athenahealth, Inc. Reports First Quarter Fiscal Year 2015 Results

Company Delivers 27% Consolidated Revenue Growth and Reaffirms Fiscal Year 2015 Guidance

Q1 2015 Financial Results

• | 27% Revenue Growth Over First Quarter of 2014 |

• | Non-GAAP Adjusted Operating Income of $16.3 million |

• | GAAP Net Loss of $8.8 million, or $0.23 Per Diluted Share |

• | Non-GAAP Adjusted Net Income of $9.1 million, or $0.24 Per Diluted Share |

WATERTOWN, MA – April 30, 2015 - athenahealth, Inc. (NASDAQ: ATHN) (“athenahealth” or “we”), a leading provider of cloud-based services and mobile applications for medical groups and health systems, today announced financial and operational results for the first quarter of fiscal year 2015. We will conduct a conference call tomorrow, Friday, May 1, 2015, at 8:00 a.m. Eastern Time to discuss these results and management’s outlook for future financial and operational performance.

• | Total revenue for the three months ended March 31, 2015, was $206.4 million, compared to $163.0 million in the same period last year, an increase of 27%. |

◦ | Revenue from athenahealth-branded services was $192.1 million, an increase of 30% over $148.2 million for the three months ended March 31, 2014. |

◦ | Revenue from Epocrates-branded services was $10.8 million, an increase of 2% over $10.6 million for the three months ended March 31, 2014. |

◦ | Third-party tenant and other non-core revenue was $3.5 million, a decrease of 17% from $4.2 million for the three months ended March 31, 2014. |

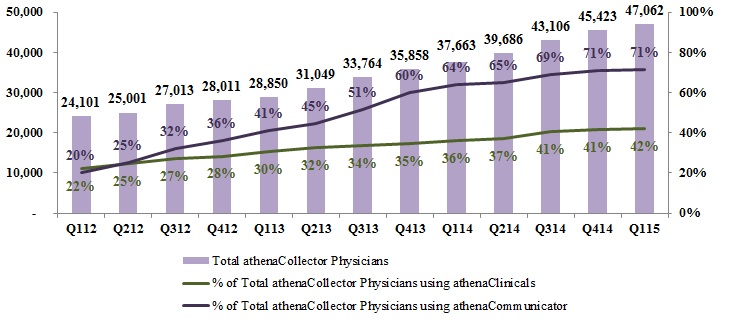

• | Grew net new active physicians on athenaCollector® (1,639 physicians added), athenaClinicals® (985 physicians added), and athenaCommunicator® (1,415 physicians added) for the three months ended March 31, 2015, compared to athenaCollector (1,805 physicians added), athenaClinicals (1,133 physicians added), and athenaCommunicator (2,514 physicians added) in the same period last year. |

“athenahealth’s first quarter performance of 2015 highlights the achievement of many of our most important growth objectives and reflects the continued momentum we see day-to-day in our business. Partnering with Trinity Health to support their mission of people-centered care and signing our first acute care deal following the acquisition of RazorInsights are nothing less than energizing,” said Jonathan Bush, chairman and chief executive officer of athenahealth. “Through the work we do and backed by our ever-growing national network, we are advancing health care connectivity across the care continuum. Every new client added to the network, every new interface built, and every new partnership formed is further support that we can achieve our vision of an always-on, results-oriented national health care internet.”

