UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||

For the transition period from __________________ to __________________ | ||

Commission file number

(Exact name of registrant as specified in its charter)

| ||

(State or Other Jurisdiction | (I.R.S. Employer | |

(Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

| Trading Symbol(s) |

| Name of each exchange on which registered |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ |

| Accelerated filer ☐ |

Smaller reporting filer | ||

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

As of May 9, 2024 there were

CYCLACEL PHARMACEUTICALS, INC.

INDEX

| Page | ||

3 | |||

Management’s Discussion and Analysis of Financial Condition and Results of Operations | 21 | ||

28 | |||

28 | |||

28 | |||

29 | |||

29 | |||

29 | |||

29 | |||

29 | |||

30 | |||

31 | |||

2

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

CYCLACEL PHARMACEUTICALS, INC.

CONSOLIDATED BALANCE SHEETS

(In $000s, except share, per share, and liquidation preference amounts)

(Unaudited)

| March 31, | December 31, | ||||

| 2024 |

| 2023 | |||

ASSETS | ||||||

Current assets: |

|

|

|

| ||

Cash and cash equivalents | $ | | $ | | ||

Prepaid expenses and other current assets |

| |

| | ||

Total current assets |

| |

| | ||

Property and equipment, net |

| |

| | ||

Right-of-use lease asset | | | ||||

Non-current deposits | | | ||||

Total assets | $ | | $ | | ||

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

| ||

Current liabilities: |

|

|

|

| ||

Accounts payable | $ | | $ | | ||

Accrued and other current liabilities |

| |

| | ||

Total current liabilities |

| |

| | ||

Lease liability | | | ||||

Total liabilities |

| |

| | ||

Stockholders’ equity: | ||||||

Preferred stock, $ |

| |||||

|

| |||||

Series A convertible preferred stock, $ |

|

| ||||

Series B convertible preferred stock, $ |

|

| ||||

Common stock, $ |

| |

| | ||

Additional paid-in capital |

| |

| | ||

Accumulated other comprehensive loss |

| ( |

| ( | ||

Accumulated deficit |

| ( |

| ( | ||

Total stockholders’ equity |

| ( |

| | ||

Total liabilities and stockholders’ equity | $ | | $ | | ||

The accompanying notes are an integral part of these consolidated financial statements.

3

CYCLACEL PHARMACEUTICALS, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(In $000s, except share and per share amounts)

(Unaudited)

| Three Months Ended | |||||

March 31, | ||||||

| 2024 |

| 2023 | |||

Revenues: |

| |||||

Clinical trial supply | $ | | $ | | ||

Revenues | $ | | $ | | ||

Operating expenses: |

|

|

|

| ||

Research and development |

| |

| | ||

General and administrative |

| |

| | ||

Total operating expenses |

| |

| | ||

Operating loss |

| ( |

| ( | ||

Other income: |

|

|

|

| ||

Foreign exchange gains (losses) |

| |

| ( | ||

Interest income |

| |

| | ||

Other income, net |

| |

| | ||

Total other income, net |

| |

| | ||

Loss before taxes |

| ( |

| ( | ||

Income tax benefit |

| |

| | ||

Net loss |

| ( |

| ( | ||

Dividend on convertible exchangeable preferred shares |

| |

| ( | ||

Net loss applicable to common shareholders | $ | ( | $ | ( | ||

Basic and diluted earnings per common share: |

|

|

|

| ||

Net loss per share – basic and diluted (common shareholders) | $ | ( | $ | ( | ||

Net loss per share – basic and diluted (redeemable common shareholders) | $ | | $ | ( | ||

The accompanying notes are an integral part of these consolidated financial statements.

4

CYCLACEL PHARMACEUTICALS, INC.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS

(In $000s)

(Unaudited)

| Three Months Ended |

| |||||

March 31, | |||||||

| 2024 |

| 2023 |

| |||

Net loss | $ | ( | $ | ( | |||

Translation adjustment |

| |

| ( | |||

Unrealized foreign exchange gain (loss) on intercompany loans |

| ( |

| | |||

Comprehensive loss | $ | ( | $ | ( | |||

The accompanying notes are an integral part of these consolidated financial statements.

5

CYCLACEL PHARMACEUTICALS, INC.

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(In $000s, except share amounts)

(Unaudited)

| Accumulated | |||||||||||||||||||||

| Additional |

| Other |

| Total | |||||||||||||||||

| Preferred Stock |

| Common Stock |

| Paid-in |

| Comprehensive |

| Accumulated |

| Stockholders’ | |||||||||||

| Shares |

| Amount |

| Shares |

| Amount |

| Capital |

| Loss |

| Deficit |

| Equity | |||||||

Balances at December 31, 2022 | | $ | — |

| | $ | | $ | | $ | ( | $ | ( | $ | | |||||||

Stock-based compensation |

| — |

| — |

| — |

| — |

| |

| — |

| — |

| | ||||||

Preferred stock dividends |

| — |

| — |

| — |

| — |

| ( |

| — |

| — |

| ( | ||||||

Unrealized foreign exchange on intercompany loans |

| — |

| — |

| — |

| — |

| — |

| |

| — |

| | ||||||

Translation adjustment |

| — |

| — |

| — |

| — |

|

| ( |

|

| ( | ||||||||

Loss for the period |

| — |

| — |

| — |

| — |

| — |

| — |

| ( |

| ( | ||||||

Balances at March 31, 2023 |

| | $ | — |

| | $ | | $ | | $ | ( | $ | ( | $ | | ||||||

Balances at December 31, 2023 | | $ | — |

| | $ | | $ | | $ | ( | $ | ( | $ | | |||||||

Issue of common stock upon conversion of pre-funded warrants in underwritten offering net of issuance costs | — |

| — |

| |

| — |

| ( |

| — |

| — |

| ( | |||||||

Series B Preferred stock conversions | ( | — | | — | — |

| — |

| — | — | ||||||||||||

Stock-based compensation |

| — |

| — |

| — |

| — |

| |

| — |

| — |

| | ||||||

Preferred stock dividends |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

| — | ||||||

Unrealized foreign exchange on intercompany loans |

| — |

| — |

| — |

| — |

| — |

| ( |

| — |

| ( | ||||||

Translation adjustment |

| — |

| — |

| — |

| — |

|

| |

|

| | ||||||||

Loss for the period |

| — |

| — |

| — |

| — |

| — |

| — |

| ( |

| ( | ||||||

Balances at March 31, 2024 |

| | $ | — |

| | $ | | $ | | $ | ( | $ | ( | $ | ( | ||||||

The accompanying notes are an integral part of these consolidated financial statements.

