Table of Contents

As filed with the Securities and Exchange Commission on June 8, 2016

Registration No. 333-211741

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 1 TO

FORM F-10

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

EMERA INCORPORATED

(Exact Name of Registrant as Specified in Its Charter)

NOVA SCOTIA, CANADA

(Province or other jurisdiction of incorporation or organization)

4911

(Primary Standard Industrial Classification Code Number)

Not Applicable

(I.R.S. Employer Identification Number)

5151 Terminal Road

Halifax NS Canada

B3J 1A1

Telephone: (902) 428-6096

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Emera US Finance LP

2711 Centerville Road, Suite 400,

Wilmington, Delaware 19808

Telephone: (302) 636-5400

(Name, address, and telephone number of agent for service in the United States)

Copies to:

| Stephen Aftanas | Byron B. Rooney | John Macfarlane | Peter O’Brien | Joel E. Binder | ||||

| 5151 Terminal Road Halifax Nova Scotia Canada B3J 1A1 (902) 428-6096 |

Davis Polk & Wardwell LLP 450 Lexington Avenue New York, New York U.S.A., 10017 (212) 450-4000 |

Osler, Hoskin & Harcourt LLP Box 50, 1 First Canadian Place Toronto, Ontario, Canada M5X 1B8 (416) 362-2111 |

Hunton & Williams LLP 200 Park Avenue 52nd Floor New York, New York U.S.A. 10166 (212) 309-1000 |

Stikeman Elliott LLP 5300 Commerce Court West 199 Bay Street Toronto, Ontario, Canada M5L 1B9 (418) 689-5500 |

Approximate date of commencement of proposed sale of the securities to the public:

As soon as practicable after this Registration Statement is declared effective.

Province of Nova Scotia, Canada

(Principal jurisdiction regulating this offering).

It is proposed that this filing shall become effective (check appropriate box):

| A. | ¨ | Upon filing with the Commission, pursuant to Rule 467(a) (if in connection with an offering being made contemporaneously in the United States and Canada). | ||||||

| B. | x | By at some future date (check appropriate box below): | ||||||

| 1. | ¨ | Pursuant to Rule 467(b) on (date) at (time) (designate a time not sooner than 7 calendar days after filing). | ||||||

| 2. | ¨ | Pursuant to Rule 467(b) on (date) at (time) (designate a time 7 calendar days or sooner after filing) because the securities regulatory authority in the review jurisdiction has issued a receipt or notification of clearance on (date). | ||||||

| 3. | x | Pursuant to Rule 467(b) as soon as practicable after notification of the Commission by the Registrant or the Canadian securities regulatory authority of the review jurisdiction that a receipt or notification of clearance has been issued with respect hereto. | ||||||

| 4. | ¨ | After the filing of the next amendment to this form (if preliminary material is being filed). | ||||||

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to the home jurisdiction’s shelf prospectus offering procedures, check the following box: x

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of Each Class of Securities to be Registered |

Amount to be Registered |

Proposed Maximum Offering

Price |

Proposed Maximum Aggregate Offering Price (1) |

Amount of Registration Fee | ||||

| Emera Incorporated: |

||||||||

| Unsecured, Subordinated Notes (the “Notes”) |

U.S.$1,250,000,000 | 100% | U.S.$1,250,000,000 | U.S.$125,875.00(3) | ||||

| First Preferred Shares (the “Preferred Shares”) |

(2) | n/a | n/a | n/a | ||||

|

| ||||||||

|

| ||||||||

| (1) | Estimated solely for purposes of calculating the registration fee. |

| (2) | There are hereby registered such indeterminate number of Preferred Shares as may be issued upon an automatic conversion of the Notes registered hereunder. Pursuant to Rule 457(i), no separate registration fee is payable where securities and securities into which conversion is offered are registered at the same time and no additional consideration is payable upon conversion. |

| (3) | U.S.$80,560.00 was previously paid upon the initial filing of this Registration Statement. The additional fee of U.S.$45,315.00 is paid herewith. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registration Statement shall become effective as provided in Rule 467 under the Securities Act of 1933, as amended, or on such date as the Commission, acting pursuant to Section 8(a) of the Act, may determine.

Table of Contents

PART I

INFORMATION REQUIRED TO BE

DELIVERED TO OFFEREES OR PURCHASERS

I-1

Table of Contents

Short Form Base Shelf Prospectus

| New Issue |

June 8, 2016 |

EMERA INCORPORATED

U.S.$1,250,000,000

Unsecured, Subordinated Notes

First Preferred Shares Issuable Upon Automatic Conversion

Emera Incorporated (“Emera” or the “Company”) may offer and sell from time to time up to U.S.$1,250,000,000 principal amount of unsecured, subordinated notes (the “Notes”), in one or more transactions during the 25 month period ending July 8, 2018 that this base shelf prospectus (this “Prospectus”), including any amendments hereto, remains valid. The Notes are convertible into First Preferred Shares of Emera in certain circumstances (see “Description of the Notes—Automatic Conversion” and “Description of Conversion Preferred Shares”). The Notes offered hereunder may be offered separately or together, in separate series, in amounts, at prices, with maturities, and on terms to be set forth in one or more shelf prospectus supplements (each, a “Prospectus Supplement”). A Prospectus Supplement may include other specific terms pertaining to the Notes that are not prohibited by the parameters set forth in this Prospectus. See “Description of the Notes”.

All shelf information permitted under applicable laws to be omitted from this Prospectus will be contained in one or more Prospectus Supplements that will be delivered to purchasers together with this Prospectus. Each Prospectus Supplement will be incorporated by reference into this Prospectus for the purposes of securities legislation as of the date of the Prospectus Supplement and only for the purposes of the Notes to which the Prospectus Supplement pertains.

Emera may sell the Notes to or through underwriters purchasing as principal and may also sell the Notes to one or more other purchasers directly or through agents. Any underwriting syndicate in respect of an offering of Notes will be led by J.P. Morgan Securities LLC. See “Plan of Distribution.” The Prospectus Supplement relating to a particular offering of Notes will identify each underwriter or agent, as the case may be, engaged by Emera in connection with the offering and sale of the Notes and will set forth the terms of the offering of such Notes, including the method of distribution of such Notes, the proceeds to Emera and any fees, discounts or other compensation payable to underwriters or agents, and any other material terms of the offering of such Notes.

In connection with any offering of Notes, the underwriters or agents may over-allot or effect transactions which stabilize or maintain the market price of the Notes offered at a level above that which might otherwise prevail in the open market. Such transactions, if commenced, may be discontinued at any time. See “Plan of Distribution.”

Investing in the Notes involves risk. See “Risk Factors.”

Emera is permitted, under the multi-jurisdictional disclosure system adopted by the United States (“U.S.”), to prepare this Prospectus in accordance with Canadian disclosure requirements. You should be aware that such requirements are different from those of the U.S.

Financial statements incorporated herein have been prepared in accordance with U.S. generally accepted accounting principles, which is referred to as “U.S. GAAP.”

Table of Contents

Owning the Notes may subject you to tax consequences both in the United States and Canada. This Prospectus or any applicable Prospectus Supplement may not describe these tax consequences fully. You should read the tax discussion in any applicable Prospectus Supplement.

Your ability to enforce civil liabilities under U.S. federal securities laws may be affected adversely by the fact that Emera is organized under the laws of Nova Scotia, that some or all of the officers and directors of Emera may be residents of Canada, that some or all of the experts named herein may be residents of Canada and that all or a substantial portion of our assets and the assets of said persons are located outside of the U.S.

J. Wayne Leonard and Richard P. Sergel are directors of Emera who reside outside of Canada and each of these directors has appointed Emera Incorporated as agent for service of process at 5151 Terminal Road, Halifax, Nova Scotia B3J 1A1. Purchasers are advised that it may not be possible for investors to enforce judgements obtained in Canada against any person who resides outside of Canada, even if the party has appointed an agent for service of process.

The Notes have not been approved or disapproved by the United States Securities and Exchange Commission (the “SEC”) or any state securities commission nor has the SEC or any state securities commission passed upon the accuracy or adequacy of this Prospectus. Any representation to the contrary is a criminal offense.

Emera’s head office is located at 5151 Terminal Road, Halifax, Nova Scotia B3J 1A1.

