☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2018 | |

OR | |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ________ to ________ | |

Delaware (State or Other Jurisdiction of Incorporation or Organization) | 52-1165937 (I.R.S. Employer Identification No.) |

One Liberty Plaza, New York, New York (Address of Principal Executive Offices) | 10006 (Zip Code) |

Large accelerated filer | ☒ | Accelerated filer | ☐ |

Non-accelerated filer | ☐ (Do not check if a smaller reporting company) | Smaller reporting company | ☐ |

Emerging growth company | ☐ | ||

Class | Outstanding at July 24, 2018 | |

Common Stock, $.01 par value per share | 164,508,507 shares | |

Page | ||

Item 1. | ||

Item 2. | ||

Item 3. | ||

Item 4. | ||

Item 1. | ||

Item 1A. | ||

Item 2. | ||

Item 3. | ||

Item 4. | ||

Item 5. | ||

Item 6. | ||

• | “Nasdaq,” “we,” “us” and “our” refer to Nasdaq, Inc. |

• | “Nasdaq Baltic” refers to collectively, Nasdaq Tallinn AS, Nasdaq Riga, AS, and AB Nasdaq Vilnius. |

• | “Nasdaq BX” refers to the cash equity exchange operated by Nasdaq BX, Inc. |

• | “Nasdaq BX Options” refers to the options exchange operated by Nasdaq BX, Inc. |

• | “Nasdaq Clearing” refers to the clearing operations conducted by Nasdaq Clearing AB. |

• | “Nasdaq GEMX” refers to the options exchange operated by Nasdaq GEMX, LLC. |

• | “Nasdaq ISE” refers to the options exchange operated by Nasdaq ISE, LLC. |

• | “Nasdaq MRX” refers to the options exchange operated by Nasdaq MRX, LLC. |

• | “Nasdaq Nordic” refers to collectively, Nasdaq Clearing AB, Nasdaq Stockholm AB, Nasdaq Copenhagen A/S, Nasdaq Helsinki Ltd, and Nasdaq Iceland hf. |

• | “Nasdaq PHLX” refers to the options exchange operated by Nasdaq PHLX LLC. |

• | “Nasdaq PSX” refers to the cash equity exchange operated by Nasdaq PHLX LLC. |

• | “The Nasdaq Stock Market” refers to the cash equity exchange operated by The Nasdaq Stock Market LLC. |

• | our strategy, growth forecasts and 2018 outlook; |

• | the integration of acquired businesses, including accounting decisions relating thereto; |

• | the scope, nature or impact of acquisitions, divestitures, investments, joint ventures or other transactional activities; |

• | the effective dates for, and expected benefits of, ongoing initiatives, including transactional activities and other strategic, restructuring, technology, de-leveraging and capital return initiatives; |

• | our products, order backlog and services; |

• | the impact of pricing changes; |

• | tax matters; |

• | the cost and availability of liquidity and capital; and |

• | any litigation, or any regulatory or government investigation or action, to which we are or could become a party or which may affect us. |

• | our operating results may be lower than expected; |

• | our ability to successfully integrate acquired businesses or divest sold businesses or assets, including the fact that any integration may be more difficult, time consuming or costly than expected, and we may be unable to realize synergies from business combinations, acquisitions, divestitures or other transactional activities; |

• | loss of significant trading and clearing volumes or values, fees, market share, listed companies, market data products customers or other customers; |

• | our ability to keep up with rapid technological advances and adequately address cybersecurity risks; |

• | economic, political and market conditions and fluctuations, including interest rate and foreign currency risk, inherent in U.S. and international operations; |

• | the performance and reliability of our technology and technology of third parties on which we rely; |

• | any significant error in our operational processes; |

• | our ability to continue to generate cash and manage our indebtedness; and |

• | adverse changes that may occur in the litigation or regulatory areas, or in the securities markets generally. |

June 30, 2018 | December 31, 2017 | ||||||

(unaudited) | |||||||

Assets | |||||||

Current assets: | |||||||

Cash and cash equivalents | $ | 322 | $ | 377 | |||

Restricted cash | 34 | 22 | |||||

Financial investments, at fair value | 313 | 235 | |||||

Receivables, net | 405 | 356 | |||||

Default funds and margin deposits | 4,441 | 3,988 | |||||

Other current assets | 212 | 235 | |||||

Assets held for sale | — | 297 | |||||

Total current assets | 5,727 | 5,510 | |||||

Property and equipment, net | 370 | 400 | |||||

Goodwill | 6,355 | 6,586 | |||||

Intangible assets, net | 2,351 | 2,468 | |||||

Other non-current assets | 338 | 390 | |||||

Total assets | $ | 15,141 | $ | 15,354 | |||

Liabilities | |||||||

Current liabilities: | |||||||

Accounts payable and accrued expenses | $ | 174 | $ | 177 | |||

Section 31 fees payable to SEC | 225 | 128 | |||||

Accrued personnel costs | 115 | 170 | |||||

Deferred revenue | 310 | 161 | |||||

Other current liabilities | 115 | 85 | |||||

Default funds and margin deposits | 4,441 | 3,988 | |||||

Short-term debt | 768 | 480 | |||||

Liabilities held for sale | — | 45 | |||||

Total current liabilities | 6,148 | 5,234 | |||||

Long-term debt | 3,079 | 3,727 | |||||

Deferred tax liabilities, net | 99 | 225 | |||||

Non-current deferred revenue | 96 | 126 | |||||

Other non-current liabilities | 177 | 162 | |||||

Total liabilities | 9,599 | 9,474 | |||||

Commitments and contingencies | |||||||

Equity | |||||||

Nasdaq stockholders’ equity: | |||||||

Common stock, $0.01 par value, 300,000,000 shares authorized, shares issued: 169,968,175 at June 30, 2018 and 172,373,432 at December 31, 2017; shares outstanding: 164,503,404 at June 30, 2018 and 167,441,030 at December 31, 2017 | 2 | 2 | |||||

Additional paid-in capital | 2,712 | 3,024 | |||||

Common stock in treasury, at cost: 5,464,771 shares at June 30, 2018 and 4,932,402 shares at December 31, 2017 | (290 | ) | (247 | ) | |||

Accumulated other comprehensive loss | (1,191 | ) | (862 | ) | |||

Retained earnings | 4,309 | 3,963 | |||||

Total Nasdaq stockholders’ equity | 5,542 | 5,880 | |||||

Total liabilities and equity | $ | 15,141 | $ | 15,354 | |||

Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||

2018 | 2017 | 2018 | 2017 | ||||||||||||

Revenues: | |||||||||||||||

Market Services | $ | 649 | $ | 620 | $ | 1,384 | $ | 1,226 | |||||||

Corporate Services | 131 | 122 | 264 | 244 | |||||||||||

Information Services | 175 | 144 | 348 | 282 | |||||||||||

Market Technology | 66 | 58 | 126 | 114 | |||||||||||

Other revenues | 6 | 50 | 56 | 97 | |||||||||||

Total revenues | 1,027 | 994 | 2,178 | 1,963 | |||||||||||

Transaction-based expenses: | |||||||||||||||

Transaction rebates | (308 | ) | (304 | ) | (657 | ) | (604 | ) | |||||||

Brokerage, clearance and exchange fees | (104 | ) | (94 | ) | (240 | ) | (182 | ) | |||||||

Revenues less transaction-based expenses | 615 | 596 | 1,281 | 1,177 | |||||||||||

Operating expenses: | |||||||||||||||

Compensation and benefits | 173 | 161 | 370 | 322 | |||||||||||

Professional and contract services | 34 | 36 | 71 | 72 | |||||||||||

Computer operations and data communications | 30 | 30 | 62 | 60 | |||||||||||

Occupancy | 23 | 23 | 49 | 46 | |||||||||||

General, administrative and other | 25 | 30 | 47 | 49 | |||||||||||

Marketing and advertising | 10 | 8 | 19 | 15 | |||||||||||

Depreciation and amortization | 53 | 47 | 106 | 92 | |||||||||||

Regulatory | 8 | 8 | 16 | 16 | |||||||||||

Merger and strategic initiatives | (10 | ) | 11 | — | 17 | ||||||||||

Total operating expenses | 346 | 354 | 740 | 689 | |||||||||||

Operating income | 269 | 242 | 541 | 488 | |||||||||||

Interest income | 2 | 2 | 5 | 4 | |||||||||||

Interest expense | (37 | ) | (36 | ) | (75 | ) | (73 | ) | |||||||

Gain on divestiture of businesses, net of disposal costs | 41 | — | 41 | — | |||||||||||

Other investment income | 8 | 1 | 8 | 2 | |||||||||||

Net income from unconsolidated investees | 5 | 2 | 7 | 6 | |||||||||||

Income before income taxes | 288 | 211 | 527 | 427 | |||||||||||

Income tax provision | 126 | 65 | 188 | 113 | |||||||||||

Net income attributable to Nasdaq | $ | 162 | $ | 146 | $ | 339 | $ | 314 | |||||||

Per share information: | |||||||||||||||

Basic earnings per share | $ | 0.98 | $ | 0.88 | $ | 2.04 | $ | 1.89 | |||||||

Diluted earnings per share | $ | 0.97 | $ | 0.87 | $ | 2.02 | $ | 1.85 | |||||||

Cash dividends declared per common share | $ | — | $ | 0.38 | $ | 0.82 | $ | 0.70 | |||||||

Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||

2018 | 2017 | 2018 | 2017 | ||||||||||||

Net income | $ | 162 | $ | 146 | $ | 339 | $ | 314 | |||||||

Other comprehensive income (loss): | |||||||||||||||

Foreign currency translation gains (losses): | |||||||||||||||

Net foreign currency translation gains (losses) | (185 | ) | 124 | (261 | ) | 166 | |||||||||

Income tax (expense) benefit(1) | 54 | (29 | ) | (61 | ) | (79 | ) | ||||||||

Total | (131 | ) | 95 | (322 | ) | 87 | |||||||||

Employee benefit plan income tax (expense)(1) | — | — | (7 | ) | — | ||||||||||

Total other comprehensive income (loss), net of tax | (131 | ) | 95 | (329 | ) | 87 | |||||||||

Comprehensive income attributable to Nasdaq | $ | 31 | $ | 241 | $ | 10 | $ | 401 | |||||||

Six Months Ended June 30, | |||||||

2018 | 2017 | ||||||

Cash flows from operating activities: | |||||||

Net income | $ | 339 | $ | 314 | |||

Adjustments to reconcile net income to net cash provided by operating activities: | |||||||

