UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

For the fiscal year ended:

For the transition period from ____________to _____________

Commission File No.

(Exact Name of Registrant as Specified in Its Charter)

| (State or other jurisdiction of | (I.R.S. Employer | |

| incorporation or organization) | Identification No.) |

| (Address of principal executive offices) | (Zip Code) |

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a

well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the registrant is not

required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate by check mark whether the registrant

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12

months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days.

Indicate by check mark whether the registrant

has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405

of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer | ☐ | ☒ | |

| Non-Accelerated Filer | ☐ | Smaller reporting company | |

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant

has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial

reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or

issued its audit report.

If securities are registered pursuant to Section

12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction

of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether registrant is

a shell company (as defined in Rule 12b-2 of the Act) Yes ☐ No

As of June 30, 2023 (the last business day of

the registrant’s most recently completed second fiscal quarter), the aggregate market value of the shares of the registrant’s

common stock held by non-affiliates (based upon the closing sale price of $1.22 per share) was approximately $

There was a total

of

DOCUMENTS INCORPORATED BY REFERENCE

CBAK ENERGY TECHNOLOGY, INC.

Annual Report on Form 10-K

TABLE OF CONTENTS

i

INTRODUCTORY NOTE

Use of Terms

Except as otherwise indicated by the context and for the purposes of this report only, references in this report to:

| ● | “Company”, “we”, “us” and “our” are to the combined business of CBAK Energy Technology, Inc., a Nevada corporation, and its consolidated subsidiaries; |

| ● | “BAK Asia” are to our Hong Kong subsidiary, China BAK Asia Holdings Limited; |

| ● | “CBAK New Energy” are to our PRC subsidiary, Dalian CBAK New Energy Co., Ltd., a company that was previously named Dalian CBAK Trading Co., Ltd. until December 12, 2023; |

| ● | “CBAK Power” are to our PRC subsidiary, Dalian CBAK Power Battery Co., Ltd.; |

| ● | “CBAK Shangqiu” are to our PRC subsidiary, CBAK New Energy (Shangqiu) Co., Ltd.; |

| ● | “CBAK Suzhou” are to our 90% owned PRC subsidiary, CBAK New Energy (Suzhou) Co., Ltd.; |

| ● | “CBAK Energy” are to our PRC subsidiary, Dalian CBAK Energy Technology Co., Ltd.; |

| ● | “BAK Investments” are to our Hong Kong subsidiary, BAK Asia Investments Limited; |

| ● | “CBAK Nanjing” are to our PRC subsidiary, CBAK New Energy (Nanjing) Co., Ltd; |

| ● | “Nanjing CBAK” are to our PRC subsidiary, Nanjing CBAK New Energy Technology Co., Ltd.; |

| ● | “Nanjing BFD” are to our PRC subsidiary, Nanjing BFD New Energy Technology Co., Ltd., a company that was previously named Nanjing Daxin New Energy Automobile Industry Co., Ltd. until February 24, 2023; |

| ● | “Hitrans Holdings” are to our Cayman Islands subsidiary, Hitrans Holdings Co., Ltd., a company that was previously named CBAK Energy Technology, Inc. until February 29, 2024; |

| ● | “Nacell Holdings” are to our Hong Kong subsidiary, Hong Kong Nacell Holdings Company Limited; |

| ● | “CBAK Energy Investments” are to our Cayman Islands subsidiary, CBAK Energy Investments Holdings; |

| ● | “CBAK Energy Lithium Holdings” are to our Cayman Islands subsidiary, CBAK Energy Lithium Battery Holdings Co., Ltd., a company that was previously named Hitrans Holdings until February 29, 2024; |

| ● | “Hitrans” are to our 67.33% owned PRC subsidiary, Zhejiang Hitrans Lithium Battery Technology (we hold 67.33% of registered equity interests of Hitrans, representing 72.99% of paid-up capital), through CBAK Power previously. On March 10, 2023, CBAK Power entered into an agreement with Nanjing BFD to transfer the 67.33% equity interests CBAK Power holds in Hitrans to Nanjing BFD. As of the date of this report, the registration of the equity transfer with the local government is still in process. Following the transaction, Nanjing BFD shall become the controlling shareholder of Hitrans, while CBAK Power no longer holds any of Hitrans’s equity interests. |

| ● | “Haisheng” are to Hitrans’s wholly-owned PRC subsidiary, Shaoxing Haisheng International Trading Co., Ltd.; |

| ● | “RMB” are to Renminbi, the legal currency of China; |

| ● | “U.S. dollar”, “$” and “US$” are to the legal currency of the United States; |

| ● | “SEC” are to the United States Securities and Exchange Commission; |

| ● | “Securities Act” are to the Securities Act of 1933, as amended; and |

| ● | “Exchange Act” are to the Securities Exchange Act of 1934, as amended. |

ii

Special Note Regarding Forward Looking Statements

Statements contained in this report include “forward-looking statements” within the meaning of such term in Section 27A of the Securities Act and Section 21E of the Exchange Act. Forward-looking statements involve known and unknown risks, uncertainties and other factors which could cause actual financial or operating results, performances or achievements expressed or implied by such forward-looking statements not to occur or be realized. Forward-looking statements made in this report generally are based on our best estimates of future results, performances or achievements, predicated upon current conditions and the most recent results of the companies involved and their respective industries. Forward-looking statements may be identified by the use of forward-looking terminology such as “may,” “will,” “could,” “should,” “project,” “expect,” “believe,” “estimate,” “anticipate,” “intend,” “continue,” “potential,” “opportunity” or similar terms, variations of those terms or the negative of those terms or other variations of those terms or comparable words or expressions.

Readers are urged to carefully review and consider the various disclosures made by us in this report and our other filings with the SEC. These reports attempt to advise interested parties of the risks and factors that may affect our business, financial condition and results of operations and prospects. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. The forward-looking statements made in this report speak only as of the date hereof and we disclaim any obligation to provide updates, revisions or amendments to any forward-looking statements to reflect changes in our expectations or future events.

Disclosures Related to Our China-Based Operations

CBAK Energy Technology, Inc. is a holding company incorporated in Nevada, the United States, with no material operations of its own. We conduct our business through our operating subsidiaries in China. This structure involves unique risks to investors, and you may never directly hold equity interests in the operating entities.

There are significant legal and operational risks and uncertainties associated with having substantially all operations in China. The PRC government has significant authority to exert influence on the ability of a company with substantial operations in China, like us, to conduct its business, accept foreign investments or be listed on a U.S. stock exchange. For example, we face risks associated with PRC regulatory approvals of offshore offerings, anti-monopoly regulatory actions, cybersecurity and data privacy, as well as with U.S. regulations, for instance, the risk relating to lack of inspection from the U.S. Public Company Accounting Oversight Board, or PCAOB, on our auditors, which is further discussed below under “—The Holding Foreign Companies Accountable Act” and in various risk factors in “Item 1A. Risk Factors.” The PRC government may also intervene with or influence our operations as the government deems appropriate to further regulatory, political and societal goals. The PRC government publishes from time to time new policies that can significantly affect our industry in which we operate and we cannot rule out the possibility that it will not in the future further release regulations or policies regarding our industry that could adversely affect our business, financial condition and results of operations. Any such action, once taken by the PRC government, could cause the value of our common stock to significantly decline or in extreme cases, become worthless.

