QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||||||

For the quarterly period ended | ||||||||

OR | ||||||||

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||||||

For the transition period | from ________ to ________ | |||||||

| (State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) | ||||||||||

| (Address of Principal Executive Offices) | (Zip Code) | ||||||||||

| No Changes | |||||||||||

| (Former name, former address and former fiscal year, if changed since last report) | |||||||||||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||||||||

| ☒ | Accelerated filer | ☐ | |||||||||

| Non-accelerated filer | ☐ | Smaller reporting company | |||||||||

| Emerging growth company | |||||||||||

| Class | Outstanding at November 1, 2023 | ||||||||||

| Common Stock, $0.01 par value per share | shares | ||||||||||

Page | ||||||||

Part I. FINANCIAL INFORMATION | ||||||||

| Item 1. | ||||||||

| Item 2. | ||||||||

| Item 3. | ||||||||

| Item 4. | ||||||||

Part II. OTHER INFORMATION | ||||||||

| Item 1. | ||||||||

| Item 1A. | ||||||||

| Item 2. | ||||||||

| Item 3. | ||||||||

| Item 4. | ||||||||

| Item 5. | ||||||||

| Item 6. | ||||||||

| September 30, 2023 | December 31, 2022 | ||||||||||

| (unaudited) | |||||||||||

| Assets | |||||||||||

| Current assets: | |||||||||||

| Cash and cash equivalents | $ | $ | |||||||||

| Restricted cash and cash equivalents | |||||||||||

Default funds and margin deposits (including restricted cash and cash equivalents of $ | |||||||||||

| Financial investments | |||||||||||

| Receivables, net | |||||||||||

| Other current assets | |||||||||||

| Total current assets | |||||||||||

| Property and equipment, net | |||||||||||

| Goodwill | |||||||||||

| Intangible assets, net | |||||||||||

| Operating lease assets | |||||||||||

| Other non-current assets | |||||||||||

| Total assets | $ | $ | |||||||||

| Liabilities | |||||||||||

| Current liabilities: | |||||||||||

| Accounts payable and accrued expenses | $ | $ | |||||||||

| Section 31 fees payable to SEC | |||||||||||

| Accrued personnel costs | |||||||||||

| Deferred revenue | |||||||||||

| Other current liabilities | |||||||||||

| Default funds and margin deposits | |||||||||||

| Short-term debt | |||||||||||

| Total current liabilities | |||||||||||

| Long-term debt | |||||||||||

| Deferred tax liabilities, net | |||||||||||

| Operating lease liabilities | |||||||||||

| Other non-current liabilities | |||||||||||

| Total liabilities | |||||||||||

| Commitments and contingencies | |||||||||||

| Equity | |||||||||||

| Nasdaq stockholders’ equity: | |||||||||||

Common stock, $ | |||||||||||

| Additional paid-in capital | |||||||||||

Common stock in treasury, at cost: | ( | ( | |||||||||

| Accumulated other comprehensive loss | ( | ( | |||||||||

| Retained earnings | |||||||||||

| Total Nasdaq stockholders’ equity | |||||||||||

| Noncontrolling interests | |||||||||||

| Total equity | |||||||||||

| Total liabilities and equity | $ | $ | |||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||

| 2023 | 2022 | 2023 | 2022 | ||||||||||||||||||||

| Revenues: | |||||||||||||||||||||||

| Market Platforms | $ | $ | $ | $ | |||||||||||||||||||

| Capital Access Platforms | |||||||||||||||||||||||

| Anti-Financial Crime | |||||||||||||||||||||||

| Other revenues | |||||||||||||||||||||||

| Total revenues | |||||||||||||||||||||||

| Transaction-based expenses: | |||||||||||||||||||||||

| Transaction rebates | ( | ( | ( | ( | |||||||||||||||||||

| Brokerage, clearance and exchange fees | ( | ( | ( | ( | |||||||||||||||||||

| Revenues less transaction-based expenses | |||||||||||||||||||||||

| Operating expenses: | |||||||||||||||||||||||

| Compensation and benefits | |||||||||||||||||||||||

| Professional and contract services | |||||||||||||||||||||||

| Computer operations and data communications | |||||||||||||||||||||||

| Occupancy | |||||||||||||||||||||||

| General, administrative and other | |||||||||||||||||||||||

| Marketing and advertising | |||||||||||||||||||||||

| Depreciation and amortization | |||||||||||||||||||||||

| Regulatory | |||||||||||||||||||||||

| Merger and strategic initiatives | |||||||||||||||||||||||

| Restructuring charges | |||||||||||||||||||||||

| Total operating expenses | |||||||||||||||||||||||

| Operating income | |||||||||||||||||||||||

| Interest income | |||||||||||||||||||||||

| Interest expense | ( | ( | ( | ( | |||||||||||||||||||

| Other income (loss) | ( | ||||||||||||||||||||||

| Net income (loss) from unconsolidated investees | ( | ( | |||||||||||||||||||||

| Income before income taxes | |||||||||||||||||||||||

| Income tax provision | |||||||||||||||||||||||

| Net income | |||||||||||||||||||||||

| Net loss attributable to noncontrolling interests | |||||||||||||||||||||||

| Net income attributable to Nasdaq | $ | $ | $ | $ | |||||||||||||||||||

| Per share information: | |||||||||||||||||||||||

| Basic earnings per share | $ | $ | $ | $ | |||||||||||||||||||

| Diluted earnings per share | $ | $ | $ | $ | |||||||||||||||||||

| Cash dividends declared per common share | $ | $ | $ | $ | |||||||||||||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||

| 2023 | 2022 | 2023 | 2022 | ||||||||||||||||||||

| Net income | $ | $ | $ | $ | |||||||||||||||||||

Other comprehensive income (loss): | |||||||||||||||||||||||

Foreign currency translation gains (losses) | ( | ( | ( | ||||||||||||||||||||

Income tax expense(1) | ( | ( | ( | ( | |||||||||||||||||||

| Foreign currency translation, net | ( | ( | ( | ||||||||||||||||||||

| Comprehensive income | |||||||||||||||||||||||

| Comprehensive loss attributable to noncontrolling interests | |||||||||||||||||||||||

| Comprehensive income attributable to Nasdaq | $ | $ | $ | $ | |||||||||||||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||||||||||||||||||||||||||

| 2023 | 2022 | 2023 | 2022 | ||||||||||||||||||||||||||||||||||||||||||||

| Shares | $ | Shares | $ | Shares | $ | Shares | $ | ||||||||||||||||||||||||||||||||||||||||

| Common stock | |||||||||||||||||||||||||||||||||||||||||||||||

| Additional paid-in capital | |||||||||||||||||||||||||||||||||||||||||||||||

| Beginning balance | |||||||||||||||||||||||||||||||||||||||||||||||

| Share repurchase program | — | — | — | — | ( | ( | ( | ( | |||||||||||||||||||||||||||||||||||||||

ASR agreement | — | — | — | — | — | — | — | ( | |||||||||||||||||||||||||||||||||||||||

| Share-based compensation | — | — | |||||||||||||||||||||||||||||||||||||||||||||

| Other issuances of common stock, net | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||

| Ending balance | |||||||||||||||||||||||||||||||||||||||||||||||

| Common stock in treasury, at cost | |||||||||||||||||||||||||||||||||||||||||||||||

| Beginning balance | ( | ( | ( | ( | |||||||||||||||||||||||||||||||||||||||||||

| Other employee stock activity | — | ( | — | ( | ( | ( | ( | ( | |||||||||||||||||||||||||||||||||||||||

| Ending balance | ( | ( | ( | ( | |||||||||||||||||||||||||||||||||||||||||||

| Accumulated other comprehensive loss | |||||||||||||||||||||||||||||||||||||||||||||||

| Beginning balance | ( | ( | ( | ( | |||||||||||||||||||||||||||||||||||||||||||

Other comprehensive income (loss) | ( | ( | ( | ||||||||||||||||||||||||||||||||||||||||||||

| Ending balance | ( | ( | ( | ( | |||||||||||||||||||||||||||||||||||||||||||

| Retained earnings | |||||||||||||||||||||||||||||||||||||||||||||||

| Beginning balance | |||||||||||||||||||||||||||||||||||||||||||||||

| Net income attributable to Nasdaq | |||||||||||||||||||||||||||||||||||||||||||||||

Cash dividends declared and paid | ( | ( | ( | ( | |||||||||||||||||||||||||||||||||||||||||||

| Ending balance | |||||||||||||||||||||||||||||||||||||||||||||||

| Total Nasdaq stockholders’ equity | |||||||||||||||||||||||||||||||||||||||||||||||

| Noncontrolling interests | |||||||||||||||||||||||||||||||||||||||||||||||

| Beginning balance | |||||||||||||||||||||||||||||||||||||||||||||||

Net activity related to noncontrolling interests | — | — | ( | ( | |||||||||||||||||||||||||||||||||||||||||||

| Ending balance | |||||||||||||||||||||||||||||||||||||||||||||||

| Total Equity | $ | $ | $ | $ | |||||||||||||||||||||||||||||||||||||||||||

| Nine Months Ended September 30, | |||||||||||

| 2023 | 2022 | ||||||||||

| Cash flows from operating activities: | |||||||||||

| Net income | $ | $ | |||||||||

| Adjustments to reconcile net income to net cash provided by operating activities: | |||||||||||

| Depreciation and amortization | |||||||||||

| Share-based compensation | |||||||||||

| Deferred income taxes | |||||||||||

| Extinguishment of debt and bridge fees | |||||||||||

| Non-cash restructuring charges | |||||||||||

Net income (loss) from unconsolidated investees | ( | ||||||||||

| Operating lease asset impairments | |||||||||||

| Other reconciling items included in net income | |||||||||||

| Net change in operating assets and liabilities, net of effects of acquisitions: | |||||||||||

