SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

|

Filed by the Registrant ☒

|

Filed by a Party other than the Registrant ☐

|

||||||||||

|

Check the appropriate box:

|

|||||||||||

| ☒ |

Preliminary Proxy Statement

|

||||||||||

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

||||||||||

| ☐ |

Definitive Proxy Statement

|

||||||||||

| ☐ |

Definitive Additional Materials

|

||||||||||

| ☐ |

Soliciting Material Pursuant to §240.14a-12

|

||||||||||

Hillman Capital Management Investment Trust

(Name of Registrant as Specified in its Charter)

Not Applicable

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check the appropriate box):

|

||||||||||||||

| ☒ |

No fee required.

|

|||||||||||||

| ☐ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|||||||||||||

|

(1)

|

Title of each class of securities to which transaction applies:

|

|||||||||||||

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|||||||||||||

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|||||||||||||

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|||||||||||||

|

(5)

|

Total fee paid:

|

|||||||||||||

| ☐ |

Fee paid previously with preliminary materials.

|

|||||||||||||

| ☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or

schedule and the date of its filing.

|

|||||||||||||

|

(1)

|

Amount Previously Paid:

|

|||||||||||||

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|||||||||||||

|

(3)

|

Filing Party:

|

|||||||||||||

|

(4)

|

Date Filed:

|

|||||||||||||

Hillman Value Fund

a series of

a series of

Hillman Capital Management Investment Trust

[PROXY DATE]

Dear Shareholder:

I am writing to inform you of the upcoming special meeting of the shareholders (the “Shareholder Meeting”) of the Hillman Value Fund (the “Existing Fund”), a series of Hillman Capital Management

Investment Trust (“Hillman”), a Delaware statutory trust.

The meeting is scheduled to be held at 10:00 a.m. eastern standard time on February 23, 2021, at 116 South Franklin Street, Rocky Mount, North Carolina 27803. Please take the time to carefully read

the Proxy Statement and cast your vote.

The purpose of the meeting is to seek your approval in connection with a proposal to reorganize the Existing Fund into a newly created series (the “New Fund”) of ALPS Series Trust (“AST”), a Delaware

statutory trust with its principal offices at 1290 Broadway, Suite 1000, Denver, CO 80203 (the “Reorganization”). The Existing Fund is currently organized as a series of Hillman, an investment company with its principal offices at 116 South Franklin

Street, Rocky Mount, North Carolina 27803. If shareholders approve the Reorganization, it will take effect on or about [CLOSING DATE]. At that time, the Existing Fund shares you currently own would be exchanged on a tax-free basis for shares of the New

Fund with the same aggregate value.

Important Information to Help you Understand and Vote on the Proposal

Q & A: Questions and Answers

Q & A: Questions and Answers

While we encourage you to read the full text of the enclosed Proxy Statement, here is a brief overview of the matter affecting you as a shareholder of the Existing Fund that

requires your vote.

What is the Purpose of the Reorganization?

The primary purpose of the Reorganization is to move the Existing Fund from Hillman to AST in an attempt to gain operational efficiencies and distribution support, which may result in lower

shareholder expenses.

Hillman Capital Management, Inc., the investment adviser to the Existing Fund (“HCM” or the “Adviser”), has determined that by reorganizing the Fund into AST, the Fund and HCM may be able to achieve

operational efficiencies and receive distribution support, which may, over time, result in lower expenses for the New Fund compared to the Existing Fund due to achieving economies of scale from a growth in assets.

HCM will continue to serve as investment adviser for the New Fund and the person responsible for the day-to-day management of the Fund will not change. The Reorganization is expected to be a tax-free

reorganization for federal income tax purposes, and, therefore, no gain or loss should be recognized by the Existing Fund or their shareholders as a result of the Reorganization.

The only changes that will occur as a result of the Reorganization are that (1) the New Fund will be overseen by a different Board of Trustees, (2) the New Fund will have different officers, and (3)

the New Fund will have different service providers.

The Board of Trustees of Hillman is different than the Board of Trustees of AST. AST also has different officers than Hillman. In addition, the third-party service providers of the Fund will change

as shown in the table below, except the Fund’s custodian, which will remain UMB Bank, n.a.

2

|

Service Provider

|

Hillman

|

AST

|

|

Fund Accounting and Administration

|

The Nottingham Company

|

ALPS Fund Services, Inc.

|

|

Transfer Agent

|

Nottingham Shareholder Services, LLC

|

ALPS Fund Services, Inc.

|

|

Distributor

|

Capital Investment Group, Inc.

|

ALPS Distributors, Inc.

|

|

Auditor

|

BBD, LLP

|

Cohen & Company, Ltd.

|

|

Legal Counsel

|

Greenberg Traurig LLP

|

Davis Graham & Stubbs LLP

|

How Will Approval of the Reorganization Affect the Operation of the Existing Fund?

Approval of the Reorganization will not affect the Existing Fund’s investment objectives, principal investment strategies, and/or associated risks. In fact, the New Fund’s investment objectives,

principal investment strategies and associated risks are identical to those of the Existing Fund. HCM, the current adviser to the Existing Fund, will continue to act as the adviser to the New Fund. The day-to-day investment management of the portfolio

of the New Fund will be provided by the same portfolio manager that currently manages the Existing Fund. Further, it is anticipated that the net expenses of the New Fund upon closing of the Reorganization will be the same or lower than the current net

expenses of the Existing Fund.

Who is Paying the Expenses Related to the Shareholder Meeting and the Reorganization?

The Adviser is responsible for paying all costs relating to the Reorganization, including the costs relating to the Shareholder Meeting and the Proxy Statement.

How Will the Reorganization Work?

The Reorganization will involve three steps:

| 1. |

The transfer of all of the assets and liabilities of the Existing Fund to the New Fund in exchange for the number of full and fractional shares of the New Fund equal to the number of full and fractional shares of the Existing Fund then

outstanding;

|

| 2. |

The pro rata distribution of shares of the New Fund to shareholders of record of the Existing Fund as of the effective date of the Reorganization in full redemption of all shares of the Existing

Fund; and

|

| 3. |

The complete liquidation and termination of the Existing Fund.

|

The total value of the New Fund shares that you receive in the Reorganization will be the same as the total value of the Existing Fund shares you held immediately before the Reorganization. HCM is

the investment adviser to the Existing Fund and will continue to act as the investment adviser to the New Fund. The day-to-day investment management of the portfolios of the New Fund will be provided by the same portfolio manager that currently manages

the Existing Fund.

How Does the Board Suggest that I Vote?

After careful consideration, Hillman’s Board of Trustees recommends that you vote “FOR” the Reorganization. Please see the Proxy Statement for a discussion of the Hillman Board’s considerations in

making its recommendations.

3

Will My Vote Make a Difference?

Yes. Your vote is needed to ensure that the proposals can be acted upon, and we encourage all shareholders to participate in the governance of the Existing Fund. Your immediate response will help

prevent the need for any further solicitations for a shareholder vote. We encourage all shareholders to participate, including small investors. If other shareholders like you do not vote, the Existing Fund may not receive enough votes to go forward

with the Shareholder Meeting. If this happens, the Reorganization would be delayed, and we may need to solicit votes again, which increases costs.

