UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x | Filed by a Party other than the Registrant o | |||||||

Check the appropriate box:

o Preliminary Proxy Statement

o Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

x Definitive Proxy Statement

o Definitive Additional Materials

o Soliciting Material under § 240.14a-12

Model N, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x No fee required.

o Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11

(Set forth the amount on which the filing fee is calculated and state how it was determined):

(4) Proposed maximum aggregate value of transaction:

(5)Total fee paid:

o Fee paid previously with preliminary materials.

o Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1) Amount Previously Paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

January 7, 2022

Dear Fellow Stockholders:

As our 2022 Annual Meeting approaches, it is my privilege as the non-executive Chair of the Board of Directors to reflect on the past year and share some highlights directly with you. As a Board, we worked to provide independent oversight of Model N’s management team, and engaged in continuous dialogue concerning corporate strategy, business objectives and corporate sustainability.

Board Oversight of Corporate Strategy and Diversity

Over the course of the past year, our management team remained steadfast in its focus on Model N’s operating performance, successfully continuing to transition from an on-premise to a SaaS business model. Model N’s overall sales velocity continued to accelerate as we closed 34% more total deals in fiscal year 2021 compared to the previous fiscal year. The management team also made significant progress integrating the acquisition of Deloitte's life science pricing and contracting business. Rebranded as Business Services, the acquisition has significantly expanded Model N’s total addressable market, enabling us to sell to pre-revenue companies up to the largest corporations in the world by enabling an integrated software and services revenue management solution for their needs.

The Board is committed to its role as your fiduciaries, and we believe that our Directors’ diverse skills and backgrounds represent the expertise required for effective oversight of Model N’s evolving business and strategies. The Board proactively refreshed itself over the recent years to add diverse new Board members who have significant experience serving as executive, marketing or product development leaders at technology and healthcare companies to oversee management’s continued expansion of Model N’s customer base and successful SaaS transitions. In addition to having three women on our Board, I am proud to share that three members of our Board are also racially or ethnically diverse.

Shareholder Engagement and Corporate Sustainability

The Board places a high priority on listening and responding to shareholder feedback. One area of particular focus for our Board was in considering valuable stockholder feedback related to environmental, social and governance (“ESG”) matters, discussions in which I personally participated. After incorporating shareholder feedback into our ESG materiality assessment process, Model N published its first Sustainability Report under the direction of the Board, which describes how Model N manages ESG factors that are material to our business. Although our inaugural report is a small first step in this important journey to begin disclosing our ESG practices, we have begun to align our focus on corporate social responsibility with certain United Nations Sustainable Development Goals to do our part in contributing to finding solutions to local and global ESG challenges. A summary of Model N’s ESG approach is described on page 10 of this proxy statement.

We believe our actions in 2021 demonstrate our steadfast commitment to both business and ESG excellence, as well as responsiveness to our shareholders. As Chairman of the Board, I am proud to work closely with my fellow independent directors and Model N’s management team to ensure that Model N is a well-governed company focused on creating value for all our stakeholders. We pledge to continue to work hard for you to ensure the sustainability and success of Model N’s long-term strategies. Thank you for your continued support.

Best regards,

Baljit Dail

Non-Executive Chair of the Board

MODEL N, INC.

777 MARINERS ISLAND BOULEVARD, SUITE 300

SAN MATEO, CALIFORNIA 94404

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held at 11:30 a.m. Pacific Time on Friday, February 18, 2022

TO THE HOLDERS OF COMMON STOCK OF MODEL N, INC.:

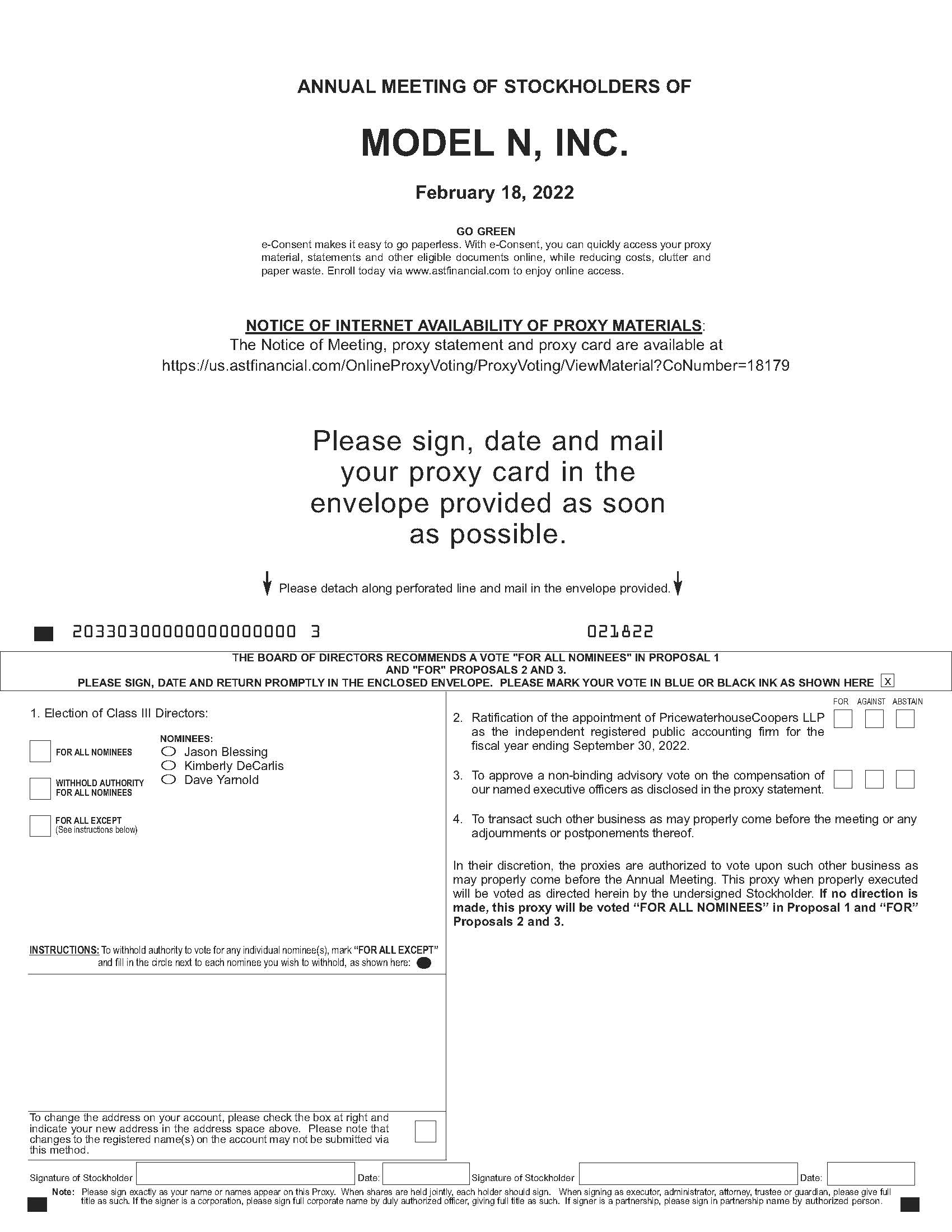

The Annual Meeting of Stockholders of Model N, Inc., a Delaware corporation (“Model N”), will be held on Friday, February 18, 2022 at 11:30 a.m. Pacific Time via live webcast at https://web.lumiagm.com/291527551 (password: Modn2022) for the following purposes:

1. To elect three Class III directors to serve until the 2025 Annual Meeting of Stockholders and until their successors are elected and qualified, subject to earlier resignation or removal;

2. To ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending September 30, 2022;

3. To hold a non-binding advisory vote on the compensation of our named executive officers as disclosed in this proxy statement; and

4. To transact such other business as may properly come before the meeting or any adjournments or postponements thereof.

The Board of Directors of Model N has fixed the close of business on December 21, 2021 as the record date for the meeting. Only stockholders of record of our common stock at the close of business on December 21, 2021 are entitled to notice of and to vote at the meeting. Further information regarding voting rights and the matters to be voted upon is presented in our proxy statement.

