As filed with the Securities and Exchange Commission on June 6, 2011

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-10267

GPS FUNDS I

(Exact name of registrant as specified in charter)

2300 CONTRA COSTA BOULEVARD, SUITE 600,

PLEASANT HILL, CA 94523-3967

(Address of principal executive offices) (Zip code)

STARR E. FROHLICH

GENWORTH FINANCIAL WEALTH MANAGEMENT, INC.

2300 CONTRA COSTA BOULEVARD, SUITE 600

PLEASANT HILL, CA 94523-3967

(Name and address of agent for service)

800-664-5345

Registrant’s telephone number, including area code

Date of fiscal year end: March 31, 2011

Date of reporting period: April 1, 2010 through March 31, 2011

Item 1. Report to Stockholders.

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

Investment Advisor |

|

|

|

|

Genworth Financial Wealth Management, Inc. |

|

|

|

|

|

|

|

|

ANNUAL REPORT |

|

|

|

|

|

|

|

|

|

|

March 31, 2011 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GUIDEMARKSM LARGE CAP GROWTH FUND |

|

|

|

|

|

|

|

|

|

GUIDEMARKSM LARGE CAP VALUE FUND |

|

|

|

|

|

|

|

|

|

GUIDEMARKSM SMALL/MID CAP CORE FUND |

|

|

|

|

|

|

|

|

|

GUIDEMARKSM WORLD EX-US FUND |

|

|

|

|

|

|

|

|

|

GUIDEMARKSM TAX-EXEMPT FIXED INCOME FUND |

|

|

|

|

|

|

|

|

|

GUIDEMARKSM CORE FIXED INCOME FUND |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

May 9, 2011

Dear Shareholder:

Enclosed is the Annual Report of the GuideMarkSM Funds (formerly, the AssetMark Funds) covering the period from April 1, 2010 through March 31, 2011. The year ended March 31 delivered positive results for the global markets, albeit with significant equity market volatility at several points. Notwithstanding a range of macroeconomic challenges, we believe the overarching upward trend reflected deepening optimism about the two-year-old recovery from the global financial crisis.

The S&P 500® Index1 rose 15.65% over the fiscal year, while the world ex-U.S., as represented by the MSCI All Country World ex-U.S. Index2, returned 13.61% for the 12-month period. Fixed income markets also moved higher for the year, with the Barclays Capital U.S. Aggregate Bond Index3 netting 5.12%, and the Barclays Capital Euro Aggregate Index4 returning 3.63%.

Finally, REIT market performance, as measured by the FTSE National Association of Real Estate Investment Trusts Equity Index5, generated a strong full year gain of 23.68%.

A Year of Contrasts and Optimism

Over the past year, high unemployment in Europe plagued countries such as Ireland and Greece, while Germany experienced the lowest unemployment in two decades and strong export growth. Commodity markets rallied, while U.S. core inflation rates touched 50-year lows. The residential housing market in the U.S. continued to struggle, yet corporate earnings were strong. And, overall, developing China and India continued to grow much faster than the developed economies.

Residential housing continued to drag, and climbing food prices threatened to erode discretionary spending not only domestically but around the world. Government debt levels remained elevated in many European countries, as well as in the U.S. and Japan. Yet, corporate earnings were strong, with companies continuing to hold record-high levels of cash. In the U.S., employment figures continued to slowly improve, and by March 31, 2011, the unemployment rate had dropped to a two-year low. All in all, as the financial crisis continued to recede, markets preferred to concentrate virtually all of their attention on the positives.

Potential Game Changers

Recent world events – the Japanese earthquake and tsunami, as well as political uprisings in the Middle East and North Africa – provided a backdrop for significant market volatility in the latter part of the fiscal year. Generally speaking, however, the markets responded by continuing to advance despite those setbacks, and yet either could impact the environment for investors as the year continues to unfold.

Events in Egypt and Libya took the spotlight in an unstable region during the year. By the end of March 2011, the price of oil had reached a 30-month high, leading to worries that oil could be a game changer for the U.S. economy and markets.6 Although oil prices could spike if inventories dry up, some analysts believe this is unlikely to happen unless supply from a major oil producing country, such as Saudi Arabia, is disrupted.7 In contrast to this view, other observers think that the political transformation taking place in the Middle East and North Africa will very likely lead to persistent increases in the price of oil, if only to compensate for elevated risk in an uncertain market.8

It is widely believed by investment professionals that the Japanese disaster will not have a major impact on global markets and that recovery will likely take place quickly. However, if leaks at the damaged nuclear power plants lead to a Chernobyl-sized disaster, the negative economic impact will more likely spread beyond Japan and persist for a longer period of time.9

Looking Ahead

Positive surprises thus far in 2011 include accelerating employment and GDP growth. Quantitative easing is scheduled to end mid-2011, in our opinion, this leaves questions as to whether a relapse into recession will follow or whether the economy will

be strong enough to move ahead without government support. In addition, we feel the possibility of interest rate increases in China and debt downgrades in Europe are areas to watch.

Ned Davis Research observes that “macro factors typically give way to company-specific factors as the bull [market] matures.” But with the unusually impactful macro events following the financial crisis – such as the Japanese disaster and burgeoning unrest in oil-producing countries, as well as continuing sovereign debt problems, particularly in Europe – macro factors may continue to drive markets.10 This perspective on the possibility for continuing macro-driven markets is compatible with views of other analysts and market observers who anticipate more modest stock gains and a “choppier ride” as 2011 continues to unfold.11 Of course, we believe a return to recession cannot be ruled out until the economy has recovered fully from the financial crisis. And, at the other extreme, investors could continue to ignore bad news, as they have preferred to do in the recent past, and markets could continue to forge their way upward.

As you are aware, effective April 1, the Funds completed a restructuring to become the GuideMarkSM Funds. We are confident that this restructuring will better position the Funds to meet the challenges and opportunities that lie ahead. We recognize the trust you have placed in us and thank you for including the Funds in your portfolio.

Sincerely,

Carrie E. Hansen

President

GuideMarkSM Funds

|

|

|

|

|

|

||

|

1 |

The S&P 500® Index, a registered trademark of the McGraw Hill Companies, is an unmanaged basket of 500 stocks that are considered to be widely held and thus believed to be a good indicator of overall market performance. You cannot invest directly into an index. |

|

|

|

|

|

|

2 |

The MSCI All Country World ex-U.S. Index is a free float-adjusted market capitalization index designed to measure the combined equity market performance of developed and emerging markets countries, excluding the United States. This index consists of 44 country indices comprising 23 developed and 21 emerging market country indices. |

|

|

|

|

|

|

3 |

The Barclays Capital U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM passthroughs), ABS, and CMBS. |

|

|

|

|

|

|

4 |

The Barclays Capital Euro Aggregate Bond Index is designed to track fixed-rate, investment grade Euro-denominated securities. Inclusion in the Benchmark Index is based on the currency of the issue, and not the domicile of the issuer. The principal sectors in the Benchmark Index are treasury, corporate, government-related and securitized. |

|

|

|

|

|

|

5 |

The FTSE NAREIT Equity REIT Index is a broad measure of the performance of publicly traded U.S. real estate securities, such as Real Estate Investment Trusts (REITs) and Real Estate Operating Companies. |

|

|

|

|

|

|

6 |

“Oil climbs to highest since 2008 on Libya conflict,” Associated Press, March 31, 2011. |

|

|

|

|

|

|

7 |

Tom Fahey, Ryan McGrail, Richard Skaggs and Joseph Taylor, “middle east politics & oil: the influences on global interest rates, credit spreads & stock prices,” Loomis Sayles, March 18, 2011. |

|

|

|

|

|

|

8 |

Javier Blas, “The politics of oil: Wells of anxiety,” Financial Times, March 29, 2011. |

|

2

|

|

|

|

|

9 |

“Following Japanese disaster, long-term investment outlook remains positive,” Natixis Global Associates, March 2011. |

|

|

|

|

|

|

10 |

Ed Clissold, CFA, “What to Expect in the Third Year of Bull Market,” Ned Davis Research Inc. Chart of the Day, March 10, 2011. |

|

|

|

|

|

|

11 |

Barbara Kollmeyer, “International stock fund investors’ dizzying spin,” MarketWatch, April 1, 2011. Also see footnote 2. |

|

Past performance is not indicative of future results. You cannot invest directly into an index.

Investments in the Funds will fluctuate, and when redeemed may be worth more or less than originally invested.

Investors should consider the Funds’ Investment objectives, risks, charges and expenses carefully before investing. The prospectus contains this and other important information about the Funds. Please read the prospectus carefully before you invest or send money. The prospectus is available upon request, without charge, by calling 1-800-238-0810.

