Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

|

Investment Company Act file number 811-10263 |

GuideStone Funds

| (Exact name of registrant as specified in charter) |

2401 Cedar Springs Road

Dallas, TX 75201-1407

(Address of principal executive offices) (Zip code)

Rodney R. Miller, Esq.

GuideStone Financial Resources of the Southern Baptist Convention

2401 Cedar Springs Road

Dallas, TX 75201-1407

| (Name and address of agent for service) |

Registrant’s telephone number, including area code: 214-720-2142

Date of fiscal year end: December 31

Date of reporting period: June 30, 2011

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Table of Contents

| Item 1. | Reports to Stockholders. |

The Report to Shareholders is attached herewith.

Table of Contents

Table of Contents

GuideStone Funds

Privacy Notice

NOTICE CONCERNING YOUR PRIVACY RIGHTS

This notice will provide you with information concerning our policies with respect to nonpublic personal information that we collect about you in connection with the following financial products and services provided and/or serviced by the entities listed below: individual retirement accounts ( “IRAs”) and/or personal mutual fund accounts.

The confidentiality of your information is important to us as we recognize that you depend on us to keep your information confidential, as described in this notice.

We collect nonpublic personal information about you with regard to your IRA and/or personal mutual fund accounts from the following sources:

| • | Information we receive from you on applications or other forms; |

| • | Information about your transactions with us, our affiliates or others (including our third party service providers); |

| • | Information we receive from others such as service providers, broker-dealers and your personal agents or representatives; and |

| • | Information you and others provide to us in correspondence sent to us, whether written, electronic or by telephone. |

We may disclose such nonpublic personal financial information about you to one or more of our affiliates as permitted by law. An affiliate of an organization means any entity that controls, is controlled by or is under common control with that organization. GuideStone Funds, GuideStone Financial Resources of the Southern Baptist Convention (“GuideStone Financial Resources”), GuideStone Capital Management (“GSCM”), GuideStone Trust Services (“GSTS”), GuideStone Financial Services (“GFS”) and GuideStone Advisors (“GA”) are affiliates of one another. GuideStone Funds, GuideStone Financial Resources, GSCM, GSTS, GFS, GA and BNY Mellon Distributors Inc. do not sell your personal information to nonaffiliated third parties.

We may also disclose any of the personal information that we collect about you to nonaffiliated third parties as permitted by law. For example, we may provide your information to nonaffiliated companies that provide account services or that perform marketing services on our behalf and to other financial institutions with whom we have joint marketing agreements. We restrict access to nonpublic personal information about you to those of our employees who need to know that information in order for us to provide and/or service products or services to you. We also maintain physical, electronic and procedural safeguards to guard your personal information.

These procedures will continue to remain in effect after you cease to receive financial products and services from us.

If you have any questions concerning our customer information policy, please contact a customer relations specialist at 1-888-98-GUIDE (1-888-984-8433).

Table of Contents

| 2 | ||||

| 3 | ||||

| 4 | ||||

| Date Target Funds: |

||||

| 7 | ||||

| 8 | ||||

| 9 | ||||

| 10 | ||||

| 11 | ||||

| 12 | ||||

| Asset Allocation Funds: |

||||

| 17 | ||||

| 18 | ||||

| 19 | ||||

| 20 | ||||

| 21 | ||||

| 27 | ||||

| 28 | ||||

| 29 | ||||

| 30 | ||||

| 31 | ||||

| Select Funds: |

||||

| 37 | ||||

| 41 | ||||

| 54 | ||||

| 74 | ||||

| 79 | ||||

| 81 | ||||

| 90 | ||||

| 96 | ||||

| 98 | ||||

| 102 | ||||

| 105 | ||||

| 117 | ||||

| 130 | ||||

| 132 | ||||

| 147 | ||||

| 199 | ||||

| 202 |

This report has been prepared for shareholders of GuideStone Funds. It is not authorized for distribution to prospective investors unless accompanied or preceded by a current prospectus, which contains more complete information about the Funds. Investors are reminded to read the prospectus carefully before investing. Past performance is no guarantee of future results. Share prices will fluctuate and there may be a gain or loss when shares are redeemed. Fund shares are distributed by BNY Mellon Distributors Inc., 760 Moore Rd., King of Prussia, PA 19406.

1

Table of Contents

Dear Shareholder:

Our journey began with the launch of 13 registered mutual funds under the AB Funds Trust brand on August 27, 2001, just weeks prior to the September 11 terrorist attacks and the global market chaos that ensued. In September 2005, AB Funds Trust was re-branded as GuideStone Funds in conjunction with its expanded mission to serve both Southern Baptist and evangelical Christian organizations. Today, GuideStone Funds has emerged as the largest Christian-based, socially screened, registered mutual fund family with assets of $8.1 billion for the period ended June 30, 2011. Investors may now choose from 25 mutual funds designed to meet a variety of investment goals and objectives.

As we look ahead, we remain steadfast in our commitment to provide our investors with the highest quality investment management services and products in the industry. Several examples of our commitment and the results are shown below:

| • | GuideStone Funds Ranked Nationally. Fi360 Fund Family Fiduciary Rankings™ ranked GuideStone Funds number two out of 222 funds. Fi360 evaluates fund families on regulatory oversight, track record, assets under management, stability of the organization, fund composition consistent with asset class and style, expense ratio/ fees relative to peers and performance relative to peers. |

| • | Comparison of Risk/Return Data Made Easier with XBRL. GuideStone Funds investors can more easily compare mutual fund risk and return data from the prospectus by uploading XBRL files from our website to the U.S. Securities and Exchange Commission’s online viewer. XBRL stands for eXtensible Business Reporting Language. |

| • | Cost Basis Reporting Change Impacts Investors. For shares purchased within personal investment accounts after January 1, 2012, GuideStone Funds will track and report the adjusted cost basis of sold securities and the holding period on IRS Form 1099-B. This information will help investors to determine the amount of capital gains/losses. More information on how this change affects investors will be forthcoming. |

We appreciate your continued confidence in GuideStone Funds and hope that you find the information in this report valuable. If you have any questions concerning the report, do not hesitate to call us at 1-888-98-GUIDE (1-888-984-8433) or visit our website at www.GuideStoneFunds.org. Thank you for choosing to invest in GuideStone Funds.

Sincerely,

John R. Jones, CFA

President

2

Table of Contents

FROM THE CHIEF INVESTMENT OFFICER

|

|

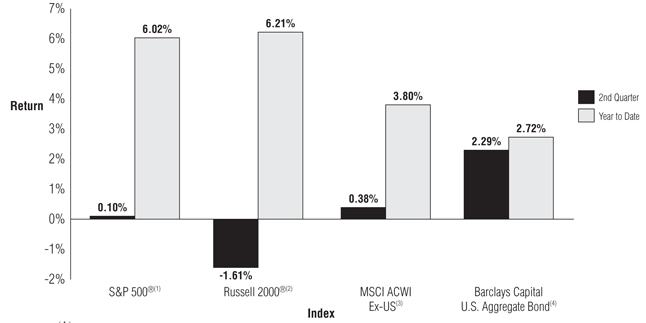

A loss of economic momentum during the second quarter caused global equity markets to take a breather from the torrid pace of the past year. The S&P 500® Index returned a very volatile 0.10% for the quarter, while more conservative investments fared much better. Led by the U.S. Treasury sector, the Barclays Capital Aggregate Bond Index posted a solid gain for the quarter, up 2.29%. Despite the slow quarter for equities, the S&P 500® Index has returned 30.69% for the 12 months ending June 30.

The U.S. economy has been operating at growth rates well below its long-term capacity since the recovery began two years ago. Risk assets such as stocks are highly dependent on the future growth of the economy, so it’s no wonder that all eyes have been keenly focused on the economy’s wellbeing. The second quarter slowdown fueled increased volatility and created an overall cautious tone in the capital markets. It is widely accepted that this slowdown is due to temporary pressures surfacing from two sources: (1) supply disruptions in Japan and (2) the recent spike in oil prices. Both of which are expected to subside and lead to improved economic conditions as we move into the second half of the year. This anticipated improvement is an important consensus within the | |

| Rodric E. Cummins, CFA |

market, because with signs of inflation beginning to emerge and with concerns surrounding the level of government debt, the ability of government to rush in and provide additional stimulus is becoming more and more constrained.

Beyond the natural ups and downs of cyclical economic growth, several major secular problems remain a constant barrier to a more rosy long term outlook. Unemployment, housing, deleveraging and our federal and state governments’ fiscal conditions are all problems for which there are no easy or quick answers. With or without resolution, they represent challenges that may weigh heavily on economic growth for a long time. Having just passed the second anniversary of the recovery, it appears that the U.S. economy may be settling into a long term pattern of below average economic growth.

