UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

For the quarterly period ended:

For the transition period from to

Commission file number:

DBMM GROUP

WWW.DBMMGROUP.COM

(Exact name of small business issuer as specified in its charter)

(Address of principal executive offices)

State of incorporation

IRS Employer Identification No.

(

(Issuer's telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such Files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company”, and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer ☐ Accelerated Filer ☐

Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act) Yes ☐ No

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| | |

|

Indicate the number of shares outstanding of each of the Issuer’s classes of common stock, as of the latest practicable date:

| Date | Shares Outstanding |

| July 15, 2024 | |

INDEX

|

|

Page No |

|

PART I. CONDENSED CONSOLIDATED FINANCIAL INFORMATION - UNAUDITED |

|

|

|

|

|

3 |

|

|

Consolidated Balance Sheets as of May 31, 2024 (unaudited) and August 31, 2023 (audited) |

3 |

|

4 |

|

|

5 |

|

|

6 |

|

|

7 |

|

|

Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations |

15 |

|

Item 3. Quantitative and Qualitative Disclosures About Market Risk |

35 |

|

35 |

|

|

|

|

|

PART II. OTHER INFORMATION |

|

|

|

|

|

36 |

|

|

36 |

|

|

Item 2. Unregistered Sale of Equity Securities and Use of Proceeds |

36 |

|

36 |

|

|

36 |

|

|

36 |

|

|

36 |

|

|

|

|

|

37 |

PART I. FINANCIAL INFORMATION

ITEM I. FINANCIAL STATEMENTS

DIGITAL BRAND MEDIA & MARKETING GROUP, INC. AND SUBSIDIARY

CONSOLIDATED BALANCE SHEETS

|

(Unaudited) |

(Audited) |

|||||||

|

May 31, |

August 31, |

|||||||

|

2024 |

2023 |

|||||||

|

ASSETS |

||||||||

|

CURRENT ASSETS |

||||||||

|

Cash |

$ | $ | ||||||

|

Accounts receivable, net |

||||||||

|

Prepaid expenses and other current assets |

||||||||

|

Total assets |

$ | |||||||

|

LIABILITIES AND STOCKHOLDERS' DEFICIT |

||||||||

|

CURRENT LIABILITIES |

||||||||

|

Accounts payable and accrued expenses |

$ | $ | ||||||

|

Accrued interest |

||||||||

|

Accrued compensation |

||||||||

|

Derivative liability |

||||||||

|

Loans payable, net |

||||||||

|

Officers loans payable |

||||||||

|

Convertible debentures, net |

||||||||

|

Loan payable, net of short-term portion |

||||||||

|

TOTAL LIABILITIES |

||||||||

|

STOCKHOLDERS' DEFICIT |

||||||||

| Preferred stock, Series 1, par value shares; |

||||||||

| Preferred stock, Series 2, par value shares; |

||||||||

| Common stock, par value shares; |

||||||||

|

Additional paid in capital |

||||||||

|

Other comprehensive loss |

( |

) | ||||||

|

Accumulated deficit |

( |

) | ( |

) | ||||

|

TOTAL STOCKHOLDERS' DEFICIT |

$ | ( |

) | $ | ( |

) | ||

|

TOTAL LIABILITIES AND STOCKHOLDERS' DEFICIT |

$ | $ | ||||||

See Notes to Unaudited Consolidated Financial Statements.

DIGITAL BRAND MEDIA & MARKETING GROUP, INC. AND SUBSIDIARY

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

|

(Unaudited) |

(Unaudited) |

(Unaudited) |

(Unaudited) |

|||||||||||||

|

For the three-month period ended May 31, |

For the nine-month period ended May 31, |

|||||||||||||||

|

2024 |

2023 |

2024 |

2023 |

|||||||||||||

|

REVENUES |

$ | $ | $ | $ | ||||||||||||

|

COST OF REVENUES |

||||||||||||||||

|

GROSS PROFIT |

( |

) | ( |

) | ||||||||||||

|

COSTS AND EXPENSES |

||||||||||||||||

|

Sales, general and administrative |

||||||||||||||||

|

TOTAL OPERATING EXPENSES |

||||||||||||||||

|

OPERATING LOSS |

( |

) | ( |

) | ( |

) | ( |

) | ||||||||

|

OTHER (INCOME) EXPENSE |

||||||||||||||||

|

Interest expense |

||||||||||||||||

|

Other income |

( |

) | ( |

) | ( |

) | ||||||||||

|

(Gain) loss on derecognition of liabilities |

( |

) | ( |

) | ||||||||||||

|

Change in fair value of derivative liability |

( |

) | ( |

) | ||||||||||||

|

TOTAL OTHER (INCOME) EXPENSES, NET |

( |

) | ( |

) | ||||||||||||

|

NET INCOME (LOSS) |

$ | ( |

) | $ | $ | ( |

) | $ | ( |

) | ||||||

|

OTHER COMPREHENSIVE LOSS |

||||||||||||||||

|

Foreign exchange translation |

( |

) | ( |

) | ( |

) | ( |

) | ||||||||

|

COMPREHENSIVE LOSS |

( |

) | ( |

) | ( |

) | ( |

) | ||||||||

|

NET LOSS PER SHARE |

||||||||||||||||

|

Basic |

$ | ( |

) | $ | ( |

) | $ | ( |

) | $ | ( |

) | ||||

|

Diluted |

$ | ( |

) | $ | ( |

) | $ | ( |

) | $ | ( |

) | ||||

|

WEIGHTED AVERAGE NUMBER OF SHARES |

||||||||||||||||

|

Basic |

||||||||||||||||

|

Diluted |

||||||||||||||||

See Notes to Unaudited Consolidated Financial Statements.

DIGITAL BRAND MEDIA & MARKETING GROUP, INC. AND SUBSIDIARY

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS' DEFICIT

|

(Unaudited) |

(Unaudited) |

|||||||

|

2024 |

2023 |

|||||||

|

(Restated) |

||||||||

|

Series 1 |

||||||||

|

Preferred Stock |

||||||||

|

Shares, beginning and end of period |

||||||||

|

Preferred Stock |

||||||||

|

Balance, beginning and end of period |

$ | $ | ||||||

|

Series 2 |

||||||||

|

Preferred Stock |

||||||||

|

Shares, beginning and end of period |

||||||||

|

Preferred Stock |

||||||||

|

Balance, beginning and end of period |

$ | $ | ||||||

|

Common Stock |

||||||||

|

Shares at March 1, |

||||||||

|

Transactions during the period |

||||||||

|

Shares, May 31, |

|

Shares, September 1, |

||||||||

|

Transactions during the period |

||||||||

|

Shares, May 31, |

|

Balance, at March 1, |

$ | $ | ||||||

|

Transactions during the period |

||||||||

|

Balance, May 31, |

$ | $ |

|

Balance, at September 1, |

$ | $ | ||||||

|

Transactions during the period |

||||||||

|

Balance, May 31, |

$ | $ |

|

Additional paid-in capital |

||||||||

|

Balance, at March 1, |

$ | $ | ||||||

|

Transactions during the period |

||||||||

|

Balance, May 31, |

$ | $ |

|

Additional paid-in capital |

||||||||

|

Balance, at September 1, |

$ | $ | ||||||

|

Transactions during the period |

||||||||

|

Balance, May 31, |

$ | $ |

|

Other Comprehensive Income (Loss) |

||||||||

|

Balance, at March 1, |

$ | $ | ||||||

|

Other comprehensive income (loss) |

( |

) | ( |

) | ||||

|

Balance, May 31, |

$ | ( |

) | $ |

|

Other Comprehensive Income (Loss) |

||||||||

|

Balance, at September 1, |

$ | $ | ||||||

|

Other comprehensive income (loss) |

( |

) | ( |

) | ||||

|

Balance, May 31, |

$ | ( |

) | $ |

|

Accumulated Deficit |

||||||||

|

Balance, at March 1, |

$ | ( |

) | $ | ( |

) | ||

|

Net loss |

( |

) | ( |

) | ||||

|

Balance, May 31, |

$ | ( |

) | $ | ( |

) |

|

Accumulated Deficit |

||||||||

|

Balance, at September 1, |

$ | ( |

) | $ | ( |

) | ||

|

Net loss |

( |

) | ( |

) | ||||

|

Balance, May 31, |

$ | ( |

) | $ | ( |

) | ||

|

Total Stockholders' Deficit |

$ | ( |

) | $ | ( |

) |

See Notes to Unaudited Consolidated Financial Statements.

