ensg-2023123100011253762023FYfalseP3Y0M0DP10YP4M0DP5Y0MP3Y0Mhttp://fasb.org/us-gaap/2023#RevenueFromContractWithCustomerExcludingAssessedTax33423100011253762023-01-012023-12-3100011253762023-06-30iso4217:USD00011253762024-01-29xbrli:shares00011253762023-12-3100011253762022-12-31iso4217:USDxbrli:shares0001125376us-gaap:ServiceMember2023-01-012023-12-310001125376us-gaap:ServiceMember2022-01-012022-12-310001125376us-gaap:ServiceMember2021-01-012021-12-310001125376ensg:RentalMember2023-01-012023-12-310001125376ensg:RentalMember2022-01-012022-12-310001125376ensg:RentalMember2021-01-012021-12-3100011253762022-01-012022-12-3100011253762021-01-012021-12-310001125376us-gaap:CommonStockMember2020-12-310001125376us-gaap:AdditionalPaidInCapitalMember2020-12-310001125376us-gaap:RetainedEarningsMember2020-12-310001125376us-gaap:TreasuryStockCommonMember2020-12-310001125376us-gaap:NoncontrollingInterestMember2020-12-3100011253762020-12-310001125376us-gaap:CommonStockMember2021-01-012021-12-310001125376us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310001125376us-gaap:TreasuryStockCommonMember2021-01-012021-12-310001125376us-gaap:RetainedEarningsMember2021-01-012021-12-310001125376us-gaap:NoncontrollingInterestMember2021-01-012021-12-310001125376us-gaap:CommonStockMember2021-12-310001125376us-gaap:AdditionalPaidInCapitalMember2021-12-310001125376us-gaap:RetainedEarningsMember2021-12-310001125376us-gaap:TreasuryStockCommonMember2021-12-310001125376us-gaap:NoncontrollingInterestMember2021-12-3100011253762021-12-310001125376us-gaap:CommonStockMember2022-01-012022-12-310001125376us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310001125376us-gaap:TreasuryStockCommonMember2022-01-012022-12-310001125376us-gaap:RetainedEarningsMember2022-01-012022-12-310001125376us-gaap:NoncontrollingInterestMember2022-01-012022-12-310001125376us-gaap:CommonStockMember2022-12-310001125376us-gaap:AdditionalPaidInCapitalMember2022-12-310001125376us-gaap:RetainedEarningsMember2022-12-310001125376us-gaap:TreasuryStockCommonMember2022-12-310001125376us-gaap:NoncontrollingInterestMember2022-12-310001125376us-gaap:CommonStockMember2023-01-012023-12-310001125376us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310001125376us-gaap:TreasuryStockCommonMember2023-01-012023-12-310001125376us-gaap:RetainedEarningsMember2023-01-012023-12-310001125376us-gaap:NoncontrollingInterestMember2023-01-012023-12-310001125376us-gaap:CommonStockMember2023-12-310001125376us-gaap:AdditionalPaidInCapitalMember2023-12-310001125376us-gaap:RetainedEarningsMember2023-12-310001125376us-gaap:TreasuryStockCommonMember2023-12-310001125376us-gaap:NoncontrollingInterestMember2023-12-31ensg:facilityensg:bedensg:senior_living_unitensg:property0001125376us-gaap:WhollyOwnedPropertiesMember2023-12-310001125376ensg:ThirdPartyOperatorsMember2023-12-31ensg:operation0001125376srt:MinimumMember2023-12-310001125376srt:MaximumMember2023-12-31ensg:leaseensg:option0001125376ensg:AssembledOccupancyAcquiredMembersrt:MinimumMember2023-12-310001125376ensg:AssembledOccupancyAcquiredMembersrt:MaximumMember2023-12-310001125376us-gaap:TradeNamesMember2023-12-310001125376us-gaap:CustomerRelationshipsMember2023-12-310001125376ensg:SelfInsuranceRetentionPerClaimMemberus-gaap:GeneralLiabilityMembersrt:ParentCompanyMember2023-12-310001125376us-gaap:GeneralLiabilityMemberensg:AggregateDeductibleMemberstpr:CAsrt:ParentCompanyMember2023-12-310001125376ensg:NonCaliforniaMemberus-gaap:GeneralLiabilityMemberensg:AggregateDeductibleMembersrt:ParentCompanyMember2023-12-310001125376us-gaap:GeneralLiabilityMembernaics:ZZ524292ensg:PerOccurenceMemberensg:AllStatesExceptColoradoMember2023-12-310001125376us-gaap:GeneralLiabilityMembernaics:ZZ524292ensg:AllStatesExceptColoradoMemberensg:PerFacilityMember2023-12-310001125376us-gaap:GeneralLiabilityMembernaics:ZZ524292ensg:AllStatesExceptColoradoMemberensg:BlanketAggregateMember2023-12-310001125376stpr:COus-gaap:GeneralLiabilityMembernaics:ZZ524292ensg:PerOccurenceMember2023-12-310001125376stpr:COus-gaap:GeneralLiabilityMembernaics:ZZ524292ensg:PerFacilityMember2023-12-310001125376us-gaap:SubsequentEventMemberensg:SelfInsuranceRetentionPerClaimMemberus-gaap:GeneralLiabilityMemberstpr:CAsrt:ParentCompanyMember2024-02-010001125376us-gaap:SubsequentEventMemberus-gaap:GeneralLiabilityMemberensg:AggregateDeductibleMemberstpr:CAsrt:ParentCompanyMember2024-02-010001125376ensg:NonCaliforniaMemberus-gaap:SubsequentEventMemberensg:SelfInsuranceRetentionPerClaimMemberus-gaap:GeneralLiabilityMembersrt:ParentCompanyMember2024-02-010001125376ensg:NonCaliforniaMemberus-gaap:SubsequentEventMemberus-gaap:GeneralLiabilityMemberensg:AggregateDeductibleMembersrt:ParentCompanyMember2024-02-010001125376us-gaap:SubsequentEventMemberus-gaap:GeneralLiabilityMembernaics:ZZ524292ensg:PerOccurenceMemberensg:AllStatesExceptColoradoMember2024-02-010001125376us-gaap:SubsequentEventMemberus-gaap:GeneralLiabilityMembernaics:ZZ524292ensg:AllStatesExceptColoradoMemberensg:PerFacilityMember2024-02-010001125376us-gaap:SubsequentEventMemberus-gaap:GeneralLiabilityMembernaics:ZZ524292ensg:BlanketAggregateMemberensg:AllStatesExceptColoradoMember2024-02-010001125376us-gaap:WorkersCompensationInsuranceMember2023-12-310001125376stpr:TXus-gaap:WorkersCompensationInsuranceMember2023-12-310001125376us-gaap:WorkersCompensationInsuranceMemberensg:LossSensitiveLimitPerClaimMemberensg:OtherStatesExceptCaliforniaTexasAndWashingtonMember2023-12-310001125376ensg:SelfInsuranceRetentionPerClaimMemberus-gaap:GeneralLiabilityMember2023-12-310001125376ensg:StopLossInsuranceLimitPerClaimMemberensg:HealthLiabilityInsuranceMember2023-12-310001125376ensg:StopLossInsuranceLimitPerClaimMemberensg:HealthLiabilityInsuranceMember2021-12-310001125376us-gaap:ServiceMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberensg:MedicaidAndMedicareMember2023-01-012023-12-31xbrli:pure0001125376us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberensg:MedicaidAndMedicareMember2022-01-012022-12-310001125376us-gaap:ServiceMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberensg:MedicaidAndMedicareMember2021-01-012021-12-310001125376us-gaap:ServiceMemberensg:MedicaidMember2023-01-012023-12-310001125376us-gaap:ServiceMemberensg:MedicaidMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2023-01-012023-12-310001125376us-gaap:ServiceMemberensg:MedicaidMember2022-01-012022-12-310001125376us-gaap:ServiceMemberensg:MedicaidMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2022-01-012022-12-310001125376us-gaap:ServiceMemberensg:MedicaidMember2021-01-012021-12-310001125376us-gaap:ServiceMemberensg:MedicaidMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2021-01-012021-12-310001125376ensg:MedicareMemberus-gaap:ServiceMember2023-01-012023-12-310001125376us-gaap:ServiceMemberensg:MedicareMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2023-01-012023-12-310001125376ensg:MedicareMemberus-gaap:ServiceMember2022-01-012022-12-310001125376us-gaap:ServiceMemberensg:MedicareMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2022-01-012022-12-310001125376ensg:MedicareMemberus-gaap:ServiceMember2021-01-012021-12-310001125376us-gaap:ServiceMemberensg:MedicareMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2021-01-012021-12-310001125376ensg:MedicaidSkilledMemberus-gaap:ServiceMember2023-01-012023-12-310001125376us-gaap:ServiceMemberensg:MedicaidSkilledMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2023-01-012023-12-310001125376ensg:MedicaidSkilledMemberus-gaap:ServiceMember2022-01-012022-12-310001125376us-gaap:ServiceMemberensg:MedicaidSkilledMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2022-01-012022-12-310001125376ensg:MedicaidSkilledMemberus-gaap:ServiceMember2021-01-012021-12-310001125376us-gaap:ServiceMemberensg:MedicaidSkilledMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2021-01-012021-12-310001125376us-gaap:ServiceMemberensg:MedicaidAndMedicareMember2023-01-012023-12-310001125376us-gaap:ServiceMemberensg:MedicaidAndMedicareMember2022-01-012022-12-310001125376us-gaap:ServiceMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberensg:MedicaidAndMedicareMember2022-01-012022-12-310001125376us-gaap:ServiceMemberensg:MedicaidAndMedicareMember2021-01-012021-12-310001125376us-gaap:ServiceMemberensg:ManagedCareMember2023-01-012023-12-310001125376us-gaap:ServiceMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberensg:ManagedCareMember2023-01-012023-12-310001125376us-gaap:ServiceMemberensg:ManagedCareMember2022-01-012022-12-310001125376us-gaap:ServiceMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberensg:ManagedCareMember2022-01-012022-12-310001125376us-gaap:ServiceMemberensg:ManagedCareMember2021-01-012021-12-310001125376us-gaap:ServiceMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberensg:ManagedCareMember2021-01-012021-12-310001125376ensg:PrivatePayAndOtherMemberus-gaap:ServiceMember2023-01-012023-12-310001125376ensg:PrivatePayAndOtherMemberus-gaap:ServiceMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2023-01-012023-12-310001125376ensg:PrivatePayAndOtherMemberus-gaap:ServiceMember2022-01-012022-12-310001125376ensg:PrivatePayAndOtherMemberus-gaap:ServiceMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2022-01-012022-12-310001125376ensg:PrivatePayAndOtherMemberus-gaap:ServiceMember2021-01-012021-12-310001125376ensg:PrivatePayAndOtherMemberus-gaap:ServiceMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2021-01-012021-12-310001125376us-gaap:ServiceMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2023-01-012023-12-310001125376us-gaap:ServiceMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2022-01-012022-12-310001125376us-gaap:ServiceMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2021-01-012021-12-3100011253762020-01-012020-12-3100011253762021-03-012021-03-310001125376ensg:MedicaidMember2023-12-310001125376ensg:MedicaidMember2022-12-310001125376ensg:ManagedCareMember2023-12-310001125376ensg:ManagedCareMember2022-12-310001125376ensg:MedicareMember2023-12-310001125376ensg:MedicareMember2022-12-310001125376ensg:PrivatePayAndOtherMember2023-12-310001125376ensg:PrivatePayAndOtherMember2022-12-310001125376us-gaap:FairValueInputsLevel2Membersrt:SubsidiariesMember2023-12-310001125376us-gaap:FairValueInputsLevel2Membersrt:SubsidiariesMember2022-12-310001125376us-gaap:FairValueInputsLevel2Member2023-12-310001125376us-gaap:FairValueInputsLevel2Member2022-12-310001125376ensg:StandardBearerHealthcareREITIncMember2023-12-310001125376ensg:StandardBearerHealthcareREITIncMemberus-gaap:WhollyOwnedPropertiesMember2023-12-310001125376ensg:ThirdPartiesMemberensg:StandardBearerHealthcareREITIncMember2023-12-310001125376ensg:StandardBearerHealthcareREITIncMemberensg:OwnedPropertiesMember2023-01-012023-12-310001125376ensg:CampusOperationMemberensg:StandardBearerHealthcareREITIncMember2023-01-012023-12-310001125376ensg:StandardBearerHealthcareREITIncMemberus-gaap:SeriesOfIndividuallyImmaterialAssetAcquisitionsMember2023-01-012023-12-310001125376ensg:StandardBearerHealthcareREITIncMemberensg:OwnedPropertiesMember2022-01-012022-12-310001125376ensg:StandardBearerHealthcareREITIncMemberus-gaap:SeriesOfIndividuallyImmaterialAssetAcquisitionsMember2022-01-012022-12-310001125376ensg:SkilledNursingOperationsMemberensg:StandardBearerHealthcareREITIncMember2022-01-012022-12-31ensg:skilled_nursing_property00011253762022-01-012022-01-310001125376ensg:StandardBearerMasterLeasesMembersrt:MinimumMember2022-01-310001125376ensg:StandardBearerMasterLeasesMembersrt:MaximumMember2022-01-310001125376ensg:StandardBearerMasterLeasesMember2022-01-31ensg:renewal0001125376ensg:StandardBearerMasterLeasesMember2023-01-012023-12-310001125376ensg:StandardBearerMasterLeasesMember2022-01-012022-12-310001125376ensg:StandardBearerMasterLeasesMember2021-01-012021-12-310001125376ensg:StandardBearerMasterLeasesMemberus-gaap:ManagementServiceBaseMember2023-01-012023-12-310001125376ensg:StandardBearerMasterLeasesMemberus-gaap:ManagementServiceIncentiveMember2023-01-012023-12-310001125376ensg:ManagementServiceTotalMemberensg:StandardBearerMasterLeasesMember2023-01-012023-12-310001125376ensg:StandardBearerMasterLeasesMemberus-gaap:ManagementServiceBaseMember2022-01-012022-12-310001125376ensg:StandardBearerMasterLeasesMemberus-gaap:ManagementServiceBaseMember2021-01-012021-12-310001125376ensg:TruistBankMemberus-gaap:BaseRateMemberus-gaap:RevolvingCreditFacilityMembersrt:MinimumMember2022-04-082022-04-080001125376ensg:TruistBankMemberus-gaap:BaseRateMemberus-gaap:RevolvingCreditFacilityMembersrt:MaximumMember2022-04-082022-04-080001125376ensg:TruistBankMemberensg:SecuredOvernightFinancingRateSOFRMemberus-gaap:RevolvingCreditFacilityMembersrt:MinimumMember2022-04-082022-04-080001125376ensg:TruistBankMemberensg:SecuredOvernightFinancingRateSOFRMemberus-gaap:RevolvingCreditFacilityMembersrt:MaximumMember2022-04-082022-04-080001125376ensg:StandardBearerEquityPlanMember2022-01-012022-01-310001125376ensg:StandardBearerEquityPlanMember2022-01-012022-12-310001125376ensg:StandardBearerEquityPlanMember2023-01-012023-12-310001125376us-gaap:RestrictedStockMemberensg:StandardBearerEquityPlanMember2022-01-012022-12-310001125376us-gaap:RestrictedStockMemberensg:StandardBearerEquityPlanMember2023-01-012023-12-310001125376ensg:SkilledNursingOperationsMember2023-01-012023-12-310001125376ensg:CampusOperationMember2023-01-012023-12-310001125376ensg:SkilledNursingOperationsMember2023-12-310001125376ensg:SeniorLivingFacilitiesMember2023-12-310001125376ensg:SkilledNursingOperationsMemberus-gaap:SubsequentEventMember2024-01-012024-02-010001125376us-gaap:SubsequentEventMemberensg:SkilledNursingOperationsMember2024-02-010001125376ensg:SkilledNursingOperationsMember2022-01-012022-12-310001125376ensg:CampusOperationMember2022-01-012022-12-310001125376ensg:SeniorLivingFacilitiesMember2022-01-012022-12-310001125376ensg:SkilledNursingOperationsMember2022-12-310001125376ensg:SeniorLivingFacilitiesMember2022-12-310001125376us-gaap:SeriesOfIndividuallyImmaterialBusinessAcquisitionsMember2022-01-012022-12-310001125376ensg:SkilledNursingOperationsMember2021-01-012021-12-310001125376ensg:RealEstatePurchasesMember2021-01-012021-12-31ensg:business0001125376ensg:RealEstatePurchasesOfPreviousOperationsMember2021-01-012021-12-310001125376ensg:SkilledNursingOperationsMember2021-12-310001125376us-gaap:SeriesOfIndividuallyImmaterialBusinessAcquisitionsMember2021-01-012021-12-310001125376us-gaap:LandMemberensg:AcquiredOperationsMember2023-01-012023-12-310001125376us-gaap:LandMemberensg:AcquiredOperationsMember2022-01-012022-12-310001125376us-gaap:LandMemberensg:AcquiredOperationsMember2021-01-012021-12-310001125376ensg:AcquiredOperationsMemberus-gaap:BuildingAndBuildingImprovementsMember2023-01-012023-12-310001125376ensg:AcquiredOperationsMemberus-gaap:BuildingAndBuildingImprovementsMember2022-01-012022-12-310001125376ensg:AcquiredOperationsMemberus-gaap:BuildingAndBuildingImprovementsMember2021-01-012021-12-310001125376us-gaap:FurnitureAndFixturesMemberensg:AcquiredOperationsMember2023-01-012023-12-310001125376us-gaap:FurnitureAndFixturesMemberensg:AcquiredOperationsMember2022-01-012022-12-310001125376us-gaap:FurnitureAndFixturesMemberensg:AcquiredOperationsMember2021-01-012021-12-310001125376ensg:AssembledOccupancyAcquiredMemberensg:AcquiredOperationsMember2023-01-012023-12-310001125376ensg:AssembledOccupancyAcquiredMemberensg:AcquiredOperationsMember2022-01-012022-12-310001125376ensg:AssembledOccupancyAcquiredMemberensg:AcquiredOperationsMember2021-01-012021-12-310001125376ensg:AcquiredOperationsMember2023-01-012023-12-310001125376ensg:AcquiredOperationsMember2022-01-012022-12-310001125376ensg:AcquiredOperationsMember2021-01-012021-12-31ensg:segment0001125376us-gaap:OperatingSegmentsMemberus-gaap:ServiceMemberensg:SkilledServicesSegmentMember2023-01-012023-12-310001125376us-gaap:OperatingSegmentsMemberus-gaap:ServiceMemberensg:StandardBearerSegmentMember2023-01-012023-12-310001125376us-gaap:OperatingSegmentsMemberus-gaap:ServiceMemberus-gaap:AllOtherSegmentsMember2023-01-012023-12-310001125376srt:ConsolidationEliminationsMemberus-gaap:ServiceMember2023-01-012023-12-310001125376us-gaap:OperatingSegmentsMemberensg:RentalMemberensg:SkilledServicesSegmentMember2023-01-012023-12-310001125376us-gaap:OperatingSegmentsMemberensg:StandardBearerSegmentMemberensg:RentalMember2023-01-012023-12-310001125376us-gaap:OperatingSegmentsMemberensg:RentalMemberus-gaap:AllOtherSegmentsMember2023-01-012023-12-310001125376srt:ConsolidationEliminationsMemberensg:RentalMember2023-01-012023-12-310001125376us-gaap:OperatingSegmentsMemberensg:SkilledServicesSegmentMember2023-01-012023-12-310001125376us-gaap:OperatingSegmentsMemberensg:StandardBearerSegmentMember2023-01-012023-12-310001125376us-gaap:OperatingSegmentsMemberus-gaap:AllOtherSegmentsMember2023-01-012023-12-310001125376srt:ConsolidationEliminationsMember2023-01-012023-12-310001125376us-gaap:OperatingSegmentsMemberus-gaap:ServiceMemberensg:SkilledServicesSegmentMember2022-01-012022-12-310001125376us-gaap:OperatingSegmentsMemberus-gaap:ServiceMemberensg:StandardBearerSegmentMember2022-01-012022-12-310001125376us-gaap:OperatingSegmentsMemberus-gaap:ServiceMemberus-gaap:AllOtherSegmentsMember2022-01-012022-12-310001125376srt:ConsolidationEliminationsMemberus-gaap:ServiceMember2022-01-012022-12-310001125376us-gaap:OperatingSegmentsMemberensg:RentalMemberensg:SkilledServicesSegmentMember2022-01-012022-12-310001125376us-gaap:OperatingSegmentsMemberensg:StandardBearerSegmentMemberensg:RentalMember2022-01-012022-12-310001125376us-gaap:OperatingSegmentsMemberensg:RentalMemberus-gaap:AllOtherSegmentsMember2022-01-012022-12-310001125376srt:ConsolidationEliminationsMemberensg:RentalMember2022-01-012022-12-310001125376us-gaap:OperatingSegmentsMemberensg:SkilledServicesSegmentMember2022-01-012022-12-310001125376us-gaap:OperatingSegmentsMemberensg:StandardBearerSegmentMember2022-01-012022-12-310001125376us-gaap:OperatingSegmentsMemberus-gaap:AllOtherSegmentsMember2022-01-012022-12-310001125376srt:ConsolidationEliminationsMember2022-01-012022-12-310001125376us-gaap:OperatingSegmentsMemberus-gaap:ServiceMemberensg:SkilledServicesSegmentMember2021-01-012021-12-310001125376us-gaap:OperatingSegmentsMemberus-gaap:ServiceMemberensg:StandardBearerSegmentMember2021-01-012021-12-310001125376us-gaap:OperatingSegmentsMemberus-gaap:ServiceMemberus-gaap:AllOtherSegmentsMember2021-01-012021-12-310001125376srt:ConsolidationEliminationsMemberus-gaap:ServiceMember2021-01-012021-12-310001125376us-gaap:OperatingSegmentsMemberensg:RentalMemberensg:SkilledServicesSegmentMember2021-01-012021-12-310001125376us-gaap:OperatingSegmentsMemberensg:StandardBearerSegmentMemberensg:RentalMember2021-01-012021-12-310001125376us-gaap:OperatingSegmentsMemberensg:RentalMemberus-gaap:AllOtherSegmentsMember2021-01-012021-12-310001125376srt:ConsolidationEliminationsMemberensg:RentalMember2021-01-012021-12-310001125376us-gaap:OperatingSegmentsMemberensg:SkilledServicesSegmentMember2021-01-012021-12-310001125376us-gaap:OperatingSegmentsMemberensg:StandardBearerSegmentMember2021-01-012021-12-310001125376us-gaap:OperatingSegmentsMemberus-gaap:AllOtherSegmentsMember2021-01-012021-12-310001125376srt:ConsolidationEliminationsMember2021-01-012021-12-310001125376us-gaap:OperatingSegmentsMemberus-gaap:ServiceMemberensg:SkilledServicesSegmentMemberensg:MedicaidMember2023-01-012023-12-310001125376us-gaap:CorporateNonSegmentMemberus-gaap:ServiceMemberensg:MedicaidMember2023-01-012023-12-310001125376us-gaap:OperatingSegmentsMemberus-gaap:ServiceMemberensg:MedicareMemberensg:SkilledServicesSegmentMember2023-01-012023-12-310001125376us-gaap:CorporateNonSegmentMemberus-gaap:ServiceMemberensg:MedicareMember2023-01-012023-12-310001125376us-gaap:OperatingSegmentsMemberus-gaap:ServiceMemberensg:MedicaidSkilledMemberensg:SkilledServicesSegmentMember2023-01-012023-12-310001125376us-gaap:CorporateNonSegmentMemberus-gaap:ServiceMemberensg:MedicaidSkilledMember2023-01-012023-12-310001125376us-gaap:OperatingSegmentsMemberus-gaap:ServiceMemberensg:SkilledServicesSegmentMemberensg:MedicaidAndMedicareMember2023-01-012023-12-310001125376us-gaap:CorporateNonSegmentMemberus-gaap:ServiceMemberensg:MedicaidAndMedicareMember2023-01-012023-12-310001125376us-gaap:OperatingSegmentsMemberus-gaap:ServiceMemberensg:SkilledServicesSegmentMemberensg:ManagedCareMember2023-01-012023-12-310001125376us-gaap:CorporateNonSegmentMemberus-gaap:ServiceMemberensg:ManagedCareMember2023-01-012023-12-310001125376ensg:PrivatePayAndOtherMemberus-gaap:OperatingSegmentsMemberus-gaap:ServiceMemberensg:SkilledServicesSegmentMember2023-01-012023-12-310001125376ensg:PrivatePayAndOtherMemberus-gaap:CorporateNonSegmentMemberus-gaap:ServiceMember2023-01-012023-12-310001125376us-gaap:CorporateNonSegmentMemberus-gaap:ServiceMember2023-01-012023-12-310001125376us-gaap:OperatingSegmentsMemberus-gaap:ServiceMemberensg:SkilledServicesSegmentMemberensg:MedicaidMember2022-01-012022-12-310001125376us-gaap:CorporateNonSegmentMemberus-gaap:ServiceMemberensg:MedicaidMember2022-01-012022-12-310001125376us-gaap:OperatingSegmentsMemberus-gaap:ServiceMemberensg:MedicareMemberensg:SkilledServicesSegmentMember2022-01-012022-12-310001125376us-gaap:CorporateNonSegmentMemberus-gaap:ServiceMemberensg:MedicareMember2022-01-012022-12-310001125376us-gaap:OperatingSegmentsMemberus-gaap:ServiceMemberensg:MedicaidSkilledMemberensg:SkilledServicesSegmentMember2022-01-012022-12-310001125376us-gaap:CorporateNonSegmentMemberus-gaap:ServiceMemberensg:MedicaidSkilledMember2022-01-012022-12-310001125376us-gaap:OperatingSegmentsMemberus-gaap:ServiceMemberensg:SkilledServicesSegmentMemberensg:MedicaidAndMedicareMember2022-01-012022-12-310001125376us-gaap:CorporateNonSegmentMemberus-gaap:ServiceMemberensg:MedicaidAndMedicareMember2022-01-012022-12-310001125376us-gaap:OperatingSegmentsMemberus-gaap:ServiceMemberensg:SkilledServicesSegmentMemberensg:ManagedCareMember2022-01-012022-12-310001125376us-gaap:CorporateNonSegmentMemberus-gaap:ServiceMemberensg:ManagedCareMember2022-01-012022-12-310001125376ensg:PrivatePayAndOtherMemberus-gaap:OperatingSegmentsMemberus-gaap:ServiceMemberensg:SkilledServicesSegmentMember2022-01-012022-12-310001125376ensg:PrivatePayAndOtherMemberus-gaap:CorporateNonSegmentMemberus-gaap:ServiceMember2022-01-012022-12-310001125376us-gaap:CorporateNonSegmentMemberus-gaap:ServiceMember2022-01-012022-12-310001125376us-gaap:OperatingSegmentsMemberus-gaap:ServiceMemberensg:SkilledServicesSegmentMemberensg:MedicaidMember2021-01-012021-12-310001125376us-gaap:CorporateNonSegmentMemberus-gaap:ServiceMemberensg:MedicaidMember2021-01-012021-12-310001125376us-gaap:OperatingSegmentsMemberus-gaap:ServiceMemberensg:MedicareMemberensg:SkilledServicesSegmentMember2021-01-012021-12-310001125376us-gaap:CorporateNonSegmentMemberus-gaap:ServiceMemberensg:MedicareMember2021-01-012021-12-310001125376us-gaap:OperatingSegmentsMemberus-gaap:ServiceMemberensg:MedicaidSkilledMemberensg:SkilledServicesSegmentMember2021-01-012021-12-310001125376us-gaap:CorporateNonSegmentMemberus-gaap:ServiceMemberensg:MedicaidSkilledMember2021-01-012021-12-310001125376us-gaap:OperatingSegmentsMemberus-gaap:ServiceMemberensg:SkilledServicesSegmentMemberensg:MedicaidAndMedicareMember2021-01-012021-12-310001125376us-gaap:CorporateNonSegmentMemberus-gaap:ServiceMemberensg:MedicaidAndMedicareMember2021-01-012021-12-310001125376us-gaap:OperatingSegmentsMemberus-gaap:ServiceMemberensg:SkilledServicesSegmentMemberensg:ManagedCareMember2021-01-012021-12-310001125376us-gaap:CorporateNonSegmentMemberus-gaap:ServiceMemberensg:ManagedCareMember2021-01-012021-12-310001125376ensg:PrivatePayAndOtherMemberus-gaap:OperatingSegmentsMemberus-gaap:ServiceMemberensg:SkilledServicesSegmentMember2021-01-012021-12-310001125376ensg:PrivatePayAndOtherMemberus-gaap:CorporateNonSegmentMemberus-gaap:ServiceMember2021-01-012021-12-310001125376us-gaap:CorporateNonSegmentMemberus-gaap:ServiceMember2021-01-012021-12-310001125376us-gaap:LandMember2023-12-310001125376us-gaap:LandMember2022-12-310001125376us-gaap:BuildingAndBuildingImprovementsMember2023-12-310001125376us-gaap:BuildingAndBuildingImprovementsMember2022-12-310001125376us-gaap:LeaseholdImprovementsMember2023-12-310001125376us-gaap:LeaseholdImprovementsMember2022-12-310001125376us-gaap:EquipmentMember2023-12-310001125376us-gaap:EquipmentMember2022-12-310001125376us-gaap:FurnitureAndFixturesMember2023-12-310001125376us-gaap:FurnitureAndFixturesMember2022-12-310001125376us-gaap:ConstructionInProgressMember2023-12-310001125376us-gaap:ConstructionInProgressMember2022-12-310001125376us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberensg:SeniorLivingOperationsMember2022-01-012022-12-310001125376ensg:AssembledOccupancyAcquiredMember2023-01-012023-12-310001125376ensg:AssembledOccupancyAcquiredMember2023-12-310001125376ensg:AssembledOccupancyAcquiredMember2022-12-310001125376us-gaap:TradeNamesMember2023-01-012023-12-310001125376us-gaap:TradeNamesMember2022-12-310001125376us-gaap:CustomerRelationshipsMember2023-01-012023-12-310001125376us-gaap:CustomerRelationshipsMember2022-12-310001125376ensg:DepreciationAndAmortizationMember2023-01-012023-12-310001125376ensg:DepreciationAndAmortizationMember2022-01-012022-12-310001125376ensg:DepreciationAndAmortizationMember2021-01-012021-12-310001125376us-gaap:TradeNamesMember2023-12-310001125376us-gaap:TradeNamesMember2022-12-310001125376ensg:MedicareandMedicaidLicensesMember2023-12-310001125376ensg:MedicareandMedicaidLicensesMember2022-12-310001125376ensg:MedicareandMedicaidLicensesMember2023-01-012023-12-310001125376ensg:MedicareandMedicaidLicensesMember2022-01-012022-12-310001125376ensg:MedicareandMedicaidLicensesMember2021-01-012021-12-310001125376us-gaap:OperatingSegmentsMemberensg:SkilledServicesSegmentMember2020-12-310001125376us-gaap:CorporateNonSegmentMember2020-12-310001125376us-gaap:CorporateNonSegmentMember2021-01-012021-12-310001125376us-gaap:OperatingSegmentsMemberensg:SkilledServicesSegmentMember2021-12-310001125376us-gaap:CorporateNonSegmentMember2021-12-310001125376us-gaap:CorporateNonSegmentMember2022-01-012022-12-310001125376us-gaap:OperatingSegmentsMemberensg:SkilledServicesSegmentMember2022-12-310001125376us-gaap:CorporateNonSegmentMember2022-12-310001125376us-gaap:OperatingSegmentsMemberensg:SkilledServicesSegmentMember2023-12-310001125376us-gaap:CorporateNonSegmentMember2023-12-310001125376us-gaap:CollateralizedDebtObligationsMember2023-12-310001125376us-gaap:CollateralizedDebtObligationsMember2022-12-310001125376ensg:TruistBankMemberus-gaap:RevolvingCreditFacilityMember2023-12-310001125376ensg:TruistBankMemberus-gaap:RevolvingCreditFacilityMembersrt:MinimumMember2022-04-082022-04-080001125376ensg:TruistBankMemberus-gaap:RevolvingCreditFacilityMembersrt:MaximumMember2022-04-082022-04-080001125376ensg:TruistBankMemberus-gaap:RevolvingCreditFacilityMember2022-04-080001125376ensg:HUDInsuredMortgagesMemberensg:TwentyThreeSubsidiariesMemberus-gaap:CollateralizedDebtObligationsMember2023-12-31ensg:subsidiary0001125376ensg:HUDInsuredMortgagesMemberus-gaap:CollateralizedDebtObligationsMembersrt:MinimumMember2023-12-310001125376ensg:HUDInsuredMortgagesMemberus-gaap:CollateralizedDebtObligationsMembersrt:MaximumMember2023-12-310001125376ensg:HUDInsuredMortgagesMemberus-gaap:CollateralizedDebtObligationsMemberensg:FirstThreeYearsMember2023-12-310001125376ensg:HUDInsuredMortgagesMemberensg:InTheFourthYearMemberus-gaap:CollateralizedDebtObligationsMember2023-12-310001125376ensg:HUDInsuredMortgagesMemberus-gaap:CollateralizedDebtObligationsMemberensg:YearsFiveThroughTenMember2023-12-310001125376ensg:HUDInsuredMortgagesMemberus-gaap:CollateralizedDebtObligationsMemberensg:AfterYearTenMember2023-12-310001125376ensg:HUDInsuredMortgagesMemberus-gaap:CollateralizedDebtObligationsMembersrt:MinimumMember2023-01-012023-12-310001125376ensg:HUDInsuredMortgagesMemberus-gaap:CollateralizedDebtObligationsMembersrt:MaximumMember2023-01-012023-12-310001125376ensg:A53PromissoryNoteMemberus-gaap:CollateralizedDebtObligationsMember2023-12-310001125376ensg:A53PromissoryNoteMemberus-gaap:CollateralizedDebtObligationsMember2023-01-012023-12-310001125376us-gaap:LetterOfCreditMember2023-01-012023-12-31ensg:plan0001125376ensg:A2022PlanMember2023-12-310001125376ensg:A2022PlanMember2023-01-012023-12-310001125376ensg:A2022PlanMemberus-gaap:ShareBasedPaymentArrangementNonemployeeMember2023-01-012023-12-31ensg:installment0001125376ensg:ExercisePriceRangeTwoMember2023-01-012023-12-310001125376ensg:ExercisePriceRangeTwoMember2023-12-310001125376ensg:ExercisePriceRangeThreeMember2023-01-012023-12-310001125376ensg:ExercisePriceRangeThreeMember2023-12-310001125376ensg:ExercisePriceRangeFourMember2023-01-012023-12-310001125376ensg:ExercisePriceRangeFourMember2023-12-310001125376ensg:ExercisePriceRangeFiveMember2023-01-012023-12-310001125376ensg:ExercisePriceRangeFiveMember2023-12-310001125376ensg:ExercisePriceRangeSixMember2023-01-012023-12-310001125376ensg:ExercisePriceRangeSixMember2023-12-310001125376ensg:ExercisePriceRangeSevenMember2023-01-012023-12-310001125376ensg:ExercisePriceRangeSevenMember2023-12-310001125376ensg:ExercisePriceRangeEightMember2023-01-012023-12-310001125376ensg:ExercisePriceRangeEightMember2023-12-310001125376ensg:ExercisePriceRangeNineMember2023-01-012023-12-310001125376ensg:ExercisePriceRangeNineMember2023-12-310001125376ensg:ExercisePriceRangeTenMember2023-01-012023-12-310001125376ensg:ExercisePriceRangeTenMember2023-12-310001125376ensg:ExercisePriceRangeElevenMember2023-01-012023-12-310001125376ensg:ExercisePriceRangeElevenMember2023-12-310001125376us-gaap:EmployeeStockOptionMember2023-01-012023-12-310001125376us-gaap:EmployeeStockOptionMember2022-01-012022-12-310001125376us-gaap:EmployeeStockOptionMember2021-01-012021-12-310001125376us-gaap:RestrictedStockMember2023-01-012023-12-310001125376us-gaap:RestrictedStockMember2022-01-012022-12-310001125376us-gaap:RestrictedStockMember2021-01-012021-12-310001125376us-gaap:RestrictedStockMembersrt:MinimumMember2023-01-012023-12-310001125376us-gaap:RestrictedStockMembersrt:MaximumMember2023-01-012023-12-310001125376us-gaap:RestrictedStockMembersrt:MinimumMember2022-01-012022-12-310001125376us-gaap:RestrictedStockMembersrt:MaximumMember2022-01-012022-12-310001125376us-gaap:RestrictedStockMembersrt:MinimumMember2021-01-012021-12-310001125376us-gaap:RestrictedStockMembersrt:MaximumMember2021-01-012021-12-310001125376us-gaap:RestrictedStockMember2020-12-310001125376us-gaap:RestrictedStockMember2021-12-310001125376us-gaap:RestrictedStockMember2022-12-310001125376us-gaap:RestrictedStockMember2023-12-310001125376us-gaap:RestrictedStockMemberus-gaap:ShareBasedPaymentArrangementNonemployeeMember2023-01-012023-12-310001125376us-gaap:RestrictedStockMemberus-gaap:ShareBasedPaymentArrangementNonemployeeMembersrt:MinimumMember2023-01-012023-12-310001125376us-gaap:RestrictedStockMemberus-gaap:ShareBasedPaymentArrangementNonemployeeMembersrt:MaximumMember2023-01-012023-12-310001125376ensg:A2019LTIPlanMemberus-gaap:SpinoffMember2019-08-270001125376ensg:A2019LTIPlanMemberus-gaap:SpinoffMember2019-08-272019-08-270001125376ensg:A2019LTIPlanMemberus-gaap:SpinoffMember2023-01-012023-12-310001125376ensg:A2019LTIPlanMemberus-gaap:SpinoffMember2022-01-012022-12-310001125376ensg:A2019LTIPlanMemberus-gaap:SpinoffMember2021-01-012021-12-310001125376ensg:StockAwardsMember2023-01-012023-12-310001125376ensg:StockAwardsMember2022-01-012022-12-310001125376ensg:StockAwardsMember2021-01-012021-12-310001125376us-gaap:EmployeeStockOptionMember2023-12-310001125376ensg:CareTrustREITMember2023-12-310001125376ensg:CareTrustREITMemberensg:TripleNetLeaseArrangementsMember2023-12-31ensg:agreement0001125376ensg:CareTrustREITMemberensg:TripleNetLeaseArrangementsMembersrt:MinimumMember2023-12-310001125376ensg:CareTrustREITMemberensg:TripleNetLeaseArrangementsMembersrt:MaximumMember2023-12-310001125376ensg:CareTrustREITMemberensg:PurchaseOptionMember2023-12-310001125376ensg:CareTrustREITMember2023-01-012023-12-310001125376ensg:CareTrustREITMember2022-01-012022-12-310001125376ensg:CareTrustREITMember2021-01-012021-12-310001125376ensg:VariousLandlordsMembersrt:MinimumMember2023-12-310001125376ensg:VariousLandlordsMembersrt:MaximumMember2023-12-310001125376ensg:VariousLandlordsMemberus-gaap:EquipmentMembersrt:MinimumMember2023-12-310001125376ensg:VariousLandlordsMemberus-gaap:EquipmentMembersrt:MaximumMember2023-12-310001125376ensg:CostofSalesandGeneralandAdministrativeExpenseMember2023-01-012023-12-310001125376ensg:CostofSalesandGeneralandAdministrativeExpenseMember2022-01-012022-12-310001125376ensg:CostofSalesandGeneralandAdministrativeExpenseMember2021-01-012021-12-310001125376ensg:VariousLandlordsMember2023-12-310001125376ensg:AmendedMasterLeaseAgreementMember2023-12-310001125376ensg:SkilledNursingOperationsMemberensg:NewMasterLeaseAgreeementMember2023-01-012023-12-310001125376ensg:SkilledNursingOperationsMemberensg:AmendedMasterLeaseMember2023-01-012023-12-310001125376ensg:SubleaseOfStandAlongSkilledNursingOperationsMember2023-01-012023-12-310001125376ensg:NewMasterLeaseAgreeementMember2023-01-012023-12-310001125376ensg:SubleaseOfStandAlongSkilledNursingOperationsMember2023-12-310001125376ensg:SubleaseOfStandAlongSkilledNursingOperationsMember2022-12-310001125376ensg:SubleaseOfStandAlongSkilledNursingOperationsMember2021-12-310001125376us-gaap:CostOfSalesMember2023-01-012023-12-310001125376us-gaap:CostOfSalesMember2022-01-012022-12-310001125376us-gaap:CostOfSalesMember2021-01-012021-12-310001125376us-gaap:GeneralAndAdministrativeExpenseMember2023-01-012023-12-310001125376us-gaap:GeneralAndAdministrativeExpenseMember2022-01-012022-12-310001125376us-gaap:GeneralAndAdministrativeExpenseMember2021-01-012021-12-310001125376ensg:SkilledNursingOperationsMemberus-gaap:SubsequentEventMemberensg:AmendedMasterLeaseAgreementMember2024-01-012024-02-010001125376ensg:SkilledNursingOperationsMemberus-gaap:SubsequentEventMemberensg:AmendedMasterLeaseAgreementMember2024-02-010001125376ensg:LeasesToThirdPartyOperatorsMemberensg:ThePennantGroupInc.Member2023-01-012023-12-310001125376ensg:LeasesToThirdPartyOperatorsMembersrt:MinimumMember2023-12-310001125376ensg:LeasesToThirdPartyOperatorsMembersrt:MaximumMember2023-12-310001125376ensg:LeaseOfCampusOperationMember2023-01-012023-12-310001125376ensg:LeaseOfCampusOperationMember2023-12-310001125376ensg:LeasesToThirdPartyOperatorsMemberensg:ThePennantGroupInc.Member2022-01-012022-12-310001125376ensg:LeasesToThirdPartyOperatorsMemberensg:ThePennantGroupInc.Member2021-01-012021-12-310001125376ensg:LeasesToThirdPartyOperatorsMemberensg:ThirdPartyTenantsMember2023-01-012023-12-310001125376ensg:LeasesToThirdPartyOperatorsMemberensg:ThirdPartyTenantsMember2022-01-012022-12-310001125376ensg:LeasesToThirdPartyOperatorsMemberensg:ThirdPartyTenantsMember2021-01-012021-12-310001125376ensg:LeasesToThirdPartyOperatorsMember2023-01-012023-12-310001125376ensg:LeasesToThirdPartyOperatorsMember2022-01-012022-12-310001125376ensg:LeasesToThirdPartyOperatorsMember2021-01-012021-12-310001125376us-gaap:QualifiedPlanMember2023-01-012023-12-310001125376us-gaap:QualifiedPlanMember2022-01-012022-12-310001125376us-gaap:QualifiedPlanMember2021-01-012021-12-310001125376us-gaap:NonqualifiedPlanMember2023-01-012023-12-310001125376us-gaap:ProfessionalMalpracticeLiabilityMember2023-12-310001125376us-gaap:ProfessionalMalpracticeLiabilityMember2022-12-310001125376us-gaap:SubsequentEventMember2024-01-192024-01-190001125376us-gaap:SubsequentEventMember2024-02-010001125376us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMemberensg:MedicaidAndMedicareMember2023-01-012023-12-310001125376us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMemberensg:MedicaidAndMedicareMember2022-01-012022-12-310001125376us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberensg:MedicaidAndMedicareMember2023-01-012023-12-310001125376us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberensg:MedicaidAndMedicareMember2021-01-012021-12-310001125376ensg:August2023RepurchaseProgramMember2023-08-290001125376ensg:August2023RepurchaseProgramMember2023-08-292023-08-290001125376ensg:July2022RepurchaseProgramMember2022-07-280001125376ensg:July2022RepurchaseProgramMember2022-07-282022-07-2800011253762023-10-012023-12-310001125376ensg:ChristopherRChristensenMember2023-10-012023-12-310001125376ensg:ChristopherRChristensenMember2023-01-012023-12-310001125376ensg:ChristopherRChristensenMember2023-12-310001125376ensg:BeverlyBWittekindMember2023-10-012023-12-310001125376ensg:BeverlyBWittekindMember2023-01-012023-12-310001125376ensg:BeverlyBWittekindMember2023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________

