UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the Fiscal Year ended December 31, 2016. | |

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the Transition period from to . | |

GenOn Energy, Inc.

(Exact name of registrant as specified in its charter)

76-0655566 (I.R.S. Employer Identification No.)

Commission File Number: 001-16455

GenOn Americas Generation, LLC

(Exact name of registrant as specified in its charter)

51-0390520 (I.R.S. Employer Identification No.)

Commission File Number: 333-63240

GenOn Mid-Atlantic, LLC

(Exact name of registrant as specified in its charter)

58-2574140 (I.R.S. Employer Identification No.)

Commission File Number: 333-61668

Delaware (State or other jurisdiction of incorporation or organization) | ||

804 Carnegie Center Princeton, New Jersey (Address of principal executive offices) | 08540 (Zip Code) | |

(609) 524-4500

(Registrants' telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined by Rule 405 of the Securities Act.

GenOn Energy, Inc. | o | Yes | þ | No | |

GenOn Americas Generation, LLC | o | Yes | þ | No | |

GenOn Mid-Atlantic, LLC | o | Yes | þ | No | |

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act.

GenOn Energy, Inc. | þ | Yes | o | No | |

GenOn Americas Generation, LLC | þ | Yes | o | No | |

GenOn Mid-Atlantic, LLC | þ | Yes | o | No | |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. (As a voluntary filer not subject to filing requirements, the registrant nevertheless filed all reports which would have been required to be filed by Section 15(d) of the Exchange Act during the preceding 12 months had the registrant been required to file reports pursuant to Section 15(d) of the Securities Exchange Act of 1934 solely as a result of having registered debt securities under the Securities Act of 1933.)

GenOn Energy, Inc. | o | Yes | o | No | |

GenOn Americas Generation, LLC | o | Yes | o | No | |

GenOn Mid-Atlantic, LLC | o | Yes | o | No | |

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

GenOn Energy, Inc. | þ | Yes | o | No | |

GenOn Americas Generation, LLC | þ | Yes | o | No | |

GenOn Mid-Atlantic, LLC | þ | Yes | o | No | |

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

GenOn Energy, Inc. | þ | |

GenOn Americas Generation, LLC | þ | |

GenOn Mid-Atlantic, LLC | þ | |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b‑2 of the Exchange Act.

Large accelerated filer | Accelerated filer | Non-accelerated filer | Smaller reporting company | |

GenOn Energy, Inc. | o | o | þ | o |

GenOn Americas Generation, LLC | o | o | þ | o |

GenOn Mid-Atlantic, LLC | o | o | þ | o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b‑2 of the Act).

GenOn Energy, Inc. | o | Yes | þ | No | |

GenOn Americas Generation, LLC | o | Yes | þ | No | |

GenOn Mid-Atlantic, LLC | o | Yes | þ | No | |

Each Registrant’s outstanding equity interests are held by its respective parent and there are no equity interests held by nonaffiliates.

Registrant | Parent | ||

GenOn Energy, Inc. | NRG Energy, Inc. | ||

GenOn Americas Generation, LLC | NRG Americas, Inc. | ||

GenOn Mid-Atlantic, LLC | NRG North America, LLC | ||

This combined Form 10-K is separately filed by GenOn Energy, Inc., GenOn Americas Generation, LLC and GenOn Mid-Atlantic, LLC. Information contained in this combined Form 10-K relating to GenOn Energy, Inc., GenOn Americas Generation, LLC and GenOn Mid-Atlantic, LLC is filed by such registrant on its own behalf and each registrant makes no representation as to information relating to registrants other than itself.

The registrants have not incorporated by reference any information into this Form 10-K from any annual report to securities holders, proxy statement or prospectus filed pursuant to 424(b) or (c) of the Securities Act.

NOTE: WHEREAS GENON ENERGY, INC., GENON AMERICAS GENERATION, LLC AND GENON MID-ATLANTIC, LLC MEET THE CONDITIONS SET FORTH IN GENERAL INSTRUCTION I(1)(a) AND (b) OF FORM 10-K, THIS COMBINED FORM 10-K IS BEING FILED WITH THE REDUCED DISCLOSURE FORMAT PURSUANT TO GENERAL INSTRUCTION I(2).

TABLE OF CONTENTS

1

Glossary of Terms

When the following terms and abbreviations appear in the text of this report, they have the meanings indicated below:

ARO | Asset Retirement Obligation | |

ASC | The FASB Accounting Standards Codification, which the FASB established as the source of authoritative GAAP | |

ASU | Accounting Standards Updates – updates to the ASC | |

Average realized prices | Volume-weighted average power prices, net of average fuel costs and reflecting the impact of settled hedges | |

Bankruptcy Court | United States Bankruptcy Court for the Northern District of Texas, Fort Worth Division | |

Baseload | Units expected to satisfy minimum baseload requirements of the system and produce electricity at an essentially constant rate and run continuously | |

CAIR | Clean Air Interstate Rule | |

CAISO | California Independent System Operator | |

CCGT | Combined Cycle Gas Turbine | |

CenterPoint | CenterPoint Energy, Inc. and its subsidiaries, on and after August 31, 2002, and Reliant Energy, Incorporated and its subsidiaries, prior to August 31, 2002 | |

CES | Clean Energy Standard | |

CFTC | U.S. Commodity Futures Trading Commission | |

CO2 | Carbon Dioxide | |

CPUC | California Public Utilities Commission | |

CSAPR | Cross-State Air Pollution Rule | |

CWA | Clean Water Act | |

D.C. Circuit | U.S. Court of Appeals for the District of Columbia Circuit | |

Deactivation | Includes retirement, mothballing and long-term protective layup. In each instance, the deactivated unit cannot be currently called upon to generate electricity. | |

Dodd-Frank Act | Dodd-Frank Wall Street Reform and Consumer Protection Act | |

Economic gross margin | Sum of energy revenue, capacity revenue and other revenue, less cost of sales and other cost of sales | |

EGU | Electric Generating Unit | |

EMAAC | Eastern Mid-Atlantic Area Council | |

EPA | United States Environmental Protection Agency | |

EPC | Engineering, Procurement and Construction | |

EPSA | The Electric Power Supply Association | |

ERISA | The Employee Retirement Income Security Act of 1974 | |

ESPS | Existing Source Performance Standards | |

Exchange Act | The Securities Exchange Act of 1934, as amended | |

FASB | Financial Accounting Standards Board | |

FCM | Forward Capacity Market | |

FERC | Federal Energy Regulatory Commission | |

FTRs | Financial Transmission Rights | |

FPA | Federal Power Act | |

GAAP | Accounting principles generally accepted in the U.S. | |

GenOn | GenOn Energy, Inc. and, except where the context indicates otherwise, its subsidiaries | |

GenOn Americas Generation | GenOn Americas Generation, LLC and, except where the context indicates otherwise, its subsidiaries | |

GenOn Americas Generation Senior Notes | GenOn Americas Generation's $695 million outstanding unsecured senior notes consisting of $366 million of 8.5% senior notes due 2021 and $329 million of 9.125% senior notes due 2031 | |

2

GenOn Energy Holdings | GenOn Energy Holdings, Inc. and, except where the context indicates otherwise, its subsidiaries | |

GenOn Energy Management | GenOn Energy Management, LLC, a wholly owned subsidiary of GenOn Americas Generation, LLC | |

GenOn Mid-Atlantic | GenOn Mid-Atlantic, LLC and, except where the context indicates otherwise, its subsidiaries, which include the coal generation units at two generating facilities under operating leases | |

GenOn Plans | Collectively, the NRG GenOn LTIP, The GenOn Energy, Inc. 2002 Long-Term Incentive Plan, the GenOn Energy, Inc. 2002 Stock Plan and the Mirant Corporation 2005 Omnibus Incentive Compensation Plan | |

GenOn Senior Notes | GenOn's $1.8 billion outstanding unsecured senior notes consisting of $691 million of 7.875% senior notes due 2017, $649 million of 9.5% senior notes due 2018, and $490 million of 9.875% senior notes due 2020 | |

GHG | Greenhouse Gas | |

HAPs | Hazardous Air Pollutants | |

IASB | International Accounting Standards Board | |

ICAP | New York Installed Capacity | |

ICE | Intercontinental Exchange | |

IFRS | International Financial Reporting Standards | |

IPA | Illinois Power Authority | |

IRC | Internal Revenue Code of 1986, as amended | |

IRC § | IRC Section | |

ISO | Independent System Operator, also referred to as RTO | |

ISO-NE | ISO New England Inc. | |

kWh | Kilowatt-hour | |

LIBOR | London Inter-Bank Offered Rate | |

LTSA | Long Term Service Agreement | |

MAAC | Mid-Atlantic Area Council | |

MATS | Mercury and Air Toxics Standards | |

MC Asset Recovery | MC Asset Recovery, LLC | |

MDE | Maryland Department of the Environment | |

Merit Order | A term used for the ranking of power stations in order of ascending marginal cost | |