1

• | For the three months ended March 31, 2015, Non-GAAP Adjusted Gross Margin was 62.7%, up from 59.8% in the same period last year. |

• | For the three months ended March 31, 2015, Non-GAAP Adjusted Operating Income was $16.3 million, or 7.9% of total revenue, compared to $8.7 million, or 5.4% of total revenue, in the same period last year. |

• | For the three months ended March 31, 2015, GAAP Net Loss was $8.8 million, or $0.23 per diluted share, compared to $8.1 million, or $0.21 per diluted share, in the same period last year. |

• | For the three months ended March 31, 2015, Non-GAAP Adjusted Net Income was $9.1 million, or $0.24 per diluted share, compared to $4.4 million, or $0.12 per diluted share, in the same period last year. |

“The business goals we set for ourselves are aspirational and aggressive; we achieve them only if we innovate regularly, think differently, and target our investments to deliver value to all stakeholders both today and over the long term,” said Kristi Matus, chief financial and administrative officer of athenahealth. “In the first quarter of the year, we delivered against many of our financial and operational goals as validated by our balanced scorecard performance of more than 100%. Revenue from athenahealth-branded services grew 30% relative to last year, in line with our growth goals. As we continue into the year, we have a lot of work ahead of us, but we love hard work. We are modeling the future of health care with our distinctive cloud-based services and results-oriented model.”

We are reaffirming the fiscal year 2015 guidance we released in conjunction with our fourth quarter and full year 2014 earnings call on February 6, 2015. Our fiscal year 2015 guidance is summarized in the following table:

For the Fiscal Year Ending December 31, 2015 | |

Forward-Looking Guidance | |

GAAP Total Revenue | $905 - $925 million |

Non-GAAP Adjusted Gross Margin | 62.5% - 63.5% |

Non-GAAP Adjusted Operating Income | $75 - $85 million |

Non-GAAP Adjusted Net Income per Diluted Share | $1.10 - $1.20 |

Non-GAAP Tax Rate | 40% |

Please refer to our press release dated February 5, 2015 for a reconciliation of these non-GAAP financial measures to comparable GAAP measures for fiscal year 2015 guidance.

Use of Non-GAAP Financial Measures

In our earnings releases, prepared remarks, conference calls, slide presentations, and webcasts, we may use or discuss non-GAAP financial measures, as defined by SEC Regulation G. The GAAP financial measure most directly comparable to each non-GAAP financial measure used or discussed, and a reconciliation of the differences between each non-GAAP financial measure and the comparable GAAP financial measure, are included in this press release after the condensed consolidated financial statements. Our earnings press releases containing such non-GAAP reconciliations can be found in the Investors section of our website at www.athenahealth.com.

2

Conference Call Information

To participate in our live conference call and webcast, please dial 877-853-5645 (or 408-940-3868 for international calls) using conference code No. 10937994, or visit the Investors section of our website at www.athenahealth.com. A replay will be available for one week following the conference call at 855-859-2056 (and 404-537-3406 for international calls) using conference code No. 10937994. A webcast replay will also be archived on our website.

About athenahealth, Inc.

athenahealth is a leading provider of cloud-based services for electronic health records (EHR), revenue cycle management and medical billing, patient engagement, care coordination, and population health management, as well as Epocrates and other point-of-care mobile apps. We connect care and drive meaningful, measurable results for more than 64,000 health care providers in medical practices and health systems nationwide. For more information, please visit www.athenahealth.com.

