UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

FOR FISCAL YEAR ENDED:

OR

For the transition period from to

Commission file number:

DBMM GROUP

WWW.DBMMGROUP.COM

(Name of small business issuer in its charter)

| | |

| (State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) |

(Address of principal executive offices)

(

(Issuer’s telephone number)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| | |

|

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of the Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ |

| Accelerated filer | ☐ |

| | ☐ |

| Smaller reporting company | |

| Emerging growth company | |

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b).

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was sold, or the average bid and asked prices of such common equity, as of the last business day of the registrants most recently completed fiscal quarter: on August 31, 2023: $

State the number of shares outstanding of each of the issuer’s classes of common equity, as of the latest practicable date:

Common Stock, par value $.001 per share:

DOCUMENTS INCORPORATED BY REFERENCE

If the following documents are incorporated by reference, briefly describe them and identify the part of the Form 10-K (e.g., Part I, Part II, etc.) into which the document is incorporated: (i) any annual report to security holders; (ii) any proxy or information statement; and (iii) any prospectus filed pursuant to Rule 424(b) or (c) of the Securities Act of 1933 (the “Securities Act”). The listed documents should be clearly described for identification purposes (e.g. annual reports to security holders for fiscal year ended December 24, 1980).

None

Transitional Small Business Disclosure Format (Check one): Yes ☐ No ☒

|

FORM 10-K |

||

|

For the Fiscal Year Ended August 31, 2023 |

||

|

TABLE OF CONTENTS |

||

|

|

|

Page |

|

PART I |

|

|

|

|

|

|

|

Item 1. |

4 |

|

|

Item 1A. |

4 |

|

|

Item 1B. |

5 |

|

|

Item 2. |

5 |

|

|

Item 3. |

5 |

|

|

Item 4. |

5 |

|

|

|

|

|

|

PART II |

|

|

|

|

|

|

|

Item 5. |

6 |

|

|

Item 6. |

6 |

|

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operation |

7 |

|

Item 8. |

27 |

|

|

Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

28 |

|

Item 9A . |

28 |

|

|

|

|

|

|

PART III |

|

|

|

|

|

|

|

Item 10. |

29 |

|

|

Item 11. |

31 |

|

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

32 |

|

Item 13. |

32 |

|

|

Item 14. |

32 |

|

|

|

|

|

|

PART IV |

|

|

|

|

|

|

|

Item 15. |

33 |

|

|

|

|

|

|

34 |

||

PART I

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report contains forward-looking statements. These forward-looking statements are based largely on our expectations and are subject to a number of risks and uncertainties, many of which are beyond our control. Actual results could differ materially from these forward-looking statements as a result of, among other factors, risks related to the large amount of our outstanding term loans; history of net losses and accumulated deficits; reliance on third parties to market, sell and distribute our products; future capital requirements; competition and technical advances; reliance on a small number of customers for a significant percentage of our revenues; and other risks. In light of these risks and uncertainties, there can be no assurance that the forward-looking information contained in this Annual Report will in fact occur.

ITEM 1. DESCRIPTION OF BUSINESS

ABOUT OUR BRAND DIGITAL CLARITY

Digital Clarity is the trading brand for Stylar Limited, a wholly owned subsidiary of Digital Brand Media & Marketing Group, Inc (DBMM), through its office in London, England. Digital Clarity is a leading provider of marketing consulting and advisory solutions, empowering businesses to achieve their marketing goals through strategic insights, innovative use of technologies, AI, and exceptional customer service. With a strong track record of success and a commitment to delivering tangible results, Digital Clarity is at the forefront of driving marketing change, driving growth, and creating lasting value for its clients.

DBMM Group can leverage its team’s experience in digital media and provide leading strategy, deployment and measurement to its core markets in many industry sectors, from creative to traditional corporate. The vertical B2B sectors encompass areas such as B2B eCommerce, SaaS, Blockchain, Fintech, Software Sales and Technology.

The Company continues to develop and roll out marketing consulting services offerings from its operating base in the UK with a plan to increase its presence into the larger markets in the US. namely Los Angeles and New York. The intent has always been a a strategy of a cash infusion to immediately correlate to build back demand and increase revenues. Growth has always been a function of available capital. Fiscal year 2023 following the challenges of Brexit, a Global Pandemic, and external factors beyond the Company’s control, the SEC Matter awaiting the Commission’s final affirmation of the dismissal, which occurred June 2, 2023. Digital Clarity is a leading provider of marketing consulting and advisory solutions, empowering businesses to achieve their marketing goals through strategic insights, innovative use of technologies, AI, and exceptional customer service. With a strong track record of success and a commitment to delivering tangible results, Digital Clarity is at the forefront of driving marketing change, driving growth, and creating lasting value for its clients.

EMPLOYEES

As of August 31, 2023, the Company had 8 full-time employees.

COMPETITION

There is strong competition in the digital marketing arena, though with the right level of investment and marketing, Digital Clarity has a confident outlook in using its experience to win new business in both local and international markets. DBMM has significant business relationships in place because it has a differentiating model.

ITEM 1A. RISK FACTORS

Smaller reporting companies are not required to provide the information required by this item.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. DESCRIPTION OF PROPERTY

DBMM's Corporate address is 845 Third Avenue, 6th Floor, New York, NY 10022. The operating headquarters is located in the UK as Stylar Ltd., trading as Digital Clarity. is on a month-to-month lease as it is evaluating larger quarters post-pandemic.

ITEM 3. LEGAL PROCEEDINGS

The U.S. Securities & Exchange Commission instituted an Administrative Proceeding, File No. 3-17990, on May 16, 2017 to revoke the Company's registration statement because of delinquent filings. A hearing was held on August 9, 2017 and the Initial Decision to revoke the registration was dated November 16, 2017. The order was subsequently remanded by order of the U.S. Supreme Court in December 2017. The Company responded to the Remand with evidence of mitigating circumstances under a Protective Order and filed all its delinquent filings: a Super 10-K for 2015-2016-2017 on May 31, 2018 and 10-Q's for 2018 1Q, 2Q on June 22, 2018 and 3Q on July 15, 2018, its due date.

The Hearing for January 15, 2019 was re-scheduled because of government shutdown. Digital Brand entered a Motion to Dismiss the Proceedings on March 19, 2019 based on being current as of July 2018, and all filings to date have been filed on time for the 2019 fiscal year. The facts were presented at the hearing. The Division did not support the dismissal in a response to which Digital Brand filed two Amendments to the Consolidated 10-K for 2015- 2016-2017 and the 10-K for 2018 on April 23 and 24, 2019 respectively, and Amendments No. 2 on October 1, 2019 to supersede language in Part II, Item 9A. On November 12, 2019, Carol Fox Foelak, Administrative Law Judge, Securities & Exchange Commission ordered an Initial Decision/Dismissal of the Proceeding. The Dismissal would have become effective under Rule 360 of the Commission's Rules of Practice, 17 C.F.R., Section 201.360, following the Commission’s Order of Finality. Unfortunately, on December 3, 2019 The Division of Enforcement Submitted a Petition for Review of Judge Carol Fox Foelak’s Initial Decision dismissing the Administrative Proceedings rendered on November 12, 2019. The Company filed a Motion for summary affirmance of the Initial Decision on December 20, 2019. The Motion for Summary Affirmance was not opposed by Enforcement, nevertheless the Petition for Review (“PFR”) was filed earlier.