6

CYCLACEL PHARMACEUTICALS, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In $000s)

(Unaudited)

Three Months Ended | ||||||

March 31, | ||||||

| 2024 |

| 2023 | |||

Operating activities: |

|

| ||||

Net loss | $ | ( | $ | ( | ||

Adjustments to reconcile net loss to net cash used in operating activities: |

|

| ||||

Depreciation | | | ||||

Stock-based compensation | | | ||||

Changes in lease liability | ( | ( | ||||

Changes in operating assets and liabilities: | ||||||

Prepaid expenses and other assets | | ( | ||||

Accounts payable, accrued and other current liabilities | | ( | ||||

Net cash used in operating activities | ( | ( | ||||

Investing activities: |

|

| ||||

Purchase of property, plant and equipment | — | ( | ||||

Net cash used in investing activities | — | ( | ||||

Financing activities: |

|

| ||||

Costs from issuing common stock and pre-funded warrants | ( | — | ||||

Payment of preferred stock dividend | — | ( | ||||

Net cash used in financing activities | ( | ( | ||||

Effect of exchange rate changes on cash and cash equivalents | ( | | ||||

Net (decrease) in cash and cash equivalents | ( | ( | ||||

Cash and cash equivalents, beginning of period | | | ||||

Cash and cash equivalents, end of period | $ | | $ | | ||

Supplemental cash flow information: |

|

| ||||

Cash received during the period for: |

|

| ||||

Interest | $ | | $ | | ||

Research & development tax credits | $ | | $ | — | ||

Cash paid during the period for: | ||||||

Taxes | $ | | $ | | ||

Non cash financing activities: |

|

| ||||

Accrual of preferred stock dividends | $ | — | $ | | ||

The accompanying notes are an integral part of these consolidated financial statements.

7

CYCLACEL PHARMACEUTICALS, INC.

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

1. Company Overview

Nature of Operations

Cyclacel Pharmaceuticals, Inc. (“Cyclacel” or the “Company”) is a clinical-stage biopharmaceutical company developing innovative cancer medicines based on cell cycle, transcriptional regulation, epigenetics and mitosis control biology. Cyclacel is a pioneer company in the field of cancer cell cycle biology with a vision to improve patient healthcare by translating insights in cancer biology into medicines that can overcome resistance and ultimately increase a patient’s overall survival.

Through March 31, 2024, substantially all efforts of the Company to date have been devoted to performing research and development, conducting clinical trials, developing and acquiring intellectual property, raising capital and recruiting and training personnel.

2. Summary of Significant Accounting Policies

Basis of Presentation

The consolidated balance sheet as of March 31, 2024, the consolidated statements of operations, comprehensive loss, stockholders’ equity, and cash flows for the three months ended March 31, 2024 and 2023, and all related disclosures contained in the accompanying notes, are unaudited. The consolidated balance sheet as of December 31, 2023 is derived from the audited consolidated financial statements included in the Annual Report on Form 10-K for the fiscal year ended December 31, 2023 filed with the Securities and Exchange Commission (the “SEC”) on March 21, 2024. The consolidated financial statements are presented on the basis of accounting principles that are generally accepted in the United States (“GAAP”) for interim financial information and in accordance with the rules and regulations of the SEC. Accordingly, they do not include all the information and footnotes required by accounting principles generally accepted in the United States for a complete set of financial statements. In the opinion of management, all adjustments, which include only normal recurring adjustments necessary to present fairly the consolidated balance sheet as of March 31, 2024, and the results of operations, comprehensive loss, and cash flows for the three months ended March 31, 2024 and 2023, have been made. The interim results for the three months ended March 31, 2024 are not necessarily indicative of the results to be expected for the year ending December 31, 2024 or for any other reporting period. The consolidated financial statements should be read in conjunction with the audited consolidated financial statements and the accompanying notes for the year ended December 31, 2023 that are included in the Company’s Annual Report on Form 10-K filed with the SEC on March 21, 2024.

Going Concern

Pursuant to the requirements of Accounting Standard Codification (“ASC”) 205-40, Presentation of Financial Statements-Going Concern, management is required at each reporting period to evaluate whether there are conditions or events, considered in the aggregate, that raise substantial doubt about an entity’s ability to continue as a going concern within one year after the date that the financial statements are issued. This evaluation initially does not take into consideration the potential mitigating effect of management’s plans that have not been fully implemented as of the date the financial statements are issued. When substantial doubt exists under this methodology, management evaluates whether the mitigating effects of its plans sufficiently alleviate the substantial doubt about the Company’s ability to continue as a going concern. The mitigating effect of management’s plans, however, is only considered if both (1) it is probable that the plans will be effectively implemented within one year after the date that the financial statements are issued, and (2) it is probable that the plans, when implemented, will mitigate the relevant conditions or events that raise substantial doubt about the entity’s ability to continue as a going concern for one year after the date that these financial statements are issued. In performing its analysis, management excluded certain elements of its operating plan that cannot be considered probable. Under ASC 205-40, the future receipts of potential funding from future equity or debt issuances or by entering into partnership agreements cannot be considered probable at this time because these plans are not entirely

8

within the Company’s control nor have they been approved by the Board of Directors as of the date of these consolidated financial statements.

Based on the Company’s current operating plan, it is anticipated that cash and cash equivalents of $

Recently Issued Accounting Pronouncements

The Financial Accounting Standards Board (“FASB”) has issued Accounting Standards Update (“ASU”) 2020-04, “Reference Rate Reform (Topic 848)”. This standard provides optional expedients and exceptions for applying GAAP to contracts, hedging relationships, and other transactions affected by reference rate reform initiatives that would replace interbank offered rates, including the London Interbank Offered Rate (LIBOR). For example, modifications of lease contracts within the scope of ASC 842 solely for changes in reference rates would be accounted for as a continuation of the existing contracts with no reassessments of the lease classification and the discount rate. Following the issuance of ASU 2022-06, “Reference Rate Reform (Topic 848): Deferral of the Sunset Date of Topic 848”, the relief remains effective for all entities as of March 12, 2020 through December 31, 2024. The Company does not currently have any contracts affected by this guidance.

The FASB has issued ASU 2023-07, “Segment Reporting (Topic 280)”. This standard will require all public entities – even those like the Company that have a single reportable segment – to disclose additional information about the title and position of the Chief Operating Decision Maker (“CODM”), the measure or measures of segment profit and loss used by the CODM in assessing segment performance and deciding how to allocate resources, an explanation of how the CODM uses the reported measure(s) in assessing segment performance, significant segment expenses that are regularly provided to the CODM, and a reconciliation of segment profit and loss to the closest consolidated totals prepared under United States GAAP. The amendments in ASU 2023-07 are effective for fiscal years beginning after December 15, 2023, and interim periods within fiscal years beginning after December 15, 2024. ASU 2023-07 will not change the way in which reportable segments are determined. However, the Company is currently evaluating the effects of ASU 2023-07 on its financial statement presentation and disclosures.

The FASB has issued ASU 2023-09, “Income Taxes (Topic 740): Improvements to Income Tax Disclosures”. This standard will require all entities to disclose the amount of income taxes paid (net of refunds received) disaggregated by federal (national), state, and foreign for each annual reporting period. The guidance in ASU 2023-09 becomes effective for annual periods beginning after December 15, 2024. The Company does not anticipate that ASU 2023-09 will require significant adjustments to the presentation of that information.

Fair Value of Financial Instruments

Financial instruments consist of cash equivalents, accounts payable and accrued liabilities. The carrying amounts of cash equivalents, accounts payable and accrued liabilities approximate their respective fair values due to the nature of the accounts, notably their short maturities.

