UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

(Mark One)

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended December 31, 2010

Or

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from ____________ to ______________

Commission file number 001-32521

|

Xfone, Inc.

|

|

(Exact name of registrant as specified in its charter)

|

|

Nevada

|

11-3618510

|

|

|

(State or other jurisdiction of

incorporation or organization)

|

(I.R.S. Employer

Identification No.)

|

5307 W Loop 289

Lubbock, Texas 79414

(Address of principal executive offices) (Zip Code)

806-771-5212

(Registrant’s telephone number, including area code)

Securities registered under Section 12(b) of the Act:

|

Title of each class registered:

|

Name of each exchange on which registered:

|

|

|

Common Stock

|

NYSE Amex LLC

|

|

|

Common Stock

|

Tel Aviv Stock Exchange Ltd.

|

Securities registered under Section 12(g) of the Act:

None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer o

|

Accelerated filer o

|

|

Non-accelerated filer o

(Do not check if smaller reporting company)

|

Smaller reporting company þ

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No þ

As of June 30, 2010, 21,119,488 shares of common stock were outstanding. The aggregate market value of the common stock held by non-affiliates of the registrant, as of June 30, 2010, the last business day of the second fiscal quarter, was approximately $24,709,800.96 based on the closing price of $1.17 for the registrant’s common stock as reported on the NYSE Amex LLC. Shares of common stock held by each director, each officer and each person who owns 10% or more of the outstanding common stock have been excluded from this calculation in that such persons may be deemed to be affiliates. The determination of affiliate status is not necessarily conclusive.

As of March 17, 2011, there were 21,119,488 shares of our common stock issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None.

-1-

|

Part I

|

||

| 3 | ||

| 13 | ||

| 13 | ||

| 13 | ||

| 15 | ||

| 16 | ||

|

Part II

|

||

| 17 | ||

| 19 | ||

| 20 | ||

| 32 | ||

| 32 | ||

| 65 | ||

| 65 | ||

| 66 | ||

|

Part III

|

||

| 67 | ||

| 73 | ||

| 79 | ||

| 82 | ||

| 89 | ||

|

Part IV

|

||

| 91 | ||

| 97 |

-2-

PART I

General

As used in this Annual Report, references to “the Company”, “we”, “our”, “ours” and “us” refer to Xfone, Inc. and consolidated subsidiaries, unless otherwise indicated. References to “Xfone” refer to Xfone, Inc. In addition, references to our “financial statements” are to our consolidated financial statements except as the context otherwise requires.

We prepare our financial statements in United States dollars and in accordance with generally accepted accounting principles as applied in the United States, referred to as U.S. GAAP. In this Annual Report, references to “$” and “dollars” are to United States dollars, “£”, “UKP”, or “GBP” are to British Pound Sterling, and references to “NIS” and “shekels” are to New Israeli Shekels.

Background

Xfone, Inc.

Xfone, Inc. was incorporated in the State of Nevada, U.S.A. in September 2000. We are a holding and managing company providing, through our subsidiaries, integrated communications services which include voice, video and data over our Fiber-To-The-Premise (“FTTP”) and other networks. We currently have operations in Texas, Mississippi and Louisiana and we also serve customers in Arizona, Colorado, Kansas, New Mexico, and Oklahoma.

In February 2007, we moved our principal executive offices from the UK to Flowood, Mississippi, and shared executive office space with our wholly owned U.S. subsidiary, Xfone USA, Inc. In May 2008, the headquarters of Xfone USA and our principal executive offices moved from the Flowood, Mississippi location to Lubbock, Texas, to the existing headquarters of NTS Communications, Inc., which we acquired in February 2008. See “NTS Communications, Inc.” below.

Our Common Stock is traded on the NYSE Amex LLC (“NYSE Amex”) and the Tel Aviv Stock Exchange Ltd. (“TASE”) under the symbol “XFN”. On March 17, 2011, the closing price of our Common Stock was $1.36 (NYSE Amex) / NIS 4.698 (TASE).

Our Organizational Structure

Subsequent to the year ending December 31, 2009, our board of directors made a strategic decision to concentrate on our operations in the U.S. As a result of this decision, on January 29, 2010 we entered into an agreement with Abraham Keinan (our significant shareholder and former Director and Chairman of our Board of Directors) and AMIT K LTD. (a company which is wholly owned and controlled by Mr. Keinan) pursuant to which we agreed to sell the entire issued share capital of our UK-based wholly owned subsidiaries - Swiftnet Limited (“Swiftnet”), Auracall Limited (“Auracall”), Equitalk.co.uk Limited (“Equitalk”), Story Telecom, Inc. (“Story”) and Story Telecom Limited (together with Swiftnet, Auracall, Equitalk, and Story, the “UK Subsidiaries”). On July 14, 2010, our shareholders approved the sale of our UK Subsidiaries. We completed the sale of our UK Subsidiaries on July 29, 2010.

Additionally, on May 14, 2010, we entered into an agreement for the sale of our majority owned Israeli subsidiary, Xfone 018 Ltd (the “Israeli Subsidiary”), to Marathon Telecom Ltd. The sale closed on August 31, 2010.

-3-

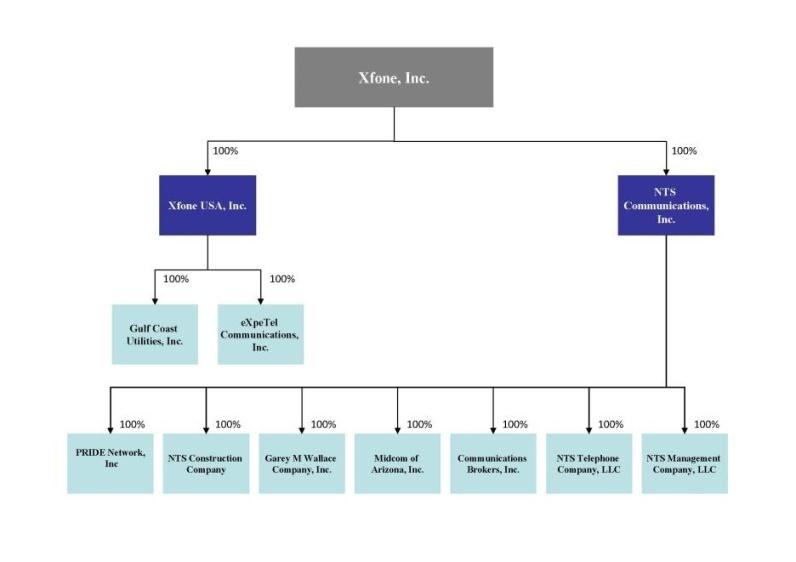

Following the sale of our UK Subsidiaries and Israeli Subsidiary we have two wholly owned subsidiaries in the United States. These subsidiaries, and their consolidated subsidiaries, are shown in the following diagram:

Swiftnet Limited

On October 4, 2000, we acquired Swiftnet Limited (“Swiftnet”) which had a business plan to provide a comprehensive range of telecommunication services and products, integrated through one website. Swiftnet was incorporated in 1990 under the laws of the United Kingdom and is headquartered in London, England. Until 1999, the main revenues for Swiftnet were derived from messaging and fax broadcast services. During 2000, Swiftnet shifted its business focus to voice services by offering a comprehensive range of calling services to resellers and end customers. Utilizing automation and proprietary software packages, Swiftnet’s strategy is to grow without the need for heavy investments and with lower expenses for operations and registration of new customers.

-4-

On January 29, 2010, we entered into an agreement with Abraham Keinan and AMIT K LTD. for the sale by us of the entire issued share capital of Swiftnet. The transaction closed on July 29, 2010. See Section A under Item 13 below.

Xfone 018 Ltd.

On April 15, 2004, we established an Israel based subsidiary, Xfone Communication Ltd., which changed its name to Xfone 018 Ltd. (“Xfone 018”) in March 2005. Headquartered in Petach Tikva, Israel, Xfone 018 is a telecommunications service provider that owns and operates its own facilities-based telecommunications switching system. Xfone 018 provides residential and business customers with international carrier services and Internet access services.

