UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-10261

Pearl Mutual Funds

on behalf of its series:

Pearl Total Return Fund

Pearl Aggressive Growth Fund

2610 Park Avenue

P.O. Box 209

Muscatine, Iowa 52761

| Robert H. Solt | Stacy H. Winick | |

| 2610 Park Avenue | Bell, Boyd & Lloyd PLLC | |

| P. O. Box 209 | 1615 L Street, N.W., Suite 1200 | |

| Muscatine, Iowa 52761 | Washington, DC 20036 |

(Name and address of agents for service)

Registrant’s telephone number, including area code: (563) 288-2773

Date of fiscal year end: December 31

Date of reporting period: December 31, 2005

| Item 1. | Reports to Shareholders. |

| PFTRX – Pearl Total Return Fund |

PFAGX – Pearl Aggressive Growth Fund |

2005 Annual Report

| Page | ||

| 1 | ||

| 2 -3 | ||

| 3 -5 | ||

| 6 -8 | ||

| 9 -11 | ||

| 12 -13 | ||

| 13 -15 | ||

| 16 -18 | ||

| 19 -22 | ||

| 23 | ||

| 24 -26 | ||

| 27 -29 | ||

| 30 -31 | ||

| 32 | ||

| 33 | ||

IRA CONTRIBUTION LIMITS FOR 2006 HAVE CHANGED!

(IRA – INDIVIDUAL RETIREMENT ACCOUNT, ALL TYPES)

| • | You may contribute $4,000 to your IRA in 2006. |

| • | Remember, the new 2006 limit is $5,000 if you are age 50 or over. |

The extra $1,000 is called a catch-up contribution.

| • | These new limits apply to both Roth and Traditional IRAs. |

IRA contribution limits may be different in subsequent years.

MORE GOOD NEWS:

| • | No maintenance fee for your Pearl IRA – or for any Pearl Funds Account. |

| Pearl Mutual Funds 2610 Park Avenue PO Box 209 Muscatine IA 52761 |

|

| E-mail: info@pearlfunds.com | 866-747-9030 (Toll-Free) | 563-288-2773 | Fax: 563-288-4101 | www.pearlfunds.com |

Chairman of the Board

DR. JAMES P. STEIN

President

DAVID M. STANLEY

Executive Vice President

ROBERT H. SOLT

Vice President

| RICHARD | R. PHILLIPS |

Chief Compliance Officer

ANTHONY J. TOOHILL

Trustees

JOHN W. AXEL

JEFFREY R. BOEYINK

DOUGLAS B. CODER

DR. DAVID N. DEJONG

DAVID L. EVANS

ROBERT H. SOLT

DAVID M. STANLEY

DR. JAMES P. STEIN

Staff

KAREN M. BROOKHART

PEGGY A. CHERRIER

RENATA R. LAMAR

February 23, 2006

| • | Pearl Total Return Fund gained 11.55% during 2005 – outperforming all 3 comparison indexes. |

| • | Pearl Aggressive Growth Fund gained 18.01% in 2005 – outperforming all 3 comparison indexes. |

| • | For the 5 years through December 31, 2005, Pearl Total Return Fund was up 62.80% – strongly outperforming all 3 comparison indexes: Dow Jones Wilshire 5000 (Full Cap) up 11.06%, MSCI World up 11.41%, and S&P 500 up 2.73%. These 5 years included most of the 3-year bear market (2000-2002) and rising stock markets in 2003, 2004, and 2005. |

| • | Pearl Total Return Fund outperformed all 3 comparison indexes during the last 1, 3, 5, and 10 years through December 31, 2005. |

| • | During its first 4 1/2 years through December 31, 2005, Pearl Aggressive Growth Fund was up 77.10% – strongly outperforming all 3 comparison indexes: Dow Jones Wilshire 5000 (Full Cap) up 17.89%, MSCI World up 24.54%, and S&P 500 up 10.11%. |

| • | Both Pearl Funds had risk-adjusted total returns (3 years through Dec. 31, 2005) that outperformed all 3 benchmark indexes. See pages 7 & 10. |

| • | All Pearl Funds performance figures are net – after deduction of all expenses of each Fund and all expenses of mutual funds in its portfolio. |

| • | Both Pearl Funds are no-load – no sales charge, commission, or redemption fee (except a 2% fee on sale of shares owned 30 days or less). Both Funds continued making all investments on a no-load basis in 2005. |

Please consider everything in this report and in the Prospectus. Figures above are not annualized. Past performance does not guarantee future results. Thank you for your confidence in Pearl Mutual Funds.

You are invited to visit our Website at www.pearlfunds.com. Please call, e-mail, fax, or write to us. We are here to help you.

| Sincerely, |

||||

| YOUR INVESTMENT MANAGEMENT TEAM: | ||||

|

| |||

| David M. Stanley |

Robert H. Solt | |||

1

PEARL MUTUAL FUNDS

Performance Review as of December 31, 2005

2005 Performance. Total Returns of Pearl Total Return Fund, Pearl Aggressive Growth Fund, and the Funds’ Comparison Indexes:*

| For the year ended 12-31-05: |

|||

| Pearl Total Return Fund |

+11.55 | % | |

| Pearl Aggressive Growth Fund |

+18.01 | % | |

| Dow Jones Wilshire 5000 (Full Cap) |

+6.32 | % | |

| MSCI World Index |

+9.49 | % | |

| Standard & Poor’s 500 Index |

+4.91 | % |

| * | All total returns include dividends reinvested. The total returns do not reflect the deduction of taxes that a shareholder would pay on fund dividends or on redemption of fund shares. Likewise, the total returns on indexes do not reflect the deduction of taxes that an investor in stocks would pay on dividends or on sale of stocks. See Page 15 for a description of each index. |

Both Pearl Aggressive Growth Fund and the more conservative Pearl Total Return Fund outperformed all 3 comparison indexes during 2005.

2005 Performance Factors. We believe Pearl Total Return Fund’s and Pearl Aggressive Growth Fund’s comparative performance and total return during 2005 were affected by many factors, including each Fund’s investment strategy and decisions by the Funds’ Manager, Pearl Management Company. These factors include:

| • | U.S. and global stock markets had losses during the 1st quarter of 2005 but strengthened during the rest of the year, especially in the 4th quarter. Investors’ reactions to good economic news, including low inflation, were helpful. |

| • | U.S. value-style stocks continued to lead U.S. growth-style stocks in 2005. Morningstar US Value Index beat the Growth and Core indexes by a small margin. Small-capitalization stocks performed slightly better than larger companies in 2005. That performance continued small-caps’ 5-year run of outperformance. Mid-cap stocks performed even better than small-caps during the year. Overall, foreign stocks performed better than U.S. stocks for most of 2005. Foreign markets continued their pattern of better returns from smaller companies. We believe these trends had a positive effect on both Pearl Total Return Fund and Pearl Aggressive Growth Fund. |

| • | During 2005, a majority of Pearl Total Return Fund’s investments were in relatively conservative mutual funds with below-average risk records, a value or blend emphasis, and a continuing tilt toward small-cap to mid-cap stocks. The Fund invested globally through mutual funds holding U.S. or foreign securities or both. The Fund held only one pure bond fund but also held a balanced fund which holds some fixed-income investments. We believe these decisions reduced risk and helped performance. The Fund’s small-and-mid-cap and foreign stock positions both helped significantly. The Fund’s value emphasis helped its investments in mutual funds holding U.S. stocks. This Fund was at least 90% invested in equity funds throughout 2005 but held large indirect investments in bonds and cash through the mutual funds in its portfolio (see page 4). The Fund’s partial defensive position helped performance during weak market periods in 2005. |

| • | Pearl Aggressive Growth Fund had a similar small-to-mid-cap leaning but a significantly stronger foreign stock emphasis than Pearl Total Return Fund. Both of these priorities contributed to the Fund’s outperformance in 2005. As its investment strategy requires, this Fund is always fully invested (95% or more) in equity mutual funds. |

2

| • | Both funds owned shares of many mutual funds that are closed to new investors, and were able to make no-load purchases of some mutual funds that would require most investors to pay a sales charge. Both factors helped performance of both Funds. See page 4. |

| • | Both Funds did not pay any sales charge, commission, or redemption fee. Both Funds made all their investments on a no-load basis. See “No-Load Investing” below. This helped both Funds control costs and helped their performance. |

| • | Pearl Management Company, the Funds’ Manager, continues to research, analyze, and evaluate data on many mutual funds, categories of funds, and global stock markets. We believe this work helps our allocation decisions and selection of mutual funds. |

Pearl Total Return Fund is a diversified fund of funds that seeks long-term total return by being primarily invested (80% or more of net assets) in equity mutual funds, except when Pearl Management Company believes a lower percentage is justified by high risks affecting stock markets. This Fund seeks to limit shareholders’ risk by frequently holding a modest defensive position and by selecting some mutual funds that have demonstrated relatively lower volatility.