DIGITAL BRAND MEDIA & MARKETING GROUP, INC. AND SUBSIDIARY

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

|

(Unaudited) |

(Unaudited) |

|||||||

|

For the nine-month period ended May 31, |

||||||||

|

2024 |

2023 |

|||||||

|

CASH FLOWS FROM OPERATING ACTIVITIES |

||||||||

|

Net loss |

$ | ( |

) | $ | ( |

) | ||

|

Adjustments to reconcile net loss to net cash used in operating activities: |

||||||||

|

Change in fair value of derivative liability |

||||||||

|

(Gain) loss on derecognition of liabilities |

( |

) | ||||||

|

Changes in operating assets and liabilities: |

||||||||

|

Accounts receivable |

||||||||

|

Prepaid expenses and other assets |

( |

) | ||||||

|

Accounts payable and accrued expenses |

||||||||

|

Accrued interest |

||||||||

|

Accrued compensation |

( |

) | ( |

) | ||||

|

NET CASH USED IN OPERATING ACTIVITIES |

( |

) | ( |

) | ||||

|

NET CASH USED IN INVESTING ACTIVITIES |

||||||||

|

CASH FLOWS FROM FINANCING ACTIVITIES |

||||||||

|

Proceeds from loan payable |

||||||||

|

Principal repayments loan payable |

( |

) | ( |

) | ||||

|

Officer loans payable |

( |

) | ( |

) | ||||

|

NET CASH PROVIDED BY FINANCING ACTIVITIES |

||||||||

|

EFFECT OF VARIATION OF EXCHANGE RATE OF CASH HELD IN FOREIGN CURRENCY |

( |

) | ||||||

|

NET INCREASE/(DECREASE) IN CASH |

( |

) | ||||||

|

CASH - BEGINNING OF YEAR |

||||||||

|

CASH - END OF YEAR |

$ | $ | ||||||

|

Supplemental disclosures of cash flow information: |

||||||||

|

Cash paid for interest |

$ | $ | ||||||

|

Cash paid for taxes |

$ | $ | ||||||

|

Noncash investing and financing activities: |

||||||||

|

Issuance of shares of common stock under convertible debt settlement |

$ | $ | ||||||

See Notes to Unaudited Consolidated Financial Statements.

DIGITAL BRAND MEDIA & MARKETING GROUP, INC.

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

NOTE 1 – ORGANIZATION, BASIS OF PRESENTATION AND GOING CONCERN

Nature of Business and History of the Company

Digital Brand Media & Marketing Group, Inc. (“The Company” or “DBMM”) is an OTC:PK listed company. The Company was organized under the laws of the State of Florida on September 29, 1998.

The Company strategically focuses on developing the business of its wholly owned and revenue generating online marketing services company, Digital Clarity. With deep DNA in its operating market, blending the services of an experienced professional workforce leveraging a technology offering positions the Company in a strong, forward looking structure. Digital Clarity operates in the growing area of digital marketing that helps companies make the most of the digital economy focusing on areas such as Search Engine Marketing (Google, Yahoo! & Bing), Social Media (Twitter, Facebook & LinkedIn) and Internet Strategy Planning including Design, Analytics and Mobile Marketing.

Following the acquisition of Digital Clarity in 2011 the Company has been honing its business model to be the differentiating service provider in digital marketing space to its clients and prospective business as DBMM grows into one of the leaders in the industry going forward.

Today, DBMM Group crafts, designs and executes digital marketing strategies across multiple ad platforms and social media networks for a broad array of clients to help each of them establish a uniform brand identity across the digital universe. The product offering is a unique value proposition of intelligent analytics provided by an experienced digital marketing and technology team. Therefore, DBMM Group is a blend of data, strategy and creative execution.

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America for interim financial information and with the instructions to Form 10-Q and Rule 10-01 of Regulation S-X. Accordingly, they do not include all the information and footnotes required by generally accepted accounting principles for complete financial statements. In the opinion of management, all normal recurring adjustments considered necessary for a fair presentation have been included. Operating results for the nine months ended May 31, 2024 are not necessarily indicative of the results that may be expected for the year ending August 31, 2024. For further information refer to the financial statements and footnotes thereto included in the Company’s Form 10-K for the year ended August 31, 2023.

Going Concern

The accompanying condensed consolidated financial statements have been prepared on a going concern basis. The financial statements do not reflect any adjustments that might result if the Company is unable to continue as a going concern.

The Company has outstanding loans and convertible notes payable aggregating $

Accordingly, the accompanying consolidated financial statements have been prepared in conformity with U.S. GAAP, which contemplates continuation of the Company as a going concern and the realization of assets and satisfaction of liabilities in the normal course of business. The carrying amounts of assets and liabilities presented in the financial statements do not necessarily purport to represent realizable or settlement values. The financial statements do not include any adjustment that might result from the outcome of this uncertainty.

NOTE 2 – CORRECTION OF AN ERROR

NOTE 3 – SIGNIFICANT ACCOUNTING POLICIES

Basis of Consolidation

The unaudited condensed consolidated financial statements include the accounts of the Company and its wholly owned subsidiary Stylar (DBA Digital Clarity). All significant inter-company transactions are eliminated. The Company has dissolved RTG Ventures (Europe) Limited (“RTGVE”), a dormant subsidiary during November 2022 and the subsidiary was removed from the United Kingdom Companies House in January 2023.

Cash and Cash Equivalents

Cash and cash equivalents consist primarily of cash in banks. The Company considers cash equivalents to include all highly liquid investments with original maturities of three months or less to be cash equivalents. The Company had no cash equivalents as of May 31, 2024.

Accounts Receivable and Allowance for Doubtful Accounts

Accounts receivable are recorded at the invoiced amount and do not bear interest. Accounts receivable are presented net of allowance for doubtful accounts.

The Company has a policy of reserving uncollectible accounts based on its best estimate of the amount of probable credit losses in its existing accounts receivable. The Company periodically reviews its accounts receivable to determine whether an allowance is necessary based on an analysis of past due accounts and other factors that may indicate that the realization of an account may be in doubt. Account balances deemed to be uncollectible are charged to the bad debt expense after all means of collection have been exhausted and the potential for recovery is considered remote. The Company had no allowance for doubtful accounts as of May 31, 2024.

Prepaid Expenses and Other Assets

Prepaid expenses and other assets primarily consists of refundable research and development tax credit as of May 31, 2024 of approximately $

Revenue Recognition

Revenue is recognized upon transfer of control of promised or services to customers in an amount that reflects the consideration we expect to receive in exchange for those services. We enter into contracts that can include various combinations of services, which are generally capable of being distinct and accounted for as separate performance obligations. Revenue is recognized net of any taxes collected from customers, which are subsequently remitted to governmental authorities.

Nature of Services

The Company generally provides its services to companies primarily with international exposure and expects the US business to grow going forward. The Company generally provides its services ratably over the terms of the contract and bills such services at a monthly fixed rate. Some of the services are billed quarterly. The Company’s services are sold without guarantees.

Significant Judgments

Our contracts with customers sometimes include promises to transfer multiple services to a customer. Determining whether services are considered distinct performance obligations that should be accounted for separately versus together may require significant judgment.

Judgment is required to determine Standalone Selling Price (SSP) for each distinct performance obligation. The Company uses a single amount to estimate SSP for items that are not sold separately, including set-up services, monthly search advertising services, and monthly optimization and management.

Contract Balances

The timing of revenue recognition may differ from the timing of invoicing to customers. The Company records receivable when revenue is recognized prior to invoicing, or unearned revenue when revenue is recognized subsequent to invoicing.

The allowance for doubtful accounts reflects our best estimate of probable losses inherent in the accounts receivable balance. We determine the allowance based on known troubled accounts, historical experience, and other currently available evidence.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, and disclosure of contingent assets and liabilities, at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Included in these estimates are assumptions about the collection of its accounts receivable, converted amount of cash denominated in a foreign currency, and estimated amounts of cash, the derivative liability could settle, if not in common shares. Actual results could differ from those estimates.