On August 31, 2010, we completed the disposition of our 69% interest in Xfone 018 pursuant to a certain agreement, dated May 14, 2010 (including any amendment and supplement thereto, the “Agreement”), by and between us, Newcall Ltd. (the former 26% minority owner of Xfone 018), Margo Pharma Ltd. (the former 5% minority owner of Xfone 018), and Marathon Telecom Ltd., the buyer of Xfone 018. See Section B under Item 13 below.

WS Telecom, Inc. / Xfone USA, Inc.

On May 28, 2004, we entered into an agreement and Plan of Merger to acquire WS Telecom, Inc., a Mississippi corporation, and its two wholly owned subsidiaries, eXpeTel Communications, Inc. and Gulf Coast Utilities, Inc., through the merger of WS Telecom with and into our wholly owned subsidiary Xfone USA, Inc (“Xfone USA”). On July 1, 2004, Xfone USA entered into a management agreement with WS Telecom which provided that Xfone USA provide management services to WS Telecom pending the consummation of the merger. The management agreement provided that all revenues generated from WS Telecom business operations would be assigned and transferred to Xfone USA. The term of the management agreement commenced on July 1, 2004, and continued until the consummation of the merger on March 10, 2005.

Xfone USA is an integrated telecommunications service provider that owns and operates its own facilities-based, telecommunications switching system and network. Xfone USA provides residential and business customers with high quality local, long distance and high-speed broadband Internet services. Xfone USA utilizes integrated multi-media offerings - combining digital voice and data services over broadband technologies to deliver services to customers throughout its service areas. Xfone USA is currently licensed to provide telecommunications services in Louisiana and Mississippi.

I-55 Internet Services, Inc.

On August 18, 2005, we entered into an Agreement and Plan of Merger to acquire I-55 Internet Services, Inc. (“I-55 Internet Services”), a Louisiana corporation, through the merger of I-55 Internet Services with and into our wholly owned subsidiary Xfone USA (the “I-55 Internet Services Merger”). The I-55 Internet Services Merger closed on March 31, 2006.

I-55 Internet Services provided Internet access and related services, such as installation of various networking equipment, website design, hosting and other Internet access installation services, throughout the Southeastern United States to individuals and businesses located predominantly in rural markets in Louisiana and Mississippi. These services are available throughout Louisiana and Mississippi. The Internet service offerings include dial-up, DSL, high speed dedicated Internet access, web services, email, the World Wide Web, Internet relay chat, file transfer protocol and Usenet news access to both residential and business customers. Xfone USA provides bundled services of voice and data (broadband Internet) to customers throughout its service areas.

I-55 Telecommunications, LLC

On August 26, 2005, we entered into an Agreement and Plan of Merger to acquire I-55 Telecommunications, LLC (“I-55 Telecommunications”), a Louisiana corporation, through the merger of I-55 Telecommunications with and into our wholly owned subsidiary Xfone USA (the “I-55 Telecommunications Merger”). The I-55 Telecommunications Merger closed on March 31, 2006.

I-55 Telecommunications provided voice, data and related services throughout Louisiana and Mississippi to both individuals and businesses. Prior to the merger with and into Xfone USA, I-55 Telecommunications was a licensed facility based CLEC operating in Louisiana and Mississippi with a next generation class 5 carrier-switching platform. I-55 Telecommunications provided a complete package of local and long distance services to residential and business customers across both states. Utilizing the I-55 network footprint, Xfone USA expanded its On-Net (facilities) service area, through I-55 Telecommunications infrastructure, into New Orleans, Louisiana and surrounding areas, including Hammond, Louisiana. Xfone USA maintains a retail sales presence in New Orleans and Hammond, Louisiana.

-5-

EBI Comm, Inc.

On January 1, 2006, Xfone USA, our wholly owned subsidiary, entered into an Agreement with EBI Comm, Inc. (“EBI”), a privately held Internet Service Provider, to purchase the assets of EBI. EBI provided a full range of Internet access options for both commercial and residential customers in north Mississippi. Based in Columbus, Mississippi, EBI’s services included Dial-up, DSL, T1 Dedicated Access and Web Hosting. The customer base, numbering approximately 1,500 Internet users at the time, is largely concentrated in the Golden Triangle area, which includes Columbus, West Point and Starkville, Mississippi. Acquired assets include the customer base and customer lists, trademarks and all related intellectual property, fixed assets and all account receivables. The transaction was closed on January 25, 2008. The acquisition was not significant from an accounting perspective.

Canufly.net, Inc.

On January 10, 2006 (effective as of January 1, 2006), Xfone USA, our wholly owned subsidiary, entered into an Asset Purchase Agreement with Canufly.net, Inc. (“Canufly.net”), an Internet Service Provider based in Vicksburg, Mississippi, and its principal shareholder, Mr. Michael Nassour. Canufly.net provided residential and business customers with high-speed Internet services and utilized the facilities-based network of Xfone USA, as an alternative to BellSouth, to provide Internet connectivity to its customers. Canufly.net also provided Internet services through a small wireless application in certain areas in Vicksburg, Mississippi. The transaction was closed on January 24, 2006. The acquisition was not significant from an accounting perspective.

Story Telecom

On May 10, 2006, we, Story Telecom, Inc., Story Telecom Limited, Story Telecom (Ireland) Limited, Nir Davison, and Trecastle Holdings Limited, a company owned and controlled by Mr. Davison, entered into a Stock Purchase Agreement. Pursuant to the Stock Purchase Agreement, we increased our ownership interest in Story Telecom from 39.2% to 69.6% in a cash transaction. The stock purchase pursuant to the Stock Purchase Agreement was completed on May 16, 2006. The transaction contemplated by the Stock Purchase Agreement was not significant from an accounting perspective.

Story Telecom, Inc., a telecommunication service provider, operated in the United Kingdom through its two wholly owned subsidiaries, Story Telecom Limited and Story Telecom (Ireland) Limited (which was dissolved on February 23, 2007). Following the acquisition, Story Telecom operated as a division of our operations in the United Kingdom.

On March 25, 2008, we purchased from Mr. Davison and Trecastle Holdings Limited, the shares of common stock of Story Telecom, Inc. that each party owned, respectively, pursuant to the terms of a Securities Purchase Agreement entered into between the parties on that date. Upon acquisition of the shares of common stock of Story Telecom, Inc. from Mr. Davison and Trecastle Holdings, Story Telecom, Inc. became our wholly owned subsidiary.

On January 29, 2010, we entered into an agreement with Abraham Keinan and AMIT K LTD. for the sale by us of the entire issued share capital of Story Telecom, Inc. and its subsidiary Story Telecom Limited. The transaction closed on July 29, 2010. See Section A under Item 13 below.

Equitalk.co.uk Limited

On May 25, 2006, we and the shareholders of Equitalk.co.uk Limited, a privately held telephone company based in the United Kingdom (“Equitalk”) entered into an Agreement relating to the sale and purchase of Equitalk (the “Equitalk Agreement”). The Equitalk Agreement provided for us to acquire Equitalk in a restricted Common Stock and warrant transaction. The acquisition was completed on July 3, 2006, and on that date Equitalk became our wholly owned subsidiary. Founded in December 1999, Equitalk, a VC-financed company, was the first fully automated e-telco in the United Kingdom. Equitalk provided both residential and business customers with low-cost IDA and CPS voice services, broadband and teleconferencing.

On January 29, 2010, we entered into an agreement with Abraham Keinan and AMIT K LTD. for the sale by us of the entire issued share capital of Equitalk. The transaction closed on July 29, 2010. See Section A under Item 13 below.

Auracall Limited

On August 15, 2007, we, Swiftnet and Dan Kirschner entered into a definitive Share Purchase Agreement which was completed on the same date, pursuant to which Swiftnet purchased from Mr. Kirschner the 67.5% equity interest in Auracall Limited (“Auracall”) that he beneficially owned, thereby increasing Swiftnet’s ownership interest in Auracall from 32.5% to 100%. Swiftnet had acquired the initial 32.5% interest in Auracall through several transactions that occurred since October 16, 2001.

-6-

On January 29, 2010, we entered into an agreement with Abraham Keinan and AMIT K LTD. for the sale by us of the entire issued share capital of Auracall Limited. The transaction closed on July 29, 2010. See Section A under Item 13 below.

NTS Communications, Inc.