Table of Contents

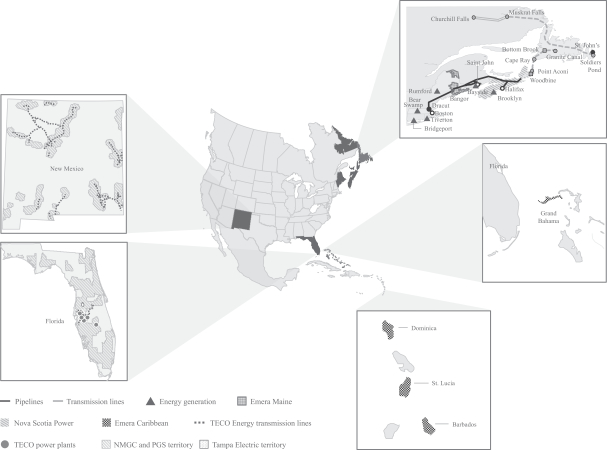

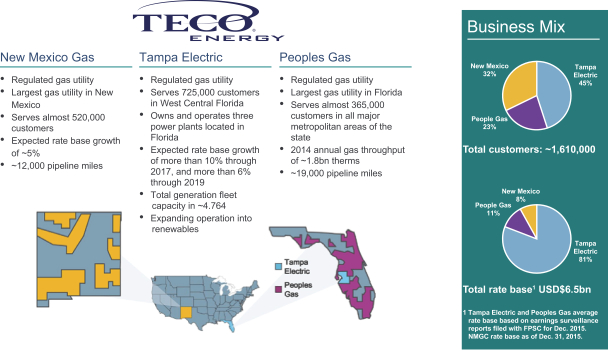

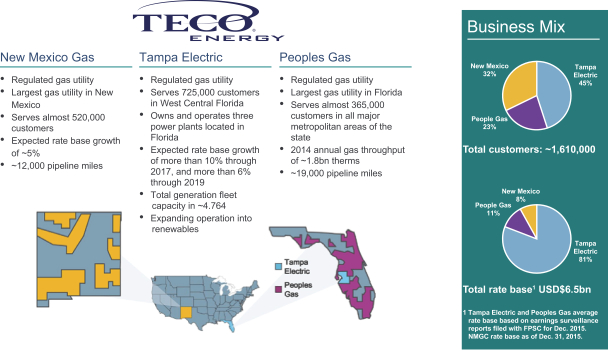

Post-Acquisition Map of Combined Emera and TECO Energy Operations

Table of Contents

| 1 | ||||

| 3 | ||||

| 3 | ||||

| 3 | ||||

| 6 | ||||

| CAUTION REGARDING UNAUDITED PRO FORMA CONSOLIDATED FINANCIAL STATEMENTS |

10 | |||

| 11 | ||||

| 12 | ||||

| 13 | ||||

| 40 | ||||

| 54 | ||||

| 74 | ||||

| 75 | ||||

| 76 | ||||

| 90 | ||||

| 196 | ||||

| 250 | ||||

| 254 | ||||

| 255 | ||||

| 259 | ||||

| 260 | ||||

| 269 | ||||

| 272 | ||||

| 274 | ||||

| 279 | ||||

| 280 | ||||

| 280 | ||||

| 280 | ||||

| 280 | ||||

| TRANSFER AGENT, REGISTRAR, PAYING AGENT AND INDENTURE TRUSTEE |

280 | |||

| 281 | ||||

-i-

Table of Contents

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Please refer to the “Glossary” beginning on page 40 of this Prospectus for a list of defined terms used herein.

This Prospectus, including the documents incorporated herein by reference, contains forward-looking information within the meaning of applicable securities laws which reflects current expectations of Emera’s management regarding: (i) the future growth, results of operations, performance, business prospects and opportunities of the Company; (ii) the timing and completion of the Acquisition Capital Markets Transactions (as defined herein) and the Acquisition (as defined herein); (iii) the benefits and the impact of the Acquisition, any offering hereunder, the other Acquisition Capital Markets Transactions and the Acquisition Credit Facilities (and the proposed refinancing thereof) on the financial position of the Company; and (iv) the future performance, business prospects and opportunities of TECO Energy and the integration of its electric and gas utility businesses with the existing operations of Emera. These expectations may not be appropriate for other purposes. Such statements are “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995. The words “anticipates,” “believes,” “budget,” “could,” “estimates,” “expects,” “forecasts,” “intends,” “may,” “might,” “plans,” “projects,” “schedule,” “should,” “targets,” “will,” “would,” and similar expressions are often intended to identify forward-looking information, although not all forward-looking information contains these identifying words. The forward-looking information reflects management’s current beliefs and is based on information currently available to the Company’s management.

The forward-looking information in this Prospectus, including the documents incorporated herein by reference, includes, but is not limited to, statements regarding: Emera’s consolidated net income and cash flow; the growth and diversification of Emera’s business and earnings base; future annual net income and dividend growth; expansion of Emera’s business in the United States and elsewhere; the completion of the Acquisition; the completion of the Acquisition Capital Markets Transactions; the expected compliance by Emera and its subsidiaries with the regulation of their operations; the expected timing of regulatory decisions; forecasted gross capital expenditures; the nature, timing and costs associated with certain capital projects; the expected impacts on Emera of challenges in the global economy; estimated energy consumption rates; expectations related to annual operating cash flows; the expectation that Emera will continue to have reasonable access to capital in the near to medium terms; expected debt maturities and repayments; expectations about increases in interest expense and/or fees associated with debt securities and credit facilities; no material adverse credit rating actions being expected in the near term; the number of customers served in the future; the successful execution of relationships with third-parties, such as agreements relating to the Maritime Link Project, Muskrat Falls and the Assembly of Nova Scotia Mi’Kmaq Chiefs; the impact of currency fluctuations; expected changes in electricity rates; and the impacts of planned investment by the industry of gas transportation infrastructure within Northeastern United States.

The forward-looking information contained herein pertaining to the Acquisition and the financing thereof, the future performance, business prospects and opportunities of TECO Energy and the integration of its electric and gas utility businesses with the existing operations of Emera includes, but is not limited to, statements regarding: the expectation that the Acquisition will increase the Company’s consolidated rate base and total customers; the expectation that the Acquisition will be accretive to earnings per common share, assuming a stable currency environment; the impact of the Acquisition on the Company’s total assets, net income, long-term growth, access to equity and debt capital markets, credit profile, economies of scale and ability to deploy capital; expectations regarding the nature, timing and costs of capital spending of Emera, TECO Energy, New Mexico Gas Company (“NMGC”), Tampa Electric and Peoples Gas System (“PGS”); the expected future unemployment rates, housing starts and GDP growth rates in Florida and New Mexico; the expectations regarding rate base growth; the complementary management teams and corporate cultures of Emera and TECO Energy; the projected use of TECO Energy’s tax carry-forwards; the locations of the combined operations after completion of the Acquisition; the projected coal and petroleum coke consumption for Tampa Electric; the expectations with respect to the impact of costs and compliance as a result of new and existing laws, regulations and guidelines, including, but not limited, to environmental and climate change matters; the financial liability with respect to Superfund sites

1

Table of Contents

and former manufactured gas plant sites of Tampa Electric and PGS, as well as other potential contamination liabilities; the impact of legal proceedings; the financing of the Acquisition, including, but not limited to, the use of the net proceeds of any offering hereunder and the other Acquisition Capital Markets Transactions, the repayments under the Acquisition Credit Facilities and the terms and conditions of the Acquisition Credit Agreements; the impact of any offering hereunder, the other Acquisition Capital Markets Transactions, the Acquisition Credit Facilities, the timing and closing of the Acquisition, capital lease and finance obligations on the capital structure of the Company; the material attributes and characteristics of the Notes and any other securities issued in connection with the Acquisition Capital Markets Transactions; the plan of distribution; and the risk factors relating to the Acquisition, the post-Acquisition combined business and operations of the Company and TECO Energy and the Acquisition Capital Markets Transactions.

