Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 20-F

| ☐ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2017

OR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ☐ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report

For the transition period from to

Commission file number: 1-14696

China Mobile Limited

(Exact Name of Registrant as Specified in Its Charter)

N/A

(Translation of Registrant’s Name into English)

Hong Kong, China

(Jurisdiction of Incorporation or Organization)

60th Floor, The Center

99 Queen’s Road Central

Hong Kong, China

(Address of Principal Executive Offices)

Grace Wong

Company Secretary

China Mobile Limited

60th Floor, The Center

99 Queen’s Road Central

Hong Kong, China

Telephone: (852) 3121-8888

Fax: (852) 2511-9092

(Name, Telephone, E-mail and/or Facsimile Number and Address of Company Contact Person)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

Name of Each Exchange on Which Registered | |

| Ordinary shares | New York Stock Exchange* |

| * | Not for trading, but only in connection with the listing on the New York Stock Exchange of American depositary shares representing the ordinary shares. |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

As of December 31, 2017, 20,475,482,897 ordinary shares were issued and outstanding.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or (15)(d) of the Securities Exchange Act of 1934. Yes ☐ No ☒

Note — Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.:

| Large accelerated filer ☒ | Accelerated filer ☐ | Non-accelerated filer ☐ | Emerging growth company ☐ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

| † | The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing.

| U.S. GAAP ☐ | International Financial Reporting Standards as issued by the International Accounting Standards Board ☒ |

Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes ☐ No ☐

Table of Contents

China Mobile Limited

| Page |

||||||

| 1 | ||||||

| PART I | ||||||

| Item 1. | 2 | |||||

| Item 2. | 2 | |||||

| Item 3. | 2 | |||||

| Item 4. | 19 | |||||

| Item 4A. | 41 | |||||

| Item 5. | 41 | |||||

| Item 6. | 55 | |||||

| Item 7. | 58 | |||||

| Item 8. | 62 | |||||

| Item 9. | 62 | |||||

| Item 10. | 63 | |||||

| Item 11. | 72 | |||||

| Item 12. | 74 | |||||

| PART II | ||||||

| Item 13. | 75 | |||||

| Item 14. | Material Modifications to the Rights of Security Holders and Use of Proceeds |

75 | ||||

| Item 15. | 75 | |||||

| Item 16A. | 76 | |||||

| Item 16B. | 76 | |||||

| Item 16C. | 76 | |||||

| Item 16D. | 76 | |||||

| Item 16E. | Purchases of Equity Securities by the Issuer and Affiliated Purchasers |

76 | ||||

| Item 16F. | 76 | |||||

| Item 16G. | 77 | |||||

| Item 16H. | 77 | |||||

| PART III | ||||||

| Item 17. | 78 | |||||

| Item 18. | 78 | |||||

| Item 19. | 78 | |||||

Table of Contents

This annual report on Form 20-F contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. These forward-looking statements are, by their nature, subject to significant risks and uncertainties. These forward-looking statements include, without limitation, statements relating to:

| • | our business objectives and strategies, including those relating to the development of our terminal procurement and distribution business; |

| • | our operations and prospects; |

| • | our network expansion and capital expenditure plans; |

| • | the expected impact of any acquisitions or other strategic transactions; |

| • | our provision of services, including fourth generation, or 4G, services, wireline broadband services and services based on technological evolution, and our ability to attract customers to these services; |

| • | the planned development of future generations of mobile technologies, including 5G technologies, and other technologies and related applications; |

| • | the anticipated evolution of the industry chain of 4G and future generations of mobile technologies, including future development in, and availability of, terminals that support our provision of services based on 4G and future generations of mobile technologies, and testing and commercialization of future generations of mobile technologies; |

| • | the expected benefit from our investment in and any arrangements with China Tower Corporation Limited; |

| • | the expected impact of the implementation in Mainland China of the policy of “speed upgrade and tariff reduction” on our business, financial condition and results of operations; |

| • | the expected impact of tariff changes on our business, financial condition and results of operations; |

| • | the expected impact of new service offerings on our business, financial condition and results of operations; and |

| • | future developments in the telecommunications industry in Mainland China, including changes in the regulatory and competitive landscape. |

The words “aim,” “anticipate,” “believe,” “could,” “endeavor,” “estimate,” “expect,” “intend,” “may,” “plan,” “seek,” “should,” “strive,” “target,” “will” and similar expressions, as they relate to us, are intended to identify certain of these forward-looking statements. We do not intend to update these forward-looking statements and are under no obligation to do so.

These forward-looking statements are subject to risks, uncertainties and assumptions, some of which are beyond our control. In addition, these forward-looking statements reflect our current views with respect to future events and are not a guarantee of future performance. Actual results may differ materially from information contained in the forward-looking statements as a result of a number of factors, including the risk factors set forth in “Item 3. Key Information — Risk Factors.”

-1-

Table of Contents

| Item 1. | Identity of Directors, Senior Management and Advisers. |

Not applicable.

| Item 2. | Offer Statistics and Expected Timetable. |

Not applicable.

| Item 3. | Key Information. |

Selected Financial Data

The following tables present selected historical financial data of our company as of and for each of the years in the five-year period ended December 31, 2017. Except for amounts presented in U.S. dollars and per American depositary share, or ADS, data, the selected historical consolidated statement of comprehensive income data and other financial data for the years ended December 31, 2015, 2016 and 2017 and the selected historical consolidated balance sheet data as of December 31, 2016 and 2017 set forth below are derived from, should be read in conjunction with, and are qualified in their entirety by reference to, our audited consolidated financial statements, including the related notes, included elsewhere in this annual report on Form 20-F. The selected historical consolidated statement of comprehensive income data (other than ADS data) for the year ended December 31, 2014 and the selected historical consolidated balance sheet data as of December 31, 2014 and 2015 set forth below should be read in conjunction with and are qualified in their entirety by reference to our audited consolidated financial statements that are included in our previous annual reports on Form 20-F. The selected historical consolidated statement of comprehensive income data for the year ended December 31, 2013 and the selected historical consolidated balance sheet data as of December 31, 2013 set forth below are derived from our internal records and management accounts that are not included in this annual report on Form 20-F. Our consolidated financial statements have been prepared in accordance with International Financial Reporting Standards, or IFRSs, as issued by the International Accounting Standards Board, or IASB.

We completed the acquisition of certain assets, businesses and related liabilities as well as their related employees in relation to the fixed-line telecommunications operations, or Target Assets and Businesses, of China TieTong Telecommunications Corporation, or China TieTong, in December 2015. See “Item 4. Information on the Company — Business Overview — Investments and Acquisitions.” Because we and Target Assets and Businesses were under common control of China Mobile Communications Group Co., Ltd.(formerly known as China Mobile Communications Corporation), or CMCC, both prior to and after the acquisition, the acquisition was considered as a business combination under common control and was accounted for using merger accounting in accordance with the Accounting Guideline 5 “Merger Accounting for Common Control Combinations,” or AG 5, issued by the Hong Kong Institute of Certified Public Accountants, or the HKICPA. Target Assets and Businesses were stated at their historical cost, and were included in the consolidated financial statements included in this annual report on Form 20-F as if Target Assets and Businesses had always been part of our company during all the relevant periods presented.