Mirant | GenOn Energy Holdings, Inc. (formerly known as Mirant Corporation) and, except where the context indicates otherwise, its subsidiaries | |

Mirant/RRI Merger | The merger completed on December 3, 2010 pursuant to the Mirant/RRI Merger Agreement | |

Mirant Debtors | GenOn Energy Holdings, Inc. (formerly known as Mirant Corporation) and certain of its subsidiaries | |

MISO | Midcontinent Independent System Operator, Inc. | |

MMBtu | Million British Thermal Units | |

MOPR | Minimum Offer Price Rule | |

Mothballed | The unit has been removed from service and is unavailable for service, but has been laid up in a manner such that it can be brought back into service with an appropriate amount of notification, typically weeks or months | |

MW | Megawatt | |

MWh | Saleable megawatt hour net of internal/parasitic load megawatt-hour | |

NAAQS | National Ambient Air Quality Standards | |

Natixis | Natixis Funding Corp. | |

NEPGA | New England Power Generators Association | |

Net Exposure | Counterparty credit exposure to GenOn, GenOn Americas Generation or GenOn Mid-Atlantic, as applicable, net of collateral | |

3

Net Generation | The net amount of electricity produced, expressed in kWhs or MWhs, that is the total amount of electricity generated (gross) minus the amount of electricity used during generation. | |

NERC | North American Electric Reliability Corporation | |

NOL | Net Operating Loss | |

NOV | Notice of Violation | |

NOx | Nitrogen Oxides | |

NPDES | National Pollution Discharge Elimination System | |

NPNS | Normal Purchase Normal Sale | |

NRG | NRG Energy, Inc. and, except where the context indicates otherwise, its subsidiaries | |

NRG Americas | NRG Americas, Inc. (formerly known as GenOn Americas, Inc.) | |

NRG GenOn LTIP | NRG 2010 Stock Plan for GenOn employees | |

NRG Merger | The merger completed on December 14, 2012 whereby GenOn became a wholly owned subsidiary of NRG | |

NSPS | New Source Performance Standards | |

NYISO | New York Independent System Operator | |

NYMEX | New York Mercantile Exchange | |

NYSPSC | New York State Public Service Commission | |

OCI | Other Comprehensive Income/ (Loss) | |

Peaking | Units expected to satisfy demand requirements during the periods of greatest or peak load on the system | |

PER | Peak Energy Rate | |

PJM | PJM Interconnection, LLC | |

Plan | The plan of reorganization that was approved in conjunction with Mirant Corporation's emergence from bankruptcy protection on January 3, 2006 | |

PPM | Parts Per Million | |

PUCO | Public Utility Commission of Ohio | |

PUHCA | Public Utility Holding Company Act of 2005 | |

PURPA | Public Utility Regulatory Policies Act of 1978 | |

RCRA | Resource Conservation and Recovery Act of 1976 | |

Registrants | GenOn, GenOn Americas Generation and GenOn Mid-Atlantic, collectively | |

REMA | NRG REMA LLC (formerly known as GenOn REMA, LLC) | |

Repowering | Technologies utilized to replace, rebuild, or redevelop major portions of an existing electrical generating facility, not only to achieve a substantial emission reduction, but also to increase facility capacity, and improve system efficiency | |

RGGI | Regional Greenhouse Gas Initiative | |

RMR | Reliability Must-Run | |

RRI Energy | RRI Energy, Inc. | |

RTO | Regional Transmission Organization | |

SCR | Selective Catalytic Reduction | |

SEC | U.S. Securities and Exchange Commission | |

Securities Act | The Securities Act of 1933, as amended | |

Seward | The Seward Generating Station, a 525 MW coal-fired facility in Pennsylvania | |

Shelby | The Shelby Generating Station, a 352 MW natural gas-fired facility in Illinois | |

SO2 | Sulfur Dioxide | |

U.S. | United States of America | |

4

PART I

Item 1 — Business (GenOn, GenOn Americas Generation and GenOn Mid-Atlantic)

General

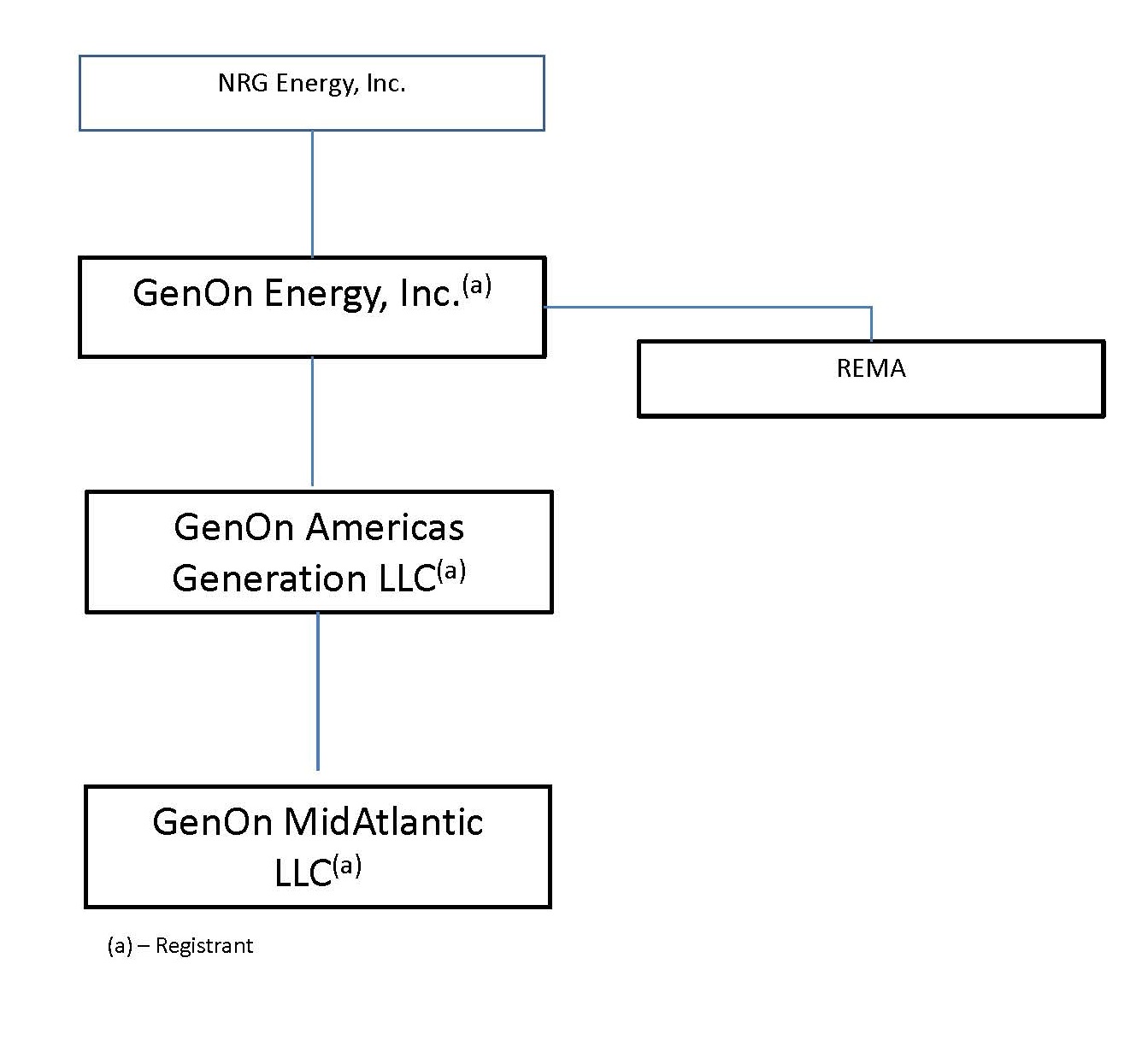

The Registrants are wholesale power generation subsidiaries of NRG, which is a competitive power company that produces, sells and delivers electricity and related services, primarily in major competitive power markets in the U.S. GenOn is an indirect wholly owned subsidiary of NRG. GenOn was incorporated as a Delaware corporation on August 9, 2000, under the name Reliant Energy Unregco, Inc. GenOn Americas Generation and GenOn Mid-Atlantic are indirect wholly owned subsidiaries of GenOn. GenOn Americas Generation was formed as a Delaware limited liability company on November 1, 2001, under the name Mirant Americas Generation, LLC. GenOn Mid-Atlantic was formed as a Delaware limited liability company on July 12, 2000, under the name Southern Energy Mid-Atlantic, LLC. GenOn Mid-Atlantic is a wholly-owned subsidiary of NRG North America and an indirect wholly owned subsidiary of GenOn Americas Generation. The Registrants are engaged in the ownership and operation of power generation facilities; the trading of energy, capacity and related products; and the transacting in and trading of fuel and transportation services.