For ten days prior to the meeting, a complete list of the stockholders entitled to vote at the meeting will be available upon request by any stockholder for any purpose relating to the meeting. Stockholders can request the list of stockholders through our investor relations website at https://investor.modeln.com/resources/information-request-form/. The stockholder list will also be available during the live webcast at https://web.lumiagm.com/291527551 (password: Modn2022). Further information regarding voting rights and the matters to be voted upon is presented in our proxy statement.

A Notice Regarding the Availability of Proxy Materials (“Notice”) is being mailed to stockholders of record as of the record date beginning on or about January 7, 2022. The Notice contains instructions on how to access our proxy statement for our 2022 Annual Meeting of Stockholders and our Annual Report on Form 10-K for our fiscal year ended September 30, 2021 (together, the proxy materials). The Notice also provides instructions on how to vote online and how to receive an email or paper copy of proxy materials. The proxy materials can be accessed directly at the following Internet address:

http://investor.modeln.com/annual-meeting/Index?KeyGenPage=1073749823.

If you have any questions regarding this information or the proxy materials, please visit our website at www.modeln.com or contact our investor relations department at (415) 877-4012.

YOUR VOTE IS IMPORTANT. Whether or not you plan to attend the Annual Meeting of Stockholders, we urge you to submit your vote via the Internet, telephone or mail.

We appreciate your continued support of Model N and look forward to receiving your proxy.

By order of the Board of Directors,

Jason Blessing

Chief Executive Officer

San Mateo, California

January 7, 2022

TABLE OF CONTENTS

QUESTIONS AND ANSWERS | |||||

PROPOSAL NO. 1—ELECTION OF DIRECTORS | |||||

Director Independence | |||||

Leadership Structure | |||||

Risk Oversight | |||||

Executive Sessions of Independent Directors | |||||

Codes of Conduct | |||||

Meetings of the Board of Directors | |||||

Committees of the Board of Directors | |||||

Compensation Committee Interlocks and Insider Participation | |||||

Considerations in Evaluating Director Nominees | |||||

Stockholder Recommendations for Nominations to the Board of Directors | |||||

Non-Employee Director Compensation | |||||

Communications with the Board of Directors | |||||

RELATED PERSON TRANSACTIONS | |||||

EXECUTIVE OFFICERS | |||||

EXECUTIVE COMPENSATION | |||||

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This proxy statement contains forward-looking statements. All statements contained in this proxy statement other than statements of historical fact, including statements regarding our business strategy and plans and our objectives for future operations, are forward-looking statements. The words “believe,” “may,” “will,” “continue,” “anticipate,” “intend,” “expect,” “seek”, and similar expressions are intended to identify forward-looking statements. We have based these forward-looking statements largely on our current expectations and projections about future events and trends. These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including those described in the “Risk Factors” section of our Annual Report on Form 10-K for the fiscal year ended September 30, 2021. Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties and assumptions, the future events and trends discussed in this proxy statement may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements. You should not rely upon forward-looking statements as predictions of future events. The events and circumstances reflected in the forward-looking statements may not be achieved or occur. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results. We are under no duty to update any of these forward-looking statements after the date of this proxy statement.

As used in this proxy statement, the terms “Model N,” “we,” “us,” and “our” mean Model N, Inc. and its subsidiaries unless the context indicates otherwise.

MODEL N, INC.

777 Mariners Island Boulevard, Suite 300

San Mateo, California 94404

PROXY STATEMENT

FOR 2022 ANNUAL MEETING OF STOCKHOLDERS

to be held on Friday, February 18, 2022 at 11:30 a.m. PT

This proxy statement and the enclosed form of proxy are furnished in connection with solicitation of proxies by our Board of Directors for use at the annual meeting of stockholders (the “Annual Meeting”) to be held at 11:30 a.m. PT on Friday, February 18, 2022, and any postponements or adjournments thereof. The Annual Meeting will be held via live webcast at https://web.lumiagm.com/291527551 (password: Modn2022). Beginning on or about January 7, 2022, we mailed to our stockholders a Notice Regarding the Availability of Proxy Materials (“Notice”) containing instructions on how to access our proxy materials.

QUESTIONS AND ANSWERS

The information provided in the “question and answer” format below is for your convenience only and is merely a summary of the information contained in this proxy statement. You should read this entire proxy statement carefully.

What matters am I voting on?

You will be voting on:

•the election of three Class III directors to hold office until the 2025 Annual Meeting of Stockholders and until their successors are elected and qualified, subject to earlier resignation or removal;

•a proposal to ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending September 30, 2022;

•a proposal to hold a non-binding advisory vote on the compensation of our named executive officers as disclosed in this proxy statement; and

•any other business that may properly come before the meeting.

How does the Board of Directors recommend I vote on these proposals?

The Board of Directors recommends a vote:

•FOR the re-election of Jason Blessing, Kim DeCarlis and Dave Yarnold, our nominees for Class III directors;

•FOR the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending September 30, 2022; and

•FOR the non-binding advisory vote on the compensation of our named executive officers as disclosed in this proxy statement.

Who is entitled to vote?

Holders of our common stock as of the close of business on December 21, 2021, the record date, may vote at the Annual Meeting. As of the record date, we had 36,432,699 shares of common stock outstanding. In deciding all matters at the Annual Meeting, each holder of common stock of Model N will be entitled to one vote for each share of common stock held as of the close of business on the record date. We do not have cumulative voting rights for the election of directors.

Registered Stockholders. If your shares are registered directly in your name with our transfer agent, you are considered the stockholder of record with respect to those shares, and the Notice was provided to you directly by us. As the stockholder of record, you have the right to grant your voting proxy directly to the individuals listed on the proxy card or to vote in person at the Annual Meeting.

1

Street Name Stockholders. If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares held in street name and the Notice was forwarded to you by your broker or nominee who is considered the stockholder of record with respect to those shares. As the beneficial owner, you have the right to direct your broker or nominee how to vote your shares. Beneficial owners are also invited to attend the Annual Meeting. However, since beneficial owners are not stockholders of record, you may not vote your shares in person at the Annual Meeting unless you follow your broker’s procedures for obtaining a legal proxy. If you request a printed copy of the proxy materials by mail, your broker or nominee will provide a voting instruction card for you to use.

How do I vote?

There are four ways for stockholders of record to vote:

•by Internet at http://www.voteproxy.com, 24 hours a day, seven days a week, until 11:59 p.m. Eastern Time on February 17, 2022 (have your Notice or proxy card in hand when you visit the website);

We encourage you to vote this way as it is the most cost-effective method.

•by toll-free telephone at 800-776-9437 (or 718-921-8500 for international callers) until 11:59 p.m. Eastern Time on February 17, 2022 (have your Notice or proxy card in hand when you call);

•by completing and mailing your proxy card so that it is received prior to the Annual Meeting; or

•by voting online at the Annual Meeting (have your Notice or proxy card in hand).

Street name holders may submit their voting instructions by internet or telephone using the information provided by their respective brokers or nominees and may complete and mail voting instruction forms to their respective brokers or nominees. However, street name holders may not vote by written ballot at the Annual Meeting unless they obtain a legal proxy from their respective brokers or nominees.

Can I change my vote?

Yes. If you are a stockholder of record, you can change your vote or revoke your proxy any time before the Annual Meeting by:

•entering a new vote by Internet or by telephone (until 11:59 p.m. Eastern Time on February 17, 2022);

•returning a later-dated proxy card so that it is received prior to the Annual Meeting;

•notifying the Corporate Secretary of Model N, in writing, at the address listed on the front page; or

•completing a ballot online at the Annual Meeting (have your Notice or proxy card in hand).

Street name holders may change their voting instructions by submitting new instructions by internet or by telephone or returning a later-dated voting instruction form to their respective brokers or nominees. In addition, street name holders who obtain a legal proxy from their respective brokers or nominees may change their votes by completing a ballot online at the Annual Meeting.

What is the effect of giving a proxy?

Proxies are solicited by and on behalf of our Board of Directors. The persons named in the proxy card have been designated as proxies by our Board of Directors. When proxy votes are properly dated, executed and returned, the shares represented by such proxies will be voted at the Annual Meeting in accordance with the instructions of the stockholder. If no specific instructions are given, however, the shares will be voted in accordance with the recommendations of our Board of Directors as described above. If any matters not described in the Proxy Statement are properly presented at the Annual Meeting, the proxy holders will use their own judgment to determine how to vote your shares. If the Annual Meeting is adjourned, the proxy holders can vote your shares at the adjourned meeting date as well, unless you have properly revoked your proxy instructions, as described above.