FORM 10-K

| | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934. |

| |

For the fiscal year ended December 31, 2023.

OR | | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934. |

| For the transition period from to . |

Commission file number: 001-33757

_____________________________

THE ENSIGN GROUP, INC.

(Exact Name of Registrant as Specified in Its Charter)

| | | | | |

| Delaware | 33-0861263 |

| (State or Other Jurisdiction of | (I.R.S. Employer |

| Incorporation or Organization) | Identification No.) |

29222 Rancho Viejo Road, Suite 127

San Juan Capistrano, CA 92675

(Address of Principal Executive Offices and Zip Code)

(949) 487-9500

(Registrant’s Telephone Number, Including Area Code)

_____________________________

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.001 per share | ENSG | NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act:

None

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Indicate by check mark: | | | | | |

| if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. | þ | Yes | ☐ | No | |

| if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. | ☐ | Yes | þ | No | |

| whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. | þ | Yes | ☐ | No | |

| whether the registrant has submitted electronically, every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). | þ | Yes | ☐ | No | |

| whether the registrant is a large accelerated filer, an accelerated filer, non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act: | | | | | |

| Large accelerated filer | þ | Accelerated filer | ☐ | Non-accelerated filer | ☐ | Smaller reporting company | ☐ | Emerging growth company | ☐ | | | | | |

| If an emerging growth company, indicate if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ | Yes | ☐ | No | |

| whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section-404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. | ☑ | Yes | ☐ | No | |

| If securities are registered pursuant to Section 12(b) of the Act, whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. | ☐ | Yes | þ | No | |

| whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). | ☐ | Yes | þ | No | |

| whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). | ☐ | Yes | þ | No | |

| | | | |

| | | | |

| As of June 30, 2023, the aggregate market value of the Registrant's Common Stock held by non-affiliates was: | |

| Common Stock | $3,156,373,000 | |

The aggregate market value of Common Stock was computed by reference to the closing price as of the last business day of the registrant's most recently completed second fiscal quarter. Shares of Common Stock held by each executive officer, director and each person owning more than 10% of the outstanding Common Stock of the registrant have been excluded (in the amount of $2,014,396,000) in that such persons may be deemed to be affiliates of the registrant. This determination of affiliate status is not necessarily a conclusive determination for other purposes. | | | | |

As of January 29, 2024, 56,665,741 shares of the registrant’s common stock, $0.001 par value, were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE:

Part III of this Form 10-K incorporates information by reference from the Registrant's definitive proxy statement for the Registrant's 2024 Annual Meeting of Stockholders to be filed within 120 days after the close of the fiscal year covered by this annual report.

THE ENSIGN GROUP, INC.

INDEX TO ANNUAL REPORT ON FORM 10-K

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2023

TABLE OF CONTENTS

| | | | | | | | | | | |

| PART I |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| PART II. |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| PART III. |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| PART IV. |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| | |

| | |

| | |

| | | |

| | | |

| | |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements, which include, but are not limited to our expected future financial position, results of operations, cash flows, financing plans, business strategy, budgets, capital expenditures, competitive positions, growth opportunities and plans and objectives of management. Forward-looking statements can often be identified by words such as “anticipates,” “expects,” “intends,” “plans,” “predicts,” “believes,” “seeks,” “estimates,” “may,” “will,” “should,” “would,” “could,” “potential,” “continue,” “ongoing,” similar expressions, and variations or negatives of these words. These statements are subject to the safe harbors under Private Securities Litigation Reform Act of 1995. These statements are not guarantees of future performance and are subject to risks, uncertainties and assumptions that are difficult to predict. Therefore, our actual results could differ materially and adversely from those expressed in any forward-looking statements as a result of various factors, some of which are listed under the section “Risk Factors” in Part I, Item 1A of this Annual Report on Form 10-K. Accordingly, you should not rely upon forward-looking statements as predictions of future events. These forward-looking statements speak only as of the date of this Annual Report, and are based on our current expectations, estimates and projections about our industry and business, management's beliefs, and certain assumptions made by us, all of which are subject to change. We undertake no obligation to revise or update publicly any forward-looking statement for any reason, except as otherwise required by law.

