Exhibit 99.1

Emera

Incorporated

Notice of Annual Meeting of Common Shareholders and Management Information Circular

Wednesday, May 15, 2019

| Dear Fellow Shareholder:

We invite you to attend the Annual Meeting of the common Shareholders of Emera Incorporated, which will be held at the Halifax Convention Centre, Argyle Suite, Level 2, 1650 Argyle Street, Halifax, Nova Scotia, on Wednesday, May 15, 2019 at 2:00 p.m. (Atlantic Time).

The Board of Directors and the executive team look forward to meeting with you to present our analysis of our 2018 financial results and outline our plans for the future.

Please take time to read this document. The Management Information Circular contains important information about the business to be conducted at the Annual Meeting, about the Directors nominated for election, about how we compensate our executive officers and Directors, and about our corporate governance practices. If you cannot attend the Annual Meeting, please use the proxy or voting instruction form provided to you in order to submit your vote prior to the meeting. It is important to us that your shares be counted.

Live coverage of the Annual Meeting will be available on our website at www.emera.com/investors. A recording of the meeting will be available on the site for several weeks following the meeting.

We hope you can join us. |

| Sincerely, |

|

| Jackie Sheppard |

| Chair of the Board |

Table of Contents

| Notice of Annual Meeting |

1 | |||

| Management Information Circular |

2 | |||

| Business of the Meeting |

4 | |||

| Director Nominees |

5 | |||

| Skills and Experience |

6 | |||

| Statement of Corporate Governance Practices |

23 | |||

| A Letter from the Management Resources and Compensation Committee to Our Shareholders |

37 | |||

| Statement of Executive Compensation |

40 | |||

| Compensation Discussion and Analysis |

45 | |||

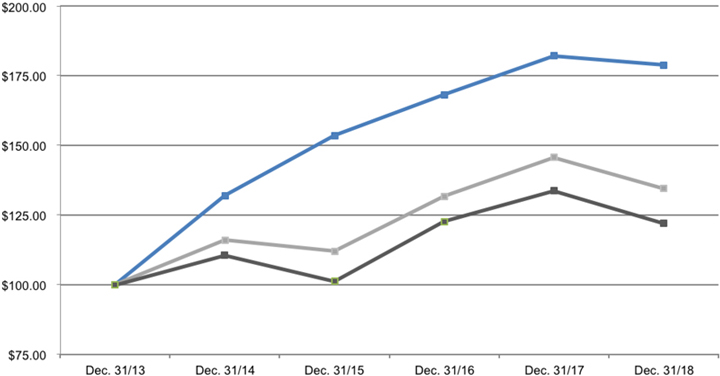

| Performance Graph |

58 | |||

| NEO Summary Compensation Table |

60 | |||

| Appendix “A” – Board of Directors Charter |

71 |

Notice of Annual Meeting

| Wednesday, May 15, 2019 2:00 p.m. Atlantic Time |

Halifax Convention Centre, 1650 Argyle Street Halifax, Nova Scotia, Canada |

Record Date Close of business March 20, 2019 |

Items of Business

1. Electing Directors to serve until the next Annual Meeting of Shareholders;

2. Appointing Auditors;

3. Authorizing the Directors to establish the Auditors’ fee;

4. Considering an advisory resolution on the Company’s approach to executive compensation; and

5. Transacting such other business as may properly come before the meeting.

As a Shareholder, it is important that you vote. Common Shareholders are encouraged to return their proxy or voting instruction form as soon as possible. A postage-paid, pre-addressed envelope is provided. As an alternative, Shareholders may choose to vote by telephone or on the internet as provided for on the proxy or voting instruction form. Proxies must be received prior to 2:00 p.m. Atlantic Time on Monday, May 13, 2019, or if the meeting is adjourned, at least 48 hours (not including Saturdays, Sundays, or statutory holidays in Nova Scotia) prior to the reconvened meeting.

Should you have questions or comments, please contact Emera Incorporated by writing to the Corporate Secretary, Emera Incorporated, P.O. Box 910, Halifax, Nova Scotia B3J 2W5 or by calling 1-800-358-1995 from anywhere in North America or (902) 428-6060 within the Halifax-Dartmouth area.

Stephen D. Aftanas

Corporate Secretary

Emera Inc. — Management Information Circular 2019 1

Management Information Circular

Information as of March 22, 2019

(unless otherwise noted)

Meeting Materials and Notice and Access

Canadian securities rules (“Notice and Access”) permit Emera Incorporated (the “Company” or “Emera”) to provide you with electronic access to this Management Information Circular (the “Circular”) and the 2018 Annual Report (the “Meeting Materials”) for the Annual Meeting of common Shareholders (“Shareholders”) instead of sending you a paper copy. Emera is sending Meeting Materials to registered holders and beneficial owners using Notice and Access. This approach is environmentally friendly as it helps reduce paper use. The notice you received includes instructions on how to access and review an electronic copy of the Meeting Materials or how to request a paper copy. The notice also provides instructions on voting by proxy at the meeting. If you would like to receive a paper copy of the Meeting Materials, please follow the instructions in the notice.

For those Shareholders who have previously provided instructions to receive paper copies of Meeting Materials, we sent you a paper copy in addition to the notice regarding their electronic availability.

Solicitation of Proxies

This Circular is furnished in connection with the solicitation of proxies by the Board of Directors of Emera (the “Board of Directors” or “Emera’s Board” or the “Board”) and management of Emera for use at the Annual Meeting (“Meeting”) of Shareholders of the Company to be held on Wednesday, May 15, 2019, as set forth in the Notice of Annual Meeting (the “Notice”).

You have received a proxy or voting instruction form. The solicitation of proxies will be primarily by mail although proxies may also be solicited by telephone, facsimile or email, in writing, or in person, by directors of the Company (“Directors”), Officers, or other employees or agents of the Company.

The Company wishes to have as many Shareholders vote as possible and has retained D.F. King Canada as the proxy solicitation agent to assist with the solicitation of votes from Shareholders. The proxy solicitation agent will monitor the number of Shareholders voting and will contact Shareholders in order to increase participation in voting. The cost of this solicitation will be borne by the Company and is not expected to exceed $50,000.

Record Date and Voting of Shares

The date for determining which Shareholders are entitled to receive the Notice is Wednesday, March 20, 2019. This is called the “Record Date”. Only Shareholders of record at the close of business on the Record Date will be entitled to vote. Each common share owned as of the Record Date entitles the holder to one vote.

To the knowledge of the Directors and Officers, as of the date of this Circular, no person owned or exercised control over more than 10 per cent of the outstanding common shares of the Company and the only outstanding voting shares were 235,872,307 common shares.

Beneficial (or Non-Registered) Owners

The voting process is different depending on whether you are a registered Shareholder, Non-Objecting Beneficial Owner or Objecting Beneficial Owner.

If you have shares registered in your own name, you are a registered Shareholder. If you do not hold shares in your own name, you are a beneficial or non-registered owner. If your shares are listed in an account statement provided to you by a broker, then it is likely that those shares will not be registered in your name, but under the broker’s name or under the name of an agent of the broker such as CDS Clearing and Depository Services Inc., the nominee for many Canadian brokerage firms, or its nominee.

There are two kinds of beneficial owners: (i) Objecting Beneficial Owners – those who object to their name being made known to the issuers of shares which they own and (ii) Non-Objecting Beneficial Owners – those who do not object to their name being made known to the issuers of the shares which they own. Non-Objecting Beneficial Owners will receive a voting instruction form from Emera’s registrar and transfer agent, AST Trust Company (Canada) (“AST”). This is to be completed and returned to AST in the envelope provided. In addition, AST provides both telephone voting and internet voting as described on the voting instruction form.

Securities regulation requires brokers or agents to seek voting instructions from Objecting Beneficial Owners in advance of the Meeting. Objecting Beneficial Owners should be aware that brokers or agents can only vote shares if instructed to do so by the Objecting Beneficial Owner. Your broker or agent (or their agent Broadridge) will have provided you with a voting instruction form or form of proxy for the purpose of obtaining your voting instructions. Every broker has its own mailing procedures and provides instructions for voting. You must follow those instructions carefully to ensure your shares are voted at the Meeting.