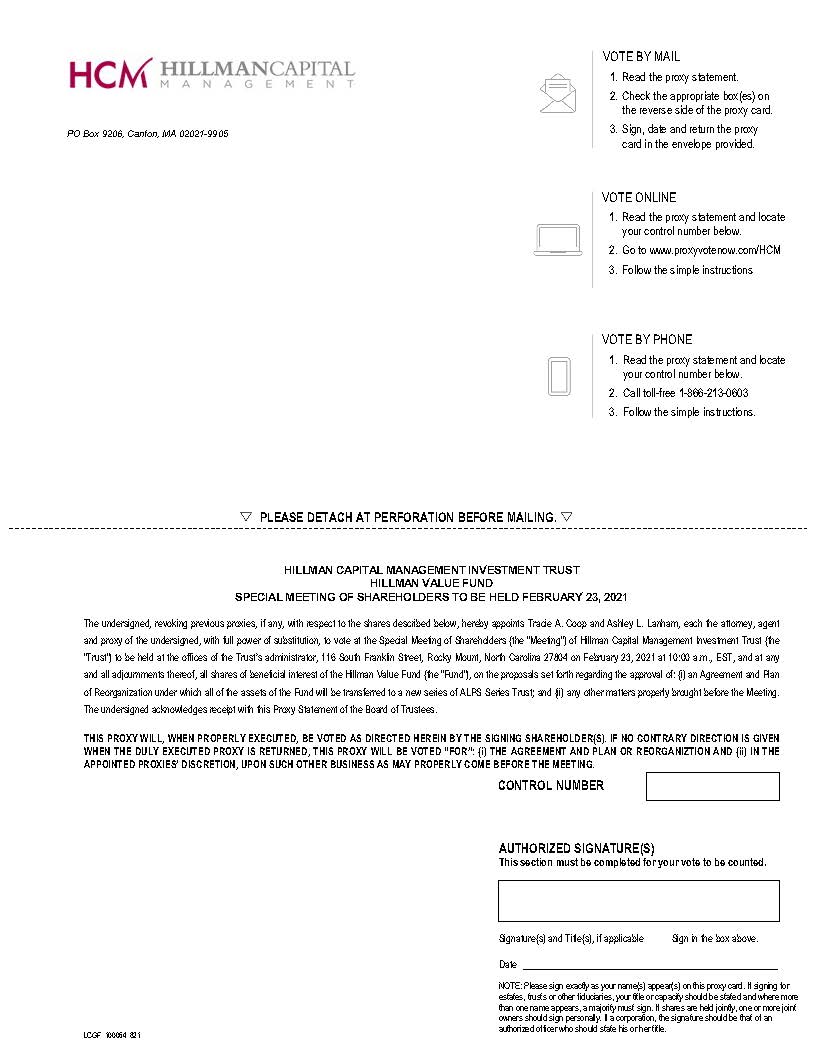

How Do I Place My Vote?

You may provide Hillman with your vote by mail, via the internet, or over the phone. You may use the enclosed postage-paid envelope to mail your proxy card. You may also vote by calling the toll-free

number printed on your proxy ballot, via the Internet at the website address printed on your proxy ballot, or in person at the Shareholder Meeting.

Whom Do I Call If I Have Questions?

We will be happy to answer your questions about this proxy solicitation. Please call (833) 290-2604 between 10:00 a.m. and 8:00 p.m. eastern standard time, Monday through Friday, with any questions

about the proxy.

Sincerely,

Mark Hillman

President

Hillman Capital Management Investment Trust

President

Hillman Capital Management Investment Trust

4

Hillman Value Fund

a series of

Hillman Capital Management Investment Trust

Hillman Capital Management Investment Trust

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD FEBRUARY 23, 2021

TO BE HELD FEBRUARY 23, 2021

Dear Shareholders:

The Board of Trustees of Hillman Capital Management Investment Trust (“Hillman”), an open-end management investment company organized as a Delaware statutory trust, has called a

special meeting of the shareholders (the “Shareholder Meeting”) of the Hillman Value Fund, a series of Hillman (the “Existing Fund” to be held at 116 South Franklin Street, Rocky Mount, North Carolina 27804, on February 23, 2021 at 10:00 a.m. eastern

standard time.

The shareholders of the Existing Fund are being asked to consider the following proposals:

| 1. |

To approve an Agreement and Plan of Reorganization, a copy of which is attached as Appendix A to the Proxy Statement, under which all of the assets of the Existing Fund will be transferred to a new series of ALPS Series Trust (the

“New Fund”). The transfer would be (a) an exchange of your shares of the Existing Fund for shares of the New Fund equivalent in value to the outstanding shares of the Existing Fund, and (b) the assumption by the New Fund of all of the

liabilities of the Existing Fund.

|

| 2. |

To transact other business that may properly come before the meeting and any adjournments thereof.

|

Shareholders of record at the close of business on December 29, 2020, are entitled to notice of, and to vote at, the Shareholder Meeting and any adjournments or postponements

thereof.

Shareholders are invited to attend the Shareholder Meeting in person. Any shareholder who does not expect to attend the Shareholder Meeting is urged to vote using the telephone or

Internet voting instructions found below or indicate voting instructions on each enclosed proxy card, date and sign it, and return it in the envelope provided, which needs no postage if mailed in the United States. In order to avoid unnecessary calls

to solicit your vote, we ask your cooperation in responding promptly, no matter how large or small your holdings may be.

By Order of the Board of Trustees,

Tracie Coop, Secretary

[PROXY DATE]

[PROXY DATE]

IMPORTANT NOTICE REGARDING THE INTERNET AVAILABILITY OF PROXY

MATERIALS FOR THE SPECIAL MEETING OF SHAREHOLDERS TO BE HELD ON February 23, 2021:

A copy of the Notice of Shareholder Meeting, the Proxy Statement (including the proposed Agreement and Plan of Reorganization), and Proxy Voting Ballot are

available at www.eproxyaccess.com/HCMAX2020

5

Hillman Value Fund

a series of

Hillman Capital Management Investment Trust

with its principal offices at

116 South Franklin Street

116 South Franklin Street

Rocky Mount, North Carolina 27804

|

PROXY STATEMENT

|

SPECIAL MEETING OF SHAREHOLDERS

To Be Held February 23, 2021

|

INTRODUCTION

|

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Trustees (the “Board of Trustees” or the “Board”) of Hillman Capital Management

Investment Trust (“Hillman”) on behalf of the Hillman Value Fund (the “Existing Fund”), a series of Hillman, for use at a special meeting of shareholders (the “Shareholder Meeting”) to be held at 116 South Franklin Street, Rocky Mount, North Carolina

27803 on February 23, 2021 at 10:00 a.m. eastern standard time, and at any and all adjournments thereof. The Notice of Meeting, Proxy Statement, and accompanying form of proxy will be mailed to shareholders on or about [PROXY DATE].

The Shareholder Meeting has been called by the Board of Trustees for the following purposes:

| 1. |

To approve an Agreement and Plan of Reorganization (the “Plan of Reorganization”), a copy of which is attached as Appendix A to this Proxy Statement, under which all of the assets of the Existing Fund will be transferred to a new

series of ALPS Series Trust (the “New Fund”). The transfer would be (a) an exchange of your shares of the Existing Fund for the shares of the New Fund equivalent in value to the outstanding shares of the Existing Fund, and (b) the assumption by

the New Fund of all of the liabilities of the Existing Fund (collectively, the “Reorganization”).

|

| 2. |

To transact other business that may properly come before the meeting and any adjournments thereof.

|

Only shareholders of record of the Existing Fund at the close of business on December 29, 2020 (the “Record Date”) are entitled to notice of, and to vote at, the Shareholder

Meeting and any adjournments or postponements thereof.

A copy of the Existing Fund’s most recent annual report and semi-annual report, including financial statements and schedules, are available at no charge by sending a written

request to Hillman at 116 South Franklin Street, Rocky Mount, North Carolina 27804 or by calling 1-800-773-3863.

PROPOSAL 1: TO APPROVE AN AGREEMENT AND PLAN OF REORGANIZATION

Overview

At a meeting held on December 17, 2020, the Board of Trustees, including a majority of the Trustees who are not “interested persons” (as that term is defined in Section 2(a)(19) of

the Investment Company Act of 1940, as amended (the “1940 Act”)) of Hillman (the “Independent Trustees”), considered and unanimously approved a Plan of Reorganization substantially similar to the copy attached to this Proxy Statement as Appendix A. Under the Plan of Reorganization, the Existing Fund, a series of Hillman, will assign all of its assets to the New Fund, a newly organized series of AST, in exchange solely for (1) the number of New Fund

shares equivalent in value to shares of the Existing Fund outstanding immediately prior to the Closing Date (as defined below), and (2) the New Fund’s assumption of all of the Existing Fund’s liabilities, followed by a distribution of those shares to

the Existing Fund’s shareholders so that the Existing Fund’s shareholders receive shares of the New Fund equivalent in value to the shares of the Existing Fund held by such shareholder on the closing date of the transaction, which is currently set to

be on or about [CLOSING DATE] (the “Closing Date”). Both the Existing Fund and New Fund are sometimes referred to in this Proxy Statement as a “Fund.” Like Hillman, AST is an open-end investment company registered with the SEC.

6

If the Plan of Reorganization is approved by the shareholders of the Existing Fund, they will become shareholders of the New Fund. The New Fund’s investment objectives, principal

investment strategies and investment risks are identical to those of the Existing Fund. In addition, the current investment adviser to the Existing Fund, Hillman Capital Management, Inc. (“HCM” or the “Adviser”), will continue to serve as the

investment adviser to the New Fund.

The only changes that will occur as a result of the Reorganization are: (1) the New Fund will be overseen by a different Board of Trustees, (2) the New Fund will have different

officers, and (3) the New Fund will have different service providers.

