edebit_10q-063011.htm

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended: June 30, 2011

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the transition period from ________ to _________

Commissions file number 0-32051

E-DEBIT GLOBAL CORPORATION

(Exact name of small business issuer

as specified in its charter)

|

COLORADO

(State or other jurisdiction

of incorporation or organization)

|

98-0233968

(IRS Employer Identification No.)

|

| |

|

#12, 3620 – 29th Avenue NE

Calgary, Alberta Canada T1Y 5Z8

Telephone (403) 290-0264

(Issuer's telephone number)

(Former name, former address and former

fiscal year, if changed since last report)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer o

|

Accelerated filer o

|

| |

|

|

Non-accelerated filer o

|

Smaller reporting company x

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS

DURING THE PRECEDING FIVE YEARS

Indicate by check mark whether the registrant filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Exchange Act after the distribution of securities under a plan confirmed by a court. Yes o No o

APPLICABLE ONLY TO CORPORATE ISSUERS

State the number of shares outstanding of each of the issuer's classes of common equity, as of the latest practicable date: As of August 8, 2011, there were 92,324,344 outstanding shares of the Registrant's Common Stock, no par value and 70,855,900 shares of Preferred Stock, no par value.

E-DEBIT GLOBAL CORPORATION

INDEX TO THE FORM 10-Q

For the quarterly period ended June 30, 2011

| |

|

|

PAGE

|

|

PART I

|

FINANCIAL INFORMATION

|

|

| |

ITEM 1.

|

CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

|

|

| |

|

Condensed Consolidated Balance Sheets

|

4

|

| |

|

Condensed Consolidated Statements of Operations

|

5

|

| |

|

Condensed Consolidated Statements of Changes in Stockholders’ Deficit

|

6

|

| |

|

Condensed Consolidated Statements of Cash Flows

|

7 |

| |

|

Notes to Condensed Financial Statements

|

9

|

| |

ITEM 2.

|

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

19

|

| |

ITEM 3.

|

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK.

|

25

|

| |

ITEM 4.

|

CONTROLS AND PROCEDURES

|

25

|

|

Part II

|

OTHER INFORMATION

|

|

| |

ITEM 1.

|

LEGAL PROCEEDINGS

|

25

|

| |

ITEM 2.

|

CHANGES IN SECURITIES

|

25

|

| |

ITEM 3.

|

DEFAULTS UPON SENIOR SECURITIES

|

25

|

| |

ITEM 4.

|

REMOVED AND RESERVED

|

25

|

| |

ITEM 5.

|

OTHER INFORMATION

|

25

|

| |

ITEM 6.

|

EXHIBITS

|

25

|

3

PART I - FINANCIAL INFORMATION

ITEM 1. CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

E-DEBIT GLOBAL CORPORATION

Condensed Consolidated Balance Sheet

|

ASSETS

|

|

June 30,

2011

(Unaudited)

|

|

|

December 31, 2010

(Derived from audited financial statements)

|

|

|

CURRENT ASSETS

|

|

|

|

|

|

|

|

Cash

|

|

$ |

51,334 |

|

|

$ |

— |

|

|

Restricted cash

|

|

|

604,334 |

|

|

|

482,681 |

|

|

Accounts receivable net of allowance for doubtful accounts of $827 and $902

|

|

|

52,731 |

|

|

|

41,773 |

|

|

Other receivable – related parties

|

|

|

55,606 |

|

|

|

37,482 |

|

|

Inventory

|

|

|

86,743 |

|

|

|

78,536 |

|

|

Prepaid expense and deposit

|

|

|

10,821 |

|

|

|

22,322 |

|

|

Total current assets

|

|

|

861,569 |

|

|

|

662,794 |

|

| |

|

|

|

|

|

|

|

|

|

Property and equipment, net of depreciation

|

|

|

167,841 |

|

|

|

183,450 |

|

|

Property and equipment, idle

|

|

|

602,086 |

|

|

|

550,033 |

|

|

Investment, at cost

|

|

|

20 |

|

|

|

10 |

|

|

Note receivable

|

|

|

163,854 |

|

|

|

160,010 |

|

|

Intangible Assets, net of amortization

|

|

|

115,069 |

|

|

|

124,853 |

|

| |

|

|

|

|

|

|

|

|

|

Total assets

|

|

$ |

1,910,439 |

|

|

$ |

1,681,150 |

|

| |

|

|

LIABILITIES AND STOCKHOLDERS’ DEFICIT

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

CURRENT LIABILITIES

|

|

|

|

|

|

|

|

|

|

Bank overdraft

|

|

$ |

— |

|

|

$ |

20,918 |

|

|

Accounts payable

|

|

|

1,184,465 |

|

|

|

811,844 |

|

|

Accrued liabilities

|

|

|

230,493 |

|

|

|

213,360 |

|

|

Loans payable

|

|

|

169,998 |

|

|

|

166,010 |

|

|

Indebtedness to related parties

|

|

|

707,629 |

|

|

|

437,353 |

|

|

Shareholder loans

|

|

|

299,014 |

|

|

|

237,014 |

|

|

Total current liabilities

|

|

|

2,591,599 |

|

|

|

1,886,499 |

|

| |

|

|

|

|

|

|

|

|

|

Total liabilities

|

|

|

2,591,599 |

|

|

|

1,886,499 |

|

| |

|

|

|

|

|

|

|

|

|

STOCKHOLDERS’ DEFICIT

|

|

|

|

|

|

|

|

|

|

Preferred stock – authorized 75,000,000 shares, no par value,

70,855,900 shares issued and outstanding at

June 30, 2011 and 70,855,900 at December 31, 2010

|

|

|

1,400,855 |

|

|

|

1,400,855 |

|

|

Common stock - authorized 500,000,000 shares, no par value;

92,324,344 shares issued and outstanding at

June 30, 2011 and 89,413,630 at December 31, 2010

|

|

|

2,184,540 |

|

|

|

2,143,790 |

|

|

Additional paid-in capital

|

|

|

624,791 |

|

|

|

624,791 |

|

|

Accumulated other comprehensive income

|

|

|

79,160 |

|

|

|

82,294 |

|

|

Accumulated deficit

|

|

|

(4,970,506 |

) |

|

|

(4,457,079 |

) |

|

Total stockholders’ deficit

|

|

|

(681,160 |

) |

|

|

(205,349 |

) |

| |

|

|

|

|

|

|

|

|

|

Total liabilities and stockholders’ Deficit

|

|

$ |

1,910,439 |

|

|

$ |

1,681,150 |

|

| |

|

|

|

|

|

|

|

|

See accompanying notes to consolidated financial statements

4

E-DEBIT GLOBAL CORPORATION

Condensed Consolidated Statements of Operations

For the six Months Ended June 30,

(Unaudited)