What is a quorum?

A quorum is the minimum number of shares required to be present at the Annual Meeting for the meeting to be properly held under our bylaws and Delaware state law. The presence, in person or by proxy, of a majority of the voting power of the shares of stock entitled to vote at the meeting will constitute a quorum at the meeting.

What is the effect of broker non-votes and abstentions?

A proxy submitted by a stockholder may indicate that the shares represented by the proxy are not being voted (stockholder withholding) with respect to a particular matter. In addition, a broker may not be permitted to vote on shares held in street name on a particular matter in the absence of instructions from the beneficial owner of the stock (broker non-vote). The shares subject to a proxy which are not being voted on a particular matter because of either stockholder withholding or broker non-votes will count for purposes of determining the presence of a quorum, but are not treated as votes cast for or against a matter and, therefore, will have no effect on the election of directors, the ratification of the appointment of PricewaterhouseCoopers LLP, or the non-binding advisory vote on the

2

compensation of our named executive officers as disclosed in this proxy statement. Abstentions are voted neither “for” nor “against” a matter, and, therefore, will have no effect on these proposals, but are counted in the determination of a quorum.

How many votes are needed for approval of each matter?

•Proposal No. 1: The election of directors requires a plurality vote of the shares of common stock voted at the meeting. “Plurality” means that the nominees who receive the largest number of votes cast “FOR” are elected as directors. As a result, any shares not voted “FOR” a particular nominee (whether as a result of stockholder withholding or a broker non-vote) will not be counted in such nominee’s favor.

•Proposal No. 2: The ratification of the appointment of PricewaterhouseCoopers LLP must receive the affirmative vote of the holders of a majority of the voting power of the shares of stock entitled to vote on such matter that are present in person or represented by proxy at the meeting and are voted for or against the matter.

•Proposal No. 3: The non-binding advisory vote on the compensation of our named executive officers as disclosed in this proxy statement must receive the affirmative vote of the holders of a majority of the voting power of the shares of stock entitled to vote on such matter that are present in person or represented by proxy at the meeting and are voted for or against the matter.

How are proxies solicited for the Annual Meeting?

The Board of Directors is soliciting proxies for use at the Annual Meeting. All expenses associated with this solicitation will be borne by Model N. We will reimburse brokers or other nominees for reasonable expenses that they incur in sending these proxy materials to you if a broker or other nominee holds your shares.

How may my brokerage firm or other intermediary vote my shares if I fail to provide timely directions?

Brokerage firms and other intermediaries holding shares of common stock in street name for customers are generally required to vote such shares in the manner directed by their customers. In the absence of timely directions, your broker will have discretion to vote your shares on our sole routine matter—the proposal to ratify the appointment of PricewaterhouseCoopers LLP. Your broker will not have discretion to vote on the election of directors or the non-binding advisory vote on the compensation of our named executive officers, which are “non-routine” matters, absent direction from you.

Why did I receive a notice regarding the availability of proxy materials on the Internet instead of a full set of proxy materials?

In accordance with the rules of the Securities and Exchange Commission (“SEC”), we have elected to furnish our proxy materials, including this proxy statement and our Annual Report on Form 10-K, primarily via the Internet. Beginning on or about January 7, 2022, we mailed to our stockholders a “Notice Regarding the Availability of Proxy Materials” that contains notice of the Annual Meeting and instructions on how to access our proxy materials on the Internet, how to vote at the meeting and how to request printed copies of the proxy materials and annual report. Stockholders may request to receive all future proxy materials in printed form by mail or electronically by e-mail by following the instructions contained in the Notice. We encourage stockholders to take advantage of the availability of the proxy materials on the Internet to help reduce the environmental impact of our annual meetings.

What does it mean if multiple members of my household are stockholders but we only received one Notice or full set of proxy materials in the mail?

The SEC has adopted rules that permit companies and intermediaries, such as brokers, to satisfy the delivery requirements for notices and proxy materials with respect to two or more stockholders sharing the same address by delivering a single notice or set of proxy materials addressed to those stockholders. In accordance with a prior notice sent to certain brokers, banks, dealers or other agents, we are sending only one Notice or full set of proxy materials to those addresses with multiple stockholders unless we received contrary instructions from any stockholder at that address. This practice, known as “householding,” allows us to satisfy the requirements for delivering Notices or proxy materials with respect to two or more stockholders sharing the same address by delivering a single copy of these documents. Householding helps to reduce our printing and postage costs, reduces the amount of mail you receive and helps to preserve the environment. If you currently receive multiple copies of the Notice or proxy materials at your address and would like to request “householding” of your communications, please contact your broker. Once you have elected “householding” of your communications, “householding” will continue until you are notified otherwise or until you revoke your consent. You may revoke your consent at any time by contacting the Corporate Secretary of Model N, in writing, at the address listed on the front page, or by telephone at (650) 610-4800.

Is my vote confidential?

Proxy instructions, ballots and voting tabulations that identify individual stockholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed either within Model N or to third parties, except as necessary to meet applicable legal requirements, to allow for the tabulation of votes and certification of the vote, or to facilitate a successful proxy solicitation.

3

Where can I find Model N’s Corporate Governance Guidelines and other governance documents?

Model N has adopted Corporate Governance Guidelines. A copy of the Corporate Governance Guidelines, as well as copies of the Code of Business Conduct for Directors, Code of Business Conduct for Employees, Audit Committee Charter, Compensation Committee Charter and Nominating and Corporate Governance Committee Charter, can be accessed through the Investor Relations section of our website, under Company—Investor Relations—Governance, or by clicking on the following link:

https://investor.modeln.com/governance/governance-documents/.

4

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Our Board of Directors may establish the authorized number of directors from time to time by resolution. Our Board of Directors currently consists of nine members. Our certificate of incorporation and bylaws provide for a classified Board of Directors consisting of three classes of directors, with directors serving staggered three-year terms.

Directors in a particular class will be elected for three-year terms at the annual meeting of stockholders in the year in which their terms expire. As a result, only one class of directors will be elected at each annual meeting of our stockholders, with the other classes continuing for the remainder of their respective three-year terms. Each director’s term continues until the election and qualification of his or her successor, or his or her earlier death, resignation or removal. The class of each director is set forth in the table below.

The directors who are serving for terms that end following the meeting, and their ages, positions and length of board service as of December 21, 2021, are provided in the table below. Additional biographical descriptions of each nominee and director are set forth in the text below the table. These descriptions include the primary individual experience, qualifications, qualities and skills of our nominees and directors that led to the conclusion that each person should serve as a member of our Board of Directors.

| Nominees | Class | Age | Position | Year Elected Director | Current Term Expires | Expiration of Term For Which Nominated | ||||||||||||||||||||||||||||||||

| Jason Blessing | III | 50 | Chief Executive Officer and Director | 2018 | 2022 | 2025 | ||||||||||||||||||||||||||||||||

| Kim DeCarlis | III | 55 | Director | 2020 | 2022 | 2025 | ||||||||||||||||||||||||||||||||

| Dave Yarnold | III | 61 | Director | 2018 | 2022 | 2025 | ||||||||||||||||||||||||||||||||

| Continuing Directors | ||||||||||||||||||||||||||||||||||||||

| Tim Adams | I | 62 | Director | 2016 | 2023 | — | ||||||||||||||||||||||||||||||||

| Manisha Shetty Gulati | I | 43 | Director | 2020 | 2023 | — | ||||||||||||||||||||||||||||||||

| Scott Reese | I | 49 | Director | 2019 | 2023 | — | ||||||||||||||||||||||||||||||||

| Baljit Dail | II | 54 | Director | 2017 | 2024 | — | ||||||||||||||||||||||||||||||||

| Melissa Fisher | II | 49 | Director | 2016 | 2024 | — | ||||||||||||||||||||||||||||||||

| Alan Henricks | II | 71 | Director | 2015 | 2024 | — | ||||||||||||||||||||||||||||||||

Nominees for Director

Jason Blessing has served as our Chief Executive Officer and a member of our Board of Directors since May 2018. Prior to joining Model N, Mr. Blessing served as Chief Executive Officer of Plex Systems, an industry-leading ERP and manufacturing automation solution provider, from January 2013 to December 2017. Prior to Plex, Mr. Blessing held a number of executive positions at Taleo, an HR cloud company, as well as several executive positions at PeopleSoft after starting his career with PricewaterhouseCoopers LLP’s management consulting practice. Mr. Blessing holds a Bachelor of Arts from the University of Michigan and currently sits on the School of Information’s Advisory Board. Our Board of Directors determined that Mr. Blessing should serve as a director based on his position as Chief Executive Officer of our Company and his understanding of the software industry.

