviews. The results help us develop future programs and initiatives.

Realignment of Senior Leadership Team

During 2014, in addition to realigning our organizational structure, we also realigned our senior leadership team into the following two levels:

| |

• |

|

Executive Vice President Team (EVPT) – consists of the chief executive officer (CEO), chief financial officer (CFO), chief operating officer (COO), and executive vice presidents (EVPs) The EVPT oversees the overall

performance of the Company, including developing and monitoring the Company’s business plan, monitoring financial performance and risks, approving policies and procedures, and overseeing acquisitions and divestitures. EVPs are specifically

responsible for the performance of our regional operating units and our business operating units. |

| |

• |

|

Executive Leadership Team (ELT) – consists of senior vice presidents and certain vice presidents. The ELT has numerous responsibilities, including the execution of our business plan and the management of the

Company’s operating performance. |

|

|

|

|

|

| Management’s Discussion and Analysis

December 31, 2014 |

|

M-9 |

|

Stantec Inc. |

Leadership Compensation

Our ability to align the activities of our senior managers with our short- and long-term financial and strategic goals is a key driver for our success. In

addition to fixed salaries, we provide short- and long-term compensation, on a discretionary basis, that is designed to reward our senior managers (including our CFO and COO, regional operating unit leaders, and business operating unit leaders) for

their individual and corporate contributions to meeting our objectives.

For our senior managers and other key employees, short-term compensation includes

an annual cash bonus. The total amount available in the annual bonus pool is calculated as a percentage of our annual pre-tax, pre-bonus net income, which encourages our senior managers to achieve profitable business results. To determine the awards

for the year, we evaluate each eligible employee’s personal contributions to our Company-wide profitability and performance. In our view, this creates a sense of shared responsibility for achieving outstanding business results and meeting our

clients’ needs.

In 2014, we revised our compensation program for the senior leadership team to provide a mix of base salary, short-term incentive

cash bonuses, and long-term incentives using both share options and performance share units (PSUs). We believe this plan further invests our senior leadership team in our long-term share performance.

As part of long-term compensation for key employees, we grant options through our long-term incentive plan, further aligning their interests with our

shareholders’ interests, as well as encouraging those employees to remain with us over the long term. In 2014, the number of options available for issuance was tied to the achievement of two key performance metrics contained in our strategic

plan: earnings per share and pre-tax, pre-bonus net income as a percentage of net revenue (“net revenue” is defined in Definition of Additional IFRS Measures in the Critical Accounting Estimates, Developments, and Measures section of this

report).

In 2015, we will continue to issue share options and will continue to supplement our long-term incentive plan for our senior leadership team

with PSUs.

Effective January 1, 2014, our CEO entered into a new employment contract with the Company, which provides for greater alignment between

the CEO’s compensation program and the rest of our senior leadership team’s compensation and our long-term shareholders’ interests. The CEO’s bonus is evaluated by the board annually based on the achievement of corporate and

individual performance metrics, and he is awarded annual long-term incentive grants of share options and PSUs.

We require our CEO, COO, CFO, and EVPs to

own a minimum number of shares in the Company. These executives must own a multiple of their base salary in shares. We believe our long-term incentive programs and the minimum ownership requirement provide the appropriate incentives for our EVPT to

achieve growth in our share price, thereby aligning their compensation with the interests of shareholders.

We Are Better Together

Strong, long-lasting relationships are at the center of everything we do, and they directly impact our employees and clients, as well as

project success. Each employee brings individual strengths to the Company, whether that is technical expertise, particular sector experience, or exceptional client relationships. When we combine those strengths, we believe we reach our full

potential as an organization and that we are a trusted advisor to our clients.

Our ability to attract and retain top clients drives the success of our

business. Currently, a majority of our business comes through repeat clients, and our 10 largest clients account for approximately 20.0% of our revenue. In 2014, we focused on the continued evolution of the organization and the enhancement of two

key strategies: client development and community engagement.

|

|

|

|

|

| Management’s Discussion and Analysis

December 31, 2014 |

|

M-10 |

|

Stantec Inc. |

Organizational Evolution

In 2014, we continued the process of realigning our internal structure to better serve our clients by formalizing our three business operating

units—Buildings, Energy & Resources, and Infrastructure. In 2015, we will continue to focus on collaborating and sharing responsibilities for operational performance in our organizational structure, and we will continue to refine and

clarify various roles.