9

Comprehensive Income (Loss)

All components of comprehensive income (loss), including net income (loss), are reported in the financial statements in the period in which they are recognized. Comprehensive income (loss) is defined as the change in equity during a period from transactions and other events and circumstances from non-owner sources. Net income (loss) and other comprehensive income (loss), including foreign currency translation adjustments, are reported, net of any related tax effect, to arrive at comprehensive income (loss).

Foreign Currency and Currency Translation

Transactions that are denominated in a foreign currency are remeasured into the functional currency at the current exchange rate on the date of the transaction. Any foreign currency-denominated monetary assets and liabilities are subsequently remeasured at current exchange rates, with gains or losses recognized as foreign exchange (losses) gains in the statement of operations. This accounting policy is also applied to intercompany payables or receivables for which settlement is planned or anticipated in the foreseeable future.

The assets and liabilities of the Company’s international subsidiary are translated from its functional currency into United States dollars at exchange rates prevailing at the balance sheet date. Average rates of exchange during the period are used to translate the statement of operations, while historical rates of exchange are used to translate any equity transactions. Translation adjustments arising on consolidation due to differences between average rates and balance sheet rates, as well as unrealized foreign exchange gains or losses arising from translation of intercompany loans for which

settlement is not planned or anticipated in the foreseeable future and that are of a long-term-investment nature, are recorded in other comprehensive loss.

Leases

The Company accounts for lease contracts in accordance with ASC 842. As of March 31, 2024, the Company’s outstanding leases are classified as operating leases.

The Company recognizes an asset for the right to use an underlying leased asset for the lease term and records lease liabilities based on the present value of the Company’s obligation to make lease payments under the lease. As the Company’s leases do not indicate an implicit rate, the Company uses a best estimate of its incremental borrowing rate to discount the future lease payments. The Company estimates its incremental borrowing rate based on observable information about risk-free interest rates that are the same tenure as the lease term, adjusted for various factors, including the effects of assumed collateral, the nature of how the loan is repaid (e.g., amortizing versus bullet), and the Company’s credit risk.

The Company evaluates options included in its lease agreements to extend or terminate the lease. The Company will reflect the effects of exercising those options in the lease term when it is reasonably certain that the Company will exercise that option. In assessing whether it is reasonably certain that the Company will exercise an option, the Company considers factors such as:

| ● | The lease payments due in any optional period; |

| ● | Penalties for failure to exercise (or not exercise) the option; |

| ● | Market factors, such as the availability of similar assets and current rental rates for such assets; |

| ● | The nature of the underlying leased asset and its importance to the Company’s operations; and |

| ● | The remaining useful lives of any related leasehold improvements. |

Lease expense for operating leases is recognized on a straight-line basis over the lease term. Variable lease payments, if any, are recognized in the period when the obligation to make those payments is incurred. Lease incentives received prior to lease commencement are recorded as a reduction in the right-of-use asset. Fixed lease incentives received after lease commencement reduce both the lease liability and the right-of-use asset.

10

The Company has elected an accounting policy to account for the lease and non-lease components as a single lease component.

Revenue Recognition

When the Company enters into contracts with customers, the Company recognizes revenue using the five step-model provided in ASC 606, Revenue from Contracts with Customers (“ASC 606”):

| (1) | identify the contract with a customer; |

| (2) | identify the performance obligations in the contract; |

| (3) | determine the transaction price; |

| (4) | allocate the transaction price to the performance obligations in the contract; and |

| (5) | recognize revenue when, or as, the Company satisfies a performance obligation. |

The transaction price includes fixed payments and an estimate of variable consideration, including milestone payments. The Company determines the variable consideration to be included in the transaction price by estimating the most likely amount that will be received and then applies a constraint to reduce the consideration to the amount which is probable of being received. When applying the constraint, the Company considers:

| ● | Whether achievement of a development milestone is highly susceptible to factors outside the entity’s influence, such as milestones involving the judgment or actions of third parties, including regulatory bodies; |

| ● | Whether the uncertainty about the achievement of the milestone is not expected to be resolved for a long period of time; |

| ● | Whether the Company can reasonably predict that a milestone will be achieved based on previous experience; and |

| ● | The complexity and inherent uncertainty underlying the achievement of the milestone. |

The transaction price is allocated to each performance obligation based on the relative selling price of each performance obligation. The best estimate of the selling price is determined after considering all reasonably available information, including market data and conditions, entity-specific factors such as the cost structure of the deliverable and internal profit and pricing objectives.

The revenue allocated to each performance obligation is recognized as or when the Company satisfies the performance obligation.

The Company recognizes a contract asset, when the value of satisfied (or part satisfied) performance obligations is in excess of the payment due to the Company, and deferred revenue when the amount of unconditional consideration is in excess of the value of satisfied (or part satisfied) performance obligations. Once a right to receive consideration is unconditional, that amount is presented as a receivable.

Grant revenue received from organizations that are not the Company’s customers, such as charitable foundations or government agencies, is presented as a reduction against the related research and development expenses.

3. Revenue

The Company recognized $

11

4. Net Loss per Common Share

The Company calculates net loss per common share in accordance with ASC 260 “Earnings Per Share” (“ASC 260”). Basic and diluted net loss per common share was determined by dividing net loss applicable to common stockholders by the weighted average number of shares of common stock outstanding during the period.

The following potentially dilutive securities have not been included in the computation of diluted net loss per share for the three months ended March 31, 2024 and 2023, as the result would be anti-dilutive:

| March 31, | March 31, | ||

| 2024 |

| 2023 | |

Stock options |

| |

| |

Restricted Stock Units |

| |

| |

| |

| | |

Series A preferred stock |

| |

| |

Series B preferred stock |

| — |

| |

Common stock warrants |

| |

| |

Total shares excluded from calculation |

| |

| |

5. Prepaid Expenses and Other Current Assets

Prepaid expenses and other current assets consisted of the following (in $000s):

| March 31, | December 31, | ||||

| 2024 |

| 2023 | |||

Research and development tax credit receivable | $ | | $ | | ||

Prepayments and VAT receivable | |

| | |||

Other current assets |

| | | |||

$ | | $ | | |||

6. Non-Current Assets

As of March 31, 2024, the Company had non-current assets of $

7. Accrued and Other Liabilities

Accrued and other current liabilities consisted of the following (in $000s):

| March 31, | December 31, | ||||

| 2024 |

| 2023 | |||

Accrued research and development | $ | | $ | | ||

Accrued legal and professional fees |

| |

| | ||

Other current liabilities |

| |

| | ||

$ | | $ | | |||

8. Leases

The Company currently has an operating lease relating to its facilities in Berkeley Heights, New Jersey.