On January 25, 2021, the Commission denied the Company’s Motion for Summary Affirmance of Judge Carol Fox-Foelak’s Dismissal of November 12, 2019 and granted the Division’s Petition for Review and set a briefing schedule beginning February 24, 2021. The Commission concluded that “briefing in the ordinary course would...assist the Commission. This appeal raises issues as to which we have an interest in articulating our views and important matters of public interest, including the proper application of the standard that governs determination of sanctions in a Section 12(j) proceeding.” Both parties have briefed and concluded April, 2021. The Company is disappointed that so much time has been lost and continues to vociferously support the original Dismissal three years ago.

The Commission notified the Company on December 9, 2021 that an extension of 90 days to issue a decision has been ordered. A sixth extension was ordered for an additional 90 days to conclude by June 5, 2023.

On June 2, 2023, the SEC issued an Order Dismissing Proceedings under Release 4413 advising us that that their pending administrative proceedings against us because of delinquent filings had been dismissed. A final Order of Dismissal closes the matter after previous unnecessary protracted delays.

Shareholders have been significantly damaged by the protracted SEC matter. The delays were further exacerbated by the unnecessary PFR requested by the Division of Enforcement while the Company continued to meet its reporting compliance since 2018 in good faith as committed to the court and contained in its cured SEC filings and thereafter.

From time to time, the Company has become or may become involved in certain lawsuits and legal proceedings which arise in the ordinary course of business. The Company intends to vigorously defend its positions. However, litigation is subject to inherent uncertainties and an adverse result in those or other matters may arise from time to time that may harm its financial position, or our business and the outcome of these matters cannot be ultimately predicted.

ITEM 4. MINE SAFETY DISCLOSURES

N/A

PART II

ITEM 5. MARKET FOR COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

MARKET INFORMATION

Our common stock is currently listed for quotation on the OTC under the symbol “DBMM”.

PER SHARE MARKET PRICE DATA

The following table sets forth, for the fiscal quarters indicated, the high and low closing bid prices per share for our common stock, as reported by on PinkSheets.com. Such quotations reflect inter-dealer prices, without retail markup, markdown or commission and may not represent actual transactions.

|

Year Ended August 31, 2023: |

High |

Low |

||||||

|

First Quarter |

$ | 0.0285 | $ | 0.0005 | ||||

|

Second Quarter |

$ | 0.0394 | $ | 0.0088 | ||||

|

Third Quarter |

$ | 0.015 | $ | 0.0032 | ||||

|

Fourth Quarter |

$ | 0.0188 | $ | 0.0087 | ||||

|

Year Ended August 31, 2022: |

High |

Low |

||||||

|

First Quarter |

$ | 0.01 | $ | 0.002 | ||||

|

Second Quarter |

$ | 0.0074 | $ | 0.0056 | ||||

|

Third Quarter |

$ | 0.0041 | $ | 0.0005 | ||||

|

Fourth Quarter |

$ | 0.0015 | $ | 0.0004 | ||||

The last reported sale price of the common stock on the OTC Electronic Bulletin Board on August 31, 2023 and 2022 were $0.0054 and $0.0005 per share, respectively. As of August 31, 2023, and 2022, there were 121 and 119 holders of record of our common stock, respectively.

On October 26, 2022, FINRA processed a Form 211 relating to the initiation of priced quotations of our shares of common stock, which means that the submitting broker-dealer has demonstrated to FINRA compliance with FINRA Rule 6432 and therefore has met the requirements under that rule to initiate a quotation for our shares of common stock within four days of October 26, 2022. FINRA’s processing of a Form 211 in no way constitutes FINRA’s approval of the security, the issuer, or the issuer’s business and relates solely to the submitting broker-dealer’s obligation to comply with FINRA Rule 6432 and SEA Rule 15c2-11 when quoting a security. (FINRA TO Glendale Securities)

Glendale Securities, Inc. is the designated Market Maker.

DIVIDENDS

We have never declared any cash dividends with respect to our common stock. Future payment of dividends is within the discretion of our board of directors and will depend on our earnings, capital requirements, financial condition and other relevant factors. Although there are no material restrictions limiting, or that are likely to limit our ability to pay dividends on our common stock, we presently intend to retain future earnings, if any, for use in our business and have no present intention to pay cash dividends on our common stock.

ITEM 6. SELECTED FINANCIAL DATA

As a “smaller reporting company”, as defined by Rule 10(f)(1) of Regulation S-K, the Company is not required to provide this information.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Certain statements contained herein are forward-looking statements and should be read in conjunction with our disclosures under the heading "Forward-Looking Statements" above. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. This discussion also should be read in conjunction with the notes to our consolidated financial statements contained in Item 8. "Financial Statements and Supplementary Data" of this Report.

The Company developed a document called the Creds Deck which provides a description to prospective clients of Digital Clarity’s value proposition http://www.dbmmgroup.com/wp-content/uploads/2023/07/DBMM_Creds_Deck_2023.pdf

The fiscal year 2023 has focused on a measured return to normalcy as businesses have faced enormous challenges over the past few years, and DBMM's operating business Digital Clarity, is no exception. However, for context, it is worth reminding investors and shareholders, that Digital Clarity was acquired by DBMM as a cash-flow positive business with a great reputation and industry network, winning industry awards.

As stated in the MD&A's for many years since the acquisition of Digital Clarity, the operating business has always been cash flow positive, but the costs of maintaining a public company far exceed the gross profit in the audited financial statements. That was expected, following the digital business model, though many digital companies do not have any operating revenues while they build the business. The business is developed to a 'to be determined level' (TBD), with all capital infusion riveand revenues (if any) remaining in the growth model.

As the economy recovers, and the Company's mitigating circumstances have all been positively concluded, there is also an opportunity for their clients, both new and prospective, to gain a competitive advantage in the post-pandemic commercial environment. The transformation of a company guided by Digital Clarity as its digital architect, demands a "seat at the table" of decision makers as the subject matter expert in the new digital landscape. Digital Clarity has earned that role. The industry as seen today and in the future is described below:

2023 REALITIES TEMPER 2024 BUDGETS AND OUTLOOK

One year ago, leaders were facing global unrest, supply chain instability, soaring inflation, the long shadow of the pandemic, and a projected economic slowdown. Yet most had overly optimistic expectations heading into budget season, with every function expecting to lock in modest budget increases for 2023.

Many of last year’s concerns didn’t materialize, and the outlook for the global economy in 2024 appears brighter as supply chain disruptions ease and inflation edges back toward targets. That said, businesses will have to deal with the after-effects of not only the global pandemic but new challenges. The backdrop as we enter 2024, it is clear that B2B leaders have concerns about inflation and higher interest rates, as they plan for 2024.

Though the general business sentiment is cautious, Digital Clarity has adapted its model to continually seek to focus on areas that will allow the business to thrive as we come out of the challenging economic backdrop.

Digital Clarity has been pivoting during these challenging headwinds and working to build upon its experience in the B2B space and engaging with prospects in the SaaS and Tech market.

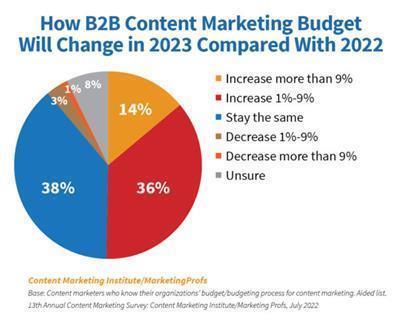

Discretionary marketing budgets, sales headcount, and software costs will continue to be scrutinized closely in 2024, though the demand for maximum performance continues, even though inflation abates particularly in the US. This will only accelerate revenue-focused marketing leadership and reduce the money invested in non-hyper-targeted channels.

Expansion will become the new-new business, making the line between revenue marketing and demand generation very thin. More of an emphasis will be on preserving revenue through retention and expansion efforts over acquiring net new customers, this is an area where Digital Clarity excels.