The forward-looking information is subject to risks, uncertainties and other factors that could cause actual results to differ materially from historical results or results anticipated by the forward-looking information. Factors which could cause results or events to differ from current expectations include, but are not limited to: derivative financial instruments, including, but not limited to, hedging availability; commodity price and availability risk; foreign exchange risk; interest rate risk; commercial relationship risk; credit risk; rating agency risk; labour risk; weather risk; regulatory risk; environmental risk; capital market risk, including, but not limited to, economic conditions, cost of financing, capital resources and liquidity risk; construction and development risks; inability to complete an offering hereunder and the financing and the completion of the Acquisition; an increase in the cash purchase price of the Acquisition; uncertainty regarding the length of time required to complete the Acquisition; the anticipated benefits of the Acquisition not materializing or not occurring within the time periods anticipated by the Company; the impact of significant demands placed on the Company as a result of the Acquisition; failure by the Company to repay the Acquisition Credit Facilities; potential unavailability of the Acquisition Credit Facilities; alternate sources of funding, including the Acquisition Capital Markets Transactions, that would be used to replace the Acquisition Credit Facilities not being available when needed; lack of control by the Company of TECO Energy and its subsidiaries prior to the closing of the Acquisition; the impact of the Acquisition-Related Expenses; accuracy and completeness of TECO Energy’s publicly disclosed information; increased indebtedness of Emera after the closing of the Acquisition; that an offering hereunder could result in a downgrade of the Company’s credit ratings; historical and pro forma combined financial information not being representative of future performance; potential undisclosed liabilities of TECO Energy; ability to retain key personnel of TECO Energy following the Acquisition; operating and maintenance risks; risks relating to the financing of Emera; risks associated with changes in economic conditions; that developments in technology could reduce demand for electricity and gas; integration of NMGC and its impact on TECO Energy’s business and operations; changes in customer energy-usage patterns; risk of failure of information technology infrastructure and cybersecurity; disruption of fuel supply; natural disasters or other catastrophic events; impairment testing of certain long-lived assets could result in impairment charges; indebtedness of TECO Energy; risks relating to the Notes; unanticipated maintenance and other expenditures; risk associated with the continuation, renewal, replacement and/or regulatory approval of power supply and capacity purchase contracts; risks associated with pension plan performance and funding requirements; regulatory and government decisions including, but not limited to, changes to environmental, financial reporting and tax legislation and regulations; risk of loss of licences and permits; risk of loss of service area; market energy sales prices; maintenance of adequate insurance coverage; impact of Acquisition-Related Expenses; labor relations and management resources. For additional information with respect to the Company’s risk factors and risk factors relating to the post-Acquisition business of Emera, the operations of Emera and TECO Energy, the Acquisition and the Acquisition Capital Markets Transactions, reference should be made to the section of this Prospectus entitled “Risk Factors” and to the documents incorporated herein by reference and to the Company’s continuous disclosure materials filed from time to time with the CSA.

All forward-looking information in this Prospectus and in the documents incorporated herein by reference is qualified in its entirety by the above cautionary statements and, except as required by law, the Company undertakes no obligation to revise or update any forward-looking information as a result of new information, future events or otherwise.

2

Table of Contents

WHERE TO FIND MORE INFORMATION

Emera has filed with the SEC, under the Securities Act, a registration statement on Form F-10 relating to the Notes and First Preferred Shares qualified by this Prospectus. This Prospectus, which constitutes a part of the registration statement, does not contain all of the information contained in the registration statement, certain items of which are contained in the exhibits to the registration statement as permitted by the rules and regulations of the SEC. Statements included or incorporated by reference in this Prospectus about the contents of any contract, agreement or other documents referred to are not necessarily complete, and in each instance, you should refer to the exhibits for a complete description of the matter involved. Emera files annual and quarterly financial information and material change reports, business acquisition reports and other material with the Nova Scotia Securities Commission and the securities regulatory authorities in each of the other Canadian provinces.

Under the multi-jurisdictional disclosure system adopted by the U.S., documents and other information that Emera files with the SEC may be prepared in accordance with the disclosure requirements of Canada, which are different from those of the U.S. You may read and download any public document that Emera has filed with the Nova Scotia Securities Commission and the securities regulatory authorities in each of the other Canadian provinces on SEDAR at www.sedar.com. You may read and copy any document that we have filed with the SEC at the SEC’s public reference room in Washington D.C., and may also obtain copies of those documents from the public reference room of the SEC at 100 F Street, N.E., Washington, D.C. 20549 by paying a fee. Additionally, you may read and download some of the documents that we have filed on EDGAR at www.sec.gov.

DOCUMENTS FILED AS PART OF THE REGISTRATION STATEMENT

The following documents are being filed with the SEC as part of the Registration Statement: (i) the documents referred to under the heading “Documents Incorporated by Reference”; (ii) the consent of PricewaterhouseCoopers LLP; (iii) the consent of Ernst & Young LLP; (iv) the consent of Osler, Hoskin & Harcourt LLP; (v) the consent of Davis Polk & Wardwell LLP; (vi) the powers of attorney from Emera’s directors and officers; (vii) the form of Indenture between Emera, American Stock Transfer & Trust Company, LLC and CST Trust Company; and (viii) the Statement of Eligibility under the Trust Indenture Act of 1939, of American Stock Transfer & Trust Company, LLC.

DOCUMENTS INCORPORATED BY REFERENCE

The disclosure documents of the Company listed below and filed with the appropriate securities commissions or similar regulatory authorities in each of the provinces of Canada are specifically incorporated by reference into and form an integral part of this Prospectus:

| (i) | the Annual Information Form of Emera dated March 30, 2016 for the year ended December 31, 2015; |

| (ii) | the audited consolidated financial statements of Emera as at and for the years ended December 31, 2015 and December 31, 2014, together with the auditors’ report thereon; |

| (iii) | Management’s Discussion and Analysis of Emera for the year ended December 31, 2015; |

| (iv) | the unaudited condensed consolidated interim financial statements of Emera as at and for the three months ended March 31, 2016 and March 31, 2015; |

| (v) | Management’s Discussion and Analysis of Emera for the three months ended March 31, 2016; and |

| (vi) | the Management Information Circular of Emera distributed in connection with Emera’s annual meeting of shareholders held on May 17, 2016 (as refiled on March 24, 2016). |

3

Table of Contents

In addition, the disclosure documents of TECO Energy listed below and filed by it with the SEC, and each also filed by the Company on SEDAR as “Documents incorporated by reference not previously filed” on June 1, 2016, are specifically incorporated by reference into and form an integral part of this Prospectus:

| (i) | the audited consolidated financial statements and schedule of TECO Energy as at and for the years ended December 31, 2015, 2014 and 2013 contained in TECO Energy’s Annual Report on Form 10-K filed with the SEC for the year ended December 31, 2015; |

| (ii) | Management’s Report on Internal Control over Financial Reporting of TECO Energy contained in TECO Energy’s Annual Report on Form 10-K filed with the SEC for the year ended December 31, 2015; and |

| (iii) | the unaudited consolidated condensed financial statements of TECO Energy as at and for the three months ended March 31, 2016 and 2015 contained in TECO Energy’s Quarterly Report on Form 10-Q filed with the SEC for the quarter ended March 31, 2016. |

Any documents of the type referred to above (other than confidential material change reports), and any other documents required under applicable securities laws to be incorporated by reference into this Prospectus, if filed by Emera with the provincial securities commissions or similar authorities in Canada after the date of this Prospectus and prior to the termination of any offering of Notes, shall be deemed to be incorporated by reference into this Prospectus. To the extent that any document or information incorporated by reference into this Prospectus is included in a report that is filed with or furnished to the SEC, such document or information shall be deemed to be incorporated by reference as an exhibit to the Registration Statement. In addition, any other report filed with or furnished to the SEC by the Company shall be deemed to be incorporated by reference as an exhibit to the Registration Statement, if and to the extent that such report expressly so provides.

Upon a new annual information form, new management information circular, new annual consolidated financial statements and accompanying management’s discussions and analysis being filed by Emera with (and where required, accepted by) the applicable securities regulatory authorities during the currency of this Prospectus, the previous annual information form, the previous management information circular, the previous annual consolidated financial statements and accompanying management’s discussion and analysis, all consolidated interim financial statements and accompanying management’s discussion and analysis, and all material change reports filed prior to the commencement of the financial year of Emera in which the new annual information form is filed shall be deemed no longer to be incorporated into this Prospectus for the purposes of future offers and sales of Notes hereunder. Upon any interim financial statements and accompanying management’s discussion and analysis being filed by Emera with (and, where required, accepted by) the applicable securities regulatory authorities during the currency of this Prospectus, all interim financial statements and accompanying management’s discussion and analysis filed prior to the new interim financial statements shall be deemed no longer to be incorporated into this Prospectus for purposes of future offers and sales of Notes hereunder.

Any statement contained in a document incorporated or deemed to be incorporated by reference in this Prospectus shall be deemed to be modified or superseded for purposes of this Prospectus to the extent that a statement contained herein, or in any other subsequently filed document which also is incorporated or is deemed to be incorporated by reference herein, modifies or supersedes such statement. The modifying or superseding statement need not state that it has modified or superseded a prior statement or include any other information set forth in the document that it modifies or supersedes. The making of a modifying or superseding statement will not be deemed to be an admission for any purpose that the modified or superseded statement, when made, constituted a misrepresentation, an untrue statement of a material fact or an omission to state a material fact that is required to be stated or that is necessary to make a statement not misleading in light of the circumstances in which it was made. Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Prospectus.

4

Table of Contents

Copies of Emera’s documents incorporated herein by reference may be obtained on request without charge from the Corporate Secretary of Emera at 5151 Terminal Road, Halifax, Nova Scotia B3J 1A1 (telephone 902-428-6096). These documents are also available through the internet on the Company’s website at www.emera.com or on SEDAR which can be accessed at www.sedar.com. Copies of TECO Energy’s documents incorporated herein by reference may be obtained on request without charge from the Director of Investor Relations of TECO Energy at 702 North Franklin Street, Tampa, Florida 33602 (telephone 813-228-4111). These documents are also available through the internet on TECO Energy’s website at www.tecoenergy.com or on the SEC’s website which can be accessed at www.sec.gov. The information contained on, or accessible through, any of these websites is not incorporated by reference into this Prospectus and is not, and should not be considered to be, a part of this Prospectus, unless it is explicitly so incorporated.