Forward-Looking Statements

This press release contains forward-looking statements, which are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, including statements reflecting management’s expectations for future financial and operational performance and operating expenditures, expected growth, and business outlook, including the reaffirmed fiscal year 2015 guidance; statements regarding the benefits of our service offerings and demand for our service offerings; statements regarding the expansion of our network, including physician additions to our network; statements regarding our market opportunity; statements regarding the expected value creation from our investments; and statements found under our “Reconciliation of Non-GAAP Financial Measures to Comparable GAAP Measures” section of this release. The forward-looking statements in this release do not constitute guarantees of future performance. These statements are neither promises nor guarantees, and are subject to a variety of risks and uncertainties, many of which are beyond our control, which could cause actual results to differ materially from those contemplated in these forward-looking statements. In particular, the risks and uncertainties include, among other things: our fluctuating operating results; our variable sales and implementation cycles, which may result in fluctuations in our quarterly results; risks associated with the acquisition and integration of companies and new technologies to achieve expected synergies, including those related to our ability to successfully integrate the services, offerings, and technologies of Epocrates, RazorInsights, and webOMR and realize the expected benefits; risks associated with our ability to realize the expected benefits from the purchase of the Arsenal on the Charles campus in Watertown, Massachusetts; risks associated with our expectations regarding our ability to maintain profitability; the impact of increased sales and marketing expenditures, including whether increased expansion in revenues is attained and impacts on margins and profitability; changes in tax rates or exposure to additional tax liabilities; the highly competitive industry in which we operate and the relative immaturity of the market for our service offerings; and the evolving and complex governmental and regulatory compliance environment in which we and our clients operate. Forward-looking statements may often be identified with words such as “we expect,” “we anticipate,” “upcoming,” “aim,” or similar indications of future expectations. These statements are neither promises nor guarantees, and are subject to a variety of risks and uncertainties, many of which are beyond our control, which could cause actual results to differ materially from those contemplated in these forward-looking statements. Existing and prospective investors are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. We undertake no obligation to update or revise the information contained in this press release, whether as a result of new information, future events or circumstances, or otherwise. For additional disclosure regarding these and other risks faced by us, please see the disclosures

3

contained in our public filings with the Securities and Exchange Commission, available on the Investors section of our website at www.athenahealth.com and on the SEC’s website at www.sec.gov.

Contact Info:

Dana Quattrochi

athenahealth, Inc. (Investors)

investorrelations@athenahealth.com

(617) 402-1329

Holly Spring

athenahealth, Inc. (Media)

media@athenahealth.com

(617) 402-1631

4

athenahealth, Inc.

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited, in thousands, except per share amounts)

March 31, 2015 | December 31, 2014 | |||||||

Assets | ||||||||

Current assets: | ||||||||

Cash and cash equivalents | $ | 32,593 | $ | 73,787 | ||||

Marketable securities | 27,160 | 40,950 | ||||||

Accounts receivable, net | 118,656 | 121,710 | ||||||

Deferred tax asset, net | 13,614 | — | ||||||

Prepaid expenses and other current assets | 26,931 | 22,627 | ||||||

Total current assets | 218,954 | 259,074 | ||||||

Property and equipment, net | 282,837 | 271,552 | ||||||

Capitalized software costs, net | 85,305 | 56,574 | ||||||

Purchased intangible assets, net | 144,249 | 139,422 | ||||||

Goodwill | 230,147 | 198,049 | ||||||

Investments and other assets | 7,455 | 7,327 | ||||||

Total assets | $ | 968,947 | $ | 931,998 | ||||

Liabilities & Stockholders’ Equity | ||||||||

Current liabilities: | ||||||||

Accounts payable | $ | 9,982 | $ | 9,410 | ||||

Accrued compensation | 41,164 | 71,768 | ||||||

Accrued expenses | 43,377 | 37,033 | ||||||

Line of credit | — | 35,000 | ||||||

Long-term debt | — | 15,000 | ||||||

Deferred revenue | 34,283 | 28,949 | ||||||

Deferred tax liability, net | — | 8,449 | ||||||

Total current liabilities | 128,806 | 205,609 | ||||||

Deferred rent, net of current portion | 22,281 | 19,412 | ||||||

Line of credit | 95,000 | — | ||||||

Long-term debt, net of current portion | 170,000 | 158,750 | ||||||

Deferred revenue, net of current portion | 54,892 | 54,473 | ||||||

Long-term deferred tax liability, net | 25,576 | 10,417 | ||||||

Other long-term liabilities | 8,640 | 8,214 | ||||||

Total liabilities | 505,195 | 456,875 | ||||||

Stockholders’ equity: | ||||||||

Preferred stock, $0.01 par value: 5,000 shares authorized; no shares issued and outstanding at March 31, 2015 and December 31, 2014 | — | — | ||||||