This will also push leaders to critically evaluate the way in which they acquire customers, including increasing their focus on the technology that helps them prioritize the right accounts. B2B companies beware, It may feel like you have fewer “in-market” accounts than in prior years, so the risk of wasting resources on accounts that won’t buy is much higher. To avoid this, double down on the ‘95-5’ rule, there will be a shift. to get in front of the 5% of in-market accounts that are ready to buy now. If not, it's inevitable that your competitors will swipe them up first.

WHY B2B IS THE RIGHT PLACE AT THE RIGHT TIME

Just before and during the pandemic, DBMM’s operating business, Digital Clarity analyzed market data as found that there was a large market segment that was very badly served by the Digital marketing sector and in particular lacked a level of planning, strategy and general, good advice when it came to sales growth and brand positioning. This was the Business to Business (B2B) sector. In particular, the technology, software and software services sector (SaaS). This pivot was to prove pivotal to Digital Clarity’s return to a level of normal trading against a continued volatile economic backdrop.

B2B is undergoing a renaissance as business models, innovation drivers, and buyers evolve dramatically from decades prior. Now some of the most profitable companies across the globe are B2B companies.

As perceptions of the U.S. economy decline, concerns over inflation persist. More than half of small business owners continue to cite it as their top concern. However, B2B leaders are hopeful about the future, even in these uncertain times.

And while many in the business community cite serious concerns over economic turmoil and rising global uncertainty, B2B leaders are largely optimistic about the fate of their organizations and the role of marketing in helping them grow.

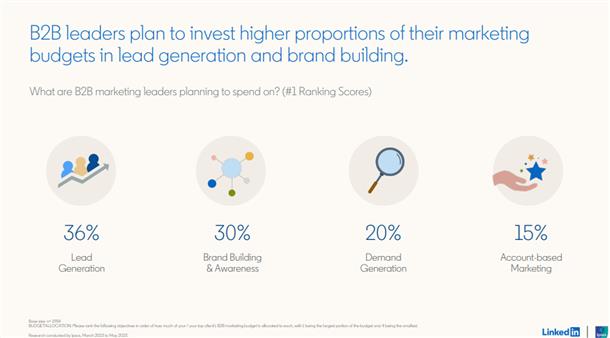

The B2B Marketing Benchmark uncovers the trends and practices fueling this optimism: Marketing budgets on the rise worldwide; Excitement among B2B leaders about emerging technologies like Generative AI;

Growth in the adoption of creative and technical skills that will help marketers meet the demands of these emerging technologies and trends.

Digital Clarity is well poised to enable B2B leaders to thrive in a rapidly changing environment and how to plan for the long term.

THE B2B BUYER JOURNEY IS COMPLEX. THIS IS WHY EXPERTS LIKE DIGITAL CLARITY NEED TO BE INVOLVED FROM THE START.

Savvy communication experts like Digital Clarity produce ideas that shape perceptions and grow markets. There has never been a better time to navigate into the B2B Marketplace as demand for an experienced, safe pair of hands is required. This sector is growing rapidly and the demand for expertise and skill to help businesses in marketing their services and products is sought after. B2B digital ad spending is projected to reach $18.47 billion by 2024, it will account for nearly 50% of total B2B ad spending that year according to Insider Intelligence.

For a long time, tried and tested B2B marketing strategies have been based around a linear model, where activities aim to gather prospects at one end of a pipeline (or funnel) and gently nudge and nurture until they leave as newly won customers at the other end.

It’s been this way for quite a while. It’s given rise to language that any B2B marketer is familiar with such as “MQLs” (marketing qualified leads) and “SQLs” (sales qualified leads), it’s shaped how B2B marketing and sales should work together (where one hands the baton on to the other in the form of a well nurtured, warm lead) and KPIs that evaluate this linear performance (pipeline velocity, #MQLs and #SQLs, to name just three).

So established is the thinking that the world’s biggest CRM platforms are structured around this linear model of how B2B buying takes place.

DEVELOPING A STRONGER US FOOTPRINT FOR DIGITAL CLARITY IN 2024-2035

The IMF last week became the latest economics organization to declare that the US economy would power ahead, forecasting an expansion of 1.5 percent next year. This compares with IMF forecasts of 1.2 percent for the eurozone and 0.6 percent for the UK.

A critical structural factor behind the US-European divergence is the difference in the industrial composition of the two economies.

2023 saw Digital Clarity have a stronger demand by prospective customers in the burgeoning B2B Tech sector and with this laser focus in the tech marketing market, Digital Clarity is well positioned to take advantage of applying it’s successful methodology ito the largest economy in the world.

The US has a booming tech sector, with successful and innovative companies such as Amazon, Alphabet, and Microsoft that have no European equivalents in Europe. With the US dominating artificial intelligence, that gap is likely to widen, economists warn.

By contrast, Europe specializes in industries that are increasingly facing the threat of Chinese competition, such as electric vehicles.

With stronger investment and better demographics, the gap between the US and Europe is likely to widen further in the coming years.

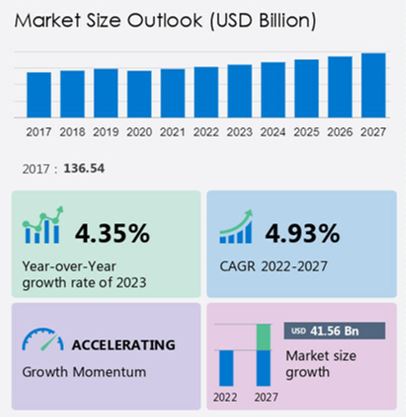

DEMAND FOR MARKETING CONSULTING IN NORTH AMERICA IS PREDICTED TO GROW BY 36%

The marketing consulting services segment is forecast to increase by USD 41.56 billion between now and 2027 with North America estimated to contribute 36% to the growth. Data from research company Technavio’s analysts have elaborately explained the regional trends, drivers, and challenges that are expected to shape the market during the forecast period. With the development of new research companies and the availability of various databases and business analytics tools, this North American region is a major contributor to the global marketing consulting market. This allows businesses to collect meaningful, useful data at a fraction of the cost that marketing consultants pay.

Additionally, the ease of scaling virtualization and automating administrative tasks dynamically will increase SaaS adoption. Due to digitalization, various businesses and organizations in this region are adopting SaaS solutions, which help improve a range of operations such as business planning, order fulfilment, and customer service. Hence, such factors are expected to drive market growth in this region during the forecast period.

B2B BRAND INVESTMENT IS THE BIG FOCUS FOR 2024 AND BEYOND

THE SHIFT TO DIGITAL IS PERMANENT

Despite slower growth, digital will continue to command a greater overall share as more B2B marketers make the permanent shift from traditional advertising to online activities.

One of the most pronounced effects the pandemic had on B2B marketing was exponentially accelerating its transition into digital. As the business world begins recovering from the pandemic and returning to more traditional models, this transition has slowed down. The past year has affirmed, however, that it will not stop.

By 2025, Gartner expects 80% of B2B sales interactions between suppliers and buyers to occur in digital channels.

B2B buying behaviors have been shifting toward a buyer-centric digital model, a change that has been accelerated the past couple of years.

Digital Clarity sit at the intersection of marketing, analysis and sale growth for B2B Tech companies. Focus on digital-lead generation and qualification. The pandemic lockdown underscored how important it is to source and qualify new leads beyond the relationships you already have. It also accelerated digital-lead generation toward high-value customer segments. Traditional lead generation tactics like cold calling are being replaced or supplemented by lower-touch digital leads focused on meeting customers “where they are.” Sales should work closely with Marketing to source leads from typical digital sources (such as Google and LinkedIn), as well as from relevant third-party affiliates (such as LendingTree for mortgages, Trivago for travel, and Buyerzone for B2B services) that are becoming initial destinations for shoppers. Leaders in digital-lead generation can cost-effectively source and qualify leads as well as automate the lead-generation process to support their sales teams with higher propensity leads.

