UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-10045

CALVERT IMPACT FUND, INC.

(Exact Name of Registrant as Specified in Charter)

1825 Connecticut Avenue NW, Suite 400, Washington, DC 20009

(Address of Principal Executive Offices)

Deidre E. Walsh

Two International Place, Boston, Massachusetts 02110

(Name and Address of Agent for Services)

(202) 238-2200

(Registrant’s Telephone Number)

September 30

Date of Fiscal Year End

September 30, 2021

Date of Reporting Period

Item 1. Reports to Stockholders

expected revenue and earnings. The share price of Tempur Sealy International, Inc., a manufacturer of mattresses and pillows, rose on strong earnings growth, improved efficiency, and continued high demand for home products as consumers remained more home-focused than normal during the period because of the pandemic.

| % Average Annual Total Returns1,2 | Class

Inception Date |

Performance

Inception Date |

One Year | Five Years | Ten Years |

| Class A at NAV | 10/01/2004 | 10/01/2004 | 38.43% | 13.57% | 14.60% |

| Class A with 4.75% Maximum Sales Charge | — | — | 31.87 | 12.47 | 14.04 |

| Class C at NAV | 04/01/2005 | 10/01/2004 | 37.35 | 12.72 | 13.70 |

| Class C with 1% Maximum Sales Charge | — | — | 36.35 | 12.72 | 13.70 |

| Class I at NAV | 04/29/2005 | 10/01/2004 | 38.73 | 13.93 | 15.12 |

| Class R6 at NAV | 02/01/2019 | 10/01/2004 | 38.83 | 13.97 | 15.14 |

|

| |||||

| Russell 2000® Index | — | — | 47.68% | 13.44% | 14.62% |

| % Total Annual Operating Expense Ratios3 | Class A | Class C | Class I | Class R6 |

| Gross | 1.22% | 1.97% | 0.97% | 0.91% |

| Net | 1.21 | 1.96 | 0.96 | 0.90 |

| Growth of Investment2 | Amount Invested | Period Beginning | At NAV | With Maximum Sales Charge |

| Class C | $10,000 | 09/30/2011 | $36,142 | N.A. |

| Class I | $250,000 | 09/30/2011 | $1,023,604 | N.A. |

| Class R6 | $1,000,000 | 09/30/2011 | $4,101,092 | N.A. |

| Beginning

Account Value (4/1/21) |

Ending

Account Value (9/30/21) |

Expenses

Paid During Period* (4/1/21 – 9/30/21) |

Annualized

Expense Ratio | |

| Actual | ||||

| Class A | $1,000.00 | $1,015.30 | $6.01 | 1.19% |

| Class C | $1,000.00 | $1,011.30 | $9.78 | 1.94% |

| Class I | $1,000.00 | $1,016.40 | $4.80 | 0.95% |

| Class R6 | $1,000.00 | $1,016.90 | $4.30 | 0.85% |

| Hypothetical | ||||

| (5% return per year before expenses) | ||||

| Class A | $1,000.00 | $1,019.10 | $6.02 | 1.19% |

| Class C | $1,000.00 | $1,015.34 | $9.80 | 1.94% |

| Class I | $1,000.00 | $1,020.31 | $4.81 | 0.95% |

| Class R6 | $1,000.00 | $1,020.81 | $4.31 | 0.85% |

| * | Expenses are equal to the Fund's annualized expense ratio for the indicated Class, multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half year period). The Example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on March 31, 2021. |

| Description | Acquisition Dates | Cost |

| Calvert Impact Capital, Inc., Community Investment Notes, 1.50%, 12/15/23 | 12/14/20 | $2,520,000 |

| ImpactAssets, Inc., Global Sustainable Agriculture Notes, 0.00%, 11/3/22 | 11/13/15 | 152,000 |

| ImpactAssets, Inc., Microfinance Plus Notes, 0.00%, 11/3/22 | 11/13/15 | 195,000 |

| September 30, 2021 | |

| Assets | |

| Investments

in securities of unaffiliated issuers, at value (identified cost $2,282,036,151) - including $6,224,576 of securities on loan |

$ 2,754,575,983 |

| Investments in securities of affiliated issuers, at value (identified cost $46,205,527) | 46,166,627 |

| Cash | 12,884,075 |

| Receivable for investments sold | 10,926,034 |

| Receivable for capital shares sold | 9,235,709 |

| Dividends and interest receivable | 2,501,832 |

| Dividends and interest receivable - affiliated | 32,132 |

| Securities lending income receivable | 804 |

| Directors' deferred compensation plan | 291,418 |

| Total assets | $2,836,614,614 |

| Liabilities | |

| Payable for investments purchased | $ 24,512,863 |

| Payable for capital shares redeemed | 2,901,506 |

| Deposits for securities loaned | 1,804,401 |

| Payable to affiliates: | |

| Investment advisory fee | 1,589,551 |

| Administrative fee | 280,509 |

| Distribution and service fees | 87,660 |

| Sub-transfer agency fee | 18,744 |

| Directors' deferred compensation plan | 291,418 |

| Accrued expenses | 702,506 |

| Total liabilities | $ 32,189,158 |

| Net Assets | $2,804,425,456 |

| Sources of Net Assets | |

| Paid-in capital | $ 2,148,906,430 |

| Distributable earnings | 655,519,026 |

| Total | $2,804,425,456 |

| Class A Shares | |

| Net Assets | $ 288,922,204 |

| Shares Outstanding | 8,718,977 |

| Net

Asset Value and Redemption Price Per Share (net assets ÷ shares of beneficial interest outstanding) |

$ 33.14 |

| Maximum

Offering Price Per Share (100 ÷ 95.25 of net asset value per share) |

$ 34.79 |

| Class C Shares | |

| Net Assets | $ 32,595,529 |

| Shares Outstanding | 1,170,727 |

| Net

Asset Value and Offering Price Per Share* (net assets ÷ shares of beneficial interest outstanding) |

$ 27.84 |

| Class I Shares | |

| Net Assets | $ 2,398,218,908 |

| Shares Outstanding | 66,574,237 |

| Net

Asset Value, Offering Price and Redemption Price Per Share (net assets ÷ shares of beneficial interest outstanding) |

$ 36.02 |

| September 30, 2021 | |

| Class R6 Shares | |

| Net Assets | $84,688,815 |

| Shares Outstanding | 2,349,032 |

| Net

Asset Value, Offering Price and Redemption Price Per Share (net assets ÷ shares of beneficial interest outstanding) |

$ 36.05 |

| On sales of $50,000 or more, the offering price of Class A shares is reduced. | |

| * | Redemption price per share is equal to the net asset value less any applicable contingent deferred sales charge. |

| Year Ended | |

| September 30, 2021 | |

| Investment Income | |

| Dividend income (net of foreign taxes withheld of $1,917) | $ 23,054,049 |

| Dividend income - affiliated issuers | 21,293 |

| Interest income | 984 |

| Interest income - affiliated issuers | 37,891 |

| Securities lending income, net | 65,520 |

| Total investment income | $ 23,179,737 |

| Expenses | |

| Investment advisory fee | $ 16,194,496 |

| Administrative fee | 2,857,853 |

| Distribution and service fees: | |

| Class A | 658,820 |

| Class C | 275,522 |

| Directors' fees and expenses | 100,334 |

| Custodian fees | 42,552 |

| Transfer agency fees and expenses | 2,144,809 |

| Accounting fees | 443,069 |

| Professional fees | 70,592 |

| Registration fees | 272,512 |

| Reports to shareholders | 189,120 |

| Miscellaneous | 66,085 |

| Total expenses | $ 23,315,764 |

| Net investment loss | $ (136,027) |

| Realized and Unrealized Gain (Loss) | |

| Net realized gain (loss): | |

| Investment securities | $ 238,415,998 |

| Investment securities - affiliated issuers | (2,399) |

| Net realized gain | $238,413,599 |

| Change in unrealized appreciation (depreciation): | |

| Investment securities | $ 380,025,251 |

| Investment securities - affiliated issuers | (25,833) |

| Net change in unrealized appreciation (depreciation) | $379,999,418 |

| Net realized and unrealized gain | $618,413,017 |

| Net increase in net assets from operations | $618,276,990 |

| Year Ended September 30, | ||

| 2021 | 2020 | |

| Increase (Decrease) in Net Assets | ||

| From operations: | ||

| Net investment income (loss) | $ (136,027) | $ 1,595,996 |

| Net realized gain (loss) | 238,413,599 | (37,030,670) |

| Net change in unrealized appreciation (depreciation) | 379,999,418 | 22,960,899 |

| Net increase (decrease) in net assets from operations | $ 618,276,990 | $ (12,473,775) |

| Distributions to shareholders: | ||

| Class A | $ — | $ (2,242,958) |

| Class C | — | (200,001) |

| Class I | (2,198,171) | (7,919,039) |

| Class R6 | (92,105) | (509,400) |

| Total distributions to shareholders | $ (2,290,276) | $ (10,871,398) |

| Capital share transactions: | ||

| Class A | $ 29,601,756 | $ 23,635,745 |

| Class C | 8,858,899 | 3,231,774 |

| Class I | 670,027,418 | 761,543,484 |

| Class R6 | 22,140,747 | 9,673,290 |

| Net increase in net assets from capital share transactions | $ 730,628,820 | $ 798,084,293 |

| Net increase in net assets | $1,346,615,534 | $ 774,739,120 |

| Net Assets | ||

| At beginning of year | $ 1,457,809,922 | $ 683,070,802 |

| At end of year | $2,804,425,456 | $1,457,809,922 |

| Class A | |||||

| Year Ended September 30, | |||||

| 2021 | 2020 | 2019 | 2018 | 2017 | |

| Net asset value — Beginning of year | $ 23.94 | $ 25.35 | $ 26.61 | $ 25.70 | $ 21.76 |

| Income (Loss) From Operations | |||||

| Net investment income (loss)(1) | $ (0.07) | $ (0.01) | $ 0.02 | $ (0.04) | $ (0.05) |

| Net realized and unrealized gain (loss) | 9.27 | (1.08) | (0.04) (2) | 4.34 | 4.32 |

| Total income (loss) from operations | $ 9.20 | $ (1.09) | $ (0.02) | $ 4.30 | $ 4.27 |

