UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

MARK ONE

☒ Quarterly Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

for the Quarterly Period ended March 31, 2016; or

☐ Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

for the transition period from ________ to ________

ZION OIL & GAS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 20-0065053 | |

| (State or other jurisdiction of | (I.R.S. Employer | |

| incorporation or organization) | Identification No.) | |

| 12655 N Central Expressway, Suite 1000, Dallas, TX | 75243 | |

| (Address of principal executive offices) | Zip Code |

(214) 221-4610

(Registrant's telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |

| Non-accelerated filer | ☐ | (Do not check if a smaller reporting company) | Smaller reporting company | ☒ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of April 29, 2016, Zion Oil & Gas, Inc. had outstanding 39,145,163 shares of common stock, par value $0.01 per share.

INDEX PAGE

PART 1 – FINANCIAL INFORMATION

| Page | |||

| Item 1 – Financial Statements – Unaudited | 1 | ||

| Balance Sheets – March 31, 2016 and December 31, 2015 | 1 | ||

| Statements of Operations for the three months ended March 31, 2016 and 2015 | 2 | ||

| Statements of Changes in Stockholders' Equity for the three months ended March 31, 2016 | 3 | ||

| Statements of Cash Flows for the three months ended March 31, 2016 and 2015 | 4 | ||

| Notes to Financial Statements | 5 | ||

| Item 2 – Management's Discussion and Analysis of Financial Condition and Results of Operations | 17 | ||

| Item 3 – Quantitative and Qualitative Disclosures About Market Risk | 27 | ||

| Item 4 – Controls and Procedures | 28 | ||

| PART II — OTHER INFORMATION | |||

| Item 1 – Legal Proceedings | 29 | ||

| Item 1A – Risk Factors | 29 | ||

| Item 2 – Unregistered Sales of Equity Securities and Use of Proceeds | 29 | ||

| Item 3 – Defaults upon Senior Securities | 29 | ||

| Item 4 – Mine Safety Disclosures | 29 | ||

| Item 5 – Other Information | 30 | ||

| Item 6 – Exhibits | 30 | ||

| Exhibit Index | 30 | ||

| SIGNATURES | 31 | ||

Zion Oil & Gas, Inc.

Balance Sheets as of (Unaudited)

| March 31, 2016 | December 31, 2015 | |||||||

| US$ thousands | US$ thousands | |||||||

| Current assets | ||||||||

| Cash and cash equivalents | 3,900 | 2,871 | ||||||

| Fixed short term bank deposits – restricted | 1,269 | 1,301 | ||||||

| Prepaid expenses and other | 347 | 360 | ||||||

| Deferred offering cost | 136 | 134 | ||||||

| Other receivables | 1,158 | 374 | ||||||

| Total current assets | 6,810 | 5,040 | ||||||

| Unproved oil and gas properties, full cost method | 5,459 | 5,022 | ||||||

| Property and equipment at cost | ||||||||

| Net of accumulated depreciation of $488 and $473 | 141 | 144 | ||||||

| Other assets | ||||||||

| Assets held for severance benefits | 245 | 226 | ||||||

| Total assets | 12,655 | 10,432 | ||||||

| Liabilities and Stockholders’ Equity | ||||||||

| Current liabilities | ||||||||

| Accounts payable | 301 | 396 | ||||||

| Asset retirement obligation | 201 | 204 | ||||||

| Accrued liabilities | 298 | 853 | ||||||

| Total current liabilities | 800 | 1,453 | ||||||

| Long-term liabilities | ||||||||

| 10% Senior convertible bonds (see Note 6) | 3,470 | - | ||||||

| Provision for severance pay | 275 | 249 | ||||||

| Total long-term liabilities | 3,745 | 249 | ||||||

| Total liabilities | 4,545 | 1,702 | ||||||

| Commitments and contingencies (see Note 5) | ||||||||

| Stockholders’ equity | ||||||||

| Common stock, par value $.01; Authorized: 200,000,000 shares at March 31, 2016: Issued and outstanding: 38,838,723 and 38,220,258 shares at March 31, 2016 and December 31, 2015 respectively | 388 | 382 | ||||||

| Additional paid-in capital | 151,376 | 150,450 | ||||||

| Accumulated deficit | (143,654 | ) | (142,102 | ) | ||||

| Total stockholders’ equity | 8,110 | 8,730 | ||||||

| Total liabilities and stockholders’ equity | 12,655 | 10,432 | ||||||

The accompanying notes are an integral part of the unaudited interim financial statements.

| 1 |

Zion Oil & Gas, Inc.

Statements of Operations (Unaudited)

| For the three months ended March 31, | ||||||||

| 2016 | 2015 | |||||||

| US$ thousands | US$ thousands | |||||||

| General and administrative | 1,172 | 1,920 | ||||||

| Other | 391 | 466 | ||||||

| Loss from operations | (1,563 | ) | (2,386 | ) | ||||

| Other income (expense), net | ||||||||

| Foreign exchange gains,(loss) | 21 | (13 | ) | |||||

| Financial (expenses), net | (10 | ) | (10 | ) | ||||

| Loss before income taxes | (1,552 | ) | (2,409 | ) | ||||

| Income taxes | — | — | ||||||

| Net loss | (1,552 | ) | (2,409 | ) | ||||

| Net loss per share of common stock - basic and diluted (in US$) | (0.04 | ) | (0.07 | ) | ||||

| Weighted-average shares outstanding–basic and diluted (in thousands) | 38,995 | 36,030 | ||||||

The accompanying notes are an integral part of the unaudited interim financial statements.

| 2 |

Zion Oil & Gas, Inc.

Statements of Changes in Stockholders’ Equity (Unaudited)

| Common Stock | Additional paid-in | Accumulated | ||||||||||||||||||

| Shares | Amounts | Capital | deficit | Total | ||||||||||||||||

| thousands | US$ thousands | US$ thousands | US$ thousands | US$ thousands | ||||||||||||||||

| Balances as of December 31, 2015 | 38,220 | 382 | 150,450 | (142,102 | ) | 8,730 | ||||||||||||||

| Funds received from sale of DSPP units and shares | 306 | 3 | 754 | — | 757 | |||||||||||||||

| Funds received from option exercises | 312 | 3 | — | — | 3 | |||||||||||||||

| Value of options granted to employees, directors and others | — | — | 172 | — | 172 | |||||||||||||||

| Net loss | — | — | — | (1,552 | ) | (1,552 | ) | |||||||||||||

| Balances as of March 31, 2016 | 38,838 | 388 | 151,376 | (143,654 | ) | 8,110 | ||||||||||||||

The accompanying notes are an integral part of the unaudited interim financial statements.

| 3 |

Zion Oil & Gas, Inc.

Statements of Cash Flows (Unaudited)

| For the three months ended March 31, | ||||||||

| 2016 | 2015 | |||||||

| US$ thousands | US$ thousands | |||||||

| Cash flows from operating activities | ||||||||

| Net loss | (1,552 | ) | (2,409 | ) | ||||

| Adjustments required to reconcile net loss to net cash used in operating activities: | ||||||||

| Depreciation | 15 | 16 | ||||||

| Cost of options issued to employees, directors & others | 172 | 178 | ||||||

| Interest on short term bank deposits | (10 | ) | 17 | |||||

| Change in assets and liabilities, net: | ||||||||

| Prepaid expenses and other | 13 | 38 | ||||||

| Change in other receivables | 31 | 140 | ||||||

| Severance pay, net | 7 | 5 | ||||||

| Accounts payable | (281 | ) | (33 | ) | ||||

| Accrued liabilities | (562 | ) | 791 | |||||

| Asset retirement obligation | (3 | ) | (14 | ) | ||||

| Net cash used in operating activities | (2,170 | ) | (1,271 | ) | ||||

| Cash flows from investing activities | ||||||||

| Investment in short term bank deposits | 42 | 531 | ||||||

| Acquisition of property and equipment | (12 | ) | (1 | ) | ||||

| Investment in unproved oil and gas properties | (244 | ) | (217 | ) | ||||

| Net cash (used in) provided by investing activities | (214 | ) | 313 | |||||

| Cash flows from financing activities | ||||||||

| Proceeds from sale of 10% Senior Convertible Bonds | 2,655 | - | ||||||

| Deferred offering cost | (2 | ) | - | |||||

| Proceeds from sale of stock and exercise of options | 760 | 428 | ||||||

| Net cash provided by financing activities | 3,413 | 428 | ||||||

| Net decrease in cash and cash equivalents | 1,029 | (530 | ) | |||||

| Cash and cash equivalents – beginning of period | 2,871 | 5,344 | ||||||

| Cash and cash equivalents – end of period | 3,900 | 4,814 | ||||||

| Non-cash investing and financing activities: | ||||||||

| 10% Senior convertible bonds - cash held in escrow | 815 | - | ||||||

| Cost of options capitalized to oil & gas properties | - | 7 | ||||||

| Unpaid investments in oil & gas properties | 248 | 72 | ||||||

The accompanying notes are an integral part of the unaudited interim financial statements.

| 4 |

Zion Oil & Gas, Inc.

