BRF S.A.

Publicly-Held Company

CNPJ 01.838.723/0001-27

NIRE 42.300.034.240

SHAREHOLDERS´ MANUAL

ORDINARY AND EXTRAORDINARY GENERAL SHAREHOLDERS’ MEETING

APRIL 29, 2019

1

|

1. Management Message |

p. 3 |

|

2. Guidance to Participate in the General Shareholders’ Meeting |

|

|

2.1. Physical Presence |

|

|

2.1.1 Shareholders

|

|

|

2.1.1.1 Individual Shareholders |

p. 5 |

|

2.1.1.2. Corporate Shareholders |

p. 5 |

|

2.1.1.3. Shareholders represented by Proxy |

p. 5 |

|

2.1.1.4. Foreign Shareholders |

p. 6 |

|

2.1.2. Holders of American Depositary Receipts – ADRs |

p. 6 |

|

2.2. Participation by distance vote |

p. 6 |

|

2.2.1. For completion instructions transmitted to the Company bookkeeping agent

|

p. 7 |

|

2.2.2. For completion instruction transmitted to their respective custodian agents |

p. 7 |

|

2.2.3. By sending the Distance Voting Form Directly to BRF |

p. 8 |

|

3. Management Proposal |

p. 11 |

|

|

|

2

Dear Shareholders,

BRF S.A. (“BRF” or “Company”) is a company which is marked by a widespread and diffuse shareholding control in which shareholders are granted equal rights and protection mechanisms.

Our shares are listed on the Novo Mercado of B3 – Brasil, Bolsa, Balcão (B3”), and on the New York Stock Exchange (“NYSE”), with level III ADRs.

In line with the high level of corporate governance adopted by the Company and reflecting the principles of transparency, uniformity, and equality that support our relationship with investors, we hereby invite Shareholders to participate in our Ordinary and Extraordinary General Shareholders’ Meeting to be held on April 29, 2019, at 11:00 a.m., at our head office located at Jorge Tzachel, 475 – Bairro Fazenda, in the City of Itajaí in the State of Santa Catarina (“AGOE”).

To reinforce our concern over the information provided, we have made available on our Investor Relations website (https://ri.brf-global.com/, item Governança Corporativa) and on the websites of the Brazilian Securities and Exchange Commission (www.cvm.gov.br), the B3 (www.b3.com.br) and the SEC - Securities and Exchange Commission (www.sec.gov), all the documents legally required and other that we deem as necessary to endorse the understanding and the decision to be taken by the shareholders that will be subject to deliberation at this AGOE, as well as in this Manual.

We will discuss the following subjects to be approved:

I – At the Ordinary General Shareholders’ Meeting:

(i) To take the account of the managers, to examine, discuss and vote on the Management Report, Financial Statements and other documents related to the fiscal year ended on December 31, 2018;

(ii) To set the annual global compensation of the management for the 2019 fiscal year;

(iii) To authorize the increase in value of the annual global compensation of the management for the 2019 fiscal year, to be applicable in case the Board of Directors decide for the increase in up to eight of the number of the members of the Company’s Executive Board;

3

(iv) To elect the members of the Fiscal Council; and

(v) To set the global compensation of the members of the Fiscal Council for the 2019 fiscal year.

II – At the Extraordinary General Shareholders’ Meeting:

(i) To amend the Company’s Restricted Share Plan and ratify the payments already made under the Plan.

We welcome your participation in our Meeting, since it will deal with matters of importance for the Company which are directed at creating value for our shareholders.

We believe the information presented here will enable our shareholders to consider their positions and facilitate the decision making. Our Investor Relations team is ready and available to answer any questions or guide you.

We are counting on your presence and take advantage of this occasion to convey our appreciation.

Sincerely,

Pedro Pullen Parente

Chairman of the Board of Directors and Global Chief Executive Officer

Ivan de Souza Monteiro

Chief Financial Officer and of Investor Relations

4

2. GUIDANCE TO PARTICIPATE IN THE ORDINARY AND EXTRAORDINARY GENERAL SHAREHOLDERS’ MEETING

2.1. PHYSICAL PRESENCE

2.1.1. SHAREHOLDERS

As stated in article 15 of the Bylaws, the Company requests the shareholders who intend to take part in the Meeting, personally or through a proxy, to forward the notarized copy of the following documents (waived the authentication of those available on the CVM website) up to April 24, 2019, i.e. 5 (five) days before the AGOE at Avenida das Nações Unidas, 8.501 - Zip Code 05425-070, Pinheiros, São Paulo-SP, to the care of the Corporate-Legal Department:

2.1.1.1. INDIVIDUAL SHAREHOLDERS

| ▪ | Picture ID; and |

| ▪ | Statement disclosing the respective shareholding stake, issued by the custodian institution responsible for the custody of the shares. |

2.1.1.2. CORPORATE SHAREHOLDERS

| ▪ | Latest version of the Bylaws or consolidated articles of association and the corporate documentation granting powers to represent the legal entity (e.g. minutes of the election of officers); |

| ▪ | Picture ID of the legal representative(s); |

| ▪ | Statement disclosing the respective shareholding stake, issued by the custodian institution responsible for the custody of the shares; |

| ▪ | In case of Investment Funds: (i) the latest consolidated version of the fund regulation; (ii) bylaws or articles of incorporation of the administrator or manager, as is the case, with the fund´s voting policy and corporate documents that prove the powers of representation (minutes of the election of officers, term(s) of office and/or power of attorney); and (iii) picture ID of the legal representative(s) of the fund administrator or manager. |

2.1.1.3. SHAREHOLDERS REPRESENTED BY PROXY

| ▪ | In addition to the documents referred to above, a notarized power of attorney which must have been granted within less than 1 (one) year for any attorney-in-fact who is a shareholder, manager of the Company, lawyer or financial institution, with the investment funds administrator responsible for representing its joint owners, as stated in the first paragraph of article 126 of Law Nº 6.404/1976. Corporate shareholders may be represented by a proxy established according to their bylaws/articles of association, not being mandatory that the proxy is a shareholder, manager of the Company, lawyer of financial institution; |

5

| ▪ | Picture ID of the attorney-at-law; |

| ▪ | If the shareholders so desire, they may use the proxies made available previously by the Company to vote on matters of interest to the AGOE, as stated in the Public Request for a Proxy undertaken by the Company, in the form provided in article 22 and following CVM Instruction Nº 481/2009. The documents referring to the public request for proxy were disclosed by the Company on the Investor Relations website (www.brf-global.com/ri, in the item Governança Corporativa) and on the websites of the Brazilian Securities and Exchange Commission – CVM (www.cvm.gov.br), of B3 S.A. – Brasil, Bolsa, Balcão (www.b3.com.br) and of the Securities and Exchange Commission (www.sec.gov). |

2.1.1.4. FOREIGN SHAREHOLDERS

Foreign shareholders must present the same documents as the Brazilian shareholders, although the corporate documents of the legal entity and the power of attorney must be accompanied by a sworn translation, not being necessary its legalization and consularization.

2.1.2. HOLDERS OF AMERICAN DEPOSITARY RECEIPTS - ADRs

The holders of ADRs will be represented by The Bank of New York Mellon, in its capacity as a depository institution within the terms of the Deposit Agreement signed with the Company.

2.2. PARTICIPATION BY DISTANCE VOTE

As stated in articles 21-A and in line with CVM Instruction Nº 481/2009, Company shareholders may send their voting instructions, from this date, on the matters to be raised at the AGOE by completing and sending the form allowing them to cast their vote from a distance (“Distance Voting Form”) whose model was made available, separately, in the website of Relations with Investors of the Company (www.brf-global.com/ri, in the item Corporate Governance) and in the websites of the Securities and Exchange Commission (www.cvm.gov.br) and of B3 S.A. – Brasil, Bolsa, Balcão (www.b3.com.br)..

To do so, the Distance Voting Form should:

· be accessed to be printed and completed in advance in the item “Governança Corporativa” of the Company´s Investor Relations site (www.brf-global.com/ri), as well as in the websites of the Brazilian Securities and Exchange Commission – CVM and of B3 S.A- Brasil, Bolsa, Balcão (www.b3.com.br); and

6

· be received within a period of 7 (seven) days before the date of the Meeting, i.e. by April 22, 2019 (inclusive). Any voting forms received after this date will be disregarded.