If you are an Objecting Beneficial Owner receiving a voting instruction form or proxy from a broker or agent, you cannot use that proxy to vote in person at the Meeting. To vote your shares at the Meeting, the voting instruction form or proxy must be returned as instructed by the broker well in advance of the Meeting. If you wish to attend and vote your shares in person at the Meeting, follow the instructions for doing so provided by your broker or agent.

2 Emera Inc. — Management Information Circular 2019

MANAGEMENT INFORMATION CIRCULAR

Shareholder Proxy Materials

These security holder materials are being sent to both registered and non-registered owners of the securities. If you are a non-registered owner, and the issuer or its agent has sent these materials directly to you, your name, address and information about your holdings of securities have been obtained in accordance with applicable securities regulatory requirements from the intermediary holding on your behalf. Emera has arranged for its registrar and transfer agent, AST, to send materials directly to Non-Objecting Beneficial Owners. Emera will bear the cost of delivering Shareholder proxy materials to registered Shareholders, Non-Objecting Beneficial Owners and Objecting Beneficial Owners.

By choosing to send these materials to you directly, Emera (and not the intermediary holding on your behalf) has assumed responsibility for

(i) delivering these materials to Non-Objecting Beneficial Owners, and (ii) executing their proper voting instructions. Please return voting instructions as specified in the voting instruction form or form of proxy.

Appointment and Revocation of Proxies

The persons named in the enclosed proxy are Jackie Sheppard, Chair of the Board, Scott Balfour, President and Chief Executive Officer, and Stephen Aftanas, Corporate Secretary of the Company.

In order for a vote by proxy or voting instruction form to be counted, it must be received prior to 5:00 p.m. (Atlantic Time) on Monday, May 13, 2019, or if the meeting is adjourned, at least 48 hours (not including Saturdays, Sundays or statutory holidays in Nova Scotia) prior to the reconvened meeting. The Company reserves the right to accept late proxies and to waive the proxy cut-off with or without notice, but is under no obligation to accept or reject any particular late proxy. For Canadian residents, a postage-paid, pre-addressed envelope is provided for this purpose. You may vote by proxy or voting instruction form via mail, the internet or telephone. If you are a registered Shareholder or a Non-Objecting Beneficial Owner, you may attend the Meeting in person and submit your completed proxy or vote by ballot.

Completion of a proxy gives discretionary authority to the proxyholder to vote as he or she sees fit in respect of amendments to matters identified in the Notice, and other matters that may properly come before the Meeting or any adjournment thereof, whether or not the amendment or other matter that comes before the Meeting is or is not routine, and whether or not the amendment or other matter that comes before the Meeting is contested. Management of the Company is not aware of any amendments or other matters to be presented for action at the Meeting.

If you appoint Ms. Sheppard, Mr. Balfour or Mr. Aftanas as your proxyholder, they will vote, or withhold from voting, in accordance with your directions. If you do not specify how you want your shares voted, they will vote “For” the:

| • | election of each of the Directors named in this Circular; |

| • | appointment of Ernst & Young LLP as Auditors; |

| • | authorization of the Directors to establish the Auditors’ fee; and |

| • | advisory resolution on the Company’s approach to executive compensation. |

They will vote in accordance with their best judgment if any other matters are properly brought before the Meeting.

You may appoint any other person (who need not be a Shareholder) to represent you at the Meeting by inserting that person’s name in the space provided on the proxy or voting instruction form. That person is your proxyholder and must attend and vote at the Meeting in order for your vote to count.

You may revoke your proxy by providing new voting instructions in a new proxy or voting instructions form with a later date, or at a later time if you are voting on the internet or by telephone. Any new voting instructions, however, will only take effect if received prior to 2:00 p.m. (Atlantic Time) on Monday, May 13, 2019 or if the meeting is adjourned, at least 48 hours (not including Saturdays, Sundays or statutory holidays in Nova Scotia) prior to the reconvened meeting. You may also revoke your proxy without providing new voting instructions by giving written notification addressed to Mr. Stephen Aftanas, Corporate Secretary, P.O. Box 910, Halifax, Nova Scotia, B3J 2W5, no later than the last business day preceding the day of the Meeting or any postponement or adjournment thereof or with the Chair of the Meeting on the day of the Meeting or any postponement or adjournment thereof or in any other manner permitted by law. Registered Shareholders and Non-Objecting Beneficial Owners may attend the Meeting and vote their shares in person and, if they do so, any voting instructions previously given by such persons for such shares will be revoked.

Restrictions on Share Ownership and Voting

Under Nova Scotia legislation, no Emera Shareholder may own or control, directly or indirectly, more than 15 per cent of the outstanding voting shares. Shareholders who are not residents of Canada may not hold, in the aggregate, more than 25 per cent of the outstanding voting shares.

These restrictions may be enforced by limiting non-complying Shareholders’ voting rights (including, in the case of the individual share constraint, by disqualifying or deeming votes to have not been cast by such non-complying Shareholders, and in the case of the non-resident share constraint, by proportionally adjusting the number of shares voted by non-resident Shareholders so that such votes cast equal 25 per cent of all votes cast), dividend rights and transfer rights. Shareholders may be required, at any time, to furnish a statutory declaration to verify the number of shares held and/or residency in order to ensure compliance with these restrictions.

If you have any questions about share ownership and voting restrictions, please contact the Corporate Secretary using the contact information contained in the Notice.

Emera Inc. — Management Information Circular 2019 3

Business of the Meeting

| 1. | Election of the Board of Directors: The 12 nominees proposed for election as Directors at the 2019 Meeting are identified under Director Nominees in this Circular. For more information about the process for nominating Directors, see Nomination of Directors and Director Recruitment Process in the Statement of Corporate Governance Practices. |

All nominees are currently Directors of the Company. Each nominee has indicated his or her willingness to serve as a Director. Each Director elected at the Meeting will hold office until the next Annual Meeting of Shareholders.

Ms. Sheppard, Mr. Balfour and Mr. Aftanas intend to vote “For” the 12 nominees unless instructed otherwise by Shareholders in their proxy.

| 2. | Appointment of Auditors: The Audit Committee has reviewed the performance of Ernst & Young LLP, including its independence relating to the audit, and recommends the re-appointment of Ernst & Young LLP as Auditors. Ernst & Young LLP have been Auditors of the Company since its inception in 1998, and before that were Auditors of the Company’s subsidiary, Nova Scotia Power Inc. (“NSPI”), since 1991. |

Ms. Sheppard, Mr. Balfour and Mr. Aftanas intend to vote “For” the re-appointment of Ernst & Young LLP as Auditors of the Company, to hold office until the close of the next Annual Meeting of Shareholders, unless a Shareholder specifies their shares be withheld from voting.

| 3. | Auditors’ Fee: The Company is incorporated under the Nova Scotia Companies Act. Shareholder approval of the authorization of Directors to establish the Auditors’ fee is required pursuant to the Companies Act. The aggregate fees billed by Ernst & Young LLP, during the last two fiscal years ended December 31, 2017 and December 31, 2018, were as follows: |

| Service Fee

|

2018 ($)

|

2017 ($)

|

||||||||

|

|

||||||||||

|

Audit Fees(1)

|

|

2,540,734

|

|

|

1,711,880

|

| ||||

|

|

||||||||||

| Audit-Related Fees(2)

|

|

154,300

|

|

|

461,269

|

| ||||

|

|

||||||||||

| Tax Fees(3)

|

|

282,326

|

|

|

468,051

|

| ||||

|

|

||||||||||

| All Other Fees(4)

|

|

13,500

|

|

|

133,000

|

| ||||

|

|

||||||||||

| Total

|

|

2,990,860

|

|

|

2,774,201

|

| ||||

|

|

||||||||||

| (1) | In the first quarter of 2018, Ernst & Young LLP assumed the responsibility as Auditors of Emera’s subsidiary, TECO Energy, Inc. (TECO). Accordingly, the 2018 Audit Fees shown above include the consolidation of such fees for Emera and TECO. For comparison purposes, in 2017 the consolidated Audit Fees were $4,116,064. |

| (2) | Audit-Related Fees for Emera relate to accounting and disclosure consultations. |

| (3) | Tax Fees for Emera relate to the structuring of cross-border financing of Emera’s subsidiaries and affiliates as well as tax compliance services and general tax consulting advice on various matters. |

| (4) | All Other Fees relate to other consulting fees. |

Ms. Sheppard, Mr. Balfour and Mr. Aftanas intend to vote “For” the authorization of Directors to establish the Auditors’ fee, unless a Shareholder instructs otherwise in their proxy.

