|

$1,250,000,000(1)

|

Toyota Auto Receivables 2019-B Owner Trust

Issuing Entity (CIK Number: 0001773407) Toyota Auto Finance Receivables LLC Depositor (CIK Number: 0001131131) Toyota Motor Credit Corporation Sponsor, Administrator and Servicer (CIK Number: 0000834071) |

|

You should review carefully the factors described under “Risk Factors” beginning on page 23 of this prospectus.

The primary assets of the issuing entity will include a pool of fixed rate motor vehicle retail installment sales contracts secured by new or used

cars, minivans, light-duty trucks and sport utility vehicles. The assets of the issuing entity will also include related security interests in the financed vehicles, proceeds from claims on related insurance policies, amounts deposited in

specified bank accounts and all proceeds of the foregoing.

The notes are asset-backed securities issued by the issuing entity and will be paid only from the assets of the issuing entity. The notes represent

the obligations of the issuing entity only and do not represent the obligations of or interests in Toyota Motor Credit Corporation or any of its affiliates. Neither the notes nor the receivables owned by the issuing entity are insured or

guaranteed by any governmental agency.

|

|

| • | The issuing entity will issue the six classes of notes described in the table below with an aggregate initial principal amount of $1,250,000,000 or an aggregate initial principal amount of $1,750,000,000. The issuing entity will also issue a certificate representing the equity interest in the issuing entity, which will be retained initially by Toyota Auto Finance Receivables LLC and is not being offered hereby. |

| • | The principal of and interest on the notes will generally be payable on the 15th day of each month, unless the 15th day is not a business day, in which case payment will be made on the following business day. The first payment will be made on June 17, 2019. |

| • | Credit enhancement for the notes consists of a reserve account, overcollateralization, a yield supplement overcollateralization amount, excess interest on the receivables and, in the case of the Class A Notes, subordination of the Class B Notes (which will have a 0.00% interest rate). |

|

Initial Principal Amount(1)

|

Interest Rate

|

Accrual Method

|

Final Scheduled Payment Date

|

|

|

Class A‑1 Notes(2)

|

$316,010,000

|

____%

|

Actual/360

|

August 17, 2020

|

|

Class A‑2a Notes(2)

|

$443,800,000 (aggregate)(3)

|

____%

|

30/360

|

February 15, 2022

|

|

Class A‑2b Notes(2)

|

One-Month LIBOR + ____%(4)

|

Actual/360

|

February 15, 2022

|

|

|

Class A‑3 Notes(2)

|

$368,900,000

|

____%

|

30/360

|

August 15, 2023

|

|

Class A‑4 Notes(2)

|

$90,040,000

|

____%

|

30/360

|

November 15, 2024

|

|

Class B Notes(2)

|

$31,250,000

|

0.00%

|

30/360

|

December 15, 2025

|

|

Initial Public Offering Price

|

Underwriting Discounts and Commissions

|

Proceeds To Depositor(5)

|

||

|

Per Class A-2a Note

|

_____%

|

_____%

|

_____%

|

|

|

Per Class A-2b Note

|

_____%

|

_____%

|

_____%

|

|

|

Per Class A-3 Note

|

_____%

|

_____%

|

_____%

|

|

|

Per Class A-4 Note

|

_____%

|

_____%

|

_____%

|

|

|

Total

|

$__________(6)

|

$__________(6)

|

$__________(6)

|

|

| (1) |

Represents the aggregate initial principal amount of the notes if the aggregate initial principal amount of the notes is $1,250,000,000. The aggregate initial principal amount of the notes may be $1,750,000,000. If the aggregate initial principal amount of the notes is $1,750,000,000, the following notes will be issued: $442,010,000 of Class A-1 Notes, $621,600,000 aggregate initial principal amount of Class A-2a Notes and Class A-2b Notes, $516,600,000 of Class A-3 Notes, $126,040,000 of Class A-4 Notes and $43,750,000 of Class B Notes. Toyota Motor Credit Corporation will make the determination regarding the initial principal amount of the notes based on, among other considerations, market conditions at the time of pricing. See “Risk Factors—Risks associated with unknown aggregate initial principal amount of the notes.” |

| (2) |

The Class A-1 Notes, the Class B Notes and approximately, but not less than, 5% (by initial principal amount) of each of the Class A-2a

Notes, the Class A-2b Notes, the Class A-3 Notes and the Class A-4 Notes will be retained initially by Toyota Auto Finance Receivables LLC.

|

| (3) |

The allocation of the initial principal amount between the Class A-2a Notes and Class A-2b Notes will be determined at the time of

pricing of the notes offered hereunder. If the aggregate initial principal amount of the notes is $1,250,000,000, Toyota Auto Finance Receivables LLC expects that the initial principal amount of the Class A-2b Notes will not exceed

$266,300,000. If the aggregate initial principal amount of the notes is $1,750,000,000, Toyota Auto Finance Receivables LLC expects that the initial principal amount of the Class A-2b Notes will not exceed $373,000,000.

|

| (4) |

If the sum of One-Month LIBOR plus ____% is less than 0.00% for any interest period, then the interest rate for the Class A-2b Notes for

such interest period will be deemed to be 0.00%. See “Description of the Notes—Payments of Interest” in this prospectus.

|

| (5) |

Before deducting expenses, estimated to be $1,000,000.

|

| (6) | Calculated using the initial principal amount of the underwritten notes. |

|

Joint Bookrunners

|

||

|

BofA Merrill Lynch

|

BNP PARIBAS

|

Lloyds Securities

|

|

Co-Managers

|

||

|

Loop Capital Markets

|

Scotiabank

|

US Bancorp

|

|

Title of Each Class of

Securities to be Registered

|

Amount to

be Registered

|

Proposed Maximum Offering Price Per Unit (1)

|

Proposed Maximum Aggregate Offering Price (1)

|

Amount of Registration Fee (2)

