Beacon Roofing Supply Reports First Quarter 2014 Results

| · | Record first quarter sales of $552.1 million vs. $513.7 million in prior year (7.5% growth) |

| · | First quarter EPS of $0.30 vs. $0.37 in prior year |

| · | Four new greenfield openings in first quarter |

HERNDON, VA. — (BUSINESS WIRE) — February 7, 2014 — Beacon Roofing Supply, Inc. (the "Company") (NASDAQ: BECN) announced results today for its first quarter ended December 31, 2014 (“2014”) of the fiscal year ended September 30, 2014 (“Fiscal 2014”).

Paul Isabella, the Company’s President and Chief Executive Officer, stated: “We again achieved solid top line growth for the quarter. We started the quarter exceptionally strong, but ended the month of December on a soft note as a result of some very challenging weather conditions in our Northern regions. We were very pleased to see a strong rebound in commercial roofing this quarter as we continue to focus on diversifying our lines of business. In addition, we are seeing success with our new branch opening process and believe we will exceed our initial targets and may open as many as 25 branches in Fiscal 2014. A challenging pricing environment continued to drive down gross margins again this quarter, although our long standing culture of cost control was able to mitigate some of the negative impact through leverage of our operating expenses. Despite the challenges with pricing, we continued to generate solid cash flows from operations and fully repaid our revolving credit facility during the quarter. We believe market pricing will improve in 2014 as demand increases as we exit the winter months, and we intend to continue to leverage our operating expenses as we grow our revenue base.”

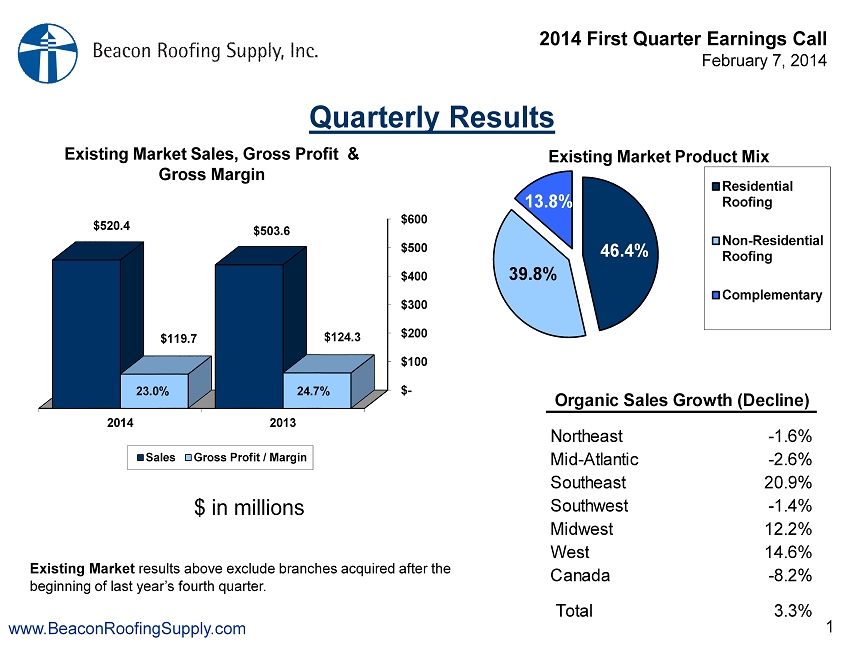

Total sales increased 7.5% to $552.1 million in 2014 from $513.7 million in 2013. Existing market (organic) sales, which exclude branches acquired after the beginning of last year’s first quarter, increased 3.3% (the first quarter of 2013 and 2014 both had the same number of business days). In existing markets, residential roofing product sales increased 1.4%, non-residential roofing product sales increased 6.6%, and complementary product sales increased 1.0%.