| Receivables, net | ( | ||||||||||

| Other assets | |||||||||||

| Accounts payable and accrued expenses | |||||||||||

| Section 31 fees payable to SEC | ( | ||||||||||

| Accrued personnel costs | ( | ( | |||||||||

| Deferred revenue | |||||||||||

| Other liabilities | ( | ( | |||||||||

| Net cash provided by operating activities | |||||||||||

| Cash flows from investing activities: | |||||||||||

| Purchases of securities | ( | ( | |||||||||

| Proceeds from sales and redemptions of securities | |||||||||||

| Acquisition of businesses, net of cash and cash equivalents acquired | ( | ||||||||||

| Purchases of property and equipment | ( | ( | |||||||||

Investments related to default funds and margin deposits, net(1) | |||||||||||

| Other investing activities | ( | ||||||||||

| Net cash used in investing activities | ( | ( | |||||||||

| Cash flows from financing activities: | |||||||||||

| Repayments of commercial paper, net | ( | ( | |||||||||

| Repayments of debt and credit commitment | ( | ||||||||||

| Payment of debt extinguishment cost and bridge fees | ( | ( | |||||||||

| Proceeds from issuances of debt, net of issuance costs | |||||||||||

| Repurchases of common stock | ( | ( | |||||||||

| ASR agreement | ( | ||||||||||

| Dividends paid | ( | ( | |||||||||

| Proceeds received from employee stock activity and other issuances | |||||||||||

| Payments related to employee shares withheld for taxes | ( | ( | |||||||||

| Default funds and margin deposits | ( | ||||||||||

| Other financing activities | ( | ( | |||||||||

| Net cash provided by financing activities | |||||||||||

| Effect of exchange rate changes on cash and cash equivalents and restricted cash and cash equivalents | ( | ( | |||||||||

| Net increase in cash and cash equivalents and restricted cash and cash equivalents | |||||||||||

Cash and cash equivalents, restricted cash and cash equivalents at beginning of period | |||||||||||

| Cash and cash equivalents, restricted cash and cash equivalents at end of period | $ | $ | |||||||||

| Reconciliation of Cash, Cash Equivalents and Restricted Cash and Cash Equivalents | |||||||||||

| Cash and cash equivalents | $ | $ | |||||||||

| Restricted cash and cash equivalents | |||||||||||

| Restricted cash and cash equivalents (default funds and margin deposits) | |||||||||||

| Total | $ | $ | |||||||||

| Supplemental Disclosure Cash Flow Information | |||||||||||

| Interest paid | $ | $ | |||||||||

| Income taxes paid, net of refund | $ | $ | |||||||||

| Three Months Ended September 30, | |||||||||||

| 2023 | 2022 | ||||||||||

| (in millions) | |||||||||||

| Market Platforms | |||||||||||

| Trading Services, net | $ | $ | |||||||||

| Marketplace Technology | |||||||||||

| Capital Access Platforms | |||||||||||

| Data & Listing Services | |||||||||||

| Index | |||||||||||

| Workflow & Insights | |||||||||||

| Anti-Financial Crime | |||||||||||

| Other revenues | |||||||||||

| Revenues less transaction-based expenses | $ | $ | |||||||||

| Nine Months Ended September 30, | |||||||||||

| 2023 | 2022 | ||||||||||

| (in millions) | |||||||||||

| Market Platforms | |||||||||||

| Trading Services, net | $ | $ | |||||||||

| Marketplace Technology | |||||||||||

| Capital Access Platforms | |||||||||||

| Data & Listing Services | |||||||||||

| Index | |||||||||||

| Workflow & Insights | |||||||||||

| Anti-Financial Crime | |||||||||||

| Other revenues | |||||||||||

| Revenues less transaction-based expenses | $ | $ | |||||||||

| Market Technology | Anti-Financial Crime | Workflow & Insights | Total | ||||||||||||||||||||

| (in millions) | |||||||||||||||||||||||

| Remainder of 2023 | $ | $ | $ | $ | |||||||||||||||||||

| 2024 | |||||||||||||||||||||||

| 2025 | |||||||||||||||||||||||

| 2026 | |||||||||||||||||||||||

| 2027 | |||||||||||||||||||||||

| 2028+ | |||||||||||||||||||||||

| Total | $ | $ | $ | $ | |||||||||||||||||||

| (in millions) | |||||

| Market Platforms | |||||

| Balance at December 31, 2022 | $ | ||||

| Foreign currency translation adjustments | ( | ||||

| Balance at September 30, 2023 | $ | ||||

| Capital Access Platforms | |||||

| Balance at December 31, 2022 | $ | ||||

| Foreign currency translation adjustments | ( | ||||

| Balance at September 30, 2023 | $ | ||||

| Anti-Financial Crime | |||||

| Balance at December 31, 2022 | $ | ||||

| Foreign currency translation adjustments | ( | ||||

| Balance at September 30, 2023 | $ | ||||

| Total | |||||

| Balance at December 31, 2022 | $ | ||||

| Foreign currency translation adjustments | ( | ||||

| Balance at September 30, 2023 | $ | ||||

| September 30, 2023 | December 31, 2022 | ||||||||||

| Finite-Lived Intangible Assets | (in millions) | ||||||||||

| Gross Amount | |||||||||||

| Technology | $ | $ | |||||||||

| Customer relationships | |||||||||||

| Trade names and other | |||||||||||

| Foreign currency translation adjustment | ( | ( | |||||||||

| Total gross amount | $ | $ | |||||||||

| Accumulated Amortization | |||||||||||

| Technology | $ | ( | $ | ( | |||||||

| Customer relationships | ( | ( | |||||||||

| Trade names and other | ( | ( | |||||||||

| Foreign currency translation adjustment | |||||||||||

| Total accumulated amortization | $ | ( | $ | ( | |||||||

| Net Amount | |||||||||||

| Technology | $ | $ | |||||||||

| Customer relationships | |||||||||||

| Trade names and other | |||||||||||

| Foreign currency translation adjustment | ( | ( | |||||||||

| Total finite-lived intangible assets | $ | $ | |||||||||

| Indefinite-Lived Intangible Assets | |||||||||||

| Exchange and clearing registrations | $ | $ | |||||||||

| Trade names | |||||||||||

| Licenses | |||||||||||

| Foreign currency translation adjustment | ( | ( | |||||||||

| Total indefinite-lived intangible assets | $ | $ | |||||||||

| Total intangible assets, net | $ | $ | |||||||||

| Three Months Ended September 30, | |||||||||||

| 2023 | 2022 | ||||||||||

| (in millions) | |||||||||||

| Amortization expense | $ | $ | |||||||||

| Nine Months Ended September 30, | |||||||||||

| 2023 | 2022 | ||||||||||

| (in millions) | |||||||||||

| Amortization expense | $ | $ | |||||||||

| (in millions) | |||||

| Remainder of 2023 | $ | ||||

| 2024 | |||||

| 2025 | |||||

| 2026 | |||||

| 2027 | |||||

| 2028+ | |||||

| Total | $ | ||||

| September 30, 2023 | December 31, 2022 | ||||||||||

| (in millions) | |||||||||||

Financial investments | $ | $ | |||||||||

| Equity method investments | |||||||||||

| Equity securities | |||||||||||

Balance at December 31, 2022 | Additions | Revenue Recognized | Adjustments | Balance at September 30, 2023 | |||||||||||||

| (in millions) | |||||||||||||||||

| Market Platforms: | |||||||||||||||||

| Market Technology | $ | $ | $ | ( | $ | ( | $ | ||||||||||

| Capital Access Platforms: | |||||||||||||||||

| Initial Listings | ( | ( | |||||||||||||||

| Annual Listings | ( | ( | |||||||||||||||

| Workflow & Insights | ( | ||||||||||||||||

| Anti-Financial Crime | ( | ||||||||||||||||

| Other | ( | ( | |||||||||||||||

| Total | $ | $ | $ | ( | $ | ( | $ | ||||||||||

Fiscal year ended: | 2023 | 2024 | 2025 | 2026 | 2027 | 2028+ | Total | ||||||||||||||||

| (in millions) | |||||||||||||||||||||||

| Market Platforms: | |||||||||||||||||||||||

| Market Technology | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||

| Capital Access Platforms: | |||||||||||||||||||||||

| Initial Listings | |||||||||||||||||||||||

| Annual Listings | |||||||||||||||||||||||

| Workflow & Insights | |||||||||||||||||||||||

| Anti-Financial Crime | |||||||||||||||||||||||

| Other | |||||||||||||||||||||||

| Total | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||

| September 30, 2023 | December 31, 2022 | ||||||||||

| (in millions) | |||||||||||

| Short-term debt: | |||||||||||

| Commercial paper | $ | $ | |||||||||

| Long-term debt - senior unsecured notes: | |||||||||||

2025 Notes, $ | |||||||||||

2026 Notes, $ | |||||||||||

2028 Notes, $ due June 28, 2028 | |||||||||||

2029 Notes, € | |||||||||||

2030 Notes, € | |||||||||||

2031 Notes, $ | |||||||||||

2032 Notes, € | |||||||||||

2033 Notes, € | |||||||||||

2034 Notes $ | |||||||||||

2040 Notes, $ | |||||||||||

2050 Notes, $ | |||||||||||

2052 Notes, $ | |||||||||||

2053 Notes, $ | |||||||||||

2063 Notes, $ | |||||||||||

| 2022 Revolving Credit Agreement | ( | ( | |||||||||

| Total long-term debt | $ | $ | |||||||||

| Total debt obligations | $ | $ | |||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||

| 2023 | 2022 | 2023 | 2022 | ||||||||||||||||||||

| (in millions) | |||||||||||||||||||||||

Savings Plan expense | $ | $ | $ | $ | |||||||||||||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||