Common stock, $0.01 par value: 125,000 shares authorized; 39,766 shares issued and 38,488 shares outstanding at March 31, 2015; 39,402 shares issued and 38,124 shares outstanding at December 31, 2014 | 398 | 395 | ||||||

Additional paid-in capital | 449,415 | 443,259 | ||||||

Treasury stock, at cost, 1,278 shares | (1,200 | ) | (1,200 | ) | ||||

Accumulated other comprehensive income | 15,490 | 24,188 | ||||||

Retained (deficit) earnings | (351 | ) | 8,481 | |||||

Total stockholders’ equity | 463,752 | 475,123 | ||||||

Total liabilities and stockholders’ equity | $ | 968,947 | $ | 931,998 | ||||

5

athenahealth, Inc.

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(Unaudited, in thousands, except per share amounts)

Three Months Ended March 31, | ||||||||

2015 | 2014 | |||||||

Revenue: | ||||||||

Business services | $ | 197,763 | $ | 154,502 | ||||

Implementation and other | 8,671 | 8,533 | ||||||

Total revenue | 206,434 | 163,035 | ||||||

Expense: | ||||||||

Direct operating | 84,557 | 72,148 | ||||||

Selling and marketing | 53,365 | 43,227 | ||||||

Research and development | 23,728 | 15,155 | ||||||

General and administrative | 36,212 | 29,357 | ||||||

Depreciation and amortization | 20,352 | 14,249 | ||||||

Total expense | 218,214 | 174,136 | ||||||

Operating loss | (11,780 | ) | (11,101 | ) | ||||

Other (expense) income: | ||||||||

Interest expense | (1,059 | ) | (1,265 | ) | ||||

Other income (expense) | 44 | (171 | ) | |||||

Total other expense | (1,015 | ) | (1,436 | ) | ||||

Loss before income tax benefit | (12,795 | ) | (12,537 | ) | ||||

Income tax benefit | 3,963 | 4,482 | ||||||

Net loss | $ | (8,832 | ) | $ | (8,055 | ) | ||

Net loss per share – Basic | $ | (0.23 | ) | $ | (0.21 | ) | ||

Net loss per share – Diluted | $ | (0.23 | ) | $ | (0.21 | ) | ||

Weighted average shares used in computing net loss per share: | ||||||||

Basic | 38,278 | 37,484 | ||||||

Diluted | 38,278 | 37,484 | ||||||

6

athenahealth, Inc.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited, in thousands)

Three Months Ended March 31, | ||||||||

2015 | 2014 | |||||||

CASH FLOWS FROM OPERATING ACTIVITIES: | ||||||||

Net loss | $ | (8,832 | ) | $ | (8,055 | ) | ||

Adjustments to reconcile net loss to net cash provided by operating activities: | ||||||||

Depreciation and amortization | 26,541 | 21,459 | ||||||

Deferred income tax | (4,219 | ) | (4,605 | ) | ||||

Stock-based compensation expense | 15,874 | 12,351 | ||||||

Other reconciling adjustments | 102 | 171 | ||||||

Changes in operating assets and liabilities: | ||||||||

Accounts receivable, net | 4,183 | 325 | ||||||

Prepaid expenses and other current assets | (4,491 | ) | (1,627 | ) | ||||

Other long-term assets | 58 | (945 | ) | |||||

Accounts payable | 1,139 | 3,913 | ||||||

Accrued expenses and other long-term liabilities | 6,683 | 2,951 | ||||||

Accrued compensation | (30,027 | ) | (13,529 | ) | ||||

Deferred revenue | 3,314 | 1,255 | ||||||

Deferred rent | 2,599 | 402 | ||||||

Net cash provided by operating activities | 12,924 | 14,066 | ||||||

CASH FLOWS FROM INVESTING ACTIVITIES: | ||||||||

Capitalized software development costs | (38,492 | ) | (11,057 | ) | ||||

Purchases of property and equipment | (22,815 | ) | (5,325 | ) | ||||

Payments on acquisitions, net of cash acquired | (40,165 | ) | — | |||||

Change in restricted cash | — | 2,806 | ||||||

Net cash used in investing activities | (101,472 | ) | (13,576 | ) | ||||

CASH FLOWS FROM FINANCING ACTIVITIES: | ||||||||

Proceeds from issuance of common stock under stock plans and warrants | 6,287 | 9,000 | ||||||