Kim DeCarlis has served as a member of our board of directors since January 2020. Since April 2019, Ms. DeCarlis has served as Chief Marketing Officer of PerimeterX, a leading provider of application security solutions that keep digital businesses safe. From April 2017 to September 2018, Ms. DeCarlis served as Chief Marketing Officer at Gigamon, an industry leader in traffic visibility solutions. From October 2014 to November 2016, Ms. DeCarlis served as Chief Marketing Officer at Imperva, a provider of data and application security solutions. Before that, Ms. DeCarlis led the worldwide marketing organization at BMC, served as the VP of corporate marketing at Citrix, and was SVP of product marketing at Information Resources, Inc., a provider of big data solutions to the CPG and retail industries. Ms. DeCarlis is a frequent speaker at industry events on cyber security, B2B marketing and C-level engagement. Ms. DeCarlis is a graduate of Stanford University with a bachelor’s degree in industrial engineering. Our board of directors determined that Ms. DeCarlis should serve as a director based on her significant experience working with SaaS companies and her significant marketing experience.

Dave Yarnold has served as a member of our board of directors since December 11, 2018. Since January 2018, Mr. Yarnold has been a board member and advisor to a variety of technology companies. From April 2009 to January 2018, Mr. Yarnold served as Chief Executive Officer of ServiceMax - now GE Digital. Prior to April 2009, Mr. Yarnold served as Vice President of several private and public companies including SuccessFactors, Extensity, Inc., Clarify, Inc. (acquired by Nortel), Platinum Software Corporation, and Oracle. Mr. Yarnold holds a Bachelor of Science degree in Accounting from San Francisco State University. Our board of directors determined that Mr. Yarnold should serve as a director based on his extensive experience as a serial entrepreneur in the enterprise software industry.

5

Continuing Directors

Tim Adams has served as a member of our Board of Directors since December 2016. Since January 2022, Mr. Adams has served as the Chief Financial Officer of Rapid7, Inc., a cybersecurity technology company. From April 2020 to December 2021, Mr. Adams served as the Chief Financial Officer of BitSight, a cybersecurity ratings company. From January 2017 to March 2020, Mr. Adams served as Chief Financial Officer of ObsEva SA, a biopharmaceutical company. From June 2014 to September 2016, Mr. Adams served as Executive Vice President, Chief Financial Officer and Treasurer of Demandware, Inc., a provider of cloud-based e-commerce solutions and services. Mr. Adams served as Senior Vice President and Chief Financial Officer of athenahealth, Inc., a provider of cloud-based services for electronic health records, practice management, and care coordination, from January 2010 to June 2014. Previously, Mr. Adams served as Chief Investment Officer of Constitution Medical Investors, Inc., a private investment firm focused on health-care-sector-related acquisitions and investments, as well as Senior Vice President of Corporate Strategy for Keystone Dental, Inc., a provider of dental health products and solutions. Earlier in his career, Mr. Adams was Chief Financial Officer at a number of other publicly traded companies. Mr. Adams began his career in public accounting at PricewaterhouseCoopers LLP, formerly Price Waterhouse, and is a Certified Public Accountant. Mr. Adams served as a member of the board of directors of ABILITY Network, a private healthcare technology company, from November 2014 to March 2018. Mr. Adams served as a member of the Board of Directors of Prevail Therapeutics, a gene therapy company from May 2019 to January 2021. In November 2021, Mr. Adams was appointed to the Board of Directors of Intelycare, a private healthcare workforce management company. Mr. Adams obtained a B.S. from Murray State University and an MBA from Boston University. Our Board of Directors determined that Mr. Adams should serve as a director based on his significant experience working with technology companies and his significant financial experience.

Baljit Dail has served as a member of our Board of Directors since May 2017. In April 2019, Mr. Dail joined IRI Worldwide as President of IRI Global and is currently President of Strategic Initiatives. Prior to joining IRI, Mr. Dail served as a senior adviser at New Mountain Capital. From May 2013 to January 2017, Mr. Dail served as the Chairman of JDA Software where he was also Chief Executive Officer from April 2014 to January 2017. From January 2009 to December 2020, Mr. Dail has served as an independent director at the Midcontinent Independent System Operator. From March 2018 to April 2019, Mr. Dail has served on the boards of Sparta Systems and One Digital. In addition, from August 2018 to April 2019 Mr. Dail served on the Beeline board of directors. From April 2012 to December 2014, Mr. Dail served as a managing director of New Mountain Capital. From April 2012 to December 2014, Mr. Dail served as a member of the board of directors and chair of the compensation committee of Western Dental. From May 2012 to April 2014, Mr. Dail served as a member of the board of directors at AmWINS Group. From November 2005 to March 2012, Mr. Dail served in several leadership roles at Aon Consulting, including Chief Executive Officer Aon Consulting and Aon Hewitt, Chief Information Officer or Aon Corporation and Chief Operating Officer of Aon Benfeild. Mr. Dail holds a B.Sc. in Computer Science from the University of Warwick in England. Our Board of Directors determined that Mr. Dail should serve as a director based on his extensive experience as a chief executive officer and his understanding of the software industry.

Melissa Fisher has served as a member of our Board of Directors since August 2016 and previously served on the board of directors for Image Sensing Systems, Inc., as chair of the audit committee, as well as Digital Generation, Inc. Since June 2020, Ms. Fisher has served as Chief Financial Officer at Outreach, the leading sales engagement platform helping companies dramatically increase productivity and drive smarter, more insightful engagement with their customers. From April 2016 to May 2020, Ms. Fisher served as Chief Financial Officer at Qualys, Inc., a provider of cloud-based security and compliance solutions. From April 2015 to April 2016, Ms. Fisher served as Head of Financial Planning and Analysis, Treasury and Investor Relations at Zynga Inc., a developer of online and mobile social games. From July 2013 to March 2015, Ms. Fisher served as Head of Corporate Development, Treasury and Investor Relations at Digital River, Inc., a cloud-based ecommerce and payments company. Prior to joining Digital River, Ms. Fisher spent 15 years as an investment banker advising companies in the technology sector. Ms. Fisher holds an MBA from Harvard Business School and A.B. degree in government from Harvard University. Our Board of Directors determined that Ms. Fisher should serve as a director based on her significant experience working with software companies and her significant financial experience.

Manisha Shetty Gulati has served as a member of our Board of Directors since December 2020. Since November 2021, Ms. Gulati has served as Chief Growth Officer of Commure, Inc., a healthcare software company. From April 2019 to November 2021, Ms. Gulati served as Chief Operating Officer of Clarify Health Solutions, a provider of advanced healthcare analytics and care optimization. From September 2006 to March 2019, Ms. Gulati served as Partner at McKinsey and Company's London and San Francisco offices working in healthcare across the health systems and medical products/life sciences practices. Before that, Ms. Gulati worked in New Delhi as the program coordinator for the American India Foundation, where she identified and funded innovative development projects in healthcare, education and microfinance. Ms. Gulati has also worked as a consultant for the United Nations Development Programme in Ethiopia and in the health portfolio of Acumen, a non-profit venture fund that supports entrepreneurs with products for low-income people in Asia and Africa. Ms. Gulati is the Vice Chair of the Board of ReSurge International, a global nonprofit that provides access to life-changing reconstructive surgical care to patients with the greatest need in lower-income countries. Ms. Gulati received a Master of Business Administration from Harvard Business School, a Master of Public Administration from the Harvard Kennedy School, and a Bachelor of Arts in Government from Harvard College. Our board of directors determined that Ms. Gulati should serve as a director based on her significant experience working in healthcare and healthcare solutions.