The PRC legal system is a civil law system based on written statutes. Unlike the common law system, prior court decisions may be cited for reference but have limited precedential value. China has not developed a fully integrated legal system, and recently enacted laws, rules and regulations may not sufficiently cover all aspects of economic activities in China or may be subject to a significant degree of interpretation by PRC regulatory agencies and courts. In particular, because these laws, rules and regulations are relatively new, and because of the limited number of published decisions and the non-precedential nature of these decisions, and because the laws, rules and regulations often give the relevant regulator significant discretion in how to enforce them, the interpretation and enforcement of these laws, rules and regulations involve uncertainties and can be inconsistent and unpredictable. Therefore, it is possible that our existing operations may be found not to be in full compliance with relevant laws and regulations in the future. In addition, the PRC legal system is based in part on government policies and internal rules, some of which are not published on a timely basis or at all, and which may have a retroactive effect. As a result, we may not be aware of our violation of these policies and rules until after the occurrence of the violation.

iii

The PRC government has initiated a series of regulatory actions and made a number of public statements on the regulation of business operations in China, including cracking down on illegal activities in the securities market, enhancing supervision over China-based companies listed overseas using a variable interest entity (“VIE”) structure, adopting new measures to extend the scope of cybersecurity reviews, and expanding efforts in anti-monopoly enforcement. We do not believe that our subsidiaries in China are directly subject to these regulatory actions or statements, as we have not carried out any monopolistic behavior, we have never adopted a VIE structure, and our business does not involve any restricted industry or implicate cybersecurity.

For additional information, see “Risk Factors—Risks Related to Doing Business in China—The PRC government exerts substantial influence over the manner in which we conduct our business activities. Its oversight and discretion over our business could result in a material adverse change in our operations and the value of our common stock. Changes in laws, regulations and policies in China and uncertainties with respect to the PRC legal system could materially and adversely affect us. In addition, rules and regulations in China can change quickly” on page 17, “Risk Factors—Risks Related to Doing Business in China—Changes in U.S. and Chinese regulations or in relations between the United States and China may adversely impact our business, our operating results, our ability to raise capital and the value of our securities. Any such changes may take place quickly and with very little notice” on page 19 and Risk Factors—Risks Related to Doing Business in China—There are uncertainties regarding the interpretation and enforcement of PRC laws, rules and regulations” on page 20.

The Holding Foreign Companies Accountable Act

In December 2021, the SEC adopted rules (the “Final Rules”) to implement the Holding Foreign Companies Accountable Act (the “HFCAA”). The HFCAA includes requirements for the SEC to identify issuers who file annual reports with audit reports issued by independent registered public accounting firms located in foreign jurisdictions that the Public Company Accounting Oversight Board (“PCAOB”) is unable to inspect or investigate completely because of a position taken by a non-U.S. authority in the accounting firm’s jurisdiction (“Commission-Identified Issuers”). The HFCAA also requires that, to the extent that the PCAOB has been unable to inspect an issuer’s independent registered public accounting firm for three consecutive years since 2021, the SEC shall prohibit the issuer’s securities registered in the United States from being traded on any national securities exchange or over-the-counter markets in the United States. On June 22, 2021, the U.S. Senate passed the Accelerating Holding Foreign Companies Accountable Act, and on December 29, 2022, legislation entitled “Consolidated Appropriations Act, 2023” (the “Consolidated Appropriations Act”) was signed into law, which contained, among other things, an identical provision to the Accelerating Holding Foreign Companies Accountable Act and amended the HFCAA by requiring the SEC to prohibit an issuer’s securities from trading on any U.S. stock exchanges if its auditor is not subject to PCAOB inspections for two consecutive years instead of three.

On December 16, 2021, the PCAOB issued a report to notify the SEC of its determination that the PCAOB was unable to inspect or investigate completely registered public accounting firms headquartered in mainland China and Hong Kong, including our former auditor, Centurion ZD CPA & Co. In May 2022, the SEC conclusively listed us as a Commission-Identified Issuer under the HFCAA following the filing of our annual report on Form 10-K for the fiscal year ended December 31, 2021. On December 15, 2022, the PCAOB issued a report that vacated its December 16, 2021 determination and removed mainland China and Hong Kong from the list of jurisdictions where it is unable to inspect or investigate completely registered public accounting firms. For this reason, we were not identified as a Commission-Identified Issuer after we filed on April 15, 2023 the annual report on Form 10-K for the fiscal year ended December 31, 2022 and do not expect to be identified as a Commission-Identified Issuer under the HFCAA after we file this annual report on Form 10-K. Each year, the PCAOB will determine whether it can inspect and investigate completely audit firms in mainland China and Hong Kong, among other jurisdictions. If PCAOB determines in the future that it no longer has full access to inspect and investigate completely accounting firms in mainland China and Hong Kong and we continue to use an accounting firm headquartered in one of these jurisdictions to issue an audit report on our financial statements filed with the SEC, we would be identified as a Commission-Identified Issuer following the filing of the annual report on Form 10-K for the relevant fiscal year. Our current auditor, ARK Pro CPA & CO, is headquartered in Hong Kong. There can be no assurance that we would not be identified as a Commission-Identified Issuer for any future fiscal year, and if we were so identified for two consecutive years, we would become subject to the prohibition on trading under the HFCAA, as amended.

For additional information, see “Risk Factor—Risks Related to Doing Business in China—The PCAOB had historically been unable to inspect our former auditor in relation to their audit work performed for our financial statements and the inability of the PCAOB to conduct inspections of our former auditor in the past has deprived our investors of the benefits of such inspections. Our common stock may be prohibited from trading in the United States under the HFCAA in the future if the PCAOB is unable to inspect or investigate completely auditors located in China. The delisting of our common stock, or the threat of its being delisted, may materially and adversely affect the value of your investment.” on page 16.

iv

Permissions Required from the PRC Authorities for Our Business Operations and Securities Offering

In addition to regular business licenses, we are required to obtain the pollutants discharge permit to operate our business in the PRC. We believe that our PRC operating subsidiaries have obtained all requisite permissions for our operations in all material aspects from relevant Chinese authorities and none of the requisite permissions for our operations in all material aspects have been denied by the Chinese authorities. However, we cannot assure you that our PRC subsidiaries are always able to successfully update or renew the licenses or permits required for the relevant business in a timely manner or that these licenses or permits are sufficient to conduct all of our present or future business. If our PRC subsidiaries (i) do not receive or maintain required permissions or approvals, (ii) inadvertently conclude that such permissions or approvals are not required, or (iii) applicable laws, regulations, or interpretations change and our PRC subsidiaries are required to obtain such permissions or approvals in the future, we could be subject to fines, legal sanctions or an order to suspend our PRC operating subsidiaries’ business, which may materially and adversely affect the business, financial condition and results of operations of us.

In connection with our previous issuance of securities, under current PRC laws, regulations and regulatory rules, as of the date of this annual report, we believe that we and our PRC subsidiaries, (i) are not required to obtain permissions from the China Securities Regulatory Commission (“CSRC”), (ii) are not required to go through cybersecurity review by the Cyberspace Administration of China (the “CAC”), and (iii) have not received or were denied such requisite permissions by any PRC authority. We cannot guarantee that the regulators will agree with us. As of the date hereof, we have not been involved in any investigations for cybersecurity review made by the CAC, and we have not received any inquiry, notice, warning, or sanctions in such respect.

However, the PRC government has recently indicated an intent to exert more oversight and control over offerings that are conducted overseas and/or foreign investment in China-based issuers. The CSRC published the Trial Measures and Listing Guidelines on February 17, 2023, designed to regulate overseas securities offerings by PRC domestic companies. On February 24, 2023, the CSRC, together with the Ministry of Finance, National Administration of State Secrets Protection and National Archives Administration of China, revised the Provisions on Strengthening Confidentiality and Archives Administration for Overseas Securities Offering and Listing, which were issued by the CSRC and National Administration of State Secrets Protection and National Archives Administration of China in 2009, or the “Provisions.” The revised Provisions were issued under the title the “Provisions on Strengthening Confidentiality and Archives Administration of Overseas Securities Offering and Listing by Domestic Companies,” and came into effect on March 31, 2023 together with the Trial Measures.

