UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: September 30, 2016

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____________ to _____________

Commission File No. 001-32898

CHINA BAK BATTERY, INC.

(Exact Name of Registrant as Specified in Its Charter)

| Nevada | 88-0442833 |

| (State or Other Jurisdiction of Incorporation or | (I.R.S. Employer Identification No.) |

| Organization) |

BAK Industrial Park, Meigui Street

Huayuankou

Economic Zone

Dalian, China, 116450

(Address of

Principal Executive Offices)

(86)(411)-3918-5985

(Registrant’s

telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered |

| Common Stock, par value $0.001 per share | The NASDAQ Global Market |

Securities registered pursuant to Section 12(g) of the Exchange Act: None

Indicate by check mark if the registrant is a well-known

seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports

pursuant to Section 13 or Section 15(d) of the Act.

Yes [

] No [X]

Indicate by check mark whether the registrant (1) has filed all

reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the

registrant was required to file such reports), and (2) has been subject to such

filing requirements for the past 90 days.

Yes

[X] No [ ]

Indicate by check mark whether the registrant has submitted

electronically and posted on its corporate Web site, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation

S-T during the preceding 12 months (or for such shorter period that the

registrant was required to submit and post such files)

Yes

[X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer [ ] | Accelerated Filer [ ] |

| Non-Accelerated Filer [ ] (Do not check if a smaller reporting company) | Smaller reporting company [X] |

Indicate by check mark whether registrant is a shell company

(as defined in Rule 12b-2 of the Act)

Yes [

] No [X]

As of March 31, 2016 (the last business day of the registrant’s most recently completed second fiscal quarter), the aggregate market value of the shares of the registrant’s common stock held by non-affiliates (based upon the closing sale price of such shares as reported on The NASDAQ Global Market) was approximately $25.8 million. Shares of the registrant’s common stock held by each executive officer and director and by each person who owns 10% or more of the outstanding common stock have been excluded from the calculation in that such persons may be deemed to be affiliates of the registrant. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

There were a total of 19,600,469 shares of the registrant’s common stock outstanding as of January 9, 2017.

DOCUMENTS INCORPORATED BY REFERENCE

None.

|

| CHINA BAK BATTERY, INC. |

| Annual Report on Form 10-K |

TABLE OF CONTENTS

i

INTRODUCTORY NOTE

Use of Terms

Except as otherwise indicated by the context and for the purposes of this report only, references in this report to:

|

• |

“Company”, “we”, “us” and “our” are to the combined business of China BAK Battery, Inc., a Nevada corporation, and its consolidated subsidiaries; |

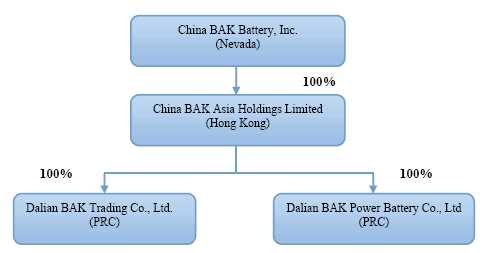

| • | “BAK Asia” are to our Hong Kong subsidiary, China BAK Asia Holdings Limited; |

| • | “Dalian BAK Trading” are to our PRC subsidiary, Dalian BAK Trading Co., Ltd.; |

| • | “Dalian BAK Power” are to our PRC subsidiary, Dalian BAK Power Battery Co., Ltd; |

| • | “China” and “PRC” are to the People’s Republic of China; |

| • | “RMB” are to Renminbi, the legal currency of China; |

| • | “U.S. dollar”, “$” and “US$” are to the legal currency of the United States; |

| • | “SEC” are to the United States Securities and Exchange Commission; |

| • | “Securities Act” are to the Securities Act of 1933, as amended; and |

| • | “Exchange Act” are to the Securities Exchange Act of 1934, as amended. |

Special Note Regarding Forward Looking Statements

Statements contained in this report include “forward-looking statements” within the meaning of such term in Section 27A of the Securities Act and Section 21E of the Exchange Act. Forward-looking statements involve known and unknown risks, uncertainties and other factors which could cause actual financial or operating results, performances or achievements expressed or implied by such forward-looking statements not to occur or be realized. Forward-looking statements made in this report generally are based on our best estimates of future results, performances or achievements, predicated upon current conditions and the most recent results of the companies involved and their respective industries. Forward-looking statements may be identified by the use of forward-looking terminology such as “may,” “will,” “could,” “should,” “project,” “expect,” “believe,” “estimate,” “anticipate,” “intend,” “continue,” “potential,” “opportunity” or similar terms, variations of those terms or the negative of those terms or other variations of those terms or comparable words or expressions. Potential risks and uncertainties include, among other things, such factors as:

| • | our ability to continue as a going concern; |

| • | our ability to remain listed on a national securities exchange; |

| • | our ability to timely complete the construction of our Dalian facilities and commence its full commercial operations; |

| • | our anticipated growth strategies and our ability to manage the expansion of our business operations effectively; |

| • | our future business development, results of operations and financial condition; |

| • | our ability to fund our operations and manage our substantial short-term indebtedness; |

| • | our ability to maintain or increase our market share in the competitive markets in which we do business; |

| • | our ability to keep up with rapidly changing technologies and evolving industry standards, including our ability to achieve technological advances; |

| • | our ability to diversify our product offerings and capture new market opportunities; |

| • | our ability to obtain original equipment manufacturer, or OEM, qualifications from brand names; |

| • | our ability to source our needs for skilled labor, machinery and raw materials economically; |

| • | uncertainties with respect to the PRC legal and regulatory environment; |

| • | other risks identified in this report and in our other reports filed with the SEC, including those identified in “Item 1A. Risk Factors” below. |

Readers are urged to carefully review and consider the various disclosures made by us in this report and our other filings with the SEC. These reports attempt to advise interested parties of the risks and factors that may affect our business, financial condition and results of operations and prospects. The forward-looking statements made in this report speak only as of the date hereof and we disclaim any obligation to provide updates, revisions or amendments to any forward-looking statements to reflect changes in our expectations or future events.

1

PART I

ITEM 1. BUSINESS.

Overview of Our Business

Our Dalian manufacturing facilities began its partial commercial operations in July 2015. We are now engaged in the business of developing, manufacturing and selling new energy high power lithium batteries, which are mainly used in the following applications:

- Electric vehicles (“EV”), such as electric cars, electric buses, hybrid electric cars and buses;

- Light electric vehicles (“LEV”), such as electric bicycles, electric motors, sight-seeing cars; and

- Electric tools, energy storage, uninterruptible power supply, and other high power applications.

We have received most of the operating assets, including customers, employees, patents and technologies of our former subsidiary, BAK International (Tianjin) Ltd. (“BAK Tianjin”). Such assets were acquired in exchange for a reduction in receivables from our former subsidiaries that were disposed in June 2014. We have outsourced and will continue to outsource our production to other manufacturers until our Dalian manufacturing facility can fulfill our customers’ needs. For the fiscal year ended September 30, 2016, Dalian BAK Power purchased batteries of approximately of $2.7 million from BAK Tianjin.

