31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form

(Mark One)

|

|

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended

OR

|

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number:

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

(State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) |

|

|

|

|

(Address of Principal Executive Offices) |

(Zip Code) |

(

(Registrant’s Telephone Number, Including Area Code)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

|

|

|

|

|

|

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

|

Large accelerated filer |

☐ |

|

Accelerated filer |

☐ |

|

|

☒ |

|

Smaller reporting company |

|

|

Emerging growth company |

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

As of April 29, 2022, the number of outstanding shares of the registrant’s common stock, par value $0.001 per share, was

CATALYST BIOSCIENCES, INC.

TABLE OF CONTENTS

|

|

|

|

|

Page No. |

||

|

|

|

|

|

|

||

|

|

3 |

|||||

|

|

|

|

|

|

||

|

Item 1. |

|

|

3 |

|||

|

|

|

|

|

|

||

|

|

|

Condensed Consolidated Balance Sheets as of March 31, 2022 (unaudited) and December 31, 2021 |

|

3 |

||

|

|

|

|

|

|

||

|

|

|

|

4 |

|||

|

|

|

|

|

|

||

|

|

|

|

5 |

|||

|

|

|

|

|

|

||

|

|

|

|

6 |

|||

|

|

|

|

|

|

||

|

|

|

Notes to the Unaudited Interim Condensed Consolidated Financial Statements |

|

7 |

||

|

|

|

|

|

|

||

|

Item 2. |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

14 |

||

|

|

|

|

|

|

||

|

Item 3. |

|

|

21 |

|||

|

|

|

|

|

|

||

|

Item 4. |

|

|

22 |

|||

|

|

|

|

|

|

||

|

|

23 |

|||||

|

|

|

|

|

|

||

|

Item 1. |

|

|

23 |

|||

|

|

|

|

|

|

||

|

Item 1A. |

|

|

23 |

|||

|

|

|

|

|

|

||

|

Item 2. |

|

|

23 |

|||

|

|

|

|

|

|

||

|

Item 3. |

|

|

23 |

|||

|

|

|

|

|

|

||

|

Item 4. |

|

|

23 |

|||

|

|

|

|

|

|

||

|

Item 5. |

|

|

23 |

|||

|

|

|

|

|

|

||

|

Item 6. |

|

|

23 |

|||

|

|

|

|

|

|

||

|

|

24 |

|||||

|

|

|

|

|

|

||

|

|

25 |

|||||

PART I. FINANCIAL INFORMATION

|

ITEM 1. |

FINANCIAL STATEMENTS |

Catalyst Biosciences, Inc.

Condensed Consolidated Balance Sheets

(In thousands, except share and per share amounts)

|

|

|

March 31, 2022 |

|

|

December 31, 2021 |

|

||

|

|

|

(Unaudited) |

|

|

|

|

|

|

|

Assets |

|

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

|

|

|

$ |

|

|

|

Short-term investments |

|

|

— |

|

|

|

|

|

|

Accounts receivable, net |

|

|

|

|

|

|

|

|

|

Prepaid and other current assets |

|

|

|

|

|

|

|

|

|

Total current assets |

|

|

|

|

|

|

|

|

|

Other assets, noncurrent |

|

|

|

|

|

|

|

|

|

Right-of-use assets |

|

|

|

|

|

|

|

|

|

Property and equipment, net |

|

|

|

|

|

|

|

|

|

Total assets |

|

$ |

|

|

|

$ |

|

|

|

Liabilities and stockholders’ equity |

|

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

|

|

|

$ |

|

|

|

Accrued compensation |

|

|

|

|

|

|

|

|

|

Deferred revenue |

|

|

— |

|

|

|

|

|

|

Other accrued liabilities |

|

|

|

|

|

|

|

|

|

Operating lease liability |

|

|

|

|

|

|

|

|

|

Total current liabilities |

|

|

|

|

|

|

|

|

|

Operating lease liability, noncurrent |

|

|

— |

|

|

|

|

|

|

Total liabilities |

|

|

|

|

|

|

|

|

|

Commitments and Contingencies (Note 9) |

|

|

|

|

|

|

|

|

|

Stockholders’ equity: |

|

|

|

|

|

|

|

|

|

Preferred stock, $ and outstanding |

|

|

|

|

|

|

|

|

|

Common stock, $ December 31, 2021, respectively |

|

|

|

|

|

|

|

|

|

Additional paid-in capital |

|

|

|

|

|

|

|

|

|

Accumulated deficit |

|

|

( |

) |

|

|

( |

) |

|

Total stockholders’ equity |

|

|

|

|

|

|

|

|

|

Total liabilities and stockholders’ equity |

|

$ |

|

|

|

$ |

|

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

3

Catalyst Biosciences, Inc.

Condensed Consolidated Statements of Operations and Comprehensive Loss

(In thousands, except share and per share amounts)

(Unaudited)

|

|

|

Three Months Ended March 31, |

|

|||||

|

|

|

2022 |

|

|

2021 |

|

||

|

Revenue: |

|

|

|

|

|

|

|

|

|

License |

|

$ |

— |

|

|

$ |

— |

|

|

Collaboration |

|

|

|

|

|

|

|

|

|

License and collaboration revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

Cost of license |

|

|

— |

|

|

|

— |

|

|

Cost of collaboration |

|

|

|

|

|

|

|

|

|

Research and development |

|

|

|

|

|

|

|

|

|

General and administrative |

|

|

|

|

|

|

|

|

|

Total operating expenses |

|

|

|

|

|

|

|

|

|

Loss from operations |

|

|

( |

) |

|

|

( |

) |

|

Interest and other income, net |

|

|

|

|

|

|

— |

|

|

Net loss and comprehensive loss |

|

$ |

( |

) |

|

$ |

( |

) |

|

Net loss per share attributable to common stockholders, basic and diluted |

|

$ |

( |

) |

|

$ |

( |

) |

|

Shares used to compute net loss per share attributable to common stockholders, basic and diluted |

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

4

Catalyst Biosciences, Inc.