FINRA 116789 051211

3

|

|

|

GuideMarkSM Large Cap Growth Fund |

|

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Unaudited) |

|

|

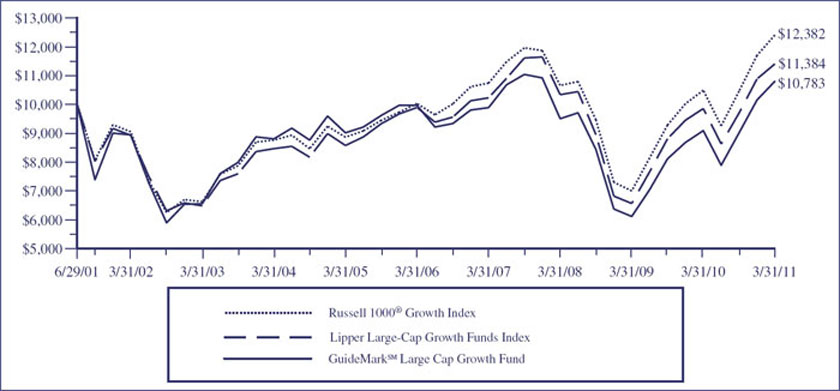

RUSSELL 1000® GROWTH INDEX – An unmanaged index which measures the performance of those Russell 1000® companies with higher price-to-book ratios and higher forecasted growth values. The Russell 1000® Index is an unmanaged index which measures the performance of the 1,000 largest companies in the Russell 3000® Index. The Russell 3000® Index is an unmanaged index which measures the performance of the 3,000 largest U.S. Companies, based on total market capitalization, which represents approximately 98% of the investable U.S. equity market.

LIPPER LARGE-CAP GROWTH FUNDS INDEX – The Lipper Large-Cap Growth Funds Index is the average of the 30 largest funds in the Lipper Large-Cap Growth Funds Category. These funds, by portfolio practice, invest at least 75% of their assets in companies with market capitalizations (on a three-year weighted basis) greater than 300% of the dollar-weighted median market capitalization of the middle 1,000 securities of the Standard & Poor’s Super Composite 1500® Index. These funds typically invest in securities that have an above average price-to-earnings ratio, price-to-book ratio and three-year sales-per-share growth value, compared to the Standard & Poor’s 500 Composite Index.

|

|

|

|

|

|

|

|

|

|

|

|

|

AVERAGE ANNUAL TOTAL RETURN (for the period ended March 31) |

|

|||||||||

|

|

|

One Year |

|

Five Year |

|

Since Inception (6/29/01) |

|

|||

|

|

|

|

|

|

||||||

|

GuideMarkSM Large Cap Growth Fund |

|

18.79 |

% |

|

1.62 |

% |

|

0.77 |

% |

|

|

Russell 1000® Growth Index |

|

18.26 |

% |

|

4.34 |

% |

|

2.22 |

% |

|

|

Lipper Large-Cap Growth Funds Index |

|

15.68 |

% |

|

2.87 |

% |

|

1.34 |

% |

|

4

|

|

|

GuideMarkSM Large Cap Growth Fund |

|

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Continued) (Unaudited) |

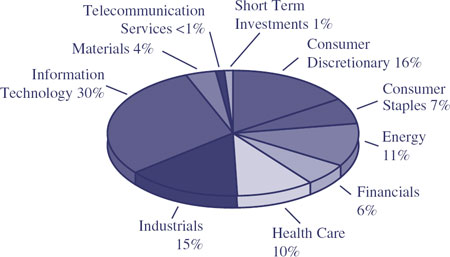

For the 12 months ended March 31, 2011, the Fund returned 18.79%, outperforming the Russell 1000® Growth Index at 18.26% and the Lipper Large-Cap Growth Funds Index at 15.68%.

|

|

|

|

• |

Security selection was the primary driver of the outperformance, with exposure to consumer oriented stocks including Apple, Inc., Priceline.Com Inc. and Netflix.Com Inc. being the largest contributors to performance over the full year. |

|

|

|

|

• |

The Fund benefited from fundamental factor exposure, specifically exposure to securities with greater momentum, lower price/earnings ratios and higher beta relative to the Russell 1000® Growth Index. |

|

|

|

|

• |

Negative sector positioning, primarily driven by underweight exposures to materials and energy, offset the benefit from fundamental factors. |

Components of Portfolio Holdings*

|

|

|

|

* |

Pie chart represents percentages of total portfolio, less securities lending collateral. |

Top Ten Holdings

|

|

|

|

|

|

|

Rank |

|

Security/Holding |

% of Net |

|

|

1 |

|

|

Apple, Inc. |

5.36 |

|

2 |

|

|

Exxon Mobil Corp. |

3.32 |

|

3 |

|

|

Google, Inc. |

2.37 |

|

4 |

|

|

Qualcomm, Inc. |

2.32 |

|

5 |

|

|

Oracle Corp. |

2.26 |

|

6 |

|

|

International Business Machines Corp. |

1.98 |

|

7 |

|

|

Amazon.com, Inc. |

1.80 |

|

8 |

|

|

EMC Corp. |

1.66 |

|

9 |

|

|

Netflix, Inc. |

1.51 |

|

10 |

|

|

Schlumberger Ltd. |

1.43 |

|

|

|

|

|

|

|

The Global Industry Classification Standard (“GICS®”) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC. |

||||

5

|

|

|

GuideMarkSM Large Cap Value Fund |

|

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Unaudited) |

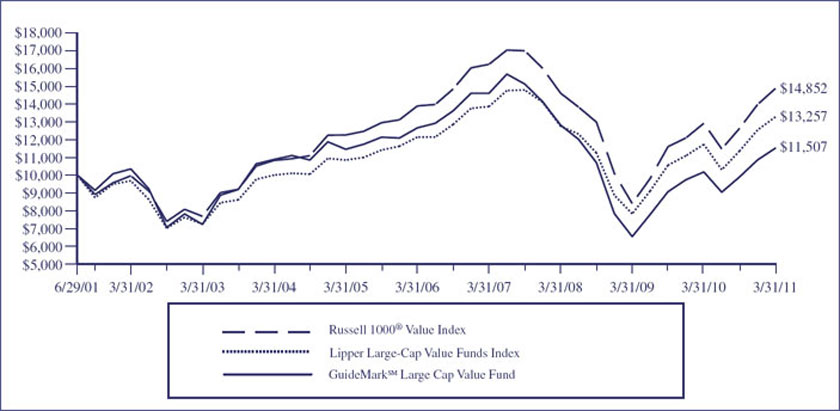

RUSSELL 1000® VALUE INDEX – An unmanaged index which measures the performance of those Russell 1000® companies with lower price-to-book ratios and lower forecasted growth values. The Russell 1000® Index is an unmanaged index which measures the performance of the 1,000 largest companies in the Russell 3000® Index. The Russell 3000® Index is an unmanaged index which measures the performance of the 3,000 largest U.S. Companies, based on total market capitalization, which represents approximately 98% of the investable U.S. equity market.

LIPPER LARGE-CAP VALUE FUNDS INDEX – The Lipper Large-Cap Value Funds Index is the average of the 30 largest funds in the Lipper Large-Cap Value Funds Category. These funds, by portfolio practice, invest at least 75% of their assets in companies with market capitalizations (on a three-year weighted basis) greater than 300% of the dollar-weighted median market capitalization of the middle 1,000 securities of the Standard & Poor’s Super Composite 1500® Index. Large-cap value funds typically invest in securities that have a below average price-to-earnings ratio, price-to-book ratio and three-year sales-per-share growth value, compared to the S&P 500® Index.

|

|

|

|

|

|

|

|

|

|

|

|

|

AVERAGE ANNUAL TOTAL RETURN (for the period ended March 31) |

|

|||||||||

|

|

|

One Year |

|

Five Year |

|

Since Inception (6/29/01) |

|

|||

|

|

|

|

|

|

||||||

|

GuideMarkSM Large Cap Value Fund |

|

|

13.15% |

|

|

-1.87% |

|

|

1.45% |

|

|

Russell 1000® Value Index |

|

|

15.15% |

|

|

1.38% |

|

|

4.14% |

|

|

Lipper Large-Cap Value Funds Index |

|

|

13.14% |

|

|

1.80% |

|

|

2.93% |

|

6

|

|

|

GuideMarkSM Large Cap Value Fund |

|

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Continued) (Unaudited) |

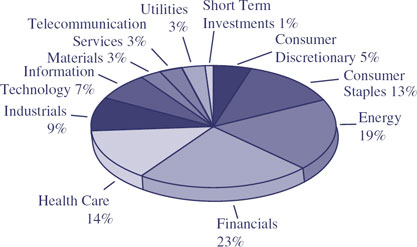

For the 12 months ended March 31, 2011, the Fund returned 13.15%, underperforming the Russell 1000® Value Index at 15.15% but in line with the Lipper Large-Cap Value Funds Index at 13.14%.