The Registrants’ generation facilities are located in the U.S. and comprise generation facilities across the merit order. The sale of capacity and power from baseload and intermediate generation facilities accounts for a majority of the Registrants’ generation revenues. In addition, the Registrants’ generation portfolio provides each with opportunities to capture additional revenues by selling power during periods of peak demand, offering capacity or similar products, and providing ancillary services to support system reliability.

The following table summarizes the generation portfolio as of December 31, 2016, by Registrant:

(In MW)(a) | |||||||||

Generation Type | GenOn | GenOn Americas Generation | GenOn Mid-Atlantic | ||||||

Natural gas(b)(c) | 10,377 | 4,040 | 1,864 | ||||||

Coal(d) | 4,199 | 2,433 | 2,433 | ||||||

Oil | 1,847 | 1,434 | 308 | ||||||

Total generation capacity | 16,423 | 7,907 | 4,605 | ||||||

(a) | MW figures provided represent nominal summer net MW capacity of power generated as adjusted for the Registrants' owned or leased interest excluding capacity from inactive/mothballed units. |

(b) | GenOn's natural gas generation portfolio includes 325 MW related to the gas addition of New Castle Units 3-5 which was completed in the second quarter of 2016 and 597 MW related to the gas addition of Shawville which was completed in the fourth quarter of 2016. GenOn's natural gas generation does not include 78 MW related to the Chalk Point capital lease which expired at the end of 2015, 352 MW related to Shelby which was sold on March 1, 2016 and 878 MW related to Aurora which was sold on July 12, 2016. |

(c) | GenOn's natural gas generation portfolio includes 275 MW related to Choctaw Unit 1 which is in forced outage which is expected to return to service in December 2017. |

(d) | GenOn's coal generation portfolio does not include 325 MW related to New Castle Units 3-5, which completed a gas addition in the second quarter of 2016, 597 MW related to Shawville, which completed a gas addition in the fourth quarter of 2016, and 94 MW related to Avon Lake Unit 7, which was deactivated in the second quarter of 2016. In addition, GenOn's coal generation portfolio does not include 525 MW related to Seward which was sold on February 2, 2016. |

Seasonality and Price Volatility

Annual and quarterly operating results of the Registrants' wholesale power generation segments can be significantly affected by weather and energy commodity price volatility. Significant other events, such as the demand for natural gas, interruptions in fuel supply infrastructure and relative levels of hydroelectric capacity, can increase seasonal fuel and power price volatility. The preceding factors related to seasonality and price volatility are fairly uniform across the Registrants' wholesale generation business.

5

2016 Significant Events and Developments

Going Concern

As disclosed in Item 15 — Note 1, Nature of Business and Note 9, Debt and Capital Leases, as of December 31, 2016, $691 million of GenOn's Senior Notes outstanding, excluding $8 million of associated premiums, are current within the GenOn consolidated balance sheet and are due on June 15, 2017. GenOn's future profitability continues to be adversely affected by (i) a sustained decline in natural gas prices and its resulting effect on wholesale power prices and capacity prices, and (ii) the inability of GenOn Mid-Atlantic and REMA to make distributions of cash and certain other restricted payments to GenOn. Based on current projections, GenOn is not expected to have sufficient liquidity exclusive of cash subject to the restrictions under the GenOn Mid-Atlantic and REMA operating leases to repay the GenOn Senior Notes due in June 2017. As a result of these factors, there is substantial doubt about GenOn's ability to continue as a going concern.

NRG, GenOn's parent company, has no obligation to provide any financial support other than the credit agreement between NRG and GenOn which provides for a $500 million revolving credit facility, all of which can be utilized for revolving loans and letters of credit as further in described in Item 15 — Note 13, Related Party Transactions. As controlled group members, ERISA requires that NRG and GenOn are jointly and severally liable for the NRG Pension Plan for Bargained Employees and the NRG Pension Plan, including the pension liabilities associated with GenOn employees.

GenOn is currently considering all options available to it, including negotiations with creditors and lessors, refinancing the GenOn Senior Notes, potential sales of certain generating assets as well as the possibility for a need to file for protection under Chapter 11 of the U.S. Bankruptcy Code. During 2016, GenOn appointed two independent directors, retained advisors and established a separate audit committee as part of this process.

As of December 31, 2016, GenOn Americas Generation, a consolidated subsidiary of GenOn, has a note receivable due from GenOn Energy Holdings, a consolidated subsidiary of GenOn, of $315 million and an accounts payable due to GenOn Energy Holdings of $43 million under the intercompany cash management program as further described in Item 15 — Note 13, Related Party Transactions. The terms of the intercompany note do not provide for priority to GenOn Americas Generation and as such, there is no assurance that options pursued by GenOn will not have an adverse impact on GenOn Americas Generation’s liquidity. As such, there is substantial doubt about GenOn Americas Generation’s ability to continue as a going concern.

With respect to GenOn Mid-Atlantic, a consolidated subsidiary of GenOn, management has determined that while it has sufficient cash on hand to fund current obligations including operating lease payments due under the GenOn Mid-Atlantic operating leases as of December 31, 2016, the potential significant adverse impact of financial stresses at GenOn Mid-Atlantic's parent companies and, to a lesser extent, any adverse impact resulting from the notification by GenOn Mid-Atlantic's lessors alleging the existence of lease events of default as further described in Note 9, Debt and Capital Leases, has caused there to be substantial doubt about GenOn Mid-Atlantic's ability to continue as a going concern.

Dispositions & Deactivations

During the year ended December 31, 2016, the Registrants completed dispositions of certain generating stations and real property further discussed in Item 15 — Note 3, Dispositions. The following table summarizes dispositions during 2016:

Name and Location of Facility | Net Generation Capacity (MW) | Power Market | Registrant | Date Sale Completed | |

Seward, New Florence, PA | 525 | PJM | GenOn | February 2, 2016 | |

Shelby, Neoga, IL | 352 | PJM | GenOn | March 1, 2016 | |

Aurora, IL | 878 | PJM | GenOn | July 12, 2016 | |

Potrero, San Francisco, CA (a) | — | N/A | GenOn Americas Generation | September 26, 2016 | |

1,755 | |||||

(a) The sale of Potrero consisted solely of real property, as the generating station was deactivated during the first quarter of 2011.

In addition, GenOn Americas Generation deactivated the Pittsburg Generating Station, a 1,029 MW natural gas-fired facility located in California, on January 1, 2017.

The Registrants' future operating revenues, gross margin and other operating costs may be adversely impacted as a result of facilities that have been sold or deactivated in 2016 or may be deactivated in the future.

6

Impairments

During 2016, GenOn recorded impairment losses on its Mandalay and Ormond Beach operating units along with its leased interests in Keystone and Conemaugh totaling $194 million. In addition, GenOn Americas Generation recorded an impairment on the Pittsburg generating station during the fourth quarter of 2016 resulting in an impairment loss of $20 million. See Item 15 — Note 8, Impairments, to the Consolidated Financial Statements for further discussion.

Competition

Wholesale power generation is a capital-intensive and commodity-driven business with numerous industry participants that compete on the basis of the location of their plants, fuel mix, plant efficiency and the reliability of the services offered. The Registrants compete on the basis of the location of their plants and ownership of portfolios of plants in various regions, which increases the stability and reliability of their energy revenues. Wholesale power generation is a regional business that is currently highly fragmented and diverse in terms of industry structure. As such, there is a wide variation in terms of the capabilities, resources, nature and identity of the companies the Registrants compete with depending on the market. Competitors include regulated utilities, municipalities, cooperatives and other independent power producers, and power marketers or trading companies, including those owned by financial institutions.

Competitive Strengths

The Registrants’ power generation assets are diversified by fuel-type, dispatch level and region, which helps mitigate the risks associated with fuel price volatility and market demand cycles. The Registrants' baseload and intermediate facilities provide each with a significant source of cash flow, while the peaking facilities provide the Registrants with opportunities to capture significant upside potential that can arise from time to time during periods of high demand.