| Less Distributions | |||||

| From net investment income | $ — | $ — | $ — | $ —(3) | $ — |

| From net realized gain | — | (0.32) | (1.24) | (3.39) | (0.33) |

| Total distributions | $ — | $ (0.32) | $ (1.24) | $ (3.39) | $ (0.33) |

| Net asset value — End of year | $ 33.14 | $ 23.94 | $ 25.35 | $ 26.61 | $ 25.70 |

| Total Return(4) | 38.43% | (4.38)% | 0.61% | 18.55% | 19.74% |

| Ratios/Supplemental Data | |||||

| Net assets, end of year (000’s omitted) | $288,922 | $185,777 | $172,277 | $158,921 | $137,860 |

| Ratios (as a percentage of average daily net assets):(5) | |||||

| Total expenses | 1.19% | 1.22% | 1.25% | 1.28% | 1.36% |

| Net expenses | 1.19% | 1.21% | 1.23% | 1.28% | 1.36% |

| Net investment income (loss) | (0.21)% | (0.03)% | 0.07% | (0.17)% | (0.22)% |

| Portfolio Turnover | 53% | 44% | 45% | 51% | 137% |

| (1) | Computed using average shares outstanding. |

| (2) | The per share amount is not in accord with the net realized and unrealized gain (loss) for the period because of the timing of Fund share transactions and the amount of the per share realized and unrealized gains and losses at such time. |

| (3) | Amount is less than $0.005. |

| (4) | Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested and do not reflect the effect of sales charges, if any. |

| (5) | Total expenses do not reflect amounts reimbursed and/or waived by the adviser and certain of its affiliates, if applicable. Net expenses are net of all reductions and represent the net expenses paid by the Fund. |

| Class C | |||||

| Year Ended September 30, | |||||

| 2021 | 2020 | 2019 | 2018 | 2017 | |

| Net asset value — Beginning of year | $ 20.27 | $ 21.63 | $ 22.90 | $ 22.58 | $ 19.30 |

| Income (Loss) From Operations | |||||

| Net investment loss(1) | $ (0.26) | $ (0.16) | $ (0.14) | $ (0.20) | $ (0.21) |

| Net realized and unrealized gain (loss) | 7.83 | (0.92) | (0.04) (2) | 3.77 | 3.82 |

| Total income (loss) from operations | $ 7.57 | $ (1.08) | $ (0.18) | $ 3.57 | $ 3.61 |

| Less Distributions | |||||

| From net realized gain | $ — | $ (0.28) | $ (1.09) | $ (3.25) | $ (0.33) |

| Total distributions | $ — | $ (0.28) | $ (1.09) | $ (3.25) | $ (0.33) |

| Net asset value — End of year | $ 27.84 | $ 20.27 | $ 21.63 | $ 22.90 | $ 22.58 |

| Total Return(3) | 37.35% | (5.10)% | (0.12)% | 17.66% | 18.82% |

| Ratios/Supplemental Data | |||||

| Net assets, end of year (000’s omitted) | $32,596 | $16,992 | $14,775 | $18,945 | $16,691 |

| Ratios (as a percentage of average daily net assets):(4) | |||||

| Total expenses | 1.94% | 1.97% | 2.01% | 2.03% | 2.22% |

| Net expenses | 1.94% | 1.96% | 1.99% | 2.03% | 2.12% |

| Net investment loss | (0.97)% | (0.78)% | (0.68)% | (0.91)% | (0.99)% |

| Portfolio Turnover | 53% | 44% | 45% | 51% | 137% |

| (1) | Computed using average shares outstanding. |

| (2) | The per share amount is not in accord with the net realized and unrealized gain (loss) for the period because of the timing of Fund share transactions and the amount of the per share realized and unrealized gains and losses at such time. |

| (3) | Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested and do not reflect the effect of sales charges, if any. |

| (4) | Total expenses do not reflect amounts reimbursed and/or waived by the adviser and certain of its affiliates, if applicable. Net expenses are net of all reductions and represent the net expenses paid by the Fund. |

| Class I | |||||

| Year Ended September 30, | |||||

| 2021 | 2020 | 2019 | 2018 | 2017 | |

| Net asset value — Beginning of year | $ 26.00 | $ 27.49 | $ 28.73 | $ 27.51 | $ 23.18 |

| Income (Loss) From Operations | |||||

| Net investment income(1) | $ 0.01 | $ 0.06 | $ 0.09 | $ 0.05 | $ 0.06 |

| Net realized and unrealized gain (loss) | 10.05 | (1.17) | (0.02) (2) | 4.67 | 4.62 |

| Total income (loss) from operations | $ 10.06 | $ (1.11) | $ 0.07 | $ 4.72 | $ 4.68 |

| Less Distributions | |||||

| From net investment income | $ (0.04) | $ (0.05) | $ (0.06) | $ (0.08) | $ (0.02) |

| From net realized gain | — | (0.33) | (1.25) | (3.42) | (0.33) |

| Total distributions | $ (0.04) | $ (0.38) | $ (1.31) | $ (3.50) | $ (0.35) |

| Net asset value — End of year | $ 36.02 | $ 26.00 | $ 27.49 | $ 28.73 | $ 27.51 |

| Total Return(3) | 38.73% | (4.12)% | 0.92% | 18.92% | 20.29% |

| Ratios/Supplemental Data | |||||

| Net assets, end of year (000’s omitted) | $2,398,219 | $1,211,029 | $461,237 | $257,089 | $93,724 |

| Ratios (as a percentage of average daily net assets):(4) | |||||

| Total expenses | 0.94% | 0.97% | 1.00% | 1.04% | 0.92% |

| Net expenses | 0.94% | 0.96% | 0.95% | 0.92% | 0.90% |

| Net investment income | 0.03% | 0.22% | 0.34% | 0.19% | 0.23% |

| Portfolio Turnover | 53% | 44% | 45% | 51% | 137% |

| (1) | Computed using average shares outstanding. |

| (2) | The per share amount is not in accord with the net realized and unrealized gain (loss) for the period because of the timing of Fund share transactions and the amount of the per share realized and unrealized gains and losses at such time. |

| (3) | Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested and do not reflect the effect of sales charges, if any. |

| (4) | Total expenses do not reflect amounts reimbursed and/or waived by the adviser and certain of its affiliates, if applicable. Net expenses are net of all reductions and represent the net expenses paid by the Fund. |

| Class R6 | |||

| Year Ended September 30, | Period

Ended September 30, | ||

| 2021 | 2020 | 2019 (1) | |

| Net asset value — Beginning of period | $ 26.01 | $ 27.50 | $ 24.93 |

| Income (Loss) From Operations | |||

| Net investment income(2) | $ 0.04 | $ 0.07 | $ 0.07 |

| Net realized and unrealized gain (loss) | 10.05 | (1.16) | 2.50 |

| Total income (loss) from operations | $ 10.09 | $ (1.09) | $ 2.57 |

| Less Distributions | |||

| From net investment income | $ (0.05) | $ (0.07) | $ — |

| From net realized gain | — | (0.33) | — |

| Total distributions | $ (0.05) | $ (0.40) | $ — |

| Net asset value — End of period | $ 36.05 | $ 26.01 | $ 27.50 |

| Total Return(3) | 38.83% | (4.07)% | 10.31% (4) |

| Ratios/Supplemental Data | |||

| Net assets, end of period (000’s omitted) | $84,689 | $44,012 | $34,782 |

| Ratios (as a percentage of average daily net assets):(5) | |||

| Total expenses | 0.86% | 0.91% | 0.93% (6) |

| Net expenses | 0.86% | 0.90% | 0.90% (6) |

| Net investment income | 0.11% | 0.28% | 0.37% (6) |

| Portfolio Turnover | 53% | 44% | 45% (7) |

| (1) | For the period from the commencement of operations, February 1, 2019, to September 30, 2019. |

| (2) | Computed using average shares outstanding. |

| (3) | Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested and do not reflect the effect of sales charges, if any. |

| (4) | Not annualized. |

| (5) | Total expenses do not reflect amounts reimbursed and/or waived by the adviser and certain of its affiliates, if applicable. Net expenses are net of all reductions and represent the net expenses paid by the Fund. |

| (6) | Annualized. |

| (7) | For the year ended September 30, 2019. |

| Asset Description | Level 1 | Level 2 | Level 3 | Total |

| Common Stocks | $ 2,752,448,564(1) | $ — | $ — | $ 2,752,448,564 |

| High Social Impact Investments | — | 2,799,750 | — | 2,799,750 |

| Short-Term Investments: | ||||

| Affiliated Fund | — | 43,689,895 | — | 43,689,895 |

| Securities Lending Collateral | 1,804,401 | — | — | 1,804,401 |

| Total Investments | $2,754,252,965 | $46,489,645 | $ — | $2,800,742,610 |

| (1) | The level classification by major category of investments is the same as the category presentation in the Schedule of Investments. |

| Year Ended September 30, | ||

| 2021 | 2020 | |

| Ordinary income | $2,290,276 | $2,610,080 |

| Long-term capital gains | $ — | $8,261,318 |

| Undistributed ordinary income | $ 89,614,352 |

| Undistributed long-term capital gains | 100,863,247 |

| Net unrealized appreciation | 465,041,427 |

| Distributable earnings | $655,519,026 |

| Aggregate cost | $2,335,701,183 |

| Gross unrealized appreciation | $ 504,712,879 |

| Gross unrealized depreciation | (39,671,452) |

| Net unrealized appreciation | $ 465,041,427 |

| Remaining Contractual Maturity of the Transactions | |||||

| Overnight

and Continuous |

<30 days | 30 to 90 days | >90 days | Total | |

| Common Stocks | $1,804,401 | $ — | $ — | $ — | $1,804,401 |

| Name | Value,

beginning of period |

Purchases | Sales

proceeds |

Net

realized gain (loss) |

Change

in unrealized appreciation (depreciation) |

Value,

end of period |

Interest/

Dividend income |

Principal

amount/Units, end of period |

| High Social Impact Investments | ||||||||

| Calvert Impact Capital, Inc., Community Investment Notes: | ||||||||

| 1.50%, 12/15/20(1) | $ 2,502,849 | $ — | $ (2,515,603) | $ — | $ 12,754 | $ — | $ 7,861 | $ — |