Depreciation and amortization | 106 | 92 | |||||

Share-based compensation | 33 | 34 | |||||

Deferred income taxes | (36 | ) | 8 | ||||

Reversal of certain Swedish tax benefits | 41 | — | |||||

Gain on divestiture of businesses, net of disposal costs | (41 | ) | — | ||||

Net income from unconsolidated investees | (7 | ) | (6 | ) | |||

Other reconciling items included in net income | 9 | 21 | |||||

Net change in operating assets and liabilities, net of effects of divestiture and acquisitions: | |||||||

Receivables, net | (52 | ) | (17 | ) | |||

Other assets | 40 | 68 | |||||

Accounts payable and accrued expenses | 11 | (34 | ) | ||||

Section 31 fees payable to SEC | 97 | 61 | |||||

Accrued personnel costs | (53 | ) | (87 | ) | |||

Deferred revenue | 131 | 84 | |||||

Other liabilities | 36 | (24 | ) | ||||

Net cash provided by operating activities | 654 | 514 | |||||

Cash flows from investing activities: | |||||||

Purchases of trading securities | (232 | ) | (234 | ) | |||

Proceeds from sales and redemptions of trading securities | 139 | 201 | |||||

Purchases of available-for-sale investment securities | (18 | ) | (12 | ) | |||

Proceeds from maturities of available-for-sale investment securities | 19 | 6 | |||||

Proceeds from divestiture of businesses, net | 294 | — | |||||

Purchases of property and equipment | (45 | ) | (64 | ) | |||

Other investment activities | (6 | ) | (1 | ) | |||

Net cash provided by (used in) investing activities | 151 | (104 | ) | ||||

Cash flows from financing activities: | |||||||

Proceeds from (repayments of) commercial paper, net | (211 | ) | 494 | ||||

Repayments of long-term debt | (115 | ) | (670 | ) | |||

Payment of debt extinguishment cost | — | (9 | ) | ||||

Proceeds from utilization of credit commitment, net of debt issuance costs | — | 10 | |||||

Cash paid for repurchase of common stock | (340 | ) | (156 | ) | |||

Cash dividends paid | (136 | ) | (116 | ) | |||

Proceeds received from employee stock activity | 10 | 30 | |||||

Payments related to employee shares withheld for taxes | (43 | ) | (49 | ) | |||

Proceeds of customer funds | — | 2 | |||||

Net cash used in financing activities | (835 | ) | (464 | ) | |||

Effect of exchange rate changes on cash and cash equivalents and restricted cash | (13 | ) | 10 | ||||

Net increase (decrease) in cash and cash equivalents and restricted cash | (43 | ) | (44 | ) | |||

Cash and cash equivalents and restricted cash at beginning of period | 399 | 418 | |||||

Cash and cash equivalents and restricted cash at end of period | $ | 356 | $ | 374 | |||

Supplemental Disclosure Cash Flow Information | |||||||

Cash paid for: | |||||||

Interest | $ | 89 | $ | 97 | |||

Income taxes, net of refund | $ | 99 | $ | 59 | |||

• | Market Data; |

• | Index; and |

• | Investment Data & Analytics. |

Accounting Standard | Description | Effective Date | Effect on the Financial Statements or Other Significant Matters |

Income Statement - Reporting Comprehensive Income In February 2018, the FASB issued ASU 2018-02, “Reclassification of Certain Tax Effects from Accumulated Other Comprehensive Income (Topic 220).” | This ASU provides an election to reclassify tax effects that are stranded in accumulated other comprehensive income as a result of tax reform to retained earnings. An election is also available to reclassify other stranded tax effects that relate to the Tax Cuts and Jobs Act but do not directly relate to the change in the federal rate. Tax effects that are stranded in accumulated other comprehensive income for other reasons (e.g., prior changes in tax law, a change in valuation allowance) may not be reclassified. Previously, the effects of changes in tax rates and laws on deferred tax balances were required to be recorded as a component of tax expense related to continuing operations for the period in which the law was enacted, even if the assets and liabilities related to items of accumulated other comprehensive income. In other words, backward tracing of the income tax effects of items originally recognized through accumulated other comprehensive income was prohibited. | January 1, 2019, with early adoption permitted. We early adopted this standard on January 1, 2018. | As a result of the adoption of this standard, in the first quarter of 2018, we recorded a reclassification of $142 million for stranded tax effects related to the Tax Cuts and Jobs Act from accumulated other comprehensive loss to retained earnings within stockholders’ equity in the Condensed Consolidated Balance Sheets. See Note 17, “Income Taxes,” for further discussion. |

Goodwill In January 2017, the FASB issued ASU 2017-04, “Simplifying the Test for Goodwill Impairment.” | This ASU simplifies how an entity is required to test goodwill for impairment and removes the second step of the goodwill impairment test, which required a hypothetical purchase price allocation if the fair value of a reporting unit is less than its carrying amount. Goodwill impairment will now be measured using the difference between the carrying amount and the fair value of the reporting unit and the loss recognized should not exceed the total amount of goodwill allocated to that reporting unit. The amendments in this ASU should be applied on a prospective basis. | January 1, 2020, with early adoption permitted for interim or annual goodwill impairment tests performed on testing dates after January 1, 2017. | We do not anticipate a material impact on our consolidated financial statements at the time of adoption of this new standard as the carrying amounts of our reporting units have been less than their corresponding fair values in recent years. Therefore, the second step of the goodwill impairment test was not required. However, changes in future projections, market conditions and other factors may cause a change in the excess of fair value of our reporting units over their corresponding carrying amounts. We do not anticipate early adoption of this standard. |

Financial Instruments - Credit Losses In June 2016, the FASB issued ASU 2016-13, “Measurement of Credit Losses on Financial Instruments.” | This ASU changes the impairment model for certain financial instruments. The new model is a forward looking expected loss model and will apply to financial assets subject to credit losses and measured at amortized cost and certain off-balance sheet credit exposures. This includes loans, held-to-maturity debt securities, loan commitments, financial guarantees and net investments in leases, as well as trade receivables. For available-for-sale debt securities with unrealized losses, credit losses will be measured in a manner similar to today, except that the losses will be recognized as allowances rather than reductions in the amortized cost of the securities. | January 1, 2020, with early adoption permitted as of January 1, 2019. | We are currently assessing the impact that this standard will have on our consolidated financial statements. We do not anticipate early adoption of this standard. |

Accounting Standard | Description | Effective Date | Effect on the Financial Statements or Other Significant Matters |

Leases In February 2016, the FASB issued ASU 2016-02, “Leases.” | Under this ASU, at the commencement date, lessees will be required to recognize a lease liability, which is a lessee’s obligation to make lease payments arising from a lease, measured on a discounted basis; and a right-of-use asset, which is an asset that represents the lessee’s right to use, or control the use of, a specified asset for the lease term. This guidance is not applicable for leases with a term of 12 months or less. Recognition, measurement and presentation of expenses will depend on classification as a finance or operating lease. The guidance also requires certain quantitative and qualitative disclosures about leasing arrangements. Lessor accounting is largely unchanged. In transition, lessees and lessors are required to recognize and measure leases at the beginning of the earliest period presented using a modified retrospective approach. | January 1, 2019, with early adoption permitted. | See discussion below. |

• | We are the administrator for the UTP Plan, in addition to being a participant in the UTP Plan. In our unique role as administrator, we facilitate the collection and dissemination of revenues on behalf of the UTP Plan participants. As a participant, we share in the net distribution of revenues according to the plan on the same terms as all other plan participants. |

• | The operating committee of the UTP Plan, which is comprised of representatives from each of the participants, including us solely in our capacity as a UTP Plan participant, is responsible for setting the level of fees to be paid by distributors and subscribers and taking action in accordance with the provisions of the UTP Plan, subject to SEC approval. |

• | Risk of loss on the revenue is shared equally among plan participants according to the UTP Plan. |

(in millions) | |||

2018(1) | $ | 125 | |

2019 | 224 | ||

2020 | 125 | ||

2021 | 88 | ||

2022 | 54 | ||

2023 and thereafter | 98 | ||

Total | $ | 714 | |

Three Months Ended June 30, 2018 | |||||||||||||||||||||||

Market Services | Corporate Services | Information Services | Market Technology | Other Revenues | Consolidated | ||||||||||||||||||

(in millions) | |||||||||||||||||||||||

Transaction-based trading and clearing, net | $ | 164 | $ | — | $ | — | $ | — | $ | — | $ | 164 | |||||||||||

Trade management services | 73 | — | — | — | — | 73 | |||||||||||||||||

Corporate solutions | — | 59 | — | — | — | 59 | |||||||||||||||||

Listing services | — | 72 | — | — | — | 72 | |||||||||||||||||

Market data products | — | — | 98 | — | — | 98 | |||||||||||||||||

Index | — | — | 50 | — | — | 50 | |||||||||||||||||

Investment data & analytics | — | — | 27 | — | — | 27 | |||||||||||||||||

Market technology | — | — | — | 66 | — | 66 | |||||||||||||||||

Other revenues | — | — | — | — | 6 | 6 | |||||||||||||||||

Revenues less transaction-based expenses | $ | 237 | $ | 131 | $ | 175 | $ | 66 | $ | 6 | $ | 615 | |||||||||||

Three Months Ended June 30, 2017 | |||||||||||||||||||||||

Market Services | Corporate Services | Information Services | Market Technology | Other Revenues | Consolidated | ||||||||||||||||||

(in millions) | |||||||||||||||||||||||

Transaction-based trading and clearing, net | $ | 150 | $ | — | $ | — | $ | — | $ | — | $ | 150 | |||||||||||

Trade management services | 72 | — | — | — | — | 72 | |||||||||||||||||

Corporate solutions | — | 57 | — | — | — | 57 | |||||||||||||||||

Listing services | — | 65 | — | — | — | 65 | |||||||||||||||||

Market data products | — | — | 90 | — | — | 90 | |||||||||||||||||

Index | — | — | 43 | — | — | 43 | |||||||||||||||||

Investment data & analytics | — | — | 11 | — | — | 11 | |||||||||||||||||

Market technology | — | — | — | 58 | — | 58 | |||||||||||||||||

Other revenues | — | — | — | — | 50 | 50 | |||||||||||||||||

Revenues less transaction-based expenses | $ | 222 | $ | 122 | $ | 144 | $ | 58 | $ | 50 | $ | 596 | |||||||||||

Six Months Ended June 30, 2018 | |||||||||||||||||||||||

Market Services | Corporate Services | Information Services | Market Technology | Other Revenues | Consolidated | ||||||||||||||||||