On August 22, 2007, we entered into a Stock Purchase Agreement (the “NTS Purchase Agreement”) with NTS Communications, Inc. (“NTS”), a provider of integrated telecommunications solutions headquartered in Lubbock, Texas, and the owners of approximately 85% of the equity interests in NTS, to acquire NTS. Subsequently, all of the remaining shareholders of NTS executed the Agreement, bringing the total percentage of equity interests in NTS owned by NTS shareholders that entered into the Agreement (the “NTS Sellers”) to 100%. On February 14, 2008, we entered into a First Amendment to the NTS Purchase Agreement to amend the agreement to further extend the expiration date for the closing of our acquisition of NTS. On February 26, 2008, we entered into a Second Amendment to the NTS Purchase Agreement which amended, among other things, the definition and elements of Working Capital, as such term is defined in the NTS Purchase Agreement, and increased the escrow amount. On April 25, 2008, we entered into a Third Amendment, pursuant to which we agreed to an extension of time for the calculation and payment of the post closing working capital adjustment under the NTS Purchase Agreement.

The acquisition closed on February 26, 2008. Upon closing of the acquisition, NTS and its six wholly owned subsidiaries, NTS Construction Company, Garey M. Wallace Company, Inc., Midcom of Arizona, Inc., Communications Brokers, Inc., NTS Telephone Company, LLC, and NTS Management Company, LLC, became our wholly owned subsidiaries. On April 3, 2009, NTS formed a seventh wholly owned subsidiary in Texas, called PRIDE Network, Inc.

On December 28, 2009, we and the NTS Sellers entered into a certain General Release and Settlement Agreement (the “Settlement Agreement”) in order to resolve all issues related to the calculation and determination of the final purchase price as provided in Article II of the NTS Purchase Agreement, including all issues which have been the subject of a proposed arbitration between the parties (hereinafter referred to as the “Disputed Issues”) by compromise and settlement and without resorting to potentially costly arbitration proceedings. Our financial statements have carried the full settlement amount. We do not expect to bear any additional expenses as a result of the Settlement Agreement.

As consideration for this settlement, (i) the NTS Sellers, their heirs, executors, administrators, agents, beneficiaries, successors and assigns, officers, directors, affiliates, employees, representatives, attorneys and insurers including those of affiliated companies, forever released and discharged us, including each of our subsidiaries, directors, officers, affiliates, employees, agents, representatives, attorneys, successors and assigns, and insurers, and their respective past and present officers, directors, employees, agents, and attorneys, of and from any and all manner of action and actions, causes and causes of action, claims, controversies, contracts, torts, debts, damages or demands whatsoever, in law or in equity, that they have had, now have, or may in the future have, arising out of or related to the Disputed Issues; and (ii) we , including each of our directors, officers, affiliates, employees, agents, representatives, attorneys, successors and assigns, and insurers, and their respective past and present officers, directors, employees, agents, and attorneys forever released and discharged the NTS Sellers, their heirs, executors, administrators, agents, beneficiaries, successors and assigns, officers, and directors, including those of affiliated companies, of and from any and all manner of action and actions, causes and causes of action, claims, controversies, contracts, torts, debts, damages or demands whatsoever, in law or in equity, that they have had, now have, or may in the future have, arising out of or related to the Disputed Issues.

NTS is an integrated telecommunications service provider that owns and operates its own fiber optic and leased facilities-based, long haul and metropolitan telecommunications networks. NTS provides business and residential customers with high quality broadband, managed data, video, local, and long distance services within its service areas. The company also provides long distance, data, and private line services to numerous communications carriers. NTS is currently authorized to provide service in Arizona, Colorado, Kansas, Louisiana, New Mexico, Oklahoma, and Texas.

Cybergate, Inc.

On November 26, 2008, Xfone USA, our wholly owned subsidiary, entered into a Sale and Purchase Agreement (the “Agreement”) with Cybergate, Inc. (“Cybergate”), pursuant to which Cybergate agreed to sell to Xfone USA all of Cybergate’s assets, as set forth in the agreement (the “Assets”). Cybergate was a provider of Internet services, including Internet access, web and server hosting, data services and e-mail. Pursuant to the Agreement Xfone USA also agreed to assume certain of the liabilities of Cybergate. The Agreement and the closing of the sale and purchase have an effective date of November 1, 2008. The acquisition was not significant from an accounting perspective.

Our Principal Services and Their Markets

We provide through our subsidiaries the following telecommunication products / services:

-7-

Services provided by NTS Communications, Inc. and its subsidiaries

Retail Services

|

·

|

Local Services: NTS delivers local telephony service to its customers through an “on-net” UNE-L connection, including voice mail, caller ID, forwarding, 3-way calling, blocking, and PBX services. In addition, NTS sells "off-net" total service resale lines. NTS provides UNE-L services in Lubbock, Abilene, Amarillo, Midland, Odessa, Pampa, Plainview, and Wichita Falls, Texas. NTS provides local services via FTTP in Lubbock Wolfforth, Levelland, and Smyer, Texas. NTS provides resold local services throughout Texas via its resale agreement with AT&T.

|

|

·

|

Retail Long Distance Services: NTS offers a full range of long distance services to its customers, including competitively priced switched long distance (including intrastate, interstate, and international), toll-free service, dedicated T-1 long distance and calling cards. The vast majority of its customers are concentrated in West Texas. A minority of its long distance customers are in Arizona, New Mexico, Oklahoma, Kansas, and Colorado.

|

|

·

|

Internet Data Services: NTS began offering broadband service in 1999. Download speeds range from 500 Kilobits to 100 Megabits per second, depending on the end user’s distance from an NTS collocation or the type of facilities used to deliver the service. NTS launched dial-up service in 1985. NTS provides broadband and dial-up Internet service in all of its Texas markets. NTS also offers Web hosting and wide area networking solutions for business applications.

|

|

·

|

Fiber-Based Services (“Fiber to the Premise” or “FTTP”): As an integrated telecom provider, NTS is capable of providing quality triple play (voice, digital video & data) on one bill at competitive prices to its FTTP customers. NTS offers a full selection of video services, including basic cable, video on demand, HDTV and DVR. NTS is a member of the National Cable Television Cooperative and as a member obtains favorable programming rates from most major networks. NTS provides FTTP service in Lubbock, Levelland, Smyer, and Wolfforth, Texas.

|

|

·

|

Customer Premise Equipment (“CPE”): NTS resells a variety of CPE and CPE related services to its customers. Primarily, these sales involve NTS acting as an authorized dealer for Toshiba phone systems. These systems are sold to customers either on a stand-alone basis, or in conjunction with the purchase of local, long distance, and/or data services from the company. In addition NTS sells a variety of other electronics such as HD displays, surveillance equipment, paging systems, nurse call systems, routers switches and internetworking gear.

|

Wholesale Services

|

·

|

Private Line Services: NTS offers aggregation and resale of leased fiber transport network from AT&T and other fiber network operators. This service is mostly provided for carrier customers that need direct network connectivity, as well as enterprises that require dedicated branch office connections. Services are generally offered under 1-year contracts for a fixed amount per month. NTS provides private line service nationwide.

|

|

·

|

Wholesale Switched Termination Services: NTS sells its wholesale-switched minutes to local telecom companies who do not have the volume to warrant attractive pricing from AT&T and other large carriers. NTS provides multi-regional switched termination, switched toll free origination and wholesale Internet access services to various carrier customers. Services are generally offered for a fixed amount per minute. NTS provides wholesale switched termination services to customers via network connections in NTS POPs and switch sites.

|

Internet Based Customer Service

|

·

|

Our Internet based customer service (found at www.ntscom.com) includes full details on all our retail products and services.

|

NTS Communications owns and operates its own facilities-based telecommunications switching system.

