NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

AND PROXY STATEMENT

Wednesday, May 17, 2023

8:00 a.m. local time

In person at: 505 Huntmar Park Drive, Herndon, Virginia 20170

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as per mitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under §240.14a-12 |

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

AND PROXY STATEMENT

Wednesday, May 17, 2023

8:00 a.m. local time

In person at: 505 Huntmar Park Drive, Herndon, Virginia 20170

A LETTER TO OUR STOCKHOLDERS:

Ambition 2025, our detailed strategic plan was unveiled in February of last year. It is a structured roadmap with initiatives that are targeted and measurable.

During the first year of the plan, we made significant progress toward achieving the targets laid out. We had record performance in 2022, generating net sales of $8.4 billion, producing 24 percent growth year over year with higher revenue across all three of our lines of business. We stayed ahead of inflation through successful pricing execution and ensuring a high-quality experience for residential, commercial, and complementary product customers. We delivered net income of $458.4 million and a record $910 million in Adjusted EBITDA and our second consecutive calendar year of strong net income margins and double-digit EBITDA margins.1

| Market fundamentals remained solid as nondiscretionary repair and re-roofing activity underpinned our residential roofing demand. At the same time, we experienced increasing softness in the regions that have a heavier new residential construction mix due to rising interest rates. Commercial contractor sentiment, which came off early year highs, remained healthy.

|

| |

| We focused on the areas within our control to drive above-market growth and excel in operational safety and efficiency. We continued to build the tools needed to achieve our Ambition 2025 targets and apply them to the multiple paths we have created for growth and margin expansion. |

Our digital capability continues to be a competitive differentiator and we have the most complete digital offering. During the year, we expanded our capabilities to serve customers in the way that brings them the most value. In October, we announced the launch of Beacon’s new PRO+ mobile app. The app was custom designed for iPhone and Android devices and specifically tailored to meet the needs of contractors who spend their days on the go. Sales through our digital channel reached $1 billion in 2022 and we are continuing to invest in building on our technology leadership.

Our private label line of high-quality building products sold under the TRI-BUILT® brand delivers professional results and permits our customers to differentiate themselves from competitors. In February, we refreshed the TRI-BUILT label brand to include a new, streamlined logo and visual appeal to contribute to the brand’s overall identity, making it easier for contractors to identify. Sales of these high-margin products reached a record high in 2022, and we remain on track to deliver on our Ambition 2025 goal of achieving revenue of $1 billion by 2025.

Our initiatives to grow national accounts are also generating results. Our ability to invest in specialized account representatives who focus on the operational dynamics in each of these end markets offers a differentiated value proposition for high-volume customers. In 2022, we grew net sales to our largest customers by an impressive 36%, reaching its highest level in history.

Our longstanding continuous improvement mindset, including the initiative to drive improved performance at our bottom quintile branches, has generated meaningful contribution for many years, and 2022 was no different. The structure to improve these branches is simple, repeatable and has made a significant contribution to the top-line and the bottom-line.

| Our Greenfield and M&A teams are executing on our pipeline of value creating investments. During the year, we exceeded our original plan to open 10 facilities by commissioning 16 new branches across 12 states. In addition, we welcomed five acquisitions, adding 22 branches with new markets, leadership, and technical capabilities. Our recent Coastal |

| |

| acquisition represents a new platform to build out our specialty waterproofing business. | ||

1 Non-GAAP measure. See Appendix A for a reconciliation to net income (loss) from continuing operations, the most directly comparable GAAP financial measure.

Our Beacon OTC® network remained a differentiator. At year end, we had 60 markets including over 280 branches where our teams work together to deliver a service model that is solely focused on solutions. The result is improved customer service, lower cost to serve, better inventory management and accelerated talent development.

Attracting and retaining the best talent is critical to unlocking the potential of our people, our growth engine, and our operations. We filled several key leadership positions within our sales force, lines of business and leadership ranks, while at the same time advancing our diversity, equity and inclusion initiatives.

We remained committed to being a vital member of the local communities in which we live, operate, and serve. As part of our Investor Day last year, we issued our inaugural Corporate Social Responsibility report centered around our core values. In addition, we set a goal to reduce our carbon emission intensity by 50% by 2030 with a focus on our facilities and fleet.

Our strategic initiatives are designed to create shareholder value, and we are committed to improving returns for owners of our stock. In 2022, we repurchased and retired shares representing more than 3⁄4 of the $500 million share repurchase authorization announced at our Investor Day last year.

As we look forward, we are confident that our resilient business model is positioned to outperform the market in a dynamic demand environment. I thank our more than seven thousand team members for an outstanding 2022 and their relentless commitment to helping our customers build more every day.

As always, we sincerely appreciate the support from the investment community as well as our valued customers, suppliers, and employees.

Sincerely,

Julian G. Francis

President and Chief Executive Officer

April 5, 2023

BEACON ROOFING SUPPLY, INC.

505 Huntmar Park Drive, Suite 300

Herndon, Virginia 20170

|

NOTICE OF THE 2023 ANNUAL MEETING OF STOCKHOLDERS

|

| DATE: | Wednesday, May 17, 2023 | |

| TIME: | 8:00 a.m. local time | |

| PLACE: | Beacon’s corporate headquarters at 505 Huntmar Park Drive, Herndon, Virginia 20170 | |

| ITEMS OF BUSINESS: | (1) Election of thirteen members to our Board of Directors to hold office until the 2024 Annual Meeting of Stockholders or until their successors are duly elected and qualified (Proposal No. 1).

(2) To ratify the selection of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2023 (Proposal No. 2).

(3) To approve the compensation for our named executive officers as presented in the Compensation Discussion and Analysis, the compensation tables, and the related disclosures contained in the accompanying Proxy Statement on a non-binding, advisory basis (Proposal No. 3).

(4) To determine how often (i.e. every one, two or three years) the Company will include a proposal, similar to Proposal No. 3 above, in our annual Proxy Statement on a non-binding, advisory basis (Proposal No. 4).

(5) To approve the Company’s 2023 Employee Stock Purchase Plan (Proposal No. 5).

(6) The transaction of such other business as may properly come before the Annual Meeting and any adjournment(s) or postponement(s) thereof. | |

| WHO MAY VOTE: | Stockholders of record as of the close of business on March 22, 2023 are entitled to vote. | |

| DATE OF MAILING: | A Notice of Internet Availability of Proxy Materials or the Proxy Statement are first being sent to stockholders on or about April 5, 2023. | |

| ANNUAL MEETING MATERIALS: | A copy of this Proxy Statement and our 2022 Annual Report are available at www.proxydocs.com/BECN. | |

| PROXY VOTING: | This is an important meeting and all stockholders are invited to attend the meeting in person. Those stockholders who are unable to attend are respectfully urged to vote by proxy over the Internet, by telephone, or by signing, dating and mailing to us your proxy card as promptly as possible. Stockholders who execute a proxy card may nevertheless attend the meeting, revoke their proxy and vote their shares in person. | |

| IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD MAY 17, 2023: The Notice of Annual Meeting and Proxy Statement and 2022 Annual Report are available at www.proxydocs.com/BECN. | ||

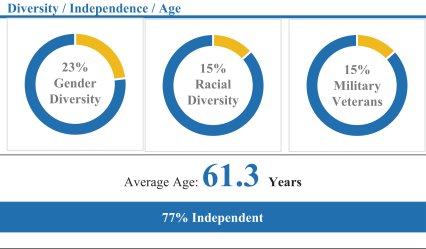

By Order of the Board of Directors

CHRISTINE S. REDDY, Corporate Secretary

Herndon, Virginia

April 5, 2023

|

TABLE OF CONTENTS

|

|

PROXY SUMMARY

|

To assist you in reviewing the proposals to be acted upon at the 2023 Annual Meeting of Stockholders (the “Annual Meeting”), we call your attention to the following information about Beacon Roofing Supply, Inc.’s (“Beacon”, the “Company,” “we,” “our” or “us”) financial performance, key executive compensation actions and decisions, and corporate governance highlights. The following description is only a summary. For more complete information about these topics, please review the Company’s Annual Report on Form 10-K for the year ended December 31, 2022, and the complete Proxy Statement that follows.