5

Table of Contents

PRESENTATION OF FINANCIAL INFORMATION

All financial information of Emera (with the exception of the Emera Maine and Emera Caribbean sections of “Management’s Discussion and Analysis”) included in this Prospectus as at December 31, 2015, 2014 and 2013 is reported in Canadian dollars and has been derived from audited historical financial statements of Emera that were prepared in accordance with U.S. GAAP. All financial information of Emera (with the exception of the Emera Maine and Emera Caribbean sections of “Management’s Discussion and Analysis”) included in this Prospectus as at March 31, 2016 and 2015 is reported in Canadian dollars and has been derived from unaudited historical financial statements of Emera that were prepared in accordance with U.S. GAAP. All financial information of TECO Energy included in this Prospectus as at December 31, 2015, 2014 and 2013 is reported in U.S. dollars and has been derived from audited historical financial statements of TECO Energy that were prepared in accordance with U.S. GAAP. All financial information of TECO Energy included in this Prospectus as at March 31, 2016 and 2015 is reported in U.S. dollars and has been derived from unaudited historical financial statements of TECO Energy that were prepared in accordance with U.S. GAAP. The revenues and expenses of TECO Energy shown in the unaudited pro forma consolidated statements of earnings of the Company for the three month period ended March 31, 2016 and for the year ended December 31, 2015 are reported in Canadian dollars and reflect the average U.S. dollar-to-Canadian dollar exchange rates for such periods. The assets and liabilities of TECO Energy shown in the unaudited pro forma consolidated balance sheet of the Company as of March 31, 2016 are reported in Canadian dollars and reflect the U.S. dollar-to-Canadian dollar period-end closing exchange rate. Financial information in this Prospectus that has been derived from the unaudited pro forma consolidated financial statements has been translated to Canadian dollars on the same basis. Certain tables in this Prospectus may not sum to total due to rounding.

Non-U.S. GAAP Financial Measures

Emera uses financial measures that do not have standardized meaning under U.S. GAAP and may not be comparable to similar measures presented by other entities. Emera calculates the non-U.S. GAAP measures by adjusting certain U.S. GAAP measures for specific items the Company believes are significant, but not reflective of underlying operations in the period, as detailed below:

| Non-U.S. GAAP measure | U.S. GAAP measure | |

| Adjusted net income attributable to common shareholders or adjusted net income |

Net income attributable to common shareholders | |

| Adjusted earnings per common share – basic |

Earnings per common share – basic | |

| Adjusted contribution to consolidated net income |

Contribution to consolidated net income | |

| Adjusted income before provision for income taxes |

Income before provision for income taxes | |

| Adjusted contribution to consolidated earnings per common share – basic |

Contribution to consolidated earnings per common share – basic | |

|

EBITDA |

Net income | |

| Adjusted EBITDA |

Net income | |

| Electric margin |

Income from operations | |

Emera believes that these non-U.S. GAAP measures are useful to investors because they are frequently used by securities analysts, investors and other interested parties in the evaluation of companies and will provide investors with a useful tool for assessing the comparability between periods of its ability to generate cash from operations sufficient to pay taxes, to service debt and to undertake capital expenditures.

You are encouraged to evaluate each adjustment to the corresponding U.S. GAAP measure and the reasons management considers them appropriate for supplemental analysis. In evaluating these non-U.S. GAAP

6

Table of Contents

measures, you should be aware that in the future Emera may incur expenses similar to the adjustments in this Prospectus. This presentation should not be construed as an inference that Emera’s future results will be unaffected by such items.

The SEC has adopted rules to regulate the use in filings with the SEC and public disclosures and press releases of non-U.S. GAAP financial measures. The rules prohibit the following, among other things, in filings with the SEC:

| • | exclusion of charges or liabilities that require, or will require, cash settlement or would have required cash settlement, absent an ability to settle in another manner, from non-U.S. GAAP liquidity measures; and |

| • | adjustment of a non-U.S. GAAP performance measure to eliminate or smooth items identified as non-recurring, infrequent or unusual, when the nature of the charge or gain is such that it has occurred in the past two years or is reasonably likely to recur within the next two years. |

The non-U.S. GAAP financial information presented in this Prospectus may not comply with these rules.

The non-U.S. GAAP financial information presented in this Prospectus are measures of our performance that are not required by, or presented in accordance with, U.S. GAAP and should not be considered as an alternative to cash flows from operations, net income, net operating income or any other performance measure derived in accordance with U.S. GAAP or as an alternative measure of our liquidity.

For additional information regarding non-U.S. GAAP measures See “Management’s Discussion and Analysis.”

Adjusted Contribution to Consolidated Net Income, Adjusted Income Before Provision for Income Taxes and Adjusted Contribution to Consolidated Earnings per Common Share—Basic

Emera calculates these non-U.S. GAAP measures by excluding the effect of certain mark-to-market adjustments from their respective U.S. GAAP equivalents.

Mark-to-market adjustments are further discussed in the sections under “Management’s Discussion and Analysis”: “—Consolidated Financial Highlights,” “—Emera Energy—Review of 2015,” “—Pipelines—Review of 2015,” “—Corporate and Other—Review of 2015,” “—Emera Energy—Review of 2016,” “—Pipelines—Review of 2016 and Corporate and Other—Review of 2016.”

Adjusted Net Income and Adjusted Earnings per Common Share—Basic

Emera calculates comparable measures by excluding the effect of:

| • | the mark-to-market adjustments related to Emera’s held-for-trading derivative instruments, including adjustments related to the price differential between the point where natural gas is sourced and where it is delivered; |

| • | the mark-to-market adjustments included in Emera’s equity income related to the business activities of Bear Swamp Power Company, LLC (“Bear Swamp”) and Northwest Wind Partners II, LLC (“NWP”), until NWP’s sale on January 29, 2015; |

| • | the amortization of transportation capacity recognized as a result of certain trading and marketing transactions; |

| • | the mark-to-market adjustments related to an interest rate swap in Emera Brunswick Pipeline Company Limited (“EBPC”); and |

| • | the mark-to-market adjustments included in Emera’s other income related to the effect of USD-denominated currency and forward contracts. These contracts were put in place to economically hedge the anticipated proceeds from the Convertible Debenture Offering in connection with the Acquisition. |

7

Table of Contents

Management believes excluding from income the effect of these mark-to-market valuations and changes thereto, until settlement, better aligns the intent and financial effect of these contracts with the underlying cash flows.

Mark-to-market adjustments are further discussed in the sections under “Management’s Discussion and Analysis”: “—Consolidated Financial Highlights,” “—Emera Energy—Review of 2015,” “—Pipelines—Review of 2015,” “—Corporate and Other—Review of 2015,” “—Emera Energy—Review of 2016,” “—Pipelines—Review of 2016” and “Corporate and Other—Review of 2016.”

The following is a reconciliation of reported net income attributable to common shareholders to adjusted net income attributable to common shareholders, and reported earnings per common share—basic to adjusted earnings per common share—basic:

| Three months ended March 31 | Year ended December 31 | |||||||||||||||||||

| 2016 | 2015 | 2015 | 2014 | 2013 | ||||||||||||||||

| millions of Canadian dollars (except per share amounts) | ||||||||||||||||||||

| Net income attributable to common shareholders |

$ | 44.3 | $ | 160.1 | $ | 397.2 | $ | 406.7 | $ | 217.5 | ||||||||||

| After-tax mark-to-market gain (loss) |

(75.9 | ) | (11.5 | ) | 67.2 | 87.5 | (41.9 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjusted net income attributable to common shareholders |

120.2 | 171.6 | 330.0 | 319.2 | 259.4 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Earnings per common share – basic |

0.30 | 1.10 | 2.72 | 2.84 | 1.64 | |||||||||||||||

| Adjusted earnings per common share – basic |

0.81 | 1.18 | 2.26 | 2.23 | 1.96 | |||||||||||||||

Emera EBITDA and Adjusted EBITDA

Earnings before interest, income taxes, depreciation and amortization (“EBITDA”) is a non-U.S. GAAP financial measure used in this Prospectus in respect of Emera. EBITDA is used by numerous investors and lenders to better understand cash flows and credit quality.

“Adjusted EBITDA” is a non-U.S. GAAP financial measure used by Emera. Similar to Adjusted Net Income calculations, this measure represents EBITDA absent the income effect of Emera’s mark-to-market adjustments, as previously discussed.

