ISSUER FREE WRITING PROSPECTUS

Dated December 12, 2013

Filed Pursuant to Rule 433

Registration No. 333-171266

RESPONSE GENETICS, INC.

FREE WRITING PROSPECTUS

On December 12, 2013, Response Genetics, Inc. (the “Company”) announced that it intends to offer and sell registered shares of its common stock in an underwritten public offering pursuant to an effective registration statement on Form S-3 (File No. 333-171266) previously filed with the Securities and Exchange Commission (the “SEC”) on December 17, 2010, as amended on January 4, 2011, and declared effective on January 6, 2011, as supplemented by the prospectus supplement relating to the offering to be filed with the SEC pursuant to Rule 424 under the Securities Act of 1933, as amended.

The following communication relates to such offering. Before you invest, you should read the prospectus supplement and the accompanying prospectus relating to the offering together with other documents the Company has filed or will file with the SEC for more complete information about the Company and the offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. You may also contact National Securities Corporation, the sole underwriter for the offering, at the following address:

National Securities Corporation

410 Park Avenue, 14th Floor

New York, NY 10022

Attn: Kim Addarich

Telephone: (212)-417-8164

Email: prospectusrequest@nationalsecurities.com

December 2013 The Right Therapy For Each Patient Thomas A. Bologna Chairman & Chief Executive Officer NASDAQ : RGDX December 2013

December 2013 F ORWARD - L OOKING S TATEMENTS 2 This presentation contains forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Any statements, other than statements of historical fact, including statements regarding our strategy, future events, future operations, future financial position, future financial performance, future revenues, projected costs, prospects, plans and objectives of management, including our expected revenue growth and net earnings for 2013, and any other statements containing the words “ may, ” “ will, ” “ should, ” “ could, ” “ would, ” “ believe ” , “ expect ” , “ anticipate ” , “ plan ” , “ estimate ” , “ intend ” , “ predict ” , “ project ” , “ potential ” , “ continue ” and similar expressions, including the negative of such terms, are forward - looking statements. These statements are only predictions based on our current beliefs, expectations and projections about future events and are subject to significant risks and uncertainties. You should not place undue reliance on these statements. Actual events or results may differ materially. In evaluating these statements, you should specifically consider various factors, including risks relating to additional financial, early - stage product development, clinical trials, clinical testing of samples, and those risk factors set forth in the Company ’ s Securities and Exchange Commission filings (many of which are beyond the Company’s control). These and other factors may cause our actual results to differ materially from any forward - looking statement. We undertake no obligation to update any of the forward - looking statements after the date of this presentation whether because of new information, future events or otherwise, except as required by law.

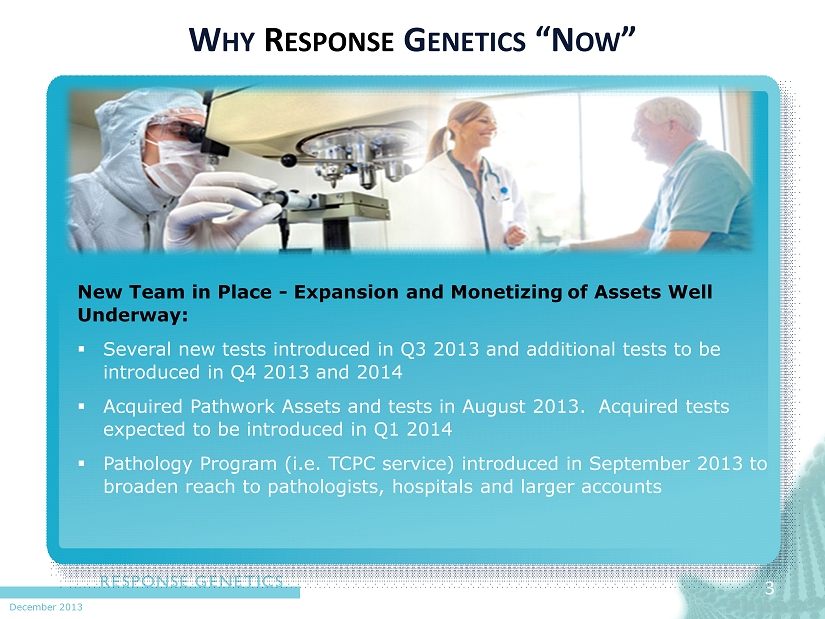

December 2013 W HY R ESPONSE G ENETICS “N OW ” 3 New Team in Place - Expansion and Monetizing of Assets Well Underway: ▪ Several new tests introduced in Q3 2013 and additional tests to be introduced in Q4 2013 and 2014 ▪ Acquired Pathwork Assets and tests in August 2013. Acquired tests expected to be introduced in Q1 2014 ▪ Pathology Program (i.e. TCPC service) introduced in September 2013 to broaden reach to pathologists, hospitals and larger accounts

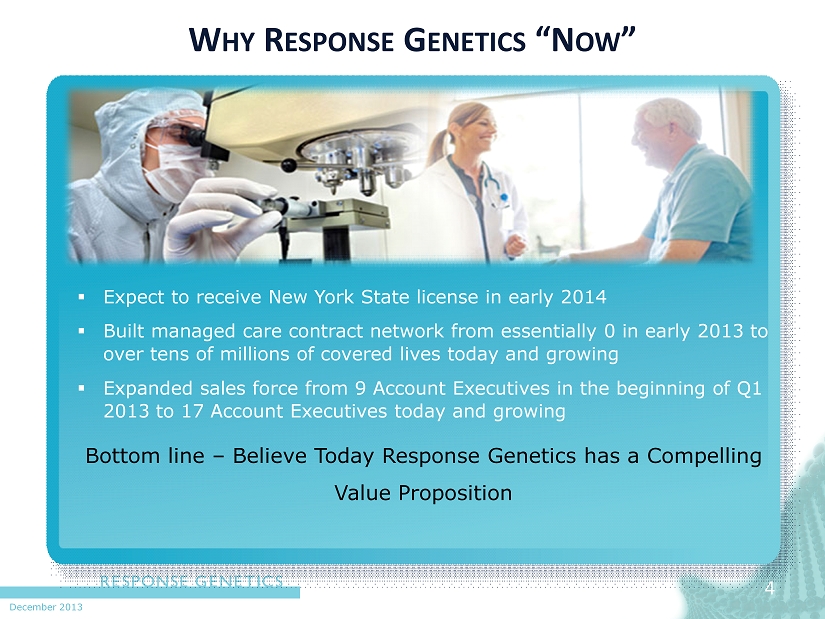

December 2013 W HY R ESPONSE G ENETICS “N OW ” 4 ▪ Expect to receive New York State license in early 2014 ▪ Built managed care contract network from essentially 0 in early 2013 to over tens of millions of covered lives today and growing ▪ Expanded sales force from 9 Account Executives in the beginning of Q1 2013 to 17 Account Executives today and growing Bottom line – Believe Today Response Genetics has a Compelling V alue P roposition

