UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K/A

Amendment No. 2

|

x |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended: June 30, 2012

|

¨ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE EXCHANGE ACT OF 1934 |

For the transition period from _________ to _________

Commission File Number: 000-50994

Gold Hills Mining, Ltd.

(Exact Name of Registrant as Specified in its Charter)

|

Nevada |

|

88-0471870 |

|

(State of other jurisdiction of |

|

(IRS Employer Identification |

|

incorporation or organization) |

|

Number) |

100 Wall Street, 10th Floor

New York, NY 10005

(Address of principal executive offices)

516-602-9065

(Registrant’s telephone number)

Securities registered pursuant to Section 12(b) of the Exchange Act: None

Securities registered pursuant to Section 12(g) of the Exchange Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act.

Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K: ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large Accelerated Filer |

¨ |

Accelerated Filer |

¨ |

|

Non-Accelerated Filer |

¨ |

Smaller Reporting Company |

x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ¨ No x

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter: $1,601,621 at December 31, 2011.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date: The Issuer had 16,623,391 shares of Common Stock, par value $.00001, outstanding as of October 11, 2012.

2

Explanatory Note

Gold Hills Mining, Ltd. (the “Company”) (formerly known as Ardent Mines Limited) is filing this Amendment Number 2 to the Company’s Annual Report on Form 10-K/A (this “Report”) to provide additional information regarding the Company’s operations and plans in Brazil as of June 30, 2012. Except where expressly indicated, this Report has not been revised or updated to reflect events subsequent to June 30, 2012.

3

TABLE OF CONTENTS

|

ITEM 1: BUSINESS |

|

6 |

|

|

|

|

|

ITEM 1A: RISK FACTORS |

|

17 |

|

|

|

|

|

ITEM 1B: UNRESOLVED STAFF COMMENTS |

|

21 |

|

|

|

|

|

ITEM 2: PROPERTIES |

|

22 |

|

|

|

|

|

ITEM 3: LEGAL PROCEEDINGS |

|

22 |

|

|

|

|

|

ITEM 4: MINE SAFETY DISCLOSURES |

|

22 |

|

|

|

|

|

ITEM 5: MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

|

23 |

|

|

|

|

|

ITEM 6: SELECTED FINANCIAL DATA |

|

26 |

|

|

|

|

|

ITEM 7: MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

|

27 |

|

|

|

|

|

ITEM 7A: QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK |

|

30 |

|

|

|

|

|

ITEM 8: FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA |

|

F-1 |

|

|

|

|

|

ITEM 9: CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE |

|

32 |

|

|

|

|

|

ITEM 9A: CONTROLS AND PROCEDURES |

|

32 |

|

|

|

|

|

ITEM 9B: OTHER INFORMATION |

|

33 |

|

|

|

|

|

ITEM 10: DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE |

|

33 |

|

|

|

|

|

ITEM 11: EXECUTIVE COMPENSATION |

|

37 |

|

|

|

|

|

ITEM 12: SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS |

|

40 |

|

|

|

|

|

ITEM 13: CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS AND DIRECTOR INDEPENDENCE |

|

41 |

|

|

|

|

|

ITEM 14: PRINCIPAL ACCOUNTING FEES AND SERVICES |

|

41 |

|

|

|

|

|

ITEM 15: EXHIBITS AND FINANCIAL STATEMENT SCHEDULES |

|

43 |

|

|

|

|

|

SIGNATURES |

|

47 |

|

|

|

|

4

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

The following cautionary statements identify important factors that could cause our actual results to differ materially from those projected in forward-looking statements made in this Report and in other reports and documents published by us from time to time. Any statements about our beliefs, plans, objectives, expectations, assumptions, future events or performance are not historical facts and may be forward-looking. These statements are often, but not always, made through the use of words or phrases such as “believes,” “will likely result,” “are expected to,” “will continue,” “is anticipated,” “estimated,” “intend,” “plan,” “projection,” “outlook” and the like, constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). However, as we issue “penny stock,” as such term is defined in Rule 3a51-1 promulgated under the Exchange Act, we are ineligible to rely on these safe harbor provisions. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of our Company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Given these uncertainties, readers are cautioned to carefully read all “Risk Factors” set forth under Item 1A and not to place undue reliance on any forward-looking statements. We disclaim any obligation to update any such factors or to announce publicly the results of any revisions of the forward-looking statements contained or incorporated by reference herein to reflect future events or developments, except as required by the Exchange Act. New factors emerge from time to time, and it is not possible for us to predict which will arise or to assess with any precision the impact of each factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

Unless otherwise provided in this Report, references to the “Company,” the “Registrant,” the “Issuer,” “we,” “us,” and “our” refer to Gold Hills Mining, Ltd., formerly known as Ardent Mines Limited.

5

PART I

ITEM 1: BUSINESS

Corporate Information

We were incorporated in the State of Nevada on July 27, 2000. We are presently engaged in the acquisition and exploration of mining properties. The Company’s address is 100 Wall Street, 10th Floor, New York, NY 10005. The Company’s telephone number is (778) 892-9490.

Background

In August 2000, we acquired the right to prospect one mineral property containing eight mining claims located on Copperkettle Creek in British Columbia, Canada. We have allowed these claims to lapse. From August 26, 2006 to December 11, 2006, we did not conduct any operations. During that period, we intended to identify an acquisition or merger candidate with ongoing operations in any field. However in December 2006 we decided to acquire the right to explore a new property in British Columbia and returned to the business of mineral exploration. On April 30, 2009, the Company decided not to renew certain claims, and later determined not to pursue its remaining claim in Canada. The Company subsequently determined to pursue other mining opportunities.

The Company’s Current Business Operations

During the period covered by this Report, the Company has appointed new officers and directors, opened a new office, and negotiated and conducted due diligence regarding several potential acquisitions. The Company’s most significant achievement to date has been its acquisition of Gold Hills Mining Ltda., as described below.

Gold Hills Mining Ltda.