-2-

Table of Contents

The statistical information set forth in this annual report on Form 20-F relating to Mainland China is taken or derived from various publicly available government publications that were not prepared or independently verified by us. This statistical information may not be consistent with other statistical information from other sources within or outside Mainland China.

| As of or for the year ended December 31, | ||||||||||||||||||||||||

| 2013 | 2014 | 2015 | 2016 | 2017 | 2017 | |||||||||||||||||||

| RMB | RMB | RMB | RMB | RMB | US$ | |||||||||||||||||||

| (in millions, except share, per share and per ADS information) |

||||||||||||||||||||||||

| Consolidated Statement of Comprehensive Income Data: |

||||||||||||||||||||||||

| Operating revenue |

640,048 | 651,509 | 668,335 | 708,421 | 740,514 | 113,815 | ||||||||||||||||||

| Operating expenses |

508,624 | 534,189 | 565,413 | 590,333 | 620,388 | 95,352 | ||||||||||||||||||

| Profit from operations |

131,424 | 117,320 | 102,922 | 118,088 | 120,126 | 18,463 | ||||||||||||||||||

| Profit before taxation |

153,649 | 142,522 | 143,734 | 144,462 | 148,137 | 22,768 | ||||||||||||||||||

| Taxation |

(36,746 | ) | (33,179 | ) | (35,079 | ) | (35,623 | ) | (33,723 | ) | (5,183 | ) | ||||||||||||

| Profit for the year attributable to equity shareholders |

116,791 | 109,218 | 108,539 | 108,741 | 114,279 | 17,564 | ||||||||||||||||||

| Basic earnings per share(1) |

5.81 | 5.38 | 5.30 | 5.31 | 5.58 | 0.86 | ||||||||||||||||||

| Diluted earnings per share(1) |

5.74 | 5.35 | 5.30 | 5.31 | 5.58 | 0.86 | ||||||||||||||||||

| Basic earnings per ADS(1) |

29.05 | 26.91 | 26.51 | 26.55 | 27.90 | 4.29 | ||||||||||||||||||

| Diluted earnings per ADS(1) |

28.71 | 26.76 | 26.50 | 26.55 | 27.90 | 4.29 | ||||||||||||||||||

| Number of shares utilized in basic earnings per share calculation (in thousands) |

20,101,232 | 20,293,254 | 20,473,119 | 20,475,483 | 20,475,483 | 20,475,483 | ||||||||||||||||||

| Number of shares utilized in diluted earnings per share calculation (in thousands) |

20,343,120 | 20,408,441 | 20,479,706 | 20,475,483 | 20,475,483 | 20,475,483 | ||||||||||||||||||

-3-

Table of Contents

| As of or for the year ended December 31, | ||||||||||||||||||||||||

| 2013 | 2014 | 2015 | 2016 | 2017 | 2017 | |||||||||||||||||||

| RMB | RMB | RMB | RMB | RMB | US$ | |||||||||||||||||||

| (in millions, except share, per share and per ADS information) |

||||||||||||||||||||||||

| Consolidated Balance Sheet Data: |

||||||||||||||||||||||||

| Working capital(2) |

80,009 | 34,433 | (12,341 | ) | 50,256 | 28,214 | 4,336 | |||||||||||||||||

| Cash and cash equivalents |

51,180 | 73,812 | 79,842 | 90,413 | 120,636 | 18,541 | ||||||||||||||||||

| Bank deposits |

375,127 | 353,507 | 323,330 | 335,297 | 279,371 | 42,939 | ||||||||||||||||||

| Accounts receivable |

14,083 | 16,715 | 17,743 | 19,045 | 24,153 | 3,712 | ||||||||||||||||||

| Property, plant and equipment |

520,571 | 605,023 | 585,631 | 622,356 | 648,029 | 99,600 | ||||||||||||||||||

| Total assets |

1,222,684 | 1,348,035 | 1,427,895 | 1,520,994 | 1,522,113 | 233,944 | ||||||||||||||||||

| Bonds–current portion(3) |

— | 1,000 | — | 4,998 | — | — | ||||||||||||||||||

| –non-current portion |

5,989 | 4,992 | 4,995 | — | — | — | ||||||||||||||||||

| Total liabilities |

401,561 | 459,052 | 507,527 | 538,856 | 533,232 | 81,956 | ||||||||||||||||||

| Share capital(4) |

2,142 | 400,737 | 402,130 | 402,130 | 402,130 | 61,806 | ||||||||||||||||||

| Shareholders’ equity |

819,171 | 886,916 | 917,336 | 979,021 | 985,636 | 151,489 | ||||||||||||||||||

| Other Financial Data: |

||||||||||||||||||||||||

| Capital expenditures and land lease prepayments(5) |

(149,121 | ) | (175,701 | ) | (173,693 | ) | (189,366 | ) | (193,605 | ) | (29,757 | ) | ||||||||||||

| Net cash generated from operating activities |

226,905 | 216,438 | 235,089 | 253,701 | 245,514 | 37,735 | ||||||||||||||||||

| Net cash used in investing activities |

(180,122 | ) | (151,230 | ) | (142,743 | ) | (194,523 | ) | (106,533 | ) | (16,374 | ) | ||||||||||||

| Net cash used in financing activities |

(71,312 | ) | (42,530 | ) | (86,510 | ) | (48,958 | ) | (108,231 | ) | (16,635 | ) | ||||||||||||

| Dividend declared |

52,675 | 47,170 | 46,145 | 48,993 | 110,909 | 17,046 | ||||||||||||||||||

| Dividend declared per share (RMB) |

2.621 | 2.311 | 2.205 | 2.385 | 5.508 | 0.820 | ||||||||||||||||||

| Dividend declared per share (HK$) |

3.311 | 2.920 | 2.721 | 2.732 | 6.405 | 0.820 | ||||||||||||||||||

| (1) | The basic earnings per share have been computed by dividing profit attributable to our equity shareholders by the weighted average number of shares outstanding in 2013, 2014, 2015, 2016 and 2017. The diluted earnings per share have been computed after adjusting for the effects of all dilutive potential ordinary shares. Dilutive potential ordinary shares resulting from the share options granted to our directors and employees under the share option scheme would decrease profit attributable to equity shareholders per share. The basic and diluted earnings per ADS amounts have been computed based on one ADS representing five ordinary shares. |

| (2) | Represents current assets minus current liabilities. |

| (3) | The current portion of the bonds as of December 31, 2014 was issued by China TieTong on August 18, 2005, with a principal amount of RMB1,000 million, at an issue price equal to the face value of the bonds. The bond was unsecured and bore interest at the rate of 4.6% per annum which is payable annually. The bond was fully repaid on August 18, 2015. The current portion of the bonds as of December 31, 2016 was issued by China Mobile Group Guangdong Co., Ltd., or Guangdong Mobile, with a principal amount of RMB5,000 million. The bonds were unsecured and bore interest at the rate of 4.5% per annum which is payable annually. The bonds, redeemable at 100% of the principal amount, were fully repaid on October 28, 2017. |

| (4) | Under the Hong Kong Companies Ordinance (Cap. 622 of the laws of Hong Kong), or the Companies Ordinance, which has been in effect since March 3, 2014, the concept of authorized share capital no longer exists and our shares no longer have a par or nominal value. There is no impact on the number of shares in issue or the relative entitlement of any of our shareholders as a result of this transition. In addition, in accordance with the transitional provisions set forth in Section 37 of Schedule 11 to the Companies Ordinance, any amount standing to the credit of the share premium account has become part of our share capital. |

| (5) | Represents payments made for capital expenditures and land lease prepayments during the year and included in net cash used in investing activities. |

-4-

Table of Contents

Exchange Rate Information

We publish our consolidated financial statements in Renminbi. Solely for the convenience of the reader, this annual report on Form 20-F contains translations of certain Renminbi and Hong Kong dollar amounts into U.S. dollars and vice versa at RMB6.5063 = US$1.00 and HK$7.8128 = US$1.00, the noon buying rates in New York for cable transfers as certified for customs purposes by the Federal Reserve Bank of New York on December 29, 2017. The noon buying rates in New York for cable transfers as certified for customs purposes by the Federal Reserve Bank of New York are published on a weekly basis in the H.10 statistical release of the Board of Governors of the Federal Reserve System of the United States. These translations should not be construed as representations that the Renminbi or Hong Kong dollar amounts could actually be converted into U.S. dollars at such rates or at all.