| 2023 | 2022 | 2023 | 2022 | ||||||||||||||||||||

| (in millions) | |||||||||||||||||||||||

Retirement Plans expense | $ | $ | $ | $ | |||||||||||||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||

| 2023 | 2022 | 2023 | 2022 | ||||||||||||||||||||

| (in millions) | |||||||||||||||||||||||

| Share-based compensation expense before income taxes | $ | $ | $ | $ | |||||||||||||||||||

| Restricted Stock | |||||||||||

| Number of Awards | Weighted-Average Grant Date Fair Value | ||||||||||

| Unvested at December 31, 2022 | $ | ||||||||||

| Granted | |||||||||||

| Vested | ( | ||||||||||

| Forfeited | ( | ||||||||||

| Unvested at September 30, 2023 | $ | ||||||||||

| Grant date | April 3, 2023 | April 1, 2022 | |||||||||

| Weighted-average risk-free interest rate | % | % | |||||||||

Expected volatility | % | % | |||||||||

| Weighted-average grant date share price | $ | $ | |||||||||

| Weighted-average fair value at grant date | $ | $ | |||||||||

| PSUs | |||||||||||

| Number of Awards | Weighted-Average Grant Date Fair Value | ||||||||||

| Unvested at December 31, 2022 | $ | ||||||||||

| Granted | |||||||||||

| Vested | ( | ||||||||||

| Forfeited | ( | ||||||||||

| Unvested at September 30, 2023 | $ | ||||||||||

Number of Stock Options | Weighted-Average Exercise Price | Weighted- Average Remaining Contractual Term (in years) | Aggregate Intrinsic Value (in millions) | |||||||||||

| Outstanding at September 30, 2023 | $ | $ | ||||||||||||

| Exercisable at September 30, 2023 | $ | $ | ||||||||||||

| Nine Months Ended September 30, 2023 | ||||||||

| Number of shares of common stock repurchased | ||||||||

Average price paid per share | $ | |||||||

Total purchase price (in millions) | $ | |||||||

| Declaration Date | Dividend Per Common Share | Record Date | Total Amount Paid | Payment Date | ||||||||||||||||||||||

| (in millions) | ||||||||||||||||||||||||||

| January 24, 2023 | $ | March 17, 2023 | $ | March 31, 2023 | ||||||||||||||||||||||

| April 18, 2023 | June 16, 2023 | June 30, 2023 | ||||||||||||||||||||||||

| July 18, 2023 | September 15, 2023 | September 29, 2023 | ||||||||||||||||||||||||

| $ | ||||||||||||||||||||||||||

| Three Months Ended September 30, | |||||||||||

| 2023 | 2022 | ||||||||||

| Numerator: | (in millions, except share and per share amounts) | ||||||||||

| Net income attributable to common shareholders | $ | $ | |||||||||

| Denominator: | |||||||||||

| Weighted-average common shares outstanding for basic earnings per share | |||||||||||

| Weighted-average effect of dilutive securities - Employee equity awards | |||||||||||

| Weighted-average common shares outstanding for diluted earnings per share | |||||||||||

| Basic and diluted earnings per share: | |||||||||||

| Basic earnings per share | $ | $ | |||||||||

| Diluted earnings per share | $ | $ | |||||||||

| Nine Months Ended September 30, | |||||||||||

| 2023 | 2022 | ||||||||||

| Numerator: | (in millions, except share and per share amounts) | ||||||||||

| Net income attributable to common shareholders | $ | $ | |||||||||

| Denominator: | |||||||||||

| Weighted-average common shares outstanding for basic earnings per share | |||||||||||

| Weighted-average effect of dilutive securities - Employee equity awards | |||||||||||

| Weighted-average common shares outstanding for diluted earnings per share | |||||||||||

| Basic and diluted earnings per share: | |||||||||||

| Basic earnings per share | $ | $ | |||||||||

| Diluted earnings per share | $ | $ | |||||||||

| September 30, 2023 | |||||||||||||||||||||||

Total | Level 1 | Level 2 | Level 3 | ||||||||||||||||||||

(in millions) | |||||||||||||||||||||||

European government debt securities | $ | $ | $ | $ | |||||||||||||||||||

State-owned enterprises and municipal securities | |||||||||||||||||||||||

Swedish mortgage bonds | |||||||||||||||||||||||

Corporate debt securities | |||||||||||||||||||||||

| Total assets at fair value | $ | $ | $ | $ | |||||||||||||||||||

| December 31, 2022 | |||||||||||||||||||||||

Total | Level 1 | Level 2 | Level 3 | ||||||||||||||||||||

(in millions) | |||||||||||||||||||||||

European government debt securities | $ | $ | $ | $ | |||||||||||||||||||

State-owned enterprises and municipal securities | |||||||||||||||||||||||

Swedish mortgage bonds | |||||||||||||||||||||||

Corporate debt securities | |||||||||||||||||||||||

| Total assets at fair value | $ | $ | $ | $ | |||||||||||||||||||

| September 30, 2023 | |||||||||||||||||

| Cash Contributions | Non-Cash Contributions | Total Contributions | |||||||||||||||

| (in millions) | |||||||||||||||||

| Default fund contributions | $ | $ | $ | ||||||||||||||

| Margin deposits | |||||||||||||||||

| Total | $ | $ | $ | ||||||||||||||

| September 30, 2023 | December 31, 2022 | ||||||||||

| (in millions) | |||||||||||

| Demand deposits | $ | $ | |||||||||

| Central bank certificates | |||||||||||

| Restricted cash and cash equivalents | $ | $ | |||||||||

| European government debt securities | |||||||||||

| Reverse repurchase agreements | |||||||||||

| Multilateral development bank debt securities | |||||||||||

| Investments | $ | $ | |||||||||

| Total | $ | $ | |||||||||

| September 30, 2023 | |||||

| (in millions) | |||||

| Commodity and seafood options, futures and forwards | $ | ||||

| Fixed-income options and futures | |||||

| Stock options and futures | |||||

| Index options and futures | |||||

| Total | $ | ||||

| Nine Months Ended September 30, | |||||||||||

| 2023 | 2022 | ||||||||||

| Commodity and seafood options, futures and forwards | |||||||||||

| Fixed-income options and futures | |||||||||||

| Stock options and futures | |||||||||||

| Index options and futures | |||||||||||

| Total | |||||||||||

| Leases | Balance Sheet Classification | September 30, 2023 | December 31, 2022 | |||||||||||||||||

| (in millions) | ||||||||||||||||||||

| Assets: | ||||||||||||||||||||

| Operating lease assets | Operating lease assets | $ | $ | |||||||||||||||||

| Liabilities: | ||||||||||||||||||||

| Current lease liabilities | $ | $ | ||||||||||||||||||

| Non-current lease liabilities | Operating lease liabilities | |||||||||||||||||||

| Total lease liabilities | $ | $ | ||||||||||||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||||||||||||

| 2023 | 2022 | 2023 | 2022 | |||||||||||||||||||||||

| (in millions) | ||||||||||||||||||||||||||

| Operating lease cost | $ | $ | $ | $ | ||||||||||||||||||||||

| Variable lease cost | ||||||||||||||||||||||||||

| Sublease income | ( | ( | ( | ( | ||||||||||||||||||||||

| Total lease cost | $ | $ | $ | $ | ||||||||||||||||||||||

| September 30, 2023 | ||||||||

| (in millions) | ||||||||

| Remainder of 2023 | $ | |||||||

| 2024 | ||||||||

| 2025 | ||||||||

| 2026 | ||||||||

| 2027 | ||||||||

| 2028+ | ||||||||

| Total lease payments | ||||||||

| Less: interest | ( | |||||||

| Present value of lease liabilities | $ | |||||||

| September 30, 2023 | ||||||||

| Weighted-average remaining lease term (in years) | ||||||||

| Weighted-average discount rate | % | |||||||

| Nine Months Ended September 30, | |||||||||||

| 2023 | 2022 | ||||||||||

| (in millions) | |||||||||||

| Cash paid for amounts included in the measurement of operating lease liabilities | $ | $ | |||||||||

| Lease assets obtained in exchange for operating lease liabilities | $ | $ | |||||||||