(in millions) | |||||||||||||||||||||||

Transaction-based trading and clearing, net | $ | 339 | $ | — | $ | — | $ | — | $ | — | $ | 339 | |||||||||||

Trade management services | 148 | — | — | — | — | 148 | |||||||||||||||||

Corporate solutions | — | 120 | — | — | — | 120 | |||||||||||||||||

Listing services | — | 144 | — | — | — | 144 | |||||||||||||||||

Market data products | — | — | 197 | — | — | 197 | |||||||||||||||||

Index | — | — | 100 | — | — | 100 | |||||||||||||||||

Investment data & analytics | — | — | 51 | — | — | 51 | |||||||||||||||||

Market technology | — | — | — | 126 | — | 126 | |||||||||||||||||

Other revenues | — | — | — | — | 56 | 56 | |||||||||||||||||

Revenues less transaction-based expenses | $ | 487 | $ | 264 | $ | 348 | $ | 126 | $ | 56 | $ | 1,281 | |||||||||||

Six Months Ended June 30, 2017 | |||||||||||||||||||||||

Market Services | Corporate Services | Information Services | Market Technology | Other Revenues | Consolidated | ||||||||||||||||||

(in millions) | |||||||||||||||||||||||

Transaction-based trading and clearing, net | $ | 297 | $ | — | $ | — | $ | — | $ | — | $ | 297 | |||||||||||

Trade management services | 143 | — | — | — | — | 143 | |||||||||||||||||

Corporate solutions | — | 114 | — | — | — | 114 | |||||||||||||||||

Listing services | — | 130 | — | — | — | 130 | |||||||||||||||||

Market data products | — | — | 180 | — | — | 180 | |||||||||||||||||

Index | — | — | 82 | — | — | 82 | |||||||||||||||||

Investment data & analytics | — | — | 20 | — | — | 20 | |||||||||||||||||

Market technology | — | — | — | 114 | — | 114 | |||||||||||||||||

Other revenues | — | — | — | — | 97 | 97 | |||||||||||||||||

Revenues less transaction-based expenses | $ | 440 | $ | 244 | $ | 282 | $ | 114 | $ | 97 | $ | 1,177 | |||||||||||

Purchase Consideration | Total Net Liabilities Acquired | Total Net Deferred Tax Liability | Acquired Intangible Assets | Goodwill | |||||||||||||||

(in millions) | |||||||||||||||||||

eVestment | $ | 744 | $ | (10 | ) | $ | (104 | ) | $ | 405 | $ | 453 | |||||||

Intangible Assets | |||

($ in millions) | |||

Customer relationships | $ | 378 | |

Discount rate used | 9.3 | % | |

Estimated average useful life | 14 years | ||

Trade name | $ | 13 | |

Discount rate used | 9.2 | % | |

Estimated average useful life | 8 years | ||

Technology | $ | 14 | |

Discount rate used | 9.2 | % | |

Estimated average useful life | 8 years | ||

Total intangible assets | $ | 405 | |

• | Nasdaq GlobeNewswire; |

• | Nasdaq Influencers; |

• | Nasdaq Media Intelligence; |

• | Nasdaq IR Websites and Newsrooms; and |

• | Nasdaq Webcasts. |

December 31, 2017 | ||||

(in millions) | ||||

Receivables, net | $ | 27 | ||

Property and equipment, net | 21 | |||

Goodwill (1) | 202 | |||

Intangible assets, net(2) | 38 | |||

Other assets | 9 | |||

Total assets held for sale | $ | 297 | ||

Deferred tax liabilities | $ | 16 | ||

Other current liabilities | 29 | |||

Total liabilities held for sale | $ | 45 | ||

(1) | The assignment of goodwill was based on the relative fair value of the disposal group and the portion of the remaining reporting unit. |

Market Services | Corporate Services | Information Services | Market Technology | Total | |||||||||||||||

(in millions) | |||||||||||||||||||

Balance at December 31, 2017 | $ | 3,546 | $ | 490 | $ | 2,362 | $ | 188 | $ | 6,586 | |||||||||

Reclassification of goodwill(1) | — | 29 | — | (29 | ) | — | |||||||||||||

Foreign currency translation adjustment | (121 | ) | (15 | ) | (87 | ) | (8 | ) | (231 | ) | |||||||||

Balance at June 30, 2018 | $ | 3,425 | $ | 504 | $ | 2,275 | $ | 151 | $ | 6,355 | |||||||||

June 30, 2018 | December 31, 2017 | ||||||||||||||||||||||||||

Gross Amount | Accumulated Amortization | Net Amount | Weighted-Average Useful Life (in Years) | Gross Amount | Accumulated Amortization | Net Amount | Weighted-Average Useful Life (in Years) | ||||||||||||||||||||

(in millions) | (in millions) | ||||||||||||||||||||||||||

Finite-Lived Intangible Assets | |||||||||||||||||||||||||||

Technology | $ | 65 | $ | (26 | ) | $ | 39 | 8 | $ | 65 | $ | (22 | ) | $ | 43 | 8 | |||||||||||

Customer relationships | 1,708 | (579 | ) | 1,129 | 18 | 1,708 | (526 | ) | 1,182 | 18 | |||||||||||||||||

Other | 17 | (5 | ) | 12 | 8 | 17 | (4 | ) | 13 | 8 | |||||||||||||||||

Foreign currency translation adjustment | (144 | ) | 60 | (84 | ) | (111 | ) | 46 | (65 | ) | |||||||||||||||||

Total finite-lived intangible assets | $ | 1,646 | $ | (550 | ) | $ | 1,096 | $ | 1,679 | $ | (506 | ) | $ | 1,173 | |||||||||||||

Indefinite-Lived Intangible Assets | |||||||||||||||||||||||||||

Exchange and clearing registrations | $ | 1,257 | $ | — | $ | 1,257 | $ | 1,257 | $ | — | $ | 1,257 | |||||||||||||||

Trade names | 127 | — | 127 | 129 | — | 129 | |||||||||||||||||||||

Licenses | 52 | — | 52 | 52 | — | 52 | |||||||||||||||||||||

Foreign currency translation adjustment | (181 | ) | — | (181 | ) | (143 | ) | — | (143 | ) | |||||||||||||||||

Total indefinite-lived intangible assets | $ | 1,255 | $ | — | $ | 1,255 | $ | 1,295 | $ | — | $ | 1,295 | |||||||||||||||

Total intangible assets | $ | 2,901 | $ | (550 | ) | $ | 2,351 | $ | 2,974 | $ | (506 | ) | $ | 2,468 | |||||||||||||

(in millions) | |||

2018(1) | $ | 56 | |

2019 | 99 | ||

2020 | 98 | ||

2021 | 97 | ||

2022 | 94 | ||

2023 and thereafter | 736 | ||

Total | $ | 1,180 | |

June 30, 2018 | December 31, 2017 | ||||||

(in millions) | |||||||

Trading securities | $ | 300 | $ | 221 | |||

Available-for-sale investment securities | 13 | 14 | |||||

Financial investments, at fair value | $ | 313 | $ | 235 | |||

Equity method investments | $ | 138 | $ | 131 | |||

Equity securities | $ | 79 | $ | 152 | |||

Initial Listing Revenues | Annual Listings Revenues | Market Technology Revenues | Corporate Solutions and Other Revenues(2) | Information Services Revenues | Other(3) | Total | |||||||||||||||||||||

(in millions) | |||||||||||||||||||||||||||

Balance at December 31, 2017 | $ | 64 | $ | 3 | $ | 109 | $ | 37 | $ | 40 | $ | 34 | $ | 287 | |||||||||||||

Additions | 17 | 223 | 69 | 141 | 84 | 15 | 549 | ||||||||||||||||||||

Revenue recognized | (12 | ) | (112 | ) | (84 | ) | (140 | ) | (51 | ) | (21 | ) | (420 | ) | |||||||||||||

Reclassification of deferred revenue(1) | — | — | (11 | ) | 11 | — | — | — | |||||||||||||||||||

Translation adjustment | (2 | ) | (1 | ) | (7 | ) | — | — | — | (10 | ) | ||||||||||||||||

Balance at June 30, 2018 | $ | 67 | $ | 113 | $ | 76 | $ | 49 | $ | 73 | $ | 28 | $ | 406 | |||||||||||||

(3) | Other primarily includes revenues from listing of additional shares fees which are included in our Listing Services business. |

Initial Listing Revenues | Annual Listings Revenues | Market Technology Revenues | Corporate Solutions Revenues | Information Services Revenues | Other(2) | Total | |||||||||||||||||||||

(in millions) | |||||||||||||||||||||||||||

Fiscal year ended: | |||||||||||||||||||||||||||

2018(1) | $ | 13 | $ | 113 | $ | 30 | $ | 39 | $ | 52 | $ | 11 | $ | 258 | |||||||||||||

2019 | 22 | — | 21 | 10 | 21 | 9 | 83 | ||||||||||||||||||||

2020 | 14 | — | 18 | — | — | 6 | 38 | ||||||||||||||||||||

2021 | 9 | — | 7 | — | — | 2 | 18 | ||||||||||||||||||||

2022 | 6 | — | — | — | — | — | 6 | ||||||||||||||||||||

2023 and thereafter | 3 | — | — | — | — | — | 3 | ||||||||||||||||||||

Total | $ | 67 | $ | 113 | $ | 76 | $ | 49 | $ | 73 | $ | 28 | $ | 406 | |||||||||||||

(2) | Other primarily includes revenues from listing of additional shares fees which are included in our Listing Services business. |

December 31, 2017 | Additions | Payments, Accretion and Other | June 30, 2018 | ||||||||||||

Short-term debt: | (in millions) | ||||||||||||||

Commercial paper | $ | 480 | $ | 2,631 | $ | (2,842 | ) | $ | 269 | ||||||

Senior unsecured floating rate notes due March 22, 2019(1) | 498 | — | 1 | 499 | |||||||||||

Total short-term debt | 978 | 2,631 | (2,841 | ) | 768 | ||||||||||

Long-term debt: | |||||||||||||||

5.55% senior unsecured notes due January 15, 2020 | 599 | — | — | 599 | |||||||||||

3.875% senior unsecured notes due June 7, 2021 | 716 | — | (18 | ) | 698 | ||||||||||

4.25% senior unsecured notes due June 1, 2024 | 496 | — | — | 496 | |||||||||||

1.75% senior unsecured notes due May 19, 2023 | 712 | — | (18 | ) | 694 | ||||||||||