| |

|

2011

|

|

|

2010

|

|

|

Revenue -

|

|

|

|

|

|

|

|

Equipment and supplies

|

|

$ |

13,790 |

|

|

$ |

6,679 |

|

|

Residual and interchange income

|

|

|

1,641,292 |

|

|

|

1,926,178 |

|

|

Other

|

|

|

19,380 |

|

|

|

29,567 |

|

|

Total revenue

|

|

|

1,674,462 |

|

|

|

1,962,424 |

|

| |

|

|

|

|

|

|

|

|

|

Cost of sales -

|

|

|

|

|

|

|

|

|

|

Equipment and supplies

|

|

|

14,633 |

|

|

|

4,708 |

|

|

Residual and interchange costs

|

|

|

1,138,142 |

|

|

|

1,321,746 |

|

|

Other

|

|

|

311,634 |

|

|

|

274,552 |

|

|

Total cost of sales

|

|

|

1,464,409 |

|

|

|

1,601,006 |

|

| |

|

|

|

|

|

|

|

|

|

Gross profit

|

|

|

210,053 |

|

|

|

361,418 |

|

| |

|

|

|

|

|

|

|

|

|

Operating expenses -

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

|

39,234 |

|

|

|

37,408 |

|

|

Consulting fees

|

|

|

99,886 |

|

|

|

86,003 |

|

|

Legal and accounting fees

|

|

|

43,715 |

|

|

|

42,811 |

|

|

Salaries and benefits

|

|

|

290,632 |

|

|

|

299,228 |

|

|

Travel, delivery and vehicle expenses

|

|

|

32,536 |

|

|

|

42,965 |

|

|

Other

|

|

|

186,607 |

|

|

|

165,972 |

|

|

Total operating expenses

|

|

|

692,610 |

|

|

|

674,387 |

|

| |

|

|

|

|

|

|

|

|

|

(-Loss-) from operations

|

|

|

(482,557 |

) |

|

|

(312,969 |

) |

| |

|

|

|

|

|

|

|

|

|

Other income (expense) -

|

|

|

|

|

|

|

|

|

|

Other income

|

|

|

35,045 |

|

|

|

22,037 |

|

|

Interest income

|

|

|

— |

|

|

|

10 |

|

|

Interest expense

|

|

|

(65,915 |

) |

|

|

(41,274 |

) |

|

Net (-loss-) before income taxes

|

|

|

(513,427 |

) |

|

|

(332,196 |

) |

| |

|

|

|

|

|

|

|

|

|

Provision for income taxes

|

|

|

— |

|

|

|

— |

|

| |

|

|

|

|

|

|

|

|

|

Net (-loss-)

|

|

$ |

(513,427 |

) |

|

$ |

(332,196 |

) |

| |

|

|

|

|

|

|

|

|

|

Basic net (-loss-) per common share

|

|

$ |

(0.01 |

) |

|

$ |

(0.01 |

) |

|

Weighted number of shares outstanding

|

|

|

92,324,344 |

|

|

|

49,352,592 |

|

| |

|

|

|

|

|

|

|

|

|

Other comprehensive income (loss) -

|

|

|

|

|

|

|

|

|

|

Net (-loss-)

|

|

$ |

(513,427 |

) |

|

$ |

(332,196 |

) |

|

Foreign currency translation adjustment

|

|

|

(3,134 |

) |

|

|

(16,584 |

) |

|

Total comprehensive (-loss-)

|

|

$ |

(516,561 |

) |

|

$ |

(348,780 |

) |

See accompanying notes to consolidated financial statements

5

E-DEBIT GLOBAL CORPORATION

Condensed Consolidated Statements of Operations

For the three Months Ended June 30,

(Unaudited)

| |

|

2011

|

|

|

2010

|

|

|

Revenue -

|

|

|

|

|

|

|

|

Equipment and supplies

|

|

$ |

5,688 |

|

|

$ |

4,340 |

|

|

Residual and interchange income

|

|

|

844,332 |

|

|

|

982,966 |

|

|

Other

|

|

|

19,380 |

|

|

|

29,567 |

|

|

Total revenue

|

|

|

869,400 |

|

|

|

1,016,873 |

|

| |

|

|

|

|

|

|

|

|

|

Cost of sales -

|

|

|

|

|

|

|

|

|

|

Equipment and supplies

|

|

|

5,180 |

|

|

|

3,674 |

|

|

Residual and interchange costs

|

|

|

588,996 |

|

|

|

678,220 |

|

|

Other

|

|

|

188,867 |

|

|

|

134,257 |

|

|

Total cost of sales

|

|

|

783,043 |

|

|

|

816,151 |

|

| |

|

|

|

|

|

|

|

|

|

Gross profit

|

|

|

86,357 |

|

|

|

200,722 |

|

| |

|

|

|

|

|

|

|

|

|

Operating expenses -

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

|

19,671 |

|

|

|

18,870 |

|

|

Consulting fees

|

|

|

51,436 |

|

|

|

42,890 |

|

|

Legal and accounting fees

|

|

|

34,341 |

|

|

|

14,879 |

|

|

Salaries and benefits

|

|

|

134,905 |

|

|

|

154,047 |

|

|

Travel, delivery and vehicle expenses

|

|

|

20,589 |

|

|

|

22,568 |

|

|

Other

|

|

|

87,880 |

|

|

|

66,964 |

|

|

Total operating expenses

|

|

|

348,822 |

|

|

|

320,218 |

|

| |

|

|

|

|

|

|

|

|

|

(-Loss-) from operations

|

|

|

(262,465 |

) |

|

|

(119,496 |

) |

| |

|

|

|

|

|

|

|

|

|

Other income (expense) -

|

|

|

|

|

|

|

|

|

|

Other income

|

|

|

15,651 |

|

|

|

— |

|

|

Interest income

|

|

|

— |

|

|

|

10 |

|

|

Interest expense

|

|

|

(37,562 |

) |

|

|

(26,319 |

) |

|

Net (-loss-) before income taxes

|

|

|

(284,376 |

) |

|

|

(145,805 |

) |

| |

|

|

|

|

|

|

|

|

|

Provision for income taxes

|

|

|

— |

|

|

|

— |

|

| |

|

|

|

|

|

|

|

|

|

Net (-loss-)

|

|

$ |

(284,376 |

) |

|

$ |

(145,805 |

) |

| |

|

|

|

|

|

|

|

|

|

Basic net (-loss-) per common share

|

|

$ |

(0.00 |

) |

|

$ |

(0.00 |

) |

|

Weighted number of shares outstanding

|

|

|

92,324,344 |

|

|

|

49,352,592 |

|

| |

|

|

|

|

|

|

|

|

|

Other comprehensive income (loss) -

|

|

|

|

|

|

|

|

|

|

Net (-loss-)

|

|

$ |

(284,376 |

) |

|

$ |

(145,805 |

) |

|

Foreign currency translation adjustment

|

|

|

4,172 |

|

|

|

5,085 |

|

|

Total comprehensive (-loss-)

|

|

$ |

(280,204 |

) |

|

$ |

(140,720 |

) |

See accompanying notes to consolidated financial statements

6

E-DEBIT GLOBAL CORPORATION

Condensed Consolidated Statements of Changes in Stockholders’ Deficit

(Unaudited)