Notes to Financial Statements (Unaudited)

Note 1 - Nature of Operations and Basis of Presentation

| A. | Nature of Operations |

Zion Oil & Gas, Inc., a Delaware corporation (“we,” “our,” “Zion” or the “Company”) is an oil and gas exploration company with a history of more than 16 years of oil and gas exploration in Israel. As of March 31, 2016, the Company had no revenues from its oil and gas operations.

Exploration Rights/Exploration Activities

Zion currently holds one active petroleum exploration license onshore Israel, the Megiddo-Jezreel License (“MJL”), comprising approximately 99,000 acres. The Company has selected the specific drill pad location from which to drill its next exploration well, which it plans to spud within the third quarter of 2016. The drilling of this well to the desired depth is subject to the Company raising sufficient funds from equity or debt offerings, of which no assurance can be provided (see Note 6).

Megiddo-Jezreel Petroleum License (“MJL”)

The MJL was awarded on December 3, 2013 for a three-year primary term through December 2, 2016, with the possibility of additional one-year extensions up to a maximum of seven years. The MJL is onshore, south and west of the Sea of Galilee.

Under the terms of this license, the Company had until July 1, 2015 to identify and submit a drilling prospect. The license terms also called for it to enter into a drilling contract by October 1, 2015 and begin drilling or “spud” a well by December 1, 2015.

On January 29, 2016, the Company submitted a second Application for Extension of Drilling Date, and on February 7, 2016, the Petroleum Commissioner formally approved the application as follows:

| NO. | ACTIVITY DESCRIPTION | TO BE CARRIED OUT BY: |

| 1 | Sign contract with drilling contractor and forward to Petroleum Commissioner | 15 April 2016 |

| 2 | Submit detailed engineering plan to carry out / perform drilling | 15 April 2016 |

| 3 | Begin drilling / spud well in license area | 1 July 2016 |

| 4 | Submit final report on the results of drilling | 15 November 2016 |

| 5 | Submit a plan for continued work in the license area | 1 December 2016 |

The Company is in negotiations with prospective drilling contractor(s) for the provision of an appropriate drilling rig (for lease and/or purchase) and staff. The Company is also in negotiations with the local kibbutz (Sde Eliyahu) on whose property the drilling pad is situated for access and drilling rights. Finally, the Company needs the requisite authorization from the Israel Lands Authority (the “ILA”), the formal lessor of the land to the Kibbutz, to access and utilize the drill site. The Company has filed with ILA all of the requisite applications and, as of the date of this report, the Company has not received formal approval from the ILA. These are critical agreements that are necessary before spudding of the planned Megiddo-Jezreel #1 well can commence.

Zion’s Former Jordan Valley, Joseph, and Asher-Menashe Licenses

On March 29, 2015, the Energy Ministry formally approved Zion’s application to merge the southernmost portion of the Jordan Valley License into the Megiddo-Jezreel License. The Company has plugged all of its exploratory wells (in the former Joseph and Asher-Menashe Licenses) but acknowledges its obligation to complete the abandonment of these well sites in accordance with guidance from the Environmental Ministry and local officials.

| 5 |

Zion Oil & Gas, Inc.

Notes to Financial Statements cont’d (Unaudited)

Note 1 - Nature of Operations and Basis of Presentation (cont’d)

| B. | Basis of Presentation |

The accompanying unaudited interim financial statements of Zion Oil & Gas, Inc. have been prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”) for interim financial information and with Article 8-03 of Regulation S-X. Accordingly, they do not include all of the information and notes required by GAAP for complete financial statements. In the opinion of management, all adjustments, consisting only of normal recurring accruals necessary for a fair statement of financial position, results of operations and cash flows, have been included. The information included in this Quarterly Report on Form 10-Q should be read in conjunction with the financial statements and the accompanying notes included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2015. The year-end balance sheet data presented for comparative purposes was derived from audited financial statements, but does not include all disclosures required by GAAP. The results of operations for the three months ended March 31, 2016 are not necessarily indicative of the operating results for the year ending December 31, 2016 or for any other subsequent interim period.

To date, the Company has not achieved a discovery of either oil or natural gas in commercial quantities. The Company incurs cash outflows from operations and all exploration activities and overhead expenses to date have been financed by way of equity and debt financing. The recoverability of the costs incurred to date is uncertain and dependent upon achieving significant commercial production.

The Company’s ability to continue as a going concern is dependent upon obtaining the necessary financing to undertake further exploration and development activities and ultimately generating profitable operations from its oil and natural gas interests in the future. The Company’s current operations are dependent upon the adequacy of its current assets to meet its current expenditure requirements and the accuracy of management’s estimates of those requirements. Should those estimates be materially incorrect, the Company’s ability to continue as a going concern may be impaired. The financial statements have been prepared on a going concern basis, which contemplates realization of assets and liquidation of liabilities in the ordinary course of business. During the three months ended March 31, 2016, the Company incurred a net loss of approximately $1.6 million and had an accumulated deficit of approximately $143.7 million. These factors raise substantial doubt about the Company’s ability to continue as a going concern.

The Company expects to incur additional significant expenditures to further its exploration program. Management is of the opinion that its currently available cash resources are sufficient to finance its plan of operations through July 2016.

To carry out further planned operations beyond that date, the Company must raise additional funds through additional equity and/or debt issuances. There can be no assurance that this capital will be available, and if it is not, the Company may be forced to curtail or cease exploration and development activities, including the drilling of the planned MJL exploratory well. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

| 6 |

Zion Oil & Gas, Inc.

Notes to Financial Statements cont’d (Unaudited)

Note 2 - Summary of Significant Accounting Policies

| A. | Net Loss per Share Data |

Basic and diluted net loss per share of common stock, par value $0.01 per share (the “Common Stock”), is presented in conformity with ASC 260-10 “Earnings Per Share.” Diluted net loss per share is the same as basic net loss per share as the inclusion of 6,039,104 and 4,785,118 Common Stock equivalents in the three-month period ended March 31, 2016 and 2015 respectively, would be anti-dilutive.

| B. | Use of Estimates |

The preparation of the accompanying financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions about future events. These estimates and the underlying assumptions affect the amounts of assets and liabilities reported, disclosures about contingent assets and liabilities, and reported amounts of revenues and expenses. Such estimates include the valuation of unproved oil and gas properties, deferred tax assets, asset retirement obligations and legal contingencies. These estimates and assumptions are based on management’s best estimates and judgment. Management evaluates its estimates and assumptions on an ongoing basis using historical experience and other factors, including the current economic environment, which management believes to be reasonable under the circumstances. The Company adjusts such estimates and assumptions when facts and circumstances dictate. Illiquid credit markets, volatile equity, foreign currency, and energy markets have combined to increase the uncertainty inherent in such estimates and assumptions. As future events and their effects cannot be determined with precision, actual results could differ significantly from these estimates. Changes in those estimates resulting from continuing changes in the economic environment will be reflected in the financial statements in future periods.

| C. | Oil and Gas Properties and Impairment |

The Company follows the full-cost method of accounting for oil and gas properties. Accordingly, all costs associated with acquisition, exploration and development of oil and gas reserves, including directly related overhead costs, are capitalized.

All capitalized costs of oil and gas properties, including the estimated future costs to develop proved reserves, are amortized on the unit-of-production method using estimates of proved reserves. Investments in unproved properties and major development projects are not amortized until proved reserves associated with the projects can be determined or until impairment occurs. If the results of an assessment indicate that the properties are impaired, the amount of the impairment is included in loss from continuing operations before income taxes and the adjusted carrying amount of the unproved properties is amortized on the unit-of-production method.

The Company’s oil and gas property represents an investment in unproved properties. These costs are excluded from the amortized cost pool until proved reserves are found or until it is determined that the costs are impaired. All costs excluded are reviewed at least quarterly to determine if impairment has occurred. The amount of any impairment is charged to expense since a reserve base has not yet been established. Impairment requiring a charge to expense may be indicated through evaluation of drilling results, relinquishing drilling rights or other information.