The Company’s EBITDA and Adjusted EBITDA may not be comparable to the EBITDA measures of other companies, but in Emera’s management’s view appropriately reflects Emera’s specific financial condition. These measures are not intended to replace “Net income” which, as determined in accordance with U.S. GAAP, is an indicator of operating performance. Emera’s EBITDA and Adjusted EBITDA are discussed further in the section entitled “Management’s Discussion and Analysis”.

The following is a reconciliation of reported net income to EBITDA and Adjusted EBITDA:

| Three months ended March 31 | Year ended December 31 | |||||||||||||||||||

| 2016 | 2015 | 2015 | 2014 | 2013 | ||||||||||||||||

| millions of Canadian dollars | ||||||||||||||||||||

| Net income |

$ | 54.8 | $ | 174.1 | $ | 452.4 | $ | 452.8 | $ | 255.3 | ||||||||||

| Interest expense, net |

75.2 | 44.4 | 212.6 | 179.8 | 172.2 | |||||||||||||||

| Income tax expense (recovery) |

26.8 | 61.4 | 92.4 | 113.6 | 43.3 | |||||||||||||||

| Depreciation and amortization |

87.5 | 82.8 | 339.9 | 329.0 | 297.8 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| EBITDA |

244.3 | 362.7 | 1,097.3 | 1,075.2 | 768.6 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Mark-to-market gain (loss), excluding income tax and interest |

(75.1 | ) | (21.5 | ) | 66.1 | 128.7 | (60.9 | ) | ||||||||||||

| Adjusted EBITDA |

$ | 319.4 | $ | 384.2 | $ | 1,031.2 | $ | 946.5 | $ | 829.5 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

8

Table of Contents

TECO Energy EBITDA

EBITDA is a non-U.S. GAAP financial measure used in this Prospectus in respect of TECO Energy. EBITDA is used by numerous investors and lenders to better understand cash flows and credit quality.

TECO Energy’s EBITDA may not be comparable to the EBITDA measures of other companies, but in TECO Energy’s management’s view appropriately reflects TECO Energy’s specific financial condition. These measures are not intended to replace “Net income” which, as determined in accordance with U.S. GAAP, is an indicator of operating performance. TECO Energy’s EBITDA is discussed further in the section entitled “Management’s Discussion and Analysis.”

The following is a reconciliation of reported net income from continuing operations to EBITDA:

| Three months ended March 31 | Year ended December 31 | |||||||||||||||||||

| 2016 | 2015 | 2015 | 2014 | 2013 | ||||||||||||||||

| millions of U.S. dollars | ||||||||||||||||||||

| Net income from continuing operations |

$ | 73.7 | $ | 63.8 | $ | 241.2 | $ | 206.4 | $188.7 | |||||||||||

| Interest expense, net |

45.9 | 47.9 | 186.4 | 171.1 | 161.4 | |||||||||||||||

| Income tax expense |

35.7 | 39.9 | 155.3 | 138.9 | 112.6 | |||||||||||||||

| Depreciation and amortization |

89.8 | 85.5 | 349.0 | 315.3 | 291.8 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| EBITDA |

$ | 245.1 | $ | 237.1 | $ | 931.9 | $ | 831.7 | $754.5 | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

Electric Margin

“Electric margin” is a non-U.S. GAAP financial measure used to show the amounts that Nova Scotia Power Incorporated (“NSPI”), Barbados Light & Power Company Limited (“BLPC”), Grand Bahama Power Company Ltd. (“GBPC”) and Dominica Electricity Services Ltd. (“Domlec”) retain to recover non-fuel costs. Prudently incurred fuel costs are recovered from customers, except in Domlec, where substantially all fuel costs are passed to customers through the fuel pass-through mechanism. Management believes measuring electric margin shows the portion of the utilities’ revenues that directly contribute to Emera’s income as distinguished from the portion of revenues that are managed through fuel adjustment mechanisms, which have a minimal impact on income. Emera Energy also reports “Electric margin” because the sales price of electricity and the cost of natural gas used to generate it are highly correlated. However, their absolute values can vary materially over time. Emera Energy believes that “Electric margin,” as the net result, provides a meaningful measure of the business’ performance in addition to the absolute values of sales and fuel expenses, which are also reported. Electric margin, as calculated by Emera, may not be comparable to the electric margin measures of other companies, but in management’s view appropriately reflects Emera’s specific condition. This measure is not intended to replace “Income from operations” which, as determined in accordance with U.S. GAAP, is an indicator of operating performance. Electric margin is discussed further in the sections under “Management’s Discussion and Analysis” “—NSPI—Electric Margin,” “—the Emera Caribbean—Electric Margin” and “—Emera Energy—Adjusted EBITDA”.

9

Table of Contents

CAUTION REGARDING UNAUDITED PRO FORMA CONSOLIDATED FINANCIAL STATEMENTS

This Prospectus contains the unaudited pro forma consolidated balance sheet as at March 31, 2016 and consolidated statements of earnings of the Company for the three month period ended March 31, 2016 and for the year ended December 31, 2015, giving effect to: (i) the Acquisition Capital Markets Transactions (as discussed under “Summary—Financing the Acquisition”), (ii) the issuance of common shares of Emera (“Common Shares”) upon conversion of the Convertible Debentures on the Final Instalment Date (assuming payment in full of the Final Instalment of the Convertible Debentures, as discussed under “Description of Other Indebtedness—Convertible Debentures”) and (iii) the consummation of the Acquisition. Any offering of Notes hereunder is not contingent upon the consummation of the Acquisition, the other Acquisition Capital Markets Transactions or payment in full of the Final Instalment of the Convertible Debentures. The unaudited pro forma financial statements included herein do not give effect to the sale by Emera of 50.1 million common shares of Algonquin Power & Utilities Corp. (“APUC”). See “Summary—Recent Developments.”

Emera intends to raise up to approximately Cdn$6.6 billion in aggregate principal amount in the Acquisition Capital Markets Transactions. The aggregate principal amounts raised in the Acquisition Capital Markets Transactions and the terms on which such securities are issued are dependent on market and other conditions and may vary. To the extent (i) Emera raises less than Cdn$6.6 billion in connection with the Acquisition Capital Markets Transactions, or (ii) Emera does not receive payment in full of the Final Instalment of the Convertible Debentures, Emera intends to pay any shortfall by drawing on the Acquisition Credit Facilities and/or using existing cash on hand (including the net proceeds of the first instalment of the Convertible Debenture Offering) or other sources available to Emera in order to consummate the Acquisition. See “Summary—Financing the Acquisition.”

The unaudited pro forma consolidated financial statements have been prepared using certain of the Company’s and TECO Energy’s respective financial statements as more particularly described in the notes to such unaudited pro forma consolidated financial statements. In preparing such unaudited pro forma consolidated financial statements, Emera has had limited access to the non-public books and records of TECO Energy and makes no representation or warranty as to the accuracy or completeness of such information provided by TECO Energy, including the financial statements of TECO Energy that were used to prepare the unaudited pro forma consolidated financial statements. The unaudited pro forma combined financial information included in this Prospectus has not been prepared in compliance with Regulation S-X.

Such unaudited pro forma consolidated financial statements are not intended to be indicative of the results that would actually have occurred, or the results expected in future periods, had the events reflected herein occurred on the dates indicated. Actual amounts recorded upon the finalization of the purchase price allocation under the Acquisition may differ from such unaudited pro forma consolidated financial statements. Since the unaudited pro forma consolidated financial statements have been developed to retroactively show the effect of transactions that are expected to occur at a later date (even though this was accomplished by following generally accepted practice using reasonable assumptions), there are limitations inherent in the very nature of pro forma data. The data contained in the unaudited pro forma consolidated financial statements represents only a simulation of the potential impact of the Acquisition. Undue reliance should not be placed on such unaudited pro forma consolidated financial statements. See “Special Note Regarding Forward-Looking Statements” and “Risk Factors.”

10

Table of Contents

In this Prospectus, unless otherwise specified or the context otherwise requires, all dollar amounts are expressed in Canadian dollars. References to “Canadian dollars”, “$”, “CAD” or “Cdn$” are to lawful currency of Canada. References to “U.S. dollars”, “USD”, “US$” or “U.S.$” are to lawful currency of the United States of America.

The following table sets forth, for each of the periods indicated, the noon exchange rate, the average noon exchange rate and the high and low noon exchange rates of one U.S. dollar in exchange for Canadian dollars as reported by the Bank of Canada.

| Three months ended March 31 | Year ended December 31 | |||||||||||||||||||

| 2016 | 2015 | 2015 | 2014 | 2013 | ||||||||||||||||

| High |

1.4589 | 1.2803 | 1.3990 | 1.1643 | 1.0697 | |||||||||||||||

| Low |

1.2962 | 1.1728 | 1.1728 | 1.0614 | 0.9839 | |||||||||||||||

| Average |

1.3732 | 1.2412 | 1.2787 | 1.1045 | 1.0299 | |||||||||||||||

| Period End |

1.2971 | 1.2683 | 1.3840 | 1.1601 | 1.0636 | |||||||||||||||

On June 7, 2016, the noon exchange rate as reported by the Bank of Canada was U.S.$1.00 = $1.2789.