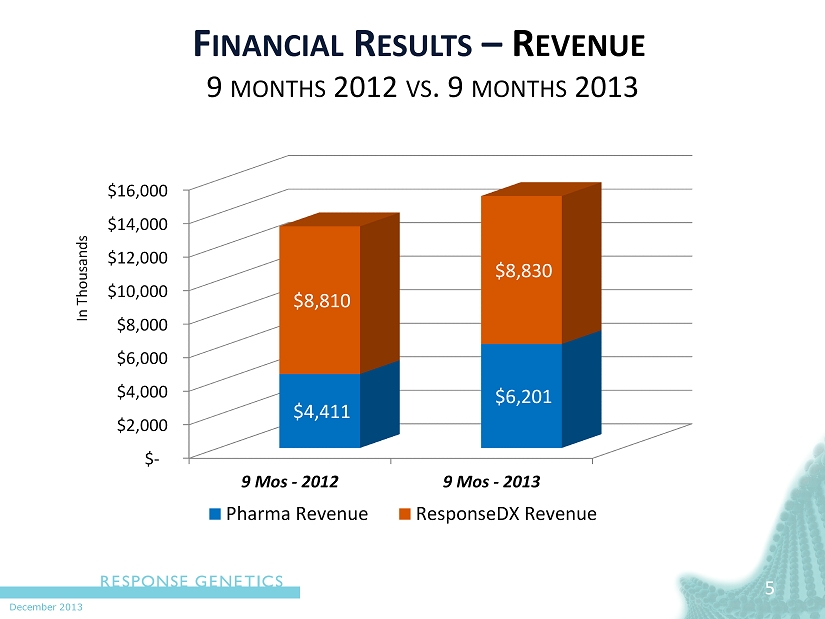

December 2013 5 F INANCIAL R ESULTS – R EVENUE 9 MONTHS 2012 VS . 9 MONTHS 2013 In Thousands $- $2,000 $4,000 $6,000 $8,000 $10,000 $12,000 $14,000 $16,000 9 Mos - 2012 9 Mos - 2013 $4,411 $6,201 $8,810 $8,830 Pharma Revenue ResponseDX Revenue

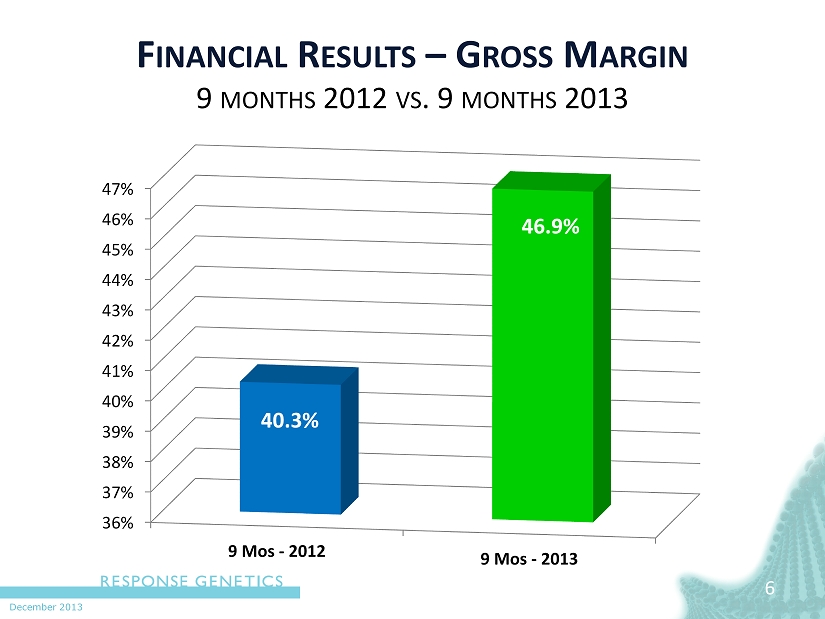

December 2013 6 6 F INANCIAL R ESULTS – G ROSS M ARGIN 9 MONTHS 2012 VS . 9 MONTHS 2013 36% 37% 38% 39% 40% 41% 42% 43% 44% 45% 46% 47% 9 Mos - 2012 9 Mos - 2013 40.3% 46.9%

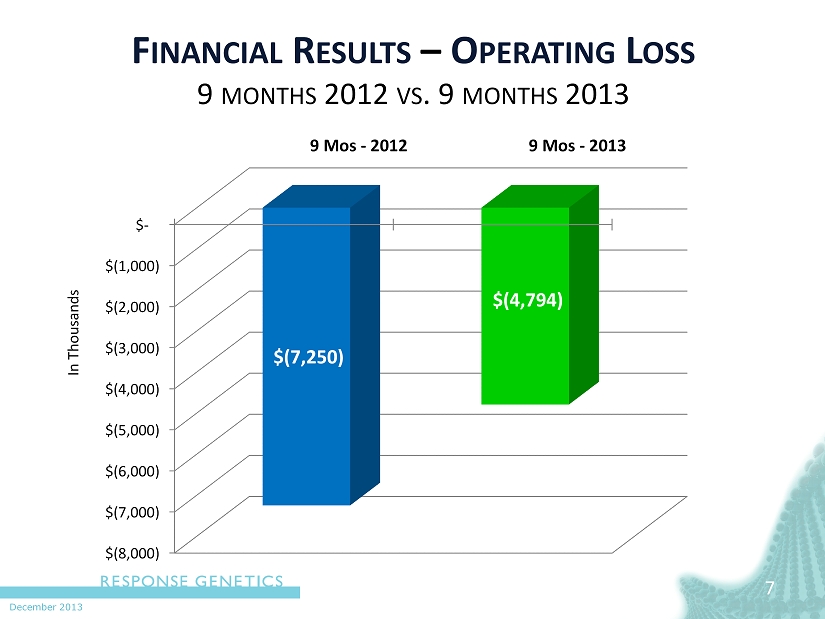

December 2013 7 7 F INANCIAL R ESULTS – O PERATING L OSS 9 MONTHS 2012 VS . 9 MONTHS 2013 In Thousands $(8,000) $(7,000) $(6,000) $(5,000) $(4,000) $(3,000) $(2,000) $(1,000) $- 9 Mos - 2012 9 Mos - 2013 $(7,250) $(4,794)