The noon buying rates in New York for cable transfers as certified for customs purposes by the Federal Reserve Bank of New York were RMB6.2765 = US$1.00 and HK$7.8486 = US$1.00, respectively, on April 19, 2018. The following table sets forth the high and low noon buying rates between Renminbi and U.S. dollars and between Hong Kong dollars and U.S. dollars for each month during the previous six months:

Noon Buying Rate

| RMB per US$1.00 | HK$ per US$1.00 | |||||||||||||||||

| High | Low | High | Low | |||||||||||||||

| October 2017 |

6.6533 | 6.5712 | October 2017 |

7.8106 | 7.7996 | |||||||||||||

| November 2017 |

6.6385 | 6.5967 | November 2017 |

7.8118 | 7.7955 | |||||||||||||

| December 2017 |

6.6210 | 6.5063 | December 2017 |

7.8228 | 7.8050 | |||||||||||||

| January 2018 |

6.5263 | 6.2841 | January 2018 |

7.8230 | 7.8161 | |||||||||||||

| February 2018 |

6.3471 | 6.2649 | February 2018 |

7.8267 | 7.8183 | |||||||||||||

| March 2018 |

6.3565 | 6.2685 | March 2018 |

7.8486 | 7.8275 | |||||||||||||

| April 2018 (up to April 19, 2018) |

6.3045 | 6.2655 | April 2018 (up to April 19, 2018) |

7.8499 | 7.8482 | |||||||||||||

The following table sets forth the average noon buying rates between Renminbi and U.S. dollars and between Hong Kong dollars and U.S. dollars in 2013, 2014, 2015, 2016 and 2017 calculated by averaging the noon buying rates on the last day of each month during the relevant year.

Average Noon Buying Rate

| RMB per US$1.00 | HK$ per US$1.00 | |||||||

| 2013 |

6.1412 | 7.7565 | ||||||

| 2014 |

6.1704 | 7.7554 | ||||||

| 2015 |

6.2869 | 7.7519 | ||||||

| 2016 |

6.6549 | 7.7618 | ||||||

| 2017 |

6.7350 | 7.7950 | ||||||

Risk Factors

The following factors, and those factors described in our other reports submitted to, or filed with, the SEC, among other factors, could affect our actual results and could cause our actual results to differ materially from those expressed in any forward-looking statements made by us or on our behalf, and such factors may have a material adverse effect on our business, financial condition, results of operations and prospects as well as the value of our ordinary shares and ADSs.

-5-

Table of Contents

Risks Relating to Our Business

The increasing competition from other telecommunications services providers and competitors in related industries and changes in the competitive landscape of the telecommunications industry in Mainland China may reduce our market share and decrease our profit margin.

We continue to face increasing competition from other telecommunications services providers in Mainland China. Principal participants in the telecommunications industry in Mainland China include China Unicom (Hong Kong) Limited, or China Unicom, China Telecom Corporation Limited, or China Telecom, and us. In particular, we have been competing against China Telecom and China Unicom in the delivery of 4G services since the MIIT granted permissions to all three telecommunications services providers to provide 4G services based on the LTE/Time Division Duplex standard, or TD-LTE technology, in December 2013. We expect that the competition will intensify after we recently received the permission to provide 4G services based on the Frequency-Division Long-Term Evolution standard, or LTE FDD technology, on April 3, 2018, while China Telecom and China Unicom obtained such permission in February 2015. In accordance with this permission, we can develop mobile IoT and Industrial Internet services nationwide, and LTE FDD services only in rural areas. Constrained by the services available to us, we may not effectively compete with other operators except for rural areas. And it may result in the potential risk of ROIC (Return on Invested Capital) of mobile IoT and LTE FDD network. Moreover, China Unicom and China Telecom have entered into a strategic cooperation agreement to promote resource-sharing in several key aspects of business operations. For further information, see “Item 4. Information on the Company — Business Overview — Competition.” Such cooperation may significantly change the competitive landscape of the telecommunications industry in Mainland China. Accordingly, we cannot assure you that we will be able to compete effectively, or that such competition will not materially and adversely affect our business, financial condition and results of operations.

The government of the People’s Republic of China, or the PRC, has extended favorable regulatory policies to some of our competitors in order to help them become more viable competitors. See “— Current or future asymmetrical and other regulatory measures adopted by the PRC regulatory authorities could materially harm our competitive position or enhance competition in the telecommunications industry.”

Furthermore, the evolution of telecommunication technologies and services has changed the competitive landscape in the telecommunications industry in Mainland China. On the one hand, the intensified competition in new products and services as a result of new technologies could reduce our tariff rates, increase our customer acquisition cost and decrease our market share as customers choose to receive mobile services from other providers. On the other hand, the increased competition from non-traditional telecommunications services providers brought by new technologies and services, such as Internet service providers, mobile software and applications developers and equipment vendors, pose challenges to us in retaining existing customers and market position. These new competitors compete against us in both voice and data businesses by offering mobile Internet access and Over The Top services, such as instant messaging, Voice over Internet Protocol, or VoIP, services, or audio or video content services delivered over the Internet. In addition, the strategic cooperation between Internet service providers and telecommunications operators is reshaping the competition in the telecommunications market. See “— Changes in the technology and business models of the PRC telecommunications industry may render our current technologies and business model obsolete, and we may encounter difficulties and challenges in developing and implementing new technologies and services.” In addition, although currently we are rapidly expanding our wireline broadband services, we obtained permission to enter into the wireline broadband market later than the other two telecommunications operators, and we cannot assure you that our wireline broadband businesses may not be constrained by the first-mover advantages of our competitors or any other factors arising from the competition in the wireline broadband market.

As part of changes in our marketing model, we may, depending on the competitive environment, offer more tariff promotions to our customers, which may negatively impact our revenues and profit margins. In the meantime, our competitors are expanding their network coverage and offering discounts to their tariff plans, which may affect our ability to retain our customers. As a result of the above, we cannot assure you that we will not experience increases in churn rates as competition intensifies, which may materially reduce our results of operations. Moreover, we cannot assure you that any potential change, and in particular, any further restructuring in the competitive landscape of the telecommunications industry in Mainland China, would not have a material adverse effect on our business, financial condition and results of operations.

-6-

Table of Contents

Moreover, the PRC government has implemented a number of measures that permit certain operators approved by the Ministry of Industry and Information Technology, or the MIIT, to lease telecommunications infrastructure and repackage mobile services for sale to end-customers. On May 17, 2013, the MIIT announced that it would accept applications from non-State-owned companies to, on a trial basis, lease mobile services from China Unicom, China Telecom or us and provide mobile services to end-customers after repackaging these services. Although the initial trial period of the pilot program ended on December 31, 2015, the mobile services leasing and repackaging will continue to be governed by the rules of the pilot program until the MIIT issues any further rules. As of December 31, 2017, the MIIT has approved 42 companies to operate such business. We may face intense competition from these new mobile network operators in light of such policy and decisions by the MIIT. In particular, increased competition may cause tariff rates to further decline, which could in turn materially and adversely affect our business, financial condition and results of operations.