This can energize a sales force. For example, a private-equity owned B2B company was recently challenged with high turnover of entry-level salespeople who lost energy after months of cold calling. Focusing on a digital lead-generation strategy helped them to source more qualified leads with a higher propensity to purchase. This was a huge boost for newer salespeople and helped to supplement their other lead-generation activities, positioning them for greater sales success and reduced salesperson churn.

SALES ARE GOING DIGITAL

Gartner Says 80% of B2B Sales Interactions Between Suppliers and Buyers Will Occur in Digital Channels by 2025.

Over the next five years, an even greater rise in digital interactions between buyers and suppliers will break traditional sales models.

The Gartner Future of Sales 2025 report predicts that by 2025, 80% of B2B sales interactions between suppliers and buyers will occur in digital channels. Chief sales officers (CSOs) and other senior sales leaders must accept that buying preferences have permanently changed and, as a result, so too will the role of sellers.

Sales organizations must be able to sell to customers everywhere the customer expects to engage, interact and transact with suppliers. Gartner defines the future of sales as the permanent transformation of organizations’ sales strategies, processes and allocation of resources, moving from a seller-centric to a buyer-centric orientation and shifting from analogy sales processes to digital-first engagement with customers.

Disruptive buyer dynamics are rewriting the rulebook for B2B sales, demanding digital-first engagement with customers. The rise in digital sales will be driven by marketing that creates demand and trust in brands.

This doesn’t portend the eventual “death of the sales rep,” but it does signal drastic changes needed in the seller role. Sales leaders must deliver significant value through digital and omnichannel sales models, aided by sales professionals who can steer self-learning customers toward more confident decisions. Digital delivers this.

THE GROWTH OF THE DIGITAL OMNICHANNEL

Gartner research shows a steady shift of customer preferences from in-person sales interactions to digital channels. B2B buyers spend only 17% of the total purchase journey with sales reps.

Because the average deal involves multiple suppliers, a sales rep gets roughly 5% of a customer’s total purchase time. And 44% of millennials prefer no sales rep interaction at all in a B2B setting.

Sales leaders must deliver significant value through digital and omnichannel sales models, aided by sales professionals who can steer self-learning customers toward more confident decisions.

THE OMNICHANNELREMAINS KEY IN B2B BUYING

Digital Clarity can help organizations adopt the B2B Omnichannel. Eight in ten B2B leaders say that omnichannel is as or more effective than traditional methods, a sentiment that has grown sharply in the last 2 years. Even as in-person engagement re-emerged as an option, buyers made clear they prefer a cross-channel mix, choosing in-person, remote, and digital self-serve interactions in equal measure.

B2B e-commerce has taken the lead as the most effective sales channel. It is rated first by 35 percent of respondents, ahead of in-person sales (26 percent), video conference (12 percent), email (10 percent), and telephone (8 percent) according to a recent report from McKinsey. Companies winning market share have not only digital self-serve channels such as their own websites but also broader e-commerce offerings. For example, 48 percent of winners are on industry-specific marketplaces, compared with only 13 percent of companies losing share.

Digital Clarity helps companies deploy hybrid marketing models, both online and online, that then feed into sales teams. Hybrid sales models, which are comprised of roles with a mix of both in-person and remote time with customers, are deployed by 57 percent of market-leading companies.

Customers are increasingly willing to spend big on e-commerce transactions. Many B2B companies shun e-commerce over concern about channel conflict: 38 percent of respondents said it was the biggest reason they avoided selling online. However, the sales growth opportunity may now outweigh related potential costs. Similar to last year, about 70 percent of decision-makers are prepared to spend up to $500,000 on a single e-commerce transaction. At the highest end of the spectrum, however, we see meaningful movement: the number of decision-makers willing to spend as much as $10 million or more has increased by 83 percent. This trend holds true particularly in China, India, and the United States, and in global energy and materials (GEM); telecommunications, media, and technology (TMT); and advanced industries sectors.

McKinsey says that the equilibrium is no accident. As B2B buyers flexed to remote and digital ways of engaging, they found much to like. The use and preference for e-commerce—self-serve, for example—has continually grown year on year.

Omnichannel is more effective than traditional sales models alone. As more companies enable face-to-face, remote, and e-commerce interactions, satisfaction with the sales model has grown exponentially. More than 90 percent of B2B companies say their go-to-market model is just as or more effective than before the pandemic began.

Taking an omnichannel approach means strategy and ROI are built in from the start too, so as an approach, it helps measure what works - allowing accurate attribution of results and enabling marketers to move the budget from what doesn’t work to doing more of what does. According to the recent DMA Response Rate Report, 65% of marketers use two or more media channels in their marketing campaigns while 44% of marketers use three or more.

There might be data, software, automation, and analytics considerations but B2B marketing is chiefly about ROI and about creating a large top-of funnel that can be nurtured through to sales conversion. Omni-channel is also inherent in the design. Campaigns that are planned for all relevant channels are not bolted into them as an afterthought.

DIGITAL CLARITY PERFECTLY POSITIONED FOR GROWTH

Organizations will have to fight hard to retain loyalty if customer needs are not met: for example, eight in ten B2B decision makers say they will actively look for a new supplier if performance guarantees.

Buyers are more willing than ever before to spend big through remote or online sales channels, with 35 percent willing to spend $500,000 or more in a single transaction. Seventy-seven percent of B2B customers are also willing to spend $50,000 or more.

B2B customers now regularly use ten or more channels to interact with suppliers.

Digital Clarity is a specialist in many of these channels and has been for a number of years. This expertise, experience, and trust will put Digital Clarity front of mind for organizations as they seek professional advice.

THE B2B MILLENIAL BUYER IS CHANGING THE LANDSCAPE

Millennials and Gen Z, or those born between 1996 and 2012, constitute 64% of business buyers.

Younger buyers are more demanding, engaging in more buying activities, and more willing to express their dissatisfaction with the buying process.

Nearly half of millennial buyers prefer no engagement with a salesperson at all, with the average being a third. In 2025, digital channels will account for four-fifths of all B2B sales engagements. Ultimately, the breakdown of the traditional sales model is driven by the digital shift in industrial buying, dramatically speeded up by the social distancing of vendors and clients.

This is where Digital Clarity comes in. Part of the consulting strategy is to help B2B product sales by reshaping marketing strategies to focus on the millennial B2B e-commerce sector. Between 2024 - 2026, over $2 trillion in B2B product sales will be taking place over ecommerce websites. However, this will still represent only a small portion of overall US B2B product sales and just over a fifth of B2B electronic sales.

Millennial refers to people born between 1981 and 1996. Gen Z refers to those born between 1996 and 2012. According to a recent report from Forrester Research Inc. Millennial and Gen Z B2B buyers are now the chief purchasers of goods and services for their organization. And when it comes to ecommerce, the growing number of millennial and Gen Z professionals have very high expectations for B2B ecommerce,

Millennial and Gen Z B2B buyers also have high standards for engaging and purchasing online from sellers. Younger buyers carry new demands and expectations for B2B buying. Forrester predicts that in two years, more than a third of millennial and Gen Z business buyers will purchase through self-guided digital channels. Those include vendor websites, marketplaces, app stores, or directly from an existing product.

Furthermore, Millennials and Gen Z B2B buyers are active information seekers. Younger buyers go to more sources and find third-party resources more impactful than vendor resources. This group is quicker to express dissatisfaction with the buying experience. 90% of younger buyers cite dissatisfaction with their vendor in at least one area compared to 71% of older buyers.