Currently, the Company has no economically recoverable reserves and no amortization base. The Company’s unproved oil and gas properties consist of capitalized exploration costs of $5,459,000 and $5,022,000 as of March 31, 2016 and December 31, 2015, respectively.

| 7 |

Zion Oil & Gas, Inc.

Notes to Financial Statements cont’d (Unaudited)

Note 2 - Summary of Significant Accounting Policies (cont’d)

| D. | Recently Adopted Accounting Pronouncements |

We do not believe that the adoption of any recently issued accounting pronouncements in 2016 had a significant impact on our financial position, results of operations, or cash flow.

Note 3 - Stockholders’ Equity

| A. | 2011 Equity Incentive Plan for employees and consultants |

During the three months ended March 31, 2016, the Company granted the following options from the 2011 Equity Incentive Plan for employees and consultants, to purchase:

| i. | 25,000 shares of Common Stock to a senior officer at an exercise price of $0.01. The options vested upon grant and are exercisable through December 31, 2025. The fair value of the options at the date of grant amounted to approximately $46,000. | |

| ii. | 25,000 shares of Common Stock to a senior officer at an exercise price of $0.01. The options vested upon grant and are exercisable through January 4, 2026. The fair value of the options at the date of grant amounted to approximately $47,000. | |

| iii. | 35,000 shares of Common Stock to a non-employee director and a staff member at an exercise price of $0.01 per share. The options vested upon grant and are exercisable through January 15, 2026. The fair value of the options at the date of grant amounted to approximately $59,000 (see Note 6). |

| B. | 2011 Non-Employee Directors Stock Option Plan |

During the three months ended March 31, 2016, the Company granted the following options from the 2011 Non-Employee Directors Stock Option Plan, to purchase:

| i. | 25,000 shares of Common Stock to a non-employee director at an exercise price of $1.87 per share. The options vested upon grant and are exercisable through January 31, 2022. The fair value of the options at the date of grant amounted to approximately $20,000 (see Note 6). |

| C. | Stock Options |

The stock option transactions since January 1, 2016 are shown in the table below:

| Weighted average | ||||||||

| Number of shares | exercise

price | |||||||

| US$ | ||||||||

| Outstanding, December 31, 2015 | 3,629,693 | 1.76 | ||||||

| Changes during 2016 to: | ||||||||

| Granted to employees, officers, directors and others | 110,000 | 0.43 | ||||||

| Expired/Cancelled/Forfeited | (102,500 | ) | 3.23 | |||||

| Exercised | (312,000 | ) | 0.01 | |||||

| Outstanding, March 31, 2016 | 3,325,193 | 1.83 | ||||||

| Exercisable, March 31, 2016 | 3,325,193 | 1.83 | ||||||

| 8 |

Zion Oil & Gas, Inc.

Notes to Financial Statements cont’d (Unaudited)

Note 3 - Stockholders’ Equity (cont’d)

| Shares underlying outstanding options (non-vested) | Shares underlying outstanding options (fully vested) | ||||||||||||||||||||||||||||

| Range

of exercise price |

Number outstanding | Weighted average remaining contractual life (years) | Weighted Average Exercise price |

Range

of exercise price |

Number Outstanding |

Weighted average remaining contractual life (years) | Weighted Average Exercise price |

||||||||||||||||||||||

| US$ | US$ | US$ | US$ | ||||||||||||||||||||||||||

| — | — | — | — | 0.01 | 2,500 | 9.01 | 0.01 | ||||||||||||||||||||||

| — | — | — | — | 0.01 | 29,500 | 05 | 0.01 | ||||||||||||||||||||||

| — | — | — | — | 0.01 | 15,000 | 8.20 | 0.01 | ||||||||||||||||||||||

| — | — | — | — | 0.01 | 45,000 | 8.00 | 0.01 | ||||||||||||||||||||||

| — | — | — | — | 0.01 | 43,500 | 7.62 | 0.01 | ||||||||||||||||||||||

| — | — | — | — | 0.01 | 20,000 | 3.84 | 0.01 | ||||||||||||||||||||||

| — | — | — | — | 0.01 | 72,500 | 9.35 | 0.01 | ||||||||||||||||||||||

| — | — | — | — | 0.01 | 75,000 | 9.51 | 0.01 | ||||||||||||||||||||||

| — | — | — | — | 0.01 | 25,000 | 9.75 | 0.01 | ||||||||||||||||||||||

| — | — | — | — | 1.38 | 108,000 | 4.76 | 1.38 | ||||||||||||||||||||||

| — | — | — | — | 1.38 | 149,750 | 8.76 | 1.38 | ||||||||||||||||||||||

| — | — | — | — | 1.67 | 390,000 | 4.51 | 1.67 | ||||||||||||||||||||||

| — | — | — | — | 1.67 | 514,443 | 51 | 1.67 | ||||||||||||||||||||||

| — | — | — | — | 1.70 | 358,500 | 6.73 | 1.70 | ||||||||||||||||||||||

| — | — | — | — | 1.70 | 120,000 | 2.73 | 1.70 | ||||||||||||||||||||||

| — | — | — | — | 1.73 | 25,000 | 2.78 | 1.73 | ||||||||||||||||||||||

| — | — | — | — | 1.82 | 25,000 | 1.20 | 1.82 | ||||||||||||||||||||||

| — | — | — | — | 1.86 | 25,000 | 2.68 | 1.86 | ||||||||||||||||||||||

| — | — | — | — | 1.87 | 25,000 | 5.84 | 1.87 | ||||||||||||||||||||||

| — | — | — | — | 1.95 | 25,000 | 4.01 | 1.95 | ||||||||||||||||||||||

| — | — | — | — | 1.96 | 25,000 | 3.43 | 1.96 | ||||||||||||||||||||||

| — | — | — | — | 2.03 | 25,000 | 5.09 | 2.03 | ||||||||||||||||||||||

| — | — | — | — | 2.28 | 25,000 | 3.28 | 2.28 | ||||||||||||||||||||||

| — | — | — | — | 2.61 | 150,000 | 1.68 | 2.61 | ||||||||||||||||||||||

| — | — | — | — | 2.61 | 1,006,500 | 5.68 | 2.61 | ||||||||||||||||||||||

| - | - | - | 0.01-2.61 | 3,325,193 | 1.83 | ||||||||||||||||||||||||

| 9 |

Zion Oil & Gas, Inc.

Notes to Financial Statements cont’d (Unaudited)

Note 3 - Stockholders’ Equity (cont’d)

Granted to employees

The following table sets forth information about the weighted-average fair value of options granted to employees and directors during the three months ended March 31, 2016 and 2015, using the Black Scholes option-pricing model and the weighted-average assumptions used for such grants:

| For

the three months ended March 31, |

||||||||

| 2016 | 2015 | |||||||

| Weighted-average fair value of underlying stock at grant date | $ | 1.81 | $ | 1.38 | ||||

| Dividend yields | — | — | ||||||

| Expected volatility | 62%-69 | % | 69%-70 | % | ||||

| Risk-free interest rates | 1.01%-1.76 | % | 1.07%-1.61 | % | ||||

| Expected lives (in years) | 3.00-5.50 | 3.00-5.25 | ||||||

| Weighted-average grant date fair value | $ | 1.56 | $ | 0.73 | ||||

Granted to non-employees

The following table sets forth information about the weighted-average fair value of options granted to non-employees during the three months ended March 31, 2016 and 2015, using the Black Scholes option-pricing model and the weighted-average assumptions used for such grants:

| For

the three months ended March 31, | ||||||||

| 2016 | 2015 | |||||||

| Weighted-average fair value of underlying stock at grant date | $ | — | $ | 1.38 | ||||

| Dividend yields | — | — | ||||||

| Expected volatility | — | 74 | % | |||||

| Risk-free interest rates | — | 2.12 | % | |||||

| Expected lives (in years) | — | 10.00 | ||||||

| Weighted-average grant date fair value | $ | — | $ | 1.08 | ||||

The risk-free interest rate is based on the U.S. Treasury yield curve in effect at the time of grant for periods corresponding with the expected life of the options.

The expected life represents the weighted average period of time that options granted are expected to be outstanding. The expected life of the options granted to employees and directors is calculated based on the Simplified Method as allowed under Staff Accounting Bulletin No. 110 (“SAB 110”), giving consideration to the contractual term of the options and their vesting schedules, as the Company does not have sufficient historical exercise data at this time. The expected life of the option granted to non-employees equals their contractual term. In the case of an extension of the option life, the calculation was made on the basis of the extended life.

| 10 |

Zion Oil & Gas, Inc.