Pearl Aggressive Growth Fund is a diversified fund of funds that seeks long-term aggressive growth of capital by being fully invested (95% or more) in equity mutual funds at all times.

“Equity mutual funds” means funds whose objective is growth or capital appreciation, including funds that invest in U.S. or foreign securities or both.

Long-Term Investing, Not Trading. Both Pearl Funds are long-term investors, not short-term traders. Your investment management team is always ready to change investments when we believe this is in our shareholders’ interest, but we work to avoid excessive turnover of the Funds’ portfolios.

We are pleased that both Funds’ portfolio turnover during the year 2005 was relatively low: 24% for Pearl Total Return Fund and 44% for Pearl Aggressive Growth Fund.

No-Load Investing. We Avoid Transaction Costs. Each Pearl Fund is a no-load investor, seeking to prevent transaction costs for you and all our shareholders. Each Fund can invest only in no-load (no sales charge, no redemption fee), load-waived (no-load due to large purchases), or low-load (sales load and redemption fee together must not exceed 2%) mutual funds. The Funds also can invest in closed-end funds but have not yet done so. The Funds do not impose any distribution fee (12b-1 fee). Some mutual funds in which the Funds may invest may impose a 12b-1 fee.

Both Funds seek to avoid completely all sales charges, commissions, and redemption fees – and both Funds did completely avoid them again in 2005.

Pearl Aggressive Growth Fund has never paid any sales charge, commission, or redemption fee. All of its investments to date were made on a no-load basis.

Pearl Total Return Fund has not paid any sales charge, commission, or redemption fee since 1998. All of its investments in the years 1999 through 2005 were made on a no-load basis.

Access to Many Funds. Both Funds’ investments in most mutual funds are generally large enough to take advantage of sales load waivers on large purchases. Thus, both Funds are able to select

3

no-load investments from a very wide range of funds – even though many of those funds would require most investors to pay a sales load.

Another potential benefit to Pearl Funds shareholders is that both Funds own shares of some mutual funds that are closed to most new investors. At December 31, 2005: Pearl Total Return Fund held 13 equity funds, and 7 of these were no longer open to new investors. These funds comprised 65% of Total Return Fund’s total assets. Of the 14 equity funds Pearl Aggressive Growth Fund held, 4 were closed to new investors. These funds comprised 27% of this Fund’s total assets.

Investments. At December 31, 2005, 90.7% of Pearl Total Return Fund’s total assets were invested in a diversified group of equity mutual funds, 1.4% in a high-quality bond fund, and 7.9% in cash.

At December 31, 2005, 97.8% of Pearl Aggressive Growth Fund’s total assets were invested in a diversified group of equity mutual funds, and 2.2% in cash.

A more precise way to measure each Fund’s asset allocation is its investment portfolio asset breakdown, which counts each Fund’s indirect investments through the mutual funds held in its portfolio, using recent information on the portfolio assets of those mutual funds. Based on the Funds’ portfolio holdings at December 31, 2005, each Fund’s investment portfolio asset breakdown was:

| Total Return Fund | Aggressive Growth Fund |

|||||

| (as a percentage of total assets) | ||||||

| Total Stocks |

76.2 | % | 92.9 | % | ||

| U.S. Stocks |

28.0 | % | 32.1 | % | ||

| Foreign Stocks |

48.2 | % | 60.8 | % | ||

| Bonds |

3.6 | % | 0.0 | % | ||

| Cash |

16.8 | % | 5.8 | % | ||

| Other |

3.4 | % | 1.3 | % | ||

For example, at December 31, 2005, Pearl Total Return Fund’s direct cash position was 7.9%, but this increased to 16.8% when the varying amounts of cash held by the mutual funds in this Fund’s portfolio were added.

Each Fund’s asset allocation and portfolio holdings vary with changes in investments.

Top 5 Mutual Fund Portfolio Holdings at December 31, 2005 (as a percentage of total assets):

| Pearl Total Return Fund: |

|||

| First Eagle Overseas, Class I |

19.78 | % | |

| Oakmark International Small Cap, Class I |

16.28 | % | |

| Matthews Asian Growth & Income |

10.33 | % | |

| Keeley Small Cap Value |

9.06 | % | |

| Dodge & Cox Balanced |

6.56 | % | |

| Pearl Aggressive Growth Fund: |

|||

| Matthews Pacific Tiger |

11.80 | % | |

| American Century Int’l Opportunity, Inv. Cl. |

11.29 | % | |

| Artisan International Small Cap, Inv. Class |

11.06 | % | |

| Hartford Capital Appreciation, Inv. Y Class |

8.65 | % | |

| US Global Investors Eastern Europe |

8.50 | % |

Year-end investments of both Funds are listed in the financial statements. The most recent month-end portfolio holdings are available at www.pearlfunds.com.

Portfolio investments are subject to change at any time without notice, and changes have been made since December 31, 2005. Each Fund’s portfolio holdings will be at least slightly different, and may be significantly different, by the time you read this report.

4

Current Investment Outlook. We still believe there are many risks in the U.S. stock market, including continued overvaluation of many stocks, continued high expectations for economic and earnings growth, so that markets are vulnerable if disappointments occur; a housing bubble in some areas; high consumer debt; long-term risks of large U.S. current account deficits, budget deficits, and national debt; uncertainty about whether recent pro-growth tax cuts will be made permanent; possible additional terrorist attacks; and the inevitable uncertainties of being at war.

However, we believe interest rates (still relatively low though rising) are positive for stocks. They still provide support for company earnings and encourage some investors to move their money from low-yielding accounts into stock investments. Another positive factor is the large amounts of cash on the sidelines, potentially available for investment.

Although always difficult to judge, on balance we believe the reward/risk ratio is neutral near-term (1-3 months), slightly negative intermediate-term (4-12 months), and moderately positive long-term. We also believe the near-term outlook no longer strongly favors small-to-mid-cap stock funds – their relative attractiveness has lessened due to their extended outperformance in recent years. We currently view small-, medium-, and large-cap stock funds as providing approximately equal opportunities.

We believe foreign stock funds overall, especially foreign mid-caps, still appear to offer a better reward/risk ratio than U.S. stock funds. We believe some of the emerging markets, especially in low-tax countries in Eastern Europe and Asia, offer special opportunities. As always, foreign markets have unique risks and opportunities.

Weighing these factors, Pearl Total Return Fund is now near the middle (about 90%) of its normal investment range in equity mutual funds. A majority of this Fund’s investments are in equity funds that we believe are relatively conservative. The Fund’s investments have a value emphasis but also include a significant growth component; lean toward mid-to-large-cap stock funds but remain largely balanced across the range of equity funds that hold small-to-mid-to-large-cap stocks; and have a continuing strong emphasis on foreign stock funds.

Pearl Aggressive Growth Fund continues to be fully invested (95% or more; recently about 98%) in equity mutual funds. In comparison with Total Return Fund, Aggressive Growth Fund’s portfolio as a whole is more volatile; includes more equity funds that emphasize growth; holds slightly more equity funds that hold large-cap stocks; has an even greater (more than 60% of portfolio) investment in foreign stock funds; and includes more emerging markets funds.

We diligently seek to select the best mutual funds in view of changing market conditions and each Fund’s investment objective. Taking into account the opportunities and the risks, we believe each Fund’s current portfolio mix is appropriate for the current market environment.

5

Pearl Total Return Fund’s 10-Year Performance Record is summarized in this graph:

COMPARISON OF CHANGE IN VALUE OF $10,000 INVESTMENT IN

PEARL TOTAL RETURN FUND AND ITS COMPARISON INDEXES *

(as of 12-31 each year – with dividends reinvested)

| * | The total returns in this report, including the graph and tables, do not reflect the deduction of taxes that a shareholder would pay on fund dividends or on redemption of fund shares. Likewise, the total returns on indexes do not reflect the deduction of taxes that an investor in stocks would pay on dividends or on sale of stocks. |

Pearl Total Return Fund’s average annual total return was + 20.94% during the last 3 years, + 10.24% over the last 5 years, and + 11.15% for the last 10 years.

The value of an investment in Pearl Total Return Fund grew 77% over the last 3 years, 63% during the last 5 years, and 188% over the last 10 years.

Performance of Pearl Total Return Fund and Comparison Indexes through 12-31-05:

| Average Annual Total Returns for years ended 12-31-05 with dividends reinvested: |

1 year | 3 years | 5 years | 10 years | ||||||||

| Pearl Total Return Fund |

+11.55 | % | +20.94 | % | +10.24 | % | +11.15 | % | ||||

| Dow Jones Wilshire 5000 (Full Cap) |

+6.32 | % | +16.37 | % | +2.14 | % | +9.16 | % | ||||

| MSCI World Index |

+9.49 | % | +18.69 | % | +2.19 | % | +7.04 | % | ||||

| Standard & Poor’s 500 Index |

+4.91 | % | +14.38 | % | +0.54 | % | +9.07 | % |

See Page 15 for a description of each index.