| Three Months Ended September 30, | |||||||||||

| 2023 | 2022 | ||||||||||

| (in millions) | |||||||||||

| Income tax provision | $ | $ | |||||||||

| Effective tax rate | % | % | |||||||||

| Nine Months Ended September 30, | |||||||||||

| 2023 | 2022 | ||||||||||

| (in millions) | |||||||||||

| Income tax provision | $ | $ | |||||||||

| Effective tax rate | % | % | |||||||||

| Three Months Ended September 30, | |||||||||||

| 2023 | 2022 | ||||||||||

| Market Platforms | (in millions) | ||||||||||

| Total revenues | $ | $ | |||||||||

| Transaction-based expenses | ( | ( | |||||||||

| Revenues less transaction-based expenses | |||||||||||

| Operating income | |||||||||||

| Capital Access Platforms | |||||||||||

| Total revenues | |||||||||||

| Operating income | |||||||||||

| Anti-Financial Crime | |||||||||||

| Total revenues | |||||||||||

| Operating income | |||||||||||

| Corporate Items | |||||||||||

| Total revenues | |||||||||||

| Operating loss | ( | ( | |||||||||

| Consolidated | |||||||||||

| Total revenues | $ | $ | |||||||||

| Transaction-based expenses | ( | ( | |||||||||

| Revenues less transaction-based expenses | $ | $ | |||||||||

| Operating income | $ | $ | |||||||||

| Nine Months Ended September 30, | |||||||||||

| 2023 | 2022 | ||||||||||

| Market Platforms | (in millions) | ||||||||||

| Total revenues | $ | $ | |||||||||

| Transaction-based expenses | ( | ( | |||||||||

| Revenues less transaction-based expenses | |||||||||||

| Operating income | |||||||||||

| Capital Access Platforms | |||||||||||

| Total revenues | |||||||||||

| Operating income | |||||||||||

| Anti-Financial Crime | |||||||||||

| Total revenues | |||||||||||

| Operating income | |||||||||||

| Corporate Items | |||||||||||

| Total revenues | |||||||||||

| Operating loss | ( | ( | |||||||||

| Consolidated | |||||||||||

| Total revenues | $ | $ | |||||||||

| Transaction-based expenses | ( | ( | |||||||||

| Revenues less transaction-based expenses | $ | $ | |||||||||

| Operating income | $ | $ | |||||||||

| Three Months Ended September 30, | |||||||||||

| 2023 | 2022 | ||||||||||

| (in millions) | |||||||||||

| Revenues - divested businesses | $ | $ | |||||||||

| Expenses: | |||||||||||

| Amortization expense of acquired intangible assets | $ | $ | |||||||||

| Merger and strategic initiatives expense | |||||||||||

| Restructuring charges | |||||||||||

| Expenses - divested businesses | |||||||||||

| Other | |||||||||||

| Total expenses | |||||||||||

| Operating loss | $ | ( | $ | ( | |||||||

| Nine Months Ended September 30, | |||||||||||

| 2023 | 2022 | ||||||||||

| (in millions) | |||||||||||

| Revenues - divested businesses | $ | $ | |||||||||

| Expenses: | |||||||||||

| Amortization expense of acquired intangible assets | |||||||||||

| Merger and strategic initiatives expense | |||||||||||

| Restructuring charges | |||||||||||

| Lease asset impairments | |||||||||||

| Extinguishment of debt | |||||||||||

| Expenses - divested businesses | |||||||||||

| Other | ( | ||||||||||

| Total expenses | |||||||||||

| Operating loss | $ | ( | $ | ( | |||||||

| Three Months Ended September 30, 2023 | Nine Months Ended September 30, 2023 | Total Program Costs Incurred | |||||||||||||||

| (in millions) | |||||||||||||||||

| Asset impairment charges | $ | $ | $ | ||||||||||||||

| Consulting services | |||||||||||||||||

| Employee-related costs | |||||||||||||||||

| Other | |||||||||||||||||

| Total restructuring charges | $ | $ | $ | ||||||||||||||

| Three Months Ended September 30, | Percentage Change | ||||||||||||||||

| 2023 | 2022 | ||||||||||||||||

| (in millions, except per share amounts) | |||||||||||||||||

| Revenues less transaction-based expenses | $ | 940 | $ | 890 | 5.6 | % | |||||||||||

| Operating expenses | 509 | 492 | 3.5 | % | |||||||||||||

| Operating income | 431 | 398 | 8.3 | % | |||||||||||||

| Net income attributable to Nasdaq | $ | 294 | $ | 294 | — | % | |||||||||||

| Diluted earnings per share | $ | 0.60 | $ | 0.59 | 1.7 | % | |||||||||||

| Cash dividends declared per common share | $ | 0.22 | $ | 0.20 | 10.0 | % | |||||||||||

| Nine Months Ended September 30, | Percentage Change | ||||||||||||||||

| 2023 | 2022 | ||||||||||||||||

| (in millions, except per share amounts) | |||||||||||||||||

| Revenues less transaction-based expenses | $ | 2,778 | $ | 2,675 | 3.9 | % | |||||||||||

| Operating expenses | 1,553 | 1,460 | 6.4 | % | |||||||||||||

| Operating income | 1,225 | 1,215 | 0.8 | % | |||||||||||||

| Net income attributable to Nasdaq | $ | 862 | $ | 884 | (2.5) | % | |||||||||||

| Diluted earnings per share | $ | 1.74 | $ | 1.77 | (1.7) | % | |||||||||||

| Cash dividends declared per common share | $ | 0.64 | $ | 0.58 | 10.3 | % | |||||||||||

▪ | Market technology support and SaaS subscription contracts as well as trade management services contracts, excluding one-time service requests. | |||||||

▪ | Proprietary market data subscriptions and annual listing fees within our Data & Listing Services business, index data subscriptions and guaranteed minimum on futures contracts within our Index business and subscription contracts under our Workflow & Insights business. | |||||||

▪ | Anti-Financial Crime support and SaaS subscription contracts. | |||||||

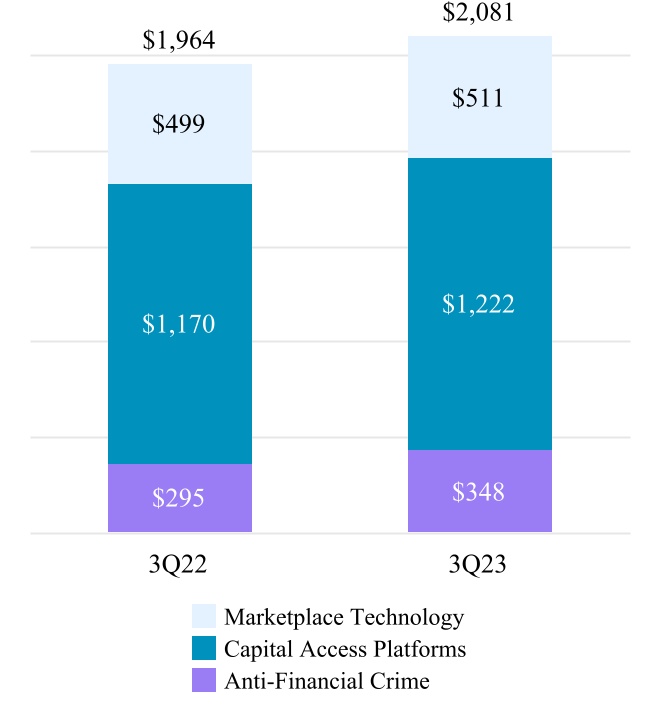

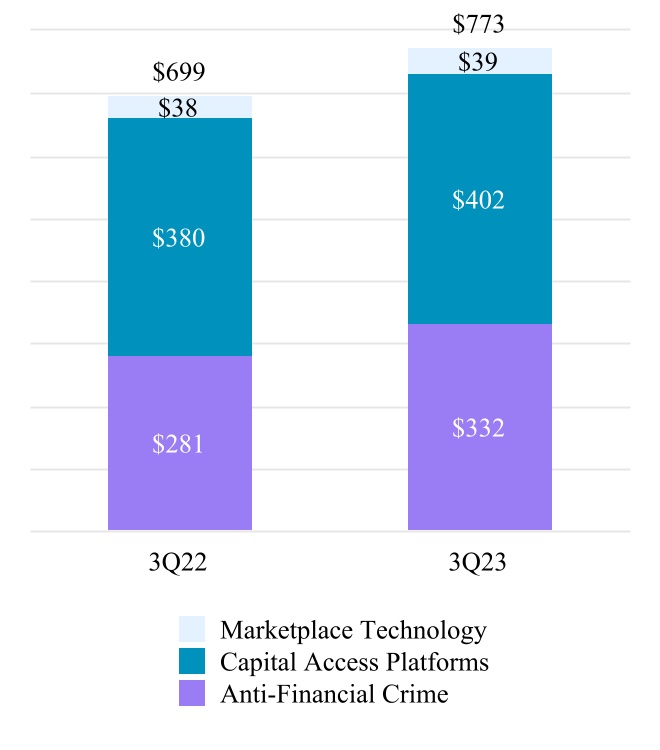

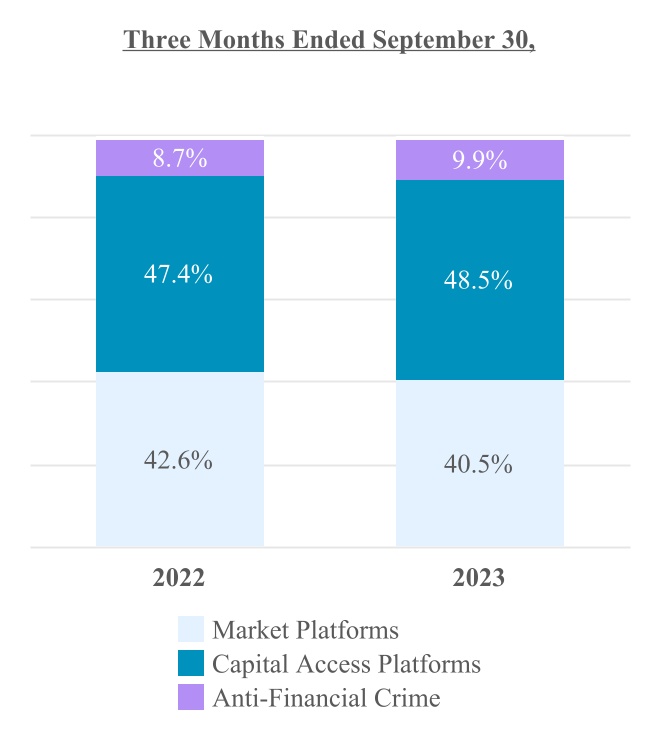

| Three Months Ended September 30, | Percentage Change | |||||||||||||||||||

| 2023 | 2022 | |||||||||||||||||||

| (in millions) | ||||||||||||||||||||

| Market Platforms | $ | 892 | $ | 1,046 | (14.7) | % | ||||||||||||||

| Capital Access Platforms | 456 | 422 | 8.1 | % | ||||||||||||||||

| Anti-Financial Crime | 93 | 77 | 20.8 | % | ||||||||||||||||

| Other revenues | 10 | 12 | (16.7) | % | ||||||||||||||||

| Total revenues | $ | 1,451 | $ | 1,557 | (6.8) | % | ||||||||||||||

| Transaction rebates | (447) | (494) | (9.5) | % | ||||||||||||||||

| Brokerage, clearance and exchange fees | (64) | (173) | (63.0) | % | ||||||||||||||||

| Total revenues less transaction-based expenses | $ | 940 | $ | 890 | 5.6 | % | ||||||||||||||