For the three months ended March 31, 2024 and 2023, the Company recognized operating lease expenses of $

12

Dundee, Scotland. Cash payments made during the three months ended March 31, 2024 and 2023 totaled $

Remaining lease payments for both facilities are as follows (in $000s):

2024 |

| $ | |

2025 | | ||

Thereafter | — | ||

Total future minimum lease obligation | $ | | |

Less imputed interest | ( | ||

Total |

| $ | |

9. Stock Based Compensation

ASC 718 requires compensation expense associated with share-based awards to be recognized over the requisite service period which, for the Company, is the period between the grant date and the date the award vests or becomes exercisable. Most of the awards granted by the Company (and still outstanding) vest ratably over to

Stock based compensation has been reported within expense line items on the consolidated statement of operations for the three months ended March 31, 2024 and 2023 as shown in the following table (in $000s):

| Three Months Ended |

| |||||

| March 31, |

| |||||

| 2024 |

| 2023 | ||||

General and administrative | $ | | $ | | |||

Research and development | | | |||||

Stock-based compensation costs | $ | | $ | | |||

2018 Plan

In May 2018, the Company’s stockholders approved the 2018 Equity Incentive Plan (the “2018 Plan”), under which Cyclacel may make equity incentive grants to its officers, employees, directors and consultants. The 2018 Plan replaced the 2015 Equity Incentive Plan (the “2015 Plan”).

The 2018 Plan allows for various types of award grants, including stock options and restricted stock units.

On June 13, 2023, the Company’s stockholders approved an additional

2020 Inducement Equity Incentive Plan

In October 2020, the Inducement Equity Incentive Plan (the “Inducement Plan”), became effective. Under the Inducement Plan, Cyclacel may make equity incentive grants to new senior level Employees (persons to whom the Company may issue securities without stockholder approval). The Inducement Plan allows for the issuance of up to

13

Option Grants and Exercises

There were

All of the options granted during the quarter ended March 31, 2024 shall vest

The fair value of the stock options granted is calculated using the Black-Scholes option-pricing model as prescribed by ASC 718 using the following assumptions:

Three months ended | Three months ended | |||

| March 31, 2024 |

| March 31, 2023 | |

Expected term (years) |

|

| ||

Risk free interest rate |

| |||

Volatility |

| |||

Expected dividend yield over expected term |

| |||

Resulting weighted average grant date fair value |

| $ | $ |

There were

As of March 31, 2024, the total remaining unrecognized compensation cost related to the non-vested stock options with service conditions amounted to approximately $

Outstanding Options

A summary of the share option activity and related information is as follows:

|

|

| Weighted |

| ||||||

|

| Weighted |

| Average |

| |||||

| Number of |

| Average |

| Remaining |

| Aggregate | |||

Options |

| Exercise |

| Contractual | Intrinsic | |||||

Outstanding | Price Per Share |

| Term (Years) | Value ($000) | ||||||

Options outstanding at December 31, 2023 |

| | $ | |

| $ | — | |||

Granted | | $ | |

| — | $ | — | |||

Exercised | — | $ | — |

| — | $ | — | |||

Cancelled/forfeited | ( | $ | |

| — | $ | — | |||

Options outstanding at March 31, 2024 |

| | $ | |

| $ | — | |||

Unvested at March 31, 2024 |

| | $ | |

| $ | — | |||

Vested and exercisable at March 31, 2024 |

| | $ | |

| $ | — | |||

Restricted Stock Units

The Company issued

14

Exactly

Summarized information for restricted stock units as of March 31, 2024 is as follows:

|

| Weighted | Weighted | ||||

|

| Average | Average | ||||

Restricted |

| Grant Date | Remaining | ||||

Stock Units | Value Per Share | Term | |||||

Restricted Stock Units outstanding at December 31, 2023 |

| | $ | | |||

Granted | | | |||||

Cancelled/forfeited | ( | | |||||

Restricted Stock Units outstanding at March 31, 2024 | | $ | | ||||

Unvested at March 31, 2024 |

| | $ | | |||

Vested at March 31, 2024 |

| | $ | | |||

10. Stockholders Equity

December 2023 Registered Direct Offering Securities Purchase Agreement

On December 21, 2023, the Company entered into a securities purchase agreement (the “Securities Purchase Agreement”) with certain institutional investors (“Purchasers”). Pursuant to the Securities Purchase Agreement, the Company agreed to sell in a registered direct offering (“Registered Direct Offering”)

Pursuant to the Securities Purchase Agreement, in a concurrent private placement (together with the Registered Direct Offering, the “Offerings”), the Company also agreed to issue to the Purchasers unregistered warrants (“Common Warrants”) to purchase up to

On December 21, 2023, in a separate concurrent insider private placement (the “Insider Private Placement”), the Company also entered into a Securities Purchase Agreement with certain of its executive officers (the “Insider Securities Purchase Agreement”) pursuant to which the Company agreed to sell in a private placement (i)

15

Ladenburg Thalmann & Co. Inc. (the “Placement Agent”) acted as the exclusive placement agent for the Offerings, pursuant to a placement agency agreement (the “Placement Agency Agreement”), dated December 21, 2023, by and between the Company and the Placement Agent.

Pursuant to the Placement Agency Agreement, the Company paid the Placement Agent a cash placement fee equal to

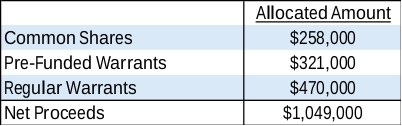

Each of the instruments issued in the Offerings and the Insider Private Placement have been classified and recorded as part of shareholders’ equity. The amounts allocated to each issued security were based on their relative fair values, resulting in initial carrying values of the respective instruments as follows:

The aggregate fair value of the Placement Agent Warrants was $

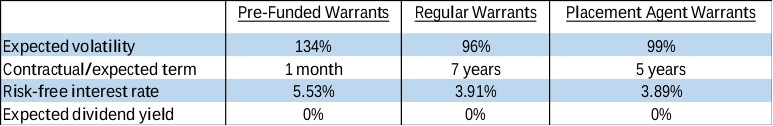

In determining the fair values of the Pre-Funded Warrants, Regular Warrants, and Placement Agent Warrants, the Company used a Black-Scholes Option Pricing model with the following assumptions:

The fair value of the common shares was determined using the closing price of the Company’s common stock as of December 26, 2023, which is the date that the Offerings and the Insider Private Placement closed.

August 2021 Controlled Equity Offering Sales Agreement

On August 12, 2021, the Company entered into a Controlled Equity Offering Sales Agreement (the “Sales Agreement”) with Cantor Fitzgerald & Co. ("Cantor"), pursuant to which the Company could issue and sell, from time to time, shares of its common stock having an aggregate offering price of up to $

16

On August 12, 2022, the Company became aware that the shelf registration statement on Form S-3 (file number 333-231923) (the “Registration Statement”) associated with this Sales Agreement had expired on June 21, 2022. Prior to becoming aware of the expiration, the Company sold an aggregate of

On August 15, 2022, due to expiry of the Registration Statement, the Sales Agreement was mutually terminated. A total of

Warrants

December 2023 Warrants

As of March 31, 2024, warrants to purchase a total of

There were

December 2020 Warrants

As of March 31, 2024, warrants to purchase

There were

April 2020 Warrants

As of March 31, 2024,

The common warrants are exercisable, at the option of each holder, in whole or in part, by delivering to the Company a duly executed exercise notice accompanied by payment in full for the number of shares of the

17

Company’s common stock purchased upon such exercise (except in the case of a cashless exercise). A holder (together with its affiliates) may not exercise any portion of the common warrant to the extent that the holder would own more than

There were

July 2017 Warrants

As of March 31, 2024,

The exercise price and the number of shares issuable upon exercise of the warrants is subject to appropriate adjustment in the event of recapitalization events, stock dividends, stock splits, stock combinations, reclassifications, reorganizations or similar events affecting the Company’s common stock. The warrant holders must pay the exercise price in cash upon exercise of the warrants unless such warrant holders are utilizing the cashless exercise provision of the warrants. On the expiration date, unexercised warrants will automatically be exercised via the “cashless” exercise provision.