| 4. | Advisory Vote on Executive Compensation: You will be asked to consider and approve, on an advisory basis, a resolution on Emera’s approach to executive compensation as disclosed in this Circular. |

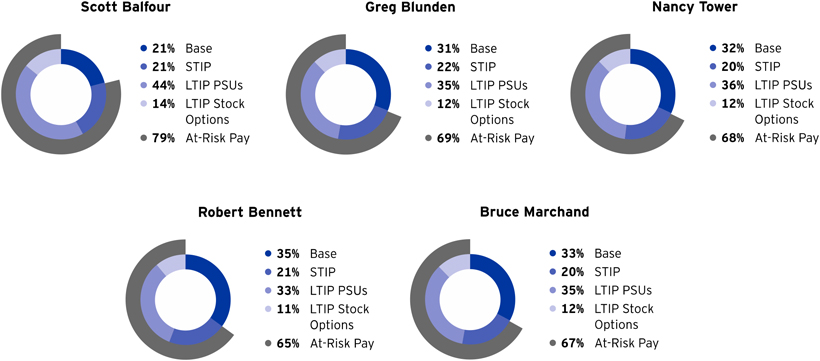

Our executive compensation programs are designed to attract, retain, motivate and reward high-calibre leaders to deliver strong performance in alignment with Emera’s corporate strategy and to create and sustain Shareholder value. Programs are designed to reflect a blend of short- and long-term incentive plans to reflect our pay-for-performance philosophy and to provide for a significant portion of an executive’s compensation to be at risk, while aligning the structure of programs and payouts with sound risk management and good governance principles.

The Board, through the Management Resources and Compensation Committee (“MRCC”), has directed and reviewed the contents of the Statement of Executive Compensation in this Circular and has unanimously approved it as part of the Committee’s report to you.

As our Shareholder, on an advisory basis, you have the opportunity to vote “For” or “Against” our approach to executive compensation through the following resolution:

“BE IT RESOLVED, on an advisory basis, and not to diminish the role and responsibilities of the Board of Directors, that the Shareholders accept the approach to executive compensation disclosed in the Company’s information circular delivered in advance of the 2019 Annual Meeting of Shareholders.”

Since your vote is advisory, it will not be binding on the Board; however, the Board, and in particular the MRCC, will seriously consider the outcome of the vote as part of its ongoing review of executive compensation.

Unless otherwise instructed, Ms. Sheppard, Mr. Balfour and Mr. Aftanas intend to vote “For” the advisory resolution on executive compensation.

4 Emera Inc. — Management Information Circular 2019

MANAGEMENT INFORMATION CIRCULAR

Director Nominees

The following pages set out the names of the nominees proposed for election as Directors of Emera. Biographical information about the Director nominees is also provided, including age, municipality and country of residence, year first elected or appointed as a Director, principal occupation, education, skills and experience. The information about each Director nominee includes Committee memberships and meeting attendance. Their membership on other public company boards in the last five years is also described.

There is information about the common shares and deferred share units (“DSUs”) of Emera held by each Director nominee for the past three years. The estimated value of each Director nominee’s common shares and DSU holdings is based on the following:

| Year-end

|

Closing price of Emera common shares ($)

|

|||

| December 31, 2016

|

|

45.39

|

| |

| December 31, 2017

|

|

46.98

|

| |

| December 31, 2018

|

|

43.71

|

| |

All Director nominees are required to meet share ownership guidelines. The information below details their status under those guidelines. For further information on the share ownership guidelines for Directors, see Director Share Ownership Guidelines in the Statement of Corporate Governance Practices later in this Circular. For further information on the share ownership guidelines for the Company’s executive officers, including Mr. Balfour, see Executive Share Ownership Requirements and Anti-Hedging Policy in the Statement of Executive Compensation.

All Director nominees, except Mr. Balfour and Mr. Ramil, are considered by the Board to be independent. For more information about the Company’s definition of independence, see Director Independence in the Statement of Corporate Governance Practices later in the Circular.

Emera Inc. — Management Information Circular 2019 5

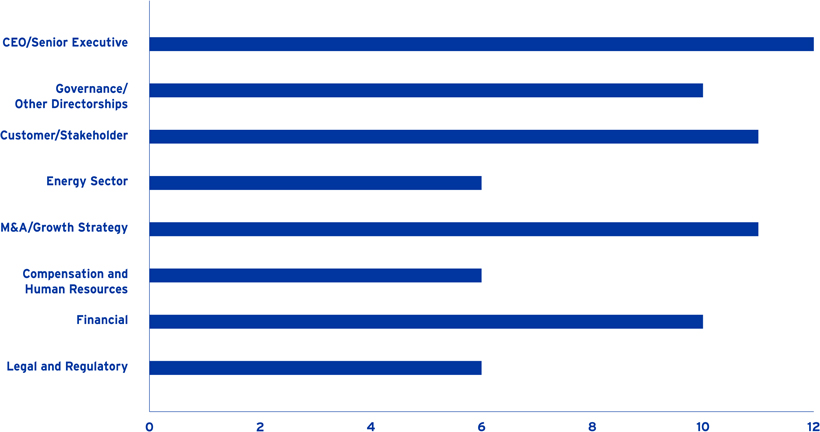

Skills and Experience Total

The above bar chart shows eight categories of skills and experience important to the Company’s business and governance (along the vertical axis), and the number of the 12 Director nominees who possess those skills and experience (along the horizontal axis). The details of each Director nominee’s skills and experience are contained in their biographies later in this Circular.

The voting results for those Directors who were nominees for election in the 2018 Annual Meeting of Shareholders are shown in the two rows below.

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

|

Percentage of votes cast “For” each Director (%) |

99.36 | 99.64 | 98.70 | 99.21 | 99.65 | 99.75 | 99.77 | 99.24 | 99.38 | 99.03 | 99.75 | 99.33 | ||||||||||||||||||||||||||||||||||||

|

Percentage of votes cast “Withheld” (%) |

0.64 | 0.36 | 1.30 | 0.79 | 0.35 | 0.25 | 0.23 | 0.76 | 0.62 | 0.97 | 0.25 | 0.67 | ||||||||||||||||||||||||||||||||||||

6 Emera Inc. — Management Information Circular 2019

Emera Inc. — Management Information Circular 2019 7

8 Emera Inc. — Management Information Circular 2019

Emera Inc. — Management Information Circular 2019 9

10 Emera Inc. — Management Information Circular 2019

Emera Inc. — Management Information Circular 2019 11

12 Emera Inc. — Management Information Circular 2019

Emera Inc. — Management Information Circular 2019 13

14 Emera Inc. — Management Information Circular 2019

Emera Inc. — Management Information Circular 2019 15

16 Emera Inc. — Management Information Circular 2019

Emera Inc. — Management Information Circular 2019 17

18 Emera Inc. — Management Information Circular 2019

MANAGEMENT INFORMATION CIRCULAR

Compensation of Directors in 2018

Purpose of Director Compensation

The compensation of Directors is designed to:

| • | attract and retain highly skilled and experienced individuals to serve on Emera’s Board of Directors; |

| • | ensure alignment with Shareholders’ long-term interests; and |

| • | recognize the substantial time commitment required to oversee management of the Company. |

For more information about the process of determining Director compensation, see Director Compensation in the Statement of Corporate Governance Practices later in the Circular.

Deferred Share units (DSUs)

Directors have the ability to elect to receive some or all of their cash compensation in the form of DSUs. In 2018, the annual retainer for each Director was $190,000, of which $125,000 was payable in DSUs. More information about the Directors’ DSU Plan is provided later in this section of the Circular. The Company does not offer option-based awards, non-equity incentive plan participation, or participation in a Company pension plan to its non-executive Directors.

Board Chair’s All-Inclusive Retainer

The annual Chair’s Retainer is an all-inclusive fee, meaning the Board Chair receives no meeting fees or any other retainer for serving as Emera’s Board Chair. The all-inclusive annual retainer of the Board Chair in 2018 was $400,000. This was comprised of $200,000 in DSUs, and the remainder in cash.