Did you know?

All performance and total return figures for each Pearl Fund are net – after deduction of all

expenses (all fees, transaction costs, etc.) – including all expenses of each Pearl Fund

and all expenses of the mutual funds in its portfolio.

6

Pearl Total Return Fund

Risk-Adjusted Total Return. Pearl Total Return Fund seeks to outperform the 3 comparison indexes on a long-term risk-adjusted total return basis. Two factors should be considered together in assessing a mutual fund’s performance: its total return and its risk. Therefore, we measure your Fund’s total return in relation to the risk (volatility) it incurred, and then we compare the risk-adjusted total returns of the Fund and the 3 benchmark indexes.

Standard deviation is the conventional statistical measure used to determine the volatility (variability) — and therefore the risk — of a mutual fund or an index. The higher the standard deviation, the greater the volatility risk. To minimize risk, a low standard deviation is desirable.

Standard Deviations of Pearl Total Return Fund and Comparison Indexes through 12-31-05:

| Annualized Standard Deviations: |

3 years | ||

| Pearl Total Return Fund |

9.20 | % | |

| Dow Jones Wilshire 5000 (Full Cap) |

9.73 | % | |

| MSCI World Index |

9.81 | % | |

| Standard & Poor’s 500 Index |

9.16 | % |

See page 15 for a description of each index.

The Sharpe ratio is a conventional measure that combines total return and standard deviation to produce a risk-adjusted performance figure. It is a ratio of reward (total return in excess of the 90-day Treasury bill return) to the volatility risk (standard deviation). The higher the number, the better the risk-adjusted return. A high Sharpe ratio is desirable.

Sharpe Ratios of Pearl Total Return Fund and Comparison Indexes through 12-31-05:

| Sharpe Ratios: |

3 years | |

| Pearl Total Return Fund |

+1.92 | |

| Dow Jones Wilshire 5000 (Full Cap) |

+1.41 | |

| MSCI World Index |

+1.61 | |

| Standard & Poor’s 500 Index |

+1.30 |

See page 15 for a description of each index.

Pearl Total Return Fund’s risk-adjusted performance was better than all 3 comparison indexes during the past 3 years through December 31, 2005.

Did you know?

We are shareholders too!

All our Trustees, Officers, and employees are Pearl Funds shareholders.

We eat our own cooking!

If your Pearl Funds investment grows or declines, so does ours!

Pearl Management Company, the Funds’ Manager, receives compensation only from Pearl Mutual

Funds. Pearl Management Company does not manage other mutual funds or separate accounts.

Our single focus helps us to avoid conflicts of interest and

give Pearl shareholders the top-priority service you deserve.

7

Pearl Total Return Fund

Performance Summary. Past performance does not predict future performance.

| • | Pearl Total Return Fund had a + 11.55% total return for the year ended December 31, 2005. |

| • | Pearl Total Return Fund’s + 11.55% total return outperformed all 3 comparison indexes for the year ended December 31, 2005. We believe this outperformance is significant because it was achieved during a period of generally rising stock markets, including a strong rise in the 4th quarter of 2005, while throughout that year this Fund had a risk-reducing partial defensive position. Often less than 80% of the Fund’s total assets were invested in stocks as measured by the actual holdings of the mutual funds in its portfolio. Its 3 benchmarks are pure stock indexes that are always 100% in stocks. See page 4. |

| • | Your Fund’s total return was + 11.55% in 2005, + 16.83% in 2004, + 35.73% in 2003, - 10.75% in 2002, + 3.13% in 2001, + 1.56% in 2000, and + 26.99% in 1999. |

| • | During the entire 5 years through December 31, 2005, Total Return Fund was up 62.80% while the 3 comparison indexes were up 8.40% on average (not annualized). See page 1. |

| • | Your Fund outperformed all 3 comparison indexes during the last 1, 3, 5, and 10 years through December 31, 2005. See pages 2 and 6. |

| • | Pearl Total Return Fund’s risk-adjusted total return outperformed all 3 comparison indexes during the last 3 years. See page 7. |

Expenses. Pearl Total Return Fund’s total net expenses, after reimbursement by the Manager (see page 14), were 0.98% of the Fund’s average net assets during the 12 months ended December 31, 2005. We believe this Fund’s 0.98% expense ratio is one of the lowest for all funds of its type (actively-managed independent fund of funds) in the U.S.

Net Asset Value and Net Assets of Pearl Total Return Fund at December 31, 2005:

NAV (net asset value) per share: $ 15.64 [$14.13 after dividends] – up from $14.02 after dividends at 12-31-04

Net assets: $ 88,460,221 [$88,158,906 after dividends] – up from $74,057,965 at 12-31-04

Did you know?

Pearl Management Company, the Funds’ Manager, and all of its Officers

do not receive any compensation or fee from any mutual fund held by either Pearl Fund,

or from any manager of any such fund.

Pearl Management Company and all of its Officers do not own shares of any company

which manages any mutual fund held by either Pearl Fund.

8

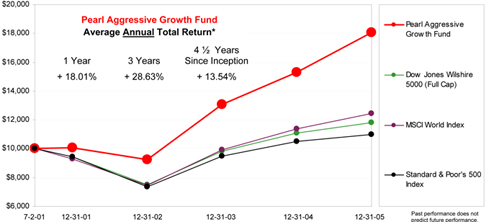

Pearl Aggressive Growth Fund’s Performance Record for the 4 1/2 years since its inception is summarized in this graph:

COMPARISON OF CHANGE IN VALUE OF $10,000 INVESTMENT IN

PEARL AGGRESSIVE GROWTH FUND AND ITS COMPARISON INDEXES *

(as of 12-31 each year, from 7-2-01 inception – with dividends reinvested)

| * | The total returns in this report, including the graph and tables, do not reflect the deduction of taxes that a shareholder would pay on fund dividends or on redemption of fund shares. Likewise, the total returns on indexes do not reflect the deduction of taxes that an investor in stocks would pay on dividends or on sale of stocks. |

Pearl Aggressive Growth Fund has come through a very volatile first 4 1/2 years of existence with a solid 77.10% gain (not annualized) – and strongly outperformed all 3 comparison indexes.

Performance of Pearl Aggressive Growth Fund and Comparison Indexes through 12-31-05:

| Average Annual Total Returns for periods ended 12-31-05 with dividends reinvested: |

1 Year | 3 Years | From 7-2-01 (inception) |

||||||

| Pearl Aggressive Growth Fund |

+18.01 | % | +28.63 | % | +13.54 | % | |||

| Dow Jones Wilshire 5000 (Full Cap) |

+6.32 | % | +16.37 | % | +3.73 | % | |||

| MSCI World Index |

+9.49 | % | +18.69 | % | +5.00 | % | |||

| Standard & Poor’s 500 Index |

+4.91 | % | +14.39 | % | +2.16 | % |

See page 15 for a description of each index.

Did you know?

Current performance, daily prices (net asset value), and month-end portfolio holdings

of both Pearl Funds are available at www.pearlfunds.com.

9

Pearl Aggressive Growth Fund

Risk-Adjusted Total Return. Even though Pearl Aggressive Growth Fund is not as focused as Pearl Total Return Fund on risk-adjusted total return, it is useful to measure Pearl Aggressive Growth Fund’s total return in relation to the risk (volatility) it incurred. Then we compare the risk-adjusted total returns of the Fund and the 3 benchmark indexes.

Standard deviation is the conventional statistical measure used to determine the volatility (variability) — and therefore the risk — of a mutual fund or an index. The higher the standard deviation, the greater the volatility risk. To minimize risk, a low standard deviation is desirable. However, an aggressive growth fund by its nature will be more risky than a more conservative fund.

Standard Deviations of Pearl Aggressive Growth Fund and Comparison Indexes through 12-31-05:

| Annualized Standard Deviations: |

3 Years | ||

| Pearl Aggressive Growth Fund |

14.00 | % | |

| Dow Jones Wilshire 5000 (Full Cap) |

9.73 | % | |

| MSCI World Index |

9.81 | % | |

| Standard & Poor’s 500 Index |

9.16 | % |

See page 15 for a description of each index.

The Sharpe ratio is a conventional measure that combines total return and standard deviation to produce a risk-adjusted performance figure. It is a ratio of reward (total return in excess of the 90-day Treasury bill return) to the volatility risk (standard deviation). The higher the number, the better the risk-adjusted return. A high Sharpe ratio is desirable.

Sharpe Ratios of Pearl Aggressive Growth Fund and Comparison Indexes through 12-31-05:

| Sharpe Ratios: |

3 Years | |

| Pearl Aggressive Growth Fund |

+1.75 | |

| Dow Jones Wilshire 5000 (Full Cap) |

+1.41 | |

| MSCI World Index |

+1.61 | |

| Standard & Poor’s 500 Index |

+1.30 |

See page 15 for a description of each index.