|

|

Asset-Backed Notes

|

$1,750,000,000

|

100%

|

$1,750,000,000

|

$212,100

|

|

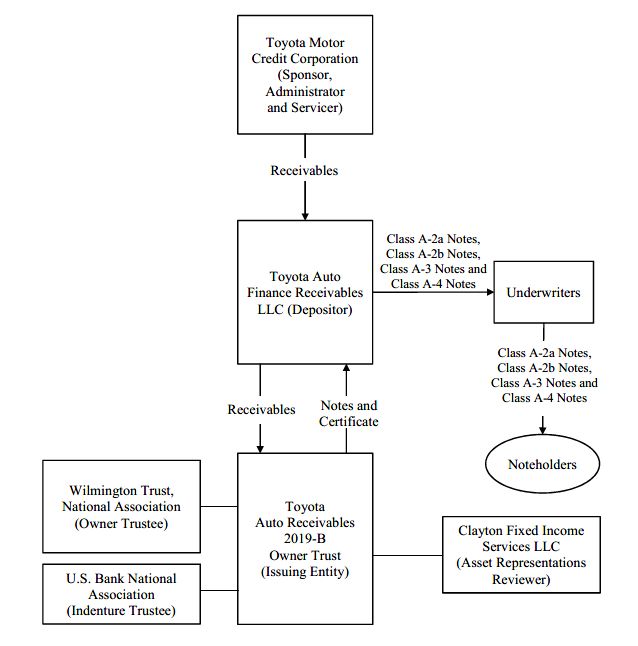

SUMMARY OF PARTIES TO THE TRANSACTION

|

5

|

|

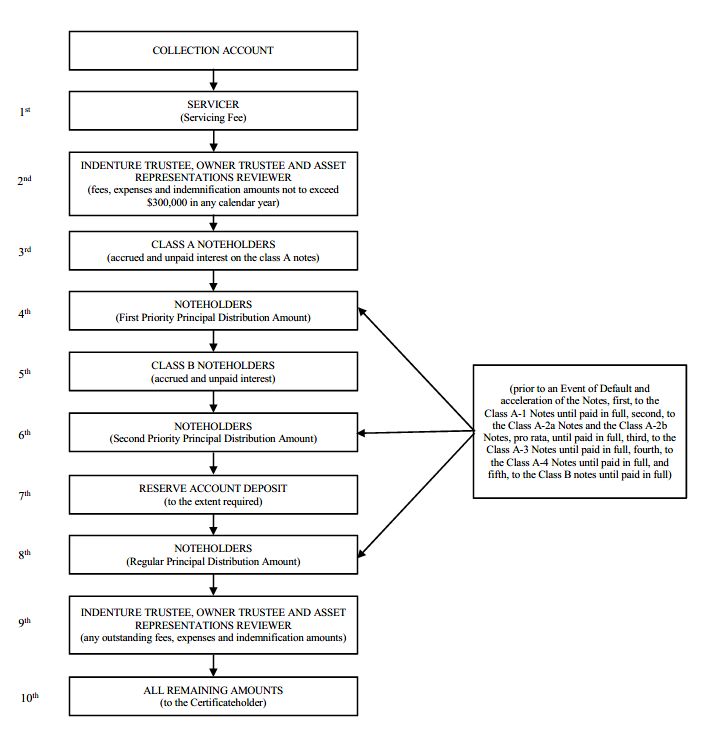

SUMMARY OF MONTHLY DISTRIBUTIONS OF COLLECTIONS

|

6

|

|

SUMMARY OF TERMS

|

7

|

|

RISK FACTORS

|

23

|

|

THE ISSUING ENTITY

|

47

|

|

CAPITALIZATION OF THE ISSUING ENTITY

|

49

|

|

THE DEPOSITOR

|

50

|

|

THE SPONSOR, ADMINISTRATOR AND SERVICER

|

51

|

|

Credit Risk Retention

|

52

|

|

Underwriting of Motor Vehicle Retail Installment Sales Contracts

|

52

|

|

Electronic Contracts and Electronic Contracting

|

53

|

|

Servicing of Motor Vehicle Retail Installment Sales Contracts

|

54

|

|

Securitization Experience

|

56

|

|

THE TRUSTEES

|

56

|

|

Duties of the Owner Trustee and Indenture Trustee

|

58

|

|

FEES AND EXPENSES

|

60

|

|

ASSET REPRESENTATIONS REVIEWER

|

60

|

|

General

|

60

|

|

Fees and Expenses

|

61

|

|

Resignation and Removal

|

61

|

|

Indemnity and Liability

|

61

|

|

AFFILIATIONS AND CERTAIN RELATIONSHIPS

|

62

|

|

THE RECEIVABLES

|

62

|

|

Asset-Level Data for the Receivables

|

72

|

|

POOL UNDERWRITING

|

72

|

|

REVIEW OF POOL ASSETS

|

72

|

|

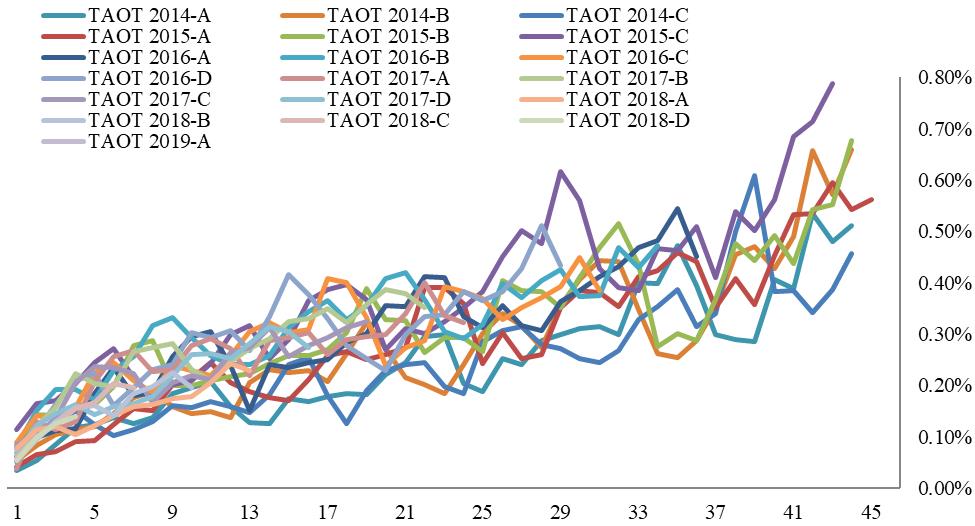

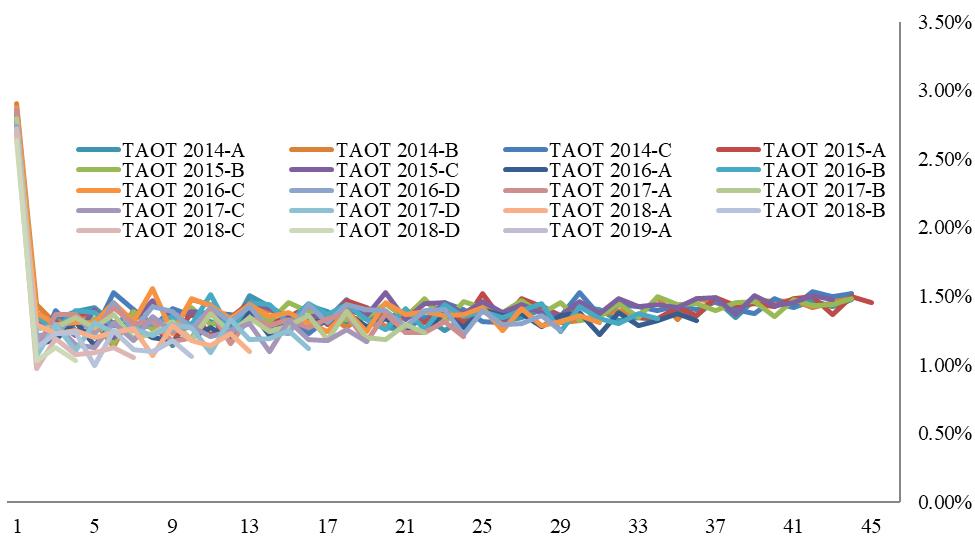

DELINQUENCIES, REPOSSESSIONS AND NET LOSSES

|

73

|

|

ASSET REPRESENTATIONS REVIEW

|

76

|

|

Delinquency Trigger

|

78

|

|

REPURCHASES OF RECEIVABLES

|

79

|

|

Dispute Resolution

|

81

|

|

STATIC POOLS

|

82

|

|

USE OF PROCEEDS

|

82

|

|

PREPAYMENT AND YIELD CONSIDERATIONS

|

82

|

|

WEIGHTED AVERAGE LIVES OF THE NOTES

|

84

|

|

POOL FACTORS AND TRADING INFORMATION

|

99

|

|

DESCRIPTION OF THE NOTES

|

99

|

|

General

|

99

|

|

Payments of Interest

|

99

|

|

Payments of Principal

|

101

|

|

Allocation of Losses

|

102

|

|

Indenture

|

102

|

|

Notices

|

105

|

|

Governing Law

|

106

|

|

Minimum Denominations

|

106

|

|

Book-Entry Registration

|

106

|

|

Definitive Securities

|

110

|

|

List of Securityholders

|

111

|

|

Reports to Securityholders

|

111

|

|

PAYMENTS TO NOTEHOLDERS

|

112

|

|

Calculation of Available Collections

|

113

|

|

Calculation of Principal Distribution Amounts

|

113

|

|

Priority of Payments

|

114

|

|

Payments After Occurrence of Event of Default Resulting in Acceleration

|

115

|

|

Credit and Cash Flow Enhancement

|

116

|

|

TRANSFER AND SERVICING AGREEMENTS

|

118

|

|

The Transfer and Servicing Agreements

|

118

|

|

Sale and Assignment of Receivables

|

118

|

|

Accounts

|

119

|

|

Servicing Procedures

|

119

|

|

Servicing Compensation and Payment of Expenses

|

121

|

|

Insurance on Financed Vehicles

|

121

|

|

Collections

|

121

|

|

Eligible Investments

|

122

|

|

Payments

|

124

|

|

Net Deposits

|

124

|

|

Optional Purchase of Receivables and Redemption of Notes

|

124

|

|

Removal of Servicer

|

124

|

|

Statements to Trustees and Issuing Entity

|

125

|

|

Evidence as to Compliance

|

125

|

|

Certain Matters Regarding the Servicer; Servicer Liability

|

125

|

|

Rights upon Servicer Default

|

126

|

|

Waiver of Past Defaults

|

127

|

|

Amendment

|

127

|

|

Non-Petition

|

128

|

|

Payment of Notes

|

128

|

|

Depositor Liability

|

128

|

|

Termination

|

128

|

|

Administration Agreement

|

129

|

|

Investor Communications

|

129

|

|

CERTAIN LEGAL ASPECTS OF THE RECEIVABLES

|

130

|

|

General

|

130

|

|

Security Interests

|

130

|

|

Repossession of Financed Vehicles

|

132

|

|

Notice of Sale of Financed Vehicles; Reinstatement and Redemption Rights

|

132

|

|

Deficiency Judgments and Excess Proceeds

|

132

|

|

Certain Bankruptcy Considerations

|

133

|

|

Dodd-Frank Act Orderly Liquidation Authority Provisions

|

134

|

|

Consumer Finance Regulation

|

136

|

|

Other Federal Regulation

|

139

|

|

Forfeiture for Drug, RICO and Money Laundering Violations

|

139

|

|

Other Limitations

|

140

|

|

LEGAL PROCEEDINGS

|

140

|

|

ERISA CONSIDERATIONS

|

140

|

|

MATERIAL U.S. FEDERAL INCOME TAX CONSEQUENCES

|

142

|

|

Tax Characterization of the Issuing Entity

|

143

|

|

Changes Made by the Bipartisan Budget Act of 2015

|

143

|

|

Tax Consequences to Owners of the Notes

|

144

|

|

CERTAIN STATE TAX CONSEQUENCES

|

147

|

|

WHERE YOU CAN FIND MORE INFORMATION ABOUT YOUR NOTES

|

148

|

|

The Issuing Entity

|

148

|

|

The Depositor

|

148

|

|

UNDERWRITING

|

149

|

|

European Economic Area

|

151

|

|

European Securitization Rules

|

151

|

|

United Kingdom

|

152

|

|

LEGAL OPINIONS

|

152

|

|

INDEX OF TERMS

|

153

|

|

ANNEX A: GLOBAL CLEARANCE, SETTLEMENT AND TAX DOCUMENTATION PROCEDURES

|

A-1

|

|

ANNEX B: STATIC POOL INFORMATION

|

B-1

|

RELATING TO NOTES ISSUED BY THE ISSUING ENTITY

|

Issuing Entity

|

Toyota Auto Receivables 2019-B Owner Trust, a Delaware statutory trust.

|

|

|

Depositor

|

Toyota Auto Finance Receivables LLC, a Delaware limited liability company, is a wholly-owned, limited purpose subsidiary of Toyota Motor Credit

Corporation. The principal executive offices of Toyota Auto Finance Receivables LLC are located at 6565 Headquarters Drive, W2-3D, Plano, Texas 75024-5965, its telephone number is (469) 486-9020 and its facsimile number is (310)

381-7739.

|

|

|

Sponsor, Administrator

and Servicer |

Toyota Motor Credit Corporation, a California corporation (“TMCC”). The principal executive offices of TMCC are located at 6565 Headquarters Drive,

Plano, Texas 75024-5965, its telephone number is (469) 486-9300 and its facsimile number is (310) 381-7739.

|

|

|

Asset Representations Reviewer

|

Clayton Fixed Income Services LLC, a Delaware limited liability company.

|

|

|

Indenture Trustee

|

U.S. Bank National Association, a national banking association.

|

|

|

Owner Trustee

|

Wilmington Trust, National Association, a national banking association.

|

|

|

Relevant Agreements

|

||

|

Indenture

|

The indenture between the issuing entity and the indenture trustee. The indenture provides for the terms of the notes.

|

|

|

Trust Agreement

|

The trust agreement, as amended and restated, between the depositor and the owner trustee. The trust agreement establishes and governs the issuing

entity and provides for the terms of the certificate.

|

|

|