Income Taxes

The Company follows the provisions of the ASC 740 -10 related to, Accounting for Uncertain Income Tax Positions. When tax returns are filed, it is highly certain that some positions taken would be sustained upon examination by the taxing authorities, while others are subject to uncertainty about the merits of the position taken or the amount of the position that would be ultimately sustained. In accordance with the guidance of ASC 740-10, the benefit of a tax position is recognized in the financial statements in the period during which, based on all available evidence, management believes it is more likely than not that the position will be sustained upon examination, including the resolution of appeals or litigation processes, if any. Tax positions taken are not offset or aggregated with other positions. Tax positions that meet the more-likely-than-not recognition threshold are measured as the largest amount of tax benefit that is more than 50 percent likely of being realized upon settlement with the applicable taxing authority. The portion of the benefits associated with tax positions taken that exceeds the amount measured as described above should be reflected as a liability for uncertain tax benefits in the accompanying balance sheet along with any associated interest and penalties that would be payable to the taxing authorities upon examination. The Company believes its tax positions are all highly certain of being upheld upon examination. As such, the Company has not recorded a liability for uncertain tax benefits.

The Company has adopted ASC 740-10-25 Definition of Settlement, which provides guidance on how an entity should determine whether a tax position is effectively settled for the purpose of recognizing previously unrecognized tax benefits and provides that a tax position can be effectively settled upon the completion of an examination by a taxing authority without being legally extinguished. For tax positions considered effectively settled, an entity would recognize the full amount of tax benefit, even if the tax position is not considered more likely than not to be sustained solely on the basis of its technical merits and the statute of limitations remains open.

Earnings (loss) per common share

The Company utilizes the guidance per FASB Codification “ASC 260 “Earnings Per Share”. Basic earnings per share is calculated on the weighted effect of all common shares issued and outstanding and is calculated by dividing net income available to common stockholders by the weighted average shares outstanding during the period. Diluted earnings per share, which is calculated by dividing net income available to common stockholders by the weighted average number of common shares used in the basic earnings per share calculation, plus the number of common shares that would be issued assuming conversion of all potentially dilutive securities outstanding, is not presented separately as it is anti- dilutive. Such securities have been excluded from the per share computations for the three months period ended May 31, 2024 and the three and nine-month periods ended May 31, 2023. During the three-month period ended May 31, 2024, the dilutive securities amounted to

Derivative Liabilities

The Company assessed the classification of its derivative financial instruments as of May 31, 2024, which consist of convertible instruments and rights to shares of the Company’s common stock and determined that such derivatives meet the criteria for liability classification under ASC 815.

ASC 815 generally provides three criteria that, if met, require companies to bifurcate conversion options from their host instruments and account for them as free standing derivative financial instruments. These three criteria include circumstances in which (a) the economic characteristics and risks of the embedded derivative instrument are not clearly and closely related to the economic characteristics and risks of the host contract, (b) the hybrid instrument that embodies both the embedded derivative instrument and the host contract is not re-measured at fair value under otherwise applicable generally accepted accounting principles with changes in fair value reported in earnings as they occur and (c) a separate instrument with the same terms as the embedded derivative instrument would be considered a derivative instrument subject to the requirements of ASC 815. ASC 815 also provides an exception to this rule when the host instrument is deemed to be conventional, as described.

During the nine-month period ended May 31, 2024 and 2023, the Company had notes payable outstanding in which the conversion rate was variable and undeterminable. Accordingly, the Company has recognized a derivative liability in connection with such instruments. The Company uses judgment in determining the fair value of derivative liabilities at the date of issuance at every balance sheet thereafter and in determining which valuation is most appropriate for the instrument (e.g., Binomial method), the expected volatility, the implied risk-free interest rate, as well as the expected dividend rate.

Fair Value of Financial Instruments

Effective January 1, 2008, the Company adopted FASB ASC 820-Fair Value Measurements and Disclosures, or ASC 820, for assets and liabilities measured at fair value on a recurring basis. ASC 820 establishes a common definition for fair value to be applied to existing generally accepted accounting principles that require the use of fair value measurements establishes a framework for measuring fair value and expands disclosure about such fair value measurements. The adoption of ASC 820 did not have an impact on the Company’s financial position or operating results but did expand certain disclosures.

ASC 820 defines fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. Additionally, ASC 820 requires the use of valuation techniques that maximize the use of observable inputs and minimize the use of unobservable inputs. These inputs are prioritized below.

|

Level 1 |

Observable inputs such as quoted market prices in active markets for identical assets or liabilities. |

|

Level 2 |

Observable market-based inputs or unobservable inputs that are corroborated by market data. |

|

Level 3 |

Unobservable inputs for which there is little or no market data, which require the use of the reporting entity’s own assumptions. |

The Company did not have any Level 2 or Level 3 assets or liabilities as of May 31, 2024, except for its derivative liabilities which are valued based on Level 3 inputs.

Cash is highly liquid and easily tradable as of May 31, 2024 and therefore classified as Level 1 within our fair value hierarchy.

In addition, FASB ASC 825-10-25 Fair Value Option, or ASC 825-10-25, was effective January 1, 2008. ASC 825-10-25 expands opportunities to use fair value measurements in financial reporting and permits entities to choose to measure many financial instruments and certain other items at fair value. The Company did not elect the fair value options for any of its qualifying financial instruments.

Convertible Instruments

The Company evaluates and accounts for conversion options embedded in its convertible instruments in accordance with professional standards for “Accounting for Derivative Instruments and Hedging Activities”.

Professional standards generally provide three criteria that, if met, require companies to bifurcate conversion options from their host instruments and account for them as free standing derivative financial instruments. These three criteria include circumstances in which (a) the economic characteristics and risks of the embedded derivative instrument are not clearly and closely related to the economic characteristics and risks of the host contract, (b) the hybrid instrument that embodies both the embedded derivative instrument and the host contract is not re-measured at fair value under otherwise applicable generally accepted accounting principles with changes in fair value reported in earnings as they occur and (c) a separate instrument with the same terms as the embedded derivative instrument would be considered a derivative instrument. Professional standards also provide an exception to this rule when the host instrument is deemed to be conventional as defined under professional standards as “The Meaning of “Conventional Convertible Debt Instrument”.

The Company accounts for convertible instruments (when it has determined that the embedded conversion options should not be bifurcated from their host instruments) in accordance with professional standards when “Accounting for Convertible Securities with Beneficial Conversion Features,” as those professional standards pertain to “Certain Convertible Instruments.” Accordingly, the Company records, when necessary, discounts to convertible notes for the intrinsic value of conversion options embedded in debt instruments based upon the differences between the fair value of the underlying common stock at the commitment date of the note transaction and the effective conversion price embedded in the note. Debt discounts under these arrangements are amortized over the term of the related debt to their earliest date of redemption. The Company also records when necessary deemed dividends for the intrinsic value of conversion options embedded in preferred shares based upon the differences between the fair value of the underlying common stock at the commitment date of the note transaction and the effective conversion price embedded in the note.

ASC 815-40 provides that, among other things, generally, if an event is not within the entity’s control or requires net cash settlement, then the contract shall be classified as an asset or a liability.

Stock Based Compensation

We account for the grant of stock options and restricted stock awards in accordance with ASC 718, “Compensation-Stock Compensation.” ASC 718 requires companies to recognize in the statement of operations the grant-date fair value of stock options and other equity-based compensation.

Foreign Currency Translation

Assets and liabilities of subsidiaries operating in foreign countries are translated into U.S. dollars using either the exchange rate in effect at the balance sheet date or historical rate, as applicable. Results of operations are translated using the average exchange rates prevailing throughout the year. The effects of exchange rate fluctuations on translating foreign currency assets and liabilities into U.S. dollars are included in a separate component of stockholders’ equity (accumulated other comprehensive loss), while gains and losses resulting from foreign currency transactions are included in operations.

Concentration of Risks

The Company’s accounts and receivable as of May 31, 2024 and August 31, 2023 and revenues for the nine-month period ended May 31, 2024 and May 31, 2023 are primarily from four customers.

Recently Issued Accounting Pronouncements

Management does not believe that any other recently issued, but not yet effective, accounting standards, if currently adopted, would have a material effect on the accompanying condensed consolidated financial statements.

NOTE 4 – LOANS PAYABLE

|

May 31, 2024 |

August 31, 2023 |

|||||||

|

Loans payable |

$ | $ | ||||||

The loans payables are generally due on demand and have not been called, are unsecured, and are bearing interest at a range of

The company may have to provide alternative consideration (which may be in cash, fixed number of shares or other financial instruments) up to amounts accrued to satisfy its fixed obligations under certain unsecured loans payable. The consideration hasn’t been issued yet and is included in accrued expenses and interest expense and was valued based on the fair value of the consideration at issuance.

|

Twelve-month period ended May 31, 2025 |

$ | |||

|

2026 |

||||

|

2027 |

||||

| $ |

NOTE 5 – CONVERTIBLE DEBENTURES

|

May 31, 2024 |

August 31, 2023 |

|||||||

|

Convertible notes payable |

$ | $ | ||||||

|

Unamortized debt discount |

||||||||

|

Total |

$ | $ | ||||||

The convertible debentures matured in 2015, and bear interest at ranges between

No convertible debentures have been issued since 2015 and none executed since 2016. Certain settlements with holders of convertible debentures have been agreed since 2018 to the Company’s benefit.