| 1.50%, 12/15/23(1) | — | 2,520,000 | — | — | (43,268) | 2,476,732 | 30,030 | 2,520,000 |

| Short-Term Investments | ||||||||

| Calvert Cash Reserves Fund, LLC | 20,895,723 | 881,484,440 | (858,692,550) | (2,399) | 4,681 | 43,689,895 | 21,293 | 43,685,527 |

| Totals | $(2,399) | $ (25,833) | $46,166,627 | $59,184 | ||||

| (1) | Restricted security. |

| Year

Ended September 30, 2021 |

Year

Ended September 30, 2020 | ||||

| Shares | Amount | Shares | Amount | ||

| Class A | |||||

| Shares sold | 2,511,035 | $ 77,975,808 | 2,505,463 | $ 59,082,941 | |

| Reinvestment of distributions | — | — | 84,645 | 2,165,230 | |

| Shares redeemed | (1,588,951) | (49,469,166) | (1,652,197) | (38,244,903) | |

| Converted from Class C | 38,198 | 1,095,114 | 25,804 | 632,477 | |

| Net increase | 960,282 | $ 29,601,756 | 963,715 | $ 23,635,745 | |

| Class C | |||||

| Shares sold | 525,736 | $ 13,902,600 | 359,892 | $ 7,284,269 | |

| Reinvestment of distributions | — | — | 8,772 | 191,136 | |

| Shares redeemed | (148,104) | (3,948,587) | (183,232) | (3,611,154) | |

| Converted to Class A | (45,209) | (1,095,114) | (30,252) | (632,477) | |

| Net increase | 332,423 | $ 8,858,899 | 155,180 | $ 3,231,774 | |

| Class I | |||||

| Shares sold | 35,089,756 | $1,189,109,366 | 41,335,024 | $1,041,863,042 | |

| Reinvestment of distributions | 60,642 | 1,893,863 | 268,712 | 7,448,686 | |

| Shares redeemed | (15,153,155) | (520,975,811) | (11,802,177) | (287,768,244) | |

| Net increase | 19,997,243 | $ 670,027,418 | 29,801,559 | $ 761,543,484 | |

| Class R6 | |||||

| Shares sold | 1,071,248 | $ 36,569,790 | 686,828 | $ 16,652,531 | |

| Reinvestment of distributions | 2,905 | 90,728 | 18,383 | 509,400 | |

| Shares redeemed | (417,221) | (14,519,771) | (277,774) | (7,488,641) | |

| Net increase | 656,932 | $ 22,140,747 | 427,437 | $ 9,673,290 | |

Boston, Massachusetts

November 22, 2021

| Name and Year of Birth | Corporation

Position(s) |

Position

Start Date |

Principal

Occupation(s) and Other Directorships During Past Five Years and Other Relevant Experience |

| Interested Director | |||

| John

H. Streur(1) 1960 |

Director

and President |

2015 | President

and Chief Executive Officer of Calvert Research and Management (since December 31, 2016). President and Chief Executive Officer of Calvert Investments, Inc. (January 2015 - December 2016); Chief Executive Officer of Calvert Investment Distributors, Inc. (August 2015 - December 2016); Chief Compliance Officer of Calvert Investment Management, Inc. (August 2015 - April 2016); President and Director, Portfolio 21 Investments, Inc. (through October 2014); President, Chief Executive Officer and Director, Managers Investment Group LLC (through January 2012); President and Director, The Managers Funds and Managers AMG Funds (through January 2012). Other Directorships in the Last Five Years. Portfolio 21 Investments, Inc. (asset management) (through October 2014); Managers Investment Group LLC (asset management) (through January 2012); The Managers Funds (asset management) (through January 2012); Managers AMG Funds (asset management) (through January 2012); Calvert Impact Capital, Inc. |

| Independent Directors | |||

| Richard

L. Baird, Jr. 1948 |

Director | 2005 | Regional Disaster

Recovery Lead, American Red Cross of Greater Pennsylvania (since 2017). Volunteer, American Red Cross (since 2015). Former President and CEO of Adagio Health Inc. (retired in 2014) in Pittsburgh, PA. Other Directorships in the Last Five Years. None. |

| Alice

Gresham Bullock 1950 |

Chair

and Director |

2016 | Professor Emerita

at Howard University School of Law. Dean Emerita of Howard University School of Law and Deputy Director of the Association of American Law Schools (1992-1994). Other Directorships in the Last Five Years. None. |

| Cari

M. Dominguez 1949 |

Director | 2016 | Former

Chair of the U.S. Equal Employment Opportunity Commission. Other Directorships in the Last Five Years. Manpower, Inc. (employment agency); Triple S Management Corporation (managed care); National Association of Corporate Directors. |

| John

G. Guffey, Jr. 1948 |

Director | 2005 | President of

Aurora Press Inc., a privately held publisher of trade paperbacks (since January 1997). Other Directorships in the Last Five Years. Calvert Impact Capital, Inc. (through December 31, 2018); Calvert Ventures, LLC. |

| Miles

D. Harper, III 1962 |

Director | 2000 | Partner,

Carr Riggs & Ingram (public accounting firm) since October 2014. Partner, Gainer Donnelly & Desroches (public accounting firm) (now Carr Riggs & Ingram) (November 1999 - September 2014). Other Directorships in the Last Five Years. Bridgeway Funds (9) (asset management). |

| Joy

V. Jones 1950 |

Director | 2000 | Attorney.

Other Directorships in the Last Five Years. Conduit Street Restaurants SUD 2 Limited; Palm Management Restaurant Corporation. |

| Name and Year of Birth | Corporation

Position(s) |

Position

Start Date |

Principal

Occupation(s) and Other Directorships During Past Five Years and Other Relevant Experience |

| Independent Directors (continued) | |||

| Anthony

A. Williams 1951 |

Director | 2016 | CEO

and Executive Director of the Federal City Council (July 2012 to present); Senior Adviser and Independent Consultant for King and Spalding LLP (September 2015 to present); Executive Director of Global Government Practice at the Corporate Executive Board (January 2010 to January 2012). Other Directorships in the Last Five Years. Freddie Mac; Evoq Properties/Meruelo Maddux Properties, Inc. (real estate management); Weston Solutions, Inc. (environmental services); Bipartisan Policy Center’s Debt Reduction Task Force; Chesapeake Bay Foundation; Catholic University of America; Urban Institute (research organization); The Howard Hughes Corporation (real estate development). |

| Name and Year of Birth | Corporation

Position(s) |

Position

Start Date |

Principal

Occupation(s) During Past Five Years |

| Principal Officers who are not Directors | |||

| Hope

L. Brown 1973 |

Chief

Compliance Officer |

2014 | Chief

Compliance Officer of 39 registered investment companies advised by CRM (since 2014). Vice President and Chief Compliance Officer, Wilmington Funds (2012-2014). |

| Deidre

E. Walsh(2) 1971 |

Secretary,

Vice President and Chief Legal Officer |

2021 | Vice

President of CRM and officer of 39 registered investment companies advised by CRM (since 2021). Also Vice President of Eaton Vance and certain of its affiliates and officer of 138 registered investment companies advised or administered by Eaton Vance. |

| James

F. Kirchner(2) 1967 |

Treasurer | 2016 | Vice

President of CRM and officer of 39 registered investment companies advised by CRM (since 2016). Also Vice President of Eaton Vance and certain of its affiliates and officer of 138 registered investment companies advised or administered by Eaton Vance. |

| (1) Mr. Streur is an interested person of the Fund because of his positions with the Fund’s adviser and certain affiliates. | |||

| (2) The business address for Ms. Walsh and Mr. Kirchner is Two International Place, Boston, MA 02110. | |||

| Privacy Notice | April 2021 |

| FACTS | WHAT

DOES EATON VANCE DO WITH YOUR PERSONAL INFORMATION? |

| Why? | Financial companies choose how they share your personal information. Federal law gives consumers the right to limit some but not all sharing. Federal law also requires us to tell you how we collect, share, and protect your personal information. Please read this notice carefully to understand what we do. |

| What? | The

types of personal information we collect and share depend on the product or service you have with us. This information can include:■ Social Security number and income ■ investment experience and risk tolerance ■ checking account number and wire transfer instructions |

| How? | All financial companies need to share customers’ personal information to run their everyday business. In the section below, we list the reasons financial companies can share their customers’ personal information; the reasons Eaton Vance chooses to share; and whether you can limit this sharing. |

| Reasons

we can share your personal information |

Does

Eaton Vance share? |

Can

you limit this sharing? |

| For our everyday business purposes — such as to process your transactions, maintain your account(s), respond to court orders and legal investigations, or report to credit bureaus | Yes | No |

| For our marketing purposes — to offer our products and services to you | Yes | No |

| For joint marketing with other financial companies | No | We don’t share |

| For our investment management affiliates’ everyday business purposes — information about your transactions, experiences, and creditworthiness | Yes | Yes |

| For our affiliates’ everyday business purposes — information about your transactions and experiences | Yes | No |

| For our affiliates’ everyday business purposes — information about your creditworthiness | No | We don’t share |

| For our investment management affiliates to market to you | Yes | Yes |

| For our affiliates to market to you | No | We don’t share |

| For nonaffiliates to market to you | No | We don’t share |

| To

limit our sharing |

Call toll-free 1-800-368-2745 or email: CRMPrivacy@calvert.comPlease note:If you are a new customer, we can begin sharing your information 30 days from the date we sent this notice. When you are no longer our customer, we continue to share your information as described in this notice. However, you can contact us at any time to limit our sharing. |

| Questions? | Call toll-free 1-800-368-2745 or email: CRMPrivacy@calvert.com |

| Privacy Notice — continued | April 2021 |

| Who we are | |

| Who is providing this notice? | Eaton Vance Management, Eaton Vance Distributors, Inc., Eaton Vance Trust Company, Eaton Vance Management (International) Limited, Eaton Vance Advisers International Ltd., Eaton Vance Global Advisors Limited, Eaton Vance Management’s Real Estate Investment Group, Boston Management and Research, Calvert Research and Management, Eaton Vance and Calvert Fund Families and our investment advisory affiliates (“Eaton Vance”) (see Investment Management Affiliates definition below) |