Receivables Purchase Agreement

|

The receivables purchase agreement between the depositor and TMCC. The receivables purchase agreement governs the sale of the receivables from

TMCC, as the originator of the receivables, to the depositor.

|

|

|

Sale and Servicing Agreement

|

The sale and servicing agreement among the issuing entity, the servicer and the depositor. The sale and servicing agreement governs the sale of the

receivables by the depositor to the issuing entity and the servicing of the receivables by the servicer.

|

|

|

Administration Agreement

|

The administration agreement among the administrator, the issuing entity and the indenture trustee. The administration agreement governs the

provision of reports by the administrator and the performance by the administrator of other administrative duties for the issuing entity.

|

|

|

Asset Representations Review Agreement

|

The asset representations review agreement among the asset representations reviewer, the issuing entity, the servicer and the administrator. The

asset representations review agreement governs the performance by the asset representations reviewer of asset representations reviews.

|

|

Relevant Dates

|

||

|

Closing Date

|

On or about May ___, 2019.

|

|

|

Cutoff Date

|

The issuing entity will purchase the receivables as of the close of business on March 31, 2019. The issuing entity will be entitled to all

collections in respect of the receivables received after the cutoff date.

|

|

|

Statistical Information

|

The statistical information concerning the receivables in this prospectus is based on the receivables as of the cutoff date.

|

|

|

Collection Period

|

The period commencing on the first day of the applicable month (or in the case of the first collection period, from, but excluding, the cutoff date)

and ending on the last day of the applicable month.

|

|

|

Payment Dates

|

The issuing entity will generally pay interest on and principal of the notes on the 15th day of each month. If the 15th day of the month is not a

business day, payments on the notes will be made on the next business day. The date that any payment is made is called a “payment date.” The first payment date will be June 17, 2019.

|

|

|

A “business day” is any day except:

|

||

|

· a Saturday or Sunday; or

|

||

|

· a day on which banks in New York, New York or Wilmington, Delaware are closed.

|

||

|

Final Scheduled Payment Dates

|

The final principal payment for each class of notes is due on the related final scheduled payment date specified on the front cover of this

prospectus.

|

|

|

Record Date

|

So long as the notes are in book-entry form, the issuing entity will make payments on the notes to the related holders of record on the day

immediately preceding the related payment date. If the notes are issued in definitive form, the record date will be the last day of the month preceding the related payment date.

|

|

|

Description of the Notes

|

The class A-1 notes, the class A-2a notes, the class A-2b notes, the class A‑3 notes and the class A‑4 notes are referred to in this prospectus

collectively as the “class A notes.” The class A-2a notes and the class A-2b notes are referred to in this prospectus collectively as the “class A-2 notes.” The class A notes and the class B notes are referred to in this prospectus

collectively as the “notes.”

The class A-1 notes, the class B notes and approximately, but not less than, 5% (by initial principal amount) of each of the class A-2a notes, the

class A-2b notes, the class A-3 notes and the class A-4 notes will be retained initially by the depositor.

The allocation of the initial principal amount of the class A-2 notes between the class A-2a notes and class A-2b notes will be determined at the

time of pricing of the notes offered hereunder. The depositor expects that, if the aggregate initial principal amount of the notes is $1,250,000,000, the initial principal amount of the class A-2b notes will not exceed $266,300,000 and,

if the aggregate initial principal amount of the notes is $1,750,000,000, the initial principal amount of the class A-2b notes will not exceed $373,000,000.

|

|

TMCC will make the determination regarding the initial principal amount of the notes based on, among other considerations, market conditions at the

time of pricing. See “Risk Factors—Risks associated with unknown aggregate initial principal amount of the notes.”

All of the notes issued by the issuing entity will be secured by the assets of the issuing entity pursuant to the indenture and by funds on deposit

in the accounts of the issuing entity.

|

||

|

For a description of how payments of interest on and principal of the notes will be made on each payment date, you should refer to “Description of the Notes” and “Payments to Noteholders” in

this prospectus.

|

||

|

Certificate

|

The issuing entity will also issue a certificate representing the equity or residual interest in the issuing entity and the right to receive amounts

that remain after the issuing entity makes full payment of interest on and principal of the notes payable on a given payment date, required deposits to the reserve account on that payment date and other required payments. The depositor

will initially retain the certificate. The certificate is not being offered by this prospectus.

|

|

|

Any information in this prospectus regarding the certificate is included only for informational purposes to facilitate a better understanding of the

notes.

|

||

|

Minimum Denominations

|

The notes will be issued in minimum denominations of $1,000 and integral multiples of $1,000 in excess thereof.

|

|

|

Registration of the Notes

|

You will generally hold your interests in the notes through The Depository Trust Company in the United States, or Clearstream Banking, société

anonyme or the Euroclear Bank SA/NV, as operator for the Euroclear System. This is referred to as book-entry form. You will not receive a definitive note except under limited circumstances.

|

|

|

For additional information, you should refer to “Description of

the Notes––Book-Entry Registration” and “Annex A: Global Clearance, Settlement and Tax Documentation Procedures” in this prospectus.

|

||

|

U.S. Credit Risk Retention

|

The risk retention regulations in Regulation RR of the Securities Exchange Act of 1934, as amended, require the sponsor, either directly or through

its majority-owned affiliates, to retain an economic interest in the credit risk of the receivables (the “U.S. retained interest”).