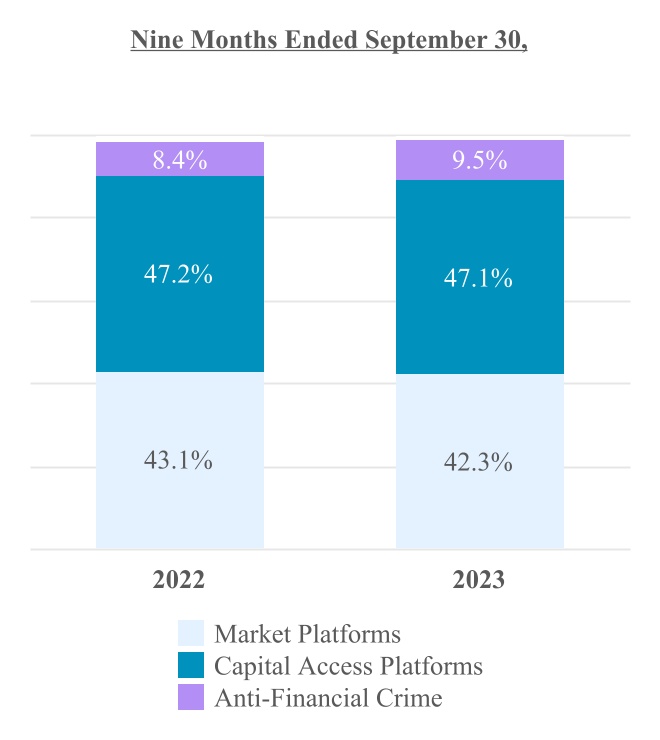

| Nine Months Ended September 30, | Percentage Change | |||||||||||||||||||

| 2023 | 2022 | |||||||||||||||||||

| (in millions) | ||||||||||||||||||||

| Market Platforms | $ | 2,813 | $ | 3,121 | (9.9) | % | ||||||||||||||

| Capital Access Platforms | 1,309 | 1,262 | 3.7 | % | ||||||||||||||||

| Anti-Financial Crime | 265 | 224 | 18.3 | % | ||||||||||||||||

| Other revenues | 30 | 37 | (18.9) | % | ||||||||||||||||

| Total revenues | 4,417 | 4,644 | (4.9) | % | ||||||||||||||||

| Transaction rebates | (1,377) | (1,605) | (14.2) | % | ||||||||||||||||

| Brokerage, clearance and exchange fees | (262) | (364) | (28.0) | % | ||||||||||||||||

| Total revenues less transaction-based expenses | $ | 2,778 | $ | 2,675 | 3.9 | % | ||||||||||||||

In the charts above, Other revenues, which make up approximately 1% for both periods presented, are not shown.

In the charts above, Other revenues, which make up approximately 1% for both periods presented, are not shown.| Three Months Ended September 30, | Percentage Change | ||||||||||||||||

| 2023 | 2022 | ||||||||||||||||

| (in millions) | |||||||||||||||||

| Trading Services | $ | 747 | $ | 906 | (17.5) | % | |||||||||||

| Marketplace Technology | 145 | 140 | 3.6 | % | |||||||||||||

| Total Market Platforms | $ | 892 | $ | 1,046 | (14.7) | % | |||||||||||

| Transaction-based expenses: | |||||||||||||||||

| Transaction rebates | (447) | (494) | (9.5) | % | |||||||||||||

Brokerage, clearance and exchange fees | (64) | (173) | (63.0) | % | |||||||||||||

| Total Market Platforms, net | $ | 381 | $ | 379 | 0.5 | % | |||||||||||

| Nine Months Ended September 30, | Percentage Change | ||||||||||||||||

| 2023 | 2022 | ||||||||||||||||

| (in millions) | |||||||||||||||||

| Trading Services | $ | 2,378 | $ | 2,712 | (12.3) | % | |||||||||||

| Marketplace Technology | 435 | 409 | 6.4 | % | |||||||||||||

| Total Market Platforms | $ | 2,813 | $ | 3,121 | (9.9) | % | |||||||||||

| Transaction-based expenses: | |||||||||||||||||

| Transaction rebates | (1,377) | (1,605) | (14.2) | % | |||||||||||||

Brokerage, clearance and exchange fees | (262) | (364) | (28.0) | % | |||||||||||||

| Total Market Platforms, net | $ | 1,174 | $ | 1,152 | 1.9 | % | |||||||||||

| Three Months Ended September 30, | Percentage Change | ||||||||||||||||

| 2023 | 2022 | ||||||||||||||||

| (in millions) | |||||||||||||||||

| U.S. Equity Derivative Trading | $ | 92 | $ | 92 | — | % | |||||||||||

| Cash Equity Trading | 93 | 94 | (1.1) | % | |||||||||||||

| U.S. Tape plans | 35 | 36 | (2.8) | % | |||||||||||||

| Other | 16 | 17 | (5.9) | % | |||||||||||||

| Trading Services, net | $ | 236 | $ | 239 | (1.3) | % | |||||||||||

| Nine Months Ended September 30, | Percentage Change | ||||||||||||||||

| 2023 | 2022 | ||||||||||||||||

| (in millions) | |||||||||||||||||

| U.S. Equity Derivative Trading | $ | 283 | $ | 275 | 2.9 | % | |||||||||||

| Cash Equity Trading | 299 | 300 | (0.3) | % | |||||||||||||

| U.S. Tape plans | 107 | 113 | (5.3) | % | |||||||||||||

| Other | 50 | 55 | (9.1) | % | |||||||||||||

| Trading Services, net | $ | 739 | $ | 743 | (0.5) | % | |||||||||||

| Three Months Ended September 30, | Percentage Change | ||||||||||||||||

| 2023 | 2022 | ||||||||||||||||

| (in millions) | |||||||||||||||||

| U.S. Equity Derivative Trading Revenues | $ | 316 | $ | 316 | — | % | |||||||||||

Section 31 fees | 9 | 26 | (65.4) | % | |||||||||||||

| Transaction-based expenses: | |||||||||||||||||

| Transaction rebates | (223) | (222) | 0.5 | % | |||||||||||||

Section 31 fees | (9) | (26) | (65.4) | % | |||||||||||||

| Brokerage and clearance fees | (1) | (2) | (50.0) | % | |||||||||||||

| U.S. Equity derivative trading revenues, net | $ | 92 | $ | 92 | — | % | |||||||||||

| Nine Months Ended September 30, | Percentage Change | ||||||||||||||||

| 2023 | 2022 | ||||||||||||||||

| (in millions) | |||||||||||||||||

| U.S. Equity Derivative Trading Revenues | $ | 940 | $ | 938 | 0.2 | % | |||||||||||

Section 31 fees | 43 | 46 | (6.5) | % | |||||||||||||

| Transaction-based expenses: | |||||||||||||||||

| Transaction rebates | (654) | (660) | (0.9) | % | |||||||||||||

Section 31 fees | (43) | (46) | (6.5) | % | |||||||||||||

| Brokerage and clearance fees | (3) | (3) | — | % | |||||||||||||

| U.S. Equity derivative trading revenues, net | $ | 283 | $ | 275 | 2.9 | % | |||||||||||

| Three Months Ended September 30, | |||||||||||

| 2023 | 2022 | ||||||||||

| U.S. equity options | |||||||||||

| Total industry average daily volume (in millions) | 39.6 | 37.0 | |||||||||

| Nasdaq PHLX matched market share | 11.0 | % | 11.2 | % | |||||||

| The Nasdaq Options Market matched market share | 5.6 | % | 8.3 | % | |||||||

| Nasdaq BX Options matched market share | 4.4 | % | 3.9 | % | |||||||

| Nasdaq ISE Options matched market share | 5.7 | % | 5.5 | % | |||||||

| Nasdaq GEMX Options matched market share | 3.0 | % | 2.1 | % | |||||||

| Nasdaq MRX Options matched market share | 2.0 | % | 1.6 | % | |||||||

| Total matched market share executed on Nasdaq’s exchanges | 31.7 | % | 32.6 | % | |||||||

| Nine Months Ended September 30, | |||||||||||

| 2023 | 2022 | ||||||||||

| U.S. equity options | |||||||||||

| Total industry average daily volume (in millions) | 40.4 | 37.9 | |||||||||

| Nasdaq PHLX matched market share | 11.2 | % | 11.4 | % | |||||||

| The Nasdaq Options Market matched market share | 6.4 | % | 8.3 | % | |||||||

| Nasdaq BX Options matched market share | 3.6 | % | 2.7 | % | |||||||

| Nasdaq ISE Options matched market share | 5.8 | % | 5.6 | % | |||||||

| Nasdaq GEMX Options matched market share | 2.3 | % | 2.3 | % | |||||||

| Nasdaq MRX Options matched market share | 1.7 | % | 1.7 | % | |||||||

| Total matched market share executed on Nasdaq’s exchanges | 31.0 | % | 32.0 | % | |||||||

| Three Months Ended September 30, | Percentage Change | ||||||||||||||||

| 2023 | 2022 | ||||||||||||||||

| (in millions) | |||||||||||||||||

| Cash Equity Trading Revenues | $ | 316 | $ | 365 | (13.4) | % | |||||||||||

Section 31 fees | 50 | 140 | (64.3) | % | |||||||||||||

| Transaction-based expenses: | |||||||||||||||||

| Transaction rebates | (219) | (266) | (17.7) | % | |||||||||||||

Section 31 fees | (50) | (140) | (64.3) | % | |||||||||||||

| Brokerage and clearance fees | (4) | (5) | (20.0) | % | |||||||||||||

| Cash equity trading revenues, net | $ | 93 | $ | 94 | (1.1) | % | |||||||||||

| Nine Months Ended September 30, | Percentage Change | ||||||||||||||||

| 2023 | 2022 | ||||||||||||||||

| (in millions) | |||||||||||||||||

| Cash Equity Trading Revenues | $ | 1,022 | $ | 1,240 | (17.6) | % | |||||||||||