NOTE 6 – OFFICERS LOANS PAYABLE

|

May 31, 2024 |

August 31, 2023 |

|||||||

|

Officers loans payable |

$ | $ | ||||||

The loans payables are due on demand, are unsecured, and are non-interest bearing.

NOTE 7 – DERIVATIVE LIABILITIES

|

May 31, 2024 |

August 31, 2023 |

|||||||

|

Effective Exercise price |

||||||||

|

Effective Market price |

||||||||

|

Volatility |

% | % | ||||||

|

Risk-free interest |

% | % | ||||||

|

Terms |

|

|

||||||

|

Expected dividend rate |

% | % | ||||||

|

Balance at August 31, 2023 |

$ | |||

|

Changes in fair value of derivative liabilities |

||||

|

Balance, May 31, 2024 |

$ |

NOTE 8 – ACCRUED COMPENSATION

As of May 31, 2024, and August 31, 2023, the Company owes $

NOTE 9 – COMMON STOCK AND PREFERRED STOCK

Preferred Stock- Series 1 and 2

The designation of the Preferred Stock- Series 1 is as follows: Authorized

The designation of the Preferred Stock- Series 2 is as follows: Authorized

Common Stock

The Authorized Shares were increased to

NOTE 10 – DERECOGNITION OF LIABIILITIES

During the nine-month period ended May 31, 2024, the Company derecognized $

During the nine-month period ended May 31, 2023, the Company successfully reached an agreement with a holder of convertible debentures aggregating $

The Company successfully reached an agreement with one its lessors to reduce its liability by $

NOTE 11 – COMMITMENTS AND CONTINGENCIES

Leases

The Company leases its facilities under non-cancellable operating leases which are renewable monthly. The leases have monthly base rents. The latest monthly base rent for the Company’s facilities ranges between $

Rental expense amounted to $

Consulting Agreement

The annual compensation of Linda Perry amounts to $

Legal Proceedings

From time to time, the Company has become or may become involved in certain lawsuits and legal proceedings which arise in the ordinary course of business. The Company intends to vigorously defend its positions. However, litigation is subject to inherent uncertainties and an adverse result in those or other matters may arise from time to time that may harm its financial position, or our business and the outcome of these matters cannot be ultimately predicted.

NOTE 12 – FOREIGN OPERATIONS

As of May 31, 2024, a majority of our revenues and assets are associated with a subsidiary located in the United Kingdom. Assets at May 31, 2024 and May 31, 2023 and revenues for the nine-month period ended May 31, 2024 and May 31, 2023 were as follows (unaudited)

|

United States |

Great Britain |

Total |

||||||||||

|

Revenues |

$ | $ | $ | |||||||||

|

Total revenues |

$ | $ | $ | |||||||||

|

Identifiable assets at May 31, 2024 |

$ | $ | $ | |||||||||

As of May 31, 2023, most of our revenues and assets are associated with a subsidiary located in the United Kingdom. Assets at May 31, 2023 and revenues for the nine-month period ended May 31, 2023 were as follows (unaudited)

|

United States |

Great Britain |

Total |

||||||||||

|

Revenues |

$ | $ | $ | |||||||||

|

Total revenues |

$ | $ | $ | |||||||||

|

Identifiable assets at May 31, 2023 |

$ | $ | $ | |||||||||

NOTE 13 – SUBSEQUENT EVENTS

The Company has analyzed its operations after May 31, 2024 through the date these financial statements were issued and has determined that it does not have any material subsequent events to disclose.

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Readers are cautioned that certain statements contained herein are forward-looking statements and should be read in conjunction with our disclosures under the heading “Forward-Looking Statements” above. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. This discussion also should be read in conjunction with the notes to our consolidated financial statements contained in Item 8. "Financial Statements and Supplementary Data" of this Report.

OPERATIONS OVERVIEW/OUTLOOK

The Company developed a document called the Creds Deck which provides a description to prospective clients of Digital Clarity’s value proposition http://www.dbmmgroup.com/wp-content/uploads/2024/03/DBMM_Creds_Deck_2024.2.pdf

Our return to normal business in the fourth quarter of 2023 faced challenges as the world shifted and attempted to stabilize post-COVID with mounting inflation. 2024 is focusing on a measured return to normalcy as businesses have faced enormous challenges over the past few years, and DBMM's operating business Digital Clarity, is no exception. However, for context, it is worth reminding investors and shareholders that Digital Clarity was acquired by DBMM as a cash-flow positive business with a great reputation and industry network, winning industry awards.

As stated in the MD&A's for many years since the acquisition of Digital Clarity, the operating business has always been cash flow positive, but the costs of maintaining a public company far exceed the gross profit in the audited financial statements. That was expected, following the digital business model, though many digital companies do not have any operating revenues while they build the business. The business is developed to a 'to be determined level' (TBD), with all capital infusion and revenues (if any) remaining in the growth model.

As the economy recovers, and the Company's mitigating circumstances have all been positively concluded, there is also an opportunity for their clients, both new and prospective, to gain a competitive advantage in the post-pandemic commercial environment. The transformation of a company guided by Digital Clarity as its digital architect demands a "seat at the table" of decision makers as the subject matter expert in the new digital landscape. Digital Clarity has earned that role. The industry as seen today and in the future is described below:

2023 REALITIES TEMPER 2024 BUDGETS AND OUTLOOK

One year ago, leaders were facing global unrest, supply chain instability, soaring inflation, the long shadow of the pandemic, and a projected economic slowdown. Yet most had overly optimistic expectations heading into budget season, with every function expecting to lock in modest budget increases for 2023.

Many of last year’s concerns didn’t materialize, and the outlook for the global economy in 2024 appears brighter as supply chain disruptions ease and inflation edges back toward targets. That said, businesses will have to deal with the after-effects of not only the global pandemic but new challenges. The backdrop as we enter 2024, it is clear that B2B leaders have concerns about inflation and higher interest rates, as they plan for 2024.

Though the general business sentiment is cautious, Digital Clarity has adapted its model to continually focus on areas that will allow the business to thrive as we come out of the challenging economic backdrop.

Digital Clarity has been pivoting during these challenging headwinds and working to build upon its experience in the B2B space and engaging with prospects in the SaaS and Tech market.

Discretionary marketing budgets, sales headcount, and software costs will continue to be scrutinized closely in 2024, though the demand for maximum performance continues, even though inflation abates particularly in the US. This will only accelerate revenue-focused marketing leadership and reduce the money invested in non-hyper-targeted channels.

Expansion will become the new-new business, making the line between revenue marketing and demand generation very thin. More of an emphasis will be on preserving revenue through retention and expansion efforts over acquiring net new customers, this is an area where Digital Clarity excels.

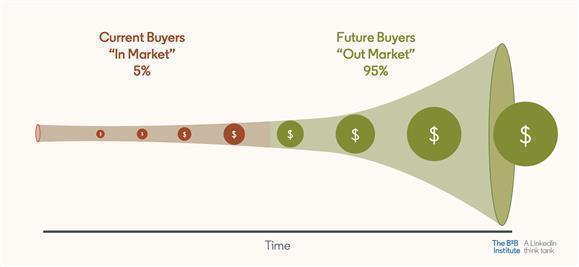

This will also push leaders to critically evaluate the way in which they acquire customers, including increasing their focus on the technology that helps them prioritize the right accounts. B2B companies beware, It may feel like you have fewer “in-market” accounts than in prior years, so the risk of wasting resources on accounts that won’t buy is much higher. To avoid this, double down on the ‘95-5’ rule, there will be a shift. to get in front of the 5% of in-market accounts that are ready to buy now. If not, it's inevitable that your competitors will target them first.

WHY B2B IS THE RIGHT PLACE AT THE RIGHT TIME

Just before and during the pandemic, DBMM’s operating business, Digital Clarity analyzed market data and found that there was a large market segment that was very badly served by the digital marketing sector and in particular lacked a level planning, strategy and general, good advice when it came to sales growth and brand positioning. This was the Business to Business (B2B) sector. In particular, the technology, software and software services sector (SaaS). This pivot was the model for Digital Clarity’s return to a level of normal trading against a continued volatile economic backdrop.