The class A-1 notes, the class B notes, the certificate, and approximately, but not less than, 5% (by initial principal amount) of each of the class

A-2a notes, the class A-2b notes, the class A-3 notes and the class A-4 notes will be retained initially by the depositor. The depositor is a wholly-owned subsidiary of TMCC and will initially retain the U.S. retained interest.

The sponsor will agree that it will not, and will cause the depositor and each affiliate of the sponsor not to, sell, transfer, finance or hedge the

U.S. retained interest, except to the extent permitted by Regulation RR.

For more information regarding Regulation RR and TMCC’s method of compliance with that regulation, see “The Sponsor, Administrator and Servicer––Credit Risk Retention” and “Underwriting––European Securitization

Rules” in this prospectus.

|

|

Structural Summary

|

|||

|

Assets of the Issuing Entity;

the Receivables and Statistical Information |

The primary assets of the issuing entity will include a pool of fixed rate retail installment sales contracts used to finance new and used cars,

minivans, light-duty trucks or sport utility vehicles. We refer to these contracts as the “receivables.” The assets of the issuing entity will also include related security interests in the financed vehicles, proceeds from claims on related

insurance policies, amounts deposited in specified bank accounts and all proceeds of the foregoing.

Purchasers of new and used cars, minivans, light-duty trucks and sport utility vehicles often finance their purchases by entering into retail

installment sales contracts with Toyota and Lexus dealers who then sell the contracts to TMCC. The purchasers of the financed vehicles are referred to as the “obligors” under the receivables. The terms of the contracts must meet

requirements specified by TMCC.

The receivables will be sold by the sponsor to the depositor and then transferred by the depositor to the issuing entity. The sale by the sponsor to

the depositor will be made pursuant to the receivables purchase agreement between the sponsor and the depositor. The sale by the depositor to the issuing entity will be made pursuant to the sale and servicing agreement among the depositor,

the servicer and the issuing entity. The receivables sold to the depositor and then transferred to the issuing entity will be selected based on certain eligibility criteria described under “The Receivables” in this prospectus.

The issuing entity will grant a security interest in the receivables and other specified assets of the issuing entity, and the depositor will grant a

security interest in the amounts on deposit in the reserve account, in each case to the indenture trustee for the benefit of the noteholders.

The issuing entity’s main source of funds for making payments on the notes will be the receivables.

The statistical information concerning the receivables presented throughout this prospectus is based on the receivables as of the cutoff date.

As of the cutoff date, if the aggregate initial principal amount of the notes is $1,250,000,000, the receivables had the following characteristics:

|

||

|

Total Principal Balance

|

$1,362,132,534.07

|

||

|

Number of Receivables

|

72,945

|

||

|

Average Principal Balance

|

$18,673.42

|

||

|

Range of Principal Balances

|

$250.59 - $94,684.89

|

||

|

Average Original Amount Financed

|

$27,745.15

|

||

|

Range of Original Amounts Financed

|

$2,000.64 - $107,816.53

|

||

|

Weighted Average Annual Percentage

|

|||

|

Rate (“APR”)(1)

|

2.56%

|

||

|

Range of APRs

|

0.00% - 18.75%

|

||

|

Weighted Average Original Number of

|

|||

|

Scheduled Payments(1)

|

65.85 payments

|

||

|

Range of Original Number of

|

|||

|

Scheduled Payments

|

12 - 72 payments

|

||

|

Percentage of Total Principal Balance Consisting of Receivables with Original Scheduled Payments Greater

Than 60 Months

|

55.05%

|

||

|

Weighted Average Remaining Number of Scheduled Payments(1)

|

50.06 payments

|

||

|

Range of Remaining Number

|

|||

|

of Scheduled Payments

|

4 - 68 payments

|

||

|

Weighted Average FICO® score

(1) (2)

|

761

|

||

|

Range of FICO® scores (2)

|

620 - 900

|

||

|

___________________

(1) Weighted by principal

balance as of the cutoff date.

(2) FICO® is a federally registered servicemark of

Fair Isaac Corporation.

|

|||

|

As of the cutoff date, if the aggregate initial principal amount of the notes is $1,750,000,000, the receivables had the following characteristics:

|

|||

|

Total Principal Balance

|

$1,907,216,811.97

|

||

|

Number of Receivables

|

102,324

|

||

|

Average Principal Balance

|

$18,639.00

|

||

|

Range of Principal Balances

|

$250.59 - $94,684.89

|

||

|

Average Original Amount Financed

|

$27,700.32

|

||

|

Range of Original Amounts Financed

|

$2,000.64 - $107,816.53

|

||

|

Weighted Average Annual Percentage

|

|||

|

Rate (“APR”)(1)

|

2.56%

|

||

|

Range of APRs

|

0.00% - 18.75%

|

||

|

Weighted Average Original Number of

|

|||

|

Scheduled Payments(1)

|

65.85 payments

|

||

|

Range of Original Number of

|

|||

|

Scheduled Payments

|

12 - 72 payments

|

||

|

Percentage of Total Principal Balance Consisting of Receivables with Original Scheduled Payments Greater

Than 60 Months

|

55.07%

|

||

|

Weighted Average Remaining Number of Scheduled Payments(1)

|

50.05 payments

|

||

|

Range of Remaining Number

|

|||

|

of Scheduled Payments

|

4 - 68 payments

|

||

|

Weighted Average FICO® score

(1) (2)

|

761

|

||

|

Range of FICO® scores (2)

|

620 - 900

|

||

|

___________________

(1) Weighted by principal

balance as of the cutoff date.

(2)

FICO® is a federally registered servicemark of Fair Isaac Corporation.

For additional information regarding the characteristics of the receivables as of the cutoff date, you should refer to “The Receivables” in this prospectus.

TMCC does not consider any of the receivables to be exceptions to its underwriting standards. For additional information regarding TMCC’s underwriting

standards, you should refer to “The Sponsor, Administrator and Servicer—Underwriting of Motor Vehicle Retail Installment Sales Contracts” in this

prospectus.

|

|||

|

The receivables must satisfy the eligibility criteria specified in the transaction documents. For additional information regarding the eligibility

criteria for receivables being acquired by the issuing entity, you should refer to “The Receivables” in this prospectus.

|

|||

|

The assets of the issuing entity will also include:

|

|||

|

· certain monies due or received under the receivables after the cutoff date;

|

|||

|

· security interests in the vehicles financed under the receivables;

|

||

|

· certain bank accounts and the proceeds of those accounts; and

|

||

|

· proceeds from claims under certain insurance policies relating to the financed vehicles or the obligors under the receivables and certain rights of the depositor under the receivables

purchase agreement.

|

||

|

For additional information regarding the assets of the issuing entity, you should refer to “The Issuing Entity” in this prospectus.

|

||

|

Review of Pool Assets

|

In connection with the offering of the notes, the depositor has performed a review of the receivables and certain disclosure in this prospectus relating

to the receivables and certain asset-level data disclosures incorporated by reference into this prospectus, and has concluded that it has reasonable assurance that such disclosure is accurate in all material respects, as described under “Review of Pool Assets” in this prospectus.

As described in “The Sponsor, Administrator and Servicer—Underwriting

of Motor Vehicle Retail Installment Sales Contracts” in this prospectus, under TMCC’s origination process, credit applications are evaluated when received and are either automatically approved, automatically declined or forwarded for

review by a TMCC credit analyst with appropriate approval authority. The credit analyst decisions applications based on an evaluation that considers an applicant’s creditworthiness and projected ability to meet the monthly payment

obligation, which is derived, among other things, from the amount financed (as defined in the sale and servicing agreement), the term, and the assigned contractual interest rate.