| |

|

|

|

|

|

|

|

|

|

|

Foreign

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Additional

|

|

|

Currency

|

|

|

|

|

|

|

|

| |

|

Preferred Stock

|

|

|

Common Stock

|

|

|

Paid-in

|

|

|

Translation

|

|

|

Accumulated

|

|

|

|

|

| |

|

Shares

|

|

|

Amount

|

|

|

Shares

|

|

|

Amount

|

|

|

Capital

|

|

|

Adjustment

|

|

|

(Deficit)

|

|

|

Total

|

|

|

Balance, December 31, 2010

|

|

|

70,855,900 |

|

|

$ |

1,400,855 |

|

|

|

89,413,630 |

|

|

$ |

2,143,790 |

|

|

$ |

624,791 |

|

|

$ |

82,294 |

|

|

$ |

(4,457,079 |

) |

|

$ |

(205,349 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exercise of options to officers for settlement of debts – related parties

|

|

|

— |

|

|

|

— |

|

|

|

1,125,000 |

|

|

|

15,750 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

15,750 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exercise of options to a director for settlement of debts – related parties

|

|

|

— |

|

|

|

— |

|

|

|

1,785,714 |

|

|

|

25,000 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

25,000 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss for the six months ended June 30, 2011

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(3,134 |

) |

|

|

(513,427 |

) |

|

|

(516,561 |

) |

|

Balance, June 30, 2011

|

|

|

70,855,900 |

|

|

$ |

1,400,855 |

|

|

|

92,324,344 |

|

|

$ |

2,184,540 |

|

|

|

624,791 |

|

|

$ |

79,160 |

|

|

$ |

(4,970,506 |

) |

|

$ |

(681,160 |

) |

See accompanying notes to consolidated financial statements

7

E-DEBIT GLOBAL CORPORATION

Condensed Consolidated Statement of Cash Flows

For the six Months Ended June 30,

(Unaudited)

| |

|

2011

|

|

|

2010

|

|

|

Cash flows from operating activities:

|

|

|

|

|

|

|

|

Net (loss) income from operations

|

|

$ |

(513,427 |

) |

|

$ |

(332,196 |

) |

|

Reconciling adjustments -

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

|

39,234 |

|

|

|

37,408 |

|

|

Other non-cash transactions

|

|

|

138,097 |

|

|

|

537,556 |

|

|

Changes in operating assets and liabilities

|

|

|

|

|

|

|

|

|

|

Restricted cash

|

|

|

(110,057 |

) |

|

|

— |

|

|

Accounts receivable

|

|

|

(26,457 |

) |

|

|

34,874 |

|

|

Inventory

|

|

|

(6,321 |

) |

|

|

(10,710 |

) |

|

Prepaid expenses and other

|

|

|

12,039 |

|

|

|

(6,168 |

) |

|

Accounts payable and accrued liabilities

|

|

|

365,124 |

|

|

|

(43,881 |

) |

|

Net cash (used for) provided by operations

|

|

|

(101,768 |

) |

|

|

216,883 |

|

| |

|

|

|

|

|

|

|

|

|

Cash flows from investing activities:

|

|

|

|

|

|

|

|

|

|

Purchase of equipment

|

|

|

(51,082 |

) |

|

|

(531,251 |

) |

|

Disposal of equipment

|

|

|

10,747 |

|

|

|

5,617 |

|

|

Net cash (used for) provided by investing activities

|

|

|

(40,335 |

) |

|

|

(525,634 |

) |

| |

|

|

|

|

|

|

|

|

|

Cash flows from financing activities:

|

|

|

|

|

|

|

|

|

|

Exercise of options

|

|

|

— |

|

|

|

31,585 |

|

|

Private offering

|

|

|

— |

|

|

|

100,000 |

|

|

Proceeds from loans

|

|

|

191,126 |

|

|

|

137,908 |

|

|

Repayments of loans

|

|

|

(13,160 |

) |

|

|

(32,611 |

) |

|

Net cash provided by financing activities

|

|

|

177,966 |

|

|

|

236,882 |

|

| |

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustment

|

|

|

36,389 |

|

|

|

141,103 |

|

|

Net change in cash and cash equivalents

|

|

|

72,252 |

|

|

|

69,234 |

|

|

Cash (overdraft) at beginning of year

|

|

|

(20,918 |

) |

|

|

586,958 |

|

|

Cash (overdraft) at end of year

|

|

$ |

51,334 |

|

|

$ |

656,192 |

|

| |

|

|

|

|

|

|

|

|

|

Supplemental schedules:

|

|

|

|

|

|

|

|

|

|

Cash paid for interest

|

|

$ |

43,628 |

|

|

$ |

29,129 |

|

|

Cash paid for income taxes

|

|

$ |

— |

|

|

$ |

— |

|

|

Noncash investing and financing activities

|

|

|

|

|

|

|

|

|

|

Shares issued for the settlement of debt

|

|

$ |

40,750 |

|

|

$ |

835,295 |

|

See accompanying notes to consolidated financial statements

8

E-DEBIT GLOBAL CORPORATION

Notes to Condensed Consolidated Financial Statements

June 30, 2011 and 2010

(Unaudited)

Note 1 – Basis of Presentation and Nature of Operations

The accompanying consolidated balance sheet as of December 31, 2010 has been derived from audited financial statements and the accompanying unaudited consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”) for interim financial information and the interim reporting requirements of Regulation S-X. The accompanying consolidated financial statements included herein have been prepared by E-Debit Global Corporation (the “Company”) without audit, pursuant to the rules and regulations of the Securities and Exchange Commission for reporting on Form 10-Q. In management's opinion, all adjustments (consisting only of normal recurring adjustments) considered necessary for a fair presentation have been included. Certain information and footnote disclosure normally included in the financial statements prepared in accordance with generally accepted accounting principles have been condensed or omitted as allowed by such rules and regulations, and E-Debit Global Corporation believes that the disclosures are adequate to make the information presented not misleading. It is suggested that these financial statements be read in conjunction with the December 31, 2010 audited financial statements and the accompanying notes thereto contained in the Annual Report on Form 10-K filed with the Securities and Exchange Commission. While management believes the procedures followed in preparing these financial statements are reasonable, the accuracy of the amounts are in some respects dependent upon the facts that will exist, and procedures that will be accomplished by E-Debit Global Corporation later in the year. The results of operations for the interim periods are not necessarily indicative of the results of operations for the full year. In management’s opinion all adjustments necessary for a fair presentation of the Company’s financial statements are reflected in the interim periods included.

Westsphere Asset Corporation, Inc. (Company) was incorporated in Colorado on July 21, 1998 as Newslink Networks TDS, Inc. and changed its name to Westsphere Asset Corporation Inc. on April 29, 1999. On April 2, 2010, the Company officially changed its name to E-Debit Global Corporation.

The Company’s primary business is the sale and operation of cash vending (ATM) and point of sale (POS) machines in Canada.