| 2023 ANNUAL MEETING OF STOCKHOLDERS |

| MEETING DATE | MEETING TIME | MEETING LOCATION | RECORD DATE | |||

|

Wednesday May 17, 2023 |

8:00 a.m. local time |

Beacon Corporate Headquarters 505 Huntmar Park Drive, Herndon, Virginia 20170 |

March 22, 2023 | |||

| Proposals That Require Your Vote |

| More Information | Board Recommendation | Vote Required for Approval | ||||||

| PROPOSAL ONE |

Election of thirteen (13) directors | Page 5 | FOR each Director Nominee | Plurality of the votes cast in the election of directors | ||||

| PROPOSAL TWO |

Ratification of the selection of the independent registered public accounting firm |

Page 24 | FOR | Majority of votes cast | ||||

| PROPOSAL THREE |

Approval of Named Executive Officer Compensation | Page 27 | FOR | Majority of votes cast | ||||

| PROPOSAL FOUR |

Frequency Vote on Proposal Three | Page 28 | ONE YEAR | Plurality of votes cast | ||||

| PROPOSAL FIVE |

Approval of Beacon’s 2023 Employee Stock Purchase Plan | Page 29 | FOR | Majority of votes cast | ||||

| About Beacon |

Overview

Beacon is the largest publicly traded distributor of roofing materials and complementary building products, such as siding and waterproofing, in North America. We have served the building industry for over 90 years and as of December 31, 2022, operated 480 branches throughout all 50 states in the U.S. and six provinces in Canada. We offer an extensive range of high-quality professional grade exterior products comprising over 130,000 stock-keeping units, and we serve nearly 100,000 residential and non-residential customers who trust us to help them save time, work more efficiently, and enhance their businesses.

We differentiate ourselves in the industry by providing our customers with seamless execution, practical innovation, and a hands-on approach that allows us to serve each of our individual customer’s specific needs. We also work closely with our suppliers, who rely on us to position their products advantageously in the market, supporting advances in products and services that ultimately benefit our customers.

Our mission is to empower our customers to build more for their customers, businesses, and communities. Our project lifecycle support helps our customers find projects, land the job, do the work and close it out with guidance that allows them to deliver on project specifications and timelines that are critical to their success. Using an omni-channel approach and our PRO+ digital suite, we differentiate our services and drive customer retention. Our customer base is composed of professional contractors, home builders, building owners, lumberyards, and retailers across the United States and Canada who depend on reliable local access to building products for residential and non-residential projects. Our customers vary in size, ranging from relatively small contractors

- i -

to large contractors and builders that operate on a national scale. A significant number of our customers have relied on us as their vendor of choice for decades.

Our product lines are designed to meet the requirements of our residential, non-residential, and complementary building products customers. We carry one of the most extensive arrays of high-quality branded products in the industry, including our private label brand, TRI-BUILT®. Our TRI-BUILT products offer a high-quality and superior-value alternative for our customers while delivering higher margins and brand exclusivity in the marketplace. We fulfill the vast majority of our warehouse orders with inventory on hand because of the breadth and depth of the inventories at our branches.

Beyond product delivery, we emphasize superior value-added services to our customers. We employ a knowledgeable sales force that possesses an in-depth understanding of roofing and the building products we provide. Our sales force provides guidance to our customers throughout the lifecycles of their projects, including training, technical support, and access to Beacon PRO+ and 3D+, where they can find leads, track storms, order online, track deliveries, view order history, participate in promotions, and pay invoices.

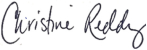

Mission and Values

We have fostered a culture where employees are encouraged to be leaders and live out Beacon’s values. To build this culture, we have integrated our values, as outlined below, into all that we do. From the top down, we hold our employees accountable for displaying Beacon’s values in their work and relationships with our customers, suppliers, investors and the communities in which we serve.

2 Non-GAAP measure. See Appendix A for a reconciliation to net income (loss) from continuing operations, the most directly comparable GAAP financial measure.

- ii -

Business Highlights

| • | On February 23, 2022, we published our inaugural Corporate Social Responsibility Report as part of our longstanding belief in responsible corporate citizenship and affirming our commitment to transparency and continuous improvement, including greenhouse gas (“GHG”) emissions intensity reduction and diversity, equity, and inclusion. |

| • On February 24, 2022, we announced our Ambition 2025 Value Creation Framework to drive growth, enhance customer service and expand our footprint in key markets, which includes targeting the achievement of specific financial goals and the strategic deployment of capital on acquisitions, growth investments and a share repurchase program.

• Also on February 24, 2022, we announced a new share repurchase program (the “Share Repurchase Program”), pursuant to which we could purchase up to $500 million of our common stock. At December 31, 2022, we had used approximately 3⁄4 of the original repurchase authorization, and on February 23, 2023, we announced an increase to the Share Repurchase Program by approximately $387.9 million, permitting future share repurchases of $500 million. |

6.8M

Shares Repurchased in 2022

| |||

M&A Transactions and New Greenfield Location Highlights

| • | On January 1, 2022, we acquired Crabtree Siding and Supply, a wholesale distributor of residential exterior building materials based in Tennessee. |

| • | On April 29, 2022, we acquired Wichita Falls Builders Wholesale, Inc., a distributor of complementary residential exterior building supplies, including windows, doors and siding to contractors, homebuilders and retail customers serving customers, in greater Wichita Falls, Texas. |

| • | On June 1, 2022, we acquired Complete Supply, Inc., an independent distributor of residential roofing and exterior building supplies to contractors and homebuilders, located in Willowbrook, Illinois (Greater Chicago). |

| • | On November 1, 2022, we acquired Coastal Construction Products, one of the largest independent distributors of specialty waterproofing products in the U.S., based in Jacksonville, Florida (with 18 locations serving the Southeast and Midwest). |

| • | On December 30, 2022, we acquired Whitney Building Products, a wholesale distributor of commercial and multifamily waterproofing and restoration products based in Boston, Massachusetts. |

| • | On January 3, 2023, we acquired First Coastal Exteriors, a wholesale distributor of complementary residential and commercial building products including siding, gutter products, and windows, with locations in Alabama and Mississippi. |

| • | In 2022, we opened a new OTC hub in Pico Rivera, CA and fifteen new greenfield branches in Little Chute, WI, College Station, TX, Sherman, TX, Lubbock, TX, Brownsville, TX, Georgetown, TX, Indianapolis, IN, Rockford, IL, Burnsville, MN, Homestead, FL, Durham, NC, La Vergne, TN, Leitchfield, KY, Hampton, VA and Augusta, GA. |

| Compensation Highlights |

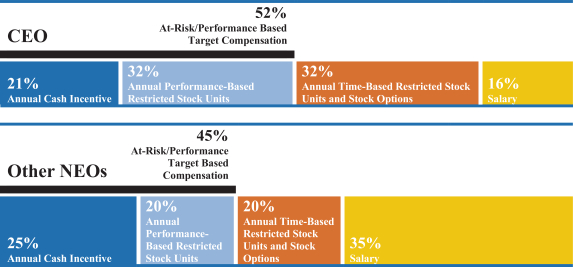

The Compensation Committee of the Board of Directors (the “Board”) continued its historic practice of granting performance incentives, pursuant to which the Company’s executives may earn annual cash incentives and long-term equity incentive compensation in the form of Company stock options and restricted stock unit awards based on various performance metrics.

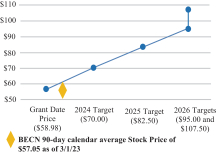

In addition, in 2022, in connection with the Company’s Ambition 2025 strategic plan and to align executives and managers at various levels of the Company with long-term stockholder returns (a priority set forth in the Ambition 2025 strategic plan), the Compensation Committee authorized 463,540 awards of performance-based restricted stock units (the “A25 Performance Stock

- iii -

Units”) to a group of approximately 133 employees. A substantial majority of the recipients were non-executive officer employees consisting of the Company’s senior management and key operations and sales leaders, in addition to executive officers (other than the Chief Executive Officer who is not eligible for the program). The full vesting of such awards is tied to significant stock appreciation that would, if achieved, result in a compounded average growth rate in the Company’s stock price of approximately 16% through the first quarter of 2026.