Given the recent nature of the introduction of the above Trial Measures, Listing Guidelines, and Revised Provisions, there remains significant uncertainty as to the enactment, interpretation and implementation of regulatory requirements related to overseas securities offerings and other capital markets activities. Notwithstanding the foregoing, as of the date of this report, we are not aware of any PRC laws or regulations in effect requiring that we obtain permission from any PRC authorities to issue securities to foreign investors, and we have not received any inquiry, notice, warning, or sanction from the CSRC, the CAC, or any other PRC authorities that have jurisdiction over our operations.

For additional information, see “Risk Factor—Risks Related to Doing Business in China—The PRC government has increasingly strengthened oversight in offerings conducted overseas or on foreign investment in China-based issuers, which could result in a material change in our operations and our common stock could decline in value or become worthless.” on page 17.

v

Cash and Asset Flows Through Our Organization

Under relevant PRC laws and regulations, we are permitted to provide funding from the proceeds of our overseas fund raising activities to our PRC subsidiaries only through loans or capital contributions. In the fiscal years ended December 31, 2022 and 2023, we transferred nil and $0.2 million to our PRC subsidiaries as capital contribution, respectively. As of December 31, 2023, CBAK Energy Technology, Inc., the Nevada issuer, had made cumulative capital contributions of $138.64 million to our existing PRC subsidiaries, which were accounted as long-term investments by us.

Before Hitrans was acquired by us in November 2021, it declared dividends twice. In January 2020, Hitrans declared dividends for the years ended December 31, 2018 and 2019. A dividend of $2,958,048 was declared and paid to its shareholder Zhejiang Meidu Graphene Technology Co., Ltd. For other shareholders, a total dividend of $2,480,944 was declared in January 2020 but remains unpaid as of the date of this report. In March 2018, Hitrans declared a dividend of $1,333,135 for the year ended December 31, 2017, among which $533,254 was paid in July 2018 and the remaining $799,881 was paid in 2019. Except for the above dividends, we and our PRC subsidiaries have not previously declared or paid any cash dividend or dividend in kind, and have no plan to declare or pay any dividends in the near future. We currently intend to retain most, if not all, of our available funds and any future earnings to operate and expand our business.

Under PRC laws and regulations, we are subject to various restrictions on intercompany fund transfers and foreign exchange control. To the extent our cash is in the PRC or held by a PRC entity, the funds may not be available for the distribution of dividends to our investors, or for other use outside of the PRC, due to the restrictions and limitations on our ability imposed by the PRC government to transfer cash. The PRC government imposes controls on the convertibility of Renminbi into foreign currencies and, in certain cases, the remittance of currency out of mainland China. Our PRC subsidiaries receive substantially all revenue in RMB. Our PRC subsidiaries may pay dividends only out of their accumulated after-tax profits, if any, upon satisfaction of relevant statutory conditions and procedures and determined in accordance with Chinese accounting standards and regulations. If the PRC foreign exchange control system prevents us from obtaining sufficient foreign currencies to satisfy the foreign currency demands, we may not be able to pay dividends in foreign currencies to our shareholders. Additionally, we may make loans to our PRC subsidiaries subject to the approval from or registration with PRC governmental authorities and limitation on amount, or we may make additional capital contributions to our PRC subsidiaries. PRC regulation of loans to and direct investment in PRC entities by offshore holding companies and governmental control of currency conversion may delay or prevent us from using our funds to make loans or additional capital contributions to our PRC subsidiaries, which could materially and adversely affect the liquidity of our PRC subsidiaries and our ability to fund and expand our business in the PRC, and cause the value of our securities to significantly decline or become worthless. We cannot assure you that the PRC government will not intervene in or impose restrictions on our ability to make intercompany cash transfers.

For additional information, see “Risk Factors—Risks Related to Doing Business in China—The PRC government exerts substantial influence over the manner in which we conduct our business activities. Its oversight and discretion over our business could result in a material adverse change in our operations and the value of our common stock. Changes in laws, regulations and policies in China and uncertainties with respect to the PRC legal system could materially and adversely affect us. In addition, rules and regulations in China can change quickly” On page 17 and “Risk Factors—Risks Related to Doing Business in China—PRC regulation of loans to, and direct investment in, PRC entities by offshore holding companies and governmental control of currency conversion may restrict or prevent CBAK Energy Technology, Inc. from making additional capital contributions or loans to its PRC subsidiaries” on page 22.

Summary of Risk Factors

Investing in our securities involves a high degree of risk. The following is a summary of significant risk factors and uncertainties that may affect our business, which are discussed in more detail below under “Item 1A. Risk Factors” included in this Annual Report on Form 10-K:

| ● | The PCAOB had historically been unable to inspect our former auditor in relation to their audit work performed for our financial statements and the inability of the PCAOB to conduct inspections of our former auditor in the past has deprived our investors of the benefits of such inspections. Our common stock may be prohibited from trading in the United States under the HFCAA in the future if the PCAOB is unable to inspect or investigate completely auditors located in China. The delisting of our common stock, or the threat of its being delisted, may materially and adversely affect the value of your investment. |

| ● | The PRC government exerts substantial influence over the manner in which we conduct our business activities. Its oversight and discretion over our business could result in a material adverse change in our operations and the value of our common stock. Changes in laws, regulations and policies in China and uncertainties with respect to the PRC legal system could materially and adversely affect us. In addition, rules and regulations in China can change quickly with little advance notice. |

vi

| ● | The PRC government has increasingly strengthened oversight in offerings conducted overseas or on foreign investment in China-based issuers, which could result in a material change in our operations and our common stock could decline in value or become worthless. |

| ● | Changes in U.S. and Chinese regulations or in relations between the United States and China may adversely impact our business, our operating results, our ability to raise capital and the value of our securities. Any such changes may take place quickly and with very little notice. |

| ● | There are uncertainties regarding the interpretation and enforcement of PRC laws, rules and regulations. |

| ● | CBAK Energy Technology, Inc., as a holding company incorporated in Nevada, the United States, without material operations of its own, relies on dividends and other distributions on equity paid by its PRC operating subsidiaries for its cash needs. |

| ● | Investors may experience difficulties in effecting service of legal process, enforcing foreign judgments or bringing original actions in China based upon U.S. laws, including the federal securities laws or other foreign laws against us or our management. |

| ● | Our independent auditors have expressed substantial doubt about our ability to continue as a going concern. |

| ● | The acquisition of a controlling interest in Hitrans may fail to result in anticipated benefits but has involved significant investment of financial and other resources. |

| ● | There are inherent risks associated with new product development and our efforts to develop and market new products could fail. |

| ● | Our failure, if any, to keep up with rapid technological changes and evolving industry standards may cause our products to become obsolete and less marketable, resulting in loss of market share to our competitors. |

| ● | Maintaining our R&D activities and manufacturing operations require significant capital expenditures, and our inability or failure to maintain our operations could have a material adverse impact on our market share and ability to generate revenue. |

| ● | We face intense competition from other battery manufacturers and cathode material and precursor producers, many of which have significantly greater resources. |

| ● | We are dependent on a limited number of customers for a significant portion of our revenues and this dependence is likely to continue. |

vii

| ● | Our business depends on the growth in demand for light electric vehicles, electric vehicles, electric tools, energy storage, such as residential energy supply and UPS application, and other high-power electric devices. |

| ● | Our success, in part, depends on the success of manufacturers of the end applications that use our products, and our failure to gain acceptance of our products from such manufacturers could materially and adversely affect our results of operations and profitability. |

| ● | We do not have product liability insurance for claims against our product quality. Defects in our products could result in a loss of customers and decrease in revenue, unexpected expenses and a loss of market share. |

| ● | We do not have long-term purchase commitments from our customers, which may result in significant uncertainties and volatility with respect to our revenue from period to period. |

| ● | We rely significantly on technology and systems to support our production, supply chain, payments, financial reporting and other key aspects of our business. Any failure, inadequacy, interruption or security failure of those systems could have a material adverse effect on our business, reputation and brand, financial condition, and results of operations. |

| ● | System security risk issues, and disruption of our internal operations or information technology systems, could have a material adverse effect on our business, financial condition, and results of operations. |

| ● | We and our independent public accounting firm identified material weaknesses in our internal control over financial reporting as of December 31, 2023. If we fail to remediate the material weaknesses, we may be unable to accurately report our financial results or prevent fraud, and investor confidence and the market price of our shares may be adversely affected. |

| ● | Numerous factors, many of which are beyond our control, may cause the market price of common stock to fluctuate significantly. |

| ● | Techniques employed by short sellers may drive down the market price of the common stock of CBAK Energy Technology, Inc. |

| ● | Other risks identified in this report and in our other reports filed with the SEC, including those identified in “Item 1A. Risk Factors” below. |