We generated revenues of $10.4 million and $13.9 million for the fiscal years ended September 30, 2016 and 2015, respectively. We had a net loss of $12.7 million in 2016 and a net profit of $15.9 million in 2015. As of September 30, 2016, we had an accumulated deficit of $139.8 million and net assets of $15.1 million. We had a working capital deficiency and accumulated deficit from recurring net losses and short-term debt obligations maturing in less than one year as of September 30, 2016.

On June 14, 2016, we renewed our banking facilities from Bank of Dandong for loans with a maximum amount of RMB130 million (approximately $19.5 million), including three-year long-term loans and three-year revolving bank acceptance and letters of credit bills for the period from June 13, 2016 to June 12, 2019. The banking facilities were guaranteed by Mr. Yunfei Li (“Mr. Li”), our CEO, and Ms. Qinghui Yuan, Mr. Li’s wife, Mr. Xianqian Li, our former CEO, Ms. Xiaoqiu Yu, the wife of our former CEO, Shenzhen BAK Battery Co., Ltd., our former subsidiary (“Shenzhen BAK”). The facilities were also secured by part of our Dalian site’s prepaid land use rights, buildings, construction in progress, machinery and equipment and pledged deposits. Under the banking facilities, from June to September 2016, we borrowed various three-year term bank loans that totaled RMB126.8 million (approximately $19.0 million), bearing fixed interest at 7.2% per annum. We also borrowed a series of revolving bank acceptance totaled $0.6 million from Bank of Dandong under the credit facilities, and bank deposit of 50% was required to secure against these bank acceptance bills.

On July 6, 2016, we obtained banking facilities from Bank of Dalian for loans with a maximum amount of RMB10 million (approximately $1.5 million) and bank acceptance bills of RMB40 million (approximately $6.0 million) to July 2017. The banking facilities were guaranteed by Mr. Li, our CEO, and Ms. Qinghui Yuan, Mr. Li’s wife, and Shenzhen BAK. Under the banking facilities, on July 6, 2016 we borrowed one year short-term loan of RMB10 million (approximately $1.5 million), bearing a fixed interest rate at 6.525% per annum. We also borrowed revolving bank acceptance totaled $6.0 million, and bank deposit of 50% was required to secure against these bank acceptance bills.

In June 2016, we received advances in the aggregate of $2.9 million from Mr. Jiping Zhou and Mr. Dawei Li. These advances were unsecured, non-interest bearing and repayable on demand. On July 8, 2016, we received further advances of $2.6 million from Mr. Jiping Zhou. On July 28, 2016, to convert these advances into equity interests in our Company, we entered into securities purchase agreements with Mr. Jiping Zhou and Mr. Dawei Li to issue and sell an aggregate of 2,206,640 shares of our common stock, at $2.5 per share, for an aggregate consideration of approximately $5.52 million. On August 17, 2016, we issued these shares to the investors.

In the meanwhile, due to the growing environmental pollution problem, the Chinese government is currently providing vigorous support to the new energy facilities and vehicles. It is expected that we will be able to secure more potential orders from the new energy market, especially from the electric car market. We believe with that the booming market demand in high power lithium ion products, we can continue as a going concern and return to profitability.

2

To promote the development of new energy electric vehicles, in April 2015, the central government of China issued Notice of Financial Support Policies for the Promotion of New Energy Vehicles in 2016-2020, which regulated favorable government subsidies for the new energy electric vehicles for years from 2016 to 2020. It led to the explosive growth in the production and selling of new electric vehicles in 2015. However, in January 2016, as it was reported that there were widespread frauds involved in obtaining government subsidies, the central government launched investigations among the electric vehicles industry. Before the completion of the investigation, the subsidies for 2015 were ceased to be granted to the manufacturers of electric vehicles, and it was said that the subsidies policy for 2016 to 2020 would be revised accordingly. Due to the continued investigation and unclear government policies, almost all the new energy electric vehicle manufacturers suspended or decreased the production and selling of electric vehicles in 2016. Accordingly, the production and selling of power batteries for use in electric vehicles dramatically decreased in 2016. In November 2016 the central government announced the result of investigation, including the list of manufacturers of electric vehicles who committed alleged frauds and the related penalties. On December 29, 2016, the Ministry of Finance of China finally issued the revised subsidy policy named Notice of Revision to Financial Support Policies for the Promotion of New Energy Vehicles in 2016-2020, which revised the subsidies standard to be based on cost and technology of the power batteries, and set up the maximum amount of the subsidies from the central and local governments. The revised subsidy policy also raised the standard and threshold for the quality of electric vehicles and power batteries, confirmed the responsibility of the manufacturers of electric vehicles, and strengthened the penalty system.

In March 2015, the Ministry of Industry and Information Technology of China (the “MIIT”) issued the Requirements of the Industry Standards for the Auto Power Storage Batteries ("Requirements"), which are applicable to auto power battery manufacturers located in China. In order to be certified as qualified manufacturers under Requirements, manufacturers are required to be examined by quality inspecting agencies appointed by Administration of Quality Inspection under Requirements after the manufacturers have obtained the following reports and certificates:

1. Environmental Acceptance Report;

2. Fire Acceptance

Report;

3. New National Standard Certificate of Power Battery: GB/T

31484-2015, GB/T 31485-2015 and GB/T 31486-2015;

4. OHSAS 18001 Occupational

Health and Safety Management System;

5. ISO14001 Environmental Management

System; and

6. Occupational Health Report Occupational Health Report.

We have obtained all the above listed required reports and certificates. While we believe that we meet all of the conditions listed under the Requirements, there is no assurance that the certification will be granted to us by the MIIT. During the transition period in 2015 and the beginning of 2016, electric automobile manufacturers were able to obtain subsidies from the governments even though their power battery suppliers were not as qualified manufacturers under the Requirements. Subsequent to that period and prior to obtaining the certification from the MIIT, we have been cooperating with Shenzhen BAK, our former subsidiary, or other qualified companies under the Requirements, by selling our key materials to those battery manufacturers for them to manufacture, pack, test and use their own process produce and sell end products in compliance with the Requirements to electric automobile manufacturers. From September 2016, the MIIT ceased to certify auto power battery manufacturers under the Requirements. Also it is reported that the compliance with Requirements will not be deemed as a precondition for qualified manufacturers of power batteries for use in electric vehicles. In the newly issued Notice of Revision to Financial Support Policies for the Promotion of New Energy Vehicles in 2016-2020, compliance with the Requirements was not listed as a precondition for qualified manufacturers of power batteries to be used in electric vehicles to obtain government subsidies.

Our Corporate History and Structure

We conduct our current business through the following two wholly-owned operating subsidiaries in China that we own through BAK Asia:

| • |

Dalian BAK Trading, located in Dalian, China, incorporated on August 14, 2013, which focuses on the wholesale of lithium batteries and lithium batteries’ materials, import & export business and related technology consulting service; and |

| • |

Dalian BAK Power, located in Dalian, China, incorporated on December 27, 2013, which focuses on the development and manufacture of high-power lithium batteries. |

Almost all of our business operations are conducted primarily through our Chinese subsidiaries. The chart below presents our current corporate structure:

3

Our Products

The use of new materials have enabled the configuration of high-power lithium battery cells to contain much higher energy density and higher voltage and have a longer life cycle and shorter charge time than other types of lithium-based batteries. These special attributes, coupled with intrinsic safety features, are suitable for batteries used for high-power applications, such as electric cars, electric bicycles, electric tools, energy storage and uninterruptible power supply, or UPS.