Every year, we provide for a stockholder advisory vote on executive compensation, which gives stockholders the opportunity to endorse or not endorse the Company’s named executive compensation program. At the Company’s 2022 Annual Meeting of Stockholders, our stockholders approved the Company’s named executive compensation program with over 98% of the votes cast being voted in favor.

| Corporate Governance Highlights |

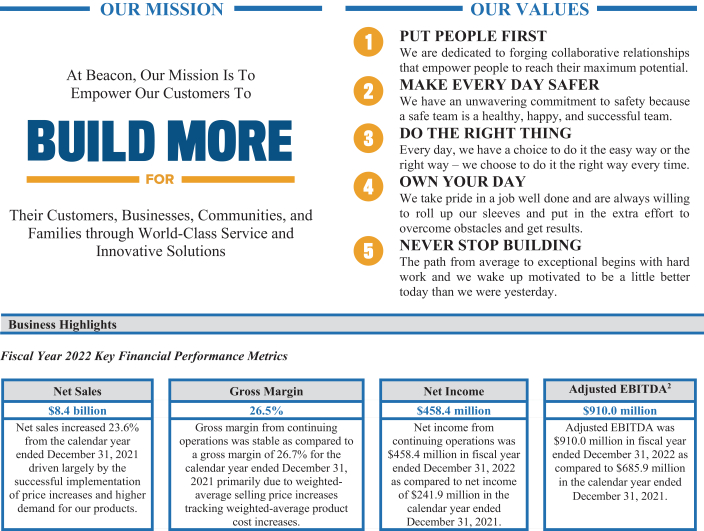

Beacon has a longstanding commitment to effective governance of its business and affairs for the benefit of stockholders, including comprising its Board with a broad diversity of experience, professions, skills and perspectives to provide the strong oversight and strategic direction required to govern our business and strengthen and support our management team. The Board’s commitment to diversity of backgrounds has been demonstrated through the appointment in recent years of highly qualified diverse candidates, including Ms. Mason in March 2023, Ms. Hart in October 2022, Mr. Newsome in March 2021 and Major General Fast in October 2018.

Further, each committee of the Board annually reviews its charter while the Board’s Nominating and Governance Committee reviews our Corporate Governance Guidelines at least annually and periodically reviews our Insider Trading Policy. These documents are revised, as appropriate, in response to changing regulatory requirements, evolving best practices and the perspectives of our stockholders and other stakeholders. Accordingly, in 2022, the Company made appropriate updates and amendments to each of its committee charters, Corporate Governance Guidelines and Insider Trading Policy.

We also maintain a Code of Ethics & Business Conduct (the “Code of Ethics”), most recently updated in November 2021, that establishes standards of conduct and expectations for our directors, officers and employees and the overall manner in which we conduct business. The Code of Ethics, along with our other policies and business standards and our overall risk and compliance programs, are components of mitigating the risks associated with the operation of our business. The full text of our Code of Ethics is available on our website at www.becn.com.

| Board Committees |

The Board has established three (3) standing committees, each composed of only independent directors: the Audit Committee, the Compensation Committee, and the Nominating and Governance Committee. Each committee meets on a regular basis, operates under a written charter and periodically performs a self-evaluation to determine whether the committee is functioning effectively and fulfilling its duties as prescribed by its charter. Each committee has the authority and ability to hire and terminate its own outside advisors. A copy of each committee’s charter is available on our website at www.becn.com.

- iv -

| Best Governance Practices |

Board Diversity

Our Board seeks independent directors with a broad diversity of experience, professions, skills and backgrounds as well as gender and racial/ethnic diversity that will enhance the quality of the Board’s deliberations and decisions. Our director nominees have a balance of tenure, independence, age, and diverse backgrounds, professional experience and skill sets, which provides our Board with an effective mix of experience and fresh perspective.

Other Governance Practices

Our corporate governance policies reflect best practices and include:

| Stockholder Protections | Board Oversight | |

| ✓ Unclassified Board with annual election of directors | ✓ Comprehensive Corporate Governance Guidelines to guide oversight and leadership, which are reviewed at least annually | |

| ✓ Active stockholder engagement program | ✓ Director overboarding policy to limit the number of public company boards that our directors may serve on | |

| ✓ Board has Lead Independent Director separate from the non-independent Chair of the Board | ✓ Director attendance of applicable Board/Committee meetings in fiscal year 2022 of over 75% | |

| ✓ The Board reflects a range of talents, ages, skills, diversity, and expertise with approximately 75% of directors independent | ✓ Board education and orientation program as well as annual Board and committee self-evaluations | |

| ✓ Director mandatory retirement age (age 72) | ✓ Board has an annual evaluation of the Chief Executive Officer and actively engages in succession planning for the Chief Executive Officer | |

| ✓ No stockholders rights plan or “poison pill” has been adopted | ✓ Independent directors regularly convene without management at executive sessions | |

- v -

| Election of Directors (Proposal One) |

You will find important information in the Proxy Statement about the qualifications and experience of each of the director nominees listed below whom, as recommended by the Board, you are being asked to elect at the 2023 Annual Meeting. The Nominating and Governance Committee performs an annual assessment to evaluate whether each of Beacon’s directors have the skills and experience to oversee the Company effectively. All of our director nominees have demonstrated that they have proven leadership ability, sound judgment, integrity and a commitment to the success of Beacon.

| Name | Director Since |

Age | Independent | Principal Occupation | Beacon Board Committees | |||||

| Philip W. Knisely |

2015 | 68 | No | Operating Partner at Clayton, Dubilier & Rice, LLC |

None | |||||

| Julian G. Francis |

2019 | 56 | No | President and CEO of Beacon | None | |||||

| Major General (Ret.) |

2018 | 69 | Yes | Strategic Advisor for Sierra Nevada Corporation, Axellio, Inc. and Huvr Inc. |

Audit N&G | |||||

| Richard W. Frost |

2012 | 71 | Yes | Former CEO and director of Louisiana-Pacific Corporation |

Compensation N&G | |||||

| Alan Gershenhorn |

2015 | 64 | Yes | Chairman and CEO of Logistics Innovation Technologies Corp. |

Compensation N&G (Chair) | |||||

| Melanie M. Hart |

2022 | 50 | Yes | Vice President, CFO and Treasurer of Pool Corporation |

Audit | |||||

| Racquel H. Mason |

2023 | 53 | Yes | Former Chief Marketing Officer of Elanco Animal Health Incorporated |

N&G | |||||

| Robert M. McLaughlin |

2016 | 66 | Yes | Former Senior Vice President and CFO of Airgas, Inc. |

Audit (Chair) Compensation | |||||

| Earl Newsome, Jr. |

2021 | 60 | Yes | Chief Information Officer of Cummins Inc. |

Audit N&G | |||||

| Neil S. Novich |

2012 | 68 | Yes | Former Chairman, President and CEO of Ryerson Inc. |

Compensation (Chair) | |||||

| Stuart A. Randle |

2006 | 63 | Yes | Former CEO of Ivenix | N&G | |||||

| Nathan K. Sleeper |

2018 2015-2016 |

49 | No | CEO and Partner at Clayton, Dubilier & Rice, LLC |

None | |||||

| Douglas L. Young |

2014 | 60 | Yes | Executive Vice President of Lennox International Inc. |

Audit Compensation | |||||

| Ratification of the Selection of the Independent Registered Public Accounting Firm (Proposal Two)

|

The Audit Committee has appointed Ernst & Young LLP as the Company’s independent registered public accounting firm for 2023. The Board recommends that you ratify the appointment of Ernst & Young LLP. While we are not required to have stockholders ratify the selection of Ernst & Young LLP as the Company’s independent auditor, we are doing so because we believe it is good corporate governance practice. If our stockholders do not ratify the selection, the Audit Committee will reconsider the appointment, but may nevertheless retain Ernst & Young LLP as the Company’s independent auditor. Even if the selection is ratified, the Audit Committee may, at its discretion, direct the appointment of a different independent registered public accounting firm at any time during the year if it determines that such change is in the best interests of the Company and its stockholders.

- vi -

| Approval of Executive Compensation (Proposal Three) |

Our Board is requesting stockholder approval of an advisory, non-binding resolution to approve the Company’s executive compensation as described in this Proxy Statement. The Board recommends that you vote for the Company’s executive compensation program. The Board and the Compensation Committee value the opinions of the Company’s stockholders and, based on the outcome of this vote, will consider stockholders’ input regarding executive compensation and evaluate whether any action is necessary to address such input.

| Approval of Frequency of Advisory Vote on Executive Compensation (Proposal Four) |

Our Board is requesting stockholder approval of an advisory, non-binding resolution to approve how often you wish us to include a proposal, similar to Proposal Three above, in our Proxy Statement. The Board recommends that you vote to hold an advisory vote on executive officer compensation every year. The Board and the Compensation Committee value the opinions of the Company’s stockholders and, based on the outcome of this vote, will consider stockholders’ input regarding the frequency of this vote and will evaluate whether any action is necessary to address such input.

| Approval of Beacon’s 2023 Employee Stock Purchase Plan (Proposal Five) |

Our Board is requesting stockholder approval of Beacon’s 2023 Employee Stock Purchase Plan. The Board recommends that you vote for the approval of the 2023 Employee Stock Purchase Plan. Beacon’s 2023 Employee Stock Purchase Plan would provide eligible employees with an opportunity to participate in the ownership of the Company, which the Board believes will benefit the Company as well as its stockholders and employees.