Summary of ATM’s and POS’s sold and related gross profits during the years ended December 31, 2010 and for the six months ended June 30, 2011:

| |

|

# of sale |

|

|

Gross Profit |

|

|

December 31, 2010

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

ATMs

|

|

|

8 |

|

|

$ |

3,067 |

|

|

POS

|

|

|

- |

|

|

$ |

- |

|

| |

|

|

|

|

|

|

|

|

| June 30, 2011 |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

ATMs

|

|

|

5 |

|

|

$ |

733 |

|

|

POS

|

|

|

- |

|

|

$ |

- |

|

ATM sales were low mainly due to E-Debit’s subsidiary Vencash Capital Corporation/Westsphere Systems Inc. (VCC/WSI) focusing on the placement and finance/lease program offered by an ATM supplier in year 2006. This finance/lease program provided VCC/WSI an opportunity to place more ATMs in the marketplace at a lower cost. However, the finance/lease program offered by the ATM supplier ended in 2008. After the program ended, E-Debit did not work to facilitate growth opportunities in the ATM and POS business due to the condition of the financial market.

On October 26, 2010, the Company has amended its articles of incorporation to increase its authorized capital to Five Hundred Million (500,000,000) shares of no par value common stock and Seventy Five Million (75,000,000) of no par value preferred stock.

9

Note 2 – Recent Accounting Pronouncements

In January 2010, the FASB issued ASU No. 2010-06, Fair Value Measurements and Disclosures: Improving Disclosures about Fair Value Measurements. ASU 2010-06 amends ASC 820 to require a number of additional disclosures regarding (1) the different classes of assets and liabilities measured at fair value, (2) the valuation techniques and inputs used, (3) the activity in Level 3 fair value measurements, and (4) the transfers between Levels 1, 2, and 3. The new disclosures and clarifications of existing disclosures are effective for interim and annual reporting periods beginning after December 15, 2009, except for the disclosures about purchases, sales, issuances, and settlements in the roll forward of activity in Level 3 fair value measurements. Those disclosures are effective for fiscal years beginning after December 15, 2010, and for interim periods within those fiscal years. The Company does not expect that the adoption of ASU 2010-06 will have a material impact on its consolidated financial statements.

In April 2010, the FASB issued Update No. 2010-17, or ASU 2010-17, Revenue Recognition—Milestone Method, which updates the guidance currently included under topic 605, Revenue Recognition. ASU 2010-17 provides guidance on defining the milestone and determining when the use of the milestone method of revenue recognition for research or development transactions is appropriate. It provides criteria for evaluating if the milestone is substantive and clarifies that a vendor can recognize consideration that is contingent upon achievement of a milestone as revenue in the period in which the milestone is achieved, if the milestone meets all the criteria to be considered substantive. ASU 2010-17 is effective for milestones achieved in fiscal years, and interim periods within those years, beginning after June 15, 2010 and should be applied prospectively. Early adoption is permitted. The Company is currently evaluating the potential impact, if any, of the new accounting guidance on its consolidated financial statements.

In April 2010, the FASB issued an authoritative pronouncement on effect of denominating the exercise price of a share-based payment award in the currency of the market in which the underlying equity securities trades and that currency is different from (1) entity’s functional currency, (2) functional currency of the foreign operation for which the employee provides services, and (3) payroll currency of the employee. The pronouncement clarifies that an employee share-based payment award with an exercise price denominated in the currency of a market in which a substantial portion of the entity’s equity securities trades should not be considered to contain a condition that is not a market, performance, or service condition, and therefore should be considered an equity award assuming all other criteria for equity classification are met. The pronouncement is for interim and annual periods beginning on or after December 15, 2010, and will be applied prospectively. Affected companies will be required to record a cumulative catch-up adjustment for all awards outstanding as of the beginning of the annual period in which the guidance is adopted. This amendment is not expected to have a material impact on the Company’s financial statements.

In May 2011, the FASB issued ASU 2011-4, “Fair Value Measurement (Topic 820) — Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and IFRSs.” This ASU represents the converged guidance of the FASB and the International Accounting Standards Board on fair value measurement. The guidance clarifies how a principal market is determined, addresses the fair value measurement of instruments with offsetting market or counterparty credit risks, addresses the concept of valuation premise and highest and best use, extends the prohibition on blockage factors to all three levels of the fair value hierarchy and requires additional disclosures. ASU 2011-4 is effective for interim and annual periods beginning after December 15, 2011 and is applied prospectively. E-Debit is currently evaluating the requirements of ASU 2011-4 and has not yet determined its impact on E-Debit’ condensed consolidated financial statements.

A variety of proposed or otherwise potential accounting standards are currently under study by standard setting organizations and various regulatory agencies. Due to the tentative and preliminary nature of those proposed standards, management has not determined whether implementation of such proposed standards would be material to our consolidated financial statements.

Note 3 - Accounts Receivable

Accounts receivable consist of amounts due from customers. The nature of the receivables consists of equipment sale, parts and accessories, and service provided. The Company considers accounts more than 180 days old to be past due. This is so the Company can withhold the transactions revenue owed to the customers should their receivables become past due. The account is deemed uncollectible and written off when the site locations are out of business and or in receivership. The Company uses the allowance method for recognizing bad debts. When an account is deemed uncollectible, it is written off against the allowance.

10

| |

|

June 30,

2011

|

|

|

December 31,

2010

|

|

|

Accounts Receivable

|

|

|

|

|

|

|

|

Equipment

|

|

$ |

205 |

|

|

$ |

- |

|

|

Services

|

|

|

- |

|

|

|

19,752 |

|

|

Others

|

|

|

53,353 |

|

|

|

22,963 |

|

| |

|

|

53,558 |

|

|

|

42,675 |

|

| |

|

|

|

|

|

|

|

|

|

Less: Allowance for doubtful accounts

|

|

|

(827 |

) |

|

|

(902 |

) |

| |

|

$ |

52,731 |

|

|

$ |

41,773 |

|

The bad debt expense for the six months ended June 30, 2011 and June 30, 2010 totaled $3,988 and $17,592, respectively. The bad debt is reflected in the accompanying consolidated Statements of Operations as Other operating expenses.

Note 4 – Inventory

Inventory consists of the following elements:

| |

|

|

Quantity |

|

|

|

Cost |

|

|

ATM

|

|

|

49 |

|

|

$ |

49,882 |

|

|

Parts and accessories

|

|

|

1,227 |

|

|

|

36,861 |

|

|

Total

|

|

|

|

|

|

$ |

86,743 |

|

Inventories are valued at the lesser of cost (on a first-in, first-out method) or net realizable value.