Enforceability of Civil Liabilities

There is uncertainty as to whether the courts of China would:

| ● | recognize or enforce judgments of United States courts obtained against us or our directors or officers predicated upon the civil liability provisions of the securities laws of the United States or any state in the United States; or |

| ● | entertain original actions brought in each respective jurisdiction against us or our directors or officers predicated upon the securities laws of the United States or any state in the United States. |

The recognition and enforcement of foreign judgments are provided for under PRC Civil Procedures Law. PRC courts may recognize and enforce foreign judgments in accordance with the requirements of PRC Civil Procedures Law based either on treaties between China and the country where the judgment is made or on reciprocity between jurisdictions. China does not have any treaties or other form of reciprocity with the United States that provide for the reciprocal recognition and enforcement of foreign judgments. In addition, according to the PRC Civil Procedures Law, courts in the PRC will not enforce a foreign judgment against us or our directors and officers if they decide that the judgment violates the basic principles of PRC law or national sovereignty, security or public interest. As a result, it is uncertain whether and on what basis a PRC court would enforce a judgment rendered by a court in the United States. Under the PRC Civil Procedures Law, foreign shareholders may originate actions based on PRC law against us in the PRC, if they can establish sufficient nexus to the PRC for a PRC court to have jurisdiction, and meet other procedural requirements, including, among others, the plaintiff must have a direct interest in the case, and there must be a concrete claim, a factual basis and a cause for the suit. However, it would be difficult for foreign shareholders to establish sufficient nexus to the PRC by virtue only of holding our shares of common stock.

viii

PART I

ITEM 1. BUSINESS.

Overview of Our Business

We are a manufacturer of new energy high power lithium and sodium batteries that are mainly used in light electric vehicles, electric vehicles, energy storage such as residential energy supply & uninterruptible power supply (UPS) application, and other high-power applications. Our primary product offering consists of new energy high power lithium and sodium batteries. In addition, after completing the acquisition of 81.56% of registered equity interests (representing 75.57% of paid-up capital) of Hitrans in November 2021, we entered the business of developing and manufacturing NCM precursor and cathode materials. Hitrans is a leading developer and manufacturer of ternary precursor and cathode materials in China, whose products have a wide range of applications on batteries that would be applied to electric vehicles, electric tools, high-end digital products and storage, among others.

We acquired most of our operating assets of CBAK Power, including customers, employees, patents and technologies from our former subsidiary BAK International (Tianjin) Ltd. (“BAK Tianjin”). We acquired these assets in exchange for a reduction in accounts receivable from our former subsidiaries that were disposed of in June 2014.

As of December 31, 2023, we report financial and operational information in two segments: (i) production of high-power lithium and sodium battery cells, and (ii) manufacture and sale of materials used in high-power lithium battery cells.

We generated revenues of $204.4 million and $248.7 million for the fiscal years ended December 31, 2023 and 2022, respectively. We had a net loss of $8.5 million and $11.3 million in the fiscal years ended December 31, 2023 and 2022, respectively. As of December 31, 2023, we had an accumulated deficit of $134.6 million and net assets of $113.5 million. We had a working capital deficiency, accumulated deficit from recurring net losses and significant short-term debt obligations maturing in less than one year as of December 31, 2023.

Favorable Policies for New Energy Industry

The clean energy industry is of strategic importance in China and many other countries. With the global emphasis on the new energy industry, we anticipate securing more potential orders from our clients.

The Chinese government has been providing support for the development of new energy facilities and vehicles for several years. Considering our major operations are in China, the policy support to the new energy industry is crucial to our business. With the growing demand for high-power lithium-ion and sodium-ion products, we are optimistic about our future prospects.

Starting in 2015, the Chinese government has been providing consumers with subsidies for purchases of electric vehicles. Subsidies vary depending on electric vehicles’ endurance mileages, battery pack energy density, energy consumption level and others, as a result of which new energy vehicles providing long driving range and high technical performance get higher subsidies. Between 2017 and 2020, the Chinese government gradually decreased subsidy levels for electric vehicles year by year. On April 23, 2020, the Chinese government extended these subsidies for another two years with a planned reduction of 10%, 20% and 30% in 2020, 2021 and 2022, respectively. Ultimately, these subsidies were discontinued entirely on December 31, 2022.

On the other hand, for the purposes of establishing a long-term mechanism for the administration of energy conservation and new energy vehicles, and promoting the development of the automobile industry, the Chinese government has implemented several policies to stimulate the production of new energy vehicles. On December 26, 2017, the Chinese government issued a policy to exempt purchase tax levied on electric vehicles for three years until 2020. In March 2020, the Chinese government extended such purchase tax exemption to 2022. In September 2022, the Chinese government again extended the purchase tax exemption to the end of 2023. On June 21, 2023, the Chinese government announced the extension of the purchase tax exemption from December 31, 2022 to December 31, 2027.

On September 28, 2017, China’s Ministry of Industry and Information Technology introduced the Measures for Parallel Administration policy. This policy monitors Average Fuel Consumption Credits and New Energy Vehicle Credits for passenger vehicle manufacturers. If a manufacturer has negative credits, high-fuel consumption vehicle production will be suspended. Positive credits can be transferred among affiliated enterprises, while negative credits require compensation or purchasing of positive new energy vehicle credits. This policy incentivizes automakers to produce more new energy vehicles, and it became effective on April 1, 2018.

1

On October 20, 2020, the State Council of PRC issued a new round of “Development Plan for New Energy Vehicles Industry (2021-2035)” (“Plan”), which is a successor to the previously published “Development Plan for Energy Conservation and New Energy Vehicles Industry (2012-2020)”. The Plan acknowledges various challenges faced by Chinese new energy vehicle manufacturers and emphasizes the need to enhancing R&D ability, expanding infrastructure and promoting industry-wide integration. The Plan further outlined the policy and administrative support that would be provided to the industry, reaffirming the importance of new energy vehicle development for China.

On January 21, 2021, the Ministry of Transport of PRC issued a new policy named “the 14th Five-year Development Plan for Green Transport” (the “14th Five-year Plan”), which aims to accelerate the adoption of new energy and clean energy vehicles for urban buses, taxis and logistical vehicles. The 14th Five-year Plan mandates that, in designated national ecological experimental zones and air pollution control zones, new energy vehicles must comprise at least 80% of buses, taxis and logistical vehicles.

On October 24, 2021, the State Council of PRC issued a new policy named the “Action Plan to Peak Carbon Dioxide Emissions before 2030” (the “Action Plan”), which further underscores the significance of promoting clean energy generation facilities and expanding charging networks for new energy vehicles. The Action Plan reflects the determination of the Chinese government in reducing carbon dioxide emissions and providing support to the development of the new energy industry.

On November 15, 2021, the Chinese Ministry of Industry and Information Technology introduced a new policy named “the 14th Five-year Plan for Green Industrial Development.” This policy sets forth a target to achieve significant progress in battery recycling for energy storage and power battery sectors by 2025.

On April 25, 2022, China’s General Office of the State Council issued a new guideline named “Guideline on Further Stimulation and Recovery of Consumption.” This guideline highlights the necessity of promoting green energy vehicles in the public transportation space.

