SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ Preliminary Proxy Statement |

¨ Confidential, for Use of the

Commission | |||

|

x Definitive Proxy Statement |

||||

|

¨ Definitive Additional Materials |

||||

|

¨ Soliciting Material Pursuant to § 240.14a-12 |

XenoPort, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box)

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| 1. | Title of each class of securities to which transaction applies: |

| 2. | Aggregate number of securities to which transaction applies: |

| 3. | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4. | Proposed maximum aggregate value of transaction: |

| 5. | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | Amount Previously Paid: |

| 2) | Form, Schedule or Registration Statement No.: |

| 3) | Filing Party: |

| 4) | Date Filed: |

3410 Central Expressway

Santa Clara, California 95051

NOTICE OF THE 2015 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 19, 2015

To the Stockholders of XenoPort, Inc.:

Notice is hereby given that the 2015 annual meeting of stockholders of XenoPort, Inc. a Delaware corporation, will be held on May 19, 2015 at 9:00 a.m., local time, at the company’s offices located at 3410 Central Expressway, Santa Clara, California 95051 for the following purposes:

| 1. | To elect two Class 1 directors to serve until the 2018 annual meeting of stockholders and until their successors have been duly elected and qualified. |

| 2. | To approve an amendment to XenoPort’s amended and restated certificate of incorporation to eliminate the supermajority voting requirement for amendments to XenoPort’s amended and restated bylaws. |

| 3. | To approve an amendment to XenoPort’s amended and restated certificate of incorporation to increase the total number of shares of common stock authorized for issuance from 100 million shares to 200 million shares. |

| 4. | To approve the XenoPort, Inc. 2015 Employee Stock Purchase Plan. |

| 5. | To ratify the selection by the audit committee of the board of directors of Ernst & Young LLP as XenoPort’s independent registered public accounting firm for the fiscal year ending December 31, 2015. |

| 6. | To approve, on an advisory basis, the compensation of XenoPort’s named executive officers, as disclosed in the proxy statement accompanying this notice. |

| 7. | To conduct any other business properly brought before the 2015 annual meeting. |

These items of business are more fully described in the proxy statement accompanying this notice.

The board of directors has fixed the close of business on March 27, 2015 as the record date for the determination of stockholders entitled to notice of, and to vote at, this annual meeting and at any postponement or adjournment thereof.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to Be Held on May 19, 2015 at 9:00 a.m., local time, at XenoPort’s offices located at 3410 Central Expressway, Santa Clara, California 95051

The Proxy Statement and Annual Report to Stockholders are available at

http://www.rrdezproxy.com/2015/XNPT

| By Order of the Board of Directors |

|

| THOMAS P. MCCRACKEN |

| Secretary |

Santa Clara, California

April 10, 2015

You are cordially invited to attend the annual meeting in person. Whether or not you expect to attend the meeting, please complete, date, sign and return the enclosed proxy as promptly as possible in order to ensure your representation at the meeting. A return envelope (which is postage prepaid if mailed in the United States) has been provided for your convenience. Even if you have voted by proxy, you may still vote in person if you attend the annual meeting. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the meeting, you must obtain a proxy issued in your name from that record holder. You may also submit your proxy over the Internet or by telephone. Please refer to the information provided with your proxy card or voting instruction form for further information.

QUESTIONS AND ANSWERS ABOUT THIS PROXY MATERIAL AND VOTING

Why am I receiving these materials?

We have sent you this proxy statement and the enclosed proxy card because the board of directors of XenoPort, Inc. is soliciting your proxy to vote at the 2015 annual meeting of stockholders, referred to as the 2015 annual meeting, including any adjournments or postponements of the 2015 annual meeting. You are invited to attend the 2015 annual meeting to vote on the proposals described in this proxy statement. However, you do not need to attend the 2015 annual meeting to vote your shares. Instead, you may simply complete, sign and return the enclosed proxy card or follow the instructions below to submit your proxy over the telephone or on the Internet.

We intend to mail this proxy statement and accompanying proxy card on or about April 10, 2015 to all stockholders of record entitled to vote at the 2015 annual meeting.

How do I attend the 2015 annual meeting?

The 2015 annual meeting will be held on May 19, 2015 at 9:00 a.m., local time, at XenoPort’s principal executive offices located at 3410 Central Expressway, Santa Clara, California 95051. Directions to the 2015 annual meeting may be found at http://www.XenoPort.com/contact/directions.htm. Information on how to vote in person at the 2015 annual meeting is discussed below.

Who can vote at the 2015 annual meeting?

Only stockholders of record at the close of business on March 27, 2015 will be entitled to vote at the 2015 annual meeting. On this record date, there were 62,764,168 shares of common stock outstanding and entitled to vote.

Stockholders of Record: Shares Registered in Your Name

If, on March 27, 2015, your shares were registered directly in your name with our transfer agent, Computershare Inc., then you are a stockholder of record. As a stockholder of record, you may vote in person at the 2015 annual meeting or vote by proxy. Whether or not you plan to attend the 2015 annual meeting, we urge you to fill out and return the enclosed proxy card or vote by proxy over the telephone or on the Internet as instructed below to ensure your vote is counted.

Beneficial Owners: Shares Registered in the Name of a Broker or Bank

If, on March 27, 2015, your shares were not held in your name, but rather in an account at a brokerage firm, bank, dealer or other similar organization, then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the 2015 annual meeting. As a beneficial owner, you have the right to direct your broker or other agent regarding how to vote the shares in your account. You are also invited to attend the 2015 annual meeting. However, since you are not the stockholder of record, you may not vote your shares in person at the 2015 annual meeting unless you request and obtain a valid proxy from your broker or other agent.

What am I voting on?

There are six matters scheduled for a vote:

| • | Election of two Class 1 directors to serve until the 2018 annual meeting of stockholders and until their successors have been duly elected and qualified; |

| • | Approval of an amendment to XenoPort’s amended and restated certificate of incorporation to eliminate the supermajority voting requirement for amendments to XenoPort’s amended and restated bylaws; |

1

| • | Approval of an amendment to XenoPort’s amended and restated certificate of incorporation to increase the authorized number of shares of common stock from 100 million shares to 200 million shares; |

| • | Approval of the XenoPort, Inc. 2015 Employee Stock Purchase Plan, or the 2015 ESPP; |

| • | Ratification of the selection of Ernst & Young LLP as XenoPort’s independent registered public accounting firm for the fiscal year ending December 31, 2015; and |

| • | Advisory approval of the compensation of XenoPort’s named executive officers, as disclosed in this proxy statement in accordance with the rules of the Securities and Exchange Commission, or SEC. |

How do I vote?