6

Alan Henricks has served as a member of our Board of Directors since May 2015. Since May 2009, Mr. Henricks has been a board member, advisor and consultant to a variety of technology companies. Since May 2021, Mr. Henricks has served as the Chief Financial Officer of Waverley Capital Acquisition Corp. 1, a blank check company. From 2009 to 2019, Mr. Henricks consulted as Chief Financial Officer for several private companies including Ring, Inc., Tile Inc., Livescribe Inc., and Santur Corporation. Prior to May 2009, Mr. Henricks served as Chief Financial Officer of several private and public companies including Pure Digital Technologies, Inc., Traiana Inc., Informix Software, Inc., Documentum, Inc., Borland International, Inc., Cornish & Carey and Maxim Integrated Products, Inc. Since August 2021, Mr. Henricks has served as a board member, audit committee chairman and lead independent director of ChowNow, Inc. From May 2012 to May 2021, Mr. Henricks served as a board member and audit committee chairman of Roku, Inc. From March 2014 to May 2020, Mr. Henricks served as a board member and audit committee chairman of A10 Networks, Inc. Mr. Henricks holds a B.S. degree in Engineering from the Massachusetts Institute of Technology and an MBA from Stanford University. Our Board of Directors determined that Mr. Henricks should serve as a director based on his extensive experience serving as a chief financial officer of both public and private companies.

Scott Reese has served as a member of our board of directors since May 2019. Since October 2020, Mr. Reese has served as Executive Vice President, Product Development at Autodesk, a provider of Cloud and Production products. From March 2003 to October 2020, Mr. Reese served in a variety of senior and executive roles at Autodesk. From November 1999 to March 2003, Mr. Reese served as Vice President of Operations at VIA Development Corporation. In addition to his work at Autodesk, Mr. Reese serves on the board of The National Action Council for Minorities in Engineering, Inc. (NACME). NACME’s goal is to increase representation and opportunities for those who are underrepresented in the engineering workforce. Mr. Reese holds an MBA and Bachelor's of Science in Computer Information Systems from Indiana Wesleyan University. Our board of directors determined that Mr. Reese should serve as a director based on his significant experience building and developing products.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR”

EACH OF THE NOMINEES NAMED ABOVE.

7

PROPOSAL NO. 2

RATIFICATION OF APPOINTMENT OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The audit committee of the Board of Directors (Audit Committee) has appointed the firm of PricewaterhouseCoopers LLP, independent registered public accountants, to audit our financial statements for the fiscal year ending September 30, 2022. During our fiscal year ended September 30, 2021, PricewaterhouseCoopers LLP served as our independent registered public accounting firm.

Notwithstanding its selection and even if our stockholders ratify the selection, our Audit Committee, in its discretion, may appoint another independent registered public accounting firm at any time during the year if the Audit Committee believes that such a change would be in our best interests and the interests of our stockholders. At the Annual Meeting, the stockholders are being asked to ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending September 30, 2022. Our Audit Committee is submitting the selection of PricewaterhouseCoopers LLP to our stockholders because we value our stockholders’ views on our independent registered public accounting firm and as a matter of good corporate governance. Representatives of PricewaterhouseCoopers LLP will be present at the Annual Meeting and they will have an opportunity to make statements and will be available to respond to appropriate questions from stockholders.

If this proposal does not receive the affirmative approval of from the holders of a majority of the voting power of the shares of stock entitled to vote on such matter that are present in person or represented by proxy at the meeting and are voted for or against the matter, the Audit Committee would reconsider the appointment.

Fees Paid to the Independent Registered Public Accounting Firm

The following table presents fees billed or to be billed by PricewaterhouseCoopers LLP for professional services rendered with respect to the fiscal years ended September 30, 2021 and September 30, 2020. All of these services rendered since the formation of the Audit Committee were approved by the Audit Committee.

| 2021 | 2020 | ||||||||||

Audit Fees (1) | $ | 1,827,000 | $ | 1,650,765 | |||||||

Audit-Related Fees | — | — | |||||||||

Tax Fees | — | — | |||||||||

All Other Fees (2) | $ | 2,900 | $ | 2,700 | |||||||

| Total | $ | 1,829,900 | $ | 1,653,465 | |||||||

___________________________

(1) Audit fees consist of fees for professional services provided in connection with the audit of our annual consolidated financial statements, the audit of our internal control over financial reporting, the review of our quarterly consolidated financial statements, and audit services that are normally provided by our independent registered public accounting firm in connection with statutory and regulatory filings or engagements for those fiscal years, such as statutory audits.

(2) All other fees for the fiscal years ended September 30, 2021 and September 30, 2020 were related to fees for access to online accounting research software.

Auditor Independence

Under its charter, the Audit Committee pre-approves all services rendered by our independent registered public accounting firm, PricewaterhouseCoopers LLP. The Audit Committee has determined that the fee paid to PricewaterhouseCoopers LLP for services other than audit fees is compatible with maintaining the principal accountants’ independence.

Pre-Approval Policies and Procedures.

Consistent with requirements of the SEC and the Public Company Accounting Oversight Board regarding auditor independence, our Audit Committee is responsible for the appointment, compensation and oversight of the work of our independent registered public accounting firm. In recognition of this responsibility, our Audit Committee (or a member of the Audit Committee delegated by the Audit Committee) generally pre-approves all audit and permissible non-audit services provided by the independent registered public accounting firm. These services may include audit services, audit-related services, tax services and other services.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR”

THE RATIFICATION OF THE APPOINTMENT OF PRICEWATERHOUSECOOPERS LLP.

8

PROPOSAL NO. 3

NON-BINDING ADVISORY VOTE ON THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS

We are providing our stockholders with an opportunity to vote, on an advisory basis, on the compensation of our named executive officers as disclosed in the “Compensation Discussion and Analysis” section, the compensation tables and the narrative discussions set forth on pages 20 to 31 of this proxy statement. This non-binding advisory vote is commonly referred to as a “Say-on-Pay” proposal.

Our Compensation Committee, which is responsible for designing and administering our executive compensation program, has designed our executive compensation program to provide a competitive and internally equitable compensation and benefits package that reflects Company performance, job complexity and strategic value of the position, while ensuring long-term retention, motivation and alignment with the long-term interests of our stockholders. We encourage you to carefully review the “Compensation Discussion and Analysis” section beginning on page 20 of this proxy statement for additional details on our compensation of executives, including our compensation philosophy and objectives, as well as the processes the Compensation Committee used to determine the structure and amounts of the compensation of our named executive officers in fiscal year 2021.

We are asking you to indicate your support for the compensation of the named executive officers as described in this proxy statement. This vote is not intended to address any specific item of compensation, but rather the overall compensation of the named executive officers and the philosophy, policies and practices described in this proxy statement. Accordingly, we are asking you to vote, on an advisory basis, which is non-binding, “FOR” the following resolution at the Annual Meeting:

“RESOLVED, that the compensation paid to Model N, Inc.’s named executive officers, as disclosed pursuant to the Securities and Exchange Commission’s compensation disclosure rules, including the “Compensation Discussion and Analysis,” compensation tables and narrative discussion set forth in the proxy statement relating to its 2022 Annual Meeting of Stockholders, is hereby APPROVED.”

The Say-on-Pay vote is advisory, and therefore not binding on us, our Board of Directors or our Compensation Committee. Our Board of Directors and Compensation Committee value the opinions of our stockholders and we will review and consider the voting results on this proposal when making future decisions regarding the compensation of our named executive officers. Unless the Board modifies its determination on the frequency of future “Say-on-Pay” advisory votes, the next “Say-on-Pay” advisory vote will be held at the next annual meeting of our stockholders in 2023.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR”

THE NON-BINDING ADVISORY RESOLUTION APPROVING THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS.

9

SUSTAINABILITY AND CORPORATE RESPONSIBILITY

Stockholder Engagement

Our Board and management value and rely upon our stockholders’ perspectives. To help ensure that we understand and focus on the priorities that matter most to our stockholders, our directors and senior management proactively conduct thorough and extensive investor outreach throughout the year. In addition to discussing business results and initiatives, strategy and capital structure, we engage with investors on various other matters integral to our business and the Company, such as governance practices, executive compensation and sustainability. Our Board and management carefully consider and evaluate feedback received during these meetings, which directly informs our approach on environmental, social and governance (“ESG”) matters.

Oversight of Environment, Social and Governance Matters

Our Board’s primary duty of overseeing our corporate strategy includes the Board’s oversight of how ESG issues may impact the Company’s long-term performance. Our employees also play a role in the governance of sustainability issues by upholding our corporate values and by implementing environmentally and socially responsible business practices.

