UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

October 26, 2023

| Commission File Number 001-16125 | |

| ASE Technology Holding Co., Ltd. | |

| (Translation of registrant’s name into English) | |

|

26, Chin 3rd Road Kaohsiung, Taiwan Republic of China | |

| (Address of principal executive offices) | |

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

| Form 20-F ☒ Form 40-F ☐ |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| ASE TECHNOLOGY HOLDING CO., LTD. | ||

| Date: October 26, 2023 | By: | /s/ Joseph Tung |

| Name: Joseph Tung | ||

| Title: Chief Financial Officer | ||

Third Quarter 2023 Earnings Release 26 October, 2023 ASE Technology Holding

Safe Harbor Notice This presentation contains "forward - looking statements" within the meaning of Section 27A of the United States Securities Act of 1933, as amended, and Section 21E of the United States Securities Exchange Act of 1934, as amended. Although these forward - looking statements, which may include statements regarding our future results of operations, financial condition or business prospects, are based on our own information and information from other sources we believe to be reliable, you should not place undue reliance on these forward - looking statements, which apply only as of the date of this press release. The words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan” and similar expressions, as they relate to us, are intended to identify these forward - looking statements in this presentation. These forward - looking statements are necessarily estimates reflecting the best judgment of our senior management and our actual results of operations, financial condition or business prospects may differ materially from those expressed or implied by the forward - looking statements for reasons including, among others, risks associated with cyclicality and market conditions in the semiconductor or electronic industry; changes in our regulatory environment, including our ability to comply with new or stricter environmental regulations and to resolve environmental liabilities; demand for the outsourced semiconductor packaging, testing and electronic manufacturing services we offer and for such outsourced services generally; the highly competitive semiconductor or manufacturing industry we are involved in; our ability to introduce new technologies in order to remain competitive; international business activities; our business strategy; our future expansion plans and capital expenditures; the strained relationship between the Republic of China and the People’s Republic of China; general economic and political conditions; the recent shift in United States trade policies; possible disruptions in commercial activities caused by natural or human - induced disasters; fluctuations in foreign currency exchange rates; and other factors. For a discussion of these risks and other factors, please see the documents we file from time to time with the Securities and Exchange Commission, including the 2022 Annual Report on Form 20 - F filed on April 10, 2023 . 2

Consolidated Statements of Income Quarterly Comparison (Unaudited) 3 (NT$ million) Q3 / 2023 % Q2 / 2023 % Q3 / 2022 % QoQ YoY Net Revenues: ATM 82,590 53.6% 75,256 55.2% 97,137 51.5% 10% -15% EMS 70,948 46.0% 60,384 44.3% 90,660 48.1% 17% -22% Others 629 0.4% 635 0.5% 829 0.4% -1% -24% Total Net Revenues 154,167 100.0% 136,275 100.0% 188,626 100.0% 13% -18% Gross Profit 24,916 16.2% 21,741 16.0% 37,972 20.1% 15% -34% Operating Income (Loss) 11,405 7.4% 9,412 6.9% 23,683 12.6% 21% -52% Pretax Income (Loss) 12,252 7.9% 10,111 7.4% 23,615 12.5% 21% -48% Income Tax Benefit (Expense) (2,890) -1.9% (1,914) -1.4% (5,046) -2.7% Non-controlling Interests (586) -0.4% (457) -0.3% (1,104) -0.6% Net Income Attributable to Shareholders of the Parent 8,776 5.7% 7,740 5.7% 17,465 9.3% 13% -50% Basic EPS(NT$) 2.04 1.80 4.03 13% -49% Diluted EPS(NT$) 2.00 1.76 3.92 14% -49% Additional Commentary From Management 1&2 : Gross Profit excl. PPA expenses 25,823 16.8% 22,654 16.6% 38,888 20.6% 14% -34% Operating Income excl. PPA expenses 12,575 8.2% 10,587 7.8% 24,860 13.2% 19% -49% Net income attributable to shareholders of the parent excl. PPA expenses 9,926 6.4% 8,902 6.5% 18,628 9.9% 12% -47% Basic EPS(NT$) excl. PPA expenses 2.31 2.07 4.30 12% -46% 1 : PPA expenses are the P&L impacts from the accounting treatment of purchase price allocation in relation to the ASE/SPIL trans act ion, which resulted in increased asset values from purchase price premiums in PP&E, intangibles and right - of - use assets. The PPA expenses excluded are related to depreciation, amortization and other expenses $1.12bn in 3Q23, $1.13bn in 2Q23, and 3Q22. 2 : PPA expenses are the P&L impacts from the accounting treatment of purchase price allocation in relation to the USI/ Asteelflash transaction, which resulted in increased asset and liability values from purchase price premiums in PP&E, intangibles, right - of - use assets an d deferred tax liability. The PPA expenses excluded are related to depreciation, amortization, other expenses and income tax benefit $0.04bn in 3Q23, 2Q23 and 3Q22 .