Compensation Rates for Directors

Listed below are the annual compensation rates for non-executive Directors. These rates are not applicable to Mr. Balfour, who is an employee of the Company.

| Annual retainers and meeting fees for Directors in 2018

|

Cash amount ($)

|

DSUs ($)

|

Total ($)

|

|||||||||

| Annual Chair’s retainer |

200,000 | 200,000 | 400,000 | |||||||||

| Annual Director’s retainer |

65,000 | 125,000 | 190,000 | |||||||||

| In-person meeting fee |

1,750 | |||||||||||

| Telephone meeting fee |

1,250 | |||||||||||

| Travel fee (if one-way travel is five hours or more) |

1,750 | |||||||||||

| Travel fee (if one-way travel is at least three hours but less than five hours) |

875 | |||||||||||

| Annual Audit Committee Chair’s retainer |

20,000 | |||||||||||

| Annual Audit Committee member’s retainer |

5,000 | |||||||||||

| Annual Management Resources and Compensation Committee Chair’s retainer |

15,000 | |||||||||||

| Annual Management Resources and Compensation Committee member’s retainer |

3,000 | |||||||||||

| Annual Nominating and Corporate Governance Committee Chair’s retainer |

10,000 | |||||||||||

| Annual Nominating and Corporate Governance Committee member’s retainer |

3,000 | |||||||||||

| Annual Health, Safety and Environment Committee Chair’s retainer |

10,000 | |||||||||||

| Annual Health, Safety and Environment Committee member’s retainer |

3,000 | |||||||||||

|

|

||||||||||||

Members of ad hoc committees receive meeting fees for their participation in each committee meeting, but typically receive no annual retainer for being a member of an ad hoc committee because of the nature of the committee’s existence, having generally been established for a specific purpose and a temporary period of time. For further information on the Company’s Committees, see Committees of the Board of Directors in the Statement of Corporate Governance Practices later in this Circular.

Emera Inc. — Management Information Circular 2019 19

Total Director Compensation in 2018

The following table sets out the total compensation earned by the Directors who served on Emera’s Board during 2018. Compensation is made up of applicable retainers and fees, at the rates described on the previous page, for attendance at Board and Committee meetings which a Director attended as a member or guest, for briefing meetings, education sessions and travel fees.

Mr. Balfour is not included in the table as his compensation for service as Emera’s President and CEO is disclosed in the Statement of Executive Compensation. He does not receive any additional compensation for his services as a member of the Board of Emera or as a member of the Board of any of Emera’s subsidiaries or investments.

In the table below, the columns under the headings “DSUs Awarded” and “DSUs Held” show detailed information about DSUs received by Directors as compensation.

Total Compensation

| DSUs Awarded | DSUs Held | |||||||||||||||||||||||||||

|

Director |

Fees earned in 2018 |

All

other |

Total ($) |

2018 Share |

Value of DSUs |

Change in |

Market value of |

|||||||||||||||||||||

| James Bertram | 113,732 | N/A | 113,732 | 113,732 | 106,413 | 0 | 106,413 | |||||||||||||||||||||

| Sylvia Chrominska | 225,500 | N/A | 225,500 | 200,375 | 257,837 | (90,087) | 1,462,029 | |||||||||||||||||||||

| Henry Demone | 222,625 | N/A | 222,625 | 222,625 | 245,516 | (45,589) | 854,903 | |||||||||||||||||||||

| Allan Edgeworth | 240,500 | N/A | 240,500 | 240,500 | 351,617 | (164,094) | 2,545,067 | |||||||||||||||||||||

| James Eisenhauer | 219,000 | N/A | 219,000 | 219,000 | 315,808 | (143,455) | 2,233,368 | |||||||||||||||||||||

| Kent Harvey(6) | 247,290 | N/A | 247,290 | 125,000 | 119,644 | (1,282) | 136,794 | |||||||||||||||||||||

| Lynn Loewen | 223,625 | N/A | 223,625 | 223,625 | 264,558 | (69,454) | 1,192,949 | |||||||||||||||||||||

| John McLennan | 84,892 | N/A | 84,892 | 84,892 | 289,784 | (276,654) | 3,987,819 | |||||||||||||||||||||

| Don Pether | 227,375 | N/A | 227,375 | 227,375 | 316,508 | (133,976) | 2,107,364 | |||||||||||||||||||||

| John Ramil(6) | 246,472 | N/A | 246,472 | 246,472 | 251,021 | (22,759) | 555,252 | |||||||||||||||||||||

| Andrea Rosen | 234,000 | N/A | 234,000 | 234,000 | 348,304 | (167,935) | 2,593,097 | |||||||||||||||||||||

| Richard Sergel(6) | 251,431 | 10,000(7) | 261,431 | 125,000 | 151,889 | (44,181) | 742,461 | |||||||||||||||||||||

| Jackie Sheppard | 400,000 | N/A | 400,000 | 400,000 | 513,841 | (178,363) | 2,898,027 | |||||||||||||||||||||

| Jochen Tilk | 109,211 | N/A | 109,211 | 84,571 | 79,160 | 0 | 79,160 | |||||||||||||||||||||

| (1) | The “Fees earned in 2018” column is the amount of Directors’ fees, and includes the dollar value of that portion of their retainer paid in DSUs. All fees are in Canadian dollars. |

| (2) | This column shows the portion of Directors’ fees earned in 2018 that was allocated to DSUs. DSUs granted in 2018 are based on the value of the Emera common share closing price on December 31, 2017 ($46.98). |

| (3) | This column shows the value of all DSUs received in 2018, including received as dividend equivalents during the year, multiplied by the December 31, 2018 Emera common share closing price of $43.71. |

| (4) | This column shows the change in value of all DSUs held by each Director at the beginning of the year as a result of the change to the Emera common share closing price from $46.98 at the beginning of the year to $43.71 on December 31, 2018. |

| (5) | This column shows the value of all DSUs held by each Director at the end of 2018 based on the December 31, 2018 Emera common share closing price of $43.71. |

| (6) | As US-domiciled Directors, the annual cash retainer, committee retainers, and the associated meeting and travel fees are paid to Mr. Harvey, Mr. Ramil and Mr. Sergel in US dollars, using a one-to-one conversion rate to the Canadian dollar. |

| (7) | Mr. Sergel also received compensation for serving as a Director of Emera US Holdings Inc. |

The table above includes compensation earned by Emera Directors who served on the Board of Directors of Emera subsidiaries. What follows is more information about Emera’s Directors who served on the Boards of its subsidiaries.

20 Emera Inc. — Management Information Circular 2019

MANAGEMENT INFORMATION CIRCULAR

Compensation of Emera Directors on Subsidiary Boards

The Emera Board of Directors, on the recommendation of the Nominating and Corporate Governance Committee, determines the compensation to be received by Emera Directors who serve on the Boards of Emera’s subsidiaries. Such compensation received by each Emera Director that serves as a Director on the Board of an Emera subsidiary is reported under “All other compensation” and “Total” in the Total Compensation table on the previous page.

Mr. Sergel was a member of the Board of Directors of Emera US Holdings Inc., a US holding company which is a direct subsidiary of Emera and holds certain US-based investments of Emera. He receives an annual retainer of $10,000 USD for serving on the Emera US Holdings Inc. Board, plus $1,000 USD for any Board meetings.

Directors’ Share Ownership Guidelines

In order to align the interests of Directors and Shareholders, the Directors are subject to share ownership guidelines that require them to own common shares and/or DSUs with a value of not less than three times the annual Director’s Retainer within a specified time frame. For the status of each Director nominee under the Director Share Ownership guidelines, see their biographies earlier in this Circular. For more information about the Director Share Ownership guidelines, see Director Share Ownership Guidelines in the Statement of Corporate Governance Practices.

Directors’ DSU Plan

Under the Directors’ Deferred Share Unit Plan (the “Directors’ DSU Plan”), non-employee Directors may elect to receive all or any portion of their compensation in DSUs in lieu of cash compensation, subject to requirements to receive a minimum portion of their annual retainer in DSUs.

Directors’ fees are paid on a quarterly basis and, at the time of each quarterly payment, the applicable amount is converted to DSUs. The number of DSUs to be credited is determined by dividing (a) the quarterly portion of the Director’s annual fee that the Director elected to be paid in DSUs by (b) the fair market value on the last trading day of the preceding calendar year, with fractions computed to three decimal places.