As part of overseeing our corporate strategy and our enterprise risk management program, our Board monitors our environmental and social practices. We believe that environmentally and socially responsible business practices go hand in hand with generating value for our stockholders. In 2020, we formed our sustainability working group, consisting of representatives from various Model N departments as well as external advisors. This year, the group continued to address and advance the ESG factors that are material to our business, which were originally identified through the evaluation of ESG risks and opportunities relevant to our Company based on the views held by our stockholders and the ESG frameworks and recommendations established by the United Nations Sustainable Development Goals, the Sustainability Accounting Standards Board and the Task Force on Climate-related Financial Disclosures.

Diversity, Employee Engagement and Talent Development

At Model N, we work to build a diverse team with different backgrounds, experiences and ideas. We are committed to creating a fair, healthy and safe workplace and establishing work environment policies that promote diversity, equality and inclusion for our valued employees. Our Diversity, Equity, Inclusion and Belonging (“DEIB”) formal strategic roadmap has three critical elements: (i) attracting, celebrating, and championing diverse identities, perspectives, and ideas; (ii) establishing norms and policies that ensure equitable access to the same opportunities; and (iii) creating a culture that is welcoming, transparent, and respectful, where each employee feels they genuinely belong and have opportunities to grow their careers. We believe that when we create a workplace where our colleagues are engaged, committed and empowered for the long-term, we are better positioned to create value for our Company and our stockholders.

Attracting and retaining talent at all levels is vital to continuing our success. We promote the work-life balance of our employees, we invest in our employees through high-quality benefits and various health and wellness initiatives, and we have created a healthy work environment in our offices. In order to incentivize and engage our workforce, Model N provides competitive compensation packages, including long-term equity grants for every employee and high-quality benefits, and proactively reviews our gender pay equity practices.

Corporate Governance, Ethics and Cybersecurity

Our Board and its committees play a critical role in oversight of our corporate culture and hold management accountable for its maintenance of governance practices, high ethical standards, and compliance programs to protect our business, employees and reputation.

Model N is committed to conducting business responsibly, with honesty and integrity, and in compliance with applicable laws, and these standards are summarized in our Code of Business Conduct for Employees and Directors, which applies to every director, officer and employee. All Model N employees are required to certify that they comply with the Code of Business Conduct and its related policies and programs. Model N has a zero-tolerance policy for bribery and corruption. The Board established a robust Whistleblower and Complaint Policy to set optimal procedures with regard to reports of concerns made by employees and other parties, and to protect whistleblowers against harassment or retaliation. A whistleblower hotline is monitored directly by our General Counsel and the Audit Committee Chairman.

Cybersecurity is one of our top priorities, given that Model N operates on a proprietary technical platform and is continuing to transition to a SaaS business model to provide revenue management solutions to our customers. We work proactively to protect our customers' sensitive information from being compromised or suffering any other data integrity breach. Our Audit Committee annually reviews our cyber risks with Model N's internal auditors and external auditors in conjunction with Model N's audit of internal controls. We have developed a comprehensive information security and privacy program based on industry standard guidelines and regulations such as CIS 20, ISO, NIST, GDPR and CCPA and have implemented appropriate technical, administrative and organizational measures designed to protect customer data against unauthorized access. We engage an independent third-party audit firm annually to

10

audit our controls and produce SOC-2 Type II audit reports. To further strengthen our data security regime, Model N also adheres to AICPA-SOC and EU-US Privacy Shield standards.

Ongoing Response to COVID-19

The global pandemic has presented, and continues to present, the business community with unprecedented challenges while reinforcing the importance of a demonstrable commitment to ESG. We used the complexities associated with the second year of COVID-19 to bolster talent and infrastructure in order to help us execute against our long-term growth objectives, while also prioritizing the needs of our employees and focusing on strengthening a best-in-class work experience for them. We adopted a “flexibility first” mindset by giving our employees the choice to determine where to work, be that a reopened office, continuing to work remotely or a hybrid. Finally, we found that remote work proved to be a catalyst for our SaaS transition strategy, as customers look for solutions that allow them to adapt to this new normal while enabling their teams to remain productive, competitive and compliant in a global marketplace.

11

DIRECTORS AND CORPORATE GOVERNANCE

Director Independence

Our common stock is listed on the New York Stock Exchange. The listing rules of the New York Stock Exchange generally require that a majority of the members of a listed company’s board of directors be independent. Our Board of Directors has determined that each of the members of our Board of Directors other than Mr. Blessing is independent. In making these determinations, our Board of Directors considered the current and prior relationships that each non-employee director has with our Company and all other facts and circumstances our Board of Directors deemed relevant in determining their independence, including the beneficial ownership of our capital stock by each non-employee director.

Leadership Structure

The positions of Chief Executive Officer and Chairman of our Board of Directors are held by two different individuals. Mr. Blessing serves as our Chief Executive Officer, and Mr. Dail serves as our Chairman. This structure allows our Chief Executive Officer to focus on our day-to-day business while our Chairman leads our Board in its fundamental role of providing advice to and independent oversight of management. Our Board believes such separation is appropriate, as it enhances the accountability of the Chief Executive Officer to the Board and strengthens the independence of the Board from management.

Risk Oversight

Our Board of Directors believes that open communication between management and the Board is essential for effective risk management and oversight. Our Board meets with our Chief Executive Officer and other members of the senior management team at quarterly Board meetings, where, among other topics, they discuss strategy and risks in the context of reports from the management team, including any cybersecurity risks, and evaluates the risks inherent in significant transactions. While our Board of Directors is ultimately responsible for risk oversight, our Board committees assist the Board in fulfilling its oversight responsibilities in certain areas of risk. The Audit Committee assists our Board in fulfilling its oversight responsibilities with respect to risk management in the areas of internal control over financial reporting and disclosure controls and procedures. The Compensation Committee assists our Board in assessing and mitigating any risks that may be created by our compensation plans, practices and policies. The Nominating and Corporate Governance Committee is charged with assisting our Board in fulfilling its oversight responsibilities with respect to the management of risk associated with Board membership and corporate governance.

Executive Sessions of Independent Directors

In order to promote open discussion among independent directors, our Board of Directors has a policy of conducting executive sessions of independent directors during each regularly scheduled Board meeting and at such other times if requested by an independent director. These executive sessions are chaired by our Chairman of the Board. The Chairman of the Board provides feedback to our Chief Executive Officer, as needed, promptly after the executive session. Mr. Blessing does not participate in such sessions.

Codes of Conduct

We have adopted a code of conduct that applies to our directors and a code of conduct that applies to our officers and all other employees. The full text of these codes of conduct are posted under the “Investor Relations” section on our website at https://investor.modeln.com/governance/governance-documents/.

Meetings of the Board of Directors

Our Board of Directors met ten times during fiscal year 2021. No director attended fewer than 75% of the total number of meetings of the Board and of any Board committees of which he or she was a member during fiscal year 2021. It is our policy that directors are invited and encouraged to attend our annual meetings of stockholders. Nine of our directors attended the 2021 Annual Meeting of Stockholders.

Committees of the Board of Directors

Our Board of Directors has established an Audit Committee, a Compensation Committee, and a Nominating and Corporate Governance Committee. Members serve on these committees until their resignation or until otherwise determined by our Board. The following table provides membership information as of September 30, 2021 for each of our Board committees:

12

| Name | Audit Committee | Compensation Committee | Nominating and Corporate Governance Committee | |||||||||||||||||

| Baljit Dail* | M | M | ||||||||||||||||||

| Tim Adams | C | M | ||||||||||||||||||

| Melissa Fisher | M | |||||||||||||||||||

| Alan Henricks | M | C | ||||||||||||||||||

| Scott Reese | M | |||||||||||||||||||

| Dave Yarnold | M | C | ||||||||||||||||||

| Kim DeCarlis | M | |||||||||||||||||||

* Non-executive Chair of the Board C = Chair M = Member

Audit Committee

Each of the members of the Audit Committee satisfies the independence requirements of Rule 10A-3. Messrs. Adams and Henricks, and Ms. Fisher are each an Audit Committee financial expert, as that term is defined under SEC rules, and possess financial sophistication as defined under the rules of the New York Stock Exchange. The designation does not impose on any of them any duties, obligations or liabilities that are greater than those generally imposed on members of our Audit Committee and our Board of Directors. The Audit Committee met six times during fiscal year 2021. Among other matters, the Audit Committee:

•evaluates the qualifications, independence and performance of our independent registered public accounting firm;

•determines the engagement of our independent registered public accounting firm and reviews and approves the scope of the annual audit and the fees paid to our independent registered public accounting firm;

•discusses with management and our independent registered public accounting firm the results of the annual audit and the review of our financial statements;

•approves the retention of our independent registered public accounting firm;

•reviews our critical accounting policies and estimates and internal control over financial reporting; and

•reviews the Audit Committee charter and its performance.