Taxes paid related to net share settlement of stock awards | (15,310 | ) | (19,464 | ) | ||||

Proceeds from line of credit | 60,000 | — | ||||||

Payments for long-term debt | (3,750 | ) | (3,750 | ) | ||||

Net cash provided by (used in) financing activities | 47,227 | (14,214 | ) | |||||

Effect of exchange rate changes on cash and cash equivalents | 127 | (15 | ) | |||||

Net decrease in cash and cash equivalents | (41,194 | ) | (13,739 | ) | ||||

Cash and cash equivalents at beginning of period | 73,787 | 65,002 | ||||||

Cash and cash equivalents at end of period | $ | 32,593 | $ | 51,263 | ||||

7

athenahealth, Inc.

STOCK-BASED COMPENSATION

(Unaudited, in thousands)

Set forth below is a breakout of stock-based compensation impacting the Condensed Consolidated Statements of Income for the three months ended March 31, 2015, and 2014:

Three Months Ended March 31, | |||||||

2015 | 2014 | ||||||

Stock-based compensation charged to Condensed Consolidated Statements of Income: | |||||||

Direct operating | $ | 3,696 | $ | 2,596 | |||

Selling and marketing | 4,952 | 3,024 | |||||

Research and development | 2,247 | 1,664 | |||||

General and administrative | 4,979 | 5,066 | |||||

Total stock-based compensation expense | 15,874 | 12,350 | |||||

Amortization of capitalized stock-based compensation related to software development (1) | 934 | 399 | |||||

Total | $ | 16,808 | $ | 12,749 | |||

(1) | In addition, for the three months ended March 31, 2015, and 2014, $1.9 million and $0.8 million, respectively, of stock-based compensation was capitalized in the line item Capitalized software costs, net in the Condensed Consolidated Balance Sheets for which $0.9 million and $0.4 million, respectively, of amortization was included in the line item Depreciation and amortization in the Condensed Consolidated Statements of Income. |

athenahealth, Inc.

AMORTIZATION OF PURCHASED INTANGIBLE ASSETS

(Unaudited, in thousands)

Set forth below is a breakout of amortization of purchased intangible assets impacting the Condensed Consolidated Statements of Income for the three months ended March 31, 2015, and 2014:

Three Months Ended March 31, | |||||||

Amortization of purchased intangible assets allocated to: | 2015 | 2014 | |||||

Direct operating | $ | 3,789 | $ | 3,939 | |||

Selling and marketing | 2,284 | 3,151 | |||||

Total amortization of purchased intangible assets | $ | 6,073 | $ | 7,090 | |||

8

athenahealth, Inc.

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

TO COMPARABLE GAAP MEASURES

(Unaudited, in thousands, except per share amounts)

The following is a reconciliation of the non-GAAP financial measures used by us to describe our financial results determined in accordance with accounting principles generally accepted in the United States of America (“GAAP”). An explanation of these measures is also included below under the heading “Explanation of Non-GAAP Financial Measures.”

While management believes that these non-GAAP financial measures provide useful supplemental information to investors regarding the underlying performance of our business operations, investors are reminded to consider these non-GAAP measures in addition to, and not as a substitute for, financial performance measures prepared in accordance with GAAP. In addition, it should be noted that these non-GAAP financial measures may be different from non-GAAP measures used by other companies, and management may utilize other measures to illustrate performance in the future. Non-GAAP measures have limitations in that they do not reflect all of the amounts associated with our results of operations as determined in accordance with GAAP.