The Board of Trustees of Hillman is different than the Board of Trustees of AST. AST also has different officers than Hillman. In addition, the third-party service providers of the

Fund will change as shown in the table below, except the Fund’s custodian, which will remain UMB Bank, n.a.

|

Service Provider

|

Hillman

|

AST

|

|

Fund Accounting and Administration

|

The Nottingham Company

|

ALPS Fund Services, Inc.

|

|

Transfer Agent

|

Nottingham Shareholder Services, LLC

|

ALPS Fund Services, Inc.

|

|

Distributor

|

Capital Investment Group, Inc.

|

ALPS Distributors, Inc.

|

|

Auditor

|

BBD, LLP

|

Cohen & Company, Ltd.

|

|

Legal Counsel

|

Greenberg Traurig LLP

|

Davis Graham & Stubbs LLP

|

The Reorganization is expected to be a tax-free reorganization for federal income tax purposes and therefore no gain or loss should be recognized by the Existing Fund or their

shareholders as a result of the Reorganization. The costs of the Reorganization, including the costs of soliciting proxies, will be borne by the Adviser, and not the Existing Fund or the New Fund. If approved, the Reorganization is expected to take

effect on or about [CLOSING DATE], although the date may be adjusted in accordance with the Plan of Reorganization.

Reasons For The Reorganization

The primary purpose of the Reorganization is to move the Existing Fund from Hillman to AST in an attempt to gain operational efficiencies and distribution support, which may result

in lower shareholder expenses.

Hillman Capital Management, Inc., the investment adviser to the Existing Fund (“HCM” or the “Adviser”), has determined that by reorganizing the Fund into AST, the Fund and HCM may

be able to achieve operational efficiencies, which may, over time, result in lower expenses for the New Fund compared to the Existing Fund due to achieving economies of scale from a growth in assets.

7

Summary Of Agreement And Plan Of Reorganization

Below is a summary of the important terms of the Plan of Reorganization. This summary is qualified in its entirety by reference to the Plan of Reorganization itself, the form of

which is set forth in Appendix A to this Proxy Statement, and which you are encouraged to read in its entirety.

The Plan of Reorganization provides that the number of full and fractional shares to be issued by the New Fund in connection with the Reorganization will be the same as the number

of shares owned by each of the Existing Fund’s shareholders on the Closing Date. The Plan of Reorganization also provides that the net asset value of shares of the New Fund will be the same as the net asset value of shares of the Existing Fund. The

value of the assets to be transferred by the Existing Fund will be calculated at the time of the closing of the Reorganization.

The Existing Fund will distribute the New Fund shares it receives in the Reorganization to its shareholders. Shareholders of record of the Existing Fund will be credited with

shares of the New Fund having an aggregate value equal to the Existing Fund shares that the shareholder holds of record on the Closing Date.

The Plan of Reorganization may be terminated by resolution of the Board of Trustees of Hillman or the Board of Trustees of AST on behalf of the Existing Fund or on behalf of the

New Fund, respectively, under certain circumstances. Completion of the Reorganization is subject to numerous conditions set forth in the Plan of Reorganization. An important condition to closing is that the Existing Fund receive a tax opinion to the

effect that the Reorganization will qualify as a “reorganization” for U.S. federal income tax purposes, subject to certain qualifications. As such, the Reorganization will not be taxable for such purposes to the Existing Fund, the New Fund or the

Existing Fund’s shareholders. The closing is also conditioned upon both the Existing Fund and the New Fund receiving the necessary documents to transfer the Existing Fund’s assets and liabilities in exchange for shares of the New Fund.

Hillman Board Considerations

At a meeting held on December 17, 2020, the Board of Trustees of Hillman approved the proposed Reorganization after reviewing detailed information regarding the Reorganization and

its effect on the shareholders of the Existing Fund. The Hillman Board considered the following matters, among others, in approving the proposal (each reference to the “Board” in the below discussion refers to the Hillman Board):

| • |

Terms and Conditions of the Reorganization. The Board reviewed the terms of the Plan of Reorganization, noting that the Reorganization would be submitted to the Existing Fund’s shareholders for approval. The Board discussed HCM’s

determination that, through the Reorganization, it may be able to achieve operational efficiencies and receive distribution support, which may, over time, result in lower expenses for the New Fund compared to the Existing Fund due to achieving

economies of scale from a growth in assets.

|

| • |

No Dilution of Shareholder Interests and Continuity of Advisory Services. In considering the Reorganization, the Board noted that the Reorganization would not result in any dilution of shareholder interests in the Existing Fund. The

Board noted that the New Fund will continue to be managed by HCM through the same portfolio manager, and as such, the New Fund would receive at least a comparable level of advisory services to as is currently being provided to the Existing

Fund.

|

| • |

Expenses Relating to the Reorganizations, Assumption of Liabilities and Tax Consequences. The Board also reflected on the fact that HCM has agreed to assume all of the expenses associated with the Reorganization. The Board further

discussed the fact that, under the Plan of Reorganization, the New Fund would assume all of the liabilities of the Existing Fund, and that such liabilities would not remain with the Trust. Finally, the Board considered that the Reorganization

is expected to not result in taxable income or gain or other adverse federal tax consequences to shareholders.

|

| • |

Effect of the Reorganization on Fund Expenses and Advisory Fees. The Board reviewed information regarding fees and expenses and noted that HCM’s advisory fee is not expected to change and that the New Fund are expected have the same

or lower expense ratios than the Existing Fund.

|

8

| • |

Investment Objectives, Policies, Restrictions, and Other Differences. The Board reviewed the investment objectives, policies, and investment restrictions, noting no material changes between the Existing Fund and the New Fund. The

Board also discussed certain other differences between the Existing Fund and the New Fund and concluded that they were not material and not expected to have an impact on the day-to-day management of the New Fund.

|

Based on the Board’s review of the circumstances presented and the recommendation of HCM and the Hillman officers, the Board determined that the Reorganization was in the best

interests of the Existing Fund and its shareholders and unanimously approved the Plan of Reorganization, subject to the approval by the Existing Fund’s shareholders, and recommends that the Existing Fund shareholder vote “FOR” the approval of the Plan

of Reorganization.

COMPARISON OF THE EXISTING FUND AND THE NEW FUND

The Existing Fund is a series of Hillman, a Delaware statutory trust, and the New Fund is organized as a series of AST, a Delaware statutory trust. The New Fund has been created as

a shell series of AST solely for the purpose of the proposed Reorganization. Set forth below is a comparison of Existing Fund’s and New Fund’s investment objectives, principal investment strategies and risks, fees and expenses, third party service

providers, shareholder information and other aspects of the Funds.

Investment Objectives, Limitations & Restrictions; Principal Investment Strategies; Risks.

The investment objectives, limitations and restrictions, as well as the principal investment strategies and risks for the New Fund will be identical to those of the Existing Fund.

Set forth below is a summary of the investment objectives, principal investment strategies and principal risks of the Existing Fund and the New Fund. The investment objective of the Existing Fund and the New Fund is to provide long-term total return

from a combination of income and capital gains. For detailed information about the principal investment strategies and risks of the Existing Fund, as well as its investment limitations and restrictions, see the current Prospectus and Statement of

Additional Information for the Existing Fund, which are incorporated herein by reference.

Fees and Expenses.