CONTENT MARKETING

Content has become a critical tool in the marketing mix for almost every B2B brand. Nine out of ten B2B marketers are using content marketing strategies to pull in new customers. This year, the most successful marketers were already spending 40% or more of their budget on their content strategy.

At its simplest, B2B content marketing is when a brand uses stories, ideas, and insights to engage and influence a business audience.

There is a realization amongst B2B brands that rather than being faceless organizations, they need to tell their brand’s story and show a more human side to their business, endear and promote demand from other businesses and customers. The best content marketing campaigns back up these stories and ideas with robust insights: interesting data points, original research, and real-world examples that help their customers understand a new trend or challenge and equip them with the tools and best practices to respond and thrive.

These data points and research is utilized by Digital Clarity to support companies in shaping their content strategy. Typically, areas that Digital Clarity help clients are:

|

|

● |

Blog posts – marketers who make blogging a priority are 13x more likely to see a positive ROI for their efforts. |

|

|

● |

White papers – favored by 22% of business leaders, these longer research-based reports provide more in-depth information. Learn more about writing a compelling B2B marketing white paper here. |

|

|

● |

Short-form articles – enjoyed by 37% of execs, these have to research-based if they are to stand out. |

|

|

● |

Case studies – these provide buyers with reassurance further down the buying funnel and can be made sector-specific. Nearly half of all business leaders appreciate them. |

|

|

● |

Infographics – these have become one of the most popular content marketing tools in recent years. |

|

|

● |

Podcasts – increasingly popular lead generation tools with marketers looking to deliver thought leadership content to buyers on the move. |

|

|

● |

Videos – companies using video, experience clickthrough rates that are 27% higher and web conversion rates 34% greater than those that don’t. |

|

|

● |

Email – nearly eight out of 10 marketers report see g an increase in email engagement over the past 12 months of 2022. |

|

|

● |

LinkedIn – generates more than 50% of all social traffic to B2B websites & blogs. |

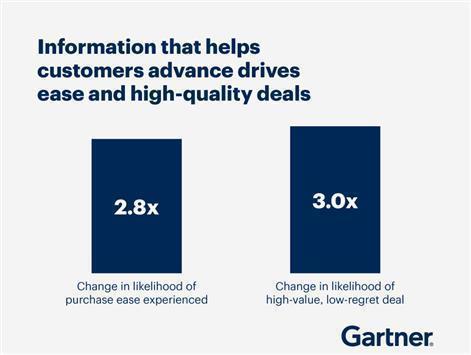

CONTENT IS INFORMATION, AND DISCOVERABLE INFORMATION DRIVES REVENUE

Information drives purchase ease and high-quality sales

All of this looping around and bouncing from one job to another means that buyers value suppliers that make it easier for them to navigate the purchase process.

In fact, Gartner research found that customers who perceived the information they received from suppliers to be helpful in advancing across their buying jobs were 2.8 times more likely to experience a high degree of purchase ease, and three times more likely to buy a bigger deal with less regret.

Digital Clarity has a process that helps shape their client’s content to become more discoverable information, and this increases revenues.

Buyer enablement, or the provisioning of information to customers in a way that enables them to complete information online, like gathering information or making a purchase, is an area that Digital Clarity are helping organizations.

KEY MILESTONES

As the market conditions in the consumer market cool slightly, the team at Digital Clarity has been busy pivoting their business model to address the need in the 2b2 business sector. This is a more strategic offering for prospective customers.

Digital Clarity has started offering a wider array of services to its fast-growing S company in the US. Services include, LinkedIn strategy, content positioning and SEO.

Digital Clarity has attended a major convergence summit with its client in the Unified Communication and Digital Transformation arena. This allowed the team to meet with the likes of SaaS CX providers, 8x8, Five9, and Mitel, amongst others. This will be an area of focus for the company into 2023.

In October, Digital Clarity was part of a select group that part of a panel that discussed the impact of NFTs, Blockchain and the growth of Web 3 and the Metaverse. The event was arranged by leading law firm Memery Crystal, part of Rosenblatt.

Digital Clarity has been on a large business development push and attended various networking events in London. The events include Enterprise Cyber Security hosted at the London Stock Exchange as well as diverse events in DeFi and InsureTech.

Other examples are representative of the diversity of client base. DBMM's approach using a client's analytics and executing an individualized model to increase ROI as the prime objective, spans a wide range of industries.

Core industry verticals for Digital Clarity include B2B, SaaS, Digital Transformation, FinTech, Unified Communication Companies and discretionary advice for professional service providers and consultants.

THE GROWTH OF DIGITAL MARKETING AND CONSULTANCY SERVICES

The marketing consulting market size is estimated to grow at a CAGR of 4.93% between now and 2027 according to reports from Technavio. As mentioned previously, there is a blurring of lines between traditional consultancy, marketing firms and advertising agencies. That said, firms like Accenture, Deloitte, IBM, KPMG, McKinsey and PwC rank among the most aggressive players in acquiring and partnering with agencies such as Digital Clarity. They still represent not only an opportunity for Digital Clarity but also a prospective exit and investment opportunity.

Digital Clarity have continued to develop their Digital Consulting and Strategy Planning offering. The forward-looking program is to be a recognized leader in this field and fulfill companies seeking Digital Transformation for their originations.

THE NEED FOR PROFESSIONAL CONSULTANCY AND THE OPPORTUNITY FOR MASSIVE GROWTH

Four consultancies lead Ad Age's ranking of the 10 largest agency companies in the world. With combined revenue of $13.2 billion, the marketing services units of Accenture, PwC, IBM and Deloitte sit just below WPP, Omnicom, Publicis Groupe, Interpublic and Dentsu. Last year, only two consultancies—Accenture Interactive and IBM iX—made the top 10. IBM iX was the first to break into the top 10.

Given the experience of the team, Digital Clarity’s advisory and consultancy is in demand. With the recent growth in these business areas, and the rise of consultancies, it is confirmation that Digital Clarity is headed in the right direction for growth.

THE GROWTH OF DIGITAL TRANSFORMATION WORLDWIDE

The Global Digital Transformation Market size is expected to reach $1.3 billion by 2027, rising at a market growth of 20.8% CAGR during the forecast period. Digital transformation is considered as the utilization of digital technology. Digitally transformed enterprises can be flexible to the changing technological landscape and can address abrupt shifts in the industry, particularly the one presently created by the COVID-19 pandemic; studies show that the efficiency and rate of adaptation of digitally transformed companies to a post-pandemic era are relatively larger than conventional businesses. Source

Digital Clarity can help various businesses that have been considerably affected by the global outbreak of the COVID-19 pandemic. One of the significant challenges for the global economy in 2020 was to facilitate business continuity in the midst of social distancing guidelines, lockdown norms, work-from-home culture, and other operational challenges. The lack of availability of digital strategies, infrastructure, or tools worsens the challenges for various companies that were needed to abruptly shift operations online or allow workers to work from their homes.

The situation, on the other hand, resulted in a considerable surge in awareness regarding the urgent requirement for digital transformation across a majority of the industries and created some lucrative opportunities for the global market. Companies are getting more aware of the advantages of digital transformation, particularly in the work-from-home culture that needs a business to allow the employees to easily learn, collaborate and perform organizational functions across remote locations.

THE IMPORTANCE OF STRATEGIC MARKETING CONSULTANCY

The fundamentals of marketing may not have changed, but everything else has: goals, roles, expectations, talent needs, and more. B2B marketing leaders need to navigate this new terrain and build the capabilities needed to win. Digital Clarity helps these organizations win.

