UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________________

FORM 10-Q

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||||||

For the quarterly period ended | ||||||||

OR | ||||||||

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||||||

For the transition period | from ________ to ________ | |||||||

Commission file number: 001-38855

___________________________________

(Exact name of registrant as specified in its charter)

| (State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) | ||||||||||

| (Address of Principal Executive Offices) | (Zip Code) | ||||||||||

Registrant’s telephone number, including area code: +1 212 401 8700

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||||||||

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| ☒ | Accelerated filer | ☐ | |||||||||

| Non-accelerated filer | ☐ | Smaller reporting company | |||||||||

| Emerging growth company | |||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

| Class | Outstanding at April 24, 2024 | ||||||||||

| Common Stock, $0.01 par value per share | shares | ||||||||||

Nasdaq, Inc.

Page | ||||||||

Part I. FINANCIAL INFORMATION | ||||||||

| Item 1. | ||||||||

| Item 2. | ||||||||

| Item 3. | ||||||||

| Item 4. | ||||||||

Part II. OTHER INFORMATION | ||||||||

| Item 1. | ||||||||

Item 1A. | ||||||||

| Item 2. | ||||||||

| Item 3. | ||||||||

| Item 4. | ||||||||

| Item 5. | ||||||||

| Item 6. | ||||||||

i

About this Form 10-Q

Throughout this Form 10-Q, unless otherwise specified:

•“Nasdaq,” “we,” “us” and “our” refer to Nasdaq, Inc.

•“Nasdaq Baltic” refers to collectively, Nasdaq Tallinn AS, Nasdaq Riga, AS, and AB Nasdaq Vilnius.

•“Nasdaq BX” refers to the cash equity exchange operated by Nasdaq BX, Inc.

•“Nasdaq BX Options” refers to the options exchange operated by Nasdaq BX, Inc.

•“Nasdaq Clearing” refers to the clearing operations conducted by Nasdaq Clearing AB.

•“Nasdaq CXC” and “Nasdaq CX2” refer to the Canadian cash equity trading books operated by Nasdaq CXC Limited.

•“Nasdaq First North” refers to our alternative marketplaces for smaller companies and growth companies in the Nordic and Baltic regions.

•“Nasdaq GEMX” refers to the options exchange operated by Nasdaq GEMX, LLC.

•“Nasdaq ISE” refers to the options exchange operated by Nasdaq ISE, LLC.

•“Nasdaq MRX” refers to the options exchange operated by Nasdaq MRX, LLC.

•“Nasdaq Nordic” refers to collectively, Nasdaq Clearing AB, Nasdaq Stockholm AB, Nasdaq Copenhagen A/S, Nasdaq Helsinki Ltd, and Nasdaq Iceland hf.

•“Nasdaq PHLX” refers to the options exchange operated by Nasdaq PHLX LLC.

•“Nasdaq PSX” refers to the cash equity exchange operated by Nasdaq PHLX LLC.

•“The Nasdaq Options Market” refers to the options exchange operated by The Nasdaq Stock Market LLC.

•“The Nasdaq Stock Market” refers to the cash equity exchange and listing venue operated by The Nasdaq Stock Market LLC.

Nasdaq also provides as a tool for the reader the following list of abbreviations and acronyms that are used throughout this Quarterly Report on Form 10-Q.

2022 Revolving Credit Facility: $1.25 billion senior unsecured revolving credit facility, which matures on December 16, 2027, which has replaced the $1.25 billion credit facility issued in 2020

2025 Notes: $500 million aggregate principal amount of 5.650% senior unsecured notes due June 28, 2025

2026 Notes: $500 million aggregate principal amount of 3.850% senior unsecured notes due June 30, 2026

2028 Notes: $1 billion aggregate principal amount of 5.350% senior unsecured notes due June 28, 2028

2029 Notes: €600 million aggregate principal amount of 1.75% senior unsecured notes due March 28, 2029

2030 Notes: €600 million aggregate principal amount of 0.875% senior unsecured notes due February 13, 2030

2031 Notes: $650 million aggregate principal amount of 1.650% senior unsecured notes due January 15, 2031

2032 Notes: €750 million aggregate principal amount of 4.500% senior unsecured notes due February 15, 2032

2033 Notes: €615 million aggregate principal amount of 0.900% senior unsecured notes due July 30, 2033

2034 Notes: $1.25 billion aggregate principal amount of 5.550% senior unsecured notes due February 15, 2034

2040 Notes: $650 million aggregate principal amount of 2.500% senior unsecured notes due December 21, 2040

2050 Notes: $500 million aggregate principal amount of 3.250% senior unsecured notes due April 28, 2050

2052 Notes: $550 million aggregate principal amount of 3.950% senior unsecured notes due March 7, 2052

2053 Notes: $750 million aggregate principal amount of 5.950% senior unsecured notes due August 15, 2053

2063 Notes: $750 million aggregate principal amount of 6.100% senior unsecured notes due June 28, 2063

ARR: Annualized Recurring Revenue

ASC: Accounting Standards Codification

ASU: Accounting Standards Update

AUM: Assets Under Management

CCP: Central Counterparty

CFTC: U.S. Commodity Futures Trading Commission

ESG: Environmental, Social and Governance

EMIR: European Market Infrastructure Regulation

ESPP: Nasdaq Employee Stock Purchase Plan

ETP: Exchange Traded Product

Exchange Act: Securities Exchange Act of 1934, as amended

FASB: Financial Accounting Standards Board

FINRA: Financial Industry Regulatory Authority

IPO: Initial Public Offering

NSCC: National Securities Clearing Corporation

OCC: The Options Clearing Corporation

OTC: Over-the-Counter

PSU: Performance Share Unit

SaaS: Software as a Service

SEC: U.S. Securities and Exchange Commission

ii

SERP: Supplemental Executive Retirement Plan

SPAC: Special Purpose Acquisition Company

SFSA: Swedish Financial Supervisory Authority

SOFR: Secured Overnight Financing Rate

S&P 500: S&P 500 Stock Index

TSR: Total Shareholder Return

U.S. GAAP: U.S. Generally Accepted Accounting Principles

U.S. Tape plans: U.S. cash equity and U.S. options industry data

NASDAQ, the NASDAQ logos, and other brand, service or product names or marks referred to in this report are trademarks or service marks, registered or otherwise, of Nasdaq, Inc. and/or its subsidiaries. FINRA and Trade Reporting Facility are registered trademarks of FINRA.

This Quarterly Report on Form 10-Q includes market share and industry data that we obtained from industry publications and surveys, reports of governmental agencies and internal company surveys. Industry publications and surveys generally state that the information they contain has been obtained from sources believed to be reliable, but we cannot assure you that this information is accurate or complete. We have not independently verified any of the data from third-party sources nor have we ascertained the underlying economic assumptions relied upon therein. Statements as to our market position are based on the most currently available market data. For market comparison purposes, The Nasdaq Stock Market data in this Quarterly Report on Form 10-Q for IPOs and new listings of equity securities (including issuers that switched from other listings venues, closed-end funds and ETPs) is based on data generated internally by us; therefore, the data may not be comparable to other publicly-available IPO data. Data in this Quarterly Report on Form 10-Q for IPOs and new listings of equity securities on the Nasdaq Nordic and Nasdaq Baltic exchanges and Nasdaq First North also is based on data generated internally by us. IPOs and new listings data is presented as of period end. While we are not aware of any misstatements regarding industry data presented herein, our estimates involve risks and uncertainties and are subject to change based on various factors. We refer you to the “Risk Factors” section in our Form 10-K for the fiscal year ended December 31, 2023 that was filed with the SEC on February 21, 2024.

Nasdaq intends to use its website, ir.nasdaq.com, as a means for disclosing material non-public information and for complying with SEC Regulation FD and other disclosure obligations.

iii

Forward-Looking Statements

The SEC encourages companies to disclose forward-looking information so that investors can better understand a company’s future prospects and make informed investment decisions. This Quarterly Report on Form 10-Q contains these types of statements. Words such as “may,” “will,” “could,” “should,” “anticipates,” “envisions,” “estimates,” “expects,” “projects,” “intends,” “plans,” “believes” and words or terms of similar substance used in connection with any discussion of future expectations as to industry and regulatory developments or business initiatives and strategies, future operating results or financial performance, and other future developments are intended to identify forward-looking statements. These include, among others, statements relating to:

•our strategic direction, including changes to our corporate structure;

•the integration of acquired businesses, including accounting decisions relating thereto;

•the scope, nature or impact of acquisitions, divestitures, investments, joint ventures or other transactional activities;

•the effective dates for, and expected benefits of, ongoing initiatives, including transactional activities and other strategic, restructuring, technology, ESG, de-leveraging and capital return initiatives;

•our products and services;

•the impact of pricing changes;

•tax matters;

•the cost and availability of liquidity and capital; and

•any litigation, or any regulatory or government investigation or action, to which we are or could become a party or which may affect us and any potential settlements of litigation, regulatory or governmental investigations or actions, including with respect to our CFTC investigation.