Client Development and Account Management

We continue to pursue a client strategy that focuses on growing global accounts while augmenting the strength of our local client base and differentiating us

from our peers in the marketplace. The purpose of our account management system is to position Stantec for sustainable organic growth. To find and retain top clients, we develop targeted marketing and business development plans—by geographic

area for regional and local clients and by sector for global and national clients. By better understanding our top clients, we can increase our ability to provide services that enhance their success and, in turn, create organic growth for our

Company.

In 2014, we created an Account Management focus group, consisting of account managers across regions and sectors, to assist with implementing

our business development framework. In 2015, we will continue to enhance our client development strategies through this framework.

We Do

What Is Right

Doing what is right means paying attention to the impact that every decision has on how we do business. It means holding

ourselves to a high standard of ethics and integrity in everything we do and committing to professional excellence in a manner that fosters a culture of safety and sustainability that is both innovative and forward looking.

Ethics and Integrity

Our reputation remains a

significant asset; therefore, the focus continues to be on aligning our actions and decisions with our integrity and ethics policies. One way we ensure this is by conducting annual ethics, integrity, and anti-corruption compliance training for all

employees. We are—and should be—held to a high standard of business practices. At Stantec, we articulate our high standard through our Project Management Framework, code of ethics, and policies and practices. In 2014, we engaged an outside

agency to monitor, review, and report any issues identified through our Integrity Hotline.

Professional Excellence

We use a number of methods to ensure high-quality project execution, including the following:

Project Management Framework. We are committed to efficient and high-quality project execution within a framework that incorporates ethics, safety,

sustainability, innovation, and profitability. Our Project Management Framework helps us improve project planning, remain committed to quality assurance, and fulfill peer review requirements.

We always strive to enhance our project execution and forecasting ability and to facilitate more efficient resource management. Currently, we use a diverse

range of tools, including our Enterprise Management System, to execute projects effectively, and we will continue to invest in these tools in 2015.

Internal Practice Audits. We conduct internal practice audits to identify opportunities for quality enhancement across regions, disciplines, and

sectors.

|

|

|

|

|

| Management’s Discussion and Analysis

December 31, 2014 |

|

M-11 |

|

Stantec Inc. |

Integrated Management Systems. Our Integrated Management Systems clarify expectations for project delivery

and client service excellence and convey the steps employees must take to achieve more consistent and successful project outcomes. These systems are certified to the International Organization for Standardization (ISO) 9001:2008 (Quality

Management), ISO 14001:2004 (Environmental Management), and ISO 20000-1:2011 (IT Service Management System) standards. We believe that benchmarking against internationally recognized management standards

such as ISO provides transparent accountability that aligns with industry best practices—and we believe this ultimately improves client service delivery and satisfaction.

Project Management Career Streams and Training. Effective project management depends not only on tools but on people as well. Project management is a

career stream at Stantec. We have a Project Delivery Office that houses a peer group of senior project managers and project management specialists who can be deployed when required on any project throughout Stantec.

Regulatory Compliance. We operate in a diverse regulatory environment and are committed to compliance with regulatory requirements. For instance, we

comply with financial reporting standards and controls and with employment practices. We also demonstrate our commitment to excellence through our documented policies and procedures.

Social Responsibility

We commit to doing what is right

by demonstrating the values of social, economic, and environmental responsibility and a culture of health and safety through the implementation of various programs.

Sustainability. In our operations, we are committed to reducing our negative impact on the environment by progressing toward least-impact approaches to

energy consumption, paper consumption, and waste disposal. We track and report our progress in our annual Sustainability Report, in the Carbon Disclosure Project (CDP), and through certification to ISO 14001:2004 (Environmental Management). In 2015,

we will remain focused on meeting established targets to reduce the environmental impacts that result from our operations.

Stantec is at the forefront in

the rapidly emerging field of Integrated Infrastructure and is implementing a new planning framework and evaluation system called Envision™, developed by the Institute for Sustainable Infrastructure and the Harvard Graduate School of Design.

Envision provides a holistic framework for planning, designing, evaluating, and rating the community, environmental, and economic benefits of infrastructure projects and systems. In total, over 100 of our professional staff achieved their Envision

Sustainability Professional (ENV SP) credentials.

Health and Safety. We are committed to ensuring the health and safety of all employees and

stakeholders involved in our professional work. We continue to promote a culture of safety across our organization by implementing numerous formal and informal initiatives. In 2014, we implemented a safe return-to-work program and received OHSAS

18001:2007 certification for the Occupational Health & Safety (OHS) Management System. We continue to work on reducing our Total Recordable Incident Rate and Total Injury Rate.