A DSU is a unit that has a value based upon the value of one Emera common share. When a dividend is paid on Emera’s common shares, the Director’s DSU account is credited with additional DSUs computed by dividing: (a) the amount obtained by multiplying the amount of the dividend declared and paid per common share by the number of DSUs recorded in the Director’s account on the record date for the payment of such dividend, by (b) the market price of a common share as of the dividend payment date.

DSUs cannot be redeemed for cash until the Director leaves the Board. The cash redemption value of a DSU equals the market value of a common share at the time of redemption. DSUs are not shares, cannot be converted to shares and do not carry voting rights. DSUs received by Directors in lieu of cash compensation and held by them represent an at-risk investment in Emera. The value of DSUs is based on the value of the common shares of Emera, and therefore is not guaranteed. See Director Compensation in the Statement of Corporate Governance Practices in this Circular for more information about the compensation of Directors. Non-employee Directors are not entitled to participate in any other compensation plan of the Company or in Emera’s Employee Common Share Purchase Plan.

Emera Inc. — Management Information Circular 2019 21

Committees of the Board of Directors

The Board of Directors has four standing Committees to assist it in carrying out its duties. They are the:

| • | Audit Committee; |

| • | Management Resources and Compensation Committee (“MRCC”); |

| • | Nominating and Corporate Governance Committee (“NCGC”); and |

| • | Health, Safety and Environment Committee (“HSEC”). |

From time to time the Board may establish ad hoc committees to assist the Board on specific matters of a temporary nature.

Certain Proceedings

To the knowledge of the Company, none of the proposed nominees for election as Directors of the Company:

| (a) | are, as at the date of this Circular, or have been, within 10 years before the date of this Circular, a director, chief executive officer or chief financial officer of any company that: |

| (i) | was subject to a cease trade order, an order similar to a cease trade order or an order that denied the relevant company access to any exemption under securities legislation that was in effect for a period of more than 30 consecutive days (an “Order”) that was issued while the proposed nominee was acting in the capacity as director, chief executive officer or chief financial officer; or |

| (ii) | was subject to an Order that was issued after the proposed nominee ceased to be a director, chief executive officer or chief financial officer and which resulted from an event that occurred while that person was acting in the capacity as director, chief executive officer or chief financial officer; |

| (b) | are, as at the date of this Circular, or have been within 10 years before the date of this Circular, a director or executive officer of a company that, while that person was acting in that capacity, or within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangements or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets; or |

| (c) | have, within the 10 years before the date of this Circular, become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold the assets of the proposed nominee. |

22 Emera Inc. — Management Information Circular 2019

MANAGEMENT INFORMATION CIRCULAR

Statement of Corporate Governance Practices

|

Corporate Governance at a Glance

| ||

|

Emera’s Board of Directors annually reviews its approach to corporate governance. It monitors best practices of leading corporations with a view to enhancing governance to create and preserve long-term Shareholder value. Details of Emera’s corporate governance practices may be found in this Statement of Corporate Governance Practices.

| ||

|

Governance Highlights

|

For Details See | |

| All Emera Directors are independent from management except the President and Chief Executive Officer and John Ramil. Mr. Ramil joined the Board following the closing of Emera’s acquisition of TECO where he previously held the position of President and CEO.

|

Board of Directors page 24 | |

| The Board oversees the Company’s strategy, which includes reviewing the strategic planning process and annually approving the strategic plan, taking into account, among other things, the opportunities and risks of the business.

|

Board of Directors page 24 | |

| The Board and, on certain matters by delegation, its Committees oversee the Company’s risk management. | Board of Directors

| |

| The Chair of the Board of Directors Charter and position descriptions for each of the Committee Chairs describe the roles and responsibilities for these leadership positions.

|

Position Descriptions

| |

| Directors receive an in-depth orientation when they become Board members. Annually, site visits are organized to operating facilities and offices. In addition, special areas of focus or interest are addressed at Board dinners and meetings. Board members are encouraged to continue to pursue education to familiarize them with the business, investments and key Company personnel.

|

Orientation of Directors and Continuing Education page 30 | |

| Creating a culture of integrity begins with the tone at the top. Directors, Officers and employees are required to annually acknowledge that they have reviewed and understand the Emera Code of Conduct, which itself is routinely reviewed by the Nominating and Corporate Governance Committee.

|

Ethical Business Conduct page 32 | |

| New Directors are recruited on the basis that they will make a strong contribution and have the background, skills and experience needed by the Board in view of the Company’s strategy. | Nomination of Directors and Director Recruitment

Process

| |

| The Company maintains compensation for Directors designed to recognize the substantial time commitment required to oversee management of the Company and to align Directors’ interests with the long-term interests of Shareholders.

|

Director Compensation

| |

| Four standing Committees assist the Board in carrying out its responsibilities: the Audit Committee; the Management Resources and Compensation Committee; the Nominating and Corporate Governance Committee; and the Health, Safety and Environment Committee. Special committees are struck from time to time as needed in regard to specific matters.

|

Committees of the Board of Directors page 33 | |

| The Board annually assesses its performance in order to find ways to improve its effectiveness and that of the Chair, individual Directors and the Board Committees. We track our conclusions and follow up.

|

Board and Director Performance Assessments

| |

|

Please read Emera’s entire Statement of Corporate Governance Practices on the following page for more important details about the Company’s

governance | ||

Emera Inc. — Management Information Circular 2019 23

Board of Directors

Board of Directors Charter

The Board of Directors believes that clear accountabilities lead to the best governance and, therefore, maintains a Charter for the Board. The Board of Directors Charter was reviewed in 2018 to ensure it appropriately reflected the Board’s responsibility. That review resulted in minor clarifying amendments being made. The Charter as amended is attached to this Circular as Appendix A.

Under the Charter, the Board is responsible for overseeing the management of the business of the Company and for providing stewardship and governance for the long-term success of the Company. The Charter describes the duties and responsibilities of the Board in matters of independence and integrity, strategic planning, risk management, leadership and succession, financial reporting, corporate communications, public disclosure and corporate governance. We encourage you to carefully review the Charter for more detail about the obligations of the Board in these areas.

Director Independence

All Emera Directors are independent from management, except for Mr. Balfour and Mr. Ramil. Mr. Balfour is the President and CEO. Mr. Ramil, who was President and CEO of TECO at the time it merged with Emera on July 1, 2016, is not considered independent. Mr. Ramil retired as President and CEO of TECO in August 2016 and he joined the Emera Board in September 2016. The question of his independence is a matter for the determination by the Emera Board having regard to the test set out below. The Board has determined that he should not be considered independent at this time, but this determination is subject to review by the Emera Board in future years, and Mr. Ramil’s status in this regard may change based on the Board’s review and further determination at that time.

Use of the term “independent” in relation to a Director in this Circular means a Director is independent as defined under applicable Canadian securities laws and, in particular, is free of any direct or indirect material relationship, which could, in the view of the Board of Directors, be reasonably expected to interfere with the Director’s independent judgment.

Directors receive no other remuneration from Emera other than Directors’ retainers, fees or retainers for service as Chair of the Board or Chair or member of a Committee. Ms. Sheppard receives an all-inclusive annual retainer as Chair of the Board of Emera. Mr. Sergel receives a retainer for being a member of the Board of Emera’s subsidiary Emera US Holdings Inc. As noted earlier in the Circular, Mr. Balfour does not receive any additional compensation for his services as a member of the Board of Emera or as a member of the Board of any of Emera’s subsidiaries or investments, beyond his compensation as Emera’s President and CEO.

The Company’s Articles of Association provide that no more than two Directors may be employees of the Company or of a subsidiary or affiliate of the Company. Mr. Balfour, as President and CEO of the Company, is the only Director employed by the Company.

Independent Chair

Ms. Sheppard, the Chair of the Board, is an independent Director. The Articles of Association of the Company require that the Chair of the Board and the President and CEO be separate individuals.

Position Descriptions

Chair of the Board

The Chair provides leadership to the Board, in order that it may fulfill its duties effectively, efficiently and independent of management. The Chair’s role is to see that the Board and Shareholder meetings function effectively. The Chair provides advice and counsel to Directors and the President and CEO. The Chair participates in the recruitment of Directors and the assessment of their performance and of the Board as a whole. For the full text of the Chair of the Board of Directors Charter, visit www.emera.com/governance.