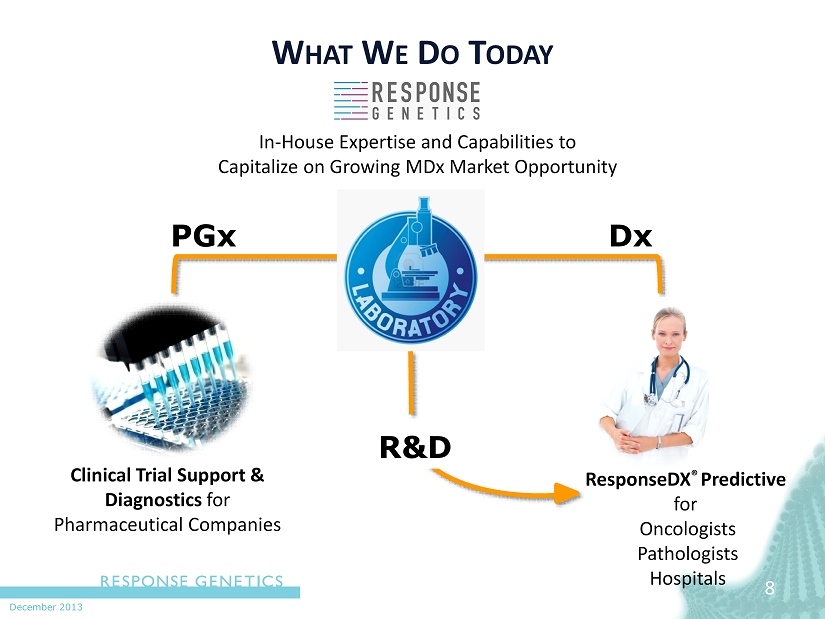

December 2013 PGx Dx 8 W HAT W E D O T ODAY ResponseDX ® Predictive for Oncologists Pathologists Hospitals Clinical Trial Support & Diagnostics for Pharmaceutical Companies R&D In - H ouse Expertise and Capabilities to Capitalize on G rowing MDx Market Opportunity

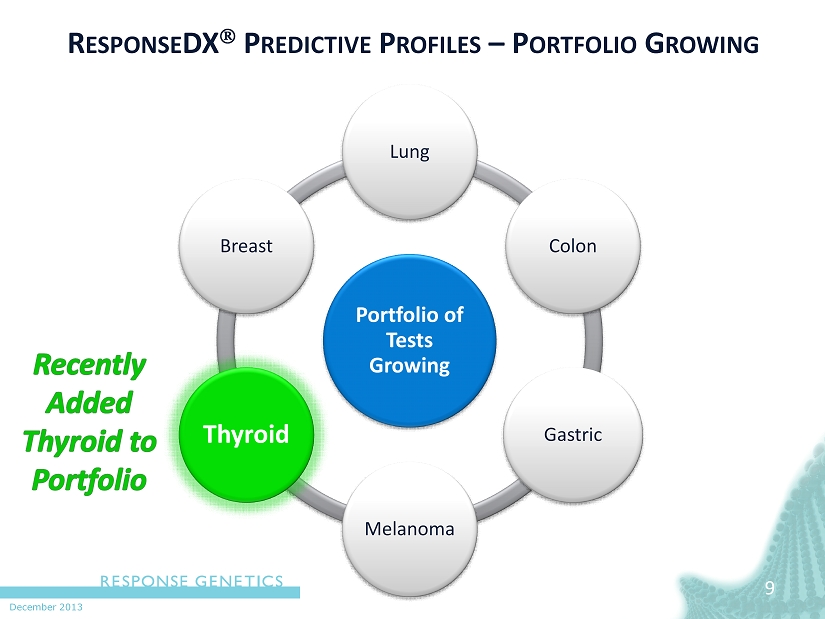

December 2013 9 R ESPONSE DX P REDICTIVE P ROFILES – P ORTFOLIO G ROWING Portfolio of Tests Growing Lung Colon Gastric Melanoma Thyroid Breast

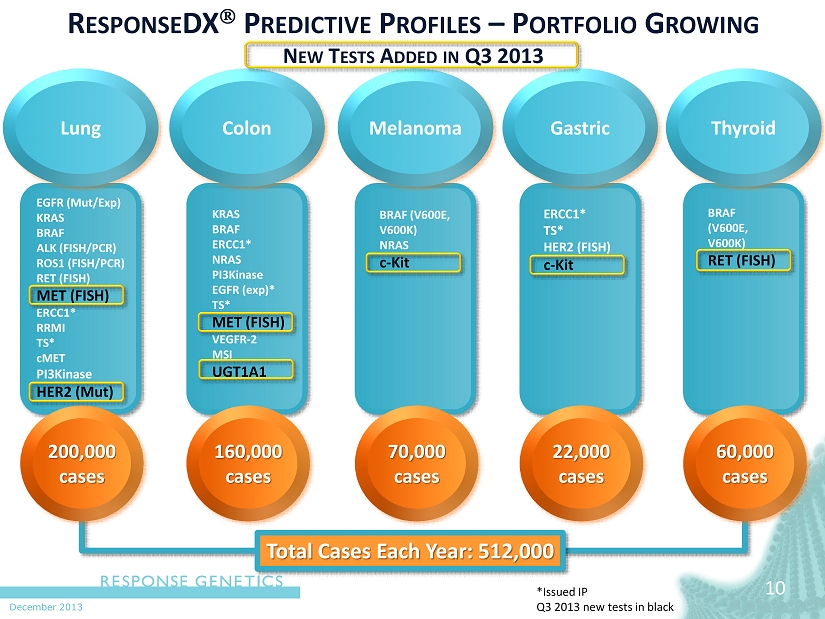

December 2013 10 R ESPONSE DX P REDICTIVE P ROFILES – P ORTFOLIO G ROWING N EW T ESTS A DDED IN Q3 2013 EGFR ( Mut / Exp ) KRAS BRAF ALK (FISH/PCR) ROS1 (FISH/PCR) RET (FISH) MET (FISH) ERCC1* RRMI TS* cMET PI3Kinase HER2 ( Mut ) Lung 200,000 cases *Issued IP Q3 2013 new tests in black Colon 160,000 cases Melanoma 70,000 cases Gastric 22,000 cases Thyroid 60,000 cases BRAF (V600E, V600K) NRAS c - Kit KRAS BRAF ERCC1* NRAS PI3Kinase EGFR ( exp )* TS* MET (FISH) VEGFR - 2 MSI UGT1A1 ERCC1* TS* HER2 (FISH) c - Kit BRAF (V600E, V600K ) RET (FISH) Total Cases Each Year: 512,000