Prior to the exercise of any warrants to purchase common stock, holders of the warrants will not have any of the rights of holders of the common stock purchasable upon exercise, including the right to vote, except as set forth therein.

There were

Series B Preferred Stock

18

Holders of Series B Preferred Stock are entitled to receive dividends on shares of Series B Preferred Stock equal, on an as-if-converted-to-Common-Stock basis, and in the same form as dividends actually paid on shares of the Common Stock. Except as otherwise required by law, the Series B Preferred Stock does not have voting rights. However, as long as any shares of Series B Preferred Stock are outstanding, the Company will not, without the affirmative vote of the holders of a majority of the then outstanding shares of the Series B Preferred Stock, (a) alter or change adversely the powers, preferences or rights given to the Series B Preferred Stock, (b) alter or amend the Certificate of Designation, (c) amend its certificate of incorporation or other charter documents in any manner that adversely affects any rights of the holders of Series B Preferred Stock, (d) increase the number of authorized shares of Series B Preferred Stock, (e) pay certain dividends or (f) enter into any agreement with respect to any of the foregoing. The Series B Preferred Stock does not have a preference upon any liquidation, dissolution or winding-up of the Company. The Purchaser may convert shares of Series B Preferred Stock through a conversion into shares of Common Stock if and solely to the extent that such conversion would not result in the Purchaser beneficially owning in excess of

During the year ended December 31, 2023,

Series A Preferred Stock

As of March 31, 2024 and 2023,

In the event of a liquidation, the holders of shares of the Series A Preferred Stock may participate on an as-converted-to-common-stock basis in any distribution of assets of the Company. The Company shall not pay any dividends on shares of common stock (other than dividends in the form of common stock) unless and until such time as dividends on each share of Series A Preferred Stock are paid on an as-converted basis. There is no restriction on the Company’s ability to repurchase shares of Series A Preferred Stock while there is any arrearage in the payment of dividends on such shares, and there are no sinking fund provisions applicable to Series A Preferred Stock.

Subject to certain conditions, at any time following the issuance of the Series A Preferred Stock, the Company has the right to cause each holder of the Series A Preferred Stock to convert all or part of such holder’s Series A Preferred Stock in the event that (i) the volume weighted average price of our common stock for consecutive trading days, or Measurement Period exceeds

The Series A Preferred Stock has no maturity date, will carry the same dividend rights as the common stock, and with certain exceptions contains no voting rights. In the event of any liquidation or dissolution of the Company, the Series A Preferred Stock ranks senior to the common stock in the distribution of assets, to the extent legally available for distribution.

19

As of March 31, 2024, there were

The Company may automatically convert the

The

The Company may, at its option, redeem the

The

11. Subsequent Events

Dividends on 6% Preferred Stock

On April 25, 2024, the Board of Directors of Cyclacel Pharmaceuticals, Inc. (the “Company”) passed a resolution to suspend payment of the quarterly cash dividend on the Company’s

Securities Purchase Agreement

On April 30, 2024, the Company entered into a securities purchase agreement with an institutional investor for the issuance and sale in a private placement of (i)

Nasdaq Listing Rule 5550(b)(1)

As a result of the above-mentioned private placement and as of the date of this filing, the Company believes it has stockholders’ equity of at least $2.5 million as required for continued listing on The Nasdaq Capital Market under Nasdaq Listing Rule 5550(b)(1).

20

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q, including, without limitation, Management’s Discussion and Analysis of Financial Condition and Results of Operations, contains “forward-looking statements” within the meaning of Section 27A of the Securities Exchange Act of 1933 as amended and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). We intend that the forward-looking statements be covered by the safe harbor for forward-looking statements in the Exchange Act. The forward-looking information is based on various factors and was derived using numerous assumptions. All statements, other than statements of historical fact, that address activities, events or developments that we intend, expect, project, believe or anticipate will or may occur in the future are forward-looking statements. Such statements are based upon certain assumptions and assessments made by our management in light of their experience and their perception of historical trends, current conditions, expected future developments and other factors they believe to be appropriate. These forward-looking statements are usually accompanied by words such as “believe,” “anticipate,” “plan,” “seek,” “expect,” “intend” and similar expressions.

Forward-looking statements necessarily involve risks and uncertainties, and our actual results could differ materially from those anticipated in the forward looking statements due to a number of factors, including those set forth in Part I, Item 1A, entitled “Risk Factors,” of our Annual Report on Form 10-K for the year ended December 31, 2023, as updated and supplemented by Part II, Item 1A, entitled “Risk Factors,” of our Quarterly Reports on Form 10-Q, and elsewhere in this report. These factors as well as other cautionary statements made in this Quarterly Report on Form 10-Q, should be read and understood as being applicable to all related forward-looking statements wherever they appear herein. The forward-looking statements contained in this Quarterly Report on Form 10-Q represent our judgment as of the date hereof. We encourage you to read those descriptions carefully. We caution you not to place undue reliance on the forward-looking statements contained in this report. These statements, like all statements in this report, speak only as of the date of this report (unless an earlier date is indicated) and we undertake no obligation to update or revise the statements except as required by law. Such forward-looking statements are not guarantees of future performance and actual results will likely differ, perhaps materially, from those suggested by such forward-looking statements. In this report, “Cyclacel,” the “Company,” “we,” “us,” and “our” refer to Cyclacel Pharmaceuticals, Inc.

Overview

We are a clinical-stage biopharmaceutical company developing innovative cancer medicines based on cell cycle, transcriptional regulation, epigenetics and mitosis control biology. We reported revenue of $29,000 for the three months ended March 31, 2024 and no revenues for the comparable quarter ended March 31, 2023. We do not expect to report a significant amount of revenue for the foreseeable future.

Our primary focus has been on our transcriptional regulation program, which is evaluating fadraciclib, a CDK2/9 inhibitor, in solid tumors and hematological malignancies. The epigenetic/anti-mitotic program is evaluating plogosertib, a PLK1 inhibitor, in advanced cancers.

We currently retain all marketing rights worldwide to the compounds associated with our drug programs.

Fadraciclib Phase 1/2 Study in Advanced Solid Tumors and Lymphoma (065-101; NCT#04983810)

In this ongoing study, a total of 47 patients have been dosed to date in the 065-101 study through eight dose levels, of which 33 are evaluable for efficacy. Dose limiting toxicities of nausea and hyperglycemia were observed, which were controlled after dose interruption, with blood glucose levels returning to normal range. Dose level 5 (100mg twice daily for 5 days per week, 4 out of 4 weeks) has been determined as the recommended Phase 2 dose.