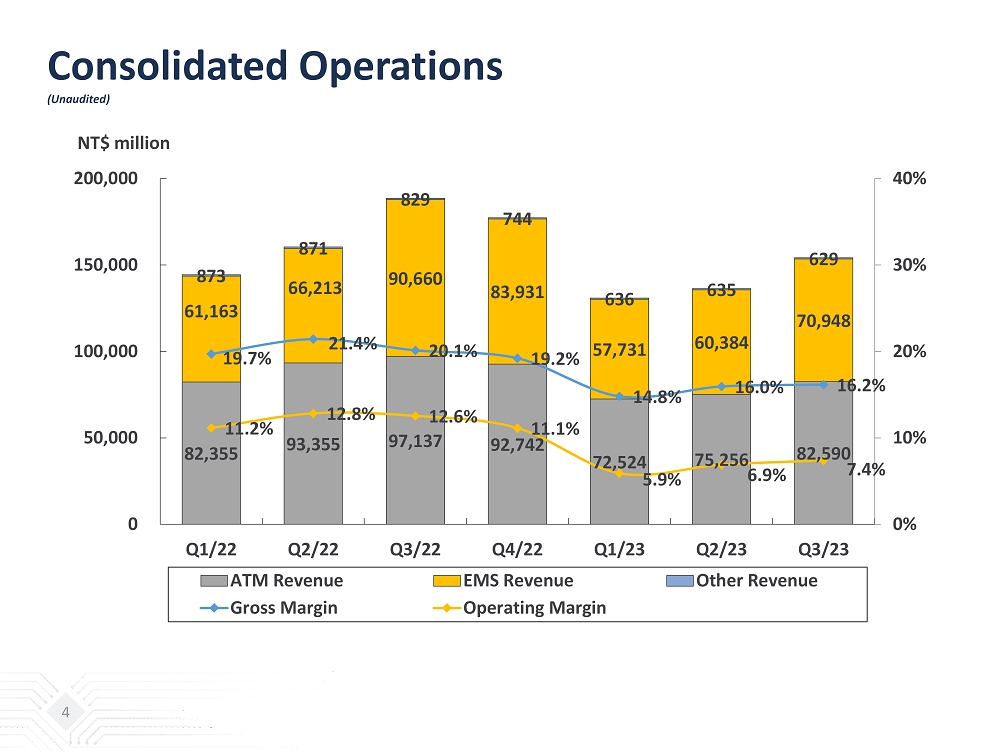

Consolidated Operations (Unaudited) 4 82,355 93,355 97,137 92,742 72,524 75,256 82,590 61,163 66,213 90,660 83,931 57,731 60,384 70,948 873 871 829 744 636 635 629 19.7% 21.4% 20.1% 19.2% 14.8% 16.0% 16.2% 11.2% 12.8% 12.6% 11.1% 5.9% 6.9% 7.4% 0% 10% 20% 30% 40% 0 50,000 100,000 150,000 200,000 Q1/22 Q2/22 Q3/22 Q4/22 Q1/23 Q2/23 Q3/23 NT$ million ATM Revenue EMS Revenue Other Revenue Gross Margin Operating Margin