As used in this Annual Report on Form 10-K, the words, "Ensign," "Company," “we,” “our” and “us” refer to The Ensign Group, Inc. and its consolidated subsidiaries. All of our independent subsidiaries, the Service Center (defined below) and our wholly-owned captive insurance subsidiary (the Captive Insurance) and captive real estate investment trust called Standard Bearer Healthcare REIT, Inc. (Standard Bearer) are operated by separate, wholly-owned, independent subsidiaries that have their own management, employees and assets. References herein to the consolidated “Company” and “its” assets and activities, as well as the use of the terms “we,” “us,” “our” and similar terms in this Annual Report on Form 10-K are not meant to imply, nor should it be construed as meaning, that The Ensign Group, Inc. has direct operating assets, employees or revenue, or that any of the subsidiaries are operated by The Ensign Group.

The Ensign Group, Inc. is a holding company with no direct operating assets, employees or revenues. In addition, certain of our wholly-owned independent subsidiaries, collectively referred to as the Service Center, provide centralized accounting, payroll, human resources, information technology, legal, risk management and other centralized services to the other independent subsidiaries through contractual relationships with such subsidiaries. The Captive Insurance provides some claims-made coverage to our independent subsidiaries for general and professional liability, as well as for certain workers' compensation insurance liabilities. Standard Bearer owns and manages our real estate business.

The Service Center address is 29222 Rancho Viejo Rd Suite 127, San Juan Capistrano, CA 92675, and our telephone number is (949) 487-9500. Our corporate website is located at www.ensigngroup.net. The information contained in, or that can be accessed through, our website does not constitute a part of this Annual Report on Form 10-K.

EnsignTM is our United States trademark. All other trademarks and trade names appearing in this annual report are the property of their respective owners.

PART I.

ITEM 1. BUSINESS

Founded in 1999, The Ensign Group, Inc. ("Ensign") is a holding company with independent subsidiaries that provide skilled nursing, senior living and rehabilitative services, as well as other ancillary businesses (including mobile diagnostics and medical transportation), in 13 states. As part of our investment strategy, we also acquire, lease and own healthcare real estate to service the post-acute care continuum through acquisition and investment opportunities in healthcare properties. For the year ended December 31, 2023, we generated approximately 96.0% of our revenue from our skilled nursing facilities. The remainder of our revenue is primarily generated from our real estate properties, senior living services and other ancillary services.

OPERATIONS

Overview

As of December 31, 2023, we offered skilled nursing, senior living and rehabilitative care services through 297 skilled nursing and senior living facilities. Of the 297 facilities, we operated 214 facilities under long-term lease arrangements and have options to purchase 11 of those 214 facilities. Our real estate portfolio includes 113 owned real estate properties, which included 83 facilities operated and managed by us, 30 operations leased to and operated by third-party operators, and the Service Center's California location. Of the 30 real estate operations leased to third-party operators, one senior living facility is located on the same real estate property as a skilled nursing facility that we own and operate.

Our Unique Approach and Structure

The name "Ensign" is synonymous with a "flag" or a "standard" and refers to our goal of setting the standard by which all others in our industry are measured. We believe that through our efforts and leadership, we can foster a new level of patient care and professional competence at our independent subsidiaries, and set a new industry standard for each patient we service. We view healthcare services primarily as a local business. We believe our success is largely driven by our proven ability to build strong relationships with key stakeholders in local healthcare communities, in part, by leveraging our reputation for providing superior care. Accordingly, our brand strategy and organizational structure promotes the empowerment of local leadership and staff to make their facility the “operation of choice” in their community. This is accomplished by allowing local leadership to discern and address the unique needs and priorities of healthcare professionals, customers and other stakeholders in the local community or market, and then work to create a superior service offering for, and reputation in, their particular community. This local empowerment is unique within the healthcare services industry.

We believe that our localized approach encourages prospective patients and referral sources to choose or recommend our local operations. In addition, our leaders are enabled and motivated to share real-time operating data and otherwise benchmark clinical and operational performance against their peers in order to improve clinical care, enhance patient satisfaction and augment operational efficiencies, promoting the sharing of best practices.

We organize our independent subsidiaries into portfolio companies, which we believe has enabled us to maintain a local, field-driven organizational structure, attract additional qualified leadership talent, and to identify, acquire, and improve operations at a generally faster rate. Each of our portfolio companies has its own leader. These leaders, who are generally taken from the ranks of operational CEOs, serve as leadership resources within their own portfolio companies, and have the primary responsibility for recruiting qualified talent, finding potential acquisition targets, and identifying other internal and external growth opportunities. We believe this organizational structure has improved the quality of our recruiting and will continue to facilitate successful acquisitions.

Since we spun-off our owned real estate properties into a public real estate investment trust (REIT) in 2014, we have continued to expand our real estate portfolio. Following the real estate spin-off, we have acquired and currently own 113 real estate properties, including 30 real estate properties that are leased to a third parties under triple-net long-term leases. We manage and operate the remaining real estate properties, including the Service Center's California location. We are committed to growing our real estate portfolio, which we believe will further enhance our earnings and maximize long-term shareholder value.

To continue with our growth strategy on our real estate portfolio, in January 2022, we formed Standard Bearer. Standard Bearer owns and manages our real estate business. The REIT structure allows us to better demonstrate the growing value of our owned real estate and provide us with an efficient vehicle for future acquisitions of properties that could be operated by our independent subsidiaries or other third parties. We believe this structure gives us new pathways to growth with transactions we would not have considered in the past. Standard Bearer elected to be taxed as a REIT, for U.S. federal income tax purposes, commencing with its taxable year ended December 31, 2022. The real estate portfolio in Standard Bearer consists of 108 of our 113 owned real estate properties. During the year ended December 31, 2023, Standard Bearer acquired the real estate of three stand-alone skilled nursing facilities and two campus operations. Of these additions, the three skilled nursing facilities and one campus operation acquired are operated by the Company's independent subsidiaries. The remaining campus operation is leased to a third-party operator. For further details on the Standard Bearer REIT, refer to Note 6, Standard Bearer, in Notes to the Consolidated Financial Statements of this Annual Report on Form 10-K.

SEGMENTS

We have two reportable segments: (1) skilled services, which includes the operation of skilled nursing facilities and rehabilitation therapy services and (2) Standard Bearer, which is comprised of select properties owned by us through our captive REIT and leased to skilled nursing and senior living operations, including our own independent subsidiaries and third-party operators.

We also report an “all other” category that includes operating results from our senior living operations, mobile diagnostics, transportation, other real estate and other ancillary operations. These businesses are neither significant individually, nor in aggregate, and therefore do not constitute a reportable segment. Our Chief Executive Officer, who is our chief operating decision maker, or CODM, reviews financial information at the operating segment level. We have presented our segment results in this Annual Report on Form 10-K on a comparative basis to conform to the segment structure. For more information about our operating segments, as well as financial information, see Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations and Note 8, Business Segments of the Notes to the Consolidated Financial Statements.