Note 5 – Property and Equipment

Property and equipment in service consists of the following elements:

| |

|

Cost

|

|

|

Accumulated

Depreciation/

Amortization

|

|

|

Net

Book Value

|

|

Depreciation

Rate

and

Method

|

|

December 31, 2010 -

|

|

|

|

|

|

|

|

|

|

|

|

Office furniture and equipment

|

|

$ |

65,355 |

|

|

$ |

26,945 |

|

|

$ |

38,410 |

|

20% DB

|

|

Computer hardware and software

|

|

|

133,694 |

|

|

|

108,921 |

|

|

|

24,773 |

|

30% DB

|

|

ATM machines

|

|

|

182,017 |

|

|

|

65,178 |

|

|

|

116,839 |

|

30% DB

|

|

Other

|

|

|

8,428 |

|

|

|

5,000 |

|

|

|

3,428 |

|

Var

|

| |

|

$ |

389,494 |

|

|

$ |

206,044 |

|

|

$ |

183,450 |

|

|

|

June 30, 2011 -

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Office furniture and equipment

|

|

$ |

66,924 |

|

|

$ |

31,527 |

|

|

$ |

35,397 |

|

20% DB

|

|

Computer hardware and software

|

|

|

136,906 |

|

|

|

115,938 |

|

|

|

20,968 |

|

30% DB

|

|

ATM machines

|

|

|

187,882 |

|

|

|

79,510 |

|

|

|

108,372 |

|

30% DB

|

|

Other

|

|

|

8,631 |

|

|

|

5,527 |

|

|

|

3,104 |

|

Var

|

| |

|

$ |

400,343 |

|

|

$ |

232,502 |

|

|

$ |

167,841 |

|

|

There are no leased ATMs included in the Company’s property and equipment for the six months ended June 30, 2011 and for the year ended December 31, 2010.

11

Depreciation and amortization have been provided in amounts sufficient to recover asset costs over their estimated useful lives. All components of property and equipment are being depreciated or amortized. Depreciation and amortization expense for the six months ended June 30, 2011 and June 30, 2010 totaled $39,234 and $37,408, respectively.

Property and equipment, idle consists of the following elements:

| |

|

Cost

|

|

|

December 31, 2010 -

|

|

|

|

|

Computer hardware and software

|

|

$ |

550,033 |

|

| |

|

$ |

550,033 |

|

|

June 30, 2011 -

|

|

|

|

|

|

Computer hardware and software

|

|

$ |

602,086 |

|

| |

|

$ |

602,086 |

|

The property and equipment, idle was related to the purchase of computer hardware and software for the card management systems in June 2010. The software and computer hardware was purchased as a turnkey operating system which focused on a loyalty based platform. As of June 30, 2011, the system is being expanded from its loyalty based platform to cash based platform. The Company is expecting the expansion of the systems to be completed by the third quarter of 2011.

Note 6 – Deferred Costs/Intangible Assets

On the 9th of November 2007, E-Debit contracted with ACI Worldwide through its wholly owned subsidiary Westsphere Systems Inc. (WSI) to provide its ACI ‘Base 24 On Demand” (AOD) hosted solution for ATM and POS transaction acquiring where WSI shares responsibilities with ACI as the transaction processor. ACI hosts the processing environment which is set up to specific requirements as set out by WSI, which supports WSI ATM and POS devices, debit and credit transaction processing and card management requirement that is unique and scalable to WSI’s current and future requirements and not shared with other ACI customers. ACI supplies software acquisition, operation and maintenance, facilities, operations and environment development and maintenance and disaster recovery infrastructure and services; whereby WSI supports, authorizes and distributes all settlements and revenues distributions through its account maintenance software developed by WSI and specific to ACI On Demand processing platform.

As a result Westsphere Systems Inc. will process all transactions through its association with ACI hosted transaction processing solution eliminating the costs, restrictions, and potential risks of relying on third party processors. Most importantly, the investment in the WSI role within the processing environment, or switch, will also enable E-Debit’s direct entry into new and emerging markets such as card management and processing.

The Company determined that it would be more appropriate to capitalizing the development costs instead of expensing them as incurred. The Company’s decision was based on the criteria that ACI has established the technological feasibility for the software to provide a solution for ATM and POS transaction acquiring which is called ACI ‘Base 24 On Demand’ (AOD) and where all research and development activities for the other components of the product or process have been completed by them. E-Debit was working with ACI to setup specific requirements as set out by WSI which will supports WSI ATM and POS devices, debit and credit transactions processing and card management requirement that is unique and scalable to WSI’s current and future requirements and not shared with other ACI customers.

The development costs commenced in 2007 and were capitalized as deferred costs. The Company decided to defer amortizing these costs until all the specific requirements as set out by WSI with ACI were completed. This was due to the matching principle where the Company had not been generating revenue from processing transactions through its association with ACI to offset against it related expenses in the same period.

E-Debit officially launched its switch in January 2009 and commenced rollover of ATMs to process all transactions through its association with ACI. The deferred costs were reclassified as intangible assets upon the completion of all the specific requirements including coding and testing in year 2009. The reclassification occurred when E-Debit commenced generation of revenue by processing transactions through its association with ACI and distributed all settlements and revenue distributions through its account maintenance software.

12

The Company assessed the useful life of the intangible asset in relation to its five-year contract with ACI. The Company also determined the technology may be outdated at the end of the term of the contract and an enhancement of the software may be required at that time.

Depreciation is calculated using a declining balance method.

Intangible assets consist of the following elements:

| |

|

Cost

|

|

|

Accumulated

Depreciation/

Amortization

|

|

|

Net

Book Value

|

|

Depreciation

Rate

and

Method

|

|

December 31, 2010 -

|

|

|

|

|

|

|

|

|

|

|

|

License – ACI

|

|

$ |

167,846 |

|

|

$ |

60,423 |

|

|

$ |

107,423 |

|

20% DB

|

|

Patent

|

|

|

15,000 |

|

|

|

13,975 |

|

|

|

1,025 |

|

20% DB

|

|

License – Paragon

|

|

|

18,227 |

|

|

$ |

1,822 |

|

|

|

16,405 |

|

20% DB

|

| |

|

$ |

201,073 |

|

|

$ |

76,220 |

|

|

$ |

124,853 |

|

|

|

June 30, 2011 -

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

License – ACI

|

|

$ |

171,879 |

|

|

$ |

72,875 |

|

|

$ |

99,004 |

|

20% DB

|

|

Patent

|

|

|

15,361 |

|

|

|

14,416 |

|

|

|

945 |

|

20% DB

|

|

License – Paragon

|

|

|

18,665 |

|

|

$ |

3,545 |

|

|

|

15,120 |

|

20% DB

|

| |

|

$ |

205,905 |

|

|

$ |

90,836 |

|

|

$ |

115,069 |

|

|

Depreciation and amortization have been provided in amounts sufficient to recover asset costs over their estimated useful lives. Depreciation and amortization expense for the six months ended June 30, 2011 and June 30, 2010 totaled $12,780 and $6,569, respectively. This depreciation and amortization expense was part of the totaled which are reflected in the accompanying consolidated statements of operations as Depreciation and amortization.

Expected future depreciation and amortization of the intangible assets are as follows:

|

Year

|

Amount

|

|

2012

|

$20,269

|

|

2013

|

$72,027

|

|

2014

|

$ 1,810

|

|

2015

|

$ 1,448

|

Note 7 – Notes Receivable

The note receivable total of $163,854 ($160,000 CDN), carries no interest rate, and requires no monthly payments due from a contractor. The purpose of this note receivable is to supply vault cash to E-Debit’s wholly owned subsidiary Westsphere Systems Inc. (WSI)’s customer-owned ATM equipment and site locations. Revenue from this note is generated from surcharge transactions at a rate of $0.51 ($0.50 CDN) per transaction.