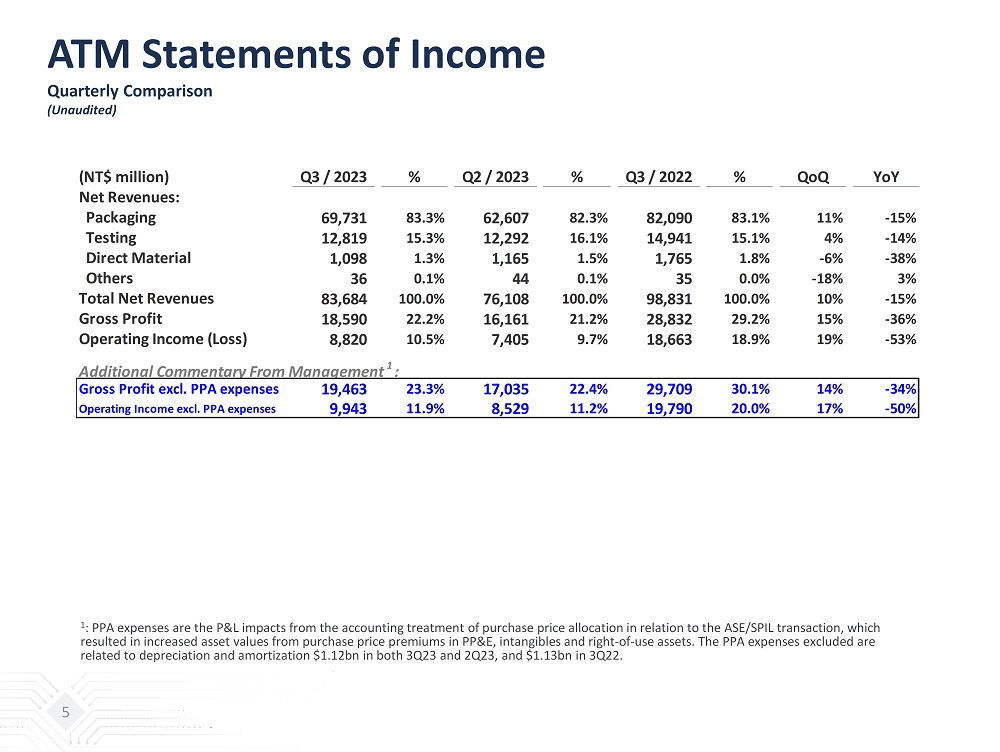

ATM Statements of Income Quarterly Comparison (Unaudited) 5 (NT$ million) Q3 / 2023 % Q2 / 2023 % Q3 / 2022 % QoQ YoY Net Revenues: Packaging 69,731 83.3% 62,607 82.3% 82,090 83.1% 11% -15% Testing 12,819 15.3% 12,292 16.1% 14,941 15.1% 4% -14% Direct Material 1,098 1.3% 1,165 1.5% 1,765 1.8% -6% -38% Others 36 0.1% 44 0.1% 35 0.0% -18% 3% Total Net Revenues 83,684 100.0% 76,108 100.0% 98,831 100.0% 10% -15% Gross Profit 18,590 22.2% 16,161 21.2% 28,832 29.2% 15% -36% Operating Income (Loss) 8,820 10.5% 7,405 9.7% 18,663 18.9% 19% -53% Additional Commentary From Management 1 : Gross Profit excl. PPA expenses 19,463 23.3% 17,035 22.4% 29,709 30.1% 14% -34% Operating Income excl. PPA expenses 9,943 11.9% 8,529 11.2% 19,790 20.0% 17% -50% 1 : PPA expenses are the P&L impacts from the accounting treatment of purchase price allocation in relation to the ASE/SPIL transacti on, which resulted in increased asset values from purchase price premiums in PP&E, intangibles and right - of - use assets. The PPA expenses e xcluded are related to depreciation and amortization $1.12bn in both 3Q23 and 2Q23, and $ 1.13bn in 3Q22.

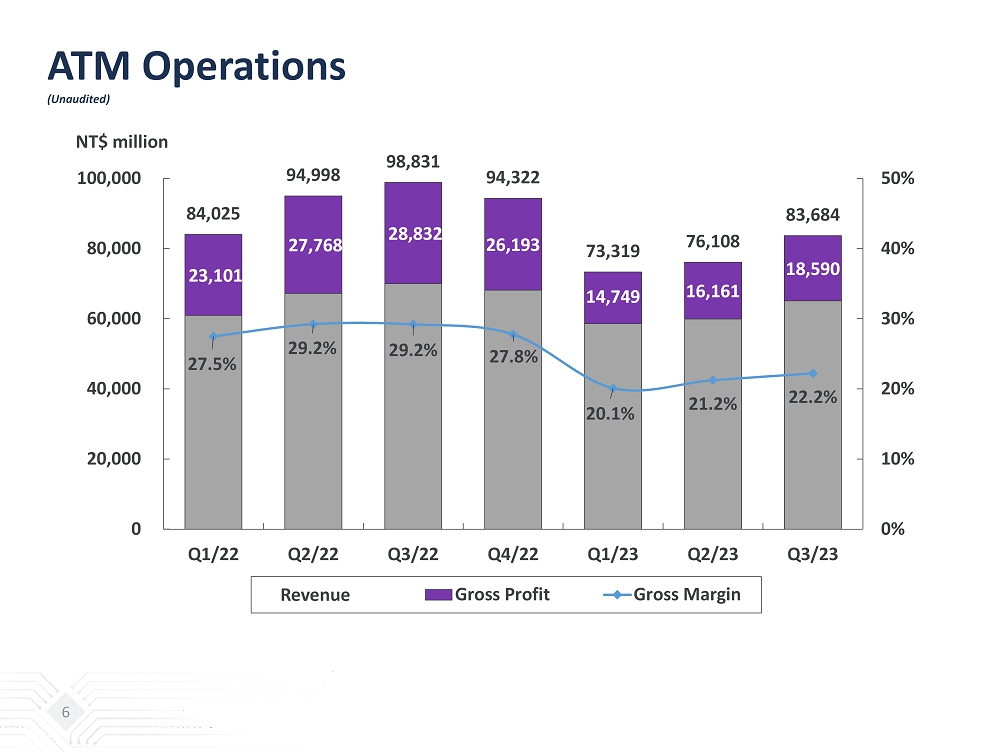

ATM Operations (Unaudited) 6 23,101 27,768 28,832 26,193 14,749 16,161 18,590 84,025 94,998 98,831 94,322 73,319 76,108 83,684 27.5% 29.2% 29.2% 27.8% 20.1% 21.2% 22.2% 0% 10% 20% 30% 40% 50% 0 20,000 40,000 60,000 80,000 100,000 Q1/22 Q2/22 Q3/22 Q4/22 Q1/23 Q2/23 Q3/23 NT$ million Gross Profit Gross Margin Revenue