Forward-looking statements involve risks and uncertainties. Factors that could cause actual results to differ materially from those contemplated by the forward-looking statements include, among others, the following:

•our operating results may be lower than expected;

•our ability to successfully integrate acquired businesses or divest sold businesses or assets, including the fact that any integration or transition may be more difficult, time consuming or costly than expected, and we may be unable to realize synergies from business combinations, acquisitions, divestitures or other transactional activities;

•loss of significant trading and clearing volumes or values, fees, market share, listed companies, market data customers or other customers;

•our ability to develop and grow our non-trading businesses;

•our ability to keep up with rapid technological advances, including our ability to effectively manage the development and use of artificial intelligence in certain of our products and offerings, and adequately address cybersecurity risks;

•economic, political and market conditions and fluctuations, including inflation, interest rate and foreign currency risk inherent in U.S. and international operations, and geopolitical instability;

•the performance and reliability of our technology and technology of third parties on which we rely;

•any significant systems failures or errors in our operational processes;

•our ability to continue to generate cash and manage our indebtedness; and

•adverse changes that may occur in the litigation or regulatory areas, or in the securities markets generally, or increased regulatory oversight domestically or internationally.

Most of these factors are difficult to predict accurately and are generally beyond our control. You should consider the uncertainty and any risk related to forward-looking statements that we make. These risk factors are more fully described in the “Risk Factors” section in our Form 10-K filed with the SEC on February 21, 2024. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this report. You should carefully read this entire Quarterly Report on Form 10-Q, including “Part I. Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the condensed consolidated financial statements and the related notes. Except as required by the federal securities laws, we undertake no obligation to update any forward-looking statement, release publicly any revisions to any forward-looking statements or report the occurrence of unanticipated events. For any forward-looking statements contained in any document, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995.

iv

PART I - FINANCIAL INFORMATION

Item 1. Financial Statements

Nasdaq, Inc.

Condensed Consolidated Balance Sheets

(in millions, except share and par value amounts)

| March 31, 2024 | December 31, 2023 | ||||||||||

| (unaudited) | |||||||||||

| Assets | |||||||||||

| Current assets: | |||||||||||

| Cash and cash equivalents | $ | $ | |||||||||

| Restricted cash and cash equivalents | |||||||||||

Default funds and margin deposits (including restricted cash and cash equivalents of $ | |||||||||||

| Financial investments | |||||||||||

| Receivables, net | |||||||||||

| Other current assets | |||||||||||

| Total current assets | |||||||||||

| Property and equipment, net | |||||||||||

| Goodwill | |||||||||||

| Intangible assets, net | |||||||||||

| Operating lease assets | |||||||||||

| Other non-current assets | |||||||||||

| Total assets | $ | $ | |||||||||

| Liabilities | |||||||||||

| Current liabilities: | |||||||||||

| Accounts payable and accrued expenses | $ | $ | |||||||||

| Section 31 fees payable to SEC | |||||||||||

| Accrued personnel costs | |||||||||||

| Deferred revenue | |||||||||||

| Other current liabilities | |||||||||||

| Default funds and margin deposits | |||||||||||

| Short-term debt | |||||||||||

| Total current liabilities | |||||||||||

| Long-term debt | |||||||||||

| Deferred tax liabilities, net | |||||||||||

| Operating lease liabilities | |||||||||||

| Other non-current liabilities | |||||||||||

| Total liabilities | |||||||||||

| Commitments and contingencies | |||||||||||

| Equity | |||||||||||

| Nasdaq stockholders’ equity: | |||||||||||

Common stock, $ | |||||||||||

| Additional paid-in capital | |||||||||||

Common stock in treasury, at cost: | ( | ( | |||||||||

| Accumulated other comprehensive loss | ( | ( | |||||||||

| Retained earnings | |||||||||||

| Total Nasdaq stockholders’ equity | |||||||||||

| Noncontrolling interests | |||||||||||

| Total equity | |||||||||||

| Total liabilities and equity | $ | $ | |||||||||

See accompanying notes to condensed consolidated financial statements.

1

Nasdaq, Inc.

Condensed Consolidated Statements of Income

(unaudited)

(in millions, except per share amounts)

| Three Months Ended March 31, | |||||||||||

| 2024 | 2023 | ||||||||||

| Revenues: | |||||||||||

| Capital Access Platforms | $ | $ | |||||||||

| Financial Technology | |||||||||||

Market Services | |||||||||||

| Other revenues | |||||||||||

| Total revenues | |||||||||||

| Transaction-based expenses: | |||||||||||

| Transaction rebates | ( | ( | |||||||||

| Brokerage, clearance and exchange fees | ( | ( | |||||||||

| Revenues less transaction-based expenses | |||||||||||

| Operating expenses: | |||||||||||

| Compensation and benefits | |||||||||||

| Professional and contract services | |||||||||||

| Computer operations and data communications | |||||||||||

| Occupancy | |||||||||||

| General, administrative and other | |||||||||||

| Marketing and advertising | |||||||||||

| Depreciation and amortization | |||||||||||

| Regulatory | |||||||||||

| Merger and strategic initiatives | |||||||||||

| Restructuring charges | |||||||||||

| Total operating expenses | |||||||||||

| Operating income | |||||||||||

| Interest income | |||||||||||

| Interest expense | ( | ( | |||||||||

Other income | |||||||||||

Net income from unconsolidated investees | |||||||||||

| Income before income taxes | |||||||||||

| Income tax provision | |||||||||||

| Net income | |||||||||||

| Net loss attributable to noncontrolling interests | |||||||||||

| Net income attributable to Nasdaq | $ | $ | |||||||||

| Per share information: | |||||||||||

| Basic earnings per share | $ | $ | |||||||||

| Diluted earnings per share | $ | $ | |||||||||

| Cash dividends declared per common share | $ | $ | |||||||||

See accompanying notes to condensed consolidated financial statements.

2

Nasdaq, Inc.

Condensed Consolidated Statements of Comprehensive Income

(unaudited)

(in millions)

| Three Months Ended March 31, | |||||||||||

| 2024 | 2023 | ||||||||||

| Net income | $ | $ | |||||||||

Other comprehensive income (loss): | |||||||||||

Foreign currency translation losses | ( | ( | |||||||||

Income tax benefit (expense)(1) | ( | ||||||||||

| Foreign currency translation, net | ( | ( | |||||||||

Net unrealized loss from cash flow hedges | ( | ||||||||||

Employee benefit plan adjustment | |||||||||||

| Employee benefit plan income tax provision | ( | ||||||||||

| Employee benefit plan, net | |||||||||||

Total other comprehensive loss, net of tax | ( | ( | |||||||||

| Comprehensive income | |||||||||||

| Comprehensive loss attributable to noncontrolling interests | |||||||||||

| Comprehensive income attributable to Nasdaq | $ | $ | |||||||||

____________

(1) Primarily relates to the tax effect of unrealized gains and losses on Euro denominated notes.

See accompanying notes to condensed consolidated financial statements.

3

Nasdaq, Inc.

Condensed Consolidated Statements of Changes in Stockholders’ Equity

(unaudited)

(in millions)

| Three Months Ended March 31, | |||||||||||||||||||||||

2024 | 2023 | ||||||||||||||||||||||

| Shares | $ | Shares | $ | ||||||||||||||||||||

| Common stock | |||||||||||||||||||||||

| Additional paid-in capital | |||||||||||||||||||||||

| Beginning balance | |||||||||||||||||||||||

| Share repurchase program | — | — | ( | ( | |||||||||||||||||||

| Share-based compensation | |||||||||||||||||||||||

| Ending balance | |||||||||||||||||||||||

| Common stock in treasury, at cost | |||||||||||||||||||||||

| Beginning balance | ( | ( | |||||||||||||||||||||

| Other employee stock activity | — | ( | ( | ( | |||||||||||||||||||

| Ending balance | ( | ( | |||||||||||||||||||||

| Accumulated other comprehensive loss | |||||||||||||||||||||||

| Beginning balance | ( | ( | |||||||||||||||||||||

Other comprehensive loss | ( | ( | |||||||||||||||||||||

| Ending balance | ( | ( | |||||||||||||||||||||

| Retained earnings | |||||||||||||||||||||||

| Beginning balance | |||||||||||||||||||||||

| Net income attributable to Nasdaq | |||||||||||||||||||||||

Cash dividends declared and paid | ( | ( | |||||||||||||||||||||

| Ending balance | |||||||||||||||||||||||

| Total Nasdaq stockholders’ equity | |||||||||||||||||||||||

| Noncontrolling interests | |||||||||||||||||||||||

| Beginning balance | |||||||||||||||||||||||

Net activity related to noncontrolling interests | ( | ( | |||||||||||||||||||||

| Ending balance | |||||||||||||||||||||||

| Total Equity | $ | $ | |||||||||||||||||||||

See accompanying notes to condensed consolidated financial statements.