Asset Class Performance Comparison

The following graph illustrates the performance of the major assets classes during 2011.

| (1) | The S&P 500® Index includes 500 of the largest stocks (in terms of market value) in the United States. |

| (2) | The Russell 2000® Index is a small-cap index consisting of the smallest 2,000 companies in the Russell 3000® Index, representing approximately 10% of the Russell 3000® Index total market capitalization. |

| (3) | The MSCI ACWI (All Country World Index) Ex-U.S. Index is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global developed and emerging markets excluding the United States. |

| (4) | The Barclays Capital U.S. Aggregate Bond Index represents securities that are SEC-registered, taxable and dollar denominated. The index covers the U.S. investment grade bond market, with index components for government and corporate securities, mortgage pass-through securities and asset-backed securities. |

3

Table of Contents

About Your Expenses (Unaudited)

As a shareholder of the Funds, you incur ongoing costs, including advisory fees and to the extent applicable, distribution (12b-1) fees and/or shareholder services fees, as well as other Fund expenses. This example is intended to help you to understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds. It is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from January 1, 2011 to June 30, 2011.

Actual Expenses

The first section of the table below provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you incurred over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses attributable to your investment during this period.

Hypothetical Example for Comparison Purposes

The second section of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. Thus, you should not use the hypothetical account values and expenses to estimate the actual ending account balance or your expenses for the period. Rather, these figures are provided to enable you to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only. Therefore, the second section of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds.

ACTUAL

| Fund |

Class | Beginning Account Value 01/01/11 |

Ending Account Value 06/30/11 |

Annualized Expense Ratio (1) |

Expenses Paid During Period (2) |

|||||||||||||||

| MyDestination 2005 |

GS4 | $ | 1,000.00 | $ | 1,041.97 | 0.20 | % | $ | 1.01 | |||||||||||

| MyDestination 2015 |

GS4 | 1,000.00 | 1,052.35 | 0.16 | 0.83 | |||||||||||||||

| MyDestination 2025 |

GS4 | 1,000.00 | 1,059.29 | 0.16 | 0.83 | |||||||||||||||

| MyDestination 2035 |

GS4 | 1,000.00 | 1,063.80 | 0.20 | 1.02 | |||||||||||||||

| MyDestination 2045 |

GS4 | 1,000.00 | 1,068.08 | 0.20 | 1.03 | |||||||||||||||

| Conservative Allocation |

GS4 | 1,000.00 | 1,029.49 | 0.12 | 0.60 | |||||||||||||||

| Balanced Allocation |

GS4 | 1,000.00 | 1,044.55 | 0.12 | 0.61 | |||||||||||||||

| Growth Allocation |

GS4 | 1,000.00 | 1,053.74 | 0.12 | 0.61 | |||||||||||||||

| Aggressive Allocation |

GS4 | 1,000.00 | 1,061.92 | 0.12 | 0.61 | |||||||||||||||

| Conservative Allocation I |

GS2 | 1,000.00 | 1,028.66 | 0.15 | 0.75 | |||||||||||||||

| Balanced Allocation I |

GS2 | 1,000.00 | 1,044.60 | 0.14 | 0.69 | |||||||||||||||

| Growth Allocation I |

GS2 | 1,000.00 | 1,054.56 | 0.15 | 0.75 | |||||||||||||||

| Aggressive Allocation I |

GS2 | 1,000.00 | 1,062.26 | 0.15 | 0.79 | |||||||||||||||

| Money Market |

GS2 | 1,000.00 | 1,000.64 | 0.18 | 0.89 | |||||||||||||||

| GS4 | 1,000.00 | 1,000.06 | 0.30 | 1.46 | ||||||||||||||||

| Low-Duration Bond |

GS2 | 1,000.00 | 1,013.13 | 0.36 | 1.80 | |||||||||||||||

| GS4 | 1,000.00 | 1,012.45 | 0.54 | 2.68 | ||||||||||||||||

| Medium-Duration Bond |

GS2 | 1,000.00 | 1,029.32 | 0.48 | 2.42 | |||||||||||||||

| GS4 | 1,000.00 | 1,028.90 | 0.60 | 3.00 | ||||||||||||||||

4

Table of Contents

ACTUAL

| Fund |

Class | Beginning Account Value 01/01/11 |

Ending Account Value 06/30/11 |

Annualized Expense Ratio (1) |

Expenses Paid During Period (2) |

|||||||||||||||

| Extended-Duration Bond |

GS2 | $ | 1,000.00 | $ | 1,038.70 | 0.54 | % | $ | 2.75 | |||||||||||

| GS4 | 1,000.00 | 1,037.14 | 0.71 | 3.59 | ||||||||||||||||

| Inflation Protected Bond |

GS4 | 1,000.00 | 1,046.47 | 0.64 | 3.22 | |||||||||||||||

| Global Bond |

GS4 | 1,000.00 | 1,052.15 | 0.83 | 4.21 | |||||||||||||||

| Equity Index |

GS2 | 1,000.00 | 1,059.64 | 0.21 | 1.07 | |||||||||||||||

| GS4 | 1,000.00 | 1,059.21 | 0.37 | 1.90 | ||||||||||||||||

| Real Estate Securities |

GS4 | 1,000.00 | 1,116.56 | 1.16 | 6.07 | |||||||||||||||

| Value Equity |

GS2 | 1,000.00 | 1,072.03 | 0.66 | 3.40 | |||||||||||||||

| GS4 | 1,000.00 | 1,071.02 | 0.87 | 4.44 | ||||||||||||||||

| Growth Equity |

GS2 | 1,000.00 | 1,057.93 | 0.87 | 4.45 | |||||||||||||||

| GS4 | 1,000.00 | 1,057.67 | 0.99 | 5.07 | ||||||||||||||||

| Small Cap Equity |

GS2 | 1,000.00 | 1,112.38 | 0.99 | 5.16 | |||||||||||||||

| GS4 | 1,000.00 | 1,112.03 | 1.16 | 6.09 | ||||||||||||||||

| International Equity (3) |

GS2 | 1,000.00 | 1,048.31 | 0.94 | 4.75 | |||||||||||||||

| GS4 | 1,000.00 | 1,047.65 | 1.14 | 5.77 | ||||||||||||||||

HYPOTHETICAL (assuming a 5% return before expenses)

| Fund |

Class | Beginning Account Value 01/01/11 |

Ending Account Value 06/30/11 |

Annualized Expense Ratio (1) |

Expenses Paid During Period (2) |

|||||||||||||||

| My Destination 2005 |

GS4 | $ | 1,000.00 | $ | 1,023.80 | 0.20 | % | $ | 1.00 | |||||||||||

| My Destination 2015 |

GS4 | 1,000.00 | 1,023.99 | 0.16 | 0.82 | |||||||||||||||

| My Destination 2025 |

GS4 | 1,000.00 | 1,023.99 | 0.16 | 0.82 | |||||||||||||||

| My Destination 2035 |

GS4 | 1,000.00 | 1,023.80 | 0.20 | 1.00 | |||||||||||||||

| My Destination 2045 |

GS4 | 1,000.00 | 1,023.80 | 0.20 | 1.00 | |||||||||||||||

| Conservative Allocation |

GS4 | 1,000.00 | 1,024.20 | 0.12 | 0.60 | |||||||||||||||

| Balanced Allocation |

GS4 | 1,000.00 | 1,024.20 | 0.12 | 0.60 | |||||||||||||||

| Growth Allocation |

GS4 | 1,000.00 | 1,024.20 | 0.12 | 0.60 | |||||||||||||||

| Aggressive Allocation |

GS4 | 1,000.00 | 1,024.20 | 0.12 | 0.60 | |||||||||||||||

| Conservative Allocation I |

GS2 | 1,000.00 | 1,024.05 | 0.15 | 0.75 | |||||||||||||||

| Balanced Allocation I |

GS2 | 1,000.00 | 1,024.12 | 0.14 | 0.68 | |||||||||||||||

| Growth Allocation I |

GS2 | 1,000.00 | 1,024.07 | 0.15 | 0.74 | |||||||||||||||

| Aggressive Allocation I |

GS2 | 1,000.00 | 1,024.03 | 0.15 | 0.77 | |||||||||||||||

| Money Market |

GS2 | 1,000.00 | 1,023.91 | 0.18 | 0.90 | |||||||||||||||

| GS4 | 1,000.00 | 1,023.33 | 0.30 | 1.48 | ||||||||||||||||

| Low-Duration Bond |

GS2 | 1,000.00 | 1,023.01 | 0.36 | 1.81 | |||||||||||||||

| GS4 | 1,000.00 | 1,022.13 | 0.54 | 2.69 | ||||||||||||||||

| Medium-Duration Bond |

GS2 | 1,000.00 | 1,022.41 | 0.48 | 2.41 | |||||||||||||||

| GS4 | 1,000.00 | 1,021.83 | 0.60 | 2.99 | ||||||||||||||||

| Extended-Duration Bond |

GS2 | 1,000.00 | 1,022.10 | 0.54 | 2.73 | |||||||||||||||

| GS4 | 1,000.00 | 1,021.27 | 0.71 | 3.56 | ||||||||||||||||

| Inflation Protected Fund |

GS4 | 1,000.00 | 1,021.65 | 0.64 | 3.18 | |||||||||||||||

| Global Bond |

GS4 | 1,000.00 | 1,020.69 | 0.83 | 4.14 | |||||||||||||||

5

Table of Contents

About Your Expenses (Unaudited) (Continued)