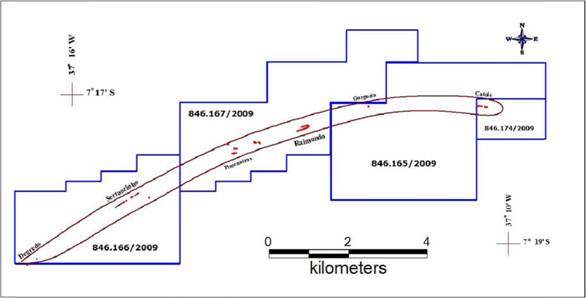

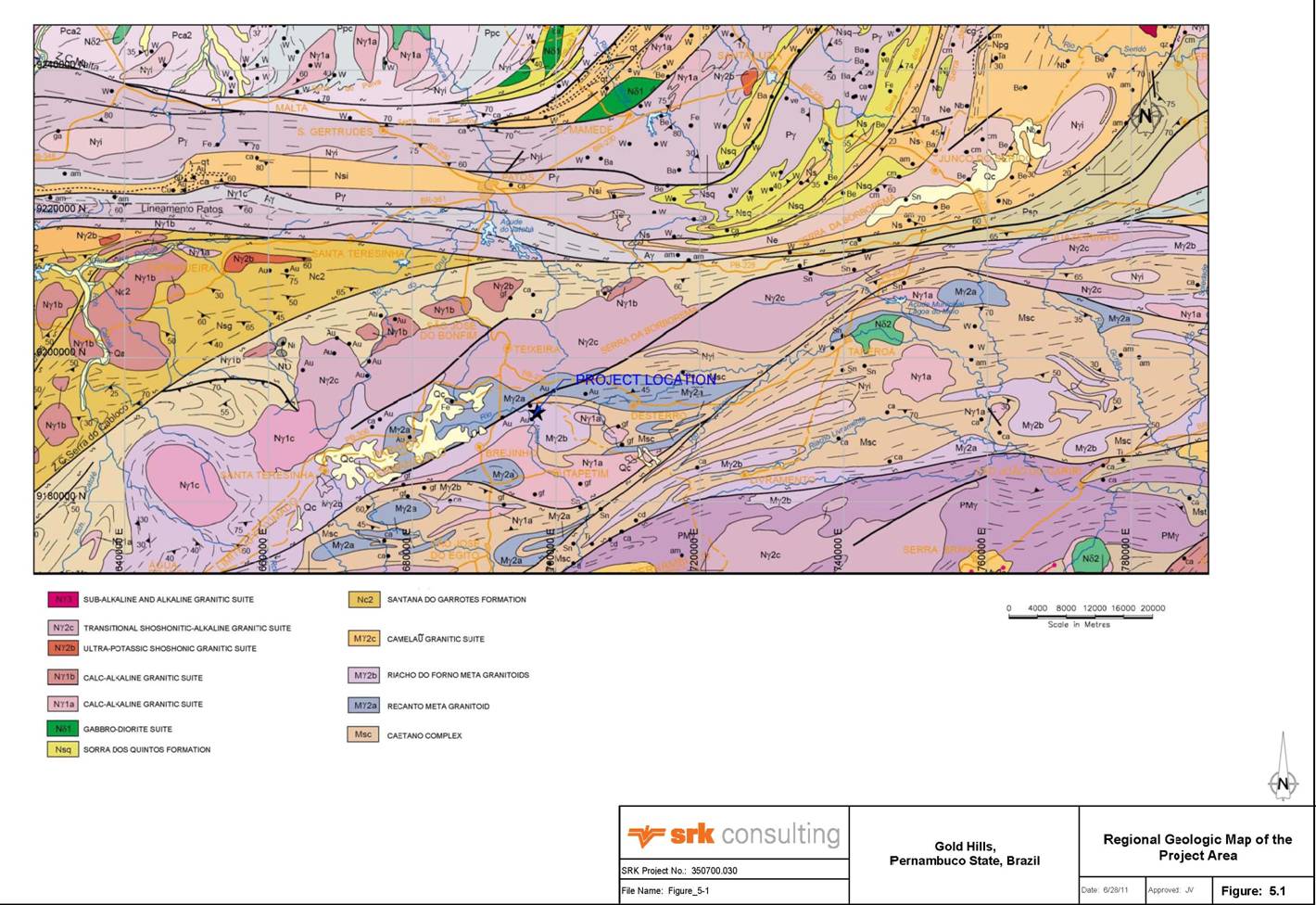

The locations of Gold Hills Mining Ltda.’s operations in Brazil.

The Gold Hills mining claims. Prepared July 5, 2011.

Acquisition of Gold Hills Mining Ltda.

In January of 2011, the Company entered into a term sheet to acquire Gold Hills Mining Ltda., a Brazilian corporation which possesses rights for mineral exploration at the Serra do Ouro (“Gold Hills”) properties located in Northeastern Brazil. After the completion of due diligence, on May 4, 2011, the Company acquired Gold Hills Mining Ltda. pursuant to a Purchase Agreement (the “Purchase Agreement”) by and between the Company, Gold Hills Mining Ltda. and the two shareholders of Gold Hills Mining Ltda. (such shareholders are referred to herein as the “Sellers”). Pursuant to the Purchase Agreement, the Sellers have sold to the Company One Hundred Percent (100%) of all the issued and outstanding equity interests (the “Shares”) of Gold Hills Mining Ltda. in accordance with the following terms:

7

|

|

(a) |

Payment of two hundred and fifty thousand U.S. dollars ($250,000), which has been paid. | |

|

|

(b) |

The Company shall conduct an exploration campaign at the Gold Hills properties (the “Exploration”). Upon the completion of the Exploration, the following amounts shall be paid by Gold Hills Mining Ltda. to the Sellers: | |

|

|

(i) |

If the Exploration confirms the existence of gold mineral reserves of less than Three Hundred Thousand (300,000) ounces, no additional payment shall be made by the Company to the Sellers. | |

|

|

(ii) |

If the Exploration confirms the existence of gold mineral reserves of between Three Hundred Thousand (300,000) and Four Hundred Ninety-Nine Thousand Nine Hundred and Ninety-Nine (499,999) ounces, the additional payment to be made to the Sellers shall be Four Hundred Thousand U.S. Dollars ($400,000). | |

|

|

(iii) |

If the Exploration confirms the existence of gold mineral reserves of greater than Four Hundred Ninety-Nine Thousand Nine Hundred and Ninety-Nine (499,999) ounces, the additional payment to be made to the Sellers shall be (a) One Million U.S. Dollars ($1,000,000); plus (b) Two U.S. Dollars ($2) per additional ounce in excess of the first Five Hundred Thousand (500,000) ounces, to be paid in four biannual installments starting in twelve (12) months. | |

|

|

(c) |

Upon Gold Hills Mining Ltda. obtaining certain enumerated environmental licenses which are necessary to commence Gold Hills Mining Ltda.’s planned mining operations, the Company will make an additional cash payment to the Sellers in the amount of Seven Hundred Thousand U.S. Dollars ($700,000). | |

|

|

(d) |

Upon the commencement of the successful mining and processing of gold by Gold Hills Mining Ltda., the Sellers shall be entitled to receive a royalty equal to Two Percent (2%) of Gold Hills’ gross income, as calculated in accordance with generally accepted accounting principles. | |

Subject to the Company’s determination of the existence of such gold reserves as set forth above, the Company has agreed to invest Three Million Five Hundred Thousand U.S. Dollars ($3,500,000) in Gold Hills.

Pursuant to the Purchase Agreement, one of the Sellers shall be appointed to Gold Hills Mining Ltda.’s Board. The Purchase Agreement also contains standard representations and warranties, and provides for arbitration in the event of any dispute.

Legal and Regulatory Issues regarding the Gold Hills Property

The Brazilian Constitution states that mineral resources, oil, gas and other resource deposits belong to the federal government, and shall be developed by means of concession or permits. The federal government’s ownership of mineral resources is distinct and independent from land ownership. The Brazilian mining Code assures the mineral rights owner full surface access to the mineral resources, and it stipulates that the exploration title holder should negotiate the access terms and conditions of surface rights directly with the individual surface land owners. In cases where such an agreement cannot be achieved, there are legal provisions to enforce the access through the intervention of the Judiciary. At the present time, Gold Hills Mining Ltda. has successfully negotiated surface rights with two of the seven landowners at the Gold Hills property, in the Sertãozinho (DNPM 846.166/2009) and Pimenteiras (DNPM 846.167/2009) concession areas. Negotiations are currently underway with the remaining landowners.

Gold Hills Mining Ltda. has been granted exploration permits by the Departamento Nacional de Produção Mineral (DNPM), an autonomous Department linked to the Ministry of Mines and Energy, for four contiguous concessions which were transferred from individual land owners. These permits have expiration dates of three years from date of issue, and can be renewed for an additional three year period by submitting a report to the DPNM justifying additional exploration activities. These titles were transferred during the period from October 2009 to April 2010. Subsequent to the period covered by this Report, the Company requested a three extension from the DPNM and is awaiting a response. The currently defined mineralized areas on the Gold Hills Mining Ltda. concessions occur within the approved license boundaries and correspond to DPMN title numbers 846.166/2009, 846.177/2009, 846.165/2009 and 846.174/2009.

Gold Hills Mining Ltda. also retains an option agreement on additional semi-contiguous concessions located west of the current license area.

An annual payment to the DNPM is required for the Gold Hills exploration concessions. During the first three years, the annual payment was determined based on R$2.36 per hectare per year. During the extension period it will increase to R$3.58 per hectare per year. Once the exploration activities have been completed, a final report must be submitted to the DNPM, to demonstrate the existence of economically extractable material; if the report is approved by the DNPM, a request for a mining concession must be filed and comply with the legal requirements established by the Mining Code within a one year period.

8

Gold Hills Mining Ltda. will be required to apply for a permit from the Pernambuco State Environment Secretariat in order to disturb vegetation at the Gold Hills property. This permit will require limited environmental work and is estimated by Gold Hills Mining Ltda. to involve a two month process to complete.