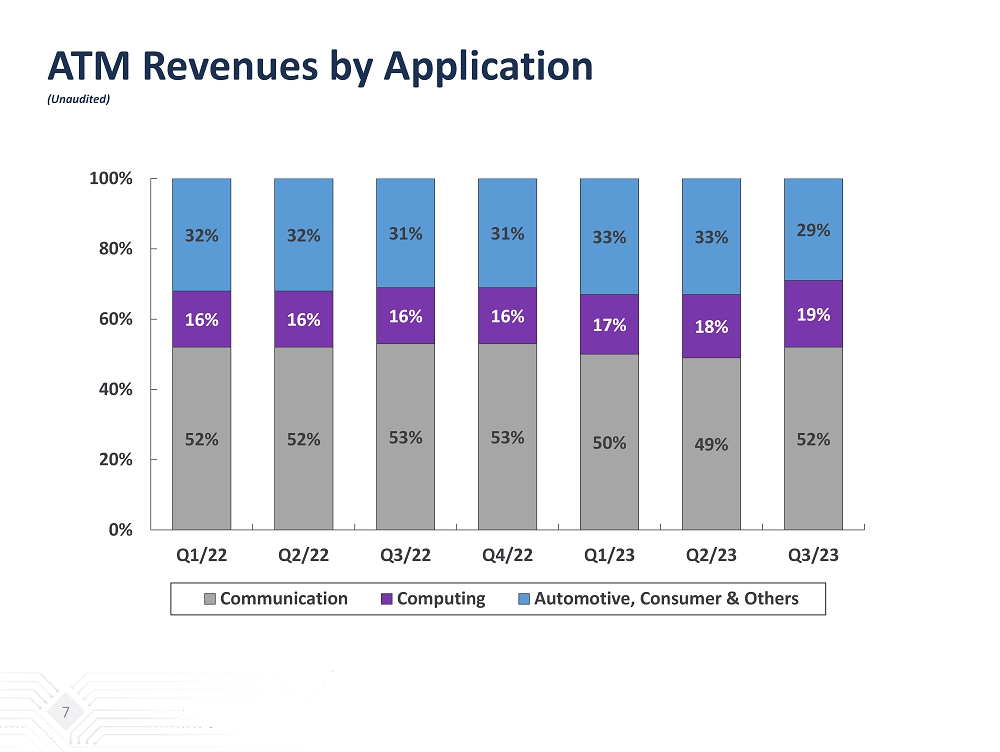

ATM Revenues by Application (Unaudited) 7 52% 52% 53% 53% 50% 49% 52% 16% 16% 16% 16% 17% 18% 19% 32% 32% 31% 31% 33% 33% 29% 0% 20% 40% 60% 80% 100% Q1/22 Q2/22 Q3/22 Q4/22 Q1/23 Q2/23 Q3/23 Communication Computing Automotive, Consumer & Others