HYPOTHETICAL (assuming a 5% return before expenses)

| Fund |

Class | Beginning Account Value 01/01/11 |

Ending Account Value 06/30/11 |

Annualized Expense Ratio (1) |

Expenses Paid During Period (2) |

|||||||||||||||

| Equity Index |

GS2 | $ | 1,000.00 | $ | 1,023.76 | 0.21 | % | $ | 1.05 | |||||||||||

| GS4 | 1,000.00 | 1,022.94 | 0.37 | 1.87 | ||||||||||||||||

| Real Estate Securities Fund |

GS4 | 1,000.00 | 1,019.06 | 1.16 | 5.79 | |||||||||||||||

| Value Equity |

GS2 | 1,000.00 | 1,021.52 | 0.66 | 3.31 | |||||||||||||||

| GS4 | 1,000.00 | 1,020.51 | 0.87 | 4.33 | ||||||||||||||||

| Growth Equity |

GS2 | 1,000.00 | 1,020.47 | 0.87 | 4.37 | |||||||||||||||

| GS4 | 1,000.00 | 1,019.87 | 0.99 | 4.97 | ||||||||||||||||

| Small Cap Equity |

GS2 | 1,000.00 | 1,019.91 | 0.99 | 4.94 | |||||||||||||||

| GS4 | 1,000.00 | 1,019.03 | 1.16 | 5.82 | ||||||||||||||||

| International Equity (3) |

GS2 | 1,000.00 | 1,020.15 | 0.94 | 4.69 | |||||||||||||||

| GS4 | 1,000.00 | 1,019.16 | 1.14 | 5.69 | ||||||||||||||||

| (1) | Expenses include the effect of contractual waivers by GuideStone Capital Management. The Date Target Funds’ and Asset Allocation Funds’ proportionate share of the operating expenses of the Select Funds is not reflected in the tables above. |

| (2) | Expenses are equal to the Fund’s annualized expense ratios for the period January 1, 2011, through June 30, 2011, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

| (3) | The expense ratios for the International Equity Fund include the impact of dividend expense on securities sold short. |

6

Table of Contents

| MYDESTINATION 2005 FUND | ||

| SCHEDULE OF INVESTMENTS | June 30, 2011 (Unaudited) |

| Shares | Value | |||||||

| MUTUAL FUNDS — 99.8% |

||||||||

| GuideStone Money Market Fund (GS4 Class)¥ |

3,739,203 | $ | 3,739,203 | |||||

| GuideStone Low-Duration Bond Fund (GS4 Class)¥ |

1,055,857 | 14,085,135 | ||||||

| GuideStone Medium-Duration Bond Fund (GS4 Class)¥ |

748,116 | 10,428,732 | ||||||

| GuideStone Inflation Protected Bond Fund (GS4 Class)¥ |

813,443 | 8,646,896 | ||||||

| GuideStone Global Bond Fund (GS4 Class)¥ |

28,678 | 289,075 | ||||||

| GuideStone Equity Index Fund (GS4 Class)¥ |

48,946 | 833,547 | ||||||

| GuideStone Real Estate Securities Fund (GS4 Class)¥ |

173,464 | 1,646,177 | ||||||

| GuideStone Value Equity Fund (GS4 Class)¥ |

393,373 | 5,884,856 | ||||||

| GuideStone Growth Equity Fund (GS4 Class)¥ |

299,113 | 5,979,271 | ||||||

| GuideStone Small Cap Equity Fund (GS4 Class)¥ |

97,458 | 1,567,124 | ||||||

| GuideStone International Equity Fund (GS4 Class)¥ |

444,474 | 6,253,753 | ||||||

|

|

|

|||||||

| Total Mutual Funds |

59,353,769 | |||||||

|

|

|

|||||||

| TOTAL INVESTMENTS — 99.8% |

59,353,769 | |||||||

| Other Assets in Excess of |

141,276 | |||||||

|

|

|

|||||||

| NET ASSETS — 100.0% |

$ | 59,495,045 | ||||||

|

|

|

|||||||

Please see abbreviation and footnote definitions beginning on page 130.

PORTFOLIO SUMMARY (based on net assets)

| % | ||||

| Bond Funds |

56.3 | |||

| Domestic Equity Funds |

26.7 | |||

| International Equity Fund |

10.5 | |||

| Money Market Fund |

6.3 | |||

| Futures |

4.9 | |||

|

|

|

|||

| 104.7 | ||||

|

|

|

|||

VALUATION HIERARCHY

The following is a summary of the inputs used, as of June 30, 2011, in valuing the Fund’s investments carried at fair value:

| Total Value |

Level 1 Quoted Prices |

Level 2 Other Significant Observable Inputs |

Level 3 Significant Unobservable Inputs |

|||||||||||||

| Assets: |

||||||||||||||||

| Investments in Securities: |

||||||||||||||||

| Mutual Funds |

$ | 59,353,769 | $ | 59,353,769 | $ | — | $ | — | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Assets — Investments in Securities |

$ | 59,353,769 | $ | 59,353,769 | $ | — | $ | — | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Other Financial Instruments*** |

||||||||||||||||

| Futures Contracts |

$ | 74,203 | $ | 74,203 | $ | — | $ | — | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Assets — Other Financial Instruments |

$ | 74,203 | $ | 74,203 | $ | — | $ | — | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| *** | Other financial instruments are derivative instruments not reflected in the Schedule of Investments, such as futures, forwards and swap contracts, which are valued at the unrealized appreciation (depreciation) on the investment. Details of these investments can be found in the Notes to Financial Statements. |

See Notes to Financial Statements.

7

Table of Contents

| MYDESTINATION 2015 FUND | ||

| SCHEDULE OF INVESTMENTS | June 30, 2011 (Unaudited) |

| Shares | Value | |||||||

| MUTUAL FUNDS — 99.5% |

||||||||

| GuideStone Money Market Fund (GS4 Class)¥ |

24,613,093 | $ | 24,613,093 | |||||

| GuideStone Low-Duration Bond Fund (GS4 Class)¥ |

1,503,560 | 20,057,493 | ||||||

| GuideStone Medium-Duration Bond Fund (GS4 Class)¥ |

2,249,619 | 31,359,690 | ||||||

| GuideStone Extended-Duration Bond Fund (GS4 Class)¥ |

658,939 | 10,859,319 | ||||||

| GuideStone Inflation Protected Bond Fund (GS4 Class)¥ |

2,845,657 | 30,249,330 | ||||||

| GuideStone Global Bond Fund (GS4 Class)¥ |

1,145,897 | 11,550,641 | ||||||

| GuideStone Equity Index Fund (GS4 Class)¥ |

284,007 | 4,836,638 | ||||||

| GuideStone Real Estate Securities Fund (GS4 Class)¥ |

1,607,506 | 15,255,235 | ||||||

| GuideStone Value Equity Fund (GS4 Class)¥ |

2,492,162 | 37,282,748 | ||||||

| GuideStone Growth Equity Fund (GS4 Class)¥ |

1,895,373 | 37,888,497 | ||||||

| GuideStone Small Cap Equity Fund (GS4 Class)¥ |

644,837 | 10,368,971 | ||||||

| GuideStone International Equity Fund (GS4 Class)¥ |

2,849,675 | 40,094,926 | ||||||

|

|

|

|||||||

| Total Mutual Funds |

274,416,581 | |||||||

|

|

|

|||||||

| TOTAL INVESTMENTS — 99.5% |

274,416,581 | |||||||

| Other Assets in Excess of |

1,356,817 | |||||||

|

|

|

|||||||

| NET ASSETS — 100.0% |

$ | 275,773,398 | ||||||

|

|

|

|||||||

Please see abbreviation and footnote definitions beginning on page 130.

PORTFOLIO SUMMARY (based on net assets)

| % | ||||

| Domestic Equity Funds |

38.3 | |||

| Bond Funds |

37.8 | |||

| International Equity Fund |

14.5 | |||

| Money Market Fund |

8.9 | |||

| Futures Contracts |

8.8 | |||

|

|

|

|||

| 108.3 | ||||

|

|

|

|||

VALUATION HIERARCHY

The following is a summary of the inputs used, as of June 30, 2011, in valuing the Fund’s investments carried at fair value:

| Total Value |

Level 1 Quoted Prices |

Level 2 Other Significant Observable Inputs |

Level 3 Significant Unobservable Inputs |

|||||||||||||

| Assets: |

||||||||||||||||

| Investments in Securities: |

||||||||||||||||

| Mutual Funds |

$ | 274,416,581 | $ | 274,416,581 | $ | — | $ | — | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Assets — Investments in Securities |

$ | 274,416,581 | $ | 274,416,581 | $ | — | $ | — | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Other Financial Instruments*** |

||||||||||||||||

| Futures Contracts |

$ | 518,949 | $ | 518,949 | $ | — | $ | — | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Assets — Other Financial Instruments |

$ | 518,949 | $ | 518,949 | $ | — | $ | — | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| *** | Other financial instruments are derivative instruments not reflected in the Schedule of Investments, such as futures, forwards and swap contracts, which are valued at the unrealized appreciation (depreciation) on the investment. Details of these investments can be found in the Notes to Financial Statements. |

See Notes to Financial Statements.