Our ability to compete effectively will also depend on how successfully we respond to various factors affecting the development of the telecommunications industry in Mainland China, including changes in consumer preferences and demand for existing and new services. We cannot assure you that the measures we are taking in response to these competitive challenges will achieve the expected results.

Changes in the technology and business models of the PRC telecommunications industry may render our current technologies and business model obsolete, and we may encounter difficulties and challenges in developing and implementing new technologies and services.

In recent years, the telecommunications industry in Mainland China has been characterized by rapidly changing and increasingly complex technologies. Accordingly, although we strive to keep our technologies up to international standards, the mobile technologies that we currently employ may become obsolete. Moreover, the rapid development of new technologies, new services and products and new business models has also accelerated the convergence of local, long-distance, wireless, cable and Internet communication services, resulted in new competitors entering the telecommunications market and changed customer behaviors. For example, due to the adoption of new technologies and the growing popularity of the Over The Top services, customer usage and revenue generated from our voice services, short message services, or SMS, and multimedia message services, or MMS, has declined in recent years. We are thus required to implement new technologies, develop new services and adjust our business strategies in order to adapt to and maintain our share of the evolving value chain of the telecommunications industry in Mainland China. In order to meet the challenges posed by changes in the technology and business models of the PRC telecommunications industry, we have striven to promote the transition from voice to data traffic operations, from mobile communication services to innovative full services, and from communication services to digital services. We cannot assure you that the measures we are taking in response to those challenges will achieve the results we expect.

Revenue generated from our wireless data traffic grew substantially in 2017, mainly due to the expansion of our 4G network, enhanced data service customer experience, and widespread use of mobile applications. However, there is no guarantee that our wireless data traffic business will continue to grow rapidly or that any increase in revenue generated from wireless data traffic will offset any decrease in our voice services revenue and revenue generated from SMS and MMS and other services. The development of 4G business and technology requires substantial investments. However, there is no guarantee that our investments and efforts will deliver the results we desire. See “— Our continued investments in the construction of our infrastructure network may not adequately address the issues resulting from the substantial increases in data traffic or otherwise achieve the desired outcomes.”

We currently provide certain Internet-related services, including home digital services, mobile payment, digital content and other applications and information services. The development of our Internet-related services depends on our ability to continue to expand and innovate our Internet-related services and take advantage of our strategic cooperation with renowned Internet service providers. However, our competitors, including telecommunications operators, Internet service providers and technology companies, have also been developing the same services, which has increased the competition in this area. If we cannot develop or expand our Internet-related services as we anticipated, or if we develop or expand our Internet-related services at a pace slower than that of our competitors, our Internet-related services may not be as successful and we may not be able to maintain steady growth in our revenue from our Internet-related services.

As the implementation of our business strategies, as well as the development of new businesses, such as mobile Internet, Internet of Things, or IoT, and cloud computing, require significant time, financial and other resources and involve substantial risks, we may not be able to successfully implement our strategies, launch or develop such new businesses in time, or achieve the expected benefits. We may also encounter unexpected technological difficulties in developing and implementing new technologies and, as a result, may incur substantial costs or services disruptions, which could have a material adverse effect on our business, financial condition, results of operations and prospects.

-7-

Table of Contents

Our tariff reduction and future policy developments in the telecommunications industry in relation to tariff reduction may continue to adversely affect our financial conditions.

From time to time, we need to adjust our tariff plans as part of our business strategy and in some cases in accordance with PRC national policies, and such adjustments may have a material negative impact on our revenue and profitability. In May 2015, the PRC government introduced the new national policy of “speed upgrade and tariff reduction. ” Since May 2015, in response to the expectations of the general public and customers and in order to implement the said national policy, we have, in addition to continue enhancing network capacity and increasing network speed, offered discounts to our tariff plans. With respect to our data traffic tariff, we launched in October 2015 an unused data traffic carry-over program for our mobile monthly plans that are charged based on pre-determined data traffic, according to which customers could carry over their monthly plan’s remaining unused data traffic to the following month. In May 2017, we rolled out a series of preferential data traffic plans as one of our tariff reduction measures. In 2017, we also substantially reduced the Internet dedicated line tariffs for small and medium enterprises. In addition, we took an orderly and balanced approach in reducing voice tariff. In response to the market demand and in light of the national policy of achieving coordinated development of Beijing Municipality, Tianjin Municipality and Hebei Province, we cancelled the domestic long-distance and roaming tariffs for voice services within the tariff zones of Beijing Municipality, Tianjin Municipality and Hebei Province in August 2015 so that our customers are only charged with local usage tariff for our voice services provided within the tariff zones. Similarly, we extended the same tariff policies to the tariff zones of Sichuan Province and Chongqing Municipality in October 2016. Furthermore, in response to the government initiative in furtherance of the “speed upgrade and tariff reduction” policy in March 2017, we cancelled all handset domestic long-distance and roaming tariffs since September 1, 2017 and reduced international long-distance call tariffs. In March 2018, the PRC government announced additional policy on network speed upgrade and tariff reduction, and we will introduce corresponding measures in due course. See “Item 4. Information on the Company — Business Overview — Tariffs.”

Such measures have resulted in reduced tariffs of our data traffic services and voice services in 2017, which in turn had a negative impact on our revenue and profitability. We believe that any prospective reduction in tariffs could continue to have an adverse impact on our financial condition and results of operations. Furthermore, we cannot assure you that we would not further reduce our tariffs or take other initiatives to respond to the market conditions or to further implement the national policy of “speed upgrade and tariff reduction” or other similar national policies, which may materially and adversely affect our financial condition and results of operations.

There remain uncertainties in connection with the future operation of the China Tower Corporation Limited (or China Tower, formerly known as China Communications Facilities Services Corporation Limited).

China Tower was established in July 2014 by China Mobile Communication Co., Ltd. or CMC, our wholly-owned subsidiary, China United Network Communications Corporation Limited, or CUCL, a wholly-owned subsidiary of China Unicom, and China Telecom for, among others, the construction, maintenance and operation of telecommunications towers. As of March 31, 2018, we indirectly owned 38% equity interest in China Tower through CMC. On October 14, 2015, CMC entered into an agreement on transfer of its then-owned telecommunications towers and related assets, or Tower Assets, for issuance of consideration shares and payment in cash, or the Transaction Agreement, with CUCL, China Telecom, China Reform Holdings Corporation Limited, or CRHC, and China Tower, pursuant to which CMC, CUCL and China Telecom shall transfer their telecommunications towers and related assets to China Tower, and CRHC shall subscribe for new shares in China Tower in cash. The transfer of Tower Assets was completed on October 31, 2015. See “Item 4. Information on the Company — The History and Development of the Company — Industry Restructuring and Changes in Our Shareholding Structure.”