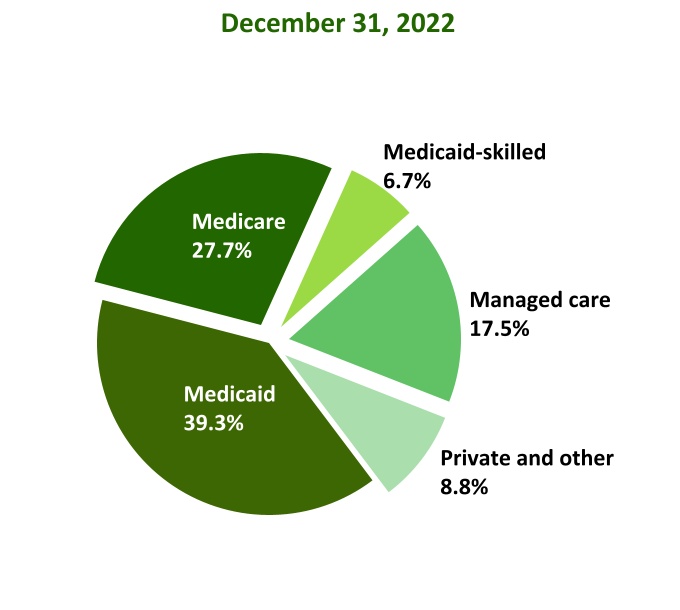

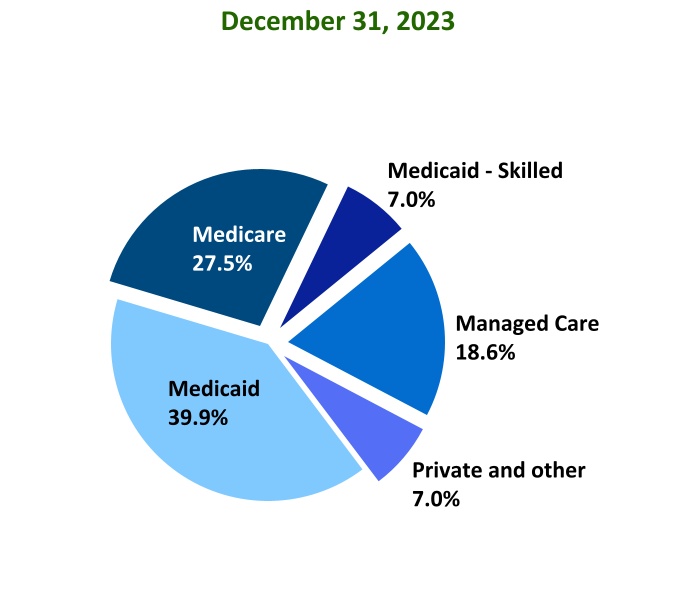

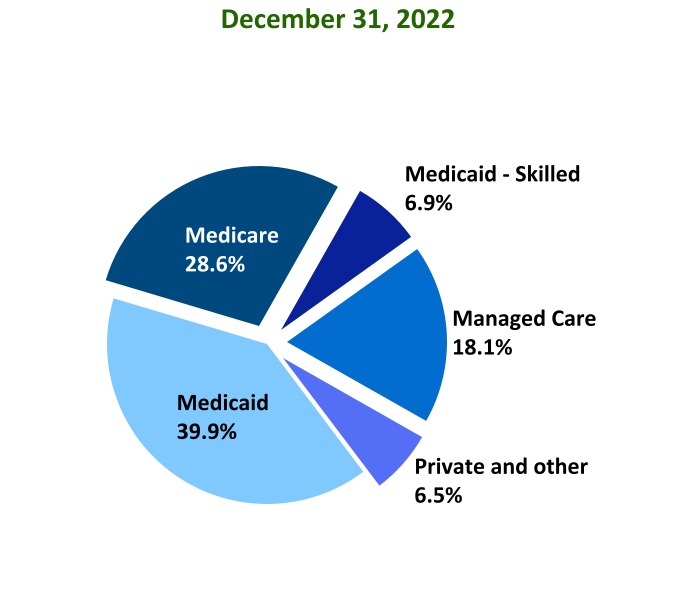

Skilled Services

As of December 31, 2023, our skilled nursing companies provided skilled nursing care at 286 operations, with 30,602 operational beds, in Arizona, California, Colorado, Idaho, Iowa, Kansas, Nebraska, Nevada, South Carolina, Texas, Utah, Washington and Wisconsin. We provide short and long-term nursing care services for patients with chronic conditions, prolonged illness, and the elderly. Our residents are often high-acuity patients that come to our facilities to recover from strokes, cardiovascular and respiratory conditions, neurological conditions, joint replacements, and other muscular or skeletal disorders. We use interdisciplinary teams of experienced medical professionals to provide services prescribed by physicians. These medical professionals provide individualized comprehensive nursing care to our short-stay and long-stay patients. Many of our skilled nursing facilities are equipped to provide specialty care, such as on-site dialysis, ventilator care, cardiac and pulmonary management. We also provide standard services such as room and board, special nutritional programs, social services, recreational activities, entertainment, and other services. We are dedicated to ensuring our residents are happy, comfortable, and motivated to achieve their health goals through the provision of quality care. We generate our skilled services revenue from Medicaid, Medicare, managed care, commercial insurance, and private pay. During the year ended December 31, 2023, approximately 46.9% and 27.5% of our skilled services revenue was derived from Medicaid and Medicare programs, respectively.

Standard Bearer

We engage in the acquisition and leasing of skilled nursing and senior living properties. We generate rental revenue primarily by leasing post-acute care properties we acquired to healthcare operators under triple-net lease arrangements, whereby the tenant is solely responsible for the costs related to the property, including property taxes, insurance and maintenance and repair costs, subject to certain exceptions. As of December 31, 2023, our real estate portfolio within Standard Bearer is comprised of 108 real estate properties located in Arizona, California, Colorado, Idaho, Kansas, Nevada, South Carolina, Texas, Utah, Washington and Wisconsin. Of these properties, 79 are leased to our independent subsidiaries and 30 are leased to operations wholly-owned and managed by third-party operators. Of the 30 real estate operations leased to third-party operators, one senior living operation is located on the same real estate property as a skilled nursing facility that we own and operate. During the year ended December 31, 2023, we generated rental revenues of $82.5 million, of which $66.7 million was derived from our independent subsidiaries, and therefore eliminated in consolidation.

Other

Revenue from our senior living operations, mobile diagnostics, transportation, other real estate and other ancillary operations comprise approximately 4.2% of our annual revenue.

Senior Living — As of December 31, 2023, we had an aggregate of 3,121 senior living units across 38 operations, of which 27 were located on the same site location as our skilled nursing care operations. Our senior living communities located in Arizona, California, Colorado, Idaho, Iowa, Kansas, Nebraska, Texas, Utah and Washington, provide residential accommodations, activities, meals, housekeeping and assistance in the activities of daily living to seniors who are independent or who require some support, but not the level of nursing care provided in a skilled nursing operation. Our independent living units are non-licensed independent living apartments in which residents are independent and require no support with the activities of daily living.

Our senior living operations comprise approximately 2.0% of our annual revenue. We generate revenue at these units primarily from private pay sources, with a small portion derived from Medicaid or other state-specific programs. Specifically, during the year ended December 31, 2023, approximately 60.7% of our senior living revenue was derived from private pay sources.

Ancillary — As of December 31, 2023, we held a majority membership interest of ancillary operations located in Arizona, California, Colorado, Idaho, Texas, Utah and Washington. We have invested in and are exploring new business lines that are complementary to our existing skilled services and senior living services. These new business lines consist of mobile ancillary services, including digital x-ray, ultrasound, electrocardiograms, sub-acute services, dialysis, respiratory, long-term care pharmacy and patient transportation to people in their homes or at long-term care facilities. To date, these businesses were not meaningful contributors to our operating results.

GROWTH

We have an established track record of successful acquisitions. Much of our historical growth can be attributed to implementing our expertise in acquiring real estate or leasing both under-performing and performing post-acute care operations and transforming them into market leaders in clinical quality, staff competency, employee loyalty and financial performance. With each acquisition, we apply our core operating expertise to improve these operations, both clinically and financially. In years where pricing has been high, we have focused on the integration and improvement of our existing independent subsidiaries while limiting our acquisitions to strategically situated properties.

From January 1, 2013 through December 31, 2023, we acquired 238 facilities, which added 20,485 operational skilled nursing beds and 4,803 senior living units to our independent subsidiaries, including the operations that were contributed in the spin-off to Pennant Group, Inc. (Pennant) in 2019. The following table summarizes cumulative skilled nursing and senior living operations, operational skilled nursing beds and senior living unit counts at the end of 2013 and each of the last five years to reflect our growth over a ten-year period and five-year period as a result of the acquisition of these facilities:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | December 31, |

| | | | | | | | | | 2013(2) | | | | | | | | | | | | 2019(1) | | 2020 | | 2021 | | 2022 | | 2023 |

| Cumulative number of skilled nursing and senior living operations | | | | | | | | 119 | | | | | | | | | | | | | 223 | | | 228 | | | 245 | | | 271 | | | 297 | |

| Cumulative number of operational skilled nursing beds | | | | | | | | 10,949 | | | | | | | | | | | | | 22,625 | | | 23,172 | | | 25,032 | | | 28,130 | | | 30,602 | |

| Cumulative number of senior living units | | | | | | | | 1,968 | | | | | | | | | | | | | 2,154 | | | 2,254 | | | 2,237 | | | 3,021 | | | 3,121 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(1) Number of operational beds and number of operations for 2019 include operational beds and operations that we no longer operated. The number of operations and operational beds do not include the closed facilities beginning in the year of their closures.

(2) Included in the 2013 number of operational units and number of operations are the operational units and senior living operations that we contributed to Pennant in 2019. In 2019 and forward, the number of operations and operational units do not include operations transferred to Pennant.

We have also invested in new business lines that are complementary to our existing businesses, such as ancillary services. We plan to continue to grow our revenue and earnings by:

•continuing to grow our talent base and develop future leaders;

•increasing the overall percentage or “mix” of higher acuity patients;

•focusing on organic growth and internal operating efficiencies;

•continuing to acquire additional operations in existing and new markets;

•expanding and renovating our existing operations, and

•strategically investing in and integrating other post-acute care healthcare businesses.

New Market CEO and New Ventures Programs. In order to broaden our reach into new markets, and in an effort to provide existing leaders in our company with the entrepreneurial opportunity and challenge of entering a new market and starting a new business, we established our New Market CEO program in 2006. Supported by our Service Center and other resources, a New Market CEO evaluates a target market, develops a comprehensive business plan, and relocates to the target market to find talent and connect with other providers, regulators and the healthcare community in that market, with the goal of ultimately acquiring businesses and establishing an operating platform for future growth. In addition, this program includes other lines of business that are closely related to the skilled nursing industry. The New Ventures program encourages our local leaders to evaluate service offerings with the goal of establishing an operating platform in new markets and new businesses. We believe that this program will not only continue to drive growth, but will also provide a valuable training ground for our next generation of leaders, who will have experienced the challenges of growing and operating a new business.

OPERATION EXPANSIONS

During the year ended December 31, 2023, we expanded through a combination of long-term leases and real estate purchases, with the addition of 25 stand-alone skilled nursing operations and one campus operation. Of these additions, Standard Bearer acquired the real estate of three of the stand-alone skilled nursing operations and one campus operation, which were leased back to Ensign's independent subsidiaries. These new operations added a total of 2,483 operational skilled nursing beds and 94 operational senior living units to be operated by our independent subsidiaries. Additionally, we invested in new ancillary services that are complementary to our existing businesses.

Subsequent to December 31, 2023, we expanded through a long-term lease, with the addition of two stand-alone skilled nursing operations totaling 241 operational skilled nursing beds to be operated by our independent subsidiaries, including one in a new state, Tennessee.

For further discussion of our acquisitions, see Note 7, Operation Expansions in the Notes to the Consolidated Financial Statements.

QUALITY OF CARE MEASURES

Improvement in Acquired Facilities — The Five-Star Quality Rating System introduced by the Centers for Medicare and Medicaid Services (CMS) intends to help consumers, their families and caregivers compare nursing homes more easily. The Five-Star Quality Rating System gives each skilled nursing operation a rating between one and five stars in various categories including health inspections, staffing and quality measures (QM). We have a strong history of quickly improving the quality of care in the facilities we acquire. Thus, as new assessments are conducted post-acquisition, the star ratings see consistent improvement. At the time of acquisition, the majority of our facilities have 1 and 2-Star ratings.