8

Table of Contents

| MYDESTINATION 2025 FUND | ||

| SCHEDULE OF INVESTMENTS | June 30, 2011 (Unaudited) |

| Shares | Value | |||||||

| MUTUAL FUNDS — 99.5% |

||||||||

| GuideStone Money Market Fund (GS4 Class)¥ |

22,179,430 | $ | 22,179,430 | |||||

| GuideStone Low-Duration Bond Fund (GS4 Class)¥ |

246,550 | 3,288,970 | ||||||

| GuideStone Medium-Duration Bond Fund (GS4 Class)¥ |

1,530,456 | 21,334,562 | ||||||

| GuideStone Extended-Duration Bond Fund (GS4 Class)¥ |

1,111,768 | 18,321,945 | ||||||

| GuideStone Inflation Protected Bond Fund (GS4 Class)¥ |

374,621 | 3,982,217 | ||||||

| GuideStone Global Bond Fund (GS4 Class)¥ |

1,790,432 | 18,047,550 | ||||||

| GuideStone Equity Index Fund (GS4 Class)¥ |

333,760 | 5,683,934 | ||||||

| GuideStone Real Estate Securities Fund (GS4 Class)¥ |

1,847,418 | 17,531,995 | ||||||

| GuideStone Value Equity Fund (GS4 Class)¥ |

3,204,547 | 47,940,019 | ||||||

| GuideStone Growth Equity Fund (GS4 Class)¥ |

2,439,253 | 48,760,666 | ||||||

| GuideStone Small Cap Equity Fund (GS4 Class)¥ |

1,004,401 | 16,150,774 | ||||||

| GuideStone International Equity Fund (GS4 Class)¥ |

3,754,541 | 52,826,394 | ||||||

|

|

|

|||||||

| Total Mutual Funds |

276,048,456 | |||||||

|

|

|

|||||||

| TOTAL INVESTMENTS — 99.5% |

276,048,456 | |||||||

| Other Assets in Excess of |

1,433,238 | |||||||

|

|

|

|||||||

| NET ASSETS — 100.0% |

$ | 277,481,694 | ||||||

|

|

|

|||||||

Please see abbreviation and footnote definitions beginning on page 130.

PORTFOLIO SUMMARY (based on net assets)

| % | ||||

| Domestic Equity Funds |

49.0 | |||

| Bond Funds |

23.5 | |||

| International Equity Fund |

19.0 | |||

| Futures Contracts |

8.7 | |||

| Money Market Fund |

8.0 | |||

|

|

|

|||

| 108.2 | ||||

|

|

|

|||

VALUATION HIERARCHY

The following is a summary of the inputs used, as of June 30, 2011, in valuing the Fund’s investments carried at fair value:

| Total Value |

Level 1 Quoted Prices |

Level 2 Other Significant Observable Inputs |

Level 3 Significant Unobservable Inputs |

|||||||||||||

| Assets: |

||||||||||||||||

| Investments in Securities: |

||||||||||||||||

| Mutual Funds |

$ | 276,048,456 | $ | 276,048,456 | $ | — | $ | — | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Assets — Investments in Securities |

$ | 276,048,456 | $ | 276,048,456 | $ | — | $ | — | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Other Financial Instruments*** |

||||||||||||||||

| Futures Contracts |

$ | 485,355 | $ | 485,355 | $ | — | $ | — | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Assets — Other Financial Instruments |

$ | 485,355 | $ | 485,355 | $ | — | $ | — | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| *** | Other financial instruments are derivative instruments not reflected in the Schedule of Investments, such as futures, forwards and swap contracts, which are valued at the unrealized appreciation (depreciation) on the investment. Details of these investments can be found in the Notes to Financial Statements. |

See Notes to Financial Statements.

9

Table of Contents

| MYDESTINATION 2035 FUND | ||

| SCHEDULE OF INVESTMENTS | June 30, 2011 (Unaudited) |

| Shares | Value | |||||||

| MUTUAL FUNDS — 100.2% |

||||||||

| GuideStone Money Market Fund (GS4 Class)¥ |

3,054,653 | $ | 3,054,653 | |||||

| GuideStone Medium-Duration Bond Fund (GS4 Class)¥ |

221,649 | 3,089,788 | ||||||

| GuideStone Extended-Duration Bond Fund (GS4 Class)¥ |

187,707 | 3,093,406 | ||||||

| GuideStone Global Bond Fund (GS4 Class)¥ |

686,404 | 6,918,951 | ||||||

| GuideStone Equity Index Fund (GS4 Class)¥ |

184,435 | 3,140,928 | ||||||

| GuideStone Real Estate Securities Fund (GS4 Class)¥ |

946,096 | 8,978,460 | ||||||

| GuideStone Value Equity Fund (GS4 Class)¥ |

1,961,026 | 29,336,954 | ||||||

| GuideStone Growth Equity Fund (GS4 Class)¥ |

1,467,305 | 29,331,430 | ||||||

| GuideStone Small Cap Equity Fund (GS4 Class)¥ |

683,538 | 10,991,283 | ||||||

| GuideStone International Equity Fund (GS4 Class)¥ |

2,407,893 | 33,879,053 | ||||||

|

|

|

|||||||

| Total Mutual Funds |

131,814,906 | |||||||

|

|

|

|||||||

| TOTAL INVESTMENTS — 100.2% |

131,814,906 | |||||||

| Liabilities in Excess of Other |

(207,746 | ) | ||||||

|

|

|

|||||||

| NET ASSETS — 100.0% |

$ | 131,607,160 | ||||||

|

|

|

|||||||

Please see abbreviation and footnote definitions beginning on page 130.

PORTFOLIO SUMMARY (based on net assets)

| % | ||||

| Domestic Equity Funds |

62.1 | |||

| International Equity Fund |

25.8 | |||

| Bond Funds |

10.0 | |||

| Money Market Fund |

2.3 | |||

| Futures Contracts |

2.0 | |||

|

|

|

|||

| 102.2 | ||||

|

|

|

|||

VALUATION HIERARCHY

The following is a summary of the inputs used, as of June 30, 2011, in valuing the Fund’s investments carried at fair value:

| Total Value |

Level 1 Quoted Prices |

Level 2 Other Significant Observable Inputs |

Level 3 Significant Unobservable Inputs |

|||||||||||||

| Assets: |

||||||||||||||||

| Investments in Securities: |

||||||||||||||||

| Mutual Funds |

$ | 131,814,906 | $ | 131,814,906 | $ | — | $ | — | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Assets — Investments in Securities |

$ | 131,814,906 | $ | 131,814,906 | $ | — | $ | — | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Other Financial Instruments*** |

||||||||||||||||

| Futures Contracts |

$ | 60,950 | $ | 60,950 | $ | — | $ | — | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Assets — Other Financial Instruments |

$ | 60,950 | $ | 60,950 | $ | — | $ | — | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| *** | Other financial instruments are derivative instruments not reflected in the Schedule of Investments, such as futures, forwards and swap contracts, which are valued at the unrealized appreciation (depreciation) on the investment. Details of these investments can be found in the Notes to Financial Statements. |

See Notes to Financial Statements.

10

Table of Contents

| MYDESTINATION 2045 FUND | ||

| SCHEDULE OF INVESTMENTS | June 30, 2011 (Unaudited) |

| Shares | Value | |||||||

| MUTUAL FUNDS — 99.8% |

||||||||

| GuideStone Money Market Fund (GS4 Class)¥ |

1,987,131 | $ | 1,987,131 | |||||

| GuideStone Global Bond Fund (GS4 Class)¥ |

34,722 | 349,997 | ||||||

| GuideStone Equity Index Fund (GS4 Class)¥ |

164,342 | 2,798,746 | ||||||

| GuideStone Real Estate Securities Fund (GS4 Class)¥ |

883,268 | 8,382,213 | ||||||

| GuideStone Value Equity Fund (GS4 Class)¥ |

1,432,000 | 21,422,727 | ||||||

| GuideStone Growth Equity Fund (GS4 Class)¥ |

1,091,149 | 21,812,065 | ||||||

| GuideStone Small Cap Equity Fund (GS4 Class)¥ |

467,951 | 7,524,655 | ||||||

| GuideStone International Equity Fund (GS4 Class)¥ |

1,729,625 | 24,335,823 | ||||||

|

|

|

|||||||

| Total Mutual Funds |

88,613,357 | |||||||

|

|

|

|||||||

| TOTAL INVESTMENTS — 99.8% |

88,613,357 | |||||||

| Other Assets in Excess of |

216,887 | |||||||

|

|

|

|||||||

| NET ASSETS — 100.0% |

$ | 88,830,244 | ||||||

|

|

|

|||||||

Please see abbreviation and footnote definitions beginning on page 130.

PORTFOLIO SUMMARY (based on net assets)

| % | ||||

| Domestic Equity Funds |

69.7 | |||

| International Equity Fund |

27.4 | |||

| Futures Contracts |

2.4 | |||

| Money Market Fund |

2.3 | |||

| Bond Fund |

0.4 | |||

|

|

|

|||

| 102.2 | ||||

|

|

|

|||

VALUATION HIERARCHY

The following is a summary of the inputs used, as of June 30, 2011, in valuing the Fund’s investments carried at fair value:

| Total Value |

Level 1 Quoted Prices |

Level 2 Other Significant Observable Inputs |

Level 3 Significant Unobservable Inputs |

|||||||||||||

| Assets: |

||||||||||||||||

| Investments in Securities: |

||||||||||||||||

| Mutual Funds |

$ | 88,613,357 | $ | 88,613,357 | $ | — | $ | — | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Assets — Investments in Securities |

$ | 88,613,357 | $ | 88,613,357 | $ | — | $ | — | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Other Financial Instruments*** |

||||||||||||||||

| Futures Contracts |

$ | 62,724 | $ | 62,724 | $ | — | $ | — | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Assets — Other Financial Instruments |

$ | 62,724 | $ | 62,724 | $ | — | $ | — | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| *** | Other financial instruments are derivative instruments not reflected in the Schedule of Investments, such as futures, forwards and swap contracts, which are valued at the unrealized appreciation (depreciation) on the investment. Details of these investments can be found in the Notes to Financial Statements. |

See Notes to Financial Statements.