|

|

|

|

|

|

• |

Over the period security selection was the largest detractor to performance, specifically positions in Diamond Offshore Drilling, Microsoft Corp. and Merck & Co Inc. were among the largest detractors. |

|

|

|

|

|

|

• |

Fundamental factor exposure also detracted from the Fund’s performance, specifically exposure to securities with higher market capitalization and less momentum relative to the Russell 1000® Value Index. |

|

|

|

|

|

|

• |

Sector positioning benefited returns primarily due to the Fund’s overweight exposures to energy and technology and underweight exposure to industrials. |

Components of Portfolio Holdings*

|

|

|

|

* |

Pie chart represents percentages of total portfolio, less securities lending collateral. |

Top Ten Holdings

|

|

|

|

|

|

|

|

Rank |

|

Security/Holding |

|

% of Net |

|

|

1 |

|

Pfizer, Inc. |

|

3.02 |

|

|

2 |

|

Wells Fargo & Co. |

|

2.97 |

|

|

3 |

|

Occidental Petroleum Corp. |

|

2.56 |

|

|

4 |

|

Johnson & Johnson |

|

2.46 |

|

|

5 |

|

Merck & Co., Inc. |

|

2.19 |

|

|

6 |

|

Chevron Corp. |

|

2.03 |

|

|

7 |

|

Devon Energy Corp. |

|

1.97 |

|

|

8 |

|

EOG Resources, Inc. |

|

1.93 |

|

|

9 |

|

CVS Caremark Corporation |

|

1.93 |

|

|

10 |

|

JPMorgan Chase & Co. |

|

1.83 |

|

7

|

|

|

GuideMarkSM Small/Mid Cap Core Fund |

|

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Unaudited) |

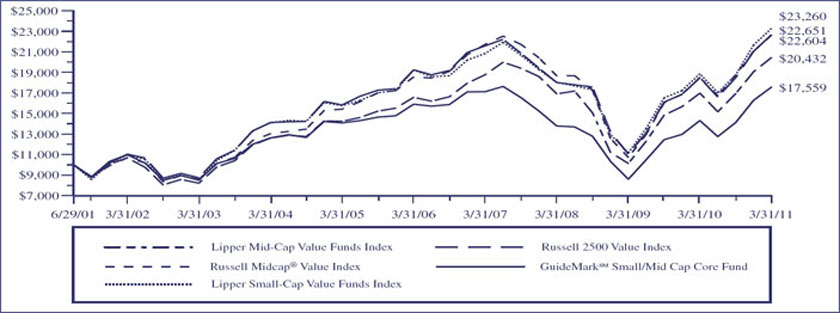

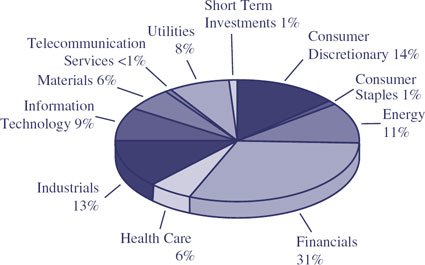

RUSSELL 2500 VALUE INDEX – An unmanaged index which measures the performance of those Russell 2500 Index companies with lower price-to-book ratios and lower forecasted growth values. The Russell 2500 Index is an unmanaged index which measures the performance of the 2,500 smallest companies in the Russell 3000® Index. The Russell 3000® Index is an unmanaged index which measures the performance of the 3,000 largest U.S. Companies, based on total market capitalization, which represents approximately 98% of the investable U.S. equity market. RUSSELL MIDCAP® VALUE INDEX – Measures the performance of those Russell Midcap companies with lower price-to-book ratios and lower forecasted growth values. The stocks are also members of the Russell 1000® Value Index. The Russell 1000® Value Index contains those securites in the Russell 1000® Index with a less-than-average growth orientation.

LIPPER SMALL-CAP VALUE FUNDS INDEX – The Lipper Small-Cap Value Funds Index is the average of the 30 largest funds in the Lipper Small-Cap Value Funds Category. These funds, by portfolio practice, invest at least 75% of their assets in companies with market capitalizations (on a three-year weighted basis) less than 250% of the dollar-weighted median market capitalization of the smallest 500 of the middle 1,000 securities of the S&P Super Composite 1500® Index. These funds typically have a below average price-to-earnings ratio, price-to-book ratio and three-year sales-per-share growth value, compared to the S&P SmallCap 600 Index™.

LIPPER MID-CAP VALUE FUNDS INDEX – The Lipper Mid-Cap Value Funds Index includes funds that, by portfolio practice, invest at least 75% of their assets in companies with market capitalizations (on a three-year weighted basis) of less than 300% of the dollar-weighted median market capitalization of the S&P Mid-Cap 400 Index. Mid-Cap Value funds seek long-term growth of capital by investing in companies that are considered to be undervalued relative to a major unmanaged stock index based on price-to-current earnings, book value, asset value, or other factors. These funds will normally have a below average price-to-earnings ratio, price-to-book ratio and three-year earnings growth figure, compared to the U.S. diversified mid-cap funds universe average.

|

|

|

|

|

|

|

|

|

|

|

|

|

AVERAGE ANNUAL TOTAL RETURN (for the period ended March 31) |

|

|||||||||

|

|

|

One Year |

|

Five Year |

|

Since Inception (6/29/01) |

|

|||

|

|

|

|

|

|

||||||

|

GuideMarkSM Small/Mid Cap Core Fund |

|

|

22.73% |

|

2.01 |

% |

|

|

5.94% |

|

|

Russell 2500 Value Index |

|

|

22.67% |

|

3.32 |

% |

|

|

8.74% |

|

|

Russell Midcap® Value Index |

|

|

22.26% |

|

4.04 |

% |

|

|

8.72% |

|

|

Lipper Small-Cap Value Funds Index |

|

|

23.34% |

|

3.88 |

% |

|

|

9.26% |

|

|

Lipper Mid-Cap Value Funds Index |

|

|

20.39% |

|

4.29 |

% |

|

|

7.60% |

|

8

|

|

|

GuideMarkSM Small/Mid Cap Core Fund |

|

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Continued) (Unaudited) |

For the 12 months ended March 31, 2011, the Fund returned 22.73%, outperforming the Russell 2500 Value Index at 22.67% and the Lipper Mid-Cap Value Funds Index at 20.39% but underperforming the Lipper Small-Cap Value Funds Index at 23.34%.

|

|

|

|

|

|

• |

Strong security selection more than offset the negative impact from fundamental factor exposure and sector allocation. The takeover of ADC Telecommunication Inc. resulted in the security being the strongest performing stock, in addition to Leucadia National Co. and Discover Financial Services Inc. |

|

|

|

|

|

|

• |

Fundamental factor exposure dampened the Fund’s performance, specifically exposure to securities with larger market capitalization, higher volatility and higher price/book ratios relative to the Russell 2500 Value Index. |

|

|

|

|

|

|

• |

Sector positioning was also a slight negative due largely to the Fund’s underweight exposures to utilities, financials and consumer staples. In the aggregate, these underweight positions offset the gains from overweight exposures to industrials and consumer discretionary. |

Components of Portfolio Holdings*

|

|

|

|

* |

Pie chart represents percentages of total portfolio, less securities lending collateral. |

Top Ten Holdings

|

|

|

|

|

|

|

|

Rank |

|

Security/Holding |

|

% of Net |

|

|

1 |

|

Trinity Industries, Inc. |

|

2.30 |

|

|

2 |

|

Spirit AeroSystems Holdings, Inc. |

|

2.02 |

|

|

3 |

|

Cabot Oil & Gas Corp. |

|

1.99 |

|

|

4 |

|

Foot Locker, Inc. |

|

1.85 |

|

|

5 |

|

Plum Creek Timber Co., Inc. |

|

1.80 |

|

|

6 |

|

CIT Group, Inc. |

|

1.75 |

|

|

7 |

|

Leucadia National Corp. |

|

1.72 |

|

|

8 |

|

Discover Financial Services |

|

1.66 |

|

|

9 |

|

Avnet, Inc. |

|

1.60 |

|

|

10 |

|

Tech Data Corp. |

|

1.56 |

|

9

|

|

|

GuideMarkSM World ex-US Fund |

|

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Unaudited) |

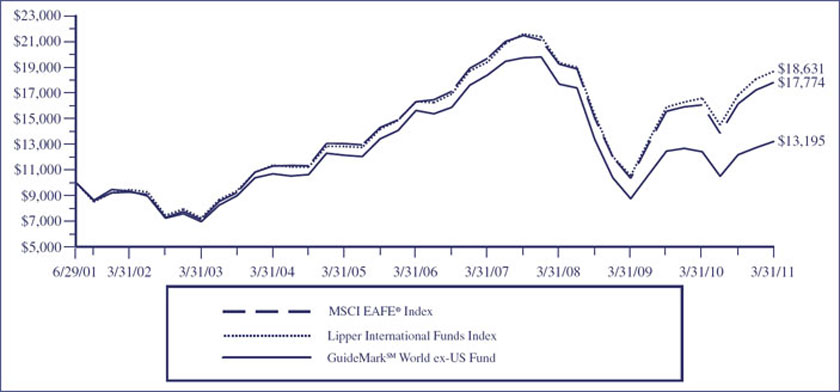

MSCI EAFE® INDEX – The MSCI Europe, Australia, and Far East Index (MSCI EAFE®) is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed countries, excluding the U.S. & Canada.