The Reorganization is not expected to result in an increase in shareholder fees paid by the Existing Fund’s shareholders on shares acquired in the Reorganization or annual fund

operating expenses. In fact, the annual operating expenses of the New Fund are expected to be identical to, or, in time, lower than the annual operating expenses of the Existing Fund. The following is a comparison of the fee tables, along with the

expense examples, of the Existing Fund and the New Fund:

|

Shareholder Fees

|

Existing Fund

|

New Fund

|

|

(fees paid directly from your investment)

|

(Current)

|

(Pro Forma)

|

|

Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price)

|

None

|

None

|

|

Maximum Deferred Sales Charge (Load) (as a % of the original purchase price)

|

None

|

None

|

|

Redemption Fee (as a % of amount redeemed)

|

None

|

None

|

|

Management Fees

|

0.85%1

|

0.85%

|

|

Distribution and/or Service (12b-1) Fees

|

None

|

None

|

|

Other Expenses

|

0.46%

|

[__]%

|

|

Total Annual Fund Operating Expenses

|

1.31%

|

[__]%

|

|

Fee Waiver1, 2

|

(0.36)%

|

[__]%

|

|

Total Annual Fund Operating Expenses After Waiver1

|

0.95%

|

[95]%

|

| (1) |

Restated to reflect current contractual management fee.

|

| (2) |

HCM has entered into an expense limitation agreement with the Trust (the “Expense Limitation Agreement”) pursuant to which HCM has agreed to waive or reduce its management fees and to assume other expenses of the

Fund, if necessary, in an amount that limits the Fund’s Total Annual Operating Expenses (exclusive of (i) any front-end or contingent deferred loads; (ii) brokerage fees and commissions; (iii) acquired fund fees and expenses; (iv) fees and

expenses associated with investments in other collective investment vehicles or derivative instruments (including for example option and swap fees and expenses); (v) borrowing costs (such as interest and dividend expense on securities sold

short); (vi) taxes; and (vii) extraordinary expenses, such as litigation expenses (which may include indemnification of Fund officers and Trustees and contractual indemnification of Fund service providers (other than HCM)) to not more than

0.95% of the average daily net assets of the Fund. The contractual arrangement runs through January 31, 2022 for the Existing Fund and, for the New Fund, 12 months following the date of the first New Fund

to commence operations which is expected to be the Closing Date which is currently set for [CLOSING DATE], unless terminated by the Board at any time.

|

9

|

1 Year

|

3 Years

|

5 Years

|

10 Years

|

|

|

Existing Fund

|

$[__]

|

$[__]

|

$[__]

|

$[__]

|

|

New Fund

|

$[__]

|

$[__]

|

$[__]

|

$[__]

|

More detailed information about the New Fund’s annual fund operating expenses will be set forth in the New Fund’s Prospectus.

Fiscal Year

The Existing Fund currently operates on a fiscal year ending September 30. Following the Reorganization, the New Fund will assume the financial history of the Existing Fund and

will continue to operate on a fiscal year ending September 30.

Comparison of Valuation Procedures

Generally, the procedures by which AST intends to value the securities of the New Fund are substantially the same as the procedures used by Hillman to value the securities of the

Existing Fund. In all cases where a price is not readily available and no other means are available for determining a price, both AST and Hillman turn to their fair value procedures for guidance. Applying AST’s valuation policies after the

Reorganization to the New Fund is not expected to result in material differences in the New Fund’s net asset values compared to applying Hillman’s valuation policies to the Existing Fund prior to the Reorganization.

Distribution and Service (Rule 12b-1) Fees, Sales Charges, and Redemption Fees

Neither the Existing Fund nor the New Fund has any 12b-1 fees, sales charges, or redemption fees and none will be imposed on shareholders in connection with the Reorganization.

MANAGEMENT

Investment Adviser

Hillman Capital Management, Inc., a registered investment adviser located at 7250 Woodmont Avenue, Suite 310, Bethesda, Maryland 20814, serves as the investment adviser to the

Existing Fund and will be the investment adviser to the New Fund pursuant to an investment advisory contract. HCM is registered as an investment adviser with the SEC under the Investment Advisers Act of 1940, as amended. HCM provides guidance and

policy direction in connection with its daily management of the Fund’s assets. HCM manages the investment and reinvestment of the Fund’s assets. HCM is also responsible for the selection of broker-dealers through which the Fund executes portfolio

transactions, subject to the brokerage policies established by the Trustees, and it provides certain executive personnel to the Fund.

10

HCM has served as a registered investment adviser to the Fund since its inception. The executives and members of the advisory staff of HCM also have extensive experience in other

capacities in managing investments for clients including individuals, corporations, non-taxable entities, and other business and private accounts since the firm was founded in 1998. As of September 30, 2020, HCM had approximately $201 million in

assets under management.

As full compensation for the investment advisory services provided to the Existing Fund, HCM receives monthly compensation based on the Fund’s average daily net assets at the

annual rate of 0.85%. HCM has entered into the Expense Limitation Agreement with the Trust, pursuant to which HCM has agreed to waive or limit its management fees and to assume other expenses so that the total annual operating expenses of the Fund

(exclusive of (i) any front-end or contingent deferred loads; (ii) brokerage fees and commissions; (iii) acquired fund fees and expenses; (iv) fees and expenses associated with investments in other collective investment vehicles or derivative

instruments (including for example option and swap fees and expenses); (v) borrowing costs (such as interest and dividend expense on securities sold short); (vi) taxes; and (vii) extraordinary expenses, such as litigation expenses (which may include

indemnification of Fund officers and Trustees and contractual indemnification of Fund service providers (other than the Adviser)) to 0.95%. The contractual arrangement runs through January 31, 2022 for the Existing Fund and, for the New Fund, 12 months

following the date of the first New Fund to commence operations which is expected to be the Closing Date which is currently set for [CLOSING DATE], unless terminated by the Board at any time. The Adviser cannot recoup from the Fund any amounts paid by

the Adviser under the Expense Limitation Agreement.

Portfolio Manager

The Existing Fund is managed on a day to day basis by Mark Hillman. The portfolio manager will not change as a result of the Reorganization. For more detailed information about the

Fund’s portfolio manager, including his principal occupation for the past five years, compensation information and other accounts managed, see the Prospectus and Statement of Additional Information for the Existing Fund.

COMPARISON OF OTHER PRINCIPAL SERVICE PROVIDERS

Independent Accountants

BBD, LLP, located at 1835 Market Street, 3rd Floor Philadelphia, PA 19103, serves as the Existing Fund’s independent accountant. After the Reorganization, Cohen &

Company, Ltd., located at 1350 Euclid Ave., Suite 800, Cleveland, Ohio 44115 will serve as the independent accountant of the New. Cohen & Company, Ltd. will perform an annual audit of the New Fund’s financial statements and provide other services

related to filings with respect to securities regulations.

Distributor

Capital Investment Group, Inc. (the “Distributor”), located at 100 E. Six Forks Road, Suite 200, Raleigh, North Carolina 27609, acts as an underwriter and distributor of the

Existing Fund’s shares for the purpose of facilitating the registration of shares of the Existing Fund under state securities laws and to assist in sales of the Existing Fund’s shares pursuant to the Distribution Agreement between the Distributor and

Hillman, on behalf of the Existing Fund. After the Reorganization, ALPS Distributors, Inc. (an affiliate of ALPS Fund Services, Inc.) (the “Distributor”), located at 1290 Broadway, Suite 1000, Denver, Colorado 80203, will serve as underwriter and

distributor of the New Fund’s shares pursuant to a distribution agreement between the Distributor and AST, on behalf of the New Fund. The Distributor is not obligated to sell any specific amount of New Fund shares.

Administrator, Fund Accounting and Transfer Agency Services

The Nottingham Company (“TNC”), located at 116 South Franklin Street, Post Office Box 69, Rocky Mount, North Carolina 27802, serves provides certain fund accounting and

administrative services to the Existing Fund. After the Reorganization, ALPS Fund Services, Inc. (an affiliate of the Distributor) (“ALPS”, located at 1290 Broadway, Suite 1000, Denver, Colorado 80203, will provide certain administrative services to

the New Fund. Nottingham Shareholder Services, LLC (“Transfer Agent”) serves as the transfer, dividend paying, and shareholder servicing agent of the Existing Fund. After the Reorganization, ALPS Fund Services, Inc. will provide those services to the

New Fund.

11

Custodian

UMB Bank, n.a., with its principal place of business located at 1010 Grand Boulevard, Kansas City, Missouri 64106, serves as custodian for the Existing Fund’s assets (the

“Custodian”). The Custodian acts as the depository for the Fund, safekeeps portfolio securities, collects all income and other payments with respect to portfolio securities, disburses monies at the Fund’s request, and maintains records in connection

with its duties as custodian. The Custodian will continue to serve in the same capacity for the New Fund.

Compliance Services

The Nottingham Company, Inc., located at 116 S Franklin Street, Rocky Mount, NC 27802, provides a Chief Compliance Officer to Hillman as well as related compliance services

pursuant to a compliance services agreement. After the Reorganization, ALPS serves in this capacity for AST, and, accordingly, will provide these services to AST with respect to the New Fund.

Legal Services

Greenberg Traurig LLP, 2200 Ross Avenue, Suite 5200, Dallas, TX 75201, currently serves as Hillman's legal counsel. Davis Graham & Stubbs LLP, 1550 17th Street, Suite 500,

Denver, Colorado 80202 serves as the counsel to AST and, accordingly, will be the New Fund’s legal counsel following the Reorganization.