If the aggregate initial principal amount of the notes is $1,250,000,000, approximately 61.54% of the aggregate principal balance of the receivables as

of the cutoff date were automatically approved, while approximately 38.46% of the aggregate principal balance of the receivables as of the cutoff date were evaluated and approved by a TMCC credit analyst with appropriate authority in

accordance with TMCC’s written underwriting guidelines. If the aggregate initial principal amount of the notes is $1,750,000,000, approximately 61.44% of the aggregate principal balance of the receivables as of the cutoff date were

automatically approved, while approximately 38.56% of the aggregate principal balance of the receivables as of the cutoff date were evaluated and approved by a TMCC credit analyst with appropriate authority in accordance with TMCC’s written

underwriting guidelines. TMCC determined that whether a receivable was accepted automatically by TMCC’s electronic credit decision system or was accepted following review by a TMCC credit analyst was not indicative of the related

receivable’s quality.

|

|

|

Asset Representations Review

|

The asset representations reviewer will perform a review of certain of the receivables for compliance with the representations made about the

receivables if:

· a delinquency trigger for the receivables is reached; and

· the required amount of noteholders vote to direct the review.

For additional information about the asset representations review, the delinquency trigger, voting requirements for a review, the representations

|

|

and warranties to be reviewed and the cost of the review, you should refer to “Asset Representations Review” in this prospectus.

|

||

|

Repurchase Dispute Resolution

|

If a request is made for the repurchase of a receivable due to a breach of a representation or warranty, and the request is not resolved within 180 days

of the receipt by TMCC or the depositor of such request, the party submitting the request will have the right to refer the matter to either mediation (including non-binding arbitration) or third-party binding arbitration. See “Repurchases of Receivables—Dispute Resolution” in this prospectus.

|

|

|

Servicing and

Servicer Compensation |

TMCC will act as servicer for the receivables owned by the issuing entity. The servicer will handle all collections, administer defaults and

delinquencies and otherwise service the contracts. On each payment date, the issuing entity will pay the servicer a monthly fee equal to one-twelfth of 1.00% multiplied by the aggregate principal balance of the receivables as of the first

day of the related collection period; provided that, for the first payment date, the issuing entity will pay the servicer a fee equal to two-twelfths of 1.00% of the aggregate principal balance of the receivables as of the cutoff date. The

servicer will also receive additional servicing compensation in the form of certain investment earnings, late fees, extension fees and other administrative fees and expenses or similar charges received by the servicer during such month.

For additional information regarding the compensation payable to the servicer, you should refer to “Transfer and Servicing Agreements––Servicing Compensation and Payment of Expenses” in this prospectus.

|

|

|

Trustees Fees and Expenses

|

The issuing entity will pay the indenture trustee an annual fee equal to $5,000. The issuing entity will also pay the owner trustee an annual fee equal

to $3,000. Each trustee will also be entitled to reimbursement or payment by the issuing entity for all expenses and indemnification amounts incurred in connection with the performance of its duties under the applicable transaction

agreements.

For additional information regarding fees, expenses and indemnification amounts reimbursable or payable to the trustees, you should refer to “Fees and Expenses” in this prospectus.

|

|

|

Asset Representations Reviewer Fees and Expenses

|

The issuing entity will pay the asset representations reviewer an annual fee equal to $5,000. The asset representations reviewer will also be entitled

to reimbursement or payment by the issuing entity for all expenses and indemnification amounts incurred in connection with the performance of its duties under the asset representations review agreement. In the event an asset representations

review occurs, the issuing entity will also pay the asset representations reviewer a fee equal to $200 for each receivable reviewed by it.

For additional information regarding fees, expenses and indemnification amounts reimbursable or payable to the asset representations reviewer, you

should refer to “Fees and Expenses” in this prospectus.

|

|

|

Administration Fee

|

As compensation for the performance of the administrator’s obligations and as reimbursement for its expenses related thereto, the administrator will be

entitled to a monthly administration fee, which will be paid by the servicer from the servicing fee.

|

|

Interest and Principal Payments

|

Interest Rates

|

|

|

The notes will bear interest for each interest period at the interest rates specified on the front cover of this prospectus.

|

||

|

Interest Accrual

|

||

|

The class A-1 notes and the class A-2b notes will accrue interest on an actual/360 basis from (and including) a payment date to (but excluding) the next

payment date, except that the first interest period for the class A-1 notes and the class A-2b notes will be from (and including) the closing date to (but excluding) the initial payment date. This means that the interest due on each of the

class A-1 notes and the class A-2b notes on each payment date will be the product of: (i) the outstanding principal amount of such class of notes; (ii) the related interest rate; and (iii) the actual number of days since the previous payment

date (or, in the case of the first payment date, from (and including) the closing date to (but excluding) the initial payment date) divided by 360.

If the sum of One-Month LIBOR and the applicable spread set forth on the front cover of this prospectus is less than 0.00% for any interest period, then

the interest rate for the class A-2b notes for such interest period will be deemed to be 0.00%. See “Description of the Notes—Payments of Interest” in

this prospectus.

|

||

|

The class A-2a notes, the class A-3 notes, the class A-4 notes and the class B notes will accrue interest on a 30/360 basis from (and including) the

15th day of the calendar month preceding a payment date to (but excluding) the 15th day of the calendar month in which the payment date occurs, except that the first interest period for the class A-2a notes, the class A-3 notes, the class A-4

notes and the class B notes will be from (and including) the closing date to (but excluding) June 15, 2019. This means that the interest due on each of the class A-2a notes, the class A-3 notes, the class A-4 notes and the class B notes on

each payment date will be the product of: (i) the outstanding principal amount of such class of notes; (ii) the related interest rate; and (iii) 30 (or, in the case of the first payment date, the number of days from (and including) the

closing date to (but excluding) June 15, 2019 (assuming a 30-day calendar month)) divided by 360.

|

||

|

If the full amount of interest due on the controlling class is not paid within five business days of a payment date, an event of default will occur,

which may result in an acceleration of the notes. If noteholders of any class do not receive all interest owed on their notes on any payment date, the issuing entity will make payments of interest on later payment dates to make up the

shortfall (together with interest on such amounts at the applicable interest rate for such class, to the extent permitted by law) to the extent funds are available to do so pursuant to the payment priorities described in this prospectus. The

class A notes will be the “controlling class” under the indenture while any class A notes are outstanding. After the class A notes have been paid in full, the class B notes will be the controlling class.

|

||

|

For additional information regarding the payment of interest on the notes, you should refer to “Description of the Notes––Payments of Interest” and “Payments to Noteholders” in this prospectus.

|

|

Principal Payments

|

||

|

On each payment date, except after the acceleration of the notes following an event of default, from the amounts allocated to the noteholders to pay

principal described in clauses (4), (6) and (8) under “—Priority of Payments” below, the issuing entity will pay principal of the notes in the following

order of priority:

1. to the class A-1 notes, until the principal amount of the class A‑1 notes is reduced to zero; then

2. to the class A-2a notes and the class A-2b notes, pro rata, based on the outstanding principal amounts of each of those classes of notes, until the principal amount of each such class

of notes is reduced to zero; then

3. to the class A-3 notes, until the principal amount of the class A‑3 notes is reduced to zero; then

4. to the class A-4 notes, until the principal amount of the class A‑4 notes is reduced to zero; and then

5. to the class B notes, until the principal amount of the class B notes is reduced to zero.

|

||

|

If the notes are declared to be due and payable following the occurrence of an event of default, the issuing entity will pay principal of the notes from

funds allocated to the noteholders, first, pro rata, based upon their respective unpaid principal amounts, to the class A-1 notes, the class A-2a notes, the class A-2b notes, the class A-3 notes and the class A-4 notes until the principal

amount of each such class of notes is reduced to zero, and second, to the class B notes until the principal amount of the class B notes is reduced to zero.

All outstanding principal and interest with respect to a class of notes will be payable in full on its final scheduled payment date.