Across industries, organizations are accelerating digital transformation processes for long-term growth and profitability. Yet: “53% of the organizations surveyed remain untested in the face of digital challenge and their digital transformation readiness therefore uncertain.” This report from Gartner highlights the need embrace change.

Businesses had no choice but to respond quickly to challenging conditions. Although not formally classed as ‘agile’, the twists and turns of the pandemic have required executives to innovate on the fly and collaborate to get things done. This has been compounded by working from home, which has cut out distractions and created more time for ‘deep thinking’. Regardless of headcount, a return to more stable trading conditions shouldn’t mean running back to the standard practices and silos that previously slowed marketers down.

Adobe says that Business-to-business (B2B) commerce will continue to undergo a major transformation as companies adopt the latest technologies to find new customers, improve their supply-chain efficiencies, and provide a more personalized user experience to their clientele.

Digital Clarity has created a unique Diagnosis Workshop that helps brands identify needs as well as assess the opportunities available. The core focus is to help reduce wastage and increase results.

Areas of focus include:

|

|

● |

Cost analysis |

|

|

● |

Audit current channels |

|

|

● |

Digital strategy planning |

|

|

● |

ROI projection planning |

|

|

● |

Digital consulting and training |

DIGITAL CLARITY HAS A COMPETITIVE ADVANTAGE

Digital Clarity operate in a highly commoditized market but have over the years build a stellar reputation that makes it different from its competitors. Some of these areas include:

|

|

1. |

Our DNA is Strategically Driven |

We believe the path to successful customer acquisition lies in understanding a client’s business – not just running a campaign. We seek to help clients understand that success has to be objective and measurable.

|

|

2. |

We are Business Led |

Digital marketing is not a cost but an asset. Not a line in a spreadsheet but an emotive force that if done right, will bring real business change and growth.

|

|

3. |

We are Digital Thinkers |

Marketing has to be at the heart of the business. Delivering real innovation in digital marketing requires not just knowledge but authority and bravery. We think digital. We drive results.

|

|

4. |

Our goal is to deliver Digital Performance |

We help our clients to understand their goals and objectives, using digital marketing to drive new business opportunities and retain their current customers.

DIGITAL CLARITY HAS DEVELOPED A WINNING STRATEGIC PROCESS

01 Discover - The first step - understand. Let's connect and see if we are the right fit.

Normally a phone call or Zoom to understand their challenges, and if there is scope for us working together.

02 Diagnose - Our diagnosis workshop helps define their goals and we discuss what’s needed to get there.

So again is either a face-to-face or a Zoom call. More in-depth. They fill in a detailed questionnaire and then we give them some exercises and get them to open up. We help them discuss their goals and objectives and what they feel the barriers are in stopping them from reaching them - .e.g. people, process, market, marketing, brand, etc.

03 Review - We take all the information, data, and objectives and build out a workable strategy. We then talk them through this game plan and how we will work with them to get there. We also can bring in people (our black book) who can get involved when there are gaps.

04 Delivery - We work with clients to implement our game plan and set clear next steps, goals, and milestones – as required.

COMPETITIVE LANDSCAPE

Digital advertising is the fastest-growing segment of the global market for advertising spending. The increasing use of smartphones and the availability of cheap internet services are the two major factors propelling the growth prospects for this market. More than 30% of the companies are planning to spend around 75% of their advertising expenditures on digital marketing within the next five years.

“U. S. Marketers are expected to spend $110.1 billion on digital ads this year, or 51% of the $214.6 billion total U.S. advertising spending forecast, excluding political ads. Newspapers, radio, magazines, and local television now account for just 21% of the U.S. ad market.” From The Wall Street Journal

THE GROWTH OF B2B SOCIAL MEDIA

2020 will go down as the year that marketing was pulled into the boardroom. 80% of senior executives said the role of marketing in setting strategy has expanded since the pandemic. Traditional consumers have moved online, making the digital environment even more important right now.

This priority has raised the profile of marketing as companies scramble to understand the digital-first consumer. The battleground for 2023 will be about speed and agility. Now that many companies have treasure troves of data, the difference is how fast they can personalize the experience and respond to consumer behaviors. Expect to see more investment and innovation in technology infrastructure alongside marketing.

|

|

● |

76% of B2B organizations use social media analytics to measure content performance. |

|

|

● |

By 2025, 80% of B2B sales interactions will occur on digital channels. |

|

|

● |

U.S. B2B business will spend $2 billion in 2022, and $2.33 billion in 2023 approximately 2-5% – 4% growth in 2024 |

GROWTH IN LINKEDIN ADVERTISING SET TO SOAR BEYOND 2023

Almost all B2B content marketers (96%) use LinkedIn. They also rated it as the top-performing organic platform.

Digital Clarity helps business organizations make the most of LinkedIn. We help customers understand and build campaigns around the 95-5 rule. The 95-5 rule advises you market mostly to buyers who are not likely to buy from you today.

THE NEW NORMAL REMAINS DIGITAL

In just one year, since the pandemic. digital adoption has happened at five to ten times the projected rate.

Lockdown periods, economic uncertainty and loss of predictability have forced customers and businesses online in previously unseen numbers. This migration has upset the power balance, with customers now more in control of the relationship and less loyal to brands and products. On top of that, 60% of companies have seen new buying behaviors such as changes to average basket size and product interests.

Pandemic disruption caused many businesses to demand a similar level of convenience to consumers. After returning to normal, there’s no question that the new normal is digital.

GROWTH IN INVESTOR AWARENESS AND OUTREACH.

We expect that, in 2024, the strategic outreach will be directed at investors around the world who understand the digital marketplace and its expanding influence on consumer decisions. DBMM will target new investors through a global digital and traditional integrated investor outreach campaign which will be run by Digital Clarity, with third parties, as required, for distribution. In all areas, the Company will act in the interests of all stakeholders.

In the full industry context of dramatic expansion of digital footprints, there has been no direct correlation between DBMM's revenues and its share price. Economic and industry analysts have opined that the industry multiple continues to grow to, in some cases, 25-30 times revenues. DBMM will expand its client and geographic scale, thus increasing revenues. There were matters outside of DBMM's control which caused growth to be in neutral, and in 2020/21 the pandemic threw all planning into disarray. With capital infusion following the closure of the SEC review with a final order in June 2023 of the earlier dismissal, 2024 will follow the model of a growing client base and geographic reach until it achieves a TBD level of profitability. We anticipate the benchmark will replicate successful industry models in digital technology, marketing and company transformation.

On October 26, 2022, FINRA processed a Form 211 relating to the initiation of priced quotations of our shares of common stock, which means that the submitting broker-dealer has demonstrated to FINRA compliance with FINRA Rule 6432 and therefore has met the requirements under that rule to initiate a quotation for our shares of common stock within four days of October 26, 2022. FINRA’s processing of a Form 211 in no way constitutes FINRA’s approval of the security, the issuer, or the issuer’s business and relates solely to the submitting broker-dealer’s obligation to comply with FINRA Rule 6432 and SEA Rule 15c2-11 when quoting a security. (FINRA TO Glendale Securities)

After OTC Markets’ review of our activities following their process, our shares of common stock returned to normal market trading without restriction or caveat emptor. The caveat emptor was removed on December 20, 2022. Accordingly, plans to grow investor awareness and outreach are underway.

Glendale Securities, Inc. is the designated Market Maker.

The SEC matter remained open even after the November 12, 2019 ALJ Dismissal regarding the cured late filings, which should have closed the matter then. This has been damaging to our investors and us and impedes our progress. Nevertheless, our compliance continued with required timely filings. In June 2023, the SEC issued an Order Dismissing Proceedings as Release 4413 advising us that their administrative proceedings against us has been dismissed, and a Final Order issued.