Pearl Aggressive Growth Fund’s risk-adjusted performance was better than all 3 comparison indexes during the past 3 years through December 31, 2005.

Did you know?

We avoid transaction costs. Pearl Aggressive Growth Fund has never paid — and Pearl Total

Return Fund has not paid since 1998 — any sales charge, commission, or redemption fee.

10

Pearl Aggressive Growth Fund

Performance Summary. Past performance does not predict future performance.

| • | Pearl Aggressive Growth Fund had a + 18.01% total return for the year ended December 31, 2005. |

| • | Pearl Aggressive Growth Fund’s + 18.01% total return outperformed all 3 comparison indexes for the year ended December 31, 2005. |

| • | Your Fund has strongly outperformed all 3 comparison indexes since its inception (July 2, 2001). During its first 4 1/2 years though December 31, 2005, Pearl Aggressive Growth Fund was up 77.10% while all 3 benchmark indexes were up 17.51% on average (not annualized). See page 1. |

| • | Pearl Aggressive Growth Fund also outperformed all 3 comparison indexes on a risk-adjusted total return basis for the 3 years ended December 31, 2005. |

Expenses. Pearl Aggressive Growth Fund’s total net expenses, after reimbursement by the Manager (see page 14), were 0.98% of the Fund’s average net assets during the 12 months ended December 31, 2005. We believe this Fund’s 0.98% expense ratio is one of the lowest for all funds of its type (actively-managed independent fund of funds) in the U.S.

Net Asset Value and Net Assets of Pearl Aggressive Growth Fund at December 31, 2005:

NAV (net asset value) per share: $15.94 [$13.50 after dividends] – up from $13.51 after dividends at 12-31-04

Net assets: $34,646,226 [$34,369,568 after dividends] – up from $26,381,816 at 12-31-04

Did you know?

Both Pearl Funds are no-load – no sales charge or commission.

To help protect long-term shareholders and discourage frequent trading of Fund shares,

a 2% redemption fee is charged if a shareholder sells shares owned for 30 days or less.

11

Pearl Total Return Fund and Pearl Aggressive Growth Fund, December 31, 2005

As a mutual fund shareholder, you may incur two types of costs. There may be transaction costs, which generally include sales charges (loads) on purchases and may include redemption or exchange fees. Both Pearl Funds have no load, sales charge, exchange fee, or redemption fee – except that to help protect long-term shareholders and discourage frequent trading of Fund shares, a 2% redemption fee is charged if a shareholder sells shares owned for 30 days or less. There are also continuing costs, which generally include investment advisory fees and other fund expenses, and may include Rule 12b-1 distribution fees. Both Pearl Funds do not impose any 12b-1 fee. Some of the mutual funds in which Pearl Funds invest may impose 12b-1 fees. The information on this page is intended to help you understand your ongoing costs of investing in Pearl Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

Analyzing your Fund’s expenses. To illustrate these ongoing costs, we have provided an example and calculated the expenses paid by investors in each Pearl Fund during the reporting period. The information in the table below is based on an initial investment of $1,000, which is invested at the beginning of the 6-months reporting period and held for the entire period. Expense information is calculated two ways; each method provides you with different information. The amount in the “actual” column is calculated using each Pearl Fund’s actual operating expenses and total return. The amount in the “hypothetical” column assumes that the return each year is 5% before expenses, and uses the Fund's actual expense ratio. You should not use the hypothetical account values and expenses to estimate either your actual account balance at the end of the period or the expenses you paid during the period. See “Compare with other funds” for details on using the hypothetical data.

Estimating your actual expenses. To estimate the expenses that you paid over the 6-months period, first you will need your account balance at the end of the period. Check your Shareholder Account Statement for this information.

1. Divide your ending account balance by $1,000. For example, if an account balance was $8,600 at the end of the period, the result would be 8.6.

2. In the “Expenses paid during the period” section of the table, locate the amount for your Fund. You will find this number in the column labeled “Actual.” Multiply this number by the result from step 1. Your answer is an estimate of the expenses you paid on your account during the period.

July 1, 2005 through December 31, 2005 (6 months):

| Account value at the beginning of the period ($) |

Account value at the end of the period ($) |

Expenses paid during the period ($) |

Fund’s annualized expense ratio (%) |

||||||||||||

| Actual | Hypothetical | Actual | Hypothetical | Actual | Hypothetical | Actual | |||||||||

| Pearl Total Return Fund |

1,000.00 | 1,000.00 | 1,100.56 | 1,025.00 | 5.19 | 5.00 | 0.98 | % | |||||||

| Pearl Aggressive Growth Fund |

1,000.00 | 1,000.00 | 1,167.99 | 1,025.00 | 5.36 | 5.00 | 0.98 | % | |||||||

12

Expenses paid during the period are equal to the Fund’s annualized expense ratio, multiplied by the average account value over the period, then multiplied by the number of days in the Fund's most recent fiscal half-year and divided by 365.

Limit on Expenses of Pearl Funds. Pearl Management Company, the Funds’ Manager, has contractually agreed to reimburse each Pearl Fund for all ordinary operating expenses (including management and administrative fees) exceeding these expense ratios: 0.98% of a Fund’s average net assets up to $100 million and 0.78% in excess of $100 million. This expense limit, and the Manager’s reimbursement of expenses that exceed the expense limit, lower the expense ratio and increase each Fund’s total return. See page 14 for more information.

Compare with other funds. Since all mutual funds are required to include the same hypothetical calculations of expenses in shareholder reports, you can use this information to compare the ongoing costs of investing in each Pearl Fund with other funds. To do so, compare the 5% hypothetical example with the 5% hypothetical examples of other funds. As you compare hypothetical examples of other funds, it is important to note that hypothetical examples are meant to highlight only the continuing costs of investing in a fund and do not reflect any transaction costs, such as sales charges or redemption or exchange fees, which may be incurred by shareholders of other funds.

Pearl Funds are no-load. It is important to note that the expense amounts shown in the table are meant to highlight only ongoing costs of investing in your Fund. As a Pearl Funds shareholder, you do not incur any transaction costs, such as sales charges, exchange fees, or redemption fees (except a 2% redemption fee if you sell shares owned for 30 days or less). The hypothetical example is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning other mutual funds whose shareholders may incur transaction costs.

Each Pearl Fund is a fund of funds. This should be kept in mind when comparing with other funds. Both Pearl Funds invested substantially all of their assets in other mutual funds throughout the reporting period. Thus, in addition to the Pearl Funds’ expenses shown in the table above, Pearl Funds shareholders also indirectly paid a proportional share of the expenses of the portfolio mutual funds in which the Pearl Funds were invested. However, there were no transaction costs for Pearl Funds’ investments in other mutual funds. Each Pearl Fund did not pay any transaction cost, such as sales charges or redemption or exchange fees, during the reporting period. Also, all Pearl Funds total return figures are net – after deduction of all expenses of each Pearl Fund and all expenses of all mutual funds in its portfolio.

This report is provided for the shareholders of Pearl Mutual Funds. This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current Prospectus. Before investing, an investor should read the Prospectus and carefully consider a Fund’s objectives, risks, charges, and expenses. To obtain a Prospectus containing this and other information, please visit our Website at www.pearlfunds.com or call toll-free 866-747-9030.

Pearl Funds shares are available to residents of certain states. Please go to www.pearlfunds.com or call toll-free 866-747-9030 to determine whether Fund shares are available in your state. This report is not an offer of or a solicitation of an offer to buy either Fund, nor shall either Fund be offered or sold to any person, in any jurisdiction in which the offer, solicitation, purchase, or sale would be unlawful under its securities law. The Funds are offered only to residents of the United States.

13

We Invite and Welcome Your Calls. A real, live person will talk with you – promptly. You will know the full name of the person you talk with. He or she will be one of our Officers or key Staff persons. You will get a straight answer. If we don’t know the answer, we will find it and get back to you quickly.

If we break this promise, tell us and you will receive our personal apology. 866-747-9030 (toll-free).

We Also Invite You to E-mail, Fax, or Write to Us:

E-mail to info@pearlfunds.com

Fax to 563-288-4101

Write to Pearl Mutual Funds, 2610 Park Avenue, PO Box 209, Muscatine, IA 52761

You May Send a Message to the Funds’ Board of Trustees on any subject. Send your message to the Pearl office, addressed to the Board of Trustees. We will promptly send it to all of the Trustees.