Committee Chairs

The Board has adopted position descriptions for each Committee Chair, which detail the duties of the Committee Chairs. Each Committee Chair is required to provide leadership to the Committee members and support the Committee’s effective operation in order to fulfill its mandate. For the full text of the position description for Committee Chairs, visit www.emera.com/governance.

President and Chief Executive Officer

The roles and responsibilities of the President and CEO are contained in his employment contract, which provides that he is chief executive of the Company. The President and CEO’s employment contract is reviewed by the Chair of the Board of Directors and the MRCC, and it is approved by the Board of Directors.

Among the various responsibilities of the Board, CEO selection is of critical importance. The Board oversees the succession planning program for the Chief Executive Officer. In 2017, the Board announced that Mr. Chris Huskilson had provided notice of his intention to retire as CEO in 2018. Concurrently, the Board also announced it would appoint Mr. Balfour as CEO upon Mr. Huskilson’s retirement. The Board appointed Mr. Balfour a Director and the President and Chief Executive Officer of Emera effective March 29, 2018. During the transition period before Mr. Huskilson’s retirement, the Board regularly met independently with Mr. Huskilson and Mr. Balfour during its in-camera sessions to garner their feedback on the transition process. For more information about succession planning, see Succession Planning and Leadership Development in the Statement of Executive Compensation.

Board Size

The Articles of Association provide that the number of Directors on the Company’s Board must not be less than eight and not more than fifteen. Twelve Director nominees are being proposed for election at the 2019 Annual Meeting.

Mr. Allan Edgeworth is not a nominee for re-election at the 2019 Annual Meeting. Mr. Edgeworth has been a Director since November 2005. He has been Chair of the Health, Safety and Environment Committee since May 2017. He has been a member of the Management Resources and Compensation Committee since February 2006 and was Committee Chair from May 2010 to May 2016. Mr. Edgeworth was a member of the Audit Committee from April 2008 to May 2013. From May 2007 to April 2008, Mr. Edgeworth was a member of the Nominating and Corporate

24 Emera Inc. — Management Information Circular 2019

MANAGEMENT INFORMATION CIRCULAR

Governance Committee. He also served as a Director of Nova Scotia Power Inc. from November 2005 to October 2006. Mr. Edgeworth’s extensive experience as a senior leader in the energy sector combined with his expertise in corporate governance has made him a valuable member of the Board.

Mr. Eisenhauer is not a nominee for re-election at the 2019 Annual Meeting. Mr. Eisenhauer has been a Director of the Company since May 2011 and a member of the Audit Committee since June 2016. He is the former Chairman of the Board of Directors of Emera’s subsidiary, Nova Scotia Power Inc., having served on its Board from 2008 to 2016.

Mr. Eisenhauer will re-join Nova Scotia Power’s Board of Directors effective May 15, 2019, where he will assume the role of independent Lead Director. His professional knowledge and experience, combined with his executive leadership in manufacturing and distribution businesses, are valuable assets to the Nova Scotia Power Board. Mr. Eisenhauer has extensive governance skills and experience, and his leadership role in the Nova Scotia business community provides him with valuable stakeholder understanding.

Nomination of Directors and Director Recruitment Process

The NCGC is responsible for providing the Company with a list of nominees for election as Directors at the Company’s Annual Meeting of Shareholders. In developing a list of nominees for election as Directors at Emera’s Annual Meeting of Shareholders, the NCGC evaluates the size of the Board and the mix of skills and experience of its Directors, its diversity overall and the level of representation of women on the Board. Director nominees must, in the opinion of the members of the NCGC, be able to contribute to the broad range of issues which come before the Board for consideration. They must be able to devote the time necessary to prepare for and attend meetings of the Board and Committees of the Board to which they may be appointed. The NCGC regularly evaluates the expected turnover of Directors in advance of their retirement from the Board and develops an effective succession plan.

Working with the Board Chair, the NCGC considers recruitment in the context of the current age and tenure of current members and in light of the Board’s overall policy of ensuring refreshment, diversity of thought and smooth Board succession. In recruiting new Directors, the NCGC considers the background, skills and experience desired for Directors in view of the Company’s strategy and activities. It develops a plan for the recruitment of additional Director nominees who can provide those characteristics.

The NCGC will consider the likely potential tenure of a Director candidate before making a selection. This is factored into the selection decision having regard to the current make-up of the Board, the skills and experience the candidate offers as a Director, and keeping in mind the age of Directors. The average tenure of all of Emera’s 12 Director nominees is 5.69 years. Three nominee Directors have served on the Board for more than a decade and two nominee Directors have served for less than a year. This represents an appropriate mix of longer-serving Directors with a history on the Emera Board, and Directors that are newer to Emera, who bring fresh perspective and approach to the Company’s Board table.

Directors’ Membership on Other Public Company Boards

Public company board membership for each Director during the last five years is set forth in their biographies earlier in the section of this Circular, entitled Director Nominees.

Common Memberships on Boards of Public Companies

Currently no other public company includes on its board two or more of Emera’s Directors.

Mechanism for Board Renewal

Emera has no term limits for its Directors. The Board of Directors oversees processes for renewal of the Board, which balance a number of factors, and have as their ultimate objective the fulfillment of the fundamental responsibility of the Board to provide stewardship and good governance for the Company. Those processes primarily include: a robust Director recruitment process, internal governance practices which entail regularly assessing each of the Board’s desired skills, and the conduct of an annual performance assessment of the Board, its Committees and individual Board members, all of which provide for renewal in a deliberate manner.

Emera’s governance practices prescribe that planned departures of Board members in any one year will not exceed two Directors. This practice contributes to Board renewal in a deliberate manner.

A rigorous annual performance assessment takes place under the leadership of the Board Chair with support from the NCGC and is described in greater detail under Board and Director Performance Assessments. The annual performance assessment is a mechanism the Board possesses to provide for Board renewal and will continue to serve the Company’s best interests, providing for appropriate renewal of the membership on the Board.

In November 2016 the Board of Directors adopted a governance practice intended to provide for Board renewal in light of the removal in 2016 of the age limit from Emera’s Articles of Association. Under this governance practice, when recommending the nomination of Directors for election, the NCGC members must consider certain principles in relation to appropriate and balanced renewal of the Board. Those principles read as follows:

Board Renewal Principles

The NCGC will adhere to a philosophy of promoting deliberate and balanced Board renewal. In keeping with such philosophy, it shall consider the following principles in respect of the list of Director nominees:

| (a) | Age: as Directors approach 70 years of age, the NCGC will assess the needs of the Board, based on the Board’s complement and other relevant factors. Where a determination is made that such Director will be retiring, the NCGC will begin the replacement process. |

| (b) | Tenure: the length of time that a nominee has served on the Company’s Board of Directors shall be considered with a view to the Board having Directors with an appropriate mixture of tenures. |

| (c) | Average age: the average age of all of the Company’s Director nominees shall be determined and considered. |

| (d) | Average tenure: the average tenure of all of the Company’s Director nominees shall be determined and considered. |

| (e) | Other relevant factors: the NCGC shall consider any other factor Committee members determine to be relevant in the promotion of orderly succession and balanced renewal of membership on the Board, having as its ultimate objective the constitution of a Board of Directors which will fulfill the fundamental responsibility of providing stewardship and good governance for the Company. |

Emera Inc. — Management Information Circular 2019 25

In practice, as a Director approaches age 70, the Board will assess the needs of the Board and may immediately commence a search. Depending on factors listed and taking a view as to the appropriate transition period, the transitioning Director may or may not be proposed for nomination, but should not expect to be nominated after the age of 72. This flexibility allows for a smooth Board transition and balances the desire for renewal against the need for continuity and stability.

Application of Board Renewal Principles

The NCGC applied the principles to the Director nominees for Emera’s 2019 Annual Meeting. Mr. Pether will be 71 at the time of the Company’s 2019 Annual Meeting. He has been a Director for ten years and is Chair of the NCGC. The Committee considered the average age of all of the Company’s Director nominees for election at the 2019 Annual Meeting, which will be 63.17 years (in 2018 it was 63.1 years), and the average tenure of all of the Company’s Director nominees as of the 2019 Annual Meeting, which will be 5.69 years (in 2018 it was 6.3 years). Also considered was Mr. Pether’s role as Chair of the NCGC, where he plays a central role in stewarding the longer-term Board succession process, and the need for continuity through this longer-term succession plan. In applying the Board Renewal Principles as described, the NCGC has recommended to the Board of Directors that Mr. Pether continue to serve as a Director because of his extensive experience with the Company, and because of the support and continuity he provides to the NCGC as Committee Chair through this Board renewal process. The Emera Board of Directors accepted the recommendation of the NCGC. As a result, Mr. Pether has been included in the list of Director nominees for election at the Meeting.