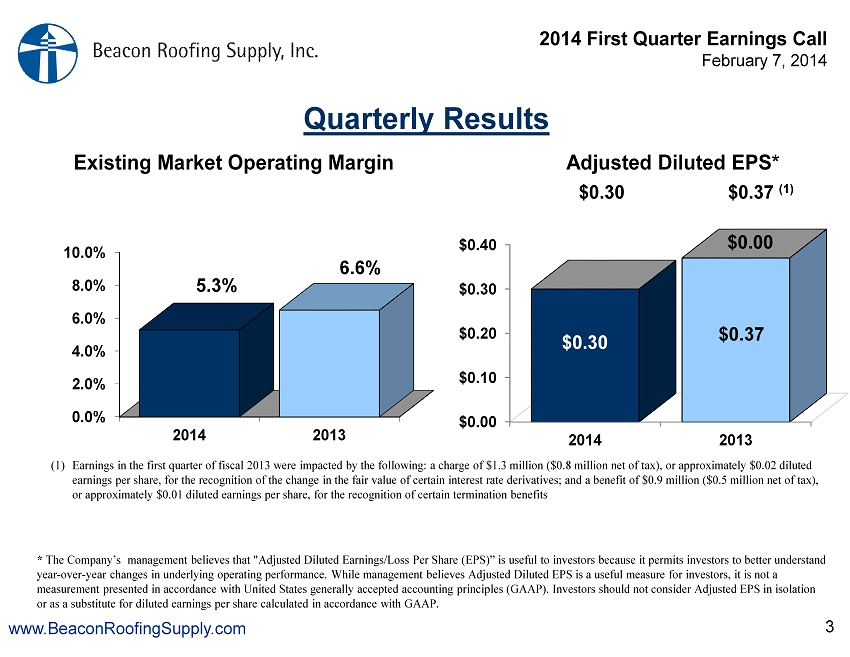

Net income for the first quarter was $15.0 million compared to $18.2 million in 2013. First quarter diluted net income per share was $0.30 compared to $0.37 in 2013. Net income for the quarter was unfavorably impacted by lower gross margins driven primarily by lower average selling prices for our residential and non-residential products and a higher mix of non-residential roofing products. This was partially offset by a lower rate of operating expenses and lower effective tax rate.

Earnings before interest, taxes, depreciation and amortization, and stock-based compensation (“Adjusted EBITDA”), which are reconciled to the net income in this press release, were $37.5 million in 2014 compared to $41.8 million in 2013, a decrease of 10.4% driven primarily by the lower net income.

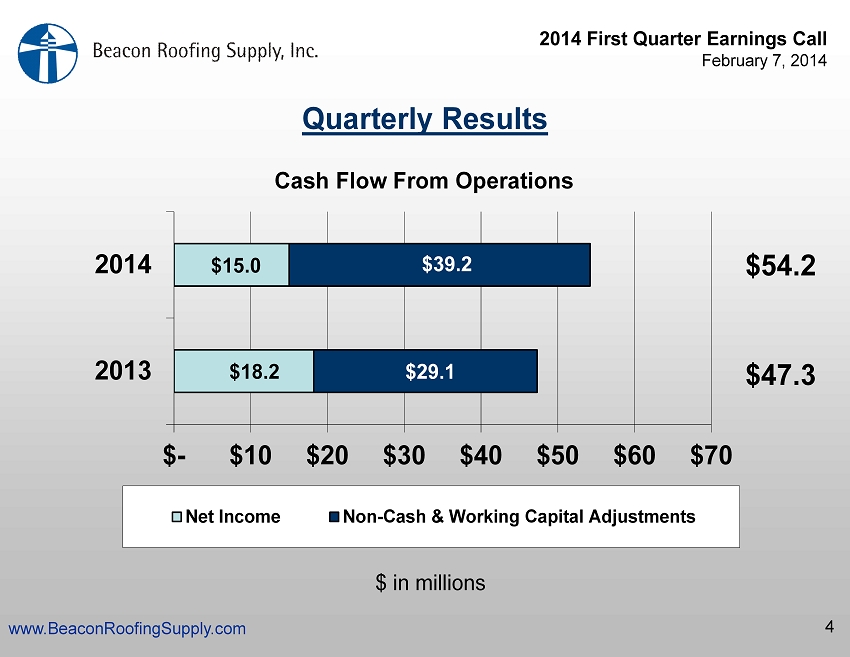

Cash flow from operations was $54.2 million in 2014 compared to $47.3 million in 2013. This increase in operating cash flows was influenced mostly by a larger benefit from net working capital changes this year. Cash on hand increased by $22.4 million to $56.4 million at December 31, 2013, compared to $34.0 million at December 31, 2012. This increase was due primarily to a reduction in cash used for investing activities in 2014, compared to 2013. As of December 31, 2013, we had available borrowings under our revolving lines of credit of $332.1 million.