Condensed Consolidated Statements of Stockholders’ Equity

(In thousands, except share amounts)

(Unaudited)

|

|

|

Convertible Preferred Stock |

|

|

Common Stock |

|

|

Additional Paid-In |

|

|

Accumulated Other Comprehensive |

|

|

Accumulated |

|

|

Total Stockholders' |

|

||||||||||||||

|

|

|

Shares |

|

|

Amount |

|

|

Shares |

|

|

Amount |

|

|

Capital |

|

|

Income |

|

|

Deficit |

|

|

Equity |

|

||||||||

|

Balance at December 31, 2021 |

|

|

— |

|

|

$ |

— |

|

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

— |

|

|

$ |

( |

) |

|

$ |

|

|

|

Stock-based compensation expense |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

Issuance of common stock from stock grants |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

|

Balance at March 31, 2022 |

|

|

— |

|

|

$ |

— |

|

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

— |

|

|

$ |

( |

) |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Convertible Preferred Stock |

|

|

Common Stock |

|

|

Additional Paid-In |

|

|

Accumulated Other Comprehensive |

|

|

Accumulated |

|

|

Total Stockholders’ |

|

||||||||||||||

|

|

|

Shares |

|

|

Amount |

|

|

Shares |

|

|

Amount |

|

|

Capital |

|

|

Income (Loss) |

|

|

Deficit |

|

|

Equity |

|

||||||||

|

Balance at December 31, 2020 |

|

|

— |

|

|

$ |

— |

|

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

( |

) |

|

$ |

|

|

|

Stock-based compensation expense |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

Issuance of common stock for public offering, net of issuance costs of $ |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

Issuance of common stock from stock grants |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

|

Balance at March 31, 2021 |

|

|

— |

|

|

$ |

— |

|

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

( |

) |

|

$ |

|

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

5

Catalyst Biosciences, Inc.

Condensed Consolidated Statements of Cash Flows

(In thousands)

(Unaudited)

|

|

|

Three Months Ended March 31, |

|

|||||

|

|

|

2022 |

|

|

2021 |

|

||

|

Operating Activities |

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

( |

) |

|

$ |

( |

) |

|

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

|

|

|

|

Stock-based compensation expense |

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

|

|

|

|

|

|

|

Bad debt expense |

|

|

|

|

|

|

— |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

|

|

|

|

|

|

|

Prepaid and other current assets |

|

|

|

|

|

|

( |

) |

|

Accounts payable |

|

|

( |

) |

|

|

( |

) |

|

Accrued compensation and other accrued liabilities |

|

|

|

|

|

|

( |

) |

|

Operating lease liability and right-of-use asset |

|

|

|

|

|

|

|

|

|

Deferred revenue |

|

|

( |

) |

|

|

( |

) |

|

Net cash flows used in operating activities |

|

|

( |

) |

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

Investing Activities |

|

|

|

|

|

|

|

|

|

Proceeds from maturities of short-term investments |

|

|

|

|

|

|

|

|

|

Net cash flows provided by investing activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financing Activities |

|

|

|

|

|

|

|

|

|

Issuance of common stock for public offering, net of issuance costs |

|

|

— |

|

|

|

|

|

|

Issuance of common stock from stock grants |

|

|

|

|

|

|

|

|

|

Net cash flows provided by financing activities |

|

|

|

|

|

|

|

|

|

Net increase (decrease) in cash and cash equivalents |

|

|

( |

) |

|

|

|

|

|

Cash and cash equivalents at beginning of the period |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents at end of the period |

|

$ |

|

|

|

$ |

|

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

6

Catalyst Biosciences, Inc.

Notes to Condensed Consolidated Financial Statements (Unaudited)

|

1. |

Nature of Operations and Liquidity |

Catalyst Biosciences, Inc. and its subsidiary (the “Company” or “Catalyst”) is a biopharmaceutical company with expertise in protease engineering and several protease assets that may address unmet medical needs in disorders of the coagulation and complement systems. The Company is focused on the monetization of its assets and is exploring several strategic alternatives. The Company is located in South San Francisco, California and operates in

The Company had a net loss of $

|

|

2. |

Summary of Significant Accounting Policies |

Basis of Presentation

The Company’s condensed consolidated financial statements have been prepared in accordance with U.S. generally accepted accounting principles (“GAAP”) and following the requirements of the Securities and Exchange Commission (the “SEC”) for interim reporting. As permitted under those rules, certain footnotes or other financial information that are normally required by GAAP can be condensed or omitted. These financial statements have been prepared on the same basis as the Company’s annual financial statements and, in the opinion of management, reflect all adjustments, consisting only of normal recurring adjustments, which are necessary for a fair presentation of the Company’s financial information. These interim results and cash flows for any interim period are not necessarily indicative of the results to be expected for the year ending December 31, 2022, or for any other future annual or interim period.

The accompanying condensed consolidated financial statements and related financial information should be read in conjunction with the consolidated financial statements filed with the Company’s Annual Report on Form 10-K for the year ended December 31, 2021 (“Annual Report”).

Accounting Pronouncements Recently Adopted

In May 2021, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2021-04, Earnings Per Share (Topic 260), Debt—Modifications and Extinguishments (Subtopic 470-50), Compensation—Stock Compensation (Topic 718), and Derivatives and Hedging—Contracts in Entity’s Own Equity (Subtopic 815-40): Issuer’s Accounting for Certain Modifications or Exchanges of Freestanding Equity-Classified Written Call Options. The amendments in ASU 2021-04 provide guidance to clarify and reduce diversity in an issuer’s accounting for modifications or exchanges of freestanding equity-classified written call options (for example, warrants) that remain equity classified after modification or exchange. The amendments in this ASU 2021-04 are effective for all entities for fiscal years beginning after December 15, 2021, and interim periods within those fiscal years, with early adoption permitted, including interim periods within those fiscal years. The Company adopted ASU 2021-04 and related updates on January 1, 2022, and the adoption did not have a material impact on its condensed consolidated financial statements.

New Accounting Pronouncements Recently Issued But Not Yet Adopted

In June 2016, the FASB issued ASU 2016-13, Measurement of Credit Losses on Financial Instruments. The main objective of ASU 2016-13 is to provide financial statement users with more decision-useful information about an entity's expected credit losses on financial instruments and other commitments to extend credit at each reporting date. To achieve this objective, the amendments in this update replace the incurred loss impairment methodology currently used today with a methodology that reflects expected credit losses and requires consideration of a broader range of reasonable and supportable information to develop credit loss estimates. ASU 2016-13 will be effective for the Company for fiscal years beginning after December 15, 2022, including interim periods within those fiscal years, using a modified retrospective approach. Early adoption is permitted. The Company plans to

7

adopt ASU 2016-13 and related updates as of January 1, 2023. The Company will assess the impact of adoption of this standard on its condensed consolidated financial statements.

|

3. |

Fair Value Measurements |

For a description of the fair value hierarchy and the Company’s fair value methodology, see “Part II - Item 8 - Financial Statements and Supplementary Data - Note 3 – Summary of Significant Accounting Policies” in the Company’s Annual Report. There were no significant changes in these methodologies during the three months ended March 31, 2022.

|

|

|

March 31, 2022 |

|

|||||||||||||

|

|

|

Level 1 |

|

|

Level 2 |

|

|

Level 3 |

|

|

Total |

|

||||

|

Financial assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Money market funds(1) |

|

$ |

|

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

|

|

|

Total financial assets |

|

$ |

|

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

|

|

|

|

|

December 31, 2021 |

|

|||||||||||||

|

|

|

Level 1 |

|

|

Level 2 |

|

|

Level 3 |

|

|

Total |

|

||||

|

Financial assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Money market funds(1) |

|

$ |

|

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

|

|

|

U.S. government agency securities(2) |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