11

Table of Contents

THIRD PARTY SOURCES AND INDUSTRY DATA

This Prospectus contains information from publicly available third party sources as well as industry data prepared by the Company’s management on the basis of its knowledge of the regulated electric and gas utility industry in which Emera operates (including management’s estimates and assumptions relating to the industry based on that knowledge). Emera’s management’s knowledge of the regulated utility industry has been developed through its experience and participation in the industry. Emera’s management believes that its industry data is accurate and that its estimates and assumptions are reasonable, but there can be no assurance as to the accuracy or completeness of this data. Third-party sources generally state that the information contained therein has been obtained from sources believed to be reliable, but there can be no assurance as to the accuracy or completeness of included information. Although Emera’s management believes it to be reliable, Emera has not independently verified any of the data from third-party sources referred to in this Prospectus or analyzed or verified the underlying studies or surveys relied upon or referred to by such sources, or ascertained the underlying economic assumptions relied upon or referred to by such sources.

12

Table of Contents

The following information is a summary only and is to be read in conjunction with, and is qualified in its entirety by, the more detailed information and financial data and statements appearing elsewhere in this Prospectus and in the documents incorporated by reference herein.

Unless otherwise indicated by the context, the terms “Emera,” the “Company,” “we,” “our,” and “us” refer to Emera Incorporated, and, if the context requires, its subsidiaries.

Unless otherwise indicated by the context, the term “TECO Energy” refers to the holding company TECO Energy, Inc. and its subsidiaries, and references to individual subsidiaries of TECO Energy, Inc. refer to that company and its respective subsidiaries.

Unless otherwise indicated by the context, the term “Acquisition” refers to the acquisition by Emera of TECO Energy pursuant to the terms of the Acquisition Agreement.

In this Prospectus, unless otherwise specified or the context otherwise requires, all dollar amounts are expressed in Canadian dollars. References to “Canadian dollars,” “$,” “CAD” or “Cdn$” are to lawful currency of Canada. References to “U.S. dollars,” “USD”, “U.S.$” or “US$” are to lawful currency of the United States of America.

Please refer to the “Glossary” beginning on page 40 of this Prospectus for a list of defined terms used herein.

Company Overview

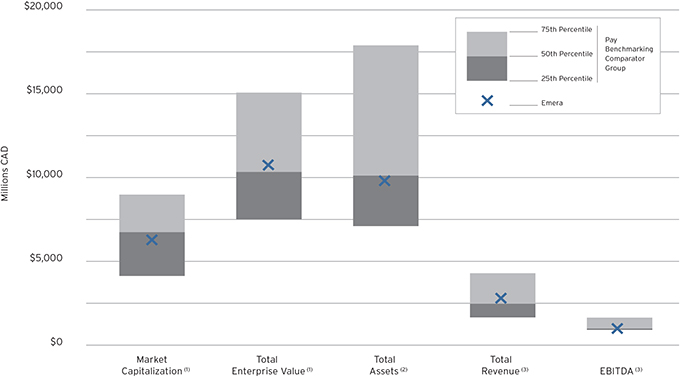

Emera

Emera is a geographically diverse energy and services company headquartered in Halifax, Nova Scotia with approximately Cdn$11.5 billion in assets as of March 31, 2016 and 2015 revenues of Cdn$2.79 billion. Emera invests in electricity generation, transmission and distribution, gas transmission and utility services. Emera currently provides regional energy solutions by connecting its assets, markets and partners in eastern Canada, northeastern United States and the Caribbean. Emera’s business continues to grow and evolve. Meeting customer demand for cleaner affordable energy remains central to Emera’s strategy.

Key Lines of Business

Utilities

Regulated utilities are the foundation of Emera’s business, providing the company with strong and consistent earnings. From its beginnings as NS Power Holdings Incorporated in 1998 following the privatization of Nova Scotia Power Corporation in 1992, Emera has grown by investing in its businesses, and through strategic acquisitions. Emera became an international business with the acquisition of Bangor Hydro in 2001, and expanded its investment in the State of Maine by adding Maine & Maritimes Corporation in 2010. In the Caribbean, Emera has built a business of scale, starting with its investment in St. Lucia’s electric utility in 2007, and now holding an indirect majority ownership interest in electric utilities in Grand Bahama and Dominica and a 100% indirect ownership interest in The Barbados Light & Power Company Limited.

At the core of Emera’s utilities strategy is identifying opportunities to invest in the transition from higher carbon methods of electricity generation to lower carbon alternatives. NSPI has invested in wind energy, biomass and hydroelectricity with the result that in 2015, 27% of NSPI’s generation mix was derived from renewable sources, and on track to meet a minimum 40% renewable standard by 2020. In the Caribbean, Emera is similarly focused on introducing cleaner generation alternatives, with an emphasis on affordability and fuel cost stability for its customers.

13

Table of Contents

Transmission

Emera is investing in electricity transmission to help get new renewable energy to market. Emera’s leadership in the Maritime Link Project is expected to transform the electricity market in the Atlantic Provinces, enabling growth in the availability of clean, renewable energy for the region. In addition, the Atlantic Provinces will be connected to the Northeastern United States, providing potential for excess renewable energy to be delivered throughout that region.

Non-regulated

Since its formation in 2003, Emera Energy has become an active participant in the Northeastern United States electricity and natural gas marketplace. It has built a strong marketing, trading and asset management business, based on comprehensive market knowledge, a focus on customer service and robust risk management. The integration and performance of the three New England Gas Generation Facilities purchased in 2013 has contributed significantly to the success of Emera Energy. Emera Energy has invested to improve the performance of its natural gas generation assets in New England, creating long-term value for its business.

As it has grown, Emera has held true to the core values that guide its business: building relationships by acting with integrity, focusing on operations and service excellence, investing in its people, and making safety and health its foremost priority. For more information on Emera’s business operations, see “Business”.

Emera’s Segments

Emera manages its reportable segments separately due to their different geographical, operating and regulatory environments. Segments are reported based on each subsidiary’s contributions of revenues, net income attributable to common shareholders and total assets. As of March 31, 2016, Emera had the following six reportable segments: NSPI, Emera Maine, Emera Caribbean, Pipelines, Emera Energy and Corporate and Other.

Nova Scotia Power Inc.

NSPI was created in 1992 through the privatization of the Crown corporation, Nova Scotia Power Corporation. NSPI is a fully-integrated regulated electric utility and is the primary electricity supplier in Nova Scotia, Canada. As of March 31, 2016 NSPI has Cdn$4.6 billion of assets and provides electricity generation, transmission and distribution services to approximately 507,000 customers. NSPI owns 2,483 megawatts (“MW”) of generating capacity, of which approximately 50% is coal-fired; 28% of which is natural gas and/or oil; 19% of which is hydro and wind and 3% of which is biomass-fueled generation. In addition, NSPI has contracts to purchase renewable energy from independent power producers (“IPP”). These IPPs own and operate 496 MW of wind and biomass fueled generation capacity, which is expected to increase to 552 MW by the end of 2016. NSPI also owns approximately 5,000 kilometres of transmission facilities and 27,000 kilometres of distribution facilities. NSPI has a workforce of approximately 1,700 people. NSPI is a public utility as defined in the Public Utilities Act (Nova Scotia) (the “Public Utilities Act”) and is subject to regulation under the Public Utilities Act by the Nova Scotia Utility and Review Board (the “UARB”). The Public Utilities Act gives the UARB supervisory powers over NSPI’s operations and expenditures. Electricity rates for NSPI’s customers are also subject to UARB approval. NSPI is not subject to a general annual rate review process, but rather participates in hearings from time to time at its request or at the UARB’s request.

NSPI is regulated under a cost-of-service model, with rates established to recover prudently incurred costs of providing electricity service to customers, and to provide an appropriate return to investors. NSPI has a fuel adjustment mechanism (“FAM”), approved by the UARB, allowing NSPI to recover fluctuating fuel expenses from customers through annual fuel rate adjustments. Differences between prudently incurred fuel for generation

14

Table of Contents

and purchased power and certain fuel-related costs and amounts recovered from customers through electricity rates in a year are deferred to a FAM regulatory asset or liability and recovered from or returned to customers in a subsequent year.

Emera Maine

Emera Maine is a transmission and distribution (“T&D”) electric utility with assets of approximately Cdn$1.1 billion serving approximately 158,000 customers in the State of Maine (as of March 31, 2016). Effective January 1, 2014, Bangor Hydro Electric Company (“Bangor Hydro”) and Maine Public Service Company (“MPS”) merged, becoming Emera Maine.