The Company will host a webcast and conference call today at 10:00 a.m. (EST) to discuss these results. The live webcast of the call, along with a webcast replay after the call, can be accessed at http://ir.beaconroofingsupply.com/events.cfm (the “Events & Presentations” page of the “Investor Relations” section of the Company’s web site). There will be a slide presentation of the results available on that page of the website as well. For those unable to connect to the Internet or who may wish to ask questions, the conference call dial-in number is 719-457-2664. To assure timely access, call participants should call in before 10:00 a.m.

Beacon Roofing Supply, Inc. is a leading distributor of roofing materials and complementary building products, currently operating 240 branches in 39 states in the United States and 6 provinces in Canada.

Forward-Looking Statements: This release contains information about management's view of the Company's future expectations, plans and prospects that constitute forward-looking statements for purposes of the safe harbor provisions under the Private Securities Litigation Reform Act of 1995. Actual results may differ materially from those indicated by such forward-looking statements as a result of various important factors, including, but not limited to, those set forth in the "Risk Factors" section of the Company's latest Form 10-K. In addition, the forward-looking statements included in this press release represent the Company's views as of the date of this press release and these views could change. However, while the Company may elect to update these forward-looking statements at some point, the Company specifically disclaims any obligation to do so, other than as required by federal securities laws. These forward-looking statements should not be relied upon as representing the Company's views as of any date subsequent to the date of this press release.

BECN-F

Beacon Roofing Supply, Inc.

Joseph Nowicki, 571-323-3940

Executive Vice President & Chief Financial Officer

JNowicki@becn.com

Source: Beacon Roofing Supply, Inc.

News Provided by Acquire Media

BEACON ROOFING SUPPLY, INC

Consolidated Statements of Operations

(unaudited; in thousands, except share and per share amounts)

| Three

Months Ended December 31, | ||||||||||||||||

| 2013 | %

of Net Sales | 2012 | %

of Net Sales | |||||||||||||

| Net sales | $ | 552,129 | 100.0 | % | $ | 513,710 | 100.0 | % | ||||||||

| Cost of products sold | 425,224 | 77.0 | % | 386,956 | 75.3 | % | ||||||||||

| Gross profit | 126,905 | 23.0 | % | 126,754 | 24.7 | % | ||||||||||

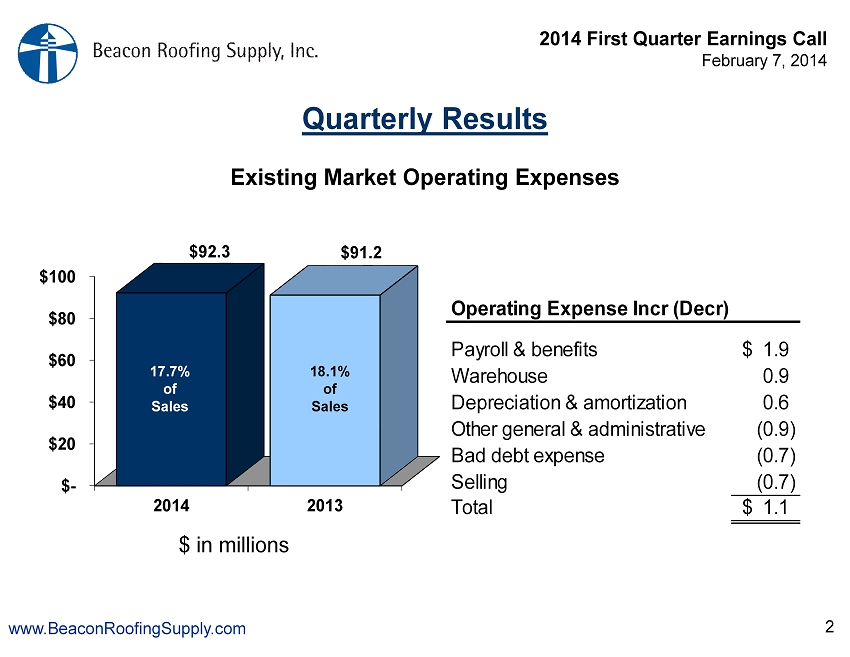

| Operating expenses | 99,818 | 18.1 | % | 94,503 | 18.4 | % | ||||||||||

| Income from operations | 27,087 | 4.9 | % | 32,251 | 6.3 | % | ||||||||||

| Interest expense, financing costs and other | 2,665 | 0.5 | % | 1,910 | 0.4 | % | ||||||||||

| Income before provision for income taxes | 24,422 | 4.4 | % | 30,341 | 5.9 | % | ||||||||||