B2B is undergoing a renaissance as business models, innovation drivers, and buyers evolve dramatically from decades prior. Now some of the most profitable companies across the globe are B2B companies.

As perceptions of the U.S. economy decline, concerns over inflation persist. More than half of small business owners continue to cite it as their top concern. However, B2B leaders are hopeful about the future, even in these uncertain times.

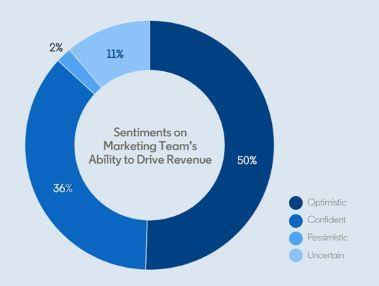

While many in the business community cite serious concerns over global economic uncertainty, B2B leaders are largely optimistic about the outlook for their organizations and the role of marketing in helping them grow.

The B2B Marketing Benchmark uncovers the trends and practices fueling this optimism: Marketing budgets are on the rise worldwide; Excitement among B2B leaders about emerging technologies like Generative AI, with growth in the adoption of creative and technical skills that will help marketers meet the demands of these emerging technologies and trends.

Digital Clarity is well poised to enable B2B leaders to thrive in a rapidly changing environment and how to plan for the long term.

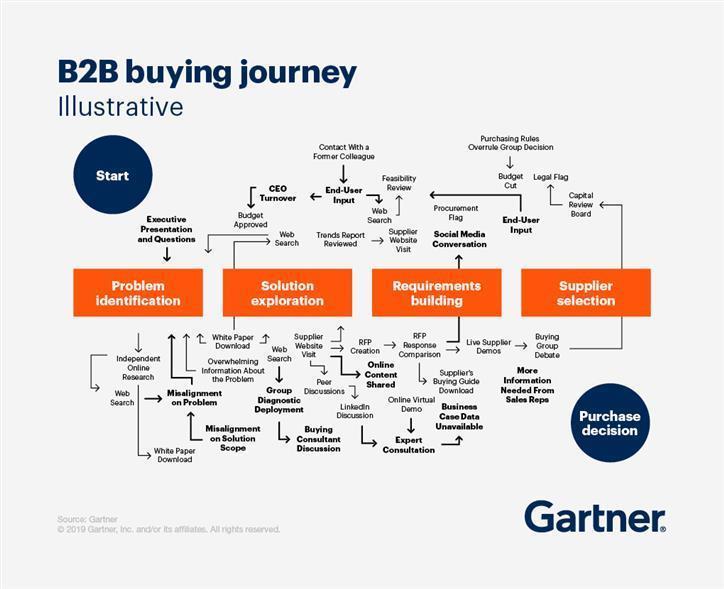

THE B2B BUYER JOURNEY IS COMPLEX. THIS IS WHY EXPERTS LIKE DIGITAL CLARITY NEED TO BE INVOLVED FROM THE START.

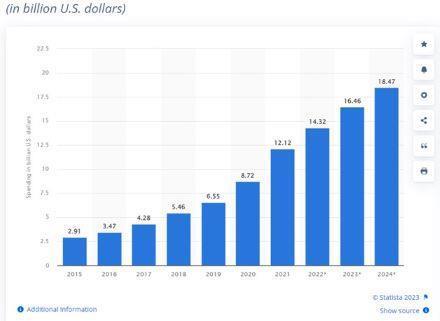

Savvy communication experts like Digital Clarity produce ideas that shape perceptions and grow markets. There has never been a better time to navigate into the B2B Marketplace as demand for an experienced, safe pair of hands is required. This sector is growing rapidly and the demand for expertise and skill to help businesses in marketing their services and products is sought after. B2B digital ad spending is projected to reach $18.47 billion by 2024, it will account for nearly 50% of total B2B ad spending that year according to Insider Intelligence.

For a long time, tried and tested B2B marketing strategies have been based around a linear model, where activities aim to gather prospects at one end of a pipeline (or funnel) and gently nudge and nurture until they leave as newly won customers at the other end.

It’s been this way for quite a while giving rise to language that any B2B marketer is familiar with such as “MQLs” (marketing qualified leads) and “SQLs” (sales qualified leads), shaping how B2B marketing and sales should work together (where one hands the baton on to the other in the form of a well nurtured, warm lead) and KPIs that evaluate this linear performance (pipeline velocity, #MQLs and #SQLs, to name just three).

So established is the thinking that the world’s biggest CRM platforms are structured around this linear model of how B2B buying takes place.

DEVELOPING A STRONGER US FOOTPRINT FOR DIGITAL CLARITY IN 2024-2025

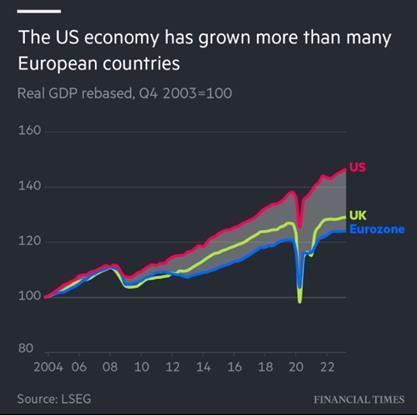

The IMF last week became the latest economics organization to declare that the US economy would power ahead, forecasting an expansion of 1.5 percent next year. This compares with IMF forecasts of 1.2 percent for the eurozone and 0.6 percent for the UK.

A critical structural factor behind the US-European divergence is the difference in the industrial composition of the economies.

2023 saw Digital Clarity have a stronger demand by prospective customers in the burgeoning B2B Tech sector and with this laser focus in the tech marketing market, Digital Clarity is well positioned to take advantage of applying its successful methodology into the largest economy in the world.

The US has a booming tech sector, with successful and innovative companies such as Amazon, Alphabet, and Microsoft that have no European equivalents in Europe. With the US dominating artificial intelligence, that gap is likely to widen, economists warn.

By contrast, Europe specializes in industries that are increasingly facing the threat of Chinese competition, such as electric vehicles.

With stronger investment and better demographics, the gap between the US and Europe is likely to widen further in the coming years.

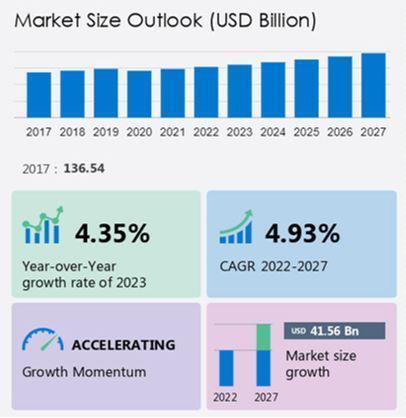

DEMAND FOR MARKETING CONSULTING IN NORTH AMERICA IS PREDICTED TO GROW BY 36%

The marketing consulting services segment is forecast to increase by USD 41.56 billion between now and 2027 with North America estimated to contribute 36% to the growth. Data from research company Technavio’s analysts have elaborately explained the regional trends, drivers, and challenges that are expected to shape the market during the forecast period. With the development of new research companies and the availability of various databases and business analytics tools, this North American region is a major contributor to the global marketing consulting market. This allows businesses to collect meaningful, useful data at a fraction of the cost that marketing consultants pay.

Additionally, the ease of scaling virtualization and automating administrative tasks dynamically will increase SaaS adoption. Due to digitalization, various businesses and organizations in this region are adopting SaaS solutions, which help improve a range of operations such as business planning, order fulfilment, and customer service. Hence, such factors are expected to drive market growth in this region during the forecast period.

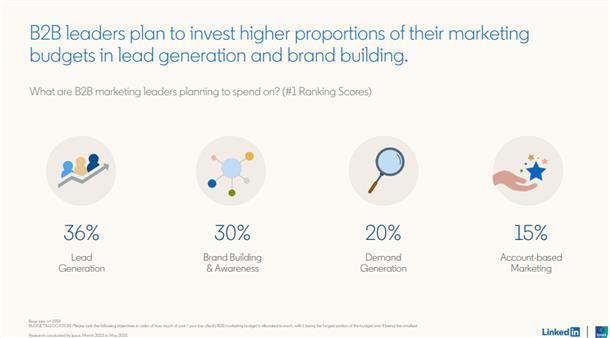

B2B BRAND INVESTMENT IS THE BIG FOCUS FOR 2024 AND BEYOND

THE SHIFT TO DIGITAL IS PERMANENT

Digital will continue to command a greater overall share as more B2B marketers make the permanent shift from traditional advertising to online activities.