To date, single agent activity, including complete response, partial response and stable disease, has been observed in certain patients with advanced endometrial, squamous non-small cell lung cancer and T-cell lymphoma. Several pretreated patients who benefitted from fadraciclib monotherapy, were retrospectively found to harbor

21

CDKN2A/CDKN2B alterations, including loss of function or deep deletion. These included patients with T-cell lymphoma and also gynecological, hepatobiliary, lung, pancreatic and testicular cancers.

We plan to enroll patients in the Phase 2 proof-of-concept stage beginning with the basket cohort which will enroll patients with mechanistically relevant biomarkers, including CDKN2A and/or CDKN2B mutation or deletion. Additional cohorts will be enrolled as resources allow. The proof-of-concept stage includes seven histologically defined cohorts thought to be sensitive to the drug’s mechanism: breast, colorectal (including KRAS mutant), endometrial/uterine, hepatobiliary, ovarian cancers and lymphomas. The basket cohort will enroll patients regardless of histology with biomarkers relevant to the drug’s mechanism, including CDKN2A/B, MCL1, MYC and/or cyclin E amplified.

Fadraciclib tablets can be given orally with repeat dosing which has led to transient suppression of anti-apoptosis proteins with generally good tolerability and no Grade 3 or higher hematological toxicity in the first cycle. We believe that fadraciclib’s inhibition of CDK2 and CDK9 may be superior to inhibiting either CDK2 or CDK9 alone.

Plogosertib Phase 1/2 Study in Advanced Solid Tumors and Lymphoma (140-101; NCT#05358379)

This ongoing open-label Phase 1/2 registration-directed study uses a streamlined design and initially seeks to determine the RP2D for single-agent oral plogosertib in a dose escalation stage. Once RP2D has been established, the study will enter into proof-of-concept, cohort stage, using a Simon 2-stage design. In this stage plogosertib will be administered to patients in up to seven mechanistically relevant cohorts including patients with bladder, breast, colorectal (including KRAS mutant), hepatocellular and biliary tract, and lung cancers (both small cell and non-small cell), as well as lymphomas. An additional basket cohort will enroll patients with biomarkers relevant to the drug’s mechanism, including MYC amplified tumors. The protocol allows for expansion of individual cohorts based on response which may allow acceleration of the clinical development and registration plan for plogosertib.

Fifteen patients have been treated at the first five dose escalation levels with no dose limiting toxicities observed. Stable disease has been observed in pretreated patients with gastrointestinal, lung, and ovarian cancers. A new, alternative salt, oral formulation of plogosertib with improved bioavailability is under development. We plan to recruit further patients to the 140-101 study after the new formulation becomes available.

Going Concern

For the three months ended March 31, 2024, we used net cash of $0.6 million to fund our operating activities. We have cash and cash equivalents of $2.8 million as of March 31, 2024, which together with the $8.0 million gross proceeds from equity financing received in May 2024 will allow it to meet our liquidity requirements into the fourth quarter of 2024. However, there remains substantial doubt about our ability to continue as a going concern. We are currently investigating ways to raise additional capital through a combination of public or private equity, debt financing or by entering into partnership agreements for further development of our drug candidates. Please refer to the following Liquidity and Capital Resources section for additional information.

Liquidity and Capital Resources

The following is a summary of our key liquidity measures as of March 31, 2024 and 2023 (in $000s):

March 31, | ||||||

| 2024 |

| 2023 | |||

Cash and cash equivalents | $ | 2,798 | $ | 11,435 | ||

Working capital: | ||||||

Current assets | $ | 4,835 | $ | 19,676 | ||

Current liabilities |

| (8,350) |

| (8,040) | ||

Total working capital | $ | (3,515) | $ | 11,636 | ||

22

Since our inception, we have relied primarily on the proceeds from sales of common and preferred equity securities to finance our operations and internal growth. Additional funding has come through research and development tax credits, government grants, the sale of product rights, interest on investments and licensing revenue. We have incurred significant losses since our inception. As of March 31, 2024, we had an accumulated deficit of $431.2 million.

Cash Flows

Cash used in operating, investing and financing activities for the three months ended March 31, 2024 and 2023 is summarized as follows (in $000s):

Three Months Ended March 31, | ||||||

| 2024 |

| 2023 | |||

Net cash used in operating activities | $ | (483) | $ | (6,861) | ||

Net cash used in investing activities |

| — |

| (6) | ||

Net cash provided by financing activities |

| (79) |

| (50) | ||

Operating activities

Net cash used in operating activities decreased by $6.4 million, from $6.9 million for the three months ended March 31, 2023 to $0.5 million for the three months ended March 31, 2024. The decrease in cash used by operating activities was primarily the result of a decrease in net loss of $2.9 million, brought about by a reduction in manufacturing and non-clinical activities, and a change in working capital of $3.5 million, due mainly to the receipt of research and development tax credits of $2.9 million during the three months ended March 31, 2024.

Investing activities

Net cash used in investing activities remained relatively small for each of the three months ended March 31, 2024 and 2023 and consisted of IT-related capital expenditure in 2023.

Financing activities

Net cash from financing activities remained relatively flat for each of the three months ended March 31, 2024 and 2023, consisting of the payment of the preferred stock dividend and costs associated with a securities purchase agreement in December 2023.

Funding Requirements and Going Concern

We do not currently have sufficient funds to complete development and commercialization of any of our drug candidates. Current business and capital market risks could have a detrimental effect on the availability of sources of funding and our ability to access them in the future, which may delay or impede our progress of advancing our drugs currently in the clinical pipeline to approval by the Food and Drug Administration (“FDA”) or European Medicines Agency (“EMA”) for commercialization. Additionally, we plan to continue to evaluate in-licensing and acquisition opportunities to gain access to new drugs or drug targets that would fit with our strategy. Any such transaction would likely increase our funding needs in the future.

23

Our future funding requirements will depend on many factors, including but not limited to:

● | the rate of progress and cost of our clinical trials, preclinical studies and other discovery and research and development activities; |

● | the costs associated with establishing manufacturing and commercialization capabilities; |

● | the costs of acquiring or investing in businesses, product candidates and technologies; |

● | the costs of filing, prosecuting, defending and enforcing any patent claims and other intellectual property rights; |

● | the costs and timing of seeking and obtaining FDA and EMA approvals; |

● | the effect of competing technological and market developments; and |

● | the economic and other terms and timing of any collaboration, licensing or other arrangements into which we may enter. |

Until we can generate a sufficient amount of product revenue to finance our cash requirements, which we may never do, we expect to finance future cash needs primarily through public or private equity offerings, debt financings or strategic collaborations. Although we are not reliant on institutional credit finance and therefore not subject to debt covenant compliance requirements or potential withdrawal of credit by banks, we are reliant on the availability of funds and activity in equity markets. We do not know whether additional funding will be available on acceptable terms, or at all. If we are not able to secure additional funding when needed, we may have to delay, reduce the scope of or eliminate one or more of our clinical trials or research and development programs or make changes to our operating plan. In addition, we may have to partner one or more of our product candidate programs at an earlier stage of development, which would lower the economic value of those programs to us.