Shareholders who choose to exercise their voting right through the Distance Voting Form should do so through one of the options described below:

2.2.1. For completion instructions transmitted to the Company bookkeeping agent

This option is aimed exclusively at shareholders whose shares are kept by Itaú Corretora de Valores S.A. (“Itaú”) and which are not held in the central depositary:

Shareholders with shares which are not held in the central depositary and who choose to exercise their voting right from a distance through service providers may transmit their instructions to the bookkeeping agent of the shares issued by BRF, Itaú Corretora de Valores S.A., in line with its rules. In this sense, Itaú created the website Assembleia Digital, a safe solution where it is possible to make the distance vote. To vote by the website, it is necessary to register and to have a digital certificate. Information on the registration and step by step on the issue of the digital certificate are described at the website: https://www.itau.com.br/securitiesservices/assembleiadigital/.

In case of doubt, shareholders should contact Itaú Corretora de Valores S.A. and verify the procedures it has established for the issue of instructions via the Distance Voting Form along with the documents and information it requires to exercise this service. The contact details for Itaú are as follows:

∙ Telephone – Shareholder attendance: 3003-9285 (Brazilian state capitals and metropolitan regions)/0800 7209285 (other locations).

∙ Attendance hours: working days, from 9:00 to 18:00 hours.

∙ E-mail: atendimentoescrituracao@itau-unibanco.com.br

∙ Address: Rua Faria Lima, 3400 – 10º andar, São Paulo, SP.

Within the terms of article 21-B of CVM Instruction Nº 481/2009, the shareholder must transmit the instructions for completion of the Distance Voting Form to the bookkeeping agent up to 7 days of the date of the Meeting, i.e. by April 22, 2019 (inclusive), unless a different deadline has been set by Itaú Corretora de Valores S.A..

7

2.2.2. For completion instruction transmitted to their respective custodian agents

This option is aimed exclusively at shareholders whose shares are in the custody of the B3 S.A. – Brasil, Bolsa, Balcão (“B3”). In this case, distance voting will be exercised by the shareholders according to the procedures adopted by their custodian agents.

Shareholders whose shares are deposited in the Central Depositary of the B3 and who choose to exercise their voting right from a distance through service providers should transmit their instructions to the respective custodian agents, in line with their rules, which, in turn, will forward these voting instructions to the Central Depositary of the B3.

To do so, shareholders should contact their custodian agents and verify the procedures they have established for the issue of instructions via the Distance Voting Form along with the documents and information they require to exercise this service.

Within the terms of article 21-B of CVM Instruction Nº 481/2009, the shareholders must transmit the instructions for completion of the Distance Voting Form to their custodian agents up to 7 days before the date of the Meeting, i.e. by April 22, 2019 (inclusive), unless a different deadline has been set by their custodian agents which must always be before this date.

2.2.3 By sending the Distance Voting Form Directly to BRF

Instead of following the procedures described in items 2.2.1 and 2.2.2 above, shareholders may also send their Distance Voting Forms directly to the Company.

To do so, shareholders should print the Distance Voting Form, complete it, initial all the pages and sign it. Shareholders should then send the Distance Voting Form, duly completed, initialed and signed, to the following postal address: Avenida das Nações Unidas, 8501, 1st floor, Pinheiros, Zip Code 05425-070, São Paulo - SP, care of the Legal-Corporate Department, along with the notarized copy of the documents described below (dismissed the certification of the documents available at CVM´s website):

Individual shareholders

§ Picture ID of the shareholder.

Corporate shareholders

8

| · | latest bylaws or consolidated articles of association and the corporate documents that prove the powers of representation (e.g. minutes of the election of officers); and |

| · | picture ID of the legal representative(s). |

Investment funds

| ▪ | the latest consolidated regulations of the fund; |

| ▪ | bylaws or articles of incorporation of its administrator or manager, as is the case, with the fund´s voting policy and corporate documents that prove the powers of representation (minutes of the election of officers, term(s) of office and/or power of attorney); and |

| ▪ | picture ID of the legal representative(s) of the administrator or manager. |

The Company does not require the notarization of the signature of the Distance Voting Forms, neither its consularization.

The corporate documents and those representing corporate shareholders and investment funds in a foreign language must have a sworn translation, not being necessary its notarization nor its consularization.

Should they prefer, shareholders may also send the documents to the Company in advance, sending the Distance Voting Form and the above-mentioned documents by digital means to the following electronic address: acoes@brf-br.com. Regardless of this, the Company must receive the original Distance Voting Form and notarized copy of the other documents sent previously by e-mail by the shareholder up to 7 (seven) days before the AGOE, i.e. by April 22, 2019, at the following address: Avenida das Nações Unidas, 8501, 1st floor, Pinheiros, Zip Code 05425-070, São Paulo, care of the Corporate-Legal Department.

Within 3 (three) days of receiving these documents, the Company will inform the shareholder through the electronic address indicated in item 2.1 of the Distance Voting Form of its receipt and acceptance.

Should the Distance Voting Form not be fully completed or accompanied by the corroborating documents described above, it will be disregarded, and this information will be sent to the shareholders through the electronic address indicated in item 2.1. of the Distance Voting Form informing the shareholders of the need to rectify or resend the Distance Voting Form or documents which accompany it (providing there is enough time), describing the procedures and periods needed to regularize the distance voting.

BRF stresses that:

9

| § | should there be differences between the Distance Voting Form received directly by the Company and the voting instruction contained in the summary voting statement from the bookkeeping agent for the same CPF (individual taxpayer number) or CNPJ (corporate taxpayer number), the voting instruction of the bookkeeping agent will prevail, as stated in Paragraph Two of article 21-W of CVM Instruction Nº 481/2009; |

| § | as stated in article 21-S of CVM Instruction Nº 481/2009, the Central Depositary of the B3, on receiving the voting instructions of the shareholders through their respective custodian agents, will disregard any different instructions in relation to a same resolution which had been issued by the same CPF or CNPJ registration number; |

| § | once the deadline for distance voting has ended, i.e. on April 22, 2019, the shareholder may not alter the voting instructions which have already been sent except in person or through a proxy at the General Meeting, through an application, explicitly calling for the voting instructions sent to be disregarded via Distance Voting Form, before the respective material is put to the vote; and |

| § | as provided in article 21-X of Instruction CVM n° 481/2009, the instructions of distance vote shall be considered normally in the event of an eventual postponement of the Meeting or it is necessary that the Meeting is held on second call, provided that the eventual postponement or performance on second call do not exceed 30 days from the date initially provided for its performance on first call. |

10

3. MANAGEMENT PROPOSAL FOR THE ORDINARY AND EXTRAORDINARY GENERAL SHAREHOLDERS’ MEETING TO BE HELD ON APRIL 29, 2019

Dear Shareholders,

Further to Instruction Nº 481/2009 of the Brazilian Securities and Exchange Commission, (local acronym CVM), we hereby present the following management proposal (“Proposal”) of BRF S.A. (“Company” or “BRF”), containing the information and documents related to the subjects to be decided at the Ordinary and Extraordinary Shareholders’ Meeting of the Company to be held on April 29, 2019, at 11:00 a.m. (“AGOE”), in the Company’s headquarters, located at Rua Jorge Tzachel, 475, Bairro Fazenda, in the City of Itajaí, State of Santa Catarina.

I. ORDINARY GENERAL SHAREHOLDERS’ MEETING.

(i) To take the account of the managers, to examine, discuss and vote on the Management Report, Financial Statements and other documents related to the fiscal year ended on December 31, 2018.

Management Proposal. To approve the management accounts and financial statements of the Company for the fiscal year ended on December 31, 2018 (“2018 Fiscal Year”), accompanied by the management report, explanatory notes, of the independent auditors report, of the Fiscal Council opinion, of the summarized annual report of the Audit and Integrity Committee and the comments of the Management on the Company´s financial situation, within the terms of Item 10 of the Company´s Reference Form, according to Appendix I of the Proposal, as required by article 9 of Instruction CVM no 481/2009.

We emphasize that the allocation of the net income from the 2018 Fiscal Year will not be the purpose of the AGO, since the Company registered a loss in this period. In this sense, it is not presented the Appendix 9-1-II of the CVM Instruction nº 481/2009.

(ii) To set the annual global compensation of the management for the 2019 fiscal year.

Management Proposal. In terms of article 17 of the Bylaws, to approve the annual global compensation related to the 2019 fiscal year for the members of the Board of Directors and Executive Board in the amount of up to R$ 90.5 million. The proposed amount refers to the limit proposed for the fixed compensation (salary or pro-labore, direct and indirect benefits and social contributions) and benefits due to termination of office, as well as the variable compensation (profit sharing) and amounts related to the Stock Option Plan and Restricted Share Plan of the Company, as summarized below.