LIPPER INTERNATIONAL FUNDS INDEX – An unmanaged index which measures the composite performance of the 30 largest “international” mutual funds, as categorized by Lipper Inc. These funds invest in securities with primary tradings markets outside of the United States.

|

|

|

|

|

|

|

|

|

|

|

|

|

AVERAGE ANNUAL TOTAL RETURN (for the period ended March 31) |

|

|||||||||

|

|

|

One Year |

|

Five Year |

|

Since Inception (6/29/01) |

|

|||

|

|

|

|

|

|

||||||

|

GuideMarkSM World ex-US Fund |

|

6.48 |

% |

|

|

-3.29% |

|

|

2.88% |

|

|

MSCI EAFE® Index |

|

10.90 |

% |

|

|

1.78% |

|

|

6.08% |

|

|

Lipper International Funds Index |

|

12.57 |

% |

|

|

2.75% |

|

|

6.60% |

|

10

|

|

|

GuideMarkSM World ex-US Fund |

|

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Continued) (Unaudited) |

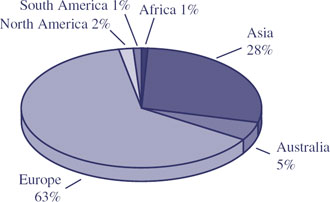

For the 12 months ended March 31, 2011, the Fund returned 6.48%, underperforming the MSCI EAFE® Index at 10.90% and the Lipper International Funds Index at 12.57%.

|

|

|

|

|

|

• |

The largest drivers of the relative underperformance were security selection and currency exposures, but sector positioning, fundamental factor exposure and country allocation also detracted from returns. |

|

|

|

|

|

|

• |

Positions in British Petroleum, RWE AG and Philips Electronics were amongst the worst performers for the period. Underweight exposure to Sweden and the Swedish Krona detracted from performance as Swedish stocks with energy exposure benefited from higher oil prices. |

|

|

|

|

|

|

• |

Large underweight exposure to materials, industrials and financials dampened returns as did higher exposures to securities with larger market capitalizations and lower price/earnings ratios relative to the MSCI EAFE® Index. |

Components of Portfolio Holdings*

|

|

|

|

* |

Pie chart represents percentages of total portfolio, less securities lending collateral. |

Top Ten Holdings

|

|

|

|

|

|

|

|

Rank |

|

Security/Holding |

|

% of Net |

|

|

1 |

|

Sanofi-Aventis SA |

|

2.87 |

|

|

2 |

|

Telefonica SA |

|

2.82 |

|

|

3 |

|

Unilever Plc |

|

2.00 |

|

|

4 |

|

GlaxoSmithKline Plc |

|

1.91 |

|

|

5 |

|

Takeda Pharmaceutical Co., Ltd. |

|

1.87 |

|

|

6 |

|

Total SA |

|

1.83 |

|

|

7 |

|

Royal Dutch Shell Plc |

|

1.81 |

|

|

8 |

|

France Telecom SA |

|

1.78 |

|

|

9 |

|

Novartis AG |

|

1.77 |

|

|

10 |

|

Seven & i Holdings Co., Ltd. |

|

1.68 |

|

11

|

|

|

GuideMarkSM Tax-Exempt Fixed Income Fund |

|

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Unaudited) |

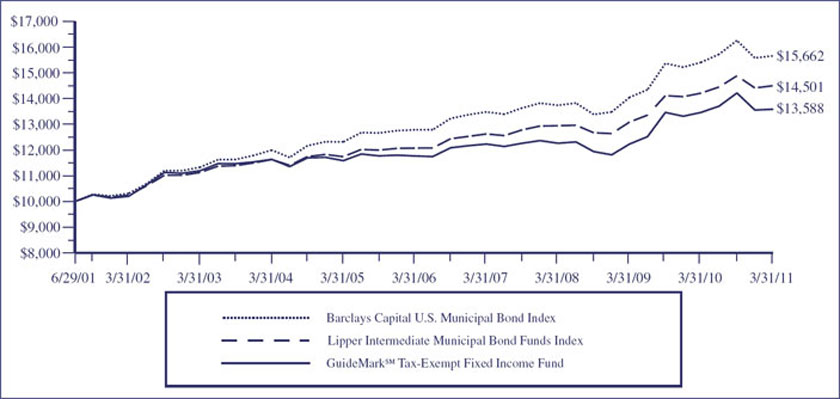

BARCLAYS CAPITAL U.S. MUNICIPAL BOND INDEX – The Barclays Capital U.S. Municipal Bond Index is a market-value-weighted index for the long-term tax-exempt bond market. To be included in the index, bonds must have a minimum credit rating of Baa. They must have an outstanding par value of at least $7 million and be issued as part of a transaction of at least $75 million. The bonds must be fixed rate, have a date after December 31, 1990, and must be at least one year from their maturity date.

LIPPER INTERMEDIATE MUNICIPAL BOND FUNDS INDEX – The Lipper Intermediate Municipal Bond Funds Index is an index of funds that invest in municipal debt issues with dollar-weighted average maturities of five to ten years.

|

|

|

|

|

|

|

|

|

|

|

|

|

AVERAGE ANNUAL TOTAL RETURN (for the period ended March 31) |

|

|||||||||

|

|

|

One Year |

|

Five Year |

|

Since Inception (6/29/01) |

|

|||

|

|

|

|

|

|

||||||

|

GuideMarkSM Tax-Exempt Fixed Income Fund |

|

|

0.89% |

|

|

2.91% |

|

|

3.19% |

|

|

Barclays Capital U.S. Municipal Bond Index |

|

|

1.63% |

|

|

4.14% |

|

|

4.71% |

|

|

Lipper Intermediate Municipal Bond Funds Index |

|

|

2.02% |

|

|

3.72% |

|

|

3.89% |

|

12

|

|

|

GuideMarkSM Tax-Exempt Fixed Income Fund |

|

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Continued) (Unaudited) |

For the 12 months ended March 31, 2011, the Fund returned 0.89%, underperforming the Barclays Capital Municipal Index at 1.63% and the Lipper Intermediate Municipal Bond Funds Index at 2.02%.

|

|

|

|

|

|

• |

The Fund’s relative underperformance for the period was primarily due to its trailing performance during the latter half of the period. A panic induced sell off in the municipal bond market created a significant headwind. |

|

|

|

|

|

|

• |

The increase in rates at the long-end of the yield curve following the Fed’s second round of quantitative easing in the last quarter of 2010, increased headline risk and technical factors related to expiration of the ‘Build America Bond’ program created significant volatility in the municipal market. |

|

|

|

|

|

|

• |

Exposure to lower rated securities detracted from performance as spreads widened following a flight to quality. A more diversified exposure across the yield curve also dampened performance as the shorter-dated maturities significantly outperformed longer-dated maturities. |