Many of the Registrants’ generation assets are located within densely populated areas, which tend to have higher wholesale pricing as a result of relatively favorable local supply-demand balance. The Registrants have generation assets located in or near the New York City, Washington, D.C., Baltimore, Pittsburgh, Los Angeles and San Francisco metropolitan areas. These facilities, some of which are aging, are often ideally situated for repowering or the addition of new capacity because their location and existing infrastructure provide significant advantages over undeveloped sites.

7

Coal Operations

The following table summarizes GenOn's U.S. coal capacity and the corresponding revenues and average natural gas prices and positions resulting from coal hedge agreements extending beyond December 31, 2016 and through 2020:

2017 | 2018 | 2019 | 2020 | Annual Average for 2017-2020 | ||||||||||||||||

(Dollars in millions unless otherwise stated) | ||||||||||||||||||||

Net Coal Capacity (MW) (a) | 4,198 | 4,198 | 4,198 | 4,198 | 4,198 | |||||||||||||||

Forecasted Coal Capacity (MW) (b) | 1,956 | 1,823 | 1,396 | 1,248 | 1,606 | |||||||||||||||

Total Coal Sales (GWh) (c) | 16,636 | 1,905 | — | — | 4,635 | |||||||||||||||

Percentage Coal Capacity Sold Forward (d) | 97 | % | 12 | % | — | % | — | % | 27 | % | ||||||||||

Total Forward Hedged Revenues (e) | $ | 629 | $ | 68 | $ | — | $ | — | $ | — | ||||||||||

Weighted Average Hedged Price ($ per MWh) (e) | $ | 37.79 | $ | 35.48 | $ | — | $ | — | $ | — | ||||||||||

Average Equivalent Natural Gas Price ($ per MMBtu) (e) | $ | 3.65 | $ | 3.43 | $ | — | $ | — | $ | — | ||||||||||

Gross Margin Sensitivities | ||||||||||||||||||||

Gas Price Sensitivity Up $0.50/MMBtu on Coal Units | $ | 37 | $ | 119 | $ | 118 | $ | 111 | $ | — | ||||||||||

Gas Price Sensitivity Down $0.50/MMBtu on Coal Units | $ | (10 | ) | $ | (90 | ) | $ | (82 | ) | $ | (74 | ) | $ | — | ||||||

Heat Rate Sensitivity Up 1 MMBtu/MWh on Coal Units | $ | 35 | $ | 61 | $ | 56 | $ | 52 | $ | — | ||||||||||

Heat Rate Sensitivity Down 1 MMBtu/MWh on Coal Units | $ | (11 | ) | $ | (49 | ) | $ | (48 | ) | $ | (43 | ) | $ | — | ||||||

(a) | Net coal capacity represents nominal summer net MW capacity of power generated as adjusted for the Registrants' ownership position excluding capacity from inactive/mothballed units. |

(b) | Forecasted generation dispatch output (MWh) based on forward price curves as of December 31, 2016, which is then divided by number of hours in a given year to arrive at MW capacity. The dispatch takes into account planned and unplanned outage assumptions. |

(c) | Includes amounts under power sales contracts and natural gas hedges. The forward natural gas quantities are reflected in equivalent GWh based on forward market implied heat rate as of December 31, 2016, and then combined with power sales to arrive at equivalent GWh hedged. The coal sales include swaps and delta of options sold which is subject to change. For detailed information on the Registrants' hedging methodology through use of derivative instruments, see discussion in Item 15 - Note 5, Accounting for Derivative Instruments and Hedging Activities, to the Consolidated Financial Statements. |

(d) | Percentage hedged is based on total coal sales as described in (c) above divided by the forecasted coal capacity. |

(e) | Represents all U.S. coal sales, including energy revenue and demand charges, excluding revenues derived from capacity auctions. |

Regulatory Matters

As owners of power plants and participants in wholesale energy markets, certain of the Registrants' subsidiaries are subject to regulation by various federal and state government agencies. These include the CFTC and FERC, as well as other public utility commissions in certain states where the Registrants' generating assets are located. In addition, the Registrants are subject to the market rules, procedures and protocols of the various ISO markets in which they participate. The Registrants must also comply with the mandatory reliability requirements imposed by NERC and the regional reliability entities in the regions where they operate.

Current Administration and Changeover at FERC — FERC is currently without a quorum and cannot issue orders in contested proceedings until a new Commissioner is appointed. FERC’s day-to-day work can continue through authority that has been delegated to FERC Staff. With a new administration and three vacant positions at FERC, the Registrants' business may be affected because its generation fleet is subject to changes in FERC regulatory policy.

PJM

2019/2020 PJM Auction Results — On May 24, 2016, PJM announced the results of its 2019/2020 base residual auction. GenOn (including GenOn Americas Generation and GenOn Mid-Atlantic) cleared approximately 6,766 MW of Capacity Performance product and 305 MW of Base Capacity product in the 2019/2020 base residual auction. GenOn's (including GenOn Americas Generation and GenOn Mid-Atlantic) expected capacity revenues from the 2019/2020 base residual auction for the 2019/2020 delivery year are approximately $260 million. GenOn Americas Generation (including GenOn Mid-Atlantic) cleared approximately 3,814 MW of Capacity Performance product in the 2019/2020 base residual auction. GenOn Americas Generation's (including GenOn Mid-Atlantic) expected capacity revenues from the 2019/2020 base residual auction for the 2019/2020 delivery year are approximately $140 million.

8

The tables below provide a detailed description of the Registrant's Base Residual Auction results:

GenOn:

Base Capacity Product | Capacity Performance Product | |||||||||||

Zone | Cleared Capacity (MW)(1) | Price ($/MW-day) | Cleared Capacity (MW)(1) | Price ($/MW-day) | ||||||||

EMAAC | 103 | $ | 99.77 | 414 | $ | 119.77 | ||||||

MAAC | 9 | $ | 80.00 | 5,802 | $ | 100.00 | ||||||

RTO | 193 | $ | 80.00 | 550 | $ | 100.00 | ||||||

Total | 305 | 6,766 | ||||||||||

(1) Includes imports. Excludes cleared capacity related to Aurora, the sale of which was completed on July 12, 2016.

GenOn Americas Generation & GenOn Mid-Atlantic:

Base Capacity Product | Capacity Performance Product | |||||||||||

Zone | Cleared Capacity (MW)(1) | Price ($/MW-day) | Cleared Capacity (MW)(1) | Price ($/MW-day) | ||||||||

MAAC (2) | — | $ | — | 3,814 | $ | 100.00 | ||||||

Total | — | 3,814 | ||||||||||

(1) Includes imports.

(2) Plants that participate in the PJM auctions for GenOn Americas Generation are solely those operated by GenOn Mid-Atlantic.

PJM Capacity Performance Appeals — On or about July 8, 2016, four petitions were filed at the D.C. Circuit seeking review of the FERC orders approving PJM's Capacity Performance revisions to its forward capacity market after motions for rehearing at FERC were denied on May 10, 2016. NRG intervened in these matters on July 29, 2016. On December 9, 2016, NRG, along with other generators and industry trade groups, filed a joint brief in support of FERC's decision. Briefing is complete and oral argument occurred in February 2017. This case governs capacity revenues already received by the Registrants, as well as the revenues for forward periods.

PJM Seasonal Capacity Proceeding — On November 17, 2016, PJM proposed to enhance the ability of capacity storage resources, intermittent resources, demand response, energy efficiency, and environmentally limited resources, or collectively the seasonal capacity performance resources, to participate in the BRA and qualify as a resource providing the capacity performance product through aggregation. NRG filed comments specifically supporting PJM’s proposal to modify the aggregation rules to allow seasonal capacity resources to aggregate across LDAs and to allow aggregations through RPM auctions. On January 23, 2017, PJM amended its proposal to address questions from FERC. The outcome of this proceeding could have a material impact on future PJM capacity prices.

Complaints Related to Extension of Base Capacity — In 2015, FERC approved changes to PJM's capacity market, which included moving from the Base Capacity product to the higher performance Capacity Performance product over the course of a five year transition. Under this transition, as of the May 2017 BRA, the Base Capacity product will no longer be available. Several parties have filed complaints at FERC seeking to maintain the RPM Base Capacity product for at least one more delivery year or until such time as PJM develops a model for seasonal resources to participate. If the transition is delayed, capacity prices could be materially impacted. The matters are pending at FERC.