- vii -

Beacon Roofing Supply, Inc.

505 Huntmar Park Drive, Suite 300

Herndon, Virginia 20170

|

PROXY STATEMENT

|

The Beacon Roofing Supply, Inc. 2023 Annual Meeting of Stockholders (the “Annual Meeting”) will be held on Wednesday, May 17, 2023, beginning at 8:00 a.m. local time, at Beacon’s corporate headquarters, 505 Huntmar Park Drive, Herndon, Virginia 20170. This Proxy Statement is furnished in connection with the solicitation by the Board of Directors (the “Board”) of Beacon Roofing Supply, Inc. of proxies from the holders of our common stock, par value $0.01 per share, for use at our 2023 Annual Meeting of Stockholders or at any adjournment(s) or postponement(s) of the Annual Meeting.

Stockholders of record of our common stock and our Series A Cumulative Participating Preferred Stock (the “Preferred Stock”) at the close of business on March 22, 2023, the record date for the meeting, are entitled to receive notice of, and to participate in, the Annual Meeting. If you were a stockholder of record on that date, you will be entitled to vote all of the shares you held on that date at the meeting, or any postponement(s) or adjournment(s) of the meeting. As of the record date, there were 64,328,029 shares of common stock outstanding, all of which are entitled to be voted at the Annual Meeting. In addition, as of the record date, there were 400,000 shares of Preferred Stock outstanding, all of which are entitled to be voted at the Annual Meeting. The Preferred Stock is entitled to vote, together with the common stock as a single class, on each matter to come before the Annual Meeting, with a number of votes based on the number of shares of common stock into which the Preferred Stock is convertible as of the record date. Accordingly, the 400,000 shares of Preferred Stock are entitled to a total of 9,694,619 votes. As a result, a total of 74,022,648 votes are eligible to be cast at the Annual Meeting based on the number of outstanding shares of common stock and Preferred Stock as of the record date. A list of our stockholders will be available at our headquarters at 505 Huntmar Park Drive, Suite 300, Herndon, Virginia 20170 for a period of ten days prior to the annual meeting and at the Annual Meeting itself for examination by any stockholder.

A Notice of Internet Availability of Proxy Materials or the Proxy Statement as well as the form of proxy are first being mailed to stockholders on or about April 5, 2023. Stockholders should review the information provided in this Proxy Statement in conjunction with our 2022 Annual Report that accompanies this Proxy Statement. In this Proxy Statement, we refer to Beacon Roofing Supply, Inc. as “we,” “our” and the “Company.” This Proxy Statement and the 2022 Annual Report are also available to be viewed and downloaded at www.proxydocs.com/BECN.

Purpose of Meeting

At the Annual Meeting, stockholders will act upon the matters outlined in the notice of meeting on the cover page of this Proxy Statement, consisting of the (1) election of directors; (2) ratification of the selection of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2023; (3) approval of the compensation of our named executive officers on a non-binding, advisory basis; (4) approval of the frequency of future advisory votes on executive compensation; (5) approval of Beacon’s 2023 Employee Stock Purchase Plan; and (6) any other matters that properly come before the meeting.

- 1 -

Change in Fiscal Year End

On August 11, 2021, our Board adopted a change in our fiscal year end from September 30 to December 31. As such, where appropriate, this Proxy Statement contains information relating to the transition quarter of October 1, 2021 to December 31, 2021 (the “Transition Quarter”), the fiscal year ended December 31, 2022 (the “Fiscal Year 2022”) and the fifteen (15)-month period composed of Fiscal Year 2022 and the Transition Quarter (the “15-Month Period”).

Board Recommendations

As more fully discussed under “Summary of Business Matters to be Voted On,” our Board recommends: (1) a vote FOR the election of the respective nominees for director named in this Proxy Statement; (2) a vote FOR the ratification of the selection of Ernst & Young LLP for the fiscal year ended December 31, 2023; (3) a vote FOR approval of the executive compensation; (4) the selection of ONE YEAR as the frequency of future advisory votes on executive compensation; and (5) a vote FOR the approval of Beacon’s 2023 Employee Stock Purchase Plan.

Unless contrary instructions are indicated on the enclosed proxy, all shares represented by valid proxies received pursuant to this solicitation (and which have not been revoked in accordance with the procedures set forth below) will be voted (1) FOR the election of the respective nominees for director named in this Proxy Statement; (2) FOR the ratification of the selection of Ernst & Young LLP for the fiscal year ended December 31, 2023; (3) FOR approval of the compensation of our named executive officers; (4) for the selection of ONE YEAR as the frequency of future advisory votes on compensation for named executive officers; (5) FOR the approval of Beacon’s 2023 Employee Stock Purchase Plan; and (6) in accordance with the recommendation of our Board, FOR or AGAINST all other matters as may properly come before the Annual Meeting. In the event a stockholder specifies a different choice by means of the enclosed proxy, such shares will be voted in accordance with the specification made.

Attendance at the Annual Meeting

All of our stockholders as of the record date, or their duly appointed proxies, may attend the meeting. Please note that if you hold your shares in “street name” (that is, through a broker or other nominee), you will need to bring a copy of a brokerage statement reflecting your stock ownership as of the record date.

Access to Proxy Materials

We are pleased to utilize the U.S. Securities and Exchange Commission (“SEC”) rule allowing companies to furnish their proxy materials to stockholders over the Internet. This method allows us to provide you with all the information that you need while reducing the costs associated with delivery of these materials and reducing the environmental impact of our Annual Meeting. As a result, we are mailing to many of our stockholders a notice about the Internet availability, instead of a paper copy, of our Proxy Statement and 2022 Annual Report. All stockholders receiving the notice will have the ability to access the proxy materials over the Internet and to request a paper copy of the proxy materials by mail.

Your notice about the Internet availability of the proxy materials, proxy form, or voting instruction form will contain instructions on how to view our proxy materials for the Annual Meeting on the Internet. Our proxy materials will be available at this website through the conclusion of the Annual Meeting.

Stockholders also may request a free copy of this Proxy Statement and/or our Annual Report on Form 10-K for the year ended December 31, 2022, filed with the SEC on February 24, 2023 (the “2022 Form 10-K”), by writing to: Beacon Roofing Supply, Inc., 505 Huntmar Park Drive, Suite 300, Herndon, Virginia 20170, Attention: Corporate Secretary, phone number (571) 323-3939. Alternatively, stockholders can access our 2022 Form 10-K on our website at: https://ir.beaconroofingsupply.com. We will also furnish any exhibit to the 2022 Form 10-K, if specifically requested.

Voting; Quorum

Common Stock. Holders of common stock are entitled to one vote per share on each matter that is submitted to stockholders for approval.

- 2 -

Preferred Stock. The holder of the Preferred Stock is entitled to an aggregate of 9,694,619 votes on each matter submitted to stockholders for approval, based on the aggregate number of shares of common stock into which the Preferred Stock is convertible as of the record date. Pursuant to the terms of the investment agreement described under “Certain Relationships and Related Transactions,” the holder of the Preferred Stock has agreed to vote in favor of each director nominated and recommended by the Board for election at the Annual Meeting. The holder is entitled to vote in its discretion on the other proposals described in this Proxy Statement.

Quorum. The presence at the meeting, in person or by proxy, of the holders of common stock and Preferred Stock representing a majority of the combined voting power of the outstanding shares of stock on the record date will constitute a quorum, permitting the meeting to conduct its business.

Required Votes

The election of the thirteen (13) director nominees named in this Proxy Statement requires the affirmative vote of shares of common stock and Preferred Stock, voting together as a single class, representing a plurality of the votes cast for such election at the Annual Meeting. This means that the thirteen (13) director nominees will be elected if they receive more “for” votes than any other person. “Withhold” votes and broker non-votes are not considered votes cast for the foregoing purpose and will have no effect on the election of the nominees.