Electricity generation is deregulated in Maine, and several suppliers compete to provide customers with the energy delivered through Emera Maine’s T&D networks. Emera Maine owns and operates approximately 1,700 kilometres of transmission facilities and 15,000 kilometres of distribution facilities. Emera Maine’s workforce is approximately 400 people.

Approximately 55% of Emera Maine’s electric revenue represents distribution operations, 31% is associated with local transmission operations and 14% relates to stranded cost recoveries. The rates for each element are established in distinct regulatory proceedings.

Emera Maine’s distribution businesses operate under a traditional cost-of-service regulatory structure, and distribution rates are set by the MPUC.

There are two transmission districts in Emera Maine: Bangor Hydro District and MPS District, each of which correspond to the service territories of the two pre-merger entities.

Local transmission rates for Bangor Hydro District (the franchise electric service territory associated with the former Bangor Hydro Electric Company in portions of the Maine counties of Penobscot, Hancock, Washington, Waldo, Piscataquis, and Aroostook) are regulated by the FERC and set annually on June 1, based on a formula utilizing prior year actual transmission investments, adjusted for current year forecasted transmission investments. The Bangor Hydro District’s bulk transmission assets are managed by ISO-NE as part of a region-wide pool of assets. ISO-NE manages the region’s bulk power generation and transmission systems and administers the open access transmission tariff. Currently, the Bangor Hydro District, along with all other participating transmission providers, recovers the full cost of service for its transmission assets from the customers of participating transmission providers in New England, based on a regional FERC approved formula that is updated June 1 each year.

Local transmission rates for MPS District (the franchise electric service territory associated with the former Maine Public Service Company in the Maine counties of Aroostook and a portion of Penobscot) are regulated by the FERC and are set annually on June 1 for wholesale and July 1 for retail customers, based on a formula utilizing prior year actual transmission investments and expenses, adjusted for current year forecasted investments. The MPS District electric service territory is not connected to the New England bulk power system and it is not a member of ISO-NE.

Emera Caribbean

Emera Caribbean includes the following consolidated and non-consolidated investments:

| • | 100% (December 31, 2015 – 95.5%) investment in Emera (Caribbean) Incorporated (“ECI”) and its wholly owned subsidiary Barbados Light & Power Company Limited (“BLPC”), a vertically integrated utility and the provider of electricity on the island of Barbados, serving approximately 126,000 customers and regulated by the Fair Trading Commission, Barbados. The government of Barbados has |

15

Table of Contents

| granted BLPC a franchise to generate, transmit and distribute electricity on the island until 2028. BLPC owns 239 MW of oil-fired generation, 116 kilometres of transmission facilities and 2,800 kilometres of distribution facilities. BLPC has a workforce of 330 people. BLPC is regulated under a cost-of-service model with rates set to recover prudently incurred costs of providing electricity service to customers, and to provide an appropriate return to investors. A fuel pass-through mechanism provides the opportunity to recover all fuel costs in a timely manner. |

| • | 50.0% direct and 30.4% indirect interest (through a 60.7% interest in ICD Utilities Ltd. (“ICDU”) in Grand Bahama Power Company Ltd. (“GBPC”), which is a vertically integrated utility and the sole provider of electricity on Grand Bahama Island. GBPC serves approximately 19,000 customers. GBPC owns 98 MW of oil-fired generation, 138 kilometres of transmission facilities and 850 kilometres of distribution facilities and has a workforce of 205 people. GBPC is regulated by Grand Bahama Port Authority (“GBPA”), which has granted GBPC a licensed, regulated and exclusive franchise to generate, transmit and distribute electricity on the island until 2054. A fuel pass-through mechanism provides the opportunity to recover all fuel costs in a timely manner. |

| • | 51.9% (December 31, 2015 – 49.6%) indirect controlling interest, through ECI, in Dominica Electricity Services Ltd. (“Domlec”), an integrated utility on the island of Dominica. Domlec serves approximately 36,000 customers and is regulated by the Independent Regulatory Commission, Dominica. Domlec owns 20 MW of oil-fired generation, 7 MW of hydro production, 452 kilometres of transmission facilities and 640 kilometres of distribution facilities. Domlec has a workforce of 238 people. On October 7, 2013, the Independent Regulatory Commission, Dominica issued a Transmission, Distribution & Supply License and a Generation License, both of which came into effect on January 1, 2014, for a period of 25 years. Domlec’s approved allowable regulated return on rate base for 2016 is 15.0%. A fuel pass-through mechanism provides the opportunity to recover substantially all fuel costs in a timely manner. |

| • | 19.1% indirect interest, through ECI, in St. Lucia Electricity Services Limited (“Lucelec”), a vertically integrated regulated electric utility on the island of St. Lucia, which is regulated by the Government of St. Lucia. The investment in Lucelec is accounted for on the equity basis. |

Pipelines

Pipelines comprises Emera’s wholly owned Brunswick Pipeline and Emera’s 12.89% interest in M&NP.

| • | Brunswick Pipeline is a 145-kilometre pipeline delivering re-gasified natural gas from the Canaport™ liquefied natural gas (“LNG”) import terminal near Saint John, New Brunswick, to markets in the northeastern United States for Repsol Energy Canada under a 25-year firm service agreement which expires in 2034. The NEB, which regulates Brunswick Pipeline, has classified it as a Group II pipeline. The agreement is accounted for as a direct financing lease. |

| • | M&NP is a 1,400-kilometre transmission pipeline built to transport natural gas from offshore Nova Scotia to markets in Atlantic Canada and the northeastern United States. The investment in M&NP is accounted for on the equity basis. |

Emera Energy

Emera Energy includes the following:

| • | Emera Energy Services (“EES”), a wholly owned physical energy marketing and trading business. |

| • | Emera Energy Generation (“EEG”), consisting of a wholly owned portfolio of electricity generation facilities in New England and the Maritime provinces of Canada with 1,410 MW of total capacity. |

16

Table of Contents

| • | Emera’s 50.0% joint venture ownership of Bear Swamp, a 600 MW pumped storage hydroelectric facility in northwestern Massachusetts. |

Corporate and Other

Corporate encompasses certain corporate-wide functions including executive management, strategic planning, treasury services, legal, financial reporting, tax planning, corporate business development, corporate governance, internal audit, investor relations, risk management, insurance, acquisition-related costs and corporate human resource activities. It also includes interest revenue on intercompany financings, and costs associated with corporate activities that are not directly allocated to the operations of Emera’s consolidated subsidiaries and investments.

Other includes various consolidated and non-consolidated investments, including:

Consolidated Investments

| • | Emera Utility Services, which is a utility services contractor primarily operating in Atlantic Canada. |

| • | Emera Reinsurance Limited, which is a captive insurance company providing insurance and reinsurance to Emera and its affiliates. |

Non-consolidated Investments

| • | Emera’s 4.75% (March 31, 2016: 23.2% ) investment in APUC. APUC is a diversified generation, transmission and distribution utility traded on the Toronto Stock Exchange (“TSX”) under the symbol “AQN,” the distribution group operates in the United States and provides rate regulated water, electricity and natural gas utility services. The non-regulated generation group owns or has interests in a portfolio of North American based contracted wind, solar, hydroelectric and natural gas powered generating facilities. The transmission group invests in rate-regulated electric transmission and natural gas pipeline systems in the United States and Canada. For information regarding Emera’s recent sale of a portion of its ownership interest in APUC, see “Summary—Recent Developments.” |

| • | Emera’s 100% investment in Emera Newfoundland and Labrador Holdings, Incorporated (“ENL”), which holds investments in the following: |

| • | Emera’s 100% investment in NSP Maritime Link Incorporated (“NSPML”), a $1.56 billion transmission project, including two 170-kilometre subsea cables, between the island of Newfoundland and Nova Scotia. The investment in NSPML is accounted for on the equity basis with equity earnings equal to the return on equity component of AFUDC. This will continue until the Maritime Link Project goes into service, which is expected in 2017. |

| • | Emera’s 59.0% (December 31, 2015 – 55.5%) investment in the partnership capital of Labrador Island Link Limited Partnership (“LIL”), a $3.1 billion electricity transmission project in Newfoundland and Labrador to enable the transmission of Muskrat Falls energy between Labrador and the island of Newfoundland. Emera’s percentage ownership in LIL is subject to change based on the balance of capital investments required from Emera and Nalcor to complete construction of the LIL. Emera’s ultimate percentage investment in LIL will be determined upon completion of the LIL and final costing of all transmission projects related to the Muskrat Falls development, including the LIL and Maritime Link Projects, such that Emera’s total investment in the Maritime Link and LIL will equal 49% of the cost of all of these transmission developments. The investment in LIL is accounted for on the equity basis. This project is expected to go into service in 2017. Emera’s total investment is expected to approximate Cdn$409.1 million. |