One of the most pronounced effects the pandemic had on B2B marketing was exponentially accelerating its transition into digital. As the business world recovers from the pandemic and returned to more traditional models, this transition has slowed down. The past year has affirmed, however, that it will not stop.

By 2025, Gartner expects 80% of B2B sales interactions between suppliers and buyers to occur in digital channels.

B2B buying behaviors have been shifting toward a buyer-centric digital model, a change that has been accelerated in the past couple of years.

Digital Clarity sits at the intersection of marketing, analysis and sales growth for B2B Tech companies. Focus on digital-lead generation and qualification. The pandemic lockdown underscored how important it is to source and qualify new leads beyond the relationships you already have. It also accelerated digital-lead generation toward high-value customer segments. Traditional lead generation tactics like cold calling are being replaced or supplemented by lower-touch digital leads focused on meeting customers “where they are.” Sales should work closely with Marketing to source leads from typical digital sources (such as Google and LinkedIn), as well as from relevant third-party affiliates (such as LendingTree for mortgages, Trivago for travel, and Buyerzone for B2B services) that are becoming initial destinations for shoppers. Leaders in digital-lead generation can cost-effectively source and qualify leads as well as automate the lead-generation process to support their sales teams with higher propensity leads.

This can energize a sales force. For example, a private-equity owned B2B company was recently challenged with high turnover of entry-level salespeople who lost energy after months of cold calling. Focusing on a digital lead-generation strategy helped them to source more qualified leads with a higher propensity to purchase. This was a huge boost for newer salespeople and helped to supplement their other lead-generation activities, positioning them for greater sales success and reduced salesperson churn.

SALES ARE GOING DIGITAL

Gartner Says 80% of B2B Sales Interactions Between Suppliers and Buyers Will Occur in Digital Channels by 2025.

Over the next five years, an even greater rise in digital interactions between buyers and suppliers will break traditional sales models.

The Gartner Future of Sales 2025 report predicts that by 2025, 80% of B2B sales interactions between suppliers and buyers will occur in digital channels. Chief sales officers (CSOs) and other senior sales leaders must accept that buying preferences have permanently changed and, as a result, so too will the role of sellers.

Sales organizations must be able to sell to customers everywhere the customer expects to engage, interact and transact with suppliers. Gartner defines the future of sales as the permanent transformation of organizations’ sales strategies, processes and allocation of resources, moving from a seller-centric to a buyer-centric orientation and shifting from analogy sales processes to digital-first engagement with customers.

Disruptive buyer dynamics are rewriting the rulebook for B2B sales, demanding digital-first engagement with customers. The rise in digital sales will be driven by marketing that creates demand and trust in brands.

This doesn’t portend the eventual “death of the sales rep,” but it does signal drastic changes needed in the seller role. Sales leaders must deliver significant value through digital and omnichannel sales models, aided by sales professionals who can steer self-learning customers toward more confident decisions. Digital delivers this.

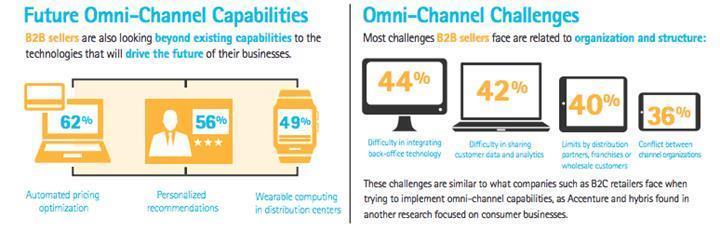

THE GROWTH OF THE DIGITAL OMNICHANNEL

Gartner research shows a steady shift of customer preferences from in-person sales interactions to digital channels. B2B buyers spend only 17% of the total purchase journey with sales reps.

Because the average deal involves multiple suppliers, a sales rep gets roughly 5% of a customer’s total purchase time. And 44% of millennials prefer no sales rep interaction at all in a B2B setting.

Sales leaders must deliver significant value through digital and omnichannel sales models, aided by sales professionals who can steer self-learning customers toward more confident decisions.

THE OMNICHANNELREMAINS KEY IN B2B BUYING

Digital Clarity can help organizations adopt the B2B Omnichannel. Eight in ten B2B leaders say that omnichannel is as or more effective than traditional methods, a sentiment that has grown sharply in the last 2 years. Even as in-person engagement re-emerged as an option, buyers made clear they prefer a cross-channel mix, choosing in-person, remote, and digital self-serve interactions in equal measure.

B2B e-commerce has taken the lead as the most effective sales channel. It is rated first by 35 percent of respondents, ahead of in-person sales (26 percent), video conference (12 percent), email (10 percent), and telephone (8 percent) according to a recent report from McKinsey. Companies winning market share have not only digital self-serve channels such as their own websites but also broader e-commerce offerings. For example, 48 percent of winners are on industry-specific marketplaces, compared with only 13 percent of companies losing share.

Digital Clarity helps companies deploy hybrid marketing models, both online and offline, that then feed into sales teams. Hybrid sales models, which are comprised of roles with a mix of both in-person and remote time with customers, are deployed by 57 percent of market-leading companies.

Customers are increasingly willing to spend big on e-commerce transactions. Many B2B companies shun e-commerce over concern about channel conflict: 38 percent of respondents said it was the biggest reason they avoided selling online. However, the sales growth opportunity may now outweigh related potential costs. Similar to last year, about 70 percent of decision-makers are prepared to spend up to $500,000 on a single e-commerce transaction. At the highest end of the spectrum, however, we see meaningful movement: the number of decision-makers willing to spend as much as $10 million or more has increased by 83 percent. This trend holds true particularly in China, India, and the United States, and in global energy and materials (GEM); telecommunications, media, and technology (TMT); and advanced industries sectors.

McKinsey says that the equilibrium is no accident. As B2B buyers flexed to remote and digital ways of engaging, they found much to like. The use and preference for e-commerce—self-serve, for example—has continually grown year on year.

Omnichannel is more effective than traditional sales models alone. As more companies enable face-to-face, remote, and e-commerce interactions, satisfaction with the sales model has grown exponentially. More than 90 percent of B2B companies say their go-to-market model is just as or more effective than before the pandemic began.

Taking an omnichannel approach means strategy and ROI are built in from the start too, so as an approach, it helps measure what works - allowing accurate attribution of results and enabling marketers to move the budget from what doesn’t work to doing more of what does. According to the recent DMA Response Rate Report, 65% of marketers use two or more media channels in their marketing campaigns while 44% of marketers use three or more.

There might be data, software, automation, and analytics considerations but B2B marketing is chiefly about ROI and about creating a large top-of funnel that can be nurtured through to sales conversion. Omni-channel is also inherent in the design. Campaigns that are planned for all relevant channels are not an afterthought.

DIGITAL CLARITY PERFECTLY POSITIONED FOR GROWTH

Organizations will have to fight hard to retain loyalty if customer needs are not met: for example, eight in ten B2B decision makers say they will actively look for a new supplier if performance guarantees.

Buyers are more willing than ever before to spend big through remote or online sales channels, with 35 percent willing to spend $500,000 or more in a single transaction. Seventy-seven percent of B2B customers are also willing to spend $50,000 or more.

B2B customers now regularly use ten or more channels to interact with suppliers.

Digital Clarity is a specialist in many of these channels and has been for a number of years. This expertise, experience, and trust will put Digital Clarity front of mind for organizations as they seek professional consultancy.

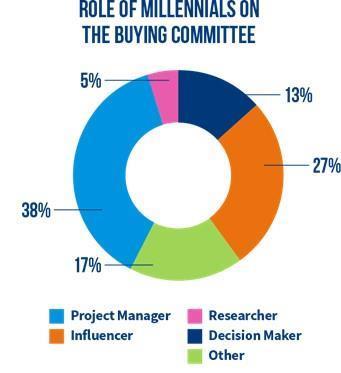

THE B2B MILLENIAL BUYER IS CHANGING THE LANDSCAPE

Millennials and Gen Z, or those born between 1996 and 2012, constitute 64% of business buyers.

Younger buyers are more demanding, engaging in more buying activities, and more willing to express their dissatisfaction with the buying process.

Nearly half of millennial buyers prefer no engagement with a salesperson at all, with the average being a third. In 2025, digital channels will account for four-fifths of all B2B sales engagements. Ultimately, the breakdown of the traditional sales model is driven by the digital shift in industrial buying, dramatically speeded up by the social distancing of vendors and clients.