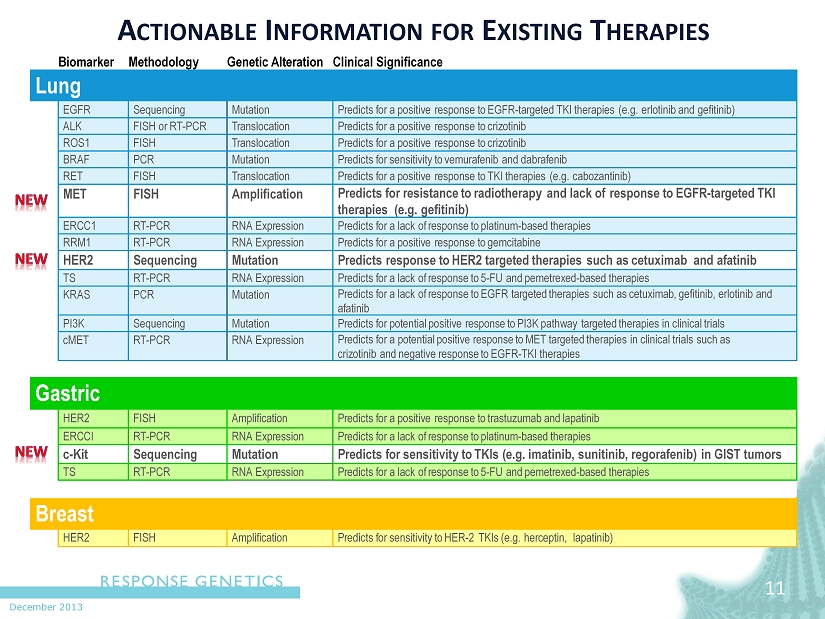

December 2013 11 11 A CTIONABLE I NFORMATION FOR E XISTING T HERAPIES Biomar k er Me thodolo g y Gen e tic Al t e r ation Clini c al Signifi c an c e L ung EGFR Sequencing M u t ation P r edi c ts f or a positi v e r esponse t o EGFR - t a r g e t ed TKI the r apies (e.g. erl o tinib and gefitinib ) ALK FISH or R T - PCR T r anslo c ation P r edi c ts f or a positi v e r esponse t o cri z o tinib R OS1 FISH T r anslo c ation P r edi c ts f or a positi v e r esponse t o cri z o tinib B R AF PCR M u t ation P r edi c ts f or sensitivi t y t o v emu r a f enib and dab r a f enib RET FISH T r anslo c ation P r edi c ts f or a positi v e r esponse t o TKI the r apies (e.g. c ab o z antinib ) MET FISH Amplifi c ation P r edi c ts f or r esi s t an c e t o r adi o the r apy and lack of r esponse t o EGFR - t a r g e t ed TKI the r apies (e.g. gefitinib ) E R C C1 R T - PCR RNA E xp r e s sion P r edi c ts f or a lack of r esponse t o platinum - based the r apies RRM1 R T - PCR RNA E xp r e s sion P r edi c ts f or a positi v e r esponse t o gemci t abine HER2 Sequencing M u t ation P r edi c ts r esponse t o HER2 t a r g e t ed the r apies such as c e tuximab and a f atinib TS R T - PCR RNA E xp r e s sion P r edi c ts f or a lack of r esponse t o 5 - FU and pem e t r ex ed - based the r apies K R AS PCR M u t ation P r edi c ts f or a lack of r esponse t o EGFR t a r g e t ed the r apies such as c e tuxima b , gefitini b , erl o tinib and a f atinib PI3K Sequencing M u t ation P r edi c ts f or p o t ential positi v e r esponse t o PI3K path w ay t a r g e t ed the r apies in clini c al trials cMET R T - PCR RNA E xp r e s sion P r edi c ts f or a p o t ential positi v e r esponse t o MET t a r g e t ed the r apies in clini c al trials such as cri z o tinib and negati v e r esponse t o EGFR - TKI the r apies Ga s tric HER2 FISH Amplifi c ation P r edi c ts f or a positi v e r esponse t o t r a s tuzumab and lapatinib E R C CI R T - PCR RNA E xp r e s sion P r edi c ts f or a lack of r esponse t o platinum - based the r apies c - Kit Sequencing M u t ation P r edi c ts f or sensitivi t y t o TKIs (e.g. imatini b , sunitini b , r ego r a f enib ) in GI S T tumors TS R T - PCR RNA E xp r e s sion P r edi c ts f or a lack of r esponse t o 5 - FU and pem e t r ex ed - based the r apies Breast HER2 FISH Amplifi c ation P r edi c ts f or sensitivi t y t o HER - 2 TKIs (e.g. he r c eptin , lapatinib )

December 2013 12 12 A CTIONABLE I NFORMATION FOR E XISTING T HERAPIES Biomar k er Me thodolo g y Gen e tic Al t e r ation Clini c al Signifi c an c e M elanoma B R AF PCR M u t ation P r edi c ts f or a positi v e r esponse t o antibody the r apy (e.g. ipilimumab ) and B R AF t a r g e t ed the r apies such as v emu r a f enib and dab r a f enib c - Kit Sequencing M u t ation P r edi c ts f or sensitivi t y t o TKIs (e.g. imatini b , sunitini b , r ego r a f enib ) N R AS Sequencing M u t ation P r edi c ts f or a positi v e r esponse t o MEK t a r g e t ed agents cu r r ently in clini c al trials such as t r am e tinib C olon K R AS PCR M u t ation P r edi c ts f or a lack of r esponse t o EGFR an t agoni s t the r apies (e.g. c e tuximab and panitumumab ) B R AF PCR M u t ation P r edi c ts f or a lack of r esponse t o EGFR an t agoni s t the r apies (e.g. c e tuximab and panitumumab ) M SI PCR Gene In s t abili t y P r edi c ts f or a positi v e r esponse t o 5 - FU and irin o t e c an MET FISH Amplifi c ation P r edi c ts f or lack of r esponse t o EGFR the r apies E R C CI R T - PCR RNA E xp r e s sion P r edi c ts f or a lack of r esponse t o platinum - based the r apies N R AS Sequencing M u t ation P r edi c ts f or a lack of r esponse t o EGFR an t agoni s t the r apies (e.g. c e tuximab and panitumumab ) PI3K Sequencing M u t ation P r edi c ts f or a lack of r esponse t o EGFR an t agoni s t the r apies (e.g. c e tuximab and panitumumab ) EGFR Sequencing M u t ation P r edi c ts f or a lack of r esponse t o EGFR an t agoni s t the r apies (e.g. c e tuximab and panitumumab ) TS R T - PCR RNA E xp r e s sion P r edi c ts f or a lack of r esponse t o 5 - FU and pem e t r ex ed - based the r apies UGT1A1 Sequencing Gen o t ype P r edi c ts f or ad v erse r esponse t o Irin o t e c an V EGFR - 2 R T - PCR RNA E xp r e s sion P r edi c ts f or r esponse t o angiogenesis inhibi t ors Thy r oid RET FISH T r anslo c ation P r edi c ts f or a positi v e r esponse t o TKI the r apies (e.g. so r a f eni b , sunitinib and c ab o z antinib ) B R AF PCR M u t ation P r edi c ts f or a positi v e r esponse t o B R AF t a r g e t ed the r apies such as v emu r a f enib and dab r a f enib