11

|

Approved 2018 |

|

Performed 2018 |

|

Proposal 2019 | ||

|

Board of Directors |

|

|

|

|

| |

|

Members |

|

10 |

|

10 |

|

10 |

|

Fees + Contributions and Benefits |

12.127 |

|

11.371 |

|

16.545 | |

|

Compensation based in Shares |

3.092 |

|

3.025 |

|

9.631 | |

|

Total Board of Directors |

15.219 |

|

14.549 |

|

26.176 | |

|

Executive Board |

|

|

|

|

| |

|

Members |

|

6 |

|

4,33 |

|

4 |

|

Fees + Contributions and Benefits |

46.246 |

|

33.816 |

|

38.348 | |

|

Compensation based in Shares |

13.750 |

|

2.596 |

|

13.072 | |

|

Profit sharing |

17.142 |

|

3.912 |

|

12.816 | |

|

Total Executive Board |

77.137 |

|

40.324 |

|

64.236 | |

|

|

|

|||||

|

TOTAL Board of Directors and Executive Board |

92.356 |

|

54.873 |

|

90.412 |

The value proposed is 2% lower when compared to the value approved for the 2018 fiscal year. However when compared to the value performed of the global compensation of the 2018 fiscal year there is a variation of 65% higher, this is mainly a result of the lower payment of variable compensation and based in shares than the planned because of the challenging scenario for the business.

Appendix II to the Proposal presents the information relative to Item 13 of the Company´s Reference Form, as required by article 12 of Instruction CVM no 481/2009.

(iii) To authorize the increase in value of the annual global compensation of the management for the 2019 fiscal year, to be applicable in case the Board of Directors decide for the increase in up to eight of the number of the members of the Company’s Executive Board;

Management Proposal. In addition to the resolution of item (ii) of the Agenda of the Ordinary General Shareholders’ Meeting, we propose the authorization to increase in up to R$27.8 million the amount of the annual global compensation of the Company's management for the fiscal year 2019, to be applicable only in case the Board of Directors approves, based on Article 24 of the Bylaws, the increase in up to eight (8) of the number of the members of the Company's Executive Board (currently, there are 4 Statutory Officers within the Company's structure). The eventual application of such increase, including the amount object of item (ii) of the Agenda of the Ordinary General Shareholders’ Meeting, will make that the total amount of the annual global compensation of the management for the fiscal year 2019, raise up to R$ 118.3 million.

12

It is important to note that any increase in the number of the Statutory Officers will not import in creation new positions in the Company’s administrative structure, but only the attribution of the statutory status to positions that already exist at a non-statutory level. Thus, although this measure increases the value of the annual global compensation of the managers to be approved at the AGOE, it should not increase the total cost incurred by the Company with the compensation of its employees.

The total amount up to R$118.3 million refers to the limit proposed to the fixed compensation (salary or pro-labore, direct and indirect benefits and social contributions) and benefits due to termination of office, as well as the variable compensation (profit sharing) and amounts related to the Stock Option Plan and Restricted Share Plan of the Company, as summarized below:

|

Approved 2018 |

|

Performed 2018 |

|

Proposal 2019 | ||

|

Board of Directors |

|

|

|

|

| |

|

Members |

|

10 |

|

10 |

|

10 |

|

Fees + Contributions and Benefits |

12.127 |

|

11.371 |

|

16.545 | |

|

Compensation based in Shares |

3.092 |

|

3.025 |

|

9.631 | |

|

Total Board of Directors |

15.219 |

|

14.549 |

|

26.176 | |

|

Executive Board |

|

|

|

|

| |

|

Members |

|

6 |

|

4,33 |

|

4 |

|

Fees + Contributions and Benefits |

46.246 |

|

33.816 |

|

50.474 | |

|

Compensation based in Shares |

13.750 |

|

2.596 |

|

21.690 | |

|

Profit sharing |

17.142 |

|

3.912 |

|

19.944 | |

|

Total Executive Board |

77.137 |

|

40.324 |

|

92.108 | |

|

|

|

|||||

|

TOTAL Board of Directors and Executive Board |

92.356 |

|

54.873 |

|

118.248 |

The proposed amount is 28% higher compared to the amount approved for fiscal year 2018 and 116% higher compared to the actual amount for the same year. This variation between the proposed amount for 2019 fiscal year and the actual in 2018 is a result, in addition to the subjects already mentioned, by the increase in the number of Statutory Officers, which generates an impact in all compensation elements, mainly.

13

(iv) To elect the members of the Fiscal Council.

Management Proposal. In view that the functioning of the Fiscal Council of the Company ends at the first Ordinary General Shareholders’ Meeting after its election, as provided in article 161, § 5 of Law n° 6.404/1976, and that the article 30 of the Bylaws establishes that the Company shall have a Fiscal Council with permanent functioning, the Management proposes, for a mandate up to the Ordinary General Shareholders’ Meeting to be held on the fiscal year of 2020, the election of the following effective and alternate members of the Fiscal Council, who are:

|

Effective Members |

Alternate Members |

|

Attilio Guaspari |

Susana Hanna Stiphan Jabra |

|

Maria Paula Soares Aranha |

Mônica Hojaij Carvalho Molina |

|

André Vicentini |

Valdecyr Maciel Gomes |

It must be noted that the candidates Maria Paula Soares Aranha (effective) and Mônica Hojaij Carvalho Molina (alternate) were appointed by the shareholder Caixa de Previdência dos Funcionários do Banco do Brasil – Previ, while the candidates André Vicentini (effective) and Valdecyr Maciel Gomes (alternate) were appointed by the shareholder Fundação Petrobras de Seguridade Social – Petros.

Appendix III to this Proposal contains the information relative to the candidates for membership of the Company´s Fiscal Council, in accordance to the Items 12.5 to 12.10 of the Company´s Reference Form, as required by article 10 of Instruction CVM no 481/2009.

(v) To set the global compensation of the members of the Fiscal Council for the 2019 fiscal year.

Management Proposal. As provided in Article 16 (vi) of the Bylaws, to approve the compensation related to the fiscal year of 2019 for the effective members of the Company´s Fiscal Council in the amount corresponding to the, at least, ten percent (10%) of the average of the Executive Officers compensation (not include benefits, representation budgets and sharing profits), in the terms of Article 162, §3º of Law 6,404/76, considering the maximum value as summarized below.

|

Proposal 2018 |

|

Performed 2018 |

|

Proposal 2019 | ||

|

Fiscal Council |

|

|

|

|

| |

|

Fees + Contributions and Benefits |

744 |

|

612 |

|

961 | |

|

Total Fiscal Council |

744 |

|

612 |

|

961 |

14

Appendix II to this Proposal presents the information relative to Item 13 of the Company´s Reference Form, as required by article 12 of CVM Instruction no 481/09.

II. EXTRAORDINARY GENERAL SHAREHOLDERS’ MEETING

(i) To amend the Company’s Restricted Share Plan and ratify the payments already made under the Plan.

Management Proposal. To approve the amendment to the Restricted Shares Grant Plan, approved at the Ordinary and Extraordinary Shareholders’ Meeting held on April 08, 2015, amended at the Ordinary and Extraordinary General Shareholders’ Meeting held on April 26, 2017 and at the Extraordinary General Shareholders Meeting held on May 25, 2018 (“Grant Plan”), in order to expressly provide that: (i) the Grant Plan shall be administrated by the Board of Directors in observance of the provisions of the Company’s Bylaws and the current applicable legislation, respecting the limits of the global annual compensation of the managers; and (ii) the payments to the beneficiaries of the Grant Plan may be made in cash or in shares issued by the Company, as well as to ratify the payments already made to the Grant Plan’s beneficiaries according to its new terms.

In this sense, below there is a table explaining the amendments to be made in the Grant Plan currently in force:

|

Item |

Current |

Proposal |

|

4.1. Restricted Shares Grant Plan Administration |

4.1. The Plan will be administrated by the Board of Directors, which may, pursuant to the pertinent legal provisions, set up a Committee specially created to assist it in the administration of the Plan.

|

4.1. The Plan will be administrated by the Board of Directors, which may, in observance of the provisions of the Company’s Bylaws and the current applicable legislation, respecting the limits of the global annual compensation of the managers, set up a Committee specially created to assist it in the administration of the Plan. |

|

5.2. Granting of the Restricted Shares |

5.2. The granting of Restricted Shares is made through the conclusion of Grant Agreements between the Company and the Beneficiaries, which shall specify, without prejudice to other conditions determined by the Board of Directors, (a) the number of Restricted Shares object of the grant and (b) the terms and conditions for the acquisition of rights related to the Restricted Shares. |

5.2. The granting of Restricted Shares is made through the conclusion of Grant Agreements between the Company and the Beneficiaries, which shall specify, without prejudice to other conditions determined by the Board of Directors, (a) the number of Restricted Shares object of the grant and (b) the terms and conditions for the acquisition of rights related to the Restricted Shares. The Board of Directors may also establish the payment of said amount in cash or in shares, in the form to be established in the respective Grant Agreement. |

15

It is what the Board of Directors has to propose and hopes to be evaluated and approved by the shareholders.