Communications Invited on Accounting and Auditing. Any person may communicate, confidentially and anonymously, any concerns regarding accounting or auditing matters to David L. Evans, Chairman of the Audit Committee of Pearl Mutual Funds, by either of these two means:

1. Mail to 32500 El Diente Court, Evergreen, CO 80439 (preferred method)

2. Telephone to 303-679-9689

Limit on Expenses. Pearl Management Company, the Funds’ Manager, has contractually agreed to reimburse each Pearl Fund for all ordinary operating expenses (including management and administrative fees) exceeding these expense ratios: 0.98% of a Fund's average net assets up to $100 million and 0.78% in excess of $100 million. When the Manager has reimbursed a Fund for expenses in excess of this limit, the Manager may recover the reimbursed amounts, for a period that does not exceed five years, to the extent this can be done without exceeding the expense limit. This expense limit does not have an expiration date, and will continue unless a change is approved by the Funds’ Board of Trustees.

The Manager’s reimbursement of expenses that exceed the expense limit lowers the expense ratio and increases the overall return to investors.

Performance is historical and does not guarantee future results. Investment return and principal value of an investment in each Pearl Fund will fluctuate, so that an investor’s shares in the Fund, when redeemed, may be worth more or less than their original cost. Performance changes over time and may be materially different by the time you read this report. For recent information on performance, prices, and portfolio holdings, go to www.pearlfunds.com or call toll-free 866-747-9030.

All investments involve risk. Even though Pearl Total Return Fund and Pearl Aggressive Growth Fund each invest in many mutual funds, that investment strategy cannot eliminate risk.

Many factors affect risks of mutual funds that invest in various kinds of stocks. For example:

Stocks of small and mid-sized companies may be more volatile or less liquid than stocks of larger companies. Smaller companies may have a shorter history of operations, may not have the ability to raise capital as easily as large companies, and may have a less diversified product line, making them more susceptible to market pressure.

Value stocks include stocks of companies that may have experienced adverse business or industry developments or may be subject to special risks that have caused the stocks to be out of favor and undervalued. Growth stocks are stocks of companies believed to have above-average potential for growth of revenue and earnings. Prices of growth stocks may be more sensitive to

14

changes in current or expected earnings than prices of other stocks. Growth stocks may not perform as well as value stocks or the stock market in general.

Investments in foreign securities involve risks, including currency fluctuation, different regulation, accounting standards, trading practices, levels of available information, generally higher transaction costs, and political risks. The risks of foreign investments are typically increased in less developed countries, which are sometimes referred to as emerging markets. For example, political and economic structures in these countries may be new and developing rapidly, which may cause instability. These countries are also more likely to experience high levels of inflation, deflation, or currency devaluations, which could hurt their economies and securities markets.

Total return means total growth of the investment, with all dividends and distributions (including capital gains) reinvested.

Privacy Policy. Because we consider the preservation of your privacy a priority, Pearl Mutual Funds has adopted a privacy policy. You may view the privacy policy at www.pearlfunds.com (click the Privacy Policy page) or by calling toll-free 866-747-9030.

Disclosure of Portfolio Holdings. The Funds’ most recent month-end portfolio holdings are disclosed to the public on the Funds’ Website: www.pearlfunds.com. The Funds also file a complete schedule of portfolio holdings with the SEC for the first and third quarters of each year on Form N-Q, and for the half-year and full year on Form N-CSR. The Funds’ Forms N-Q and N-CSR are available on the SEC’s Website at www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

Proxy Votes by the Funds. A description of each Fund’s proxy voting policies and procedures and a record of each Fund’s proxy votes for the most recent 12-months period ended June 30 are available without charge at www.pearlfunds.com or by calling toll-free 866-747-9030, and are also available on the SEC’s Website at www.sec.gov.

Comparison Indexes. The Dow Jones Wilshire 5000 Composite Index (Full Cap), commonly referred to as Dow Jones Wilshire 5000 (Full Cap), is an unmanaged index that is market-capitalization weighted, includes all publicly-traded U.S. common stocks headquartered in the U.S. with readily available price data, and is generally representative of the performance of the average dollar invested in U.S. common stocks. The MSCI World Index is an unmanaged index that is market-capitalization weighted and is generally representative of the performance of the global (including U.S. and international) market for common stocks. The Standard & Poor’s (S & P) 500 Index is an unmanaged index of 500 stocks that is market-capitalization weighted and is generally representative of the performance of larger companies in the U.S.

The Funds’ holdings are not identical to the indexes. Each Pearl Fund’s performance will not mirror the returns of any particular index. It is not possible to invest directly in an index. Trademarks and copyrights relating to the indexes are owned by: Dow Jones Wilshire 5000 (Full cap): Dow Jones Indexes and Wilshire Associates, Inc; MSCI World Index: Morgan Stanley Capital International; Standard & Poor’s 500 Index: The McGraw Hill Companies.

Other Information. Please consult your tax advisor regarding the tax consequences of owning shares of the Funds in your particular circumstances.

From July 1, 1972 through July 1, 2001, Pearl Total Return Fund’s shares were not registered under the Securities Act of 1933 and only private sales were made. The Fund began offering its shares to the public pursuant to an effective registration statement on July 2, 2001.

15

The names and ages of the Trustees and Officers of Pearl Mutual Funds, the date each was first elected or appointed to office, and their principal business occupations and other public company directorships they have held during at least the last five years, are shown below. Each Trustee and Officer serves in that capacity for each of the two series of Pearl Mutual Funds: Pearl Total Return Fund and Pearl Aggressive Growth Fund.

| Name and Age at 12-31-05 |

Positions Held with Both Funds |

Date First Elected or Appointed to Office ** |

Principal Occupations during Past 5 Years |

Other Public Company Directorships | ||||

| Trustees who are “Interested Persons” of the Funds: * | ||||||||

| Robert H. Solt, 38 | Executive Vice President, Chief Operating Officer, Chief Financial Officer, Secretary, Treasurer, and Trustee | Feb. 2001 | Director since Feb. 2001, Executive Vice President, Chief Operating Officer, Chief Financial Officer, Secretary, and Treasurer since June 2001, Chief Compliance Officer since Sept. 2004, Vice President, Asst. Secretary, and Asst. Treasurer, Feb. 2001 to June 2001, Pearl Management Company. Prior thereto (beginning 1991), Officer, Iowans for Tax Relief, Tax Education Foundation, and Tax Education Support Organization (nonprofit public interest organizations). | None. | ||||

| David M. Stanley, 77 | President, Chief Executive Officer, Chief Legal Officer, Asst. Secretary, and Trustee | July 1972 | Chairman, President, Chief Executive Officer, Chief Legal Officer, Asst. Secretary, and Director, Pearl Management Company. Chairman and Director, Midwest Management Corporation (private investment company). | None. | ||||

| Trustees who are not “Interested Persons” of the Funds: | ||||||||

| John W. Axel, 64 | Trustee | Dec. 1974 | Owner and Chief Executive Officer, Iowa Companies, Inc. (holding company). President, Environmental Services Inc. (waste hauling). President, Perfect Pallet Co. (pallet manufacturer). | None. | ||||

| Jeffrey R. Boeyink, 43 | Trustee | Oct. 1997 | Executive Vice President, Iowans for Tax Relief, Tax Education Foundation, and Tax Education Support Organization (nonprofit public interest organizations). | None. | ||||

| Douglas B. Coder, 69 | Trustee | Dec. 1974 | Owner, Coder Co. (business brokerage). Owner, DBC Realty (investments). Chairman and Director, Catalyst International (software). | None. | ||||

| Dr. David N. DeJong, 42 | Trustee | Dec. 1998 | Professor of Economics, University of Pittsburgh. | None. | ||||

| David L. Evans, 64 | Trustee | June 1977 | Owner and CEO, Evanwood Corporation (consulting) since Jan. 1992. Director, John Deere Receivables, Inc. (asset-backed securities). Chief Executive, Rose Creek Ridge LLC (farming) since Aug. 2003. | None. | ||||