4

Nasdaq, Inc.

Condensed Consolidated Statements of Cash Flows

(unaudited)

(in millions)

| Three Months Ended March 31, | |||||||||||

| 2024 | 2023 | ||||||||||

| Cash flows from operating activities: | |||||||||||

| Net income | $ | $ | |||||||||

| Adjustments to reconcile net income to net cash provided by operating activities: | |||||||||||

| Depreciation and amortization | |||||||||||

| Share-based compensation | |||||||||||

| Deferred income taxes | ( | ||||||||||

| Non-cash restructuring charges | |||||||||||

Net income from unconsolidated investees | ( | ( | |||||||||

| Other reconciling items included in net income | |||||||||||

Net change in operating assets and liabilities: | |||||||||||

| Receivables, net | ( | ||||||||||

| Other assets | ( | ||||||||||

| Accounts payable and accrued expenses | ( | ( | |||||||||

| Section 31 fees payable to SEC | ( | ( | |||||||||

| Accrued personnel costs | ( | ( | |||||||||

| Deferred revenue | |||||||||||

| Other liabilities | |||||||||||

| Net cash provided by operating activities | |||||||||||

| Cash flows from investing activities: | |||||||||||

| Purchases of securities | ( | ( | |||||||||

| Proceeds from sales and redemptions of securities | |||||||||||

| Purchases of property and equipment | ( | ( | |||||||||

Investments related to default funds and margin deposits, net(1) | ( | ( | |||||||||

| Other investing activities | ( | ||||||||||

Net cash used in investing activities | ( | ( | |||||||||

| Cash flows from financing activities: | |||||||||||

Repayments of commercial paper, net | ( | ( | |||||||||

Repayments of term loan | ( | ||||||||||

| Repurchases of common stock | ( | ||||||||||

| Dividends paid | ( | ( | |||||||||

| Payments related to employee shares withheld for taxes | ( | ( | |||||||||

| Default funds and margin deposits | ( | ||||||||||

| Other financing activities | ( | ||||||||||

Net cash used in financing activities | ( | ( | |||||||||

| Effect of exchange rate changes on cash and cash equivalents and restricted cash and cash equivalents | ( | ||||||||||

Net decrease in cash and cash equivalents and restricted cash and cash equivalents | ( | ( | |||||||||

Cash and cash equivalents, restricted cash and cash equivalents at beginning of period | |||||||||||

| Cash and cash equivalents, restricted cash and cash equivalents at end of period | $ | $ | |||||||||

| Reconciliation of Cash, Cash Equivalents and Restricted Cash and Cash Equivalents | |||||||||||

| Cash and cash equivalents | $ | $ | |||||||||

| Restricted cash and cash equivalents | |||||||||||

| Restricted cash and cash equivalents (default funds and margin deposits) | |||||||||||

| Total | $ | $ | |||||||||

| Supplemental Disclosure Cash Flow Information | |||||||||||

| Interest paid | $ | $ | |||||||||

| Income taxes paid, net of refund | $ | $ | |||||||||

(1) Includes purchases and proceeds from sales and redemptions related to the default funds and margin deposits of our clearing operations. For further information, see "Default Fund Contributions and Margin Deposits," within Note 14, "Clearing Operations."

See accompanying notes to condensed consolidated financial statements.

5

Nasdaq, Inc.

Notes to Condensed Consolidated Financial Statements

(Unaudited)

1. ORGANIZATION AND NATURE OF OPERATIONS

Nasdaq is a global technology company serving corporate clients, investment managers, banks, brokers, and exchange operators as they navigate and interact with the global capital markets and the broader financial system. We aspire to deliver world-leading platforms that improve the liquidity, transparency, and integrity of the global economy. Our diverse offering of data, analytics, software, exchange capabilities, and client-centric services enables clients to optimize and execute their business vision with confidence.

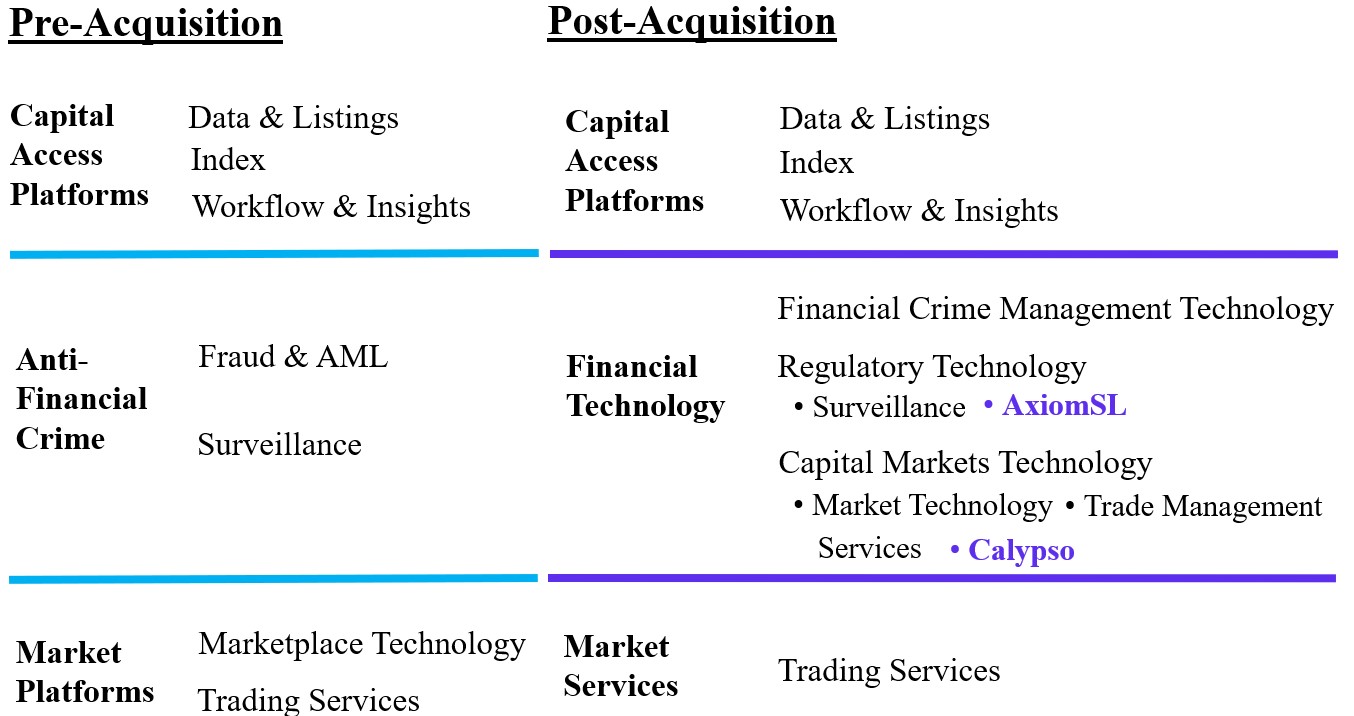

In the fourth quarter of 2023, following the completion of the Adenza Holdings, Inc., or Adenza, acquisition, including its two flagship solutions, AxiomSL and Calypso, we further aligned our business more closely with the foundational shifts that are driving the evolution of the global financial system. We now manage, operate and provide our products and services in three business segments: Capital Access Platforms, Financial Technology and Market Services. The divisional structure, which was implemented during the fourth quarter of 2023, is as follows:

Capital Access Platforms

Our Capital Access Platforms segment comprises Data & Listing Services, Index and Workflow & Insights.

Our Data business distributes historical and real-time market data to sell-side customers, the institutional investing community, retail online brokers, proprietary trading firms and other venues, as well as internet portals and data distributors. Our data products can enhance the transparency of market activity within our exchanges and provide critical information to professional and non-professional investors globally.