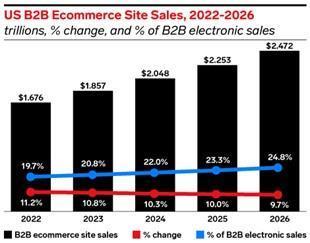

This is where Digital Clarity comes in. Part of the consulting strategy is to help B2B product sales by reshaping marketing strategies to focus on the millennial B2B e-commerce sector. Between 2024 - 2026, over $2 trillion in B2B product sales will be taking place over ecommerce websites. However, this will still represent only a small portion of overall US B2B product sales and just over a fifth of B2B electronic sales.

Millennial refers to people born between 1981 and 1996. Gen Z refers to those born between 1996 and 2012. According to a recent report from Forrester Research Inc. Millennial and Gen Z B2B buyers are now the chief purchasers of goods and services for their organization. And when it comes to ecommerce, the growing number of millennial and Gen Z professionals have very high expectations for B2B ecommerce,

Millennial and Gen Z B2B buyers also have high standards for engaging and purchasing online from sellers. Younger buyers carry new demands and expectations for B2B buying. Forrester predicts that in two years, more than a third of millennial and Gen Z business buyers will purchase through self-guided digital channels. Those include vendor websites, marketplaces, app stores, or directly from an existing product.

Furthermore, Millennials and Gen Z B2B buyers are active information seekers. Younger buyers go to more sources and find third-party resources more impactful than vendor resources. This group is quicker to express dissatisfaction with the buying experience. 90% of younger buyers cite dissatisfaction with their vendor in at least one area compared to 71% of older buyers. Digital is permanent and its market share growing. That is the future.

CONTENT MARKETING

Content has become a critical tool in the marketing mix for almost every B2B brand. Nine out of ten B2B marketers are using content marketing strategies to pull in new customers. This year, the most successful marketers were already spending 40% or more of their budget on their content strategy.

At its simplest, B2B content marketing is when a brand uses stories, ideas, and insights to engage and influence a business audience.

There is a realization amongst B2B brands that rather than being faceless organizations, they need to tell their brand’s story and show a more human side to their business, endear and promote demand from other businesses and customers. The best content marketing campaigns back up these stories and ideas with robust insights: interesting data points, original research, and real-world examples that help their customers understand a new trend or challenge and equip them with the tools and best practices to respond and thrive.

These data points and research is utilized by Digital Clarity to support companies in shaping their content strategy. Typically, areas that Digital Clarity help clients are:

|

|

● |

Blog posts – marketers who make blogging a priority are 13x more likely to see a positive ROI for their efforts. |

|

|

|

|

|

|

● |

White papers – favored by 22% of business leaders, these longer research-based reports provide more in-depth information. Learn more about writing a compelling B2B marketing white paper here. |

|

|

|

|

|

|

● |

Short-form articles – enjoyed by 37% of execs, these have to research-based if they are to stand out. |

|

|

|

|

|

|

● |

Case studies – these provide buyers with reassurance further down the buying funnel and can be made sector-specific. Nearly half of all business leaders appreciate them. |

|

|

|

|

|

|

● |

Infographics – these have become one of the most popular content marketing tools in recent years. |

|

|

|

|

|

|

● |

Podcasts – increasingly popular lead generation tools with marketers looking to deliver thought leadership content to buyers on the move. |

|

|

|

|

|

|

● |

Videos – companies using video, experience clickthrough rates that are 27% higher and web conversion rates 34% greater than those that don’t. |

|

|

|

|

|

|

● |

Email – nearly eight out of 10 marketers report seeing an increase in email engagement over the past 12 months of 2022. |

|

|

|

|

|

|

● |

LinkedIn – generates more than 50% of all social traffic to B2B websites & blogs. |

CONTENT IS INFORMATION, AND DISCOVERABLE INFORMATION DRIVES REVENUE

Information drives purchase ease and high-quality sales

All of this looping around and bouncing from one job to another means that buyers value suppliers that make it easier for them to navigate the purchase process.

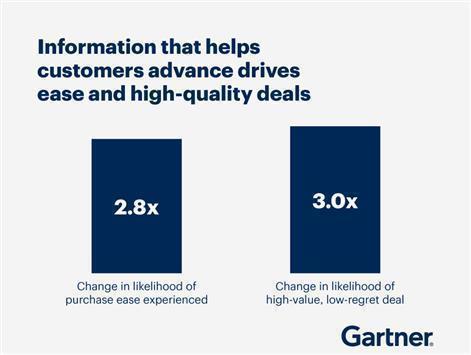

In fact, Gartner research found that customers who perceived the information they received from suppliers to be helpful in advancing across their buying jobs were 2.8 times more likely to experience a high degree of purchase ease, and three times more likely to buy a bigger deal with less regret.

Digital Clarity’s model shapes their client’s content to provide more discoverable, differentiating information, and this increases revenues. This process is one of Digital Clarity’s competitive advantages.

Buyer enablement, or the provisioning of information to customers in a way that enables them to complete information online, like gathering information or making a purchase, is an area that Digital Clarity are helping organizations.

KEY MILESTONES

As the market conditions in the consumer market are increasing in the US, the team at Digital Clarity pivoted their business model to address the need in the B2B business sector. This is a more strategic offering for prospective customers.

Digital Clarity has started offering a wider array of services to its fast-growing S company in the US. Services include, LinkedIn strategy, content positioning and SEO.

Digital Clarity has attended a major convergence summit with its client in the Unified Communication and Digital Transformation arena. This allowed the team to meet with the likes of SaaS CX providers, 8x8, Five9, and Mitel, amongst others. This will be an area of focus for the company into 2023.

In October, Digital Clarity was part of a select group that part of a panel that discussed the impact of NFTs, Blockchain and the growth of Web 3 and the Metaverse. The event was arranged by leading law firm Memery Crystal, part of Rosenblatt.

Digital Clarity has been on a large business development path and attended various networking events in London. The events include Enterprise Cyber Security hosted at the London Stock Exchange as well as diverse events in DeFi and InsureTech.

Other examples are representative of the diversity of our client base. DBMM's approach using a client's analytics and executing an individualized model to increase ROI as the prime objective, spans a wide range of industries.

Core industry verticals for Digital Clarity include B2B, SaaS, Digital Transformation, FinTech, Unified Communication Companies and discretionary advice for professional service providers and consultants.

THE GROWTH OF DIGITAL MARKETING AND CONSULTANCY SERVICES

The marketing consulting market size is estimated to grow at a CAGR of 4.93% between now and 2027 according to reports from Technavio. As mentioned previously, there is a blurring of lines between traditional consultancy, marketing firms and advertising agencies. That said, firms like Accenture, Deloitte, IBM, KPMG, McKinsey and PwC rank among the most aggressive players in acquiring and partnering with consultancies such as Digital Clarity. The growth represents not only an opportunity for Digital Clarity but also a prospective exit and investment opportunity.

Digital Clarity have continued to develop their Digital Consultancy and Strategy Planning offering. The forward-looking program is to be a recognized leader in this field and fulfill companies seeking Digital Transformation for their originations.

THE NEED FOR PROFESSIONAL CONSULTANCY AND THE OPPORTUNITY FOR MASSIVE GROWTH

Four consultancies lead Ad Age's ranking of the 10 largest agency companies in the world. With combined revenue of $13.2 billion, the marketing services units of Accenture, PwC, IBM and Deloitte sit just below WPP, Omnicom, Publicis Groupe, Interpublic and Dentsu. Last year, only two consultancies—Accenture Interactive and IBM iX—made the top 10. IBM iX was the first to break into the top 10.

Given the experience of the team, Digital Clarity’s advisory and consultancy is in demand. With the recent growth in these business areas, and the rise of consultancies, it is confirmation that Digital Clarity is headed in the right direction for growth.

THE GROWTH OF DIGITAL TRANSFORMATION WORLDWIDE

The Global Digital Transformation Market size is expected to reach $1.3 billion by 2027, rising at a market growth of 20.8% CAGR during the forecast period. Digital transformation is considered as the utilization of digital technology. Digitally transformed enterprises can be flexible to the changing technological landscape and can address abrupt shifts in the industry, particularly the one created by the COVID-19 pandemic; studies show that the efficiency and rate of adaptation of digitally transformed companies to a post-pandemic era are relatively larger than conventional businesses.