Directors Meet Without Management

There were 21 Emera Board and Committee meetings during 2018. The Board and each Committee has adopted the practice of meeting in an in-camera session, during which the President and CEO and all other members of management are excluded. This practice has been implemented and the Board held such an in-camera session at each Board and Committee meeting.

As the former President and Chief Executive Officer of TECO, who joined Emera’s Board following the closing of the TECO acquisition in 2016, John Ramil provides excellent industry and jurisdictional expertise. Recognizing the importance of independent dialogue, the Board developed a separate protocol concerning Mr. Ramil’s participation on the Board during his early tenure as a Director. That protocol meant that Mr Ramil recused himself for a portion of each meeting. In 2018, it was determined this protocol was no longer necessary, and that Mr. Ramil should participate in all in-camera sessions.

The Board also holds an evening session before the day of a regularly scheduled Board meeting and prior to the Board’s annual strategy meeting. As a governance practice, and at least once a year, the non-executive Directors conduct such an evening session to the exclusion of all management, including the President and CEO. See Board Dinner Sessions for more information.

Board Dinner Sessions

Board dinner sessions are scheduled the evening prior to regularly scheduled Board meetings. Board dinners are treated as an opportunity to accomplish a number of important governance objectives, including:

| • | Meeting as Directors in an atmosphere that is not a Board meeting. The Board’s practice is to have one dinner each year at which only the non-executive Directors attend. Based upon Director feedback from the 2018 Board Assessment, there will be two such meetings commencing in 2019; |

| • | Meeting in a less formal atmosphere with the CEO and other senior officers; |

| • | Holding educational sessions on important topics for the Company’s business and strategic direction; |

| • | Meeting high-potential employees in order to advance the succession planning for the Company; and |

| • | Strengthening Directors’ collegial working relationship. |

Strategic Planning

Oversight and guidance on the Company’s strategy is one of the primary roles of the Board. Management, led by the President and CEO, collaborates with the Board of Directors each year to develop, review and update the Company’s strategic plan. The strategic plan determines the annual and longer-term objectives for the Company.

In 2018, the Board dedicated a portion of each scheduled meeting to receiving an update on the Company’s strategy. A significant component of every regularly scheduled Board meeting is dedicated to the discussion of strategic matters. Directors use such Board meeting time to evaluate progress made in executing the Company’s strategy, including reviewing near- and longer-term risks and opportunities relevant to its corporate strategy.

A full-day Board off-site meeting was held in July 2018 to deal with the Company’s strategy. This off-site meeting: (i) analyzed trends in the Company’s industry; (ii) reviewed the Company’s approach to innovation; (iii) examined the current financial position and forecast; and (iv) considered the Company’s opportunities and challenges in various regions. At its next regularly scheduled meeting after the strategy off-site session, the Board focused upon the strategy of a select subsidiary business. As such, at its September meeting, the Board undertook a review of its behind-the-meter strategy and reviewed in greater detail the strategy of one of its operating subsidiaries.

An example of the Board’s oversight of strategy was its review of the factors contributing to long-term value creation and above-average performance in the utilities sector, including the evolution of North American capital markets. This review led to the Board’s approval of a change in Emera’s annual dividend growth target and the announcement that preferred funding for its capital investment profile included the proceeds from select asset sales.

With respect to current strategic priorities, the Company’s emphasis has not changed, and remains focused on: (i) investing in delivering cleaner, affordable energy through investing in renewables, investing in natural gas as a cleaner fuel for electricity generation and customer use, and investing in electricity transmission to deliver new renewable energy to market; (ii) identifying opportunities to invest in the transition from higher carbon methods of electricity generation to lower carbon alternatives, including the creation of a separate wholly owned subsidiary focused exclusively on innovation; and (iii) maintaining its focus on customer solutions and on what we believe the utility of the future needs to look like.

26 Emera Inc. — Management Information Circular 2019

MANAGEMENT INFORMATION CIRCULAR

Board and Director Performance Assessments

The Board annually assesses its effectiveness in order to find ways to improve its performance.

Assessment Process

Each year, the NCGC, in consultation with the Board Chair, and with the intention of continuously improving, determines the process by which assessments of the Board, Directors, Committees and individual Committee members will be conducted. The process has included the use of questionnaires and one-on-one interviews with each Director by the Board Chair. A written report from the Board Chair on the assessment is provided to the NCGC and the Board of Directors. An in-camera Board session is held to consider the report. Issues arising from the assessment are identified, an action plan is developed and progress is monitored throughout the year with oversight on that process by the NCGC.

2017 Assessment Findings and Action Plans to Address Findings

The 2017 Board and Director Performance Assessment resulted in several priority actions for 2018. With the assistance of the NCGC, the Board Chair reviewed progress made to address those priorities. This progress was reported to the Board, with significant areas including:

| (a) | Corporate Strategy: a strategic and risk framework is applied to business opportunities and potential investments, and the Company’s decision-making process regularly applies comprehensive macro analysis and peer review, supported by recently enhanced planning and modelling capabilities. |

| (b) | Strategies and Plans at the Operating Subsidiaries: Emera’s Board receives a subsidiary operations report at each scheduled Board meeting, including updates on large projects of operating subsidiaries. The Board also receives updates about subsidiaries’ strategies. Director’s annual Board education sessions include meetings with subsidiary management, facility tours and market presentations. The Board conducted reviews of its subsidiary holdings through a strategic lens, leading to key decisions and action in 2018. This process will continue, representing important focus on capital allocation and overall strategy in order to position the Company’s utilities to meet the future needs of customers, and to ensure they are ready and able to compete on price, reliability and customer service, while focused on achieving world class safety and remaining an employer of choice in order to attract and retain the best possible talent. |

| (c) | Organizational Structure and Capacity: the Company has reviewed its organizational structure and operating subsidiary governance model in order to better secure alignment. TECO Services, Inc.’s role in the organization has evolved within the Emera group of companies in order to provide shared services with regulatory recovery of costs incurred based upon a well-developed allocation model. The Board will continue to receive updates on the Company’s learning and education initiatives, leadership development and succession programs, the overview of corporate costs, and the Company’s regulatory and stakeholder engagement program. |

| (d) | Board and Committee Effectiveness: Director education, including site visits, continues to provide Board members with important opportunities to gain exposure to employees of the Company’s operating subsidiaries in the facilities and communities where they work. The 2018 site visit to Tampa, Florida provided Directors with an opportunity to meet employees of Tampa Electric Company and Peoples Gas System. |

| (e) | Corporate Governance: A framework for how the Company governs, promotes and measures corporate culture was reviewed, and work will continue to be done in this area. |

| (f) | Board Composition and Succession: In accordance with the Board’s Renewal Principles and anticipated retirements, it developed a five-year Board succession plan. In accordance with this plan, recruitment efforts resulted in the appointment in July 2018 of two new Directors, James Bertram and Jochen Tilk. With the addition of new Directors and the anticipated retirement of others, the NCGC and the Board Chair undertook a review of Committee Chair positions and Committee membership. As a result of that review, a plan to update Committee composition has been determined and will be implemented to support the ongoing valuable work of these Committees under the leadership of their respective Committee Chairs. |

2018 Board Director/Board Chair Performance Assessment

The Chair of the Board interviewed each non-executive Director as part of the 2018 Board and Director Performance Assessment. A series of questions was sent to each Director for advance consideration. The questions pertained to a number of themes, including:

| • | Emera’s strategy and business; |

| • | Organizational structure and capacity; |

| • | Board and Committee effectiveness; |

| • | Corporate governance; |

| • | Board composition and succession; |

| • | An assessment of their own performance as Directors; |

| • | An assessment of their peer Directors on the Board; and |

| • | The CEO’s 2018 evaluation, and the 2019 goals and objectives of the CEO. |

The assessment of the Chair of the Board was conducted in a meeting of all Directors that excluded the Board Chair, and was led by the Chair of the NCGC. Directors were asked to provide feedback directly to, and were given an opportunity to discuss the assessment of, the Chair of the Board in a one-on-one format with the Chair of the NCGC in advance of the meeting.