Our Listing Services business operates listing platforms in the U.S. and Europe to provide multiple global capital raising solutions for public companies. Our main listing markets are The Nasdaq Stock Market and the Nasdaq Nordic and Nasdaq Baltic exchanges. Through Nasdaq First North, our Nordic and Baltic operations also offer alternative marketplaces for smaller companies and growth companies.

As of March 31, 2024, a total of 5,223 companies listed securities on our U.S., Nasdaq Nordic, Nasdaq Baltic and Nasdaq First North exchanges. As of March 31, 2024, there were 4,020 total listings on The Nasdaq Stock Market, including 619 ETPs. The combined market capitalization in the U.S. was approximately $29.4 trillion. In Europe, the Nasdaq Nordic and Nasdaq Baltic exchanges, together with Nasdaq First North, were home to 1,203 listed companies with a combined market capitalization of approximately $2.2 trillion.

Our Index business develops and licenses Nasdaq-branded indices and financial products. We also license cash-settled options, futures and options on futures on our indices. As of March 31, 2024, 361 ETPs listed on 27 exchanges in over 20 countries tracked a Nasdaq index and accounted for $519 billion in AUM.

Workflow & Insights includes our analytics and corporate solutions businesses. Our analytics business provides asset managers, investment consultants and institutional asset owners with information and analytics to make data-driven investment decisions, deploy their resources more productively, and provide liquidity solutions for private funds. Through our eVestment and Solovis solutions, we provide a suite of cloud-based solutions that help institutional investors and consultants conduct pre-investment due diligence, and monitor their portfolios post-investment. The eVestment platform also enables asset managers to efficiently distribute information about their firms and funds to asset owners and consultants worldwide.

Through our Solovis platform, endowments, foundations, pensions and family offices transform how they collect and aggregate investment data, analyze portfolio performance, model and predict future outcomes, and share meaningful portfolio insights with key stakeholders. The Nasdaq Fund Network and Nasdaq Data Link are additional platforms in our suite of investment data analytics offerings and data management tools.

Our corporate solutions business serves both public and private companies and organizations through our Investor Relations Intelligence, ESG Solutions and Governance Solutions products. Our public company clients can be companies listed on our exchanges or other U.S. and global exchanges. Our private company clients include a diverse group of organizations ranging from family-owned companies, government organizations, law firms, privately held entities, and various non-profit organizations to hospitals and healthcare systems. We help organizations enhance their ability to understand and expand their global shareholder base, improve corporate governance, and navigate the evolving ESG landscape through our suite of advanced technology, analytics, reporting and consulting services.

6

Financial Technology

Our Financial Technology segment comprises Financial Crime Management Technology, Regulatory Technology and Capital Markets Technology solutions.

Financial Crime Management Technology includes our Verafin solution, a cloud-based platform to help financial institutions detect, investigate, and report money laundering and financial fraud.

Regulatory Technology comprises our surveillance and AxiomSL solutions. Our surveillance solutions are designed for banks, brokers and other market participants to assist them in complying with market abuse and integrity rules and regulations. In addition, we provide regulators and exchanges with a platform for surveillance. AxiomSL is a global leader in risk data management and regulatory reporting solutions for the financial industry, including banks, broker dealers and asset managers. Its unique enterprise data management platform delivers data lineage, risk aggregation, analytics, workflow automation, reconciliation, validation and audit functionality, as well as disclosures. AxiomSL’s platform supports compliance across a wide range of global and local regulations.

Capital Markets Technology includes market technology, trade management services and Calypso. Our market technology business is a leading global technology solutions provider and partner to exchanges, clearing organizations, central securities depositories, regulators, banks, brokers, buy-side firms and corporate businesses. Our market technology solutions are utilized by leading markets in North America, Europe and Asia as well as emerging markets in the Middle East, Latin America, and Africa. Our trade management services provide market participants with a wide variety of alternatives for connecting to and accessing our markets for a fee. Our marketplaces may be accessed via a number of different protocols used for quoting, order entry, trade reporting and connectivity to various data feeds. We also provide colocation services to market participants, whereby we offer firms cabinet space and power to house their own equipment and servers within our data centers. Additionally, we offer a number of wireless connectivity offerings between select data centers using millimeter wave and microwave technology. Calypso is a leading provider of front-to-back technology solutions for the financial markets. The Calypso platform provides customers with a single platform designed from the outset to enable consolidation, innovation and growth.

Market Services

Our Market Services segment includes revenues from equity derivatives trading, cash equity trading, Nordic fixed income trading & clearing, Nordic commodities and U.S. Tape plans data. We operate 19 exchanges across several asset classes, including derivatives, commodities, cash equity, debt, structured products and ETPs. In addition, in certain countries where we operate exchanges, we also provide clearing, settlement and central depository services. In June

2023, we entered into an agreement to sell our European energy trading and clearing business, subject to regulatory approval. Revenues from this business are reflected in Other Revenues in the Condensed Consolidated Statements of Income for all periods, and in our Corporate segment for our segment disclosures. Additionally, certain data revenues from this business that were previously included in our Capital Access Platforms segment are also reflected in Other Revenues in the Condensed Consolidated Statements of Income for all periods, and in our Corporate segment for our segment disclosures.

Our transaction-based platforms provide market participants with the ability to access, process, display and integrate orders and quotes. The platforms allow the routing and execution of buy and sell orders as well as the reporting of transactions, providing fee-based revenues.

2. BASIS OF PRESENTATION AND PRINCIPLES OF CONSOLIDATION

The condensed consolidated financial statements are prepared in accordance with U.S. GAAP and include the accounts of Nasdaq, its wholly-owned subsidiaries and other entities in which Nasdaq has a controlling financial interest. When we do not have a controlling interest in an entity, but exercise significant influence over the entity’s operating and financial policies, such investment is accounted for under the equity method of accounting. We recognize our share of earnings or losses of an equity method investee based on our ownership percentage. See “Equity Method Investments,” of Note 6, “Investments,” for further discussion of our equity method investments.

The accompanying condensed consolidated financial statements reflect all adjustments which are, in the opinion of management, necessary for a fair statement of the results. These adjustments are of a normal recurring nature. All significant intercompany accounts and transactions have been eliminated in consolidation.

As permitted under U.S. GAAP, certain footnotes or other financial information can be condensed or omitted in the interim condensed consolidated financial statements. The information included in this Quarterly Report on Form 10-Q should be read in conjunction with the consolidated financial statements and accompanying notes included in Nasdaq’s Form 10-K. The year-end balance sheet data was derived from the audited financial statements, but does not include all disclosures required by U.S. GAAP.

Certain prior year amounts have been reclassified to conform to the current year presentation.

Accounting Estimates

In preparing our condensed consolidated financial statements, we make assumptions, judgments and estimates that can have a significant impact on our revenues, operating income and net income, as well as on the value of certain assets and liabilities in our Condensed Consolidated Balance Sheets. At least quarterly, we evaluate our assumptions, judgments and estimates, and make changes as deemed necessary.

7

Recent Accounting Developments

In November 2023, the FASB issued ASU 2023-07, “Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures.” ASU 2023-07 requires disclosure of significant segment expenses that are regularly provided to the chief operating decision maker ("CODM") and included within the segment measure of profit or loss, an amount and description of its composition for other segment items to reconcile to segment profit or loss, and the title and position of the entity’s CODM and an explanation of how the CODM uses the reported measure of segment profit or loss in assessing segment performance and deciding how to allocate resources. ASU 2023-07 will be applied retrospectively and is effective for annual reporting periods in fiscal years beginning after December 15, 2023, and interim reporting periods in fiscal years beginning after December 31, 2024. We are currently reviewing the impact that the adoption of ASU 2023-07 may have on our consolidated financial statements and disclosures.

Subsequent Events

3. REVENUE FROM CONTRACTS WITH CUSTOMERS

Disaggregation of Revenue

The following table summarizes the disaggregation of revenue by major product and service and by segment for the three months ended March 31, 2024 and 2023:

| Three Months Ended March 31, | |||||||||||

2024 | 2023 | ||||||||||

| (in millions) | |||||||||||

| Capital Access Platforms | |||||||||||

| Data & Listing Services | $ | $ | |||||||||

| Index | |||||||||||

| Workflow & Insights | |||||||||||

| Financial Technology | |||||||||||

| Financial Crime Management Technology | |||||||||||

Regulatory Technology | |||||||||||

Capital Markets Technology | |||||||||||

Market Services, net | |||||||||||

| Other revenues | |||||||||||

| Revenues less transaction-based expenses | $ | $ | |||||||||

Substantially all revenues from the Capital Access Platforms segment were recognized over time for the three months ended March 31, 2024 and 2023. For the three months ended March 31, 2024, 12.2 % of Regulatory Technology revenues, related to AxiomSL, were recognized at a point in time and 11.3 % of Capital Markets Technology revenues, related to Calypso, were recognized at a point in time. The remaining Financial Technology revenues were recognized over time. For the three months ended March 31, 2024 and 2023 approximately 97.3 %, and 93.3 %, respectively, of Market Services revenues were recognized at a point in time and 2.7 %, and 6.7 %, respectively, were recognized over time.