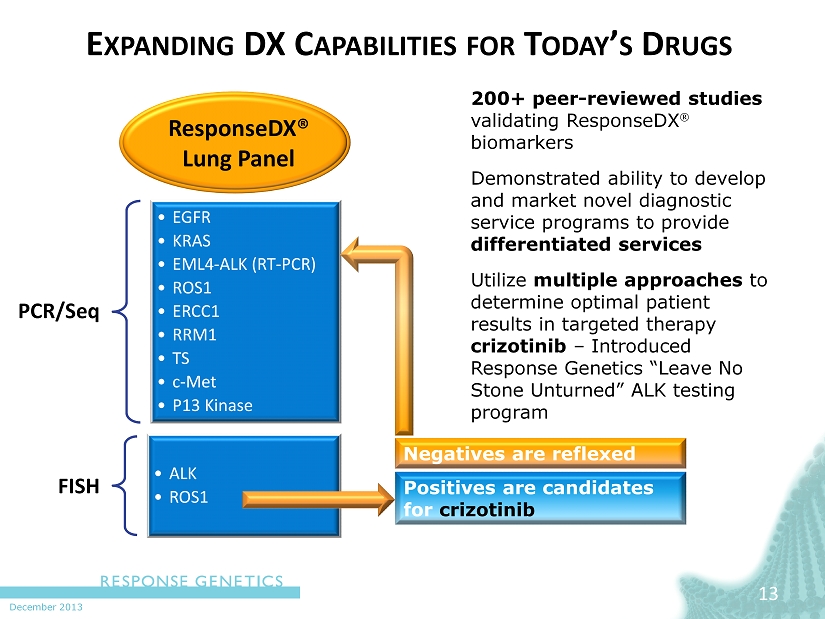

December 2013 E XPANDING DX C APABILITIES FOR T ODAY ’ S D RUGS 200+ peer - reviewed studies validating ResponseDX biomarkers Demonstrated ability to develop and market novel diagnostic service programs to provide differentiated services Utilize multiple approaches to determine optimal patient results in targeted therapy crizotinib – Introduced Response Genetics “Leave No Stone Unturned” ALK testing program 13 ResponseDX ® Lung Panel Positives are candidates for crizotinib Negatives are reflexed PCR/ Seq • EGFR • KRAS • EML4 - ALK (RT - PCR) • ROS1 • ERCC1 • RRM1 • TS • c - Met • P13 Kinase FISH • ALK • ROS1

December 2013 14 14

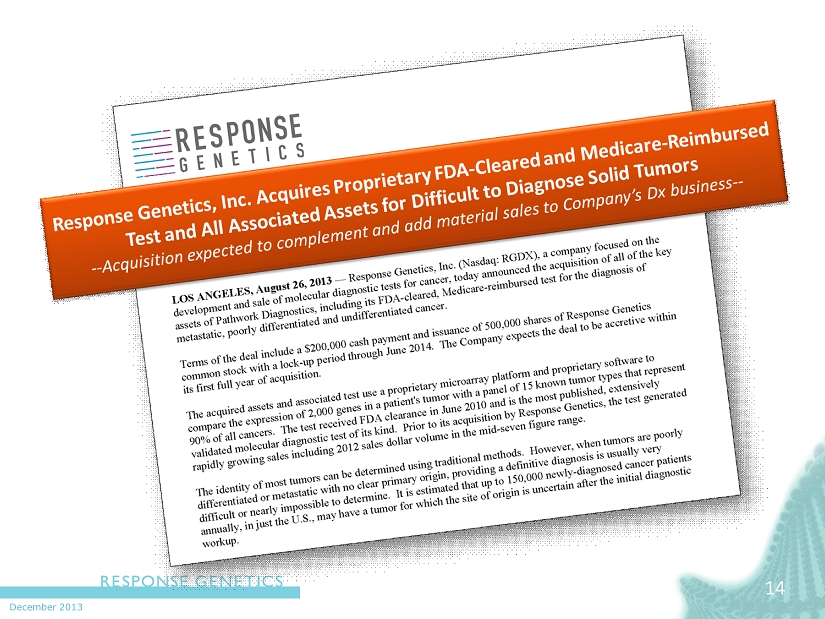

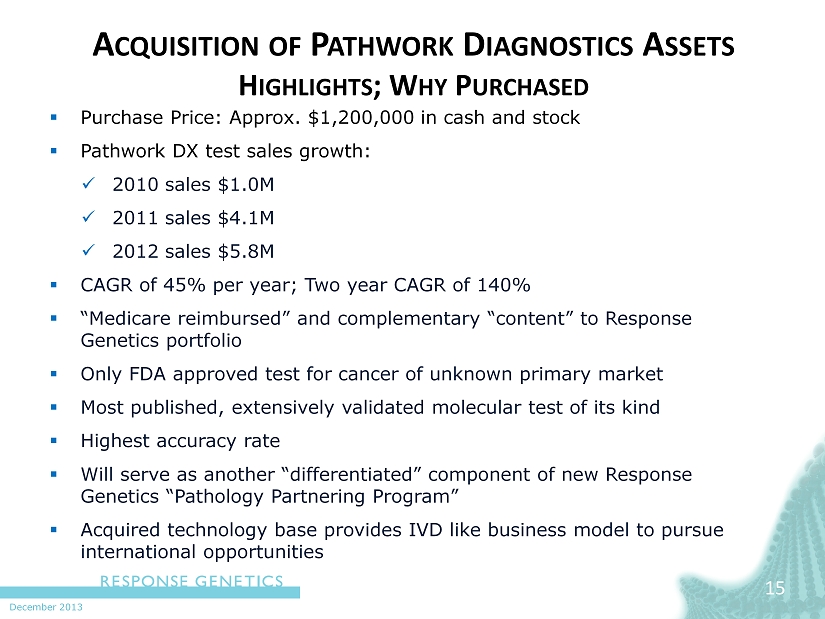

December 2013 A CQUISITION OF P ATHWORK D IAGNOSTICS A SSETS H IGHLIGHTS ; W HY P URCHASED ▪ Purchase Price: Approx. $1,200,000 in cash and stock ▪ Pathwork DX test sales growth: x 2010 sales $1.0M x 2011 sales $ 4.1M x 2012 sales $ 5.8M ▪ CAGR of 45% per year; Two year CAGR of 140% ▪ “Medicare reimbursed” and complementary “content” to Response Genetics portfolio ▪ Only FDA approved test for cancer of unknown primary market ▪ Most published, extensively validated molecular test of its kind ▪ Highest accuracy rate ▪ Will serve as another “differentiated” component of new Response Genetics “Pathology Partnering Program” ▪ Acquired technology base provides IVD like business model to pursue international opportunities 15