Notes to Financial Statements cont’d (Unaudited)

Note 3 - Stockholders’ Equity (cont’d)

| D. | Compensation Cost for Option Issuances |

The following table sets forth information about the compensation cost of all option issuances recognized for employees and directors:

| For the three months ended March 31, | ||||||

| 2016 | 2015 | |||||

| US$ | US$ | |||||

| 172,000 | 174,000 | |||||

The following table sets forth information about the compensation cost of all option issuances recognized for non-employees:

| For the three months ended March 31, | ||||||

| 2016 | 2015 | |||||

| US$ | US$ | |||||

| - | 11,000 | |||||

| E. | Dividend Reinvestment and Stock Purchase Plan (“DSPP”) |

On March 27, 2014, the Company launched its Dividend Reinvestment and Stock Purchase Plan (the “DSPP”) pursuant to which stockholders and interested investors can purchase shares of the Company’s Common Stock as well as units of the Company’s securities. The terms of the DSPP are described in the Prospectus Supplement originally filed on March 31, 2014 (the “Original Prospectus Supplement”) with the Securities and Exchange Commission (“SEC”) under the Company’s effective registration Statement on Form S-3, as thereafter amended. On January 13, 2015, the Company amended the Original Prospectus Supplement (“Amendment No. 3”) to provide for a unit option (the “Unit Option”) under the DSPP comprised of one share of Common Stock and three (3) Common Stock purchase warrants with each unit priced at $4.00. Each warrant afforded the investor or stockholder the opportunity to purchase the Company’s Common Stock at a warrant exercise price of $1.00. Each of the three warrant series have different expiration dates that have been extended.

On December 28, 2015, Amendment No. 6 to the Original Prospectus Supplement was filed extending the scheduled termination date of the Unit Option to March 31, 2016. On March 31, 2016, the Unit Option terminated. They are not in a sufficient quantity to justify OTC trading.

The warrants became first exercisable on May 2, 2016 (the first exercise day after the 31st day following the Unit Option Termination Date) and continue to be exercisable through May 2, 2017 for ZNWAB (1 year), May 2, 2018 for ZNWAC (2 years) and May 2, 2019 for ZNWAD (3 years), respectively, at a per share exercise price of $1.00.

Through the three months ended March 31, 2016, approximately $757,000 has been raised under the DSPP program. As a result, the Company issued approximately 306,000 shares of its Common Stock during the same period.

Additionally, warrants for approximately 286,000 shares of Common Stock were issued during the three months ended March 31, 2016 (approximately 95,000 each of ZNWAB, ZNWAC, and ZNWAD). The total amount of funds received from the DSPP from the inception date through March 31, 2016 is approximately $9,444,000.

| 11 |

Zion Oil & Gas, Inc.

Notes to Financial Statements cont’d (Unaudited)

Note 3 - Stockholders’ Equity (cont’d)

| F. | Warrant Descriptions |

The price and the expiration dates for the series of warrants to investors are as follows:

| Period of Grant | US$ | Expiration Date | ||||||

| ZNWAA Warrants | March 2013 – December 2014 | 2.00 | January 31, 2020 | |||||

On February 2, 2015, the ZNWAA listed warrants began trading on the NASDAQ Global Market but on February 11, 2015, NASDAQ halted trading on the ZNWAA warrants pending the Company’s response to NASDAQ's request for additional information. As of April 9, 2015, ZNWAA is listed on NASDAQ for trading.

Note 4 - Unproved Oil and Gas Properties, Full Cost Method

Unproved oil and gas properties, under the full cost method, are comprised as follows:

| March 31, 2016 | December 31, 2015 | |||||||

| US$ thousands | US$ thousands | |||||||

| Excluded from amortization base: | ||||||||

| Inventory, and other operational related costs | 1,620 | 1,312 | ||||||

| Capitalized salary costs | 1,218 | 1,177 | ||||||

| Legal costs, license fees and other preparation costs | 2,591 | 2,506 | ||||||

| Other costs | 30 | 27 | ||||||

| 5,459 | 5,022 | |||||||

| 12 |

Zion Oil & Gas, Inc.

Notes to Financial Statements cont’d (Unaudited)

Note 5 - Commitments and Contingencies

| A. | Litigation |

From time to time, the Company may be subject to routine litigation, claims, or disputes in the ordinary course of business. The Company defends itself vigorously in all such matters. In the opinion of management, no pending or known threatened claims, actions or proceedings against the Company are expected to have a material adverse effect on its financial position, results of operations or cash flows. However, the Company cannot predict with certainty the outcome or effect of any such litigation or investigatory matters or any other pending litigation or claims. There can be no assurance as to the ultimate outcome of any such lawsuits and investigations.

| B. | Environmental and Onshore Licensing Regulatory Matters |

The Company is engaged in oil and gas exploration and production and may become subject to certain liabilities as they relate to environmental cleanup of well sites or other environmental restoration procedures and other obligations as they relate to the drilling of oil and gas wells or the operation thereof.

In July 2013, the Environmental Ministry published: “Environmental Guidelines for the preparation of an environmental document supplementary to a license for searching – experimental drilling and land extraction tests.” This document extensively details the requirements for a supplemental environmental document to an oil and gas exploration plan. On January 21, 2015, the Company formally submitted its Environmental Impact Assessment (“EIA”) document for our upcoming Megiddo-Jezreel #1 well to Israel’s Energy Ministry and thereafter, on January 25, 2015, to the Environmental Ministry. This key milestone is required by the MJL work plan as well as by Israeli law and regulations.

On December 3, 2013, the State of Israel’s Petroleum Commissioner awarded the Company the Megiddo-Jezreel Petroleum Exploration License No. 401. Subsequently, the Company secured a bank guarantee from an Israeli based bank in the amount of $930,000, in accordance with the performance guarantee guidelines. Consequently, Zion believes it has met the requirements of the June 2012 onshore exploratory licensing guidelines and the October 2012 performance guarantee guidelines.

On February 6, 2014, the Energy Ministry issued proposed guidelines for bank guarantees and insurance requirements with respect to oil and gas rights. Under these guidelines, applicants for and existing holders of exploration rights will be required to submit certain bank guarantees and insurance policies that were not previously required.

On September 17, 2014, the proposed guidelines became effective and the Energy Ministry issued a guidance document entitled “Instructions for the Giving of Guarantees with respect to Oil Rights.” As it relates to existing onshore license holders like Zion, the Instructions call for the Company to obtain a new base bank guarantee in the amount of $500,000, per each existing license area, split into two deposit dates as follows: (1) $250,000 by November 30, 2014 and (2) $250,000 by March 31, 2015.

Furthermore, prior to the start of drilling, an additional bank guarantee of $250,000 will be required at least 14 days before the spud date. In summary, this is a potential cumulative total of $750,000 that is separate and apart from the Company’s existing bank guarantees discussed below in Section C.

The Petroleum Commissioner has discretion to raise or lower those amounts or may also forfeit a Company’s existing guarantee and/or cancel a petroleum right under certain circumstances.

| 13 |

Zion Oil & Gas, Inc.

Notes to Financial Statements cont’d (Unaudited)

Note 5 - Commitments and Contingencies (cont’d)

In addition, new and extended insurance policy guidelines were added. The Petroleum Commissioner may also view non-compliance with the new insurance provisions as breaching the work plan and the rights granted and act accordingly.

Due to the Petroleum Commissioner’s discretion in the matter, the Company has not provided bank guarantees based on the September 2014 guidelines as it has not had a request from the Commissioner. As of March 31, 2016, the Company has not received a specific request seeking payment and therefore, has not yet provided any of the additional bank guarantees called for in the new guidelines.

On January 11, 2015 the Energy Ministry issued revised guidelines (initially issued in February 2012) for onshore wellbore abandonment that are based on U.S. regulations on well abandonment found in 43 CFR, Section 3162.3-4; applicable Texas Railroad Commission guidelines; and Well Abandonment and Inactive Well Practices for U.S. Exploration and Production Operations found in API Bulletin E3. This guideline is effective April 1, 2015.

On February 12, 2015, the Energy Ministry issued guidance for preparation and submission of the drilling program (first presented on April 29, 2014), describing types of and purposes of production tests depending on the stage of development of a reservoir. This guideline is effective April 1, 2015.

On April 27, 2015, the Energy Ministry issued guidelines for well testing, establishing procedures and minimum requirements for pressure testing, production flow testing, fluid analyses testing, etc.