We believe these energy efficiency policies will foster healthy development in the new energy vehicles market in the long term. In the short term, the extension of the purchase tax exemption policy alleviates pressure on electric vehicle manufacturers, benefiting the Chinese EV battery market. China’s new energy market has experienced rapid growth. According to the Chinese Ministry of Industry and Information Technology (the “MIIT”), there are 9.587 million new energy vehicles manufactured and 9.495 million sold in 2023, representing 35.8% and 37.9% increases from 2022. However, the electric vehicle market is highly competitive and faces increased downward pressure on pricing. We believe this situation presents growth potential for the light electric vehicle market, including electric bicycles, as well as the energy storage market. A research report from China Energy Storage Alliance shows a 300% increase in installed capacity in the energy storage market compared to 2022. We plan to maintain our focus on cylindrical batteries for residential energy supply & UPS and other energy storage markets, while allocating resources to higher energy density products for the light electric vehicle market. We are also researching new products to meet EV market demand. Our strategies involve closely monitoring market changes and adjusting operations as needed.

Expansion of Manufacturing Capabilities

We have three major manufacturing centers for new energy batteries, including lithium and sodium batteries in Nanjing, Dalian and Shangqiu, and a manufacturing plant for precursors and cathode materials in Shaoxing.

In June 2020, our wholly-owned subsidiary, BAK Asia entered into a framework investment agreement with Jiangsu Gaochun Economic Development Zone Development Group Company (“Gaochun EDZ”), a company affiliated with the local government of Gaochun Economic Development Zone in Nanjing, Jiangsu, PRC. According to the agreement, we intended to develop certain lithium battery projects within Gaochun EDZ which are expected to have a total production capacity of 20 GWh per year after completion (the “Nanjing Project”). As of December 31, 2023, we had received government subsidies in an amount of RMB47.1 million (approximately $6.6 million) from Gaochun EDZ. We plan to utilize the targeted total capacity of 20 GWh per year to produce lithium batteries for the light electric vehicle (LEV), electric vehicle, and energy storage sectors. The Company expects to achieve such capacity expansion under the Nanjing Project through two phases of construction. In Phase I, we secured plant rentals and completed interior construction by 2021, featuring two production lines. One line is dedicated to manufacturing model 32140 lithium batteries, while the other is versatile, capable of producing either model 32140 lithium or sodium batteries. Our production capacity for Phase I stands at 2 GWh annually when both lines are assigned to lithium battery production. However, allocating one line exclusively for sodium battery production reduces the capacity to 1.5 GWh per year. The completed Phase I plants spans roughly 27,173 square meters, and as of December 31, 2023, the two production lines constructed during Phase I have been put into operation. Phase II, scheduled for completion by the end of 2027, aims to add another three large manufacturing facilities and augment our annual production capacity by an additional 18 GWh. As of December 31, 2023, the initial major plant has reached the ceiling construction stage, with interior construction ongoing. However, the actual production capacities and construction schedules for Phase II may be adjusted based on market reception of our new battery offerings.

2

Our sales have continued to grow in recent years. Our model 26650 batteries produced in our Dalian manufacturing center have gained popularity in European and American markets. As a result, our Dalian facilities had experienced client demand that exceeded then-existing supply. As of December 31, 2023, we had three production lines in Dalian, with a total capacity of 1 GWh per year.

In addition to adding one more production line in our Dalian facilities, we rented a manufacturing center in Shangqiu, Henan, China to acquire an additional annual capacity of 0.5 GWh per year with two production lines for model 26700 lithium batteries.

Our Hitrans facilities currently have a manufacturing capacity of 13,000 tons for NCM precursors and 3,000 tons for NCM cathode materials. Hitrans is actively engaged in constructing a new manufacturing plant, slated for completion in June 2024 and expected to be operational in the first half of 2025. Upon completion, this new facility will increase Hitrans’ NCM precursor production capacity by an additional 37,000 tons.

Additionally, we continue to renovate our existing facilities, upgrade equipment, add new equipment, improve product functionality, and enhance the raw materials and components used for production.

Development of New Battery Models

Currently, our primary battery product offering consists of model 26650, 26700 and 32140 lithium cells, and 32140 sodium cells. Model 26650, 26700 and 32140 batteries can be used in light electric vehicles, electric vehicles, electric tools, energy storage (such as residential energy supply & uninterruptible power supply (UPS) application), and other high-power applications. Our sodium cells can be used in ultra-low temperature conditions and have fast-charging capability. Actual testing data shows that our model 32140 sodium cells retain 85% capacity under -40℃ and could be charged to 90% capacity within 10 minutes.

To maintain our competitive position, we are expanding the range of our cylindrical battery models to include larger products, such as model 40140 and 46120. Larger cylindrical batteries typically offer superior performance at lower manufacturing costs. As of December 31, 2023, the model 40140 was in the A-sample stage, which precedes the B-sample stage and mass production, while the model 46120 was in the B-sample stage. We anticipate that the development of the model 40140 will progress to the B-sample stage, and the model 46120 will be ready for mass production by the end of 2024. Based on different client demand, we may produce sodium versions of these models.

Acquisition of a Raw Materials Manufacturer

On July 20, 2021, CBAK Power, a wholly-owned Chinese subsidiary of the Company, entered into a framework agreement relating to CBAK Power’s investment in Zhejiang Hitrans Lithium Battery Technology Co., Ltd, pursuant to which CBAK Power agreed to acquire 81.56% of registered equity interests (representing 75.57% of paid-up capital) of Hitrans (the “Acquisition”). The Acquisition was completed on November 26, 2021.

CBAK Power paid approximately RMB40.74 million ($6.4 million) in cash to acquire 21.56% of registered equity interests (representing 21.18% of paid-up capital) of Hitrans from Hitrans management shareholders. In addition, CBAK Power entered into a loan agreement with Hitrans to lend Hitrans approximately RMB131 million ($20.6 million) (the “Hitrans Loan”) by remitting approximately RMB131 million ($20.6 million) into the account of Shaoxing Intermediate People’s Court to remove the freeze on Zhejiang Meidu Graphene Technology Co., Ltd. (“Meidu Graphene”)’s 60% of registered equity interests (representing 54.39% of paid-up capital) of Hitrans which freeze was imposed as a result of a lawsuit for Hitrans’s failure to make payments in connection with the purchase of land use rights, plants, equipment, pollution discharge permit and other assets (the “Assets”). CBAK Power assigned RMB118 million ($18.5 million) of the Hitrans Loan to Mr. Junnan Ye as consideration for the acquisition of 60% of registered equity interests (representing 54.39% of paid-up capital) of Hitrans from Mr. Ye who, acting as an intermediary, first purchased the 60% of registered equity interests (representing 75.57% of paid-up capital) of Hitrans from Meidu Graphene. After such assignment, Hitrans shall repay Mr. Ye at least RMB70 million ($10.84 million) within two months of obtaining title to the Assets and the rest RMB48 million ($7.43 million) by December 31, 2021, along with a fixed interest of RMB3.5 million ($0.54 million) which can be reduced by up to RMB1 million ($0.15 million) if the loan is repaid before its due date. Hitrans shall repay the remaining approximately RMB13 million ($2.01 million) of the Hitrans Loan to CBAK Power at an interest rate of 6% per annum. As of January 29, 2022, Hitrans repaid all the loan principal of RMB118 million ($18.5 million) and interest of RMB3.5 million ($0.54 million) to Mr. Ye.

3

Prior to the Acquisition, CBAK Power and Hangzhou Juzhong Daxin Asset Management Co., Ltd. (“Juzhong Daxin”) entered into a framework investment agreement (the “Letter of Intent”) for a potential acquisition of Hitrans, and CBAK Power paid RMB20 million ($3.10 million) to Juzhong Daxin as a security deposit under the Letter of Intent. On July 27, 2021, Juzhong Daxin returned RMB7 million ($1.1 million) of the security deposit to CBAK Power. Juzhong Daxin has refused to refund an additional RMB3 million ($0.5 million), claiming that the amount was a justified risk premium for their facilitation of the acquisition. CBAK Power believes this assertion is baseless and has initiated legal proceedings against Juzhong Daxin to recover the outstanding RMB3 million. As of December 31, 2023, CBAK Power had not recovered the RMB3 million from Juzhong Daxin.