You may either vote “For” each of the nominees to the board of directors or you may “Withhold” your vote for any nominee you specify. For each of the other matters to be voted on, you may vote “For” or “Against” or abstain from voting. The procedures for voting are fairly simple:

Stockholders of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote in person at the 2015 annual meeting, vote by proxy using the enclosed proxy card, vote by proxy over the telephone or vote by proxy on the Internet. Whether or not you plan to attend the 2015 annual meeting, we urge you to vote by submitting your proxy to ensure that your vote is counted. You may still attend the 2015 annual meeting and vote in person even if you have already voted by proxy.

| • | To vote in person, come to the 2015 annual meeting and we will give you a ballot at the 2015 annual meeting. |

| • | To vote using the proxy card, simply complete, sign and date the enclosed proxy card and return it promptly in the envelope provided. If you return your signed proxy card to us before the 2015 annual meeting, we will vote your shares as you direct. |

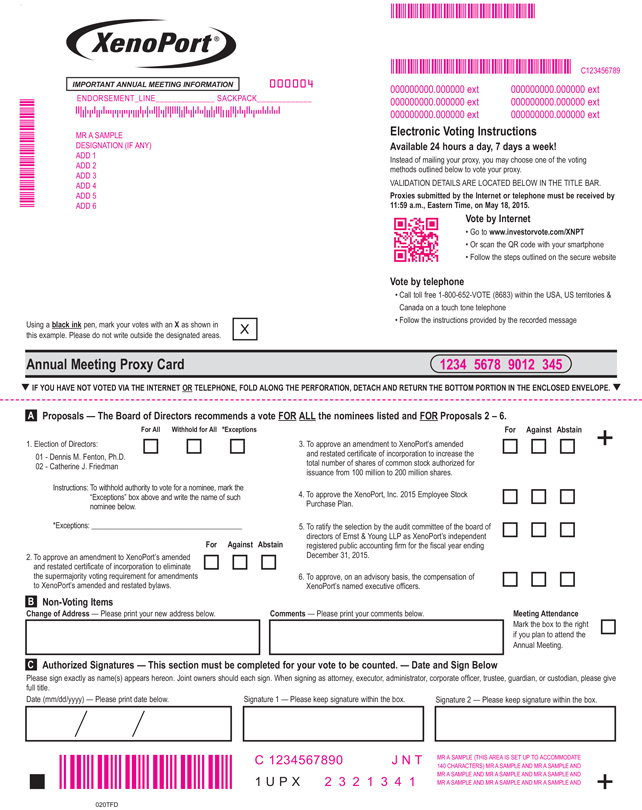

| • | To vote over the telephone, dial toll-free 1-800-652-VOTE (8683) using a touch-tone phone and follow the recorded instructions. You will be asked to provide the company number and control number from the enclosed proxy card. Your vote must be received by 11:59 p.m., Eastern Time, on May 18, 2015 to be counted. |

| • | To vote on the Internet, go to www.investorvote.com/XNPT to complete an electronic proxy card. You will be asked to provide the company number and control number from the enclosed proxy card. Your vote must be received by 11:59 p.m., Eastern Time, on May 18, 2015 to be counted. |

Beneficial Owners: Shares Registered in the Name of a Broker or Bank

If you are a beneficial owner of shares registered in the name of your broker, bank or other agent, you should have received a proxy card and voting instructions with these proxy materials from that organization rather than directly from XenoPort. Simply complete and mail the proxy card to ensure that your vote is counted. Alternatively, you may vote by telephone or over the Internet as instructed by your broker or bank. To vote in person at the 2015 annual meeting, you must obtain a valid proxy from your broker, bank or other agent. Follow the instructions from your broker or bank included with these proxy materials, or contact your broker or bank to request a proxy form.

Telephone and Internet voting procedures are designed to ensure the authenticity and correctness of your proxy vote instructions. However, please be aware that you must bear any costs associated with your Internet access, such as usage charges from Internet access providers and telephone companies.

2

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of common stock you owned as of March 27, 2015.

What if I return a proxy card but do not make specific choices?

Stockholders of Record: Shares Registered in Your Name

If you are a stockholder of record and you do not specify your vote on each proposal individually when voting on the Internet or over the telephone, or if you sign and return a proxy card without giving specific voting instructions, then your shares will be voted “FOR ALL” two of XenoPort’s nominees named herein to the board of directors (Proposal 1); “FOR” the approval of an amendment to XenoPort’s amended and restated certificate of incorporation to eliminate the supermajority voting requirement for amendments to XenoPort’s amended and restated bylaws (Proposal 2); “FOR” the approval of an amendment to XenoPort’s amended and restated certificate of incorporation to increase the authorized number of shares of common stock from 100 million shares to 200 million shares (Proposal 3); “FOR” the approval of the 2015 ESPP (Proposal 4); “FOR” the ratification of Ernst & Young LLP as XenoPort’s independent registered public accounting firm for the fiscal year ending December 31, 2015 (Proposal 5); and “FOR” the advisory approval of the compensation of our named executive officers (Proposal 6). If any other matter is properly presented at the 2015 annual meeting, your proxyholder (one of the individuals named on your proxy card) will vote your shares using his or her best judgment.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank

If you are a beneficial owner of shares registered in the name of your broker, bank or other nominee, and you do not provide the broker or other nominee that holds your shares with voting instructions, the broker or other nominee will determine if it has the discretionary authority to vote on the particular matter. See “What are ‘broker non-votes’?” below. We encourage you to provide voting instructions to the organization that holds your shares to ensure that your vote is counted on all six proposals.

Who is paying for this proxy solicitation?

We will pay for the entire cost of soliciting proxies. In addition to these mailed proxy materials, our directors and employees may also solicit proxies in person, by telephone or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

What does it mean if I receive more than one proxy card?

If you receive more than one proxy card, your shares are registered in more than one name or are registered in different accounts. Please complete, sign and return each proxy card to ensure that all of your shares are voted.

Can I change my vote after submitting my proxy?

Yes. You can revoke your proxy at any time before the final vote at the 2015 annual meeting. If you are the record holder of your shares, you may revoke your proxy in any one of three ways:

| • | You may submit another properly completed proxy card with a later date. |

| • | You may send a timely written notice that you are revoking your proxy to XenoPort’s Secretary at 3410 Central Expressway, Santa Clara, California 95051. |

| • | You may attend the 2015 annual meeting and vote in person. Simply attending the 2015 annual meeting will not, by itself, revoke your proxy. |

3

If your shares are held by your broker or bank as a nominee or agent, you should follow the instructions provided by your broker or bank.

How are votes counted?

Votes will be counted by the inspector of election appointed for the 2015 annual meeting, who will separately count: for the proposal to elect directors, votes “For,” “Withhold” and broker non-votes; and, with respect to the other proposals, votes “For” and “Against,” abstentions and, if applicable, broker non-votes. Abstentions will be counted towards the tabulation of shares present in person or represented by proxy and entitled to vote and will have the same effect as “Against” votes on all proposals except the election of directors (Proposal 1). Broker non-votes will not be counted for purposes of determining the number of shares present in person or represented by proxy and entitled to vote with respect to a particular proposal. Thus, broker non-votes will not affect the outcome of the vote on any of the proposals except Proposals 2 and 3.

What are “broker non-votes”?

Broker non-votes occur when a beneficial owner of shares held in “street name” does not give instructions to the broker or nominee holding the shares as to how to vote on matters deemed “non-routine.” Generally, if shares are held in street name, the beneficial owner of the shares is entitled to give voting instructions to the broker or nominee holding the shares. If the beneficial owner does not provide voting instructions, the broker or nominee can still vote the shares with respect to matters that are considered to be “routine,” but not with respect to “non-routine” matters. Under the rules and interpretations of the New York Stock Exchange, or NYSE, “non-routine” matters are matters that may substantially affect the rights or privileges of stockholders, such as mergers, stockholder proposals, elections of directors and executive compensation, including the advisory stockholder votes on executive compensation. Accordingly, the broker or nominee may not vote your shares with respect to the election of directors (Proposal 1), the 2015 ESPP (Proposal 4) or the stockholder advisory vote on executive compensation (Proposal 6), if you have not provided instructions, but may vote your shares on the ratification of independent registered public accounting firm (Proposal 5). In addition, it is possible that brokers will not have discretionary voting authority with respect to the amendment to XenoPort’s amended and restated certificate of incorporation to eliminate the supermajority voting requirement for amendments to XenoPort’s amended and restated bylaws (Proposal 2), or the amendment to our amended and restated certificate of incorporation to increase the authorized number of shares of common stock from 100 million shares to 200 million shares (Proposal 3). We strongly encourage you to submit your proxy and exercise your right to vote as a stockholder.