For additional information regarding the payment of principal of the notes, you should refer to “Payments to Noteholders” in this prospectus.

|

||

|

Priority of Payments

|

||

|

On each payment date, except after the acceleration of the notes following an event of default, the issuing entity will make payments from available

collections received during the related collection period (and, if applicable, amounts withdrawn from the reserve account) in the following order of priority:

|

||

|

1. Servicing Fee –– to the servicer, the total servicing fee (which includes any supplemental

servicing fee, to the extent not previously retained by the servicer);

2. Transaction Fees and Expenses — to the indenture trustee, the owner trustee and the asset

representations reviewer, the amount of any fees, expenses and indemnification amounts due to each such party, pro rata, based on amounts due to each such party, in an aggregate amount not to exceed $300,000 in any calendar year;

|

|

3. Class A Note Interest –– to the class A noteholders (pro rata, based upon the aggregate amount

of interest due to each class of the class A notes), accrued and unpaid interest on each class of class A notes;

|

||

|

4. Class A Note Principal –– to the noteholders, to be paid in the priority described under “—Principal Payments” above, the first priority principal distribution amount;

the “first priority principal distribution amount” means, with respect to any payment date, an amount equal to the excess, if any, of (a) the aggregate

outstanding principal amount of the class A notes as of such payment date (before giving effect to any principal payments made on the class A notes on such payment date), over (b) the aggregate principal balance of the receivables less the

yield supplement overcollateralization amount (which amount is referred to in this prospectus as the “adjusted pool balance”), in each case, as of the last day of the related collection period; provided, that, for the final scheduled payment

date of any class of class A notes, the “first priority principal distribution amount” will not be less than the amount necessary to reduce the outstanding principal amount of such class of class A notes to zero;

|

||

|

5. Class B Note Interest –– to the class B noteholders, accrued and unpaid interest on the class

B notes;

|

||

|

6. Note Principal –– to the noteholders, to be paid in the priority described under “—Principal Payments” above, the second priority principal distribution amount;

the “second priority principal distribution amount” means, with respect to any payment date, an amount equal to (a) the excess, if any, of (i) the

aggregate outstanding principal amount of the class A notes and class B notes as of such payment date (before giving effect to any principal payments made on the class A notes and class B notes on such payment date), over (ii) the adjusted

pool balance as of the last day of the related collection period, minus (b) the first priority principal distribution amount for such payment date; provided, that, for the final scheduled payment date of the class B notes, the “second

priority principal distribution amount” will not be less than the amount necessary to reduce the outstanding principal amount of the class B notes to zero;

|

||

|

7. Reserve Account Deposit –– to the reserve account, to the extent amounts then on deposit in the

reserve account are less than the specified reserve account balance described below under “—Credit Enhancement—Reserve Account,” until the amount on

deposit in the reserve account equals such specified reserve account balance;

|

||

|

8. Note Principal –– to the noteholders, to be paid in the priority described under “—Principal Payments” above, the regular principal distribution amount;

the “regular principal distribution amount” means, with respect to any payment date, an amount equal to (a) the excess, if any, of (i) the aggregate

outstanding principal amount of the notes as of such payment date (before giving effect to any principal payments made on the notes on such payment date), over (ii) the adjusted pool balance as of the last day of the related collection period

less the overcollateralization target amount, minus (b) the sum of the first priority principal distribution amount and the second priority principal distribution amount for such payment date;

|

|

9. Additional Transaction Fees and Expenses –– to the indenture trustee, the owner trustee, and

the asset representations reviewer, the amount of any fees, expenses and indemnification amounts due to each such party and remaining unpaid, pro rata, based on amounts due to each such party; and

|

||

|

10. Excess Amounts –– to the certificateholder, any remaining amounts.

|

||

|

For additional information regarding the priority of payments on the notes, you should refer to “Payments to Noteholders—Calculation of Available Collections” and “—Priority of Payments” in this prospectus.

|

||

|

Change in Priority of Distribution upon Events of Default Resulting in an Acceleration of the Notes

Following the occurrence of an event of default under the indenture that results in the acceleration of the maturity of the notes, and unless and until

such acceleration has been rescinded, the issuing entity will make the following payments in the following order of priority from available collections received during the related collection period:

|

||

|

1. Servicing Fee –– to the servicer, the total servicing fee (which includes any supplemental

servicing fee, to the extent not previously retained by the servicer);

|

||

|

2. Transaction Fees and Expenses –– to the indenture trustee, the owner trustee and the asset

representations reviewer, the amount of any fees, expenses and indemnification amounts due to each such party, pro rata, based on amounts due to each such party;

|

||

|

3. Class A Note Interest –– to the class A noteholders (pro rata, based upon the aggregate amount

of interest due to each class of the Class A notes), accrued and unpaid interest on each class of class A notes;

|

||

|

4. Class A Note Principal –– to the class A noteholders, to be paid in the priority described under

“—Principal Payments” above;

|

||

|

5. Class B Note Interest –– to the class B noteholders, accrued and unpaid interest on the class B

notes;

|

||

|

6. Class B Note Principal –– to the class B noteholders, until the principal amount of the class B

notes is reduced to zero; and

|

||

|

7. Excess Amounts –– to the certificateholder, any remaining amounts.

|

||

|

Following the occurrence of an event of default under the indenture that results in the acceleration of the maturity of the notes, amounts on deposit in

the reserve account will be withdrawn and used to the extent necessary to pay principal of the notes as described in clauses (4) and (6) above, in that order of priority.

For additional information regarding the priority of payments on the notes after the acceleration of the notes following an event of default, you should

refer to “Payments to Noteholders—Calculation of Available Collections” and “—Priority of Payments” in this prospectus.

|

|

Final Scheduled Payment Dates

|

||

|

The issuing entity is required to pay the outstanding principal amount of each class of notes in full on or before the related final scheduled payment

date specified on the front cover of this prospectus.

|

||

|

Events of Default

|

Each of the following will constitute an event of default under the indenture:

|

|

|

(a) a default for five business days or more in the payment of any interest on any of the outstanding classes of the controlling class;

(b) a default in the payment in full of the principal of any note on its final scheduled payment date or the redemption date for such note;

(c) a default in the observance or performance of any covenant or agreement of the issuing entity made in the indenture which materially and adversely affects the noteholders, subject to

notice and cure provisions;

(d) any representation or warranty made by the issuing entity in the indenture having been incorrect in a material respect as of the time made, subject to notice and cure provisions; or

(e) certain events of bankruptcy, insolvency, receivership or liquidation of the issuing entity;

provided, however, that a delay in or failure of performance referred to in clause (a), (b), (c) or (d) above will not constitute an event of default

for a period of 30 days after the applicable cure period under the indenture if that delay or failure was caused by force majeure or other similar occurrence.

If an event of default under the indenture should occur and is continuing, the indenture trustee or the holders of notes evidencing not less than a

majority of the aggregate principal amount of the notes of the controlling class then outstanding (excluding for these purposes the outstanding principal amount of any notes held of record or beneficially owned by TMCC, the depositor or any

of their affiliates), acting together as a single class, may declare an acceleration of the notes and the principal of the notes to be immediately due and payable.

For additional information regarding the events of default, you should refer to “Description of the Notes—Indenture—Events of Default; Rights Upon Event of Default” in this prospectus.

|

||

|

Credit Enhancement

|

Credit enhancement is intended to protect you against losses and delays in payments on your notes. If losses on the receivables and other shortfalls in

cash flows exceed the amount of available credit enhancement, such losses will not be allocated to write down the principal amount of any class of notes. Instead, the amount available to make payments on the notes will be reduced to the

extent of such losses. The credit enhancement for the notes is:

|

|

|

· the reserve account;

· overcollateralization;

|

|

· the yield supplement overcollateralization amount;

· in the case of the class A notes, subordination of the class B notes; and

· excess interest on the receivables.

|

||

|

If the credit enhancement is not sufficient to cover all amounts payable on the notes, notes having a later scheduled final payment date generally will

bear a greater risk of loss than notes having an earlier final scheduled payment date. For additional information, you should refer to “Risk Factors—Payment

priorities increase risk of loss or delay in payment to certain classes of notes,” “Risk Factors—You must rely for repayment only upon payments from

the issuing entity’s assets, which may not be sufficient to make full payments on your notes” and “Payments to Noteholders” in this prospectus.

|

||

|

Reserve Account

|

||

|

On each payment date, funds will be withdrawn from the reserve account (1) to cover shortfalls in the amounts required to be paid on that payment date

with respect to clauses (1) through (6) under “—Priority of Payments”

above, (2) after an event of default that results in the acceleration of the maturity of the notes, to pay principal on the notes, and (3) to pay principal on any class of notes on the final scheduled payment date of that class of notes.