FINANCIAL OVERVIEW/OUTLOOK

DBMM has been honing its commercial model since the acquisition of Digital Clarity (“DC”) in 2011, and has been cash flow-positive as an operating company since then. Unfortunately, external events outside of DBMM’s control have precluded the growth expected to this point; however, its margins of 35-50% are accurate. Aspirationally, when the Company reaches appropriate scale and profitability TBD, the business will meet all stakeholder expectations.

The growth trajectory anticipated during 2023 remained deferred until the Company returned to normal business and normal trading. However, the timeframe was only the last quarter of the 2023 fiscal year. Normal trading has resumed; however, the management has used the analogy of, “It’s like turning around a yacht.” Nevertheless, clients will benefit due to a wider range of resources, and the shareholders will benefit as the market cap grows. The media market multiple far exceeds the “old” manufacturing multiples, as digital technology and marketing has become one of fastest growing industries in the world today. The trading in our shares of common stock returned to normal on December 20, 2022 with no restrictions. The US retail marketplace of our shares of common stock was open finally to all investors. We began the process of restarting the growth infrastructure in the fourth quarter of fiscal 2023 following the Final Order of Dismissal issued on June 2, 2023.

The return to normal business is a step-by-step process now that the SEC matter is closed in our favor and all mitigating factors circumstances concluded to our benefit. DBMM’s place in the industry reputationally is strong, particularly for its size. The industry environment continues to grow exponentially, and digital marketing and company transformation is an essential strategy for any commercial activity, and thus has become embedded in planning.

Nevertheless, since 2020, revenues have slowed down temporarily due to a number of factors: 1) client uncertainty caused by Brexit trade issues, 2) COVID-19 global slowdown with some clients pausing as lockdowns stopped and started, 3) clients needing to extend or double down lacked the resources, and 4) DBMM addressing its mitigating circumstances brought about by the SEC Matter, all of which were external events through no fault of the Company, DBMM. To address the changing environment, the business development model has evolved and, as such, Digital Clarity has earned a “seat at the table,” client by client. With precision, the revenues are turning around.

Revenues have been increasing quarter to quarter following the pandemic slowdown.

Several years ago, the Company received a commitment for future working capital to grow the Company in key markets. Growth capital will be directed to support a client base rebalancing and leveraging of a very dynamic, transformational, digital landscape. DC’s mantra remains the same: “ROI is our DNA.” Going forward, there will be an emphasis on investor awareness now that normal business recommenced. DBMM intends to make significant strides in aggressively broadening its brand exposure. There are investors around the globe who understand the digital marketplace and its increasing influence on commercial decisions. DBMM will be targeting new shareholders in the public market through a global digital and traditional, integrated campaign run by DC, with third parties, as required for distribution.

The expectations for fiscal year 2023 were to return to normal trading first, which now has occurred, and then move ahead to a scaled growth plan in multiple geographies once normal business recommenced and the SEC matter is finally closed. The result will benefit all stakeholders. This process is step-by-step in order to assure all growth is sustainable and continuing.

Regarding capital infusion, the Company resolved in 2015 to eliminate any consideration of using convertible debentures as a financing vehicle. Accordingly, the Company has not issued convertible debentures since 2015 nor have any convertible debentures been executed since 2016.

Additionally, we have demonstrated our adherence to such a philosophy by renegotiating its aged debt with lenders, one at a time, at fixed settlement amounts with no conversion terms. Furthermore, such renegotiations lead to the derecognition of derivative liabilities overhanging our balance sheet. The Company intends to continue its debt negotiation and modification program.

This has been a successful strategy thus far:

During fiscal year 2021 and so far in 2023, and to a lesser extent in fiscal 2020, we successfully reached agreements with certain lenders resulting in a gain on extinguishment for loans payable which amounted to the difference between the carrying value and the revised amount of the obligations.

The gain on extinguishment of principal and accrued interest amounted to $169,837 and $57,802 during fiscal 2021 and 2020, respectively.

We also successfully reached an agreement with a holder of convertible debentures aggregating $249,800 to modify its terms. Such debentures are no longer convertible, are now non-interest bearing, and have been reclassified to loans payable. It also resulted in a decrease in derivative liabilities and an increase in additional paid-in capital of approximately $260,000 during fiscal 2021.

Furthermore, in March 2022, we reached an agreement with a holder of convertible debentures to satisfy obligations aggregating $85,000 in consideration of 30 million shares of the Company’s common stock.

In February 2023, we reached an agreement with a holder of convertible debentures to satisfy obligations aggregating $76,000 in consideration of 7.5 million shares of the Company’s common stock.

In May 2023, we reduced our liability to a lessor by $15,000.

Fiscal Year 2023

We had $45,000 in cash and our working capital deficiency amounted to approximately $6.5 million at August 31, 2023.

During fiscal 2023, we used cash in our operating activities amounting to $437,000. Our cash used in operating activities was comprised of our net loss of $713,000 adjusted primarily for the following:

Change in fair value of derivative liability of $42,070 and loss on extinguishment of debt of $73,000.

Additionally, the following variations in operating assets and liabilities during fiscal 2023 impacted our cash used in operating activity: - to

Increase in accounts payable, accrued expenses, accrued interest, and accrued compensation, of $245,000, resulting from a short fall in liquidity and capital resources.

We generated cash from financing activities of $471,000 which primarily consists of the proceeds from the issuance of loans payable.

Fiscal Year 2022

We had approximately $10,000 in cash and our working capital deficiency amounted to approximately $5.9 million at August 31, 2022.

During fiscal 2022, we used cash in our operating activities amounting to approximately $389,000. Our cash used in operating activities was comprised of our net loss of approximately $626,000 adjusted primarily for the following:

Change in fair value of derivative liability of $201,000 and loss on extinguishment of debt of $83,000.

Accounts payable, accrued expenses, accrued interest, and accrued compensation, of approximately $363,000, resulting from a short fall in liquidity and capital resources.

During fiscal 2022, we generated cash from financing activities of approximately $389,000 which primarily consists of the proceeds from demand notes payable of approximately $399,000.

Going Concern

The accompanying consolidated financial statements have been prepared on a going concern basis. The financial statements do not reflect any adjustments that might result if The Company is unable to continue as a going concern.

The Company has outstanding loans and convertible notes payable aggregating $3.0 million at August 31, 2023 and doesn’t have sufficient cash on hand to satisfy such obligations. The preceding raise substantial doubt about the ability of the Company to continue as a going concern. However, the Company generated proceeds of approximately $471,000 from financing activities during fiscal 2023. The Company also has a non-binding Commitment Letter from an investor of $250,000 which also includes a right of first refusal on additional capital raise up to $3 million which will contribute to satisfying such obligations and fund any potential cash flow deficiencies from operations for the foreseeable future.

Accordingly, the accompanying consolidated financial statements have been prepared in conformity with U.S. GAAP, which contemplates continuation of the Company as a going concern and the realization of assets and satisfaction of liabilities in the normal course of business. The carrying amounts of assets and liabilities presented in the financial statements do not necessarily purport to represent realizable or settlement values. The financial statements do not include any adjustment that might result from the outcome of this uncertainty.