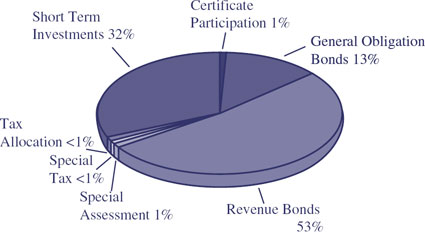

Components of Portfolio Holdings*

|

|

|

|

* |

Pie chart represents percentages of total portfolio. |

Top Ten Holdings

|

|

|

|

|

|

|

|

Rank |

|

Security/Holding |

|

% of Net |

|

|

1 |

|

Massachusetts

Health & Educational Facilities Authority, |

|

3.11 |

|

|

2 |

|

Massachusetts

Health & Educational Facilities Authority, |

|

2.94 |

|

|

3 |

|

California

Statewide Communities Development Authority, |

|

2.94 |

|

|

4 |

|

Capital Area

Cultural Education Facilities Finance |

|

0.82 |

|

|

5 |

|

Miami-Dade

County Educational Facilities, Series A, |

|

0.82 |

|

|

6 |

|

Allegheny

County Hospital Development Authority, |

|

0.80 |

|

|

7 |

|

Maryland

Department of Transportation County T |

|

0.80 |

|

|

8 |

|

New York City, Series A. GO, 5.000%, 08/01/2020 |

|

0.78 |

|

|

9 |

|

Pennsylvania

Economic Development Financing Authority, |

|

0.75 |

|

|

10 |

|

San Francisco

Steinhart Aquarium, Series F, GO, |

|

0.72 |

|

13

|

|

|

GuideMarkSM Core Fixed Income Fund |

|

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Unaudited) |

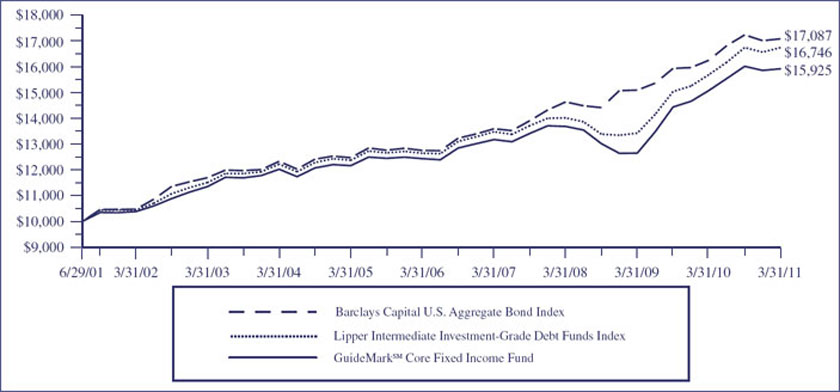

BARCLAYS CAPITAL U.S. AGGREGATE BOND INDEX – An unmanaged index which measures the performance of securities from the Barclays Capital Government/Corporate Bond Index, Mortgage-Backed Securities Index and the Asset-Backed Securities Index. The Barclays Capital U.S. Aggregate Bond Index is a broad representation of the investment-grade fixed-income market in the U.S. and includes U.S. Government and corporate debt securities, mortgage and asset-backed securities and international U.S. dollar-denominated bonds. All securities contained in the Barclays Capital U.S. Aggregate Bond Index have a minimum term to maturity of one year.

LIPPER INTERMEDIATE INVESTMENT-GRADE DEBT FUNDS INDEX – The Lipper Intermediate Investment-Grade Debt Funds Index is an index of funds that invest at least 65% of their assets in investment-grade debt issues (rated in the top four grades) with dollar-weighted average maturities of five to ten years.

|

|

|

|

|

|

|

|

|

|

|

|

|

AVERAGE ANNUAL TOTAL RETURN (for the period ended March 31) |

|

|||||||||

|

|

|

One Year |

|

Five Year |

|

Since Inception (6/29/01) |

|

|||

|

|

|

|

|

|

||||||

|

GuideMarkSM Core Fixed Income Fund |

|

|

5.58% |

|

|

5.04% |

|

|

4.87% |

|

|

Barclays Capital U.S. Aggregate Bond Index |

|

|

5.12% |

|

|

6.03% |

|

|

5.65% |

|

|

Lipper Intermediate Investment-Grade Debt Funds Index |

|

|

6.68% |

|

|

5.77% |

|

|

5.43% |

|

14

|

|

|

GuideMarkSM Core Fixed Income Fund |

|

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Continued) (Unaudited) |

For the 12 months ended March 31, 2011, the Fund returned 5.58%, outperforming the Barclays Capital Aggregate Bond Index at 5.12% but underperforming the Lipper Intermediate Investment Grade Debt Funds Index at 6.68%.

|

|

|

|

|

|

• |

Overweight exposure to spread sectors and favorable security selection within corporates were the primary drivers of the outperformance over the period. Duration exposure and yield curve positioning were generally neutral to modestly negative for the period. |

|

|

|

|

|

|

• |

Exposure to structured securities including mortgage backed securities benefited performance as investors continued to favor higher spread sectors. However, an underweight exposure to commercial mortgage backed securities dampened returns for the period. |

|

|

|

|

|

|

• |

Overweight exposure to corporate credit bonds, particularly those rated below investment grade, benefited performance as investors continued to reward the higher yielding securities within the taxable fixed income market. |

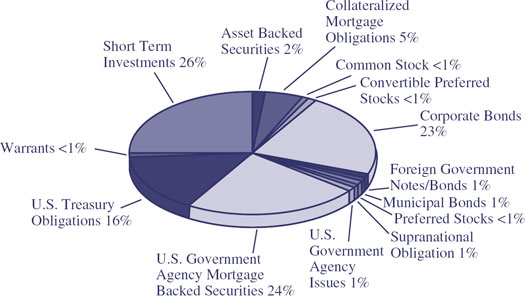

Components of Portfolio Holdings*

|

|

|

|

* |

Pie chart represents percentages of total portfolio, less securities lending collateral. |

Top Ten Holdings

|

|

|

|

|

|

|

|

Rank |

|

Security/Holding |

|

% of Net |

|

|

1 |

|

U.S. Treasury Note, 3.625%, 02/15/2021 |

|

3.51 |

|

|

2 |

|

U.S. Treasury Note, 2.000%, 01/31/2016 |

|

2.67 |

|

|

3 |

|

Federal

National Mortgage Association, Pool# TBA, |

|

2.43 |

|

|

4 |

|

U.S. Treasury Note, 1.250%, 03/15/2014 |

|

2.06 |

|

|

5 |

|

Government

National Mortgage Association, Pool# TBA |

|

1.95 |

|

|

6 |

|

Federal

National Mortgage Association, Pool# TBA, |

|

1.44 |

|

|

7 |

|

U.S. Treasury Note, 2.125%, 02/29/2016 |

|

1.30 |

|

|

8 |

|

Federal

National Mortgage Association, Pool# TBA, |

|

1.28 |

|

|

9 |

|

U.S. Treasury Note, 1.375%, 01/15/2013 |

|

1.11 |

|

|

10 |

|

Federal Home

Loan Mortgage Corp. - Gold, Pool# TBA, |

|

1.08 |

|

15

|

|

|

GuideMarkSM Funds |

|

EXPENSE EXAMPLE (Unaudited) |

|

March 31, 2011 |

As a shareholder of the GuideMarkSM Funds (the “Funds”), you incur ongoing costs, including management fees; distribution and/or service fees; and other Fund expenses. The Expense Example shown in this section is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The Expense Example is based on an investment of $1,000 invested at the beginning of a six month period and held for the entire period (October 1, 2010 – March 31, 2011) for the GuideMarkSM Large Cap Growth Fund, GuideMarkSM Large Cap Value Fund, GuideMarkSM Small/Mid Cap Core Fund, GuideMarkSM World ex-US Fund, GuideMarkSM Tax-Exempt Fixed Income Fund and GuideMarkSM Core Fixed Income Fund.

Actual Expenses

The first line of the

Expense Example table provides information about actual account values and

actual expenses. You may use the information in this line, together with the

amount you invested, to estimate the expenses that you paid over the period.

Simply divide your account value by $1,000 (for example, an $8,600 account

value divided by $1,000 = 8.6), then multiply the result by the number in the

first line under the heading entitled “Expenses Paid During Period” to estimate

the expenses you paid on your account during this period.

The example includes, but is not limited to, management fees, shareholder servicing fees, distribution fees, fund accounting, custody and transfer agent fees. However, the example below does not include portfolio trading commissions and related expenses, interest expense or dividends on short positions taken by the Funds and other extraordinary expenses as determined under generally accepted accounting principles. To the extent that a Fund invests in shares of other investment companies as part of its investment strategy, you will indirectly bear your proportionate share of any fees and expenses charged by the underlying funds in which a Fund invests in addition to the expenses of the Fund. Actual expenses of the underlying funds are expected to vary among the various underlying funds. These expenses are not included in the example below.