CERTAIN INFORMATION REGARDING THE TRUSTEES AND OFFICERS

In connection with the Reorganization, the operations of the New Fund will be overseen by the Board of Trustees of AST (the “AST Board”) in accordance with AST’s Agreement and

Declaration of Trust and AST’s By-Laws (the “Governing Documents”), which have been filed with the SEC and are available upon request. The AST Board approves all significant agreements between/among the New Fund and the persons or companies that

furnish services to the New Fund, including agreements with its distributor, HCM, administrator, custodian and transfer agent. The day-to-day operations of the New Fund are delegated to HCM and the New Fund’s administrator.

The name, address, year of birth, and principal occupations for the past five years of the Trustees and officers of AST are listed below, along with the number of portfolios in the Fund Complex

overseen by and the other directorships held by the Trustee.

AST Independent Trustees

|

Name, Birth Year

& Address*

|

Position(s) Held

with Fund

|

Term of Office

and Length of

Time Served**

|

Principal Occupation(s)

During Past 5 Years***

|

Number of Funds in Fund

Complex

Overseen by

Trustee****

|

Other Directorships

Held by Trustee

During Past

5 Years***

|

|

Ward D. Armstrong,

Birth year: 1954 |

Trustee and Chairman

|

Mr. Armstrong was appointed to the Board on May 27, 2016. Mr. Armstrong was appointed Chairman of the Board at the August 24, 2017 meeting of the Board of Trustees.

|

Mr. Armstrong is currently retired. From February 2010 to July 2015, he was Co-Founder and Managing Partner of NorthRock Partners, a private wealth advisory firm providing comprehensive wealth

management and family office services to the high net-worth marketplace. Previously, he was Senior Vice President, Ameriprise Financial (September 2005 to May 2007); Chairman of Ameriprise Trust Company (2005 – 2007) and President, American

Express Institutional Asset Management (1984 – 2002). He has also served on several investment related Boards including Kenwood Capital Management, RiverSource Investments, American Express Asset Management International and was Chair of the

Ordway Theatre Endowment Committee.

|

10

|

Mr. Armstrong is a Director of the Heartland Group, Inc. (3 funds) (2008 to present).

|

12

|

J. Wayne Hutchens,

Birth year: 1944

|

Trustee

|

Mr. Hutchens was elected to the Board on October 30, 2012.

|

Mr. Hutchens is currently retired. From 2000 to January 2020, he served as Trustee of the Denver Museum of Nature and Science and from May 2012 to February 2020, he was a Trustee of Children's Hospital Colorado. From April 2006 to December

2012, he served as President and CEO of the University of Colorado (CU) Foundation and from April 2009 to December 2012, he was Executive Director of the CU Real Estate Foundation. Mr. Hutchens is also Director of AMG National Trust Bank

(June 2012 to present). Prior to these positions, Mr. Hutchens spent 29 years in the banking industry, retiring as Chairman of Chase Bank Colorado.

|

10

|

Mr. Hutchens is a Director of RiverNorth Opportunities Fund, Inc. (2013 to present), RiverNorth Opportunistic Municipal Income Fund, Inc. (2018 to present), RiverNorth/Doubleline Strategic Opportunity Fund, Inc. (2018 to present),

RiverNorth Specialty Finance Corporation (2018 to present), RiverNorth Managed Duration Municipal Income Fund, Inc. (2019 to present), RiverNorth Flexible Municipal Income Fund, Inc. (2020 to present). He is an Advisory Board member of

RiverNorth Funds (3 funds) (2020 to present).

|

|

Patrick Seese,

Birth year: 1971 |

Trustee

|

Mr. Seese was elected to the Board on October 30, 2012.

|

Mr. Seese is an owner and a Managing Director of Integris Partners, a middle-market investment banking firm serving closely-held companies, financial sponsors and public companies (February 2008 to

present). Prior to this, Mr. Seese was a Managing Director of Headwaters MB, a middle-market investing banking firm (December 2003 to February 2008). Prior to that, Mr. Seese worked in Credit Suisse First Boston’s Mergers and Acquisitions

Group and served as Head of Corporation Development, Katy Industries, a publicly traded industrial and consumer products company and at Deloitte & Touche LLP, where he began his career in 1994.

|

10

|

Mr. Seese is a Director of The Mile High Five Foundation (2013 to present) and SJ Panthers Foundation (2016 to present).

|

13

AST Interested Trustee

|

Name, Birth Year

& Address*

|

Position(s) Held

with Fund

|

Term of Office

and Length of

Time Served**

|

Principal Occupation(s)

During Past 5 Years***

|

Number of

Funds in Fund

Complex

Overseen by

Trustee****

|

Other Directorships

Held by Trustee

During Past

5 Years***

|

|

Jeremy O. May,

Birth year: 1970

|

Trustee

|

Mr. May was elected Trustee on October 30, 2012. Mr. May was President from October 30, 2012 to May 23, 2019. Mr. May was Chairman from October 30, 2012 to August 24, 2017.

|

Mr. May is currently COO of Magnifi LLC and is CEO and Founder of Paralel Technologies, LLC. Mr. May previously served as President and Director of ALPS Fund Services, Inc., ALPS Distributors, Inc.,

and ALPS Portfolio Solutions Distributor, Inc., Executive Vice President and Director of ALPS Holdings, Inc. and ALPS Advisors, Inc., working at ALPS from June 1995 until June 2019. Because of his positions with these entities, Mr. May is

deemed an affiliate of the Trust as defined under the 1940 Act. Mr. May is also on the Board of Directors of the University of Colorado Foundation and the AV Hunter Trust.

|

10

|

Mr. May is Trustee of the Reaves Utility Income Fund (1 fund) (2009 to present). IMr. May also serves on the Board of Directors of The Bow River Evergreen Fund (as of 2020) and the New Age Alpha Trust

(as of 2020).

|

14

AST Officers

|

Name, Birth

Year & Address*

|

Position(s) Held

with Fund

|

Term of Office and

Length of Time Served**

|

Principal Occupation(s) During Past 5 Years***

|

|

Bradley Swenson,

Birth year: 1972 |

President

|

Since May 2019

|

Mr. Swenson joined ALPS Fund Services, Inc. (“ALPS”) in 2004 and has served as its President since June 2019. In this role, he serves as an officer to certain other closed-end and open-end investment companies. He previously served as the

Chief Operating Officer of ALPS (2015-2019). Mr. Swenson also previously served as Chief Compliance Officer to ALPS, its affiliated entities, and to certain ETF, closed-end and open-end investment companies (2004-2015).

|

|

Erich Rettinger,

Birth year: 1985 |

Treasurer

|

Since August 2020

|

Mr. Rettinger joined ALPS in 2007 and is currently Vice President and Fund Controller of ALPS. He has served as Fund Controller of ALPS (since 2013) and Fund Accounting of ALPS (2013-2017). He also served as Assistant Treasurer of the Trust

(May 2019-August 2020). Mr. Rettinger is also Assistant Treasurer of the Stone Harbor Investment Funds.

|

|

Lucas Foss,

Birth Year: 1977 |

Chief Compliance Officer

|

Since January 2018

|

Mr. Foss rejoined ALPS in November 2017 as Vice President and Deputy Chief Compliance Officer. Prior to his current role, Mr. Foss served as the Director of Compliance at Transamerica Asset Management (2015–2017) and Deputy Chief Compliance

Officer at ALPS (2012-2015). Mr. Foss is also CCO of X-Square Balanced Fund, Goehring & Rozencwajg Investment Funds, Broadstone Real Estate Access Fund, Inc., Clough Global Funds; Clough Funds Trust; SPDR® S&P 500® ETF

Trust, SPDR® Dow Jones® Industrial Average ETF Trust, SPDR® S&P MIDCAP 400® ETF Trust and 1WS Credit Income Fund.

|

|

Vilma DeVooght, Birth year:

1977 |

Secretary

|

Since May 2020

|

Ms. DeVooght has served as Senior Counsel of ALPS since 2014 and previously served as Associate Counsel of First Data Corporation from 2012 to 2014 and Legal Counsel of Invesco 2009 to 2011. Ms. DeVooght also serves as Assistant Secretary

of the Stone Harbor Investment Funds, the Stone Harbor Emerging Markets Income Fund and the Stone Harbor Emerging Markets Total Income Fund (since 2015).

|

|

Anne M. Berg,

Birth year: 1973 |

Assistant Secretary

|

Since August 2018

|

Ms. Berg joined ALPS as Senior Investment Company Act Paralegal in February 2017. Prior to joining ALPS, she was a Senior Legal Manager at Janus Capital Management LLC (2000-2017).

|

|

*

|

All communications to Trustees and Officers may be directed to ALPS Series Trust c/o 1290 Broadway, Suite 1000, Denver, CO 80203.

|

|

**

|

This is the period for which the Trustee or Officer began serving the Trust. Each Trustee serves an indefinite term, until such Trustee’s successor is elected and appointed, or such Trustee

resigns or is deceased. Officers are elected on an annual basis.

|

|

***

|

Except as otherwise indicated, each individual has held the office shown or other offices in the same company for the last five years.

|

|

****

|

The Fund Complex currently consists of 10 series of the Trust.

|

15

Ward D. Armstrong

Mr. Armstrong has been an Independent Trustee of AST since May 27, 2016. He has been Director of the Heartland Group, Inc. since February 2008 and was Chairman of Ameriprise Trust Company from November 1996 to May 2007.