FTTP Network Extensions / Stimulus Fundings

Levelland/Smyer, Texas

NTS, through its wholly owned subsidiary, NTS Telephone Company, LLC, has extended its FTTP network to the nearby communities of Levelland (located approximately 30 miles west of Lubbock) and Smyer (approximately 15 miles west of Lubbock). These communities have added approximately 6,000 passings to the NTS FTTP footprint and bring total FTTP passings to approximately 21,000. NTS Telephone Company, LLC, has received approval from the Rural Utilities Service (“RUS”) for an $11.8 million, 17-year debt financing to complete this overbuild. The RUS loan is non-recourse to NTS and all other NTS subsidiaries and interest is charged at the average rate of U.S. government obligations (equivalent to approximately 3.60% a year at today’s rates). Data from marketing surveys, and robust sales results indicates very strong demand for triple play (voice, data/Internet, and video) service offerings and we are projecting ultimate total market penetration of 69%. NTS’ initial capital investment in the project was a $2.5 million equity contribution. NTS provisions voice, data, and video services for NTS Telephone Company and also provides billing, sales and marketing, back and front offices services to this subsidiary. NTS receives a management fee from NTS Telephone Company equal to 15% of its revenues. NTS began marketing its triple-play service to limited areas of Levelland in 2009 and construction was completed on April 8, 2010. NTS will continue to work diligently to secure sales and complete installations in pursuit of its take rate goals.

-8-

Texas South Plains; Burkburnett and Iowa Park, Texas; St. Helena, Washington, and Tangipahoa Parishes in Southern Louisiana

In March 2010, we were notified that the applications of our wholly owned subsidiary, PRIDE Network, Inc. (“PRIDE Network”), for RUS funding from the U.S. Department of Agriculture under the Broadband Initiative Program for the FTTP build out of PRIDE Network’s projects in Texas, have been approved. PRIDE Network was selected to receive approximately $63.7 million in RUS funding for these projects, which will be split between loans of approximately $35.53 million and grants of approximately $28.14 million.

In September 2010, we were notified that another application of PRIDE Network for additional funding under the Broadband Initiative Program for the FTTP build out of its project in Louisiana has been approved. PRIDE Network was selected to receive approximately $36.2 million in additional RUS funding which will be split between a loan of approximately $18.46 million and a grant of approximately $17.74 million.

These awards are a significant milestone in our strategy to grow the FTTP business. These fundings will enable us to expand the rollout of our state-of-the-art FTTP infrastructure to bring broadband services to the Texas south plains, to the communities of Burkburnett and Iowa Park, Texas, and to St. Helena, Washington, and Tangipahoa Parishes in Southern Louisiana. Additionally, these fundings will help stimulate the economic growth of these communities by creating hundreds of new jobs associated with the network build out.

When completed, the PRIDE Network is expected to add 30,000 FTTP passings to the NTS network bringing company-wide FTTP passings to over 50,000.

The fundings are contingent upon PRIDE Network meeting the terms of the loans, grants or loans/grants agreement.

Services provided by Xfone USA

|

·

|

Local Telephone Service: Using our own network in concentrated local areas throughout Mississippi and Louisiana and utilizing the underlying network of BellSouth Telecommunications, Inc. (the new ATT), outside of our local areas, we provide local dial tone and calling features, such as hunting, call forwarding and call waiting to both business and residential customers throughout Louisiana and Mississippi, including T-1 and PRI local telephone services to business customers.

|

|

·

|

Long Distance Service: We use our own network where available and QWEST, a nationwide long distance carrier, as our underlying long distance network provider. In conjunction with Local Telephone Services, we provide Long Distance Services to our residential and business customers. We provide two different categories of long distance services - Switched Services to both residential and small business customers, which include 1+ Outbound Service, Toll Free Inbound Service and Calling Card Service. For larger business customers we also provide Dedicated Services such as T-1 and PRI Services. Our long distance services are only available to customers who use our local telephone services.

|

|

·

|

Internet/Data Service: We provide high-speed broadband Internet access to residential and business customers utilizing our own integrated digital data network and utilizing the broadband gateway network of the new ATT. Our DSL service provides up to 3 Mbps of streaming speed combined with Dynamic IP addresses, as well as multiple mailboxes and Web space. Our DSL services also include spam filter, instant messaging, pop-up blocking, web mail access, and parental controls. We also provide dial-up Internet access service for quick and dependable connection to the web. Our Internet/Data services are stand-alone products or are bundled with our voice services for residential and business customers.

|

|

·

|

Customer Service: Customer Service is paramount at Xfone USA and is one of our major differentiating characteristics, thus tantamount to being one of our product offerings. Customers have been conditioned to accept poor customer service from the larger monopoly companies because they have never had any real choice in service providers, especially in the residential market. Our attentive customer service department is an additional “product offering” which sells - as well as retains - customers. The full scope of communications service entails network service, customer service, and repair service.

|

|

·

|

Customer Premise Equipment (“CPE”): Xfone USA also resells a variety of CPE and CPE related services to its customers. Primarily, these sales involve acting with NTS Communications as an authorized dealer for Toshiba phone systems. These systems are sold to customers either on a stand-alone basis, or in conjunction with the purchase of local, long distance, and/or data services from the company. In addition, the company sells a variety of other electronics such as HD displays, surveillance equipment, paging systems, nurse call systems, routers switches and internetworking gear.

|

Xfone USA owns and operates its own facilities-based telecommunications carrier class-switching platform.

-9-

Our Distribution and Marketing Methods

We use the following distribution methods to market our services:

|

·

|

We use full time, Account Executives “AE’s” to sell into Small, Mid-Market & Enterprise business customers in our fiber & legacy CLEC markets. Additionally, a subset of AE’s working within our PRIDE FTTU markets focus on selling directly to consumers. All AE’s carry quota’s which vary based on their responsibilities, titles and type of market assigned to them. AE’s receive a base salary paid bi-monthly in addition to any commissions that may have been earned under the specific compensation plan that AE falls under;

|

|

·

|

We actively pursue opportunities with other Carriers; ILEC’s, CLEC’s, ITSP’s, MSO’s and Agents who purchase wholesale Origination & Termination, Point to Point Circuits, Carrier Metro Ethernet, Long Haul, Dedicated Internet Access, Dark Fiber, Interconnect CPE & Internetworking equipment such as routers & switches directly from us and then resell these wholesale services & products at a mark-up to end-users under their own brand. This is strictly a “white labeled” offering and these entities generate their own invoices from call detail records CDR’s that we provide them. We call this division “National Accounts” and also refer to it as “Carrier Wholesale”. Our National Account Managers are specialist and typically have over 20 years of experience;

|

|

·

|

We utilize traditional Agents & VAR’s that sell our services directly to end-users at our established prices; these agents receive an ongoing residual commission of approximately 5%-12% of the total monthly recurring charges “MRC’s” based on their individual contracts on collected revenues less any bad debt;

|

|

·

|

We have used and in the future may engage third party direct sales organizations (telesales and door-to-door) to register new customers when internal human capital is not available or when we want to target a specific service area aggressively for a period of time for the purpose of increase market share or a sales blitz around a new product offering;

|

|

·

|

We cooperate with major companies and worker’s councils;

|

|

·

|

We have retail and wholesale sales offices; employees at these sales offices receive annual salaries and commissions;

|

|

·

|

We deploy direct marketing resources including but not limited to: Internet/Social Networking, Advertising through newspaper, radio, television, outdoor boards, digital signage, direct mail campaigns, door hangers, community events and sponsorships, chambers affinity groups and alumni associations;

|

|

·

|

We attend telecommunications trade shows to network and to promote our products and services; and

|

|

·

|

We utilize the Internet as an additional distribution channel for our services.

|

Our Billing Practices

We charge our customers based on a monthly fixed amount or on actual usage by full or partial minutes. Our rates vary with distance, duration, time, type of call, and product or service provided, but are not dependent upon the facilities selected for the call transmission. The standard terms for our customers require either pre-payments or payments due as early as 16 or as late as 30 days from the date of the invoice, or within 90 days from when the invoice is issued by the local operator. Our supplier’s standard terms are payment within 30 to 90 days from invoice date; however, some new suppliers ask for shorter payment terms.

Divisions

We operate the following divisions:

|

·

|

Partner Division - Our Partner Division operates as a separate profit center by attempting to recruit new resellers and agents to market our products and services and to provide support and guidance to resellers and agents.

|

|

·

|

Customer Service Division - We operate a live customer service center that operates 24 hours a day, 7 days a week.

|

|

·

|

Operations Division - Our Operations Division provides the following operational functions to our business: (a) 24 hour/7 day a week technical support; (b) inter-company network; (c) hardware and software installations; and (d) operating switch and other platforms.

|

|

·

|

Administration Division - Our Administration Division provides the billing, collection, credit control, and customer support aspects of our business.

|

|

·

|

Marketing Division - Our Marketing Division is responsible for our marketing and selling campaigns that target potential and existing retail customers.

|

-10-

Geographic Markets

Our primary geographic markets are Texas, Mississippi and Louisiana, United States. However, we also serve customers in Arizona, Colorado, Kansas, New Mexico, and Oklahoma.