Hypothetical Example for Comparison Purposes

The second line of the

table below provides information about hypothetical account values and

hypothetical expenses based on the Funds’ actual expenses ratios and an assumed

rate of return of 5% per year before expenses, which is not the Funds’ actual

return. The hypothetical account values and expenses may not be used to

estimate the actual ending account balance or expenses you paid for the period.

You may use this information to compare the ongoing costs of investing in the

Funds and other funds. To do so, compare this 5% hypothetical example with the

5% hypothetical examples that appear in the shareholder reports of the other

funds.

16

|

|

|

GuideMarkSM Funds |

|

EXPENSE EXAMPLE (Continued) (Unaudited) |

|

March 31, 2011 |

|

|

|

|

|

|

|

|

|

|

Beginning |

Ending |

Annualized |

Expenses

Paid |

|

GuideMarkSM Large Cap |

Actual |

$1,000.00 |

$1,197.80 |

1.43% |

$7.84 |

|

Growth Fund |

Hypothetical3 |

$1,000.00 |

$1,017.80 |

1.43% |

$7.19 |

|

GuideMarkSM Large Cap |

Actual |

$1,000.00 |

$1,162.70 |

1.42% |

$7.66 |

|

Value Fund |

Hypothetical3 |

$1,000.00 |

$1,017.85 |

1.42% |

$7.14 |

|

GuideMarkSM Small/Mid Cap |

Actual |

$1,000.00 |

$1,244.40 |

1.63% |

$9.12 |

|

Core Fund |

Hypothetical3 |

$1,000.00 |

$1,016.80 |

1.63% |

$8.20 |

|

GuideMarkSM World ex-US |

Actual |

$1,000.00 |

$1,085.10 |

1.47% |

$7.64 |

|

Fund |

Hypothetical3 |

$1,000.00 |

$1,017.60 |

1.47% |

$7.39 |

|

GuideMarkSM Tax-Exempt |

Actual |

$1,000.00 |

$ 955.50 |

1.29% |

$6.29 |

|

Fixed Income Fund |

Hypothetical3 |

$1,000.00 |

$1,018.50 |

1.29% |

$6.49 |

|

GuideMarkSM Core |

Actual |

$1,000.00 |

$ 994.10 |

1.23% |

$6.12 |

|

Fixed Income Fund |

Hypothetical3 |

$1,000.00 |

$1,018.80 |

1.23% |

$6.19 |

|

|

|

|

1 |

The expense ratio excludes the securities lending credit. |

|

2 |

Expenses are equal to the Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 182/365 to reflect the one-half year period. |

|

3 |

5% return before expenses. |

17

|

|

|

GuideMarkSM Large Cap Growth Fund |

|

SCHEDULE OF INVESTMENTS |

|

March 31, 2011 |

|

|

|

|

|

|

|

|

|

Number of |

|

|

|

Value |

|

|

|

|

|

|

|

|||

|

|

|

COMMON STOCKS - 99.08% |

|

|

|

|

|

|

|

Aerospace & Defense - 2.77% |

|

|

|

|

|

12,900 |

|

Boeing Co. |

|

$ |

953,697 |

|

|

21,300 |

|

Honeywell International, Inc. |

|

|

1,271,823 |

|

|

7,540 |

|

Precision Castparts Corp. |

|

|

1,109,737 |

|

|

7,500 |

|

TransDigm Group, Inc. (a) |

|

|

628,725 |

|

|

22,200 |

|

United Technologies Corp. |

|

|

1,879,230 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

5,843,212 |

|

|

|

|

|

|

|

||

|

|

|

Air Freight & Logistics - 0.68% |

|

|

|

|

|

3,750 |

|

C.H. Robinson Worldwide, Inc. |

|

|

277,988 |

|

|

22,950 |

|

Expeditors International of |

|

|

|

|

|

|

|

Washington |

|

|

1,150,713 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

1,428,701 |

|

|

|

|

|

|

|

||

|

|

|

Airlines - 0.23% |

|

|

|

|

|

50,600 |

|

Delta Air Lines, Inc. (a) |

|

|

495,880 |

|

|

|

|

|

|

|

||

|

|

|

Auto Components - 1.34% |

|

|

|

|

|

29,500 |

|

Johnson Controls, Inc. |

|

|

1,226,315 |

|

|

29,250 |

|

TRW Automotive Holdings |

|

|

|

|

|

|

|

Corp. (a) |

|

|

1,611,090 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

2,837,405 |

|

|

|

|

|

|

|

||

|

|

|

Automobiles - 1.21% |

|

|

|

|

|

125,840 |

|

Ford Motor Co. (a) |

|

|

1,876,274 |

|

|

22,100 |

|

General Motors Co. (a) |

|

|

685,763 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

2,562,037 |

|

|

|

|

|

|

|

||

|

|

|

Beverages - 2.58% |

|

|

|

|

|

11,670 |

|

Anheuser-Busch InBev NV - ADR |

|

|

667,174 |

|

|

19,260 |

|

Coca-Cola Enterprises, Inc. |

|

|

525,798 |

|

|

21,100 |

|

Dr. Pepper Snapple Group, Inc. |

|

|

784,076 |

|

|

7,910 |

|

Hansen Natural Corp. (a) |

|

|

476,419 |

|

|

33,900 |

|

PepsiCo, Inc. |

|

|

2,183,499 |

|

|

12,370 |

|

The Coca-Cola Company |

|

|

820,750 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

5,457,716 |

|

|

|

|

|

|

|

||

|

|

|

Biotechnology - 3.08% |

|

|

|

|

|

2,750 |

|

Alexion Pharmaceuticals, Inc. (a) |

|

|

271,370 |

|

|

10,800 |

|

Amgen, Inc. (a) |

|

|

577,260 |

|

|

26,220 |

|

Celgene Corp. (a) |

|

|

1,508,437 |

|

|

51,330 |

|

Gilead Sciences, Inc. (a) |

|

|

2,178,445 |

|

|

22,700 |

|

Regeneron Pharmaceuticals (a) |

|

|

1,020,138 |

|

|

20,100 |

|

Vertex Pharmaceuticals, Inc. (a) |

|

|

963,393 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

6,519,043 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

Number of |

|

|

|

Value |

|

|

|

|

|

|

|

|||

|

|

|

Capital Markets - 2.56% |

|

|

|

|

|

18,200 |

|

Ameriprise Financial, Inc. |

|

$ |

1,111,656 |

|

|

2,400 |

|

Blackrock, Inc. |

|

|

482,424 |

|

|

3,280 |

|

Franklin Resources, Inc. |

|

|

410,262 |

|

|

5,100 |

|

Goldman Sachs Group, Inc. |

|

|

808,197 |

|

|

8,400 |

|

Lazard Ltd. - ADR |

|

|

349,272 |

|

|

21,200 |

|

T. Rowe Price Group, Inc. |

|

|

1,408,104 |

|

|

47,560 |

|

The Charles Schwab Corp. |

|

|

857,507 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

5,427,422 |

|

|

|

|

|

|

|

||

|

|

|

Chemicals - 2.30% |

|

|

|

|

|

5,400 |

|

CF Industries Holdings, Inc. |

|

|

738,666 |

|

|

11,720 |

|

E.I. du Pont de Nemours & Co. |

|

|

644,248 |

|

|

6,590 |

|

FMC Corp. |

|

|

559,689 |

|

|

18,150 |

|

Monsanto Co. |

|

|

1,311,519 |

|

|

13,670 |

|

Potash Corp., Inc. |

|

|

805,573 |

|

|

21,000 |

|

The Dow Chemical Co. |

|

|

792,750 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

4,852,445 |

|

|

|

|

|

|

|

||

|

|

|

Commercial Banks - 1.31% |

|

|

|

|

|

87,500 |

|

Wells Fargo & Co. |

|

|

2,773,750 |

|

|

|

|

|

|

|

||

|

|

|

Communications Equipment - 3.53% |

|

|

|

|

|

8,730 |

|

Acme Packet, Inc. (a) |

|

|

619,481 |

|

|

3,590 |

|

F5 Networks, Inc. (a) |

|

|

368,226 |

|

|

37,390 |

|

Juniper Networks, Inc. (a) |

|

|

1,573,371 |

|

|

89,320 |

|

Qualcomm, Inc. |

|

|

4,897,416 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

7,458,494 |

|

|

|

|

|

|

|

||

|

|

|

Computers & Peripherals - 11.01% |

|

|

|

|

|

32,470 |

|

Apple, Inc. (a) |

|

|

11,314,171 |

|

|

131,960 |

|

EMC Corp. (a) |

|

|

3,503,538 |

|

|

63,810 |

|

Hewlett-Packard Co. |

|

|

2,614,296 |

|

|

25,580 |

|

International Business Machines |

|

|

|

|

|

|

|

Corp. |

|

|

4,171,331 |

|

|

8,950 |

|

NetApp, Inc. (a) |

|

|

431,211 |

|

|

23,400 |

|

Teradata Corp. (a) |

|

|

1,186,380 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

23,220,927 |

|

|

|

|

|

|

|

||

|

|

|

Construction & Engineering - 0.38% |

|

|

|

|

|

11,000 |

|

Fluor Corp. |

|

|

810,260 |

|

|

|

|

|

|

|

||

|

|

|

Consumer Finance - 0.39% |

|

|

|

|

|

18,160 |

|

American Express Co. |

|

|

820,832 |

|

|

|

|

|

|

|

||

|

|

|

Diversified Financial Services - 0.80% |

|

|

|

|

|

4,400 |

|

IntercontinentalExchange, Inc. (a) |

|

|

543,576 |

|

|

24,620 |

|

JPMorgan Chase & Co. |

|

|

1,134,982 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

1,678,558 |

|

|

|

|

|

|

|

||

See notes to financial statements.