How many votes are needed to approve each proposal?

| • | For Proposal 1, the election of directors, the two Class 1 nominees receiving the most “For” votes from the holders of shares present in person or represented by proxy and entitled to vote on the election of directors will be elected. Only “For” or “Withhold” votes will affect the outcome. Broker non-votes will have no effect. |

| • | To be approved, Proposal 2, the amendment to XenoPort’s amended and restated certificate of incorporation to eliminate the supermajority voting requirement for amendments to XenoPort’s amended and restated bylaws, must receive “For” votes from at least 66 2/3% of our issued and outstanding shares of common stock. If you “Abstain” from voting, it will have the same effect as an “Against” vote. Broker non-votes will have the same effect as an “Against” vote. |

| • | To be approved, Proposal 3, the amendment of our amended and restated certificate of incorporation to increase the authorized number of shares of common stock from 100 million shares to 200 million shares, must receive “For” votes from at least 66 2/3% of our issued and outstanding shares of common stock. If you “Abstain” from voting, it will have the same effect as an “Against” vote. Broker non-votes will have the same effect as an “Against” vote. |

4

| • | To be approved, Proposal 4, approval of the 2015 ESPP, must receive “For” votes from the holders of a majority of the shares present in person or represented by proxy and entitled to vote at the 2015 annual meeting. If you “Abstain” from voting, it will have the same effect as an “Against” vote. Broker non-votes will not affect the outcome of the vote on Proposal 4. |

| • | To be approved, Proposal 5, the ratification of the selection of Ernst & Young LLP as XenoPort’s independent registered public accounting firm for the fiscal year ending December 31, 2015, must receive “For” votes from the holders of a majority of the shares present in person or represented by proxy and entitled to vote at the 2015 annual meeting. If you “Abstain” from voting, it will have the same effect as an “Against” vote. Broker non-votes will not affect the outcome of the vote on Proposal 5. |

| • | To be approved, Proposal 6, the approval, on an advisory basis, of the compensation of XenoPort’s named executive officers, must receive “For” votes from the holders of a majority of the shares present in person or represented by proxy and entitled to vote at the 2015 annual meeting. If you “Abstain” from voting, it will have the same effect as an “Against” vote. Broker non-votes will not affect the outcome of the vote on Proposal 6. |

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if stockholders holding at least a majority of the outstanding shares are present at the 2015 annual meeting in person or represented by proxy. On the record date, there were 62,764,168 shares outstanding and entitled to vote. Thus, the holders of at least 31,382,085 shares of common stock must be present in person or represented by proxy at the 2015 annual meeting to have a quorum.

Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote in person at the 2015 annual meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, the chairman of the 2015 annual meeting or a majority of shares present at the 2015 annual meeting in person or represented by proxy may adjourn the 2015 annual meeting to another date.

How can I find out the results of the voting at the 2015 annual meeting?

Final voting results will be published in a current report on Form 8-K that we expect to file within four business days following the 2015 annual meeting. If final voting results are not available to us in time to file a Form 8-K within four business days after the 2015 annual meeting, we intend to file a Form 8-K disclosing preliminary results and, within four business days after the final results are known to us, file an additional Form 8-K to publish the final results.

When are stockholder proposals due for next year’s annual meeting?

To be considered for inclusion in next year’s proxy materials, your proposal must be submitted in writing by the close of business on December 12, 2015, to XenoPort’s Secretary at 3410 Central Expressway, Santa Clara, California 95051, and you must comply with all applicable requirements of Rule 14a-8 promulgated under the Securities Exchange Act of 1934, as amended, or the Exchange Act. However, if our 2016 annual meeting of stockholders is not held between April 19, 2016 and June 18, 2016, then the deadline will be a reasonable time prior to the time we begin to print and send our proxy materials.

If you wish to submit a proposal that is not to be included in next year’s proxy materials or nominate a director, you must provide specified information to XenoPort’s Secretary at 3410 Central Expressway, Santa Clara, California 95051 between the close of business on January 20, 2016 and the close of business on February 19, 2016, unless the date of our 2016 annual meeting of stockholders is before April 19, 2016 or after

5

June 18, 2016, in which case such proposals shall be submitted no earlier than the close of business on the date 120 days prior to the 2016 annual meeting, and no later than the close of business on the later of (i) 90 days before the 2016 annual meeting of stockholders or (ii) ten days after notice of the date of the 2016 annual meeting is first publicly given. You are also advised to review our bylaws, which contain additional requirements about advance notice of stockholder proposals and director nominations. The chair of the 2016 annual meeting of stockholders may determine, if the facts warrant, that a matter has not been properly brought before the meeting and, therefore, may not be considered at the meeting. The proxy solicited by the board of directors for the 2016 annual meeting of stockholders will confer discretionary voting authority with respect to any proposal presented by a stockholder at that meeting for which XenoPort has not been provided with timely notice. In addition, if the stockholder proposal is timely and in accordance with XenoPort’s bylaws, the proxy solicited will confer discretionary voting authority with respect to the proposal if the stockholder does not comply with the requirements of Rule 14a-4(c)(2) promulgated under the Exchange Act.

What proxy materials are available on the Internet?

This proxy statement and our 2014 Annual Report to Stockholders are available at http://www.rrdezproxy.com/2015/XNPT.

6

PROPOSAL 1

ELECTION OF DIRECTORS

Our amended and restated certificate of incorporation, as amended, and our amended and restated bylaws provide that the board of directors shall be divided into three classes, each class consisting, as nearly as possible, of one third of the total number of directors, and with each class having a three-year term. Vacancies on the board of directors may be filled only by persons elected by a majority of the remaining directors. A director elected by the board of directors to fill a vacancy in a class shall serve for the remainder of the full term of that class and until the director’s successor is elected and qualified. This applies to vacancies created by an increase in the authorized number of directors or by the death, resignation, disqualification or removal of a director.

Our board of directors presently has nine members, and there are no vacancies. On February 24, 2015, Ernest Mario, Ph.D., a current director of XenoPort, informed the nominating and corporate governance committee of our board of directors of his decision to not stand for re-election as a Class 1 director of the company at the 2015 annual meeting of stockholders, due to a desire to reduce his professional responsibilities related to public company boards. Upon the departure of Dr. Mario, the size of our board of directors will be reduced to, and our board of directors will be comprised of, eight directors. Proxies may only be voted for the two directors in Class 1 nominated for election at the 2015 annual meeting, the class whose term of office expires in 2015. Each of Dennis M. Fenton, Ph.D. and Catherine J. Friedman is currently a Class 1 director of XenoPort who was previously elected to the board of directors by the stockholders and was recommended for re-election to the board of directors by the nominating and corporate governance committee of the board of directors. If elected at the 2015 annual meeting, each of these two nominees would serve until the 2018 annual meeting of stockholders and until his or her successor is elected and has qualified, or until the director’s death, resignation or removal. Each of these two nominees is submitted for re-election to the board of directors on the proxy card.

Directors are elected by a plurality of the votes present in person or represented by proxy and entitled to vote at the 2015 annual meeting. The persons named as proxies on the proxy card intend to vote the proxies “FOR ALL” two of XenoPort’s nominees named below unless you indicate on the proxy card a vote to “WITHHOLD” your vote with respect to any of these nominees. Cumulative voting is not permitted. In the event that any nominee named below should become unavailable for election as a result of an unexpected occurrence, the proxies will be voted for the election of a substitute nominee or nominees proposed by the nominating and corporate governance committee of the board of directors. If any such substitute nominee(s) are designated, we will file an amended proxy statement and proxy card that, as applicable, identifies the substitute nominee(s), discloses that such nominee(s) have consented to being named in the revised proxy statement and to serve if elected, and includes biographical and other information about such nominee(s) as required by the rules of the Securities and Exchange Commission. Each nominee named below has agreed to serve if elected, and our board of directors has no reason to believe that any such nominee will be unable to serve.