Competitive Business Conditions

NTS operates in a highly competitive environment which is generally characterized by the dominance of the Incumbent Local Exchange Carrier (ILEC). With respect to its primary Texas markets, the dominant ILEC is either AT&T (formerly Southwestern Bell Telephone Company) or Windstream Communications. NTS also competes with the Incumbent Cable TV Provider (ICTVP) in markets where that carrier provides voice, data and/or video services. In its core Texas markets, the ICTVP is SuddenLink Communications, CoBridge Communications, Time Warner Communications, or other smaller operators. Within these same core markets, NTS also competes with a variety of widely dispersed smaller Competitive Local Exchange Carriers (CLEC). With respect to its data and long distance products, the company competes with various national and regional players including AT&T, Verizon, Suddenlink, Qwest, Level 3 and others.

Xfone USA also operates in highly competitive markets in Mississippi and Louisiana. In these markets Xfone USA competes against the dominate ILEC, AT&T (formerly BellSouth Telecommunications), as well as many smaller CLECs.

Principal Suppliers

In fiscal year 2010, our principal supplier of telephone routing and switching services constituted 58.9% of our costs of revenues.

We are dependent on several of our suppliers, including those that provide significant hardware and software products and support. However, these suppliers are required to provide us with services in accordance with the relevant regulations and their licenses to operate as a telecommunications provider in the relevant jurisdictions.

Major Customers

We have four major types of customers:

|

·

|

Residential - Pre-subscribed customers, including for local, long distance, internet and cable television services.

|

|

·

|

Commercial - We serve small to complex business customers within our service areas.

|

|

·

|

Governmental agencies - We provide various governmental entities a broad range of servcies, including local, long distance, internet, managed data, and private line services.

|

|

·

|

Resellers & Wholesale - We provide resellers and other carriers with various switched and non-switched voice and data services on a wholesale basis. We also provide long haul transport, metro access, and switched termination services to a variety of communications companies throughout the United States.

|

We are not dependant upon any major customer. However, our revenues are dependent upon certain factors, including: price competition; access provided to our services by other telecom companies and the prices for that access; demand for our services; economic conditions in our markets; and our ability to market our services.

Patents and Trademarks

On January 9, 2004, we received notification from the Trademarks Registry Office of Great Britain that as of August 8, 2003, our trademark, “XFONE”, was registered by that government agency.

The Mark “XFONE” was registered by the United States Patent and Trademark Office (the “USPTO”) on July 15, 2008.

The Mark, “NTS Communications” related to the provision of telephone telecommunications services in the United States, was registered by the USPTO on September 4, 1984, and has been renewed through the year 2014.

The Mark, “NTS Communications (with design)” related to the provision of telephone communications services in the United States, was registered by the USPTO on October 12, 1993, and has been renewed through the year 2013.

-11-

The Mark, “NTS-ONLINE (with design)” related to the provision of web hosting, on-line message boards and information, was registered by the USPTO on August 15, 2000, and has been renewed through the year 2020.

On February 6, 2007, NTS filed an application with the USPTO to register the Mark, “NTS-ONLINE” related to the provision of expanded telecom services, web hosting services, and domain name services. The application also seeks to eliminate the design associated with the mark. On May 27, 2008, the USPTO issued a Notice of Allowance. NTS’ Statement of Use was accepted by the USPTO on January 3, 2009. The mark was registered by the USPTO on February 10, 2009.

On April 22, 2005, Xfone USA received notification from the USPTO that as of April 12, 2005, its Mark, “eXpeTel” was registered by that government agency.

We do not have any other patents or registered trademarks.

Regulatory Matters

We provide our services in certain States, each of which may have different regulations, standards and controls related to licensing, telecommunications, import/export, currency and trade. We believe that we are in substantial compliance with these laws and regulations.

Xfone USA is currently licensed as a CLEC and an Inter-exchange Carrier to provide local telephone and long distance services in the states of Louisiana and Mississippi. During fiscal 2008, Xfone USA was also licensed in Alabama, Florida, and Georgia, however, we withdrew these licenses during the first quarter of fiscal 2009. Internet and data services provided by Xfone USA are not regulated services.

On February 14, 2008, Xfone, Inc. and NTS received domestic and international Section 214 authorization from the United States Federal Communications Commission to transfer control of NTS to Xfone, Inc.

NTS has certain domestic and international Section 214 authority, which authorizes NTS to provide long distance service in the United States.

NTS is registered re-seller of long-distance services in the states of Arizona, Colorado, Kansas, New Mexico, Oklahoma and Texas. NTS is also registered to provide local services in New Mexico and Texas. Further, in Texas, NTS has the authority to provide local telecommunications services throughout the state of Texas, and has authorization to provide video services in designated areas within Lubbock, Wolfforth, Smyer and Levelland. In addition, NTS has entered into 9-1-1 Emergency Service Agreements with the applicable 9-1-1 entities in the markets it serves.

NTS also has authority to provide video services in certain communities in the following Parishes in the state of Louisiana: Livingston, St. Helena, St. Tammany, Tangipahoa, and Washington.

On May 19, 2008 a petition was filed with the Federal Communications Commission (In the Matter of NTS Communications, Inc., Petition for Extension of Waiver of Section 76.1204(a)(1) of the Commission’s Rules, CS Docket No. 97-80). This Petition seeks a two-year extension of the relief previously granted from Commission Rules banning the use of integrated set-top boxes by cable service providers. The original waiver, granted on July 23, 2007, expired on July 1, 2008. The May 19, 2008 petition is currently pending.

On June 27, 2008, a petition was filed with the Federal Communications Commission (In the Matter of Xfone USA, Inc., Petition for Waiver of Sections 54.307(c) and 54.802(a) of the Commission’s Rules, CS Docket No. 96-45). This Petition seeks relief from the failure to timely file reports necessary to receive FUSF reimbursement for the provision of telecommunications service in high cost areas of Mississippi. On April 21, 2009, the FCC entered an order that granted Xfone USA’s request for waiver of the December 30, 2007 and December 31, 2007, line count filing deadlines but denied waiver of the March 30, 2008 and March 31, 2008, line count deadlines. Xfone USA did not seek reconsideration of the order. Xfone USA received payment for the December 2007 filings in July 2009.

Effect of Probable Governmental Regulations

As an ETC (Eligible Telecommunications Carrier), there are numerous actions proposed at both the state and federal level which could limit NTS and Xfone USA’s future access to reimbursement from various Universal Service Funds (“USF”). NTS currently only receives minimal reimbursement from USF for its provision of Lifeline and LinkUp services While Xfone USA received significant support for services provided in high cost areas of Mississippi. These measures could limit NTS and Xfone USA’s ability to obtain reimbursement for services provided in high cost areas. In areas where it has not deployed its own last mile facilities, NTS and Xfone USA continue to rely on AT&T for access to high cap interoffice and last mile copper loop facilities. AT&T’s obligation to provide these facilities is created by the Federal Telecommunications Act of 1996 and corresponding regulations of the FCC and memorialized in interconnection agreements between NTS and Xfone USA and Incumbent Local Exchange Carriers. Should laws or regulations be changed to limit and or eliminate competitive access to these essential facilities, our business could be adversely affected. The FCC has recently issued Notice of Proposed Rulemaking announcing its plans to reform USF and Intercarrier Compensation (ICC). Among the issues to be addressed in the ICC reform is the treatment of VoIP traffic, namely the compensation due, if any, to terminating carriers for VoIP originated calls. Resolution of this issue will clarify legal and regulatory uncertainty about the treatment of these calls and could have the effect of opening the door to new markets for our wholesale switched services.