On July 8, 2016, CMC entered into the Commercial Pricing Agreement, or the Lease Agreement, with China Tower, pursuant to which CMC agreed to lease from China Tower telecommunications towers and related assets acquired and newly constructed by China Tower. On January 31, 2018, the parties entered into a supplementary agreement to the Lease Agreement. See “Item 7. Major Shareholders and Related Party Transactions — Related Party Transactions — Telecommunications Towers and Related Assets Lease Arrangement.” The purpose of establishing China Tower is to reduce the overall capital expenditures and operational costs and redundant projects of the three major telecommunications operators and to improve network coverage of the operators. We believe that participating in the establishment of China Tower will benefit our operation and business development in the following significant aspects: (i) to enhance our telecommunications network coverage ability, (ii) to save capital expenditures and optimize cash management, and (iii) to realize investment return from the equity investment in the long run. However, because we do not own a majority interest of, or otherwise control, China Tower, China Tower may not always act in the best interests of us, and there are uncertainties as to whether the services of China Tower can sufficiently support our business needs and plans, in particular, our plan to expand our 4G business, and whether China Tower can fulfill any usage arrangements to be agreed with us and properly operate, maintain and manage its assets.

-8-

Table of Contents

Furthermore, since it is expected that none of us, China Unicom or China Telecom will construct any telecommunications tower after the establishment of China Tower, our business will rely on the Lease Agreement and any other telecommunications towers usage arrangements with China Tower. We cannot assure you that we are able to use telecommunications towers and related assets on terms and conditions we desire. The Lease Agreement provides for a pricing adjustment mechanism under which the fees may be further negotiated or agreed upon after considering any effects of inflation, significant fluctuations in the real estate market or the steel price, many of which are beyond our control. Furthermore, prior to the expiration of lease periods of individual towers, we have to negotiate with China Tower new leases of such towers. If we are unable to enter into any new leases or if we are able to enter into new leases but the lease terms are less favorable to us, our business operations, financial condition and results of operations may materially and adversely affected. In addition, establishment of China Tower may enable our competitors to expand their 4G networks and businesses at a faster pace, which may, in turn, reduce our competitiveness and market share. Failure of China Tower to fulfill any usage arrangements with us or properly operate, maintain and manage its telecommunications tower assets or to provide stable services to us could adversely affect the quality and uninterrupted services of our networks, which would in turn materially and adversely affect our business operations as well as our financial condition and results of operations.

Further, during 2016 and 2017, the SEC issued comment letters relating to the Company’s previously filed annual reports on Form 20-F for the fiscal years ended December 31, 2015 and 2016. The comment letters inquired mainly about the background, execution process, and accounting treatment in relation to the Company’s disposal and lease of telecommunications towers and related assets with the China Tower. The Company responded to these comment letters and was notified by the SEC in its letter dated October 20, 2017 that it has completed its review of such previously filed annual reports of the Company. The SEC did not in its October 2017 letter require us to make any amendment to those previously filed annual reports. However, given the significance of the transactions with the China Tower, there is no assurance that the SEC will not issue comment letters on our disclosure relating to these and future transactions with the China Tower.

Current or future asymmetrical and other regulatory measures adopted by the PRC regulatory authorities could materially harm our competitive position or enhance competition in the telecommunications industry.

The PRC government has extended favorable regulatory policies to some of our competitors in order to help them become more viable competitors to us. For example, the MIIT has decided to make asymmetrical changes, effective January 1, 2014, to the public telecommunications network interconnection settlement standards of basic telecommunications operators in Mainland China. As a result of these changes, when mobile users of China Telecom and China Unicom and our mobile users in Mainland China (excluding TD-SCDMA users with certain specified prefix numbers) make calls to each other, the settlement charges payable by China Telecom and China Unicom to us were adjusted from RMB0.06/minute to RMB0.04/minute, while the settlement charges payable by us to China Telecom and China Unicom remained at RMB0.06/minute. The MIIT will assess the above interconnection settlement policy once every two years based on the development conditions of the telecommunications market and will make adjustments when appropriate. See “Item 4. Information on the Company — Business Overview — Interconnection.” Moreover, in 2016, MIIT approved the China Telecom and China Unicom to refarm their respective spectrum by reallocating the frequencies initially allocated to 2G and 3G services to 4G services. Compared to the higher frequencies allocated to 4G, frequencies allocated to 2G and 3G services are lower, therefore they can reach farther and have less penetration loss. As a result, the spectrum refarming would facilitate such operators to raise the overall network quality at a lower cost. We received the permission to provide 4G services based on the LTE FDD technology on April 3, 2018 and our parent company, CMCC, is applying to the MIIT to refarm its spectrum by reallocating the frequencies initially allocated to 2G services for use in LTE FDD services. However, there remain uncertainties in the timing of obtaining the approval and the scope and use of the permitted spectrum refarming. Constrained by the frequency spectrum available to us, we may not effectively compete with these operators in our provision of 4G services. See “— Our future network capacity growth may be constrained by the frequency spectrum available to us.”

The PRC government has adopted other regulatory measures to encourage competition in the telecommunications industry. For example, in recent years, the PRC governmental authorities have taken more stringent measures to enforce the PRC Anti-Monopoly Law, such as the anti-monopoly investigation in 2012 undertaken by the National Development and Reform Commission, or the NDRC, which remains ongoing, of other PRC telecommunication companies over certain pricing practices with respect to Internet dedicated leased line services provided by them to Internet service providers. Any amendments to the PRC Anti-Monopoly Law or any changes to the PRC anti-unfair competition regime, in particular those on the telecommunications industry, may subject us to more stringent anti-monopoly and anti-unfair competition regulation. As a result of the regulatory measures, the competitive landscape in the PRC telecommunications industry may further diversify, causing more intensified competition.

-9-

Table of Contents

The implementation of asymmetrical and other regulatory measures could materially harm our competitive position or enhance competition in the telecommunications industry, which could in turn significantly reduce our revenues and profitability, and our financial condition and results of operations also may be materially and adversely affected.

Cyber attacks could have an adverse effect on our business.

Cyber attacks, including through the use of malware, computer viruses, distributed denial of services attacks, credential harvesting and other means for obtaining unauthorized access to or disrupting the operation of our networks and systems and those of our suppliers, vendors and other service providers, could have an adverse effect on our business. Cyber attacks may cause equipment failures, loss of information, including sensitive personal information of customers or employees or valuable technical and marketing information, as well as disruptions to our operations or our customers’ operations. As a telecommunications operator, we are considered a critical information infrastructure operator under the relevant PRC law and therefore may be more likely to be targeted by cyber-attack activities. We devote significant resources to network security, data security and other security measures to protect our systems and data, such as deploying network protection devices, performing regular security assessment and anonymizing personal data. We cannot assure you that the security measures we have implemented will not be bypassed or otherwise can fully protect the integrity of our network, including our mobile network. The economic costs to us to eliminate or alleviate cyber attacks could be significant and may be difficult to estimate or calculate because the loss may differ based on the identity and motive of the programmer or hacker, which are often difficult to identify. Further, the perpetrators of cyber attacks are not restricted to specific groups or persons. These attacks may be committed by company employees or external actors operating in any geography, including jurisdictions where law enforcement measures to address such attacks are unavailable or ineffective, and may even be launched by or at the behest of nation states. While, to date, we have not been subject to cyber attacks which, individually or in the aggregate, have been material to our operations or financial condition, the preventive actions we take to reduce the risks associated with cyber attacks, including protection of our systems and networks, may be insufficient to repel or mitigate the effects of a major cyber attack in the future.