| • | Other investments. |

17

Table of Contents

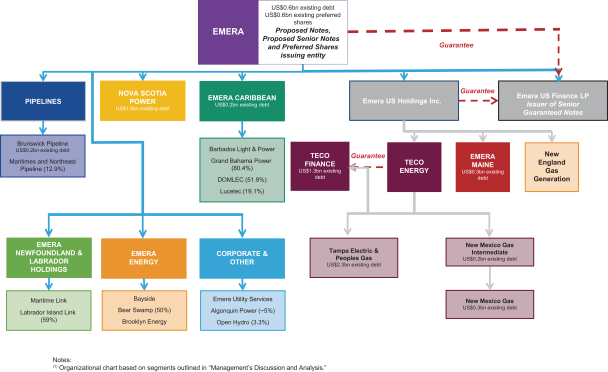

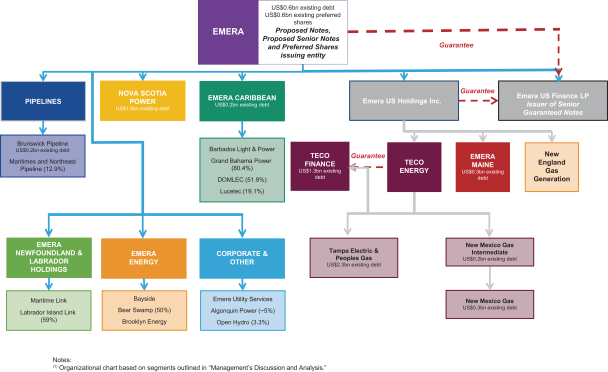

Organizational Structure

The following chart provides a summary of Emera’s organizational structure as of December 31, 2015 on a pro forma basis after giving effect to the Acquisition. The chart depicts (i) Emera’s reportable segments (including consolidated and non-consolidated investments) and (ii) selected subsidiaries of Emera.

Simplified Pro Forma Organization Chart

Business Strategy

Emera’s business strategy consists of the following key components:

Focus on identifying reliable and affordable energy solutions, typically including the replacement of higher carbon electricity generation with generation from cleaner sources, and the related transmission and distribution infrastructure to deliver energy to that market

| • | Emera is investing Cdn$2.2 billion to build the Maritime Link and associated projects, which will bring clean hydro energy from Labrador to Nova Scotia, and create opportunities for surplus renewable energy to supply other markets. |

| • | NSPI has invested in wind energy, biomass and hydroelectricity, which has driven substantial increases in the portion of its generation mix derived from renewable sources (reaching 27% in 2015 and on track to meet its 40% target by 2020). |

| • | Numerous other investments and initiatives are underway, from a new utility grade solar facility in Barbados to the Maine Renewable Energy Interconnect (“MREI”) transmission proposal, designed to deliver new wind energy in northern Maine to markets in southern New England. |

18

Table of Contents

Develop strong partnerships and relationships throughout the regions in which we operate and utilize a collaborative approach to strategic partnerships

| • | The foundation of Emera’s strategy is its collaborative approach to strategic partnerships and its ability to develop strong relationships throughout the regions in which it operates. Prime examples of Emera’s success in this areas include: |

| • | The Maritime Link project, where Emera and its partner Nalcor, along with the Government of Canada and the Provinces of Nova Scotia and Newfoundland and Labrador, have entered into numerous agreements and partnerships to deliver and finance the Maritime Link, the Labrador Island Link and the related Muskrat Falls project. |

| • | Emera’s Strategic Investment Agreement (“SIA”) with APUC establishes how Emera and APUC will work together to pursue specific strategic investments of mutual benefit. While Emera recently announced that it has reduced its direct investment in APUC, the SIA remains in place as both companies value the partnership. See “Summary—Recent Developments.” |

| • | Emera has a number of other partnerships and collaborative agreements across its operating regions, including a joint dispatch project between NSPI and New Brunswick Power Corporation (“NB Power”), a partnership between Emera Maine and Central Maine Power Company to develop the MREI, and the Massachusetts Clean Electricity Partnership, an alliance including Brookfield Renewable Partners, Hydro-Québec, Nalcor, NB Power, SunEdison and TDI New England to promote clean energy investments in New England. |

Establish a diverse investment and operations profile

| • | Emera is a geographically diverse company, operating in Canada, the United States, and the Caribbean. |

| • | Its operations include: |

| • | vertically integrated electric utilities in Nova Scotia, Barbados, Dominica and Grand Bahama; |

| • | a transmission and distribution electric utility in Maine; |

| • | a portfolio of generation facilities, including combined-cycle natural gas and pumped storage hydro in Atlantic Canada and the U.S. northeast; |

| • | investments in two natural gas pipelines in Atlantic Canada and New England; |

| • | natural gas marketing and trading; |

| • | a utility services contractor in Atlantic Canada; |

| • | a Cdn$2.2 billion project to bring clean hydro energy from Labrador to Nova Scotia; and |

| • | minority interests in numerous energy projects and companies. |

Employ operating and governance models that focus on operational excellence, constructive regulatory approaches, proactive stakeholder engagement and a customer focus through service reliability and rate stability

| • | Emera’s focus on maintaining the highest standards of governance practices is evident in a number of ways including, for example: |

| • | The Maritime Link project’s on time and on budget record, notwithstanding the ambitious and ground-breaking nature of the project, the changing economic climate during the course of the project, and the challenge other similar projects have had with budget and schedule; |

19

Table of Contents

| • | Emera’s consistently high ranking (2nd overall in 2015) in a survey of governance practices among Canada’s publicly traded companies, conducted each year by the Globe & Mail’s Report on Business; and |

| • | The establishment of operating boards for Emera’s subsidiaries, and the inclusion of local business and community leaders on these boards as well as Emera executives. This practice has helped Emera develop constructive regulatory approaches, proactive stakeholder engagement and maintain a customer focus in its businesses in each of the markets it operates in. |

Competitive Strengths

We believe we have the following key competitive strengths to enable us to carry out our business strategy.

Diverse, increasingly regulated profile

| • | The portion of Emera’s adjusted net income generated from rate regulated business has grown from 67% in 2014 to 72% in the 12 months ended March 31, 2016. On a pro forma basis, the Acquisition will bring Emera’s regulated earnings to greater than 80%. |

| • | Emera targets achieving 75% to 85% of its adjusted net income from rate-regulated subsidiaries, which contribute strong, predictable income and cash flows, and which is reflective of Emera’s risk tolerance. |

Supportive and stable regulatory environments

| • | Through its long history of operating regulated businesses, Emera has gained an appreciation for the importance of constructive, professional regulatory oversight. Emera’s experience in jurisdictions such as Nova Scotia and Maine, where it has built robust regulatory teams and practices, was a significant factor in making stable regulatory environments a key criteria in its assessment of growth opportunities, including the Acquisition. |

Strong balance sheet, cash flow and liquidity position

| • | Over the last 10 years, Emera’s strong balance sheet, and its ability to raise the capital necessary to fund investments has been a strong enabler of its growth. This was demonstrated in Emera’s issue of the Convertible Debentures represented by instalment receipts in connection with the Acquisition. |

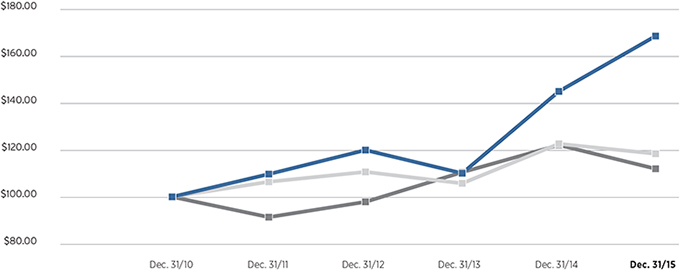

| • | In addition to access to debt and equity capital markets, cash flow from operations has grown substantially, from Cdn$419 million for the year ended December 31, 2010 to approximately Cdn$674 million for the year ended December 31, 2015. |

| • | Emera and its subsidiaries maintain strong credit metrics, and Emera has consistently maintained a strong, investment grade credit rating, which is an important component of Emera’s financing strategy. |

Sizeable capital investment plan to drive growth

| • | Emera has a Cdn$4.2 billion capital investment plan over the next five years, a significant portion of which is related to the Maritime Link and Labrador Island Link projects. |

| • | This capital plan increases to Cdn$8.3 billion, on a pro forma basis, when TECO Energy’s US$4.1 billion in planned capital investments are included. |

20

Table of Contents

Disciplined investment criteria

| • | Emera’s focused growth strategy and disciplined investment criteria has served it well. Throughout the period of declining interest rates, its investment hurdle rate has remained unchanged, ensuring that any investment met long term criteria. |