Total financial assets |

|

$ |

|

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

|

|

|

|

(1) |

|

|

|

(2) |

|

The carrying amounts of cash and cash equivalents, accounts receivable, accounts payable, and accrued liabilities approximate their fair values due to the short-term maturity of these instruments.

|

4. |

Financial Instruments |

Cash equivalents and short-term investments (debt securities) which are classified as available-for-sale debt securities, consisted of the following (in thousands):

|

March 31, 2022 |

|

Amortized Cost |

|

|

Gross Unrealized Gains |

|

|

Gross Unrealized Losses |

|

|

Estimated Fair Value |

|

||||

|

Money market funds (cash equivalents) |

|

$ |

|

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

|

|

|

Total financial assets |

|

$ |

|

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

|

|

|

Classified as: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

December 31, 2021 |

|

Amortized Cost |

|

|

Gross Unrealized Gains |

|

|

Gross Unrealized Losses |

|

|

Estimated Fair Value |

|

||||

|

Money market funds (cash equivalents) |

|

$ |

|

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

|

|

|

U.S. government agency securities |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

Total financial assets |

|

$ |

|

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

|

|

|

Classified as: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

Short-term investments |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

There have been

8

|

5. |

Lease |

Operating lease liabilities are recognized based on the present value of the future minimum lease payments over the lease term. In calculating the present value of the lease payments, the Company has elected to utilize its incremental borrowing rate based on the original lease term and not the remaining lease term. The lease includes non-lease components (e.g., common area maintenance) that are paid separately from rent based on actual costs incurred and, therefore, were not included in the right-of-use asset and lease liability but are reflected as an expense in the period incurred.

The Company leases office space for its corporate headquarters, located in South San Francisco, CA. The lease term is through

In March 2022, the Company entered into a sublease agreement for one of its leased facilities that commenced in April 2022. Under the terms of the sublease agreement, the Company will receive $

For the three months ended March 31, 2022 and 2021, the Company’s operating lease expense was $

|

|

|

March 31, 2022 |

|

|

December 31, 2021 |

|

||

|

Weighted-average remaining lease term |

|

|

|

|

|

|

||

|

Weighted-average discount rate |

|

|

|

% |

|

|

|

% |

The maturity of the Company’s operating lease liabilities as of March 31, 2022 were as follows (in thousands):

|

Year Ending December 31, |

|

Amount |

|

|

|

Remaining in 2022 |

|

$ |

|

|

|

2023 |

|

|

|

|

|

Total undiscounted lease payments |

|

|

|

|

|

Less imputed interest |

|

|

( |

) |

|

Total operating lease liability |

|

$ |

|

|

Supplemental cash flow information related to operating leases was as follows (in thousands):

|

|

|

Three Months Ended March 31, |

|

|||||

|

|

|

2022 |

|

|

2021 |

|

||

|

Cash paid for amounts included in the measurement of lease liabilities |

|

$ |

|

|

|

$ |

|

|

|

6. |

Stock Based Compensation |

2018 Omnibus Incentive Plan

In June 2018, stockholders of the Company approved the Company’s 2018 Omnibus Incentive Plan (the “2018 Plan”). The 2018 Plan had previously been approved by the Company’s Board of Directors (the “Board”) and the Compensation Committee (the “Committee”) of the Board, subject to stockholder approval. The 2018 Plan became effective on June 13, 2018. On June 9, 2021, the stockholders of the Company approved an amendment previously approved by the Board to increase the number of shares of common stock reserved for issuance under the 2018 Plan by

9

The following table summarizes stock option activity under the Company’s 2018 Plan and related information:

|

|

|

Number of Shares Underlying Outstanding Options |

|

|

Weighted- Average Exercise Price |

|

|

Weighted- Average Remaining Contractual Term (Years) |

|

|||

|

Outstanding — December 31, 2021 |

|

|

|

|

|

$ |

|

|

|

|

|

|

|

Options granted |

|

|

|

|

|

$ |

|

|

|

|

|

|

|

Options forfeited |

|

|

( |

) |

|

$ |

|

|

|

|

|

|

|

Options expired |

|

|

( |

) |

|

$ |

|

|

|

|

|

|

|

Outstanding — March 31, 2022 |

|

|

|

|

|

$ |

|

|

|

|

|

|

|

Exercisable — March 31, 2022 |

|

|

|

|

|

$ |

|

|

|

|

|

|

Valuation Assumptions

The Company estimated the fair value of stock options granted using the Black-Scholes option-pricing formula and a single option award approach. Due to its limited history as a public company and limited number of sales of its common stock, the Company estimated its volatility considering a number of factors including the use of the volatility of comparable public companies. The expected term of options granted under the Plan, all of which qualify as “plain vanilla” per SEC Staff Accounting Bulletin 107, is determined based on the simplified method due to the Company’s limited operating history. The risk-free rate is based on the yield of a U.S. Treasury security with a term consistent with the option. This fair value is being amortized ratably over the requisite service periods of the awards, which is generally the vesting period.

|

|

|

Three Months Ended March 31, |

|

|||||

|

|

|

2022 |

|

|

2021 |

|

||

|

Employee Stock Options: |

|

|

|

|

|

|

|

|

|

Risk-free interest rate |

|

|

|

% |

|

|

|

% |

|

Expected term (in years) |

|

|

|

|

|

|

|

|

|

Dividend yield |

|

|

|

|

|

|

|

|

|

Volatility |

|

|

|

% |

|

|

|

% |

|

Weighted-average fair value of stock options granted |

|

$ |

|

|

|

$ |

|

|

Total stock-based compensation expense recognized was as follows (in thousands):

|

|

|

Three Months Ended March 31, |

|

|||||

|

|

|

2022 |

|

|

2021 |

|

||

|

Research and development |

|

$ |

|

|

|

$ |

|

|

|

General and administrative(1) |

|

|

|

|

|

|

|

|

|

Total stock-based compensation expense |

|

$ |

|

|

|

$ |

|

|

|

|

(1) |

|

As of March 31, 2022,

|

7. |

Collaborations |

Mosaic

In October 2017, the Company entered into a strategic research collaboration with Mosaic Biosciences (“Mosaic”) to develop intravitreal anti-complement factor 3 (C3) products for the treatment of dry Age-related Macular Degeneration (AMD) and other retinal diseases. The Company subsequently amended this agreement in December 2018, December 2019 and May 2020.

Under the as amended Mosaic collaboration agreement, Mosaic is eligible to receive up to $

10

receives from Biogen or any other amounts the Company receives related to sublicense fees, research and development payments, or any other research, regulatory, clinical or commercial milestones and royalties on any other development candidates.