To date, Gold Hills Mining Ltda. has not been required to get an environmental license for the Gold Hills project, as the area is a former mining site and no deforestation or construction has been done. Determinations regarding the necessary licenses will be made at a later date.

Description of the Gold Hills Property

The Gold Hills Mining Ltda. property compromises four contiguous mineral concessions totaling 3,499.6 hectares. The property is located in Itapetim County, State of Pernambuco, Brazil. The closest town is Teixeira across the border in Paraíba State, located approximately 170 km west of the city of Campinae and 406 km west of Recife, the Capital of Pernambuco state. The property is centered at UTM Coordinate 696.103.41E, 9,193,566.04S (UTM Zone 24).

Minerals at the Gold Hills Property

The mineral deposit at the Gold Hills property is a classic shear zone “lode” type, with gold bearing quartz veins and “mylonitic” (strain-crushed) rocks. The Gold Hills property is located in an area with an impressive historical record of gold mining. The potential for resources at the property is supported by preliminary sampling, however, Gold Hills Mining Ltda. has not yet confirmed the amount of known resources at the Gold Hills property.

On July 5, 2011, the Company announced that it has received a 43-101 Technical Report on Exploration prepared by SRK Consulting (U.S.) Inc. for the Gold Hills project. The report was prepared upon SRK's completion of a site visit and the analysis of geological and geophysical evidence. SRK confirmed the existence of a highly mineralized vein containing gold of high grade (4 to 7 g/t), originally prospected by the CPRM, an agency of the Brazilian government.

Gold mineralization has been defined along a 13.5 km southwesterly strike length. The mineralization consists of a vein system related to a shear zone in granitic rocks. The main mineralization is associated to quartz veins and mylonitic rocks. The ore grades vary widely, reaching up to 56 g/tons in the richest zones. The system extends over 25km, 15km of which are inside Gold Hills Mining Ltda.’s concessions. Seven main targets have been already identified by geological works, and diamond drilling has confirmed the persistency of the mineralization in depth. The variation of grades are related to structural and lithological features, most of which already defined by the studies already done.

Samples were collected at the location of the Gold Hills Mining Ltda. project during the period 1981 to 1985 by Compania de Pesquisa de Recursos Minerais (CPRM), a Brazilian government authority that was the previous operator of one of the exploration concessions. These samples included soil, rock chip, drill hole and steam sediment samples. The methods and approach are largely undocumented. The total collected sample was grinded, concentrated and then amalgamated in order to measure the gold recovered to concentrate, which was reported as “gold recoverable grade”.

Gold Hills Mining Ltda. has collected tailing samples, underground channel samples and underground helicoidal samples during the period 2009 to 2011. It has not been possible to witness or verify any of the methodologies or results from the CPRM programs due to their historical nature. The various sampling programs completed by Gold Hills Mining Ltda. were conducted by professional geologists and engineers who performed to industry standards. The sample collection methodology and analysis is well documented, based on a review of sampling methods, chain of custody, sample preparation and analysis. The historic drilling, logging and sampling procedures described in archival CPRM reports is both incomplete and not verifiable, and therefore unreliable. The sampling methodologies utilized by Gold Hills Mining Ltda. in their 2009 to 2011 are appropriate to accurately characterize the mineralization and to distinguish any zones internal to the mineralization, which may have anomalously high or low-grade values. The sample lengths chosen by Gold Hills Mining Ltda. between 2009 to 2011 are appropriate to a deposit of this type, in order to accurately characterize the mineralization and to distinguish any zones internal to the mineralization which may have anomalously high or low-grade values. The relevant samples are the mineralized intervals of the underground and tailings samples collected and analyzed by Gold Hills Mining Ltda.

The underground channel, helicoidal and surface tailings samples were collected and prepared by Gold Hills Mining Ltda. field personnel during the period 2009 to 2011. All samples collected by Gold Hills Mining Ltda. were submitted to the ALS Chemex sample preparation lab in Belo Horizonte, Brazil. Sample preparation consisted of crushing to -75% passing 2 mm mesh and pulverizing to 85% passing 75 μm, and splitting to a 1,000 g sample for analysis. The samples were assayed using conventional fire assay with an AA finish (ALS Chemex procedure Au-AA23). If results exceeded the detection limit of 10.0 ppm, the samples were reanalyzed using an “ore grade” finish (ALS Chemex procedure Au-AA25). All analyses utilized a primary sample charge of 30 g (one assay tone). Most ALS Minerals laboratories are registered or are pending registration to ISO 9001:2008, and a number of analytical facilities have received ISO 17025 accreditations for specific laboratory procedures. The Belo Horizonte lab is ISO 9001:2008 accredited.

9

Gold Hills Mining Ltda. did not employ any internal QA/QC controls in 2009 to 2011 sampling program at the Gold Hills property. ALS Chemex labs conduct their own internal QA/QC program which consists of the insertion of standards (certified reference material or “CRM”) and blanks, and the re-assay of a number of pulp duplicated in accordance with its QA/QC protocols.

Transportation at the Gold Hills Project

Campina Grande, located approximately 160 km from the property, maintains an airport served by a number of commercial airlines that offer daily flights, with connections to Brazilian and other international airports. Access to the property from Campina Grande is via a network of Federal and State highways and secondary roads.

Water and Electricity at the Gold Hills Project

A 230 kV line transects the Pernambuco and Paraíba State approximately 100 km from the project and additional capacity is available through the state grid. A 40 kV generator currently serves all on site needs, which are limited to underground lighting and a winch that services the cage for access to the historic underground working. On site water needs may require the drilling of pumping wells, and surface water availability is limited. Other potential water sources include nearby reservoirs, located within 1 km from the project area, or installation of rain water collection ponds at site. Sufficient water supply exists to engage in exploration efforts.

Current Exploration at the Gold Hills Project

On July 2, 2012, the Company announced the commencement of geological exploration work at the Gold Hills Mining Ltda. project. Gold Hills Mining Ltda. has received a definitive exploration permit from the Ministry of Mines and Energy allowing the Company to commence its exploration program. The Company has utilized the services of Para Geoexperts for certain tasks at the Gold Hills project. On August 16, 2012, the Company announced that it has contracted Drilrent Ltd., a Brazilian-based company, to commence an exploratory drilling campaign at Gold Hills. This campaign at the Gold Hills project will be overseen by the Company’s President, Luciano de Freitas Borges, and Mr. Alexey Kotov, a consultant. Both Mr. Borges and Mr. Kotov are geologists.

Subsequent to the period covered by this Report, Gold Hills Mining Ltda. concluded the first phase of the diamond drill drilling campaign on the property, with 1,604.86 meters of drilling, corresponding to 11 eleven drill holes, with an average depth of 150 meters, which resulted in the confirmation of the persistence of the gold mineralized zone in depth, below the galleries. The drilling campaign was preceded and accompanied by the continuation of detailed geological mapping (surface and galleries of the old CPRM mine), topographic survey and specific geologic studies. Gold Hills Mining Ltda. has also prepared a detailed technical report which was filed at the DNPM along with a request for the extension of the exploration permit for three more years. The exploration program at the property is going on, and currently Gold Hills Mining Ltda. is processing all the exploration and drilling data, in order to proceed with a preliminary resources/reserves estimation, in order to comply with the legal requirements of the Brazilian Mining Code.

As an exploration property, both the equipment and infrastructure are provisional, consisting mainly in vehicles and outsourced drilling equipment, and simple premises such as office and drill core storage buildings. In addition, Gold Hills Mining Ltda. has recovered the old CPRM mine underground galleries, which are fully accessible through a shaft equipped with an elevator. In the event that operations at the Gold Hills property expand, mining may be conduct both open-pit and underground.