Section 31 fees | 201 | 296 | (32.1) | % | |||||||||||||

| Transaction-based expenses: | |||||||||||||||||

| Transaction rebates | (708) | (921) | (23.1) | % | |||||||||||||

Section 31 fees | (201) | (296) | (32.1) | % | |||||||||||||

| Brokerage and clearance fees | (15) | (19) | (21.1) | % | |||||||||||||

| Cash equity trading revenues, net | $ | 299 | $ | 300 | (0.3) | % | |||||||||||

| Three Months Ended September 30, | |||||||||||

| 2023 | 2022 | ||||||||||

| Total U.S.-listed securities | |||||||||||

| Total industry average daily share volume (in billions) | 10.4 | 10.9 | |||||||||

| Matched share volume (in billions) | 106.7 | 119.9 | |||||||||

| The Nasdaq Stock Market matched market share | 15.5 | % | 15.9 | % | |||||||

| Nasdaq BX matched market share | 0.4 | % | 0.5 | % | |||||||

| Nasdaq PSX matched market share | 0.3 | % | 0.8 | % | |||||||

| Total matched market share executed on Nasdaq’s exchanges | 16.2 | % | 17.2 | % | |||||||

| Market share reported to the FINRA/Nasdaq Trade Reporting Facility | 40.2 | % | 36.9 | % | |||||||

| Total market share | 56.4 | % | 54.1 | % | |||||||

| Nasdaq Nordic and Nasdaq Baltic securities | |||||||||||

| Average daily number of equity trades executed on Nasdaq’s exchanges | 556,257 | 784,672 | |||||||||

| Total average daily value of shares traded (in billions) | $ | 3.6 | $ | 4.3 | |||||||

| Total market share executed on Nasdaq’s exchanges | 71.6 | % | 71.1 | % | |||||||

| Nine Months Ended September 30, | |||||||||||

| 2023 | 2022 | ||||||||||

| Total U.S.-listed securities | |||||||||||

| Total industry average daily share volume (in billions) | 11.0 | 12.1 | |||||||||

| Matched share volume (in billions) | 342.2 | 401.2 | |||||||||

| The Nasdaq Stock Market matched market share | 15.9 | % | 16.3 | % | |||||||

| Nasdaq BX matched market share | 0.4 | % | 0.5 | % | |||||||

| Nasdaq PSX matched market share | 0.4 | % | 0.8 | % | |||||||

| Total matched market share executed on Nasdaq’s exchanges | 16.7 | % | 17.6 | % | |||||||

| Market share reported to the FINRA/Nasdaq Trade Reporting Facility | 35.2 | % | 34.8 | % | |||||||

| Total market share | 51.9 | % | 52.4 | % | |||||||

| Nasdaq Nordic and Nasdaq Baltic securities | |||||||||||

| Average daily number of equity trades executed on Nasdaq’s exchanges | 676,132 | 953,090 | |||||||||

| Total average daily value of shares traded (in billions) | $ | 4.5 | $ | 5.6 | |||||||

| Total market share executed on Nasdaq’s exchanges | 70.6 | % | 72.1 | % | |||||||

| Three Months Ended September 30, | Percentage Change | ||||||||||||||||

| 2023 | 2022 | ||||||||||||||||

| (in millions) | |||||||||||||||||

| U.S. Tape plans | $ | 35 | $ | 36 | (2.8) | % | |||||||||||

| Nine Months Ended September 30, | Percentage Change | ||||||||||||||||

| 2023 | 2022 | ||||||||||||||||

| (in millions) | |||||||||||||||||

| U.S. Tape plans | $ | 107 | $ | 113 | (5.3) | % | |||||||||||

| Three Months Ended September 30, | Percentage Change | ||||||||||||||||

| 2023 | 2022 | ||||||||||||||||

| (in millions) | |||||||||||||||||

| Other | $ | 16 | $ | 17 | (5.9) | % | |||||||||||

| Nine Months Ended September 30, | Percentage Change | ||||||||||||||||

| 2023 | 2022 | ||||||||||||||||

| (in millions) | |||||||||||||||||

| Other | $ | 50 | $ | 55 | (9.1) | % | |||||||||||

| Three Months Ended September 30, | |||||||||||

| 2023 | 2022 | ||||||||||

| Nasdaq Nordic and Nasdaq Baltic options and futures | |||||||||||

| Total average daily volume of options and futures contracts | 245,986 | 267,137 | |||||||||

| Nine Months Ended September 30, | |||||||||||

| 2023 | 2022 | ||||||||||

| Nasdaq Nordic and Nasdaq Baltic options and futures | |||||||||||

| Total average daily volume of options and futures contracts | 298,785 | 303,095 | |||||||||

| Three Months Ended September 30, | Percentage Change | ||||||||||||||||

| 2023 | 2022 | ||||||||||||||||

| (in millions) | |||||||||||||||||

| Marketplace Technology | $ | 145 | $ | 140 | 3.6 | % | |||||||||||

| Nine Months Ended September 30, | Percentage Change | ||||||||||||||||

| 2023 | 2022 | ||||||||||||||||

| (in millions) | |||||||||||||||||

| Marketplace Technology | $ | 435 | $ | 409 | 6.4 | % | |||||||||||

| As of or Three Months Ended September 30, | ||||||||||||||

| 2023 | 2022 | |||||||||||||

| (in millions) | ||||||||||||||

| ARR | $ | 511 | $ | 499 | ||||||||||

| Quarterly annualized SaaS revenues | 39 | 38 | ||||||||||||

| Order intake | 33 | 30 | ||||||||||||

| Nine Months Ended September 30, | ||||||||||||||

| 2023 | 2022 | |||||||||||||

| (in millions) | ||||||||||||||

| Order intake | 155 | 157 | ||||||||||||

| Three Months Ended September 30, | Percentage Change | ||||||||||||||||

| 2023 | 2022 | ||||||||||||||||

| (in millions) | |||||||||||||||||

| Data & Listing Services | $ | 188 | $ | 179 | 5.0 | % | |||||||||||

| Index | 144 | 125 | 15.2 | % | |||||||||||||

| Workflow & Insights | 124 | 118 | 5.1 | % | |||||||||||||

| Total Capital Access Platforms | $ | 456 | $ | 422 | 8.1 | % | |||||||||||

| Nine Months Ended September 30, | Percentage Change | ||||||||||||||||

| 2023 | 2022 | ||||||||||||||||

| (in millions) | |||||||||||||||||

| Data & Listing Services | $ | 559 | $ | 545 | 2.6 | % | |||||||||||

| Index | 383 | 370 | 3.5 | % | |||||||||||||

| Workflow & Insights | 367 | 347 | 5.8 | % | |||||||||||||

| Total Capital Access Platforms | $ | 1,309 | $ | 1,262 | 3.7 | % | |||||||||||

| As of or Nine Months Ended September 30, | |||||||||||

| 2023 | 2022 | ||||||||||

| (in millions) | |||||||||||

| ARR | $ | 1,222 | $ | 1,170 | |||||||

| Quarterly annualized SaaS revenues | 402 | 380 | |||||||||

| Three Months Ended September 30, | ||||||||||||||

| 2023 | 2022 | |||||||||||||

| IPOs | ||||||||||||||

| The Nasdaq Stock Market | 39 | 35 | ||||||||||||

| Exchanges that comprise Nasdaq Nordic and Nasdaq Baltic | — | 3 | ||||||||||||

| Total new listings | ||||||||||||||

| The Nasdaq Stock Market | 87 | 98 | ||||||||||||

| Exchanges that comprise Nasdaq Nordic and Nasdaq Baltic | 3 | 9 | ||||||||||||

| Nine Months Ended September 30, | ||||||||||||||

| 2023 | 2022 | |||||||||||||

| IPOs | ||||||||||||||

| The Nasdaq Stock Market | 102 | 143 | ||||||||||||

| Exchanges that comprise Nasdaq Nordic and Nasdaq Baltic | 3 | 33 | ||||||||||||

| Total new listings | ||||||||||||||

| The Nasdaq Stock Market | 230 | 292 | ||||||||||||

| Exchanges that comprise Nasdaq Nordic and Nasdaq Baltic | 16 | 53 | ||||||||||||

| Number of listed companies | ||||||||||||||

| The Nasdaq Stock Market | 4,086 | 4,296 | ||||||||||||

| Exchanges that comprise Nasdaq Nordic and Nasdaq Baltic | 1,236 | 1,253 | ||||||||||||

| As of or Three Months Ended September 30, | ||||||||||||||

| 2023 | 2022 | |||||||||||||

| Number of licensed ETPs | 393 | 374 | ||||||||||||

| TTM change in period end ETP AUM tracking Nasdaq indexes (in billions) | ||||||||||||||

| Beginning balance | $ | 311 | $ | 361 | ||||||||||

| Net appreciation (depreciation) | 78 | (106) | ||||||||||||

| Net impact of ETP sponsor switches | (2) | — | ||||||||||||

| Net inflows | 24 | 56 | ||||||||||||

| Ending balance | $ | 411 | $ | 311 | ||||||||||

| Quarterly average ETP AUM tracking Nasdaq indexes (in billions) | $ | 423 | $ | 346 | ||||||||||