WSI supplies vault cash to these site locations because its customers do not have sufficient vault cash for these site locations. WSI has subcontracted an armored car service to delivery vault cash to these site locations. The armored car company is accountable for the rotation of the cash. The Company is secured with a note receivable where the Company can demand funds be returned at anytime.

This note receivable is reflected in the accompanying consolidated balance sheet as note receivable.

13

In September 2007, WSI entered into a loan agreement with an initial term of twelve months totaling $102,409 ($100,000 CDN) with an external arms-length investor, bearing interest at 12% per annum, with blended monthly payments of interest only of $1,033 ($1,000 CDN). The initial term may be automatically extended for further six (6) month terms (a “renewal period”) after the end of the initial term or terminated subject to mutual termination agreements. The investor must give a written notice not less than 90 days before the end of the initial term or renewal period, whichever the case may be, to not renew the loan agreement. WSI must notify the investor not less than 60 days before the end of the initial term or renewal period, its intention to terminate the loan. Currently, no written notice has been received from the investor to WSI or vice versa. The purpose of the loan is to supply vault cash to WSI’s customer-owned ATM equipment and site locations. WSI supplies vault cash to these site locations because its customers do not have sufficient vault cash for these site locations.

The loan amount has been forwarded to an armored car company that supplies vault cash to these site locations. The armored car company is accountable for the rotation of the cash and has signed a note receivable for the amount (see note 7).

As of June 30, 2011, the balance is $102,409 ($100,000 CDN). This loan is reflected in the accompanying consolidated balance sheet as Loans payable.

In November 2007, E-Debit’s subsidiary Westsphere Systems Inc. (WSI) raised $134,155 ($131,000 CDN) through a loan agreement with an initial term of twenty-four months with an external arms-length investor, bearing interest at 12% per annum, with blended monthly payments of interest only of $1,354 ($1,310 CDN). The initial term may be automatically extended for further twelve month terms (a “renewal period”) after the end of the initial term or terminated subject to mutual termination agreements. The investor must give a written notice not less than 90 days before the end of the initial term or renewal period, whichever the case may be, to not renew the loan agreement. WSI must notify the investor not less than 30 days before the end of the initial term or renewal period, its intention to terminate the loan. Currently, no written notice has been received from the investor to WSI or vice versa. The purpose of the loan is to fund the switch development project. In February 2010, the loan was reduced by $66,566 ($65,000 CDN) to purchase E-Debit’s private offering memorandum of 622,123 common shares at $0.10 per share.

As of June 30, 2011, the balance is $67,589 ($66,000 CDN). This loan is reflected in the accompanying consolidated balance sheet as Loans payable.

Note 9– Commitments and Contingencies

The Company leases real estate (office and warehouse space) under non-cancellable operating leases that expire on varying dates through 2014.

The Company leases additional real estate (office and warehouse space) for an “Initial Term” commencing June 1, 2010 on a month to month basis. The company may renew the Lease on a monthly basis by giving notice to the Landlord not less than thirty (30) days prior to the expiration of the Initial Term.

The Company also has various obligations for auto and equipment leases through 2015.

The Company real estate leases and one auto lease are signed with an affiliated company that is controlled by the Company’s president.

Minimum future rental payments under non-cancellable operating leases having remaining terms in excess of one year are as follows:

| |

|

Real Estate

|

|

|

Other

|

|

|

2012

|

|

$

|

72,662

|

|

|

$

|

14,282

|

|

|

2013

|

|

$

|

72,662

|

|

|

$

|

7,307

|

|

|

2014

|

|

$

|

12,110

|

|

|

$

|

6,880

|

|

|

2015

|

|

$

|

—

|

|

|

$

|

2,293

|

|

| |

|

|

June 30, |

|

| |

|

|

2011

|

|

|

|

2010

|

|

| |

|

|

|

|

|

|

|

|

|

Rental expense

|

|

$

|

62,099

|

|

|

$

|

94,568

|

|

14

On April 7, 2004, the Company sued Fred and Linda Sebastian to recover an outstanding loan of $80,000 (CDN) plus interest and court costs. The Company has reserved this amount due to the uncertainty of recovery. The defendant has withdrawn the counterclaim. As of March 2008, no further actions were filed by either party.

On May 28, 2004 Peter Gregory filed an action in the Ontario Superior Court of Justice against Vencash Capital Corporation. Peter Gregory was a Vencash distributor and agent who filed the action related to a claim of wrongful dismissal from Vencash of $260,000 (CDN). On July 30, 2004 Vencash filed a Statement of Defence and Counterclaim in the amount of $1,600,000 for breach of contract, breach of confidence, breach of fiduciary duties, interference with economic relations, damages for inducing breach of contract, and punitive damages. The Company believes the claim by Gregory to be without merit and has not accrued a liability for the claim. As of April 2009, the court actions and negotiation with Peter Gregory have been terminated with the withdrawal of the company lawyer. No further actions were filed by either party.

Note 10 – Related Party

Investment, at cost:

In October 2010, E-Debit decided to sell 41 common shares (41%) of the issued and outstanding shares held in its wholly owned subsidiary, 1105725 Alberta Ltd. o/a Personal Financial Solutions (PFS) at $1.00 per share. The common shares were sold to a number company that is controlled by an officer of E-Debit. The purchaser agrees that the current outstanding advances made to the company by E-Debit will remain outstanding and owed by the Company to E-Debit. As a result of the sale transaction, E-Debit remains a 10% shareholder in Personal Financial Solutions. The sale transaction will save administration and audit costs to E-Debit. E-Debit did not restate its financial statements to deconsolidate the PFS subsidiary, as PFS’s balances are immaterial to E-Debit’s consolidated financial statements. PFS has had no active business activities for the last four years. PFS had total assets and an accumulated deficit of $497 and $37,826, respectively, at December 31, 2010.

The 10% or $10 interest in Personal Financial Solutions is reflected in the accompanying consolidated balance sheet as investment, at cost.

In May 2011, E-Debit decided to sell 90 common shares (90%) of the issued and outstanding shares held in its wholly owned subsidiary, Cash Direct Financial Services Ltd. (CDF) at $1.00 per share. The common shares were sold to a number company that is controlled by the president of E-Debit. The purchaser agrees that the current outstanding advances made to the company by E-Debit will remain outstanding and owed by the Company to E-Debit. As a result of the sale transaction, E-Debit remains a 10% shareholder in Cash Direct Financial Services. The sale transaction will save administration and audit costs to E-Debit. E-Debit did not restate its financial statements to deconsolidate the CDF subsidiary, as CDF’s balances are immaterial to E-Debit’s consolidated financial statements. CDF has had no active business activities for the last two years. CDF had total assets and an accumulated deficit of $475 and $15,145, respectively, at April 30, 2011.

The 10% or $10 interest in Cash Direct Financial Services is reflected in the accompanying consolidated balance sheet as investment, at cost.

Other receivable – related parties:

The other receivable – related parties was from the sale transaction of 41% of the subsidiary 1105725 Alberta Ltd. o/s Personal Financial Solutions (PFS) in October 2010 and sale transaction of 90% of the subsidiary Cash Direct Financial Services Ltd. (CDF) in May 2011, and sale transactions to E-Debit’s directors.