11

Table of Contents

| STATEMENTS OF ASSETS AND LIABILITIES | June 30, 2011 (Unaudited) |

| MyDestination 2005 Fund |

MyDestination 2015 Fund |

MyDestination 2025 Fund |

MyDestination 2035 Fund |

MyDestination 2045 Fund |

||||||||||||||||

| Assets |

||||||||||||||||||||

| Investments in securities of affiliated issuers, at value(1) |

$ | 59,353,769 | $ | 274,416,581 | $ | 276,048,456 | $ | 131,814,906 | $ | 88,613,357 | ||||||||||

| Cash collateral for derivatives |

149,200 | 972,000 | 975,300 | 221,000 | 164,500 | |||||||||||||||

| Receivables: |

||||||||||||||||||||

| Dividends |

17 | 104 | 94 | 21 | 15 | |||||||||||||||

| Investment securities sold |

— | — | — | 564,314 | — | |||||||||||||||

| Fund shares sold |

801 | 297,433 | 373,375 | 222,249 | 28,872 | |||||||||||||||

| Variation margin |

16,303 | 104,995 | 98,837 | 21,389 | 21,235 | |||||||||||||||

| Receivable from advisor |

3,813 | — | — | — | 439 | |||||||||||||||

| Prepaid expenses and other assets |

22,194 | 22,032 | 22,760 | 21,742 | 20,900 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total Assets |

59,546,097 | 275,813,145 | 277,518,822 | 132,865,621 | 88,849,318 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Liabilities |

||||||||||||||||||||

| Payables: |

||||||||||||||||||||

| Investment securities purchased |

— | — | — | 1,232,500 | — | |||||||||||||||

| Fund shares redeemed |

37,016 | — | — | 3,500 | 3,061 | |||||||||||||||

| Accrued expenses: |

||||||||||||||||||||

| Investment advisory fees |

— | 23,283 | 23,049 | 6,309 | — | |||||||||||||||

| Other expenses |

14,036 | 16,464 | 14,079 | 16,152 | 16,013 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total Liabilities |

51,052 | 39,747 | 37,128 | 1,258,461 | 19,074 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net Assets |

$ | 59,495,045 | $ | 275,773,398 | $ | 277,481,694 | $ | 131,607,160 | $ | 88,830,244 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net Assets Consist of: |

||||||||||||||||||||

| Paid-in capital |

$ | 61,815,718 | $ | 269,783,488 | $ | 260,920,928 | $ | 119,014,084 | $ | 74,636,341 | ||||||||||

| Undistributed net investment income |

481,500 | 3,161,132 | 2,095,645 | 468,796 | 193,075 | |||||||||||||||

| Accumulated net realized loss on investments and futures transactions |

(9,911,111 | ) | (23,181,126 | ) | (10,618,353 | ) | (2,721,126 | ) | (1,598,630 | ) | ||||||||||

| Net unrealized appreciation (depreciation) on investments and futures |

7,108,938 | 26,009,904 | 25,083,474 | 14,845,406 | 15,599,458 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net Assets |

$ | 59,495,045 | $ | 275,773,398 | $ | 277,481,694 | $ | 131,607,160 | $ | 88,830,244 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net Asset Value: |

||||||||||||||||||||

| $0.001 par value, unlimited shares authorized |

||||||||||||||||||||

| Net assets applicable to the GS4 Class |

$ | 59,495,045 | $ | 275,773,398 | $ | 277,481,694 | $ | 131,607,160 | $ | 88,830,244 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| GS4 shares outstanding |

5,992,549 | 28,009,246 | 29,312,888 | 14,345,223 | 9,761,877 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net asset value, offering and redemption price per GS4 share |

$ | 9.93 | $ | 9.85 | $ | 9.47 | $ | 9.17 | $ | 9.10 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

(1) Investments in securities of affiliated issuers, at cost |

$ | 52,319,034 | $ | 248,925,626 | $ | 251,450,337 | $ | 117,030,450 | $ | 73,076,623 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

See Notes to Financial Statements.

12

Table of Contents

| STATEMENTS OF OPERATIONS | For the Six Months Ended June 30, 2011 (Unaudited) |

| MyDestination 2005 Fund |

MyDestination 2015 Fund |

MyDestination 2025 Fund |

MyDestination 2035 Fund |

MyDestination 2045 Fund |

||||||||||||||||

| Investment Income |

||||||||||||||||||||

| Income dividends received from affiliated funds |

$ | 389,761 | $ | 1,869,332 | $ | 1,652,827 | $ | 585,340 | $ | 273,036 | ||||||||||

| Interest |

— | 12,801 | 8,829 | — | 285 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total Investment Income |

389,761 | 1,882,133 | 1,661,656 | 585,340 | 273,321 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Expenses |

||||||||||||||||||||

| Investment advisory fees |

29,079 | 132,676 | 131,058 | 62,181 | 42,058 | |||||||||||||||

| Transfer agent fees: |

||||||||||||||||||||

| GS4 Shares |

9,473 | 10,504 | 10,591 | 10,058 | 9,966 | |||||||||||||||

| Custodian fees |

2,685 | 7,562 | 7,654 | 6,807 | 5,674 | |||||||||||||||

| Accounting and administration fees |

5,058 | 10,771 | 10,800 | 7,033 | 5,894 | |||||||||||||||

| Professional fees |

23,382 | 23,382 | 23,381 | 23,382 | 23,382 | |||||||||||||||

| Blue sky fees: |

||||||||||||||||||||

| GS4 Shares |

12,653 | 13,307 | 13,497 | 12,886 | 12,576 | |||||||||||||||

| Shareholder reporting fees: |

||||||||||||||||||||

| GS4 Shares |

4,012 | 3,784 | 2,387 | 4,175 | 5,331 | |||||||||||||||

| Trustee expenses |

208 | 828 | 764 | 351 | 228 | |||||||||||||||

| Line of credit facility fees |

342 | 1,353 | 1,222 | 563 | 364 | |||||||||||||||

| Other expenses |

8,248 | 7,660 | 7,510 | 7,509 | 7,503 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total Expenses |

95,140 | 211,827 | 208,864 | 134,945 | 112,976 | |||||||||||||||

| Expenses waived/reimbursed net of amount recaptured(1) |

(37,552 | ) | — | — | (13,453 | ) | (31,239 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net Expenses |

57,588 | 211,827 | 208,864 | 121,492 | 81,737 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net investment income |

332,173 | 1,670,306 | 1,452,792 | 463,848 | 191,584 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Realized and Unrealized Gain (Loss) |

||||||||||||||||||||

| Capital gain distributions received from affiliated funds |

66,029 | 275,241 | 132,038 | 33,573 | 19,236 | |||||||||||||||

| Net realized gain (loss) on investment securities of affiliated issuers |

536,242 | (4,082,136 | ) | (3,274,482 | ) | (380,717 | ) | (328,842 | ) | |||||||||||

| Net realized gain (loss) on investment securities of unaffiliated issuers |

— | (14,767 | ) | 14,802 | 2,815 | 2 | ||||||||||||||

| Net realized gain on futures transactions |

(5,360 | ) | 193,843 | 132,989 | 103,069 | 117,066 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net realized gain (loss) |

596,911 | (3,627,819 | ) | (2,994,653 | ) | (241,260 | ) | (192,538 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Change in unrealized appreciation on investment securities of affiliated issuers |

1,348,418 | 14,640,815 | 15,597,069 | 7,194,439 | 5,219,978 | |||||||||||||||

| Change in unrealized appreciation on investment securities of unaffiliated issuers |

— | 22,455 | (5,450 | ) | (941 | ) | (22 | ) | ||||||||||||

| Change in unrealized appreciation on futures |

74,203 | 416,227 | 422,209 | 29,003 | 26,388 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net change in unrealized appreciation |

1,422,621 | 15,079,497 | 16,013,828 | 7,222,501 | 5,246,344 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net Realized and Unrealized Gain |

2,019,532 | 11,451,678 | 13,019,175 | 6,981,241 | 5,053,806 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net Increase in Net Assets Resulting from Operations |

$ | 2,351,705 | $ | 13,121,984 | $ | 14,471,967 | $ | 7,445,089 | $ | 5,245,390 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (1) | See Note 3a and 3c in Notes to Financial Statements. |

See Notes to Financial Statements.