MOPR Revisions — On May 2, 2013, FERC accepted PJM's proposal to substantially revise its Minimum Offer Price Rule, or MOPR. Among other things, FERC approved the portions of the PJM proposal that exempt many new entrants from demonstrating that their proposed projects are economic, as well as providing a similar exemption for public power entities and certain self-supply entities. This exemption is subject to certain conditions designed to limit the financial incentive of such entities to suppress market prices. On June 3, 2013, NRG filed a request for rehearing of the FERC order and subsequently protested the manner in which PJM proposed to implement the FERC order. On October 15, 2015, FERC denied the requests for rehearing and accepted PJM’s compliance filing. NRG, along with other parties, filed a petition for review of FERC's decision with the D.C. Circuit. Briefing is complete. The case is pending at the D.C. Circuit.

9

Illinois Zero Emission Credit Legislation and Related PJM Complaint — Pursuant to legislation in Illinois, the Illinois Power Agency is to procure contracts for Zero Emission Credits, or ZECs, through a process that would take into account environmental benefits, including the preservation of zero emission facilities. The procurement would be subject to review by the Illinois Commerce Commission. These ZECs are out-of-market subsidies that threaten to artificially suppress prices in the PJM auctions. On February 14, 2017, NRG, along with other companies, filed a complaint in the District Court for the Northern District of Illinois; another plaintiff group filed a similar complaint on the same day.

As a result of the ZEC scheme adopted by the Illinois legislature and to address the effect of subsidies set to be paid to Illinois to certain nuclear units, on January 9, 2017, NRG and other generators and its trade association filed a joint amendment to the pending complaint seeking to apply the MOPR in the capacity market to existing resources that receive out-of-market subsidies. This amendment is to the March 21, 2016 complaint filed by NRG and other companies related to ratepayer-funded subsidies approved by the PUCO.

New England (GenOn and GenOn Americas Generation)

2020/2021 ISO-NE Auction Results — On February 6, 2017, ISO-NE announced the results of its 2020/2021 forward capacity auction. GenOn, including GenOn Americas Generation, cleared 1,112 MW at $5.297 per KW month providing expected annual capacity revenues of $71 million.

Peak Energy Rent Adjustment Complaint — On September 30, 2016, the New England Power Generators Association, or NEPGA, filed a complaint against ISO-NE asking FERC to find the Peak Energy Rent, or PER, unjust and unreasonable. On January 9, 2017, FERC granted NEPGA’s complaint requiring a change to how the PER strike price is calculated and determine any refunds during the time period provided for in the complaint. The first FERC-ordered settlement conference occurred on February 16, 2017.

Performance Incentive Proposal — On January 17, 2014, ISO-NE filed at FERC to revise its forward capacity market, or FCM, by making a resource’s forward capacity market compensation dependent on resource output during short intervals of operating reserve scarcity. The ISO-NE proposal would replace the existing shortage event penalty structure with a new performance incentive mechanism, resulting in capacity payments to resources that would be the combination of two components: (1) a base capacity payment and (2) a performance payment or charge. The performance payment or charge would be entirely dependent upon the resource’s delivery of energy or operating reserves during scarcity conditions, and could be larger than the base payment.

On May 30, 2014, FERC found that most of the provisions in the ISO-NE proposal, with modifications, together with an increase to the reserve constraint penalty factors, provided a just and reasonable structure. FERC instituted a proceeding for further hearings and required ISO-NE to make a compliance filing to modify its proposal and adopt the increases to the reserve constraint penalty factors. FERC denied rehearing. The NEPGA filed a petition for review of FERC's decision with the D.C. Circuit. Briefing is complete.

New York (GenOn and GenOn Americas Generation)

New York Clean Energy Standard and Zero Emission Credit Nuclear Bailout — On August 1, 2016, the NYSPSC issued its Clean Energy Standard, or CES, order. The CES order included three main components: (i) a commitment to move New York to 50% renewables by 2030; (ii) new renewable energy credit pricing for both new and existing renewable facilities; and (iii) a ZEC that would provide more than $7.6 billion over 12 years in out-of-market subsidy payments to certain selected nuclear generating units in the state. The stated purpose of the ZECs is to keep nuclear units running even though they would be uneconomic and likely retire if they received compensation only from the FERC-jurisdictional wholesale power market. The ZECs would have the effect of suppressing wholesale market prices and interfere with the wholesale market. On October 19, 2016, NRG, along with other entities, filed a complaint in the U.S. District Court for the Southern District of New York, challenging the validity of the NYSPSC action and the ZEC program. On December 9, 2016, Exelon, the NYSPSC and other parties filed a motion to dismiss the complaint. On January 6, 2017, NRG, along with other parties, filed an opposition to the motions to dismiss. The motions are pending before the U.S. District Court.

Independent Power Producers of New York (IPPNY) Complaint — On January 9, 2017, EPSA requested FERC to promptly direct the NYISO to file tariff provisions to address pending market concerns related to out of market payments to existing generation in the NYISO. This request was prompted by the ZEC program initiated by the NYSPSC. This request follows IPPNY’s complaint at FERC against the NYISO on May 10, 2013, as amended on March 25, 2014. The generators asked FERC to direct the NYISO to require that capacity from existing generation resources that would have exited the market but for out-of-market payments. Failure to implement buyer-side mitigation measures could result in uneconomic entry, which artificially decreases capacity prices below competitive market levels.

10

New York Public Service Commission Retail Energy Market Proceedings — On February 23, 2016, the NYSPSC issued what it refers to as its “Retail Reset” order, or Reset Order, in docket 12-M-0476 et al. Among other things, the Reset Order instituted a price cap on energy supply offers and required many retail providers to seek affirmative consent from certain retail customers over a very short period of time to retain those customers. Retail suppliers who cannot meet these conditions will be required to return their customers to energy supply service provided by the local utility. On July 25, 2016, the New York Supreme Court vacated part of the Reset Order on procedural grounds and remanded the matter to the NYSPSC for further consideration. Additionally, the Court affirmed the NYSPSC’s authority to regulate Energy Service Companies prices. The matter is now on appeal before the Supreme Court of New York, Appellate Division. On December 2, 2016 in the same docket, the NYSPSC issued notice of an evidentiary proceeding and collaborative process to determine the future structure of the retail energy market in New York. The outcome of this evidentiary and collaborative process, combined with the outcome of the appeal of the Reset Order, could affect the viability of the New York retail energy market.

MISO (GenOn)

Revisions to MISO Capacity Construct — On November 20, 2015, FERC issued a final order denying NRG’s request for rehearing of a 2012 FERC order approving the MISO capacity construct. NRG filed a petition for review of FERC’s decision with the D.C. Circuit on the grounds that FERC’s order denies merchant generators in MISO’s footprint any reasonable opportunity to recover their fixed costs. On November 2, 2016, NRG filed its initial brief and briefing continues. The eventual outcome of this proceeding could impact MISO’s attempts to redesign its capacity markets and thereby affect the value of NRG’s uncontracted assets within the MISO footprint.

MISO Forward Capacity Market Design for Retail Choice States — MISO staff has proposed revisions to its market design by implementing a three-year Forward Resource Auction for Illinois and the portion of Michigan with Retail Choice Load with a Sloped Demand Curve. On November 1, 2016, MISO filed its proposal with FERC. On December 14, 2016, NRG filed a protest to MISO’s proposal. On February 2, 2017, FERC rejected MISO’s proposal.

Environmental Matters

The Registrants are subject to a wide range of environmental laws in the development, construction, ownership and operation of projects. These laws generally require that governmental permits and approvals be obtained before construction and during operation of power plants. The electric generation industry is facing new requirements regarding GHGs, combustion byproducts, water discharge and use, and threatened and endangered species. Future laws may require the addition of emissions controls or other environmental controls or impose restrictions on the operations of the Registrants' facilities, which could have a material effect on the Registrants' operations. Complying with environmental laws involves significant capital and operating expenses. The Registrants decide to invest capital for environmental controls based on the relative certainty of the requirements, an evaluation of compliance options, and the expected economic returns on capital.

A number of regulations with the potential to affect the Registrants and their facilities are in development, under review or have been recently promulgated by the EPA, including ESPS/NSPS for GHGs, ash disposal requirements, NAAQS revisions and implementation and effluent guidelines. The Registrants are currently reviewing the outcome and any resulting impact of recently promulgated regulations and cannot fully predict such impact until legal challenges are resolved and the new presidential administration decides how to proceed with some of the more controversial regulations. Federal and state environmental laws generally have become more stringent over time, although this trend could change in the near term with respect to federal laws under the new U.S. presidential administration.