The purpose of the sale of the subsidiaries was to save administration and audit costs to E-Debit since PFS and CDF have had no active business activities for the last four years.

15

The following table summarizes the Company’s others receivable to related parties transactions as at June 30, 2011 and December 31, 2010:

| |

|

2011

|

|

|

2010

|

|

1105725 Alberta Ltd. o/a

Personal Financial Solutions

|

|

$

|

38,340

|

|

|

$

|

37,482

|

|

| Cash Direct Financial Services Ltd. |

|

|

12,822 |

|

|

|

- |

|

|

Accounts receivable – directors

|

|

|

4,444

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$

|

55,606

|

|

|

$

|

37,482

|

|

The current outstanding advances are reflected in the accompanying consolidated balance sheet as other receivable – related parties and totaled $55,606 and $37,482, respectively, at June 30, 2011 and December 31, 2010.

Indebtedness to related parties:

The Company expensed $25,499 ($24,675 CDN) during the second quarter of 2011 for consulting and management services to an affiliated company that is controlled by the Company’s president. This expensed is reflected in the accompanying consolidated Statements of Operations as a Consulting fees.

The following table summarizes the Company’s indebtedness to related parties transactions as at June 30, 2011:

|

Payable to:

|

|

Amount

|

|

Terms/Maturities

|

Interest Rate

|

|

A loan advanced from E-Debit’s President for working capital.

|

|

$ |

39,794 |

|

Demand loans

|

8% per annum

|

|

A loan advanced from an affiliated company that is controlled by E-Debit’s President for working capital.

|

|

|

454,638 |

|

Demand loans

|

8% per annum

|

|

A loan advanced from E-Debit’s vice President for working capital.

|

|

|

6,199 |

|

Demand loans

|

8% per annum

|

|

A loan advanced from E-Debit’s officers for working capital.

|

|

|

33,749 |

|

Demand loans

|

8% per annum

|

|

A loan advanced from E-Debit’s directors for working capital.

|

|

|

66,238 |

|

Demand loans

|

8% per annum

|

|

A loan advanced from E-Debit’s director for working capital.

|

|

|

48,116 |

|

Demand loans

|

No interest

|

|

Officers’ and Directors’ bonuses payable carried forward from year 2002

|

|

|

34,246 |

|

Demand loans

|

No interest

|

|

A loan advanced from an affiliated company that is controlled by E-Debit’s President for working capital.

|

|

|

24,649 |

|

Demand loans

|

No interest

|

|

Total

|

|

$ |

707,629 |

|

|

|

The indebtedness to related parties consist of loans that are payable on demand by the related parties. The interest rate is Eight (8%) percent annually calculated and paid quarterly attached to the related party loans. There are no interest attached to a loan advanced from E-Debit’s director of $48,116, the Officers’ and Directors’ bonuses payable carried forward from year 2002 of $34,246, and the loan advanced from an affiliated company that is controlled by E-Debit’s President for working capital of $24,649. The above obligations are reflected in the accompanying consolidated balance sheet as indebtedness to related parties.

16

Note 11 – Shareholder loans

The following table summarizes the Company’s shareholder loans transactions as at June 30, 2011:

|

Payable to:

|

|

Amount

|

|

Terms/Maturities

|

Interest Rate

|

|

A loan advanced from E-Debit’s vice President for working capital.

|

|

|

56,325 |

|

Demand loans

|

8% per annum

|

|

A loan advanced from E-Debit’s directors for working capital.

|

|

|

145,914 |

|

Demand loans

|

8% per annum

|

|

A loan advanced from E-Debit’s vice President for working capital.

|

|

|

45,572 |

|

Demand loans

|

12% per annum

|

|

A loan advanced from E-Debit’s shareholder for working capital.

|

|

|

51,203 |

|

Demand loans

|

9% per annum

|

|

Total

|

|

$ |

299,014 |

|

|

|

E-Debit’s shareholder loans related to cash advance from E-Debit’s vice president total $56,325 and the directors total $145,914 have an interest rate of 8% per annum calculated and paid quarterly with no specific terms of repayment. The remaining balance of shareholder loans total $96,775 consist of a loan advance from E-Debit’s vice president total $45,572 has an interest rate of 12% per annum with no specific terms of repayment, and a loan advance from a shareholder of $51,203 has an interest rate of 9% per annum with no specific terms of repayment. The above obligations are reflected in the accompanying consolidated balance sheet as shareholder loans.

Note 12 – Shareholder’s Deficit

In January 2011, a director exercised his options of 1,785,714 common shares at $0.014 per share for a total of $25,000. The issuance of 1,785,714 shares was issued as the settlement of $25,000 of debt.

In January 2011, an officer exercised his options of 1,125,000 common shares at $0.014 per share for a total of $15,750. The issuance of 1,125,000 shares was issued as the settlement of $15,750 of debt owed to an affiliated company that is controlled by the Company’s president.

Note 13 – Cease Trade Order in British Columbia Securities Commission, Canada

On December 23, 2010 the British Columbia Securities Commission (BCSC) delivered to the Company a “Cease Trade Order” related to trading of our common stock in the jurisdiction of British Columbia, Canada. On January 5, 2011 the Company delivered to the British Columbia Securities Commission notice requesting a hearing with the Commission to appeal a Cease Trade Order and a request for a Stay of the Order. The Company is waiting for notice of the date of the Commission hearing. The actions originating from the BCSC has no effect on our trading status in any other jurisdiction than British Columbia but it does affect trading activity in Canada. E-Debit as a company conducting its business activities through our Canadian subsidiaries we take every effort to ensure the integrity and complete compliance of our business activities in each jurisdiction we conduct our businesses. We will continue to conduct our business in this same manner.

On March 23, 2011 the Company made application to the British Columbia Securities Commission for Reporting Issuer Designation Order. On April 27, 2011 the Company advised the British Columbia Securities Commission that it has had its SEDAR subscriber number to enable the Company to post its SEDAR filings as required and acknowledged. The Company advised that upon completion of our submission and acceptance as a reporting issuer we will be withdrawing our request for a Hearing with the British Columbia Securities Commission and our Notice of Appeal and Request for Review and Stay of Cease Trade Order as noted.

17

On May 27, 2011 the British Columbia Securities Commission issued its Revocation Order revoking the Cease Trade Order issued on December 23, 2010. As of May 27, 2011 the Company is a reporting issuer across Canada reporting to the BCSC. As a result the Company issued its notice to the British Columbia Securities Commission on June 7, 2011 to withdraw its “Notice of Appeal and Request for Review and Stay of Cease Trade Order”.

Note 14 – Going Concern

The accompanying financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, which contemplate continuation of the Company as a going concern. The Company has incurred net losses for the three months ended June 30, 2011 and 2010, and as of June 30, 2011, had a working capital deficit of $1,730,030 and an accumulated deficit of $681,160. These conditions raise substantial doubt as to the Company's ability to continue as a going concern. These financial statements do not include any adjustments that might result from the outcome of this uncertainty. These financial statements do not include any adjustments relating to the recoverability and classification of recorded asset amounts, or amounts and classification of liabilities that might be necessary should the Company be unable to continue as a going concern.