Mr. Armstrong served as Managing Partner of NorthRock Partners, LLC from October 2013 to July 2015, Managing Director of Northrock Partners, a Private Wealth Advisory Practice of Ameriprise Financial from February 2010 to October 2013, Senior Vice

President of Ameriprise Financial, Inc. from November 1984 to May 2007 and President of American Express Asset Management from 2002 to 2004. Mr. Armstrong received a B.S. in Business Administration (Finance Emphasis) from the University of Minnesota,

Carlson School of Management. He was selected to serve as a Trustee of AST based on his business, financial services and investment management experience.

J. Wayne Hutchens

Mr. Hutchens has been an Independent Trustee of AST since October 30, 2012. He has been a Director of the RiverNorth Opportunities Fund, Inc. since 2013, the RiverNorth Opportunistic Municipal Income Fund, Inc. since

2018, the RiverNorth/DoubleLine Strategic Opportunity Fund, Inc. since 2018, the RiverNorth Specialty Finance Corporation since 2018, the RiverNorth Managed Duration Municipal Income Fund, Inc. since 2019; the RiverNorth Flexible Municipal Income Fund,

Inc. since 2020; an Advisory Board member of RiverNorth Funds since 2020 , Trustee of the Denver Museum of Nature and Science from 2000 to 2020; Trustee of Children's Hospital Colorado from May 2012 to February 2020; President and CEO of the University

of Colorado (CU) Foundation from April 2006 to December 2012; and Executive Director of the CU Real Estate Foundation from April 2009 to December 2012. Mr. Hutchens is also Director of AMG National Trust Bank since June 2012. Prior to these positions,

Mr. Hutchens spent 29 years in the banking industry, retiring as Chairman of Chase Bank Colorado. Mr. Hutchens is a graduate of the University of Colorado at Boulder’s School of Business and has done graduate study at Syracuse University and the

University of Colorado. He was selected to serve as a Trustee of AST based on his business and financial services experience.

Patrick Seese

Mr. Seese has been an Independent Trustee of AST since October 30, 2012. He has been a Director of The Mile High Five Foundation since 2013 and SJ Panthers Foundation since 2016. He has been an owner and a Managing

Director of Integris Partners, a middle-market investment banking firm, since February 2008. Prior to this, Mr. Seese was a Managing Director of Headwaters, MB, middle-market investing banking firm from 2003 to 2008. Prior to this, Mr. Seese was

working in Credit Suisse First Boston’s Mergers and Acquisitions Group and served as Head of Corporate Development for Katy Industries, a publicly traded industrial and consumer products company and at Deloitte & Touche, LLP, where he began his

career in 1994. Mr. Seese is a graduate of the University of Colorado and earned an MBA from The University of Chicago Booth School of Business. He is one of the founders of The Mile High Five Foundation (MH5), a charity dedicated to fund

youth/health-related organizations. Mr. Seese was selected to serve as a Trustee of AST based on his business, financial services and accounting experience.

Jeremy O. May

Mr. May is currently COO of Magnifi LLC and is CEO and Founder of Paralel Technologies, LLC. Mr. May has been an Interested Trustee of AST since October 30, 2012. He has been a Trustee of the Reaves

Utility Income Fund since 2009. Mr. May previously served as President and Director of ALPS Fund Services, Inc., ALPS Distributors, Inc., the Fund’s principal underwriter, ALPS Portfolio Solutions Distributor, Inc., Executive Vice President and

Director of ALPS Holdings, Inc. and ALPS Advisors, Inc., working at ALPS from June 1995 to June 2019. Before joining ALPS, Mr. May worked for Deloitte where he earned his CPA and worked on audits of financial services companies. In addition to AST, Mr.

May also serves on the Board of Directors of the Reaves Utility Income Fund, The Bow River Evergreen Fund, and the New Age Alpha Trust. Mr. May is also on the Board of Directors of the University of Colorado Foundation. Mr. May has a B.S. in Business

Administration from the University of Colorado. He was selected to serve as a Trustee of AST based on his business, financial services, accounting and investment management experience.

16

None of the Independent Trustees owns securities in Hillman Capital Management, Inc., the New Fund’s investment adviser, or ALPS Distributors, Inc., the New Fund’s principal underwriter, nor do they own securities in any

entity directly controlling, controlled by, or under common control with these entities.

AST Leadership Structure and Oversight Responsibilities

Overall responsibility for oversight of the New Fund rests with the Trustees. AST has engaged HCM to manage the New Fund on a day-to day basis. The AST Board is responsible for overseeing HCM and other service providers

in the operations of the New Fund in accordance with the provisions of the 1940 Act, applicable provisions of state and other laws and AST’s Declaration of Trust. The AST Board is currently composed of four members, three of whom are Independent

Trustees. The AST Board meets at regularly scheduled quarterly meetings each year. In addition, the AST Board may hold special in-person or telephonic meetings or informal conference calls to discuss specific matters that may arise or require action

between regular meetings. As described below, the AST Board has established a Nominating and Corporate Governance Committee and an Audit Committee, and may establish ad hoc committees or working groups from time

to time, to assist the AST Board in fulfilling its oversight responsibilities. The Independent Trustees have also engaged independent legal counsel to assist them in performing their oversight responsibilities.

The AST Board has appointed Ward D. Armstrong, an Independent Trustee, to serve in the role of Chairman. The Chairman’s role is to preside at all meetings of the AST Board and to act as a liaison with HCM, other service

providers, counsel and other Trustees generally between meetings. The Chairman may also perform such other functions as may be delegated by the AST Board from time to time. The AST Board reviews matters related to its leadership structure annually. The

AST Board has determined that the AST Board’s leadership structure is appropriate given AST’s characteristics and circumstances. These include AST’s series of fund shares, each fund’s single portfolio of assets, each fund’s net assets and the services

provided by the New Fund’s service providers.

Risk oversight forms part of the AST Board’s general oversight of the New Fund and is addressed as part of various Board and Committee activities. As part of its regular oversight of the New Fund, the AST Board, directly

or through a Committee, interacts with and reviews reports from, among others, Fund management, HCM, the New Fund’s Chief Compliance Officer, the New Fund’s legal counsel and the independent registered public accounting firm for the New Fund regarding

risks faced by the New Fund. The AST Board, with the assistance of the New Fund’s management and HCM, reviews investment policies and risks in connection with its review of the New Fund’s performance. The AST Board has appointed a Chief Compliance

Officer to oversee the implementation and testing of the New Fund’s compliance program and reports to the AST Board regarding compliance matters for the New Fund and its principal service providers. In addition, as part of the AST Board’s periodic

review of the New Fund’s advisory and other service provider agreements, the AST Board may consider risk management aspects of these service providers’ operations and the functions for which they are responsible.

AST Board Committees

Audit Committee. The AST Board has an Audit Committee that considers such matters pertaining to AST’s books of account, financial records, internal accounting controls and changes in accounting

principles or practices as the Trustees may from time to time determine. The Audit Committee also considers the engagement and compensation of the independent registered public accounting firm (“Firm”) and ensures receipt from the Firm of a formal

written statement delineating relationships between the Firm and AST, consistent with Public Company Accounting Oversight Board Rule 3526. The Audit Committee also meets privately with the representatives of the Firm to review the scope and results of

audits and other duties as set forth in the Audit Committee’s Charter. The Audit Committee members, each of whom is an Independent Trustee, are: Ward D. Armstrong, J. Wayne Hutchens and Patrick Seese. The Audit Committee met four times during the

fiscal year ended September 30, 2020.

Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee meets periodically to advise and assist the AST Board in selecting nominees to serve as trustees

of AST. The Nominating and Corporate Governance Committee believes the AST Board generally benefits from diversity of background, experience and views among its members and considers this a factor in evaluating the composition of the AST Board, but has

not adopted any specific policy in this regard. The Nominating and Corporate Governance Committee also advises and assists the AST Board in establishing, implementing and executing policies, procedures and practices that assure orderly and effective

governance of AST and effective and efficient management of all business and financial affairs of AST. Members of the Nominating and Corporate Governance Committee are currently: Ward D. Armstrong, J. Wayne Hutchens and Patrick Seese. The Nominating

and Corporate Governance Committee of the AST Board met one time during the fiscal year ended September 30, 2020.

17

Comparison of Trustees’ and Officers’ Fees

The Existing Fund

The officers of Hillman will not receive compensation from Hillman for performing the duties of their offices. Each Independent Trustee receives an annual retainer of $5,000 plus a

meeting fee of $500 for each quarterly meeting. In addition, each Independent Trustee receives a meeting fee of $500 for each special meeting attended in-person and $250 for each special meeting attended by telephone. These amounts may be paid pro rata

in the event that the Existing Fund closes during the fiscal year. All Trustees and officers are reimbursed for any out-of-pocket expenses incurred in connection with attendance at meetings.

The New Fund

Trustees’ and officers’ expenses and fees are Trust-wide expenses, and each series of AST (including the New Fund) pays a portion of the Trust-wide expenses. The Independent

Trustees of AST receive a quarterly retainer of $11,000, plus $4,000 for each regular AST Board or Committee meeting attended and $2,000 for each special telephonic or in-person AST Board or Committee meeting attended. Additionally, the Audit Committee

Chair receives a quarterly retainer of $1,250 and the Independent Chair receives a quarterly retainer of $2,500. The Independent Trustees are also reimbursed for all reasonable out-of-pocket expenses relating to attendance at meetings.

FEDERAL INCOME TAX CONSEQUENCES

As an unwaivable condition of the Reorganization, Hillman and AST will receive an opinion of counsel to AST to the effect that the Reorganization will qualify as a tax-free

reorganization for federal income tax purposes under Section 368(a)(1)(F) of the Internal Revenue Code of 1986, as amended (the “Code”). Provided that the Reorganization so qualifies, the Existing Fund, the New Fund, and the shareholders of the

Existing Fund will not recognize any gain or loss for federal income tax purposes as a result of the Reorganization. In addition, the tax basis of, and the holding period for, the New Fund shares received by each shareholder of the Existing Fund in the

Reorganization will be the same as the tax basis of, and the holding period for, the Existing Fund shares exchanged by such shareholder in the Reorganization (provided that, with respect to the holding period for the New Fund shares received, the

Existing Fund shares exchanged must have been held as capital assets by the shareholder).

The Existing Fund believes that, since inception, it has qualified for treatment as a “regulated investment company” under the Code. Accordingly, the Existing Fund believes it has

been, and expects to continue to be, relieved of any federal income tax liability on its taxable income and net gains distributed to its shareholders. Note that because (1) for certain federal tax purposes, the New Fund will be treated just as the

Existing Fund would have been treated if there had been no Reorganization, with the result that, among other things, the Reorganization will not terminate the Existing Fund’s taxable year and the part of its taxable year before the Reorganization will

be included in the New Fund’s taxable year after the Reorganization, and (2) the New Fund expects to operate on a fiscal, and therefore taxable, year ending September 30 of each year, which is a continuation of the Existing Fund taxable year ending

September 30 of each year.

Provided that the Reorganization qualifies as a tax-free reorganization under Code Section 368(a), then for U.S. federal income tax purposes, generally:

|

•

|

Each participating Existing Fund will not recognize any gain or loss as a result of the Reorganization;

|

|

•

|

The Existing Fund shareholder will not recognize any gain or loss as a result of the receipt of the New Fund shares in exchange for such shareholder’s Existing Fund shares pursuant to the Reorganization;

|

18

|

•

|

The tax basis in and holding period for the Existing Fund’s assets will be maintained when transferred to the New Fund; and

|

|

•

|

The Existing Fund shareholder’s aggregate tax basis in the New Fund shares received pursuant to the Reorganization will equal such shareholder’s aggregate tax basis in the Existing Fund shares held immediately

before the Reorganization.

|

Notwithstanding the foregoing, no opinion will be obtained, and no assurance will be provided, concerning whether gain or loss may be recognized (i) in connection with the transfer

of stock held by the Existing Fund in a passive foreign investment company as defined in Section 1297(a) of the Code, or (ii) under U.S. federal income tax principles that require the recognition of gain or loss upon the transfer of assets regardless

of whether such transfer qualifies as a reorganization under Code Section 368(a). Although Hillman is not aware of any adverse state income tax consequences, it has not made any investigation as to those consequences for the shareholders. Because each

shareholder may have unique tax issues, shareholders should consult their own tax advisers.

VOTING SECURITIES, PRINCIPAL SHAREHOLDERS AND MANAGEMENT OWNERSHIP

Voting Securities

Shareholders of the Existing Fund at the close of business on the Record Date will be entitled to be present and vote at the Shareholder Meeting. Each shareholder will be entitled

to one vote for each whole Existing Fund share and a fractional vote for each fractional Existing Fund share held as of the Record Date. As of the Record Date, there were [____] shares issued and outstanding of the Existing Fund.

Principal Shareholders and Management Ownership

Federal securities laws require that we include information about the shareholders who own 5% or more of the outstanding voting shares of the Existing Fund. A “control person” is a

person who owns beneficially or through controlled companies more than 25% of the outstanding voting securities of the Existing Fund. Shareholders owning 25% or more of outstanding shares may be in control and may be able to affect the outcome of

certain matters presented for a vote of shareholders. As of December 29, 2020, the following shareholders owned of record or beneficially 5% or more of the outstanding shares of the Existing Fund:

|

Shareholder and Address

|

Percentage

of Fund Owned |

Type of Ownership

|

|

[__]

|

[__]%

|

[__]

|

As of December 29, 2020, the Officers and Trustees of Hillman, as a group, owned less than 1% of the Existing Fund.

Participation in the Shareholder Meeting and Revocation of Proxies

If you wish to participate in the Shareholder Meeting you may submit the proxy card included with this Proxy Statement or attend in person. Your vote is important no matter how

many shares you own. You may vote in one of three ways:

|

•

|

Complete and sign the enclosed proxy card and mail it to us in the enclosed prepaid return envelope (if mailed in the United States);

|

|

•

|

Vote on the internet at the website address printed on your proxy ballot; or

|

|

•

|

Call the toll-free number printed on your proxy ballot

|

You may revoke a proxy once it is given, as long as it is submitted within the voting period, by submitting a later-dated proxy or a written notice of revocation to the Existing

Fund. You may also give written notice of revocation in person at the Shareholder Meeting. All properly executed proxies received in time for the Shareholder Meeting will be voted as specified in the proxy, or, if no specification is made, shares will

be voted FOR the proposal.

19

Quorum and Required Vote for the Existing Fund

The presence in person or by proxy of the holders of record of one-third of the shares of the Existing Fund issued and outstanding and entitled to vote shall constitute a quorum

with respect to the Existing Fund for the transaction of business at the Shareholder Meeting. The approval of the Plan of Reorganization with respect to the Existing Fund requires the affirmative vote of a majority of its shares, as defined below,

either in person or by proxy. For purposes of each proposal, majority means the lesser of: (a) 67% or more of the voting securities of the Existing Fund present at the meeting, if 50% or more of the outstanding voting securities of the Existing Fund

are represented in person or by proxy; or (b) 50% or more of the outstanding voting securities of the Existing Fund.

For purposes of determining (i) the presence of a quorum, and (ii) whether sufficient votes have been received for approval of a particular proposal, abstentions and broker

“non-votes” (that is, proxies from brokers or nominees indicating that such persons have not received instructions from the beneficial owner or other persons entitled to vote shares on a particular matter with respect to which the brokers or nominees

do not have discretionary power) will be treated as shares that are present at the meeting, but which have not been voted. For this reason, abstentions and broker non-votes will assist the Existing Fund in obtaining a quorum, but both have the

practical effect of a “no” vote for purposes of obtaining the requisite vote for approval of the proposal.