The inability to operate our networks and systems or those of our suppliers, vendors and other service providers as a result of cyber attacks, even for a limited period of time, may result in significant expenses to us and/or a loss of market share to other telecommunications operators. The potential costs associated with these attacks could exceed the insurance coverage we maintain. In addition, if we fail to prevent the theft of valuable information such as financial data, sensitive information about our intellectual property, or if we fail to protect the privacy of customer and employee confidential data against cyber attacks, it could result in lawsuits, government claims, investigations or proceedings, and damage to our reputation, which could adversely impact customer and investor confidence. Any of these occurrences could result in a material adverse effect on our results of operations and financial condition.

We may encounter difficulties and challenges in the research and development of 5G technologies and commercializing 5G services.

We have been actively engaged in 5G-related research and development, or R&D, activities and are involved in setting 5G standards. See “Item 4. Information on the Company — Business Overview — Research and Development — Setting Technical Standards and Promoting Industry Development.” These efforts require us to devote financial and operational resources. In addition, as we are developing relevant technologies for the eventual launch of our 5G services, we expect to make substantial investments in the construction of the infrastructure of our future 5G network. However, there remain uncertainties in the timing of obtaining such approvals from the relevant authorities, including the operating permit and frequency spectrum for launching and providing our future 5G services. Furthermore, we have been exploring optimal business models for our future 5G services. If we are unable to launch 5G services in a timely and commercially viable manner, the expected benefits from our significant investment in the R&D of 5G technologies and relevant infrastructure construction would not be fully realized or if at all, which in turn could materially and adversely affect our business, financial conditions and results of operations.

-10-

Table of Contents

Our continued investments in the construction of our infrastructure network may not adequately address the issues resulting from the substantial increases in data traffic or otherwise achieve the desired outcomes.

Our wireless data traffic business has experienced significant growth in recent years, which has contributed to the growth of our operating revenue and provides our business with further opportunities for development. In addition, we have launched our 4G services, which are expected to drive further growth in data traffic. The continued substantial increase in data traffic significantly strains the existing capacity of our telecommunications network infrastructure, which we expect to make continuous investments to improve. Accordingly, the amount of our capital expenditures in future years could remain high. We incurred capital expenditures of RMB177,533 million in 2017, which was spent on areas including 4G, transmission, broadband access, NB-IoT and IT support in order to back the development of the “four growth engines” and continuously strengthen network development capabilities. We estimate to incur an additional capital expenditures of approximately RMB166.1 billion in 2018. See “Item 5. Operating and Financial Review and Prospects — Liquidity and Capital Resources — Capital Expenditures” for more information on our expected capital expenditures. Moreover, our increased efforts to facilitate the commercialization of 5G technologies and services require investment in the construction of relevant network infrastructure. As a result, we have made and will continue to make substantial investments in the construction of our infrastructure network, including TD-LTE, LTE FDD and 5G infrastructure, to carry the increasing data traffic and capture the first-mover advantage in the new generation of technology. We cannot assure you that these investments would successfully address the issues resulting from the substantial increases in data traffic or otherwise achieve the desired outcomes.

We may suffer damage to our reputation and financial losses due to communications fraud carried out on our network.

Communications fraud in Mainland China poses a risk to our business. Because we provide connections to the network and host websites for customers and develop Internet content and applications, we may be perceived as being associated with the content distributed through our network or displayed on websites that we host. If any communications fraud is committed on our network, websites or applications, we may face litigations due to the perceived association with such fraud. We have carried out various technical and administrative measures to control and prevent such fraud. For example, we have implemented the real-name registration system for our customers in accordance with the requirements of government authorities, developed a number of anti-fraud systems to detect and intercept fraud calls, spam SMS and smartphone malware, refined our customer service to facilitate the instant reporting of fraud, and strengthened the protection of customers’ personal data from unauthorized access and leakage. See “Item 4. Information on the Company — Business Overview — Sales and Customer Services — Service Quality.” However, we cannot and do not screen all of the information distributed through our network or websites. There is no assurance that our measures to prevent or detect fraud will work effectively. Litigations arising from the claims of communications fraud have been brought against other providers of online services in the past. Regardless of the merits of the litigations, they can be costly to defend, divert management resources and attention, which could in turn damage our reputation and have an adverse effect on our business and results of operations.

Failure to capitalize on new business opportunities may substantially reduce our growth potential.

We may pursue acquisitions or otherwise make investments in other business opportunities as such opportunities arise. We cannot assure you that we will be successful in pursuing such acquisitions or investments or will otherwise be able to successfully integrate any acquired business into our existing operations. Our ability to capture new business opportunities may also depend on the availability of sufficient financing from internal as well as external sources. Any failure to capitalize on new business opportunities may materially harm our competitive position, as well as materially reduce our future profitability and growth.

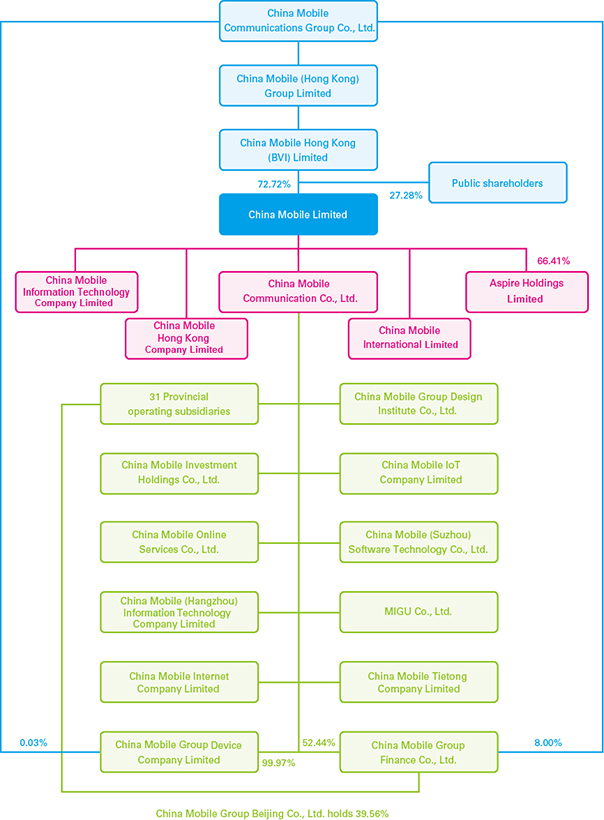

We made acquisitions of and hold investments in other entities, with some of which we also established contractual arrangements such as the strategic cooperation. Such investments and acquisitions include our equity interest in Shanghai Pudong Development Bank, or SPD Bank, IFLYTEK CO., LTD., or IFLYTEK, True Corporation Public Company Limited, or True Corporation and China Mobile Innovative Business Fund (Shenzhen) Partnership (Limited Partnership), or China Mobile Fund, our acquisitions of business and assets of China TieTong, and ShiJinShi Credit Information Services Co. Ltd., our joint venture with China Merchants Group. See “Item 4. Information on the Company — Business Overview — Investments and Acquisitions.” Furthermore, we have established certain subsidiaries to carry out specialized operations, such as China Mobile Group Device Company Limited, or China Mobile Device, China Mobile International Limited, or China Mobile International, China Mobile IoT Company Limited, China Mobile Online Services Co., Ltd., China Mobile (Suzhou) Software Technology Co., Ltd., China Mobile (Hangzhou) Information Technology Company Limited, MIGU Co., Ltd., or MIGU, China Mobile Internet Company Limited and China Mobile Investment Holdings Co., Ltd. We expect to further enhance our operational efficiency by establishing other subsidiaries that operate certain other aspects of our businesses in accordance with our business development strategies.