Following the pandemic, a considerable surge in awareness regarding the urgent requirement for digital transformation across a majority of the industries which created some lucrative opportunities for the global market. Companies are becoming more aware of the advantages of digital transformation, particularly in the work-from-home culture that needs a business to allow the employees to easily learn, collaborate and perform organizational functions across remote locations.

THE IMPORTANCE OF STRATEGIC MARKETING CONSULTANCY

The fundamentals of marketing may not have changed, but everything else has: goals, roles, expectations, talent needs, and more. B2B marketing leaders need to navigate this new terrain and build the capabilities needed to win. Digital Clarity helps these organizations win.

Across industries, organizations are accelerating digital transformation processes for long-term growth and profitability. Yet: “53% of the organizations surveyed remain untested in the face of digital challenge and their digital transformation readiness therefore uncertain.” This report from Gartner highlights that need embraces change.

Businesses had no choice but to respond quickly to challenging conditions. Although not formally classed as ‘agile’, the twists and turns of the pandemic have required executives to innovate on the fly and collaborate to get things done. This has been compounded by working from home, which has cut out distractions and created more time for ‘deep thinking’. Regardless of headcount, a return to more stable commercial conditions shouldn’t mean running back to the standard practices and silos that previously slowed marketers down.

Adobe says that Business-to-business (B2B) commerce will continue to undergo a major transformation as companies adopt the latest technologies to find new customers, improve their supply-chain efficiencies, and provide a more personalized user experience to their clientele.

Digital Clarity has created a unique Diagnosis Workshop that helps brands identify needs as well as assess the opportunities available. The core focus is to help reduce wastage and increase results.

Areas of focus include:

|

|

● |

Cost analysis |

|

|

|

|

|

|

● |

Audit current channels |

|

|

|

|

|

|

● |

Digital strategy planning |

|

|

|

|

|

|

● |

ROI projection planning |

|

|

|

|

|

|

● |

Digital consulting and training |

DIGITAL CLARITY HAS A COMPETITIVE ADVANTAGE

Digital Clarity operate in a highly commoditized market but have over the years build a stellar reputation that makes it different from its competitors. Some of these areas include:

|

|

1. |

Our DNA is Strategically Driven |

We believe the path to successful customer acquisition lies in understanding a client’s business – not just running a campaign. We seek to help clients understand that success has to be objective and measurable.

|

|

2. |

We are Business Led |

Digital marketing is not a cost but an asset. Not a line in a spreadsheet but an emotive force that if done right, will bring real business change and growth.

|

|

3. |

We are Digital Thinkers |

Marketing has to be at the heart of the business. Delivering real innovation in digital marketing requires not just knowledge but authority and bravery. We think digital. We drive results.

|

|

4. |

Our goal is to deliver Digital Performance |

We help our clients to understand their goals and objectives, using digital marketing to drive new business opportunities and retain their current customers.

DIGITAL CLARITY HAS DEVELOPED A WINNING STRATEGIC PROCESS

1. Discover - The first step - understand. Let's connect and see if we are the right fit.

Normally a phone call or Zoom to understand their challenges, and if there is scope for us working together.

2. Diagnose - Our diagnosis workshop helps define their goals and we discuss what’s needed to get there.

So again is either a face-to-face or a Zoom call. More in-depth. They fill in a detailed questionnaire and then we give them some exercises and get them to open up. We help them discuss their goals and objectives and what they feel the barriers are in stopping them from reaching them - .e.g. people, process, market, marketing, brand, etc.

3. Review - We take all the information, data, and objectives and build out a workable strategy. We then talk them through this game plan and how we will work with them to get there. We also can bring in people (our black book) who can get involved when there are gaps.

4. Deliver - We work with clients to implement our game plan and set clear next steps, goals, and milestones – as required.

COMPETITIVE LANDSCAPE

Digital advertising is the fastest-growing segment of the global market for advertising spending. The use of smartphones and the availability of cheap internet services are the two major factors propelling the growth prospects for this market. More than 30% of the companies are planning to spend around 75% of their advertising expenditures on digital marketing within the next five years.

“U. S. Marketers are expected to spend $110.1 billion on digital ads this year, or 51% of the $214.6 billion total U.S. advertising spending forecast, excluding political ads. Newspapers, radio, magazines, and local television now account for just 21% of the U.S. ad market.” From The Wall Street Journal

THE GROWTH OF B2B SOCIAL MEDIA

2020 will go down as the year that marketing was pulled into the boardroom. 80% of senior executives said the role of marketing in setting strategy has expanded since the pandemic. Traditional consumers have moved online, making the digital environment even more important right now.

This priority has raised the profile of marketing as companies scramble to understand the digital-first consumer. The battleground for 2024 will be about speed and agility. Now that many companies have treasure troves of data, the difference is how fast they can personalize the experience and respond to consumer behaviors. We expect to see more investment and innovation in technology infrastructure alongside marketing.

|

|

● |

76% of B2B organizations use social media analytics to measure content performance. |

|

|

|

|

|

|

● |

By 2025, 80% of B2B sales interactions will occur on digital channels. |

|

|

|

|

|

|

● |

U.S. B2B business spent $2 billion in 2022, and $2.33 billion in 2023 approximately 2-5% – 4% growth in 2024 |

GROWTH IN LINKEDIN ADVERTISING SET TO SOAR BEYOND 2023

Almost all B2B content marketers (96%) use LinkedIn. They also rated it as the top-performing organic platform.

Digital Clarity helps business organizations make the most of LinkedIn. We help customers understand and build campaigns around the 95-5 rule. The 95-5 rule advises you market mostly to buyers who are not likely to buy from you today.

THE NEW NORMAL REMAINS DIGITAL

Since the pandemic, digital adoption has happened at five to ten times the projected rate.

Lockdown periods, economic uncertainty and loss of predictability have forced customers and businesses online in previously unseen numbers. This migration has upset the power balance, with customers now more in control of the relationship and less loyal to brands and products. On top of that, 60% of companies have seen new buying behaviors such as changes to average basket size and product interests.

Pandemic disruption caused many businesses to demand a similar level of convenience to consumers. After returning to normal, there’s no question that the new normal is digital.

GROWTH IN INVESTOR AWARENESS AND OUTREACH.

We expect that, in 2024, the strategic outreach will be directed at investors around the world who understand the digital marketplace and its expanding influence on consumer decisions. DBMM will target new investors through a global digital and traditional integrated investor outreach campaign which will be run by Digital Clarity, with third parties, as required, for distribution. In all areas, the Company will act in the interests of all stakeholders.

In the full industry context of dramatic expansion of digital footprints, there has been no direct correlation between DBMM's revenues and its share price. Economic and industry analysts have opined that the industry multiple continues to grow to, in some cases, 25-30 times revenues. DBMM will expand its client and geographic scale, thus increasing revenues. There were matters outside of DBMM's control which caused growth to be in neutral, and in 2020/21 the pandemic threw all planning into disarray. With capital infusion following the closure of the SEC review with a final order in June 2023 of the earlier dismissal standing order, 2024 will follow the model of a growing client base and geographic reach until it achieves a TBD level of profitability. We anticipate the benchmark will replicate successful industry models in digital technology, marketing and company transformation.

On October 26, 2022, FINRA processed a Form 211 relating to the initiation of priced quotations of our shares of common stock, which means that the submitting broker-dealer has demonstrated to FINRA compliance with FINRA Rule 6432 and therefore has met the requirements under that rule to initiate a quotation for our shares of common stock within four days of October 26, 2022. FINRA’s processing of a Form 211 in no way constitutes FINRA’s approval of the security, the issuer, or the issuer’s business and relates solely to the submitting broker-dealer’s obligation to comply with FINRA Rule 6432 and SEA Rule 15c2-11 when quoting a security. (FINRA TO Glendale Securities)

After OTC Markets’ review of our activities following their process, our shares of common stock returned to normal market trading without restriction or caveat emptor. The caveat emptor was removed on December 20, 2022. Accordingly, plans to grow investor awareness and outreach are underway.

Glendale Securities, Inc. is the designated Market Maker.

The SEC matter remained open even after the November 12, 2019 ALJ Dismissal regarding the cured late filings, which should have closed the matter then. This has been damaging to our investors and us and impeded our business progress. Nevertheless, our compliance continued with required timely filings. In June 2023, the SEC issued an Order Dismissing Proceedings as Release 4413 advising us that their administrative proceedings against us had been dismissed, and a Final Order issued.

FINANCIAL OVERVIEW/OUTLOOK