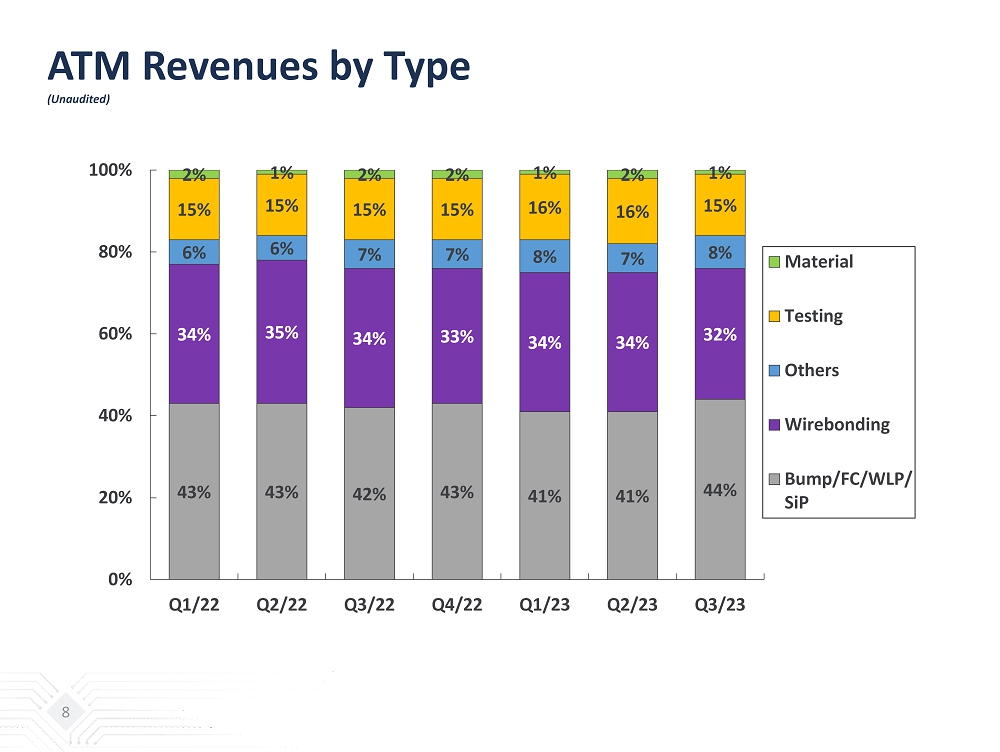

ATM Revenues by Type (Unaudited) 8 43% 43% 42% 43% 41% 41% 44% 34% 35% 34% 33% 34% 34% 32% 6% 6% 7% 7% 8% 7% 8% 15% 15% 15% 15% 16% 16% 15% 2% 1% 2% 2% 1% 2% 1% 0% 20% 40% 60% 80% 100% Q1/22 Q2/22 Q3/22 Q4/22 Q1/23 Q2/23 Q3/23 Material Testing Others Wirebonding Bump/FC/WLP/ SiP

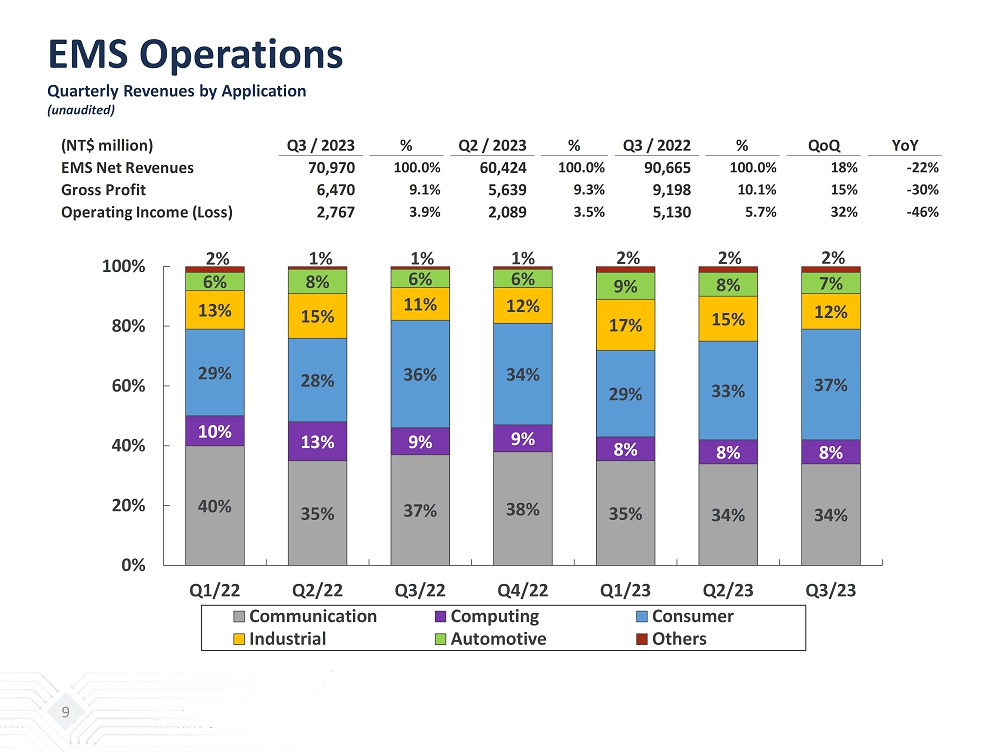

EMS Operations Quarterly Revenues by Application (unaudited) 9 (NT$ million) Q3 / 2023 % Q2 / 2023 % Q3 / 2022 % QoQ YoY EMS Net Revenues 70,970 100.0% 60,424 100.0% 90,665 100.0% 18% -22% Gross Profit 6,470 9.1% 5,639 9.3% 9,198 10.1% 15% -30% Operating Income (Loss) 2,767 3.9% 2,089 3.5% 5,130 5.7% 32% -46% 40% 35% 37% 38% 35% 34% 34% 10% 13% 9% 9% 8% 8% 8% 29% 28% 36% 34% 29% 33% 37% 13% 15% 11% 12% 17% 15% 12% 6% 8% 6% 6% 9% 8% 7% 2% 1% 1% 1% 2% 2% 2% 0% 20% 40% 60% 80% 100% Q1/22 Q2/22 Q3/22 Q4/22 Q1/23 Q2/23 Q3/23 Communication Computing Consumer Industrial Automotive Others