The Gold Hills property is at medium to advanced exploration stage. The purpose of the current activities is to conclude the geological studies (mapping, topography, geochemistry, geophysics and drilling) in order to produce a prefeasibility study of the property. Gold Hills Mining Ltda. has not yet confirmed the amount of reserves at the Gold Hills Property. Provided that the necessary funds can be raised, it is anticipated that exploration work (including infrastructure, geology and geochemistry) will continue through June of 2014. Drilling will continue through March of 2013. Prefeasibility studies will be completed by June of 2014, with feasibility studies completed by the end of December 2014. A mining concession request will be completed by June of 2015. Environmental licensing will be an ongoing process, portions of which will be completed by June 2013, and other portions of which will be completed between April and December of 2015. Gold Hills Mining Ltda. anticipates that equipment will be purchased during the period from April of 2013 through December of 2013. If exploration is a success, and the necessary permits are received, plant construction will commence between July and December of 2013, with provisional and commercial production to commence thereafter.

The total costs incurred through June 30, 2012 at the Gold Hills project have amounted to approximately US$800,000, and the projected budget from now to the feasibility study, which is considered the end of the exploration phase, is estimated at US$12,000,000, of which $4,000,000 will be spent during the fiscal year ended June 30, 2013. It is anticipated that the current drilling program is anticipated to cost approximately $700,000. The Company will need to raise such funds from loans or the sale of additional securities in order to continue work at the Gold Hills project.

10

Acquisition of Mineral Rights in Brazil’s Carajás Mining District in the State of Para, Brazil

The Company announced on October 24, 2011 that Gold Hills Mining Ltda., its wholly owned Brazilian subsidiary, has, effective October 18, 2011, closed on its acquisition of the mineral rights in a highly mineralized area of 9,000 Hectares located in the Carajas Mineral Province, State of Para, with an option exercise payment of $350,000 plus additional payments totaling $107,756 made to the Cooperativa dos Produtores de Minerios de Curionópolis (“COOPEMIC”). The Company refers to this property as Serra do Sereno, or Misty Hills.

In addition to the option exercise payment made to COOPEMIC, the Company has undertaken certain exploration commitments to COOPEMIC. The Company has also agreed to make subsequent payments to COOPEMIC on the basis of the exploration report and the extent of the extraction of gold, silver, copper and their respective by-products. If the Company determines it is advisable to continue exploration, the Company shall pay to COOPEMIC $250,000 after six months of exploration and an additional $150,000 after twelve months of exploration. If the Company’s exploration activities confirm the existence of gold, silver or cooper and their respective by-products in excess of 400,000 gold equivalent ounces, certified under the standard NI-43101, as established by the Canadian Securities Administration as “measured resources,” the Company shall pay to COOPEMIC, at the end of such initial exploration, 30% of $21 per gold equivalent ounce contained in the mineral reserves in three tranches: (i) one-third shall be paid when the Brazilian National Department of Mineral Production shall approve the final mineral exploration report; (ii) one-third shall be paid upon commencement of the extraction of gold, silver, copper and their respective by-products, contained in the areas covered by the mining rights; and (iii) one-third shall be paid within six months from the date of commencement of the extraction of gold, silver and copper and their respective by-products, contained in the areas covered by the mining rights.

11

Legal and Regulatory Issues regarding the Misty Hills Property

Gold Hills Mining Ltda. holds a federal mineral exploration permit granted by the DNPM. Gold Hills Mining Ltda. acquired these rights from COOPEMIC, an artisanal miners cooperative.

The Misty Hills property is officially identified by the DNPM Process Number 851.223/2011. That process number corresponds to a mineral exploration permit, located in the County of Curionópolis, in Pará State in the North of Brazil. The permit was granted on May 8, 2012, for an initial period of three years that can be renewed or extended for another three years. As noted under “Legal and Regulatory Issues regarding the Gold Hills Property,” the surface rights (land ownership) related to properties of this type are distinct from the ownership of mineral rights related to properties of this type, including this particular property.

The Misty Hills exploration permit consists in a single claim, which covers 9,000 hectares, and was originally granted for gold (primary ore “load type”), however, in the event that Gold Hills Mining Ltda. were to identify another mineral in the area it could acquires the right to include such mineral in its permits after advising the DNPM.

An annual payment to the DNPM is required for the Misty Hills exploration concessions. During the first three years, the annual payment is determined based on R$2.23 per hectare per year. During the extension period it will increase to R$3.38 per hectare per year. The first period will expire on May 8, 2014. Once the exploration activities have been completed, a final report must be submitted to the DNPM, to demonstrate the existence of economically extractable material; if the report is approved by DNPM, a request for a mining concession must be filed and comply with the legal requirements established by the Mining Code within a one year period.

On August 23, 2012, the Company announced that the Brazilian National Department of Minerals Production has completed the legal procedures required to transfer to the Company the exploration rights for the Company’s Misty Hills property.

Gold Hills Mining Ltda. will be required to apply for a permit from the Para State Environment Secretariat in order to disturb vegetation at the Misty Hills property. This permit will require limited environmental work and is estimated by Gold Hills Mining Ltda. to involve a two month process to complete.

To date, Gold Hills Mining Ltda. has not been required to get an environmental license for the Mist Hills project. Determinations regarding the necessary licenses will be made at a later date. The Misty Hills property will likely be subject to stricter environmental regulation than the Gold Hills project.

Description of the Misty Hills Property

The Misty Hills property comprises 9,000 hectares, covered by a single exploration permit. The property is located in Curionópolis, a town located on the Southeast portion of the Pará State, Brazil. The property is centered about the geographic coordinates 6O 14 21.76’’ S 49 36 21.92 W (UTM 660,115.81 E and 9321,386.53 S – DATUM SAD 69). Although Gold Hills Mining Ltda. already has free access to the area, Gold Hills Mining Ltda. is presently negotiating agreements with the relevant landowners.

Minerals at the Misty Hills Property

The Serra dos Carajás Mineral Province is a distinct geologic dominium, well known worldwide for hosting Brazil’s largest iron, copper and gold deposits.

The local geology at the Misty Hills property is represented by Archean volcanic and meta-sedimentary rocks associated to the Rio Novo Group, a unity of the Xingu Complex. The area is intersected by the eastern-southeastern edge of the Itacaiunas Shear Zone, a regional NW-SE structure that hosts many of the precious and base metals deposits known in the Carajás Mineral Province. The gold mineralization is associated with quartz veins and a copper-rich hydrothermal breccia that delineates a 23 kilometer North East-South East anomalous trend.

12

The Carajás Mineral Province is the most important mining area of Brazil, hosting world class deposits of iron ore, manganese, nickel, bauxite copper and gold. The Misty Hills property was initially prospected by artisanal miners, and then by another mining company, prior to the involvement of Gold Hills Mining, Ltda. in the project. Preliminary exploration works, including superficial mapping and geochemical survey, revealed the existence of an anomalous gold trend that extends over 20 km, cutting the area as two roughly parallel elongated stripes with 0.5 to 1 km width, these exploration works have also indicated the potential for the existence of an IOCG –type deposit (iron ore, copper and gold ore), a conclusion consistent to further discoveries at surrounding properties. The company which previously engaged in exploration at the property failed to keep the property for not presenting the final report on time and the DNPM put the area on a public bid, which was won by the artisanal miners cooperative COOPEMIC. Samples at the main old artisanal miners pit have returned high grade values for copper and gold, confirming the potential of the area and justifying the exploration works envisaged from the area. The mineral deposit at the Misty Hills property is a “lode” type.

All samples were collected and prepared by Gold Hills Mining Ltda.’s personnel in the field, with the necessary care to avoid contamination of metals eventually contained in any kind of jewelry or personal accessories, properly logged and shipped to the Acme Labs preparation facility in Goiânia, Brazil, from where the samples were shipped to Acme’s Santiago, Chile and/or Vancouver, Canada laboratories for fire assay gold analysis or multi-element analyses, depending on the case. The Company utilized a QA/QC chain of custody program overseen by its geologists concerning its samples, and blanks and standards are used to follow the analyses assurance. Double checking using a second internationally certified lab is also included in the methodology.