For purposes of determining how often (i.e. every one, two or three years) the Company will include a proposal on executive compensation in our annual proxy statement, the Company will treat the option receiving a plurality of the votes cast as the option approved by stockholders. This means that the option receiving more “for” votes than any other option will be treated by the Company as the option approved by stockholders. Abstentions and broker non-votes are not considered votes cast for the foregoing purpose and will have no effect on the vote for this proposal.

The remaining proposals, including the ratification of the selection of Ernst & Young LLP, approval of the compensation of our named executive officers and approval of the Company’s 2023 Employee Stock Purchase Plan, all require the affirmative vote of shares of common stock and Preferred Stock, voting together as a single class, representing a majority of votes cast on such proposal at the Annual Meeting (meaning that such number of shares voted “for” such proposal exceeds the number of shares voted “against” such proposal). Abstentions and broker non-votes are not considered votes cast for the foregoing purpose and will have no effect on the vote for these proposals.

Although our Board intends to carefully consider the stockholder vote on the ratification of the selection of Ernst & Young LLP, the compensation of our named executive officers and the frequency of such vote, such votes will not be binding on us and are advisory in nature.

The inspector of election for the Annual Meeting shall determine the number of shares of common stock and Preferred Stock represented at the meeting, confirm the existence of a quorum and the validity and effect of proxies, and shall also count and tabulate ballots and votes and determine the results thereof. Proxies received but marked as abstentions and broker non-votes will be included in the calculation of the number of shares considered to be present at the meeting for purposes of determining a quorum. A “broker non-vote” will occur when a nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary power with respect to that proposal and has not received instructions from the beneficial owner. If less than a majority of the combined voting power of the outstanding shares of common stock and Preferred Stock is represented at the Annual Meeting, the holders of shares representing a majority of the voting power so represented may adjourn the Annual Meeting to another time without further notice.

Effect of Not Voting

If you are a stockholder of record and do not vote by telephone or over the Internet or by completing and returning your proxy card, your shares will not be voted. If you are a beneficial owner and do not instruct your broker, bank or other nominee how to vote your shares, the question of whether your broker, bank or other nominee will still be able to vote your shares depends on whether Nasdaq deems the particular proposal to be a “routine” matter. Brokers, banks or other nominees can use their discretion to vote “uninstructed” shares with respect to matters that are considered to be “routine,” but not with respect to “non-routine”

- 3 -

matters. Under the rules and interpretations of the Nasdaq, “non-routine” matters are matters that may substantially affect the rights or privileges of stockholders, such as mergers, stockholder proposals, elections of directors (even if not contested) and executive compensation. Accordingly, your broker, bank or other nominee may not vote your shares on Proposals One, Three, Four and Five but may vote your shares on Proposal Two.

Voting Methods

If you are a holder of record (that is, if your shares are registered in your own name with our transfer agent), you may vote by proxy over the Internet, by telephone, or by signing, dating, and returning the enclosed proxy card. Voting instructions for each method are provided on the proxy card contained in the proxy materials.

If you are a participant in the Beacon stock fund under the Beacon Sales Acquisition, Inc. 401(k) Profit Sharing Plan (the “Beacon 401(k) Plan”), you may furnish voting instructions over the Internet, by telephone, or by signing, dating and returning the enclosed proxy card. Voting instructions for each method are provided on the proxy card contained in the proxy materials.

If you are a street name holder (that is, if you hold your shares through a bank, broker or other holder of record), you must vote in accordance with the voting instruction form provided by your bank, broker or other holder of record. The availability of telephone or internet voting will depend upon your bank’s, broker’s, or other holder of record’s voting process.

If you come to the meeting, you can vote in person. If you are a street name holder and wish to vote at the meeting, you must first obtain a proxy from your bank, broker or other holder of record authorizing you to vote.

Revoking Proxies

The giving of a proxy does not eliminate the right to vote in person should any stockholder giving the proxy so desire. Stockholders have an unconditional right to revoke their proxy at any time prior to the exercise of that proxy, by voting in person at the Annual Meeting, by filing a written revocation with our Corporate Secretary at our headquarters or by submitting a later dated proxy by telephone, over the Internet, or by mail.

Solicitation Costs

The costs of preparing this Proxy Statement, the Notice of Annual Meeting of Stockholders and the Annual Report and proxy card, along with the cost of posting the proxy materials on a website, and any mailing costs, are to be borne by us. Our directors, officers and employees may solicit proxies personally and by telephone, e-mail and other electronic means or by U.S. mail. They will receive no compensation in addition to their regular salaries. We may request banks, brokers and other custodians, nominees and fiduciaries to forward copies of the proxy material to their principals and to request authority for the execution of proxies. We may reimburse these persons for their expenses in so doing.

- 4 -

| SUMMARY OF BUSINESS MATTERS TO BE VOTED ON |

|

PROPOSAL ONE: ELECTION OF DIRECTORS

|

Our Amended and Restated Certificate of Incorporation and By-Laws provide that our Board shall consist of not less than three members. The authorized number of directors for this election is set at thirteen (13) members. In keeping with corporate governance best practices, our Board is not staggered; the full Board is up for election every year. As a result, the Nominating and Governance Committee of the Board has nominated the thirteen (13) current members of the Company’s Board, to serve as directors until the 2024 Annual Meeting of Stockholders or until their successors have been duly elected and qualified:

| Philip W. Knisely Julian G. Francis Barbara G. Fast Richard W. Frost Alan Gershenhorn Melanie M. Hart Racquel H. Mason |

Robert M. McLaughlin Earl Newsome, Jr. Neil S. Novich Stuart A. Randle Nathan K. Sleeper Douglas L. Young |

Each nominee has consented to serve as a director; however, in the event that a nominee for a directorship is unable to accept election or if any other unforeseen contingencies should arise, it is intended that proxies will be voted for the remaining nominees, if any, and for such other person as may be designated by the Board, unless it is directed by a proxy to do otherwise. The Board has no reason to believe that any of the nominees will be unable to serve. Except as indicated in this Proxy Statement, there are no arrangements or understandings between any of the nominees and any other person pursuant to which such nominees were selected.

Our Company has grown rapidly through organic growth and acquisitions to become the largest publicly traded distributor of residential and non-residential roofing materials and complementary building products in the United States and Canada, operating branches in all 50 U.S. states and six Canadian provinces. Accordingly, our Board nominees have experience in a variety of areas important to our Company, such as managing and overseeing the management of large public and private companies (including distribution companies), corporate governance and executive compensation, strategic planning, mergers and acquisitions, procuring financing for business growth, international operations, cybersecurity, information technology and marketing, and experience in our industry. Our Nominating and Governance Committee and Board believe that these Board nominees provide us with the range and depth of experience and capabilities needed to effectively oversee the management of our Company. In addition, we believe our directors complement each other well and together comprise a cohesive unit in terms of Board process and collaboration.

|

|

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE FOR THE

|

- 5 -

| INFORMATION ABOUT OUR NOMINEES |

The following sets forth certain information about our nominees. There are no family relationships between any of our directors or executive officers. The Company believes in serving its stockholders through representation on the Board that ensures oversight of the Company, as well as implementation of the strategic plan and business model. The Nominating and Governance Committee, on behalf of the entire Board, reviews not only the personal qualities and characteristics in a Board member or potential candidate, but also the individual’s diverse education, business and cultural backgrounds to address our current and anticipated needs as our opportunities and challenges evolve.

|

PHILIP W. KNISELY Chair, Not Independent

Director since: October 2015 Age: 68 Committees: None Other Current Public Company Directorships: Covetrus, Inc.

|

Mr. Knisely was appointed non-executive Chairman of the Board of Directors in February 2020. He became an operating partner at Clayton, Dubilier & Rice, LLC (“CD&R”), a private equity firm, in 2019, and prior to that, served as an advisor to CD&R since 2011. He currently serves as Chairman of CD&R Hydra Holdings, Inc. (parent entity of SunSource Holdings, Inc.), a privately held power distribution company, White Cap Supply Holdings, LLC, a $4 billion privately owned distributor of concrete accessories and complementary products, and Covetrus, Inc. a global animal-health technology and services company, and is a former Chairman of Roofing Supply Group, LLC (“RSG”). He also serves on the board of Carestream Dental, a privately held provider of dental imaging equipment and software and Indicor Holdings, LLC, a diversified industrial solutions company. He previously served on the board of Atkore International Group Inc. Mr. Knisely spent a decade as Executive Vice President and Corporate Officer of Danaher Corporation, where he was responsible for businesses totaling more than $4 billion in sales. Prior to Danaher, Mr. Knisely co-founded Colfax Corporation, a designer, manufacturer, and distributor of fluid handling products, where he served as President and Chief Executive Officer. Previously, Mr. Knisely was President and Chief Executive Officer of AMF Industries, a privately held diversified manufacturer, and spent ten years at Emerson Electric. He has previously served on the board of trustees of the Darden School Foundation at the University of Virginia, where he received his MBA. Mr. Knisely was also a GM Fellowship Scholar at General Motors Institute, where he earned a BS in industrial engineering.