Contract Balances

Substantially all of our revenues are considered to be revenues from contracts with customers. The related accounts receivable balances are recorded in our Condensed Consolidated Balance Sheets as receivables, which are net of allowance for doubtful accounts of $18

For the majority of our contracts with customers, except for our market technology and listing services contracts, our performance obligations range from three months to three years and there is no significant variable consideration.

Deferred revenue is the only significant contract asset or liability as of March 31, 2024. Deferred revenue represents consideration received that is yet to be recognized as revenue for unsatisfied performance obligations. Deferred revenue primarily represents our contract liabilities related to our fees for Annual and Initial Listings, Workflow & Insights, Financial Crime Management Technology, Regulatory Technology and Capital Markets Technology contracts. See Note 7, “Deferred Revenue,” for our discussion on deferred revenue balances, activity, and expected timing of recognition.

We do not provide disclosures about transaction price allocated to unsatisfied performance obligations if contract durations are less than one year. For our initial listings, the transaction price allocated to remaining performance obligations is included in deferred revenue, and therefore not included below. For our Financial Crime Management Technology, Regulatory Technology, Capital Markets Technology and Workflow & Insights contracts, the portion of transaction price allocated to unsatisfied performance obligations is presented in the table below. To the extent consideration has been received, unsatisfied performance obligations would be included in the table below as well as deferred revenue.

8

The following table summarizes the amount of the transaction price allocated to performance obligations that are unsatisfied, for contract durations greater than one year, as of March 31, 2024:

| Financial Crime Management Technology | Regulatory Technology | Capital Markets Technology | Workflow & Insights | Total | |||||||||||||||||||||||||

| (in millions) | |||||||||||||||||||||||||||||

Remainder of 2024 | $ | $ | $ | $ | $ | ||||||||||||||||||||||||

| 2025 | |||||||||||||||||||||||||||||

| 2026 | |||||||||||||||||||||||||||||

| 2027 | |||||||||||||||||||||||||||||

| 2028 | |||||||||||||||||||||||||||||

| 2029+ | |||||||||||||||||||||||||||||

| Total | $ | $ | $ | $ | $ | ||||||||||||||||||||||||

4. ACQUISITION

2023 Acquisition

In June 2023, we entered into a definitive agreement to acquire Adenza, a provider of mission-critical risk management and regulatory software to the financial services industry, for $5.75 billion in cash (subject to customary post-closing adjustments) and a fixed amount of 85.6 million shares of Nasdaq common stock, based on the volume-weighted average price per share over 15 consecutive trading days prior to signing. Nasdaq issued approximately $5.0 billion of debt, and entered into a $600 million term loan, and used the proceeds for the cash portion of the consideration. See “Senior Unsecured Notes” and “2023 Term Loan” in “Financing of the Adenza Acquisition” of Note 8, “Debt Obligations,” for further discussion.

On November 1, 2023, Nasdaq completed the acquisition of Adenza for a total purchase consideration of $9,984 million, which comprises the following:

(in millions, except price per share) | |||||

Shares of Nasdaq common stock issued | |||||

Closing price per share of Nasdaq common stock on November 1, 2023 | $ | ||||

Fair value of equity portion of the purchase consideration | $ | ||||

Cash consideration | $ | ||||

Total purchase consideration | $ | ||||

At the closing of the transaction, the 85.6 million shares of Nasdaq common stock were issued to Thoma Bravo, the sole shareholder of Adenza, and represented approximately 15 % of the outstanding shares of Nasdaq. For further discussion on the rights of common stockholders refer to “Common Stock” of Note 11, “Nasdaq Stockholders’ Equity.” Adenza is part of our Financial Technology segment.

The amounts in the table below represent the preliminary allocation of the purchase price to the acquired intangible assets, the deferred tax liability on the acquired intangible assets and other assets acquired and liabilities assumed based on their preliminary respective estimated fair values on the date of acquisition. These amounts are subject to revision during the remainder of the measurement period, a period not to exceed 12 months from the acquisition date.

Adjustments to the provisional values, which may include tax and other estimates, during the measurement period will be recorded in the reporting period in which the adjustment amounts are determined. Changes to amounts recorded as assets and liabilities may result in a corresponding adjustment to goodwill.

The excess purchase price over the net tangible and acquired intangible assets has been recorded as goodwill. The goodwill recognized is attributable primarily to expected synergies and is assigned to our Financial Technology segment.

(in millions) | |||||

| Goodwill | $ | ||||

Acquired intangible assets | |||||

Receivables, net | |||||

Other net assets acquired | |||||

Cash and cash equivalents | |||||

Accrued personnel costs | ( | ||||

Deferred revenue | ( | ||||

Deferred tax liability on acquired intangible assets | ( | ||||

Total purchase consideration | $ | ||||

Intangible Assets

The following table presents the details of acquired intangible assets at the date of acquisition. Acquired intangible assets with finite lives are amortized using the straight-line method.

Customer Relationships | Technology | Trade Names | Total Acquired Intangible Assets | |||||||||||

| Intangible asset value (in millions) | $ | $ | $ | $ | ||||||||||

| Discount rate used | % | % | % | |||||||||||

| Estimated average useful life | ||||||||||||||

Customer Relationships

Customer relationships represent the contractual relationships with customers.

Methodology

Customer relationships were valued using the income approach, specifically an excess earnings method. The excess earnings method examines the economic returns contributed by the identified tangible and intangible assets of a company, and then isolates the excess return that is attributable to the intangible asset being valued.

9

Discount Rate

The discount rate used reflects the amount of risk associated with the hypothetical cash flows for the customer relationships relative to the overall business. In developing a discount rate for the customer relationships, we estimated a weighted-average cost of capital for the overall business and we utilized this rate as an input when discounting the cash flows. The resulting discounted cash flows were then tax-effected at the applicable statutory rate.

A discounted tax amortization benefit was added to the fair value of the assets under the assumption that the customer relationships would be amortized for tax purposes over a period of 15 years.

Technology

As part of our acquisition of Adenza, we acquired developed technology relating to AxiomSL and Calypso.

Methodology

The developed technology was valued using the income approach, specifically the relief-from-royalty method, which is used to estimate the cost savings that accrue to the owner of an intangible asset who would otherwise have to pay royalties or license fees on revenues earned through the use of the asset. The royalty rate is applied to the projected revenue over the expected remaining life of the intangible asset to estimate royalty savings. The net after-tax royalty savings are calculated for each year in the remaining economic life of the technology and discounted to present value.

Discount Rate

The discount rate used reflects the amount of risk associated with the hypothetical cash flows for the developed technology relative to the overall business as discussed above in “Customer Relationships.”

Trade Name

As part of our acquisition of Adenza, we acquired the AxiomSL and Calypso trade names. The trade names are recognized in the industry and carry a reputation for quality. As such, the reputation and positive recognition embodied in the trade names is a valuable asset to Nasdaq.

Methodology

The AxiomSL and Calypso trade names were valued using the income approach, specifically the relief-from-royalty method as discussed above in “Technology.”

Discount Rate

The discount rate used reflects the amount of risk associated with the hypothetical cash flows for the trade name relative to the overall business as discussed above in “Customer Relationships.”