|

||

|

On the closing date, (i) if the aggregate initial principal amount of the notes is $1,250,000,000, the depositor will cause to be deposited

$3,125,000.70 into the reserve account, and (ii) if the aggregate initial principal amount of the notes is $1,750,000,000, the depositor will cause to be deposited $4,375,002.67 into the reserve account, which in each case is approximately

0.25% of the related adjusted pool balance as of the cutoff date. On each payment date, after making required payments to the servicer, the indenture trustee, the owner trustee, the asset representations reviewer and the noteholders, any

remaining available collections will be deposited into the reserve account to the extent necessary to maintain the amount on deposit in the reserve account at the specified reserve account balance.

|

||

|

On any payment date prior to an event of default that results in an acceleration of the maturity of the notes, if the amount in the reserve account

exceeds the specified reserve account balance, the excess will be distributed to the depositor. If the aggregate initial principal amount of the notes is $1,250,000,000, the “specified reserve account balance” is, on any payment date, the

lesser of (a) $3,125,000.70 (which is approximately 0.25% of the adjusted pool balance as of the cutoff date) and (b) the aggregate outstanding balance of the notes after giving effect to all payments of principal on that payment date. If

the aggregate initial principal amount of the notes is $1,750,000,000, the “specified reserve account balance” is, on any payment date, the lesser of (a) $4,375,002.67 (which is approximately 0.25% of the adjusted pool balance as of the

cutoff date) and (b) the aggregate outstanding balance of the notes after giving effect to all payments of principal on that payment date. In addition, on any payment date prior to an event of default that results in an acceleration of the

maturity of the notes, investment income on the amounts on deposit in the reserve account will be distributed to the depositor.

|

|

For additional information regarding the reserve account, you should refer to “Payments to Noteholders—Credit and Cash Flow Enhancement—Reserve Account” in this prospectus.

|

||

|

Overcollateralization

|

||

|

Overcollateralization represents the amount by which the adjusted pool balance exceeds the aggregate outstanding principal amount of the notes.

Overcollateralization will be available as an additional source of funds to absorb losses on the receivables that are not otherwise covered by excess collections on the receivables. The adjusted pool balance as of the cutoff date is expected

to be approximately equal to the aggregate initial principal amount of the notes.

The application of funds according to clause (8) under “—Interest and

Principal Payments—Priority of Payments” above is designed to achieve and maintain the level of overcollateralization as of any payment date to

a target amount of 0.85% of the adjusted pool balance as of the cutoff date. This amount is referred to in this prospectus as the “overcollateralization target amount.”

|

||

|

For additional information regarding overcollateralization, you should refer to “Payments to Noteholders—Credit and Cash Flow Enhancement—Overcollateralization” in this prospectus.

|

||

|

Yield Supplement Overcollateralization Amount

|

||

|

The yield supplement overcollateralization amount for each payment date or with respect to the closing date is the aggregate amount by which the

principal balance as of the last day of the related collection period or the cutoff date, as applicable, of each receivable with an APR below 6.80% (referred to herein as the “required rate”), other than any defaulted receivable, exceeds the

present value of the future payments on such receivables, calculated as if their APRs were equal to the required rate, assuming such future payment is made on the last day of each month and each month has 30 days.

For additional information regarding the calculation of the yield supplement overcollateralization amount and its effect on the payment of principal,

you should refer to “Payments to Noteholders—Credit and Cash Flow Enhancement—Yield Supplement Overcollateralization Amount” and “—Overcollateralization” in this prospectus.

|

||

|

Subordination

|

||

|

Payments of interest on the class B notes will be subordinated to payments of interest on the class A notes and certain other payments on each payment

date (including principal payments of the class A notes in specified circumstances). No payments of principal will be made on the class B notes until the principal of and interest on the class A notes has been paid in full.

If an event of default that results in the acceleration of payment of the notes occurs, no payments of interest or principal will be made on the class B

notes until the class A notes are paid in full. Consequently, the holders of the class B notes will incur losses and shortfalls because of delinquencies and losses on the receivables before the holders of the class A notes incur those losses

and shortfalls.

While any class A notes are outstanding, the failure to pay interest on the class B notes will not be an event of default.

|

|

For additional information, you should refer to “Payments to

Noteholders—Credit and Cash Flow Enhancement—Subordination of Principal and Interest” in this prospectus.

|

||

|

Excess Interest

|

||

|

More interest is expected to be paid by the obligors in respect of the receivables than is necessary to pay the sum of (i) the servicing fee, (ii) fees

required to be paid to the indenture trustee, the owner trustee and the asset representations reviewer and (iii) interest on the notes each month. Any such excess in interest payments from obligors will serve as additional credit

enhancement.

For additional information, you should refer to “Payments to

Noteholders—Credit and Cash Flow Enhancement—Excess Interest” in this prospectus.

|

||

|

Optional Redemption; Clean-Up Call

|

The servicer may purchase the receivables remaining in the issuing entity at a price equal to at least the unpaid principal amount of the notes plus any

accrued and unpaid interest thereon on any payment date when the aggregate outstanding principal balance of the receivables has declined to 5% or less of the aggregate principal balance of the receivables as of the cutoff date. Upon the

exercise of this clean-up call option by the servicer, the issuing entity must redeem the notes in whole, and not in part.

|

|

|

For additional information, you should refer to “Transfer and

Servicing Agreements––Optional Purchase of Receivables and Redemption of Notes” in this prospectus.

|

||

|

Removal of Pool Assets

|

Breaches of Representations and Warranties. Upon sale of the

receivables to the depositor, TMCC will make certain representations and warranties to the depositor regarding the receivables, and upon sale of the receivables to the issuing entity, the depositor will make certain corresponding

representations and warranties to the issuing entity regarding the receivables. The depositor is required to repurchase from the issuing entity, and TMCC is required to repurchase from the depositor, in turn, any receivable for which a

representation or warranty has been breached if such breach materially and adversely affects the issuing entity or the noteholders and such breach has not been cured in all material respects.

|

|

|

For additional information, you should refer to “Repurchases of

Receivables” in this prospectus.

|

||

|

Breach of Servicer Covenants. The servicer will be required

to purchase any receivable with respect to which specified servicing covenants made by the servicer under the sale and servicing agreement are breached and are not cured in all material respects.

|

||

|

CUSIP Numbers

|

Class A-1 Notes: 89239J AA2

Class A-2a Notes: 89239J AB0

Class A-2b Notes: 89239J AC8

Class A-3 Notes: 89239J AD6

Class A-4 Notes: 89239J AE4

Class B Notes: 89239J AF1

|

|

Tax Status

|

Subject to important considerations described under “Material U.S. Federal

Income Tax Consequences” and “Certain State Tax Consequences” in this prospectus, Morgan, Lewis & Bockius LLP, special tax counsel to the issuing entity, will deliver its opinion that:

|

|

|

· the notes held by parties unaffiliated with the issuing entity will be classified as debt for U.S. federal income tax purposes; and

|

||

|

· the issuing entity will not be classified as an association or a publicly traded partnership taxable as a corporation for U.S. federal income tax purposes.

|

||

|

If you purchase the notes, you will agree to treat the notes as debt for U.S. federal and state income tax, franchise tax and any other tax measured

in whole or in part by income. You should consult your own tax advisor regarding the U.S. federal tax consequences of the purchase, ownership and disposition of the notes, and the tax consequences arising under the laws of any state or

other taxing jurisdiction.

|

||

|

For additional information regarding the application of U.S. federal income and state tax laws to the issuing entity and the notes, you should refer

to “Material U.S. Federal Income Tax Consequences” and “Certain

State Tax Consequences” in this prospectus.

|

||

|

ERISA Considerations

|

The notes sold to parties unaffiliated with the issuing entity may be purchased by employee benefit plans and individual retirement accounts, subject

to those considerations discussed under “ERISA Considerations” in this prospectus.

|

|

|

For additional information, you should refer to “ERISA

Considerations” in this prospectus. If you are a benefit plan fiduciary considering the purchase of the notes you should, among other things, consult with your counsel in determining whether all required conditions have been

satisfied.