Since our inception, we have relied primarily on the proceeds from sales of common and preferred equity securities to finance our operations and internal growth. Additional funding has come through research and development tax credits, government grants, the sale of product rights, interest on investments, licensing revenue, royalty income, and a limited amount of product revenue from operations discontinued in September 2012.

As discussed in Note 2 of the Notes to the Consolidated Financial Statements accompanying this Quarterly Report on Form 10-Q, under ASC Topic 205-40, Presentation of Financial Statements - Going Concern, management is required at each reporting period to evaluate whether there are conditions and events, considered in the aggregate, that raise substantial doubt about an entity’s ability to continue as a going concern within one year after the date that the financial statements are issued. This evaluation initially does not take into consideration the potential mitigating effect of management’s plans that have not been fully implemented as of the date the financial statements are issued.

Our history of losses, our negative cash flows from operations, our liquidity resources currently on hand, and our dependence on the ability to obtain additional financing to fund our operations after the current resources are exhausted, about which there can be no certainty, have resulted in our assessment that there is substantial doubt about our ability to continue as a going concern for a period of at least twelve months from the issuance date of this Quarterly Report on Form 10-Q. While we have plans in place to mitigate this risk, which primarily consist of raising additional capital through a combination of public or private equity or debt financings or by entering into partnership agreements for further development of our drug candidates, there is no guarantee that we will be successful in these mitigation efforts.

24

Results of Operations

Three Months Ended March 31, 2024 and 2023

Revenues

The Company recognized $29,000 of revenue for the three months ended March 31, 2024, relating to recovery of clinical manufacturing costs associated with an investigator sponsored. There were no revenues recognized for the comparative period in 2023.

The future

We expect to completely fulfill our obligations under this agreement by the second quarter of 2024 and further recognize a small amount of revenues at that time. The associated clinical manufacturing costs are presented as a component of research & development.

Research and Development Expenses

From our inception, we have focused on drug discovery and development programs, with a particular emphasis on orally available anticancer agents, and our research and development expenses have represented costs incurred to discover and develop novel small molecule therapeutics, including clinical trial costs for fadraciclib and plogosertib. We have also incurred costs in the advancement of product candidates toward clinical and preclinical trials and the development of in-house research to advance our biomarker program and technology platforms. We expense all research and development costs as they are incurred. Research and development expenses primarily include:

| ● | Clinical trial and regulatory-related costs; |

| ● | Payroll and personnel-related expenses, including consultants and contract research organizations; |

| ● | Preclinical studies, supplies and materials; |

| ● | Technology license costs; |

| ● | Stock-based compensation; and |

| ● | Rent and facility expenses for our offices. |

The following table provides information with respect to our research and development expenditures for the three months ended March 31, 2024 and 2023 (in $000s except percentages):

Three Months Ended | ||||||||||||

March 31, | Difference | |||||||||||

2024 |

| 2023 |

| $ |

| % | ||||||

Transcriptional Regulation (fadraciclib) | $ | 1,752 | $ | 4,087 | $ | (2,335) | (57) | |||||

Epigenetic/anti-mitotic (plogosertib) | 963 | 1,351 | (388) | (29) | ||||||||

Other research and development expenses | 87 | 236 | (149) | (63) | ||||||||

Total research and development expenses | $ | 2,802 | $ | 5,674 | $ | (2,872) | (51) | |||||

Total research and development expenses represented 64% and 78% of our operating expenses for the three months ended March 31, 2024 and 2023, respectively.

25

Research and development expenses decreased by $2.9 million from $5.7 million for the three months ended March 31, 2023 to $2.8 million for the three months ended March 31, 2024. Expenditure for the transcriptional regulation program decreased by $2.2 million relative to the respective comparative period, primarily due to decreases in manufacturing and non-clinical expenditure. Research and development expenses relating to plogosertib decreased by $0.4 million relative to the respective comparative period due to decreases in manufacturing and non-clinical expenditure.

The future

We anticipate that overall research and development expenses for the year ended December 31, 2024 will decrease compared to the year ended December 31, 2023 as we focus on our Phase 1/2 programs in advanced solid tumors and lymphomas.

General and Administrative Expenses

General and administrative expenses include costs for administrative personnel, legal and other professional expenses and general corporate expenses. The following table summarizes the general and administrative expenses for the three months ended March 31, 2024 and 2023 (in $000s except percentages):

Three Months Ended | |||||||||||

March 31, | Difference | ||||||||||

2024 |

| 2023 |

| $ |

| % |

| ||||

Total general and administrative expenses | $ | 1,582 | $ | 1,645 | $ | (63) | (4) | ||||

Total general and administrative expenses represented 36% and 22% of our operating expenses for the three months ended March 31, 2024 and 2023, respectively. General and administrative expenses decreased by $0.1 million relative to the respective comparative period due mainly to reduction in stock compensation costs.

The future

We expect general and administrative expenditures for the year ended December 31, 2024 to remain relatively flat compared to the year ended December 31, 2023.

Other income (expense), net

The following table summarizes other income for the three months ended March 31, 2024 and 2023 (in $000 except percentages):

Three Months Ended | |||||||||||

March 31, | Difference | ||||||||||

2024 |

| 2023 |

| $ |

| % | |||||

Foreign exchange gains (losses) | $ | 1 | $ | (87) | $ | 88 | (101) | ||||

Interest income |

| 2 |

| 116 |

| (114) | (98) | ||||

Other income (expense), net |

| 52 |

| 166 |

| (114) | (69) | ||||

Total other income (expense), net | $ | 55 | 195 | $ | (140) | (72) | |||||

Total other income decreased by $0.1 million from $0.2 million for the three months ended March 31, 2023 to $0.1 million for the three months ended March 31, 2024. Other income relates to royalties receivable under a December 2005 Asset Purchase Agreement, or APA, whereby Xcyte Therapies, Inc., or Xcyte (a business acquired by us in March 2006) sold certain assets and intellectual property to ThermoFisher Scientific Company, or TSC (formerly Invitrogen Corporation) through the APA and other related agreements. The assets and technology were not part of our product development plan following the transaction between Xcyte and Cyclacel in March 2006. Accordingly, we

26

presented $52,000 and $0 as other income arising from royalties from the APA during the three months ended March 31, 2024 and 2023 respectively.

Foreign exchange gains (losses)

Foreign exchange gains increased by $88,000, from a loss of $87,000 for the three months ended March 31, 2023, to a gain of $1,000 for the three months ended March 31, 2024.

The future

Other income (expense), net for the year ended December 31, 2024, will continue to be impacted by changes in foreign exchange rates and the receipt of income under the APA. As we are not in control of sales made by TSC, we are unable to estimate the level and timing of income under the APA, if any.