| Provision for income taxes | 9,465 | 1.7 | % | 12,135 | 2.4 | % | ||||||||||

| Net income | $ | 14,957 | 2.7 | % | $ | 18,206 | 3.5 | % | ||||||||

| Net income per share: | ||||||||||||||||

| Basic | $ | 0.31 | $ | 0.38 | ||||||||||||

| Diluted | $ | 0.30 | $ | 0.37 | ||||||||||||

| Weighted average shares used in computing net income per share: | ||||||||||||||||

| Basic | 48,984,767 | 47,858,626 | ||||||||||||||

| Diluted | 49,884,611 | 48,865,099 | ||||||||||||||

BEACON ROOFING SUPPLY, INC

Consolidated Balance Sheets

(in thousands)

| December 31, 2013 | September 30, 2013 | December 31, 2012 | ||||||||||

| (unaudited) | (audited) | (unaudited) | ||||||||||

| Assets | ||||||||||||

| Cash and cash equivalents | $ | 56,399 | $ | 47,027 | $ | 34,025 | ||||||

| Accounts receivable, net | 243,752 | 329,673 | 231,500 | |||||||||

| Inventories | 308,660 | 251,370 | 270,363 | |||||||||

| Prepaid expenses and other assets | 96,730 | 62,422 | 94,605 | |||||||||

| Deferred income taxes | 14,380 | 14,591 | 15,793 | |||||||||

| Total current assets | 719,921 | 705,083 | 646,286 | |||||||||

| Property and equipment, net | 68,321 | 67,659 | 58,246 | |||||||||

| Goodwill | 468,032 | 469,203 | 468,757 | |||||||||

| Other assets, net | 92,469 | 96,751 | 113,739 | |||||||||

| Total assets | $ | 1,348,743 | $ | 1,338,696 | $ | 1,287,028 | ||||||

| Liabilities & Stockholders' Equity | ||||||||||||

| Current liabilities: | ||||||||||||

| Accounts payable | $ | 213,557 | $ | 182,914 | $ | 176,322 | ||||||

| Accrued expenses | 73,324 | 68,298 | 84,519 | |||||||||

| Current portion of long-term obligations | 15,440 | 62,524 | 62,830 | |||||||||

| Total current liabilities | 302,321 | 313,736 | 323,671 | |||||||||

| Senior notes payable and other obligations, net of current portion | 194,063 | 196,875 | 205,313 | |||||||||

| Deferred income taxes | 61,108 | 61,003 | 58,037 | |||||||||

| Long-term obligations under equipment financing and other, net of current portion | 18,582 | 12,726 | 15,809 | |||||||||

| Stockholders' equity: | ||||||||||||

| Common stock | 491 | 488 | 483 | |||||||||

| Undesignated preferred stock | - | - | - | |||||||||

| Additional paid-in capital | 318,473 | 312,962 | 294,507 | |||||||||

| Retained earnings | 456,239 | 441,282 | 386,881 | |||||||||

| Accumulated other comprehensive income (loss) | (2,534 | ) | (376 | ) | 2,327 | |||||||

| Total stockholders' equity | 772,669 | 754,356 | 684,198 | |||||||||

| Total liabilities and stockholders' equity | $ | 1,348,743 | $ | 1,338,696 | $ | 1,287,028 | ||||||

BEACON ROOFING SUPPLY, INC

Consolidated Statements of Cash Flows

(unaudited; in thousands)

| Three Months Ended December 31, | ||||||||

| 2013 | 2012 | |||||||

| Operating activities: | ||||||||

| Net income | $ | 14,957 | $ | 18,206 | ||||

| Adjustments to reconcile net income to net cash provided by operating activities: | ||||||||

| Depreciation and amortization | 8,140 | 7,057 | ||||||

| Stock-based compensation | 2,532 | 2,524 | ||||||

| Certain interest expense and other financing costs | 272 | (1,051 | ) | |||||

| Gain on sale of fixed assets | (374 | ) | (226 | ) | ||||

| Deferred income taxes | 156 | (133 | ) | |||||

| Other | (3 | ) | - | |||||

| Changes in assets and liabilities, net of the effects of businesses acquired: | ||||||||