The nominating and corporate governance committee seeks to assemble a board of directors that, as a whole, possesses the appropriate balance of professional and industry knowledge, financial expertise and high-level management experience necessary to oversee and direct our business. To that end, the nominating and corporate governance committee has identified and evaluated the two director nominees named below in the broader context of the board of directors’ overall composition, with the goal of recruiting members who complement and strengthen the skills of other members and who also exhibit integrity, collegiality, sound business judgment and other qualities that the nominating and corporate governance committee views as critical to the effective functioning of our board of directors. In selecting these two director nominees, as well as the remaining current directors, the nominating and corporate governance committee focused on selecting a diverse group of experienced board candidates and members with strong credentials and relevant industry expertise who will work together constructively to execute our strategic plan for delivering long-term growth and stockholder value. Our board of directors is pleased to nominate for election as directors the two persons named in this proposal and on the enclosed proxy card.

7

The brief biographies below include information, as of the date of this proxy statement, regarding the specific and particular experience, qualifications, attributes or skills of each of Dr. Fenton and Ms. Friedman, our director nominees, and of each director whose term will continue after the 2015 annual meeting, that led the nominating and corporate governance committee and the board of directors to believe such director or nominee should continue to serve on our board of directors.

CLASS 1 NOMINEES FOR ELECTION FOR A THREE-YEAR TERM EXPIRING AT THE 2018 ANNUAL MEETING

Dennis M. Fenton, Ph.D.

Dennis M. Fenton, Ph.D., age 63, has been a member of our board of directors since August 2009. From 1982 to 2008, Dr. Fenton held numerous positions, including executive roles in process development, manufacturing, sales and marketing and research and development, at Amgen, Inc., a biotechnology company. From 2000 to 2008, Dr. Fenton was executive vice president responsible for worldwide operations, manufacturing, process development and quality. From 1995 to 2000, Dr. Fenton was senior vice president of operations, and from 1992 to 1995, Dr. Fenton was senior vice president of sales, marketing and process development for Amgen. Dr. Fenton received a B.S. in biology from Manhattan College and a Ph.D. in microbiology from Rutgers University. Dr. Fenton is a member of the board of directors of Dendreon Corporation, a publicly-traded biotechnology company, Hospira, Inc., a publicly-traded pharmaceutical company, Kythera Biopharmaceuticals, Inc., a publicly-traded pharmaceutical company focused on the aesthetic medicine market, and Portola Pharmaceuticals, Inc., a publicly-traded biopharmaceutical company. Dr. Fenton was a member of the board of directors of Genzyme Corporation, a publicly-traded biotechnology company, from 2010 to 2011.

The nominating and corporate governance committee and the board of directors believe that Dr. Fenton’s 27 years of experience, including numerous leadership positions at Amgen, a high-growth biotechnology company, brings a range of experience important to the board of directors. In particular, the nominating and corporate governance committee believes that Dr. Fenton’s experience in development, operations and sales and marketing is very valuable to the board of directors as we pursue commercialization of our product and product candidates.

Catherine J. Friedman

Catherine J. Friedman, age 54, has been a member of our board of directors since September 2007. Ms. Friedman has been an independent financial consultant to private and public companies in the life sciences industry since 2006. Prior to that, Ms. Friedman held numerous positions over a 23-year investment banking career with Morgan Stanley & Co., an investment banking company, including Managing Director from 1997 to 2006 and Head of West Coast Healthcare and Co-Head of the Biotechnology Practice from 1993 to 2006. Ms. Friedman received a B.A. from Harvard College and an M.B.A. from the University of Virginia Darden School of Business. Ms. Friedman is a member of the boards of directors of EnteroMedics Inc., a publicly-traded medical device company focused on obesity management, GSV Capital Corp, a publicly-traded and externally managed, non-diversified closed-end management investment company, and Theravance, Inc., a publicly-traded royalty management company specializing in respiratory assets.

The nominating and corporate governance committee and the board of directors believe that Ms. Friedman’s 23 years of experience as a leading investment banker in the life sciences industry provides important industry and financial expertise. The nominating and corporate governance committee believes that Ms. Friedman’s extensive experience with company financing and capital market access are of particular importance as we continue to finance our operations.

8

THE BOARD OF DIRECTORS RECOMMENDS

A VOTE “FOR” EACH NAMED NOMINEE.

CLASS 2 DIRECTORS CONTINUING IN OFFICE UNTIL THE 2016 ANNUAL MEETING

Paul L. Berns

Paul L. Berns, age 48, has been a member of our board of directors since November 2005. Since March 2014, he has served as president and chief executive officer of Anacor Pharmaceuticals, Inc., a biopharmaceutical company. Prior to March 2014, he was a self-employed consultant to the pharmaceutical industry. From March 2006 to August 2012, he served as president, chief executive officer and a member of the board of directors of Allos Therapeutics, Inc., a biopharmaceutical company, which was acquired by Spectrum Pharmaceuticals, Inc. in August 2012. From 2002 to 2005, Mr. Berns was chief executive officer, president and a director of Bone Care International, Inc., a specialty pharmaceutical company that was acquired by Genzyme Corporation in 2005. From 2001 to 2002, Mr. Berns served as vice president and general manager of the Immunology, Oncology and Pain Therapeutics business unit of Abbott Laboratories, a pharmaceutical company. He served as vice president, marketing of BASF Pharmaceuticals-Knoll, a pharmaceutical company, from 2000 to 2001. From 1990 to 2000, Mr. Berns held various positions, including senior management roles, at Bristol-Myers Squibb Company, a pharmaceutical company. Mr. Berns received a B.S. from the University of Wisconsin. Mr. Berns is chairman of the board of directors of Anacor Pharmaceuticals, and is a member of the board of directors of Jazz Pharmaceuticals, plc, a publicly-traded specialty pharmaceutical company focused on neurology and psychiatry and Cellectar Biosciences, Inc., a publicly-traded specialty pharmaceutical company focused on cancer treatment and diagnosis.

The nominating and corporate governance committee and the board of directors believe that Mr. Berns’ experience as a chief executive officer of Bone Care International and Allos Therapeutics provides significant operational and pharmaceutical industry leadership experience to the board of directors. In particular, Mr. Berns guided Allos Therapeutics through a period that included U.S. Food and Drug Administration approval of Allos’ first product.

John G. Freund, M.D.

John G. Freund, M.D., age 61, has been a member of our board of directors since 1999 and our lead independent director since July 2008. He has been a managing director of Skyline Ventures, a venture capital firm specializing in healthcare companies, since 1997. From 1995 to 1997, Dr. Freund was a managing director in the private equity group at Chancellor Capital Management, a private capital investment firm. AMVESCAP plc, an investment services company, acquired Chancellor Capital Management in 1998 and renamed the division INVESCO Private Capital. In 1995, he co-founded Intuitive Surgical, Inc., a medical device company. From 1988 to 1994, he held various positions at Acuson Corp., a maker of ultrasound equipment, most recently as executive vice president. Siemens Corp. acquired Acuson in 2000. Prior to Acuson, Dr. Freund was a general partner of Morgan Stanley Venture Partners, a venture capital management firm, from 1987 to 1988. From 1982 to 1988, Dr. Freund was at Morgan Stanley & Co., an investment banking company, where he was a co-founder of the Healthcare Group in the Corporate Finance Department. He received a B.A. from Harvard College, an M.D. from Harvard Medical School and an M.B.A. from Harvard Business School. Dr. Freund was a member of the boards of directors of The New Economy Fund, a U.S.-registered investment fund, from 2000 to 2009, Sirtris Pharmaceuticals, Inc., a publicly-traded pharmaceutical company, from 2004 to 2008, Hansen Medical, Inc., a publicly-traded company specializing in medical robotics, from 2002 to 2010, MAP Pharmaceuticals, Inc., a publicly-traded company developing inhalation-based pharmaceuticals, from 2004 to 2011, and MAKO Surgical Corp., a publicly-traded company that designs and sells an advanced robotic-arm solution, together with proprietary implants for minimally invasive orthopedic procedures from 2008 to 2013. Dr. Freund is currently a member of the boards of directors of SMALLCAP World Fund, Fundamental Investors, Inc. and The Growth Fund of America, Inc., each of which are U.S.-registered investment funds. He is also a director of Concert Pharmaceuticals, Inc., Tetraphase Pharmaceuticals, Inc. and Proteon Therapeutics, Inc., each of which are publicly-traded pharmaceutical companies.