Ozone NAAQS — On October 26, 2015, the EPA promulgated a rule that reduces the ozone NAAQS to 0.070 ppm. If it survives legal challenges, this more stringent NAAQS will obligate the states to develop plans to reduce NOx (an ozone precursor), which could affect some of the Registrants' units.

11

Cross-State Air Pollution Rule — The EPA finalized CSAPR in 2011, which was intended to replace CAIR in January 2012, to address certain states' obligations to reduce emissions so that downwind states can achieve federal air quality standards. In December 2011, the D.C. Circuit stayed the implementation of CSAPR and then vacated CSAPR in August 2012 but kept CAIR in place until the EPA could replace it. In April 2014, the U.S. Supreme Court reversed and remanded the D.C. Circuit's decision. In October 2014, the D.C. Circuit lifted the stay of CSAPR. In response, the EPA in November 2014 amended the CSAPR compliance dates. Accordingly, CSAPR replaced CAIR on January 1, 2015. On July 28, 2015, the D.C. Circuit held that the EPA had exceeded its authority by requiring certain reductions that were not necessary for downwind states to achieve federal standards. Although the D.C. Circuit kept the rule in place, the court ordered the EPA to revise the Phase 2 (or 2017) (i) SO2 budgets for four states including Texas and (ii) ozone-season NOx budgets for 11 states including Maryland, New Jersey, New York, Ohio, Pennsylvania and Texas. On October 26, 2016, the EPA finalized the CSAPR Update Rule, which reduces future NOx allocations and discounts the current banked allowances to account for the more stringent 2008 Ozone NAAQS and to address the D.C. Circuit's July 2015 decision. This rule has been challenged in the D.C. Circuit. The Registrants believe that their investment in pollution controls and cleaner technologies leave the fleet well-positioned for compliance.

MATS — In February 2012, the EPA promulgated standards (the MATS rule) to control emissions of HAPs from coal and oil-fired electric generating units. The rule established limits for mercury, non-mercury metals, certain organics and acid gases, which had to be met beginning in April 2015 (with some units getting a 1-year extension). In June 2015, the U.S. Supreme Court issued a decision in the case of Michigan v. EPA, and held that the EPA unreasonably refused to consider costs when it determined that it was "appropriate and necessary" to regulate HAPs emitted by electric generating units. The U.S. Supreme Court did not vacate the MATS rule but rather remanded it to the D.C. Circuit for further proceedings. In December 2015, the D.C. Circuit remanded the MATS rule to the EPA without vacatur. On April 25, 2016, the EPA released a supplemental finding that the benefits of this regulation outweigh the costs to address the U.S. Supreme Court's ruling that the EPA had not properly considered costs. This finding has been challenged in the D.C. Circuit. While the Registrants cannot predict the final outcome of this rulemaking, the Registrants believes that because they have already invested in pollution controls and cleaner technologies, the fleet is well-positioned to comply with the MATS rule.

Clean Power Plan — The attention in recent years on GHG emissions has resulted in federal regulations and state legislative and regulatory action. In October 2015, the EPA finalized the Clean Power Plan, or CPP, addressing GHG emissions from existing EGUs. On February 9, 2016, the U.S. Supreme Court stayed the CPP. The D.C. Circuit, sitting en banc, heard oral argument on the legal challenges to the CPP in September 2016. Due to the ongoing litigation and the potential impact of the new U.S. presidential administration, the Registrants believe the CPP is not likely to survive.

Effluent Limitations Guidelines — In November 2015, the EPA revised the Effluent Limitations Guidelines for Steam Electric Generating Facilities, which will impose more stringent requirements (as individual permits are renewed) for wastewater streams from flue gas desulfurization, fly ash, bottom ash, and flue gas mercury control. The Registrants estimate that it would cost approximately $45 million over the next five years to comply with this rule at the Registrants' coal-fired plants. This regulation has been challenged and is subject to legal uncertainty. The change in U.S. presidential administration increases the likelihood that the legal challenges will succeed. The Registrants decide to invest capital for environmental controls based on: the certainty of regulations; evaluation of different technologies; options to convert to gas; and the expected economic returns on the capital. Over the next several years, the Registrants will decide whether to proceed with these investments at each of the plants as permits are renewed based on, among other things, the legal certainty of the regulation and market conditions at that time.

See Item 15 — Note 15, Regulatory Matters, Note 16, Environmental Matters, and Note 17, Guarantees, to the Consolidated Financial Statements.

Regional Environmental Issues

RGGI — The Registrants operate generating units in Maryland, Massachusetts and New York that are subject to RGGI, which is a regional cap and trade system. In 2013, each of these states finalized a rule that reduced and will continue to reduce the number of allowances through 2020. The nine RGGI states are re-evaluating the program and may alter the rules to further reduce the number of allowances. The revisions being currently contemplated could adversely impact the Registrants' results of operations, financial condition and cash flows.

Massachusetts Global Warming Solutions Act Proposed Regulation — In May 2016, the Massachusetts Supreme Judicial Court held that Massachusetts DEP had not complied with the 2008 Global Warming Solutions Act, which requires establishing limits for sources of GHGs. The Court held that participation in RGGI was not sufficient. In December 2016, the Massachusetts DEP proposed a regulation that would limit GHG emissions from large electric generating facilities located in Massachusetts. A final regulation is expected by August 2017. If promulgated in its current form, the regulation may limit the operations of affected facilities.

12

New Source Review — The EPA and various states have been investigating compliance of electric generating facilities with the pre-construction permitting requirements of the CAA known as “new source review,” or NSR. In January 2009, GenOn received an NOV from the EPA alleging that past work at Keystone, Portland and Shawville generating stations violated regulations regarding NSR. In June 2011, GenOn received an NOV from the EPA alleging that past work at Avon Lake and Niles generating stations violated NSR. In December 2007, the NJDEP filed suit alleging that NSR violations occurred at the Portland generating station, which suit was resolved pursuant to a July 2013 Consent Decree.

Environmental Capital Expenditures

GenOn estimates that environmental capital expenditures from 2017 through 2021 required to comply with environmental laws will be approximately $61 million for GenOn, which includes $31 million for GenOn Americas Generation. The estimate for GenOn Americas Generation includes $31 million for GenOn Mid-Atlantic.

Employees

As of December 31, 2016, GenOn had 1,581 employees of which 580 employees were part of GenOn Americas Generation and 430 employees were part of GenOn Mid-Atlantic, approximately 66.3%, 67.8% and 70.2%, respectively, of whom were covered by bargaining agreements. During 2016, the Registrants did not experience any labor stoppages or labor disputes at any of their facilities.

Available Information

The Registrants’ annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to section 13(a) or 15(d) of the Exchange Act are available free of charge through NRG's website, www.nrg.com, as soon as reasonably practicable after they are electronically filed with, or furnished to the SEC.

13

Item 1A — Risk Factors

The Registrants are subject to the following factors that could have a material adverse effect on their future performance, results of operations, financial condition and cash flows. In addition, such factors could affect their ability to service indebtedness and other obligations, to raise capital and could affect their future growth opportunities. Also, see Cautionary Statement Regarding Forward Looking Information and Item 7 — Management's Narrative Analysis of the Results of Operations and Financial Condition of this Form 10-K.

Risks Related to the Operation of the Registrants' Businesses

There is substantial doubt about GenOn's ability to continue as a going concern.

GenOn’s consolidated financial statements have been prepared assuming GenOn will continue as a going concern, which contemplates continuity of operations, realization of assets and the satisfaction of liabilities in the normal course of business. As such, the accompanying condensed consolidated financial statements do not include any adjustments relating to the recoverability and classification of assets and their carrying amounts, or the amount and classification of liabilities that may result should GenOn be unable to continue as a going concern. Such adjustments could have a material adverse impact on GenOn's results of operations, cash flows and financial position.

As disclosed in Item 15 — Note 1, Nature of Business and Note 9, Debt and Capital Leases, $691 million of GenOn's Senior Notes outstanding, excluding $8 million of associated premiums, are current within the GenOn consolidated balance sheet and are due on June 15, 2017. GenOn's future profitability continues to be adversely affected by (i) a sustained decline in natural gas prices and its resulting effect on wholesale power prices and capacity prices, and (ii) the inability of GenOn Mid-Atlantic and REMA to make distributions of cash and certain other restricted payments to GenOn. Based on current projections, GenOn is not expected to have sufficient liquidity to repay the GenOn Senior Notes due in June 2017. As a result, there is substantial doubt about GenOn's ability to continue as a going concern.