-12-

Cost of Compliance with Environmental Laws

During 2007, NTS incurred approximately $31,000 in expenses related to the encapsulation of asbestos insulation located on certain of the basement piping and basement boiler jacket of the Metro Tower, a property owned in Lubbock, Texas, and in connection with the replacement of the roof of the building to remediate a potential interior mold problem with originated from a roof leak. NTS will from time to time incur additional similar expenses in the future to monitor and encapsulate, where necessary, isolated areas of asbestos. On March 21, 2008, NTS received notice that the remediation project at Metro Tower had been completed, and accordingly does not anticipate significant future expenses related to mold remediation at this property over and above those normally associated with customary and usual building maintenance.

We currently have no other costs associated with compliance with environmental regulations. We do not anticipate any other future costs associated with environmental compliance; however, there can be no assurance that we will not incur such costs in the future.

Employees

We currently have 291 employees in the United States and 3 employees in Israel.

Not applicable.

Not applicable.

Our principal executive offices are located at 5307 W. Loop 289, Lubbock, Texas 79414, USA.

In the U.S

Real Property Owned by NTS and subsidiaries

Our video headend and operations center is located at 8902 Alcove Avenue, Wolfforth, Texas 79382. This is a single story 3,500 sq. ft. building built in 2004. The building is used for equipment storage warehouse, office space, and the video and data headend. A satellite farm is located adjacent to the building. The building sits on two fenced acres within a ten acre lot.

Our retail and Toshiba sales offices, is located in the Metro Tower, which is a 20-story building located at 1220 Broadway, Lubbock, Texas 79401. The building also houses local switching, local provisioning and outside technicians. Each floor of the building measures approximately 5,000 sq. ft. We lease office space in the building to various businesses including many technology and telecommunications companies. We also lease roof space to companies to house communications antennas.

We own two buildings at 615 N. Price Road, Pampa, Texas 79065. One single story building is used as office space for sales and technicians. The first building measures an estimated 3,552 sq. ft. The second building is a single story 9 bay garage with a small shop area and is used for equipment storage. The second building measures an estimated 3,000 sq. ft.

We own a building at 400 S. Columbia, Plainview, Texas 79072. The single story building measures an estimated 1,000 sq. ft. and is used as office space for sales and technicians.

We own a 7,700 sq. ft. single story building at 601 College Avenue, Levelland, Texas, 79336. The building houses our operations in Levelland.

-13-

Real Property Leased through NTS and subsidiaries

|

·

|

Our corporate offices, Network Control Center, Customer Care, and Internet help desk are located at 5307 W. Loop 289, Lubbock, TX, measuring 45,072 sq. ft. on three floors with annual triple net base rent of $518,328. The lease expires July 31, 2013 and contains three options for five year renewal terms. We believe the building has sufficient space for our operations.

|

|

·

|

Local sales offices located at 801 S. Fillmore, Suite 130, Amarillo, TX, measuring 3,958 sq. ft. with annual rent of $45,516. The lease expires on November 30, 2015 and has no renewal option.

|

|

·

|

Point of Presence (“POP”) site and fiber node located at 201 E Main, Ste. 104, El Paso Texas, measuring 950 sq. ft. (including 850 linear feet of conduit) with annual rent of $54,070. The lease expires on March 31, 2015 and contains no option to renew.

|

|

·

|

Local sales office located at 450E 10 Desta Drive Midland, TX, measuring 2,981 sq. ft. with annual rent of $27,574. The lease expires on February 28, 2011 and contains one option for a two year renewal term.

|

|

·

|

POP, switch site and fiber node located at 500 Chestnut, Suite 936, Abilene, TX, measuring 4,763 sq. ft. (including roof space for one (1) GPS antenna) with annual rent of $49,896. The lease expires on December 31, 2013 and contains two options for three year renewal terms.

|

|

·

|

Local sales office located at 400 Pine Street, Suite 980, Abilene, TX measuring 2,205 sq. ft. with annual rent of $28,872. The lease will expire in August 2011, with an option to renew for one additional year.

|

|

·

|

POP located at 201 Robert S. Kerr, Suite 1070, Oklahoma City, OK, measuring 4,092 sq. ft. with annual rent of $16,926. The lease expires on April 30, 2011.

|

|

·

|

Equipment room located at 8212 Ithaca, Room W-12, Lubbock, TX, of approximately 16 sq. ft. of wall space with annual rent of $480. The lease is on a month-to-month term.

|

|

·

|

Local sales and technician offices located at 4214 Kell, Suite 104 Wichita Falls, TX, measuring 2,400 sq. ft. with annual rent of $39,600. The lease expires in August 2011 and has options to renew for two additional 36 month terms.

|

|

·

|

POP site located at United Center, 1049 N. 3rd, Abilene, TX, measuring approximately 300 sq. ft. with annual rent of $6,600. The lease is on a month-to-month term.

|

|

·

|

POP, switch site, and fiber node located at Petroleum Building, 203 W. 8th Street Suite 102, Amarillo, TX, measuring 3,056 sq. ft. with annual rent of $36,672. The lease is on a month-to-month term.

|

|

·

|

POP, switch site, and fiber node located at 710 Lamar Street, Suite 10-25, Wichita Falls, TX, measuring approximately 890 sq. ft. plus 200 sq. ft. to house a gas generator at 714 Travis, 6th Floor, Wichita Falls. Annual rent for both spaces totals $12,833.40. The lease expires April 30, 2015 and has one option for a five year renewal term.

|

|

·

|

POP and switch site located at 4316 Bryan, Dallas, TX, measuring 3,816 sq. ft. with annual base rent of $196,860. The lease expires on October 31, 2012 and has two options for renewal terms of three years.

|

|

Real Property Leased through Xfone USA

|

|

|

·

|

Local sales and operations center located at 2506 Lakeland Drive, Flowood, Mississippi 39232, measuring 4,753 sq. ft. The lease will expire on September 30, 2011 with no option to renew. The monthly base rent is $5,941.

|

|

·

|

Equipment storage located at Suite 1015 at 650 Poydras Office Building. The lease expires on May 15, 2011. The monthly lease payments are $16,750.

|

|

·

|

Sales office located at 3636 S. I-10 Service Road, Suite 214, Metairie, Louisiana. The premises measures 2,022 sq. ft. The lease will expire on September 30, 2011, with one option to renew for an additional three-year term. The monthly base rent is $2,907.

|

|

·

|

Baton Rouge Sales Office and sales support is located at 3636 South Sherwood Forest Boulevard, measuring 2,100 sq. ft. The lease is on a month-to-month term. The yearly lease payments are $28,644.

|

|

·

|

Housing of communication equipment is located at 408 West Thomas Street, Hammond, Louisiana, measuring 2,500 sq. ft. The term of the lease is August 1, 2008 through July 31, 2013, and the payments are $4,400 per month.

|

|

·

|

We lease a fiber riser at 1515 Poydras in New Orleans, LA for $1,000 per month. The term of the lease is month-to-month.

|

|

·

|

We lease a fiber riser at 650 Poydras in New Orleans, Louisiana for $730.00 per month. The lease expires on September 30, 2013.

|

|

·

|

We hold 21 collocations facilities in Texas through NTS, and 8 collocations facilities in Mississippi and 6 collocations facilities in Louisiana through Xfone USA.

|

-14-

Easements and Private Rights of Way through NTS and subsidiaries

|

·

|

Perpetual Construction and Utility Easement from Benny Judah for facility hut at 10508 Topeka, Lubbock, Texas, 79424.

|

|

·

|

Perpetual Construction and Utility Easement from CDC-Lubbock, LLC, for a manhole at 10th & T in Lubbock, Texas.

|

|

·

|

Perpetual Facilities Easement from Stellar Land Company, Ltd., for a facilities cabinet in the Vintage Township Addition to the City of Lubbock, Texas.

|

|

·

|

Perpetual Underground Utility Easement from Stellar Land Company, Ltd., for underground facilities in the Vintage Township Addition to the City of Lubbock.

|

|

·

|

Right of Way Use Permit: City of Midland, Texas, Right of Way Use Permit for S. Marienfeld Street and W. Missouri Avenue.

|

In Israel

Our Israeli office is located at 11 Rabbi Akiva Street, Modi'in Illit, Israel, measuring 516 sq. ft. The monthly rent (including municipal rate) is NIS 2,230 (approximately $615). The lease expires June 3, 2012 and has one option for a two years renewal term.