|

||

|

Certain Investment Company Act Considerations

|

The issuing entity will be relying on an exclusion or exemption from the definition of “investment company” under the Investment Company Act of 1940,

as amended, contained in Rule 3a-7 under the Investment Company Act of 1940, as amended, although there may be additional exclusions or exemptions available to the issuing entity. The issuing entity is being structured so as not to

constitute a “covered fund” for purposes of the regulations adopted to implement Section 619 of the Dodd-Frank Wall Street Reform and Consumer Protection Act.

|

|

The notes are not suitable

investments for all investors. |

The notes are not a suitable investment for any investor that requires a regular or predictable schedule of payments or payment

on specific dates. The notes are complex investments that should be considered only by sophisticated investors. We suggest that only investors who, either alone or with their financial, tax and legal advisors, have the expertise to

analyze the prepayment, reinvestment and default risks, the tax consequences of an investment and the interaction of these factors should consider investing in the notes.

|

|

|

Risks associated with unknown aggregate initial principal amount of the notes.

|

Whether the issuing entity will issue notes with an aggregate initial principal amount of $1,250,000,000 or $1,750,000,000 is not

expected to be known until the day of pricing. TMCC will make the determination regarding the aggregate initial principal amount of the notes based on, among other considerations, market conditions at the time of pricing. The size of a

class of notes may affect liquidity of that class, with smaller classes being less liquid than larger classes. In addition, if your class of notes is larger than you expected, then you will hold a smaller percentage of that class of

notes and the voting power of your notes will be diluted.

|

|

|

You must rely for repayment only upon payments from the issuing entity’s assets, which may not be sufficient

to make full payments on your notes.

|

The notes represent indebtedness of the issuing entity and will not be insured or guaranteed by the depositor, sponsor,

administrator, servicer or any of their respective affiliates, any governmental entity, the trustees or any other person. The only sources of payment on your notes are payments received on the receivables and, to the extent available,

any funds on deposit in the accounts of the issuing entity, including amounts on deposit in the reserve account. The amounts deposited in the reserve account will be limited. If the entire reserve account has been used and the available

credit enhancement is exhausted, the issuing entity will depend solely on current collections on the receivables to make payments on the notes. The issuing entity will also have the benefit of overcollateralization (including the yield

supplement overcollateralization amount) to provide limited protection against low-interest yielding receivables. For additional information, you should refer to “Payments to Noteholders—Credit and Cash Flow Enhancement—Overcollateralization,” “—Yield Supplement Overcollateralization Amount,”

“—Reserve Account” and “Risk Factors—Risks associated with

unknown aggregate initial principal amount of the notes” in this prospectus. If the assets of the issuing entity are not sufficient to pay interest on and principal of the notes you hold, you will suffer a loss.

Certain events (including some that are not within the control of the issuing entity, the depositor, the sponsor, the

administrator, the servicer, the indenture trustee, the owner trustee or of their respective affiliates) may result in events of default under the indenture and cause acceleration of all outstanding notes. If so directed by the holders

of notes evidencing not less than a majority of principal amount of the notes of the controlling class then outstanding, acting together as a single class, following an event of default resulting in an acceleration of the notes, the

indenture trustee will liquidate the assets of the issuing entity only in limited circumstances, and the issuing entity may be required promptly to sell the receivables, liquidate its assets and apply the proceeds to the payment of the

notes. Liquidation would be likely to accelerate payment of all notes that are then outstanding. If a liquidation occurs close to the date when any class otherwise would have been paid in full, repayment of that class might be delayed

while liquidation of the assets is occurring. The issuing entity cannot predict the length of time that will be

|

|

required for liquidation of its assets to be completed. In addition, the amounts received from a sale in these circumstances may not be sufficient

to pay all amounts owed to the holders of all classes of notes or any class of notes, and you may suffer a loss. This deficiency will be more severe in the case of any notes where the aggregate principal amount of the notes exceeds the

aggregate principal balance of the receivables. Even if liquidation proceeds are sufficient to repay the notes in full, any liquidation that causes principal of a class of notes to be paid before the related final scheduled payment date

will involve the prepayment risks described under “—Prepayments on receivables may cause prepayments on the notes, resulting in reduced returns on your

investment and reinvestment risk to you” below. Also, an event of default that results in the acceleration of the maturity of the notes will cause priority of payments of the notes to change, as described under “Payments to Noteholders—Payments After Occurrence of Event of Default Resulting in Acceleration” in this prospectus. Therefore, all outstanding notes

may be affected by any shortfall in liquidation proceeds. For additional information, you should refer to “—Prepayments on receivables may cause

prepayments on the notes, resulting in reduced returns on your investment and reinvestment risk to you” below.

|

||

|

The absence of a secondary market for the notes or a lack of liquidity in the secondary markets could limit

your ability to resell the notes or adversely affect the market value of your notes.

|

The notes will not be listed on any securities exchange. Therefore, to sell your notes, you must first locate a willing

purchaser. The underwriters may, but are not obligated to, provide a secondary market for the notes and even if the underwriters make a market in the notes, the underwriters may stop making offers at any time. In addition, the prices

offered, if any, may not reflect prices that other potential purchasers would be willing to pay, were they to be given the opportunity.

For several years after the 2008 financial crisis, major disruptions in the global financial markets caused a significant

reduction in liquidity in the secondary market for asset-backed securities. While conditions in the financial markets and the secondary markets have improved, periods of illiquidity could occur again and affect the secondary market,

thereby adversely affecting the value of your notes and limiting your ability to locate a willing purchaser of your notes. Furthermore, the global financial markets have in the past experienced increased volatility due to uncertainty

surrounding the level and sustainability of the sovereign debt of various countries. Concerns regarding sovereign debt may spread to other countries at any time. There can be no assurance that this uncertainty related to the sovereign

debt of various countries will not lead to disruption of the credit markets in the United States. Accordingly, you may not be able to sell your notes when you want to do so or you may be unable to obtain the price that you wish to

receive for your notes and, as a result, you could suffer a loss on your investment.

|

|

|

Economic developments, geopolitical conditions and other market events may adversely affect the performance

and market value of your notes.

|

The United States has in the past experienced, and may in the future experience, a recession or period of economic contraction.

During the economic downturn following the 2008 financial crisis, elevated unemployment, decreases in home values and lack of available credit led to increased delinquency and default rates by obligors, as well as decreased consumer

demand for automobiles and declining market values of the automobiles securing the receivables. If an economic downturn were to occur again, delinquencies and losses on the receivables could increase, which could result in losses on your

notes.

Although the economy has improved in the years since the 2008 financial crisis, consumer debt levels remain elevated as a result

of increased consumer spending, and there have been increasing trends in rates of delinquency and default frequency. As consumers assume higher debt levels,

|

|

delinquencies and losses on the receivables may increase, which could result in losses on your notes.

Events in the global financial markets, including downgrades of sovereign debt, devaluation of currencies by foreign governments

and slowing economic growth have caused or may cause a significant reduction in liquidity in the secondary market for asset-backed securities, which could adversely affect the market value of the notes and limit the ability of an investor

to sell its notes. On June 23, 2016, the United Kingdom voted in a referendum to discontinue its membership in the European Union. On March 29, 2017, the United Kingdom provided formal notice to the European Council stating its

intention to leave the European Union. The exit of the United Kingdom or any other country out of the European Union or the abandonment by any country of the euro may have a destabilizing effect on all eurozone countries and their

economies and a negative effect on the global economy as a whole. No prediction or assurance can be made as to the effect of economic developments on the rate of delinquencies, prepayments and/or losses on the receivables or the market

value of your notes.

Geopolitical conditions and other market events may impact TMCC and your notes. Restrictive exchange or import controls or other

disruptive trade policies, disruption of operations as a result of systemic political or economic instability, outbreak of war or expansion of hostilities, and acts of terrorism, could each have a material adverse effect on TMCC’s

business, results of operations and financial condition. Any such events could also adversely affect TMCC’s ability to service the receivables and perform its other obligations under the transaction agreements, which could have an

adverse effect on your notes.

|

||

|

Additionally, higher future energy and fuel prices could reduce the amount of disposable income that the affected obligors have

available to make monthly payments on their automobile finance contracts. Higher energy costs could also cause business disruptions, which could cause unemployment and a deepening economic downturn. Such obligors could potentially become