| |

|

Director Qualifications: Mr. Knisely’s tenure as Chairman of RSG gave him in-depth knowledge of the building products industry. Mr. Knisely has extensive experience in business strategy and operations, which is helpful as we look to expand our available products and pursue additional growth opportunities. Mr. Knisely is a director nominee designated by CD&R pursuant to the terms of the investment agreement described under “Certain Relationships and Related Transactions.”

| ||

|

JULIAN G. FRANCIS President and CEO, Not Independent

Director since: August 2019 Age: 56 Committees: None Other Current Public Company Directorships: None

|

Mr. Francis has served as Beacon’s President and Chief Executive Officer since August 2019. Prior to Beacon, Mr. Francis was the President of the Insulation Business at Owens Corning, a global leader in insulation, roofing and fiberglass composite materials, since October 2014. Mr. Francis led Owens Corning’s largest business segment, with over $2.7 billion in revenue in 2018, to significant sales and EBIT growth in each of the preceding three years. From 2012-2014, he served as Vice President and General Manager for Owens Corning’s Residential Insulation Business. Mr. Francis also has served as Vice President and Managing Director for Owens Corning’s Glass Reinforcements, Americas, in the Composite Solutions Business. Prior to joining Owens Corning, Mr. Francis was Vice President and Publishing Director at Reed Business Information, a $2.5 billion global leader in publishing, information, and marketing services. Prior to joining Reed, Mr. Francis spent 10 years at USG Corporation rising through the marketing, strategy, and general management ranks. He last served as Vice President, Marketing, where he created the overall strategy for USG’s $3.3 billion manufacturing business. Mr. Francis earned his bachelor’s degree in mathematics and his doctorate in materials engineering at Swansea University in the United Kingdom and earned his MBA at DePaul University.

| |

|

Director Qualifications: Mr. Francis has over 20 years of experience in the building materials industry, with a unique blend of executive and operational experience. We believe that it is important that the Chief Executive Officer be an integral part of our Board’s decision-making process.

| ||

- 6 -

|

MAJOR GENERAL (RET.) BARBARA G. FAST Independent

Director since: October 2018 Age: 69 Committees: Audit, N&G Other Current Public Company Directorships: None |

Major General Fast is the President/CEO of BGF Enterprises, LLC. She is currently (2014-present) a strategic advisor for the Sierra Nevada Corporation, a privately held aerospace engineering firm. She serves on the Strategic Advisory Boards of Axellio, Inc., a privately owned network intelligence platforms company, and Huvr Inc., a privately owned virtual platform company. She serves on the Board of Directors for Achieve Cyber Security Holdings, LLC, a private equity backed firm. She previously provided consulting services for and was a board director of Radiance Technologies, Inc. (2019-2022), an employee-owned engineering services firm. Major General Fast was also a director of American Public Education, Inc. (Nasdaq: APEI), a for-profit education company, from 2009 to 2021, serving as Chair for five of those years. She also served as Chair of APEI’s subsidiary Hondros College of Nursing from 2016 to 2021. From 2011 to 2016, she served as Senior Vice President, Army Defense and Intelligence Programs, then Senior Vice President, Strategic Engagements for CGI Federal (Nasdaq: GIB), an information technology and consulting services firm. She also previously served as Vice President, Cyber and Information Solutions for The Boeing Company (NYSE: BA), a leading manufacturer of commercial jetliners and defense, space, and security programs. Major General Fast retired from the U.S. Army in 2008 after over 32 years of service during which she held a variety of key command and staff positions. Major General Fast holds a Bachelor of Science in Education (German and Spanish) from the University of Missouri, a Master of Science in Business Administration from Boston University, and Honorary Doctorate degrees from Central Missouri State University and American Military University. She is also a graduate of the Army War College.

| |

|

Director Qualifications: Major General Fast’s unique cybersecurity expertise, deep public company executive and corporate governance experience, and tremendous leadership skills developed over her long and distinguished military and private sector careers are valuable assets as we move forward with our growth initiatives, particularly our leading e-commerce platform.

| ||

|

RICHARD W. FROST Independent

Director since: July 2012 Age: 71 Committees: Comp., N&G Other Current Public Company Directorships: None

|

Mr. Frost retired as Chief Executive Officer and a director of Louisiana-Pacific Corporation, a manufacturer of building materials, in May 2012, having served in those capacities since December 2004. Mr. Frost previously served as that company’s Executive Vice President, Commodity Products, Procurement and Engineering from March 2003 to November 2004; Executive Vice President, OSB, Procurement and Engineering from May 2002 to February 2003; and Vice President, Timberlands and Procurement from 1996 to April 2002. Mr. Frost previously served on the board of Tractor Supply Company, the largest operator of retail farm and ranch stores in the United States, and on the board of privately held Westervelt, Inc. Mr. Frost holds dual bachelor’s degrees from Louisiana State University and an MBA, Finance from Northwestern State University of Louisiana.

| |

|

Director Qualifications: Mr. Frost has both executive and director experience, including deep operational experience in the building products industry, which is helpful as we look to expand our available products and pursue additional growth opportunities.

| ||

- 7 -

|

ALAN GERSHENHORN Independent

Director since: May 2015 Age: 64 Committees: Comp., N&G (Chair) Other Current Public Company Directorships: Logistics Innovation Technologies Corp. (Nasdaq: LITT)

|

Mr. Gershenhorn is currently the Chairman and Chief Executive Officer of Logistics Innovation Technologies Corp., a publicly traded special purpose acquisition company focusing on opportunities in the global logistics industry. Mr. Gershenhorn previously served as the Executive Vice President and Chief Commercial Officer of United Parcel Service, Inc. (“UPS”), the world’s largest package delivery company, through June 2018. At UPS, Mr. Gershenhorn directed strategy, mergers and acquisitions, marketing, sales, public affairs, communications, and key growth strategies globally across the organization. He served as a member of the UPS Management Committee, which directs global strategy and the day-to-day operations, for over a decade, and led numerous transformational programs during his 39-year tenure. Mr. Gershenhorn previously served in several significant UPS leadership positions with both global and regional responsibilities, including Chief Sales and Marketing Officer, Senior Vice President and President UPS International; President UPS Supply Chain Solutions Global Transportation and Shared Services; President Supply Chain Solutions Europe, Asia, Middle East and Africa; and President UPS Canada. Mr. Gershenhorn also currently serves on the boards of Transportation Insight, OTR Capital and Ascend Transport Group, which are privately held enterprise logistics companies, and acts in an advisory role to 8VC, a venture capital firm. Mr. Gershenhorn holds a degree in finance from the University of Houston.

| |

|

Director Qualifications: Mr. Gershenhorn has extensive operational and functional experience, particularly in supply chain, logistics, e-commerce, and strategy and marketing, which is extremely valuable for our planned growth and development of new and more efficient and effective ways to serve our customers.

| ||

|

MELANIE M. HART Independent

Director since: October 2022 Age: 50 Committees: Audit Other Current Public Company Directorships: None

|

Ms. Hart currently serves as Vice President, Chief Financial Officer and Treasurer of Pool Corporation (Nasdaq: POOL) (“PoolCorp”)¸ the world’s largest wholesale distributor of swimming pool supplies and outdoor living products, and has served in such position since 2021. Ms. Hart previously served as PoolCorp’s Chief Accounting Officer and Corporate Controller from 2008 to 2021, including Vice President beginning in 2019, Corporate Controller from 2007 to 2008, and Senior Director of Corporate Accounting from 2006 to 2007. Prior to joining PoolCorp in 2006, Ms. Hart spent twelve years serving in the Assurance and Advisory Business Services Group at Ernst & Young. Ms. Hart earned a Bachelor of Science degree in Accounting from the University of New Orleans and graduated from the General Management Program at the Wharton School of Business. She is a certified public accountant and National Association of Corporate Directors (NACD) Directorship Certified.