Our offices are in good condition and are sufficient to conduct our operations.

We do not intend to renovate, improve or develop any properties; however, from time to time we improve leased office space in order to comply with local legislation and to provide an office environment necessary to conduct business in the markets in which we operate. We are not subject to competitive conditions for property. We have no policy with respect to investments in real estate or interests in real estate and no policy with respect to investments in real estate mortgages. We have no policy with respect to investments in securities of or interests in persons primarily engaged in real estate activities.

FCC Enforcement Bureau (EB-06-IH-0904)

On March 6, 2006, the FCC’s Enforcement Bureau initiated an investigation into Telephone Electronic Company’s (“TEC”) compliance with FCC Rules for compensation of payphone service providers. The Enforcement Bureau issued requests for production to TEC, its affiliates and subsidiaries. TEC was a majority shareholder of NTS Communications, Inc. (“NTS”) at the time of this investigation which was prior to our acquisition of NTS in February 2008. On April 26, 2006, NTS filed its response to the request for production. The FCC has the authority to issue fines for violations of its regulations. NTS believes it was in compliance and will not incur any fine. In February 2011, we were informally advised by the FCC staff that the FCC does not currently anticipate taking any action against NTS. However, there can be no assurance that the FCC will not make a determination to take action against NTS in the future.

Eliezer Tzur et al. vs. 012 Telecom Ltd. et al.

On January 19, 2010, Eliezer Tzur et al. (the “Petitioners”) filed a request to approve a claim as a class action (the “Class Action Request”) against Xfone 018 Ltd. (“Xfone 018”), our former 69% Israel-based subsidiary, and four other Israeli telecom companies, all of which are entities unrelated to us (collectively with Xfone 018, the “Defendants”), in the District Court in Petach Tikva, Israel (the “Israeli Court”). The Petitioners’ claim alleges that the Defendants have not fully fulfilled their alleged legal requirement to bear the cost of telephone calls by consumers to the Defendants’ respective technical support numbers. One of the Petitioners, Mr. Eli Sharvit (“Mr. Sharvit”), seeks damages from Xfone 018 for the cost such telephone calls allegedly made by him during the 5.5-year period preceding the filing of the Class Action Request, which he assessed at NIS 54.45 (approximately $15.34). The Class Action Request, to the extent it pertains to Xfone 018, states total damages of NIS 7,500,000 (approximately $2,113,271) which reflects the Petitioners’ estimation of damages caused to all consumers that (pursuant to the Class Action Request) allegedly called Xfone 018’s technical support number during a certain period defined in the Class Action Request.

-15-

On February 22, 2011, Xfone 018 and Mr. Sharvit entered into a settlement agreement (the “Settlement Agreement”). Pursuant to the Settlement Agreement, Xfone 018 agreed to compensate its registered customers of international calling services (the “Services”) who called its telephone service center from December 15, 2004 until December 31, 2009, due to a problem in the Services, and were charged for such calls (the “Compensation”). The Compensation includes a right for a single, up to ten minutes, free of charge, international call to one landline destination around the world, and shall be valid for a period of six months. In addition, Xfone 018 agreed to pay Mr. Sharvit a one-time special reward in the amount of NIS 10,000 (approximately $2,817) (the “Reward”). Xfone 018 further agreed to pay Mr. Sharvit attorneys' fee for professional services in the amount of NIS 40,000 (approximately $11,271) plus VAT (the “Attorneys Fee”). In return, Mr. Sharvit and the members of the Represented Group (as defined in the Settlement Agreement) agreed to waive any and all claims in connection with the Class Action Request. As required by Israeli law in such cases, the Settlement Agreement is subject to the approval of the Israeli Court. A court hearing with respect to the Class Action Request has been scheduled for April 17, 2011. At this hearing, the Israeli Court will consider Xfone 018 and Mr. Sharvit's request to approve the Settlement Agreement.

On May 14, 2010, we entered into an agreement (including any amendment and supplement thereto, the “Agreement”) with Marathon Telecom Ltd. for the sale of our majority (69%) holdings in Xfone 018. Pursuant to Section 10 of the Agreement, we are fully and exclusively liable for any and all amounts, payments or expenses which will be incurred by Xfone 018 as a result of the Class Action Request. Section 10 of the Agreement provides that we shall bear any and all expenses or financial costs which are entailed by conducting the defense on behalf of Xfone 018 and/or the financial results thereof, including pursuant to a judgment or settlement (it was agreed that in the event that Xfone 018 will be obligated to provide services at a reduced price, we shall bear only the cost of such services). Section 10 of the Agreement further provides that the defense by Xfone 018 shall be performed in full cooperation with us and with mutual assistance. It is agreed between us and Xfone 018 that subject to and upon the approval of the Settlement Agreement by the Israeli Court, we shall bear and/or pay: (i) the costs of the Compensation; (ii) the Reward; (iii) the Attorneys Fee; (iv) Xfone 018 attorneys' fees for professional services in connection with the Class Action Request, estimated at approximately NIS 75,000 (approximately $21,133); and (v) a lump sum of NIS 20,000 (approximately $5,635) plus VAT for Xfone 018's expenses in connection with the implementation of the Settlement Agreement.

In the event the Settlement Agreement is not approved by the Israeli Court, Xfone 018 shall vigorously defend the Class Action Request.

-16-

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Our Common Stock was quoted and began trading on the NYSE Amex LLC (formerly named the American Stock Exchange and the NYSE Alternext US LLC) (the “NYSE Amex”) on June 8, 2005 under the symbol “XFN.”

As of July 24, 2006, our Common Stock is also quoted and traded under the symbol “XFN” on the Tel Aviv Stock Exchange (“TASE”).

On March 17, 2011, the closing price of our Common Stock was $1.36 (NYSE Amex) / NIS 4.698 (TASE).

Below is the market information pertaining to the range of the high and low closing price of our Common Stock for each quarter in 2010 and 2009. The quotations reflect inter-dealer prices, without retail markup, markdown or commission and may not represent actual transactions.

|

Period

|

Low

|

High

|

||||||

|

2010

|

||||||||

|

Fourth Quarter

|

$ | 1.08 | $ | 1.49 | ||||

|

Third Quarter

|

$ | 1.04 | $ | 1.30 | ||||

|

Second Quarter

|

$ | 0.99 | $ | 1.49 | ||||

|

First Quarter

|

$ | 0.60 | $ | 1.85 |

|

2009

|

||||||||

|

Fourth Quarter

|

$

|

0.66

|

$

|

0.99

|

||||

|

Third Quarter

|

$

|

0.79

|

$

|

1.08

|

||||

|

Second Quarter

|

$

|

0.50

|

$

|

1.12

|

||||

|

First Quarter

|

$

|

0.47

|

$

|

0.81

|

The source of the above information is http://www.nysenet.com.

Holders

On March 17, 2011, there were 277 holders of record of our Common Stock.

-17-

Dividends

We have not declared or paid cash dividends on our common stock in the last several years. We currently intend to retain future earnings, if any, to operate and expand our business, and we do not anticipate paying cash dividends on our common stock in the foreseeable future. Any payment of cash dividends in the future will be at the discretion of our Board of Directors and will depend upon our results of operations, earnings, capital requirements, contractual restrictions and other factors deemed relevant by our Board of Directors.

Securities Authorized For Issuance under Equity Compensation Plans

Equity Compensation Plan Information

as of December 31, 2010

|

Plan category

|

Number of Securities to be Issued upon Exercise of Outstanding Options, Warrants and Rights

|

Weighted Average Exercise Price of Outstanding Options, Warrants and Rights

|

Number of Securities Remaining Available for Future Issuance under the Plan

|

||||||

|

(a)

|

(b)

|

(c)

|

|||||||

|

Compensation plans approved by security holders(1) (2) (3)

|

11,470,368

|

$ |

2.54

|

7,743,095

|

|||||

|

Compensation plans not approved by security holders

|

-

|

-

|

-

|

||||||

|

Total

|

11,470,368

|

$ |

2.54

|

7,743,095

|

|||||

(1) Represents the number of shares issuable under the Company’s 2004 Stock Option Plan (the “2004 Plan”) and 2007 Stock Incentive Plan (the “2007 Plan”).