Because the nature of funding advanced through intercompany loans is that of a long-term investment, unrealized foreign exchange gains and losses on such funding will be recognized in other comprehensive income until repayment of the intercompany loan becomes foreseeable. Foreign exchange gains and losses relating to intercompany operating expenditure, which is expected to be settled in the foreseeable future,, will be recognized within the statement of operations.

Income Tax Benefit

Credit is taken for research and development tax credits, which are claimed from the United Kingdom’s revenue and customs authority, or HMRC, in respect of qualifying research and development costs incurred.

The following table summarizes total income tax benefit for the three months ended March 31, 2024 and 2023 (in $000s except percentages):

Three Months Ended | |||||||||||

March 31, | Difference | ||||||||||

2024 |

| 2023 |

| $ |

| % | |||||

Total income tax benefit | $ | 1,354 | $ | 1,320 | $ | 34 | 3 | ||||

The total income tax benefit, which comprised of research and development tax credits recoverable, remained flat at approximately $1.3 million for each of the three months ended March 31, 2024 and 2023. The level of tax credits recoverable is linked directly to qualifying research and development expenditure incurred in any one year and the availability of trading losses.

The future

We expect to continue to be eligible to receive United Kingdom research and development tax credits for the year ended December 31, 2024 and will continue to elect to receive payment of the tax credit. The amount of tax credits we will receive is entirely dependent on the amount of eligible expenses we incur and could be restricted by any future cap introduced by HMRC. Beyond 2024, we cannot be certain of our eligibility to receive this tax credit or if eligible, the amount that may be received, due to proposed changes by HMRC to the eligibility criteria.

Critical Accounting Policies and Estimates

Our critical accounting policies are those policies which require the most significant judgments and estimates in the preparation of our consolidated financial statements. We evaluate our estimates, judgments, and assumptions on an ongoing basis. Actual results may differ from these estimates under different assumptions or conditions. A summary of our critical accounting policies is presented in Part II, Item 7, of our Annual Report on Form 10-K for the year ended December 31, 2023 and Note 2 to our unaudited consolidated financial statements included elsewhere in this Quarterly

27

Report on Form 10-Q. There have been no material changes to our critical accounting policies during the three months ended March 31, 2024.

Item 3. Quantitative and Qualitative Disclosures about Market Risk

As a smaller reporting company, we are not required to provide information in response to this item.

Item 4. Controls and Procedures

Under the supervision and with the participation of our management, including our chief executive officer and principal financial and accounting officer, we conducted an evaluation of the effectiveness, as of March 31, 2024, of our disclosure controls and procedures, as defined in Rules 13a-15(e) and 15d-15(e) under the Securities Exchange Act of 1934, as amended, or the Exchange Act. Based upon such evaluation, our chief executive officer and principal financial and accounting officer have concluded that, as of March 31, 2024, our disclosure controls and procedures to ensure that information required to be disclosed by us in reports we file or submit under the Exchange Act is (i) recorded, processed, summarized, evaluated and reported, as applicable, within the time periods specified in the SEC’s rules and forms and (ii) accumulated and communicated to our management, including our Chief Executive Officer and Chief Financial Officer, as appropriate to allow timely decisions regarding required disclosures were not effective at the reasonable assurance level due to the material weakness in internal control over financial reporting.

Our remediation process is ongoing and cannot be considered complete at this time. There can be no assurance that we will be successful in remediating the material weaknesses. We plan to continue to assess internal controls and procedures and intend to take further action as necessary or appropriate to address any other matters as they are identified. Notwithstanding the identified material weakness in internal control over financial reporting, we have concluded that the consolidated financial statements in this Quarterly Report on Form 10-Q present fairly, in all material respects, our financial position, results of operations and cash flows as of the dates, and for the periods, presented, in conformity with GAAP.

Changes in Internal Control over Financial Reporting

There were no significant changes made in our internal controls over financial reporting.

Inherent Limitation on the Effectiveness of Internal Controls

The effectiveness of any system of internal control over financial reporting, including ours, is subject to inherent limitations, including the exercise of judgment in designing, implementing, operating, and evaluating the controls and procedures, and the inability to eliminate misconduct completely. Accordingly, any system of internal control over financial reporting, including ours, no matter how well designed and operated, can only provide reasonable, not absolute, assurances. In addition, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate. We intend to continue to monitor and upgrade our internal controls as necessary or appropriate for our business but cannot ensure that such improvements will be sufficient to provide us with effective internal control over financial reporting.

PART II. Other Information

Item 1. Legal Proceedings

None.

28

Item 1A. Risk Factors

Except as set forth below, there have been no material changes to our risk factors contained in our Annual Report on Form 10-K for the year ended December 31, 2023. For a further discussion of our Risk Factors, refer to Part I, Item 1A, “Risk Factors,” of our Annual Report on Form 10-K for the year ended December 31, 2023.

If we fail to comply with the continued listing requirements of the Nasdaq Capital Market, our common stock may be delisted and the price of our common stock and our ability to access the capital markets could be negatively impacted.

On March 27, 2024, we received a written notice (the “Notice”) from The Nasdaq Stock Market LLC (“Nasdaq”) indicating that we are not in compliance with Nasdaq Listing Rule 5550(b)(1), which requires companies listed on The Nasdaq Capital Market to maintain a minimum of $2,500,000 in stockholders’ equity for continued listing (the “Stockholders’ Equity Requirement”). Our stockholders’ equity was $607,000 as of December 31, 2023 and, as a result, we do not currently satisfy Listing Rule 5550(b)(1).

We have submitted a plan to Nasdaq’s Listing Qualifications Staff (“Staff”) by the required date advising of actions we have taken or will take to regain compliance with Nasdaq Listing Rule 5550(b)(1). If the Staff determines to accept the plan, the Staff can grant us an extension of up to 180 calendar days from the date of the Notice to regain compliance. If the Staff does not approve the plan, we may appeal that decision to a Nasdaq hearings panel.

The Notice has no immediate effect on our Nasdaq listing, and our common stock will continue to be listed under the symbol “CYCC.” However, if we fail to timely regain compliance with the Nasdaq Listing Rule 5550(b)(1), then our common stock will be subject to delisting from Nasdaq.

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds

None.

Item 3. Defaults upon Senior Securities

None.

Item 4. Mine Safety Disclosures

Not applicable.

Item 5. Other Information

29

Item 6. Exhibits

Exhibit |

| Description |

101 | The following materials from Cyclacel Pharmaceuticals, Inc.’s Quarterly Report on Form 10-Q for the period ended March 31, 2024, formatted in iXBRL (Inline eXtensible Business Reporting Language): (i) the Consolidated Statements of Income, (ii) the Consolidated Balance Sheets, (iii) the Consolidated Statements of Cash Flows, and (iv) Notes to Consolidated Financial Statements. | |

104 | The cover page from the Company’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2024, formatted in Inline eXtensible Business Reporting Language (included with Exhibit 101). |

30

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned.

| CYCLACEL PHARMACEUTICALS, INC. | ||

Date: May 14, 2024 | By: | /s/ Paul McBarron | |

Paul McBarron | |||

Chief Operating Officer, Chief Financial Officer and Executive Vice President, Finance | |||

31