3.85% senior unsecured notes due June 30, 2026 | 496 | — | — | 496 | |||||||||||

$400 million senior unsecured term loan facility due November 25, 2019 (average interest rate of 3.27% for the period January 1, 2018 through June 30, 2018) | 100 | — | — | 100 | |||||||||||

$1 billion revolving credit commitment due April 25, 2022 (average interest rate of 2.74% for the period January 1, 2018 through June 30, 2018) | 110 | — | (114 | ) | (4 | ) | |||||||||

Total long-term debt | 3,229 | — | (150 | ) | 3,079 | ||||||||||

Total debt obligations | $ | 4,207 | $ | 2,631 | $ | (2,991 | ) | $ | 3,847 | ||||||

Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||

2018 | 2017 | 2018 | 2017 | ||||||||||||

(in millions) | |||||||||||||||

Share-based compensation expense before income taxes | $ | 18 | $ | 19 | $ | 33 | $ | 34 | |||||||

Income tax benefit | (5 | ) | (8 | ) | (9 | ) | (14 | ) | |||||||

Share-based compensation expense after income taxes | $ | 13 | $ | 11 | $ | 24 | $ | 20 | |||||||

Restricted Stock | ||||||

Number of Awards | Weighted-Average Grant Date Fair Value | |||||

Unvested balances at January 1, 2018 | 1,988,500 | $ | 57.34 | |||

Granted | 484,750 | $ | 81.69 | |||

Vested | (646,994 | ) | $ | 46.87 | ||

Forfeited | (191,365 | ) | $ | 62.09 | ||

Unvested balances at June 30, 2018 | 1,634,891 | $ | 68.15 | |||

Six Months Ended June 30, | |||||

2018 | 2017 | ||||

Weighted-average risk free interest rate(1) | 2.36 | % | 1.44 | % | |

Expected volatility(2) | 18.7 | % | 19.2 | % | |

Weighted-average grant date share price | $86.24 | $69.45 | |||

Weighted-average fair value at grant date | $116.86 | $81.57 | |||

(1) | The risk-free interest rate for periods within the expected life of the award is based on the U.S. Treasury yield curve in effect at the time of grant. |

(2) | We use historic volatility for PSU awards issued under the three-year PSU program, as implied volatility data could not be obtained for all the companies in the peer groups used for relative performance measurement within the program. |

PSUs | |||||||||||||

One-Year Program | Three-Year Program | ||||||||||||

Number of Awards | Weighted-Average Grant Date Fair Value | Number of Awards | Weighted-Average Grant Date Fair Value | ||||||||||

Unvested balances at January 1, 2018 | 333,004 | $ | 61.39 | 1,009,958 | $ | 78.18 | |||||||

Granted | 131,185 | $ | 80.29 | 484,075 | $ | 90.92 | |||||||

Vested | (6,702 | ) | $ | 49.40 | (655,204 | ) | $ | 64.08 | |||||

Forfeited | (22,037 | ) | $ | 60.69 | — | $ | — | ||||||

Unvested balances at June 30, 2018 | 435,450 | $ | 67.30 | 838,829 | $ | 96.55 | |||||||

Number of Stock Options | Weighted-Average Exercise Price | Weighted-Average Remaining Contractual Term (in years) | Aggregate Intrinsic Value (in millions) | |||||||||

Outstanding at January 1, 2018 | 571,380 | $ | 43.84 | 5.40 | $ | 19 | ||||||

Exercised | (88,000 | ) | 24.51 | |||||||||

Forfeited | (954 | ) | 34.53 | |||||||||

Outstanding at June 30, 2018 | 482,426 | $ | 47.38 | 5.61 | $ | 21 | ||||||

Exercisable at June 30, 2018 | 303,214 | $ | 35.98 | 3.96 | $ | 17 | ||||||

Six Months Ended June 30, | ||||||||

2018 | 2017 | |||||||

Number of shares of common stock repurchased | 3,929,520 | 2,215,755 | ||||||

Average price paid per share | $ | 86.58 | $ | 70.64 | ||||

Total purchase price (in millions) | $ | 340 | $ | 156 | ||||

Declaration Date | Dividend Per Common Share | Record Date | Total Amount Paid | Payment Date | ||||||||

(in millions) | ||||||||||||

January 30, 2018 | $ | 0.38 | March 16, 2018 | $ | 63 | March 30, 2018 | ||||||

March 26, 2018 | 0.44 | June 15, 2018 | 73 | June 29, 2018 | ||||||||

$ | 136 | |||||||||||

Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||

2018 | 2017 | 2018 | 2017 | ||||||||||||

Numerator: | (in millions, except share and per share amounts) | ||||||||||||||

Net income attributable to common shareholders | $ | 162 | $ | 146 | $ | 339 | $ | 314 | |||||||

Denominator: | |||||||||||||||

Weighted-average common shares outstanding for basic earnings per share | 165,748,107 | 165,415,989 | 166,331,583 | 165,941,611 | |||||||||||

Weighted-average effect of dilutive securities: | |||||||||||||||

Employee equity awards | 1,651,497 | 3,072,316 | 1,812,437 | 3,410,429 | |||||||||||

Weighted-average common shares outstanding for diluted earnings per share | 167,399,604 | 168,488,305 | 168,144,020 | 169,352,040 | |||||||||||

Basic and diluted earnings per share: | |||||||||||||||

Basic earnings per share | $ | 0.98 | $ | 0.88 | $ | 2.04 | $ | 1.89 | |||||||

Diluted earnings per share | $ | 0.97 | $ | 0.87 | $ | 2.02 | $ | 1.85 | |||||||

June 30, 2018 | |||||||||||||||

Total | Level 1 | Level 2 | Level 3 | ||||||||||||

(in millions) | |||||||||||||||

Financial investments, at fair value | $ | 313 | $ | 128 | $ | 185 | $ | — | |||||||

Default fund and margin deposit investments | 1,607 | 54 | 1,553 | — | |||||||||||

Total | $ | 1,920 | $ | 182 | $ | 1,738 | $ | — | |||||||

December 31, 2017 | |||||||||||||||

Total | Level 1 | Level 2 | Level 3 | ||||||||||||

(in millions) | |||||||||||||||

Financial investments, at fair value | $ | 235 | $ | 135 | $ | 100 | $ | — | |||||||

Default fund and margin deposit investments | 2,129 | 371 | 1,758 | — | |||||||||||

Total | $ | 2,364 | $ | 506 | $ | 1,858 | $ | — | |||||||

June 30, 2018 | |||||||||||

Cash Contributions | Non-Cash Contributions | Total Contributions | |||||||||

(in millions) | |||||||||||

Default fund contributions | $ | 427 | $ | 132 | $ | 559 | |||||

Margin deposits | 4,014 | 4,038 | 8,052 | ||||||||

Total | $ | 4,441 | $ | 4,170 | $ | 8,611 | |||||

June 30, 2018 | |||

(in millions) | |||

Commodity and seafood options, futures and forwards(1)(2)(3) | $ | 1,447 | |

Fixed-income options and futures(1)(2) | 763 | ||

Stock options and futures(1)(2) | 260 | ||

Index options and futures(1)(2) | 80 | ||

Total | $ | 2,550 | |

(1) | We determined the fair value of our option contracts using standard valuation models that were based on market-based observable inputs including implied volatility, interest rates and the spot price of the underlying instrument. |

(2) | We determined the fair value of our futures contracts based upon quoted market prices and average quoted market yields. |

(3) | We determined the fair value of our forward contracts using standard valuation models that were based on market-based observable inputs including LIBOR rates and the spot price of the underlying instrument. |

June 30, 2018 | June 30, 2017 | ||||

Commodity and seafood options, futures and forwards(1) | 1,162,716 | 1,397,771 | |||

Fixed-income options and futures | 11,286,397 | 10,160,127 | |||

Stock options and futures | 11,940,062 | 13,526,164 | |||

Index options and futures | 24,641,397 | 21,616,323 | |||

Total | 49,030,572 | 46,700,385 | |||

(1) | The total volume in cleared power related to commodity contracts was 577 Terawatt hours (TWh) for the six months ended June 30, 2018 and 647 TWh for the six months ended June 30, 2017. |

• | junior capital contributed by Nasdaq Clearing, which totaled $16 million as of June 30, 2018; |

• | a loss sharing pool related only to the financial market that is contributed to by clearing members and only applies if the defaulting member’s portfolio includes interest rate swap products; |

• | specific market default fund where the loss occurred (i.e., the financial, commodities, or seafood market), which includes capital contributions of the clearing members on a pro-rata basis; |

• | senior capital contributed to each specific market by Nasdaq Clearing, calculated in accordance with |

• | mutualized default fund, which includes capital contributions of the clearing members on a pro-rata basis. |

Three Months Ended June 30, | Percentage Change | ||||||||||

2018 | 2017 | ||||||||||

($ in millions) | |||||||||||

Income tax provision | $ | 126 | $ | 65 | 93.8 | % | |||||

Effective tax rate | 43.8 | % | 30.8 | % | |||||||

Six Months Ended June 30, | Percentage Change | ||||||||||

2018 | 2017 | ||||||||||

($ in millions) | |||||||||||

Income tax provision | $ | 188 | $ | 113 | 66.4 | % | |||||

Effective tax rate | 35.7 | % | 26.5 | % | |||||||

Market Services | Corporate Services | Information Services | Market Technology | Corporate Items | Consolidated | ||||||||||||||||||

(in millions) | |||||||||||||||||||||||

Three Months Ended June 30, 2018 | |||||||||||||||||||||||

Total revenues | $ | 649 | $ | 131 | $ | 175 | $ | 66 | $ | 6 | $ | 1,027 | |||||||||||

Transaction-based expenses | (412 | ) | — | — | — | — | (412 | ) | |||||||||||||||

Revenues less transaction-based expenses | 237 | 131 | 175 | 66 | 6 | 615 | |||||||||||||||||

Operating income (loss) | $ | 134 | $ | 37 | $ | 112 | $ | 9 | $ | (23 | ) | $ | 269 | ||||||||||

Three Months Ended June 30, 2017 | |||||||||||||||||||||||

Total revenues | $ | 620 | $ | 122 | $ | 144 | $ | 58 | $ | 50 | $ | 994 | |||||||||||

Transaction-based expenses | (398 | ) | — | — | — | — | (398 | ) | |||||||||||||||