| Accounts receivable | 85,006 | 76,209 | ||||||

| Inventories | (57,967 | ) | (34,257 | ) | ||||

| Prepaid expenses and other assets | (35,511 | ) | (28,370 | ) | ||||

| Accounts payable and accrued expenses | 36,942 | 7,326 | ||||||

| Net cash provided by operating activities | 54,150 | 47,285 | ||||||

| Investing activities: | ||||||||

| Purchases of property and equipment | (5,390 | ) | (3,092 | ) | ||||

| Acquisition of businesses | - | (64,484 | ) | |||||

| Proceeds from sales of assets | 268 | 291 | ||||||

| Net cash used in investing activities | (5,122 | ) | (67,285 | ) | ||||

| Financing activities: | ||||||||

| (Repayments) borrowings under revolving lines of credit, net | (47,398 | ) | 6,100 | |||||

| Repayments under term loan | (2,812 | ) | - | |||||

| Borrowings (repayments) under equipment financing facilities and other, net | 6,199 | (3,807 | ) | |||||

| Proceeds from exercises of options | 3,961 | 9,915 | ||||||

| Income tax benefit from stock-based compensation deductions in excess of the associated compensation costs | 192 | 1,755 | ||||||

| Net cash (used in) provided by financing activities | (39,858 | ) | 13,963 | |||||

| Effect of exchange rate changes on cash | 202 | (143 | ) | |||||

| Net increase (decrease) in cash and cash equivalents | 9,372 | (6,180 | ) | |||||

| Cash and cash equivalents at beginning of period | 47,027 | 40,205 | ||||||

| Cash and cash equivalents at end of period | $ | 56,399 | $ | 34,025 | ||||

BEACON ROOFING SUPPLY, INC

(unaudited; dollars in millions)

| Consolidated Sales by Product Line | ||||||||||||||||||||||||

| Three Months Ended | ||||||||||||||||||||||||

| December 31, 2013 | December 31, 2012 | |||||||||||||||||||||||

| Net Sales | Mix % | Net Sales | Mix % | Change | ||||||||||||||||||||

| Residential roofing products | $ | 251.8 | 45.6 | % | $ | 240.9 | 46.9 | % | $ | 11.0 | 4.5 | % | ||||||||||||

| Non-residential roofing products | 218.7 | 39.6 | % | 196.9 | 38.3 | % | 21.7 | 11.0 | % | |||||||||||||||

| Complementary building products | 81.6 | 14.8 | % | 75.9 | 14.8 | % | 5.7 | 7.6 | % | |||||||||||||||

| $ | 552.1 | 100.0 | % | $ | 513.7 | 100.0 | % | $ | 38.4 | 7.5 | % | |||||||||||||

| Consolidated Sales by Product Line for Existing Markets* | ||||||||||||||||||||||||

| Three Months Ended | ||||||||||||||||||||||||

| December 31, 2013 | December 31, 2012 | |||||||||||||||||||||||

| Net Sales | Mix % | Net Sales | Mix % | Change | ||||||||||||||||||||

| Residential roofing products | $ | 241.3 | 46.4 | % | $ | 238.0 | 47.3 | % | $ | 3.3 | 1.4 | % | ||||||||||||

| Non-residential roofing products | 207.4 | 39.8 | % | 194.5 | 38.6 | % | 12.8 | 6.6 | % | |||||||||||||||

| Complementary building products | 71.7 | 13.8 | % | 71.0 | 14.1 | % | 0.7 | 1.0 | % | |||||||||||||||

| $ | 520.4 | 100.0 | % | $ | 503.6 | 100.0 | % | $ | 16.7 | 3.3 | % | |||||||||||||

| Existing Market Sales By Business Day** | ||||||||||||||||||||||||

| Three Months Ended | ||||||||||||||||||||||||

| December 31, 2013 | December 31, 2012 | |||||||||||||||||||||||

| Net Sales | Mix % | Net Sales | Mix % | Change | ||||||||||||||||||||

| Residential roofing products | $ | 3.892 | 46.4 | % | $ | 3.840 | 47.3 | % | $ | 0.053 | 1.4 | % | ||||||||||||

| Non-residential roofing products | 3.345 | 39.8 | % | 3.138 | 38.6 | % | 0.207 | 6.6 | % | |||||||||||||||

| Complementary building products | 1.157 | 13.8 | % | 1.145 | 14.1 | % | 0.011 | 1.0 | % | |||||||||||||||

| $ | 8.393 | 100.0 | % | $ | 8.123 | 100.0 | % | $ | 0.271 | 3.3 | % | |||||||||||||

Note: Some totals above may not foot due to rounding.

*Excludes branches acquired during the four quarters prior to the start of the first quarter of Fiscal 2014.

**There were 62 business days in each of the quarters ended December 31, 2013 and 2012.

BEACON ROOFING SUPPLY, INC.