5. GOODWILL AND ACQUIRED INTANGIBLE ASSETS

Goodwill

The following table presents the changes in goodwill by business segment during the three months ended March 31, 2024:

| (in millions) | |||||

| Capital Access Platforms | |||||

| Balance at December 31, 2023 | $ | ||||

| Foreign currency translation adjustments | ( | ||||

| Balance at March 31, 2024 | $ | ||||

Financial Technology | |||||

| Balance at December 31, 2023 | $ | ||||

| Foreign currency translation adjustments | ( | ||||

| Balance at March 31, 2024 | $ | ||||

Market Services | |||||

| Balance at December 31, 2023 | $ | ||||

| Foreign currency translation adjustments | ( | ||||

| Balance at March 31, 2024 | $ | ||||

| Total | |||||

| Balance at December 31, 2023 | $ | ||||

| Foreign currency translation adjustments | ( | ||||

| Balance at March 31, 2024 | $ | ||||

Goodwill represents the excess of purchase price over the value assigned to the net assets, including identifiable intangible assets, of a business acquired. Goodwill is allocated to our reporting units based on the assignment of the fair values of each reporting unit of the acquired company. We test goodwill for impairment at the reporting unit level annually, or in interim periods if certain events occur indicating that the carrying amount may be impaired, such as changes in the business climate, poor indicators of operating performance or the sale or disposition of a significant portion of a reporting unit. There was no

10

Acquired Intangible Assets

The following table presents details of our total acquired intangible assets, both finite- and indefinite-lived:

| March 31, 2024 | December 31, 2023 | ||||||||||

| Finite-Lived Intangible Assets | (in millions) | ||||||||||

| Gross Amount | |||||||||||

| Technology | $ | $ | |||||||||

| Customer relationships | |||||||||||

| Trade names and other | |||||||||||

| Foreign currency translation adjustment | ( | ( | |||||||||

| Total gross amount | $ | $ | |||||||||

| Accumulated Amortization | |||||||||||

| Technology | $ | ( | $ | ( | |||||||

| Customer relationships | ( | ( | |||||||||

| Trade names and other | ( | ( | |||||||||

| Foreign currency translation adjustment | |||||||||||

| Total accumulated amortization | $ | ( | $ | ( | |||||||

| Net Amount | |||||||||||

| Technology | $ | $ | |||||||||

| Customer relationships | |||||||||||

| Trade names and other | |||||||||||

| Foreign currency translation adjustment | ( | ( | |||||||||

| Total finite-lived intangible assets | $ | $ | |||||||||

| Indefinite-Lived Intangible Assets | |||||||||||

| Exchange and clearing registrations | $ | $ | |||||||||

| Trade names | |||||||||||

| Licenses | |||||||||||

| Foreign currency translation adjustment | ( | ( | |||||||||

| Total indefinite-lived intangible assets | $ | $ | |||||||||

| Total intangible assets, net | $ | $ | |||||||||

There was no

The following table presents our amortization expense for acquired finite-lived intangible assets:

| Three Months Ended March 31, | |||||||||||

| 2024 | 2023 | ||||||||||

| (in millions) | |||||||||||

| Amortization expense | $ | $ | |||||||||

The table below presents the estimated future amortization expense (excluding the impact of foreign currency translation adjustments of $82 million as of March 31, 2024) of acquired finite-lived intangible assets as of March 31, 2024:

| (in millions) | |||||

Remainder of 2024 | $ | ||||

| 2025 | |||||

| 2026 | |||||

| 2027 | |||||

| 2028 | |||||

| 2029+ | |||||

| Total | $ | ||||

6. INVESTMENTS

The following table presents the details of our investments:

| March 31, 2024 | December 31, 2023 | ||||||||||

| (in millions) | |||||||||||

Financial investments | $ | $ | |||||||||

| Equity method investments | |||||||||||

| Equity securities | |||||||||||

Financial Investments

Financial investments are comprised of trading securities, primarily highly rated European government debt securities, of which $160 million as of March 31, 2024 and $168 million as of December 31, 2023 are assets primarily utilized to meet regulatory capital requirements, mainly for our clearing operations at Nasdaq Clearing.

Equity Method Investments

We record our estimated pro-rata share of earnings or losses each reporting period and record any dividends as a reduction in the investment balance. As of March 31, 2024 and 2023, our equity method investments primarily included our 40.0

The carrying amounts of our equity method investments are included in other non-current assets in the Condensed Consolidated Balance Sheets. No

Net income recognized from our equity interest in the earnings and losses of these equity method investments, primarily OCC, was $3 million and $14 million for the three months ended March 31, 2024 and 2023, respectively.

11

Equity Securities

The carrying amounts of our equity securities are included in other non-current assets in the Condensed Consolidated Balance Sheets. We elected the measurement alternative for substantially all of our equity securities as they do not have a readily determinable fair value. No material adjustments were made to the carrying value of our equity securities for the three months ended March 31, 2024 and 2023. As of March 31, 2024 and December 31, 2023, our equity securities primarily represent various strategic minority investments made through our corporate venture program.

7. DEFERRED REVENUE

Deferred revenue represents consideration received that is yet to be recognized as revenue. The changes in our deferred revenue during the three months ended March 31, 2024 are reflected in the following table:

| Balance at December 31, 2023 | Additions | Revenue Recognized | Adjustments | Balance at March 31, 2024 | |||||||||||||

| (in millions) | |||||||||||||||||

| Capital Access Platforms: | |||||||||||||||||

| Initial Listings | $ | $ | $ | ( | $ | ( | $ | ||||||||||

| Annual Listings | ( | ( | |||||||||||||||

| Workflow & Insights | ( | ||||||||||||||||

| Financial Technology: | |||||||||||||||||

| Financial Crime Management Technology | ( | ( | |||||||||||||||

Regulatory Technology | ( | ( | |||||||||||||||

Capital Markets Technology | ( | ( | |||||||||||||||

| Other | ( | ( | |||||||||||||||

| Total | $ | $ | $ | ( | $ | ( | $ | ||||||||||

In the above table:

•Additions reflect deferred revenue billed in the current period, net of recognition.

•Revenue recognized includes revenue recognized during the current period that was included in the beginning balance.

•Adjustments reflect foreign currency translation adjustments.

As of March 31, 2024, we estimate that our deferred revenue will be recognized in the following years:

Fiscal year ended: | 2024 | 2025 | 2026 | 2027 | 2028 | 2029+ | Total | ||||||||||||||||

| (in millions) | |||||||||||||||||||||||

| Capital Access Platforms: | |||||||||||||||||||||||

| Initial Listings | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||

| Annual Listings | |||||||||||||||||||||||

| Workflow & Insights | |||||||||||||||||||||||

| Financial Technology: | |||||||||||||||||||||||

| Financial Crime Management Technology | |||||||||||||||||||||||

| Regulatory Technology | |||||||||||||||||||||||

| Capital Markets Technology | |||||||||||||||||||||||

| Other | |||||||||||||||||||||||

| Total | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||

In the above table, 2024 represents the remaining nine months of 2024.

12

8. DEBT OBLIGATIONS

The following table presents the carrying amounts of our debt outstanding, net of unamortized debt issuance costs:

| March 31, 2024 | December 31, 2023 | ||||||||||

| Short-term debt: | (in millions) | ||||||||||

| Commercial paper | $ | $ | |||||||||

| Long-term debt - senior unsecured notes: | |||||||||||

2025 Notes, $ | |||||||||||

2026 Notes, $ | |||||||||||

2028 Notes, $ | |||||||||||

2029 Notes, € | |||||||||||

2030 Notes, € | |||||||||||

2031 Notes, $ | |||||||||||

2032 Notes, € | |||||||||||

2033 Notes, € | |||||||||||

2034 Notes $ | |||||||||||

2040 Notes, $ | |||||||||||

2050 Notes, $ | |||||||||||

2052 Notes, $ | |||||||||||

2053 Notes, $ | |||||||||||

2063 Notes, $ | |||||||||||

2023 Term Loan | |||||||||||

2022 Revolving Credit Facility | ( | ( | |||||||||

| Total long-term debt | $ | $ | |||||||||

| Total debt obligations | $ | $ | |||||||||

Commercial Paper Program

Our U.S. dollar commercial paper program is supported by our 2022 Revolving Credit Facility, which provides liquidity support for the repayment of commercial paper issued through this program. See “2022 Revolving Credit Facility” below for further discussion. The effective interest rate of commercial paper issuances fluctuates as short-term interest rates and demand fluctuate. The fluctuation of these rates may impact our interest expense. As of March 31, 2024, we had $224 million outstanding under the commercial paper program.

Senior Unsecured Notes

Our 2040 Notes were issued at par. All of our other outstanding senior unsecured notes were issued at a discount. As a result of the discount, the proceeds received from each issuance were less than the aggregate principal amount. As of March 31, 2024, the amounts in the table above reflect the aggregate principal amount, less the unamortized debt issuance costs, which are being accreted through interest expense over the life of the applicable notes. The accretion of these costs was $3 million for the three months ended March 31, 2024. Our Euro denominated notes are adjusted for the impact of foreign currency translation. Our senior unsecured notes are general unsecured obligations which rank equally with all of our existing and future unsubordinated obligations and are not guaranteed by any of our subsidiaries. The senior unsecured notes were issued under indentures that, among other things, limit our ability to consolidate, merge or sell all or substantially all of our assets, create liens, and enter into sale and leaseback transactions. The senior unsecured notes may be redeemed by Nasdaq at any time, subject to a make-whole amount.