Community Engagement. Our purpose is to create communities. At Stantec, we aim to be active members in our communities, making lasting connections with

the people where we live and work. We regularly partner with a number of charitable and community organizations to help support their growth and development by working on social projects, environmental projects, charitable initiatives, and more. In

addition to the many community outreach activities we participate in throughout the year, in 2014, we held our second Company-wide Stantec in the Community Day—more than 5,500 employees spent the day volunteering in their communities.

|

|

|

|

|

| Management’s Discussion and Analysis

December 31, 2014 |

|

M-12 |

|

Stantec Inc. |

In every region, we make decisions locally with local input and focus. We recognize that local staff best

understand how to match our resources and unique capabilities with the priorities of their communities and how to provide support to the organizations that make a difference. Corporately, we provide the framework that guides decision making,

ensuring our community investments align with our organizational objectives and resonate with our employees and business leaders in the communities we serve. We target donating 1% of our annual pre-tax profits, through direct cash contributions or

services in kind, to charitable or not-for-profit endeavors in the arts, education, environment, and health and wellness.

We Are Driven

to Achieve

Achievement at every level begins and ends with a firm commitment to being the best that we can be. To capitalize on market

opportunities and core strengths, we identify and adapt to changing market conditions in our various sectors. We identify growth opportunities—both organically and by acquisition—where we are well positioned and able to effectively manage

risk. We remain committed to growing our top and bottom line through a continued focus on design services and by maintaining a low to moderate risk profile.

Growth Opportunities

Our aim is to achieve consistent

growth and profitability. We will do this by sustaining a culture of excellence that remains committed to our clients, our people, our communities, and our shareholders. We commit to maintaining our diversification strategy, ensuring an appropriate

balance within our sector mix.

Achieving a high level of market presence in the communities we serve is a key driver to our success. Our approach to

regional growth is to effectively service our existing regional and local clients, develop new relationships, and grow our reputation and business where opportunities exist. Our target is to be among the

top-tier service providers in each region and sector. With this level of market presence, we will less likely be affected by downturns in regional economies.

Our strong presence in Canadian markets gives us the ability to capitalize on opportunities within each region. We continue to pursue areas in Canada where we

believe we can further increase our market presence in specific sectors. In the United States, our market position is growing, and we have taken strong steps to better position ourselves as a national firm. We have an emerging international

presence, mainly in our Buildings business operating unit and our Mining sector, and we aim to grow organically by introducing more services to current and new clients.

Organic growth has been and continues to be a key driver to our success. To achieve growth, we leverage client relationships through our sector approach, by

cross-selling, and through our account management programs, and we refine internal strategies that foster a culture of revenue generation in all areas of the Company.

Acquisitions are key to our strategy, and increasing the depth of our capabilities and broadening our geographic coverage enables us to better service our

clients and achieve growth. Therefore, we maintain a consistent and disciplined approach to sourcing firms that align with our Company’s culture and strategy. We continue to target these “right fit” firms based on sector and regional

priorities, while we remain open to new opportunities.

|

|

|

|

|

| Management’s Discussion and Analysis

December 31, 2014 |

|

M-13 |

|

Stantec Inc. |

Because we operate in a highly fragmented industry, we are confident that we can continue to take advantage of

acquisition opportunities. According to internal analyses and Engineering News-Record’s 2014 report on the top 500 design firms, the largest engineering and architecture companies (our principal competitors) operating in North America

generate about US$100 billion in annual design fees. Currently, our share is approximately 3%.

When we acquire a firm, integration starts immediately

following the acquisition closing date. Full integration usually takes between six months and two years to complete and involves implementing our Company-wide information technology and financial management systems and providing support services

from our corporate and regional offices. This approach allows new staff to focus, with minimal interruption, on their primary responsibility: continuing to serve clients while allowing staff to take advantage of our systems and expertise.

We measure our success integrating acquired employees by using a post-integration survey and assessing the results to improve future integration activities.

We also monitor leadership retention from acquisitions, key project submissions, and key client pursuits. In addition, we measure our growth success by monitoring our year-over-year increase in gross revenue

attributable to organic and acquisition growth.

Financing

Our continued ability to finance our growth plan supports our success. Adequate financing gives us the flexibility to acquire firms that are appropriate for

our vision and complement our business model.

Since our shares began being publicly traded on the Toronto Stock Exchange (TSX) in 1994, we have increased

our gross revenue at a compound annual rate of 18.3%. To fund acquisition growth, we require cash generated from both internal and external sources. Historically, we have completed acquisitions using (almost entirely) cash generated from operations

and vendor notes.