| Three Months Ended September 30, | Percentage Change | ||||||||||||||||

| 2023 | 2022 | ||||||||||||||||

| (in millions) | |||||||||||||||||

| Anti-Financial Crime | $ | 93 | $ | 77 | 20.8 | % | |||||||||||

| Nine Months Ended September 30, | Percentage Change | ||||||||||||||||

| 2023 | 2022 | ||||||||||||||||

| (in millions) | |||||||||||||||||

| Anti-Financial Crime | $ | 265 | $ | 224 | 18.3 | % | |||||||||||

| As of or Three Months Ended September 30, | ||||||||||||||

| 2023 | 2022 | |||||||||||||

| (in millions) | ||||||||||||||

| ARR | $ | 348 | $ | 295 | ||||||||||

| Total signed ARR | 381 | 320 | ||||||||||||

| Quarterly annualized SaaS revenues | 332 | 281 | ||||||||||||

| Three Months Ended September 30, | Percentage Change | ||||||||||||||||

| 2023 | 2022 | ||||||||||||||||

| (in millions) | |||||||||||||||||

| Compensation and benefits | $ | 260 | $ | 249 | 4.4 | % | |||||||||||

| Professional and contract services | 31 | 34 | (8.8) | % | |||||||||||||

| Computer operations and data communications | 58 | 50 | 16.0 | % | |||||||||||||

| Occupancy | 28 | 25 | 12.0 | % | |||||||||||||

| General, administrative and other | 26 | 38 | (31.6) | % | |||||||||||||

| Marketing and advertising | 12 | 10 | 20.0 | % | |||||||||||||

| Depreciation and amortization | 64 | 63 | 1.6 | % | |||||||||||||

| Regulatory | 9 | 9 | — | % | |||||||||||||

| Merger and strategic initiatives | 4 | 14 | (71.4) | % | |||||||||||||

| Restructuring charges | 17 | — | N/M | ||||||||||||||

| Total operating expenses | $ | 509 | $ | 492 | 3.5 | % | |||||||||||

| Nine Months Ended September 30, | Percentage Change | ||||||||||||||||

| 2023 | 2022 | ||||||||||||||||

| (in millions) | |||||||||||||||||

| Compensation and benefits | $ | 777 | $ | 750 | 3.6 | % | |||||||||||

| Professional and contract services | 92 | 97 | (5.2) | % | |||||||||||||

| Computer operations and data communications | 168 | 150 | 12.0 | % | |||||||||||||

| Occupancy | 99 | 78 | 26.9 | % | |||||||||||||

| General, administrative and other | 62 | 94 | (34.0) | % | |||||||||||||

| Marketing and advertising | 30 | 31 | (3.2) | % | |||||||||||||

| Depreciation and amortization | 198 | 195 | 1.5 | % | |||||||||||||

| Regulatory | 27 | 24 | 12.5 | % | |||||||||||||

| Merger and strategic initiatives | 51 | 41 | 24.4 | % | |||||||||||||

| Restructuring charges | 49 | — | N/M | ||||||||||||||

| Total operating expenses | $ | 1,553 | $ | 1,460 | 6.4 | % | |||||||||||

| Three Months Ended September 30, | Percentage Change | ||||||||||||||||

| 2023 | 2022 | ||||||||||||||||

| (in millions) | |||||||||||||||||

| Interest income | $ | 72 | $ | 2 | 3,500.0% | ||||||||||||

| Interest expense | (101) | (32) | 215.6 | % | |||||||||||||

| Net interest expense | (29) | (30) | (3.3) | % | |||||||||||||

Other income | 1 | 6 | (83.3) | % | |||||||||||||

| Net income (loss) from unconsolidated investees | (12) | 8 | (250.0) | % | |||||||||||||

| Total non-operating expense | $ | (40) | $ | (16) | 150.0 | % | |||||||||||

| Nine Months Ended September 30, | Percentage Change | ||||||||||||||||

| 2023 | 2022 | ||||||||||||||||

| (in millions) | |||||||||||||||||

| Interest income | $ | 86 | $ | 3 | 2,766.7 | % | |||||||||||

| Interest expense | (174) | (96) | 81.3 | % | |||||||||||||

| Net interest expense | (88) | (93) | (5.4) | % | |||||||||||||

| Other income (loss) | (6) | 8 | (175.0) | % | |||||||||||||

Net income (loss) from unconsolidated investees | (8) | 23 | (134.8) | % | |||||||||||||

| Total non-operating expenses | $ | (102) | $ | (62) | 64.5 | % | |||||||||||

| Three Months Ended September 30, | Percentage Change | ||||||||||||||||

| 2023 | 2022 | ||||||||||||||||

| (in millions) | |||||||||||||||||

| Interest expense on debt | $ | 97 | $ | 30 | 223.3 | % | |||||||||||

| Accretion of debt issuance costs and debt discount | 3 | 1 | 200.0 | % | |||||||||||||

| Other fees | 1 | 1 | — | % | |||||||||||||

| Interest expense | $ | 101 | $ | 32 | 215.6 | % | |||||||||||

| Nine Months Ended September 30, | Percentage Change | ||||||||||||||||

| 2023 | 2022 | ||||||||||||||||

| (in millions) | |||||||||||||||||

| Interest expense on debt | $ | 166 | $ | 89 | 86.5 | % | |||||||||||

| Accretion of debt issuance costs and debt discount | 6 | 5 | 20.0 | % | |||||||||||||

| Other fees | 2 | 2 | — | % | |||||||||||||

| Interest expense | $ | 174 | $ | 96 | 81.3 | % | |||||||||||

| Three Months Ended September 30, | Percentage Change | ||||||||||||||||

| 2023 | 2022 | ||||||||||||||||

| ($ in millions) | |||||||||||||||||

Income tax provision | $ | 97 | $ | 88 | 10.2 | % | |||||||||||

Effective tax rate | 24.8 | % | 23.0 | % | |||||||||||||

| Nine Months Ended September 30, | Percentage Change | ||||||||||||||||

| 2023 | 2022 | ||||||||||||||||

| (in millions) | |||||||||||||||||

| Income tax provision | $ | 262 | $ | 270 | (3.0) | % | |||||||||||

Effective tax rate | 23.3 | % | 23.4 | % | |||||||||||||

| Three Months Ended September 30, | |||||||||||

| 2023 | 2022 | ||||||||||

| (in millions, except per share amounts) | |||||||||||

| U.S. GAAP net income attributable to Nasdaq | $ | 294 | $ | 294 | |||||||

| Non-GAAP adjustments: | |||||||||||

| Amortization expense of acquired intangible assets | 37 | 38 | |||||||||

| Merger and strategic initiatives expense | 4 | 14 | |||||||||

| Restructuring charges | 17 | — | |||||||||

| Net loss (income) from unconsolidated investees | 12 | (8) | |||||||||

Other income | 9 | 17 | |||||||||

| Total non-GAAP adjustments | 79 | 61 | |||||||||

| Total non-GAAP tax adjustments | (24) | (20) | |||||||||

| Total non-GAAP adjustments, net of tax | 55 | 41 | |||||||||

| Non-GAAP net income attributable to Nasdaq | $ | 349 | $ | 335 | |||||||

| U.S. GAAP effective tax rate | 24.8 | % | 23.0 | % | |||||||

| Total adjustments from non-GAAP tax rate | 0.9 | % | 1.4 | % | |||||||

| Non-GAAP effective tax rate | 25.7 | % | 24.4 | % | |||||||

| Weighted-average common shares outstanding for diluted earnings per share | 494.1 | 496.3 | |||||||||

| U.S. GAAP diluted earnings per share | $ | 0.60 | $ | 0.59 | |||||||

| Total adjustments from non-GAAP net income | 0.11 | 0.09 | |||||||||

| Non-GAAP diluted earnings per share | $ | 0.71 | $ | 0.68 | |||||||

| Nine Months Ended September 30, | |||||||||||

| 2023 | 2022 | ||||||||||

| (in millions, except per share amounts) | |||||||||||

| U.S. GAAP net income attributable to Nasdaq | $ | 862 | $ | 884 | |||||||

| Non-GAAP adjustments: | |||||||||||

| Amortization expense of acquired intangible assets | 112 | 116 | |||||||||

| Merger and strategic initiatives expense | 51 | 41 | |||||||||

| Restructuring charges | 49 | — | |||||||||

| Lease asset impairments | 24 | — | |||||||||

| Extinguishment of debt | — | 16 | |||||||||

Net loss (income) from unconsolidated investees | 8 | (23) | |||||||||

Other income | 7 | 19 | |||||||||

| Total non-GAAP adjustments | 251 | 169 | |||||||||

| Total non-GAAP tax adjustments | (76) | (48) | |||||||||

| Total non-GAAP adjustments, net of tax | 175 | 121 | |||||||||

| Non-GAAP net income attributable to Nasdaq | $ | 1,037 | $ | 1,005 | |||||||

| U.S. GAAP effective tax rate | 23.3 | % | 23.4 | % | |||||||

| Total adjustments from non-GAAP tax rate | 1.3 | % | 0.7 | % | |||||||

| Non-GAAP effective tax rate | 24.6 | % | 24.1 | % | |||||||

| Weighted-average common shares outstanding for diluted earnings per share | 494.2 | 498.2 | |||||||||

| U.S. GAAP diluted earnings per share | $ | 1.74 | $ | 1.77 | |||||||

| Total adjustments from non-GAAP net income | 0.36 | 0.25 | |||||||||

| Non-GAAP diluted earnings per share | $ | 2.10 | $ | 2.02 | |||||||

| September 30, 2023 | December 31, 2022 | |||||||||||||

| (in millions) | ||||||||||||||

| Cash and cash equivalents | $ | 5,340 | $ | 502 | ||||||||||

| Financial investments | 272 | 181 | ||||||||||||

| Total financial assets | $ | 5,612 | $ | 683 | ||||||||||

| Nine Months Ended September 30, | |||||||||||

| 2023 | 2022 | ||||||||||

| Net cash provided by (used in): | (in millions) | ||||||||||

| Operating activities | $ | 1,279 | $ | 1,212 | |||||||

| Investing activities | (158) | (25) | |||||||||

| Financing activities | 3,019 | 4,275 | |||||||||

| Effect of exchange rate changes on cash and cash equivalents and restricted cash and cash equivalents | (300) | (1,724) | |||||||||