Please note that these figures may not sum exactly due to rounding.

Non-GAAP Adjusted Gross Margin

Set forth below is a presentation of our “Non-GAAP Adjusted Gross Profit” and “Non-GAAP Adjusted Gross Margin,” which represents Non-GAAP Adjusted Gross Profit as a percentage of total revenue.

(unaudited, in thousands) | Three Months Ended | ||||||

March 31, | |||||||

2015 | 2014 | ||||||

Total revenue | $ | 206,434 | $ | 163,035 | |||

Direct operating expense | 84,557 | 72,148 | |||||

Total revenue less direct operating expense | 121,877 | 90,887 | |||||

Add: Stock-based compensation allocated to direct operating expense | 3,696 | 2,596 | |||||

Add: Amortization of purchased intangible assets allocated to direct operating expense | 3,789 | 3,939 | |||||

Non-GAAP Adjusted Gross Profit | $ | 129,362 | $ | 97,422 | |||

Non-GAAP Adjusted Gross Margin | 62.7 | % | 59.8 | % | |||

9

Non-GAAP Adjusted EBITDA

Set forth below is a reconciliation of our “Non-GAAP Adjusted EBITDA” and “Non-GAAP Adjusted EBITDA Margin,” which represents Non-GAAP Adjusted EBITDA as a percentage of total revenue.

(unaudited, in thousands) | Three Months Ended | ||||||

March 31, | |||||||

2015 | 2014 | ||||||

Total revenue | $ | 206,434 | $ | 163,035 | |||

GAAP net loss | (8,832 | ) | (8,055 | ) | |||

Add: Benefit from income taxes | (3,963 | ) | (4,482 | ) | |||

Add: Total other expense | 1,015 | 1,436 | |||||

Add: Stock-based compensation expense | 15,874 | 12,350 | |||||

Add: Depreciation and amortization | 20,352 | 14,249 | |||||

Add: Amortization of purchased intangible assets | 6,073 | 7,090 | |||||

Add: Integration and transaction costs | 964 | — | |||||

Add: Lease termination costs | 4,185 | — | |||||

Non-GAAP Adjusted EBITDA | $ | 35,668 | $ | 22,588 | |||

Non-GAAP Adjusted EBITDA Margin | 17.3 | % | 13.9 | % | |||

Non-GAAP Adjusted Operating Income

Set forth below is a reconciliation of our “Non-GAAP Adjusted Operating Income” and “Non-GAAP Adjusted Operating Income Margin,” which represents Non-GAAP Adjusted Operating Income as a percentage of total revenue.

(unaudited, in thousands) | Three Months Ended | ||||||

March 31, | |||||||

2015 | 2014 | ||||||

Total revenue | $ | 206,434 | $ | 163,035 | |||

GAAP net loss | (8,832 | ) | (8,055 | ) | |||

Add: Benefit from income taxes | (3,963 | ) | (4,482 | ) | |||

Add: Total other expense | 1,015 | 1,436 | |||||

Add: Stock-based compensation expense | 15,874 | 12,350 | |||||

Add: Amortization of capitalized stock-based compensation related to software development | 934 | 399 | |||||

Add: Amortization of purchased intangible assets | 6,073 | 7,090 | |||||

Add: Integration and transaction costs | 964 | — | |||||

Add: Lease termination costs | 4,185 | — | |||||

Non-GAAP Adjusted Operating Income | $ | 16,250 | $ | 8,738 | |||

Non-GAAP Adjusted Operating Income Margin | 7.9 | % | 5.4 | % | |||

10

Non-GAAP Adjusted Net Income

Set forth below is a reconciliation of our “Non-GAAP Adjusted Net Income” and “Non-GAAP Adjusted Net Income per Diluted Share.”