In 2014, we extended the maturity date of our existing $350 million revolving credit facility to August 31, 2018. This facility

also gives us access to $150 million in additional funds, subject to approval from our lenders. At December 31, 2014, we had $281.9 million of additional borrowing available under the facility. In 2011, we issued $70 million of 4.332% secured

notes due May 10, 2016, and $55 million of 4.757% senior secured notes due May 10, 2018, which were used to repay existing debt.

|

|

|

|

|

| Management’s Discussion and Analysis

December 31, 2014 |

|

M-14 |

|

Stantec Inc. |

Results

Overall Annual Performance

In 2014, we achieved solid growth. We completed eight acquisitions in the year and had organic growth in all geographic

regions and business operating units. Our 2014 organic growth demonstrates the effectiveness of our diversified business model: even though during the second half of the year we had a retraction in our Energy & Resources business operating

unit, we experienced growth in our Buildings and Infrastructure business operating units.

The following highlights other major financial achievements and

strategic activities in 2014 that contributed to our financial performance and overall financial condition:

| |

• |

|

Continuous profitability. Since the inception of our Company, we have achieved uninterrupted profitability. We ended 2014 with 13.1% growth in gross revenue, a 12.8% increase in EBITDA, a 12.5% increase in

net income, and a 10.8% increase in diluted earnings per share compared to 2013. (The terms “gross revenue” and “EBITDA” are defined in Definition of Additional IFRS Measures and Definition of Non-IFRS Measures in the Critical

Accounting Estimates, Developments, and Measures section (together, the “Definitions section”) of this report.) |

| |

• |

|

Growth through acquisitions. Acquisitions completed in 2013 and 2014 contributed $144.6 million or 6.5% to the increase in our gross revenue in 2014 compared to 2013. In particular, we strengthened our presence

in the United States as we continued to build a top-tier position in our sectors. |

| |

• |

|

Organic growth. In 2014, we achieved organic gross revenue growth of 3.9% and net revenue growth of 4.1%. By consistently executing our business strategy, we were able to capitalize on opportunities to increase

project activity in all business operating units. In particular, we experienced strong growth in our Power, Water, and Community Development sectors. |

| |

• |

|

Growth in backlog. Our contract backlog grew 28.6% from $1.4 billion at December 31, 2013, to $1.8 billion at December 31, 2014. (“Backlog” is a non-IFRS measure and is further discussed in

the Definitions section of this report.) |

| |

• |

|

Strong balance sheet and liquidity. Our balance sheet remains strong with a net debt to EBITDA ratio of 0.53. (“Net debt to EBITDA” is a non-IFRS measure and is defined in the Definitions section of

this report.) Cash flows from operations in the year supported acquisition growth and continued dividends. During the year, we extended the maturity date of our existing $350 million revolving credit facility to August 31, 2018. As at

December 31, 2014, $281.9 million of additional borrowing was available under our revolving credit facility for future acquisitions, working capital needs, and general corporate purposes. |

|

|

|

|

|

| Management’s Discussion and Analysis

December 31, 2014 |

|

M-15 |

|

Stantec Inc. |

| |

• |

|

Two-for-one share split. Our board of directors declared a two-for-one share split that was effected by way of a share dividend. Shareholders of record on October 31, 2014, received a share dividend on

November 14, 2014. |

| |

• |

|

Evolution to business operating units. In 2014, we realigned our organizational structure from five practice area units to three business operating units: Buildings, Energy & Resources, and

Infrastructure. Our matrix-based business model and leadership structure are organized around geographic diversification and business operating units, and we continue to provide services throughout the project life cycle. This realignment allows us

to better support our clients and better align us with their business drivers. |

Selected Annual Information

The following table highlights trending of certain annual information:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (In millions of Canadian dollars,

except per share and share amounts) |

|

2014 |

|

|

2014 vs.

2013

(%) |

|

|

2013 |

|

|

2013 vs.