9

The nominating and corporate governance committee and the board of directors believe that Dr. Freund’s 30 years of healthcare venture capital investing, healthcare investment banking and management of healthcare companies provide significant and extensive industry expertise. Dr. Freund has served as a director of the company since 1999, bringing historic knowledge and continuity to the board of directors. Dr. Freund has served, or currently serves, as a member of the boards of directors of numerous other pharmaceutical or medical device companies, providing appropriate perspective and extensive familiarity with compensation and financial matters.

William J. Rieflin

William J. Rieflin, age 55, has been a member of our board of directors since September 2010. In September 2010, Mr. Rieflin was appointed chief executive officer and a member of the board of directors of NGM Biopharmaceuticals, Inc., a privately held biopharmaceutical company focused on metabolic diseases. Mr. Rieflin previously served as our president from 2004 to September 2010. From 1996 to 2004, he held various positions with Tularik Inc., a biotechnology company focused on the discovery and development of product candidates based on the regulation of gene expression, most recently as executive vice president, administration, chief financial officer, general counsel and secretary. Amgen Inc. acquired Tularik in 2004. Mr. Rieflin received a B.S. from Cornell University, an M.B.A. from the University of Chicago Graduate School of Business and a J.D. from Stanford Law School. Mr. Rieflin is the lead independent member of the board of directors of Anacor Pharmaceuticals, Inc., a publicly traded pharmaceutical company.

The nominating and corporate governance committee and the board of directors believe that Mr. Rieflin brings to the board substantial experience with the company, given his past role as our president, and extensive leadership skills, industry knowledge and operational expertise from his numerous positions as a biotechnology company executive.

CLASS 3 DIRECTORS CONTINUING IN OFFICE UNTIL THE 2017 ANNUAL MEETING

Ronald W. Barrett, Ph.D.

Ronald W. Barrett, Ph.D., age 59, is one of our founders and has served as our chief executive officer since September 2001. He served as our chief scientific officer from 1999 to 2001. Dr. Barrett has been a director since August 1999. From 1989 to 1999, he held various positions at Affymax Research Institute, a company employing combinatorial chemistry and high-throughput target screening for drug discovery, most recently as senior vice president of research. Glaxo Wellcome plc acquired Affymax Research Institute in 1995. Glaxo Wellcome subsequently merged with SmithKline Beecham plc in 2000 to form GlaxoSmithKline plc, a pharmaceutical company. Prior to Affymax Research Institute, Dr. Barrett was a molecular pharmacologist in the Neuroscience Group at Abbott Laboratories, a healthcare company, from 1986 to 1989. Dr. Barrett received a B.S. from Bucknell University and a Ph.D. in pharmacology from Rutgers University. Dr. Barrett is a member of the board of directors of Concert Pharmaceuticals, Inc., a publicly-traded clinical-stage biopharmaceutical company.

The nominating and corporate governance committee and the board of directors believe that Dr. Barrett’s extensive experience with the company as a founder and through his long tenure as chief executive officer, brings necessary historic knowledge and operational continuity to the board of directors. The nominating and corporate governance committee also believes that, as result of his long tenure with the company in scientific and executive positions, Dr. Barrett brings to the board of directors key scientific expertise, corporate development and investor relations experience and substantial leadership skills.

Jeryl L. Hilleman

Jeryl L. Hilleman, age 57, has been a member of our board of directors since January 2005. She has served as the chief financial officer at Intersect ENT, Inc., a medical device company, since June 2014. Prior to joining Intersect ENT in June 2014, she served as the chief financial officer, chief accounting officer and secretary of the

10

biopharmaceutical company Ocera Therapeutics, Inc., a biopharmaceutical company. Prior to joining Ocera in September 2013, Ms. Hilleman provided independent financial and strategic consulting for biotech and cleantech companies. From January 2008 to May 2012, she was chief financial officer of Amyris Biotechnologies, Inc., a company specializing in synthetic biology. Prior to joining Amyris in January 2008, she was executive vice president and chief financial officer of Symyx Technologies, Inc., a company specializing in high-throughput experimentation for the discovery of materials, from 1997 to June 2007. Prior to joining Symyx in 1997, Ms. Hilleman served as vice president finance and chief financial officer of two public biotechnology companies, Geron Corporation and Cytel Corporation, which merged with Epimmune Inc. in 1999. Ms. Hilleman received an A.B. from Brown University and an M.B.A. from the Wharton Graduate School of Business.

The nominating and corporate governance committee and the board of directors believe that Ms. Hilleman’s significant experience as a chief financial officer of several public biotechnology companies provides valuable financial and audit expertise, particularly in light of Ms. Hilleman’s role as chairperson of the audit committee of the board of directors. As a result of her tenure as chairperson of the audit committee, Ms. Hilleman also provides valuable historic knowledge and continuity with respect to the company’s interactions with the SEC regarding complex accounting matters. The nominating and corporate governance committee further believes that Ms. Hilleman’s educational background and public company experience provides her with significant expertise in: (i) oversight of preparing, auditing, analyzing or evaluating financial statements that present a breadth and level of complexity of accounting issues that are generally comparable to the breadth and complexity of issues that can reasonably be expected to be raised by the company’s financial statements, including complex cost accounting and revenue recognition matters; and (ii) understanding internal controls and procedures for financial reporting as applicable for a company of our size and in our industry.

Wendell Wierenga, Ph.D.

Wendell Wierenga, Ph.D., age 67, has been a member of our board of directors since 2000. From June 2011 to February 2014, he served as executive vice president, research and development at Santarus, Inc., a publicly-traded specialty biopharmaceutical company that was acquired by Salix Pharmaceuticals, Ltd. in January 2014. Prior to joining Santarus, Dr. Wierenga was executive vice president of research and development at Ambit Biosciences, Inc., a biopharmaceutical company engaged in the discovery and development of small-molecule kinase inhibitors, from January 2007 to May 2011. Dr. Wierenga was executive vice president of research and development at Neurocrine Biosciences, Inc., a biopharmaceutical company developing therapeutics for neuropsychiatric, neuroinflammatory and neurodegenerative diseases, from 2003 to 2007. From 2000 to 2003, Dr. Wierenga was chief executive officer of Syrrx, Inc., a company focused on small-molecule drug compounds. Prior to joining Syrrx, from 1990 to 2000, he was senior vice president of worldwide pharmaceutical sciences, technologies and development at Parke-Davis, a division of Warner Lambert Co., a pharmaceutical company. Pfizer Inc., a research-based pharmaceutical company, acquired Warner Lambert in 2000. Prior to Parke-Davis, Dr. Wierenga worked at Upjohn Co., later Pharmacia & Upjohn, Inc., a pharmaceutical and biotechnology company, for 16 years in various positions, most recently as executive director of discovery research. Pfizer acquired Pharmacia & Upjohn, then named Pharmacia Corp., in 2002. Dr. Wierenga is currently a member of the board of directors of Cytokinetics, Inc., Ocera Therapeutics, Concert Pharmaceuticals, Inc., Apricus Biosciences, Inc. and Anacor Pharmaceuticals, Inc., all of which are publicly-traded biopharmaceutical companies. From 1996 to 2013, Dr. Wierenga was a member of the board of directors of Onyx Pharmaceuticals, Inc., a public biopharmaceutical company specializing in oncology that was acquired by Amgen in 2013. Dr. Wierenga received a B.S. from Hope College and a Ph.D. in chemistry from Stanford University.