We believe high power lithium batteries represent the main direction of the development of new energy vehicle technologies according to the “12th Five-Year Plan” published by the Chinese government.

Our Dalian manufacturing facilities focus on the development and manufacture of high power lithium batteries, for use in the following end applications:

| Battery Cell Type | End applications* | |

| High-power lithium battery | Electric bus [6,000-20,000] | |

| Electric car [1,500-3,5000] | ||

| Hybrid electric vehicle [500-2000] | ||

| Light electric vehicle [10-150] | ||

| Cordless power tool [10-30] | ||

| Uninterruptible power supply [30-300] | ||

| Energy Storage [>300 ] |

* Bracketed numbers denote number of cells per particular battery.

Key High Power Lithium Battery Applications

End-product applications that are driving the demand for high power lithium batteries include electric vehicles, such as electric cars, electric buses, hybrid electric cars and buses; light electric vehicles, such as electric bicycles, electric motors, sight-seeing cars; and electric tools, energy storage, uninterruptible power supply, and other high power applications.

Electric Vehicles

An electric vehicle, sometimes referred to as an electric drive vehicle, uses one or more electric motors for propulsion. Electric vehicles include electric cars, electric buses, electric trains, electric lorries, electric airplanes, electric boats, and hybrid electric vehicles, plug in hybrid electric vehicles and electric spacecraft. Electric cars and electric buses are propelled by one or more electric motors powered by rechargeable battery packs. Electric cars and buses have the potential to significantly reduce city pollution by having zero tail pipe emissions. Electric cars and buses are also expected to have less dependence on oil. World governments are pledging significant funds to fund the development of electric vehicles and their components due in part to these advantages. Due to these factors and a lithium battery’s relatively environmentally-friendly, light-weight and high-capacity features, the demand for lithium batteries in the field of electric cars and buses is increasing.

4

Due to such recent trends as renewed concerns relating to the availability and price of oil, increased legal fuel-efficiency requirements and incentives, and heightened interest in environmentally-friendly or “green” technologies, hybrid electric vehicles are likely to continue to attract substantial interest from vehicle manufacturers and consumers. Hybrid electric vehicles include automobiles, trucks, buses, and other vehicles that combine a conventional propulsion system with a rechargeable energy storage system to achieve better fuel economy than conventional vehicles. As these vehicles tend to be large and heavy, their rechargeable energy storage system generally consists of a large quantity of rechargeable high-power lithium cells.

The year 2014 was seen as the first real year for the development of China's new energy vehicle industry by many industry insiders. After explosive growth in 2015, the production and sales of new energy vehicles continued to grow tremendously in 2016. According to China Association of Automobile Manufacturers, from January to October 2016, the production of new energy vehicles in China reached 355,000 units - up 77.9 percent year-on-year; and sales in China reached 337,000 units - up 82.2 percent year-on-year. As the core mechanism for new energy vehicles, the power battery industry has also recently welcomed an unprecedented growth. According to the Development Program for the Energy Efficient and New Energy Vehicle Industry 2012-2020 designed by the State Council of the PRC, some major objectives are: to enthusiastically advance innovation in power battery technologies; scientifically plan the industrial layout; focus on developing power battery industry clusters; and actively promote the mass production of power batteries. With the recent introduction of a number of supporting policies, the production of power batteries for vehicles has grown remarkably.

Light Electric Vehicles

Light electric vehicles include bicycles, scooters, and motorcycles, with rechargeable electric motors. Due to their relatively small size and light design, approximately 10-150 high-power lithium cells can be used to power light electric vehicles. The electric bicycle market in China is huge. According to MIIT, from January to September 2016, the production of electric bicycles in China was 22.6 million units, up 4.6% year-on-year.

Energy Storage

Energy storage mainly means storage of electric energy by battery, inductor, and capacitor. Battery energy storage is mainly used for storage of emergency supply, battery car, and redundant energy of power plants.

Electric Tools

Electric tools such as drills, saws and grinders are used for both commercial and personal use. Due to high power requirements, many electric tools have historically used small combustion engines, used heavier nickel metal hydride batteries or relied on external power sources. Manufacturers of electric tools, such as Milwaukee Electric Tool Corporation, Stanley Black & Decker, Inc., the Bosch Group, Metabowerke GmbH and Rigid Tool Company have begun to use lithium-ion technology. The market for portable high-powered electric tools is rapidly growing and has prompted many users, both commercial and personal, to replace or upgrade their current power tools.

Uninterruptible Power Supplies

A UPS provides emergency power from a separate source when utility power is not available. The most common type of battery used in UPS is Sealed Lead-Acid, however, due to the lithium battery’s relatively small size, light design and environmentally-friendly features, the demand for lithium batteries in this industry is increasing.

Revenue by Products

Before June 30, 2014, we derived our revenues from BAK International and its subsidiaries which produced prismatic cells, cylindrical cells, lithium polymer cells and high-power lithium batteries. Since July 1, 2014, our revenue has been mainly from Dalian BAK Power for sale of batteries manufactured by BAK Tianjin under outsourcing arrangements. Starting from October 2015, we generated revenues from high-power lithium battery cells manufactured by Dalian BAK Power as well as batteries outsourced from BAK Tianjin and other manufacturers. The following table sets forth the breakdown of our net revenues by product types:

5

| Year Ended September 30, | ||||||||||||

| 2015 | 2016 | |||||||||||

| % of Net | % of Net | |||||||||||

| Amount | Revenues | Amount | Revenues | |||||||||

| (in thousands of U.S. dollars, except percentages) | ||||||||||||

| High-power lithium batteries used in: | ||||||||||||

| Electric vehicles | $ | - | - | $ | 6,488 | 62.57 | ||||||

| Light electric vehicles | - | - | 553 | 5.33 | ||||||||

| Uninterruptable supplies | 13,904 | 100.00 | 3,328 | 32.10 | ||||||||

| Total | $ | 13,904 | 100.00 | $ | 10,369 | 100.00 | ||||||

Sales and Marketing

We plan to build an extensive sales and service network in China, highlighted by our presence in the regions where China’s main EV and LEV productions is located, such as Beijing, Shandong Province, Guangdong Province, Sichuan Province and three provinces in Northeast China. We intend to gradually establish post-sales service offices in these areas to serve brand owners and pack manufacturers in each designated area as currently our marketing department at headquarters is responsible for our promoting efforts. In doing so, our sales staff works closely with our customers to understand their needs and provide feedback to us so that we can better address their needs and improve the quality and features of our products.

We also engage in marketing activities such as attending industry-specific conferences and exhibitions to promote our products and brand name. We believe these activities are conducive in promoting our products and brand name among key industry participants.