As part of the Acquisition, Hitrans obtained title to the Assets. Upon the closing of the Acquisition, CBAK Power became the largest shareholder of Hitrans holding 81.56% of its registered equity interests (representing 75.57% of paid-up capital). As required by applicable Chinese laws, CBAK Power is obliged to make capital contributions for the portion of Hitrans’s registered capital subscribed but unpaid in accordance with the articles of association of Hitrans.

On July 8, 2022, Hitrans held a shareholder meeting to pass a resolution to increase the registered capital of Hitrans from RMB40 million to RMB44 million (approximately $6.2 million) and to accept an investment of RMB22 million (approximately $3.1 million) from Shaoxing Haiji Enterprise Management & Consulting Partnership (“Shaoxing Haiji”) and another investment of RMB18 million (approximately $2.5 million) from Mr. Haijun Wu (collectively, the “Management Shareholder Investments”). Under the resolution, 10% of the Management Shareholder Investments (RMB4 million or $0.5 million) will be counted towards Hitrans’s registered capital and the remaining 90% (RMB36 million or $5.1 million) will be treated as additional paid-in capital. 25% of the Management Shareholder Investments was required to be in place before August 15, 2022. As of September 30, 2022, RMB10 million (approximately $1.4 million), representing 25% of the Management Shareholder Investments was received. Another 25% (RMB10 million) and 50% (RMB20 million) of the Management Shareholder Investments were required to be received before December 31, 2022 and June 30, 2024, respectively. As of December 31, 2023, the 25% (RMB10 million) of the Management Shareholder Investments were received. Shaoxing Haiji and Mr. Haijun Wu are currently in negotiations with other shareholders of Hitrans to extend the payment due date for the remaining unpaid 25% and 50% of the Management Shareholder Investments to May 31, 2029. In addition, in 2022, CBAK Power injected an additional RMB60 million (approximately $8.7 million) in Hitrans comprising RMB6 million ($0.9 million) towards Hitrans’s registered capital and RMB54 million ($7.8 million) as additional paid-in capital.

On December 8, 2022, CBAK Power entered into agreements with five investors (together, the “Hitrans Investors”) to transfer an aggregate of 6.8183% equity interests CBAK Power holds in Hitrans to these Hitrans Investors. Among the five investors, four of them invested RMB5 million (approximately $0.7 million) each to obtain 1.1364% equity interests, respectively, while the fifth investor paid RMB10 million (approximately $1.5 million) to acquire 2.2727% equity interests. Following the above financing and transfer transactions, CBAK Power’s equity interests in Hitrans decreased to 67.33%, representing 69.12% of paid up capital, as of December 31, 2022 and 72.99% of paid-up capital as of December 31, 2023.

Trends in End Applications of Our Products

Our business, financial condition and results of operations depend on whether end-application manufacturers are willing to use our products. We target the battery markets for light electric vehicles, electric vehicles, energy storage (such as residential energy supply & UPS application), and other high-power electric devices. However, our revenues derived from a specific end-application have been fluctuating depending on various factors such as governmental policies, technological changes, evolving industry standards and customer needs and preferences. After the acquisition of Hitrans, we have broadened our target markets to include battery manufacturers, offering them cathode materials and precursors.

During the period from 2017 to 2019, our largest electric vehicle customers included Dongfeng Autos, Dayun Motor and Yema Auto. Our battery sales in the electric vehicle market have decreased significantly during the period of 2018–2021 as a result of changes to the Chinese government’s new energy vehicle subsidy policies. More specifically, under the subsidy policies, new energy vehicles receive different subsidies based on their driving range and technical performance. New energy vehicles providing long driving range and high technical performance qualify for higher subsidies and the Chinese government has gradually raised the performance thresholds for electric vehicles to receive subsidies over the years. During 2019-2021, as the battery packs comprising our primary model 26650 batteries were only able to support energy vehicles that qualify for the lowest level of subsidies, electric vehicle producers had reduced incentives to purchase batteries from us. However, we have been looking for opportunities to re-enter the electric vehicle battery market by continuing to develop batteries suitable for electric vehicles and actively cooperating with previous electric vehicle customers in battery pack after-sales service and technical support. As a result of our efforts, we generated approximately $2.9 million and $4.7 million in revenues from electric vehicle customers in 2023 and 2022, respectively. Our largest revenue-generating market has been the energy storage market. We have established partnerships with several leading players in this sector, resulting in ample orders to adequately utilize our production lines.

4

Our Corporate History and Structure

CBAK Energy Technology, Inc. was incorporated in the State of Nevada on October 4, 1999. The shares of common stock of CBAK Energy Technology, Inc. traded in the over-the-counter market through the Over-the-Counter Bulletin Board between 2005 and May 31, 2006. On May 31, 2006, CBAK Energy Technology, Inc. obtained approval to list its common stock on the Nasdaq Global Market, and trading commenced on the same date under the symbol “CBAK.” Effective November 30, 2018, the trading symbol for the common stock of CBAK Energy Technology, Inc. changed from CBAK to “CBAT.” Effective June 21, 2019, CBAK Energy Technology, Inc.’s common stock started trading on the Nasdaq Capital Market.

We currently conduct our business primarily through (i) CBAK Power, a wholly-owned subsidiary in China that we own through BAK Asia, an investment holding company formed under the laws of Hong Kong on July 9, 2013; (ii) Nanjing CBAK, a 100% owned subsidiary of CBAK Nanjing (as further described below); (iii) CBAK Shangqiu, a wholly owned subsidiary in China that we own through CBAK Power; (iv) Nanjing BFD, a 100% owned subsidiary of CBAK Nanjing; and (v) Hitrans, a subsidiary of CBAK Power, where CBAK Power owns 67.33% of registered equity interests (representing 72.99% of paid-up capital):

| ● | CBAK Power, wholly-owned by BAK Asia, located in Dalian, China, incorporated on December 27, 2013, focuses on the development and manufacture of high-power lithium batteries. |

| ● | CBAK Shangqiu, wholly-owned by CBAK Power, located in Shangqiu, China, incorporated on July 25, 2023, focuses on the development and manufacture of high-power lithium batteries. |

| ● | CBAK Energy, wholly-owned by BAK Asia, located in Dalian, China, incorporated on November 21, 2019. CBAK Energy does not have any significant operations as of the date of this report. |

| ● | CBAK Suzhou, 90% owned by CBAK Power, located in Suzhou, China, incorporated on May 4, 2018, used to focus on the development and manufacture of new energy high power battery packs. CBAK Suzhou currently does not employee any local staff. Since its lease expired in October 2019, CBAK Suzhou has stopped using the facilities located at its registered address. Some of its business has been transferred to our subsidiaries in Dalian and CBAK Suzhou’s remaining assets are temporarily stored in our facilities in Dalian. We plan to dissolve CBAK Suzhou as soon as practicable. |

| ● | Hitrans, 67.33% owned by CBAK Power, located in Shangyu, Shaoxing, China, incorporated on December 16, 2015, principally engaged in the business of research and development, production and sales of cathode materials and precursors for NCM lithium batteries. |

| ● | Guangdong Meidu Hitrans Resources Recycling Technology Co., Ltd. (“Guangdong Hitrans”), 80% owned by Hitrans, located in Dongguan, Guangdong, China, incorporated on July 6, 2018, principally engaged in the business of wastes recycling. Guangdong Hitrans was dissolved on January 30, 2024. |

| ● | Haisheng, wholly-owned by Hitrans, located in Shangyu, Shaoxing, China, incorporated on October 9, 2021, principally engaged in the business of cathode raw materials trading. |