16

| Name and Age at 12-31-05 |

Positions Held with Both Funds |

Date First Elected or Appointed to Office ** |

Principal Occupations during Past 5 Years |

Other Public Company Directorships | ||||

| Dr. James P. Stein, 54 | Chairman of the Board and Trustee | Oct. 2003 | Chairman of Board of Directors and Director, Central Bancshares, Inc. Director, subsidiary banks of Central Bancshares, Inc. Doctor of Veterinary Medicine. Private investor. | None. | ||||

| Other Officers of Pearl Mutual Funds: |

||||||||

| Anthony J. Toohill, 29 | Chief Compliance Officer | Aug. 2004 | Chief Compliance Officer since Aug. 2004, Pearl Mutual Funds. Accounting Supervisor, Financial and Operational Principal, and Internal Control Committee Co-Chair, Modern Woodmen of America (insurance and securities), Jan. 2003 to Aug. 2004. Audit Senior July 2000 to Jan. 2003, Audit Staff July 1999 to July 2000, Deloitte & Touche LLP. | None. | ||||

| Karen M. Brookhart, 34 | Portfolio Management Associate | March 2002 | Portfolio Management Associate since Sept. 2004, Asst. Secretary March 2002 to Sept. 2004, Administrative Assistant Sept. 2001 to Sept. 2004, Pearl Management Company. Customer Service Representative, HON Company (office furniture), July 1999 to Aug. 2001. | None. | ||||

| Peggy A. Cherrier, 53 | Compliance Associate and Assistant Secretary | March 2001 | Compliance Associate since Sept. 2004, Asst. Secretary since Feb. 2001, Administrative Assistant Aug. 2000 to Sept. 2004, Pearl Management Company. | None. | ||||

| Renata R. LaMar, 41 | Controller and Assistant Treasurer | March 2001 | Controller since Sept. 2004, Asst. Treasurer since Feb. 2001, Financial Administrator Feb. 2001 to Sept. 2004, Accountant Aug. 2000 to Feb. 2001, Pearl Management Company. | None. | ||||

| Richard R. Phillips, 52 | Vice President | Aug. 2005 | Vice President, Pearl Management Company, since Aug. 2005. Vice President, Secretary, General Counsel, Reynolds Engineering, since Apr. 1998. Owner, Phillips Law Office, since Apr. 1998. | None. | ||||

| * | Mr. Stanley is an “Interested Person” of Pearl Mutual Funds, as defined in the Investment Company Act of 1940, because he is the Chairman, President, Chief Executive Officer, and a Director of Pearl Management Company, the investment manager for Pearl Mutual Funds. |

| * | Mr. Solt is an “Interested Person” of Pearl Mutual Funds, as defined in the Investment Company Act of 1940, because he is the Executive Vice President, Chief Operating Officer, Chief Financial Officer, Chief Compliance Officer, Secretary, Treasurer, and a Director of Pearl Management Company, the investment manager for Pearl Mutual Funds. |

| ** | Dates prior to June 2001 correspond to the date first elected or appointed as a Director or Officer of Mutual Selection Fund, Inc., the Funds’ predecessor. |

17

The business address of the Trustees and Officers affiliated with Pearl Management Company is: 2610 Park Avenue, PO Box 209, Muscatine, Iowa 52761.

The addresses of the other Trustees are:

Mr. Axel – 319 East Second Street, Suite 302, Muscatine, IA 52761

Mr. Boeyink – 303 Woodcreek Lane, Muscatine, IA 52761

Mr. Coder – 8711 East Pinnacle Peak Road, Scottsdale, AZ 85255

Dr. DeJong – Department of Economics, University of Pittsburgh, Pittsburgh, PA 15260

Mr. Evans – 32500 El Diente Court, Evergreen, CO 80439

Dr. Stein – Central State Bank Building, Room 207, 301 Iowa Avenue, Muscatine, IA 52761

The Board of Trustees has overall responsibility for the affairs of Pearl Mutual Funds. Each Trustee serves for an indefinite term of unlimited duration until the next meeting of shareholders called for the purpose of considering the election or re-election of such Trustee or a successor, and until the election and qualification of his or her successor. The Board of Trustees may fill any vacancy provided that at least two-thirds of the Trustees have been elected by the shareholders. A Trustee may be removed, with or without cause, at any time by a vote of at least two-thirds of the Funds’ outstanding shares or by written instrument signed by at least two-thirds of the remaining Trustees.

The Board of Trustees elects or appoints the Officers of Pearl Mutual Funds annually. Each Officer serves until the election and qualification of his or her successor, or until he or she sooner dies, resigns, or is removed or disqualified. The Board of Trustees may remove any Officer, with or without cause, at any time.

Statement of Additional Information. The Funds’ Statement of Additional Information includes more information about the Trustees and Officers. You may obtain a free copy of the Statement of Additional Information in any of these ways:

View (and print, if desired) the Statement of Additional Information at www.pearlfunds.com

Call toll-free 866-747-9030

E-mail to info@pearlfunds.com

Fax to 563-288-4101

Write to Pearl Mutual Funds, 2610 Park Avenue, PO Box 209, Muscatine, IA 52761

18

Board Approval of the Existing Advisory Agreement

The Contract Review Committee (the “Committee”) of the Board of Trustees meets on at least an annual basis and as otherwise necessary or advisable to review the advisory agreement (the “Agreement”) of Pearl Mutual Funds (the “Funds”) and determines whether to recommend that the full Board approve the continuation of the Agreement for an additional term. The Committee is comprised of all of the independent Trustees. After the Committee has made its recommendation, the full Board, including the independent Trustees, determines whether to approve the continuation of the Agreement. In addition, the Board, including the independent Trustees, considers matters bearing on the Agreement at most other meetings throughout the year and meets at least quarterly with the portfolio managers employed by Pearl Management Company (the “Manager”), the Funds’ investment adviser.

The Trustees receive all materials that they or the Manager believe to be reasonably necessary for them to evaluate the Agreement and determine whether to approve the continuation of the Agreement. Those materials generally include, among other items, (1) information on the investment performance of the Funds, characterized relative to comparison indexes and other funds with similar investment objectives over short- and long-term investment horizons, (2) information on the Funds’ advisory fees and other expenses, including information comparing the Funds’ expenses to those of peer groups of funds (including public funds of funds and equity funds), and information about any applicable expense caps and fee breakpoints, (3) share sales and redemption data, (4) information about the profitability to the Manager and its affiliates of their relationships with the Funds and potential “fall-out” or ancillary benefits that the Manager and its affiliates may receive as a result of their relationships with the Funds, and (5) information obtained through the Manager’s response to a questionnaire prepared by the Committee with the assistance of Bell, Boyd & Lloyd LLC, independent counsel to the Funds and to the independent Trustees.

The Trustees may also consider other information such as (1) the Manager’s financial results and financial condition, (2) each Fund’s investment objective and strategies and the size, education, and experience of the Manager’s investment staffs and their use of technology, external research, and trading cost measurement tools, (3) the allocation of the Funds’ brokerage, if any, (4) the resources devoted to, and the record of compliance with, the Funds’ investment policies and restrictions, policies on personal securities transactions, and other compliance policies, (5) information included in the Manager’s current Form ADV, (6) information about the Manager’s services and performance, (7) any possible conflicts of interest of the Manager that might materially impair the best interest of the Funds and their shareholders, and (8) the economic outlook generally and for the mutual fund industry in particular. Throughout the process, the Trustees have the opportunity to ask questions of and request additional materials from the Manager.

On December 13, 2005 the Board of Trustees most recently approved the continuation of the Agreement through January 31, 2007. The Board actions followed Committee meetings held on September 9 and December 12, 2005.

In considering whether to approve the continuation of the Agreement, the Trustees, including the independent Trustees, did not identify any single factor as determinative, and each weighed the various factors as he deemed appropriate. The Trustees considered the following matters in connection with their continuation of the Agreement.

19

Nature, quality, and extent of services. The Trustees reviewed the nature, quality, and extent of the Manager’s services to the Funds, taking into account the investment objective and strategy of each Fund and the knowledge gained from the Board’s regular meetings with management on at least a quarterly basis. In addition, the Trustees reviewed the Manager’s resources and facilities, and the education, experience, and number of key personnel, especially those who provide investment management services to the Funds. The Trustees considered the Manager’s research and decision-making processes, including methods adopted to ensure compliance with investment objectives, policies, and restrictions of the Funds. The Trustees also considered other services provided to the Funds by the Manager, such as managing the execution of portfolio transactions, providing support services for the Board and Board committees, communicating with shareholders, and overseeing the activities of other service providers, including monitoring compliance with various Fund policies and procedures and with applicable securities laws and regulations. Lastly, the Trustees considered the fact that the Funds are the Manager’s only client that pays for investment advisory services and that neither the Manager nor any of its personnel receives compensation for managing any other portfolio, fund, or account (although the Manager also provides accounting services and certain other services without compensation to one private investment company and several nonprofit organizations, and has done so since before the Funds were publicly offered).

The Trustees concluded that the nature and extent of the services provided by the Manager to each Fund were appropriate and consistent with the terms of the Agreement, that the quality of those services had been consistent with or superior to quality norms in the industry, and that the Funds were likely to benefit from the continued provision of those services. They also concluded that the Manager had appropriate personnel and procedures in place to assist the Funds with compliance matters. Overall, the Trustees concluded that the Manager had sufficient personnel, with the appropriate education and experience, to serve the Funds effectively and had demonstrated its continuing ability to attract and retain well-qualified personnel.

Performance of the Funds. The Trustees considered the short-term and longer-term performance of each Fund. They reviewed information comparing each Fund’s performance with the performance of the Fund’s benchmarks and with the performance of comparable funds and peer groups identified by the Manager with the assistance of the Committee.