Net increase in cash and cash equivalents and restricted cash and cash equivalents | 3,840 | 3,738 | |||||||||

| Cash and cash equivalents, restricted cash and cash equivalents at beginning of period | 6,994 | 5,496 | |||||||||

| Cash and cash equivalents, restricted cash and cash equivalents at end of period | $ | 10,834 | $ | 9,234 | |||||||

| Reconciliation of Cash, Cash Equivalents and Restricted Cash and Cash Equivalents | |||||||||||

| Cash and cash equivalents | $ | 5,340 | $ | 301 | |||||||

| Restricted cash and cash equivalents | 25 | 51 | |||||||||

| Restricted cash and cash equivalents (default funds and margin deposits) | 5,469 | 8,882 | |||||||||

| Total | $ | 10,834 | $ | 9,234 | |||||||

| 2023 | 2022 | ||||||||||

| First quarter | $ | 0.20 | $ | 0.18 | |||||||

| Second quarter | 0.22 | 0.20 | |||||||||

| Third quarter | 0.22 | 0.20 | |||||||||

| Total | $ | 0.64 | $ | 0.58 | |||||||

| Maturity Date | September 30, 2023 | December 31, 2022 | ||||||||||||||||||

| (in millions) | ||||||||||||||||||||

| Short-term debt: | ||||||||||||||||||||

| Commercial paper | $ | — | $ | 664 | ||||||||||||||||

Total short-term debt | $ | — | $ | 664 | ||||||||||||||||

Long-term debt - senior unsecured notes: | ||||||||||||||||||||

2025 Notes | May 2025 | 497 | — | |||||||||||||||||

2026 Notes | June 2026 | 499 | 498 | |||||||||||||||||

2028 Notes | May 2028 | 991 | — | |||||||||||||||||

| 2029 Notes | March 2029 | 630 | 637 | |||||||||||||||||

| 2030 Notes | February 2030 | 630 | 637 | |||||||||||||||||

| 2031 Notes | January 2031 | 644 | 644 | |||||||||||||||||

2032 Notes | February 2032 | 784 | — | |||||||||||||||||

| 2033 Notes | July 2033 | 645 | 653 | |||||||||||||||||

2034 Notes | February 2034 | 1,239 | — | |||||||||||||||||

| 2040 Notes | December 2040 | 644 | 644 | |||||||||||||||||

| 2050 Notes | April 2050 | 487 | 486 | |||||||||||||||||

| 2052 Notes | March 2052 | 541 | 541 | |||||||||||||||||

| 2053 Notes | August 2053 | 738 | — | |||||||||||||||||

| 2063 Notes | June 2063 | 738 | — | |||||||||||||||||

2022 Revolving Credit Agreement | December 2027 | (4) | (5) | |||||||||||||||||

Total long-term debt | $ | 9,703 | $ | 4,735 | ||||||||||||||||

Total debt obligations | $ | 9,703 | $ | 5,399 | ||||||||||||||||

| Payments Due by Period | |||||||||||||||||

| (in millions) | Total | <1 year | 1-3 years | 3-5 years | 5+ years | ||||||||||||

| Debt obligation by contractual maturity | $ | 16,001 | $ | 386 | $ | 1,740 | $ | 1,673 | $ | 12,202 | |||||||

| Operating lease obligations | 636 | 80 | 136 | 114 | 306 | ||||||||||||

| Purchase obligations | 421 | 86 | 107 | 89 | 139 | ||||||||||||

| Total | $ | 17,058 | $ | 552 | $ | 1,983 | $ | 1,876 | $ | 12,647 | |||||||

| Euro | Swedish Krona | Canadian Dollar | Other Foreign Currencies | U.S. Dollar | Total | |||||||||||||||||||||||||||||||||

| (in millions, except currency rate) | ||||||||||||||||||||||||||||||||||||||

| Three Months Ended September 30, 2023 | ||||||||||||||||||||||||||||||||||||||

| Average foreign currency rate to the U.S. dollar | 1.088 | 0.093 | 0.746 | # | N/A | N/A | ||||||||||||||||||||||||||||||||

| Percentage of revenues less transaction-based expenses | 6.1% | 3.8% | 0.9% | 3.1% | 86.1% | 100.0% | ||||||||||||||||||||||||||||||||

| Percentage of operating income | 8.5% | (3)% | (6.5)% | (4.9)% | 105.9% | 100.0% | ||||||||||||||||||||||||||||||||

| Impact of a 10% adverse currency fluctuation on revenues less transaction-based expenses | $(6) | $(4) | $(1) | $(2) | $— | $(13) | ||||||||||||||||||||||||||||||||

| Impact of a 10% adverse currency fluctuation on operating income | $(4) | $(1) | $(3) | $(2) | $— | $(10) | ||||||||||||||||||||||||||||||||

| Euro | Swedish Krona | Canadian Dollar | Other Foreign Currencies | U.S. Dollar | Total | |||||||||||||||||||||||||||||||||

| (in millions, except currency rate) | ||||||||||||||||||||||||||||||||||||||

| Nine Months Ended September 30, 2023 | ||||||||||||||||||||||||||||||||||||||

| Average foreign currency rate to the U.S. dollar | 1.083 | 0.094 | 0.743 | # | N/A | N/A | ||||||||||||||||||||||||||||||||

| Percentage of revenues less transaction-based expenses | 6.3% | 4.2% | 0.9% | 3.0% | 85.6% | 100.0% | ||||||||||||||||||||||||||||||||

| Percentage of operating income | 9.9% | (3.6)% | (6.9)% | (5.7)% | 106.3% | 100.0% | ||||||||||||||||||||||||||||||||

| Impact of a 10% adverse currency fluctuation on revenues less transaction-based expenses | $(18) | $(12) | $(3) | $(8) | $— | $(41) | ||||||||||||||||||||||||||||||||

| Impact of a 10% adverse currency fluctuation on operating income | $(12) | $(4) | $(8) | $(7) | $— | $(31) | ||||||||||||||||||||||||||||||||

| Net Assets | Impact of a 10% Adverse Currency Fluctuation | |||||||||||||

| (in millions) | ||||||||||||||

| Swedish Krona | $ | 2,976 | $ | 298 | ||||||||||

| British Pound | 144 | 14 | ||||||||||||

| Norwegian Krone | 137 | 14 | ||||||||||||

| Canadian Dollar | 104 | 10 | ||||||||||||

| Australian Dollar | 98 | 10 | ||||||||||||

| Euro | 48 | 5 | ||||||||||||

| Period | (a) Total Number of Shares Purchased | (b) Average Price Paid Per Share | (c) Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs | (d) Maximum Dollar Value of Shares that May Yet Be Purchased Under the Plans or Programs (in millions) | ||||||||||||||||||||||

| July 2023 | ||||||||||||||||||||||||||

| Share repurchase program | — | $ | — | — | $ | 491 | ||||||||||||||||||||

| Employee transactions | 31,331 | $ | 49.72 | N/A | N/A | |||||||||||||||||||||

| August 2023 | ||||||||||||||||||||||||||

| Share repurchase program | — | $ | — | — | $ | 491 | ||||||||||||||||||||

| Employee transactions | — | $ | — | N/A | N/A | |||||||||||||||||||||

| September 2023 | ||||||||||||||||||||||||||

| Share repurchase program | — | $ | — | — | $ | 2,000 | ||||||||||||||||||||

| Employee transactions | 453 | $ | 51.94 | N/A | N/A | |||||||||||||||||||||

| Total Quarter Ended September 30, 2023 | ||||||||||||||||||||||||||

| Share repurchase program | — | $ | — | — | $ | 2,000 | ||||||||||||||||||||

| Employee transactions | 31,784 | $ | 49.75 | N/A | N/A | |||||||||||||||||||||

| Exhibit Number | ||||||||

| 101 | The following materials from the Nasdaq, Inc. Quarterly Report on Form 10-Q for the quarter ended September 30, 2023, formatted in iXBRL (Inline eXtensible Business Reporting Language): (i) Condensed Consolidated Balance Sheets as of September 30, 2023 and December 31, 2022; (ii) Condensed Consolidated Statements of Income for the three and nine months ended September 30, 2023 and 2022; (iii) Condensed Consolidated Statements of Comprehensive Income for the three and nine months ended September 30, 2023 and 2022; (iv) Condensed Consolidated Statements of Changes in Stockholders' Equity for the three and nine months ended September 30, 2023 and 2022; (v) Condensed Consolidated Statements of Cash Flows for the nine months ended September 30, 2023 and 2022; and (vi) notes to condensed consolidated financial statements. | |||||||

| 104 | Cover Page Interactive Data File, formatted in iXBRL and contained in Exhibit 101. | |||||||

| Nasdaq, Inc. | ||||||||

| (Registrant) | ||||||||

| By: | /s/ Adena T. Friedman | |||||||

| Name: | Adena T. Friedman | |||||||

| Title: | Chief Executive Officer | |||||||

| Date: | November 3, 2023 | |||||||

| By: | /s/ Ann M. Dennison | |||||||

| Name: | Ann M. Dennison | |||||||

| Title: | Executive Vice President and Chief Financial Officer | |||||||

| Date: | November 3, 2023 | |||||||

154 West 42nd Street, NY, 10036 USA | Nasdaq.com

154 West 42nd Street, NY, 10036 USA | Nasdaq.com