2012

(%) |

|

|

2012* |

|

|

|

|

|

|

|

| Gross revenue (note 1) |

|

|

2,529.9 |

|

|

|

13.1% |

|

|

|

2,236.4 |

|

|

|

19.6% |

|

|

|

1,870.3 |

|

| Net revenue (note 1) |

|

|

2,075.3 |

|

|

|

13.3% |

|

|

|

1,832.4 |

|

|

|

17.9% |

|

|

|

1,553.8 |

|

| EBITDA (note 2) |

|

|

294.7 |

|

|

|

12.8% |

|

|

|

261.2 |

|

|

|

18.1% |

|

|

|

221.0 |

|

| Net income |

|

|

164.5 |

|

|

|

12.5% |

|

|

|

146.2 |

|

|

|

20.8% |

|

|

|

121.0 |

|

| Earnings per share – basic (note 3) |

|

|

1.76 |

|

|

|

11.4% |

|

|

|

1.58 |

|

|

|

19.7% |

|

|

|

1.32 |

|

| Earnings per share – diluted (note 3) |

|

|

1.74 |

|

|

|

10.8% |

|

|

|

1.57 |

|

|

|

18.9% |

|

|

|

1.32 |

|

| Cash dividends declared per common share (note 3) |

|

|

0.37 |

|

|

|

12.1% |

|

|

|

0.33 |

|

|

|

10.0% |

|

|

|

0.30 |

|

|

|

|

|

|

|

| Total assets |

|

|

2,010.5 |

|

|

|

20.5% |

|

|

|

1,668.2 |

|

|

|

13.9% |

|

|

|

1,464.2 |

|

| Total long-term debt |

|

|

309.3 |

|

|

|

29.9% |

|

|

|

238.1 |

|

|

|

(20.4%) |

|

|

|

299.3 |

|

|

|

|

|

|

|

| Cash flows |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| From operating activities |

|

|

207.2 |

|

|

|

|

|

|

|

272.1 |

|

|

|

|

|

|

|

180.6 |

|

| Used in investing activities |

|

|

(174.3) |

|

|

|

|

|

|

|

(117.4) |

|

|

|

|

|

|

|

(143.2) |

|

| Used in financing activities |

|

|

(24.7) |

|

|

|

|

|

|

|

(54.2) |

|

|

|

|

|

|

|

(31.3) |

|

|

|

|

|

|

|

| Outstanding common shares as at |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| December 31 (note 3) |

|

|

93,836,258 |

|

|

|

|

|

|

|

93,152,264 |

|

|

|

|

|

|

|

91,967,788 |

|

| February 25, 2015 |

|

|

93,839,015 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Outstanding share options as at |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| December 31 (note 3) |

|

|

2,676,568 |

|

|

|

|

|

|

|

2,610,830 |

|

|

|

|

|

|

|

2,951,646 |

|

| February 25, 2015 |

|

|

2,673,811 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

note 1: Gross revenue and net revenue are defined in Definition of Additional IFRS Measures in the

Definitions section of this report.

note 2: EBITDA is calculated as net income before income taxes plus net interest expense,

amortization of intangible assets, and depreciation of property and equipment (further discussed in the Definitions section of this report).

note 3: All comparative earnings per share, dividends per share, common share, and share option amounts have been adjusted from previously

reported amounts for the two-for-one share split that occurred on November 14, 2014.

* Certain figures for 2012 have been

restated due to the adoption of IFRS 10 and 11.

|

|

|

|

|

| Management’s Discussion and Analysis

December 31, 2014 |

|

M-16 |

|

Stantec Inc. |

2014 vs. 2013. Eight acquisitions completed in 2014 and five completed in 2013 contributed to our

year-over-year growth in gross revenue, EBITDA, and net income, as well as growth in our basic and diluted earnings per share. As a result of acquisitions, gross revenue increased 6.5%. Also, gross revenue increased 3.9% and net revenue increased

4.1% because of organic growth. Organic growth occurred in all geographic regions and all business operating units. In Canada, the 3.8% organic gross revenue growth was primarily caused by increased activity in our Oil & Gas, Water, and

Community Development sectors. In the United States, organic gross revenue grew 2.7%, primarily in our Power, Transportation, and Water sectors. Internationally, we had organic growth that mainly occurred in our Buildings business operating unit.

Our EBITDA as a percentage of net revenue for 2014 was 14.2%—remaining consistent with 2013. Gross margin increased from 54.7% in 2013 to 54.9% in

2014, partly due to our revenue base growing in higher margin business operating units (Buildings and Infrastructure). In addition, gross margin increased as a result of improvements in project management in our Buildings business operating unit and

Transportation sector. (“Gross margin” is defined in the Definitions section of this report.) Administrative and marketing expenses increased mainly due to lower utilization, which was partly caused by increased integration activities from

acquisitions. The growth in net income and basic and diluted earnings per share over 2013 was a result of the above-noted factors.

2013 vs. 2012.

Five acquisitions completed in 2013 and seven completed in 2012 contributed to our year-over-year growth in gross revenue, EBITDA, and net income, as well as our growth in basic and diluted earnings per share.