They noted that as of September 30, 2005, Pearl Total Return Fund had outperformed its benchmarks for the latest quarter, year-to-date, one-year, three-year, five-year and ten-year periods, and Pearl Aggressive Growth Fund had outperformed its benchmarks for the latest quarter, year-to-date, one-year, three-year, and since inception periods. Also, the Trustees noted that for the one-year period ended October 31, 2005, Pearl Total Return Fund had outperformed 12 of the 22 peer funds selected by the Contract Review Committee, and for the five-year period ended October 31, 2005, the Fund had outperformed 17 of the 20 peer funds with a five-year history. Pearl Aggressive Growth Fund had outperformed 20 of its 22 peer funds selected by the Contract Review Committee for the one-year period ended October 31, 2005.

The Trustees concluded that although past performance is not necessarily indicative of future results, the Funds’ performance record and investment process were important factors in the Trustees’ evaluation of the quality of services provided by the Manager under the Agreement.

20

Costs of Services and Profits Realized by the Manager. The Trustees examined information on fees and expenses of each Fund in comparison to information for other comparable funds as provided by the Manager. They considered that both the contractual rates of advisory fees and the actual advisory and administration fees for the Funds were lower than 17 of the 22 funds in the Funds’ peer group (selected by the Contract Review Committee). The Trustees also considered that the expense ratio of each Fund was also lower than 19 of the 22 funds in the peer group. In addition, the Trustees considered the benefits of the Expense Limit Agreement between the Manager and the Funds, which requires the Manager to reimburse each Fund for all ordinary operating expenses (including management and administrative fees) exceeding these expense ratios: 0.98% of a Fund’s average annual net assets up to $100 million, and 0.78% of a Fund’s average annual net assets in excess of $100 million. The Trustees considered that when the Manager has reimbursed a Fund for expenses in excess of this limit, the Manager may recover the reimbursed amounts, for a period that does not exceed five years, to the extent this can be done without exceeding the expense limit. This expense limit does not have an expiration date, and will continue unless a change is approved by the Funds’ Board of Trustees.

The Trustees reviewed information on the profitability of the Manager in serving as each Fund’s investment adviser and of the Manager and its affiliates in all of their relationships with each Fund, as well as an explanation of the methodology utilized in allocating various expenses among the Funds. The Trustees considered the methodology used by the Manager in determining compensation payable to portfolio managers and the very competitive environment for investment management talent. The Trustees recognized that profitability comparisons among fund managers are difficult because very little comparative information is publicly available and profitability of any manager is affected by numerous factors, including the organizational structure of the particular manager, the types of funds and other accounts it manages, possible other lines of business, the methodology for allocating expenses, and the manager’s capital structure and cost of capital. However, based on the information available and taking those factors into account, the Trustees concluded that the profitability of the Manager regarding each Fund in relation to the services rendered was not unreasonable. Finally, the Trustees considered the financial condition of the Manager, which they found to be sound.

The Trustees concluded that the advisory fees and other compensation payable by the Funds to the Manager and its affiliates were reasonable in relation to the nature and quality of the services to be provided, taking into account the fees charged by other advisers for managing comparable mutual funds with similar strategies. The Trustees also concluded that the Funds’ estimated overall expense ratios, taking into account quality of services provided by the Manager and the investment performance of the Funds, were reasonable. In addition, the Trustees observed that the Manager’s reimbursement of expenses that exceed the expense limit lowers the Funds’ expense ratios and increases the overall return to shareholders.

Economies of Scale. The Trustees noted that the advisory fee schedule for each Fund contains one or more breakpoints that reduce the fee rate on assets above specified levels. The Trustees received and discussed information concerning whether the Manager realizes economies of scale as a Fund’s assets increase. The Trustees noted that the expense limits discussed above, as well as the breakpoints in place, were reasonably designed to allow the Funds and their shareholders to share in any economies of scale. The Trustees concluded that the fee schedule for each Fund currently in effect represents a sharing of economies of scale at current asset levels.

21

Other Benefits to the Manager. The Trustees also considered benefits that accrue to the Manager and its affiliates from their relationship with the Funds. The Trustees concluded that, other than the services to be provided by the Manager and its affiliates pursuant to the Agreement and the fees payable by the Funds therefor, the Funds and the Manager may potentially benefit from their relationship with each other in other ways. Recognizing that the Manager also provides administrative and transfer agency services to the Funds and receives compensation from the Funds for those services, the Trustees determined that such compensation was fair and reasonable. They also concluded that the Manager’s success could enhance its ability to serve the Funds.

After full consideration of the above factors as well as other factors that were instructive in analyzing the Agreement, the Trustees, including all of the independent Trustees, concluded that the continuation of the Agreement was in the best interest of each Fund and their shareholders. On December 13, 2005, the Trustees continued the Agreement through January 31, 2007.

22

|

Deloitte & Touche LLP | |

| 111 S. Wacker Drive | ||

| Chicago, IL 60606-4301 | ||

| USA | ||

| Tel: +1 312 486 1000 | ||

| Fax: +1 312 486 1486 | ||

| www.deloitte.com | ||

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Trustees of

Pearl Mutual Funds

Muscatine, IA

We have audited the accompanying statements of net assets of Pearl Mutual Funds, including Pearl Total Return Fund and Pearl Aggressive Growth Fund (collectively, the “Funds”) as of December 31, 2005, and the related statements of operations for the year ended, and the statements of changes in net assets and financial highlights for the periods presented. These financial statements and financial highlights are the responsibility of the Funds’ management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits. The financial highlights for the years ended prior to December 31, 1999 were audited by other auditors whose report, dated February 22, 1999, expressed an unqualified opinion on those financial highlights.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. The Funds are not required to have, nor were we engaged to perform, audits of their internal control over financial reporting. An audit includes consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Funds’ internal control over financial reporting. Accordingly, we express no such opinions. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of December 31, 2005, by correspondence with the custodian. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, such financial statements and financial highlights present fairly, in all material respects, the financial position of the Funds at December 31, 2005, and the results of their operations, changes in their net assets, and their financial highlights for the periods presented in conformity with accounting principles generally accepted in the United States of America.

|

| Chicago, Illinois |

| January 31, 2006 |

Member of

Deloitte Touche Tohmatsu

23

STATEMENT OF NET ASSETS

December 31, 2005

| Shares owned |

% of net assets |

Market value | ||||||

| ASSETS: |

||||||||

| INVESTMENTS in mutual funds, all common stocks of unaffiliated issuers: |

||||||||

| Equity mutual funds: |

||||||||

| Artisan Mid Cap Value Fund |

218,082 | 4.64 | % | $ | 4,089,042 | |||

| Bridgeway Small Cap Growth Fund |

77,226 | 1.19 | % | 1,046,406 | ||||

| Dodge & Cox Balanced Fund |

71,428 | 6.59 | % | 5,809,944 | ||||

| Dodge & Cox Stock Fund |

20,589 | 3.20 | % | 2,825,191 | ||||

| First Eagle Overseas Fund, Class I |

754,532 | 19.85 | % | 17,512,687 | ||||

| Keeley Small Cap Value Fund |

183,922 | 9.10 | % | 8,024,520 | ||||

| Kinetics Paradigm Fund |

238,910 | 5.50 | % | 4,852,260 | ||||

| LSV Value Equity Fund |

214,174 | 3.94 | % | 3,469,614 | ||||

| Mairs & Power Growth Fund |

5,739 | 0.47 | % | 411,440 | ||||

| Matthews Asian Growth and Income Fund |

533,777 | 10.38 | % | 9,148,940 | ||||

| Oakmark International Small Cap Fund, Class I |

721,513 | 16.35 | % | 14,415,832 | ||||

| Thornburg International Value Fund, Class I |

191,373 | 5.19 | % | 4,571,910 | ||||

| William Blair International Growth Fund, Class I |

160,603 | 4.65 | % | 4,103,410 | ||||

| TOTAL EQUITY MUTUAL FUNDS |

91.05 | % | 80,281,196 | |||||

| Income mutual funds: |

||||||||

| PIMCO Total Return Fund, Institutional Class |

118,542 | 1.41 | % | 1,244,693 | ||||

| TOTAL INCOME MUTUAL FUNDS |

1.41 | % | 1,244,693 | |||||

| Money market mutual funds: |

||||||||

| Vanguard Money Market Prime Fund |

11,414 | 0.01 | % | 11,414 | ||||

| TOTAL MONEY MARKET FUNDS |

0.01 | % | 11,414 | |||||

| TOTAL INVESTMENTS (cost $65,661,987, including reinvested dividends and distributions) |

92.47 | % | 81,537,303 | |||||

| Cash |

7.92 | % | 6,979,683 | |||||

| Accrued interest |

0.02 | % | 18,067 | |||||

| TOTAL ASSETS |

100.41 | % | 88,535,053 | |||||

| LIABILITIES: |

||||||||

| Distribution payable |

0.34 | % | 301,320 | |||||

| Investment manager’s fees payable (Note 5) |

0.06 | % | 57,265 | |||||

| Payable to manager for expenses of Fund (Note 5) |

0.01 | % | 12,754 | |||||

| Payable for shares redeemed |

0.00 | % | 3,745 | |||||

| Other liabilities |

0.00 | % | 1,063 | |||||

| TOTAL LIABILITIES |

0.41 | % | 376,147 | |||||

| NET ASSETS, applicable to 6,238,735 outstanding shares of beneficial interest (no par value); unlimited shares authorized |

100.00 | % | 88,158,906 | |||||

| NET ASSET VALUE – OFFERING AND REDEMPTION PRICE PER SHARE |

$ | 14.13 | ||||||

| NET ASSETS CONSIST OF: |

||||||||

| Capital |

72,283,087 | |||||||

| Accumulated undistributed net investment income |

490 | |||||||

| Accumulated net realized gains |

13 | |||||||

| Net unrealized appreciation in value of investments |

15,875,316 | |||||||

| TOTAL NET ASSETS |

88,158,906 | |||||||

See notes to financial statements.