| What we do | |

| How

does Eaton Vance protect my personal information? |

To protect your personal information from unauthorized access and use, we use security measures that comply with federal law. These measures include computer safeguards and secured files and buildings. We have policies governing the proper handling of customer information by personnel and requiring third parties that provide support to adhere to appropriate security standards with respect to such information. |

| How

does Eaton Vance collect my personal information? |

We

collect your personal information, for example, when you■ open an account or make deposits or withdrawals from your

account ■ buy securities from us or make a wire transfer ■ give us your contact informationWe also collect your personal information from others, such as credit bureaus, affiliates, or other companies. |

| Why can’t I limit all sharing? | Federal

law gives you the right to limit only■ sharing for affiliates’ everyday business purposes — information

about your creditworthiness ■ affiliates from using your information to market to you ■ sharing for nonaffiliates to market to youState laws and individual companies may give you additional rights to limit sharing. See below for more on your rights under state law. |

| Definitions | |

| Investment

Management Affiliates |

Eaton Vance Investment Management Affiliates include registered investment advisers, registered broker- dealers, and registered and unregistered funds. Investment Management Affiliates does not include entities associated with Morgan Stanley Wealth Management, such as Morgan Stanley Smith Barney LLC and Morgan Stanley & Co. |

| Affiliates | Companies related by common ownership or control. They can be financial and nonfinancial companies.■ Our affiliates include companies with a Morgan Stanley name and financial companies such as Morgan Stanley Smith Barney LLC and Morgan Stanley & Co. |

| Nonaffiliates | Companies not related by common ownership or control. They can be financial and nonfinancial companies.■ Eaton Vance does not share with nonaffiliates so they can market to you. |

| Joint marketing | A formal agreement between nonaffiliated financial companies that together market financial products or services to you.■ Eaton Vance doesn’t jointly market. |

| Other important information | |

| Vermont: Except as permitted by law, we will not share personal information we collect about Vermont residents with Nonaffiliates unless you provide us with your written consent to share such information.California: Except as permitted by law, we will not share personal information we collect about California residents with Nonaffiliates and we will limit sharing such personal information with our Affiliates to comply with California privacy laws that apply to us. | |

Global Water Fund

| % Average Annual Total Returns1,2 | Class

Inception Date |

Performance

Inception Date |

One Year | Five Years | Ten Years |

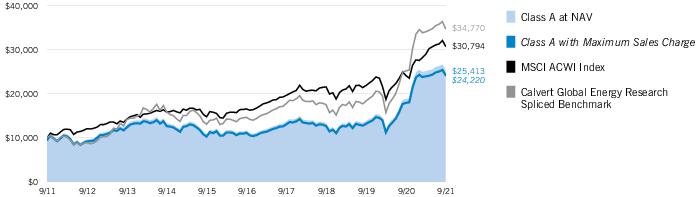

| Class A at NAV | 05/31/2007 | 05/31/2007 | 35.00% | 16.77% | 9.77% |

| Class A with 4.75% Maximum Sales Charge | — | — | 28.53 | 15.64 | 9.24 |

| Class C at NAV | 07/31/2007 | 05/31/2007 | 33.93 | 15.91 | 8.82 |

| Class C with 1% Maximum Sales Charge | — | — | 32.93 | 15.91 | 8.82 |

| Class I at NAV | 05/31/2007 | 05/31/2007 | 35.28 | 17.10 | 10.18 |

|

| |||||

| MSCI ACWI Index | — | — | 27.44% | 13.19% | 11.89% |

| Calvert Global Energy Research Spliced Benchmark | — | — | 37.92 | 18.81 | 13.18 |

| Calvert Global Energy Research Index | — | — | 37.92 | 18.78 | — |

| Ardour Global Alternative Energy Index | — | — | 49.21 | 28.38 | 17.65 |

| % Total Annual Operating Expense Ratios3 | Class A | Class C | Class I |

| Gross | 1.54% | 2.29% | 1.29% |

| Net | 1.24 | 1.99 | 0.99 |

| Growth of Investment | Amount Invested | Period Beginning | At NAV | With Maximum Sales Charge |

| Class C | $10,000 | 09/30/2011 | $23,293 | N.A. |

| Class I | $250,000 | 09/30/2011 | $659,747 | N.A. |

| % Average Annual Total Returns1,2 | Class

Inception Date |

Performance

Inception Date |

One Year | Five Years | Ten Years |

| Class A at NAV | 09/30/2008 | 09/30/2008 | 33.05% | 10.91% | 10.92% |

| Class A with 4.75% Maximum Sales Charge | — | — | 26.73 | 9.84 | 10.38 |

| Class C at NAV | 09/30/2008 | 09/30/2008 | 32.05 | 10.09 | 10.06 |

| Class C with 1% Maximum Sales Charge | — | — | 31.05 | 10.09 | 10.06 |

| Class I at NAV | 01/31/2014 | 09/30/2008 | 33.41 | 11.25 | 11.24 |

|

| |||||

| MSCI ACWI Index | — | — | 27.44% | 13.19% | 11.89% |

| Calvert Global Water Research Spliced Benchmark | — | — | 35.18 | 12.54 | 13.46 |

| Calvert Global Water Research Index | — | — | 35.18 | 12.54 | — |

| S-Network Global Water Index | — | — | 27.27 | 11.08 | 12.78 |

| % Total Annual Operating Expense Ratios3 | Class A | Class C | Class I |

| Gross | 1.34% | 2.09% | 1.09% |

| Net | 1.24 | 1.99 | 0.99 |

| Growth of Investment2 | Amount Invested | Period Beginning | At NAV | With Maximum Sales Charge |

| Class C | $10,000 | 09/30/2011 | $26,089 | N.A. |

| Class I | $250,000 | 09/30/2011 | $726,147 | N.A. |

| Effective April 11, 2016, the Calvert Global Water Fund changed its investment objective and principal investment strategies to track the Calvert Global Water Research Index and implement the Calvert Principles for Responsible Investment. Prior to April 11, 2016, the Fund employed an active management strategy. Performance prior to April 11, 2016 reflects the Fund’s performance under its former investment objective and policies. In connection with such changes, the Fund changed its secondary benchmark from S-Network Global Water Index to Calvert Global Water Research Index.Calvert Research and Management became the investment adviser to each Fund on December 31, 2016. Performance reflected prior to such date is that of each Fund’s former investment adviser. | |

| 3 | Source: Fund prospectus. Net expense ratios reflect a contractual expense reimbursement that continues through 1/31/22. Without the reimbursement, if applicable, performance would have been lower. The expense ratios for the current reporting period can be found in the Financial Highlights section of this report. |

| Additional Information | |

| S&P 500® Index is an unmanaged index of large-cap stocks commonly used as a measure of U.S. stock market performance. S&P Dow Jones Indices are a product of S&P Dow Jones Indices LLC (“S&P DJI”) and have been licensed for use. S&P® and S&P 500® are registered trademarks of S&P DJI; Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); S&P DJI, Dow Jones and their respective affiliates do not sponsor, endorse, sell or promote the Fund, will not have any liability with respect thereto and do not have any liability for any errors, omissions, or interruptions of the S&P Dow Jones Indices. Nasdaq Composite Index is a market capitalization-weighted index of all domestic and international securities listed on Nasdaq. Source: Nasdaq, Inc. The information is provided by Nasdaq (with its affiliates, are referred to as the “Corporations”) and Nasdaq’s third party licensors on an “as is” basis and the Corporations make no guarantees and bear no liability of any kind with respect to the information or the Fund. MSCI Golden Dragon Index is an unmanaged index of common stocks traded in China, Hong Kong and Taiwan. MSCI World Index is an unmanaged index of equity securities in the developed markets. MSCI EAFE Index is an unmanaged index of equities in the developed markets, excluding the U.S. and Canada. MSCI Emerging Markets Index is an unmanaged index of emerging markets common stocks. |

| Beginning

Account Value (4/1/21) |

Ending

Account Value (9/30/21) |

Expenses

Paid During Period* (4/1/21 – 9/30/21) |

Annualized

Expense Ratio | |

| Actual | ||||

| Class A | $1,000.00 | $1,010.30 | $ 6.25** | 1.24% |

| Class C | $1,000.00 | $1,005.90 | $10.01 ** | 1.99% |

| Class I | $1,000.00 | $1,010.90 | $ 4.99** | 0.99% |

| Hypothetical | ||||

| (5% return per year before expenses) | ||||

| Class A | $1,000.00 | $1,018.85 | $ 6.28** | 1.24% |

| Class C | $1,000.00 | $1,015.09 | $10.05 ** | 1.99% |

| Class I | $1,000.00 | $1,020.10 | $ 5.01** | 0.99% |

| * | Expenses are equal to the Fund's annualized expense ratio for the indicated Class, multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half year period). The Example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on March 31, 2021. |

| ** | Absent a waiver and/or reimbursement of expenses by an affiliate, expenses would be higher. |

| Beginning

Account Value (4/1/21) |

Ending

Account Value (9/30/21) |

Expenses

Paid During Period* (4/1/21 – 9/30/21) |

Annualized

Expense Ratio | |

| Actual | ||||

| Class A | $1,000.00 | $1,060.40 | $ 6.40** | 1.24% |

| Class C | $1,000.00 | $1,056.50 | $10.26 ** | 1.99% |

| Class I | $1,000.00 | $1,061.90 | $ 5.12** | 0.99% |

| Hypothetical | ||||

| (5% return per year before expenses) | ||||

| Class A | $1,000.00 | $1,018.85 | $ 6.28** | 1.24% |

| Class C | $1,000.00 | $1,015.09 | $10.05 ** | 1.99% |

| Class I | $1,000.00 | $1,020.10 | $ 5.01** | 0.99% |

| * | Expenses are equal to the Fund's annualized expense ratio for the indicated Class, multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half year period). The Example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on March 31, 2021. |

| ** | Absent a waiver and/or reimbursement of expenses by an affiliate, expenses would be higher. |

| Description | Acquisition Dates | Cost |

| Calvert Impact Capital, Inc., Community Investment Notes, 1.50%, 12/15/23 | 12/14/20 | $200,000 |

| ImpactAssets, Inc., Global Sustainable Agriculture Notes, 0.00%, 11/3/22 | 11/13/15 | 53,000 |