As of December 31, 2016, GenOn has consolidated cash and cash equivalents of $1.0 billion, of which $471 million and $100 million is held by GenOn Mid-Atlantic and REMA, respectively. Under their respective operating leases, GenOn Mid-Atlantic and REMA are not permitted to make any distributions and other restricted payments unless: (a) they satisfy the fixed charge coverage ratio for the most recently ended period for four fiscal quarters; (b) they are projected to satisfy the fixed charge coverage ratio for each of the two following periods of four fiscal quarters, commencing with the fiscal quarter in which such payment is proposed to be made; and (c) no significant lease default or event of default has occurred and is continuing. Additionally, GenOn Mid-Atlantic and REMA must be in compliance with the requirement to provide credit support to the owner lessors securing their obligations to pay scheduled rent under their respective leases. As a result, GenOn Mid-Atlantic has not been able to make distributions of cash and certain other restricted payments since the quarter ended March 31, 2014 which was the last quarterly period for which GenOn Mid-Atlantic satisfied the conditions under its operating agreement. REMA has not satisfied the conditions under its operating agreement to make distributions of cash and certain other restricted payments since 2009.

NRG, GenOn's parent company, has no obligation to provide any financial support other than the credit agreement between NRG and GenOn which provides for a $500 million revolving credit facility, all of which can be utilized for revolving loans and letters of credit as further described in Item 15 — Note 13, Related Party Transactions. As controlled group members, ERISA requires that NRG and GenOn are jointly and severally liable for the NRG Pension Plan for Bargained Employees and the NRG Pension Plan, including the pension liabilities associated with GenOn employees.

GenOn is currently considering all options available to it, including negotiations with creditors, refinancing the GenOn Senior Notes, potential sales of certain generating assets as well as the possibility for a need to file for protection under Chapter 11 of the U.S. Bankruptcy Code. During 2016, GenOn appointed two independent directors, retained advisors and established a separate audit committee as part of this process.

As of December 31, 2016, GenOn Americas Generation, a consolidated subsidiary of GenOn, has a note receivable due from GenOn Energy Holdings, a consolidated subsidiary of GenOn, of $315 million and an accounts payable due to GenOn Energy Holdings of $43 million under the intercompany cash management program as further described in Item 15 — Note 13, Related Party Transactions. The terms of the intercompany note do not provide for priority to GenOn Americas Generation and as such, there is no assurance that options pursued by GenOn will not have an adverse impact on GenOn Americas Generation’s liquidity. As such, there is substantial doubt about GenOn Americas Generation’s ability to continue as a going concern.

14

With respect to GenOn Mid-Atlantic, a consolidated subsidiary of GenOn, management has determined that while it has sufficient cash on hand to fund current obligations including operating lease payments due under the GenOn Mid-Atlantic operating leases as of December 31, 2016, the potential significant adverse impact of financial stresses at GenOn Mid-Atlantic's parent companies and, to a lesser extent, any adverse impact resulting from the notification by GenOn Mid-Atlantic's lessors alleging the existence of lease events of default as further described in Note 9, Debt and Capital Leases, has caused there to be substantial doubt about GenOn Mid-Atlantic's ability to continue as a going concern.

GenOn is a wholly-owned subsidiary of NRG and is highly dependent on NRG for services under a shared services agreement.

GenOn relies on NRG for its administrative and management functions and services including human resources-related functions, accounting, tax administration, information systems, legal services, treasury and planning, operations and asset management, risk and commercial operations, and other support services under a management services agreement. GenOn anticipates continuing to rely upon NRG to provide many of these services. If NRG terminates the management services agreement or defaults in the performance of its obligations under the agreement, GenOn may be unable to contract with a substitute service provider on similar terms or at all, and the costs of substituting service providers may be substantial. In addition, in light of NRG's familiarity with GenOn's assets, a substitute service provider may not be able to provide the same level of service due to lack of preexisting synergies. If GenOn cannot locate a service provider that is able to provide it with substantially similar services as NRG does under the management services agreement on similar terms, it would likely have a material adverse effect on GenOn's business, financial condition, results of operation and cash flows.

The interests of NRG as GenOn's equity holder may conflict with the interests of holders of debt.

GenOn is owned and controlled by NRG. The interests of NRG may not in all cases be aligned with the interests of the holders of GenOn's debt or the debt and lease obligations of GenOn's subsidiaries. If GenOn encounters financial difficulties or becomes unable to pay its debts as they mature, NRG does not have any liability for any obligations under the GenOn notes or the notes and lease obligations of the GenOn subsidiaries. In addition, NRG may have an interest in pursuing acquisitions, divestitures, financings or other transactions that, in its judgment, could enhance its equity investments, even though such transactions might involve risks to GenOn's business or the holders of GenOn's and its subsidiaries' debt. Furthermore, NRG may own businesses that directly or indirectly compete with GenOn. NRG also may pursue acquisition opportunities that may be complementary to NRG's business, and as a result, those acquisition opportunities may not be available to GenOn.

The Registrants' financial results are unpredictable because most of their generating facilities operate without long-term power sales agreements, and their revenues and results of operations depend on market and competitive forces that are beyond their control.

The Registrants provide energy, capacity, ancillary and other energy services from their generating facilities in a variety of markets and to bi-lateral counterparties, including participating in wholesale energy markets, entering into tolling agreements, sales of resource adequacy and participation in capacity auctions. The Registrants' revenues from selling capacity are a significant part of their overall revenues. The Registrants are not guaranteed recovery of their costs or any return on their capital investments through mandated rates.

The market for wholesale electric energy and energy services reflects various market conditions beyond the Registrants' control, including the balance of supply and demand, transmission congestion, competitors' marginal and long-term costs of production, the price of fuel, and the effect of market regulation. The price at which the Registrants can sell their output may fluctuate on a day-to-day basis, and their ability to transact may be affected by the overall liquidity in the markets in which the Registrants operate. These markets remain subject to regulations that limit their ability to raise prices during periods of shortage to the degree that would occur in a fully deregulated market. In addition, unlike most other commodities, electric energy can be stored only on a very limited basis and generally must be produced at the time of use. As a result, the wholesale power markets are subject to substantial price fluctuations over relatively short periods of time and can be unpredictable.

The Registrants' revenues, results of operations and cash flows are influenced by factors that are beyond their control, including those set forth above, as well as:

• | the failure of market regulators to develop and maintain efficient mechanisms to compensate merchant generators for the value of providing capacity needed to meet demand; |

• | actions by regulators, ISOs, RTOs and other bodies that may artificially modify supply and demand levels and prevent capacity and energy prices from rising to the level necessary for recovery of the Registrants' costs, investment and an adequate return on investment; |

• | environmental regulations and legislation; |

15

• | legal and political challenges to or changes in the rules used to calculate capacity payments in the markets in which the Registrants operate or the establishment of bifurcated markets, incentives, other market design changes or bidding requirements that give preferential treatment to new generating facilities over existing generating facilities or otherwise reduce capacity payments to existing generating facilities; |

• | the ability of wholesale purchasers of power to make timely payment for energy or capacity, which may be adversely affected by factors such as retail rate caps, refusals by regulators to allow utilities to recover fully their wholesale power costs and investments through rates, catastrophic losses and losses from investments by utilities in unregulated businesses; |

• | increases in prevailing market prices for fuel oil, coal, natural gas and emission allowances that may not be reflected in prices the Registrants receive for sales of energy; |

• | increases in electricity supply as a result of actions of the Registrants' current competitors or new market entrants, including the development of new generating facilities or alternative energy sources that may be able to produce electricity less expensively than the Registrants' generating facilities and improvements in transmission that allow additional supply to reach their markets; |

• | increases in credit standards, margin requirements, market volatility or other market conditions that could increase the Registrants' obligations to post collateral beyond amounts that are expected, including additional collateral costs associated with OTC hedging activities as a result of future OTC regulations adopted pursuant to the Dodd-Frank Act; |

• | decreases in energy consumption resulting from demand-side management programs such as automated demand response, which may alter the amount and timing of consumer energy use; |

• | the competitive advantages of certain competitors, including continued operation of older power facilities in strategic locations after recovery of historic capital costs from ratepayers; |

• | existing or future regulation of the markets in which the Registrants operate by FERC, ISOs and RTOs, including any price limitations, non-performance penalties and other mechanisms to address some of the price volatility or illiquidity in these markets or the physical stability of the system; |

• | the Registrants' obligation under any default sharing mechanisms in RTO and ISO markets, such mechanisms exist to spread the risk of defaults by transmission owning companies or other RTO members across all market participants; |

• | regulatory policies of state agencies that affect the willingness of the Registrants' customers to enter into long-term contracts generally, and contracts for capacity in particular; |

• | access to contractors and equipment; |

• | changes in the rate of growth in electricity usage as a result of such factors as national and regional economic conditions and implementation of conservation programs; |

• | seasonal variations in energy and natural gas prices, and capacity payments; and |

• | seasonal fluctuations in weather, in particular abnormal weather conditions. |

As discussed above, the market for wholesale electric energy and energy services reflects various market conditions beyond the Registrants' control, including the balance of supply and demand, the Registrants' competitors' marginal and long-term costs of production, and the effect of market regulation. The Registrants cannot ensure that higher earnings or price increases will result from industry retirements of coal-fired generating facilities or that higher earnings from their remaining facilities will offset or more than offset reduced earnings from facility deactivations.