18

|

|

|

GuideMarkSM Large Cap Growth Fund |

|

SCHEDULE OF INVESTMENTS (Continued) |

|

March 31, 2011 |

|

|

|

|

|

|

|

|

|

Number of |

|

|

|

Value |

|

|

|

|

|

|

|

|||

|

|

|

COMMON STOCKS (Continued) |

|

|

|

|

|

|

|

Electrical Equipment - 2.60% |

|

|

|

|

|

37,330 |

|

Agilent Technologies, Inc. (a) |

|

$ |

1,671,637 |

|

|

13,260 |

|

AMETEK, Inc. |

|

|

581,716 |

|

|

21,700 |

|

Cooper Industries Plc - ADR |

|

|

1,408,330 |

|

|

8,870 |

|

Emerson Electric Co. |

|

|

518,274 |

|

|

36,300 |

|

GT Solar International, Inc. (a) |

|

|

386,958 |

|

|

9,880 |

|

Rockwell Automation, Inc. |

|

|

935,142 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

5,502,057 |

|

|

|

|

|

|

|

||

|

|

|

Electronic Equipment & Instruments - 0.15% |

|

|

|

|

|

15,170 |

|

Corning, Inc. |

|

|

312,957 |

|

|

|

|

|

|

|

||

|

|

|

Energy Equipment & Services - 3.56% |

|

|

|

|

|

10,710 |

|

Baker Hughes, Inc. |

|

|

786,435 |

|

|

14,250 |

|

Halliburton Co. |

|

|

710,220 |

|

|

23,380 |

|

National-Oilwell Varco, Inc. |

|

|

1,853,333 |

|

|

25,200 |

|

Noble Corp. - ADR |

|

|

1,149,624 |

|

|

32,440 |

|

Schlumberger Ltd. - ADR |

|

|

3,025,354 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

7,524,966 |

|

|

|

|

|

|

|

||

|

|

|

Food & Staples Retailing - 1.65% |

|

|

|

|

|

13,900 |

|

Costco Wholesale Corp. |

|

|

1,019,147 |

|

|

20,590 |

|

CVS Caremark Corporation |

|

|

706,649 |

|

|

24,900 |

|

Walgreen Co. |

|

|

999,486 |

|

|

14,570 |

|

Wal-Mart Stores, Inc. |

|

|

758,369 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

3,483,651 |

|

|

|

|

|

|

|

||

|

|

|

Food Products - 0.44% |

|

|

|

|

|

14,230 |

|

Green Mountain Coffee Roasters, |

|

|

|

|

|

|

|

Inc. (a) |

|

|

919,400 |

|

|

|

|

|

|

|

||

|

|

|

Health Care Equipment & Supplies - 1.81% |

|

|

|

|

|

35,300 |

|

Covidien Plc - ADR |

|

|

1,833,482 |

|

|

1,450 |

|

Intuitive Surgical, Inc. (a) |

|

|

483,517 |

|

|

15,800 |

|

St. Jude Medical, Inc. (a) |

|

|

809,908 |

|

|

11,300 |

|

Stryker Corp. |

|

|

687,040 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

3,813,947 |

|

|

|

|

|

|

|

||

|

|

|

Health Care Providers & Services - 1.87% |

|

|

|

|

|

14,900 |

|

Aetna, Inc. |

|

|

557,707 |

|

|

14,420 |

|

AmerisourceBergen Corp. |

|

|

570,455 |

|

|

9,450 |

|

Express Scripts, Inc. (a) |

|

|

525,515 |

|

|

8,090 |

|

HCA Holdings, Inc. (a) |

|

|

274,008 |

|

|

10,100 |

|

McKesson Corp. |

|

|

798,405 |

|

|

26,900 |

|

UnitedHealth Group, Inc. |

|

|

1,215,880 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

3,941,970 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

Number of |

|

|

|

Value |

|

|

|

|

|

|

|

|||

|

|

|

Health Care Technology - 0.18% |

|

|

|

|

|

6,840 |

|

SXC Health Solutions Corp. - |

|

|

|

|

|

|

|

ADR (a) |

|

$ |

374,832 |

|

|

|

|

|

|

|

||

|

|

|

Hotels, Restaurants & Leisure - 1.70% |

|

|

|

|

|

16,700 |

|

Carnival Corp. - ADR |

|

|

640,612 |

|

|

1,700 |

|

Chipotle Mexican Grill, Inc. (a) |

|

|

463,029 |

|

|

16,570 |

|

Darden Restaurants, Inc. |

|

|

814,084 |

|

|

6,230 |

|

Las Vegas Sands Corp. (a) |

|

|

263,031 |

|

|

21,760 |

|

Marriott International, Inc. |

|

|

774,221 |

|

|

8,260 |

|

McDonald’s Corp. |

|

|

628,503 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

3,583,480 |

|

|

|

|

|

|

|

||

|

|

|

Household Products - 0.30% |

|

|

|

|

|

10,200 |

|

Procter & Gamble Co. |

|

|

628,320 |

|

|

|

|

|

|

|

||

|

|

|

Industrial Conglomerates - 1.65% |

|

|

|

|

|

29,800 |

|

3M Co. |

|

|

2,786,300 |

|

|

34,500 |

|

General Electric Co. |

|

|

691,725 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

3,478,025 |

|

|

|

|

|

|

|

||

|

|

|

Insurance - 0.74% |

|

|

|

|

|

10,950 |

|

Aflac, Inc. |

|

|

577,941 |

|

|

36,200 |

|

Hartford Financial Services |

|

|

|

|

|

|

|

Group, Inc. |

|

|

974,866 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

1,552,807 |

|

|

|

|

|

|

|

||

|

|

|

Internet & Catalog Retail - 4.68% |

|

|

|

|

|

21,070 |

|

Amazon.com, Inc. (a) |

|

|

3,795,340 |

|

|

13,440 |

|

Netflix, Inc. (a) |

|

|

3,189,715 |

|

|

5,710 |

|

Priceline.com, Inc. (a) |

|

|

2,891,772 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

9,876,827 |

|

|

|

|

|

|

|

||

|

|

|

Internet Software & Services - 4.05% |

|

|

|

|

|

22,800 |

|

Akamai Technologies, Inc. (a) |

|

|

866,400 |

|

|

43,600 |

|

eBay, Inc. (a) |

|

|

1,353,344 |

|

|

8,520 |

|

Google, Inc. (a) |

|

|

4,994,509 |

|

|

6,300 |

|

MercadoLibre, Inc. (a) |

|

|

514,269 |

|

|

22,700 |

|

Verisign, Inc. |

|

|

821,967 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

8,550,489 |

|

|

|

|

|

|

|

||

|

|

|

IT Services - 1.94% |

|

|

|

|

|

26,400 |

|

Accenture Plc - ADR |

|

|

1,451,208 |

|

|

14,220 |

|

Cognizant Technology Solutions |

|

|

|

|

|

|

|

Corp. (a) |

|

|

1,157,508 |

|

|

42,200 |

|

The Western Union Co. |

|

|

876,494 |

|

|

8,390 |

|

Visa, Inc. |

|

|

617,672 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

4,102,882 |

|

|

|

|

|

|

|

||

See notes to financial statements.