| ImpactAssets, Inc., Microfinance Plus Notes, 0.00%, 11/3/22 | 11/13/15 | 68,000 |

| Abbreviations: | |

| ADR | – American Depositary Receipt |

| NVDR | – Non-Voting Depository Receipt |

| PCL | – Public Company Limited |

| Description | Acquisition Dates | Cost |

| Calvert Impact Capital, Inc., Community Investment Notes, 1.50%, 12/15/23 | 12/14/20 | $630,000 |

| ImpactAssets, Inc., Global Sustainable Agriculture Notes, 0.00%, 11/3/22 | 11/13/15 | 284,000 |

| ImpactAssets, Inc., Microfinance Plus Notes, 0.00%, 11/3/22 | 11/13/15 | 366,000 |

| Abbreviations: | |

| ADR | – American Depositary Receipt |

| PC | – Participation Certificate |

| PCL | – Public Company Limited |

| PFC Shares | – Preference Shares |

| September 30, 2021 | ||

| Global Energy Solutions Fund | Global Water Fund | |

| Assets | ||

| Investments in securities of unaffiliated issuers, at value (identified cost $191,328,244 and $406,853,887, respectively) - including $9,194,758 and $21,413,354, respectively, of securities on loan | $ 225,612,211 | $ 571,977,098 |

| Investments in securities of affiliated issuers, at value (identified cost $1,170,124 and $3,560,671, respectively) | 1,166,769 | 3,550,040 |

| Cash denominated in foreign currency, at value (cost $305,611 and $445,288, respectively) | 304,323 | 440,372 |

| Receivable for investments sold | 1,291,194 | — |

| Receivable for capital shares sold | 534,584 | 1,053,152 |

| Dividends and interest receivable | 234,615 | 1,324,343 |

| Dividends and interest receivable - affiliated | 2,409 | 7,580 |

| Securities lending income receivable | 1,494 | 1,964 |

| Tax reclaims receivable | 149,549 | 410,665 |

| Receivable from affiliate | 33,826 | 11,964 |

| Directors' deferred compensation plan | 55,220 | 293,564 |

| Total assets | $229,386,194 | $579,070,742 |

| Liabilities | ||

| Due to custodian | $ 1,688 | $ — |

| Payable for investments purchased | 810,917 | 2,316,197 |

| Payable for capital shares redeemed | 93,499 | 364,578 |

| Deposits for securities loaned | 2,653,387 | 12,161,176 |

| Payable to affiliates: | ||

| Investment advisory fee | 144,242 | 348,572 |

| Administrative fee | 23,079 | 57,994 |

| Distribution and service fees | 30,692 | 89,281 |

| Sub-transfer agency fee | 9,516 | 16,096 |

| Directors' deferred compensation plan | 55,220 | 293,564 |

| Accrued expenses | 145,629 | 228,061 |

| Total liabilities | $ 3,967,869 | $ 15,875,519 |

| Net Assets | $225,418,325 | $563,195,223 |

| Sources of Net Assets | ||

| Paid-in capital | $ 228,300,398 | $ 404,751,540 |

| Distributable earnings (Accumulated loss) | (2,882,073) | 158,443,683 |

| Total | $225,418,325 | $563,195,223 |

| Class A Shares | ||

| Net Assets | $ 100,038,066 | $ 246,978,421 |

| Shares Outstanding | 7,824,475 | 8,632,790 |

| Net

Asset Value and Redemption Price Per Share (net assets ÷ shares of beneficial interest outstanding) |

$ 12.79 | $ 28.61 |

| Maximum

Offering Price Per Share (100 ÷ 95.25 of net asset value per share) |

$ 13.43 | $ 30.04 |

| Class C Shares | ||

| Net Assets | $ 11,009,499 | $ 41,631,269 |

| Shares Outstanding | 922,795 | 1,589,630 |

| Net

Asset Value and Offering Price Per Share* (net assets ÷ shares of beneficial interest outstanding) |

$ 11.93 | $ 26.19 |

| September 30, 2021 | ||

| Global Energy Solutions Fund | Global Water Fund | |

| Class I Shares | ||

| Net Assets | $114,370,760 | $274,585,533 |

| Shares Outstanding | 8,789,172 | 9,522,317 |

| Net

Asset Value, Offering Price and Redemption Price Per Share (net assets ÷ shares of beneficial interest outstanding) |

$ 13.01 | $ 28.84 |

| On sales of $50,000 or more, the offering price of Class A shares is reduced. | |

| * | Redemption price per share is equal to the net asset value less any applicable contingent deferred sales charge. |

| Year Ended September 30, 2021 | ||

| Global Energy Solutions Fund | Global Water Fund | |

| Investment Income | ||

| Dividend income (net of foreign taxes withheld of $379,831 and $841,596, respectively) | $ 3,299,069 | $ 12,583,435 |

| Dividend income - affiliated issuers | 802 | 1,105 |

| Interest income | 381 | 1,838 |

| Interest income - affiliated issuers | 3,207 | 11,645 |

| Securities lending income, net | 119,400 | 31,811 |

| Total investment income | $ 3,422,859 | $ 12,629,834 |

| Expenses | ||

| Investment advisory fee | $ 1,459,231 | $ 3,723,407 |

| Administrative fee | 233,477 | 616,870 |

| Distribution and service fees: | ||

| Class A | 228,559 | 566,637 |

| Class C | 102,991 | 422,227 |

| Directors' fees and expenses | 8,275 | 26,136 |

| Custodian fees | 66,661 | 53,600 |

| Transfer agency fees and expenses | 296,532 | 633,103 |

| Accounting fees | 58,020 | 124,258 |

| Professional fees | 31,262 | 44,598 |

| Registration fees | 79,641 | 72,776 |

| Reports to shareholders | 20,158 | 43,846 |

| Miscellaneous | 28,198 | 38,342 |

| Total expenses | $ 2,613,005 | $ 6,365,800 |

| Waiver and/or reimbursement of expenses by affiliate | $ (349,085) | $ (284,409) |

| Net expenses | $ 2,263,920 | $ 6,081,391 |

| Net investment income | $ 1,158,939 | $ 6,548,443 |

| Realized and Unrealized Gain (Loss) | ||

| Net realized gain (loss): | ||

| Investment securities | $ 29,995,393 | $ 31,523,950 |

| Investment securities - affiliated issuers | (66) | (309) |

| Foreign currency transactions | (39,980) | 24,068 |

| Net realized gain | $29,955,347 | $ 31,547,709 |

| Change in unrealized appreciation (depreciation): | ||

| Investment securities | $ 9,639,146 | $ 96,677,316 |

| Investment securities - affiliated issuers | (2,006) | (3,817) |

| Foreign currency | (32,367) | (32,078) |

| Net change in unrealized appreciation (depreciation) | $ 9,604,773 | $ 96,641,421 |

| Net realized and unrealized gain | $39,560,120 | $128,189,130 |

| Net increase in net assets from operations | $40,719,059 | $134,737,573 |

| Global Energy Solutions Fund | Global Water Fund | |||

| Year Ended September 30, | ||||

| 2021 | 2020 | 2021 | 2020 | |

| Increase (Decrease) in Net Assets | ||||

| From operations: | ||||

| Net investment income | $ 1,158,939 | $ 727,040 | $ 6,548,443 | $ 2,974,014 |

| Net realized gain | 29,955,347 | 8,877,835 | 31,547,709 | 5,551,449 |

| Net change in unrealized appreciation (depreciation) | 9,604,773 | 19,963,491 | 96,641,421 | 11,179,783 |

| Net increase in net assets from operations | $ 40,719,059 | $ 29,568,366 | $134,737,573 | $ 19,705,246 |

| Distributions to shareholders: | ||||

| Class A | $ (576,225) | $ (529,616) | $ (1,611,609) | $ (1,611,283) |

| Class C | (12,463) | (26,519) | (12,508) | (108,693) |

| Class I | (567,285) | (359,921) | (2,142,987) | (2,089,882) |

| Total distributions to shareholders | $ (1,155,973) | $ (916,056) | $ (3,767,104) | $ (3,809,858) |

| Capital share transactions: | ||||

| Class A | $ 15,894,369 | $ (1,151,504) | $ 8,216,239 | $ (7,542,026) |

| Class C | 671,750 | (956,642) | (9,252,815) | (12,448,296) |

| Class I | 53,344,764 | 11,184,843 | 23,806,274 | 2,202,758 |

| Net increase (decrease) in net assets from capital share transactions | $ 69,910,883 | $ 9,076,697 | $ 22,769,698 | $ (17,787,564) |

| Net increase (decrease) in net assets | $109,473,969 | $ 37,729,007 | $153,740,167 | $ (1,892,176) |

| Net Assets | ||||

| At beginning of year | $ 115,944,356 | $ 78,215,349 | $ 409,455,056 | $ 411,347,232 |

| At end of year | $225,418,325 | $115,944,356 | $563,195,223 | $409,455,056 |

| Global Energy Solutions Fund — Class A | |||||

| Year Ended September 30, | |||||

| 2021 | 2020 | 2019 | 2018 | 2017 | |

| Net asset value — Beginning of year | $ 9.54 | $ 7.08 | $ 6.95 | $ 7.23 | $ 6.23 |

| Income (Loss) From Operations | |||||

| Net investment income(1) | $ 0.06 | $ 0.06 | $ 0.08 | $ 0.10 | $ 0.08 |

| Net realized and unrealized gain (loss) | 3.27 | 2.48 | 0.15 | (0.29) | 0.98 |

| Total income (loss) from operations | $ 3.33 | $ 2.54 | $ 0.23 | $ (0.19) | $ 1.06 |

| Less Distributions | |||||

| From net investment income | $ (0.08) | $ (0.08) | $ (0.10) | $ (0.09) | $ (0.06) |

| Total distributions | $ (0.08) | $ (0.08) | $ (0.10) | $ (0.09) | $ (0.06) |

| Net asset value — End of year | $ 12.79 | $ 9.54 | $ 7.08 | $ 6.95 | $ 7.23 |

| Total Return(2) | 35.00% | 36.12% | 3.60% | (2.73)% | 17.28% |

| Ratios/Supplemental Data | |||||

| Net assets, end of year (000’s omitted) | $100,038 | $62,428 | $47,596 | $51,502 | $58,695 |