On August 13, 2015, the Energy Ministry issued a new guideline for hydraulic fracturing design and operations that are based on Canadian regulations per Directive 083. This guideline is effective November 21, 2015. The procedures seek to prevent impacts on water wells, non-saline aquifers and prevent surface impacts.

On September 9, 2015, the Energy Ministry issued information relating to application forms for exploration drilling, detailing certain operator requirements prior to drilling, including required submission of an Application for Permit to Drill (APD) and Supplemental APD Information Sheet - Casing Design, both due 30 days prior to commencement of work. In addition, an Application for Permit to Modify (APM) form is provided relating to changes to and modifications of already-approved drilling programs and other actions that were omitted from the original application such as production testing, abandonment, etc. Finally, an End of Operation Report (EOR) form is provided to report the end of drilling or a temporary or a final end of operations.

The Company believes that these new regulations will significantly increase the expenditures associated with obtaining new exploration rights and drilling new wells, coupled with the heavy financial burden of reserving significant amounts of cash that could otherwise be used for operational purposes. Finally, this will also considerably increase the time needed to obtain all of the necessary authorizations and approvals prior to drilling.

| C. | Former Drilling Contract with AME/GYP |

On March 4, 2014, the Company received from the International Court of Arbitration in Paris, France (“ICA”) a request for arbitration in London filed by Guyney Yildizi Petrol Uretim Sondaj Mut, ve Tic A. S. (“GYP”) over a $550,000 drilling rig demobilization fee.

On May 1, 2014, Zion filed an answer in which it denied GYP’s claim for payment of the demobilization fee, and in addition, it asserted a Counterclaim against GYP.

| 14 |

Zion Oil & Gas, Inc.

Notes to Financial Statements cont’d (Unaudited)

Note 5 - Commitments and Contingencies (cont’d)

On April 29, 2015, the arbitrator issued her Partial Award ordering Zion to pay GYP the demobilization fee of $550,000 plus interest in the amount of approximately $237,000, which continues to accrue at the rate of $180.82 per day until paid. However, any Final Award sum was not determinable until resolution of Zion’s fraud and other tort counterclaims against GYP. The Company recorded a provision in the amount of $910,000 to cover the Company's potential liability.

On December 22, 2015, Zion and GYP entered into a Settlement Agreement and Mutual Release resolving the arbitration by which Zion is required to pay the sum of $550,000 to and/or for the benefit of GYP plus required value added tax (“VAT”) and income tax withholding under Israeli tax law. All attorneys’ fees are to be paid by the party incurring same. Netted out of the $550,000 was an old VAT obligation of GYP and most of the required withholding taxes, both of which Zion paid directly to the Israeli Tax Authority (“ITA”). The new VAT paid by Zion on this transaction is recoverable by Zion and should be received from the ITA in the near future. All required sums under the settlement agreement have been paid by Zion and GYP, with the exception of reimbursement to Zion of $47,500 by GYP upon the future filing of certain Israeli tax returns by GYP. On April 25, 2016, a Final Award by Consent was signed by the arbitrator incorporating the terms of the settlement (see Note 6).

| D. | Bank Guarantees |

As of March 31, 2016, the Company provided bank guarantees to various governmental bodies (approximately $1,131,000) and others (approximately $67,000) in respect of its drilling operation in an aggregate amount of approximately $1,198,000. The funds backing these guarantees and additional amounts added to support currency fluctuations as required by the bank are held in interest-bearing accounts and are reported on the Company’s balance sheets as “restricted cash.” (See also Note 6).

Note 6 - Senior Convertible Bonds Rights Offering (October 21, 2015 – March 31, 2016)

10% Senior Convertible Notes due May 2, 2021

On October 21, 2015, the Company filed with the SEC a prospectus supplement for a new rights offering. Under the new rights offering, the Company distributed at no cost, 360,000 non-transferable subscription rights to subscribe for, on a per right basis, two 10% Convertible Senior Bonds par $100 due May 2, 2021 (the “Notes”), to persons who owned shares of the Company’s Common Stock on October 15, 2015, the record date for the offering. Each whole subscription right entitled the participant to purchase two convertible bonds at a purchase price of $100.00 per bond. Effective October 21, 2015, the Company executed a Supplemental Indenture, as issuer, with the American Stock Transfer & Trust Company, LLC, a New York limited liability trust company (“AST”), as trustee for the Notes (the “Indenture”).

The offering was scheduled to terminate on January 15, 2016 but was extended to March 31, 2016. On March 31, 2016, the rights offering terminated.

On May 2, 2016, the Company issued approximately $3,470,000 aggregate principal amount of Notes in connection with the rights offering. The Company received net proceeds of approximately $3,334,000, in which approximately $815,000 are cash held in escrow as of March 31 2016, from the sale of the Notes, after deducting fees and expenses of $136,000 incurred in connection with the rights offering. The Notes are governed by the terms of the Indenture. The Notes are senior unsecured obligations of the Company and bear interest at a rate of 10% per year, payable annually in arrears on May 2 of each year, commencing May 2, 2017. The Notes will mature on May 2, 2021, unless earlier redeemed by the Company or converted by the holder.

Interest and principal may be repaid, at the Company’s option, in shares of the Company’s Common Stock. The number of shares for the payment of interest in shares of Common Stock, in lieu of the cash amount, shall be based on the average of the closing prices of the Company’s Common Stock as reported by Bloomberg L.P. for the 30 trading days preceding the record date for the payment of interest, which we have designated as 10 business days prior to the interest payment date on May 2 of each year. The number of shares for the payment of principal and unpaid interest, in lieu of the cash amount, shall be based upon the average of the closing price of the Company’s Common Stock as reported by Bloomberg L.P. for the 30 trading days preceding the principal repayment date, which we have designated as the trading day immediately prior to the 30 day period preceding the maturity date of May 2, 2021. Fractional shares will not be issued and the final number of shares being rounded up to the next whole share.

At any time prior to the close of business on the business day immediately preceding April 2, 2021, holders may convert their Notes into Common Stock, in multiples of $100 principal amount, at the conversion rate of 44 shares per $100 bond (which is equivalent to $2.27 per share). The conversion rate is subject to adjustment from time to time upon the occurrence of certain events, including, but not limited to, the issuance of stock dividends and payment of cash dividends.

Beginning May 3, 2018, the Company is entitled to redeem for cash the outstanding Notes at an amount equal to the outstanding principal and accrued and unpaid interest, plus a 10% premium. No “sinking fund” is provided for the Notes, which means that we are not required to periodically redeem or retire the Notes.

| 15 |

Zion Oil & Gas, Inc.

Notes to Financial Statements cont’d (Unaudited)

Note 6 - Senior Convertible Bonds Rights Offering (October 21, 2015 – March 31, 2016) (cont’d)

Upon the occurrence of certain fundamental changes involving us, holders of the Notes may require us to repurchase for cash all or part of their Convertible Notes at a repurchase price equal to 100% of the principal amount of the Convertible Notes to be repurchased, plus accrued and unpaid interest. The indenture contains customary terms and covenants and events of default. If an event of default (other than certain events of bankruptcy, insolvency or reorganization involving us) occurs and is continuing, the holders of at least a majority in principal amount of the outstanding Notes by written notice to us and AST, as trustee, or AST, on behalf of and as requested by such holders, may declare 100% of the principal of and accrued and unpaid interest, if any, on all of the Convertible Notes to be due and payable. Upon such a declaration of acceleration, such principal and accrued and unpaid interest, if any, will be due and payable immediately. In case of certain events of bankruptcy, insolvency or reorganization, involving us or a significant subsidiary, 100% of the principal of and accrued and unpaid interest on the notes will automatically become due and payable. Notwithstanding the foregoing, the indenture provides that, to the extent we elect and for up to 365 days, the sole remedy for an event of default relating to certain failures by us to comply with certain reporting covenants in the indenture consists exclusively of the right to receive additional interest on the Convertible Notes.

The indenture does not contain any financial or maintenance covenants or restrictions on the payments of dividends or the issuance or repurchase of securities by us or any of our subsidiaries. There are restrictions on the incurrence of future debt under certain circumstances.

In accordance with accounting guidance for debt with conversion and other options, the Company is currently evaluating the note for derivative accounting treatment; the determination of the accounting treatment will be made in Q2 since the notes were issued on May 2, 2016.

Note 7 - Subsequent Events

Approximately $450,000 was collected through the Company’s DSPP program during the period April 1, 2016 through April 30, 2016. These funds were for the purchase of Zion shares and not for units or bonds since both the units and bonds terminated on March 31, 2016.