ISU Abxis

In December 2018, the Company entered into an amended and restated license agreement with ISU Abxis (the “A&R ISU Abxis Agreement”), which amended and restated its previous license and collaboration agreement with ISU Abxis previously entered into in September 2013, as subsequently amended in October 2014 and December 2016 (the “Original ISU Abxis Agreement”). Under the A&R ISU Abxis Agreement, ISU Abxis will receive commercialization rights in South Korea to the Company’s engineered Factor IX dalcinonacog alfa - DalcA and the Company will receive clinical development and commercialization rights in the rest of world (excluding South Korea) and manufacturing development and manufacturing rights worldwide (including South Korea). The A&R ISU Abxis Agreement eliminates the profit-sharing arrangement in the Original ISU Abxis Agreement and provides for a low single-digit royalty payment to ISU Abxis, on a country-by-country basis, for net product sales of DalcA by the Company or its affiliates in each country other than South Korea. Pursuant to the A&R ISU Abxis Agreement, the Company will also pay up to an aggregate of $

Biogen

On December 18, 2019, the Company and Biogen International GmbH (“Biogen”) entered into a License and Collaboration Agreement (the “Biogen Agreement”), under which the Company granted Biogen a worldwide, royalty-bearing, exclusive, with the right to sublicense, license (“Exclusive License”) to develop and commercialize CB 2782-PEG and other anti-C3 proteases for potential treatment of dry AMD and other disorders. Pursuant to the Biogen Agreement, the Company performed certain pre-clinical and manufacturing activities (“Research Services”), and Biogen was solely responsible for funding the pre-clinical and manufacturing activities and performing IND-enabling activities, worldwide clinical development, and commercialization.

Under the terms of the Biogen Agreement, the Company received an up-front payment for the transfer of the Exclusive License (inclusive of certain know-how) of $

The Company determined that the performance obligations under the Biogen Agreement were the Exclusive License and the Research Services. For the Exclusive License, the Company used the residual approach in determining the standalone selling price, or SSP, which includes the upfront payments, milestones and royalties. For the Research Services, the Company used the historical pricing approach for determining the SSP, which includes the reimbursement of personnel and out-of-pocket costs.

In March 2022, the Company received written notice from Biogen to terminate the Biogen Agreement which will be effective in May 2022. As a result of the termination, Biogen will no longer have the Exclusive License to develop, manufacture and commercialize CB 2782-PEG and other anti-C3 proteases for potential treatment of dry AMD and other disorders. In March 2022, Biogen returned full rights to CB 2782-PEG.

For the three months ended March 31, 2022 and 2021, the Company recognized

For the three months ended March 31, 2022 and 2021, respectively, the Company recognized $

For the three months ended March 31, 2022 and 2021, respectively, $

For the three months ended March 31, 2022, the Company recognized $

11

|

8. |

Net Loss per Share Attributable to Common Stockholders |

|

|

|

Three Months Ended March 31, |

|

|||||

|

|

|

2022 |

|

|

2021 |

|

||

|

Options to purchase common stock |

|

|

|

|

|

|

|

|

|

Common stock warrants |

|

|

|

|

|

|

|

|

|

Total |

|

|

|

|

|

|

|

|

|

9. |

Commitments and Contingencies |

Manufacturing Agreements

The Company signed an agreement with AGC Biologics, Inc. (“AGC”) to perform certain manufacturing services related to the Company’s collaboration agreement with Biogen, which includes firm work orders totaling $

In July 2021, the Company entered into two separate agreements, one for additional clinical trial services for MarzAA, and another for the Company’s screening and natural history of disease clinical studies related to CFI deficiency, with total payments of up to $

On September 16, 2021, the Company signed a Manufacturing and Research and Development Studies Agreement to support the lyophilized drug product, CB 4332. The agreement covers analytical method qualification to support good manufacturing practices (“GMP”) manufacturing. The Company currently has firm work orders related to this agreement totaling $

In November 2021, the Company provided notice of intent to terminate its MarzAA manufacturing agreements and incurred charges of $

COVID-19

The current COVID-19 pandemic has presented a substantial public health and economic challenge around the world and is affecting the Company’s employees, potential trial participants and business operations. The full extent to which the COVID-19 pandemic will directly or indirectly impact the Company’s business, results of operations and financial condition will depend on future developments that are highly uncertain and cannot be accurately predicted, including new information that may emerge concerning COVID-19, the actions taken to contain it or treat its impact and the economic impact on local, regional, national, and international markets. The COVID-19 pandemic may disrupt the operations of the Company’s manufacturers or disrupt supply logistics, which could impact the timing of deliveries and potentially increase expenses under the Company’s agreements. The Company is actively monitoring the impact of COVID-19 and the possible effects on its financial condition, liquidity, operations, clinical trials, suppliers, industry and workforce.

|

10. |

Interest and Other Income, Net |

The following table shows the detail of interest and other income, net as follows (in thousands):

|

|

|

Three Months Ended March 31, |

|

|||||

|

|

|

2022 |

|

|

2021 |

|

||

|

Interest income |

|

$ |

|

|

|

$ |

|

|

|

Gain from extinguishment of liability |

|

|

|

|

|

|

— |

|

|

Other |

|

|

( |

) |

|

|

( |

) |

|

Total interest and other income, net |

|

$ |

|

|

|

$ |

— |

|

12

|

11. |

Restructuring |

In November 2021, the Board approved a restructuring of its business based on its decision to stop the clinical development of MarzAA and focus solely on its complement programs and protease medicines platform. The restructuring included a reduction-in-force whereby approximately

In March 2022, the Board approved a further reduction of its workforce as part of its restructuring plan whereby

13

|

ITEM 2. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

Unless otherwise indicated, in this Quarterly Report on Form 10-Q, references to “Catalyst,” “we,” “us,” “our” or the “Company” mean Catalyst Biosciences, Inc. and our subsidiary. The following discussion and analysis of our financial condition and results of operations should be read in conjunction with the unaudited condensed consolidated financial statements and related notes that appear in this Quarterly Report on Form 10-Q (this “Report”) and with the audited consolidated financial statements and related notes that are included as part of our Annual Report on Form 10-K for the year ended December 31, 2021 (“Annual Report”).

In addition to historical information, this Report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (“the Exchange Act”). Forward-looking statements are identified by words such as “believe,” “will,” “may,” “estimate,” “continue,” “anticipate,” “intend,” “should,” “plan,” “expect,” “predict,” “could,” “potentially” or the negative of these terms or similar expressions. You should read these statements carefully because they discuss future expectations, contain projections of future results of operations or financial condition, or state other “forward-looking” information. These statements relate to our future plans, objectives, expectations, intentions and financial performance and the assumptions that underlie these statements. For example, forward-looking statements include any statements regarding the strategies, prospects, plans, expectations or objectives of management for future operations, the progress, scope or duration of the development of product candidates or programs, clinical trial plans, timelines and potential results, the benefits that may be derived from product candidates or the commercial or market opportunity in any target indication, our ability to protect intellectual property rights, our anticipated operations, financial position, revenues, costs or expenses, statements regarding future economic conditions or performance, statements of belief and any statement of assumptions underlying any of the foregoing. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those anticipated in the forward-looking statements. Factors that might cause such a difference include, but are not limited to, those discussed in this report in Part II, Item 1A — “Risk Factors,” elsewhere in this Report and in Part I - Item 1A – “Risk Factors” in the Annual Report. Forward-looking statements are based on our management’s beliefs and assumptions and on information currently available to our management. These statements, like all statements in this Report, speak only as of their date, and we undertake no obligation to update or revise these statements in light of future developments. We caution investors that our business and financial performance are subject to substantial risks and uncertainties.