Suppliers

The primary raw materials used in the manufacture of lithium-ion batteries include electrode materials, cases and caps, foils, electrolyte and separators. Cost of these raw materials is a key factor in pricing our products. We believe that there is an ample supply of most of the raw materials we need in China. We are seeking to identify alternative raw material suppliers to the extent there are viable alternatives and to expand our use of alternative raw materials.

We aim to maintain multiple supply sources for each of our key raw materials to ensure that supply problems with any one supplier will not materially disrupt our operations. In addition, we strive to develop strategic relationships with new suppliers to secure a stable supply of materials and introduce competition in our supply chain, thereby increasing our ability to negotiate better pricing and reducing our exposure to possible price fluctuations.

For the fiscal year ended September 30, 2016, our key raw material suppliers were as follows:

| Materials | Main Suppliers | |

| NCM | Shenzhen Tianjiao Technology, Co., Ltd. | |

| Cathode materials | Huzhou Chuangya Power Battery Material Co., Ltd | |

| Anode materials | Chang’s Ascending Enterprise Co., Ltd. | |

| BMS | Shenzhen Klclear Technology Co., Ltd. | |

| Solvent NMP | MYJ Chemical Co., Ltd. | |

| Electrolyte | Dongguan Shanshan Battery Material Co., Ltd | |

| Aluminum foil | Shanghai Huxin Aluminum Foil Products Co., Ltd | |

| Cases and caps | Changzhou Wujinzhongrui Electric Co., Ltd | |

| Copper sheet | Dalian Desen Metal Products Co.,Ltd | |

| Copper foil | Lingbao Wason Copper Foil Co., Ltd | |

| NCM | Shenzhen Tianjiao Technology, Co., Ltd. | |

| Cathode materials | Huzhou Chuangya Power Battery Material Co., Ltd |

We source our manufacturing equipment both locally and from overseas, based on consideration of their cost and function. Our key equipment as of September 30, 2016 was purchased from the following suppliers:

6

| Instruments | Main Suppliers | |

| Winder | Kaido Manufacturing Co., Ltd. | |

| Charge and Discharge Equipment | Zhejiang Hangke Technologies Co., Ltd | |

| Electrode Preparing Machine | Zhuhai Higrand Electronic Technology Inc. | |

| Laser welding machine | United Winners Laser Co., Ltd. | |

| Infusing Machine | Kinlo Technology & System (Shenzhen) Co. Ltd. | |

| Coating Machine | Shenzhen Haoneng Technology Co., Ltd. | |

| Automatic Line Machine | Shenzhen Zhongji Automation Co., Ltd. | |

| Vacuum Oven | Wujiang Jiangling Equipment Co., Ltd | |

| Dehumidifier | Hangzhou Dry Air Treatment Equipment Co., Ltd. |

Intellectual Property

On August 25, 2014, we entered into an intellectual property rights use agreement with Shenzhen BAK, pursuant to which we are authorized to use Shenzhen BAK’s registered logo, trademarks and patents obtained as of June 30, 2014 for a period of 5 years for free from June 30, 2014. As of June 30, 2014, Shenzhen BAK had registered 80 trademarks in the PRC, including BAK in both English and in Chinese characters as well as its logo, and had registered 49 trademarks in the United States, European Union, Korea, Russia, Taiwan, India, Canada and Hong Kong. As of June 30, 2014, Shenzhen BAK had registered 522 patents in the PRC and other countries relating to battery cell materials, design and manufacturing processes. We have registered the following Internet and WAP domain name: www.cbak.com.cn.

As of September 30, 2016, Dalian BAK Power has 20 patents including 18 utility model patents and 2 patents for invention in the PRC. 17 of these patents were acquired by BAK Asia, from an unrelated third party at RMB1 and were contributed as paid up capital of Dalian BAK Power.

We also have unpatented proprietary technologies for our product offerings and key stages of the manufacturing process. Our management and key technical personnel have entered into agreements requiring them to keep confidential all information relating to our customers, methods, business and trade secrets during their terms of employment with us and thereafter and to assign to us their inventions, technologies and designs they develop during their term of employment with us.

We have institutionalized our efforts to safeguard our intellectual property rights by establishing an internal department that includes professionals such as attorneys, engineers, information managers and archives managers responsible for handling matters relating to our intellectual property rights. We have published internally a series of rules to protect our intellectual property rights.

Seasonality

According to the market demands, we usually experience seasonal peaks during the months of October to March for electric vehicle markets, and during the months of May to October for light electric markets. Also, at various times during the year, our inventories may be increased in anticipation of increased demand for consumer electronics. The period from the end of September to February tends to be seasonally low sales months due to plant closures for National Day holiday and the Chinese New Year in the PRC.

Customers

We have many well-known customers, including electric vehicle manufacturers, such as Pingxiang Anyuan Tourist Bus Co., Ltd., Ltd, Shandong Tangjun Electric Co., Ltd, Chery Automobile Co. Ltd., FAW Bus and Coach Co., Ltd., Dongfeng Special Automobile Co., Ltd., Dongfeng Xiangyang Touring Car Co., Ltd.; and electric bicycle manufacturers, such as Taiwan Taibag Co., Ltd, Tianjin FSD Bicycles Co., Ltd, , Shenzhen Xidesheng Bicycle Co., Ltd., and Gamma Bicycle Co., Ltd, and battery pack manufacturers, such as Guangdong Pisen Electronics Co., Ltd., Sichuan Pisen Electric Co., Ltd, Shenzhen Max Technology Co., Ltd, Dongguan Large Electronics Co., Ltd, and manufacturers in UPS and other applications, such as Yangzhou Fengwei New Energy Technology Co., Ltd., Emerald Battery Technologies Co., Ltd., Robotics Technology Ltd. We believe that we will continue to increase our revenue and market share as we gradually increase our high-power batteries production as the demand for these batteries has been increasing.

7

Geography of Sales

Before June 30, 2014, we sold our products domestically and internationally. Thereafter, we sell high-power lithium battery primarily to customers in China. The following table sets forth certain information relating to our total revenues by location of our customers for the last two fiscal years.

| Year Ended September 30, | ||||||||||||

| 2015 | 2016 | |||||||||||

| % of Net | % of Net | |||||||||||

| Amount | Revenues | Amount | Revenues | |||||||||

| (in thousands of U.S. dollars, except percentages) | ||||||||||||

| Mainland China | $ | 13,904 | 100.00 | $ | 9,017 | 86.96 | ||||||

| Europe | - | - | 457 | 4.41 | ||||||||

| PRC Taiwan | - | - | 413 | 3.98 | ||||||||

| Korea | - | - | 258 | 2.49 | ||||||||

| Israel | - | - | 224 | 2.16 | ||||||||

| Total | $ | 13,904 | 100.00 | $ | 10,369 | 100.00 | ||||||

Competition

We face intense competition from high-power lithium battery makers in China, as well as in Korea and Japan for each of our product types. The following table sets forth our major competitors for the EV market and LEV market as of September 30, 2016:

| Product Type | Competitors | ||

| EV battery | Japan: | Panasonic Corporation | |

| Korea: |

Samsung Electronics Co., Ltd.