At the present time, the Misty Hills property is the subject of a full historical data review and the field activities are restricted to previous works and exploration history review, reconnaissance, superficial mapping, regional sampling and gathering of environment information for the environmental study necessary to apply for the state environmental license. To date, no reserves have been confirmed at the Misty Hills property.

Transportation at the Misty Hills Property

The Misty Hills property is located 796 kilometers from Belem, the capital of the State of Para, Brazil. There are roads located within several hundred meters of the Misty Hills property. The Carajas airport is located within 80 kilometers of the project. Curionóplois is accessible through paved roads to the two most important regional centers, Paraupebas (located 70 kilometers away) and Marabá (located 150 kilometers).

Water and Electricity at the Misty Hills Project

Once the Misty Hills project becomes active, the project will have access to power provided by the Tucurui Power Plant, Brazil’s second-largest hydroelectric plant, located 150 kilometers from the property. The Misty Hills property has adequate access to water.

Current Exploration at the Misty Hills Project

To date, Gold Hills Mining, Ltda.’s efforts at the Misty Hills property have mainly involved gathering samples. During the period covered by this Report, minimal funds were expended at the Misty Hills property. The Company plans to begin the initial exploration campaign at Misty Hills as soon as financing for the project can be obtained. The Company has agreed, under the Option Agreement, to expend a minimum of $5,000,000 in the exploration of the applicable mining rights area. The Company expects that the initial campaign will cost between $5,000,000 and $10,000,000. The Company has not yet raised the necessary funds to commence exploration at the Misty Hills project.

Provided that the necessary funds can be raised, it is anticipated that exploration work (including infrastructure, geology and geochemistry) will continue through June of 2014. Drilling will continue through December of 2014. Prefeasibility studies will be completed by September of 2014, with feasibility studies completed by the end of March 2015. A mining concession request will be completed by June of 2015. Environmental licensing will be an ongoing process, portions of which will be completed between April of 2015 and March of 2017. Gold Hills Mining Ltda. anticipates that equipment will be purchased during the period from June of 2015 through March of 2016. If exploration is a success, and the necessary permits are received, plant construction will commence in April of 2017, with provisional and commercial production to commence thereafter.

The campaign at the Misty Hills project will be overseen by the Company’s President, Luciano de Freitas Borges, and Mr. Alexey Kotov, a consultant. Both Mr. Borges and Mr. Kotov are geologists. It is unknown at this time whether mining operations at the Misty Hills property would be conducted underground or open-pit.

13

Other Prospective Acquisitions

On September 25, 2010, the Company entered into a letter of intent (the “Letter of Intent”) with Rio Sao Pedro Mineracao LTDA (“Rio Sao Pedro”), a Brazilian mining company. Rio Sao Pedro owns a prospective gold mine, the “Fazenda Lavras,” which is near the Morro do Ouro mine of Kinross Gold Corporation in the city of Paracatu, located in the State of Minas Gerais, Brazil. The Rio Sao Pedro Fazenda Lavras property covers approximately 211 hectares (approximately 521 acres), with gold mining rights and other mineral rights on a total of 828 hectares (approximately 2,046 acres). The Company and Rio Sao Pedro and the Sellers continued negotiations for the acquisition of Rio Sao Pedro amicably for some time, however, at the present time, the Company does not anticipate that this transaction will proceed.

On December 12, 2010, the Company entered into an Exploration and Acquisition Agreement (the “Capri Agreement”) with Afrocan Resources Ltd. (“Afrocan”). Afrocan owns 100% of all issued and outstanding shares of Capri General Trading Co. Ltd. (“Capri”), which is the legal and beneficial owner of 100% of all mineral rights on a property in Tanzania (the “Shenda Property”). The Company agreed that subject to certain conditions, including final due diligence satisfactory to the Company and the completion and execution of detailed long form agreements supplementing the terms and conditions of the Capri Agreement, the Company would conduct exploration activities at the Shenda Property. In the event that the Company could ascertain certain levels of commercially available and commercially exploitable reserves, the Company would acquire all of the issued and outstanding equity interests in Capri from Afrocan in exchange for shares of the Company’s common stock. As of the date of this Report, the Company is no longer actively pursuing the Capri transaction.

During 2011, the Company agreed to general terms for the purchase of 100% of the shares of Sociedad Minera Las Cumbres SAC (“Las Cumbres”), the operator of a silver mine located in the Churín region of Peru, approximately 150 miles Northeast of the capital city of Lima. The Company also entered into an option agreement with Alfredo de Lima SMRL to purchase the mineral rights for the Condorsenga mine, where the Las Cumbres operation is located. These agreements were subject to certain conditions which were not fulfilled by the counterparties, and the Company is no longer pursuing these transactions. The Company determined that due to certain political and regulatory changes and uncertainties, it is not advisable for the Company to pursue potential mining operations in Peru in the immediate future.

Employees

As of the end of the period covered by this Report, we had no employees in Brazil, other than Mr. Luciano Borges, and we utilized the services of consultants at the Gold Hills project as needed. Since June of 2012, we have also utilized the services of Para Geoexperts for certain tasks at the project. Subsequent to the period covered by this Report, the Company’s staff has expanded, and now includes one employee in the United States, one in Brazil and two in Europe (the Company’s Chief Exploration Geologist / Exploration Vice President of Gold Hills Ltda. and the Company’s Investor Relations Manager). The Company has also hired two independent consultants, a geologist and an exploration technician. In addition, subsequent to the period covered by this Report, the Company announced that it has contracted Drilrent Ltd., a Brazilian-based company, to commence an exploratory drilling campaign at Gold Hills, and certain work at Gold Hills will be conducted by temporary employees of Drilrent. The Gold Hills project is currently staffed by between 30-35 technicians, laborers and geologists at any given time, including Mr. Borges, the Company’s consultants, and employees of Para Geoexperts and Drilrent. The Company intends to maintain this level of staffing at the Gold Hills project through the end of December, 2012, as the Company proceeds with its exploratory campaign work.

14

Corporate Development Services Agreement

On September 27, 2010, the Company entered into a Corporate Development Services Agreement (the “Services Agreement”) with CRG Finance AG (“CRG”). Pursuant to the Services Agreement, CRG agreed to render to the Company consulting and other strategic advisory services (collectively, the “Advisory Services”). The Company agreed to pay to CRG the following amounts for the Advisory Services: (i) an inception fee of US$100,000.00 (one hundred thousand U.S. dollars) and (ii) a monthly services fee of US$25,000.00 (twenty five thousand U.S. dollars) per month, payable each month for the period commencing as of September 1, 2010. The Company agreed to pay CRG $10,000 per month of the Advisory Services Fee beginning September 1, 2010, with the balance of $15,000 per month of the Advisory Services Fees together with the Inception Payment accruing until completion of the first Company financing when such accruals shall be fully due and payable. In consideration of any and all Investment Banking Services provided to the Company, CRG shall receive in cash ten percent (10%) of the total value of each such transaction, payable at the closing of each such transaction. The Services Agreement also contains provisions for the reimbursement of reasonable expenses incurred by CRG, and for indemnification of CRG and its affiliates from claims related to the services provided under the Services Agreement. The term of the Services Agreement shall be three years, and may be terminated at any time for any reason by CRG upon not less than thirty (30) days’ advance written notice. During May and June 2011, the inception fee and the accrued monthly service fees through June 2011 were paid in full. In July 2011, Ardent Mines and CRG entered into a suspension agreement whereby the investment banking services were terminated and the monthly service fees beginning July 2011 will no longer be due. During the year ended June 30, 2011, we borrowed a total of $750,000 from CRG Finance AG at a rate of 7.5% per annum, calculated based on a year of 365 days and actual days elapsed. The loan, plus any interest accumulated, is due upon demand after the first anniversary of the agreement date within thirty calendar days upon delivery to the Borrower a written demand by the Lender. On October 18, 2011, the loan become convertible into common stock at the holder’s option at $3.68 per share.