-11-

Table of Contents

We cannot assure you that our abovementioned investments will achieve the desired level of return, or that any strategic cooperation and integration will produce the expected benefits, if at all. The profitability of entities held by us is impacted to some extent by macroeconomic conditions and changes in monetary and fiscal policies in the countries and regions in which they operate. Moreover, if we encounter difficulties in carrying out our cooperation with our strategic cooperation partners or the integration with the target companies we acquired, the prospects of relevant business operations may be materially and adversely affected. In addition, we cannot assure you that the business model of each of the entities we held would be sustainable, and the expected benefits from our investment in networks, licenses and new technologies may not be realized.

Any failure to achieve and maintain effective internal controls could have a material adverse effect on our reputation, business, results of operations and the market prices of our shares and ADSs.

Effective internal controls are necessary for us to provide reasonable assurance with respect to our financial reports and to prevent fraud. We are required to comply with various Hong Kong and U.S. laws, rules and regulations on internal controls, including the Sarbanes-Oxley Act of 2002. In particular, Section 404 of the Sarbanes-Oxley Act of 2002 requires that we include a report of management on our internal control over financial reporting in our annual reports on Form 20-F that contains an assessment by our management of the effectiveness of our internal control over financial reporting. In addition, our independent registered public accounting firm must issue an auditor’s report on the effectiveness of our internal control over financial reporting.

Internal controls may not prevent or detect misstatements because of their inherent limitations, including the possibility of human error, the circumvention or overriding of controls, or fraud. In addition, projections of any evaluation of the effectiveness of our internal control over financial reporting to future periods are subject to the risk that controls may become inadequate because of changes in operating conditions or a deterioration in the degree of compliance with our policies or procedures. As a result, even effective internal controls are able to provide only reasonable assurance with respect to the preparation and fair presentation of financial statements. If we fail to maintain the adequacy of our internal control over financial reporting, our management may not be able to conclude on an ongoing basis that we have effective internal control over financial reporting. Moreover, even if our management concludes that our internal control over financial reporting is effective, our independent registered public accounting firm may disagree. If our independent registered public accounting firm is not satisfied with our internal control over financial reporting or the level at which our controls are designed or operated, or if the independent registered public accounting firm interprets the requirements, rules or regulations differently from us, it may decline to express an opinion on the effectiveness of our internal control over financial reporting or may issue an adverse opinion. Any of these possible outcomes could result in a loss of investor confidence in the reliability of our consolidated financial statements, which could cause the market prices of our ordinary shares and ADSs to decline significantly. In addition, any deficiency in our internal control over financial reporting could expose us to increased risk of fraud or misuse of corporate assets and subject us to potential delisting from the New York Stock Exchange, regulatory investigations and civil or criminal sanctions.

Some employee misconduct, including misconduct by senior management, may not be detected or prevented in a timely manner, and such misconduct may damage our reputation and cause the trading price of our ordinary shares and ADSs to decrease significantly.

Certain management personnel of certain subsidiaries of our Company were alleged to have engaged in unlawful conduct in recent periods. Such allegations of unlawful conduct include the acceptance of bribes. While some of these incidents are still under investigation, we believe that such management misconduct are isolated incidents resulting from individual misconduct.

In order to further strengthen our internal system and policies for detecting and preventing similar and other misconduct, we have re-examined our policies and procedures and have implemented additional operational measures. In particular, with respect to our business cooperation arrangements with third parties, we have adjusted the model of business cooperation and have implemented more stringent policies and processes. These efforts are expected to reduce the probability of third parties engaging in improper business relationships with our employees. We have also further expanded the type of equipment, products and services that are subject to centralized procurement. Furthermore, we have implemented a rotation policy under which the management of our major operating subsidiaries will rotate among different subsidiaries every few years. In addition, we have revised our policy in relation to, and strengthened control over, the material investment projects. We have also provided ongoing compliance and ethics trainings to our employees.

-12-

Table of Contents

As described above, we have taken various measures to prevent employee misconduct. We cannot assure you, however, that all misconducts or allegations of misconduct by our management and staff will be detected or prevented in a timely manner. If various measures we have taken prove ineffective in preventing employee misconduct, our reputation may be severely harmed, and the trading price of our ordinary shares and ADSs could decrease significantly.

Our success depends on the continued services of our senior management team and other qualified employees.

Our continued success and growth depends on our ability to identify, hire, train and retain suitably skilled and qualified employees, including management personnel, with relevant professional skills. The services of our directors and members of senior management are essential to our success and future growth. The loss of a significant number of our directors and senior management could have a material adverse effect on our business if we are unable to find suitable replacements in a timely manner. We also face fierce competitions with other telecommunication operators and technology companies in hiring and retaining qualified employees or other talents with skills tailored to our development. Therefore, we cannot assure you that we will always be able to attract and retain our desired personnel, and any failure to recruit and retain the necessary management personnel and other key personnel for our operations could have a material adverse impact on our business and results of operations.

We are controlled by CMCC, which may not always act in our best interest.

As of March 31, 2018, CMCC indirectly owned approximately 72.72% of our outstanding shares. Accordingly, CMCC is, and will be, able to (i) nominate substantially all of the members of our board of directors and, in turn, indirectly influence the selection of our senior management; (ii) control the timing and amount of our dividend payments; and (iii) otherwise control or influence actions that require approvals of our shareholders.

The interests of CMCC as our ultimate controlling person may conflict with the interests of our minority shareholders. In particular, CMCC may take actions with respect to our business that may not be in our other shareholders’ best interest.

In addition, CMCC provides our operating subsidiaries in Mainland China with services that are necessary for our business activities. See “Item 5. Operating and Financial Review and Prospects — Overview of Our Operations — Our Operating Arrangements with CMCC Have Affected and May Continue to Affect Our Financial Results.” Furthermore, we operate our 3G and 4G businesses pursuant to arrangements with CMCC, which was granted licenses by the PRC government to operate a 3G business based on TD-SCDMA technology and a 4G business based on TD-LTE technology and LTE FDD technology. The interests of CMCC as the provider of these services to our operating subsidiaries in Mainland China may conflict with the interests of us or our other shareholders.

We may conduct a public offering and listing of our shares in Mainland China, which may result in increased regulatory scrutiny and compliance costs as well as increased fluctuations in the prices of our ordinary shares and ADSs listed in overseas markets.

We may conduct a public offering and listing of our shares on a stock exchange in Mainland China. We have not set a specific timetable or decided on any specific form for an offering in the PRC. The precise timing of the offering and listing of our shares in Mainland China would depend on a number of factors, including relevant regulatory developments and market conditions. If we complete a public offering in Mainland China, we would become subject to the applicable laws, rules and regulations governing public companies listed in Mainland China, in addition to the various laws, rules and regulations that we are currently subject to in Hong Kong and the United States. The listing and trading of our securities in multiple jurisdictions and multiple markets may lead to increased compliance costs for us, and we may face the risk of significant intervention by regulatory authorities in these jurisdictions and markets.

In addition, under current PRC laws, rules and regulations, our ordinary shares listed on The Stock Exchange of Hong Kong Limited, or the Hong Kong Stock Exchange, will not be interchangeable or fungible with any shares we may decide to list on a Mainland China stock exchange, and there is no trading or settlement between these two markets. As a result, the trading prices of our ordinary shares listed on the Hong Kong Stock Exchange may not be the same as the trading prices of any shares we may decide to list on a Mainland China stock exchange. The issuance of a separate class of shares and fluctuations in its trading price may also lead to increased volatility in, and may otherwise materially and adversely affect, the prices of our ordinary shares and ADSs listed in overseas markets.