13

Table of Contents

STATEMENTS OF CHANGES IN NET ASSETS

| MyDestination 2005 Fund | ||||||||

| For the Six Months Ended 06/30/11 |

For the Year Ended 12/31/10 |

|||||||

| (Unaudited) | ||||||||

| Operations: |

||||||||

| Net investment income |

$ | 332,173 | $ | 957,660 | ||||

| Net realized gain (loss) on investment securities and futures transactions |

596,911 | (2,591,615 | ) | |||||

| Net change in unrealized appreciation (depreciation) on investment securities and futures |

1,422,621 | 7,862,555 | ||||||

|

|

|

|

|

|||||

| Net increase in net assets resulting from operations |

2,351,705 | 6,228,600 | ||||||

|

|

|

|

|

|||||

| Dividends and Distributions to Shareholders: |

||||||||

| Dividends from net investment income(1) |

— | (1,382,009 | ) | |||||

| Distributions from net realized capital gains |

— | — | ||||||

|

|

|

|

|

|||||

| Total dividends and distributions |

— | (1,382,009 | ) | |||||

|

|

|

|

|

|||||

| Capital Share Transactions: |

||||||||

| Proceeds from GS4 shares sold |

10,031,501 | 16,345,475 | ||||||

| Reinvestment of dividends and distributions into GS4 shares |

— | 1,381,875 | ||||||

| Value of GS4 shares redeemed |

(7,571,070 | ) | (34,721,138 | ) | ||||

|

|

|

|

|

|||||

| Net increase (decrease) from capital share transactions(2) |

2,460,431 | (16,993,788 | ) | |||||

|

|

|

|

|

|||||

| Total increase (decrease) in net assets |

4,812,136 | (12,147,197 | ) | |||||

|

|

|

|

|

|||||

| Net Assets: |

||||||||

| Beginning of Period |

54,682,909 | 66,830,106 | ||||||

|

|

|

|

|

|||||

| End of Period* |

$ | 59,495,045 | $ | 54,682,909 | ||||

|

|

|

|

|

|||||

| *Including undistributed net investment income |

$ | 481,500 | $ | 149,327 | ||||

|

|

|

|

|

|||||

| (1) | Includes dividends paid from the short-term portion of capital gain distributions received from affiliated funds. |

| (2) | See Note 7 in Notes to Financial Statements. |

See Notes to Financial Statements.

14

Table of Contents

| MyDestination 2015 Fund | MyDestination 2025 Fund | MyDestination 2035 Fund | MyDestination 2045 Fund | |||||||||||||||||||||||||||

| For the Six Months Ended 06/30/11 |

For the Year Ended 12/31/10 |

For the Six Months Ended 06/30/11 |

For the Year Ended 12/31/10 |

For the Six Months Ended 06/30/11 |

For the Year Ended 12/31/10 |

For the Six Months Ended 06/30/11 |

For the Year Ended 12/31/10 |

|||||||||||||||||||||||

| (Unaudited) | (Unaudited) | (Unaudited) | ||||||||||||||||||||||||||||

| $ | 1,670,306 | $ | 3,914,330 | $ | 1,452,792 | $ | 3,326,828 | $ | 463,848 | $ | 1,149,458 | $ | 191,584 | $ | 605,319 | |||||||||||||||

| (3,627,819 | ) | (6,101,491 | ) | (2,994,653 | ) | (705,885 | ) | (241,260 | ) | (925,478 | ) | (192,538 | ) | 443,618 | ||||||||||||||||

| 15,079,497 | 32,497,322 | 16,013,828 | 26,572,953 | 7,222,501 | 13,928,400 | 5,246,344 | 8,943,961 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| 13,121,984 | 30,310,161 | 14,471,967 | 29,193,896 | 7,445,089 | 14,152,380 | 5,245,390 | 9,992,898 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| — | (5,104,591 | ) | — | (3,787,639 | ) | — | (1,213,587 | ) | — | (603,947 | ) | |||||||||||||||||||

| — | — | — | — | — | (98,451 | ) | — | (257,097 | ) | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| — | (5,104,591 | ) | — | (3,787,639 | ) | — | (1,312,038 | ) | — | (861,044 | ) | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| 28,171,870 | 47,065,643 | 30,802,591 | 50,705,586 | 17,015,171 | 28,363,630 | 14,341,473 | 25,499,963 | |||||||||||||||||||||||

| — | 5,104,589 | — | 3,787,605 | — | 1,312,038 | — | 861,044 | |||||||||||||||||||||||

| (11,192,047 | ) | (50,968,664 | ) | (4,294,749 | ) | (12,960,593 | ) | (3,059,315 | ) | (7,729,184 | ) | (6,559,185 | ) | (3,849,382 | ) | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| 16,979,823 | 1,201,568 | 26,507,842 | 41,532,598 | 13,955,856 | 21,946,484 | 7,782,288 | 22,511,625 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| 30,101,807 | 26,407,138 | 40,979,809 | 66,938,855 | 21,400,945 | 34,786,826 | 13,027,678 | 31,643,479 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| 245,671,591 | 219,264,453 | 236,501,885 | 169,563,030 | 110,206,215 | 75,419,389 | 75,802,566 | 44,159,087 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| $ | 275,773,398 | $ | 245,671,591 | $ | 277,481,694 | $ | 236,501,885 | $ | 131,607,160 | $ | 110,206,215 | $ | 88,830,244 | $ | 75,802,566 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| $ | 3,161,132 | $ | 1,490,826 | $ | 2,095,645 | $ | 642,853 | $ | 468,796 | $ | 4,948 | $ | 193,075 | $ | 1,491 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

See Notes to Financial Statements.

15

Table of Contents

FINANCIAL HIGHLIGHTS (Unaudited)

For a Share Outstanding For the Years Ending December 31, unless otherwise indicated

| Ratios to Average Net Assets | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net Asset Value, Beginning of Year |

Net Investment Income(1) |

Capital Gain Distributions Received from Affiliated Funds |

Realized and Unrealized Gain (Loss) on Investments |

Dividends from Net Investment Income(2) |

Distributions from Net Realized Capital Gains |

Net Asset Value, End of Year |

Total Return |

Net Assets, End of Year (000) |

Expenses, Net(3) |

Expenses, Gross(3)(4) |

Investment Income, Net (1)(5) |

Portfolio Turnover Rate |

||||||||||||||||||||||||||||||||||||||||

| MyDestination 2005 Fund* |

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

| GS4 Class |

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

| 2011(6) |

$ | 9.53 | $ | 0.06 | # | $ | 0.01 | $ | 0.33 | $ | — | $ | — | $ | 9.93 | 4.20 | % | $ | 59,495 | 0.20 | % | 0.33 | % | 1.15 | % | 10 | % | |||||||||||||||||||||||||

| 2010 |

8.84 | 0.14 | # | 0.09 | 0.70 | (0.24 | ) | — | 9.53 | 10.56 | 54,683 | 0.20 | 0.26 | 1.50 | 19 | |||||||||||||||||||||||||||||||||||||

| 2009 |

7.44 | 0.18 | # | 0.04 | 1.40 | (0.22 | ) | — | 8.84 | 21.84 | 66,830 | 0.20 | 0.26 | 2.31 | 57 | |||||||||||||||||||||||||||||||||||||

| 2008 |

10.35 | 0.30 | # | 0.08 | (2.75 | ) | (0.31 | ) | (0.23 | ) | 7.44 | (22.78 | ) | 50,678 | 0.20 | 0.29 | 3.25 | 40 | ||||||||||||||||||||||||||||||||||

| 2007 |

10.00 | 0.33 | # | 0.62 | (0.31 | ) | (0.28 | ) | (0.01 | ) | 10.35 | 6.42 | 57,667 | 0.20 | 0.43 | 3.16 | 21 | |||||||||||||||||||||||||||||||||||

| MyDestination 2015 Fund* |

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

| GS4 Class |

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

| 2011(6) |

$ | 9.36 | $ | 0.06 | # | $ | 0.01 | $ | 0.42 | $ | — | $ | — | $ | 9.85 | 5.24 | % | $ | 275,773 | 0.16 | % | 0.16 | % | 1.29 | % | 11 | % | |||||||||||||||||||||||||

| 2010 |

8.42 | 0.14 | # | 0.06 | 0.94 | (0.20 | ) | — | 9.36 | 13.54 | 245,672 | 0.16 | 0.16 | 1.65 | 28 | |||||||||||||||||||||||||||||||||||||

| 2009 |

6.83 | 0.17 | # | 0.02 | 1.58 | (0.18 | ) | — | 8.42 | 26.27 | 219,264 | 0.16 | 0.16 | 2.25 | 25 | |||||||||||||||||||||||||||||||||||||

| 2008 |

10.33 | 0.26 | # | 0.09 | (3.39 | ) | (0.19 | ) | (0.27 | ) | 6.83 | (29.31 | ) | 146,140 | 0.20 | 0.18 | 2.87 | 22 | ||||||||||||||||||||||||||||||||||

| 2007 |

10.00 | 0.29 | # | 0.83 | (0.50 | ) | (0.28 | ) | (0.01 | ) | 10.33 | 6.12 | 169,953 | 0.20 | 0.24 | 2.74 | 7 | |||||||||||||||||||||||||||||||||||