* * *

Company shareholders interested in accessing information or raising questions relating to the above proposals should contact the Company´s Investor Relations at the following phone numbers +55 (11) 2322-5397 or via e-mail: acoes@brf-br.com. All documents related to this Meeting are available to shareholders at the following sites: https://ri.brf-global.com/, www.b3.com.br and www.cvm.gov.br.

São Paulo, March 29, 2019.

16

CONTENTS

Appendix to the Proposal of the Board of Directors to the Ordinary General Shareholders Meeting to be held on April 24, 2019

|

|

|

Appendix I – Managers comments on the financial situation of the company according to Item 10 of the Reference Form of the Company p. 18

Appendix II – Remuneration of the Managers and of the Fiscal Council (Item 13 of the Reference Form, in line with Instruction CVM Nº 480, of December 7, 2009) p. 93

Appendix III – Information on candidates to the positions of members of the Fiscal Council (items 12.5 to 12.10 of the Reference Form, in line with Instruction CVM Nº 480, of December 7, 2009) p. 154

|

|

|

|

|

* * *

17

BRF S.A.

Appendix I - Managers comments on the financial situation of the company according to Item 10 of the Reference Form of the Company

10. Directors´ Comments

The following information presented has been evaluated and commented on by the Company´s Directors:

10.1. The Directors should comment on:

a. Financial conditions and general assets

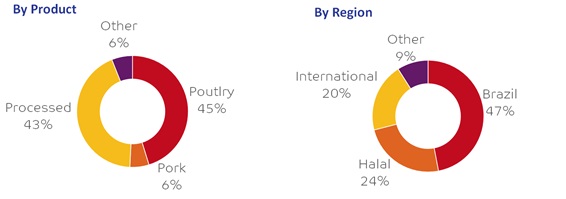

BRF is a Brazilian multinational, with a comprehensive and diversified product portfolio, which operates globally as one of the world's largest food producers. With focus on the breeding, production and slaughter of poultry and swine, industrialization, commercialization and distribution of meats in-natura, processed meat products, pasta, frozen vegetables and and soybean derivatives, among which, the following stand out:

· Whole chicken and turkey, cuts of frozen chicken, turkey and swine;

· Hams, bologna, franks, sausages and other smoked products;

· Hamburgers, breaded products, kibes and meatballs;

· Lasagna, pizzas, cheese bread, pies and frozen vegetables;

· Margarine;

· Soy bran and refined soy flour, as well as pet food.

The Company´s portfolio strategy is based on creating new, convenient, healthy and practical products for consumers, according to their needs. In this regard, the Company has a solid process of innovation, which generates products with high added value, to differentiate itself from its competitors and strengthen its brands.

The business model consists of a system of vertical and integrated production, through a wide-ranging distribution network, where the products are brought to the five continents in order to cater to supermarkets, retail stores, wholesalers, restaurants and other institutional customers. In addition, the production facilities are strategically located near suppliers of raw materials or their main consumer markets.

The Company has sufficient financial conditions and assets to continue its business plan and meet its short and long-term obligations, including third party loans, as well as to meet the financing of its activities and to cover its resource needs, at least for the next 12 months.

The table below shows how the Company´s main financial indicators have developed, considering its consolidated financial statements:

18

|

Ratio |

2018 |

20171 |

20161 |

|

Current Liquidity |

1,31 |

1,29 |

1,50 |

|

Overall Liquidity |

0,76 |

0,77 |

0,80 |

|

Leverage (Net Debt2 / EBITDA3) |

6,37 |

4,79 |

3,25 |

__________________

((1) For the financial years of 2018, 2017 and 2016, we consider only the continued operations for the calculation of current liquidity ratios and overall liquidity. The discontinued operations were considered as assets held for sale.

(2) The Company calculates net debt as the balance of loans and financing, debentures and derivative financial instruments net of cash and cash equivalents and marketable securities. Net debt is not a measure, according to the Accounting Practices Adopted in Brazil, in line with the IFRS or US GAAP.

(3) (³) EBITDA, defined as the earnings before interest, tax, depreciation and amortization, is used as a means of measuring the performance of the Company´s management. The pro-forma EBITDA is used for the calculation of the net leverage, that is, adjusted by EBITDA LTM of the acquisitions in the period. For further information, see item 3.2 of this Reference Form.

2018

2018 was the most challenging year in BRF's 10-year history and tested our ability to react and respond. It was also the year in which we carried out one of the largest sets of management, assets and financial adjustments in our history, laying the foundations for the Company's recovery.

Protectionist measures that closed important import markets, the pressure of costs in a domestic market where it was not possible to transfer prices and the strike of the truck drivers are among the main external elements of this period. The problems in our governance, the extensive de-structuring of teams, systems and processes and a second phase of a federal police investigation were other elements to compose this challenging scenario. The most visible consequences in our business that we had to face during 2018 were the fall in our margins, a high increase in our indebtedness and the constitution of much higher stocks of raw material than the desirable level. If we exclude these non-recurring factors, our negative result would be much lower.

We recognize that the results of 2018 were far from expected. They evidently do not reflect our vision on the maximum potential of value creation for the Company and its shareholders. But even so, 2018 will have been a key year for the Company's rebuilding as well as the beginning of its recovery because it was when the seeds of structural change were planted regarding strategy and operation.

The Company had a consolidated net revenue of R$30,188.4 million (6.6% above 2017), with emphasis on commercial units in Brazil and Halal. Operating income, measured by EBIT, was R$206.3 million, with a net loss of R$4,466.2 million.

The Company's net debt stood at R$15,689.4 million, 17.9% higher than 2017, impacted by the financial effects of exchange variation and derivatives, as well as free cash consumption in 2018. This increase resulted in a debt net of pro forma on 12-month adjusted EBITDA of 5.12x at the end of 2018.

19

Net financial expenses totaled negative R$2,241.5 million in 2018, 19.1% less than in the same period of the previous year.

On December 31, 2018, the Company's shareholders' equity totaled R$7,531.8 million, below the R$11,712.8 million recorded on December 31, 2017, as a result of the accumulated loss for the year, as well as the lower reserve of profit in the period.

2017

The 2017 financial year was defined by challenging events for the food industry, permeated by a Brazilian macroeconomic environment still in initial phase of recovery. Besides that, the Company made important changes in the management model, viewing to sustain its growth and profitability in the long term. Business units were consolidated in one single international division, whose corporate scope began to act in a more integrated and global manner.

In Brazil, the Company increased its base of clients served, ending the year with 187 thousand clients, while the company continued to increase the levels of services rendered. The company reinforced the position of the brands Sadia, Qualy and Perdigão with more than 70 innovations, among them the well successful re-release of the category of Lasagnas of the brand Perdigão, after the end of all the restrictions imposed by the Administrative Board of Economic Defense (“CADE”) for five years. It must be emphasized, in the turn of 2017 to 2018, the release of Kidelli, new brand focused in a new segment of the market for the Company. Furthermore, the Company continued focused in the global growth through synergies in the acquisitions and local partnerships by the Middle East, mainly. It must be emphasized that the beginning of the operations of OneFoods, subsidiary headquartered in Dubai dedicated to the Muslim market, as well as the acquisition and consolidation of Banvit, biggest producer of poultry in Turkey, made in partnership with Qatar Investment Authority (“QIA”).

The Company presented a consolidated net revenue of R$28,314.1 million (1.5% above the one of 2016), with emphasis to the commercial units of Brazil, and Halal. The operational result, measured by EBIT, was of R$663.2 million, with net loss of R$1,098.9 million.

The net debt of the Company was of R$13,309,8 million, 19.5% above the one registered in 2016, impacted by the acquisition of Banvit, as well as financial effects of exchange variation and derivatives. This increase resulted in a net debt over EBITDA (last twelve months) of 4.79x in the end of the period of 2017.

20

The net financial expenses totaled negative R$1,881.8 million in 2018, 3% lower in relation to the same period of the previous year.

On December 31, 2017, the net equity of the Company totaled the amount of R$11,712.8 million, below the R$12,219.4 million registered on December 31, 2016, due to the accrued loss of the year, as well as a lower profit reserve in the period.

2016

Although the sector and macroeconomic scenario are still challenging, 2016 was a decisive year for the Company, which believes it has made progress in consolidating a global business faced with all the changes carried out over the year. The Company invested in the improving processes of the entire productivity chain, raising the levels of service by consolidating the go-to-market (“GTM”) model throughout Brazil, reinforcing the positioning of the Sadia, Qualy and Perdigão brands with more than 25 innovations, including Salamitos in the snacks market and the partnership with international chef Jamie Oliver in the ready-made dishes category. Moreover, the Company maintained its focus on expansion and global growth through synergies and acquisitions and local partnerships in Middle East/North Africa (“MENA”), Europe and Asia. It is worth highlighting the consolidation of the OneFoods subsidiary in the Islamic world in the turnover period between 2016 and 2017.