Overview

We are a biopharmaceutical company with expertise in protease engineering and several protease assets that may address unmet medical needs in disorders of the complement or coagulation systems. Proteases are an important class of enzymes, which are key natural regulators of many biological processes, including the complement system. Our complement pipeline includes the development candidates CB 4332 and CB 2782-PEG. CB 4332 is a wholly owned, first-in-class improved albumin-fused Complement Factor I (“CFI”) molecule intended for prophylactic subcutaneously (“SQ”) or intravitreal (“IVT”) administration in individuals with an imbalance in complement homeostasis or a CFI deficiency. CB 2782-PEG is a potential best-in-class component 3 (“C3”) degrader product candidate in preclinical development for the treatment of dry age-related macular degeneration (“AMD”). We have proteases from our ProTUNE™ C3b/C4b degrader and ImmunoTUNE™ C3a/C5a degrader platforms designed to target specific disorders of the complement or inflammatory pathways. These programs all target diseases caused by deficient regulation of the complement system and inflammation. We have also used our protein engineering platform to develop potential therapies for coagulation disorders, including marzeptacog alfa (activated) (“MarzAA”), a SQ administered next-generation engineered coagulation Factor VIIa (“FVIIa”) for the treatment of episodic bleeding and prophylaxis in subjects with rare bleeding disorders, and dalcinonacog alfa (“DalcA”), a next-generation SQ FIX, both of which has shown sustained efficacy and safety in mid-stage clinical trials. As of March this year we ceased the development of our protease programs and are focused on the monetization of our assets.

The product candidates generated by our protease engineering platform are designed to have improved functional properties such as longer half-life, improved specificity and targeting, higher potency, and increased bioavailability. These characteristics potentially allow for improved safety and efficacy for SQ administration of recombinant complement regulators, or less frequently dosed intravitreal products than current therapeutics in development.

14

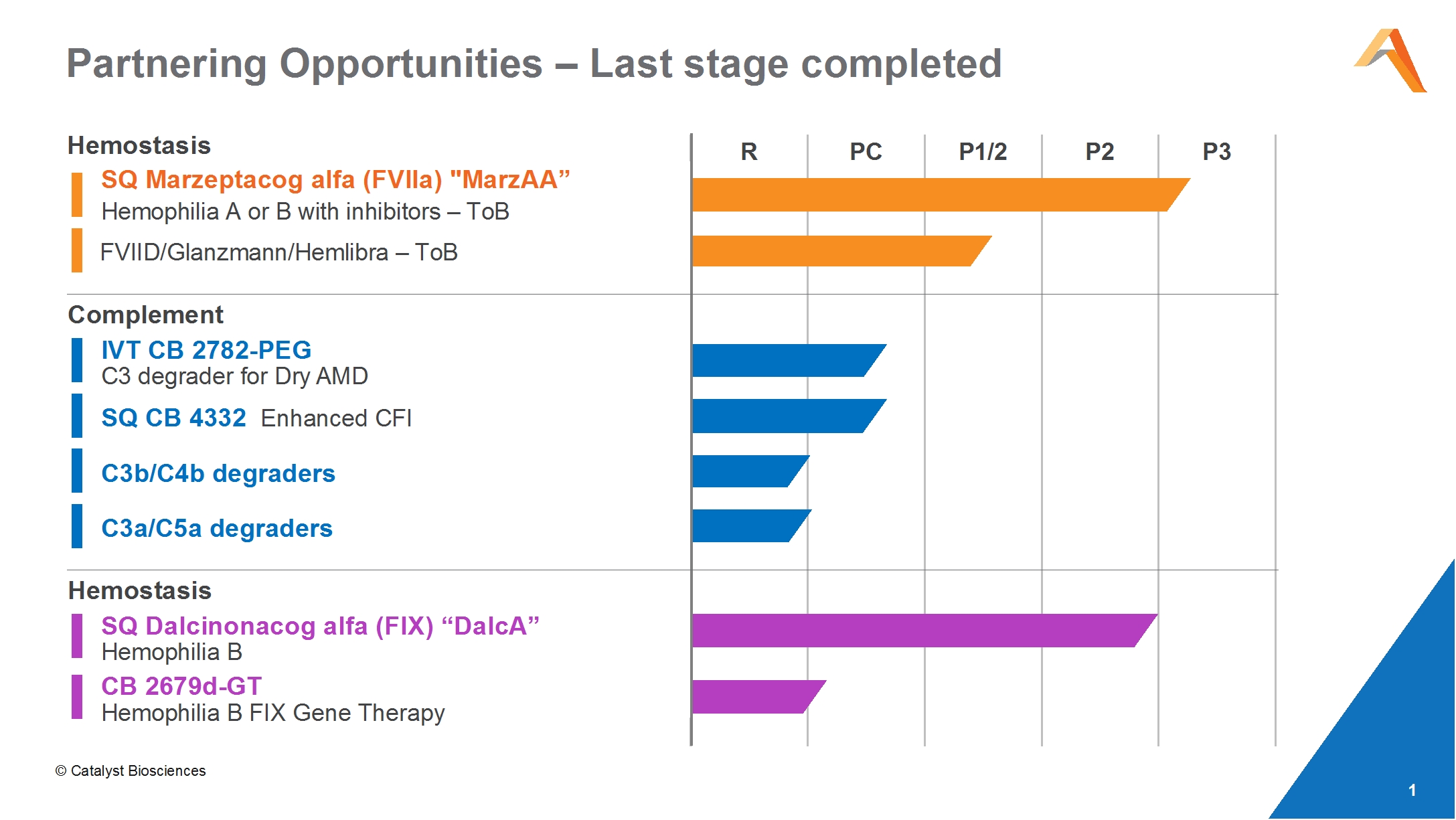

The following table summarizes our current programs with their latest stage of development.

In February 2022, we announced that we had engaged Perella Weinberg Partners as a financial advisor to assist us in exploring strategic alternatives to monetize our assets.

Program Status

Complement

Our protease programs are designed to take advantage of nature’s natural complement regulators that restore complement homeostasis and potentially treat a variety of complement-mediated disorders. We have several protease programs currently in preclinical discovery or early non-clinical development. These programs target diseases caused by aberrant regulation of the complement system including both ocular programs, specifically for dry AMD, and systemic complement disorders, all of which are wholly owned by Catalyst.