CRG Finance AG Commitment Agreement

On March 1, 2012, the Company and CRG Finance AG entered into a commitment letter (the “Commitment Letter”) pursuant to which CRG Finance AG has agreed to provide the Company with up to One Million U.S. Dollars (USD $1,000,000) to maintain the Company’s ordinary course of business operations. Funds underlying the Commitment Letter may be drawn by the Company in increments or tranches upon written consent of CRG Finance AG at any time prior to the first anniversary of the date of the Commitment Letter. The Commitment Letter will facilitate funding for the Company as a supplement to the prior commitment of CRG Finance AG in the amount of One Million U.S. Dollars (USD $1,000,000) that was contained in the Corporate Development Services Agreement between CRG Finance AG and the Company, dated September 27, 2010, which has been fully drawn by the Company.

Any and all draws against the Commitment Letter shall be subject to the following conditions: (i) adherence of the Company to its business plan; (ii) satisfactory progress with respect to operations of the Company; (iii) satisfactory management of the Company; (iv) satisfactory compliance of the Company with any and all laws, rules, and regulations applicable to the Company, its subsidiaries and their respective operations; and (v) in such increments or tranches reasonably acceptable to CRG Finance AG (collectively, each of (i), (ii), (iii), (iv) and (v), are referred to as the “Conditions Precedent”). The satisfactory nature of any and all of the Conditions Precedent shall in each case be determined at the sole discretion of CRG Finance AG. Neither the Company nor any third party shall have any rights of any nature of kind whatsoever to compel CRG Finance AG to perform in respect of the Commitment Letter if CRG Finance AG has determined that the Company is deficient with respect to one or more of the Conditions Precedent.

15

Amended and Restated Senior Secured Note

On March 1, 2012, the Company issued an Amended and Restated Senior Secured Note to CRG Finance AG in the amount of $1,142,900 (the “Amended and Restated Note”). The Amended and Restated Note consolidates (i) all the outstanding loans, advances and interest due and payable to CRG Finance AG for all periods prior to December 31, 2011; (ii) the additional advances and loans to the Company subsequent to December 31, 2011 through February 28, 2012, but without the inclusion of interest; and (iii) all advisory fees due and payable to CRG through February 28, 2012.

The Amended and Restated Note has an interest rate of seven and one-half percent (7.5%) per annum. All principal and interest on the Amended and Restated Note shall be due and payable thirty (30) days after notice and demand to the Company by CRG Finance AG. In the event of a default by the Company under the terms of the Amended and Restated Note, the interest rate shall increase to sixteen percent (16%) per annum.

Security Agreement

The Amended and Restated Note is secured by a senior security interest of CRG Finance AG in all tangible and intangible assets and properties of the Company and its subsidiaries as collateral pursuant to the terms and conditions of a Security Agreement entered into with CRG Finance AG (the “Security Agreement”). The Security Agreement will also secure and include all future notes issued by the Company as and when the Company draws upon the supplemental funds to be made available to the Company under the terms of the Commitment Letter. The extent of the security interest in such collateral includes all currently owned assets and properties of the Company and its subsidiaries and all after-acquired worldwide assets of the Company and its subsidiaries.

Where You Can Find More Information

The Company files annual, quarterly and other requisite filings with the U.S. Securities and Exchange Commission (the “SEC”). Members of the public may read and copy any materials which we file with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Room 1580, Washington, D.C. 20549. Members of the public may obtain additional information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC also maintains an internet site that contains reports, proxy and information statements, as well as other information regarding issuers that file electronically with the SEC. This site is located at http://www.sec.gov.

We maintain an Internet website at www.ardentmines.com. In addition to news and other information about our company, we make available on our website our annual report on Form 10-K, our quarterly reports on Form 10-Q, our current reports on Form 8-K and all amendments to those reports as soon as reasonably practicable after we electronically file this material with, or furnish it to, the Securities and Exchange Commission and copies of our Code of Ethics. The information available on our website is provided for convenience only and is not incorporated into this Report.

You may also request a copy of our filings at no cost, by writing or telephoning us at:

Ardent Mines Limited

100 Wall Street, 10th Floor

New York, NY 10005

Telephone: (516) 602-9065

Attention: Urmas Turu

Title: Interim Chief Executive Officer

16

ITEM 1A. RISK FACTORS

An investment in our Company involves a risk of loss. You should carefully consider the risks described below, before you make any investment decision regarding our Company. Additional risks and uncertainties may also impair our business. If any such risks actually materialize, our business, financial condition and operating results could be adversely affected. In such case, the trading price of our common stock could decline.

Risks Related to Our Company

We have not yet commenced revenue generating operations under our business model and we have no past performance which can serve as an indicator of our future potential.

We are presently at the early stages of the implementation of our business plan. Our most recent financial statements will therefore not provide sufficient information to assess our future prospects. Our likelihood of success must be considered in light of all of the risks, expenses and delays inherent in establishing a new business, including, but not limited to unforeseen expenses, complications and delays, established competitors and other factors.

Our Auditors have issued an opinion expressing uncertainty regarding our ability to continue as a going concern. If we are not able to continue operations, investors could lose their entire investment in our Company.

We have a history of operating losses, and may continue to incur operating losses for the foreseeable future. This raises substantial doubts about our ability to continue as a going concern. Our auditors issued an opinion in their audit report dated October 15, 2012 expressing uncertainty about our ability to continue as a going concern. This means that there is substantial doubt whether we can continue as an ongoing business without additional financing and/or generating profits from our operations. If we are unable to continue as a going concern and our Company fails, investors in our Company could lose their entire investment.

We need to raise additional capital which may not be available to us or might not be available on favorable terms.

We will need additional funds to implement our business plan as our business model requires significant capital expenditures. We will need substantially more capital to execute our business plan. Our future capital requirements will depend on a number of factors, including our ability to grow our revenues and manage our business. Our growth will depend upon our ability to raise additional capital, possibly through the issuance of long-term or short-term indebtedness or the issuance of our equity securities in private or public transactions. If we are successful in raising equity capital, because of the number and variability of factors that will determine our use of the capital, our ultimate use of the proceeds may vary substantially from our current plans.

We were incorporated in July 2000 and have yet to generate any revenues. We have losses which we expect to continue into the future. As a result, we may have to suspend or cease operations.

We were incorporated on July 27, 2000, and have not generated any revenues. Our net loss since inception is significant. To achieve and maintain profitability and positive cash flow we are dependent upon our ability to generate revenues and control exploration costs.

Based upon current plans, we expect to incur operating losses in future periods. This will happen because there are expenses associated with the exploration of our mineral properties. As a result, we may not generate revenues in the future. Failure to generate revenues will cause us to suspend or cease operations.

We will have to hire additional qualified personnel. If we cannot locate qualified personnel, we may have to suspend or cease operations.

We will have to hire additional qualified persons to perform surveying, exploration, and excavation of the Gold Hills property and properties we may acquire in the future. If we are unable to hire additional skilled employees, our operations will not succeed.

17

Indebtedness may burden us with high interest payments and highly restrictive terms which could adversely affect our business.

As a matter of Company policy, our financial plans will limit our debt exposure to a reasonable level. However, a significant amount of indebtedness could increase the possibility that we may be unable to generate sufficient revenues to service the payments on indebtedness, when due, including principal, interest and other amounts.

We may be exposed to tax audits.

Our U.S. federal and state tax returns may be audited by the U.S. Internal Revenue Service (the “IRS”). An audit may result in the challenge and disallowance of deductions claimed by us. We are unable to guarantee the deductibility of any item that we acquire. We will claim all deductions for federal and state income tax purposes which we reasonably believe that we are entitled to claim. In the event the IRS should disallow any of our deductions, the directors, in their sole discretion, will decide whether to contest such disallowance. No assurance can be given that in the event of such a contest the deductions would be sustained by the courts.

Because we intend to conduct our mineral exploration activities outside of the United States, we will be required to obtain approvals from foreign national and local governments.