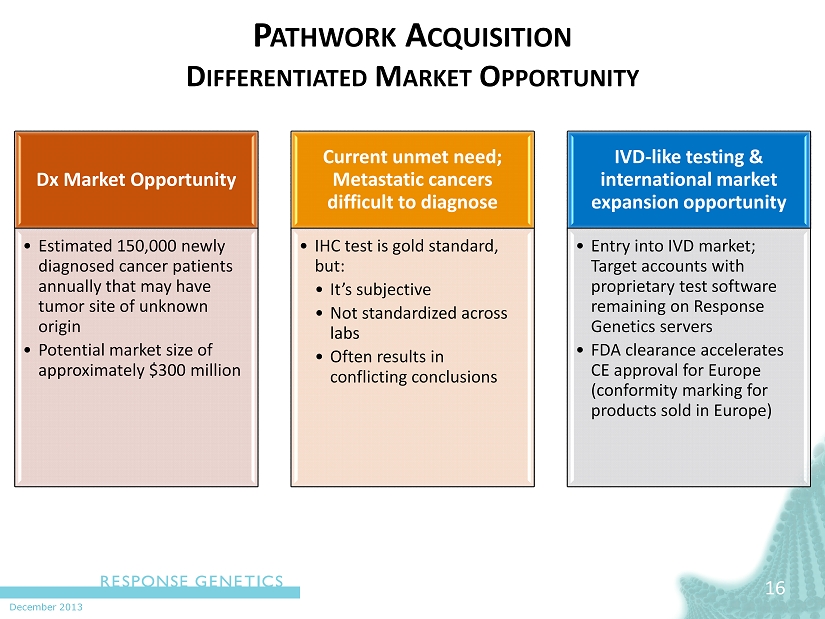

December 2013 P ATHWORK A CQUISITION D IFFERENTIATED M ARKET O PPORTUNITY 16 Dx Market Opportunity • Estimated 150,000 newly diagnosed cancer patients annually that may have tumor site of unknown origin • Potential market size of approximately $300 million Current unmet need; Metastatic cancers difficult to diagnose • IHC test is gold standard, but: • It’s subjective • Not standardized across labs • Often results in conflicting conclusions IVD - like testing & international market expansion opportunity • Entry into IVD market; Target accounts with proprietary test software remaining on Response Genetics servers • FDA clearance accelerates CE approval for Europe (conformity marking for products sold in Europe)

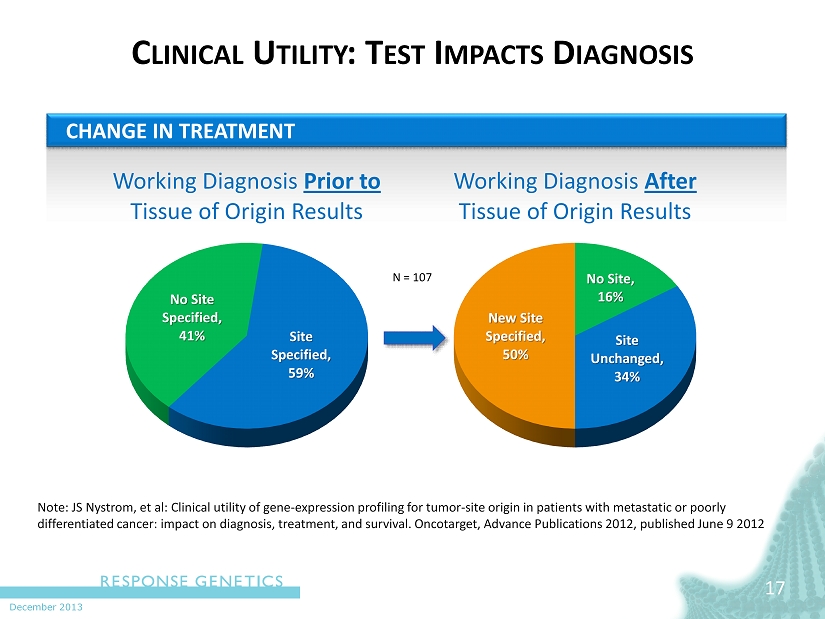

December 2013 C LINICAL U TILITY : T EST I MPACTS D IAGNOSIS 17 No Site Specified, 41% Site Specified, 59% Working Diagnosis Prior to Tissue of Origin Results New Site Specified, 50% No Site, 16% Site Unchanged, 34% Working Diagnosis After Tissue of Origin Results CHANGE IN TREATMENT Note: JS Nystrom, et al: Clinical utility of gene - expression profiling for tumor - site origin in patients with metastatic or poorly differentiated cancer: impact on diagnosis, treatment, and survival. Oncotarget , Advance Publications 2012, published June 9 2012 N = 107

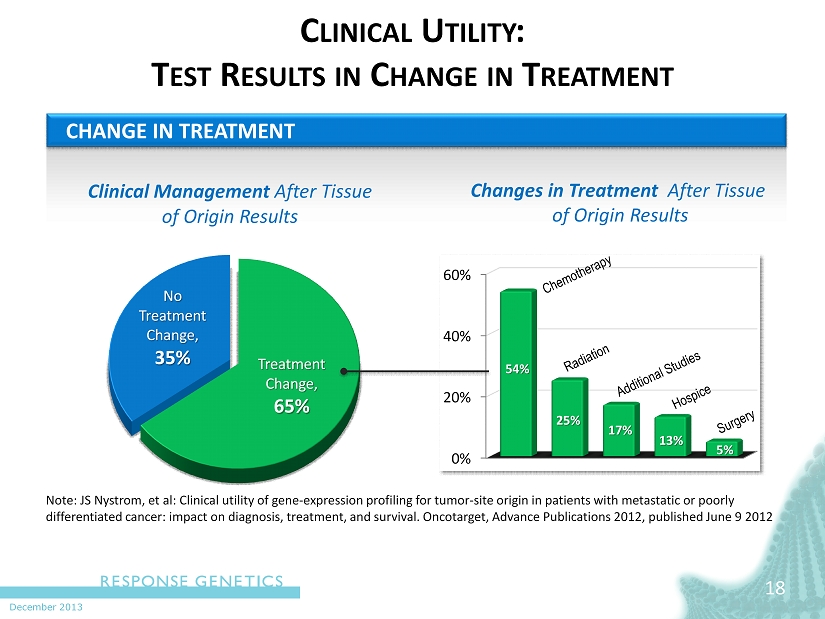

December 2013 C LINICAL U TILITY : T EST R ESULTS IN C HANGE IN T REATMENT Treatment Change, 65% No Treatment Change, 35% Clinical Management After Tissue of Origin Results 18 CHANGE IN TREATMENT N ote: JS Nystrom, et al: Clinical utility of gene - expression profiling for tumor - site origin in patients with metastatic or poorly differentiated cancer: impact on diagnosis, treatment, and survival. Oncotarget , Advance Publications 2012, published June 9 2012 0% 20% 40% 60% 54% 25% 17% 13% 5% Changes in Treatment After Tissue of Origin Results