19

|

|

|

GuideMarkSM Large Cap Growth Fund |

|

SCHEDULE OF INVESTMENTS (Continued) |

|

March 31, 2011 |

|

|

|

|

|

|

|

|

|

Number of |

|

|

|

Value |

|

|

|

|

|

|

|

|||

|

|

|

COMMON STOCKS (Continued) |

|

|

|

|

|

|

|

Leisure Equipment & Products - 0.37% |

|

|

|

|

|

31,600 |

|

Mattel, Inc. |

|

$ |

787,788 |

|

|

|

|

|

|

|

||

|

|

|

Life Sciences Tools & Services - 0.69% |

|

|

|

|

|

13,600 |

|

Thermo Fisher Scientific, Inc. (a) |

|

|

755,480 |

|

|

8,000 |

|

Waters Corp. (a) |

|

|

695,200 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

1,450,680 |

|

|

|

|

|

|

|

||

|

|

|

Machinery - 5.44% |

|

|

|

|

|

14,800 |

|

Caterpillar, Inc. |

|

|

1,647,980 |

|

|

7,040 |

|

Cummins, Inc. |

|

|

771,725 |

|

|

19,040 |

|

Deere & Co. |

|

|

1,844,785 |

|

|

28,985 |

|

Dover Corp. |

|

|

1,905,473 |

|

|

20,000 |

|

Illinois Tool Works, Inc. |

|

|

1,074,400 |

|

|

5,760 |

|

Joy Global, Inc. |

|

|

569,146 |

|

|

13,600 |

|

Navistar International Corp. (a) |

|

|

942,888 |

|

|

16,810 |

|

Paccar, Inc. |

|

|

880,004 |

|

|

11,600 |

|

Parker Hannifin Corp. |

|

|

1,098,288 |

|

|

14,400 |

|

Timken Co. |

|

|

753,120 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

11,487,809 |

|

|

|

|

|

|

|

||

|

|

|

Media - 1.08% |

|

|

|

|

|

57,900 |

|

News Corp. |

|

|

1,016,724 |

|

|

8,850 |

|

Omnicom Group, Inc. |

|

|

434,181 |

|

|

19,070 |

|

The Walt Disney Co. |

|

|

821,726 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

2,272,631 |

|

|

|

|

|

|

|

||

|

|

|

Metals & Mining - 1.94% |

|

|

|

|

|

7,590 |

|

BHP Billiton Ltd. - ADR |

|

|

727,729 |

|

|

27,900 |

|

Freeport-McMoran Copper & |

|

|

|

|

|

|

|

Gold, Inc. |

|

|

1,549,845 |

|

|

10,810 |

|

Goldcorp, Inc. - ADR |

|

|

538,338 |

|

|

13,100 |

|

Newmont Mining Corp. |

|

|

714,998 |

|

|

4,230 |

|

Walter Energy, Inc. |

|

|

572,869 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

4,103,779 |

|

|

|

|

|

|

|

||

|

|

|

Multiline Retail - 1.99% |

|

|

|

|

|

25,500 |

|

Big Lots, Inc. (a) |

|

|

1,107,465 |

|

|

26,190 |

|

Kohl’s Corp. |

|

|

1,389,118 |

|

|

33,900 |

|

Target Corp. |

|

|

1,695,339 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

4,191,922 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

Number of |

|

|

|

Value |

|

|

|

|

|

|

|

|||

|

|

|

Oil & Gas - 7.54% |

|

|

|

|

|

11,420 |

|

Apache Corp. |

|

$ |

1,495,106 |

|

|

10,400 |

|

Chevron Corp. |

|

|

1,117,272 |

|

|

8,780 |

|

Concho Resources, Inc. (a) |

|

|

942,094 |

|

|

83,300 |

|

Exxon Mobil Corp. |

|

|

7,008,030 |

|

|

10,935 |

|

Hess Corp. |

|

|

931,771 |

|

|

6,120 |

|

Noble Energy, Inc. |

|

|

591,498 |

|

|

7,300 |

|

Occidental Petroleum Corp. |

|

|

762,777 |

|

|

9,650 |

|

Pioneer Natural Resources Co. |

|

|

983,528 |

|

|

26,600 |

|

Suncor Energy, Inc. - ADR |

|

|

1,192,744 |

|

|

17,800 |

|

Ultra Petroleum Corp. - ADR (a) |

|

|

876,650 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

15,901,470 |

|

|

|

|

|

|

|

||

|

|

|

Pharmaceuticals - 2.42% |

|

|

|

|

|

21,420 |

|

Allergan, Inc. |

|

|

1,521,248 |

|

|

39,300 |

|

Mylan Laboratories, Inc. (a) |

|

|

890,931 |

|

|

5,790 |

|

Perrigo Co. |

|

|

460,421 |

|

|

15,200 |

|

Salix Pharmaceuticals, Inc. (a) |

|

|

532,456 |

|

|

6,220 |

|

Shire Plc - ADR |

|

|

541,762 |

|

|

23,150 |

|

Teva Pharmaceutical Industries, |

|

|

|

|

|

|

|

Ltd. - ADR |

|

|

1,161,436 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

5,108,254 |

|

|

|

|

|

|

|

||

|

|

|

Road & Rail - 1.25% |

|

|

|

|

|

8,310 |

|

CSX Corp. |

|

|

653,166 |

|

|

32,980 |

|

J.B. Hunt Transport Services, Inc. |

|

|

1,497,952 |

|

|

5,000 |

|

Union Pacific Corp. |

|

|

491,650 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

2,642,768 |

|

|

|

|

|

|

|

||

|

|

|

Semiconductor & Semiconductor |

|

|

|

|

|

|

|

Equipment - 2.48% |

|

|

|

|

|

66,650 |

|

Broadcom Corp. |

|

|

2,624,677 |

|

|

20,570 |

|

Marvell Technology Group Ltd. - |

|

|

|

|

|

|

|

ADR (a) |

|

|

319,864 |

|

|

31,000 |

|

NVIDIA Corp. (a) |

|

|

572,260 |

|

|

24,500 |

|

Skyworks Solutions, Inc. (a) |

|

|

794,290 |

|

|

26,900 |

|

Texas Instruments, Inc. |

|

|

929,664 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

5,240,755 |

|

|

|

|

|

|

|

||

See notes to financial statements.

20

|

|

|

GuideMarkSM Large Cap Growth Fund |

|

SCHEDULE OF INVESTMENTS (Continued) |

|

March 31, 2011 |

|

|

|

|

|

|

|

|

|

Number of |

|

|

|

Value |

|

|

|

|

|

|

|

|||

|

|

|

COMMON STOCKS (Continued) |

|

|

|

|

|

|

|

Software - 6.22% |

|

|

|

|

|

61,000 |

|

Activision Blizzard, Inc. (a) |

|

$ |

669,170 |

|

|

11,270 |

|

Autodesk, Inc. (a) |

|

|

497,120 |

|

|

18,200 |

|

BMC Software, Inc. (a) |

|

|

905,268 |

|

|

17,500 |

|

Check Point Software Technologies |

|

|

|

|

|

|

|

Ltd. - ADR (a) |

|

|

893,375 |

|

|

18,280 |

|

Citrix Systems, Inc. (a) |

|

|

1,342,849 |

|

|

6,180 |

|

Factset Research Systems, Inc. |

|

|

647,231 |

|

|

16,300 |

|

Informatica Corp. (a) |

|

|

851,349 |

|

|

8,330 |

|

Intuit, Inc. (a) |

|

|

442,323 |

|

|

19,600 |

|

Microsoft Corp. |

|

|

497,056 |

|

|

142,940 |

|

Oracle Corp. |

|

|

4,769,909 |

|

|

7,280 |

|

Salesforce.com, Inc. (a) |

|

|

972,462 |

|

|

7,910 |

|

VMware, Inc. (a) |

|

|

644,981 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

13,133,093 |

|

|

|

|

|

|

|

||

|

|

|

Specialty Retail - 2.36% |

|

|

|

|

|

13,100 |

|

Abercrombie & Fitch Co. |

|

|

768,970 |

|

|

17,660 |

|

CarMax, Inc. (a) |

|

|

566,886 |

|

|

18,580 |

|

Limited Brands, Inc. |

|

|

610,910 |

|

|

50,500 |

|

Lowe’s Companies, Inc. |

|

|

1,334,715 |

|

|

14,400 |

|

Ross Stores, Inc. |

|

|

1,024,128 |

|

|

5,200 |

|

Tiffany & Co. |

|

|

319,488 |

|

|

11,990 |

|

Urban Outfitters, Inc. (a) |

|

|

357,662 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

4,982,759 |

|

|

|

|

|

|

|

||

|

|

|

Textiles, Apparel & Luxury Goods - 0.92% |

|

|

|

|

|

14,550 |

|

Nike, Inc. |

|

|

1,101,435 |

|

|

8,500 |

|

VF Corp. |

|

|

837,505 |

|

|

|

|

|

|