The complement system is an enzyme-based innate immune defense system with the primary role of protecting the body from pathogens. The system is naturally regulated by proteases which is the basis for our approach to addressing complement-driven diseases. Deficient or excessive activation of the complement system may lead to severe disorders, including microthrombotic, autoimmune and/or immune-complex diseases, severe infectious diseases, and degenerative ophthalmic or neurologic diseases affecting a variety of tissues and organ systems. The absence of regulation can cause the complement system to become self-destructive or not provide the necessary protection when needed. The protease therapeutic candidates generated by our platforms are designed to correct or restore the missing balance in the complement system that drives several diseases.

Proteases are uniquely poised to regulate key biological functions such as the complement system, either by promoting or limiting the cascade of events that leads to eventual clearing of foreign and damaged proteins, inflammation, and formation of the membrane attack complex, which is deposited on the surface of cells and drives their destruction. Compared with antibodies and small molecule inhibitors that generally require a sustained excess of therapeutic compound over that of the target, Catalyst’s protease therapeutic candidates are based on natural regulatory proteins that are capable of rapidly engaging and modulating large quantities of target molecules, as each protease molecule can degrade many target molecules over their effective lifetime. This means that our proteases are ideal for regulating high abundancy targets such as complement proteins in a way antibodies and small molecule inhibitors cannot.

CB 2782-PEG is an engineered pegylated C3 degrader previously licensed to Biogen that we designed with a best-in-class anti-C3 profile for geographic atrophy (“GA”) in dry AMD. Dry AMD is an ocular disease that leads to vision loss and blindness for which there is currently no approved therapy. CB 2782-PEG degrades C3 in the eye reducing the steady state level of C3 activity. It is expected

15

that maintaining low C3 levels in the eye can significantly slow disease progression and vision loss in patients with dry AMD. We have demonstrated in preclinical non-human primate models that we have the potential to reduce C3 levels in humans based on modeling studies for up to 3 months with a single intravitreal injection. In September 2021, Apellis released the results of the DERBY and OAKS phase 3 trials for GA secondary to dry AMD, showing that once-monthly pegcetacoplan, a pegylated C3 targeted inhibitor, was safe and efficacious, meeting its primary endpoint in one trial and narrowly missing the primary endpoint in a second trial for reducing GA lesion growth over a 12-month period. Further subpopulation analyses demonstrated a greater effect of reducing GA lesion growth in those subjects with extrafoveal lesions at baseline. CB 2782-PEG provides a differentiated mechanism of action by degrading both C3 and one of its byproducts, C3a potentially offering not only less frequent dosing but a more efficacious mechanism than pegcetacoplan or other complement inhibitors in development for GA. In March 2022, Biogen terminated the license agreement and returned full rights to CB 2782-PEG.

CB 4332 is an engineered albumin-fused version of the CFI protease with an extended half-life that can be dosed subcutaneously or intravitreally in individuals who would benefit from enhanced regulation of complement. CFI is the central regulator of the complement system and CB 4332 has the potential to address several mechanistically related diseases driven by complement imbalance such as: Lupus Nephritis (“LN”), Systemic Lupus Erythematosus (“SLE”), warm Autoimmune Hemolytic Anemia (“wAIHA”), atypical Hemolytic Uremic Syndrome (“aHUS”), C3 Glomerulonephritis (“C3G”), and Immune Complex Membranoproliferative Glomerulonephritis (“IC-MPGN”), dry AMD and complete CFI deficiency (“CFID”), a rare immunodeficiency primarily affecting children. These are severe, chronic, life-threatening diseases that result in a significantly decreased quality of life for the afflicted individual.

CB 4332 can be dosed subcutaneously for systemic diseases and has the potential for infrequent IVT injections for ophthalmic indications. As a key complement regulator, CFI has the potential to be used in several complement dysregulated diseases (e.g., those associated with hyperactive complement) in which additional upstream regulation may prove more effective than inhibiting specific downstream targets such as C3 or C5, where many of current molecules in development are targeted.

Individuals with complete or significant absence of endogenous CFI may present with a variety of disease manifestations, such as recurrent invasive infections with encapsulated bacteria, but these patients are also at risk of developing autoimmune and/or immune-complex diseases such as chronic inflammation of the blood vessels of the brain, spinal cord, heart, or kidneys. No CFI replacement therapy, including for prophylactic use, has been approved, and patients often receive supportive care with lifelong antibiotic treatment, which may cause a range of additional problems. We have received pre-IND guidance from the FDA as well as Rare Pediatric Disease Designation of CB 4332 for treatment of CFI deficiency in January 2022.

Low circulating serum CFI levels have been shown to be associated with rare CFI genetic variants and all forms of AMD ranging from early to late-stage manifestations. Studies have estimated the prevalence rates of CFI deficiency in GA to be approximately 20%, suggesting that CFI is a prognostic biomarker for progression of GA. Approximately 1 million individuals globally are predicted to have low serum CFI levels and may potentially benefit from targeted CFI therapy. Gyroscope released interim results from its FOCUS phase 1/2a trial for patients with GA and having rare CFI variants, showing that gene therapy with GT005, an AAV-delivered CFI rebalanced the overactivation of complement observed in the vitreous with sustained expression of CFI. The FOCUS data also showed that AAV-delivered CFI reduced complement biomarkers in the broader GA population who do not have a rare CFI genetic variant.

We have additional early-stage complement discovery programs that target different proteins of the complement system including proteases from our ProTUNE™ C3b/C4b degrader and ImmunoTUNE™ C3a/C5a degrader platforms. These proteases are designed to target specific disorders of the complement or inflammatory pathways. The ProTUNE™ platform generates optimized, next-generation engineered CFI molecules that are selectively enhanced for potency and target engagement.

Coagulation Programs

MarzAA

MarzAA is a potent, subcutaneously administered, next-generation Factor VIIa variant. We commenced enrollment of a Phase 3 registrational trial of MarzAA for episodic treatment of spontaneous or traumatic bleeding episodes in adolescents and adults with congenital hemophilia A or hemophilia B with inhibitors in May 2021. We have discontinued this trial based on a number of factors, including challenges in enrollment resulting from the limited number of potential patients eligible to enroll in this trial, competition from competing approved therapies, delays in enrollment resulting from COVID-19, the capital requirements to complete the trial, and other factors. Patients enrolled in the study returned to their standard of care and completed all required safety assessments. In the patients enrolled to date, we have successfully treated bleeds with SQ MarzAA and have not observed any adverse events. We plan to report these data at an appropriate medical conference in the future. We had also begun enrollment of a Phase 1/2 trial of MarzAA for treatment of bleeding in individuals with Factor VII Deficiency, Glanzmann Thrombasthenia, and hemophilia A with inhibitors on emicizumab prophylaxis. We have discontinued this trial as well, in light of the difficulties in identifying and enrolling eligible patients,

16

the capital requirements to complete the trial and other factors. We believe that a SQ recombinant Factor VIIa therapy, like MarzAA, has the potential to be an important treatment option for patients with various bleeding disorders and are exploring opportunities to license or sell MarzAA to another party for further development.