This acquisition growth was supplemented by stronger organic growth in 2013 than in 2012. As a result of strong organic growth, gross revenue increased 8.8% and net revenue increased 7.6%. Organic growth occurred in all geographic regions and in all

practice area units except Buildings, mainly due to intensified competition and the softening of the buildings market, particularly in healthcare. Organic growth in other practice area units was mainly a result of a robust oil and gas market and

increased project activity in our Transportation sector.

Our 2013 EBITDA was impacted by a decrease in our gross margin—from 55.0% in 2012 to 54.7%

in 2013—while our administrative and marketing expenses as a percentage of net revenue remained the same as 2012 at 40.7%. Our gross margin declined slightly in 2013 because our revenue base grew in lower margin operations (Industrial and

Transportation in the United States), resulting in an overall lower 2013 consolidated gross margin. The growth in net income and basic and diluted earnings per share over 2012 was a result of the above-noted

factors.

|

|

|

|

|

| Management’s Discussion and Analysis

December 31, 2014 |

|

M-17 |

|

Stantec Inc. |

Results Compared to 2014 Targets

In our 2013 Management’s Discussion and Analysis, we established various ranges of expected performance for 2014. In 2014, we met or performed better than

all of our targets. The following table presents those results:

|

|

|

|

|

|

|

|

|

|

|

|

|

| Measure |

|

2014

Target Range |

|

Results

Achieved |

|

|

| Gross margin as % of net revenue |

|

Between 54% and 56% |

|

|

|

54.9 |

% |

|

|

ü |

|

|

| Administrative and marketing expenses as % of net revenue |

|

Between 40% and 42% |

|

|

|

40.8 |

% |

|

|

ü |

|

|

| EBITDA as % of net revenue (notes 1 and 4) |

|

Between 13% and 15% |

|

|

|

14.2 |

% |

|

|

ü |

|

|

| Net income as % of net revenue |

|

At or above 6% |

|

|

|

7.9 |

% |

|

|

ü |

|

|

| Effective income tax rate |

|

At or below 28.5% |

|

|

|

26.3 |

% |

|

|

ü |

|

|

| Return on equity (notes 2 and 4) |

|

At or above 14% |

|

|

|

16.8 |

% |

|

|

ü |

|

|

| Net debt to EBITDA (notes 1, 3, and 4) |

|

Below 2.5 |

|

|

|

0.5 |

|

|

|

ü |

|

|

note 1: EBITDA as a percentage of net revenue is calculated as EBITDA divided by net revenue. EBITDA is

calculated as income before income taxes, plus net interest expense, amortization of intangible assets, and depreciation of property and equipment.

note 2: Return on equity is calculated as net income for the last four quarters, divided by the average shareholders’ equity over each

of the last four quarters.

note 3: Net debt to EBITDA is calculated as the sum of (1) long-term debt, including current

portion, plus bank indebtedness, less cash and cash equivalents, divided by (2) EBITDA for the last four quarters.

note 4:

Return on equity, EBITDA as a percentage of net revenue, and net debt to EBITDA are non-IFRS measures (discussed in the Definitions section of this report).

ü Met or performed better than target.

Acquisitions

Consideration for acquisitions completed was $186.9 million in 2014 and $11.4 million in 2013. We completed the following acquisitions in 2014:

| |

• |

|

On January 24, 2014, we acquired Williamsburg Environmental Group, Inc. and Cultural Resources, Inc. (WEG), adding approximately 115 staff to our Company. This addition expands our environmental services in the US

Mid Atlantic. |

| |

• |

|

On March 7, 2014, we acquired Processes Unlimited International, Inc. (ProU), which added approximately 450 staff to our Company. This addition expands our oil and gas expertise in the United States.

|

| |

• |

|

On May 9, 2014, we acquired JBR Environmental Consultants, Inc. (JBR), adding approximately 140 staff to our Company. The addition of JBR increases the depth of our services in various market sectors, including

manufacturing, oil and gas, mining, and power generation and transmission in the United States. |

| |

• |

|

On May 23, 2014, we acquired Group Affiliates Inc. (SHW), increasing the number of staff in our Company by approximately 300. Adding SHW enhances our US architectural, interior design, planning, and engineering

services to higher education and K–12 clients. |

| |

• |

|

On June 6, 2014, we acquired Wiley Engineering, Inc. (Wiley); this added 14 staff to our Company. Based in Georgia, this firm provides automation, electrical, and instrumentation engineering services to oil and

gas, mining, power, and other industries. |

| |

• |

|

On June 27, 2014, we acquired USKH Inc. (USKH), increasing our staff count by approximately 130. The addition of USKH enables us to provide locally based infrastructure, building, and geospatial services in Alaska