(unaudited, in thousands) | Three Months Ended | ||||||

March 31, | |||||||

2015 | 2014 | ||||||

GAAP net loss | $ | (8,832 | ) | $ | (8,055 | ) | |

Add: Stock-based compensation expense | 15,874 | 12,350 | |||||

Add: Amortization of capitalized stock-based compensation related to software development | 934 | 399 | |||||

Add: Amortization of purchased intangible assets | 6,073 | 7,090 | |||||

Add: Integration and transaction costs | 964 | — | |||||

Add: Lease termination costs | 4,185 | — | |||||

Sub-total of tax deductible items | 28,030 | 19,839 | |||||

Less: Tax impact of tax deductible items (1) | (11,212 | ) | (7,936 | ) | |||

Add: Tax impact resulting from applying non-GAAP tax rate (2) | 1,155 | 533 | |||||

Non-GAAP Adjusted Net Income | $ | 9,141 | $ | 4,381 | |||

Weighted average shares - diluted | 38,278 | 37,484 | |||||

Non-GAAP Adjusted Net Income per Diluted Share | $ | 0.24 | $ | 0.12 | |||

(1) | Tax impact calculated using a statutory tax rate of 40%. |

(2) | Represents adjusting the GAAP net loss at a non-GAAP tax rate of 40%. We used a non-GAAP tax rate of 40% to normalize the tax impact to our Non-GAAP Adjusted Net Income per Diluted Share based on the fact that a relatively small change in pre-tax GAAP income (loss) in any one period could result in a volatile GAAP effective tax rate. |

11

(unaudited, in thousands) | Three Months Ended | ||||||

March 31, | |||||||

2015 | 2014 | ||||||

GAAP net loss per share - diluted | $ | (0.23 | ) | $ | (0.21 | ) | |

Add: Stock-based compensation expense | 0.41 | 0.33 | |||||

Add: Amortization of capitalized stock-based compensation related to software development | 0.02 | 0.01 | |||||

Add: Amortization of purchased intangible assets | 0.16 | 0.19 | |||||

Add: Integration and transaction costs | 0.03 | — | |||||

Add: Lease termination costs | 0.11 | — | |||||

Sub-total of tax deductible items | 0.73 | 0.53 | |||||

Less: Tax impact of tax deductible items (1) | (0.29 | ) | (0.21 | ) | |||

Add: Tax impact resulting from applying non-GAAP tax rate (2) | 0.03 | 0.01 | |||||

Non-GAAP Adjusted Net Income per Diluted Share | $ | 0.24 | $ | 0.12 | |||

Weighted average shares - diluted | 38,278 | 37,484 | |||||

(1) | Tax impact calculated using a statutory tax rate of 40%. |

(2) | Represents adjusting the GAAP net loss at a non-GAAP tax rate of 40%. We used a non-GAAP tax rate of 40% to normalize the tax impact to our Non-GAAP Adjusted Net Income per Diluted Share based on the fact that a relatively small change in pre-tax GAAP income (loss) in any one period could result in a volatile GAAP effective tax rate. |

12

Explanation of Non-GAAP Financial Measures

We report our financial results in accordance with accounting principles generally accepted in the United States of America, or GAAP. However, management believes that, in order to properly understand our short-term and long-term financial and operational trends, investors may wish to consider the impact of certain non-cash or non-recurring items, when used as a supplement to financial performance measures in accordance with GAAP. These items result from facts and circumstances that vary in frequency and impact on continuing operations. Management also uses results of operations before such items to evaluate the operating performance of athenahealth and compare it against past periods, make operating decisions, and serve as a basis for strategic planning. These non-GAAP financial measures provide management with additional means to understand and evaluate the operating results and trends in our ongoing business by eliminating certain non-cash expenses and other items that management believes might otherwise make comparisons of our ongoing business with prior periods more difficult, obscure trends in ongoing operations, or reduce management’s ability to make useful forecasts. Management believes that these non-GAAP financial measures provide additional means of evaluating period-over-period operating performance. In addition, management understands that some investors and financial analysts find this information helpful in analyzing our financial and operational performance and comparing this performance to our peers and competitors.