| Ratios (as a percentage of average daily net assets):(3) | |||||

| Total expenses | 1.42% | 1.54% | 1.72% | 1.69% | 1.94% |

| Net expenses | 1.24% | 1.24% | 1.26% | 1.28% | 1.38% |

| Net investment income | 0.48% | 0.76% | 1.27% | 1.34% | 1.26% |

| Portfolio Turnover | 50% | 45% | 40% | 38% | 133% |

| (1) | Computed using average shares outstanding. |

| (2) | Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested and do not reflect the effect of sales charges, if any. |

| (3) | Total expenses do not reflect amounts reimbursed and/or waived by the adviser and certain of its affiliates, if applicable. Net expenses are net of all reductions and represent the net expenses paid by the Fund. |

| Global Energy Solutions Fund — Class C | |||||

| Year Ended September 30, | |||||

| 2021 | 2020 | 2019 | 2018 | 2017 | |

| Net asset value — Beginning of year | $ 8.92 | $ 6.63 | $ 6.50 | $ 6.76 | $ 5.82 |

| Income (Loss) From Operations | |||||

| Net investment income (loss)(1) | $ (0.03) | $ (—)(2) | $ 0.02 | $ 0.04 | $ 0.03 |

| Net realized and unrealized gain (loss) | 3.06 | 2.32 | 0.16 | (0.26) | 0.92 |

| Total income (loss) from operations | $ 3.03 | $ 2.32 | $ 0.18 | $ (0.22) | $ 0.95 |

| Less Distributions | |||||

| From net investment income | $ (0.02) | $ (0.03) | $ (0.05) | $ (0.04) | $ (0.01) |

| Total distributions | $ (0.02) | $ (0.03) | $ (0.05) | $ (0.04) | $ (0.01) |

| Net asset value — End of year | $ 11.93 | $ 8.92 | $ 6.63 | $ 6.50 | $ 6.76 |

| Total Return(3) | 33.93% | 35.03% | 2.85% | (3.31)% | 16.38% |

| Ratios/Supplemental Data | |||||

| Net assets, end of year (000’s omitted) | $11,009 | $ 7,841 | $6,752 | $9,996 | $11,938 |

| Ratios (as a percentage of average daily net assets):(4) | |||||

| Total expenses | 2.17% | 2.29% | 2.48% | 2.44% | 2.78% |

| Net expenses | 1.99% | 1.99% | 2.01% | 2.03% | 2.13% |

| Net investment income (loss) | (0.27)% | (0.01)% | 0.38% | 0.59% | 0.55% |

| Portfolio Turnover | 50% | 45% | 40% | 38% | 133% |

| (1) | Computed using average shares outstanding. |

| (2) | Amount is less than $(0.005). |

| (3) | Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested and do not reflect the effect of sales charges, if any. |

| (4) | Total expenses do not reflect amounts reimbursed and/or waived by the adviser and certain of its affiliates, if applicable. Net expenses are net of all reductions and represent the net expenses paid by the Fund. |

| Global Energy Solutions Fund — Class I | |||||

| Year Ended September 30, | |||||

| 2021 | 2020 | 2019 | 2018 | 2017 | |

| Net asset value — Beginning of year | $ 9.70 | $ 7.20 | $ 7.07 | $ 7.34 | $ 6.35 |

| Income (Loss) From Operations | |||||

| Net investment income(1) | $ 0.10 | $ 0.08 | $ 0.11 | $ 0.15 | $ 0.13 |

| Net realized and unrealized gain (loss) | 3.31 | 2.52 | 0.14 | (0.31) | 0.97 |

| Total income (loss) from operations | $ 3.41 | $ 2.60 | $ 0.25 | $ (0.16) | $ 1.10 |

| Less Distributions | |||||

| From net investment income | $ (0.10) | $ (0.10) | $ (0.12) | $ (0.11) | $ (0.11) |

| Total distributions | $ (0.10) | $ (0.10) | $ (0.12) | $ (0.11) | $ (0.11) |

| Net asset value — End of year | $ 13.01 | $ 9.70 | $ 7.20 | $ 7.07 | $ 7.34 |

| Total Return(2) | 35.28% | 36.40% | 3.89% | (2.33)% | 17.66% |

| Ratios/Supplemental Data | |||||

| Net assets, end of year (000’s omitted) | $114,371 | $45,676 | $23,867 | $19,178 | $ 5,503 |

| Ratios (as a percentage of average daily net assets):(3) | |||||

| Total expenses | 1.17% | 1.29% | 1.47% | 1.43% | 1.66% |

| Net expenses | 0.99% | 0.99% | 0.98% | 0.93% | 0.97% |

| Net investment income | 0.80% | 1.08% | 1.60% | 2.00% | 1.99% |

| Portfolio Turnover | 50% | 45% | 40% | 38% | 133% |

| (1) | Computed using average shares outstanding. |

| (2) | Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested and do not reflect the effect of sales charges, if any. |

| (3) | Total expenses do not reflect amounts reimbursed and/or waived by the adviser and certain of its affiliates, if applicable. Net expenses are net of all reductions and represent the net expenses paid by the Fund. |

| Global Water Fund — Class A | |||||

| Year Ended September 30, | |||||

| 2021 | 2020 | 2019 | 2018 | 2017 | |

| Net asset value — Beginning of year | $ 21.67 | $ 20.70 | $ 20.00 | $ 19.92 | $ 17.71 |

| Income (Loss) From Operations | |||||

| Net investment income(1) | $ 0.33 | $ 0.14 | $ 0.23 | $ 0.23 | $ 0.20 |

| Net realized and unrealized gain | 6.80 | 1.02 | 0.70 | 0.04 | 2.01 |

| Total income from operations | $ 7.13 | $ 1.16 | $ 0.93 | $ 0.27 | $ 2.21 |

| Less Distributions | |||||

| From net investment income | $ (0.19) | $ (0.19) | $ (0.23) | $ (0.19) | $ — |

| Total distributions | $ (0.19) | $ (0.19) | $ (0.23) | $ (0.19) | $ — |

| Net asset value — End of year | $ 28.61 | $ 21.67 | $ 20.70 | $ 20.00 | $ 19.92 |

| Total Return(2) | 33.05% | 5.57% | 4.86% | 1.34% | 12.48% |

| Ratios/Supplemental Data | |||||

| Net assets, end of year (000’s omitted) | $246,978 | $180,956 | $181,139 | $201,243 | $235,266 |

| Ratios (as a percentage of average daily net assets):(3) | |||||

| Total expenses | 1.29% | 1.34% | 1.38% | 1.39% | 1.46% |

| Net expenses | 1.24% | 1.24% | 1.25% | 1.28% | 1.28% |

| Net investment income | 1.21% | 0.70% | 1.17% | 1.14% | 1.11% |

| Portfolio Turnover | 27% | 35% | 28% | 40% | 34% |

| (1) | Computed using average shares outstanding. |

| (2) | Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested and do not reflect the effect of sales charges, if any. |

| (3) | Total expenses do not reflect amounts reimbursed and/or waived by the adviser and certain of its affiliates, if applicable. Net expenses are net of all reductions and represent the net expenses paid by the Fund. |

| Global Water Fund — Class C | |||||

| Year Ended September 30, | |||||

| 2021 | 2020 | 2019 | 2018 | 2017 | |

| Net asset value — Beginning of year | $ 19.84 | $ 18.98 | $ 18.32 | $ 18.28 | $ 16.37 |

| Income (Loss) From Operations | |||||

| Net investment income (loss)(1) | $ 0.10 | $ (0.02) | $ 0.08 | $ 0.07 | $ 0.07 |

| Net realized and unrealized gain | 6.26 | 0.92 | 0.66 | 0.03 | 1.84 |

| Total income from operations | $ 6.36 | $ 0.90 | $ 0.74 | $ 0.10 | $ 1.91 |

| Less Distributions | |||||

| From net investment income | $ (0.01) | $ (0.04) | $ (0.08) | $ (0.06) | $ — |

| Total distributions | $ (0.01) | $ (0.04) | $ (0.08) | $ (0.06) | $ — |

| Net asset value — End of year | $ 26.19 | $ 19.84 | $ 18.98 | $ 18.32 | $ 18.28 |

| Total Return(2) | 32.05% | 4.75% | 4.08% | 0.61% | 11.67% |

| Ratios/Supplemental Data | |||||

| Net assets, end of year (000’s omitted) | $41,631 | $39,358 | $50,369 | $58,455 | $67,096 |

| Ratios (as a percentage of average daily net assets):(3) | |||||

| Total expenses | 2.04% | 2.09% | 2.13% | 2.14% | 2.17% |

| Net expenses | 1.99% | 1.99% | 2.01% | 2.03% | 2.03% |

| Net investment income (loss) | 0.42% | (0.08)% | 0.43% | 0.40% | 0.41% |

| Portfolio Turnover | 27% | 35% | 28% | 40% | 34% |

| (1) | Computed using average shares outstanding. |

| (2) | Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested and do not reflect the effect of sales charges, if any. |

| (3) | Total expenses do not reflect amounts reimbursed and/or waived by the adviser and certain of its affiliates, if applicable. Net expenses are net of all reductions and represent the net expenses paid by the Fund. |

| Global Water Fund — Class I | |||||

| Year Ended September 30, | |||||

| 2021 | 2020 | 2019 | 2018 | 2017 | |

| Net asset value — Beginning of year | $ 21.83 | $ 20.85 | $ 20.15 | $ 20.08 | $ 17.79 |

| Income (Loss) From Operations | |||||

| Net investment income(1) | $ 0.40 | $ 0.20 | $ 0.29 | $ 0.36 | $ 0.30 |

| Net realized and unrealized gain (loss) | 6.86 | 1.02 | 0.70 | (0.02) | 1.99 |

| Total income from operations | $ 7.26 | $ 1.22 | $ 0.99 | $ 0.34 | $ 2.29 |

| Less Distributions | |||||

| From net investment income | $ (0.25) | $ (0.24) | $ (0.29) | $ (0.27) | $ — |

| Total distributions | $ (0.25) | $ (0.24) | $ (0.29) | $ (0.27) | $ — |

| Net asset value — End of year | $ 28.84 | $ 21.83 | $ 20.85 | $ 20.15 | $ 20.08 |