Changes in the wholesale energy markets or in the Registrants' generating facility operations could result in impairments or other charges.

If the ongoing evaluation of the Registrants' business results in decisions to deactivate or dispose of additional facilities, the Registrants could have impairments or other charges. These evaluations involve significant judgments about the future. Actual future market prices, project costs and other factors could be materially different from current estimates.

16

The Registrants are exposed to the risk of fuel cost volatility because they must pre-purchase coal and oil.

Most of the Registrants' fuel contracts are at fixed prices with terms of two years or less. Although the Registrants purchase coal and oil based on expected requirements, they still face the risks of fuel price volatility if they require more or less fuel than expected.

The Registrants' cost of fuel may not reflect changes in energy and fuel prices in part because they must pre-purchase inventories of coal and oil for reliability and dispatch requirements, and thus the price of fuel may have been determined at an earlier date than the price of energy generated from the fuel. Similarly, the price the Registrants can obtain from the sale of energy may not rise at the same rate, or may not rise at all, to match a rise in fuel costs.

The Registrants are exposed to the risk of their fuel providers and fuel transportation providers failing to perform.

The Registrants purchase most of their coal from a limited number of suppliers. Because of a variety of operational issues, the Registrants' coal suppliers may not provide the contractual quantities on the dates specified within the agreements, or the deliveries may be carried over to future periods. Also, interruptions to planned or contracted deliveries to the Registrants' generating facilities can result from a lack of, or constraints in, coal transportation because of rail, river or road system disruptions, adverse weather conditions and other factors.

If the Registrants' coal suppliers do not perform in accordance with the agreements, the Registrants may have to procure higher priced coal in the market to meet their needs, or higher priced power in the market to meet their obligations. In addition, generally the Registrants' coal suppliers do not have investment grade credit ratings nor do they post collateral with the Registrants and, accordingly, the Registrants may have limited ability to collect damages in the event of default by such suppliers.

For the Registrants' oil-fired generating facilities, the Registrants typically purchase fuel from a limited number of suppliers. If the Registrants' oil suppliers do not perform in accordance with the agreements, the Registrants may have to procure higher priced oil in the market to meet their needs, or higher priced power in the market to meet their obligations. For the Registrants' gas-fired generating facilities, any curtailments or interruptions on transporting pipelines could result in curtailment of operations or increased fuel supply costs.

The operation of the Registrants' generating facilities involves risks that could result in disruption, curtailment or inefficiencies in their operations.

The operation of the Registrants' generating facilities involves various operating risks, including, but not limited to:

•the output and efficiency levels at which those generating facilities perform;

•interruptions in fuel supply and quality of available fuel;

•disruptions in the delivery of electricity;

•adverse zoning;

•breakdowns or equipment failures (whether a result of age or otherwise);

•violations of permit requirements or changes in the terms of, or revocation of, permits;

•releases of pollutants to air, soil, surface water or groundwater;

•ability to transport and dispose of coal ash at reasonable prices;

•curtailments or other interruptions in natural gas supply;

•shortages of equipment or spare parts;

•labor disputes, including strikes, work stoppages and slowdowns;

•the aging workforce at many of the Registrants' facilities;

•operator errors;

•curtailment of operations because of transmission constraints;

•failures in the electricity transmission system, which may cause large energy blackouts;

•implementation of unproven technologies in connection with environmental improvements; and

•catastrophic events such as fires, explosions, floods, earthquakes, hurricanes or other similar occurrences.

These factors could result in a material decrease, or the elimination of, the revenues generated by the Registrants' facilities or a material increase in the Registrants' costs of operations.

17

The Registrants operate in a limited number of markets and a significant portion of revenues are derived from the PJM market. The effect of adverse developments in the markets, especially the PJM market, may be greater on the Registrants than on more geographically diversified competitors.

As of December 31, 2016, GenOn's generating capacity is 58% in PJM, 23% in CAISO, 7% in NYISO, 7% ISO-NE and 5% in MISO, and GenOn Americas Generation's generating capacity is 58% in PJM, 13% in CAISO, 15% in NYISO and 14% ISO-NE. As of December 31, 2016, all of GenOn Mid-Atlantic's generating capacity is in PJM. Adverse developments in these regions, especially in the PJM market, may adversely affect the Registrants. Further, the effect of such adverse regional developments may be greater on the Registrants than on more geographically diversified competitors.

The integration of the Capacity Performance product into the PJM market and the Pay-for-Performance mechanism in ISO-NE could lead to substantial changes in capacity income and non-performance penalties, which could have a material adverse effect on the Registrants’ results of operations, financial condition and cash flows.

Both ISO-NE and PJM operate a pay-for-performance model where capacity payments are modified based on real-time generator performance. Capacity market prices are sensitive to design parameters, as well as additions of new capacity. The Registrants may experience substantial changes in capacity income and non-performance penalties, which could have a material adverse effect on the Registrants’ results of operations, financial condition and cash flows.

The Registrants are exposed to possible losses that may occur from the failure of a counterparty to perform according to the terms of a contractual arrangement, particularly in connection with non-collateralized power hedges with financial institutions.

Failure of a counterparty to perform according to the terms of a contractual arrangement may result in losses to the Registrants. Specifically, GenOn Mid-Atlantic's credit exposures on power and gas hedges with financial institutions in excess of applicable collateral thresholds are senior unsecured obligations of such counterparties. Deterioration in the financial condition of such counterparties could result in their failure to pay amounts owed to GenOn Mid-Atlantic or to perform obligations or services owed to GenOn Mid-Atlantic beyond collateral posted.

Changes in technology may significantly affect the Registrants' generating business by making their generating facilities less competitive.

The Registrants generate electricity using fossil fuels at large central facilities. This method results in economies of scale and lower costs than newer technologies such as fuel cells, battery storage, microturbines, windmills and photovoltaic solar cells. It is possible that advances in those technologies, or governmental incentives for renewable energies, will reduce their costs to levels that are equal to or below that of most central station electricity production.

The expected decommissioning and/or site remediation obligations of certain of the Registrants' generating facilities may negatively affect their cash flows.

Some of the Registrants' generating facilities and related properties are subject to decommissioning and/or site remediation obligations that may require material expenditures. Furthermore, laws and regulations may change to impose material additional decommissioning and remediation obligations on the Registrants in the future.

Terrorist attacks and/or cyber-attacks may result in the Registrants' inability to operate and fulfill their obligations, and could result in material repair costs.

As power generators, the Registrants face heightened risk of terrorism, including cyber terrorism, either by a direct act against one or more of their generating facilities or an act against the transmission and distribution infrastructure that is used to transport the power. Although the entire industry is exposed to these risks, the Registrants' generating facilities and the transmission and distribution infrastructure located in the PJM market are particularly at risk because of the proximity to major population centers, including governmental and commerce centers.

The Registrants rely on information technology networks and systems to operate their generating facilities, engage in asset management activities, and process, transmit and store electronic information. Security breaches of this information technology infrastructure, particularly through cyber-attacks and cyber terrorism, including by computer hackers, foreign governments and cyber terrorists, could lead to system disruptions, generating facility shutdowns or unauthorized disclosure of confidential information related to their employees, vendors and counterparties. Confidential information includes banking, vendor, counterparty and personal identity information.

18

Systemic damage to one or more of the Registrants' generating facilities and/or to the transmission and distribution infrastructure could result in the inability to operate in one or all of the markets the Registrants serve for an extended period of time. If the Registrants' generating facilities are shut down, they would be unable to respond to the ISOs and RTOs or fulfill their obligations under various energy and/or capacity arrangements, resulting in lost revenues and potential fines, penalties and other liabilities. Pervasive cyber-attacks across the industry could affect the ability of ISOs and RTOs to function in some regions. The cost to restore the Registrants' generating facilities after such an occurrence could be material.

The Registrants' operations are subject to hazards customary to the power generating industry. The Registrants may not have adequate insurance to cover all of these hazards.