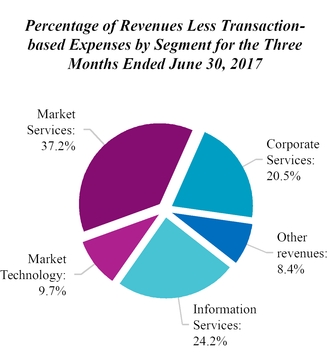

Revenues less transaction-based expenses | 222 | 122 | 144 | 58 | 50 | 596 | |||||||||||||||||

Operating income (loss) | $ | 121 | $ | 37 | $ | 105 | $ | 14 | $ | (35 | ) | $ | 242 | ||||||||||

Six Months Ended June 30, 2018 | |||||||||||||||||||||||

Total revenues | $ | 1,384 | $ | 264 | $ | 348 | $ | 126 | $ | 56 | $ | 2,178 | |||||||||||

Transaction-based expenses | (897 | ) | — | — | — | — | (897 | ) | |||||||||||||||

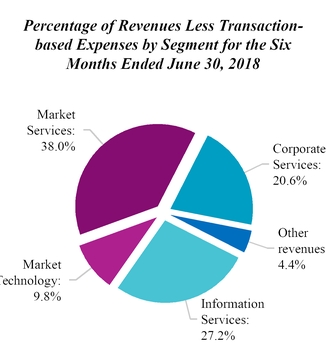

Revenues less transaction-based expenses | 487 | 264 | 348 | 126 | 56 | 1,281 | |||||||||||||||||

Operating income (loss) | $ | 281 | $ | 80 | $ | 225 | $ | 11 | $ | (56 | ) | $ | 541 | ||||||||||

Six Months Ended June 30, 2017 | |||||||||||||||||||||||

Total revenues | $ | 1,226 | $ | 244 | $ | 282 | $ | 114 | $ | 97 | $ | 1,963 | |||||||||||

Transaction-based expenses | (786 | ) | — | — | — | — | (786 | ) | |||||||||||||||

Revenues less transaction-based expenses | 440 | 244 | 282 | 114 | 97 | 1,177 | |||||||||||||||||

Operating income (loss) | $ | 241 | $ | 74 | $ | 207 | $ | 25 | $ | (59 | ) | $ | 488 | ||||||||||

Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||

2018 | 2017 | 2018 | 2017 | ||||||||||||

(in millions) | |||||||||||||||

Revenues - divested businesses | $ | 6 | $ | 50 | $ | 56 | $ | 97 | |||||||

Expenses: | |||||||||||||||

Amortization expense of acquired intangible assets | 28 | 22 | 56 | 45 | |||||||||||

Merger and strategic initiatives expense | (10 | ) | 11 | — | 17 | ||||||||||

Extinguishment of debt | — | 10 | — | 10 | |||||||||||

Expenses - divested businesses | 8 | 42 | 51 | 84 | |||||||||||

Other | 3 | — | 5 | — | |||||||||||

Total expenses | 29 | 85 | 112 | 156 | |||||||||||

Operating loss | $ | (23 | ) | $ | (35 | ) | $ | (56 | ) | $ | (59 | ) | |||

• | the demand by companies and other organizations for the products sold by our Corporate Solutions business, which is largely driven by the overall state of the economy and the attractiveness of our offerings; |

• | the challenges created by the automation of market data consumption, including competition and the quickly evolving nature of the market data business; |

• | the outlook of our technology customers for capital market activity; |

• | technological advances and members’ and customers’ demand for speed, efficiency, and reliability; |

• | the acceptance of cloud-based services and advanced analytics by our customers and global regulators; |

• | trading volumes and values in equity derivative, cash equity and FICC, which are driven primarily by overall macroeconomic conditions; |

• | the number of companies seeking equity financing, which is affected by factors such as investor demand, the global economy, and availability of diverse sources of financing, as well as tax and regulatory policies; |

• | the demand for information about, or access to, our markets, which is dependent on the products we trade, our importance as a liquidity center, and the quality and pricing of our market data and trade management services; |

• | the demand for licensed ETPs, enhanced analytics and other financial products based on our indexes as well as changes to the underlying assets associated with existing licensed financial products; |

• | continuing pressure in transaction fee pricing due to intense competition in the U.S. and Europe; |

• | competition related to pricing, product features and service offerings; and |

• | regulatory changes relating to market structure or affecting certain types of instruments, transactions, pricing structures or capital market participants. |

• | rapidly evolving technology for our businesses and their clients; |

• | increased demand for applications using emerging technologies and sophisticated analytics by both new entrants and industry incumbents; |

• | the expansion of the number of industries, and emergence of new industries, seeking to use advanced market technology; |

• | intense competition among U.S. exchanges and dealer-owned systems for cash equity trading and strong competition between MTFs and exchanges in Europe for cash equity trading; and |

• | globalization of exchanges, customers and competitors extending the competitive horizon beyond national markets. |

Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||

2018 | 2017 | 2018 | 2017 | |||||||||||||

Market Services | ||||||||||||||||

Equity Derivative Trading and Clearing | ||||||||||||||||

U.S. equity options | ||||||||||||||||

Total industry average daily volume (in millions) | 17.0 | 14.8 | 18.2 | 14.7 | ||||||||||||

Nasdaq PHLX matched market share | 15.6 | % | 16.8 | % | 15.8 | % | 17.0 | % | ||||||||

The Nasdaq Options Market matched market share | 9.2 | % | 9.8 | % | 9.6 | % | 9.6 | % | ||||||||

Nasdaq BX Options matched market share | 0.4 | % | 0.7 | % | 0.5 | % | 0.7 | % | ||||||||

Nasdaq ISE Options matched market share | 8.6 | % | 9.0 | % | 8.5 | % | 9.3 | % | ||||||||

Nasdaq GEMX Options matched market share | 4.5 | % | 4.9 | % | 4.6 | % | 5.3 | % | ||||||||

Nasdaq MRX Options matched market share | 0.1 | % | 0.2 | % | 0.1 | % | 0.1 | % | ||||||||

Total matched market share executed on Nasdaq’s exchanges | 38.4 | % | 41.4 | % | 39.1 | % | 42.0 | % | ||||||||

Nasdaq Nordic and Nasdaq Baltic options and futures | ||||||||||||||||

Total average daily volume of options and futures contracts(1) | 365,204 | 376,280 | 359,846 | 356,603 | ||||||||||||

Cash Equity Trading | ||||||||||||||||

Total U.S.-listed securities | ||||||||||||||||

Total industry average daily share volume (in billions) | 6.86 | 6.85 | 7.23 | 6.85 | ||||||||||||

Matched share volume (in billions) | 83.8 | 79.4 | 172.4 | 154.1 | ||||||||||||

The Nasdaq Stock Market matched market share | 15.2 | % | 14.4 | % | 15.1 | % | 14.2 | % | ||||||||

Nasdaq BX matched market share | 3.1 | % | 3.2 | % | 3.2 | % | 2.9 | % | ||||||||

Nasdaq PSX matched market share | 0.8 | % | 0.8 | % | 0.8 | % | 0.9 | % | ||||||||

Total matched market share executed on Nasdaq’s exchanges | 19.1 | % | 18.4 | % | 19.1 | % | 18.0 | % | ||||||||

Market share reported to the FINRA/Nasdaq Trade Reporting Facility | 33.4 | % | 33.9 | % | 33.5 | % | 34.4 | % | ||||||||

Total market share(2) | 52.5 | % | 52.3 | % | 52.6 | % | 52.4 | % | ||||||||

Nasdaq Nordic and Nasdaq Baltic securities | ||||||||||||||||

Average daily number of equity trades executed on Nasdaq’s exchanges | 623,555 | 594,901 | 637,820 | 549,501 | ||||||||||||

Total average daily value of shares traded (in billions) | $ | 5.8 | $ | 5.7 | $ | 5.9 | $ | 5.3 | ||||||||

Total market share executed on Nasdaq’s exchanges | 66.9 | % | 65.7 | % | 68.2 | % | 65.3 | % | ||||||||

FICC | ||||||||||||||||

Fixed Income | ||||||||||||||||

U.S. fixed income notional trading volume (in billions) | $ | 4,134 | $ | 4,755 | $ | 9,290 | $ | 9,796 | ||||||||

Total average daily volume of Nasdaq Nordic and Nasdaq Baltic fixed income contracts | 124,539 | 118,234 | 128,476 | 114,748 | ||||||||||||

Commodities | ||||||||||||||||

Power contracts cleared (TWh)(3) | 305 | 268 | 577 | 647 | ||||||||||||

Corporate Services | ||||||||||||||||

Initial public offerings | ||||||||||||||||

The Nasdaq Stock Market | 56 | 36 | 93 | 53 | ||||||||||||

Exchanges that comprise Nasdaq Nordic and Nasdaq Baltic | 22 | 39 | 35 | 50 | ||||||||||||

Total new listings | ||||||||||||||||

The Nasdaq Stock Market(4) | 89 | 64 | 151 | 106 | ||||||||||||

Exchanges that comprise Nasdaq Nordic and Nasdaq Baltic(5) | 29 | 45 | 44 | 61 | ||||||||||||

Number of listed companies | ||||||||||||||||

The Nasdaq Stock Market(6) | 3,004 | 2,912 | 3,004 | 2,912 | ||||||||||||

Exchanges that comprise Nasdaq Nordic and Nasdaq Baltic(7) | 1,008 | 945 | 1,008 | 945 | ||||||||||||

Information Services | ||||||||||||||||

Number of licensed ETPs | 347 | 316 | 347 | 316 | ||||||||||||

ETP assets under management tracking Nasdaq indexes (in billions) | $ | 187 | $ | 147 | $ | 187 | $ | 147 | ||||||||

Market Technology | ||||||||||||||||

Order intake (in millions)(8) | $ | 64 | $ | 50 | $ | 109 | $ | 92 | ||||||||

Total order value (in millions)(9) | $ | 714 | $ | 684 | $ | 714 | $ | 684 | ||||||||

(1) | Includes Finnish option contracts traded on Eurex. |

(2) | Includes transactions executed on The Nasdaq Stock Market’s, Nasdaq BX’s and Nasdaq PSX’s systems plus trades reported through the FINRA/Nasdaq Trade Reporting Facility. |

(3) | Transactions executed on Nasdaq Commodities or OTC and reported for clearing to Nasdaq Commodities measured by Terawatt hours (TWh). |

(4) | New listings include IPOs, including those completed on a best efforts basis, issuers that switched from other listing venues, closed-end funds and separately listed ETPs. |

(5) | New listings include IPOs and represent companies listed on the Nasdaq Nordic and Nasdaq Baltic exchanges and companies on the alternative markets of Nasdaq First North. |