Upon a change of control triggering event (as defined in the various supplemental indentures governing the applicable notes), the terms require us to repurchase all or part of each holder’s notes for cash equal to 101 % of the aggregate principal amount purchased plus accrued and unpaid interest, if any.

The 2029 Notes, 2030 Notes, 2032 Notes and 2033 Notes pay interest annually. All other notes pay interest semi-annually. The U.S senior unsecured notes coupon rates may vary with Nasdaq’s debt rating, to the extent Nasdaq is downgraded below investment grade, up to an upward rate adjustment not to exceed 2 %.

Net Investment Hedge

Our Euro denominated notes have been designated as a hedge of our net investment in certain foreign subsidiaries to mitigate the foreign exchange risk associated with certain investments in these subsidiaries. Accordingly, the remeasurement of these notes is recorded in accumulated other comprehensive loss within Nasdaq’s stockholders’ equity in the Condensed Consolidated Balance Sheets. For the three months ended March 31, 2024, the impact of translation decreased the U.S. dollar value of our Euro denominated notes by $62 million.

13

Financing of the Adenza Acquisition

Senior Unsecured Notes

In June 2023, Nasdaq issued six series of notes for total proceeds of $5,016 million, net of debt issuance costs of $38 million, with various maturity dates ranging from 2025 to 2063. The net proceeds from these notes were used to finance the majority of the cash consideration due in connection with the Adenza acquisition. For further discussion of the Adenza acquisition, see “2023 Acquisition,” of Note 4, “Acquisition.”

2023 Term Loan

In June 2023, in connection with the financing of the Adenza acquisition, we entered into a term loan credit agreement, or the 2023 Term Loan. The 2023 Term Loan provided us with the ability to borrow up to $600 million to finance a portion of the cash consideration for the Adenza acquisition, for repayment of certain debt of Adenza and its subsidiaries, and to pay fees, costs and expenses related to the transaction. Under the 2023 Term Loan, borrowings bear interest on the principal amount outstanding at a variable interest rate based on the SOFR plus an applicable margin that varies with Nasdaq’s credit rating. On November 1, 2023, we borrowed $599 million, net of fees, under this term loan towards payment of the cash consideration due in connection with the Adenza acquisition. We made a partial repayment during the fourth quarter of 2023 and paid the remaining balance in the first quarter of 2024.

Credit Facilities

2022 Revolving Credit Facility

In December 2022, Nasdaq amended and restated its previously issued $1.25 billion five-year revolving credit facility, with a new maturity date of December 16, 2027. Nasdaq intends to use funds available under the 2022 Revolving Credit Facility for general corporate purposes and to provide liquidity support for the repayment of commercial paper issued through the commercial paper program. Nasdaq is permitted to repay borrowings under our 2022 Revolving Credit Facility at any time in whole or in part, without penalty.

As of March 31, 2024, no amounts were outstanding on the 2022 Revolving Credit Facility. The $(4 ) million balance represents unamortized debt issuance costs which are being accreted through interest expense over the life of the credit facility.

Borrowings under the revolving credit facility and swingline borrowings bear interest on the principal amount outstanding at a variable interest rate based on either the SOFR (or a successor rate to SOFR), the base rate (as defined in the 2022 Revolving Credit Facility agreement), or other applicable rate with respect to non-dollar borrowings, plus an applicable margin that varies with Nasdaq’s debt rating. We are charged commitment fees of 0.100 % to 0.250 %, depending on our credit rating, whether or not amounts have been borrowed. These commitment fees are included in interest expense and were not material for the three months ended March 31, 2024 and 2023.

The 2022 Revolving Credit Facility contains financial and operating covenants. Financial covenants include a maximum leverage ratio. Operating covenants include, among other things, limitations on Nasdaq’s ability to incur additional indebtedness, grant liens on assets, dispose of assets and make certain restricted payments. The facility also contains customary affirmative covenants, including access to financial statements, notice of defaults and certain other material events, maintenance of properties and insurance, and customary events of default, including cross-defaults to our material indebtedness.

The 2022 Revolving Credit Facility includes an option for Nasdaq to increase the available aggregate amount by up to $750 million, subject to the consent of the lenders funding the increase and certain other conditions.

Other Credit Facilities

Certain of our European subsidiaries have several other credit facilities, which are available in multiple currencies, primarily to support our Nasdaq Clearing operations in Europe, as well as to provide a cash pool credit line for one subsidiary. These credit facilities, in aggregate, totaled $180 million as of March 31, 2024 and $191 million as of December 31, 2023 in available liquidity, none one-year term. The amounts borrowed under these various credit facilities bear interest on the principal amount outstanding at a variable interest rate based on a base rate (as defined in the applicable credit agreement), plus an applicable margin. We are charged commitment fees (as defined in the applicable credit agreement), whether or not amounts have been borrowed. These commitment fees are included in interest expense and were not material for the three months ended March 31, 2024 and 2023.

These facilities include customary affirmative and negative operating covenants and events of default.

Debt Covenants

As of March 31, 2024, we were in compliance with the covenants of all of our debt obligations.

14

9. RETIREMENT PLANS

Defined Contribution Savings Plan

We sponsor a 401(k) plan, which is a voluntary defined contribution savings plan, for U.S. employees. Employees are immediately eligible to make contributions to the plan and are also eligible for an employer contribution match at an amount equal to 100.0 6.0 The following table presents the savings plan expense for the three months ended March 31, 2024 and 2023, which is included in compensation and benefits expense in the Condensed Consolidated Statements of Income:

| Three Months Ended March 31, | |||||||||||

| 2024 | 2023 | ||||||||||

| (in millions) | |||||||||||

Savings Plan expense | $ | $ | |||||||||

Pension and Supplemental Executive Retirement Plans

Prior to 2024, we maintained non-contributory, defined-benefit pension plans, non-qualified SERPs for certain senior executives and other post-retirement benefit plans for eligible employees in the U.S. Most employees outside the U.S. are covered by local retirement plans or by applicable social laws. Benefits under social laws are generally expensed in the periods in which the costs are incurred.

In June 2023, we terminated our U.S. pension plan and took steps to wind down the plan and transfer the resulting liability to an insurance company which started in 2023 and was completed in 2024. These steps included settling all future obligations under our U.S. pension plan through a combination of lump sum payments to eligible, electing participants (completed in 2023) and the transfer of any remaining benefits to a third-party insurance company through a group annuity contract. In connection with the plan termination and partial settlement, a pre-tax loss of $9 million was recorded to compensation and benefits expense in 2023. We finalized the transfer of any remaining benefits during the first quarter of 2024 and recorded an additional settlement pre-tax loss of $23 million to compensation and benefits expense in the Condensed Consolidated Statements of Income. This was offset by a $19 million adjustment to Other Comprehensive Income and a $4 million cash settlement.

The total expense for these plans is included in compensation and benefits expense in the Condensed Consolidated Statements of Income:

| Three Months Ended March 31, | |||||||||||

| 2024 | 2023 | ||||||||||

| (in millions) | |||||||||||

Retirement Plans expense | $ | $ | |||||||||

Nonqualified Deferred Compensation Plan

10. SHARE-BASED COMPENSATION

We have a share-based compensation program for employees and non-employee directors. Share-based awards granted under this program include restricted stock (consisting of restricted stock units), PSUs and stock options. For accounting purposes, we consider PSUs to be a form of restricted stock. Generally, annual employee awards are granted on or about April 1st of each year.

Summary of Share-Based Compensation Expense

The following table presents the total share-based compensation expense resulting from equity awards and the 15.0

| Three Months Ended March 31, | |||||||||||

| 2024 | 2023 | ||||||||||

| (in millions) | |||||||||||

| Share-based compensation expense before income taxes | $ | $ | |||||||||

Common Shares Available Under Our Equity Plan

As of March 31, 2024, we had approximately 24.9 million shares of common stock authorized for future issuance under our Equity Plan.

Restricted Stock

We grant restricted stock to most employees. The grant date fair value of restricted stock awards is based on the closing stock price at the date of grant less the present value of future cash dividends. Restricted stock awards granted to employees below the manager level generally vest 33 % on the first anniversary of the grant date, 33 % on the second anniversary of the grant date, and the remainder on the third anniversary of the grant date. Restricted stock awards granted to employees at or above the manager level generally vest 33 % on the second anniversary of the grant date, 33 % on the third anniversary of the grant date, and the remainder on the fourth anniversary of the grant date.