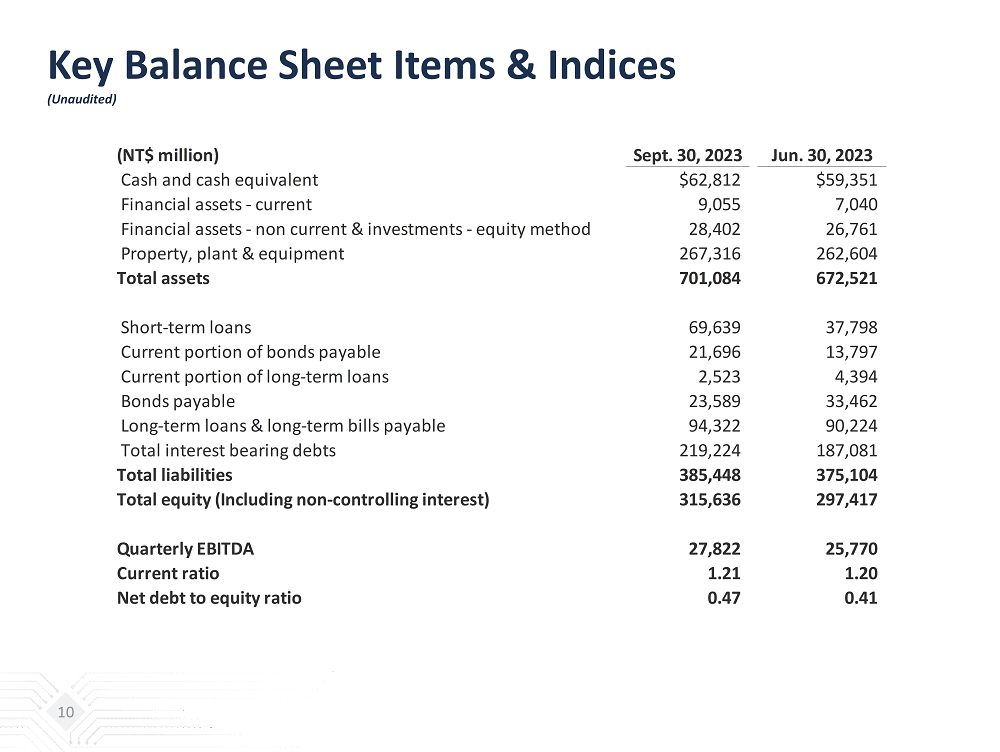

Key Balance Sheet Items & Indices (Unaudited) 10 (NT$ million) Sept. 30, 2023 Jun. 30, 2023 Cash and cash equivalent $62,812 $59,351 Financial assets - current 9,055 7,040 Financial assets - non current & investments - equity method 28,402 26,761 Property, plant & equipment 267,316 262,604 Total assets 701,084 672,521 Short-term loans 69,639 37,798 Current portion of bonds payable 21,696 13,797 Current portion of long-term loans 2,523 4,394 Bonds payable 23,589 33,462 Long-term loans & long-term bills payable 94,322 90,224 Total interest bearing debts 219,224 187,081 Total liabilities 385,448 375,104 Total equity (Including non-controlling interest) 315,636 297,417 Quarterly EBITDA 27,822 25,770 Current ratio 1.21 1.20 Net debt to equity ratio 0.47 0.41

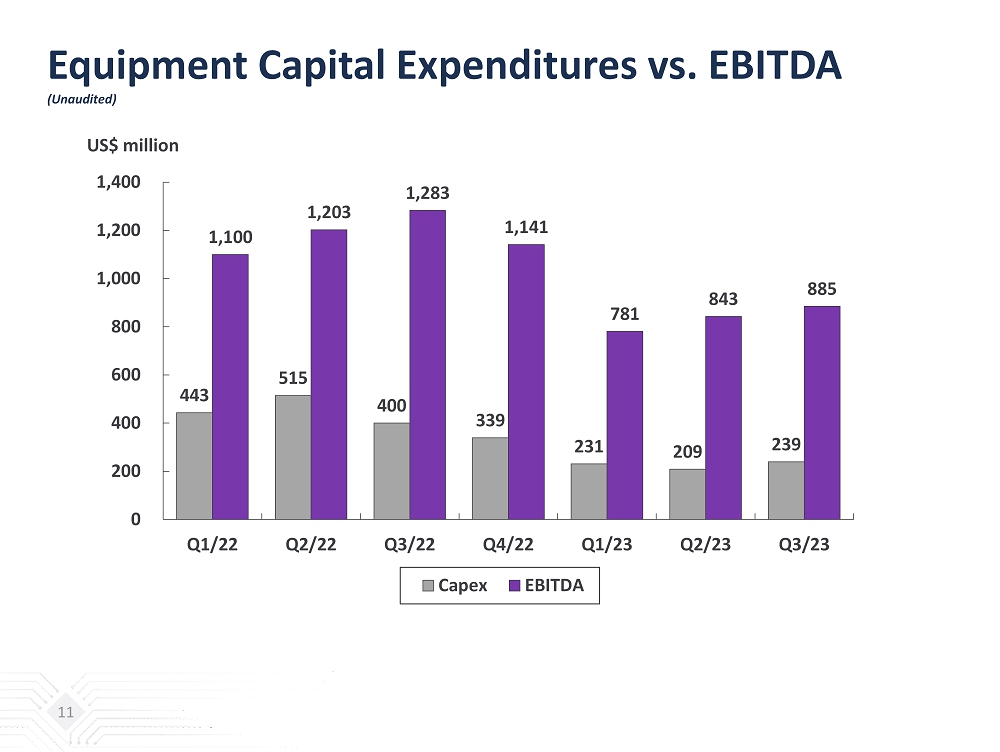

Equipment Capital Expenditures vs. EBITDA (Unaudited) 11 443 515 400 339 231 209 239 1,100 1,203 1,283 1,141 781 843 885 0 200 400 600 800 1,000 1,200 1,400 Q1/22 Q2/22 Q3/22 Q4/22 Q1/23 Q2/23 Q3/23 US$ million Capex EBITDA