LG Chemical | ||

| China:

|

Tianjin Lishen

Battery Joint-stock Co., Ltd Contemporary Amperex Technology Co., Limited BYD Co. Ltd Hefei Guoxuan Hi-Tech Power Energy Co., Ltd Amperex Technology Limited | ||

| LEV battery |

China: |

Tianneng Power International

Limited Chaowei Power Holdings Limited Phylion Battery Co., Ltd |

We believe that we are able to leverage our low-cost advantage to compete favorably with our competitors. Compared to Korean and Japanese battery makers, we are able to source our needs for skilled labor and raw materials locally and economically. Compared to Chinese battery makers, we believe we have higher consistency and safety in product quality, which enables us to compete favorably with local competitors.

Research and Development

The R&D of next-generation advanced lithium battery and its key materials – characterized by high energy density, high security, long-lasting life, and low cost – as well as the training of related technical talents, have become a major demand in the development of advanced electric vehicles in China. We have reached strategic cooperation agreements with Dalian Institute of Chemical Physics of Chinese Academy of Sciences ("DICP"), Dalian University of Technology, Dalian Maritime University and Dalian Jiaotong University. Under the agreements, these institutions and us will jointly research and develop the next-generation key technologies and materials with an aim to produce the most powerful battery worldwide.

We have an advanced R&D center in Dalian, receiving almost all the R&D achievements, R&D equipment and staff of BAK Tianjin. BAK Tianjin began its R&D manufacturing and distribution of high-power lithium battery and battery modules in December 2006, for use in electric cars, electric bicycles, UPS, and other applications.

During the fiscal years ended September 30, 2015 and 2016, our expenditures for research and development activities were $1.0 million and $1.9 million, respectively, or 7.2% and 18.1% of net revenues, respectively.

8

Environmental Compliance

As we conduct our manufacturing activities in China, we are subject to the requirements of PRC environmental laws and regulations on air emission, waste water discharge, solid waste and noise. The major environmental regulations applicable to us include the PRC Environmental Protection Law, the PRC Law on the Prevention and Control of Water Pollution and its Implementation Rules, the PRC Law on the Prevention and Control of Air Pollution and its Implementation Rules, the PRC Law on the Prevention and Control of Solid Waste Pollution, and the PRC Law on the Prevention and Control of Noise Pollution. We aim to comply with environmental laws and regulations. We have built environmental treatment facilities concurrently with the construction of our manufacturing facilities, where waste air, waste water and waste solids we generate can be treated in accordance with the relevant requirements. We outsource our disposal of solid waste we generate in the Dalian facility to a third party contractor. Certain key materials used in manufacturing, such as cobalt dioxide, electrolyte and separators, have proven innocuous to worker’s health and safety as well as the environment. We are not subject to any admonitions, penalties, investigations or inquiries imposed by the environmental regulators, nor are we subject to any claims or legal proceedings to which we are named as a defendant for violation of any environmental law or regulation. We do not have any reasonable basis to believe that there is any threatened claim, action or legal proceedings against us that would have a material adverse effect on our business, financial condition or results of operations.

Employees

We had a total of approximately 631 employees as of September 30, 2016. The following table sets forth the number of our employees by function.

| Function | Number | |||||

| Production | 357 | |||||

| Research and development | 93 | |||||

| Sales and marketing | 14 | |||||

| General and administrative | 167 | |||||

| Total | 631 |

Our employees are not represented by a labor organization or covered by a collective bargaining agreement. We have not experienced any work stoppages. We believe we maintain good relations with our employees.

ITEM 1A. RISK FACTORS.

RISKS RELATED TO OUR BUSINESS

Our failure to timely complete the construction of our Dalian facility and commence its full commercial operations could negatively affect our business operations.

We are currently constructing our Dalian facility and we have relocated most of the operating assets, including machinery and equipment, as well as the customers, employees, patents and technologies from BAK Tianjin to the Dalian facility. We have completed the construction of two plants of the Dalian facility and their commercial operation began in July 2015. We are currently constructing two more plants and have completed their civil work and the product lines are expected to be completed by June 2017, but we cannot give assurance that the construction will be completed as scheduled or, without cost overrun. Even if the construction is completed on a timely basis, we cannot give assurance that the full commercial operation can begin as we expected. In addition, we may not be able to attract a sufficient number of skilled workers to meet the needs of the new facility. If we experience delays in construction or commencement of the full commercial operations, increased costs or lack of skilled labor, or other unforeseen events occur, our business, financial condition and results of operations could be adversely impacted. Operating results could also be unfavorably impacted by start-up costs until production at the new facility reaches planned levels.

Our independent registered auditors have expressed substantial doubt about our ability to continue as a going concern.

Our independent auditors have added an explanatory paragraph to their audit opinion issued in connection with our financial statements included in this report which states that the financial statements were prepared assuming that we would continue as a going concern. As discussed in Note 1 to the consolidated financial statements included with this report, we had a working capital deficiency, accumulated deficit from recurring losses and short-term debt obligations as of September 30, 2016. These conditions raise substantial doubt about our ability to continue as a going concern. As disclosed under Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Recent Development” and Note 1 to the consolidated financial statements, our Dalian manufacturing facilities began partial commercial operations in July 2015 which focus on production and sale of the new energy high power batteries for use in electric vehicles, light electric vehicles and other high power applications. In June and July 2016, we obtained advances with an aggregate amount of $5.5 million from potential investors and converted these loans to common stock in August 2016. On June 14, 2016, we renewed our banking facilities from Bank of Dandong to provide loans and bank acceptances up to a total amount of $19.5 million with a term expiring on June 12, 2019. On July 6, 2016, we obtained banking facilities from Bank of Dalian to provide loans and bank acceptances up to a total amount of $7.5 million with a term expiring in July 2017. As of September 30, 2016, we had unutilized committed banking facilities of $0.2 million. We plan to renew our bank borrowings upon maturity and raise additional funds through bank borrowings and equity financing in the future to meet our daily cash demands. However, there can be no assurance that we will be successful in obtaining the financing. The consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty.

9

We rely on a few battery suppliers to fulfill our customers’ orders. If we fail to effectively manage our relationships with, or lose the services of these suppliers and we cannot substitute suitable alternative suppliers, our operations would be materially adversely affected.

Before the production at our Dalian facility can completely fulfill our customers’ orders, we expect to continue to generate part of our revenues by outsourcing our customers’ orders to BAK Tianjin and a few other suppliers. If our business relationship with BAK Tianjin and other suppliers changes negatively or their financial condition deteriorates, or their operating environment changes, our business may be harmed in many ways. BAK Tianjin and other suppliers may unilaterally terminate battery supply to us or increase the prices. As a result, we are not assured of an uninterrupted supply of high power lithium batteries of acceptable quality or at acceptable prices from BAK Tianjin and other suppliers. We may not be able to substitute suitable alternative contract manufacturers in a timely manner on commercially acceptable term or at all. We may be forced to default on the agreements with our customers. This may negatively impact our revenues and adversely affect our reputation and relationships with our customers, causing a material adverse effect on our financial condition, results of operations and prospects.