Management defines “Non-GAAP Adjusted Gross Profit” as total revenue, less direct operating expense, plus (1) stock-based compensation expense allocated to direct operating expense and (2) amortization of purchased intangible assets allocated to direct operating expense, and “Non-GAAP Adjusted Gross Margin” as Non-GAAP Adjusted Gross Profit as a percentage of total revenue. Management considers these non-GAAP financial measures to be important indicators of our operational strength and performance of our business and a good measure of our historical operating trends. Moreover, management believes that these measures enable investors and financial analysts to closely monitor and understand changes in our ability to generate income from ongoing business operations.

Management defines “Non-GAAP Adjusted EBITDA” as the sum of GAAP net loss before benefit from income taxes, total other (income) expense, stock-based compensation expense, depreciation and amortization, amortization of purchased intangible assets, integration and transaction costs, and lease termination costs and “Non-GAAP Adjusted EBITDA Margin” as Non-GAAP Adjusted EBITDA as a percentage of total revenue. Management defines “Non-GAAP Adjusted Operating Income” as the sum of GAAP net loss before benefit from income taxes, total other (income) expense, stock-based compensation expense, amortization of capitalized stock-based compensation related to software development, amortization of purchased intangible assets, integration and transaction costs, and lease termination costs and “Non-GAAP Adjusted Operating Income Margin” as Non-GAAP Adjusted Operating Income as a percentage of total revenue. Management defines “Non-GAAP Adjusted Net Income” as the sum of GAAP net loss before stock-based compensation expense, amortization of capitalized stock-based compensation related to software development, amortization of purchased intangible assets, integration and transaction costs, and lease termination costs and any tax impact related to these preceding items, and an adjustment to the tax provision for the non-GAAP tax rate and “Non-GAAP Adjusted Net Income per Diluted Share” as Non-GAAP Adjusted Net Income divided by weighted average diluted shares outstanding. Management considers all of these non-GAAP financial measures to be important indicators of our operational strength and performance of our business and a good measure of our historical operating trends, in particular the extent to which ongoing operations impact our overall financial performance.

13

Management excludes or adjusts each of the items identified below from the applicable non-GAAP financial measure referenced above for the reasons set forth with respect to that excluded item:

• | Stock-based compensation expense and amortization of capitalized stock-based compensation related to software development — excluded because these are non-cash expenditures that management does not consider part of ongoing operating results when assessing the performance of our business, and also because the total amount of the expenditure is partially outside of our control because it is based on factors such as stock price, volatility, and interest rates, which may be unrelated to our performance during the period in which the expenses are incurred. |

• | Amortization of purchased intangible assets — purchased intangible assets are amortized over their estimated useful lives and generally cannot be changed or influenced by management after the acquisition. Accordingly, this item is not considered by management in making operating decisions. Management does not believe such charges accurately reflect the performance of our ongoing operations for the period in which such charges are incurred. |

• | Integration and transaction costs — integration costs are the severance payments and retention bonuses for certain employees relating to the RazorInsights acquisition. Transaction costs are non-recurring costs related to specific transactions. Accordingly, management believes that such expenses do not have a direct correlation to future business operations, and therefore, these costs are not considered by management in making operating decisions. Management does not believe such charges accurately reflect the performance of our ongoing operations for the period in which such charges are incurred. |

• | Lease termination costs — represents costs to terminate certain lease agreements. Management does not believe such costs accurately reflect the performance of our ongoing operations for the period in which such costs are incurred. |

• | Non-GAAP tax rate — We use a non-GAAP tax rate of 40% to normalize the tax impact to our Non-GAAP Adjusted Net Income per Diluted Share based on the fact that a relatively small change in pre-tax GAAP income (loss) in any one period could result in a volatile GAAP effective tax rate. |

14