The Audit Committee operates under a written charter that was adopted by our Board of Directors and satisfies the applicable standards of the SEC and the New York Stock Exchange. A copy of the Audit Committee charter is posted under the “Investors” section on our website at https://investor.modeln.com/governance/governance-documents/.

Compensation Committee

Each member of the Compensation Committee is an outside director, as defined pursuant to Section 162(m) of the Code, is a “non-employee director” under Rule 16b-3(b)(3)(i) of the Exchange Act, and is independent within the meaning of New York Stock Exchange rules. The Compensation Committee met eleven times during fiscal year 2021. Among other matters, the Compensation Committee:

•reviews and approves goals and objectives relevant to compensation of our Chief Executive Officer and other executive officers;

•evaluates the performance of these officers in light of those goals and objectives and sets the compensation of these officers based on such evaluations; and

•administers the issuance of restricted stock units, stock options and other awards under our equity incentive plans.

At least annually, our Compensation Committee is responsible for reviewing, evaluating and approving the compensation arrangements of our executive officers and for establishing and maintaining our executive compensation policies and practices. Under its charter, our Compensation Committee has the authority to retain outside counsel or other advisors. The Compensation Committee retains and does not delegate any of its exclusive power to determine all matters of executive compensation and benefits, although the Chief Executive Officer and the Chief People Officer present compensation and benefit proposals to the Compensation Committee. However, our named executive officers, including our Chief Executive Officer, are not present for deliberations or voting with respect to their compensation.

The Compensation Committee operates under a written charter that was adopted by our Board of Directors and satisfies the applicable standards of the SEC and the New York Stock Exchange. A copy of the Compensation Committee charter is posted under the “Investors” section on our website at https://investor.modeln.com/governance/governance-documents/.

13

Nominating and Corporate Governance Committee

Each member of the Nominating and Corporate Governance Committee is independent within the meaning of New York Stock Exchange rules. The Nominating and Corporate Governance Committee met four times during fiscal year 2021. Among other matters, the Nominating and Corporate Governance Committee:

•makes recommendations to our Board of Directors regarding candidates for directorships;

•makes recommendations to our Board of Directors regarding the structure and composition of the Board of Directors and its committees;

•develops corporate governance guidelines and renew and assess corporate governance best practices; and

•makes recommendations to our Board of Directors concerning governance matters.

The Nominating and Corporate Governance Committee operates under a written charter that was adopted by our Board of Directors and satisfies the applicable standards of the SEC and the New York Stock Exchange. A copy of the Nominating and Governance Committee charter is posted under the “Investors” section on our website at https://investor.modeln.com/governance/governance-documents/.

Compensation Committee Interlocks and Insider Participation

None of the members of our Compensation Committee is, or has at any time during the past fiscal year been, an officer or employee of ours. None of our executive officers currently serve, or in the past fiscal year has served, as a member of the board of directors or compensation committee of any other entity that has one or more executive officers serving on our Board of Directors or Compensation Committee.

Considerations in Evaluating Director Nominees

The Nominating and Corporate Governance Committee is responsible for identifying, evaluating and recommending candidates to the Board for Board membership. A variety of methods are used to identify and evaluate director nominees, with the goal of maintaining and further developing a diverse, experienced and highly qualified Board. Candidates may come to our attention through current members of our Board, professional search firms, stockholders or other persons.

The Nominating and Corporate Governance Committee will recommend to the Board for selection all nominees to be proposed by the Board for election by the stockholders, including approval or recommendation of a slate of director nominees to be proposed by the Board for election at each annual meeting of stockholders, and will recommend all director nominees to be appointed by the Board to fill interim director vacancies.

Director Qualifications

The Nominating and Corporate Governance Committee also reviews and recommends to the Board for determination the desired qualifications, expertise and characteristics of Board members, with the goal of developing a diverse, experienced and highly qualified Board. The Nominating and Corporate Governance Committee and the Board believe that candidates for director should have certain minimum qualifications, including, without limitation:

•demonstrated business acumen and leadership, and high levels of accomplishment;

•ability to exercise sound business judgment and to provide insight and practical wisdom based on experience;

•commitment to understand Model N and its business, industry and strategic objectives;

•integrity and adherence to high personal ethics and values, consistent with our code of conduct;

•ability to read and understand financial statements and other financial information pertaining to Model N;

•commitment to enhancing stockholder value;

•willingness to act in the interest of all stockholders; and

•for non-employee directors, independence under New York Stock Exchange listing standards and other applicable rules and regulations.

In the context of the Board’s existing composition, other requirements that are expected to contribute to the Board’s overall effectiveness and meet the needs of the Board and its committees may be considered.

In addition, under Model N’s Corporate Governance Guidelines (“Guidelines”), a director is expected to spend the time and effort necessary to properly discharge such director’s responsibilities. Accordingly, a director is expected to regularly attend meetings of the Board and committees on which such director sits, and to review prior to meetings material distributed in advance for such meetings. Thus, the number of other public company boards and other boards (or comparable governing bodies) on which a prospective nominee is a member, as well as his or her other professional responsibilities, will be considered. Also under the Guidelines, there are no limits on the number of three-year terms that may be served by a director. However, in connection with evaluating recommendations for nomination for re-election, director tenure is considered. Model N values diversity on a company-wide basis and believes it complies with applicable California law regarding Board diversity.

14

Stockholder Recommendations for Nominations to the Board of Directors

The Nominating and Corporate Governance Committee will consider properly submitted stockholder recommendations for candidates for our Board who meet the minimum qualifications as described above. The Nominating and Corporate Governance Committee does not intend to alter the manner in which it evaluates candidates, including the use of the minimum criteria set forth above, based on whether or not the candidate was recommended by a stockholder. A stockholder of record can nominate a candidate for election to the Board of Directors by complying with the procedures in Article I, Section 1.11 of our bylaws. Any eligible stockholder who wishes to submit a nomination should review the requirements in the bylaws on nominations by stockholders. Any nomination should be sent in writing to the Corporate Secretary, Model N, Inc., 777 Mariners Island Boulevard, Suite 300, San Mateo, California 94404. Submissions must include the full name of the proposed nominee, complete biographical information, a description of the proposed nominee’s qualifications as a director, other information specified in our bylaws, and a representation that the nominating stockholder is a beneficial or record holder of our stock and has been a holder for at least one year. Any such submission must be accompanied by the written consent of the proposed nominee to be named as a nominee and to serve as a director if elected. These candidates are evaluated at meetings of the Nominating and Corporate Governance Committee, and may be considered at any point during the year. If any materials are provided by a stockholder in connection with the recommendation of a director candidate, such materials are forwarded to the Nominating and Corporate Governance Committee.

All proposals of stockholders that are intended to be presented by such stockholder at an annual meeting of stockholders must be in writing and notice must be delivered to the Corporate Secretary at the principal executive offices of Model N not later than the close of business on the seventy-fifth (75th) day nor earlier than the close of business on the one hundred and fifth (105th) day prior to the first anniversary of the preceding year’s annual meeting. Stockholders are also advised to review our bylaws, which contain additional requirements with respect to advance notice of stockholder proposals and director nominations.

Non-Employee Director Compensation

Our non-employee directors are entitled to receive cash and equity compensation for their service as directors. Our Board of Directors has determined that non-employee directors will receive an annual RSU grant with a value of $135,000. In addition, non-employee directors are entitled to receive a cash retainer of $35,000 for service on our Board, and an annual RSU grant with a value of $20,000 for the chair of the Audit Committee, $12,000 for the chair of the Compensation Committee and $8,000 for the chair of the Nominating and Corporate Governance Committee. In addition, non-employee directors will receive an annual RSU grant with a value of $10,000 for serving on the Audit Committee, $6,000 for serving on the Compensation Committee and $4,000 for serving on the Nominating and Corporate Governance Committee. In addition, the lead independent director, if any, or the non-employee chair of the Board is entitled to receive an annual RSU grant with a value of $25,000.