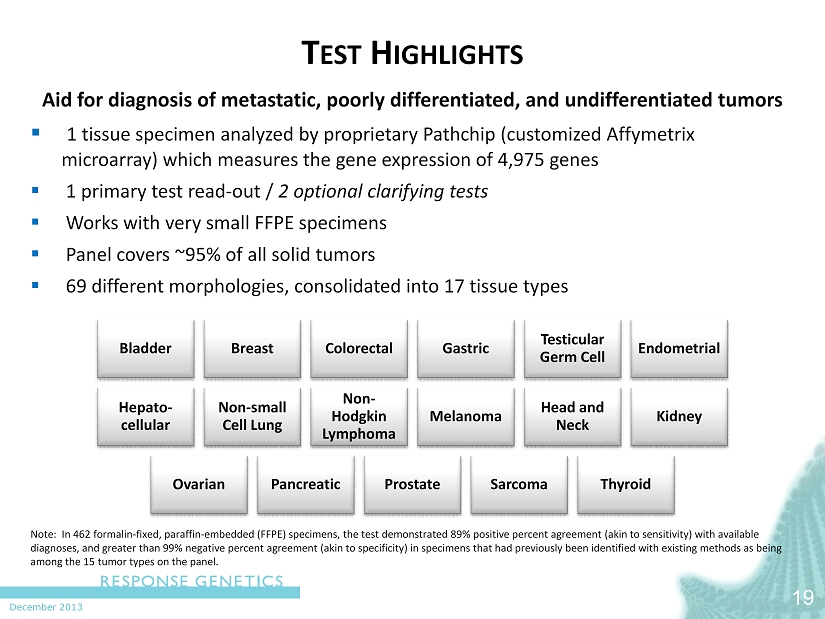

December 2013 T EST H IGHLIGHTS 19 Aid for diagnosis of metastatic, poorly differentiated, and undifferentiated tumors ▪ 1 tissue s pecimen analyzed by proprietary Pathchip (customized Affymetrix microarray) which measures the gene expression of 4,975 genes ▪ 1 primary test read - out / 2 optional clarifying tests ▪ Works with very small FFPE specimens ▪ Panel covers ~95% of all solid tumors ▪ 69 different morphologies, consolidated into 17 tissue types Note: In 462 formalin - fixed, paraffin - embedded (FFPE) specimens, the test demonstrated 89% positive percent agreement (akin to sensitivit y) with available diagnoses, and greater than 99% negative percent agreement (akin to specificity) in specimens that had previously been identi fie d with existing methods as being among the 15 tumor types on the panel. Bladder Breast Colorectal Gastric Testicular Germ Cell Endometrial Hepato - cellular Non - small Cell Lung Non - Hodgkin Lymphoma Melanoma Head and Neck Kidney Ovarian Pancreatic Prostate Sarcoma Thyroid

December 2013 US S ALES AND M ARKETING I NFRASTRUCTURE 20 Nationwide DX Sales Force – Currently 17 Reps Building to 20 Reps by end of Q1 2014 3 Regional Sales Directors Vice President of Sales and Sr. Director of Marketing in Place Director of Managed Care in Place

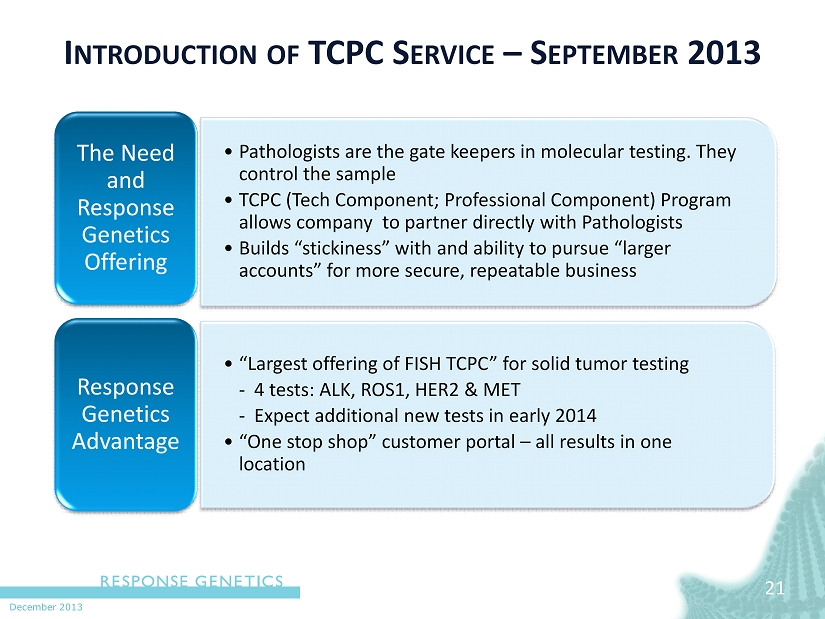

December 2013 21 • Pathologists are the gate keepers in molecular testing. They control the sample • TCPC (Tech Component; Professional Component) Program allows company to partner directly with Pathologists • Builds “stickiness” with and ability to pursue “larger accounts” for more secure, repeatable business The Need and Response Genetics Offering • “Largest offering of FISH TCPC” for solid tumor testing - 4 tests: ALK, ROS1, HER2 & MET - Expect additional new tests in early 2014 • “One stop shop” customer portal – all results in one location Response Genetics Advantage I NTRODUCTION OF TCPC S ERVICE – S EPTEMBER 2013

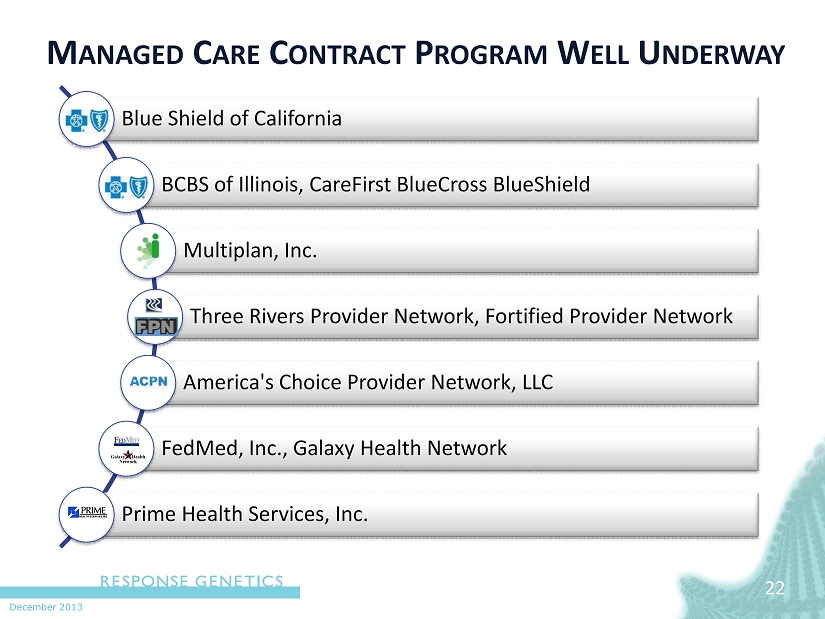

December 2013 M ANAGED C ARE C ONTRACT P ROGRAM W ELL U NDERWAY 22 Blue Shield of California BCBS of Illinois, CareFirst BlueCross BlueShield Multiplan, Inc. Three Rivers Provider Network, Fortified Provider Network America's Choice Provider Network, LLC FedMed , Inc., Galaxy Health Network Prime Health Services, Inc.