The Company had consolidated net revenues of R$27,883.9 million, highlighted by the Asia, Eurasia and Africa regions. The operating result came to R$1, 962.9 million, with a net loss of R$367.3 million.

The Company’s net debt came to R$11,141.2 million, 51.9% higher than in 2015. This was impacted by the share buyback program, payment of dividends and merger and acquisition operations, resulting in a net debt/EBITDA ratio (last 12 months) of 3.25x.

Net financial expenses came to a negative R$1,940.9 million in 2016. This increase occurred mainly because of the higher net interest.

On December 31, 2016, the Company had shareholder’s equity of R$12,219.4 million, below the R$13,835.9 million registered on December 31, 2015. This was due to the loss accumulated in the year, along with the lower profit reserve, also resulting from the share buyback carried out during the period.

b. Capital structure

On December 31, 2018, the Company's capital structure comprised 25.0% of own capital and 75.0% of third-party capital.

On December 31, 2017, the Company’s capital structure consisted of 36.0% own capital and 64.0% capital of third-party capital.

21

On December 31, 2016, the Company’s capital structure consisted of 39.0% own capital and 61.0% capital of third-party capital.

The Company's financing model is based on the use of its own resources and the capital of third parties, this latter consisting of loans from financial institutions or issues on the debt market. More information about the Company´s use of capital from third parties can be obtained from item 10.1.f below.

c. Payment capacity in relation to financial commitments

As 79.5% of the gross debt in 2018 is long term, the Company has cash of R$6,528.8 million available (cash and cash equivalents) to meet its short-term financial commitments of R$4,547.4 million. Besides that, the Company expects a more robust cash flow for the year 2019, due to initiatives to improve operations in the period, greater efficiency in working capital and maintaining CAPEX, it believes it is in a comfortable position as far as its payment capacity is concerned.

d. Sources of financing for working capital and investments in non-current assets

The Company´s main sources of liquidity have been cash generation from its operating activities, loans and other financing. The Company has raised resources over the last three financial years through loan and financing operations from the financial and capital markets which were used to finance its working capital needs and short and long-term investments (see item 10.1.f for details on relevant loans and financing contracts).

e. Sources of financing for working capital and investments in non-current assets to be used to cover liquidity shortfalls

The Company will contract new loans and financing from the financial and capital markets when it identifies the need for additional resources to finance the long-term investment plan or in order to continue improving its debt profile.

Whenever possible, the Company will continue to look for low-cost funding and long-term financing from funding bodies such as the Economic and Social Development Bank (“BNDES”) and Research and Project Financing (“FINEP”), where the resources are used mainly for fixed capital.

The Company believes these sources of financing will be enough to cover its working capital needs in the normal course of its business.

f. Debt levels and features of such debt, also describing:

22

The main source of the Company´s debt comes from the raising of resources to finance its investments in fixed assets and capital spending. In 2018, the Company's loans and financing totaled R$22,165.4 million, of which R$10,627.1 million were denominated in local currency and R$11,538.3 million in foreign currency, primarily in US dollars. Loans and financing in 2017 came to R$20,444.4 million, of which R$9,343.0 million was denominated in domestic currency and R$11,101.3 million in foreign currency, mainly in U.S. dollars. Loans and financing in 2016 came to R$18,962.4 million, of which R$8,643.7 million was denominated in domestic currency and R$10,318.7 million in foreign currency, mainly U.S. dollars. Loans and financing in 2015 came to R$15,179.3 million, of which R$3,819.6 million was denominated in domestic currency and R$11,359.6 million in foreign currency mainly U.S. dollars.

The Company uses the funds obtained from financing for working capital, liquidity and purchasing raw materials. The following table shows the Company´s debt (according to the kind of debt and currency) net of cash, cash equivalents and negotiable securities for the financial years indicated:

|

|

December 31 of | ||||

|

|

Short-term |

Long- term |

2018 |

2017 |

2016 |

|

|

(Reais million, except where indicated) | ||||

|

Total Debt |

(4,782.4) |

(17,618.1) |

(22,400.5) |

(20,444.4) |

(18,962.4) |

|

Other financial assets and liabilities, net |

(52,7) |

- |

(52.7) |

(209.0) |

(331.5) |

|

Cash and cash equivalents and marketable securities: |

|

|

|

|

|

|

Domestic currency |

4,381,7 |

660.2 |

5,041.9 |

4,714.4 |

5,327.9 |

|

Foreign currency |

1,272.2 |

214.7 |

1,486.9 |

2,629.3 |

2,824.9 |

|

Total |

5,653.9 |

874.9 |

6,528,8 |

7,343.7 |

8,152.7 |

|

Net debt |

1,053.8 |

(16,743.1) |

(15,689.3) |

13,309.6 |

11,141.2 |

|

Currency exposure (U.S$ million) |

|

|

U.S.$ (60,6) |

U.S.$ 16.7 |

U.S.$ (183.6) |

The following table presents an additional breakdown of the Company´s debt by type:

|

|

| ||||

|

Short-term Debt on December 31, 2018 |

Long-term debt on December 31, 2018 |

Total debt on December 31, 2018 |

Total debt on December 31, 2017 |

Total debt on December 31, 2016 | |

|

(R$ million) | |||||

|

Credit Lines from Development Banks |

220.4 |

44.1 |

264.5 |

570.1 |

881.0 |

|

Other guaranteed debts |

- |

- |

- |

- |

129.6 |

|

Export Credit Lines |

39.3 |

1,586.0 |

1,625.3 |

1,889.2 |

1,922.3 |

|

Bonds |

- |

- |

- |

503.8 |

502.9 |

|

Working Capital Credit Lines |

1,695.4 |

4,167.6 |

5,863.0 |

2,555.4 |

1,326.1 |

|

PESA Loan |

3.8 |

269.7 |

273.5 |

249.4 |

251.6 |

|

Agribusiness Receivable Certification |

1,114.9 |

1,482.6 |

2,597.5 |

3,571.7 |

3,630.1 |

|

Tax Incentives |

3.3 |

- |

3.3 |

3.6 |

0.1 |

|

Domestic Currency |

3,077.1 |

7,550.1 |

10,627.1 |

9,343.0 |

8,643.7 |

|

Export Credit Lines |

998.7 |

384.5 |

1,383.2 |

2,150.7 |

1,310.6 |

|

Bonds |

99.6 |

9,646.9 |

9,746.5 |

8,529.9 |

8,493.7 |

|

Credit Lines from Development Banks |

- |

- |

- |

3.6 |

8.9 |

|

Other guaranteed debts |

- |

- |

- |

- |

0.8 |

|

Currency contract advances |

214.2 |

- |

214.2 |

- |

291.9 |

|

Working Capital Credit Lines |

157.8 |

36.7 |

194.5 |

417.1 |

291.9 |

|

Foreign Currency |

1,470.3 |

10,068.0 |

11,538.3 |

11,101.3 |

10,318.7 |

|

Total: |

4,547.4 |

17,618.0 |

22,165.4 |

20,444,4 |

18,962,4 |

23

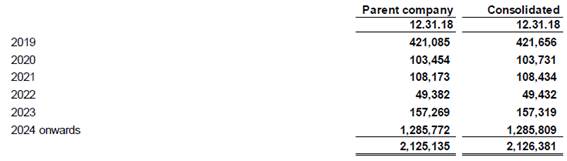

The timetable for the maturity of the Company´s debt on December 31, 2017 is as follows:

|

|

|

Consolidated |

|

|

|

31.12.18 |

|

2019 |

|

4,555,943 |

|

2020 |

|

3,395,433 |

|

2021 |

|

2,936,023 |

|

2022 |

|

3,072,727 |

|

2023 |

|

3,399,909 |

|

2024 going forward |

|

4,805,409 |

|

|

|

22,165,444 |

The following tables present the selected information on the amount of the Company´s debt over the last three financial years:

24

Current and Non-Current Loans and Financing 2018-2017 (In Thousands of R$)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated | |

|

Local currency |

Charges (p.a.) |

Weighted average rate of interest (p.a.) |

PMPV (1) |

Current |

Non-Current |

Balance 12.31.18 |

Discontinued |

Lib/Apl |

Amortization |

Interest paid |

Accrued interest |

Fair Value Sum |

Exchange variation |

Monetary adjustment |

|

Balance 12.31.17 |

|

Working capital |

Fixed rate / 118% (7.78% on 12.31.17) |

7.78% (7.78% on 12.31.17) |

1.7 |

1,695,390 |

4,167,633 |

5,863,023 |

|

4,431,145 |

(1,235,896) |

(149,701) |

262,113 |

- |

- |

- |

|

2,555,363 |

|

Credit export facilities |

109.45% of CDI (100.35% of CDI on 12.31.17) |

9.02% (6.91% on 12.31.17) |

3.2 |

39,294 |

1,586,033 |

1,625,327 |

|

1,621,124 |

(1,850,000) |

(188,743) |

153,747 |

- |

- |

- |

|

1,889,198 |

|

Credit lines of development banks |

Fixed Rate/Selic/TJLP + 1.25% (Selic/Fixed Rate/TJLP + 1.48% on 12.31.17) |

6.16% (6.78% on 12.31.17) |

1.1 |

220,414 |

44,131 |

264,545 |

|

- |

(315,119) |

(20,346) |

29,929 |

- |

- |

- |

|

570,082 |

|

Bonds |

7.75% (7.75% on 12.31.17) |

7.75% (7.75% on 12.31.17) |

0.1 |

- |

- |

- |

|

- |

(500,000) |

(19,375) |

15,573 |

- |

- |

- |

|

503,802 |

|

Special program of asset reorganization |

Fixed Rate / IGPM + 4.9% (Fixed Rate / IGPM + 4.9% on 12.31.17) |

12.45% (4.36% on 12.31.17) |

1.4 |

3,761 |

269,665 |

273,426 |

|

- |

- |

(8,101) |

32,161 |

- |

- |

- |

|

249,366 |

|

Tax incentives |

2.40% (2.40% on 12.31.17) |

2.40% (2.40% on 12.31.17) |

0.5 |

3,317 |

- |

3,317 |

|

57,246 |

(57,500) |

(445) |

451 |

- |

- |

- |

|

3,566 |

|

Certificate of agribusiness receivables |

96,40% of CDI / IPCA + 5.897% (96.5% CDI/IPCA + 5.897% on 12.31.17) |

6.08% (7.41% on 12.31.17) |

1.6 |

1,114,903 |

1,482,598 |

2,597,501 |

|

- |

(996,986) |

(223,144) |

245,977 |

- |

- |

- |

|

3,571,653 |

|

|

|

|

|

3,077,079 |

7,550,060 |

10,627,139 |

- |

6,109,515 |

(4,955,501) |

(609,854) |

739,951 |

- |

- |

- |

|

9,343,030 |

|

Foreign currency |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bonds |

4.07%(4.08% on 12.31.17) + v.c. US$, EUR and ARS |

4.07%(4.08% on 12.31.17 + v.c. US$, EUR and ARS) |

4.8 |

99,568 |

9,646,878 |

9,746,446 |

(87,113)) |

- |

(14,791) |

(466,552) |

506,484 |

- |

1,278,498 |

- |

|

8,529,919 |

|

Credit export facilities |

Libor + 0.25% (LIBOR + 1.85% on 12.31.17) + v.c. US$ |

2.47% (3.35% on 12.31.17) + v.c. US$ |

0.8 |

998,731 |

384,462 |

1,383,193 |

|

8,395 |

(1,067,367) |

(75,878) |

67,621 |

- |

299,692 |

- |

|

2,150,727 |

|

Working Capital |

0.00% (23.10% 12.31.17)+ v.c. ARS / + v.c. USD |

0.00% (23.10% 12.31.17) + v.c. ARS / + v.c. USD |

- |

- |

- |

- |

(68,660) |

813,279 |

(898,283) |

(3,632) |

(46,025) |

- |

(56,616) |

- |

|

167,888 |

|

Credit line of development banks |

- |

0.00% (6.22% 12.31.17) + v.c. USD and other currencies |

- |

- |

- |

- |

|

- |

(3,850) |

(192) |

471 |

- |

- |

- |

|

3,572 |

|

Other guaranteed debts and lease |

0.00% (00.00% 12.31.17)+ v.c. ARS |

0.00% (00.00% 12.31.17)+ v.c. ARS |

- |

- |

- |

- |

|

- |

- |

- |

- |

- |

- |

- |

|

- |

|

Advance of exchange agreements |

(4.67% + v.c. US$) |

(4.67% + v.c. US$) |

0.8 |

214,192 |

- |

214,192 |

|

208,474 |

- |

- |

1,077 |

- |

4,641 |

- |

|

- |

|

Working capital |

21.91% + v.c. TRY (15.95% + v.c. TRY on 12.31.17) |

21.91% + v.c. TRY (15.95% + v.c. TRY on 12.31.17) |

0.7 |

157,819 |

36,655 |

194,474 |

|

193,058 |

(216,610) |

(21,057) |

35,934 |

- |

(46,901) |

- |

|

249,240 |

|

|

|

|

|

1,470,310 |

10,067,995 |

11,538,305 |

(155,773) |

1,223,206 |

(2,200,902) |

(567,312) |

657,312 |

- |

1,480,123 |

- |

|

11,101,346 |

|

|

|

|

|

4,547,389 |

17,618,055 |

22,165,444 |

(155,773) |

7,332,721 |

(7,156,403) |

(1,177,166) |

1,397,564 |

- |

1,480,123 |

- |

|

20,444,376 |

25

Current and Non-Current Loans and Financing 2017-2016

(In Thousands of R$)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated | |

|

Local currency |

Charges (p.a.) |

Weighted average rate of interest (p.a.) |

PMPV (1) |

Current |

Non-Current |

Balance 12.31.17 |

Taken

|

Business Combination |

Amortization |

Interest Paid |

Interest Appropriated |

Exchange Rate Variation |

Monetary Correction |

Current |

Non-current |

Balance 12.31.16 |

|

Working capital |

7.79% 8.90% on 12.31.16 |

7.79% % (8.90%on 12.31.16) |

0.8 |

1,631,469 |

923.894 |

2,555,363 |

3,579,445 |

- |

(2,400,985) |

(162,218) |

212,995 |

- |

- |

1,326,1265 |

- |

1,326,126 |

|

Certificate of agribusiness receivables |

96.51% of CDI/IPCA + 5.90% (96.50% of CDI/IPCA on 12.31.16) |

7.41% (13.67% on 12.31.16) |

2.4 |

1.97.882 |

2,473,770 |

3,571,652 |

780,000 |

- |

(779190) |

(393,809) |

334,574 |

-- |

|

168,110 |

3,461,967709 |

3,630,077 |

|

Credit lines of development banks |

Fixed rate/Selic/TJLP + 0. 1,48%% Fixed rate/Selic/TJLP + 0,75%% on 12.31.16)