| |

|

Director Qualifications: Ms. Hart’s experience as a senior executive at a distribution-focused company and past experience at a major accounting firm provides value in our financial reporting and financial oversight responsibilities.

| ||

- 8 -

|

RACQUEL H. MASON Independent

Director since: Feb. 2023 Age: 53 Committees: N&G Other Current Public Company Directorships: None

|

Ms. Mason currently serves as a member of the board of directors of NeilsenIQ, a leading consumer intelligence company, which she joined in 2021. She previously served as Executive Vice President and Chief Marketing Officer at Elanco Animal Health Incorporated, a provider of animal health products and services, from April 2020 to January 2022. Prior to that, Ms. Mason was employed at the Coca-Cola Company for 14 years, most recently serving from 2018 to 2020 as Senior Vice President and General Manager for the McDonald’s Division USA. Earlier at Coca-Cola, she held the consecutive roles of Vice President, Sprite and Sparkling Flavors & Multicultural Marketing, and Vice President, Coca-Cola and Coke Zero brands. Earlier in her career, Ms. Mason held positions of increasing responsibility in brand management and marketing with Procter & Gamble, Johnson & Johnson, Ahold and Abbott Laboratories. Ms. Mason earned a Bachelor of Science degree in Economics from The Wharton School at the University of Pennsylvania and a master’s degree in Business Administration from the Kellogg Graduate School of Management at Northwestern University.

| |

|

Director Qualifications: Ms. Mason’s past experience as an executive and in management positions focused on marketing, brand management and e-commerce platforms at product manufacturing and distribution companies provides value as we continue to execute on our growth strategy.

| ||

|

ROBERT M. MCLAUGHLIN Independent

Director since: June 2016 Age: 66 Committees: Audit (Chair), Other Current Public Company Directorships: Axalta Coating Systems Ltd. (NYSE: AXTA)

|

Mr. McLaughlin is the former Senior Vice President and Chief Financial Officer of Airgas, Inc., the nation’s leading single-source supplier of gases, welding and safety products. Mr. McLaughlin served in that position from 2006 until his retirement in 2016, after serving as Airgas’s Vice President and Controller since joining Airgas in 2001. Previously, he was Vice President-Finance for Asbury Automotive Group, a multibillion-dollar automotive retailer, after serving as Vice President of Finance and in other financial management roles with Unisource Worldwide, Inc., a multibillion-dollar international paper and industrial supply distribution company. Prior to Unisource, he had a thirteen-year career with Ernst & Young. Mr. McLaughlin serves on the board of publicly traded Axalta Coating Systems Ltd., a global leader in the development, manufacture and sale of liquid and powder coatings, where he is the chairman of their audit committee and also serves on their compensation committee. Mr. McLaughlin earned his bachelor’s degree in accounting from the University of Dayton.

| |

|

Director Qualifications: Mr. McLaughlin’s deep experience as a senior executive in financial management for multibillion-dollar distribution firms provides value as we pursue additional growth opportunities.

| ||

- 9 -

|

EARL NEWSOME, JR. Independent

Director since: March 2021 Age: 60 Committees: Audit, N&G Other Current Public Company Directorships: None

|

Mr. Newsome is currently Chief Information Officer of Cummins Inc., a $28.0 billion global power leader that designs, manufactures, sells, and services diesel and alternative fuel engines. Previously, he served as Chief Information Officer, Americas IT for Linde PLC, a $28 billion global industrial gases and engineering firm formed by the merger of Linde and Praxair, Inc. until March 2021. Prior to the merger, he served as Global Chief Information Officer and Vice President of Praxair from May 2016 to March 2019. Mr. Newsome currently serves on the board of First Independence Bank and First Independence Corporation, a bank and related bank holding company, and Navisite, a managed cloud service provider. Prior to joining Praxair, he was Corporate Chief Information Officer and Vice President, Digital at TE Connectivity, a producer of highly engineered connectivity and sensing products, where he built a world-class IT organization that accelerated each business unit’s success. Mr. Newsome also previously served as Vice President, Global IT Services at Estée Lauder, where he transformed the Shared Services organization into a global team and established its Global Innovation Lab, and as Senior Director, Strategy and Integration and Global Operations, for Bowne & Co., where he directed the M&A strategy of the digital business unit and managed global operations. Earlier in his career, Mr. Newsome served as VP and Chief Information Officer of Owens-Illinois and was Partner at Deloitte & Touche. Mr. Newsome was Captain in the U.S. Army and received his Bachelor of Science in Computer Science from the United States Military Academy at West Point.

| |

|

Director Qualifications: Mr. Newsome’s strategic vision and broad IT/cybersecurity expertise will help us align technology with business requirements as we move to accelerate our growth initiatives, particularly our leading e-commerce platform.

| ||

|

NEIL S. NOVICH Independent

Director since: July 2012 Age: 68 Committees: Comp. (Chair) Other Current Public Company Directorships: Hillenbrand, Inc. (NYSE: HI); W.W. Grainger, Inc. (NYSE: GWW)

|

Mr. Novich is the former Chairman, President and Chief Executive Officer of Ryerson Inc., a global metals distributor and fabricator. He joined Ryerson in 1994 as Chief Operating Officer, was named President and Chief Executive Officer in 1995, and was additionally appointed Chairman in 1999. He remained Chairman and Chief Executive Officer until 2007, when the company was sold. Prior to his time at Ryerson, Mr. Novich spent 13 years with Bain & Company, an international management consulting firm, where he was a partner. Mr. Novich currently serves on the boards of publicly traded Hillenbrand, Inc., a global diversified industrial company, where he is chairman of the audit committee and a member of the nominating and corporate governance and mergers and acquisitions committees, and W.W. Grainger, Inc., an industrial supplies and equipment provider, where he is a member of the audit, board affairs, nominating and cyber ad hoc committees. He was formerly a director of publicly traded Analog Devices, Inc. Mr. Novich has a bachelor’s degree in physics from Harvard University and master’s degrees in both nuclear engineering and management from the Massachusetts Institute of Technology.

| |

|

Director Qualifications: Mr. Novich understands the critical success factors for executive management of a public corporation, including corporations focused on distribution. He has excellent financial knowledge and extensive board and managerial experience, including many years as a chairman.

| ||

- 10 -

|

STUART A. RANDLE Lead Independent Director

Director since: Feb. 2006 Age: 63 Committees: N&G Other Current Public Company Directorships: Teleflex Incorporated (NYSE: TFX); Comera Life Sciences, Inc. (Nasdaq: CMRA)

|

In 2019, Mr. Randle retired from his role as the Chief Executive Officer of Ivenix, a privately held medical technology company. He is a director of Teleflex Incorporated, a publicly traded provider of specialty medical devices, where he serves as chairman of its nominating & governance committee and a member of its compensation committee. He is a also a director of Comera Life Sciences, Inc. a publicly traded life sciences company, where he serves as lead independent director, chairman of its nominating & governance committee and a member of its compensation committee. He previously served as a director of Flex Pharma, Inc., a publicly traded biotechnology company that merged with Salarius Pharmaceuticals in 2019. From 2004 to 2014, Mr. Randle served as President, Chief Executive Officer and director of GI Dynamics, a healthcare company. Previously, Mr. Randle was an Entrepreneur-in-Residence for Advanced Technology Ventures, a healthcare and IT venture capital firm. From 1998 to 2001, he was President, Chief Executive Officer and a director of Act Medical, Inc., and prior to that spent a combined ten years with Baxter Healthcare and its spin-off, Allegiance, in a variety of senior roles, including six years in the distribution business. Mr. Randle holds a BS in mechanical engineering from Cornell University and an MBA from the Kellogg Graduate School of Management, Northwestern University.

| |

|

Director Qualifications: Mr. Randle’s executive and director experience, including success in growth situations, is a valuable asset as we continue to execute our growth strategy.

| ||

|

NATHAN K. SLEEPER Not Independent

Director since: Jan. 2018 (also Age: 49 Committees: None Other Current Public Company Directorships: Core & Main, Inc. (NYSE: CNM) |