| MyDestination 2025 Fund* |

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

| GS4 Class |

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

| 2011(6) |

$ | 8.94 | $ | 0.05 | # | $ | — | † | $ | 0.48 | $ | — | $ | — | $ | 9.47 | 5.93 | % | $ | 277,482 | 0.16 | % | 0.16 | % | 1.13 | % | 10 | % | ||||||||||||||||||||||||

| 2010 |

7.88 | 0.14 | # | 0.03 | 1.04 | (0.15 | ) | — | 8.94 | 15.32 | 236,502 | 0.20 | 0.17 | 1.72 | 15 | |||||||||||||||||||||||||||||||||||||

| 2009 |

6.18 | 0.14 | # | 0.01 | 1.69 | (0.14 | ) | — | 7.88 | 30.12 | 169,563 | 0.20 | 0.19 | 2.11 | 13 | |||||||||||||||||||||||||||||||||||||

| 2008 |

10.24 | 0.21 | # | 0.09 | (3.89 | ) | (0.15 | ) | (0.32 | ) | 6.18 | (35.00 | ) | 96,826 | 0.20 | 0.21 | 2.47 | 10 | ||||||||||||||||||||||||||||||||||

| 2007 |

10.00 | 0.25 | # | 1.13 | (0.85 | ) | (0.28 | ) | (0.01 | ) | 10.24 | 5.29 | 105,102 | 0.20 | 0.30 | 2.37 | 5 | |||||||||||||||||||||||||||||||||||

| MyDestination 2035 Fund* |

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

| GS4 Class |

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

| 2011(6) |

$ | 8.62 | $ | 0.03 | # | $ | — | † | $ | 0.52 | $ | — | $ | — | $ | 9.17 | 6.38 | % | $ | 131,607 | 0.20 | % | 0.22 | % | 0.76 | % | 4 | % | ||||||||||||||||||||||||

| 2010 |

7.52 | 0.10 | # | 0.01 | 1.10 | (0.10 | ) | (0.01 | ) | 8.62 | 16.02 | 110,206 | 0.20 | 0.23 | 1.32 | 9 | ||||||||||||||||||||||||||||||||||||

| 2009 |

5.85 | 0.10 | # | — | † | 1.70 | (0.11 | ) | (0.02 | ) | 7.52 | 30.99 | 75,419 | 0.20 | 0.28 | 1.57 | 4 | |||||||||||||||||||||||||||||||||||

| 2008 |

10.24 | 0.17 | # | 0.09 | (4.25 | ) | (0.10 | ) | (0.30 | ) | 5.85 | (38.86 | ) | 37,637 | 0.20 | 0.40 | 2.02 | 5 | ||||||||||||||||||||||||||||||||||

| 2007 |

10.00 | 0.19 | # | 1.31 | (0.98 | ) | (0.28 | ) | — | † | 10.24 | 5.20 | 35,117 | 0.20 | 0.64 | 1.83 | 2 | |||||||||||||||||||||||||||||||||||

| MyDestination 2045 Fund* |

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

| GS4 Class |

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

| 2011(6) |

$ | 8.52 | $ | 0.02 | # | $ | — | † | $ | 0.56 | $ | — | $ | — | $ | 9.10 | 6.81 | % | $ | 88,830 | 0.20 | % | 0.28 | % | 0.47 | % | 8 | % | ||||||||||||||||||||||||

| 2010 |

7.38 | 0.08 | # | — | † | 1.16 | (0.07 | ) | (0.03 | ) | 8.52 | 16.80 | 75,803 | 0.20 | 0.30 | 1.08 | 1 | |||||||||||||||||||||||||||||||||||

| 2009 |

5.75 | 0.08 | # | — | † | 1.67 | (0.09 | ) | (0.03 | ) | 7.38 | 30.71 | 44,159 | 0.20 | 0.41 | 1.23 | 7 | |||||||||||||||||||||||||||||||||||

| 2008 |

10.12 | 0.16 | # | 0.10 | (4.34 | ) | (0.06 | ) | (0.23 | ) | 5.75 | (40.29 | ) | 17,998 | 0.20 | 0.79 | 1.97 | 5 | ||||||||||||||||||||||||||||||||||

| 2007 |

10.00 | 0.17 | # | 1.37 | (1.09 | ) | (0.28 | ) | (0.05 | ) | 10.12 | 4.46 | 11,659 | 0.19 | 1.48 | 1.60 | 9 | |||||||||||||||||||||||||||||||||||

| † | Amount represents less than $0.005 per share. |

| # | Calculated using the average shares outstanding method. |

| * | Inception date was December 29, 2006. |

| (1) | Recognition of net investment income by the Fund is affected by the timing of the declaration of dividends by the underlying investment companies in which the Fund invests. |

| (2) | Includes dividends paid from the short-term portion of capital gain distributions received from affiliated Funds. |

| (3) | Does not include expenses of the investment companies in which the Fund invests. |

| (4) | The ratio excludes expenses waived/reimbursed net of amount recaptured. |

| (5) | The ratio includes expenses waived/reimbursed net of amount recaptured and fees paid indirectly, where applicable; if expenses waived/reimbursed net of amount recaptured and fees paid indirectly were excluded, the ratio would have been lower than the ratio shown. |

| (6) | For the six months ended June 30, 2011. All ratios for the period have been annualized. Total return and portfolio turnover for the period have not been annualized. |

See Notes to Financial Statements.

16

Table of Contents

| SCHEDULE OF INVESTMENTS |

June 30, 2011 (Unaudited) |

| Shares | Value | |||||||

| MUTUAL FUNDS — 99.9% |

||||||||

| GuideStone Money Market Fund (GS4 Class)¥ |

11,541,879 | $ | 11,541,879 | |||||

| GuideStone Low-Duration Bond Fund (GS4 Class)¥ |

11,950,716 | 159,422,552 | ||||||

| GuideStone Inflation Protected Bond Fund (GS4 Class)¥ |

3,793,031 | 40,319,918 | ||||||

| GuideStone Equity Index Fund (GS4 Class)¥ |

168,686 | 2,872,729 | ||||||

| GuideStone Value Equity Fund (GS4 Class)¥ |

1,208,403 | 18,077,706 | ||||||

| GuideStone Growth Equity Fund (GS4 Class)¥ |

931,123 | 18,613,143 | ||||||

| GuideStone Small Cap Equity Fund (GS4 Class)¥ |

273,441 | 4,396,926 | ||||||

| GuideStone International Equity Fund (GS4 Class)¥ |

1,365,041 | 19,206,127 | ||||||

|

|

|

|||||||

| Total Mutual Funds |

274,450,980 | |||||||

|

|

|

|||||||

| TOTAL INVESTMENTS — 99.9% |

274,450,980 | |||||||

| Other Assets in Excess of Liabilities — 0.1% |

304,849 | |||||||

|

|

|

|||||||

| NET ASSETS — 100.0% |

$ | 274,755,829 | ||||||

|

|

|

|||||||

Please see abbreviation and footnote definitions beginning on page 130.

PORTFOLIO SUMMARY (based on net assets)

| % | ||||

| Bond Funds |

72.7 | |||

| Domestic Equity Funds |

16.0 | |||

| International Equity Fund |

7.0 | |||

| Money Market Fund |

4.2 | |||

| Futures Contracts |

4.0 | |||

|

|

|

|||

| 103.9 | ||||

|

|

|

|||

VALUATION HIERARCHY

The following is a summary of the inputs used, as of June 30, 2011, in valuing the Fund’s investments carried at fair value:

| Total Value |

Level 1 Quoted Prices |

Level 2 Other Significant Observable Inputs |

Level

3 Significant Unobservable Inputs |

|||||||||||||

| Assets: |

||||||||||||||||

| Investments in Securities: |

||||||||||||||||

| Mutual Funds |

$ | 274,450,980 | $ | 274,450,980 | $ | — | $ | — | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Assets — Investments in Securities |

$ | 274,450,980 | $ | 274,450,980 | $ | — | $ | — | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Other Financial Instruments*** |

||||||||||||||||

| Futures Contracts |

$ | 206,202 | $ | 206,202 | $ | — | $ | — | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Assets — Other Financial Instruments |

$ | 206,202 | $ | 206,202 | $ | — | $ | — | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| *** | Other financial instruments are derivative instruments not reflected in the Schedule of Investments, such as futures, forwards and swap contracts, which are valued at the unrealized appreciation (depreciation) on the investment. Details of these investments can be found in the Notes to Financial Statements. |

See Notes to Financial Statements.