and expands our presence in the Pacific Northwest. |

| |

• |

|

On September 19, 2014, we acquired ADD, Inc., adding close to 210 staff to our Company. This addition enhances our architecture, interior design, planning, and branding services in the Boston market and widens our

presence in southern Florida. |

|

|

|

|

|

| Management’s Discussion and Analysis

December 31, 2014 |

|

M-18 |

|

Stantec Inc. |

| |

• |

|

On October 24, 2014, we acquired Penfield & Smith Engineers, Inc. (Penfield & Smith), adding approximately 90 staff to our Company. Penfield & Smith is based in Santa Barbara, California,

with additional offices in Camarillo, Santa Maria, and Lancaster, California. This addition strengthens our civil engineering and land planning expertise and enhances our presence along the California Central Coast. |

Discussion of Operations

Our Company operates in one reportable

segment: Consulting Services. We provide knowledge-based solutions for infrastructure and facilities projects through value-added professional services, principally under fee-for-service agreements with clients.

The following table summarizes key operating results on a percentage of net revenue basis and the percentage increase in the dollar amount for each key

operating result:

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Year Ended Dec 31 |

|

| |

|

Percentage of

Net Revenue |

|

|

Percentage

Increase

(Decrease) * |

|

| |

|

2014 |

|

|

2013 |

|

|

2014 vs. 2013 |

|

|

|

|

|

| Gross revenue ** |

|

|

121.9% |

|

|

|

122.0% |

|

|

|

13.1% |

|

| Net revenue ** |

|

|

100.0% |

|

|

|

100.0% |

|

|

|

13.3% |

|

| Direct payroll costs |

|

|

45.1% |

|

|

|

45.3% |

|

|

|

12.9% |

|

| Gross margin ** |

|

|

54.9% |

|

|

|

54.7% |

|

|

|

13.6% |

|

| Administrative and marketing expenses |

|

|

40.8% |

|

|

|

40.7% |

|

|

|

13.4% |

|

| Depreciation of property and equipment |

|

|

1.9% |

|

|

|

1.8% |

|

|

|

19.4% |

|

| Amortization of intangible assets |

|

|

1.2% |

|

|

|

1.2% |

|

|

|

14.6% |

|

| Net interest expense |

|

|

0.4% |

|

|

|

0.5% |

|

|

|

(1.2%) |

|

| Other net finance expense (income) |

|

|

0.1% |

|

|

|

(0.2%) |

|

|

|

n/m |

|

| Share of income from joint ventures and associates |

|

|

(0.1%) |

|

|

|

(0.1%) |

|

|

|

4.3% |

|

| Foreign exchange gain |

|

|

0.0% |

|

|

|

0.0% |

|

|

|

n/m |

|

| Other (income) expense |

|

|

(0.2%) |

|

|

|

(0.1%) |

|

|

|

n/m |

|

| Income before income taxes |

|

|

10.8% |

|

|

|

10.9% |

|

|

|

12.2% |

|

| Income taxes |

|

|

2.9% |

|

|

|

2.9% |

|

|

|

11.4% |

|

| Net income |

|

|

7.9% |

|

|

|

8.0% |

|

|

|

12.5% |

|

n/m = not meaningful

* Percentage increase (decrease) calculated based on the dollar change from the comparable period.

** The terms gross and net revenue and gross margin are discussed in the Definitions section of this report.

The percentage increase in gross and net revenue in 2014 compared to 2013 was due to acquisition growth and organic growth in all geographic regions and

business operating units (further explained in the Gross and Net Revenue section that follows). We were positively impacted by an increase in our gross margin as a percentage of net revenue. This was partly offset by our administrative and marketing

expenses and depreciation of property and equipment since both as a percentage of net revenue increased compared to 2013 (further explained in the respective sections of this report). Our net income for 2014 increased by 12.5%.

|

|

|

|

|

| Management’s Discussion and Analysis

December 31, 2014 |

|

M-19 |

|

Stantec Inc. |

Gross and Net Revenue

The following discussion includes forward-looking statements. For an outline of the material risks and assumptions associated with these statements, refer to

the Cautionary Note Regarding Forward-Looking Statements at the end of this report. For definitions of “gross revenue” and “net revenue,” refer to Definition of Additional IFRS Measures in the Definitions section of this

report.

Revenue earned by acquired companies in the first 12 months following acquisition is reported as revenue from acquisitions and, thereafter, as

organic growth.