Convertible bonds were issued on May 2, 2016 by our trustee, American Stock Transfer & Trust, in the total sum of $3,470,000.

Upon GYP making a required VAT payment to the Israeli Tax Authority and furnishing the required tax receipts to Zion in April, 2016, the arbitration was closed by a Final Award by Consent signed by arbitrator on April 25, 2016.

On May 15, 2016 the Company entered into a surface use agreement with Kibbutz Sde Eliyahu regarding the drilling of the Megiddo-Jezreel #1 well.

A new bank guarantee was deposited for the Contract with Sde Eliyahu for the amount of approximately $10,500.

On April 4, 2016, the Company granted options from the 2011 Equity Incentive Plan for employees and consultants, to purchase 10,000 shares of Common Stock to one senior officer at an exercise price of $0.01 per share. The options vested in equal quarterly installments over four consecutive quarters, beginning with the quarter ended June 30, 2016 and are exercisable through April 3, 2026. The fair value of the options at the date of grant amounted to approximately $18,000.

| 16 |

| ITEM 2. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

THE FOLLOWING DISCUSSION SHOULD BE READ IN CONJUNCTION WITH OUR UNAUDITED INTERIM FINANCIAL STATEMENTS AND THE RELATED NOTES TO THOSE STATEMENTS INCLUDED IN THIS FORM 10-Q. SOME OF OUR DISCUSSION IS FORWARD-LOOKING AND INVOLVES RISKS AND UNCERTAINTIES. FOR INFORMATION REGARDING RISK FACTORS THAT COULD HAVE A MATERIAL ADVERSE EFFECT ON OUR BUSINESS, REFER TO THE DISCUSSION OF RISK FACTORS IN THE “DESCRIPTION OF BUSINESS” SECTION OF OUR ANNUAL REPORT ON FORM 10-K FOR THE YEAR ENDED DECEMBER 31, 2015, FILED WITH THE SECURITIES AND EXCHANGE COMMISSION.

Forward-Looking Statements

Certain statements made in this discussion are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements may materially differ from actual results.

Forward-looking statements can be identified by terminology such as “may”, “should”, “expects”, “intends”, “anticipates”, “believes”, “estimates”, “predicts”, or “continue” or the negative of these terms or other comparable terminology and include, without limitation, statements regarding:

| ● | our ability to explore for and develop oil and natural gas resources successfully and economically; | |

| ● | our liquidity and our ability to raise capital to finance our exploration and development activities; | |

| ● | the quality of our license areas with regard to, among other things, the existence of reserves in economic quantities; | |

| ● | the likelihood of being granted new or revised petroleum exploration rights by Israeli authorities; | |

| ● | the availability of equipment, such as drilling rigs, oil transport trucks, and transportation pipelines and the cost thereof; | |

| ● | the impact of governmental regulations, permitting and other legal requirements in Israel relating to onshore exploratory drilling and production; | |

| ● | our estimates of the timing and number of exploratory wells we expect to drill and other exploration activities and planned expenditures and the time frame within which they will be undertaken; | |

| ● | changes in our drilling plans and related budgets; | |

| ● | anticipated trends in our business; | |

| ● | our future results of operations; | |

| ● | our capital expenditure program; | |

| ● | future market conditions in the oil and gas industry; and | |

| ● | demand for oil and natural gas, both locally in Israel, regionally, and globally. |

| 17 |

Overview

Zion Oil and Gas, Inc., a Delaware corporation, is an oil and gas exploration company with a history of over 16 years of oil and gas exploration in Israel. We were incorporated in Florida on April 6, 2000 and reincorporated in Delaware on July 9, 2003. We completed our initial public offering in January 2007. Our common stock, par value $0.01 per share (the “Common Stock”) currently trades on the NASDAQ Global Market under the symbol “ZN” and our Common Stock warrant under the symbol “ZNWAA.”

Zion currently holds one active petroleum exploration license onshore Israel, the Megiddo-Jezreel License (“MJL”), comprising approximately 99,000 acres. The Company has selected the specific drill pad location from which to drill its next exploration well, which it plans to spud within the third quarter of 2016. We are currently in negotiations with prospective drilling contractor(s) for the provision of an appropriate drilling rig (for lease and/or purchase) and staff. We are also in negotiations with the local kibbutz on whose property the drilling pad is situated for access and drilling rights. Finally, the Company needs the requisite authorization from the Israel Lands Authority, the formal lessor of the land to the Kibbutz, to access and utilize the drill site. The Company has filed with ILA all of the requisite applications and, as of the date of this report, the Company has not received formal approval from the ILA. These are critical agreements that are necessary before spudding of the planned Megiddo-Jezreel #1 well can commence. In addition, the spudding and drilling of this well to the desired depth is subject to the Company raising sufficient working capital from existing shareholders or other investors.

Depending on the results of the planned exploratory well and subject to adequate cash resources, multiple wells could be drilled from this pad site, as several subsurface geologic targets can be reached using directional well trajectories.

At present, we have no revenues or operating income. Our ability to generate future revenues and operating cash flow will depend on the successful exploration and exploitation of our current and any future petroleum rights or the acquisition of oil and/or gas producing properties, and the volume and timing of such production. In addition, even if we are successful in producing oil and gas in commercial quantities, our results will depend upon commodity prices for oil and gas, as well as operating expenses, including taxes and royalties.

Our executive offices are located at 12655 North Central Expressway, Suite 1000, Dallas, Texas 75243, and our telephone number is (214) 221-4610. Our branch office’s address in Israel is 9 Halamish Street, North Industrial Park, Caesarea 3088900, and the telephone number is +972-4-623-8500. Our website address is: www.zionoil.com.

| 18 |

Current Exploration and Operation Efforts

Megiddo-Jezreel Petroleum License

We were awarded the Megiddo-Jezreel License, No. 401 (“MJL”) on December 3, 2013 for a three-year primary term through December 2, 2016 with the possibility of additional one-year extensions up to a maximum of seven years. The MJL is onshore, south and west of the Sea of Galilee.

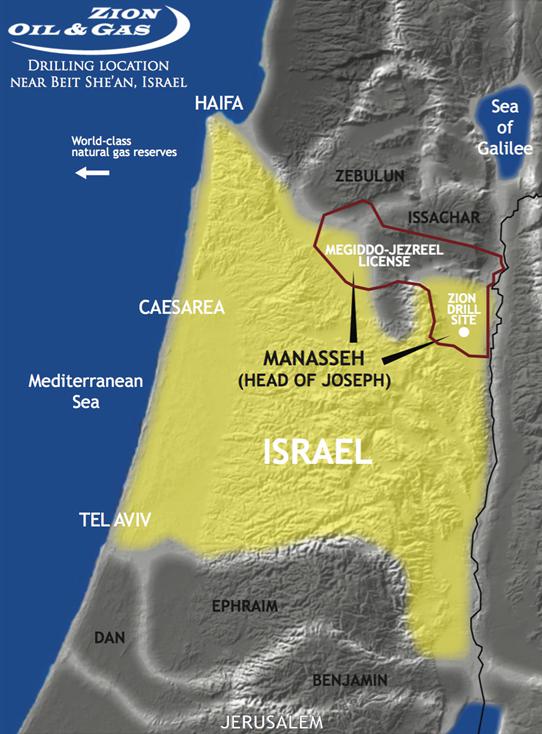

Map 1. Zion’s Megiddo-Jezreel Petroleum Exploration License as of May, 2016.

Under the original terms of this license, we had until July 1, 2015 to identify and submit a drilling prospect. The license terms also called for us to enter into a drilling contract by October 1, 2015 and begin drilling or “spud” a well by December 1, 2015. Zion has twice applied for an extension/revision of the current MJL terms which were both granted, giving us until July 1, 2016 to spud a well within the MJL (see below for additional detail).

| 19 |

In late June 2015, the Company entered into drilling contract negotiations with Viking Services, BV (“Viking”), and Viking’s Israeli subsidiary, for use of a land-based rig with deep drilling capacity and certain other oilfield services for exploration activities within Zion’s MJL. Zion later became aware that Viking was undergoing a restructuring whereby there would be a high-level management change and Viking’s Israel operations would very likely change. Therefore, drilling contract negotiations with Viking were temporarily suspended pending the outcome of the restructuring. Viking’s restructuring efforts have now been completed. We once again resumed negotiations with Viking when they changed the proposed rig and modified the terms on a substitute rig. Negotiations are ongoing in an effort to resolve key differences. However, we are currently exploring other options, including the possible lease and/or purchase of a drilling rig to be used in Israel.