If either (a) a quorum is not present at the meeting, or (b) a quorum is present but sufficient votes in favor of the proposal have not been obtained, then the persons named as

proxies may propose one or more adjournments of the meeting with respect to the Existing Fund, without further notice to the shareholders of the Existing Fund, to permit further solicitation of proxies, provided such persons determine, after

consideration of all relevant factors, including the nature of the proposal, the percentage of votes then cast, the percentage of negative votes then cast, the nature of the proposed solicitation activities and the nature of the reasons for such

further solicitation, that an adjournment and additional solicitation is reasonable and in the interests of shareholders. The persons named as proxies will vote those proxies that such persons are required to vote FOR the proposal, as well as proxies

for which no vote has been directed, in favor of such an adjournment and will vote those proxies required to be voted AGAINST such proposal against such adjournment. If the Plan of Reorganization is not approved by shareholders, the Board of Hillman

will consider other options, which may include but is not limited to, seeking shareholder approval of the Plan of Reorganization again or declining to complete the Reorganization.

Solicitation of Shareholder Vote

The Board of Trustees of Hillman is making this solicitation of proxies. HCM has engaged Di Costa Partners, 509 Madison Avenue, Suite 1206, New York, NY 10022, a proxy solicitation

firm, to assist in the solicitation. The estimated fees anticipated to be paid to Di Costa Partners are approximately $[___]. The cost of preparing and mailing this Proxy Statement, the accompanying Notice of Special Meeting and proxy and any

additional materials relating to the Meeting and the cost of soliciting proxies will be borne by HCM. In addition to solicitation by mail, Hillman will request banks, brokers and other custodial nominees and fiduciaries, to supply proxy materials to

the respective beneficial owners of shares of each of the Existing Fund of whom they have knowledge, and HCM will reimburse them for their expenses in so doing. Certain officers, employees and agents of Hillman and HCM may solicit proxies in person or

by telephone, facsimile transmission, or mail, for which they will not receive any special compensation.

Householding

As permitted by law, only one copy of this Proxy Statement is being delivered to shareholders residing at the same address, unless such shareholders have notified Hillman of their

desire to receive multiple copies of the reports and proxy statements that Hillman sends. If you would like to receive an additional copy, please contact Hillman by writing to c/o Nottingham Shareholder Services, 116 South Franklin Street, Post Office

Box 4365, Rocky Mount, North Carolina 27803-0365 or calling 1-800-773-3863. The Existing Fund will then promptly deliver a separate copy of the Proxy Statement to any shareholder residing at an address to which only one copy was mailed. Shareholders

wishing to receive separate copies of the Existing Fund’s reports and proxy statements in the future, and shareholders sharing an address that wish to receive a single copy if they are receiving multiple copies should also direct requests as indicated.

20

Appendix A

FORM OF AGREEMENT AND PLAN OF REORGANIZATION

THIS AGREEMENT AND PLAN OF REORGANIZATION (“Reorganization Agreement”) is made as of this day of , 2020 by ALPS Series Trust, a Delaware statutory trust (“Acquiring Trust”), on behalf

of the Hillman Value Fund, (a series of the Acquiring Trust, and the “Acquiring Fund”); Hillman Capital Management Investment Trust, a Delaware statutory trust (“Target Trust”), on behalf of the Hillman Value Fund (a series of the Target

Trust and the “Target Fund”) (the Acquiring Fund and Target Fund may be referred to herein individually as a “Fund” and collectively as the “Funds”); Hillman Capital Management, Inc., a Maryland corporation (“Adviser”), the

proposed investment adviser to the Acquiring Fund (only for purposes of Sections 1.7, 5.10, 5.12, 9.1 and 9.2 of this Reorganization Agreement). The principal place of business of the Adviser Target Trust is 7250 Woodmont Avenue, Suite 310, Bethesda,

Maryland 20814, the principal place of business of the Target Trust is 116 South Franklin Street, Rocky Mount, NC 27802, and the principal place of business of the Acquiring Trust is 1290 Broadway, Suite 1000, Denver, Colorado 80203.

Notwithstanding anything to the contrary contained herein, the obligations, agreements, representations and warranties with respect to each Fund shall be the obligations,

agreements, representations and warranties of that Fund only, and in no event shall any other series of the Acquiring Trust or the Target Trust or the assets of any other series of the Acquiring Trust or the Target Trust be held liable with respect to

the breach or other default by an obligated Fund of its obligations, agreements, representations and warranties as set forth herein.

This Reorganization Agreement is intended to be and is adopted as a plan of “reorganization” within the meaning of Section 368(a) of the Internal Revenue Code of 1986, as amended

(“Code”), and the Treasury Regulations promulgated thereunder. The reorganization will consist of:

|

(a)

|

the transfer of all the assets of the Target Fund to the Acquiring Fund, in exchange solely for shares of beneficial interest, no par value per share, of the Shares of the Acquiring Fund

(collectively, “Acquiring Fund Shares”) and the assumption by the Acquiring Fund of all the liabilities of the Target Fund; and

|

|

(b)

|

the pro rata distribution of all Shares of the Acquiring Fund to the shareholders of the Target Fund (as calculated pursuant to this Reorganization Agreement), and the termination,

dissolution and complete liquidation of the Target Fund as provided herein, all upon the terms and conditions set forth in this Reorganization Agreement (“Reorganization”).

|

WHEREAS, the Acquiring Fund is a series of the Acquiring Trust, the Target Fund is a separate series of the Target Trust, the Acquiring Trust and the Target Trust are open-end

management investment companies registered under the Investment Company Act of 1940, as amended (“1940 Act”), and the Target Fund owns securities that generally are assets of the character in which the Acquiring Fund is permitted to invest;

WHEREAS, the Acquiring Fund has been organized to continue the business and operations of the Target Fund;

WHEREAS, the Acquiring Fund is authorized to issue the Acquiring Fund Shares;

WHEREAS, the Acquiring Fund currently has no assets and has carried on no business activities prior to the date first written above and will have no assets and will have carried on no business

activities prior to the consummation of the Reorganization, except as necessary to consummate the Reorganization and to issue the Initial Shares (as defined in Section 1.10 of this Agreement) as part of the organization of the Acquiring Fund;

WHEREAS, the Board of Trustees of the Acquiring Trust, including a majority of the trustees who are not “interested persons” of the Acquiring Trust as that term is defined in

Section 2(a)(19) of the 1940 Act (the “Independent Trustees”), has determined that the Reorganization is in the best interests of the Acquiring Fund; and

21

WHEREAS, the Board of Trustees of the Target Trust, including a majority of its Independent Trustees, has determined that the Reorganization is in the best interests of the Target

Fund and that the interests of the existing shareholders of the Target Fund will not be diluted as a result of the Reorganization.

NOW, THEREFORE, in consideration of the premises and of the covenants and agreements hereinafter set forth, the parties hereto covenant and agree as follows:

ARTICLE I

TRANSFER OF ASSETS OF THE TARGET FUND IN EXCHANGE FOR ACQUIRING FUND SHARES

AND THE ASSUMPTION OF THE TARGET FUND’S LIABILITIES, AND TERMINATION AND

LIQUIDATION OF THE TARGET FUND

1.1 THE EXCHANGE. Subject to the terms and conditions contained

herein and on the basis of the representations and warranties contained herein, the Target Fund agrees to transfer all its assets, as set forth in Section 1.2 of this Reorganization Agreement, to the Acquiring Fund. In consideration for such transfer,

the Acquiring Fund agrees (a) to deliver to the Target Fund the number of full and fractional Acquiring Fund Shares computed in the manner set forth in Section 2.3 of this Reorganization Agreement; and (b) to assume all the liabilities of the Target

Fund, as set forth in Section 1.3 of this Reorganization Agreement. All Acquiring Fund Shares delivered to the Target Fund shall be delivered at net asset value (“NAV”) without a sales load, commission or other similar fee being imposed. Such

transactions shall take place at the closing provided for in Section 3.1 of this Reorganization Agreement (“Closing”).

1.2 ASSETS TO BE TRANSFERRED. The Target Fund shall transfer all its

assets to the Acquiring Fund, including, without limitation, all cash, securities, commodities, interests in futures and dividends or interest receivables, owned by the Target Fund and any deferred or prepaid expenses shown as an asset on the books of

the Target Fund on the Closing Date (as defined in Section 3.1 of this Reorganization Agreement).

1.3 LIABILITIES TO BE ASSUMED. The Target Fund will endeavor,

consistent with its obligation to continue to pursue its investment objective and employ its investment strategies in accordance with the terms of its prospectus, to discharge all its known liabilities and obligations to the extent possible before the

Closing Date, other than those liabilities and obligations which otherwise would be discharged at a later date in the ordinary course of business or any liabilities or obligations that are intended to be assumed and paid by another person or entity

(including the Adviser). Notwithstanding the foregoing, the Acquiring Fund shall assume all liabilities of the Target Fund, which assumed liabilities shall include all of the Target Fund’s liabilities, debts, obligations, and duties of whatever kind or