Effective with the annual meeting on February 18, 2022, our non-employee directors will receive an annual RSU grant with a value of $170,000. In addition, the lead independent director, if any, or the non-employee chair of the Board will be entitled to receive an annual RSU grant with a value of $32,500.

The following table presents the total compensation for each person who served as a non-employee member of our Board of Directors in the fiscal year ended September 30, 2021. Other than as set forth in the table and described more fully below, in the fiscal year ended September 30, 2021 we did not pay any fees to, make any equity awards or non-equity awards to, or pay any other compensation to, the non-employee members of our Board of Directors. Non-employee directors may be reimbursed for travel and other expenses incurred in the performance of their duties. Non-employee directors are also subject to stock ownership guidelines with required ownership equal to the lesser of three times the value of the annual cash retainer or 12,000 shares. As of September 30, 2021, all of our non-employee directors satisfied the minimum ownership requirement.

The following table sets forth information regarding compensation earned by our non-employee directors for the fiscal year ended September 30, 2021:

| Name(1) | Fees earned or paid in cash ($) | Stock Awards | (2) | Total ($) | ||||||||||

| Tim Adams | $ | 35,000 | $ | 165,123 | (3) | $ | 200,123 | |||||||

| Baljit Dail | $ | 35,000 | $ | 175,602 | (3) | $ | 210,602 | |||||||

| Kim DeCarlis | $ | 35,000 | $ | 146,973 | (3) | $ | 181,973 | |||||||

| Melissa Fisher | $ | 35,000 | $ | 149,740 | (3) | $ | 184,740 | |||||||

| Manisha Shetty Gulati | $ | 33,250 | $ | 97,728 | (3) | $ | 130,978 | |||||||

| Alan Henricks | $ | 35,000 | $ | 162,181 | (3) | $ | 197,181 | |||||||

| Scott Reese | $ | 35,000 | $ | 151,972 | (3) | $ | 186,972 | |||||||

| Dave Yarnold | $ | 35,000 | $ | 155,612 | (3) | $ | 190,612 | |||||||

__________________________

15

(1) As of September 30, 2021, the above-listed directors held outstanding RSUs pursuant to which the following shares of our Common Stock are issuable: Mr. Adams (2,153 shares subject to RSUs); Mr. Dail (2,302 shares subject to RSUs); Ms. DeCarlis (1,910 shares subject to RSUs); Ms. Fisher (1,964 shares subject to RSUs); Ms. Gulati (1,828 shares subject to RSUs); Mr. Henricks (2,126 shares subject to RSUs); Mr. Reese (1,964 shares subject to RSUs); and Mr. Yarnold (2,018 shares subject to RSUs)).

(2) The amounts in this column represent the aggregate grant date fair values for restricted stock unit awards granted to the Board of Directors computed in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718. The assumptions used in calculating the aggregate grant date fair value of the restricted stock unit awards reported in this column are set forth in Note 11 of the notes to our consolidated financial statements included in our Annual Report on Form 10-K for fiscal year 2021. These amounts reflect our accounting costs for these awards, and do not correspond to the actual value that may be realized by the above-named board members.

(3) In February 2021, each of Messrs. Adams, Dail, Henricks, Reese and Yarnold, and Mses. DeCarlis, Fisher and Gulati was granted an award of 4,305, 4,603, 4,251, 3,926, and 4,034, respectively, and 3,818, 3,926 and 3,655 RSUs, respectively, which will vest over a one-year period with 25% of the shares granted vesting on each quarterly anniversary of the vesting commencement date.

Communications with the Board of Directors

Stockholders and all interested parties wishing to communicate with the Board of Directors or with an individual member of the Board of Directors may do so by writing to the Board of Directors or to the particular member of the Board of Directors, care of the Corporate Secretary, at Model N, Inc., 777 Mariners Island Boulevard, Suite 300, San Mateo, California 94404. The envelope should indicate that it contains a stockholder or interested party communication. All such communications will be forwarded to the director or directors to whom the communications are addressed.

16

AUDIT COMMITTEE REPORT

With respect to Model N’s financial reporting process, the management of Model N is responsible for (1) establishing and maintaining internal controls and (2) preparing Model N’s consolidated financial statements. Model N’s independent registered public accounting firm, PricewaterhouseCoopers LLP (“PwC”), is responsible for auditing these financial statements. It is the responsibility of the Audit Committee to oversee these activities. The Audit Committee does not itself prepare financial statements or perform audits, and its members are not auditors or certifiers of Model N’s financial statements.

The Audit Committee has reviewed and discussed the audited financial statements for the year ended September 30, 2021 with Model N’s management and with PwC, including the results of the independent registered public accounting firm’s audit of Model N’s financial statements. The Audit Committee has also discussed with PwC all matters that the independent registered public accounting firm was required to communicate and discuss with the Audit Committee, including the matters required to be discussed by Auditing Standard No. 1301, “Communications with Audit Committees.”

The Audit Committee also has received and reviewed the written disclosures and the letter from PwC required by applicable requirements of the Public Company Accounting Oversight Board regarding PwC’s communications with the Audit Committee concerning independence, and has discussed with PwC its independence from Model N, as well as any relationships that may impact PwC’s objectivity and independence.

Based on the Audit Committee’s review and discussions with Model N’s management and independent registered public accountants discussed above, the Audit Committee recommends to the Board of Directors that the audited financial statements be included in Model N’s Annual Report on Form 10-K for the fiscal year ended September 30, 2021, for filing with the Securities and Exchange Commission.

Submitted by the Audit Committee of the Board of Directors:

Tim Adams (Chair)

Melissa Fisher

Alan Henricks

Scott Reese

17

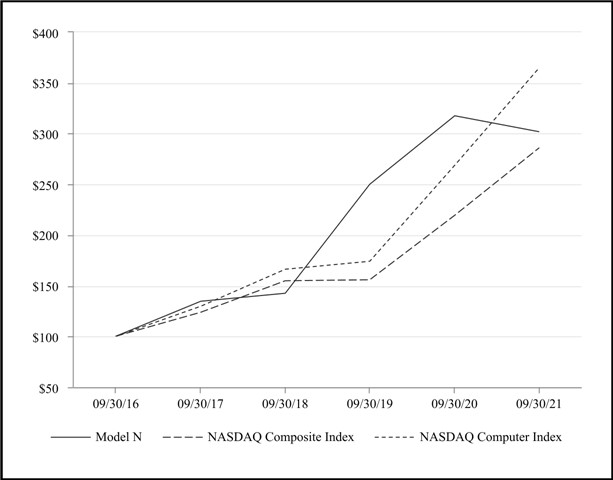

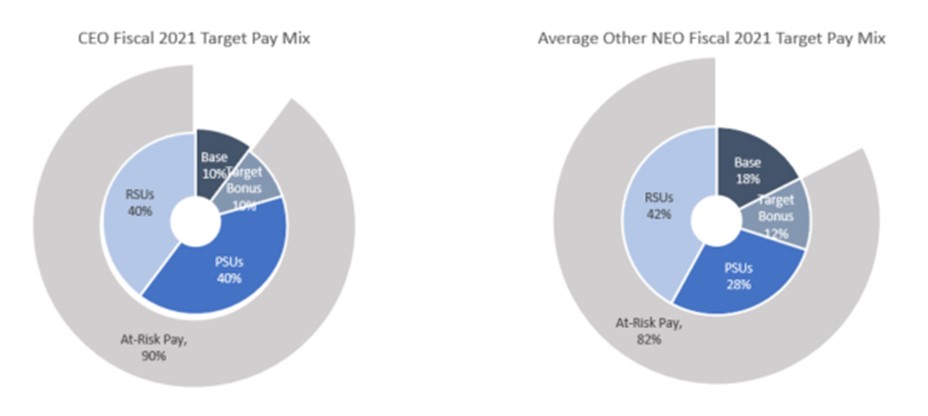

RELATED PERSON TRANSACTIONS