(6) | Number of total listings on The Nasdaq Stock Market at period end, including 380 ETPs as of June 30, 2018 and 345 as of June 30, 2017. |

(7) | Represents companies listed on the Nasdaq Nordic and Nasdaq Baltic exchanges and companies on the alternative markets of Nasdaq First North at period end. |

(8) | Total contract value of orders signed during the period. |

(9) | Represents total contract value of signed orders that are yet to be recognized as revenue. Market technology deferred revenue, as discussed in Note 8, “Deferred Revenue,” to the condensed consolidated financial statements, represents consideration received that is yet to be recognized as revenue for these signed orders. Total order value for the three and six months ended June 30, 2017 was restated as a result of the adoption of Topic 606. |

Three Months Ended June 30, | Percentage Change | Six Months Ended June 30, | Percentage Change | |||||||||||||||||||

2018 | 2017 | 2018 | 2017 | |||||||||||||||||||

(in millions, except per share amounts) | (in millions, except per share amounts) | |||||||||||||||||||||

Revenues less transaction-based expenses | $ | 615 | $ | 596 | 3.2 | % | $ | 1,281 | $ | 1,177 | 8.8 | % | ||||||||||

Operating expenses | 346 | 354 | (2.3 | )% | 740 | 689 | 7.4 | % | ||||||||||||||

Operating income | 269 | 242 | 11.2 | % | 541 | 488 | 10.9 | % | ||||||||||||||

Interest expense | (37 | ) | (36 | ) | 2.8 | % | (75 | ) | (73 | ) | 2.7 | % | ||||||||||

Gain on divestiture of businesses, net of disposal costs | 41 | — | N/M | 41 | — | N/M | ||||||||||||||||

Income before income taxes | 288 | 211 | 36.5 | % | 527 | 427 | 23.4 | % | ||||||||||||||

Income tax provision | 126 | 65 | 93.8 | % | 188 | 113 | 66.4 | % | ||||||||||||||

Net income attributable to Nasdaq | $ | 162 | $ | 146 | 11.0 | % | $ | 339 | $ | 314 | 8.0 | % | ||||||||||

Diluted earnings per share | $ | 0.97 | $ | 0.87 | 11.5 | % | $ | 2.02 | $ | 1.85 | 9.2 | % | ||||||||||

Cash dividends declared per common share | $ | — | $ | 0.38 | (100.0 | )% | $ | 0.82 | $ | 0.70 | 17.1 | % | ||||||||||

Three Months Ended June 30, | Percentage Change | Six Months Ended June 30, | Percentage Change | |||||||||||||||||||

2018 | 2017 | 2018 | 2017 | |||||||||||||||||||

(in millions) | (in millions) | |||||||||||||||||||||

Market Services | $ | 649 | $ | 620 | 4.7 | % | $ | 1,384 | $ | 1,226 | 12.9 | % | ||||||||||

Transaction-based expenses | (412 | ) | (398 | ) | 3.5 | % | (897 | ) | (786 | ) | 14.1 | % | ||||||||||

Market Services revenues less transaction-based expenses | 237 | 222 | 6.8 | % | 487 | 440 | 10.7 | % | ||||||||||||||

Corporate Services | 131 | 122 | 7.4 | % | 264 | 244 | 8.2 | % | ||||||||||||||

Information Services | 175 | 144 | 21.5 | % | 348 | 282 | 23.4 | % | ||||||||||||||

Market Technology | 66 | 58 | 13.8 | % | 126 | 114 | 10.5 | % | ||||||||||||||

Other revenues | 6 | 50 | (88.0 | )% | 56 | 97 | (42.3 | )% | ||||||||||||||

Total revenues less transaction-based expenses | $ | 615 | $ | 596 | 3.2 | % | $ | 1,281 | $ | 1,177 | 8.8 | % | ||||||||||

Three Months Ended June 30, | Percentage Change | Six Months Ended June 30, | Percentage Change | |||||||||||||||||||

2018 | 2017 | 2018 | 2017 | |||||||||||||||||||

(in millions) | (in millions) | |||||||||||||||||||||

Market Services Revenues: | ||||||||||||||||||||||

Equity Derivative Trading and Clearing Revenues(1) | $ | 201 | $ | 191 | 5.2 | % | $ | 431 | $ | 382 | 12.8 | % | ||||||||||

Transaction-based expenses: | ||||||||||||||||||||||

Transaction rebates | (119 | ) | (115 | ) | 3.5 | % | (256 | ) | (228 | ) | 12.3 | % | ||||||||||

Brokerage, clearance and exchange fees(1) | (10 | ) | (9 | ) | 11.1 | % | (26 | ) | (20 | ) | 30.0 | % | ||||||||||

Equity derivative trading and clearing revenues less transaction-based expenses | 72 | 67 | 7.5 | % | 149 | 134 | 11.2 | % | ||||||||||||||

Cash Equity Trading Revenues(2) | 351 | 333 | 5.4 | % | 755 | 652 | 15.8 | % | ||||||||||||||

Transaction-based expenses: | ||||||||||||||||||||||

Transaction rebates | (187 | ) | (185 | ) | 1.1 | % | (396 | ) | (367 | ) | 7.9 | % | ||||||||||

Brokerage, clearance and exchange fees(2) | (93 | ) | (84 | ) | 10.7 | % | (213 | ) | (160 | ) | 33.1 | % | ||||||||||

Cash equity trading revenues less transaction-based expenses | 71 | 64 | 10.9 | % | 146 | 125 | 16.8 | % | ||||||||||||||

FICC Revenues | 24 | 24 | — | % | 50 | 49 | 2.0 | % | ||||||||||||||

Transaction-based expenses: | ||||||||||||||||||||||

Transaction rebates | (2 | ) | (4 | ) | (50.0 | )% | (5 | ) | (9 | ) | (44.4 | )% | ||||||||||

Brokerage, clearance and exchange fees | (1 | ) | (1 | ) | — | % | (1 | ) | (2 | ) | (50.0 | )% | ||||||||||

FICC revenues less transaction-based expenses | 21 | 19 | 10.5 | % | 44 | 38 | 15.8 | % | ||||||||||||||

Trade Management Services Revenues | 73 | 72 | 1.4 | % | 148 | 143 | 3.5 | % | ||||||||||||||

Total Market Services revenues less transaction-based expenses | $ | 237 | $ | 222 | 6.8 | % | $ | 487 | $ | 440 | 10.7 | % | ||||||||||

(1) | Includes Section 31 fees of $9 million in the second quarter of 2018, $23 million in the first six months of 2018, $9 million in the second quarter of 2017, and $18 million in the first six months of 2017. Section 31 fees are recorded as equity derivative trading and clearing revenues with a corresponding amount recorded in transaction-based expenses. |

(2) | Includes Section 31 fees of $89 million in the second quarter of 2018, $204 million in the first six months of 2018, $80 million in the second quarter of 2017, and $152 million in the first six months of 2017. Section 31 fees are recorded as cash equity trading revenues with a corresponding amount recorded in transaction-based expenses. |

• | an increase in our overall U.S. matched market share executed on Nasdaq's exchanges; and |

• | an increase in Section 31 pass-through fees, partially offset by; |

• | a decrease in the U.S. average capture rate. |

• | an increase in our overall U.S. matched market share executed on Nasdaq's exchanges; and |

• | an increase in the U.S. average net capture rate. |

Three Months Ended June 30, | Percentage Change | Six Months Ended June 30, | Percentage Change | ||||||||||||||||||

2018 | 2017 | 2018 | 2017 | ||||||||||||||||||

(in millions) | (in millions) | ||||||||||||||||||||

Corporate Services: | |||||||||||||||||||||

Corporate Solutions | $ | 59 | $ | 57 | 3.5 | % | $ | 120 | $ | 114 | 5.3 | % | |||||||||

Listing Services | 72 | 65 | 10.8 | % | 144 | 130 | 10.8 | % | |||||||||||||

Total Corporate Services | $ | 131 | $ | 122 | 7.4 | % | $ | 264 | $ | 244 | 8.2 | % | |||||||||

Three Months Ended June 30, | Percentage Change | Six Months Ended June 30, | Percentage Change | |||||||||||||||||||

2018 | 2017 | 2018 | 2017 | |||||||||||||||||||

(in millions) | (in millions) | |||||||||||||||||||||

Information Services: | ||||||||||||||||||||||

Market Data | $ | 98 | $ | 90 | 8.9 | % | $ | 197 | $ | 180 | 9.4 | % | ||||||||||

Index | 50 | 43 | 16.3 | % | 100 | 82 | 22.0 | % | ||||||||||||||

Investment Data & Analytics | 27 | 11 | 145.5 | % | 51 | 20 | 155.0 | % | ||||||||||||||

Total Information Services | $ | 175 | $ | 144 | 21.5 | % | $ | 348 | $ | 282 | 23.4 | % | ||||||||||

Three Months Ended June 30, | Percentage Change | Six Months Ended June 30, | Percentage Change | |||||||||||||||||||

2018 | 2017 | 2018 | 2017 | |||||||||||||||||||

(in millions) | (in millions) | |||||||||||||||||||||

Market Technology | $ | 66 | $ | 58 | 13.8 | % | $ | 126 | $ | 114 | 10.5 | % | ||||||||||

Three Months Ended June 30, | Percentage Change | Six Months Ended June 30, | Percentage Change | |||||||||||||||||||

2018 | 2017 | 2018 | 2017 | |||||||||||||||||||

(in millions) | (in millions) | |||||||||||||||||||||

Compensation and benefits | $ | 173 | $ | 161 | 7.5 | % | $ | 370 | $ | 322 | 14.9 | % | ||||||||||

Professional and contract services | 34 | 36 | (5.6 | )% | 71 | 72 | (1.4 | )% | ||||||||||||||

Computer operations and data communications | 30 | 30 | — | % | 62 | 60 | 3.3 | % | ||||||||||||||

Occupancy | 23 | 23 | — | % | 49 | 46 | 6.5 | % | ||||||||||||||

General, administrative and other | 25 | 30 | (16.7 | )% | 47 | 49 | (4.1 | )% | ||||||||||||||

Marketing and advertising | 10 | 8 | 25.0 | % | 19 | 15 | 26.7 | % | ||||||||||||||

Depreciation and amortization | 53 | 47 | 12.8 | % | 106 | 92 | 15.2 | % | ||||||||||||||

Regulatory | 8 | 8 | — | % | 16 | 16 | — | % | ||||||||||||||

Merger and strategic initiatives | (10 | ) | 11 | (190.9 | )% | — | 17 | (100.0 | )% | |||||||||||||