Each business operating unit generates a portion of gross revenue in the United States. The value of the Canadian dollar averaged US$0.91

in 2014 compared to US$0.97 in 2013—a 6.2% decrease. The weakening of the Canadian dollar for the year had a positive effect on revenue reported in 2014 compared to 2013.

Our contract backlog grew 28.6%—from $1.4 billion at December 31, 2013, to $1.8 billion at December 31, 2014. A significant majority of this

increase resulted from recent project wins and acquisitions completed in the year. We define “backlog” as the total value of secured work that has not yet been completed where we have an executed contract or a letter of intent that

management is reasonably assured will be finalized in a formal contract (further described in the Definitions section of this report). Only approximately the first 12 to 18 months of the total value of secured work for a project is included in

contract backlog.

The following tables summarize the impact of acquisition growth, organic growth, and foreign exchange on our gross and net revenue for

2014 compared to 2013:

|

|

|

|

|

| Management’s Discussion and Analysis

December 31, 2014 |

|

M-20 |

|

Stantec Inc. |

|

|

|

|

|

| Gross Revenue

(In millions of Canadian dollars) |

|

2014 vs. 2013 |

|

|

|

| Increase due to |

|

|

|

|

| Acquisition growth |

|

|

144.6 |

|

| Organic growth |

|

|

86.4 |

|

| Impact of foreign exchange rates on revenue earned by foreign subsidiaries |

|

|

62.5 |

|

|

|

| Total net increase in gross revenue |

|

|

293.5 |

|

|

|

| Net Revenue

(In millions of Canadian dollars) |

|

2014 vs. 2013 |

|

| Increase due to |

|

|

|

|

| Acquisition growth |

|

|

119.6 |

|

| Organic growth |

|

|

74.8 |

|

| Impact of foreign exchange rates on revenue earned by foreign subsidiaries |

|

|

48.5 |

|

|

|

| Total net increase in net revenue |

|

|

242.9 |

|

The increase in acquisition gross and net revenue in 2014 compared to 2013 was due to the revenue earned in 2013 that was

attributed to the acquisitions listed in the Gross Revenue by Region and Gross Revenue by Business Operating Unit sections below. We experienced increases in organic gross revenue in 2014 compared to 2013 in all regions and all business operating

units.

Gross Revenue by Region

The following charts and

tables summarize gross revenue and gross revenue growth in our three regional operating units—Canada, United States, and International:

|

|

|

|

|

| Management’s Discussion and Analysis

December 31, 2014 |

|

M-21 |

|

Stantec Inc. |

The following table summarizes the growth in gross revenue by region for 2014 compared to 2013:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (In millions of Canadian dollars) |

|

Year Ended

Dec 31,

2014 |

|

|

Year Ended

Dec 31,

2013 |

|

|

Total

Change |

|

|

Change Due

to

Acquisitions |

|

|

Change Due

to Organic

Growth |

|

|

Change Due

to Foreign

Exchange |

|

|

|

|

|

|

|

|

| Canada |

|

|

1,346.6 |

|

|

|

1,290.2 |

|

|

|

56.4 |

|

|

|

7.8 |

|

|

|

48.6 |

|

|

|

n/a |

|

| United States |

|

|

1,090.6 |

|

|

|

867.5 |

|

|

|

223.1 |

|

|

|

136.8 |

|

|

|

23.8 |

|

|

|

62.5 |

|

| International |

|

|

92.7 |

|

|

|

78.7 |

|

|

|

14.0 |

|

|

|

- |

|

|

|

14.0 |

|

|

|

- |

|

|

|

|

|

|

|

|

| Total |

|

|

2,529.9 |

|

|

|

2,236.4 |

|

|

|

293.5 |

|

|

|

144.6 |

|

|

|

86.4 |

|

|

|

62.5 |

|

Total gross revenue was positively impacted by acquisitions completed in 2013 and 2014, by organic growth, and by the

weakening of the Canadian dollar in 2014 compared to 2013.

Following is a list of acquisitions completed in 2013 and 2014 that impacted specific regions

during 2014:

| |

• |

|

Canada: Ashley-Pryce Interior Designers Inc. (AP/ID) (May 2013); JDA Architects Limited (JDA) (November 2013); and Cambria Gordon Ltd. (CGL) (November 2013) |

| |

• |

|

United States: IBE Consulting Engineers, Inc. (IBE) (May 2013); Roth Hill, LLC (Roth Hill) (June 2013); Williamsburg Environmental Group, Inc. and Cultural Resources, Inc. (WEG) (January 2014); Processes