Over the last few years, CMS has modified the star rating requirements. These changes have been significant and made it more difficult to achieve a 4 or 5-Star rating, resulting in certain skilled nursing operations losing stars in their "Quality" and "Staffing" ratings, which negatively impacted the "Overall" ratings. Nevertheless, we continue to demonstrate strong performance in the Five-Star Quality Rating System. We believe compliance and quality outcomes are precursors to outstanding financial performance. Thus, we strive to aggressively increase quality and compliance in every facility we acquire, and to adjust our overall policies to adapt to CMS’s changing criteria for the Five-Star Quality Rating System.

On October 1, 2023, a significant change impacting the QM category was a shift in focus from a resident's functional status to their functional abilities and goals, commonly referred to as the Minimum Data Set (MDS) Section G to Section GG. The transition will result in numerous QM modifications and changes which will impact the Five-Star rating. As part of this change, starting in April 2024, CMS will freeze the associated new and modified quality measures as part of the transition on the Nursing Home Compare website. Starting in October 2024, CMS will replace the short-stay functionality QM with the new cross-setting functionality QM, which is used in the SNF Quality Reporting Program (QRP). The remaining three measures will continue to be frozen until January 2025 while the data for the equivalent measures are collected. Therefore, the predictability and movement in the QM ratings during 2024 will not necessarily be consistent with our current quality performance. In addition, what and how we are measuring the QM will not be consistent with the historical practice and accordingly will be not comparable. Therefore, depending on the changes, we may experience periods of time where the number of facilities with 4 or 5-Star ratings decline.

The table below summarizes the number of our facilities with 4 and 5-Star ratings since 2019:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | As of December 31, |

| | | | | | | | | | 2019 | | 2020 | | 2021 | | 2022 | | 2023 |

| | | | | | | | | | | | | | | | | |

| 4 and 5-Star Quality Rated skilled nursing facilities | | | | | | | | | 102 | | | 116 | | | 114 | | | 113 | | | 134 | |

| | | | | | | | | | | | | | | | | |

Above-Average Ratings — Additionally, despite the fact that Ensign’s acquisition of facilities with 1 or 2-Star ratings skews our company-wide ratings, our mean score on the Five-Star Quality Rating System is 65.4%, which exceeds the national average score of 57.2%. Our average cycle 1 health inspections for all of our facilities, which is based on the latest inspections, is 7.9% better than the national average.

INDUSTRY TRENDS

The post-acute care industry has evolved to meet the growing demand for post-acute and custodial healthcare services generated by an aging population, increasing life expectancies and the trend toward shifting patient care to lower cost settings. The industry has evolved in recent years, which we believe has led to a number of favorable improvements in the industry, as described below:

•Shift of Patient Care to Lower Cost Alternatives — The growth of the senior population in the U.S. continues to increase healthcare costs, often faster than the available funding from government-sponsored healthcare programs. In response, federal and state governments have adopted cost-containment measures that encourage the treatment of patients in more cost-effective settings such as skilled nursing facilities, for which the staffing requirements and associated costs are often significantly lower than acute care hospitals and other post-acute care settings. As a result, skilled nursing facilities are generally serving a larger population of higher acuity patients than in the past.

•Significant Acquisition and Consolidation Opportunities — The skilled nursing industry is large and highly fragmented, characterized predominantly by numerous local and regional providers. Due to the increasing demands from hospitals and insurance carriers to implement sophisticated and expensive reporting systems, we believe this fragmentation provides us with significant acquisition and consolidation opportunities.

•Improving Supply and Demand Balance — The number of skilled nursing facilities has declined modestly over the past several years. We expect that the supply and demand balance in the skilled nursing industry will continue to improve due to the shift of patient care to lower cost settings, an aging population and increasing life expectancies.

•Increased Demand Driven by Aging Populations — As seniors account for an increasing percentage of the total U.S. population, we believe the demand for skilled nursing and senior living services will continue to increase. According to the census projection released by the U.S. Census Bureau in early 2020, between 2016 and 2030, the number of individuals over 65 years old is projected to be one of the fastest growing segments of the United States population, growing from 15% to 21%. The Bureau expects this segment to increase nearly 50% to 73 million, as compared to the total U.S. population which is projected to increase by 10% over that time period. Furthermore, the generation currently retiring has accumulated less savings than prior generations, creating demand for more affordable senior housing and skilled nursing services. As a high-quality provider in lower cost settings, we believe we are well-positioned to benefit from this trend.

•Value-based Care and Reimbursement Reform — In response to rising healthcare spending in the United States, commercial, government and other payors are generally shifting away from fee-for-service (FFS) payment models towards value-based models, including risk-based payment models that tie financial incentives to quality, efficiency and coordination of care. We believe that patient-centered outcomes driven reimbursement models will continue to grow in prominence. Many of our operations already receive value-based payments, and as valued-based payment systems continue to increase in prominence, it is our view that our strong clinical outcomes will be increasingly rewarded.

A significant goal of U.S. federal health care reform is to transform the delivery of health care by changing reimbursement to reflect and support a focus on equity, payment for value, and efficacious delivery of person-centered care. Reimbursement models and demonstrations that increase accountability and provide financial incentives to encourage efficiency, affordability, and high-quality care, have been developed and implemented by government and commercial third-party payers. Special focus is placed on increasing the number of beneficiaries in care relationships with accountability for quality and total cost of care, improvements in care coordination, reducing inequities at the population level, and supporting care innovation to close care gaps and increase access. The most prominent value-based models designed to accomplish these aims include Accountable Care Models (e.g., MSSP ACOs, ACO REACH) and Disease-Specific & Episode-Based Models (e.g., BPCI Advanced, GUIDE Model, CJR). These models, alongside State & Community, Statutory, and Health Plan Models, are aimed at alignment across payers and care settings, leveraging effective clinical tools, outcomes-focused payment approaches, and stakeholder-led policy development. Reimbursement methodology reform includes Value-Based Purchasing (VBP), in which a portion of provider reimbursement is redistributed based on relative performance, or improvement on designated economic, clinical quality and patient satisfaction metrics. These reimbursement methodologies and similar programs are likely to continue and expand, both in government and commercial health plans. Many of our operations already participate in value-based initiatives and models. With our focus on quality care and strong clinical outcomes, Ensign is well-positioned to benefit from these outcome-based payment models.

We believe the post-acute industry has been and will continue to be impacted by several other trends. The use of long-term care insurance is increasing among seniors as a means of planning for the costs of skilled nursing services. In addition, as a result of increased mobility in society, reduction of average family size and the increased number of two-wage earner couples, more residents are looking for alternatives outside the family for their care.

Our business is affected by seasonal fluctuations in occupancy and acuity which are most prominent when comparing the summer and winter months of the calendar year.

REVENUE SOURCES

We derive revenue primarily from the Medicaid and Medicare programs, managed care and commercial insurance payors and private pay patients. The majority of our revenue is derived from skilled nursing, which is highly dependent upon the Medicaid and Medicare programs. Thus, any changes to payment models, reimbursements and budgets impact our revenue, some positively and some negatively. A detailed discussion of the regulatory framework impacting our business is found in the Government Regulation section below. See also, Item 1A., Risk Factors.

A brief overview of each of our revenue sources is as follows:

Medicaid — Medicaid is a program financed by state funds and matching federal funds administered by the states and their political subdivisions, and often go by state-specific names, such as Medi-Cal in California and the Arizona Healthcare Cost Containment System in Arizona. Medicaid programs generally provide health benefits for qualifying individuals, and may supplement Medicare benefits for the disabled and for persons aged 65 and older meeting financial eligibility requirements. Medicaid reimbursement formulas are established by each state with the approval of the federal government in accordance with federal guidelines. Seniors who enter skilled nursing facilities as private pay clients can become eligible for Medicaid once they have substantially depleted their assets. Medicaid is generally the largest source of funding for most skilled nursing facilities.

Medicaid reimbursement varies from state to state and is based upon a number of different systems, including cost-based, prospective payment; case mixed adjusted payments and negotiated rate systems. Rates are subject to a state’s annual budgetary requirements and funding, statutory and regulatory changes and interpretations and rulings by individual state agencies and State Plan Amendments approved by CMS.

Medicaid typically covers patients that require standard room and board services and provides reimbursement rates that are generally lower than rates earned from other sources. We monitor our payor mix to measure the level received from each payor across each of our business units. We intend to continue to focus on enhancing our care offerings to accommodate more high acuity patients.

Approximately 87.2% of our Medicaid revenue comes from Arizona, California, Colorado, Texas, Utah and Washington. In California, the state enacted legislation expanding their Medicaid program, which in recent years has continued to see budget increases, but will see Medicaid spending decrease in the 2023-2024 period. It is projected that California General Fund spending on California Medicaid will be $225.9 billion for the 2023-2024 budget year, which is a decrease of 3.7% from its 2022-2023 budget estimate. California also estimates that the 2024-2025 budget year's Medicaid spending will decrease by $0.4 billion to $36.6 billion. Over the longer term, however, California expects its Medicaid spending to increase, reaching more than $43 billion by the 2027-2028 budget year. Texas is one of the remaining states that has not expanded Medicaid under the Affordable Care Act. Texas lawmakers have, in the past, underfunded Medicaid, requiring an infusion of state and federal funds. Funding for the 2023-2024 Texas biennium includes approximately $144.0 billion in general revenue funds, which is an increase of 10.5% in general funds from the 2022-2023 biennium amounts. In Arizona, the state enacted legislation expanding their Medicaid program in 2013, but has seen decreased Medicaid enrollments in recent years. Their 2023 budget for the state Medicaid program included $16.8 billion from the general fund, a decrease of 2.8% from the 2022. The 2024 budget is expected to increase by 2.0% from 2023 to $17.8 billion. In Utah, the fiscal year 2022 Medicaid spending was $4.6 billion and the state’s budget for 2023 fiscal year Medicaid spending, which will continue into 2024, is expected to be similar.