On September 3, 2015, Zion submitted its Application for Extension of Drilling Date (Megiddo-Jezreel License No. 401). The application was based on regulatory and other delays that precluded Zion from spudding the well by December 1, 2015 and sought an extension to March 1, 2016.

On January 29, 2016, we submitted a second Application for Extension of Drilling Date, seeking additional work program date extensions/revisions. On February 7, 2016, the Petroleum Commissioner formally approved the application with minor modifications as follows:

| NO. | ACTIVITY DESCRIPTION | TO BE CARRIED OUT BY: | ||

| 1 | Sign contract with drilling contractor and forward to Petroleum Commissioner | 15 April 2016 | ||

| 2 | Submit detailed engineering plan to carry out / perform drilling | 15 April 2016 | ||

| 3 | Begin drilling / spud well in license area | 1 July 2016 | ||

| 4 | Submit final report on the results of drilling | 15 November 2016 | ||

| 5 | Submit a plan for continued work in the license area | 1 December 2016 |

On December 21, 2015, the Northern District Committee unanimously granted approval of our Drilling Request (“Hafkada”), including the EIA. This is a critically important step to drill a well under Israel’s complex, detailed, and extensive regulatory process.

The final step in the process is for Zion to submit this approved “Hafkada” along with our Application to Drill to Israel’s Energy Ministry for their final drilling program approval. After Zion reaches agreement with the local kibbutz and the Israel Land Authority, we plan to begin drill site construction (which should take 30-45 days to complete). Zion currently has until July 1, 2016 to begin drilling. However, we now plan to seek additional work program date extensions/revisions to allow us to spud the Megiddo-Jezreel #1 well in the third quarter of 2016, subject to the success of our capital raising efforts.

Zion’s Former Jordan Valley, Asher-Menashe and Joseph Licenses

On March 29, 2015, the Energy Ministry formally approved Zion’s application to merge the southernmost portion of the Jordan Valley License into the Megiddo-Jezreel License. The Joseph License expired on October 10, 2013, after our final extension. The Asher-Menashe License expired on June 9, 2014 as its full seven-year term ended. Zion has plugged all of its exploratory wells on those License areas and the reserve pits have been evacuated, but acknowledges its obligation to complete the abandonment of these well sites in accordance with guidance from the Energy Ministry, Environmental Ministry and local officials. We continue to make significant progress toward fully abandoning all these sites and currently await Environmental Ministry permission to move forward.

Onshore Licensing, Oil and Gas Exploration and Environmental Guidelines

Zion is engaged in oil and gas exploration and production and may become subject to certain liabilities as they relate to environmental cleanup of well sites or other environmental restoration procedures and other obligations as they relate to the drilling of oil and gas wells or the operation thereof.

In July 2013, the Environmental Ministry published: “Environmental Guidelines for the preparation of an environmental document supplementary to a license for searching – experimental drilling and land extraction tests.” This document extensively details the requirements for a supplemental environmental document to an oil and gas exploration plan. On January 21, 2015, Zion formally submitted its Environmental Impact Assessment (“EIA”) document for our upcoming Megiddo-Jezreel #1 well to Israel’s Energy Ministry and thereafter, on January 25, 2015, to the Environmental Ministry. This key milestone is required by the MJL work plan as well as by Israeli law and regulations.

On December 3, 2013, the State of Israel’s Petroleum Commissioner awarded Zion the Megiddo-Jezreel Petroleum Exploration License No. 401. Subsequently, we secured a bank guarantee in the amount of $930,000 from an Israeli based bank in accordance with the performance guarantee guidelines. Consequently, Zion believes it has met the requirements of the June 2012 onshore exploratory licensing guidelines and the October 2012 performance guarantee guidelines.

| 20 |

On February 6, 2014, the Energy Ministry issued proposed guidelines for bank guarantees and insurance requirements with respect to oil and gas rights. Under these guidelines, applicants for and existing holders of exploration rights are required to submit certain bank guarantees and insurance policies that were not previously required.

On September 17, 2014, the proposed guidelines became effective, and the Energy Ministry issued a guidance document entitled “Instructions for the Giving of Guarantees with respect to Oil Rights.” As it relates to existing onshore license holders like Zion, the above referenced instructions required us to obtain a new Base Bank Guarantee in the amount of $500,000 per each existing license area, split into two deposit dates as follows: (1) $250,000 by November 30, 2014 and (2) $250,000 by March 31, 2015.

Furthermore, prior to the start of drilling, an additional bank guarantee of $250,000 will be required at least 14 days before the spud date. In summary, this is a potential cumulative total of $750,000 that is separate and apart from Zion’s existing Bank Guarantees discussed below in Liquidity and Capital Resources section. The Petroleum Commissioner has discretion to raise or lower those amounts or may also forfeit a company’s existing guarantee and/or cancel a petroleum right under certain circumstances. In addition, new and extended insurance policy guidelines were added. The Petroleum Commissioner may also view non-compliance with the new insurance provisions as breaching the work plan and the rights granted and act accordingly.

Due to the Petroleum Commissioner's discretion in the matter, as of March 31, 2016, Zion has not provided the additional bank guarantees based on the September 2014 guidelines, as it has not had a specific request for same from the Commissioner. In addition, the Commissioner has discretion to raise or lower those amounts or may also forfeit a company's existing guarantee and/or cancel a petroleum right under certain circumstances.

On January 11, 2015 the Energy Ministry issued revised guidelines (initially issued in February 2012) for onshore wellbore abandonment that are based on US regulations on well abandonment found in 43 CFR, Section 3162.3-4; applicable Texas Railroad Commission guidelines; and Well Abandonment and Inactive Well Practices for U.S. Exploration and Production Operations found in API Bulletin E3. This guideline is effective April 1, 2015.

On February 12, 2015, the Energy Ministry issued guidance for preparation and submission of the drilling program (first presented on April 29, 2014), describing types of and purposes of production tests depending on the stage of development of a reservoir. This guideline is effective April 1, 2015.

On April 27, 2015, the Energy Ministry issued guidelines for well testing, establishing procedures and minimum requirements for pressure testing, production flow testing, fluid analyses testing, etc.

On August 13, 2015, the Energy Ministry issued a new guideline for hydraulic fracturing design and operations that are based on Canadian regulations per Directive 083. This guideline is effective November 21, 2015. The procedures seek to prevent impacts on water wells, non-saline aquifers and prevent surface impacts.

On September 9, 2015, the Energy Ministry issued information relating to application forms for exploration drilling, detailing certain operator requirements prior to drilling, including required submission of an Application for Permit to Drill (APD) and Supplemental APD Information Sheet - Casing Design, both due 30 days prior to commencement of work. An Application for Permit to Modify (APM) form is now provided relating to changes to and modifications of already-approved drilling programs and other actions that were omitted from the original application such as production testing, abandonment, etc. An End of Operation Report (EOR) form is also provided to report the end of drilling or a temporary or a final end of operations.

On December 31, 2015, the Energy Ministry issued a new guidance for wellsite design and spacing for onshore and offshore sites. The guidelines relate to the necessary safety distance between installations and equipment at the drill site, flare pit and flare design and design of the drill site.

On December 31, 2015, the Energy Ministry issued revised guidance for “Transfer or Lien of Oil Rights” section 76 of the Petroleum Law. The guidelines apply to the transfer of petroleum and related rights, license and production lease as well as rights to profit and royalties. The guidelines specify transfer of control in a corporation and the necessary procedure to apply and receive approval from the Petroleum Commissioner for transfer of petroleum rights.

| 21 |

We believe that these new regulations will significantly increase the expenditures associated with obtaining new exploration rights and drilling new wells, coupled with the heavy financial burden of “locking away” significant amounts of cash that could otherwise be used for operational purposes. Finally, this will also considerably increase the time needed to obtain all of the necessary authorizations and approvals prior to drilling.

Capital Resources Highlights

We need to raise significant funds to finance the drilling and testing of our next exploratory well and maintain orderly operations. To date, we have funded our operations through the issuance of our securities. We will need to continue to raise funds through the issuance of equity and/or debt securities (or securities convertible into or exchangeable for equity securities). No assurance can be provided that we will be successful in raising the needed equity on terms favorable to us (or at all).

The Dividend Reinvestment and Stock Purchase Plan

On March 27, 2014, we launched our Dividend Reinvestment and Stock Purchase Plan (the “DSPP”) pursuant to which stockholders and interested investors can purchase our shares of Common Stock. The terms of the DSPP are described in the Prospectus Supplement originally filed on March 31, 2014 (the “Original Prospectus Supplement”) with the Securities and Exchange Commission (“SEC”) under the Company’s effective registration Statement on Form S-3, as thereafter amended.