|

6.78% (7.93% on 12.31.16) |

1.7 |

313,311 |

256,771,709 |

570,082 |

62,439 |

- |

(403,772) |

(37,256) |

47,359 |

196 |

20,104 |

381,303 |

499, |

881.012 |

|

Bonds |

7.75% (7.75% on 12.31.16) |

7.75% (7.75% on 12.31.16) |

0.4 |

503,802 |

- |

503,802 |

- |

- |

- |

(38,750) |

46,425 |

- |

(6,806) |

4,140 |

498,769 |

502,933 |

|

Credit export facilities |

100,35% of CDI (13.68% on 12.31.16) |

9.61% of CDI (13.68% on 12.31.16) |

1.2 |

39.198 |

1,850,000 |

1,850,0007 |

1,889,198 |

- |

- |

(241,311) |

818,212 |

- |

- |

72,297 |

1,850,000- |

1,922,297- |

|

Special program of asset reorganization |

Fixed rateIGPM + 4.90% (Fixed rateIGPM + 4.90% on 12.31.16) |

4.36% (12.09% on 12.31.16) |

2.2 |

3,532 |

245,834 |

249,366 |

- |

- |

- |

(8,055) |

9,736 |

(1,662) |

(2,209) |

3,546 |

248,010 |

251,556 |

|

Other debts guaranteed |

(8.50%on 12.31.16) |

(8.50% ( on 12.31.16) |

- |

- |

- |

- |

- |

- |

(129,874) |

(8,904) |

9,185 |

- |

11 |

32,331 |

97,251 |

129,582 |

|

Tax incentives |

2.40% (2.40% on 12.31.16) |

2.40% (2.40% on 12.31.16) |

0.5 |

3.566 |

- |

3.566 |

34.405 |

- |

(30.911) |

(220) |

220 |

- |

- |

72- |

- |

72 |

|

|

|

|

|

3,592,760 |

5,750,269 |

9,343,029 |

4,456,289 |

- |

(3,744,732) |

(863,523) |

841,706 |

(1,466) |

11.100 |

1,987.925 |

6,655,730 |

8,643,655 |

|

Foreign currency |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bonds |

4.08% (4.71% on 12.31.16) + v.c. US$, EUR and ARS |

4.08% (4.71% on 12.31.16) + v.c. US$, EUR and ARS |

6.0 |

105,080 |

8,424,841 |

8,529,921 |

77,129 |

- |

(395,970) |

(382,020) |

410,433 |

326,687 |

- |

489,229 |

8,004,433 |

8.493.662 |

|

Credit export facilities |

LIBOR + 1.85% (LIBOR + 2.71% on 12.31.16) + v.c. US$ |

3.35% (3.85% on 12.31.16) + v.c. US$ |

2.2 |

953,502 |

1,197,226 |

2,150,728 |

3,576,033 |

- |

(2,981,166) |

(98,501) |

105,475 |

238,293 |

- |

312,219 |

998,375 |

1,310,594 |

|

Advance of exchange agreements |

(2.39 on 12.31.16) + v.c. US$ |

(2.39% on 12.31.16) + v.c. US$ |

- |

- |

- |

- |

4,065 |

- |

(203,396) |

(4,741) |

347 |

(9,115) |

- |

212,840 |

- |

212,840 |

|

Credit line of development banks |

UMBNDES + 1.73% (UMBNDES + 2.10% on 12.31.16) + v.c. US$ and other currencies |

6.22% (6.24% on 12.31.16) + v.c. and other currencies |

1.1 |

2,613 |

959 |

3,572 |

- |

- |

(5,906) |

(372) |

1.213 |

(264) |

- |

5,863 |

3,18- |

8,901 |

|

Working Capital |

23,10% (14,28% on 12.31.16) + v.c. ARS/+v.c. US$ |

23.10% (14.28% on 12.31.15) + v.c. ARS |

1.5 |

128,156 |

39,732 |

167,888 |

1,584,848 |

- |

(1,629,418) |

(19,777) |

59,246 |

(119,739) |

- |

236,908 |

55,820 |

292,728 |

|

Working capital |

15,28% + v.c. TRY |

15,95% + v.c. TRY |

0.1 |

249,240 |

- |

249,240 |

- |

389,151 |

(40,644) |

(41) |

5,103 |

(104,439) |

- |

- |

- |

- |

|

|

|

|

|

1,438,591 |

9,662,758 |

11,101,349 |

5,242,075 |

389,151 |

(5,256,500) |

(505,452) |

581,817 |

331,533 |

- |

1,257,079 |

9,061,646 |

10,318,725 |

|

|

|

|

|

5,031,351 |

15,413,027 |

20,444,378 |

9,698,364 |

389,151 |

(9,001,232) |

(1,368,975) |

1,423,523 |

330,067 |

11,100 |

23,245,004 |

15,717,376 |

18,962,380 |

26

Current and Non-Current Loans and Financing 2016-2015

(In Thousands of R$)

|

|

|

|

|

|

|

|

|

Consolidated | |

|

Local currency |

Charges (p.a.) |

Weighted average rate of interest (p.a.) |

PMPV (1) |

Current |

Non-Current |

Balance 12.31.16 |

Current |

Non-current |

Balance 12.31.15 |

|

Working capital |

8.90% (7.24% in 12.31.15) |

8.90% (7.24% in 12.31.15) |

0.4 |

1,326,126 |

- |

1,326,126 |

1,169,635 |

- |

1,169,635 |

|

Certificate of agribusiness receivables |

96.50% of CDI/IPCA + 5.90% (96.90% of CDI on 12.31.15) |

13.43% (13.67% on 12.31.15) |

3.5 |

168,110 |

3,461,967 |

3,630,077 |

33,078 |

992,165 |

1,025,243 |

|

Credit lines of development banks |

Fixed rate/Selic/TJLP + 0. 75% Fixed rate/Selic/TJLP + 1.00% on 12.31.15)

|

7.93% (4.57% on 12.31.15) |

0.9 |

381,303 |

499,709 |

881,012 |

217,426 |

508,928 |

726,354 |

|

Bonds |

7.75% (7.75% on 12.31.15) |

7.75% (7.75% on 12.31.15) |

1.4 |

4,140 |

498,793 |

502,933 |

4,140 |

497,921 |

502,061 |

|

Credit export facilities |

13.68% (0.00% on 12.31.15) |

13.68% (0.00% on 12.31.16) |

2.2 |

72,297 |

1,850,000 |

1,922,297 |

- |

- |

- |

|

Special program of asset reorganization |

Fixed rate/Selic/IGPM + 4.90% (Fixed rate/Selic/IGPM + 4.90% on 12.31.15) |

12.09% (15.44% on 12.31.15) |

3.2 |

3,546 |

248,010 |

251,556 |

3,315 |

231,488 |

234,803 |

|

Other debts guaranteed |

8.50% (8.14% on 12.31.15) |

8.50% (8.14% on 12.31.15) |

2.2 |

32,331 |

97,251 |

129,582 |

32,580 |

127,077 |

159,657 |

|

Tax incentives |

2.40% (2.40% on 12.31.15) |

2.40% (2.40% on 12.31.15) |

0.5 |

72 |

- |

72 |

1,872 |

- |

1,872 |

|

|

|

|

|

1,987,925 |

6,655,730 |

8,643,655 |

1,462,046 |

2,357,579 |

3,819,625 |

|

Foreign currency |

|

|

|

|

|

|

|

|

|

|

Bonds |

4.71% (5.23% on 12.31.15) + v.c. US$, EUR and ARS |

4.71% (5.23% on 12.31.15) + v.c. US$, EUR and ARS |

6.7 |

489,229 |

8,004,433 |

8,493,662 |

159,445 |

8,628,430 |

8,787,875 |

|

Credit export facilities |

LIBOR + 2.71% (LIBOR + 2.15% on 12.31.15) + v.c. US$ |

3.85% (2.85% on 12.31.15) + v.c. US$ |

1.5 |

312,219 |

998,375 |

1,310,594 |

598,811 |

1,553,520 |

2,152,331 |

|

Advance of exchange agreements |

2.39% (1.76% on 12.31.15) v.c. US$ |

2.39% (1.76% on 12.31.15) + v.c. US$ |

0.1 |

212,840 |

- |

212,840 |

391,053 |

- |

391,053 |

|

Credit line of development banks |

UMBNDES + 2.10% (UMBNDES + 2.26% on 12.31.15) + v.c. US$ and other currencies |

6.24% (6.34% on 12.31.15) + v.c. and other currencies |

0.9 |

5,883 |

3,018 |

8,901 |

12,630 |

11,575 |

24,205 |

|

Other debt guarantees |

15.01% (15.09% on 12.31.15) + v.c. ARS |

15.01% (15.09% on 12.31.15) + v.c. ARS |

0.1 |

790 |

- |

790 |

3,535 |

- |

3,535 |

|

Working capital |

14.28% (22.00% on 12.31.15) + v.c. ARS/+ v.c. US$ |

14.28% (22.00% on 12.31.15) + v.c. ARS/+v.c. US$ |

0.8 |

236,118 |

55,820 |

291,938 |

659 |

- |

659 |

|

|

|

|

|

1,257,079 |

9,061,646 |

10,318,725 |

1,166,133 |

10,193,525 |

11,359,658 |

|

|

|

|

|

3,245,004 |

15,717,376 |

18,962,380 |

2,628,179 |

12,551,104 |

15,179,283 |

27

i. Relevant loans and financing contracts:

The main debt instruments valid on December 31, 2018 are described below.

Debt in Domestic Currency

Development Bank Credit Lines

BNDES FINEM Credit Lines. On December 31, 2018, the Company had outstanding obligations to the BNDES, including loans under its FINEM program in the amount of R$217.6 million. The loans from the BNDES were taken out to finance purchases of machinery and equipment and the construction and improvement or expansion of production facilities. Principal and interest on the loans are generally payable monthly, with maturity dates varying from 2019 to 2020. The amount of the principal of the loans is denominated in Reais, which bears interest subject to the variations of the long-term rate (TJLP) and SELIC. These loans are included in the line “Development bank credit lines—Local currency” of the above tables.

FINEP Financing. The Company obtained certain loans from the Financiadora de Estudos e Projetos (“FINEP”), a public financing company bound to the Brazilian Ministry of Science, Technology and Innovation. It obtained FINEP credit lines of R$46,9 million at a fixed rate of 4.72% a year for projects related to research, development and innovation, with maturity dates in 2019. These loans are included in the line “Development bank credit lines—Local currency” of the above tables.

Working Capital Credit Lines

Rural Credit Financing. The Company had short-term loans in the amount of R$1,695 million as of December 31, 2018, with commercial banks under a Brazilian federal government program that offers attractive interest rates focused on incentives to rural activities. The proceeds of these loans are generally invested and are included in the line “Working capital facilities—Local currency” in the tables above.