Our business depends on the growth in demand for electric vehicles, light electric vehicles, electric tools, energy storage, UPS, and other high-power electric devices.

As the demand for our products is directly related to the market demand for high-power electric devices, a fast growing high-power electric devices market will be critical to the success of our business. In anticipation of an expected increase in the demand for high-power electric devices such as electric vehicles, light electric vehicles, electric tools, energy storage and UPS in the next few years, we have built our Dalian manufacturing facilities. However, the markets we have targeted, primarily those in the PRC, may not achieve the level of growth we expect. If this market fails to achieve our expected level of growth, we may have excess production capacity and may not be able to generate enough revenue to obtain our profitability.

If we cannot continue to develop new products in a timely manner, and at favorable margins, we may not be able to compete effectively.

The battery industry has been notable for the pace of innovations in product life, product design and applied technology. We and our competitors have made, and continue to make, investments in research and development with the goal of further innovation. The successful development and introduction of new products and line extensions face the uncertainty of customer acceptance and reaction from competitors, as well as the possibility of cannibalization of sales of our existing products. In addition, our ability to create new products and line extensions and to sustain existing products is affected by whether we can:

| • | develop and fund research and technological innovations; |

| • | receive and maintain necessary intellectual property protections; |

| • | obtain governmental approvals and registrations; |

| • | comply with governmental regulations; and |

| • | anticipate customer needs and preferences successfully. |

10

The failure to develop and launch successful new products could hinder the growth of our business and any delay in the development or launch of a new product could also compromise our competitive position. If competitors introduce new or enhanced products that significantly outperform ours, or if they develop or apply manufacturing technology which permits them to manufacture at a significantly lower cost relative to ours, we may be unable to compete successfully in the market segments affected by these changes.

Our efforts to develop products for new commercial applications could fail.

Although we are involved with developing certain products for new commercial applications, we cannot provide assurance that acceptance of our products will occur due to the highly competitive nature of the business. There are many new product and technology entrants into the marketplace, and we must continually reassess the market segments in which our products can be successful and seek to engage customers in these segments that will adopt our products for use in their products. In addition, these companies must be successful with their products in their markets for us to gain increased business. Increased competition, failure to gain customer acceptance of products, the introduction of competitive technologies or failure of our customers in their markets could have a further adverse effect on our business.

Our future success depends on the success of manufacturers of the end applications that use our products.

As we expand to the battery markets for global electric vehicles, light electric vehicles, electric tools, energy storage, UPS and other high-power electric devices, our future success depends on whether end-application manufacturers are willing to use batteries that incorporate our products. To secure acceptance of our products, we must constantly develop and introduce more reliable and cost-effective battery cells with enhanced functionality to meet evolving industry standards. Our failure to gain acceptance of our products from these manufacturers could materially and adversely affect our future success.

Even if a manufacturer decides to use batteries that incorporate our products, the manufacturer may not be able to market and sell its products successfully. The manufacturer’s inability to market and sell its products successfully, whether from lack of market acceptance or otherwise, could materially and adversely affect our business and prospects because this manufacturer may not order new products from us. If we cannot achieve the expected level of sales, we will not be able to make sufficient profits to offset the expenditures we have incurred to expand our production capacity, nor will we be able to grow our business. Accordingly, our business, financial condition, results of operations and future success would be materially and adversely affected.

Our failure to keep up with rapid technological changes and evolving industry standards may cause our products to become obsolete and less marketable, resulting in loss of market share to our competitors.

The lithium-based battery market is characterized by changing technologies and evolving industry standards, which are difficult to predict. This, coupled with frequent introduction of new products and models, has shortened product life cycles and may render our products obsolete or unmarketable. Our ability to adapt to evolving industry standards and anticipate future standards will be a significant factor in maintaining and improving our competitive position and our prospects for growth. To achieve this goal, we have invested and plan to continue investing significant financial resources in our R&D infrastructure. R&D activities, however, are inherently uncertain, and we might encounter practical difficulties in commercializing our research results. Accordingly, our significant investment in our R&D infrastructure may not bear fruit. On the other hand, our competitors may improve their technologies or even achieve technological breakthroughs that would render our products obsolete or less marketable. Therefore, our failure to effectively keep up with rapid technological changes and evolving industry standards by introducing new and enhanced products may cause us to lose our market share and to suffer a decrease in our revenue.

A change in our product mix may cause our results of operations to differ substantially from the anticipated results in any particular period.

Our overall profitability may not meet expectations if our products, customers or geographic mix are substantially different than anticipated. Our profit margins vary among products, customers and geographic markets. Consequently, if our mix of any of these is substantially different from what is anticipated in any particular period, our profitability could be lower than anticipated.

11

We may be subject to declining average selling prices, which may harm our revenue and gross profits.

Consumer electronics such as electric vehicles, light electric vehicles, electric tools, energy storage, UPS are subject to declines in average selling prices due to rapidly evolving technologies, industry standards and consumer preferences. As a result, manufacturers of these electronic devices expect us as suppliers to cut our costs and lower the price of our products in order to mitigate the negative impact on their own margins. We have reduced the price of some of our electric bike batteries in the past in order to meet market demand and expect to continue to face market-driven downward pricing pressures in the future. Our revenue and profitability will suffer if we are unable to offset any declines in our average selling prices by developing new or enhanced products with higher selling prices or gross profit margins, increasing our sales volumes or reducing our costs on a timely basis.

We may face impairment charges if economic environments in which our businesses operate and key economic and business assumptions substantially change.

Assessment of the potential impairment of property, plant and equipment and other identifiable intangible assets is an integral part of our normal ongoing review of operations. Testing for potential impairment of long-lived assets is dependent on numerous assumptions and reflects our best estimates at a particular point in time, which may vary from testing date to testing date. The economic environments in which our businesses operate and key economic and business assumptions with respect to projected product selling prices and materials costs, market growth and inflation rates, can significantly affect the outcome of impairment tests. Estimates based on these assumptions may differ significantly from actual results. Changes in factors and assumptions used in assessing potential impairments can have a significant impact on both the existence and magnitude of impairments, as well as the time at which such impairments are recognized. Future changes in the economic environment and the economic outlook for the assets being evaluated could also result in impairment charges. Any significant asset impairments would adversely impact our financial results.

We experience fluctuations in quarterly and annual operating results.

Our quarterly and annual operating results have fluctuated in the past and likely will fluctuate in the future. The demand for our products is driven largely by the demand for the end-product applications that are powered by our products. Accordingly, the rechargeable battery industry is affected by market conditions that are often outside our control. Our results of operations may fluctuate significantly from period to period due to a number of factors, including seasonal variations in consumer demand for batteries and their end applications, capacity ramp up by competitors, industry-wide technological changes, the loss of a key customer and the postponement, rescheduling or cancellation of large orders by a key customer. As a result of these factors and other risks discussed in this section, period-to-period comparisons should not be relied upon to predict our future performance.

We may not be able to substantially increase our manufacturing output in order to maintain our cost competitiveness.