On January 13, 2015, the Company amended the Original Prospectus Supplement (“Amendment No. 3”) to provide for a new unit option (the “Unit Option”) under the DSPP comprised of one share of Common Stock and three (3) Common Stock purchase warrants with each unit priced at $4.00. Each warrant afforded the investor or stockholder the opportunity to purchase the Company’s Common Stock at a warrant exercise price of $1.00. Each of the three warrant series have different expiration dates that have been extended. On December 28, 2015, Amendment No. 6 to the Original Prospectus Supplement was filed extending the scheduled termination date of the Unit Option to March 31, 2016. On March 31, 2016, the Unit Option terminated.

The warrants become exercisable on May 2, 2016 (the first exercise day after the 31st day following the Unit Option Termination Date) and continue to be exercisable through May 2, 2017 for ZNWAB (1 year), May 2, 2018 for ZNWAC (2 years) and May 2, 2019 for ZNWAD (3 years), respectively, at a per share exercise price of $1.00.

The total amount of funds received from the DSPP from the inception date through March 31, 2016 is approximately $9,444,000.

| 22 |

| Senior Convertible Bonds Rights Offering |

10% Senior Convertible Notes due May 2, 2021

On October 21, 2015, we filed with the SEC a prospectus supplement for a rights offering pursuant to which we distributed at no cost, 360,000 non-transferable subscription rights to subscribe for, on a per right basis, two 10% Convertible Senior Bonds par $100 due May 2, 2021 (the “Notes”), to persons who owned shares of the Company’s Common Stock on October 15, 2015, the record date for the offering. Each whole subscription right entitled the participant to purchase two convertible bonds at a purchase price of $100.00 per bond. Effective October 21, 2015, the Company executed a Supplemental Indenture, as issuer, with the American Stock Transfer & Trust Company, LLC, a New York limited liability trust company (“AST”), as trustee for the Notes (the “Indenture”).

The offering was scheduled to terminate on January 15, 2016 but was extended to March 31, 2016. On March 31, 2016, the rights offering terminated.

On May 2, 2016, we issued approximately $3,470,000 aggregate principal amount of Notes in connection with the rights offering. We received net proceeds of approximately $3,334,000 from the sale of the Notes, after deducting fees and expenses of $136,000 incurred in connection with the rights offering. The Notes are governed by the terms of the Indenture. The Notes are senior unsecured obligations and bear interest at a rate of 10% per year, payable annually in arrears on May 2 of each year, commencing May 2, 2017. The Notes will mature on May 2, 2021, unless earlier redeemed by the Company or converted.

Interest and principal may be repaid, at the Company’s option, in shares of the Company’s common stock. The number of shares for the payment of interest in shares of our common stock, in lieu of the cash amount, shall be based on the average of the closing prices of our common stock as reported by Bloomberg L.P. for the 30 trading days preceding the record date for the payment of interest, which we have designated as 10 business days prior to the interest payment date on May 2 of each year. The number of shares for the payment of principal and unpaid interest, in lieu of the cash amount, shall be based upon the average of the closing price of our common stock as reported by Bloomberg L.P. for the 30 trading days preceding the principal repayment date, which we have designated as the trading day immediately prior to the 30-day period preceding the maturity date of May 2, 2021. Fractional shares will not be issued and the final number of shares being rounded up to the next whole share.

At any time prior to the close of business on the business day immediately preceding April 2, 2021, holders may convert their Notes, in multiples of $100 principal amount, at a conversion rate of 44 shares per $100 bond (which is equivalent to $2.27 per share). The conversion rate is subject to adjustment from time to time upon the occurrence of certain events, including, but not limited to, the issuance of stock dividends and payment of cash dividends.

| 23 |

Principal Components of our Cost Structure

Our operating and other expenses primarily consist of the following:

| ● | Impairment of Unproved Oil and Gas Properties: Impairment expense is recognized if a determination is made that a well will not be able to be commercially productive. The amounts include amounts paid in respect of the drilling operations as well as geological and geophysical costs and various amounts that were paid to Israeli regulatory authorities. |

| ● | General and Administrative Expenses: Overhead, including payroll and benefits for our corporate staff, costs of managing our exploratory operations, audit and other professional fees, and legal compliance are included in general and administrative expenses. General and administrative expenses also include non-cash stock-based compensation expense, investor relations related expenses, lease and insurance and related expenses. | |

| ● | Depreciation, Depletion, Amortization and Accretion: The systematic expensing of the capital costs incurred to explore for natural gas and oil represents a principal component of our cost structure. As a full cost company, we capitalize all costs associated with our exploration, and apportion these costs to each unit of production, if any, through depreciation, depletion and amortization expense. As we have yet to have production, the costs of abandoned wells are written off immediately versus being included in this amortization pool. |

Going Concern Basis

Since we have limited capital resources, no revenue to date and a loss from operations, our financial statements have been prepared on a going concern basis, which contemplates realization of assets and liquidation of liabilities in the ordinary course of business. The appropriateness of using the going concern basis is dependent upon our ability to obtain additional financing or equity capital and, ultimately, to achieve profitable operations. Therefore, there is substantial doubt about our ability to continue as a going concern. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

| 24 |

Critical Accounting Policies

Management’s discussion and analysis of financial condition and results of operations is based upon our consolidated financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States of America. The preparation of these financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expense during the reporting period.

Impairment of Oil and Gas Properties

We follow the full-cost method of accounting for oil and gas properties. Accordingly, all costs associated with acquisition, exploration and development of oil and gas reserves, including directly related overhead costs, are capitalized.

All capitalized costs of oil and gas properties, including the estimated future costs to develop proved reserves, are amortized on the unit-of-production method using estimates of proved reserves. Investments in unproved properties and major development projects are not amortized until proved reserves associated with the projects can be determined or until impairment occurs. If the results of an assessment indicate that the properties are impaired, the amount of the impairment is included in income from continuing operations before income taxes, and the adjusted carrying amount of the unproved properties is amortized on the unit-of-production method.

Our oil and gas property represents an investment in unproved properties. Oil and gas property in general is excluded from the amortized cost pool until proved reserves are found or until it is determined that the costs are impaired. All costs excluded are reviewed at least quarterly to determine if impairment has occurred. The amount of any impairment is charged to expense since a reserve base has not yet been established. Impairment requiring a charge to expense may be indicated through evaluation of drilling results, relinquishing drilling rights or other information.

Abandonment of properties is accounted for as adjustments to capitalized costs. The net capitalized costs are subject to a “ceiling test” which limits such costs to the aggregate of the estimated present value of future net revenues from proved reserves discounted at ten percent based on current economic and operating conditions, plus the lower of cost or fair market value of unproved properties. The recoverability of amounts capitalized for oil and gas properties is dependent upon the identification of economically recoverable reserves, together with obtaining the necessary financing to exploit such reserves and the achievement of profitable operations.

The total net book value of our unproved oil and gas properties under the full cost method is $5,459,000 at March 31, 2016.

Asset Retirement Obligation

We record a liability for asset retirement obligation at fair value in the period in which it is incurred and a corresponding increase in the carrying amount of the related long lived assets.

RESULTS OF OPERATIONS

| For the three months ended March 31 | ||||||||

| 2016 | 2015 | |||||||

| (US $ in thousands) | ||||||||

| Operating costs and expenses: | ||||||||

| General and administrative expenses | 1,172 | 1,920 | ||||||

| Other | 391 | 466 | ||||||

| Subtotal Operating costs and expenses | 1,563 | 2,386 | ||||||

| Other expense, net | (11 | ) | 23 | |||||

| Net loss | 1,552 | 2,409 | ||||||

| 25 |

Revenue. We currently have no revenue generating operations.

Operating costs and expenses. Operating costs and expenses for the three months ended March 31, 2016 were $1,563,000 compared to $2,386,000 for the three months ended March 31, 2015. The decrease in operating costs and expenses during the three months ended March 31, 2016 compared to 2015 is primarily attributable to decrease in general and administrative expenses.

General and administrative expenses. General and administrative expenses for the three months ended March 31, 2016 were $1,172,000 compared to $1,920,000 for the three months ended March 31, 2015. The decrease in general and administrative expenses during the three months ended March 31, 2016 compared to 2015 is primarily attributable to higher legal and other professional fees related to the GYP arbitration and settlement during 2015, offset by higher salary cost due to a growth in workforce and cost during 2016.