Management recognizes that the Company must generate additional resources to enable it to continue operations. Management intends to raise additional funds through debt financing and equity financing or through other means that it deems necessary, with a view to moving forward and sustaining a prolonged growth in its strategy phases. However, no assurance can be given that the Company will be successful in raising additional capital. Furthermore, the management is in the process of restructuring, reorganization and consolidation of all its operations as a whole in order to save costs. In addition, there is no demand for payment on the indebtedness to related parties of $707,629 and shareholder loans of $299,014 as these liabilities are owed to internal officers and directors. Further, even if the Company raises additional capital, there can be no assurance that the Company will achieve profitability or positive cash flow. If management is unable to raise additional capital and expected significant revenues do not result in positive cash flow, the Company will not be able to meet its obligations and may have to cease operations.

18

ITEM 2. MANAGEMENT'S DISCUSSION AND ANALYSIS OR PLAN OF OPERATION

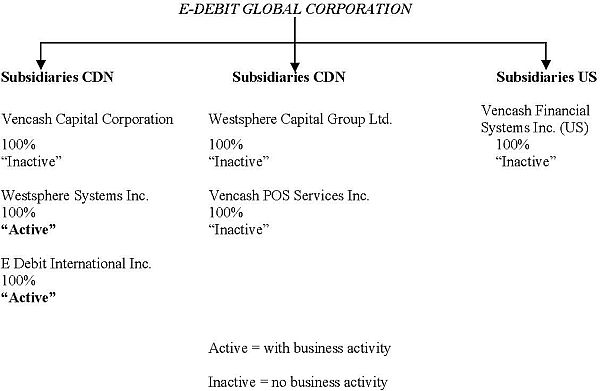

Current Corporate Structure – June 30, 2011

19

Plan of Operations

Results of Operations – Three Month Period

During the three (3) month period of operations ended June 30, 2011, E-Debit and its subsidiaries generated a net loss from operations of $284,376, while a net loss from operations of $145,805 was realized for the same period from the previous year. The increase in net loss of $138,571 over the same period from the previous year was caused by a decrease in gross profit of $114,365, an increase in legal and accounting fees of $19,462, and an increase in interest expenses of $11,243. The increase in net loss is partially offset against an increase in other income of $15,651 over the same period from the previous year.

The decrease in gross profit was primarily caused by a decrease in residual and interchange income of $138,634 and an increase in other cost of sales of $54,610. The decrease is partially offset against a decrease in residual and interchange costs of $89,224.

The decrease in residual and interchange income was caused by a decrease in processing of ABM transactions over the same period from the previous year.

The increase in other cost of sales was mainly related to an increase in switching expense of $27,779 and an increase in telephone ATM expense of $19,073.

The increase in interest expense was due to interest charge for the late payment to vendors during the year.

The increase in other income was mainly due to the gain on the sale of 90 common shares (90%) of the issued and outstanding shares held in its wholly owned subsidiary, Cash Direct Financial Services Ltd. in May 2011. As a result of the sale transaction, E-Debit remains a 10% shareholder in Cash Direct. The sale transaction will save administration and audit costs to E-Debit since Cash Direct has had no active business activities for the last two years.

To this date, 480 ATM are being processed between three switches. There was no change in operations during the year 2011 as compared to prior year.

Results of Operations – Six Month Period

During the six (6) month period of operations ending June 30, 2011, E-Debit and its subsidiaries generated a net loss from operations of $513,427, while a net loss from operations of $332,196 was realized for the same period from the previous year. The increase in net loss of $181,231 over the same period from the previous year was mainly caused by a decrease in gross profit of $151,365, an increase in other operating expenses of $20,635, and an increase in interest expenses of $24,641. The increase in net loss is partially offset against a decrease in travel, delivery and vehicle expenses of $10,429 over the same period from the previous year.

The decrease in gross profit was primarily caused by a decrease in residual and interchange income of $284,886 and an increase in other cost of sales of $37,082. The decrease is partially offset against a decrease in residual and interchange costs of $183,604.

The decrease in residual and interchange income was caused by a decrease in processing of ABM transactions over the same period from the previous year.

The increase in other cost of sales was mainly related to an increase in switching expense of $17,664 and an increase in telephone ATM expense of $20,260.

The increase in other operating expenses was caused by an increase in rent of $21,805 and an increase in advertising and promotion of $12,676. The increase is partially offset against a decrease in bad debt expense of $13,604.

The increase in rent was due to the Company leases additional real estate (office and warehouse space) for an “Initial Term” commencing June 1, 2010 on a month to month basis. The company may renew the Lease on a monthly basis by giving notice to the Landlord not less than thirty (30) days prior to the expiration of the Initial Term.

20

The increase in advertising and promotion was primarily due to E-Debit entered into a short term investor relations consulting agreement with a company to provide and render public relations and communications services.

The increase in interest expense was due to interest charge for the late payment to vendors during the year.

E-Debit and its subsidiaries currently did not generate sufficient revenues to meet overhead needs. This is due to E-Debit switch operations which was launched in January 2009 and commence rollover of ATMs to process all transactions. The switch operations currently did not generate sufficient revenue to cover it expenses. In addition, E-Debit continues experiencing a steady decrease in gross profit. Management recognizes that the Company must generate additional resources to enable it to continue operations. Management intends to raise additional funds through debt financing and equity financing or through other means that it deems necessary, with a view to moving forward and sustaining a prolonged growth in its strategy phases. However, no assurance can be given that the Company will be successful in raising additional capital.

E-Debit believes that the continued investment from related parties and outside investors will continue to produce sufficient ongoing funding to meet its current and future financial requirements.

In order to meet its growth plan, E-Debit will continue to be dependent on equity funds raised, joint venture arrangements and/or loan proceeds. E-Debit believes that it will continue as a going concern with the present revenues from its subsidiary Westsphere Systems Inc. and loan advanced by the related parties but it would be unable to meet its market growth projections without further funding outside of the ongoing revenue from operations of Westsphere Systems Inc.

Changes in Financial Position

During the Six (6) month period ending June 30, 2011, total assets increased from $1,681,150 to $1,910,439. The increase is primarily due to an increase in cash of $51,334, an increase in restricted cash of $121,653, an increase in accounts receivable related parties of $18,124, and an increase in property and equipment – idle of $52,053. The increase is partially offset against a decrease in prepaid expense and deposit of $11,501.

The increase in restricted cash was mainly caused by the surcharge and interchange settlement owed to customers as of June 30, 2011. These surcharge and interchange are returned to the customers on July 2, 2011.

The increase in property and equipment - idle was mainly caused by the purchase of computer hardware and software for the switch specifically for communication between ATM to the switch’s server. At present time the hardware and software are being tested and expect to place it in production by the end of the third quarter.

As of June 30, 2011, E-Debit’s current liabilities consisted of accounts payable of $1,184,465, accrued liabilities of $230,493, loans payable of $169,998, indebtedness to related parties of $707,629, and shareholder loans of $299,014.