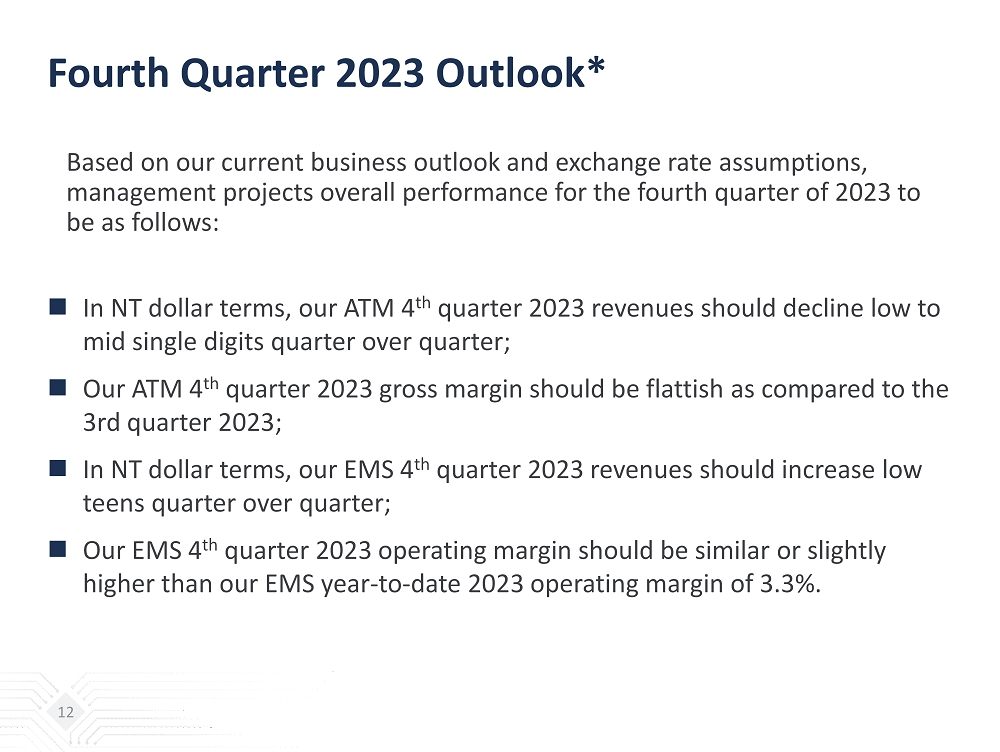

Fourth Quarter 2023 Outlook* Based on our current business outlook and exchange rate assumptions, management projects overall performance for the fourth quarter of 2023 to be as follows: In NT dollar terms, our ATM 4 th quarter 2023 revenues should decline low to mid single digits quarter over quarter ; Our ATM 4 th quarter 2023 gross margin should be flattish as compared to the 3rd quarter 2023; In NT dollar terms, our EMS 4 th quarter 2023 revenues should increase low teens quarter over quarter; Our EMS 4 th quarter 2023 operating margin should be similar or slightly higher than our EMS year - to - date 2023 operating margin of 3.3 %. 12