DalcA

DalcA is a next-generation SQ Factor IX product candidate for the prophylactic treatment of individuals with hemophilia B. An open-label, Phase 2b study was completed in 2020, demonstrating that FIX plasma activity levels were raised from severe to mild hemophilia B levels and maintained throughout the course of the study. We have received guidance from the FDA on the design of the registrational Phase 3 clinical trial, have the necessary data to support its initiation, and are exploring opportunities to license or sell DalcA to another party for further development.

Recent Financing

We have no drug products approved for commercial sale and have not generated any revenue from drug product sales. From inception to March 31, 2022, we have raised net proceeds of approximately $510.1 million, primarily from private placements of convertible preferred stock since converted to common stock, proceeds from our merger with Targacept, issuances of shares of common stock and warrants, including $84.3 million in total cash receipts from our license and collaboration agreements.

We have never been profitable and have incurred significant operating losses in each year since inception. Our net losses were $14.5 million and $22.4 million for the three months ended March 31, 2022 and 2021, respectively. As of March 31, 2022, we had an accumulated deficit of $417.2 million. As of March 31, 2022, our cash and cash equivalents balance was $34.8 million. Substantially all our operating losses were incurred in our research and development programs and in our general and administrative operations.

Financial Operations Overview

License and Collaboration Revenue

License and collaboration revenue consists of revenue earned for performance obligations satisfied pursuant to our license and collaboration agreement with Biogen which was entered into in December 2019. In consideration for the grant of an exclusive license and related know-how, we received an up-front license payment of $15.0 million in January 2020, which was recorded in license revenue during the year ended December 31, 2020. We recognized collaboration revenue for reimbursable third-party vendor, out-of-pocket and personnel costs pertaining to the Biogen Agreement of $0.8 million and $1.5 million for the three months ended March 31, 2022 and 2021, respectively. In March 2022, we received notice that Biogen is terminating the license and collaboration agreement. Under the terms of the Biogen Agreement, termination will be effective in May 2022.

We have not generated any revenue from the sale of any drug products and we do not expect to generate any revenue from the sale of drug products until we obtain regulatory approval of and commercialize our product candidates.

Cost of License and Collaboration Revenue

Cost of license and collaboration revenue consists of fees for research and development services payable to third-party vendors, and personnel costs, corresponding to the recognition of license and collaboration revenue from Biogen. Cost of license and collaboration revenue does not include any allocated overhead costs. In connection with the license revenue recognized from Biogen as discussed above in 2020, we paid Mosaic a $3.0 million sublicense fee and recorded such payment as cost of license. We recognized third-party vendor, out-of-pocket and personnel costs, most of which were reimbursable, pertaining to the Biogen Agreement of $0.8 million and $1.5 million for the three months ended March 31, 2022 and 2021, respectively, and recorded such costs as cost of collaboration revenue.

Research and Development Expenses

Research and development expenses represent costs incurred to conduct research, such as the discovery and development of our product candidates. We recognize all research and development costs as they are incurred. Nonrefundable advance payments for goods or services used in research and development are deferred and capitalized. The capitalized amounts are then expensed as the related goods are delivered or services are performed, or until it is no longer expected that the goods or services will be delivered.

17

Research and development expenses consist primarily of the following:

|

|

• |

employee-related expenses, which include salaries, benefits and stock-based compensation; |

|

|

• |

laboratory and vendor expenses, including payments to consultants and third parties, related to the execution of preclinical, non-clinical, and clinical studies; |

|

|

• |

the cost of acquiring and manufacturing preclinical and clinical materials and developing manufacturing processes; |

|

|

• |

clinical trial expenses, including costs of third-party clinical research organizations; |

|

|

• |

performing toxicity and other preclinical studies; and |

|

|

• |

facilities and other allocated expenses, which include direct and allocated expenses for rent and maintenance of facilities, depreciation and amortization expense and other supplies. |

The table below details our internal and external costs for research and development for the period presented (in thousands). See Overview and Program Status for further discussion of the current research and development programs.

|

|

|

Three Months Ended March 31, |

|

|||||

|

|

|

2022 |

|

|

2021 |

|

||

|

Personnel and other |

|

$ |

4,140 |

|

|

$ |

4,624 |

|

|

Complement |

|

|

3,383 |

|

|

|

4,650 |

|

|

Hemophilia |

|

|

2,052 |

|

|

|

7,370 |

|

|

Stock-based compensation |

|

|

128 |

|

|

|

369 |

|

|

Total research and development expenses |

|

$ |

9,703 |

|

|

$ |

17,013 |

|

The largest component of our total operating expenses has historically been our investment in research and development activities, including the clinical and manufacturing development of our product candidates. Costs listed for our hemophilia and complement programs above consist of clinical trial, manufacturing and research costs. Our internal resources, employees and infrastructure, identified above as personnel and other, are generally not directly tied to individual product candidates or development programs. As such, we do not maintain information regarding these costs incurred for these research and development programs on a project-specific basis.

Since we have ceased research and development activities, we expect our aggregate research and development expenses will be minimal during the next year as we continue to explore strategic opportunities for the clinical and manufacturing development of our programs.

On May 20, 2016, we signed a development and manufacturing services agreement with AGC, pursuant to which AGC will conduct manufacturing development of agreed upon product candidates. We will own all intellectual property developed in such manufacturing development activities that are specifically related to our product candidates and will have a royalty-free and perpetual license to use AGC’s intellectual property to the extent reasonably necessary to make these product candidates, including commercial manufacturing. As of March 31, 2022, six GMP batches have been manufactured at AGC in addition to an engineering batch.

The initial term of the agreement is ten years or, if later, until all stages under outstanding statements of work have been completed. Either party may terminate the agreement in its entirety upon written notice of a material uncured breach or upon the other party’s bankruptcy, and we may terminate the agreement upon prior notice for any reason. In addition, each party may terminate the agreement in the event that the manufacturing development activities cannot be completed for technical or scientific reasons. We had firm work orders with AGC to manufacture MarzAA and DalcA to support clinical trials totaling $15.8 million. The payment obligations were fully paid off as of December 31, 2021. We also have firm work orders with AGC to perform certain manufacturing services related to our collaboration agreement with Biogen totaling $0.7 million and the payment obligations were fully paid off as of March 31, 2022.

In July 2021, we entered into two separate agreements, one for additional clinical trial services for MarzAA, and another for our screening and natural history of disease clinical studies related to CFI deficiency, with total payments of up to $3.2 million and $6.5 million, respectively. In November 2021, we provided notice of intent to terminate our MarzAA manufacturing agreements and incurred charges of $3.8 million to write-off prepaid manufacturing costs that will no longer be used for the clinical development of MarzAA. We can terminate the CFI agreement at our discretion and upon termination will be responsible to pay for those services incurred prior to termination plus reasonable wind-down expenses.