The nominating and corporate governance committee and the board of directors believe that Dr. Wierenga’s significant pharmaceutical research, clinical development and regulatory experience provide valuable scientific and technical expertise to the board of directors. Dr. Wierenga has served, or currently serves, as a member of the boards of directors of numerous other publicly-traded biopharmaceutical companies, providing appropriate perspective and extensive familiarity with financial and operations management, risk oversight, business strategy and governance matters. Dr. Wierenga also brings executive leadership experience to the board of directors.

11

CORPORATE GOVERNANCE AND BOARD MATTERS

INDEPENDENCE OF THE XENOPORT BOARD

As required under The NASDAQ Stock Market LLC, or Nasdaq, listing standards, a majority of the members of a listed company’s board of directors must qualify as “independent,” as affirmatively determined by the board of directors. Our board of directors consults with our counsel to ensure that the board’s determinations are consistent with all relevant securities and other laws and regulations regarding the definition of “independent,” including those set forth in pertinent listing standards of Nasdaq, as in effect from time to time. Consistent with these considerations, our board of directors has affirmatively determined that all of our directors are independent directors within the meaning of the applicable Nasdaq listing standards, except for Ronald W. Barrett, Ph.D., our chief executive officer, and William J. Rieflin, our former president. In addition, our board of directors has determined that each member of our audit committee, compensation committee and nominating and corporate governance committee is an independent director within the meaning of the applicable Nasdaq listing standards and SEC rules.

INFORMATION REGARDING THE XENOPORT BOARD

Corporate Governance Guidelines

Our board of directors has adopted Corporate Governance Guidelines to ensure that the board of directors has the necessary authority and practices in place to review and evaluate our business operations as needed and to make decisions that are independent of our management. The guidelines are also intended to align the interests of directors and management with those of our stockholders. The Corporate Governance Guidelines set forth the principles that the board of directors will follow with respect to board member responsibilities, board of directors composition and selection, board of directors meetings and involvement of senior management, succession planning and board of directors committees and compensation. The Corporate Governance Guidelines were adopted by the board of directors to, among other things, reflect changes to the Nasdaq listing standards and SEC rules adopted to implement provisions of the Sarbanes-Oxley Act of 2002. The Corporate Governance Guidelines may be viewed on our website at www.XenoPort.com under the section entitled “Investors/Corporate Governance.”

Meetings

During 2014, our board of directors held 30 meetings, including telephonic meetings, and acted by unanimous consent four times. All directors attended at least 75% of the aggregate of the meetings of the board of directors and of the committees on which they served that were held during the period for which they were a director or a committee member. As required under applicable Nasdaq listing standards, in 2014, our independent directors met ten times in regularly scheduled executive sessions at which only independent directors were present. Although we do not have a formal policy regarding attendance by members of the board of directors at our annual meetings of stockholders, directors are encouraged to attend the annual meeting of XenoPort stockholders. With the exception of Dr. Mario, all directors attended the 2014 annual meeting of stockholders in person or via telephonic conference.

Leadership Structure

Our board of directors does not currently have a formally-appointed chairman or other formal leadership structure that would allow one director to entirely shape the work of the board of directors. Dr. Freund has been appointed as our lead independent director, with authority and responsibility to: (i) in conjunction with the chief executive officer, establish meeting agendas; (ii) preside over meetings of the independent directors; (iii) preside over any portions of meetings of the full board of directors at which the evaluation or compensation of the chief executive officer is presented or discussed; (iv) preside over any portions of meetings of the full board of directors at which the performance of the board of directors is presented or discussed; and (v) coordinate the

12

activities of the other independent directors. We believe that having a lead independent director separate from our chief executive officer reinforces the independence of the board of directors in its oversight of the business and affairs of the company. In addition, we believe that having a lead independent director creates an environment that is more conducive to objective evaluation and oversight of management’s performance, increasing management accountability and improving the ability of the board of directors to monitor whether management’s actions are in the best interests of the company and its stockholders. As a result, we believe that having a lead independent director can enhance the effectiveness of the board of directors as a whole.

Risk Oversight

One of the board of directors’ key functions is informed oversight of important enterprise risks facing the company. Our board of directors does not have a standing risk management committee, but rather administers this oversight function directly through the board of directors as a whole and through the board of directors’ committees. In particular, our board of directors is responsible for monitoring and assessing strategic risk exposure, including a determination of the nature and level of risk appropriate for the company. Our audit committee has the responsibility to consider and discuss our major financial risk exposures and the steps our management has taken to monitor and control these exposures, including guidelines and policies to govern the process by which risk assessment and management is undertaken. Our compensation committee assesses and monitors whether any of our compensation policies and programs has the potential to encourage excessive risk-taking. Our nominating and corporate governance committee monitors the effectiveness of our corporate governance guidelines, including whether they are successful in preventing illegal or improper conduct. The board of directors’ role includes receiving regular reports from members of senior management on areas of material risk to the company, including operational, financial, legal, regulatory, compliance, strategic and reputational risks. The board of directors and each committee also receive incidental reports as matters may arise. It is the responsibility of the committee chairs to report findings regarding material risk exposures to the entire board of directors as appropriate.

COMMITTEES OF THE BOARD

Our board of directors has three standing committees: an audit committee, a compensation committee and a nominating and corporate governance committee. The following table provides membership and meeting information for 2014 for each of the board of directors’ committees:

| Name |

Audit | Compensation | Nominating and Corporate Governance | |||

| Paul L. Berns |

— | X* | — | |||

| Dennis M. Fenton, Ph.D. |

— | X | — | |||

| John G. Freund, M.D. (1) |

X | — | X* | |||

| Catherine J. Friedman |

X | — | X | |||

| Jeryl L. Hilleman |

X* | — | — | |||

| Ernest Mario, Ph.D. (2) |

— | — | X | |||

| William J. Rieflin |

— | — | — | |||

| Wendell Wierenga, Ph.D. |

— | X | — | |||

|

|

|

| ||||

| Total meetings in 2014 |

6 | 7 | 2 | |||

| Total actions by unanimous consent in 2014 |

5 | 14 | 2 |

| * | Committee Chairperson |

| (1) | Dr. Freund serves as the lead independent director of the board of directors. |

| (2) | Dr. Mario will retire from our board of directors effective as of the date of our 2015 annual meeting, May 19, 2015. |

13

Below is a description of each standing committee of our board of directors. Each of the committees has authority to engage legal counsel or other experts or consultants, as it deems appropriate, to carry out its responsibilities. The board of directors has determined that each member of each committee meets the applicable rules and regulations regarding “independence” and that each member is free of any relationship that would interfere with his or her individual exercise of independent judgment with regard to XenoPort.