| Total Return(2) | 33.41% | 5.83% | 5.18% | 1.68% | 12.87% |

| Ratios/Supplemental Data | |||||

| Net assets, end of year (000’s omitted) | $274,586 | $189,141 | $179,839 | $170,996 | $16,094 |

| Ratios (as a percentage of average daily net assets):(3) | |||||

| Total expenses | 1.04% | 1.09% | 1.13% | 1.14% | 1.12% |

| Net expenses | 0.99% | 0.99% | 0.97% | 0.93% | 0.93% |

| Net investment income | 1.47% | 0.97% | 1.48% | 1.78% | 1.61% |

| Portfolio Turnover | 27% | 35% | 28% | 40% | 34% |

| (1) | Computed using average shares outstanding. |

| (2) | Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested and do not reflect the effect of sales charges, if any. |

| (3) | Total expenses do not reflect amounts reimbursed and/or waived by the adviser and certain of its affiliates, if applicable. Net expenses are net of all reductions and represent the net expenses paid by the Fund. |

| Asset Description | Level 1 | Level 2 | Level 3 | Total |

| Common Stocks: | ||||

| Australia | $ — | $ 1,668,021 | $ — | $ 1,668,021 |

| Austria | — | 1,423,877 | — | 1,423,877 |

| Belgium | — | 1,954,633 | — | 1,954,633 |

| Brazil | 2,273,840 | — | — | 2,273,840 |

| Canada | 9,943,820 | — | — | 9,943,820 |

| China | 2,516,767 | 12,899,175 | — | 15,415,942 |

| Denmark | — | 5,543,115 | — | 5,543,115 |

| Finland | — | 1,215,572 | — | 1,215,572 |

| France | — | 11,519,797 | — | 11,519,797 |

| Germany | — | 15,150,766 | — | 15,150,766 |

| Greece | — | 1,043,876 | — | 1,043,876 |

| Ireland | — | 2,405,172 | — | 2,405,172 |

| Italy | — | 5,896,838 | — | 5,896,838 |

| Japan | — | 10,625,076 | — | 10,625,076 |

| Netherlands | — | 2,893,009 | — | 2,893,009 |

| New Zealand | — | 4,139,739 | — | 4,139,739 |

| Norway | — | 2,625,286 | — | 2,625,286 |

| Singapore | 1,405,164 | 2,497,673 | — | 3,902,837 |

| South Korea | — | 4,952,844 | — | 4,952,844 |

| Spain | 1,235,355 | 8,999,675 | — | 10,235,030 |

| Sweden | — | 4,380,658 | — | 4,380,658 |

| Switzerland | — | 3,709,101 | — | 3,709,101 |

| Taiwan | — | 12,019,734 | — | 12,019,734 |

| Asset Description | Level 1 | Level 2 | Level 3 | Total |

| Thailand | $ — | $ 2,196,420 | $ — | $ 2,196,420 |

| United Kingdom | 1,216,940 | 8,089,083 | — | 9,306,023 |

| United States | 76,405,161 | — | — | 76,405,161 |

| Total Common Stocks | $94,997,047 | $127,849,140 (1) | $ — | $222,846,187 |

| High Social Impact Investments | $ — | $ 309,203 | $ — | $ 309,203 |

| Short-Term Investments: | ||||

| Affiliated Fund | — | 970,203 | — | 970,203 |

| Securities Lending Collateral | 2,653,387 | — | — | 2,653,387 |

| Total Investments | $97,650,434 | $129,128,546 | $ — | $226,778,980 |

| (1) | Includes foreign equity securities whose values were adjusted to reflect market trading of comparable securities or other correlated instruments that occurred after the close of trading in their applicable foreign markets. |

| Asset Description | Level 1 | Level 2 | Level 3(1) | Total |

| Common Stocks: | ||||

| Australia | $ — | $ 12,363,705 | $ — | $ 12,363,705 |

| Brazil | 17,585,946 | — | — | 17,585,946 |

| Canada | 9,455,313 | — | — | 9,455,313 |

| Chile | — | 9,094,767 | — | 9,094,767 |

| China | — | 26,728,053 | — | 26,728,053 |

| Denmark | — | 2,719,428 | — | 2,719,428 |

| Finland | — | 10,337,855 | — | 10,337,855 |

| France | — | 25,884,062 | — | 25,884,062 |

| Germany | — | 6,082,647 | — | 6,082,647 |

| Italy | — | 8,725,161 | — | 8,725,161 |

| Japan | — | 56,417,262 | — | 56,417,262 |

| Netherlands | — | 8,254,235 | — | 8,254,235 |

| Singapore | — | 3,126,222 | 0 | 3,126,222 |

| South Korea | — | 6,023,433 | — | 6,023,433 |

| Spain | — | 5,866,314 | — | 5,866,314 |

| Switzerland | 1,555,427 | 22,436,913 | — | 23,992,340 |

| Taiwan | — | 2,984,301 | — | 2,984,301 |

| Thailand | — | 9,082,378 | — | 9,082,378 |

| United Kingdom | 3,164,139 | 45,626,379 | — | 48,790,518 |

| United States | 265,696,931 | — | — | 265,696,931 |

| Total Common Stocks | $297,457,756 | $261,753,115 (2) | $ 0 | $559,210,871 |

| High Social Impact Investments | $ — | $ 1,224,234 | $ — | $ 1,224,234 |

| Short-Term Investments: | ||||

| Affiliated Fund | — | 2,930,857 | — | 2,930,857 |

| Asset Description | Level 1 | Level 2 | Level 3(1) | Total |

| Securities Lending Collateral | $ 12,161,176 | $ — | $ — | $ 12,161,176 |

| Total Investments | $309,618,932 | $265,908,206 | $ 0 | $575,527,138 |

| (1) | None of the unobservable inputs for Level 3 assets, individually or collectively, had a material impact on the Fund. |

| (2) | Includes foreign equity securities whose values were adjusted to reflect market trading of comparable securities or other correlated instruments that occurred after the close of trading in their applicable foreign markets. |

| Global Energy Solutions | Global Water | |

| Class A | $ 16 | $ 78 |

| Class C | 509 | 850 |

| Global Energy Solutions | Global Water | |

| Purchases | $164,312,531 | $159,424,475 |

| Sales | 96,066,183 | 134,798,701 |

| Global Energy Solutions | Global Water | |||

| Year Ended September 30, | Year Ended September 30, | |||

| 2021 | 2020 | 2021 | 2020 | |

| Ordinary income | $1,155,973 | $916,056 | $3,767,104 | $3,809,858 |

| Global Energy Solutions | Global Water | |

| Change in: | ||

| Paid-in capital | $ 94,917 | $ 334,885 |

| Distributable earnings (Accumulated loss) | $(94,917) | $(334,885) |

| Global Energy Solutions | Global Water | |

| Undistributed ordinary income | $ 894,015 | $ 5,727,090 |

| Deferred capital losses | (37,797,659) | (7,587,478) |

| Net unrealized appreciation | 34,021,571 | 160,304,071 |

| Distributable earnings (Accumulated loss) | $ (2,882,073) | $158,443,683 |

| Global Energy Solutions | Global Water | |

| Deferred capital losses: | ||

| Short-term | $ — | $(7,587,478) |

| Long-term | (37,797,659) | — |

| Global Energy Solutions | Global Water | |

| Aggregate cost | $192,729,940 | $415,215,097 |

| Gross unrealized appreciation | $ 41,561,546 | $ 184,173,218 |

| Gross unrealized depreciation | (7,512,506) | (23,861,177) |

| Net unrealized appreciation | $ 34,049,040 | $160,312,041 |

| Global Energy Solutions | Global Water | |

| Securities on Loan | $ 9,194,758 | $ 21,413,354 |

| Collateral Received: | ||

| Cash | 2,653,387 | 12,161,176 |

| U.S. government and/or agencies securities | 6,872,291 | 10,540,068 |

| Total Collateral Received | $9,525,678 | $22,701,244 |

| Global Energy Solutions | Remaining Contractual Maturity of the Transactions | ||||

| Overnight

and Continuous |

<30 days | 30 to 90 days | >90 days | Total | |

| Common Stocks | $2,653,387 | $ — | $ — | $ — | $2,653,387 |

| Global Water | Remaining Contractual Maturity of the Transactions | ||||

| Overnight

and Continuous |

<30 days | 30 to 90 days | >90 days | Total | |

| Common Stocks | $12,161,176 | $ — | $ — | $ — | $12,161,176 |

| Name | Value,

beginning of period |

Purchases | Sales

proceeds |

Net

realized gain (loss) |

Change

in unrealized appreciation (depreciation) |

Value,

end of period |

Interest/

Dividend income |

Principal

amount/Units, end of period |

| High Social Impact Investments | ||||||||

| Calvert Impact Capital, Inc., Community Investment Notes: | ||||||||

| 1.50%, 12/15/20(1) | $ 262,231 | $ — | $ (263,568) | $ — | $ 1,337 | $ — | $ 824 | $ — |

| 1.50%, 12/15/23(1) | — | 200,000 | — | — | (3,434) | 196,566 | 2,383 | 200,000 |

| Short-Term Investments | ||||||||

| Calvert Cash Reserves Fund, LLC | 258,630 | 44,903,119 | (44,191,571) | (66) | 91 | 970,203 | 802 | 970,106 |

| Totals | $ (66) | $ (2,006) | $1,166,769 | $ 4,009 | ||||

| (1) | Restricted security. |

| Name | Value,

beginning of period |

Purchases | Sales

proceeds |

Net

realized gain (loss) |

Change

in unrealized appreciation (depreciation) |

Value,

end of period |

Interest/

Dividend income |

Principal

amount/Units, end of period |

| High Social Impact Investments | ||||||||

| Calvert Impact Capital, Inc., Community Investment Notes: | ||||||||

| 1.50%, 12/15/20(1) | $1,317,403 | $ — | $ (1,324,116) | $ — | $ 6,713 | $ — | $ 4,138 | $ — |

| 1.50%, 12/15/23(1) | — | 630,000 | — | — | (10,817) | 619,183 | 7,507 | 630,000 |

| Short-Term Investments | ||||||||

| Calvert Cash Reserves Fund, LLC | 1,005,664 | 48,188,492 | (46,263,277) | (309) | 287 | 2,930,857 | 1,105 | 2,930,564 |