| ● | CBAK Nanjing, wholly-owned by BAK Investments located in Nanjing, China, incorporated on July 31, 2020. CBAK Nanjing does not have any significant operations as of the date of this report. |

| ● | Nanjing CBAK, wholly owned by CBAK Nanjing, located in Nanjing, China, incorporated on August 6, 2020, focuses on the development and manufacture of larger-sized cylindrical lithium batteries. |

| ● | CBAK New Energy, wholly-owned by BAK Investments, located in Dalian, China, incorporated on August 14, 2013, previously named Dalian CBAK Trading Co., Ltd. until December 12, 2023, was transferred from BAK Asia to BAK Investments on December 26, 2023. On March 5, 2024, CBAK New Energy was transferred from BAK Investments to Nacell Holdings. CBAK New Energy does not have any significant operations as of the date of this report. |

| ● | Nanjing BFD, wholly-owned by CBAK Nanjing, incorporated on November 9, 2020, formally known as Nanjing Daxin, renamed on March 8, 2023, focuses on the development and manufacture of sodium-ion batteries. Nanjing BFD’s original business of the development and manufacture of electric bicycle, motorcycle and automotive spare parts will be gradually marginalized. |

| ● | Daxin New Energy Automobile Technology (Jiangsu) Co., Ltd. (“Jiangsu Daxin”), wholly-owned by Nanjing BFD, incorporated on August 4, 2021, focuses on the development and manufacture of electric bicycle, motorcycle and automotive spare parts. Jiangsu Daxin was dissolved on December 22, 2023. |

| ● | Hitrans Holdings, our wholly owned subsidiary, incorporated on July 28, 2021 under the laws of the Cayman Islands, previously named “CBAK Energy Technology, Inc.,” was renamed as “Hitrans Holdings Co., Ltd.” on February 29, 2024. Hitrans Holdings owns 100% equity interests of Nacell Holdings. |

| ● | Nacell Holdings, a direct, wholly owned subsidiary of Hitrans Holdings, was incorporated on July 7, 2023 under the laws of Hong Kong. Nacell Holdings had no significant operations as of the date of this report. |

| ● | CBAK Energy Lithium Holdings, our wholly owned subsidiary, incorporated on July 12, 2023 under the laws of the Cayman Islands in the name of “Hitrans Holdings,” was renamed as “CBAK Energy Lithium Holdings” on February 29, 2024. |

| ● | CBAK Energy Investments, our wholly owned subsidiary, was incorporated on February 26, 2024 under the laws of the Cayman Islands. CBAK Energy Investments does not have any significant operations as of the date of this report. |

5

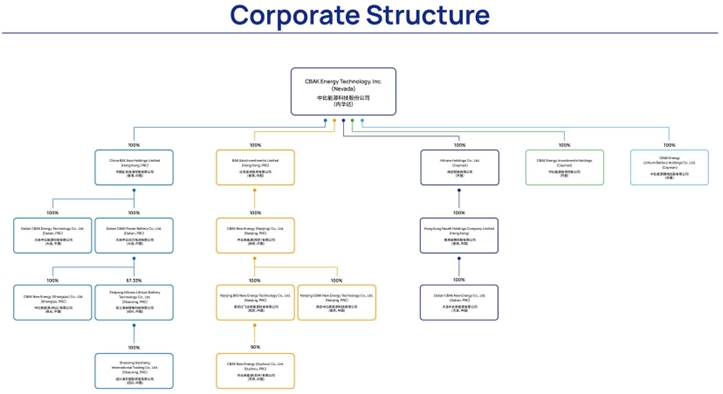

Almost all of our business operations are conducted primarily through our Chinese subsidiaries. The chart below presents our current corporate structure:

Our Products

The use of new materials has enabled the configuration of high-power lithium battery cells to contain much higher energy density and higher voltage and have a longer life cycle and shorter charge time than other types of lithium-based batteries. These special attributes, coupled with intrinsic safety features, are suitable for batteries used for high-power applications, such as electric cars, electric bicycles, electric tools, and energy storage such as residential energy supply and uninterruptible power supply, or UPS application.

We currently are manufacturing the following high power lithium batteries, which can be used for various applications:

| Battery Cell Type | End applications* | |

| High-power lithium battery | Electric bus [6,000-20,000] | |

| Electric car [1,500-3,5000] | ||

| Hybrid electric vehicle [500-2000] | ||

| Light electric vehicle [10-150] | ||

| Cordless power tool [10-30] | ||

| Energy Storage including Residential Energy Supply and UPS [>30] |

| * | Bracketed numbers denote number of cells per particular battery. |

6

On November 29, 2021, we announced the completion of the acquisition of 81.56% equity interests of Hitrans. We since then have incorporated the manufacture and sale of the following materials used in high power lithium batteries as part of our operations:

| Material Type | End applications* | |

| Cathode | High-power NCM lithium battery | |

| Precursor | NCM cathode materials |

Precursors are in general made from nickel salts, cobalt salts and manganese salts, and are used in manufacturing cathode materials. Cathode materials are crucial raw materials to manufacture lithium-ion batteries.

Key High Power Lithium Battery Applications

End-product applications that are driving the demand for high power lithium batteries include electric vehicles, such as electric cars, electric buses, hybrid electric cars and buses; light electric vehicles, such as electric bicycles, electric motors, electric tricycles, smaller-sized electric cars; and energy storage applications including but not limited to residential energy supply and uninterruptible power supply, and other high-power applications.

Electric Vehicles

An electric vehicle, sometimes referred to as an electric drive vehicle, uses one or more electric motors for propulsion. Electric vehicles include electric cars, electric buses, electric trains, electric lorries, electric airplanes, electric boats, and hybrid electric vehicles, plug in hybrid electric vehicles and electric spacecraft. Electric cars and electric buses are propelled by one or more electric motors powered by rechargeable battery packs. Electric cars and buses have the potential to significantly reduce city pollution by having zero tail pipe emissions. Electric cars and buses are also expected to have less dependence on oil. World governments are pledging significant funds to fund the development of electric vehicles and their components due in part to these advantages. Due to these factors, as well as lithium batteries’ relatively environmentally-friendly, light-weight and high-capacity features, the demand for lithium batteries in the field of electric cars and buses is increasing.

Due to such recent trends as renewed concerns relating to the availability and price of oil, increased legal fuel-efficiency requirements and incentives, and heightened interest in environmentally-friendly or “green” technologies, hybrid electric vehicles are likely to continue to attract substantial interest from vehicle manufacturers and consumers. Hybrid electric vehicles include automobiles, trucks, buses, and other vehicles that combine a conventional propulsion system with a rechargeable energy storage system to achieve better fuel economy than conventional vehicles. As these vehicles tend to be large and heavy, their rechargeable energy storage system generally consists of a large quantity of rechargeable high-power lithium cells.

2014 was considered the inaugural year for China’s new energy vehicle (NEV) industry, with explosive growth seen in 2017. Despite a slight decline in 2019, the production and sales of NEVs continued to surge in 2018, 2020, and 2021. According to the Ministry of Industry and Information Technology of China, production in China reached 1,270,000 units in 2018, up 43.4% year-on-year, with sales reaching 1,256,000 units, up 61.7% year-on-year. In 2019, production and sales dropped to 1,242,000 units and 1,206,000 units, down 2.3% and 4.0% year-on-year, respectively. However, 2020 saw a rebound, with production and sales reaching 1,366,000 units and 1,267,000 units, up 10.0% and 5.1% from 2019. In 2021, both production and sales of NEVs reached record highs of 3,545,000 units and 3,521,000 units, respectively, nearly 1.6 times higher than the previous year. This growth trend continued in 2022, with 7,058,000 units manufactured and 6,887,000 units sold, marking increases of 96.9% and 93.4%, respectively. In 2023, production and sales figures climbed to 9,587,000 units and 9,495,000 units, up by 35.8% and 37.9%, respectively. The subsidy policy on NEVs was discontinued on December 31, 2022. However, the purchase tax exemption policy aimed at boosting NEV purchases was extended from the end of 2023 to 2027. Looking ahead, we anticipate that the NEV market will gradually become highly competitive, with NEVs gaining increasing popularity in the long term.