(2) On November 24, 2004, our board of directors approved and adopted the principal items forming our 2004 Plan. On November 1, 2005, the 2004 Plan was approved by our board of directors, and on March 13, 2006 by our shareholders, at a Special Meeting. Under the 2004 Plan, the Plan Administrator is authorized to grant options to acquire up to a total of 5,500,000 shares of our Common Stock underlying such options. The purpose of the 2004 Plan is to retain the services of valued key employees and consultants of the Company and such other persons as the Plan Administrator (as defined in the 2004 Plan) shall select, and to encourage such persons to acquire a greater proprietary interest in the Company, thereby strengthening their incentive to achieve the objectives of the shareholders of the Company, and to serve as an aid and inducement in the hiring of new employees and to provide an equity incentive to consultants and other persons selected by the Plan Administrator.

(3) On October 28, 2007, our Board of Directors adopted and approved the 2007 Plan which is designated for the benefit of employees, directors and consultants of the Company and its affiliates. On December 17, 2007, our shareholders approved this plan at the Annual Meeting of stockholders. The 2007 Plan authorizes the issuance of awards for up to a total of 8,000,000 shares of our Common Stock underlying such awards. The purpose of the 2007 Plan is to promote the best interests of the Company, and its shareholders by (i) assisting the Company and its affiliates in the recruitment and/or retention of persons with ability and initiative, (ii) providing an incentive to such persons to contribute to the growth and success of the Company’s businesses by affording such persons equity participation in the Company, and (iii) associating the interests of such persons with those of the Company and its affiliates and shareholders.

Recent Grants under our 2007 Plan

On February 15, 2010, we granted the following options to directors, officers and employees under our 2007 Plan:

Guy Nissenson, our President, Chief Executive Officer and director was granted options to purchase 1,500,000 shares of our common stock, fully vested, exercisable at $1.10 per share and expiring five years from the date of grant.

Niv Krikov, our Treasurer, Chief Financial Officer and director was granted options to purchase 400,000 shares of our common stock, exercisable at $1.10 per share and expiring seven years from the grant date. The options vested as to 25% of the underlying shares 12 months from the date of grant. The remaining 75% of the options shall vest in equal quarterly installments after 15 months from the date of grant. In the event of a change of control of the Company, any unvested and outstanding portion of the options shall immediately and fully vest.

-18-

The grant of these options was recommended by our Compensation Committee and approved by our Board of Directors.

An aggregate of 1,372,500 options to purchase shares of our common stock were granted to other employees of the Company and its subsidiaries. Each such option is exercisable at $1.10 per share and expiring seven years from the date of grant. Of these options, 85,000 options were fully vested on the date of grant. The remaining 1,287,500 options vested as to 25% of the underlying shares 12 months from the date of grant, with the remaining 75% of the options vesting in equal quarterly installments after 15 months from the date of grant. Additionally, 125,000 of the options will immediately and fully vest in the event of a change in control of the Company. On March 22, 2010, 69,500 of these options were exercised.

On September 20, 2010, we granted the following options to directors and employees under our 2007 Plan:

Each of Messrs Itzhak Almog, Shemer S. Schwarz, Israel Singer and Arie Rosenfeld, members of our Board of Directors, was granted options to purchase 90,000 shares of our common stock, on the following terms: exercise price - $1.22, vesting date - 10,000 options per month until all options are vested after 9 months from date of grant, expiration date - 5 years from the grant date.

The grant of these options was recommended by our Compensation Committee and approved by our Board of Directors.

An aggregate of 135,000 options to purchase shares of our common stock were granted to other employees of the Company and its subsidiaries. Each such option is exercisable at $1.22 per share and expiring seven years from the date of grant. Thee options vested as to 25% of the underlying shares 12 months from the date of grant, with the remaining 75% of the options vesting in equal quarterly installments after 15 months from the date of grant.

Recent Sales of Unregistered Securities

On March 23, 2010, we entered into a Securities Purchase Agreement (the “Burlingame Purchase Agreement”) with an existing shareholder, Burlingame Equity Investors, LP (“Burlingame”), pursuant to which Burlingame agreed to purchase from us and we agreed to sell and issue to Burlingame 2,173,913 shares of our Common Stock at a purchase price of $1.15 per share, for an aggregate purchase price of $2,500,000; and a warrant to purchase 950,000 shares of our Common Stock, which shall be exercisable at a price of $2.00 per share for a period of 5 years. The Burlingame Purchase Agreement is further described in Section F of Item 13 below.

On March 23, 2010, we entered into a Subscription Agreement (the “Gagnon Subscription Agreement”) with certain investors affiliated with Gagnon Securities LLC, an existing shareholder (collectively, “Gagnon”), pursuant to which Gagnon agreed to purchase from us and we agreed to sell and issue to Gagnon 500,000 shares of our Common Stock at a purchase price of $1.15 per share, for an aggregate purchase price of $575,000. The Gagnon Subscription Agreement is further described in Section G of Item 13 below.

Issuances Subsequent to Fiscal 2010

None.

Private Placements Subsequent to Fiscal 2010

None.

Not applicable.

-19-

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

FORWARD-LOOKING STATEMENTS

The information set forth in this Management's Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”) contains certain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995, including, among others (i) expected changes in Xfone, Inc.'s (referred to herein as the "Company", or "Xfone", "we", "our", "ours" and "us") revenues and profitability, (ii) prospective business opportunities and (iii) our strategy for financing its business. Forward-looking statements are statements other than historical information or statements of current condition. Some forward-looking statements may be identified by use of terms such as “believes”, “anticipates”, “intends” or “expects”. These forward-looking statements relate to our plans, objectives and expectations for future operations. Although we believe that our expectations with respect to the forward-looking statements are based upon reasonable assumptions within the bounds of our knowledge of our business and operations, in light of the risks and uncertainties inherent in all future projections, the inclusion of forward-looking statements in this Annual Report should not be regarded as a representation by us or any other person that our objectives or plans will be achieved.

You should read the following discussion and analysis in conjunction with the Financial Statements and Notes attached hereto, and the other financial data appearing elsewhere in this Annual Report.

Our revenues and results of operations could differ materially from those projected in the forward-looking statements as a result of numerous factors, including, but not limited to, the following: the risk of significant natural disaster, the inability of the Company to insure against certain risks, inflationary and deflationary conditions and cycles, currency exchange rates, and changing government regulations domestically and internationally affecting our products and businesses.

US Dollars are denoted herein by “USD”, New Israeli Shekels are denoted herein by “NIS”, and the Pound Sterling is denoted herein by “GBP”.

OVERVIEW

Xfone, Inc. was incorporated in Nevada, U.S.A. in September 2000. We are a holding and managing company providing, through our subsidiaries, integrated communications services which include voice, video and data over our Fiber-To-The-Premise (FTTP) and other networks. We currently have operations in Texas, Mississippi and Louisiana.

Our principal executive offices are located in Lubbock, Texas.

Divestitures

Subsequent to the year ended December 31, 2009, our board of directors made a strategic decision to concentrate on our operations in the U.S. As a result of this decision, we decided to divest our operations in the United Kingdom (“UK”), and Israel. The assets, liabilities and results of operations of the U.K. and Israel operations have been classified as discontinued operations for all periods presented.

Discontinued operations in the UK. On January 29, 2010, we entered into an agreement (the “Agreement”) with Abraham Keinan, a significant shareholder and then Chairman of the Board of Xfone, Inc. (“Keinan”), and AMIT K LTD, a company registered in England & Wales which is wholly owned and controlled by Keinan (“Buyer”), for the sale of Swiftnet Limited (“Swiftnet”), Auracall Limited (“Auracall”), Equitalk.co.uk Limited (“Equitalk”) and Story Telecom, Inc. and its wholly owned U.K. subsidiary, Story Telecom Limited (collectively, “Story Telecom”) (collectively, the “UK Subsidiaries”), which we owned (the “Transaction”). Pursuant to the Agreement, the consideration paid by Buyer and/or Keinan to us would be comprised of the following components:

|

1.

|

A release of us from the repayment of the loan from Iddo Keinan, the son of Mr. Keinan and an employee of Swiftnet, dated December 10, 2009, pursuant to which Iddo Keinan extended to Swiftnet a loan of £860,044 ($1,344,073);

|

||

|

2.

|