Thank you

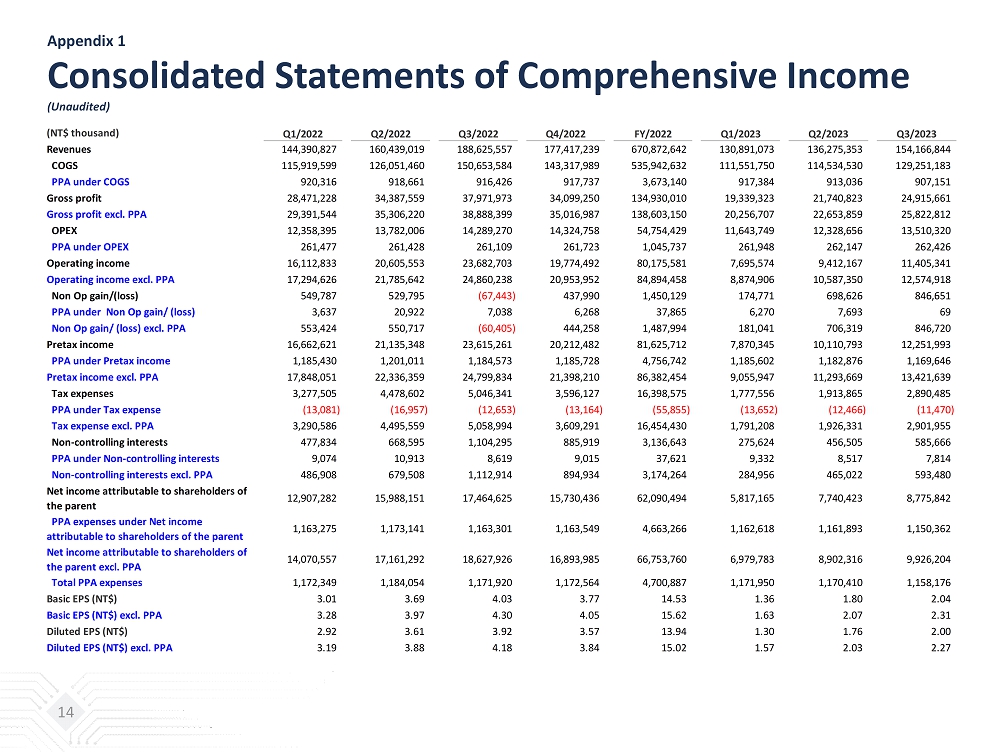

Appendix 1 Consolidated Statements of Comprehensive Income (Unaudited) 14 (NT$ thousand) Q1/2022 Q2/2022 Q3/2022 Q4/2022 FY/2022 Q1/2023 Q2/2023 Q3/2023 Revenues 144,390,827 160,439,019 188,625,557 177,417,239 670,872,642 130,891,073 136,275,353 154,166,844 COGS 115,919,599 126,051,460 150,653,584 143,317,989 535,942,632 111,551,750 114,534,530 129,251,183 PPA under COGS 920,316 918,661 916,426 917,737 3,673,140 917,384 913,036 907,151 Gross profit 28,471,228 34,387,559 37,971,973 34,099,250 134,930,010 19,339,323 21,740,823 24,915,661 Gross profit excl. PPA 29,391,544 35,306,220 38,888,399 35,016,987 138,603,150 20,256,707 22,653,859 25,822,812 OPEX 12,358,395 13,782,006 14,289,270 14,324,758 54,754,429 11,643,749 12,328,656 13,510,320 PPA under OPEX 261,477 261,428 261,109 261,723 1,045,737 261,948 262,147 262,426 Operating income 16,112,833 20,605,553 23,682,703 19,774,492 80,175,581 7,695,574 9,412,167 11,405,341 Operating income excl. PPA 17,294,626 21,785,642 24,860,238 20,953,952 84,894,458 8,874,906 10,587,350 12,574,918 Non Op gain/(loss) 549,787 529,795 (67,443) 437,990 1,450,129 174,771 698,626 846,651 PPA under Non Op gain/ (loss) 3,637 20,922 7,038 6,268 37,865 6,270 7,693 69 Non Op gain/ (loss) excl. PPA 553,424 550,717 (60,405) 444,258 1,487,994 181,041 706,319 846,720 Pretax income 16,662,621 21,135,348 23,615,261 20,212,482 81,625,712 7,870,345 10,110,793 12,251,993 PPA under Pretax income 1,185,430 1,201,011 1,184,573 1,185,728 4,756,742 1,185,602 1,182,876 1,169,646 Pretax income excl. PPA 17,848,051 22,336,359 24,799,834 21,398,210 86,382,454 9,055,947 11,293,669 13,421,639 Tax expenses 3,277,505 4,478,602 5,046,341 3,596,127 16,398,575 1,777,556 1,913,865 2,890,485 PPA under Tax expense (13,081) (16,957) (12,653) (13,164) (55,855) (13,652) (12,466) (11,470) Tax expense excl. PPA 3,290,586 4,495,559 5,058,994 3,609,291 16,454,430 1,791,208 1,926,331 2,901,955 Non-controlling interests 477,834 668,595 1,104,295 885,919 3,136,643 275,624 456,505 585,666 PPA under Non-controlling interests 9,074 10,913 8,619 9,015 37,621 9,332 8,517 7,814 Non-controlling interests excl. PPA 486,908 679,508 1,112,914 894,934 3,174,264 284,956 465,022 593,480 Net income attributable to shareholders of the parent 12,907,282 15,988,151 17,464,625 15,730,436 62,090,494 5,817,165 7,740,423 8,775,842 PPA expenses under Net income attributable to shareholders of the parent 1,163,275 1,173,141 1,163,301 1,163,549 4,663,266 1,162,618 1,161,893 1,150,362 Net income attributable to shareholders of the parent excl. PPA 14,070,557 17,161,292 18,627,926 16,893,985 66,753,760 6,979,783 8,902,316 9,926,204 Total PPA expenses 1,172,349 1,184,054 1,171,920 1,172,564 4,700,887 1,171,950 1,170,410 1,158,176 Basic EPS (NT$) 3.01 3.69 4.03 3.77 14.53 1.36 1.80 2.04 Basic EPS (NT$) excl. PPA 3.28 3.97 4.30 4.05 15.62 1.63 2.07 2.31 Diluted EPS (NT$) 2.92 3.61 3.92 3.57 13.94 1.30 1.76 2.00 Diluted EPS (NT$) excl. PPA 3.19 3.88 4.18 3.84 15.02 1.57 2.03 2.27