On September 16, 2021, we signed a Manufacturing and Research and Development Studies Agreement to support the lyophilized drug product, CB 4332. The agreement covers analytical method qualification to support GMP manufacturing. We have firm work orders related to this agreement totaling $0.3 million and the payment obligations remaining as of March 31, 2022 were $0.1 million.

18

We also have a long-term clinical supply services agreement with Catalent Indiana, LLC (“Catalent”). Catalent has facilities in the U.S. and Europe and conducts drug product development and manufacturing for MarzAA and DalcA. We successfully completed development work for a variety of vial sizes which supports flexible dosing.

General and Administrative Expenses

General and administrative expenses consist of personnel costs, allocated expenses and other expenses for outside professional services, including legal, human resources, audit and accounting services. Personnel costs consist of salaries, bonus, benefits and stock-based compensation. We incur expenses associated with operating as a public company, including expenses related to compliance with the rules and regulations of the Securities and Exchange Commission (“SEC”) and Nasdaq Stock Market LLC (“Nasdaq”), insurance expenses, audit expenses, investor relations activities, Sarbanes-Oxley compliance expenses and other administrative expenses and professional services. We expect such expenses to fluctuate as we continue to explore strategic opportunities for our programs.

Results of Operations

The following table set forth our results of operations data for the periods presented (in thousands):

|

|

|

Three Months Ended March 31, |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

2022 |

|

|

2021 |

|

|

Change ($) |

|

|

Change (%) |

|

||||

|

Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

License |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

* |

|

|

|

Collaboration |

|

|

794 |

|

|

|

1,467 |

|

|

|

(673 |

) |

|

|

46 |

% |

|

License and collaboration revenue |

|

|

794 |

|

|

|

1,467 |

|

|

|

(673 |

) |

|

|

46 |

% |

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of license |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

* |

|

|

|

Cost of collaboration |

|

|

798 |

|

|

|

1,480 |

|

|

|

(682 |

) |

|

|

46 |

% |

|

Research and development |

|

|

9,703 |

|

|

|

17,013 |

|

|

|

(7,310 |

) |

|

|

43 |

% |

|

General and administrative |

|

|

4,994 |

|

|

|

5,412 |

|

|

|

(418 |

) |

|

|

8 |

% |

|

Total operating expenses |

|

|

15,495 |

|

|

|

23,905 |

|

|

|

(8,410 |

) |

|

|

35 |

% |

|

Loss from operations |

|

|

(14,701 |

) |

|

|

(22,438 |

) |

|

|

7,737 |

|

|

|

34 |

% |

|

Interest and other income, net |

|

|

165 |

|

|

|

— |

|

|

|

165 |

|

|

* |

|

|

|

Net loss and comprehensive loss |

|

$ |

(14,536 |

) |

|

$ |

(22,438 |

) |

|

$ |

7,902 |

|

|

|

35 |

% |

*Not meaningful

License and Collaboration Revenue

License and collaboration revenue was $0.8 million and $1.5 million during the three months ended March 31, 2022 and 2021, respectively. In the three months ended March 31, 2022 and 2021, revenue consisted primarily of reimbursable collaboration expenses from our Biogen Agreement.

Cost of License and Collaboration

Cost of license and collaboration revenue was $0.8 million and $1.5 million during the three months ended March 31, 2022 and 2021, respectively. Cost of collaboration for the three months ended March 31, 2022 and 2021 was primarily reimbursable third-party vendor and personnel costs we incurred pertaining to the Biogen Agreement.

19

Research and Development Expenses

Research and development expenses were $9.7 million and $17.0 million during the three months ended March 31, 2022 and 2021, respectively, a decrease of $7.3 million, or 43%. The decrease was due primarily to a decrease of $5.3 million in hemophilia-related costs, a decrease of $1.3 million in complement-related costs, a decrease of $0.5 million in personnel-related costs, and a decrease of $0.2 million in stock-based compensation expense. Research and development expenses for the three months ended March 31, 2022 include approximately $0.6 million of severance and other costs related to our reduction-in-force.

General and Administrative Expenses

General and administrative expenses were $5.0 million and $5.4 million during the three months ended March 31, 2022 and 2021, respectively, a decrease of $0.4 million, or 8%. The decrease was due primarily to a decrease of $0.6 million in professional services, partially offset by an increase of $0.2 million related to our allowance for doubtful accounts. General and administrative expenses for the three months ended March 31, 2022 include approximately $0.4 million of severance and other costs related to our reduction-in-force.

Interest and Other Income, Net

The $0.2 million increase in interest and other income, net for the three months ended March 31, 2022 compared to the three months ended March 31, 2021 was primarily due to a $0.2 million gain recognized upon the extinguishment of a liability.

Recent Accounting Pronouncements

Refer to “Accounting Pronouncements Recently Adopted” included in Note 2, Summary of Significant Accounting Policies, in the “Notes to the Condensed Consolidated Financial Statements” in this Form 10-Q.

Liquidity and Capital Resources

As of March 31, 2022, we had $34.8 million of cash and cash equivalents. For the three months ended March 31, 2022, we had a $14.5 million net loss and $12.1 million cash used in operating activities. We have an accumulated deficit of $417.2 million as of March 31, 2022. Our primary uses of cash are to fund operating and business development expenses and general and administrative expenditures. Cash used to fund operating expenses is impacted by the timing of when we pay these expenses, as reflected in the change in our outstanding accounts payable and accrued expenses.

We believe that our existing capital resources, including cash and cash equivalents will be sufficient to meet our projected operating requirements for at least the next 12 months from the date of this filing. We have based this estimate on assumptions that may prove to be wrong, and we could utilize our available capital resources sooner than we currently expect. We plan to continue to fund losses from operations and capital funding needs through future equity and/or debt financings, as well as potential additional asset sales, licensing transactions, collaborations or strategic partnerships with other companies. At the year ended March 31, 2022, we had effective registration statements on Form S-3 that enable us to sell up to $150.0 million in securities subject to limitations under SEC rules. The sale of additional equity or convertible debt could result in additional dilution to our stockholders. The incurrence of indebtedness would result in debt service obligations and could result in operating and financing covenants that would restrict our operations. Licensing transactions, collaborations or strategic partnerships may result in us relinquishing valuable rights. We can provide no assurance that financing will be available in the amounts we need or on terms acceptable to us, if at all. If we are not able to secure adequate additional funding we may be forced to delay, make reductions in spending, extend payment terms with suppliers, liquidate assets where possible, and/or suspend or curtail planned programs. Any of these actions could materially harm our business.

The following table summarizes our cash flows for the periods presented (in thousands):

|

|

|

Three Months Ended March 31, |

|

|||||

|

|

|

2022 |

|

|

2021 |

|

||

|

Cash used in operating activities |

|

$ |

(12,050 |

) |

|

$ |

(24,356 |

) |

|

Cash provided by investing activities |

|

|

2,504 |

|

|

|