-13-

Table of Contents

On November 17, 2014, the China Securities Regulatory Commission, or the CSRC, and the Hong Kong Securities and Futures Commission, or the SFC, launched a pilot scheme to allow investors in Mainland China to trade shares in designated companies listed on the Hong Kong Stock Exchange, including constituent stocks of the Hang Seng Composite LargeCap Indexes such as our ordinary shares, subject to certain quota limitations. We cannot predict the impact that this initiative will have on cross-border investment by investors in Mainland China or on the trading prices of our ordinary shares and ADSs.

Our future network capacity growth may be constrained by the frequency spectrum available to us.

Mobile network capacity is to a certain extent limited by the amount of frequency spectrum available for its use. Since the MIIT controls the allocation of frequency spectrum to mobile operators in Mainland China, the capacity of our mobile network is limited by the amount of spectrum that the MIIT allocates to our parent company, CMCC. For our Global System for Mobile Communications, or GSM, network, the MIIT has allocated a total of 45x2 MHz of spectrum in the 900 MHz and 1800 MHz frequency bands to be used nationwide for transmission and reception to our parent company, CMCC. In connection with our 3G business, the MIIT has allocated to CMCC, in various frequency bands, a total of 35 MHz of spectrum to be used for nationwide coverage and an additional 50 MHz of spectrum to be used for indoor coverage. In connection with our 4G business, the MIIT has allocated to CMCC, in various frequency bands, a total of 145 MHz of spectrum to be used for nationwide coverage, including 20 MHz of spectrum previously allocated for use by our 3G business for outdoor coverage and 50 MHz of spectrum previously allocated for use by our 3G business for indoor coverage. In addition, CMCC is applying to the MIIT to refarm its spectrum by reallocating the frequencies initially allocated to 2G services for use in LTE FDD services. However, there remain uncertainties in the timing of obtaining the approval and the scope and use of the permitted spectrum refarming. Meanwhile, the MIIT may reallocate 900MHz and 1800MHz bands that expire at the end of 2019. There will be an uncertainty that we can get more spectrum or maintain the existing spectrum at that time. Under the existing agreement between CMCC and us, we have the right to use the allocated frequency spectrum in Mainland China.

We believe that our current spectrum allocation is sufficient for anticipated customer growth in the near term. However, we may need additional spectrum to accommodate future customer growth or to further develop our 4G services, and the quality of spectrum available to us may affect our competitive position. We cannot assure you that we will be able to obtain additional spectrum from the MIIT that would meet our expectations or business needs on a timely basis. Our network expansion or upgrade plans may be affected if we are unable to obtain additional spectrum. This could in turn constrain our future network capacity growth and our market share, which would in turn materially and adversely affect our business and prospects as well as our financial condition and results of operations.

Since our services require interconnection with networks of other operators, disruption in interconnections with those networks could have a material adverse effect on our business, profitability and growth.

Our mobile services depend, in large part, upon our interconnection arrangements and access to other networks. Interconnection is necessary in the case of all calls between our customers and customers of other networks. We have entered into interconnection and transmission line leasing agreements with other operators. Any disruption in our interconnection with the networks of other operators with which we interconnect due to technical or competitive reasons may affect our operations, service quality and customer satisfaction, and in turn our business and results of operations. In addition, any obstacles in existing interconnection arrangements and leased line agreements or any change in their terms, as a result of natural events, accidents, or for regulatory, technological, competitive or other reasons, could lead to temporary service disruptions and increased costs that could severely harm our operations and materially decrease our profitability and growth.

Compliance with the SEC’s rule for disclosures on “conflict minerals” may be time-consuming and costly and could adversely affect our reputation.

Under the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, the SEC has adopted a rule that applies to companies that use certain minerals and metals, known as conflict minerals, in their products, including certain products manufactured for them by third parties. The rule will require companies that use conflict minerals in the production of their products to conduct due diligence as to whether or not such minerals originate from the Democratic Republic of Congo and adjoining countries and to file certain information with the SEC about the use of these minerals. We filed our conflict minerals report for the years ended December 31, 2014, 2015 and 2016 with the SEC, and our conflict minerals report for the year ended December 31, 2017 is due May 31, 2018. We will incur additional costs to comply with the due diligence and disclosure requirements. In addition, depending upon our findings, or our inability to make reliable findings, about the source of any possible conflict minerals that may be used in any products manufactured for us by third parties, our reputation could be harmed, and there may also be disruptions to our business and strategy.

-14-

Table of Contents

Risks Relating to the Telecommunications Industry in Mainland China

We are subject to extensive government regulation and any change in the regulatory environment in the PRC, especially with respect to the telecommunications industry, may materially impact us.

As a telecommunications operator in China, we are subject to regulation by, and under the supervision of, the MIIT, the primary regulator of the telecommunications industry in China. Other PRC government authorities also take part in regulating the telecommunications industry in areas such as tariff policies and foreign investment. The regulatory framework within which we operate may limit our flexibility to respond to changes in market conditions or competition and could negatively affect our cost structure, profit margin and market share. For example, in recent years, PRC government authorities have required the implementation of real name registration for mobile users. Furthermore, since 2015, the PRC government announced a number of policies on network speed upgrade and tariff reduction, and we introduced, and will continue to introduce, corresponding measures. See “Item 4. Information on the Company — Business Overview — Tariffs.” The PRC government may announce additional tariff reduction policies in the future, and we cannot predict to what extent we may be required to further reduce tariffs. Future changes in tariff policies could significantly decrease our revenues and materially reduce our profitability. See “— Risks Relating to Our Business — Our tariff reduction and future policy developments in the telecommunications industry in relation to tariff reduction may continue to adversely affect our financial conditions.” Additionally, the PRC government had started mobile number portability pilot programs to allow customers in certain cities to switch mobile carriers while retaining their numbers. If the PRC government expands the mobile number portability pilot programs in more cities or implement mobile number portability in the Mainland China, the competition among telecommunication operators may significantly intensify. In response, we may offer more tariff promotions to attract and retain customers. As a result of such intensified competition and related counter measures adopted, our results of operations, profitability and market share may suffer. Any change in the regulatory environment in the PRC, especially with respect to the telecommunications industry, may have a material adverse effect on our business, financial condition, results of operations and prospects.

The MIIT, under the direction of the State Council, has been preparing a draft telecommunications law, which, once adopted, will become the fundamental telecommunications statute and the legal basis for telecommunications regulations in Mainland China. In 2000, the State Council promulgated a set of telecommunications regulations, or the Telecommunications Regulations, that apply in the interim period prior to the adoption of the telecommunications law. Although we expect that the telecommunications law will positively affect the overall development of the telecommunications industry in Mainland China, we do not fully know what will be its nature and scope. The telecommunications law and other new telecommunications regulations or rules may contain provisions that could have a material adverse effect on our business, financial condition, results of operations and prospects.

We operate our businesses with approvals granted by the State Council and under licenses granted by the MIIT. We also have arrangements with CMCC, our parent company, under which we operate 3G and 4G telecommunications businesses based on the 3G and 4G licenses granted by the MIIT. Any future adverse change in the conditions or other obligations relating to these approvals and licenses could have a material adverse effect on our business, financial condition, results of operations and prospects.