24

PEARL TOTAL RETURN FUND

STATEMENT OF OPERATIONS

| Year Ended December 31, 2005 |

||||

| INVESTMENT INCOME: |

||||

| Income: |

||||

| Dividends |

$ | 1,939,387 | ||

| Interest on bank account |

164,549 | |||

| TOTAL INVESTMENT INCOME |

2,103,936 | |||

| Expenses, current year (Note 5): |

||||

| Associations |

4,130 | |||

| Auditors’ fees |

39,502 | |||

| Chief Compliance Officer compensation |

9,130 | |||

| Chief Compliance Officer expenses |

1,910 | |||

| Continuing Education, Trustees |

858 | |||

| Custodian fees |

7,488 | |||

| Data processing |

22,636 | |||

| Trustees’ fees (Note 6) |

65,335 | |||

| Registration fees |

32,843 | |||

| Insurance |

14,506 | |||

| Investment management and administrative services fees (Note 5) |

642,813 | |||

| Legal fees |

70,273 | |||

| Meetings |

7,721 | |||

| Other |

18,334 | |||

| TOTAL EXPENSES BEFORE REIMBURSEMENT |

937,479 | |||

| Expenses reimbursed by investment manager (Note 5) |

(153,719 | ) | ||

| TOTAL EXPENSES |

783,760 | |||

| NET INVESTMENT INCOME |

1,320,176 | |||

| NET REALIZED AND UNREALIZED GAINS (LOSSES) ON INVESTMENTS: |

||||

| Net realized gains on investments (securities of unaffiliated issuers) |

7,214,770 | |||

| Change in net unrealized appreciation of investments |

618,502 | |||

| NET REALIZED AND UNREALIZED GAINS ON INVESTMENTS |

7,833,272 | |||

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS |

$ | 9,153,448 | ||

See notes to financial statements.

25

PEARL TOTAL RETURN FUND

STATEMENTS OF CHANGES IN NET ASSETS

| Year Ended December 31, 2005 |

Year Ended December 31, 2004 |

|||||||

| INCREASE (DECREASE) IN NET ASSETS: |

||||||||

| FROM OPERATIONS: |

||||||||

| Net investment income |

$ | 1,320,176 | $ | 1,422,528 | ||||

| Net realized gains on investments |

7,214,770 | 4,392,824 | ||||||

| Change in net unrealized appreciation of investments |

618,502 | 4,614,304 | ||||||

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS |

9,153,448 | 10,429,656 | ||||||

| FROM DISTRIBUTIONS TO SHAREHOLDERS (Note 7): |

||||||||

| Dividends from net investment income |

(1,320,117 | ) | (1,422,528 | ) | ||||

| Distributions from net realized gains |

(7,214,831 | ) | (2,609,260 | ) | ||||

| TOTAL DISTRIBUTIONS |

(8,534,948 | ) | (4,031,788 | ) | ||||

| FROM CAPITAL SHARES TRANSACTIONS: |

||||||||

| Proceeds received for shares sold (568,650 and 754,175 shares) |

8,120,998 | 9,953,729 | ||||||

| Net asset value of shares (582,706 and 276,998 shares) issued in reinvestment of distributions |

8,233,629 | 3,883,508 | ||||||

| Paid on redemption of shares (196,679 and 187,504 shares), including exchanges into Pearl Aggressive Growth Fund |

(2,872,186 | ) | (2,529,317 | ) | ||||

| INCREASE IN NET ASSETS FROM CAPITAL SHARES TRANSACTIONS: |

||||||||

| (net increase of 954,677 and 843,669 shares) |

13,482,441 | 11,307,920 | ||||||

| TOTAL INCREASE IN NET ASSETS |

14,100,941 | 17,705,788 | ||||||

| NET ASSETS: |

||||||||

| Beginning of period |

74,057,965 | 56,352,177 | ||||||

| End of period (including accumulated undistributed net investment income, $490 and $432, respectively) |

$ | 88,158,906 | $ | 74,057,965 | ||||

See notes to financial statements.

26

STATEMENT OF NET ASSETS

December 31, 2005

| Shares owned |

% of net assets |

Market value | ||||||

| ASSETS: |

||||||||

| INVESTMENTS in mutual funds, all common stocks of unaffiliated issuers: |

||||||||

| Equity mutual funds: |

||||||||

| American Century International Opportunities Fund, Investor Class |

375,904 | 11.39 | % | $ | 3,913,164 | |||

| Artisan International Small Cap Fund, Investor Class |

193,543 | 11.16 | % | 3,834,082 | ||||

| Berwyn Fund |

70,677 | 6.10 | % | 2,096,978 | ||||

| Brandywine Blue Fund |

50,913 | 4.38 | % | 1,505,999 | ||||

| Diamond Hill Large Cap Fund, Class I |

86,305 | 3.63 | % | 1,248,832 | ||||

| Fidelity Leveraged Company Stock Fund |

102,337 | 7.75 | % | 2,662,807 | ||||

| Hartford Capital Appreciation Fund, Class Y |

79,236 | 8.73 | % | 2,999,091 | ||||

| Lazard Emerging Markets Fund |

136,255 | 7.07 | % | 2,430,785 | ||||

| Matthews Pacific Tiger Fund |

212,339 | 11.89 | % | 4,091,766 | ||||

| Munder Small Cap Value Fund, Class Y |

25,077 | 2.01 | % | 689,370 | ||||

| Oakmark Global Fund, Class I |

95,421 | 6.52 | % | 2,239,524 | ||||

| T. Rowe Price Emerging European Mediterranean Fund |

92,143 | 6.76 | % | 2,322,918 | ||||

| US Global Investors Eastern European Fund |

74,640 | 8.58 | % | 2,948,291 | ||||

| Wasatch Micro Cap Fund |

144,189 | 2.67 | % | 917,043 | ||||

| TOTAL EQUITY MUTUAL FUNDS |

98.64 | % | 33,900,650 | |||||

| Money market mutual fund: |

||||||||

| Vanguard Money Market Prime Fund |

6,653 | 0.02 | % | 6,653 | ||||

| TOTAL INVESTMENTS (cost $27,895,017, including reinvested dividends and distributions) |

98.66 | % | 33,907,303 | |||||

| Cash |

2.22 | % | 764,453 | |||||

| Accrued interest |

0.01 | % | 1,901 | |||||

| TOTAL ASSETS |

100.89 | % | 34,673,657 | |||||

| LIABILITIES: |

||||||||

| Distribution payable |

0.81 | % | 276,811 | |||||

| Investment manager’s fees payable (Note 5) |

0.07 | % | 23,618 | |||||

| Payable to manager for expenses of Fund (Note 5) |

0.01 | % | 3,578 | |||||

| Other liabilities |

0.00 | % | 82 | |||||

| TOTAL LIABILITIES |

0.89 | % | 304,089 | |||||

| NET ASSETS, applicable to 2,545,913 outstanding shares of beneficial interest (no par value); unlimited shares authorized |

100.00 | % | $ | 34,369,568 | ||||

| NET ASSET VALUE - OFFERING AND REDEMPTION PRICE PER SHARE |

$ | 13.50 | ||||||

| NET ASSETS CONSIST OF: |

||||||||

| Capital |

$ | 28,357,200 | ||||||

| Accumulated undistributed net investment income |

39 | |||||||

| Accumulated net realized gains |

43 | |||||||

| Net unrealized appreciation in value of investments |

6,012,286 | |||||||

| TOTAL NET ASSETS |

$ | 34,369,568 | ||||||

See notes to financial statements.

27

PEARL AGGRESSIVE GROWTH FUND

STATEMENT OF OPERATIONS

| Year Ended December 31, 2005 |

||||

| INVESTMENT INCOME (LOSS): |

||||

| Income: |

||||

| Dividends |

$ | 926,654 | ||

| Interest on bank account |

19,355 | |||

| TOTAL INVESTMENT INCOME |

946,009 | |||