Total operating expenses | $ | 346 | $ | 354 | (2.3 | )% | $ | 740 | $ | 689 | 7.4 | % | ||||||||||

Three Months Ended June 30, | Percentage Change | Six Months Ended June 30, | Percentage Change | |||||||||||||||||||

2018 | 2017 | 2017 | 2016 | |||||||||||||||||||

(in millions) | (in millions) | |||||||||||||||||||||

Interest income | $ | 2 | $ | 2 | — | % | $ | 5 | $ | 4 | 25.0 | % | ||||||||||

Interest expense | (37 | ) | (36 | ) | 2.8 | % | (75 | ) | (73 | ) | 2.7 | % | ||||||||||

Net interest expense | (35 | ) | (34 | ) | 2.9 | % | (70 | ) | (69 | ) | 1.4 | % | ||||||||||

Gain on divestiture of businesses, net of disposal costs | 41 | — | N/M | 41 | — | N/M | ||||||||||||||||

Other investment income | 8 | 1 | 700.0 | % | 8 | 2 | 300.0 | % | ||||||||||||||

Net income from unconsolidated investees | 5 | 2 | 150.0 | % | 7 | 6 | 16.7 | % | ||||||||||||||

Total non-operating income (expenses) | $ | 19 | $ | (31 | ) | (161.3 | )% | $ | (14 | ) | $ | (61 | ) | (77.0 | )% | |||||||

Three Months Ended June 30, | Percentage Change | Six Months Ended June 30, | Percentage Change | |||||||||||||||||||

2018 | 2017 | 2017 | 2016 | |||||||||||||||||||

(in millions) | (in millions) | |||||||||||||||||||||

Interest expense on debt | $ | 35 | $ | 34 | 2.9 | % | $ | 70 | $ | 69 | 1.4 | % | ||||||||||

Accretion of debt issuance costs and debt discount | 2 | 1 | 100.0 | % | 4 | 3 | 33.3 | % | ||||||||||||||

Other bank and investment-related fees | — | 1 | (100.0 | )% | 1 | 1 | — | % | ||||||||||||||

Interest expense | $ | 37 | $ | 36 | 2.8 | % | $ | 75 | $ | 73 | 2.7 | % | ||||||||||

Three Months Ended June 30, | Percentage Change | ||||||||||

2018 | 2017 | ||||||||||

($ in millions) | |||||||||||

Income tax provision | $ | 126 | $ | 65 | 93.8 | % | |||||

Effective tax rate | 43.8 | % | 30.8 | % | |||||||

Six Months Ended June 30, | Percentage Change | ||||||||||

2018 | 2017 | ||||||||||

($ in millions) | |||||||||||

Income tax provision | $ | 188 | $ | 113 | 66.4 | % | |||||

Effective tax rate | 35.7 | % | 26.5 | % | |||||||

• | For the three and six months ended June 30, 2018, we recorded a reversal of previously recognized certain Swedish tax benefits. See Note 17, “Income Taxes,” to the condensed consolidated financial statements for further discussion. |

• | The impact of the newly enacted U.S. tax legislation is related to the Tax Cuts and Jobs Act which was enacted on December 22, 2017. For the six months ended June 30, 2018, we recorded an increase to tax expense of $5 million, which reflects the reduced federal tax benefit associated |

• | For the six months ended June 30, 2018, we recorded excess tax benefits of $5 million related to employee share-based compensation which reflects the recognition |

Three Months Ended June 30, 2018 | Three Months Ended June 30, 2017 | |||||||||||||||

Net Income | Diluted Earnings Per Share | Net Income | Diluted Earnings Per Share | |||||||||||||

(in millions, except share and per share amounts) | (in millions, except share and per share amounts) | |||||||||||||||

U.S. GAAP net income attributable to Nasdaq and diluted earnings per share | $ | 162 | $ | 0.97 | $ | 146 | $ | 0.87 | ||||||||

Non-GAAP adjustments: | ||||||||||||||||

Amortization expense of acquired intangible assets | 28 | 0.17 | 22 | 0.13 | ||||||||||||

Merger and strategic initiatives | (10 | ) | (0.06 | ) | 11 | 0.07 | ||||||||||

Gain on divestiture of businesses, net of disposal costs | (41 | ) | (0.24 | ) | — | — | ||||||||||

Extinguishment of debt | — | — | 10 | 0.06 | ||||||||||||

Other | 3 | 0.02 | 2 | 0.01 | ||||||||||||

Adjustment to the income tax provision to reflect non-GAAP adjustments and other tax items | 15 | 0.08 | (21 | ) | (0.12 | ) | ||||||||||

Reversal of certain Swedish tax benefits | 41 | 0.24 | — | — | ||||||||||||

Total non-GAAP adjustments, net of tax | 36 | 0.22 | 24 | 0.14 | ||||||||||||

Non-GAAP net income attributable to Nasdaq and diluted earnings per share | $ | 198 | $ | 1.18 | $ | 170 | $ | 1.01 | ||||||||

Weighted-average common shares outstanding for diluted earnings per share | 167,399,604 | 168,488,305 | ||||||||||||||

Six Months Ended June 30, 2018 | Six Months Ended June 30, 2017 | |||||||||||||||

Net Income | Diluted Earnings Per Share | Net Income | Diluted Earnings Per Share | |||||||||||||

(in millions, except share and per share amounts) | (in millions, except share and per share amounts) | |||||||||||||||

U.S. GAAP net income attributable to Nasdaq and diluted earnings per share | $ | 339 | $ | 2.02 | $ | 314 | $ | 1.86 | ||||||||

Non-GAAP adjustments: | ||||||||||||||||

Amortization expense of acquired intangible assets | 56 | 0.33 | 45 | 0.27 | ||||||||||||

Merger and strategic initiatives | — | — | 17 | 0.10 | ||||||||||||

Gain on divestiture of businesses, net of disposal costs | (41 | ) | (0.24 | ) | — | — | ||||||||||

Extinguishment of debt | — | — | 10 | 0.06 | ||||||||||||

Other | 5 | 0.03 | 2 | 0.01 | ||||||||||||

Adjustment to the income tax provision to reflect non-GAAP adjustments and other tax items | 7 | 0.04 | (33 | ) | (0.19 | ) | ||||||||||

Reversal of certain Swedish tax benefits | 41 | 0.24 | — | — | ||||||||||||

Impact of newly enacted U.S. tax legislation | 5 | 0.03 | — | — | ||||||||||||

Excess tax benefits related to employee share-based compensation | (5 | ) | (0.03 | ) | (23 | ) | (0.14 | ) | ||||||||

Total non-GAAP adjustments, net of tax | 68 | 0.40 | 18 | 0.11 | ||||||||||||

Non-GAAP net income attributable to Nasdaq and diluted earnings per share | $ | 407 | $ | 2.42 | $ | 332 | $ | 1.97 | ||||||||

Weighted-average common shares outstanding for diluted earnings per share | 168,144,020 | 169,352,040 | ||||||||||||||

• | deterioration of our revenues in any of our business segments; |

• | changes in regulatory and working capital requirements; and |

• | an increase in our expenses. |

• | operating covenants contained in our credit facilities that limit our total borrowing capacity; |

• | increases in interest rates under our credit facilities; |

• | credit rating downgrades, which could limit our access to additional debt; |

• | a decrease in the market price of our common stock; and |

• | volatility or disruption in the public debt and equity markets. |

June 30, 2018 | December 31, 2017 | |||||||

(in millions) | ||||||||

Cash and cash equivalents | $ | 322 | $ | 377 | ||||

Restricted cash | 34 | 22 | ||||||

Financial investments, at fair value | 313 | 235 | ||||||

Total financial assets | $ | 669 | $ | 634 | ||||

• | repurchases of our common stock; |

• | repayments made on commercial paper, net; |

• | cash dividends paid on our common stock; |

• | repayments of long-term debt; |

• | net purchases of financial investments; |

• | purchases of property and equipment; and |

• | payments related to employee shares withheld for taxes, partially offset by; |

• | net cash provided by operating activities; and |

• | proceeds from divestiture of businesses, net. |

2018 | 2017 | ||||||

First quarter | $ | 0.82 | $ | 0.32 | |||

Second quarter | — | 0.38 | |||||

Total | $ | 0.82 | $ | 0.70 | |||

Maturity Date | June 30, 2018 | December 31, 2017 | ||||||||

(in millions) | ||||||||||

Short-term debt: | ||||||||||

Commercial paper | Weighted-average maturity of 28 days | $ | 269 | $ | 480 | |||||

Senior unsecured floating rate notes(1) | March 2019 | 499 | 498 | |||||||

Total short-term debt | 768 | 978 | ||||||||

Long-term debt: | ||||||||||

$400 million senior unsecured term loan facility | November 2019 | 100 | 100 | |||||||

5.55% senior unsecured notes | January 2020 | 599 | 599 | |||||||

3.875% senior unsecured notes | June 2021 | 698 | 716 | |||||||

$1 billion revolving credit commitment | April 2022 | (4 | ) | 110 | ||||||

1.75% senior unsecured notes | May 2023 | 694 | 712 | |||||||

4.25% senior unsecured notes | June 2024 | 496 | 496 | |||||||

3.85% senior unsecured notes | June 2026 | 496 | 496 | |||||||

Total long-term debt | 3,079 | 3,229 | ||||||||

Total debt obligations | $ | 3,847 | $ | 4,207 | ||||||

Broker-Dealer Subsidiaries | Total Net Capital | Required Minimum Net Capital | Excess Capital | |||||||||

(in millions) | ||||||||||||

Nasdaq Execution Services | $ | 16.8 | $ | 0.3 | $ | 16.5 | ||||||

Execution Access | 34.0 | 0.3 | 33.7 | |||||||||

NPM Securities | 0.7 | 0.3 | 0.4 | |||||||||

SMTX | 2.6 | 0.3 | 2.3 | |||||||||

Nasdaq Capital Markets Advisory | 0.5 | 0.3 | 0.2 | |||||||||

Six Months Ended June 30, | Percentage Change | ||||||||||

2018 | 2017 | 2018 vs. 2017 | |||||||||

(in millions) | |||||||||||

Net cash provided by (used in): | |||||||||||

Operating activities | $ | 654 | $ | 514 | 27.2 | % | |||||

Investing activities | 151 | (104 | ) | (245.2 | )% | ||||||

Financing activities | (835 | ) | (464 | ) | 80.0 | % | |||||

Effect of exchange rate changes on cash and cash equivalents and restricted cash | (13 | ) | 10 | (230.0 | )% | ||||||