We believe that our ability to provide cost-effective products is one of the most significant factors that contributed to our past success and will be essential for our future growth. We believe this is one of our competitive advantages over our Japanese and Korean competitors. We need to increase our manufacturing output to a level that will enable us to substantially reduce the cost of our products on a per unit basis through economies of scale. However, our ability to substantially increase our manufacturing output is subject to significant constraints and uncertainties, including:

- the need to raise significant additional funds to purchase and prepay raw materials or to build additional manufacturing facilities, which we may be unable to obtain on reasonable terms or at all;

- delays and cost overruns as a result of a number of factors, many of which may be beyond our control, such as increases in raw material prices and problems with equipment vendors;

- delays or denial of required approvals by relevant government authorities;

- diversion of significant management attention and other resources; and

- failure to execute our expansion plan effectively.

If we are unable to increase our manufacturing output because of any of the risks described above, we may be unable to maintain our competitive position or achieve the growth we expect. Moreover, even if we expand our manufacturing output, we may not be able to generate sufficient customer demand for our products to support our increased production output.

12

Maintaining our manufacturing operations will require significant capital expenditures, and our inability or failure to maintain our operations would have a material adverse impact on our market share and ability to generate revenue.

We had capital expenditures of approximately $12.9 million and $5.9 million in fiscal years 2015 and 2016, respectively. We may incur significant additional capital expenditures as a result of unanticipated expenses, regulatory changes and other events that impact our business. If we are unable or fail to adequately maintain our manufacturing capacity or quality control processes, we could lose customers and there could be a material adverse impact on our market share and our ability to generate revenue.

We may incur significant costs because of the warranties we supply with our products and services.

With respect to the sale of our battery products from fiscal 2016, we typically offer warranties against any defects due to product malfunction or workmanship for a period of six months-to-five years from the date of purchase, including a period of six to twelve months for battery cells, and a period of twelve to twenty seven months for battery modules for electric bicycles, and a period of three years to five years for battery modules for electric vehicles. We will provide a reserve for these potential warranty expenses, which is based on an analysis of historical warranty issues. There is no assurance that future warranty claims will be consistent with past history, and in the event we experience a significant increase in warranty claims, there is no assurance that our reserves will be sufficient. This could have a material adverse effect on our business, financial condition and results of operations.

We do not have insurance coverage against damages or losses of our products. Defects in our products could result in a loss of customers and decrease in revenue, unexpected expenses and a loss of market share.

We have not purchased product liability insurance to provide against any claims against us based on our product quality. We expect that we will purchase product liability insurance in fiscal year 2017. If we fail to purchase product liability insurance, defects in our products could result in a loss of customers and decrease in revenue, unexpected expenses and a loss of market share, and any of our products are found to have reliability, quality or compatibility problems, we will be required to accept returns, provide replacements, provide refunds, or pay damages. As the insurance policy imposes a ceiling for maximum coverage and high deductibles, we may not be able to obtain from the insurance policy a sufficient amount to compensate our customers for damages they suffered attributable to the quality of the products. Moreover, the insurance policy also excludes certain types of claims from its coverage, and if any of our customers’ claims against us falls into those exclusions, we would not receive any amount from the insurance policy at all. In either case, we may still be required to incur substantial amounts to indemnify our customers in respect of their product quality claims against us, which would materially and adversely affect the results of our operations and severely damage our reputation.

We may not be able to accurately plan our production based on our sales contracts, which may result in excess product inventory or product shortages.

Our sales contracts typically provide for a non-binding, three-month forecast on the quantity of products that our customers may purchase from us. We typically have only a 15-day lead time to manufacture products to meet our customers’ requirements once our customers place orders with us. To meet the short delivery deadline, we generally make significant decisions on our production level and timing, procurement, facility requirements, personnel needs and other resources requirements based on our estimate in light of this forecast, our past dealings with such customers, market conditions and other relevant factors. Our customers’ final purchase orders may not be consistent with our estimates. If the final purchase orders substantially differ from our estimates, we may have excess product inventory or product shortages. Excess product inventory could result in unprofitable sales or write-offs as our products are susceptible to obsolescence and price declines. Producing additional products to make up for any product shortages within a short time frame may be difficult, making us unable to fill out the purchase orders. In either case, our results of operation would fluctuate from period to period.

We historically depended on third parties to supply key raw materials and components to us. Failure to obtain a sufficient supply of these raw materials and components in a timely fashion and at reasonable costs could significantly delay our production and shipments, which would cause us to breach our sales contracts with our customers.

We historically purchased from Chinese domestic suppliers certain key raw materials and components such as electrolytes, electrode materials and import separators, a key component of battery cells, from foreign countries. We purchased raw materials and components on the basis of purchase orders. In the absence of firm and long-term contracts, we may not be able to obtain a sufficient supply of these raw materials and components from our existing suppliers or alternates in a timely fashion or at a reasonable cost. If we fail to secure a sufficient supply of key raw materials and components in a timely fashion, it would result in a significant delay in our production and shipments, which may cause us to breach our sales contracts with our customers. Furthermore, failure to obtain sufficient supply of these raw materials and components at a reasonable cost could also harm our revenue and gross profit margins.

13

Fluctuations in prices and availability of raw materials, particularly LiFePO4 and Ni, Co, Mn, could increase our costs or cause delays in shipments, which would adversely impact our business and results of operations.

Our operating results could be adversely affected by increases in the cost of raw materials, particularly LiFePO4 and Ni, Co, Mn, the primary cost component of our battery products, or other product parts or components. Our average purchase price of LiFePO4 and Ni, Co, Mn were $10.1 per kilogram and $12.2 per kilogram during the years ended September 30, 2015 and 2016, respectively. The price of LiFePO4 and Ni, Co, Mn is not stable as most output of cobalt is conducted in unstable or developing countries such as the Democratic Republic of the Congo, and we cannot predict the price trend. If the price increases, it will negatively impact our financial results in years ahead. We historically have not been able to fully offset the effects of higher costs of raw materials through price increases to customers or by way of productivity improvements.

A significant increase in the price of one or more raw materials, parts or components or the inability to successfully implement price increases/ surcharges to mitigate such cost increases could have a material adverse effect on our results of operations.

We mainly manufacture and market lithium-based battery cells. If a viable substitute product or chemistry emerges and gains market acceptance, our business, financial condition and results of operations will be materially and adversely affected.

We mainly manufacture and market lithium-based batteries. As we believe that the market for lithium-based batteries has good growth potential, we have focused our R&D activities on exploring new chemistries and formulas to enhance our product quality and features while reducing cost. Some of our competitors are conducting R&D on alternative battery technologies, such as fuel cells. If any viable substitute product emerges and gains market acceptance because it has more enhanced features, more power, more attractive pricing, or better reliability, the market demand for our products may be reduced, and accordingly our business, financial condition and results of operations would be materially and adversely affected.

Manufacturing or use of our products may cause accidents, which could result in significant production interruption, delay or claims for substantial damages.