The Company intends to pursue projects outside of the United States, which may require us to seek the approval of various foreign governments. Seeking such approvals may be expensive, complex, time consuming and uncertain.

Risks related to our Stock

We do not anticipate paying cash dividends.

We do not anticipate paying cash dividends in the foreseeable future. We intend to retain any cash flow we generate for investment in our business. Accordingly, our common stock may not be suitable for investors who are seeking current income from dividends. Any determination to pay dividends on our common stock in the future will be at the discretion of our board of directors.

Because the market for our common shares is limited, investors may not be able to resell their common shares.

Our common shares trade on the pink sheets electronic quotation system. Trading in our shares has historically been subject to very low volumes and wide disparity in pricing. Investors may not be able to sell or trade their common shares because of thin volume and volatile pricing with the consequence that they may have to hold your shares for an indefinite period of time.

There are legal restrictions on the resale of the common shares offered, including penny stock regulations under the U.S. Federal Securities Laws.

Our common stock may continue to be subject to the penny stock rules under the Securities Exchange Act of 1934, as amended. These rules regulate broker/dealer practices for transactions in “penny stocks.” Penny stocks are generally equity securities with a price of less than $5.00. The penny stock rules require broker/dealers to deliver a standardized risk disclosure document that provides information about penny stocks and the nature and level of risks in the penny stock market. The broker/dealer must also provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker/dealer and its salesperson and monthly account statements showing the market value of each penny stock held in the customer's account. The bid and offer quotations and the broker/dealer and salesperson compensation information must be given to the customer orally or in writing prior to completing the transaction and must be given to the customer in writing before or with the customer's confirmation. In addition, the penny stock rules require that prior to a transaction, the broker and/or dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written agreement to the transaction. The transaction costs associated with penny stocks are high, reducing the number of broker-dealers who may be willing to engage in the trading of our shares. These additional penny stock disclosure requirements are burdensome and may reduce all of the trading activity in the market for our common stock. As long as the common stock is subject to the penny stock rules, our shareholders may find it more difficult to sell their shares.

18

If we raise additional funds through the issuance of equity or convertible debt securities, your ownership will be diluted.

If we raise additional funds through the issuance of equity or convertible debt securities, the percentage ownership held by existing shareholders will be reduced. New securities may contain certain rights, preferences or privileges that are senior to those of our common shares. Furthermore, any additional equity financing may be dilutive to shareholders, and debt financing, if available, may involve restrictive covenants, which may limit our operating flexibility with respect to certain business matters.

Grants of stock options and other rights to our directors, officers and employees may dilute your stock ownership.

We plan to attract and retain our directors, officers and employees in part by offering stock options and other purchase rights for a significant number of common shares. The issuance of common shares pursuant to such options, and additional options which may be issued in the future, will have the effect of reducing the percentage of ownership of our shareholders.

Our stock price may be volatile and market movements may adversely affect your investment.

The market price of our stock may fluctuate substantially due to a variety of factors, many of which are beyond our control. The stock markets in general have experienced substantial volatility that has often been unrelated to the operating performance of particular companies. These broad market fluctuations may adversely affect the market price of our stock. Future sales of our common shares by our shareholders could depress the price of our stock.

Risks Related to the Exploration of Minerals

Mining involves financial risk and uncertainty related to hazardous operations.

The operations carried out by the Company will be subject to all the hazards and risks normally encountered in the exploration of gold mineral reserves and mining operations generally, including unusual and unexpected geologic formations, seismic activity, cave-ins, flooding and other conditions involved in the drilling and removal of material, any of which could result in damage to, or destruction of, producing facilities, damage to life or property and environmental damage, all of which may result in possible legal liability. The exploration of mineral deposits involves significant risks, which even a combination of careful evaluation, experience and knowledge may not eliminate.

The Company may not be able to adequately insure against risk.

Although we intend to maintain insurance to protect against certain risks in such amounts as we consider being reasonable, our insurance will not cover all the potential risks associated with our exploration and mining activities. We may also be unable to maintain insurance to cover these risks at economically feasible premiums. Insurance coverage may not continue to be available or may not be adequate to cover any resulting liability. We may also become subject to liability for pollution or other hazards that may not be insured against or that we may elect not to insure against because of premium costs or other reasons. Losses from these events may cause us to incur significant costs that could have a material adverse effect upon our financial performance and results of operations.

The financial success of a mining operation is difficult to predict.

Major expenses may be required to locate and establish mineral reserves. The same is true for the construction of mining facilities at a particular site once such mineral reserves have been established. It is impossible to ensure that the exploration of the gold mineral reserves by us will result in a profitable commercial mining operation. Whether a mineral deposit will be commercially viable depends on a number of factors, some of which are: the particular attributes of the deposit, such as size, grade and proximity to infrastructure; metal prices; and government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. The exact effect of these factors cannot be accurately predicted, but the combination of these factors may result in us not receiving an adequate return on invested capital.

19

The success of the exploration of gold mineral reserves by us will also be subject to a number of factors including the availability and performance of engineering and construction contractors, suppliers and consultants, the receipt of required governmental approvals and permits (including environmental permits). There can be no assurance that personnel and equipment will be available in a timely manner or on reasonable terms to successfully complete our activities as planned; that we will be able to obtain all necessary governmental approvals and permits if necessary; and that the ongoing operating costs associated with the exploration of the gold mineral reserves will not be significantly higher than anticipated by us. Any of the foregoing factors could adversely affect our operations and financial condition.

There is no certainty that the expenditures which will be made by us towards the search and evaluation of mineral deposits will result in discoveries of commercial quantities of gold ore.

Environmental risks and hazards may adversely impact the profitability of our Company.

All phases of our Gold Hills operations will be subject to environmental regulation in Brazil. Other mines that we may operate will also be subject to regulation in any other jurisdiction where we operate. These regulations may mandate, among other things, water quality standards and land reclamation. These standards may also regulate the generation, transportation, storage and disposal of hazardous waste. This will require a high degree of responsibility for us and our officers, directors and employees. There is no assurance that existing or future environmental regulation will not materially adversely affect our business, financial condition and results of operations.

Inadequate infrastructure could adversely impact the Company’s profitability.

Exploration activities depend, to one degree or another, on adequate infrastructure. Reliable roads, bridges, power sources and water supply are important determinants, which affect capital and operating costs. Unusual or infrequent weather phenomena, sabotage, government or other interference in the maintenance or provision of such infrastructure could adversely affect our operations, financial condition and results of operations.

The Company will require certain permits to commence operations.

Our exploration activities are subject to receiving and maintaining permits from appropriate governmental authorities. There is no assurance that delays will not occur in connection with obtaining all necessary renewals of permits, additional permits for any possible future changes to operations, or additional permits associated with new legislation. Prior to any operations on any of our properties, we must receive permits from appropriate governmental authorities. There can be no assurance that we will continue to hold all permits necessary to operate or continue operating at any particular property.

There are risks of economic and political instability in Brazil.

The Gold Hills property where the Company has rights for mineral extraction is located in Brazil. There are risks relating to an uncertain or unpredictable political and economic environment in Brazil.

Certain political and economic events, such as acts or failures to act by a government authority in Brazil and political and economic instability in Brazil could have a material adverse effect on our ability to continue our exploration activities in Brazil.

These risks and uncertainties include, but are not limited to: terrorism; hostage taking; extreme fluctuations in currency exchange rates; high rates of inflation; labor unrest; the risks of war or civil unrest; expropriation and nationalization; renegotiation or nullification of existing concessions, licenses, permits and contracts; changes in taxation policies; restrictions on foreign exchange and repatriation; and changing political conditions, currency controls and governmental regulations that favor or require the awarding of contracts to local contractors or require foreign contractors to employ citizens of, or purchase supplies from, a particular jurisdiction.

20

The occurrence of these various factors and uncertainties cannot be accurately predicted and could have an adverse effect on our operations or profitability.