2018 Assessment Findings

The principal areas of focus which emerged from the 2018 Board and Director Performance Assessment included: corporate strategy; management structure, capacity and succession; and corporate governance.

| (a) | Corporate Strategy |

Balance sheet management activities were central to discussions on strategy in 2018, insofar as a healthy balance sheet was seen as fundamental to underpinning execution of the Company’s business plans. The Board and management have been quick to understand and manage the perspectives of capital markets and rating agencies.

Emera Inc. — Management Information Circular 2019 27

Solid execution and delivery of large accretive capital projects in Emera’s core businesses, such as the Maritime Link project of Emera Newfoundland and Labrador Holdings in Atlantic Canada, and the solar generation and Big Bend modernization projects of Tampa Electric Company in Florida, have been and remain strategic imperatives. The Board concurrently challenges management to think longer term in assessing other growth opportunities in each operating subsidiary.

| (b) | Management Structure, Capacity and Succession |

The integration of TECO Energy was an area of principal focus, and continued improvements were seen in the areas of safety, workplace transparency and collaboration.

The Board continued to review short- and longer-term senior management succession plans. It has a keen interest in having first hand knowledge of and familiarity with high-potential employees.

| (c) | Corporate Governance |

Emera upholds high governance standards throughout the organization. All Board members agree that good governance is foundational to good decision making and good business. The Board operates effectively, and the boardroom chemistry and culture is strong.

In anticipation of approaching retirements, and recognizing Emera’s new size and complexity, the Board has continued implementation of a five-year Director recruiting plan. Work will continue in 2019 under that plan. In the absence of term limits, the Emera Board’s application of renewal principles has allowed for more flexibility and a more orderly process for the transition in Board and Committee composition.

Board Diversity

To ensure that there are a significant number of women on the Company’s Board of Directors, the Company recruits Board members under a formal written corporate governance practice, adopted by the NCGC in 1994, which requires that a minimum percentage of the members of the Board of Directors are women. In November 2018, on the recommendation of the NCGC, the Board of Directors increased to 30 per cent, from 25 per cent, the minimum percentage of women constituting the Board. The list of Director nominees for the 2019 Annual Meeting includes four women out of 12 Director nominees, or 33 per cent, which exceeds this minimum requirement. In each of the last 10 years, women have represented at least 30 per cent of the Director nominees for election at the Company’s annual Shareholder meetings.

The NCGC reviews the criteria for selecting Director nominees in light of this governance practice. This governance practice reflects the Board’s view that gender diversity is an important part of fostering diversity of perspective and experience around the Board table, leading to improved overall performance of the Board and its Committees. Diversity extends beyond gender. Through the Board assessment process and discussion on the findings, it is clear Board members believe that in light of the many changes facing the industry, whether through technology, policy or otherwise, diversity of thought at the Board level is an important strategic objective of the Board and the Board succession process.

Representation of Women in Executive Officer Appointments

While Emera does not have targets regarding women in executive officer appointments, management is of the view that gender diversity among the senior executive team within the Emera group of companies serves the best interests of the Company in the following ways:

| • | It is important that Emera’s executive ranks reflect our diverse customer base. |

| • | Gender diversity will help the Company better understand the needs of its customer base. |

| • | The available workforce is increasingly made up of women. As baby boomers retire and as a competitive labour market is anticipated, Emera needs to access talent from the broadest recruitment pool. |

| • | Leadership in diversity will make the Company an employer of choice and help us to recruit, retain, and engage high-performing employees. |

| • | It is demonstrable that business performance improves with greater gender diversity; it is good for business. |

Among the executive officers(1) of Emera Inc. and its major subsidiary,(2) Tampa Electric Company, 15 are female, representing 35 per cent. Of Emera’s 12 operating subsidiaries, women are the leaders of five, namely: Tampa Electric Company, Nova Scotia Power Inc., Emera Energy Inc., TECO Services, Inc. and Dominica Electricity Services Ltd.

Emera monitors the progression of women into leadership positions within Emera and its subsidiary companies.

With a view to fostering diversity within Emera, the Company’s management does not believe that targets are the right approach. Rather, management continues to be focused on ensuring Emera’s hiring and pay practices promote equity between men and women. Progress is being made. In 2017 and 2018, Emera’s largest subsidiaries hired an almost equal number of men and women. Emera and its subsidiaries have also recently focused efforts to reach women earlier in their lives through opportunities such as a new scholarship program focused on supporting women and through an engineer-in-training program. Emera’s plan to address gender and pay equity aligns with its inclusion and diversity strategy, and includes: (a) annual analysis of pay equity; (b) continued development and promotion of programs such as the engineer-in-training program that are focused on increasing female participation in the energy industry, particularly for traditionally male-dominated roles; and (c) examination of recruitment strategies to limit pay gaps at entry into the organization and monitoring of the gender of new hires.

| (1) | The term executive officer is defined as the Company’s Board Chair, president, a vice-president in charge of a principal business unit, division or function, or any person who performed a policy-making function in respect of the issuer. |

| (2) | Major subsidiary means a subsidiary of the Company, the assets or revenue of which are 30 per cent or more of the consolidated assets or revenue of the Company as included in the financial statements of the Company for a relevant period. Only Tampa Electric Company meets this definition. |

28 Emera Inc. — Management Information Circular 2019

MANAGEMENT INFORMATION CIRCULAR

Compensation

Executive Compensation

On the recommendation of the MRCC, the Board of Directors determines the compensation for the Company’s senior executives and other officers of the Company. See Compensation Discussion and Analysis with respect to compensation of the Company’s Named Executive Officers.

Director Compensation

The Board of Directors determines the compensation for the Company’s Directors on the recommendation of the NCGC. The compensation of Directors is designed to recognize the substantial time commitments required to oversee management of the Company. It is intended to attract and retain highly skilled and experienced individuals to serve on Emera’s Board, and to ensure alignment with Shareholders’ long-term interests. Appropriate compensation for Directors, independently determined, is also intended to support their independence of management.

The annual retainer for Directors in 2018 was $190,000 per annum, payable as follows:

| • | $65,000 cash; and |

| • | $125,000 in DSUs. |

To address the impact of changes in the Canadian and US foreign exchange rate, the annual cash retainer, meeting fees, travel fees and committee retainers for US-domiciled Board members are paid in US dollars using a one-to-one conversion rate to the Canadian dollar.

For more details on total compensation received by Emera Directors in 2018, see Compensation of Directors in 2018.

Annual Review

The NCGC annually reviews the compensation of Directors to ensure it is appropriate. The last increase in Director compensation occurred on January 1, 2017.

The NCGC reviews the compensation practices of publicly traded companies similar to Emera’s size and complexity to determine whether the Directors are appropriately compensated for the responsibilities and risks involved in being a member of the Company’s Board. The review is based upon publicly available information concerning Directors’ compensation and the advice of Mercer (Canada) Ltd., a third-party compensation consultant.

The NCGC has adopted the 50th percentile as a target for Director compensation, and has determined it would be appropriate for Emera to continue to position total compensation of Directors at approximately the median of its peer group. The peer group used for Director compensation purposes is the same as the benchmarking comparator group used for senior executive compensation purposes and disclosed in the Statement of Executive Compensation later in the Circular.

Based on this approach and on such annual review, the NCGC recommended no change in 2019 to the retainer and equity compensation for Emera Directors or the annual retainer for the Chair of the Board.

Director Share Ownership Guidelines

Under guidelines established by the Board of Directors, within a prescribed time frame, each Director must own Emera common shares and DSUs with a market value of three times the annual Board retainer. Based on the annual retainer for Emera Directors noted above, under these guidelines, each Director must own Emera shares or DSUs, or a combination of the two, worth $570,000 within five years following their appointment date or within five years of any change to the Director’s compensation, whichever is the later date.

Details of each Director’s share and DSU ownership, and status under the Share Ownership guidelines, is shown in each Director nominee biography earlier in this Circular. All of Emera’s Director nominees are in compliance with these guidelines.

Directors Are Increasing Their Share/DSU Ownership Over Time