December 2013 23 Extensive pharma experience in DX testing, servicing and bridging with multi - year partnership with GSK Support pharma development programs including GSK’s MAGE A3 & BRAF Comprehensive understanding of parallel path between therapeutic and diagnostic development P ROVIDE MD X S ERVICES TO S ELECT B IG P HARMA Service revenue and milestone payments Pharma business leverages overhead

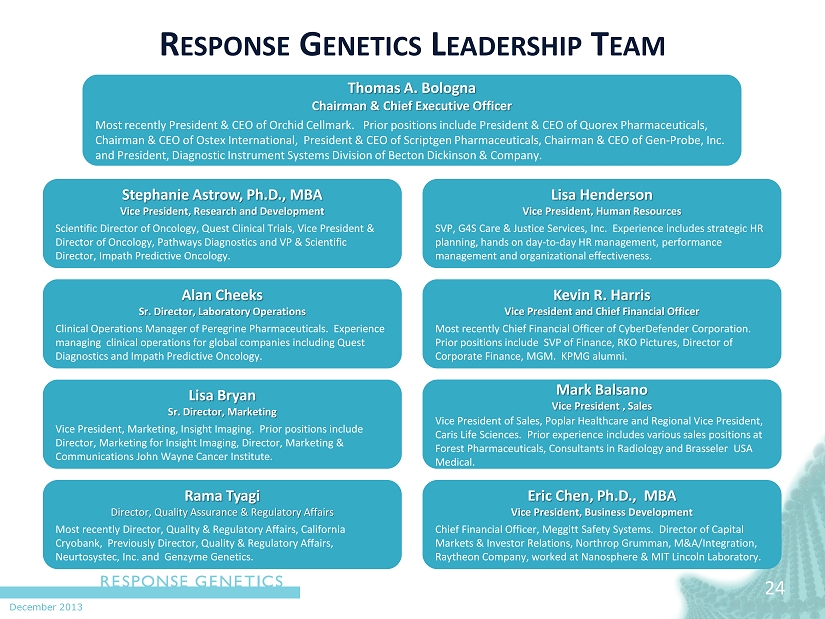

December 2013 R ESPONSE G ENETICS L EADERSHIP T EAM 24 Thomas A. Bologna Chairman & Chief Executive Officer Most recently President & CEO of Orchid Cellmark. Prior positions include President & CEO of Quorex Pharmaceuticals, Chairman & CEO of Ostex International, President & CEO of Scriptgen Pharmaceuticals, Chairman & CEO of Gen - Probe, Inc. and President, Diagnostic Instrument Systems Division of Becton Dickinson & Company. Stephanie Astrow, Ph.D ., MBA Vice President, Research and Development Scientific Director of Oncology, Quest Clinical Trials, Vice President & Director of Oncology, Pathways Diagnostics and VP & Scientific Director, Impath Predictive Oncology. Lisa Henderson Vice President, Human Resources SVP, G4S Care & Justice Services, Inc. Experience includes strategic HR planning, hands on day - to - day HR management, performance management and organizational effectiveness. Kevin R. Harris Vice President and Chief Financial Officer Most recently Chief Financial Officer of CyberDefender Corporation. Prior positions include SVP of Finance, RKO Pictures, Director of Corporate Finance, MGM. KPMG alumni. Lisa Bryan Sr. Director, Marketing Vice President, Marketing, Insight Imaging. Prior positions include Director, Marketing for Insight Imaging, Director, Marketing & Communications John Wayne Cancer Institute. Eric Chen, Ph.D., MBA Vice President, Business Development Chief Financial Officer, Meggitt Safety Systems. Director of Capital Markets & Investor Relations, Northrop Grumman, M&A/Integration, Raytheon Company, worked at Nanosphere & MIT Lincoln Laboratory. Mark Balsano Vice President , Sales Vice President of Sales, Poplar Healthcare and Regional Vice President, Caris Life Sciences. Prior experience includes various sales positions at Forest Pharmaceuticals, Consultants in Radiology and Brasseler USA Medical. Alan Cheeks Sr. Director , Laboratory Operations Clinical Operations Manager of Peregrine Pharmaceuticals. Experience managing clinical operations for global companies including Quest Diagnostics and Impath Predictive Oncology. Rama Tyagi Director, Quality Assurance & Regulatory Affairs Most recently Director, Quality & Regulatory Affairs, California Cryobank , Previously Director, Quality & Regulatory Affairs, Neurtosystec, Inc. and Genzyme Genetics.

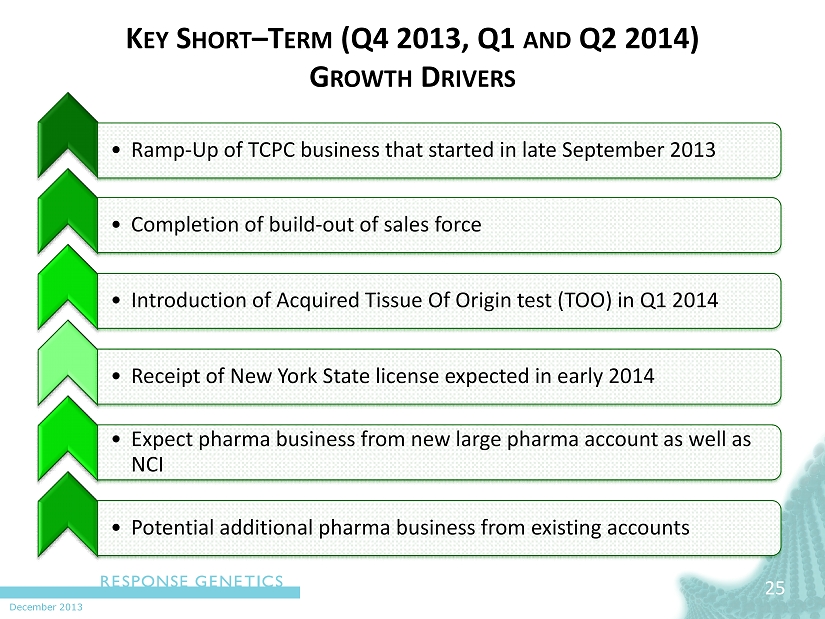

December 2013 K EY S HORT – T ERM (Q4 2013, Q1 AND Q2 2014) G ROWTH D RIVERS • Ramp - Up of TCPC business that started in late September 2013 • Completion of build - out of sales force • Introduction of Acquired Tissue Of Origin test (TOO) in Q1 2014 • Receipt of New York State license expected in early 2014 • Expect pharma business from new large pharma account as well as NCI • Potential additional pharma business from existing accounts 25