RESULTS OF OPERATIONS

Comparison of Results for fiscal 2023 and 2022

|

For the Years Ended |

||||||||||||||||

|

Increase/ |

Increase/ |

|||||||||||||||

|

(Decrease) |

(-)Decrease | |||||||||||||||

|

August 31, 2023 |

August 31, 2022 |

$ |

% |

|||||||||||||

|

SALES |

$ | 309,644 | $ | 225,842 | $ | 83,802 | 37 | % | ||||||||

|

COST OF SALES |

260,774 | 131,272 | 129,502 | 99 | % | |||||||||||

|

GROSS PROFIT |

48,870 | 94,570 | (45,700 |

) |

-48 | % | ||||||||||

|

COSTS AND EXPENSES |

||||||||||||||||

|

Sales, general and administrative |

463,694 | 553,042 | (89,348 |

) |

-16 | % | ||||||||||

|

TOTAL OPERATING (GAIN) EXPENSES |

463,694 | 553,042 | (89,348 |

) |

-16 | % | ||||||||||

|

OPERATING GAIN (LOSS) |

(414,824 |

) |

(458,472 |

) |

(43,648 |

) |

-10 | % | ||||||||

|

OTHER (INCOME) EXPENSE |

||||||||||||||||

|

Interest expense |

313,235 | 384,615 | (71,380 |

) |

-19 | % | ||||||||||

|

Other income |

(46,255 |

) |

(98,265 |

) |

52,010 | NM | ||||||||||

|

Loss (gain) on extinguishment of debt |

73,349 | 82,845 | (9,496 |

) |

NM | |||||||||||

|

Change in fair value of derivative liability |

(42,070 |

) |

(201,239 |

) |

159,169 | NM | ||||||||||

|

TOTAL OTHER EXPENSE |

298,259 | 167,956 | 130,303 | NM | ||||||||||||

|

NET LOSS |

$ | (713,083 |

) |

$ | (626,428 |

) |

$ | 86,655 | 14 |

% |

||||||

NM: not meaningful

We currently generate revenue through our Pay-Per-Click Advertising, Search Engine Marketing, Search Engine Optimization Services, Web Design, Social Media, Digital analytics and Advisory Services.

Our primary sources of revenue are Advisory Services (including Web design) and Per-Click Advertising which amounted to 63% and 25% of our revenues, respectively, during fiscal 2023 and 54% and 38%, respectively, during fiscal 2022.

Revenue is recognized upon transfer of control of promised or services to customers in an amount that reflects the consideration the Company expects to receive in exchange for those services. The Company enter into contracts that can include various combinations of services, which are generally capable of being distinct and accounted for as separate performance obligations. Revenue is recognized net of any taxes collected from customers, which are subsequently remitted to governmental authorities.

Geopolitical conflicts and uncertainties as well as risks of recession, high inflation alongside energy costs, and interest rate rises and means global conditions remain challenging going into 2024.

Our revenues increased during fiscal 2023 when compared to the prior year, primarily as a result of increased advisory services revenues.

Cost of sales during fiscal 2023 increased when compared to the prior year, primarily from additional expenses to meet increased demand.

The general and administrative costs during fiscal 2023, when compared to the prior year, decreased primarily from reduced overhead.

The decrease in interest expense, which includes interest accrued on certain notes and loans, is primarily due to lesser inducements offered to noteholders in fiscal 2023.

Additionally, the Company’s loss or gain on extinguishment of debt is a function of the terms at which we can settle our obligations and the fair value of the stock price at the measurement date.

The decrease in change of fair value of derivative liability during fiscal 2023 when compared to the prior year is primarily a function of lower volatility during fiscal 2023, which is one of the primary assumptions in computing the fair value of such liability.

The other income reflects the recognition of tax credits related to expenses incurred in the UK.

Non-GAAP Financial Measures

Management considers earnings (loss) before interest, taxes, depreciation and amortization, or EBITDA, as adjusted, an important indicator in evaluating our business on a consistent basis across various periods. Due to the significance of non-recurring items, EBITDA, as adjusted, enables our management to monitor and evaluate our business on a consistent basis. We use EBITDA, as adjusted, as a primary measure, among others, to analyze and evaluate financial and strategic planning decisions regarding future operating investments and potential acquisitions. We believe that EBITDA, as adjusted, eliminates items that are not part of our core operations, such as interest expense, or items that do not involve a cash outlay, such as loss on extinguishment of debt and change in fair value of derivative liability. EBITDA, as adjusted, should be considered in addition to, rather than as a substitute for, pre-tax income (loss), net income (loss) and cash flows used in operating activities. This non-GAAP financial measure excludes significant expenses that are required by GAAP to be recorded in our financial statements and is subject to inherent limitations. Investors should review the reconciliation of this non-GAAP financial measure to the comparable GAAP financial measure included below. Investors should not rely on any single financial measure to evaluate our business.

|

Fiscal |

||||||||

|

2023 |

2022 |

|||||||

|

Net loss |

$ | (713,083 |

) |

$ | (626,428 |

) |

||

|

Interest |

313,235 | 384,615 | ||||||

|

Loss on extinguishment of debt |

73,349 | 82,845 | ||||||

|

Change in fair value of derivative liability |

(42,070 | ) | (201,239 | ) | ||||

|

EBITDA, as adjusted |

$ | (368,569 |

) |

$ | (360,207 |

) |

||

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK.

As a “smaller reporting company”, as defined by Rule 10(f)(1) of Regulation S-K, the Company is not required to provide this information.

ITEM 8. CONSOLIDATED FINANCIAL STATEMENTS

| INDEX TO CONSOLIDATED FINANCIAL STATEMENTS | |

|

| Page |

|

|

|

| Report of Independent Registered Public Accounting Firm (PCAOB ID | F-1 |

|

|

|

| F-2 | |

|

|

|

| F-3 | |

|

|

|

| F-4 | |

|

|

|

| Consolidated Statements of Cash Flows for the years ended August 31, 2023 and 2022 | F-5 |

|

|

|

| F-6 | |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Stockholders of Digital Brand Media & Marketing Group, Inc.

Opinion on the Financial Statements

We have audited the accompanying consolidated balance sheets of Digital Brand Media & Marketing Group, Inc. (the Company) as of August 31, 2023 and 2022, and the related consolidated statements of operations and comprehensive income (loss), changes in stockholders’ deficit, and cash flows for each of the years in the two-year period ended August 31, 2023, and the related notes (collectively referred to as the financial statements). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Company as of August 31, 2022 and 2022, and the results of its operations and its cash flows for each of the years in the two-year period ended August 31, 2023, in conformity with accounting principles generally accepted in the United States of America.

Going Concern

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 1 to the financial statements, the Company has suffered net losses from operations and has a net capital deficiency, which raises substantial doubt about its ability to continue as a going concern. Management’s plans regarding those matters are discussed in Note 1. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Basis for Opinion

These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on the Company’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and the significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe our audits provide a reasonable basis for our opinion.

Critical Audit Matters

The critical audit matter communicated below is a matter arising from the current period audit of the financial statements that were communicated or required to be communicated to the audit committee and that: (1) relate to accounts or disclosures that are material to the financial statements and (2) involved our especially challenging, subjective, or complex judgments. The communication of critical audit matters does not alter in any way our opinion on the financial statements, taken as a whole, and we are not, by communicating the critical audit matters below, providing separate opinion on the critical audit matters or on the accounts or disclosures to which they relate.

As discussed in Note 7 to the financial statements, the company has a derivative liability due to a tainted equity environment.

To evaluate the appropriateness of the fair value determined by management, we examined and evaluated the inputs management used in calculating the fair value of the stock-based compensation. To evaluate the appropriateness of the estimates used by the derivative specialist, we examined and evaluated the inputs the specialist used in calculating the value of the derivatives.

/s/ M&K CPAS, PLLC

We have served as the Company’s auditor since 2020

November 29, 2023

DIGITAL BRAND MEDIA & MARKETING GROUP, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

|

August 31, |

August 31, |

|||||||

|

2023 |