Audit Committee

The audit committee oversees (i) our corporate accounting and financial reporting practices and the audits of our financial statements and (ii) our healthcare compliance program, and it has the responsibility to consider and discuss our major financial risk exposures and the steps our management has taken to monitor and control these exposures, including guidelines and policies to govern the process by which risk assessment and management is undertaken. For this purpose, the audit committee performs several functions. The audit committee evaluates the performance and assesses the qualifications of the independent registered public accounting firm; determines and approves the engagement of the independent registered public accounting firm; determines whether to retain or terminate the existing independent registered public accounting firm or to appoint and engage a new independent registered public accounting firm; reviews and approves the retention of the independent registered public accounting firm to perform any proposed permissible audit, audit-related and non-audit services; sets the compensation of the independent registered public accounting firm; reviews and approves the scope of the audit of the independent registered public accounting firm; monitors the rotation of partners of the independent registered public accounting firm on the company’s audit engagement team as required by law; confers with management and the independent registered public accounting firm regarding the scope, adequacy and effectiveness of internal controls over financial reporting; reviews and approves or rejects transactions between the company and any related persons; establishes procedures, as required under applicable law, for the retention and treatment of complaints received by the company regarding accounting, internal accounting controls or auditing matters and the confidential and anonymous submission by employees of concerns regarding questionable accounting, auditing or healthcare compliance matters; reviews the results of management’s efforts to monitor compliance with the company’s programs and policies designed to ensure adherence to applicable laws and rules addressed by the healthcare compliance program; and meets to review the company’s annual audited financial statements and quarterly financial statements with management and the independent registered public accounting firm, including reviewing the company’s disclosures under “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

The audit committee is currently comprised of three directors: Dr. Freund, Ms. Friedman and Ms. Hilleman. Ms. Hilleman serves as the chairperson of the audit committee. The board of directors annually reviews the Nasdaq listing standards’ definition of independence for audit committee members and has determined that all members of our audit committee are independent (as independence is currently defined in Rule 5605(a)(2) of the Nasdaq listing standards and in Rule 10A-3(b)(1) of the Exchange Act. Our board of directors has also determined that Ms. Hilleman is an “audit committee financial expert” as defined in applicable SEC rules and satisfies the financial sophistication requirements of the Nasdaq listing standards. The board of directors made a qualitative assessment of Ms. Hilleman’s level of knowledge and experience based on a number of factors, including her formal education and experience as a chief financial officer for public reporting companies.

During 2014, the audit committee met six times and acted by unanimous consent five times. The audit committee is governed by a written audit committee charter. The audit committee charter may be viewed on our website at www.XenoPort.com under the section entitled “Investors/Corporate Governance.”

14

Report of the Audit Committee of the Board of Directors1

The audit committee of the board of directors of XenoPort, Inc. oversees the company’s corporate accounting and financial reporting practices on behalf of the board of directors, including: (a) general oversight of the financial reporting process of the company; (b) monitoring the quality and integrity of the company’s financial statements and systems of internal accounting and financial controls; (c) compliance with legal and regulatory requirements related to the preparation and external audit of the company’s financial statements; and (d) the selection, evaluation and retention of the company’s independent registered public accounting firm. Each of the members of the audit committee is independent as defined under the listing standards of Nasdaq and Rule 10A-3(b)(1) of the Exchange Act.

The audit committee is governed by a written charter approved by the board of directors. XenoPort’s management has primary responsibility for preparing the company’s financial statements, ensuring the integrity of such data and establishing the financial reporting process, including the company’s systems of internal controls. Ernst & Young LLP, XenoPort’s independent registered public accounting firm, is responsible for performing an audit of the company’s annual financial statements, expressing an opinion as to the fair presentation of the financial statements in conformity with accounting principles generally accepted in the United States and reviewing the company’s unaudited interim financial statements. The audit committee’s responsibility is to oversee and review these processes.

In fulfilling its oversight responsibilities, the audit committee reviewed the audited financial statements in XenoPort’s Annual Report on Form 10-K for the year ended December 31, 2014 with management, including a discussion of the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments and the clarity of disclosures in the financial statements. The audit committee reviewed with XenoPort’s independent registered public accounting firm its judgments as to the quality, not just the acceptability, of the company’s accounting principles and such other matters as are required to be discussed with the audit committee under generally accepted auditing standards, including those matters set forth in the Public Company Accounting Oversight Board, or PCAOB, Auditing Standard No. 16. In addition, the audit committee has discussed with XenoPort’s independent registered public accounting firm its independence from management and the company and has received the written disclosures and the letter from the independent registered public accounting firm required by applicable requirements of the PCAOB regarding the independent registered public accounting firm’s communications with the audit committee concerning independence, and has also considered the compatibility of non-audit services with the independent registered public accounting firm’s independence. The audit committee discussed with XenoPort’s independent registered public accounting firm the overall scope and plans for its audit. The audit committee meets with the independent registered public accounting firm, with and without management present, to discuss the results of its examinations, its considerations of the company’s internal controls and the overall quality of the company’s financial reporting. The audit committee approved all audit, audit-related and non-audit services provided by XenoPort’s independent registered public accounting firm. The audit committee only approved services that were integrally connected to the audit services or that were at a level that did not otherwise compromise the independent registered public accounting firm’s independence. The audit committee has not approved any services by the independent registered public accounting firm that are related to financial information systems design and implementation or strategic tax planning services.

| 1 | The material in this report is not “soliciting material,” is not deemed “filed” with the SEC and is not to be incorporated by reference into any filing of XenoPort under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing. |

15

During fiscal year 2014, the audit committee held six meetings. In reliance on the reviews and discussions referred to above, the audit committee recommended to the board of directors (and the board has approved) that the audited financial statements be included in XenoPort’s Annual Report on Form 10-K for the year ended December 31, 2014 for filing with the SEC. The audit committee has selected, and the board of directors has recommended that the stockholders ratify the selection of, Ernst & Young LLP as XenoPort’s independent registered public accounting firm for the fiscal year ending December 31, 2015.

| Respectfully submitted, |

| The Audit Committee of the Board of Directors |

| Jeryl L. Hilleman (Chairperson) |

| John G. Freund, M.D. |

| Catherine J. Friedman |

Compensation Committee

The compensation committee reviews and approves the overall compensation strategy and policies for the company. The compensation committee: reviews and approves corporate performance goals and objectives relevant to the compensation of our executive officers; evaluates and recommends to the board of directors for approval the compensation plans and programs advisable for the company; establishes policies with respect to equity compensation arrangements; reviews and approves the terms of any employment agreements, severance arrangements, change-of-control protections and other compensatory arrangements for our executive officers; evaluates and recommends to the board of directors for approval the compensation and other terms of employment for our chief executive officer; evaluates, determines and approves the compensation and other terms of employment for our other executive officers; reviews and assesses the potential impact of our compensation practices on enterprise risk; administers our equity incentive plans and employee stock purchase plan, stock bonus plans, bonus plans, deferred compensation plans and other similar programs, and reviews and determines the compensation to be paid to the non-employee members of our board of directors. The compensation committee also reviews with management the company’s Compensation Discussion and Analysis and considers whether to recommend that it be included in proxy statements and other filings.