Net increase in cash and cash equivalents and restricted cash | (43 | ) | (44 | ) | (2.3 | )% | |||||

Cash and cash equivalents and restricted cash at beginning of period | 399 | 418 | (4.5 | )% | |||||||

Cash and cash equivalents and restricted cash at end of period | $ | 356 | $ | 374 | (4.8 | )% | |||||

Payments Due by Period | ||||||||||||||||||||

Contractual Obligations | Total | Less than 1 year | 1-3 years | 3-5 years | More than 5 years | |||||||||||||||

(in millions) | ||||||||||||||||||||

Debt obligations by contract maturity(1) | $ | 4,389 | $ | 887 | $ | 1,596 | $ | 807 | $ | 1,099 | ||||||||||

Minimum rental commitments under non-cancelable operating leases, net(2) | 666 | 75 | 135 | 96 | 360 | |||||||||||||||

Purchase obligations(3) | 25 | 12 | 13 | |||||||||||||||||

Other obligations(4) | 13 | 9 | 4 | — | — | |||||||||||||||

Total | $ | 5,093 | $ | 983 | $ | 1,748 | $ | 903 | $ | 1,459 | ||||||||||

(1) | Our debt obligations include both principal and interest obligations. As of June 30, 2018, an interest rate of 3.99% was used to compute the amount of the contractual obligations for interest on the 2016 Credit Facility and 2.86% was used to compute the amount of the contractual obligations for interest on the 2019 Notes. All other debt obligations were primarily calculated on a 360-day basis at the contractual fixed rate multiplied by the aggregate principal amount as of June 30, 2018. See Note 9, “Debt Obligations,” to the condensed consolidated financial statements for further discussion. |

(2) | We lease some of our office space under non-cancelable operating leases with third parties and sublease office space to third parties. Some of our leases contain renewal options and escalation clauses based on increases in property taxes and building operating costs. |

(3) | Purchase obligations primarily represent minimum outstanding obligations due under software license agreements. |

(4) | Other obligations primarily consist of potential future escrow agreement payments related to prior acquisitions. |

• | Note 15, “Clearing Operations,” to the condensed consolidated financial statements for further discussion of our non-cash default fund contributions and margin deposits received for clearing operations; and |

• | Note 16, “Commitments, Contingencies and Guarantees,” to the condensed consolidated financial statements for further discussion of: |

• | Guarantees issued and credit facilities available; |

• | Lease commitments; |

• | Other guarantees; |

• | Non-cash contingent consideration; |

• | Escrow agreements; |

• | Routing brokerage activities; |

• | Legal and regulatory matters; and |

• | Tax audits. |

Euro | Swedish Krona | Other Foreign Currencies | U.S. Dollar | Total | ||||||||||||||||

(in millions, except currency rate) | ||||||||||||||||||||

Three Months Ended June 30, 2018 | ||||||||||||||||||||

Average foreign currency rate to the U.S. dollar | 1.1913 | 0.1153 | # | N/A | N/A | |||||||||||||||

Percentage of revenues less transaction-based expenses | 9.4 | % | 7.2 | % | 5.0 | % | 78.4 | % | 100.0 | % | ||||||||||

Percentage of operating income | 14.2 | % | (0.4 | )% | (5.7 | )% | 91.9 | % | 100.0 | % | ||||||||||

Impact of a 10% adverse currency fluctuation on revenues less transaction-based expenses | $ | (6 | ) | $ | (4 | ) | $ | (3 | ) | $ | — | $ | (13 | ) | ||||||

Impact of a 10% adverse currency fluctuation on operating income | $ | (4 | ) | $ | — | $ | (1 | ) | $ | — | $ | (5 | ) | |||||||

Euro | Swedish Krona | Other Foreign Currencies | U.S. Dollar | Total | ||||||||||||||||

(in millions, except currency rate) | ||||||||||||||||||||

Six Months Ended June 30, 2018 | ||||||||||||||||||||

Average foreign currency rate to the U.S. dollar | 1.2098 | 0.1191 | # | N/A | N/A | |||||||||||||||

Percentage of revenues less transaction-based expenses | 9.5 | % | 7.6 | % | 5.4 | % | 77.5 | % | 100.0 | % | ||||||||||

Percentage of operating income | 14.9 | % | 0.2 | % | (5.8 | )% | 90.7 | % | 100.0 | % | ||||||||||

Impact of a 10% adverse currency fluctuation on revenues less transaction-based expenses | $ | (12 | ) | $ | (10 | ) | $ | (7 | ) | $ | — | $ | (29 | ) | ||||||

Impact of a 10% adverse currency fluctuation on operating income | $ | (8 | ) | $ | — | $ | (3 | ) | $ | — | $ | (11 | ) | |||||||

# | Represents multiple foreign currency rates. |

N/A | Not applicable. |

Net Assets | Impact of a 10% Adverse Currency Fluctuation | |||||||

(in millions) | ||||||||

Swedish Krona(1) | $ | 3,267 | $ | (327 | ) | |||

Norwegian Krone | 188 | (19 | ) | |||||

Canadian Dollar | 123 | (12 | ) | |||||

British Pound | 162 | (16 | ) | |||||

Euro | 95 | (10 | ) | |||||

Australian Dollar | 104 | (10 | ) | |||||

(1) | Includes goodwill of $2,440 million and intangible assets, net of $579 million. |

Period | (a) Total Number of Shares Purchased | (b) Average Price Paid Per Share | (c) Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs | (d) Maximum Dollar Value of Shares that May Yet Be Purchased Under the Plans or Programs (in millions) | ||||||||||

April 2018 | ||||||||||||||

Share repurchase program | — | $ | — | — | $ | 627 | ||||||||

Employee transactions | 10,051 | 89.66 | N/A | N/A | ||||||||||

May 2018 | ||||||||||||||

Share repurchase program | 2,095,530 | $ | 89.48 | 2,095,530 | $ | 440 | ||||||||

Employee transactions | 2,604 | 89.62 | N/A | N/A | ||||||||||

June 2018 | ||||||||||||||

Share repurchase program | 575,044 | $ | 93.19 | 575,044 | $ | 386 | ||||||||

Employee transactions | — | — | N/A | N/A | ||||||||||

Total Quarter Ended June 30, 2018 | ||||||||||||||

Share repurchase program | 2,670,574 | $ | 90.28 | 2,670,574 | $ | 386 | ||||||||

Employee transactions | 12,655 | $ | 89.65 | N/A | N/A | |||||||||

• | an annual base salary of no less than $550,000; and |

• | annual incentive compensation that is targeted at not less than $825,000 based on the achievement of one or more performance goals established for such year by the Chief Executive Officer and the management compensation committee of Nasdaq’s board of directors (the “Target Bonus”). |

• | any pro rata Target Bonus with respect to the calendar year in which the termination occurs; |

• | continued vesting of all unvested equity; |

• | a taxable monthly cash payment equal to the Consolidated Omnibus Budget Reconciliation Act (“COBRA”) premium for the highest level of coverage available under Nasdaq’s group health plans, reduced by the monthly amount that Mr. Knight would pay for such coverage if he was an active employee, until the earlier of 18 months or the date Mr. Knight is eligible for coverage under the health care plans of a subsequent employer; and |

• | 24 months of financial and tax services and executive physical exams. |

• | a cash payment equal to any pro rata Target Bonus with respect to the calendar year in which the termination occurs; and |

• | accelerated vesting of all unvested equity awarded as of the effective date of the employment agreement. |

• | a cash payment equal to the sum of: (i) his base salary for the remaining term of the agreement and (ii) the target amount of his annual incentive compensation for the fiscal years in the remaining term of the agreement; |

• | a taxable monthly cash payment equal to the COBRA premium for the highest level of coverage available under Nasdaq’s group health plans, reduced by the monthly amount that Mr. Knight would pay for such coverage if he was an active employee, until the earlier of 24 months or the date Mr. Knight is eligible for coverage under the health care plans of a subsequent employer; and |

• | continued life insurance and accidental death and dismemberment insurance benefits for the same period as the continued health coverage payments. |

Exhibit Number | ||

Amended and Restated Board Compensation Policy, effective on April 24, 2018.* | ||

Form of Nasdaq Restricted Stock Unit Award Certificate (employees).* | ||

Form of Nasdaq Restricted Stock Unit Award Certificate (directors).* | ||

Form of Nasdaq One-Year Performance Share Unit Agreement.* | ||

Form of Nasdaq Three-Year Performance Share Unit Agreement.* | ||

Statement regarding computation of per share earnings (incorporated herein by reference from Note 13 to the condensed consolidated financial statements under Part I, Item 1 of this Form 10-Q). | ||

Certification of President and Chief Executive Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 (“Sarbanes-Oxley”). | ||

Certification of Executive Vice President, Corporate Strategy and Chief Financial Officer pursuant to Section 302 of Sarbanes-Oxley. | ||

Certifications Pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of Sarbanes-Oxley. | ||

101.INS | XBRL Instance Document.** | |

101.SCH | XBRL Taxonomy Extension Schema. | |

101.CAL | XBRL Taxonomy Extension Calculation Linkbase. | |

101.DEF | Taxonomy Extension Definition Linkbase. | |

101.LAB | XBRL Taxonomy Extension Label Linkbase. | |

101.PRE | XBRL Taxonomy Extension Presentation Linkbase. | |

* | Management contract or compensatory plan or arrangement. |

** | The following materials from the Nasdaq, Inc. Quarterly Report on Form 10-Q for the three and six months ended June 30, 2018, formatted in XBRL (eXtensible Business Reporting Language): (i) Condensed Consolidated Balance Sheets as of June 30, 2018 and December 31, 2017; (ii) Condensed Consolidated Statements of Income for the three and six months ended June 30, 2018 and 2017; (iii) Condensed Consolidated Statements of Comprehensive Income for the three and six months ended June 30, 2018 and 2017; (iv) Condensed Consolidated Statements of Cash Flows for the six months ended June 30, 2018 and 2017; and (v) notes to condensed consolidated financial statements. |

Nasdaq, Inc. | ||||

(Registrant) | ||||

Date: August 1, 2018 | By: | /s/ Adena T. Friedman | ||

Name: | Adena T. Friedman | |||

Title: | President and Chief Executive Officer | |||

Date: August 1, 2018 | By: | /s/ Michael Ptasznik | ||

Name: | Michael Ptasznik | |||

Title: | Executive Vice President, Corporate Strategy and Chief Financial Officer | |||