Light Electric Vehicles

Light electric vehicles include bicycles, scooters, and motorcycles, tricycles and smaller-sized electric cars. Due to their relatively small size and light design, approximately 10-150 high-power lithium cells can be used to power light electric vehicles. We believe that the electric bicycle market in China is significant.

7

Light electric vehicles have drawn great attention from the international market as a solution to the global environment and energy problems. With governments in China, Japan, Europe, South Asia, and North America promoting the application of light electric vehicles, this market has been growing considerably. China has the world’s biggest electric bicycle market, promoted by the adoption of new “national standard” of electric bicycles by the Chinese government, which leads to a nation-wide upgrading of electric bicycles from old “national standard.” Additionally, the popularity of the concept of shared electric bicycles in China further creates momentum to the growth of the market. The pandemic of Covid-19 has stimulated the development of food delivery industry that increases the demand for shared electric bicycles.

In India, Southeast Asia and European markets, thanks to the carbon emission and pollution reduction policies promoted by local governments, electric vehicles have been viewed as a solution to replace traditional gasoline-powered vehicles. Unlike electric vehicles whose market has already been fully competitive, we believe that light electric vehicles including electric bicycles still have great growth potential.

Residential Energy Supply & Uninterruptible Power Supplies (“UPS”)

Energy storage primarily involves the storage of electric energy using batteries, inductors, and capacitors. Battery energy storage is widely used for storing power for residential buildings, outdoor applications, emergency backup, electric vehicles, and for storing excess energy generated by power plants. Uninterruptible Power Supplies (UPS) and residential energy storage units are examples of energy storage applications. UPS systems provide emergency power from a separate source when the main utility power is unavailable, while portable power banks serve outdoor needs. Residential energy storage units offer a reliable power supply for entire households, a popular choice in some European regions.

Sales and Marketing

Currently, our marketing and promotional efforts are primarily undertaken by our marketing department in both Dalian and Nanjing. We plan to build an extensive sales and service network in China, as we expand our presence into the regions where China’s main lithium battery productions are located, such as Tianjin City, Shandong Province, Guangdong Province and Jiangsu Province.

We also engage in marketing activities such as attending industry-specific conferences and exhibitions to promote our products and brand name. We believe these activities are beneficial to promoting our products and brand name among key industry participants.

Suppliers

The primary raw materials used in the manufacture of lithium-ion batteries include electrode materials, cases and caps, foils, electrolyte and separators. The primary raw materials used in our materials business include cobaltous sulfates, manganese sulfates, lithium hydroxides, lithium carbonates and liquid nickel sulfates. The cost of these raw materials is a key factor in pricing our products. We source such raw materials from a number of suppliers across China. We are seeking to identify alternative raw material suppliers to the extent there are viable alternatives and to expand our use of alternative raw materials.

We aim to maintain multiple supply sources for each of our key raw materials to ensure that supply problems with any one supplier will not materially disrupt our operations. In addition, we constantly strive to develop strategic relationships with new suppliers to secure a stable supply of materials and introduce competition in our supply chain, thereby increasing our ability to negotiate better pricing and reducing our exposure to possible price fluctuations.

Intellectual Property

As of December 31, 2023, CBAK Power held 142 patents in the PRC, which will expire between 2024 to 2042. Among the 142 patents, two were acquired by BAK Asia, from an unrelated third party at RMB1 and were contributed as paid-in capital to CBAK Power. As of December 31, 2023, CBAK Energy held 8 patents in the PRC, all of which will expire between 2030 and 2040; Nanjing CBAK held 29 patents in the PRC, all of which will expire between 2031 and 2043; Nanjing BFD held 18 patents in the PRC, all of which will expire between 2028 and 2043; and Hitrans held 21 patents in the PRC, all of which will expire between 2028 and 2039.

8

We have registered the following Internet and WAP domain name: www.cbak.com.cn.

We also have unpatented proprietary technologies for our product offerings and key stages of the manufacturing process. Our management and key technical personnel have entered into agreements requiring them to keep confidential all information relating to our customers, methods, business and trade secrets during their terms of employment with us and thereafter and to assign to us their inventions, technologies and designs they develop during their term of employment with us.

We have institutionalized our efforts to safeguard our intellectual property rights by establishing an internal department that includes professionals such as attorneys, engineers, information managers and archives managers responsible for handling matters relating to our intellectual property rights. We have published internally a series of rules to protect our intellectual property rights.

While our intellectual property rights in the aggregate are important to our business operations, we do not believe that our business would be materially affected by the expiration of any particular intellectual property right.

Seasonality

Seasonality does not materially affect our business or operating results. As our battery cell and battery material products have a wide range of applications, we have not experienced significant seasonal fluctuations in market demands or sales recently. Market demands for our products generally slightly drop during the Chinese New Year holiday, a major national holiday in China.

Customers

Currently, major customers for our high power lithium batteries business include Viessmann Faulquemont S.A.S, Northvolt Battery System Poland Sp. z.o.o., Anker Innovations, Shenzhen ACE Battery Co., Ltd., PowerOAK, NSURE Energy, Hello Tech (Jackery) and JinPeng Group. We believe that our revenue and market share will increase as we gradually expand our high-power battery production to meet the growing demand for these batteries.

Geography of Sales

Our revenues are generated from both domestic and international customers, but the percentage contribution from each group varies significantly from year to year. The following table sets forth certain information relating to our total revenues by location of our customers for the last two fiscal years:

| Fiscal Years ended | ||||||||||||||||

| December 31, 2022 | December 31, 2023 | |||||||||||||||

| % of Net | % of Net | |||||||||||||||

| Amount | Revenues | Amount | Revenues | |||||||||||||

| (in thousands of U.S. dollars, except percentages) | ||||||||||||||||

| Mainland China | $ | 198,114,578 | 79 | $ | 119,307,085 | 58 | ||||||||||

| USA | 36,525 | - | 5,216 | - | ||||||||||||

| Europe | 50,378,076 | 20 | 78,575,290 | 38 | ||||||||||||

| Others | 196,306 | 1 | 6,550,774 | 4 | ||||||||||||

| Total | $ | 248,725,485 | 100 | $ | 204,438,365 | 100 | ||||||||||

9

Competition

We face intense competition from high-power lithium battery makers and raw materials manufacturers in China. The following table sets forth our major competitors in the battery market broken down by battery models as well as in the materials market, as of December 31, 2023:

| Product Type | Competitors | |||

| Model 26650/26700 | China: | Shandong Goldencell; EVPS; Power Long Battery | ||

| Model 32140 | China: | Gotion Hi-tech; EVE Battery | ||

| Cathode & Precursor | China: | Beijing Easpring; Ronbay Technology; Huayou Cobalt |

We believe that we are able to leverage our cutting-edge battery manufacturing techniques and R&D capabilities to compete favorably with our competitors. Compared to Chinese battery makers, we believe we have higher consistency and safety in product quality, which enables us to compete favorably with local competitors.

Research and Development

The development of advanced electric vehicles and new-type energy storage in China has created a significant demand for the R&D of next-generation advanced lithium, sodium and other type of batteries and their key materials, which must be characterized by high energy density, high security, long-lasting life, and low cost. Furthermore, the training of technical talent in this field is equally important.

We have an advanced R&D center in Dalian for research and development of lithium batteries, receiving almost all the R&D achievements, equipment and staff of BAK Tianjin. BAK Tianjin began its R&D manufacturing and distribution of high-power lithium battery and battery modules in December 2006, for use in electric cars, electric bicycles, residential energy supply & UPS, and other applications. We are setting up a larger R&D center as part of our Nanjing Project, and we anticipate that eventually our battery R&D department will be headquartered in Nanjing.