| Totals | $(309) | $ (3,817) | $3,550,040 | $12,750 | ||||

| (1) | Restricted security. |

| Year

Ended September 30, 2021 |

Year

Ended September 30, 2020 | ||||

| Shares | Amount | Shares | Amount | ||

| Class A | |||||

| Shares sold | 2,383,314 | $ 30,070,042 | 754,608 | $ 5,816,261 | |

| Reinvestment of distributions | 44,331 | 530,637 | 63,936 | 495,506 | |

| Shares redeemed | (1,288,358) | (16,341,022) | (1,071,928) | (8,061,751) | |

| Converted from Class C | 140,620 | 1,634,712 | 79,273 | 598,480 | |

| Net increase (decrease) | 1,279,907 | $ 15,894,369 | (174,111) | $ (1,151,504) | |

| Class C | |||||

| Shares sold | 340,490 | $ 4,055,452 | 118,738 | $ 859,345 | |

| Reinvestment of distributions | 1,094 | 12,290 | 3,456 | 25,163 | |

| Shares redeemed | (147,435) | (1,761,280) | (176,751) | (1,242,670) | |

| Converted to Class A | (150,565) | (1,634,712) | (84,574) | (598,480) | |

| Net increase (decrease) | 43,584 | $ 671,750 | (139,131) | $ (956,642) | |

| Class I | |||||

| Shares sold | 6,761,201 | $ 87,955,567 | 2,478,591 | $ 19,373,804 | |

| Reinvestment of distributions | 46,193 | 561,712 | 44,987 | 353,601 | |

| Shares redeemed | (2,727,005) | (35,172,515) | (1,128,620) | (8,542,562) | |

| Net increase | 4,080,389 | $ 53,344,764 | 1,394,958 | $11,184,843 | |

| Year

Ended September 30, 2021 |

Year

Ended September 30, 2020 | ||||

| Shares | Amount | Shares | Amount | ||

| Class A | |||||

| Shares sold | 1,224,165 | $ 33,471,723 | 1,009,457 | $ 20,886,003 | |

| Reinvestment of distributions | 58,166 | 1,458,802 | 67,917 | 1,499,614 | |

| Shares redeemed | (1,232,467) | (32,868,802) | (1,566,924) | (31,683,730) | |

| Converted from Class C | 233,616 | 6,154,516 | 88,411 | 1,756,087 | |

| Net increase (decrease) | 283,480 | $ 8,216,239 | (401,139) | $ (7,542,026) | |

| Class C | |||||

| Shares sold | 231,435 | $ 5,877,257 | 165,165 | $ 3,190,157 | |

| Reinvestment of distributions | 497 | 11,475 | 4,561 | 92,739 | |

| Shares redeemed | (371,062) | (8,987,031) | (744,118) | (13,975,105) | |

| Converted to Class A | (254,816) | (6,154,516) | (96,329) | (1,756,087) | |

| Net decrease | (393,946) | $ (9,252,815) | (670,721) | $(12,448,296) | |

| Year

Ended September 30, 2021 |

Year

Ended September 30, 2020 | ||||

| Shares | Amount | Shares | Amount | ||

| Class I | |||||

| Shares sold | 2,444,848 | $ 67,005,702 | 2,263,617 | $ 46,188,116 | |

| Reinvestment of distributions | 77,478 | 1,954,775 | 81,579 | 1,811,063 | |

| Shares redeemed | (1,662,422) | (45,154,203) | (2,308,016) | (45,796,421) | |

| Net increase | 859,904 | $ 23,806,274 | 37,180 | $ 2,202,758 | |

Boston, Massachusetts

November 22, 2021

| Global Energy Solutions | $ 2,472,129 |

| Global Water | $ 9,030,756 |

| Global Energy Solutions | 18.76% |

| Global Water | 52.69% |

| Foreign Taxes | Foreign Source Income | ||

| Global Energy Solutions | $274,104 | $ 2,798,647 | |

| Global Water | $675,374 | $10,214,522 |

| Name and Year of Birth | Corporation

Position(s) |

Position

Start Date |

Principal

Occupation(s) and Other Directorships During Past Five Years and Other Relevant Experience |

| Interested Director | |||

| John

H. Streur(1) 1960 |

Director

and President |

2015 | President

and Chief Executive Officer of Calvert Research and Management (since December 31, 2016). President and Chief Executive Officer of Calvert Investments, Inc. (January 2015 - December 2016); Chief Executive Officer of Calvert Investment Distributors, Inc. (August 2015 - December 2016); Chief Compliance Officer of Calvert Investment Management, Inc. (August 2015 - April 2016); President and Director, Portfolio 21 Investments, Inc. (through October 2014); President, Chief Executive Officer and Director, Managers Investment Group LLC (through January 2012); President and Director, The Managers Funds and Managers AMG Funds (through January 2012). Other Directorships in the Last Five Years. Portfolio 21 Investments, Inc. (asset management) (through October 2014); Managers Investment Group LLC (asset management) (through January 2012); The Managers Funds (asset management) (through January 2012); Managers AMG Funds (asset management) (through January 2012); Calvert Impact Capital, Inc. |

| Independent Directors | |||

| Richard

L. Baird, Jr. 1948 |

Director | 2005 | Regional Disaster

Recovery Lead, American Red Cross of Greater Pennsylvania (since 2017). Volunteer, American Red Cross (since 2015). Former President and CEO of Adagio Health Inc. (retired in 2014) in Pittsburgh, PA. Other Directorships in the Last Five Years. None. |

| Alice

Gresham Bullock 1950 |

Chair

and Director |

2016 | Professor Emerita

at Howard University School of Law. Dean Emerita of Howard University School of Law and Deputy Director of the Association of American Law Schools (1992-1994). Other Directorships in the Last Five Years. None. |

| Cari

M. Dominguez 1949 |

Director | 2016 | Former

Chair of the U.S. Equal Employment Opportunity Commission. Other Directorships in the Last Five Years. Manpower, Inc. (employment agency); Triple S Management Corporation (managed care); National Association of Corporate Directors. |

| John

G. Guffey, Jr. 1948 |

Director | 2005 | President of

Aurora Press Inc., a privately held publisher of trade paperbacks (since January 1997). Other Directorships in the Last Five Years. Calvert Impact Capital, Inc. (through December 31, 2018); Calvert Ventures, LLC. |

| Miles

D. Harper, III 1962 |

Director | 2000 | Partner,

Carr Riggs & Ingram (public accounting firm) since October 2014. Partner, Gainer Donnelly & Desroches (public accounting firm) (now Carr Riggs & Ingram) (November 1999 - September 2014). Other Directorships in the Last Five Years. Bridgeway Funds (9) (asset management). |

| Joy

V. Jones 1950 |

Director | 2000 | Attorney.

Other Directorships in the Last Five Years. Conduit Street Restaurants SUD 2 Limited; Palm Management Restaurant Corporation. |

| Name and Year of Birth | Corporation

Position(s) |

Position

Start Date |

Principal

Occupation(s) and Other Directorships During Past Five Years and Other Relevant Experience |

| Independent Directors (continued) | |||

| Anthony

A. Williams 1951 |

Director | 2016 | CEO

and Executive Director of the Federal City Council (July 2012 to present); Senior Adviser and Independent Consultant for King and Spalding LLP (September 2015 to present); Executive Director of Global Government Practice at the Corporate Executive Board (January 2010 to January 2012). Other Directorships in the Last Five Years. Freddie Mac; Evoq Properties/Meruelo Maddux Properties, Inc. (real estate management); Weston Solutions, Inc. (environmental services); Bipartisan Policy Center’s Debt Reduction Task Force; Chesapeake Bay Foundation; Catholic University of America; Urban Institute (research organization); The Howard Hughes Corporation (real estate development). |

| Name and Year of Birth | Corporation

Position(s) |

Position

Start Date |

Principal

Occupation(s) During Past Five Years |

| Principal Officers who are not Directors | |||

| Hope

L. Brown 1973 |

Chief

Compliance Officer |

2014 | Chief

Compliance Officer of 39 registered investment companies advised by CRM (since 2014). Vice President and Chief Compliance Officer, Wilmington Funds (2012-2014). |

| Deidre

E. Walsh(2) 1971 |

Secretary,

Vice President and Chief Legal Officer |

2021 | Vice

President of CRM and officer of 39 registered investment companies advised by CRM (since 2021). Also Vice President of Eaton Vance and certain of its affiliates and officer of 138 registered investment companies advised or administered by Eaton Vance. |

| James

F. Kirchner(2) 1967 |

Treasurer | 2016 | Vice

President of CRM and officer of 39 registered investment companies advised by CRM (since 2016). Also Vice President of Eaton Vance and certain of its affiliates and officer of 138 registered investment companies advised or administered by Eaton Vance. |

| (1) Mr. Streur is an interested person of the Funds because of his positions with the Funds' adviser and certain affiliates. | |||

| (2) The business address for Ms. Walsh and Mr. Kirchner is Two International Place, Boston, MA 02110. | |||

| Privacy Notice | April 2021 |

| FACTS | WHAT

DOES EATON VANCE DO WITH YOUR PERSONAL INFORMATION? |

| Why? | Financial companies choose how they share your personal information. Federal law gives consumers the right to limit some but not all sharing. Federal law also requires us to tell you how we collect, share, and protect your personal information. Please read this notice carefully to understand what we do. |

| What? | The

types of personal information we collect and share depend on the product or service you have with us. This information can include:■ Social Security number and income ■ investment experience and risk tolerance ■ checking account number and wire transfer instructions |

| How? | All financial companies need to share customers’ personal information to run their everyday business. In the section below, we list the reasons financial companies can share their customers’ personal information; the reasons Eaton Vance chooses to share; and whether you can limit this sharing. |

| Reasons

we can share your personal information |

Does

Eaton Vance share? |

Can

you limit this sharing? |

| For our everyday business purposes — such as to process your transactions, maintain your account(s), respond to court orders and legal investigations, or report to credit bureaus | Yes | No |

| For our marketing purposes — to offer our products and services to you | Yes | No |

| For joint marketing with other financial companies | No | We don’t share |

| For our investment management affiliates’ everyday business purposes — information about your transactions, experiences, and creditworthiness | Yes | Yes |