15

Summary of Restricted Stock Activity

The following table summarizes our restricted stock activity for the three months ended March 31, 2024:

| Restricted Stock | |||||||||||

| Number of Awards | Weighted-Average Grant Date Fair Value | ||||||||||

Unvested at December 31, 2023 | $ | ||||||||||

| Granted | |||||||||||

| Vested | ( | ||||||||||

| Forfeited | ( | ||||||||||

Unvested at March 31, 2024 | $ | ||||||||||

As of March 31, 2024, $108 million of total unrecognized compensation cost related to restricted stock is expected to be recognized over a weighted-average period of 1.6 years.

PSUs

We grant three-year PSUs to certain eligible employees. PSUs are based on performance measures that impact the amount of shares that each PSU eligible individual receives, subject to the satisfaction of applicable market performance conditions, with a three-year cumulative performance period that vest at the end of the performance period and which settle in shares of our common stock. Compensation cost is recognized over the three-year performance period, taking into account an estimated forfeiture rate, regardless of whether the market condition is satisfied, provided that the requisite service period has been completed. Performance will be determined by comparing Nasdaq’s TSR to two peer groups, each weighted 50.0 %. The first peer group consists of exchange companies, and the second peer group consists of all companies in the S&P 500. Beginning in 2024, we replaced the exchange company peer group with the S&P 500 GICS 4020 Index, which is a blend of exchanges, as well as data, financial technology and banking companies to align more closely with Nasdaq’s diverse business and competitors. Nasdaq’s relative performance ranking against each of these groups will determine the final number of shares delivered to each individual under the program. The award issuance under this program will be between 0.0 % and 200.0 % of the number of PSUs granted and will be determined by Nasdaq’s overall performance against both peer groups. However, if Nasdaq’s TSR is negative for the three-year performance period, regardless of TSR ranking, the award issuance will not exceed 100.0 % of the number of PSUs granted. We estimate the fair value of PSUs granted under the three-year PSU program using the Monte Carlo simulation model, as these awards contain a market condition.

Grants of PSUs that were issued in 2021 with a three-year performance period exceeded the applicable performance parameters. As a result, an additional 387,011 units above the original target were granted in the first quarter of 2024 and were fully vested upon issuance.

Summary of PSU Activity

The following table summarizes our PSU activity for the three months ended March 31, 2024:

| PSUs | ||||||||||||||

| Three-Year Program | ||||||||||||||

| Number of Awards | Weighted-Average Grant Date Fair Value | |||||||||||||

Unvested at December 31, 2023 | $ | |||||||||||||

| Granted | ||||||||||||||

| Vested | ( | |||||||||||||

| Forfeited | ( | |||||||||||||

Unvested at March 31, 2024 | $ | |||||||||||||

In the table above, the granted amount primarily includes additional awards granted based on overachievement of performance parameters.

As of March 31, 2024, the total unrecognized compensation cost related to the PSU program is $47 million and is expected to be recognized over a weighted-average period of 1.4 years.

Stock Options

There were no stock option awards granted for the three months ended March 31, 2024. There were no stock options exercised for the three months ended March 31, 2024 and 2023.

A summary of our outstanding and exercisable stock options at March 31, 2024 is as follows:

Number of Stock Options | Weighted-Average Exercise Price | Weighted- Average Remaining Contractual Term (in years) | Aggregate Intrinsic Value (in millions) | |||||||||||

Outstanding at March 31, 2024 | $ | $ | ||||||||||||

Exercisable at March 31, 2024 | $ | $ | ||||||||||||

As of March 31, 2024, the aggregate pre-tax intrinsic value of the outstanding and exercisable stock options in the above table was $33 million and represents the difference between our closing stock price on March 31, 2024 of $63.10 and the exercise price, times the number of shares that would have been received by the option holder had the option holder exercised the stock options on that date. This amount can change based on the fair market value of our common stock. As of March 31, 2024 and 2023, 0.8 22.23

16

ESPP

We have an ESPP under which approximately 11.4 million shares of our common stock were available for future issuance as of March 31, 2024. Under our ESPP, employees may purchase shares having a value not exceeding 10.0 % of their annual compensation, subject to applicable annual Internal Revenue Service limitations. We record compensation expense related to the 15.0 % discount that is given to our employees.

11. NASDAQ STOCKHOLDERS’ EQUITY

Common Stock

As of March 31, 2024, 900,000,000 shares of our common stock were authorized, 599,052,284 shares were issued and 575,758,581 shares were outstanding. As of December 31, 2023, 900,000,000 shares of our common stock were authorized, 598,014,520 shares were issued and 575,159,336 shares were outstanding. The holders of common stock are entitled to one 5.0

Common Stock in Treasury, at Cost

We account for the purchase of treasury stock under the cost method with the shares of stock repurchased reflected as a reduction to Nasdaq stockholders’ equity and included in common stock in treasury, at cost in the Condensed Consolidated Balance Sheets. Shares repurchased under our share repurchase program are currently retired and canceled and are therefore not included in the common stock in treasury balance. If treasury shares are reissued, they are recorded at the average cost of the treasury shares acquired. We held 23,293,703 shares of common stock in treasury as of March 31, 2024 and 22,855,184 shares as of December 31, 2023, most of which are related to shares of our common stock withheld for the settlement of employee tax withholding obligations arising from the vesting of restricted stock and PSUs.

Share Repurchase Program

As of March 31, 2024, the remaining aggregate authorized amount under the existing share repurchase program was $1.9 billion. There were no share repurchased under our share repurchase program in the first quarter of 2024.

These repurchases may be made from time to time at prevailing market prices in open market purchases, privately-negotiated transactions, block purchase techniques, an accelerated share repurchase program or otherwise, as determined by our management. The repurchases are primarily funded from existing cash balances. The share repurchase program may be suspended, modified or discontinued at any time, and has no defined expiration date.

For the three months ended March 31, 2024, we repurchased an aggregate of 438,519 shares withheld to satisfy tax obligations of the grantee upon the vesting of restricted stock and PSUs, and these repurchases are excluded from our repurchase program.

Preferred Stock

Our certificate of incorporation authorizes the issuance of 30,000,000 0.01 no

Cash Dividends on Common Stock

During the first quarter of 2024, our board of directors declared and paid the following cash dividends:

| Declaration Date | Dividend Per Common Share | Record Date | Total Amount Paid | Payment Date | ||||||||||||||||||||||

| (in millions) | ||||||||||||||||||||||||||

| January 29, 2024 | $ | March 14, 2024 | $ | March 28, 2024 | ||||||||||||||||||||||

| $ | ||||||||||||||||||||||||||

The total amount paid of $127 million was recorded in retained earnings within Nasdaq’s stockholders’ equity in the Condensed Consolidated Balance Sheets at March 31, 2024.

In April 2024, the board of directors approved a regular quarterly cash dividend of $0.24 per share on our outstanding common stock, which reflects an increase of 9 % from our most recent quarterly cash dividend of $0.22 per share. The dividend is payable on June 28, 2024 to shareholders of record at the close of business on June 14, 2024. The estimated aggregate payment of this dividend is $138 million. Future declarations of quarterly dividends and the establishment of future record and payment dates are subject to approval by the board of directors.

The board of directors maintains a dividend policy with the intention to provide shareholders with regular and increasing dividends as earnings and cash flows increase.

17

12. EARNINGS PER SHARE

The following table sets forth the computation of basic and diluted earnings per share:

| Three Months Ended March 31, | |||||||||||

| 2024 | 2023 | ||||||||||

| Numerator: | (in millions, except share and per share amounts) | ||||||||||

| Net income attributable to common shareholders | $ | $ | |||||||||

| Denominator: | |||||||||||

| Weighted-average common shares outstanding for basic earnings per share | |||||||||||

| Weighted-average effect of dilutive securities: | |||||||||||

| Weighted-average effect of dilutive securities - Employee equity awards | |||||||||||

| Weighted-average common shares outstanding for diluted earnings per share | |||||||||||

| Basic and diluted earnings per share: | |||||||||||

| Basic earnings per share | $ | $ | |||||||||

| Diluted earnings per share | $ | $ | |||||||||

Securities that were not

13. FAIR VALUE OF FINANCIAL INSTRUMENTS

The following tables present our financial assets and financial liabilities that were measured at fair value on a recurring basis as of March 31, 2024 and December 31, 2023.

| March 31, 2024 | |||||||||||||||||||||||

Total | Level 1 | Level 2 | Level 3 | ||||||||||||||||||||