Earnings Before Interest, Taxes, Depreciation and Amortization and Stock-Based Compensation ("Adjusted EBITDA")

(unaudited; in thousands)

| Three Months Ended December 31, | ||||||||

| 2013 | 2012 | |||||||

| Net income | $ | 14,957 | $ | 18,206 | ||||

| Interest expense, net | 2,394 | 1,910 | ||||||

| Income taxes | 9,465 | 12,135 | ||||||

| Depreciation and amortization | 8,140 | 7,057 | ||||||

| Stock-based compensation | 2,532 | 2,524 | ||||||

| Adjusted EBITDA (1) | $ | 37,488 | $ | 41,832 | ||||

(1) Adjusted EBITDA is defined as net income plus interest expense (net of interest income), income taxes, depreciation and amortization, adjustments to contingent consideration, and stock-based compensation. EBITDA is a measure commonly used in the distribution industry, and we present Adjusted EBITDA to enhance your understanding of our operating performance. Adjusted EBITDA is used in our bank covenants and we use Adjusted EBITDA as an internal performance measurement and as one criterion for evaluating our performance relative to that of our peers. We believe that Adjusted EBITDA is an operating performance measure that provides investors and analysts with a measure of operating results unaffected by differences in capital structures, capital investment cycles, and ages of related assets among otherwise comparable companies. Further, we believe that Adjusted EBITDA is a useful measure because it improves comparability of results of operations, since purchase accounting used for acquisitions can render depreciation and amortization non-comparable between periods. Management uses these supplemental measures to evaluate performance period over period and to analyze the underlying trends in the Company’s business and to establish operational goals and forecasts that are used in allocating resources. We expect to compute our non-GAAP financial measures using the same consistent method from quarter to quarter and year to year.

While we believe Adjusted EBITDA is a useful measure for investors, it is not a measurement presented in accordance with United States generally accepted accounting principles, or GAAP. You should not consider Adjusted EBITDA in isolation or as a substitute for net income, cash flows from operations, or any other items calculated in accordance with GAAP. In addition, Adjusted EBITDA has inherent material limitations as a performance measure. It does not include interest expense. Because we have borrowed money, interest expense is a necessary element of our costs. In addition, Adjusted EBITDA does not include depreciation and amortization expense. Because we have capital and intangible assets, depreciation and amortization expense is a necessary element of our costs. Adjusted EBITDA also does not include stock-based compensation, which is a necessary element of our costs since we make stock awards to key members of management as an important incentive to maximize overall company performance and as a benefit. Moreover, Adjusted EBITDA does not include taxes, and payment of taxes is a necessary element of our operations. Accordingly, since Adjusted EBITDA excludes these items, it has material limitations as a performance measure. The Company’s management separately monitors capital expenditures, which impact depreciation expense, as well as amortization expense, interest expense, and income tax expense. Because not all companies use identical calculations, our presentation of Adjusted EBITDA may not be comparable to other similarly titled measures of other companies.

BEACON ROOFING SUPPLY INC

Adjusted Diluted Net Income per Share ("Adjusted Earnings per Share")

(unaudited; in thousands except per share amounts)

| Three Months Ended December 31, | ||||||||||||||||

| 2013 | EPS | 2012 | EPS | |||||||||||||

| Net income | $ | 14,957 | $ | 0.30 | $ | 18,206 | $ | 0.37 | ||||||||

| Company adjustments, net of income taxes: | ||||||||||||||||

| Fair value of certain interest rate derivatives and charge associated with refinancing | - | - | (769 | ) | (0.02 | ) | ||||||||||

| Termination benefits | - | - | 542 | 0.01 | ||||||||||||

| Adjusted net income per share | $ | 14,957 | $ | 0.30 | $ | 17,979 | $ | 0.37 | ||||||||

Note: Some totals above may not foot due to rounding.

The Company’s management believes that "Adjusted Earnings per Share," which excludes certain events such as the recognition of changes in the fair value of certain interest rate derivatives and termination benefits is useful to investors because it permits investors to better understand year-over-year changes in underlying operating performance.

The majority of termination benefits are associated with the retirement of our former CFO. While management believes Adjusted Earnings per Share (EPS) is a useful measure for investors, it is not a measurement presented in accordance with United States generally accepted accounting principles (GAAP). You should not consider Adjusted Earnings per Share in isolation or as a substitute for net loss per share or diluted earnings per share calculated in accordance with GAAP.