Export Credit Facilities

Pre-financing export credit facilities. The Company has a pre-financing export credit facility with total balance of R$25,3 million on December 31, 2018. The debt in the scope of these credit lines is denominated in Reais with maturity date in 2019. The interest of these lines accumulates in the period of six months and correspond to 109.45% of the CDI. These loans are included in the line “Export credit facilities – Local Currency” of the tables above.

PESA Loan Facility

28

PESA. The Company had a loan facility obtained through the Special Sanitation Program for Agroindustrial Assets (PESA) for an outstanding amount of R$273.4 million on December 31, 2018, subject to the variation of the IGP-M index plus interest of 4.9% per year, secured by endorsements and pledges of public debt securities. This loan is included in the “Special Sanitation Program for Agroindustrial Assets – Local Currency” in the above tables.

Fiscal Incentives

State Fiscal Incentives. The Company also had an outstanding loan of R$3.3 million on December 31, 2018 under credit facilities offered by state tax incentive programs to promote investments in those states. Under these programs, the Company is granted credit proportional to the payment of the ICMS tax (VAT) generated by investments in the construction or expansion of manufacturing facilities in these states. These credit incentives have a 20-year term and fixed interest rates. These credit lines are included in the “Fiscal Incentives – Local Currency” in the above table.

Agribusiness Credit Receivables ("CRA")

On April 19, 2016, the Company concluded the issuance of CRA, which involved a public distribution offer of the 1st Series of the 9th Issue of Octante Securitizadora S.A., totaling R$1,000,000 net of interest at a cost of 96.50% p.a. of the DI rate, with the principal maturing in a single installment on April 19, 2019 and interest paid every 9 months. The CRAs are based on credits arising from the Company’s exports contracted with BRF Global GmbH, which were granted to the referred securitization company. On December 16, 2016, the Company concluded the issue of CRAs linked to the public distribution of the 1st and 2nd Series of the 1st Issue of Vert Companhia Securitizadora, amounting to R$1,500,000 net of interest. The CRAs of the 1st Series were issued at a cost of 96.00% p.a. of the DI rate, with the principal maturing in a single instalment on December 16, 2020 and interest paid every 8 months. The CRAs of the 2nd Series were issued at a cost of 5.8970% p.a. restated by the variation of the IPCA index, with the principal maturing in a single instalment on December 18, 2023 and interest paid every 16 or 18 months. The CRAs are backed by credits arising from the Company’s exports contracted with BRF Global GmbH and BRF Foods GmbH and were granted and/or promised to the referred securitization company. On 08.15.17, the CRA related to the issue of 12.16.16 and related to the public offer of distribution of the 1st. Series was transferred to the company SHB Comércio e Indústria de Alimentos S.A. (“SHB”), subsidiary of the Company, based on the export between SHB and BRF Foods GmbH. The conditions negotiated on the date of issue remained effective. On 12.31.18, these CRA were transferred to BRF due to the merger of SHB Comércio e Indústria de Alimentos S.A. This operation is included in the line of “Agribusiness Credit Receivable Certificates – Local Currency” in the tables above.

Debt in Foreign Currency

29

Export Credit Lines

Export Prepayment facilities. The Company had several export prepayment facilities in a total amount of R$718.9 million on December 31, 2018. The debt under these facilities is generally denominated in U.S. dollars, with maturity dates between 2019 and 2023. Interest under these export prepayment facilities accrues with a period of six to twelve months and is equivalent to LIBOR plus spread. Under each of these facilities, the Company received a loan from one or more lenders secured by the accounts receivable relating to exports of products to specific customers. The facilities are generally guaranteed by the Company. The covenants established under these agreements include restrictions on liens and mergers. These credit lines are included in the line “Export credit facilities—Foreign currency” in the tables above.

Other loans. The Company had several trade-related business loan facilities in an aggregate outstanding amount of R$4668.9 million on December 31, 2018. The debt under these facilities is usually denominated in U.S. dollars, with maturity date in 2019. These facilities bear interest at LIBOR plus spread, payable quarterly. The proceeds from these facilities are used to import raw materials or to finance the working capital needs. The covenants under these agreements generally include limitations on mergers and sales of assets. These credit lines are included in the line “Export credit facilities—Foreign currency” of the tables above.

Working Capital Credit Lines

Working capital in foreign currency. These are funds obtained from international financial institutions, mainly used as working capital operations of subsidiaries located in Turkey, amounting to R$194,8 million and with maturities between 2019 and 2020. These credit lines are included in the line “Working capital—Foreign currency” in the tables above.

Bonds

BFF Notes 2020: On January 28, 2010, BFF International Limited, subsidiary of the Company, issued Senior Notes totaling US$750.0 million, with the bonds guaranteed by the Company, with a nominal interest rate of 7.25% p.a. and effective rate of 7.54% p.a. to mature on January 28, 2020. On June 20, 2013, the amount of US$120,7 million of these Senior Notes was swapped for Senior Notes BRF 2023. On May 15, 2014, the amount of US$409,6 million was repurchased with part of the resources obtained from the Senior Notes BRF 2024. On May 28, 2015, the Company finalized a buyback offer for the bonds amounting to US$101,4 million, so that the amount outstanding on December 31, 2015 came to US$118.2 million. A premium was paid in the transaction, net of interest, in the amount of US$16,0 million (equivalent to R$52,0 million). On September 14, 2016, the Company finalized an offer to buy back the amount of US$32,2 million (equivalent to R$104,9 million), with a premium paid in the transaction, net of interest, in the amount of US$4,9 million (equivalent to R$13,4 million). The premium paid to the holders of the existing bonds was registered as a financial expense. On December 31, 2018, US$88.5 million of these bonds were outstanding.

30

Senior Notes BRF 2022: On June 6, 2012, the Company issued Senior Notes with a total nominal value of US$500,0 million, with a nominal interest rate of 5.88% p.a. and an effective rate of 6.00% p.a. to mature on June 6, 2022. On June 26, 2012, the Company made an additional funding of US$250,0 million, with a nominal interest rate of 5.88% p.a. and effective rate of 5.50% p.a. On May 28, 2015, the company finalized a buyback offer amounting to US$577.1 million, so that the amount outstanding came to US$172.9 million, with a premium paid in the transaction, net of interest, in the amount of US$79,4 million (equivalent to R$258,6 million). On September 14, 2016, the Company finalized a buyback offer in the amount of US$54,2 million (equivalent to R$176,7 million), with a premium being paid in the transaction, net of interest, in the amount of US$5,7 million (equivalent to R$18,6 million). The premium paid to the existing bond holders was registered as a financial expense. On December 31, 2018, US$116.5 million of these bonds were outstanding

Senior Notes BRF 2023: On May 15, 2013 the Company made an international bond issue of 10 years, totaling US$500.0 million, with the principal due on May 22, 2023 ("Senior Notes BRF 2023"), with a coupon (interest) of 3.95% a year (yield to maturity of 4.135%), payable semi-annually, from November 22, 2013. On December 31, 2018, US$487.5 million of these bonds were outstanding.

Senior Notes BRF 2018: On May 15, 2013 the Company made an international Senior Notes issue of five years, totaling US$500.0 million, with the principal due on May 22, 2018 at interest rates of 7.75% a year (yield to maturity of 7.75%), payable semi-annually, from November 22, 2013. On December 31, 2018, US$748.2 million of these bonds were outstanding.

Senior Notes BRF 2024: Sen May 15, 2014 the Company made an international Senior Notes issue of 10 years, totaling US$750.0 million, with the principal due on May 22, 2024 ("Senior Notes BRF 2024"), with a coupon (interest) of 4.75% a year (yield to maturity of 4.952%), payable semi-annually, from November 22, 2014. On December 31, 2018, US$748.2 million of these bonds were outstanding.

Senior Notes BRF 2022: On May 29, 2015, BRF concluded a Senior Notes offer of seven years, totaling EUR500.0 million, with the principal due on May 3, 2022, with a coupon (interest) of 2.75% a year (yield to maturity of 2.822%), payable annually, from June 3, 2016. On December 31, 2019, EUR506.5 million of these bonds were outstanding.

Senior Notes BRF 2026: On September 29, 2016, BRF, through its wholly-owned subsidiary BRF GmbH, finalized an offer of Senior Notes of 10 (ten) years, in the total amount of US$500,0, with the principal due on September 29, 2026, with a coupon (interest) of 4.35% p.a. (yield to maturity of 4.625%), to be paid semi-annually, from March 29, 2017. On December 31, 2018, US$494.4 million of these bonds were outstanding.

31

Derivatives