Changes in policy by the Brazilian Government could adversely impact the Company.

Changes, if any, in mining or investment policies or shifts in political attitude in Brazil where Gold Hills operates may adversely affect its operations or profitability. Operations may be affected in varying degrees by government regulations with respect to, but not limited to, price controls, export controls, currency remittance, income and other taxes, expropriation of property, foreign investment, maintenance of claims, environmental legislation, land use, land claims of local people and water use. Failure to comply strictly with applicable laws, regulations and local practices relating to mineral right applications and tenure, could result in loss, reduction or expropriation of entitlements, or the imposition of additional local or foreign parties as joint venture partners with carried or other interests.

The Company could experience problems with title to its current property or to future properties.

Although we believe that we have taken reasonable measures to ensure proper title in all the issued and outstanding equity interests of Gold Hills and have carried out a reasonable due diligence as to the proper title of Gold Hills in the rights for mineral extraction on the property, there is no guarantee that any such title or interest will not be challenged or impaired. Third parties may have valid claims underlying portions of our Gold Hills interests, including prior unregistered liens, agreements, transfers or claims, and title may be affected by, among other things, undetected defects. In addition, we may be unable to exercise or to enforce our respective rights. As the Company acquires additional properties, similar issues could arise in connection with those properties as well.

The Company faces intense competition.

The mining industry is intensely competitive in all of its phases and we will compete with companies possessing greater financial and technical resources than we do. Competition in the precious metals mining industry is primarily for: mineral rich properties that can be operated economically; the technical expertise to find and operate such properties; the labor to operate the properties; and the capital for the purpose of funding such properties. Existing or future competition in the mining industry could materially adversely affect our prospects for mineral exploration and success in the future.

The Company will face extensive governmental regulation of the mining industry.

Our mineral exploration activities will be subject to various laws governing exploration, taxes, labor standards, mine safety, toxic substances and other matters. Mining and exploration activities are also subject to various laws and regulations relating to the protection of the environment. Amendments to current laws and regulations governing the operations and activities of our Company or more stringent implementation thereof could have a material adverse effect on our business, financial condition and results of operations.

Our right to engage in mineral extraction may be terminated in certain circumstances. Under the laws of certain jurisdictions in which we may operate, mineral resources belong to the state and governmental concessions are required to explore for, and exploit, mineral reserves. Termination of any one or more of the Company’s exploration or other rights could have a material adverse effect on our financial condition or results of operations.

ITEM 1B: UNRESOLVED STAFF COMMENTS

None.

21

ITEM 2: PROPERTIES

The Company does not own any real estate or other property. The Company owns mineral exploration rights but does not own the relevant land on which it operates. Our business office is located at 100 Wall Street, 10th Floor, New York, New York 10005. There is no rent charged for this space, which is being temporarily provided to the Company by its counsel. The Company has also established offices in Brazil.

ITEM 3: LEGAL PROCEEDINGS

During the fiscal year ended June 30, 2012, the Company filed a Complaint with the Supreme Court of the State of New York. The action was removed to the United States District Court for the Southern District of New York on May 17, 2011. The defendants include Tydus Richards; Lotus Funds, Inc.; Dave Hibbard, as trustee of the Irrevocable Trust For the Benefit of Sloane Ricky Richards dated January 14, 2008; Christopher Wilson, individually and as trustee of the Irrevocable Trust For the Benefit of Chloe Belle Richards dated January 14, 2008; Scott Richards, as trustee of the Irrevocable Trust For the Benefit of Major Tydus Richards, dated January 14, 2008; Blackwater Industries LLC; Shelly Sean Singhal; and Pacific Stock Transfer Company.

Tydus Richards has demanded the replacement of certain certificates of shares which he contends are his and which were lost or misplaced. The Company contends that Mr. Richards is not entitled to the certificates since he did not perform under a consulting agreement with the Company (Mr. Richards was supposed to perform certain services in consideration of the certificates). It is the Company’s position that since Mr. Richards did not perform under his agreement with the Company, he is not entitled to the certificates. In January 2012 the Company filed a withdrawal of the injunctive action with the court and returned the certificates to counsel for the shareholders of record affiliated with Mr. Richards thereby terminating the litigation against the Richards shareholder group. Since January 2012, there has been no known or threatened legal action on the part of the Company or shareholders of record affiliated with Mr. Richards.

ITEM 4: MINE SAFETY DISCLOSURES

Not Applicable.

22

PART II

ITEM 5: MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

(a) Market Information.

Our common stock began quotation on the Bulletin Board operated by the National Association of Securities Dealers on September 3, 2004, and is currently quoted under the symbol “ADNT” on the pink sheets electronic quotation system. The following sets forth the high and low bid quotations for the common stock as reported on the applicable quotation system for each quarter since July 1, 2010. These quotations reflect prices between dealers do not include retail mark-ups, markdowns, and commissions and may not necessarily represent actual transactions.

|

|

|

Common Stock |

| |||||

|

|

|

High |

|

|

Low |

| ||

|

Quarter Ended June 30, 2012 |

|

|

0.64 |

|

|

|

0.23 |

|

|

Quarter Ended March 31, 2012 |

|

|

0.29 |

|

|

|

0.08 |

|

|

Quarter Ended December 31, 2011 |

|

|

4.50 |

|

|

|

0.10 |

|

|

Quarter Ended September 30, 2011 |

|

|

5.75 |

|

|

|

3.75 |

|

|

Quarter Ended June 30, 2011 |

|

|

5.62 |

|

|

|

4.40 |

|

|

Quarter Ended March 31, 2011 |

|

|

5.00 |

|

|

|

4.05 |

|

|

Quarter Ended December 31, 2010 |

|

|

4.00 |

|

|

|

1.55 |

|

|

Quarter Ended September 30, 2010 |

|

|

2.10 |

|

|

|

.35 |

|

(b) Holders.

At October 11, 2012, the Company had 16,623,391 shares issued and outstanding (the number of shares issued and outstanding includes 350,000 shares of the Company’s common stock which the Company has undertaken to issue, but which the Company’s transfer agent has not yet issued). At October 11, 2012 there were 27 stockholders of record of the Company’s common stock. As of October 11, 2012, Cede & Company, held of record 5,725,264 shares of Company common stock as the custodian for stockholders whose shares are held in brokerage accounts.

(c) Dividends.

We have not declared any cash dividends, nor do we intend to do so. We are not subject to any legal restrictions respecting the payment of dividends, except that they may not be paid to render us insolvent. Dividend policy will be based on our cash resources and needs and it is anticipated that all available cash will be needed for our operations in the foreseeable future.

(d) Securities authorized for issuance under equity compensation plans

On February 24, 2012, the Company adopted a Stock Option Plan, authorizing the grant of up to 1,600,000 shares of the Company’s common stock. This plan was amended on June 28, 2012.

23

|

Plan category |

Number of securities to be issued upon exercise of outstanding options, warrants and rights |

Weighted-average exercise price of outstanding options, warrants and rights |

Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) |

|

|

(a) |

(b) |

(c) |

|

Equity compensation plans approved by security holders |

0 |

$0 |

0 |

|

Equity compensation plans not approved by security holders |

1,300,000 |

$0.13 |

300,000(1) |

|

Total |

1,300,000 |

$0.13 |

300,000(1) |

(1) On July 1, 2012, these options to purchase 300,000 shares of the Company’s common stock were issued to two employees of the Company.

Recent Sales of Unregistered Securities; Use of Proceeds from Registered Securities

Issuances of Shares

Between April 26, 2011 and June 14, 2011, the Company executed five subscription agreements to sell a total of 556,000 shares of the Company’s Common Stock (the “Shares”) at a purchase price of $3.85 per share. The Company raised a total of $2,140,600 from the sale of an aggregate of 556,000 shares. All of the aforementioned stock issuance transactions were subscribed by non-U.S. persons and were undertaken by the Company in reliance upon the exemption from securities registration under Regulation S of the U.S. Securities Act of 1933, as amended.