17

Table of Contents

| SCHEDULE OF INVESTMENTS |

June 30, 2011 (Unaudited) |

| Shares | Value | |||||||

| MUTUAL FUNDS — 99.8% |

||||||||

| GuideStone Money Market Fund (GS4 Class)¥ |

60,850,570 | $ | 60,850,570 | |||||

| GuideStone Low-Duration Bond Fund (GS4 Class)¥ |

12,403,309 | 165,460,147 | ||||||

| GuideStone Medium-Duration Bond Fund (GS4 Class)¥ |

17,219,411 | 240,038,590 | ||||||

| GuideStone Extended-Duration Bond Fund (GS4 Class)¥ |

5,768,352 | 95,062,443 | ||||||

| GuideStone Global Bond Fund (GS4 Class)¥ |

5,574,455 | 56,190,508 | ||||||

| GuideStone Equity Index Fund (GS4 Class)¥ |

1,387,408 | 23,627,553 | ||||||

| GuideStone Value Equity Fund (GS4 Class)¥ |

10,375,496 | 155,217,420 | ||||||

| GuideStone Growth Equity Fund (GS4 Class)¥ |

7,920,043 | 158,321,650 | ||||||

| GuideStone Small Cap Equity Fund (GS4 Class)¥ |

2,395,277 | 38,516,049 | ||||||

| GuideStone International Equity Fund (GS4 Class)¥ |

11,963,990 | 168,333,344 | ||||||

|

|

|

|||||||

| Total Mutual Funds |

1,161,618,274 | |||||||

|

|

|

|||||||

| TOTAL INVESTMENTS — 99.8% |

1,161,618,274 | |||||||

| Other Assets in Excess of Liabilities — 0.2% |

2,244,837 | |||||||

|

|

|

|||||||

| NET ASSETS — 100.0% |

$ | 1,163,863,111 | ||||||

|

|

|

|||||||

Please see abbreviation and footnote definitions beginning on page 130.

PORTFOLIO SUMMARY (based on net assets)

| % | ||||

| Bond Funds |

47.8 | |||

| Domestic Equity Funds |

32.3 | |||

| International Equity Fund |

14.5 | |||

| Money Market Fund |

5.2 | |||

| Futures Contracts |

5.0 | |||

|

|

|

|||

| 104.8 | ||||

|

|

|

|||

VALUATION HIERARCHY

The following is a summary of the inputs used, as of June 30, 2011, in valuing the Fund’s investments carried at fair value:

| Total Value |

Level 1 Quoted Prices |

Level 2 Other Significant Observable Inputs |

Level 3 Significant Unobservable Inputs |

|||||||||||||

| Assets: |

||||||||||||||||

| Investments in Securities: |

||||||||||||||||

| Mutual Funds |

$ | 1,161,618,274 | $ | 1,161,618,274 | $ | — | $ | — | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Assets — Investments in Securities |

$ | 1,161,618,274 | $ | 1,161,618,274 | $ | — | $ | — | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Other Financial Instruments*** |

||||||||||||||||

| Futures Contracts |

$ | 1,286,393 | $ | 1,286,393 | $ | — | $ | — | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Assets — Other Financial Instruments |

$ | 1,286,393 | $ | 1,286,393 | $ | — | $ | — | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| *** | Other financial instruments are derivative instruments not reflected in the Schedule of Investments, such as futures, forwards and swap contracts, which are valued at the unrealized appreciation (depreciation) on the investment. Details of these investments can be found in the Notes to Financial Statements. |

See Notes to Financial Statements.

18

Table of Contents

| SCHEDULE OF INVESTMENTS |

June 30, 2011 (Unaudited) |

| Shares | Value | |||||||

| MUTUAL FUNDS — 99.9% |

||||||||

| GuideStone Money Market Fund (GS4 Class)¥ |

15,068,297 | $ | 15,068,297 | |||||

| GuideStone Low-Duration Bond Fund (GS4 Class)¥ |

4,670,142 | 62,299,694 | ||||||

| GuideStone Medium-Duration Bond Fund (GS4 Class)¥ |

6,405,462 | 89,292,134 | ||||||

| GuideStone Extended-Duration Bond Fund (GS4 Class)¥ |

2,114,764 | 34,851,310 | ||||||

| GuideStone Global Bond Fund (GS4 Class)¥ |

2,090,594 | 21,073,191 | ||||||

| GuideStone Equity Index Fund (GS4 Class)¥ |

1,563,772 | 26,631,041 | ||||||

| GuideStone Value Equity Fund (GS4 Class)¥ |

12,446,371 | 186,197,717 | ||||||

| GuideStone Growth Equity Fund (GS4 Class)¥ |

9,420,907 | 188,323,931 | ||||||

| GuideStone Small Cap Equity Fund (GS4 Class)¥ |

2,840,843 | 45,680,763 | ||||||

| GuideStone International Equity Fund (GS4 Class)¥ |

14,368,194 | 202,160,495 | ||||||

|

|

|

|||||||

| Total Mutual Funds |

871,578,573 | |||||||

|

|

|

|||||||

| TOTAL INVESTMENTS — 99.9% |

871,578,573 | |||||||

| Other Assets in Excess of Liabilities — 0.1% |

930,453 | |||||||

|

|

|

|||||||

| NET ASSETS — 100.0% |

$ | 872,509,026 | ||||||

|

|

|

|||||||

Please see abbreviation and footnote definitions beginning on page 130.

PORTFOLIO SUMMARY (based on net assets)

| % | ||||

| Domestic Equity Funds |

51.2 | |||

| Bond Funds |

23.8 | |||

| International Equity Fund |

23.2 | |||

| Futures Contracts |

1.8 | |||

| Money Market Fund |

1.7 | |||

|

|

|

|||

| 101.7 | ||||

|

|

|

|||

VALUATION HIERARCHY

The following is a summary of the inputs used, as of June 30, 2011, in valuing the Fund’s investments carried at fair value:

| Total Value |

Level 1 Quoted Prices |

Level 2 Other Significant Observable Inputs |

Level

3 Significant Unobservable Inputs |

|||||||||||||

| Assets: |

||||||||||||||||

| Investments in Securities: |

||||||||||||||||

| Mutual Funds |

$ | 871,578,573 | $ | 871,578,573 | $ | — | $ | — | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Assets — Investments in Securities |

$ | 871,578,573 | $ | 871,578,573 | $ | — | $ | — | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Other Financial Instruments*** |

||||||||||||||||

| Futures Contracts |

$ | 344,951 | $ | 344,951 | $ | — | $ | — | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Assets — Other Financial Instruments |

$ | 344,951 | $ | 344,951 | $ | — | $ | — | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| *** | Other financial instruments are derivative instruments not reflected in the Schedule of Investments, such as futures, forwards and swap contracts, which are valued at the unrealized appreciation (depreciation) on the investment. Details of these investments can be found in the Notes to Financial Statements. |

See Notes to Financial Statements.

19

Table of Contents

| SCHEDULE OF INVESTMENTS |

June 30, 2011 (Unaudited) |

| Shares | Value | |||||||

| MUTUAL FUNDS — 99.8% |

||||||||

| GuideStone Money Market Fund (GS4 Class)¥ |

14,449,087 | $ | 14,449,087 | |||||

| GuideStone Equity Index Fund (GS4 Class)¥ |

1,828,462 | 31,138,708 | ||||||

| GuideStone Value Equity Fund (GS4 Class)¥ |

14,527,586 | 217,332,680 | ||||||

| GuideStone Growth Equity Fund (GS4 Class)¥ |

11,131,730 | 222,523,293 | ||||||

| GuideStone Small Cap Equity Fund (GS4 Class)¥ |

3,321,538 | 53,410,328 | ||||||

| GuideStone International Equity Fund (GS4 Class)¥ |

16,886,245 | 237,589,471 | ||||||

|

|

|

|||||||

| Total Mutual Funds |

776,443,567 | |||||||

|

|

|

|||||||

| TOTAL INVESTMENTS — 99.8% |

776,443,567 | |||||||

| Other Assets in Excess of Liabilities — 0.2% |

1,309,555 | |||||||

|

|

|

|||||||

| NET ASSETS — 100.0% |

$ | 777,753,122 | ||||||

|

|

|

|||||||

Please see abbreviation and footnote definitions beginning on page 130.

PORTFOLIO SUMMARY (based on net assets)

| % | ||||

| Domestic Equity Funds |

67.4 | |||

| International Equity Fund |

30.5 | |||

| Futures Contracts |

2.0 | |||

| Money Market Fund |

1.9 | |||

|

|

|

|||

| 101.8 | ||||

|

|

|

|||

VALUATION HIERARCHY

The following is a summary of the inputs used, as of June 30, 2011, in valuing the Fund’s investments carried at fair value:

| Total Value |

Level 1 Quoted Prices |

Level 2 Other Significant Observable Inputs |

Level

3 Significant Unobservable Inputs |

|||||||||||||

| Assets: |

||||||||||||||||

| Investments in Securities: |

||||||||||||||||

| Mutual Funds |

$ | 776,443,567 | $ | 776,443,567 | $ | — | $ | — | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Assets — Investments in Securities |

$ | 776,443,567 | $ | 776,443,567 | $ | — | $ | — | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Other Financial Instruments*** |

||||||||||||||||

| Futures Contracts |

$ | 437,073 | $ | 437,073 | $ | — | $ | — | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Assets — Other Financial Instruments |

$ | 437,073 | $ | 437,073 | $ | — | $ | — | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| *** | Other financial instruments are derivative instruments not reflected in the Schedule of Investments, such as futures, forwards and swap contracts, which are valued at the unrealized appreciation (depreciation) on the investment. Details of these investments can be found in the Notes to Financial Statements. |

See Notes to Financial Statements.

20

Table of Contents

| STATEMENTS OF ASSETS AND LIABILITIES | June 30, 2011 (Unaudited) |

| Conservative Allocation Fund |

Balanced Allocation Fund |

Growth Allocation Fund |

Aggressive Allocation Fund |

|||||||||||||

| Assets |

||||||||||||||||

| Investments in securities of affiliated issuers, at value (1) |