Mr. Sleeper is a partner of CD&R, and on January 1, 2020 he became CD&R’s chief executive officer. He leads CD&R’s investment activity in the industrial sector and serves on its Investment and Management Committees. Mr. Sleeper is currently a director of publicly traded Core & Main, Inc., as well as privately held Indicor Holdings, LLC, Cornerstone Building Brands, Inc. (formerly Ply Gem Industries, Inc.), Multi-Color Corporation, Brand Industrial Holdings, Inc., PowerTeam Services Holdco, LLC, CD&R Hydra Holdings, Inc. (parent entity of SunSource Holdings, Inc.) and White Cap Supply Holdings, LLC. He previously served on the boards of publicly traded Atkore International Group Inc., HD Supply Holdings, Inc., and Hertz Global Holdings, Inc., as well as Wilsonart International Holdings, LLC, CHC Group, Ltd., Culligan International Company, Hussmann Parent, Inc., and US Foods, Inc. Prior to joining CD&R in 2000, Mr. Sleeper worked for Goldman Sachs & Co, and Tiger Management. Mr. Sleeper holds a bachelor’s degree from Williams College and an MBA from Harvard Business School.

| |

|

Director Qualifications: Mr. Sleeper’s broad experience in the financial and investment communities brings important insights into business strategy to our Board. Mr. Sleeper is a director nominee designated by CD&R pursuant to the terms of the investment agreement described under “Certain Relationships and Related Transactions.”

| ||

- 11 -

|

DOUGLAS L. YOUNG Independent

Director since: Oct. 2014 Age: 60 Committees: Audit, Comp. Other Current Public Company Directorships: None

|

Mr. Young is Executive Vice President of Lennox International Inc., a global leader in the climate control industry. Mr. Young joined Lennox in 1999 and served as the President and Chief Operating Officer of Lennox’s Residential Heating and Cooling Segment from 2006 through 2022. Mr. Young had previously served as Vice President & General Manager of North American Residential Products since 2003 and as Vice President & General Manager of Lennox North American Residential Sales, Marketing, & Distribution from 1999-2003. Prior to his career with Lennox, Mr. Young was employed in the Appliances division of GE, where he held various management positions before serving as General Manager of Marketing for GE Appliance division’s retail group from 1997-1999 and as General Manager of Strategic Initiatives in 1999. He holds a BSBA from Creighton University and an MS in Management from Purdue University.

| |

|

Director Qualifications: Mr. Young’s executive experience is a valuable resource on issues involving sales, marketing, finance, product development, distribution and compensation.

| ||

- 12 -

|

BOARD OF DIRECTORS’ MEETINGS,

|

Director Independence

The Board has determined that each of the current Company directors, with the exceptions of Philip W. Knisely, Julian G. Francis and Nathan K. Sleeper, is “independent” under Nasdaq listing standards and the rules of the SEC. Messrs. Knisely, Sleeper and Francis are not independent due to Messrs. Knisely’s and Sleeper’s relationship with CD&R, our largest stockholder, and Mr. Francis’ service as our President and Chief Executive Officer. We believe we comply with all applicable requirements of Nasdaq and the SEC relating to director independence and the composition of the committees of our Board.

Board Committees and Meetings

Our Board has an Audit Committee, a Compensation Committee and a Nominating and Governance Committee. Each such committee operates under a formal charter that governs its duties and conduct and requires a majority of committee members to make a quorum and a majority of the quorum to approve committee actions. Each charter is reviewed at least annually and revised, as appropriate, to comply with changing regulatory requirements and reflect evolving best practices. A copy of each committee’s charter and the Company’s Corporate Governance Guidelines are available on our website at www.becn.com. In addition, each committee’s charter and the Company’s Corporate Governance Guidelines are available in print to any stockholder who requests it in writing to our Corporate Secretary at Beacon Roofing Supply, Inc., 505 Huntmar Park Drive, Suite 300, Herndon, Virginia 20170.

| Name | Audit Committee | Compensation Committee | |

Nominating and Governance Committee |

| |||||||

| Philip W. Knisely* |

||||||||||||

| Julian G. Francis |

||||||||||||

| Major General (Ret.) Barbara G. Fast |

|

Member |

|

|

Member |

| ||||||

| Richard W. Frost |

|

Member |

|

|

Member |

| ||||||

| Alan Gershenhorn |

|

Member |

|

|

Chair |

| ||||||

| Melanie M. HartO |

|

Member |

|

|||||||||

| Racquel H. Mason |

|

Member |

| |||||||||

| Robert M. McLaughlinO |

|

Chair |

|

|

Member |

|

||||||

| Earl Newsome, Jr. |

|

Member |

|

|

Member |

| ||||||

| Neil S. Novich |

|

Chair |

|

|||||||||

| Stuart A. Randle† |

|

Member |

| |||||||||

| Nathan K. Sleeper |

||||||||||||

| Douglas L. Young |

|

Member |

|

|

Member |

|

||||||

| O Audit | Committee Financial Expert |

| * Chair | of the Board |

| † Lead | Independent Director |

Each director serving on the Audit Committee, Compensation Committee and/or Nominating and Governance Committee are independent under Nasdaq listing standards (as adopted under SEC rules). Each director serving on the Audit Committee meets the independence criteria prescribed by applicable law and the rules of the SEC for Audit Committee membership and meets Nasdaq’s financial knowledge requirements. The Board has determined that Mr. McLaughlin and Ms. Hart are “audit committee financial experts” as such term is defined in Regulation S-K promulgated by the SEC. Further, each director serving on the Compensation Committee is a non-employee director (as defined in Rule 16b-3 under the Securities Exchange Act), and does not have “interlocking” or other relationships with us that would detract from their independence as committee members.

- 13 -

The table below shows the number of Board and Committee meetings held in Fiscal Year 2022 and the Transition Quarter.

| Number of Meetings Held in Fiscal Year 2022 |

Number of Meetings Held in the Transition Quarter | |||

| Board of Directors |

5 | 4 | ||

| Audit Committee |

9 | 1 | ||

| Compensation Committee |

6 | 2 | ||

| Nominating and Governance Committee |

4 | 1 | ||

It is our policy for all directors to attend the Annual Meeting of Stockholders, unless attendance is not feasible owing to unavoidable circumstances. No incumbent director attended fewer than 75% of the aggregate of (i) the number of meetings of the Board held during the period he or she served on the Board and (ii) the number of committee meetings of the Board held during the period he or she served on these committees, in each case during both the Transition Quarter and Fiscal Year 2022. All of the then current Board members attended the 2022 Annual Meeting of Stockholders.

| Committee |

Committee Function | |

| Audit: Robert McLaughlin, Chair Barbara Fast Melanie M. Hart Earl Newsome Douglas Young

Mr. Berquist served as the Chair of the Audit Committee until May 12, 2022. |

• Monitors management’s process for ensuring the integrity of our financial statements and compliance with legal and regulatory requirements, including through separate systems of reporting to the Audit Committee by each of management, the internal audit department and the independent registered public accounting firm;

• Oversees the performance of our internal audit function and independent registered public accounting firm (currently Ernst & Young LLP);

• Selects the independent registered public accounting firm and receives reports directly from the independent registered public accounting firm;

• Reviews the independent registered public accounting firm’s qualifications and independence, including overseeing hiring policies for employees or former employees of the independent registered public accounting firm;

• Approves the scope of the annual audit activities of the independent registered public accounting firm and the audit fee payable to the independent registered public accounting firm;

• Reviews audit results with the independent registered public accounting firm; and

• Monitors the Company’s Enterprise Risk Management, including but not limited to, issues relating to data protection, cybersecurity and fraud detection and prevention.

Please refer to the Report of the Audit Committee, which is set forth in this Proxy Statement, for a further description of our Audit Committee’s responsibilities and its recommendation with respect to our audited consolidated financial statements.

|

- 14 -

| Compensation: Neil Novich, Chair Richard Frost Alan Gershenhorn Robert McLaughlin Douglas Young |

• Reviews and makes recommendations to the Board regarding the compensation of the Chief Executive Officer;

• Reviews the Chief Executive Officer’s recommendations on, and approves the compensation of, executive officers and key employees of the Company;

• Administers and makes equity awards under the Company’s long-term incentive plan and oversees and approves the Company’s stock ownership guidelines for executive officers and directors;

• Approves the design and administration of the annual cash incentive plan for the executive committee members, including the named executive officers;

• Provides a general review of our compensation and benefit plans to ensure that they meet our objectives of transparency and integrity and do not encourage unnecessary or excessive risk-taking;

• Makes recommendations for adopting and changing major compensation policies and practices; and