Compensation Committee Processes and Procedures

Historically, the compensation committee has made most significant adjustments to annual compensation, determined bonus and equity awards and approved new performance objectives at one or more meetings held during the first quarter of the year. However, the compensation committee also considers matters related to individual compensation, such as compensation for new executive hires or new hire inducement stock award grants, at various meetings throughout the year or pursuant to actions by unanimous consent. Generally, the compensation committee’s process comprises two related elements: the determination of compensation levels and the establishment of performance objectives for the current year. For executive compensation decisions, including decisions relating to the grant of equity awards to executive officers, the compensation committee typically considers the recommendations of Dr. Barrett, XenoPort’s chief executive officer, and he often participates in the compensation committee’s deliberations about executive compensation matters. However, the compensation committee also meets in executive session, and Dr. Barrett does not participate in the determination of his own compensation, nor does he participate in deliberations with respect thereto. In the case of the chief executive officer, the evaluation of his performance is conducted by the compensation committee, which determines and recommends to the board of directors for approval any adjustments to his compensation as well as awards to be granted. From time to time, various members of management, including Mr. Angotti, XenoPort’s executive vice president, chief operating officer; Ms. Gianna Bosko, XenoPort’s former senior vice president, chief legal officer and secretary and current consultant to the company; and Mr. William Harris, XenoPort’s senior vice president, chief financial officer, and other employees as well as outside advisors or

16

consultants have been or may in the future be invited by the compensation committee to make presentations, provide financial or other background information or advice or otherwise participate in compensation committee meetings. The compensation committee has direct responsibility for the oversight of the work of any advisers engaged for the purpose of advising the committee. In particular, the compensation committee has the sole authority to retain compensation consultants and other advisers, at XenoPort’s expense, to assist in its evaluation of executive compensation, including the authority to approve the consultant’s reasonable fees and other retention terms. The compensation committee may select, or receive advice from, a compensation consultant, legal counsel or other adviser to the compensation committee, other than in-house legal counsel and certain other types of advisers, only after taking into consideration six factors, prescribed by the SEC and Nasdaq, that bear upon the adviser’s independence; however, there is no requirement that any adviser be independent. For all executives, as part of its deliberations, the compensation committee may review and consider, as appropriate, materials such as financial reports and projections, operational data, tax and accounting information, executive stock ownership information, company stock performance data, analyses of historical executive compensation levels and current company-wide compensation levels and recommendations of the compensation consultant, including analyses of executive compensation paid at other companies identified by the consultant.

During 2014, after taking into consideration the six factors prescribed by the SEC and Nasdaq referenced above, the compensation committee engaged Radford, an Aon Hewitt Company, as compensation consultants. The compensation committee requested that Radford (i) evaluate the efficacy of the company’s existing compensation strategy and practices in supporting and reinforcing the company’s long-term strategic goals, (ii) assist in refining the company’s compensation strategy and developing and implementing a competitive executive compensation program to execute that strategy and (iii) conduct an independent review of our non-employee director compensation program.

As part of its engagement, Radford was requested by the compensation committee to develop a comparative group of companies and to perform analyses of competitive performance and compensation levels for that group. The compensation committee has analyzed whether the work of Radford as a compensation consultant has raised any conflict of interest and determined, based on its review, that the work of Radford and the individual compensation advisors employed by Radford as compensation consultants to the compensation committee has not created any conflict of interest. The compensation committee will continue to assess the independence of any compensation advisers by reference to the foregoing factors, consistent with applicable Nasdaq listing standards. The specific determinations of the compensation committee with respect to executive compensation for 2014 are described in greater detail in the Compensation Discussion and Analysis section of this proxy statement. The specific determinations of the compensation committee with respect to non-employee director compensation are described in greater detail in the Director Compensation section of this proxy statement.

The compensation committee may form, and delegate authority to, subcommittees, including a subcommittee composed of one or more members of the board of directors to grant stock awards under the company’s equity incentive plans.

The compensation committee is currently comprised of three directors: Mr. Berns and Drs. Fenton and Wierenga. Mr. Berns serves as the chairperson of the compensation committee. All members of the compensation committee are independent (as independence is currently defined in Rule 5605(a)(2) of the Nasdaq listing standards). The compensation committee met seven times, and acted by unanimous consent 14 times, during 2014. The compensation committee is governed by a written compensation committee charter. The compensation committee charter may be viewed on our website at www.XenoPort.com under the section entitled “Investors/Corporate Governance.”

17

Compensation Committee Report2

The compensation committee has reviewed and discussed with management the Compensation Discussion and Analysis, or CD&A, contained in this proxy statement. Based on this review and discussion, the compensation committee has recommended to the board of directors that the CD&A be included in this proxy statement and incorporated into XenoPort’s Annual Report on Form 10-K for the fiscal year ended December 31, 2014.

| Respectfully submitted, |

| The Compensation Committee of the Board of Directors

|

| Paul L. Berns (Chairperson) |

| Dennis M. Fenton, Ph.D. |

| Wendell Wierenga, Ph.D. |

Compensation Committee Interlocks and Insider Participation

During the year ended December 31, 2014, our compensation committee consisted of Mr. Berns and Drs. Fenton and Wierenga. During 2014, none of the members of our compensation committee had at any time been an officer or employee of XenoPort. During 2014, none of our executive officers served as a director or member of the compensation committee of any other entity whose executive officers served on our board of directors or compensation committee.

Nominating and Corporate Governance Committee

The nominating and corporate governance committee is responsible for: overseeing all aspects of our corporate governance functions on behalf of the board of directors; making recommendations to the board of directors regarding corporate governance issues; identifying, reviewing and evaluating candidates to serve as directors; reviewing, evaluating and considering the recommendation for nomination of incumbent directors for re-election to the board of directors; monitoring the size of the board of directors; recommending candidates to the board of directors and making such other recommendations to the board of directors regarding affairs relating to our directors; assessing the performance of our board of directors and its committees and of individual directors; reviewing and assessing our corporate governance principles; and overseeing our legal, regulatory and ethical compliance programs, other than handling complaints related to accounting, financial or healthcare compliance matters, which are delegated to the audit committee.

To date, the nominating and corporate governance committee has not adopted a formal policy with respect to a fixed set of specific minimum qualifications for its candidates for membership on the board of directors. Instead, when considering candidates for director, the nominating and corporate governance committee will generally consider all of the relevant qualifications of board of directors candidates, including such factors as the candidate’s relevant expertise upon which to be able to offer advice and guidance to management, having sufficient time to devote to the affairs of the company, demonstrated excellence in his or her field, having relevant financial or accounting expertise, having the ability to exercise sound business judgment, having the commitment to rigorously represent the long-term interests of our stockholders and whether the board candidates will be independent for purposes of the Nasdaq listing standards, as well as the current needs of the board of directors and the company. In addition, while it does not have a formal policy on the board of directors’ diversity, the nominating and corporate governance committee takes into account a broad range of diversity considerations

| 2 | The material in this report is not “soliciting material,” is not deemed “filed” with the SEC and is not to be incorporated by reference into any filing of XenoPort under the Securities Act of 1933, as amended, or the Exchange Act, other than XenoPort’s Annual Report on Form 10-K where it shall be deemed furnished, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing. |

18

when assessing director candidates, including individual backgrounds and skill sets, professional experiences and other factors that contribute to the board of directors having an appropriate range of expertise, talents, experiences and viewpoints. The nominating and corporate governance committee considers diversity criteria in view of the needs of the board of directors as a whole when making decisions on director nominations. In the case of incumbent directors whose terms of office are set to expire, the nominating and corporate governance committee will also review, prior to nominating such directors for another term, such directors’ overall service to XenoPort during their term. The nominating and corporate governance committee will conduct any appropriate and necessary inquiries into the backgrounds and qualifications of possible candidates after considering the function and needs of the board of directors.

Similarly, the nominating and corporate governance committee, to date, has not adopted a formal policy with regard to the consideration of director candidates recommended by stockholders and will consider director candidates recommended by stockholders on a case-by-case basis, as appropriate. Stockholders wishing to recommend individuals for consideration by the nominating and corporate governance committee may do so by delivering a written recommendation to XenoPort’s Secretary at 3410 Central Expressway, Santa Clara, California 95051 and providing the candidate’s name, biographical data and qualifications and a document indicating the candidate’s willingness to serve if elected.

The nominating and corporate governance committee does not intend to alter the manner in which it evaluates candidates based on whether the candidate was recommended by a stockholder or not. We have, from time to time, engaged an executive search firm to assist the nominating and corporate governance committee in identifying and recruiting potential candidates for membership on the board of directors.