Due to the high energy density inherent in lithium-based batteries, our batteries can pose certain safety risks, including the risk of fire. Although we incorporate safety procedures in the research, development, manufacture and transportation of batteries that are designed to minimize safety risks, the manufacture or use of our products may still cause accidents. Any accident, whether occurring at the manufacturing facilities or from the use of our products, may result in significant production interruption, delays or claims for substantial damages caused by personal injuries or property damages.

We face intense competition from other battery manufacturers, many of which have significantly greater resources.

The market for batteries used in electric vehicles and light electric vehicles is intensely competitive and is characterized by frequent technological changes and evolving industry standards. We expect competition to become more intense. Increased competition may result in declines in average selling prices, causing a decrease in gross profit margins. We have faced and will continue to face competition from manufacturers of traditional rechargeable batteries, such as lead-acid batteries other manufacturers of lithium-ion batteries, as well as from companies engaged in the development of batteries incorporating new technologies. Other manufacturers of high-power lithium batteries currently include Panasonic Corporation, Samsung Electronics Co., Ltd., BYD Co. Ltd., Tianjin Lishen Battery Joint Stock Co., Ltd., Amperex Technology Limited, BYD Co. Ltd, Hefei Guoxuan Hi-Tech Power Energy Co., Ltd and Chaowei Power Holdings Limited.

Many of these existing competitors have greater financial, personnel, technical, manufacturing, marketing, sales and other resources than we do. As a result, these competitors may be in a stronger position to respond quickly to market opportunities, new or emerging technologies and evolving industry standards. Many of our competitors are developing a variety of battery technologies, such as lithium polymer and fuel cell batteries, which are expected to compete with our existing product lines. Other companies undertaking R&D activities of solid-polymer lithium-ion batteries have developed prototypes and are constructing commercial scale production facilities. It is possible that our competitors will be able to introduce new products with more desirable features than ours and their new products will gain market acceptance. If our competitors successfully do so, we may not be able to maintain our competitive position and our future success would be materially and adversely affected.

14

We are dependent on a limited number of customers for a significant portion of our revenues and this dependence is likely to continue.

We have been dependent on a limited number of customers for a significant portion of our revenue. Our top five customers accounted for approximately 83.8% and 78.9% of our revenues for the years ended September 30, 2015 and 2016, respectively. Dependence on a few customers could make it difficult to negotiate attractive prices for our products and could expose us to the risk of substantial losses if a single dominant customer stops purchasing our products. We expect that a limited number of customers will continue to contribute a significant portion of our sales in the near future. Our ability to maintain close relationships with these top customers is essential to the growth and profitability of our business. If we fail to sell our products to one or more of these top customers in any particular period, or if a large customer purchases fewer of our products, defers orders or fails to place additional orders with us, or if we fail to develop additional major customers, our revenue could decline, and our results of operations could be adversely affected.

We do not have long-term purchase commitments from our customers, which may result in significant uncertainties and volatility with respect to our revenue from period to period.

We do not have long-term purchase commitments from our customers and the term of our sales contracts with our customers is typically one year or less. Furthermore, these contracts leave certain major terms such as price and quantity of products open to be determined in each purchase order. These contracts also allow parties to re-adjust the contract price for substantial changes in market conditions. As a result, if our customers hold stronger bargaining power than us or the market conditions are in their favor, we may not be able to enjoy the price downside protection or upside gain. Furthermore, our customers may decide not to continue placing purchase orders with us in the future at the same level as in prior periods. As a result, our results of operations may vary from period to period and may fluctuate significantly in the future.

We extend relatively long payment terms to some large customers.

As is customary in the industry in the PRC, we extend relatively long payment terms to some large customers. As a result of the size of many of our orders, these extended terms may adversely affect our cash flow and our ability to fund our operations out of our operating cash flow. In addition, although we attempt to establish appropriate reserves for our receivables, those reserves may not prove to be adequate in view of actual levels of bad debts. The failure of our customers to pay us timely would negatively affect our working capital, which could in turn adversely affect our cash flow.

Our customers often place large orders for products, requiring fast delivery, which impacts our working capital. If our customers do not incorporate our products into their products and sell them in a timely fashion, for example, due to excess inventories, sales slowdowns or other issues, they may not pay us in a timely fashion, even on our extended terms. Our customers’ failure to pay may force us to defer or delay further product orders, which may adversely affect our cash flows, sales or income in subsequent periods.

We face risks associated with the marketing, distribution and sale of our products internationally, and if we are unable to effectively manage these risks, they could impair our ability to expand our business abroad.

For the years ended September 30, 2015 and 2016, we derived nil and 13.0%, respectively, of our sales from outside the PRC mainland. We still deem overseas market as an important revenue source for us, and have been actively exploring overseas customers. The marketing, international distribution and sale of our products expose us to a number of risks, including:

| • |

fluctuations in currency exchange rates; |

| • |

difficulty in engaging and retaining distributors that are knowledgeable about, and can function effectively in, overseas markets; |

| • |

increased costs associated with maintaining marketing efforts in various countries; |

| • |

difficulty and cost relating to compliance with the different commercial and legal requirements of the overseas markets in which we offer our products; |

| • |

inability to obtain, maintain or enforce intellectual property rights; and |

| • |

trade barriers such as export requirements, tariffs, taxes and other restrictions and expenses, which could increase the prices of our products and make us less competitive in some countries. |

15

Our business depends substantially on the continuing efforts of our senior executives and other key personnel, and our business may be severely disrupted if we lost their services.

Our future success heavily depends on the continued service of our senior executives and other key employees. In particular, we rely on the expertise and experience of our Chairman, Chief Executive Officer, President Mr. Yunfei Li, our Interim Chief Financial Officer, Mr. Wenwu Wang, and our Interim Chief Technology Officer, Dr. Jian Lin. If one or more of our other senior executives are unable or unwilling to continue to work for us in their present positions, we may encounter similar problems, but on a compounded basis. Moreover, if any of our current or former senior executives joins a competitor or forms a competing company, we may lose customers, suppliers, know-how and key personnel. Each of our executive officers has entered into an employment agreement with us, which contains non-competition and confidentiality clauses. However, if any dispute arises between our current or former executive officers and the Company, it is hard to predict the extent to which any of these agreements could be enforced in China, where these executive officers reside, in light of the uncertainties with China’s legal system.

We have experienced significant management changes which could increase our control risks and have a material adverse effect on our ability to do business and our results of operations.

Since February 2009, we have had a number of changes in our senior management, including multiple changes in our Chief Financial Officer. The magnitude of these past and expected changes and the short time interval in which they have occurred or are expected to occur, particularly during the ongoing economic and financial crisis, add to the risks of control failures, including a failure in the effective operation of our internal control over financial reporting or our disclosure controls and procedures. Control failures could result in material adverse effects on our financial condition and results of operations. It may take time for the new management team to become sufficiently familiar with our business and each other to effectively develop and implement our business strategies. This turnover of key management positions could further harm our financial performance and results of operations. Management attention may be diverted from regular business concerns by reorganizations.

The success of our business depends on our ability to attract, train and retain highly skilled employees and key personnel.

Because of the highly specialized, technical nature of our business, we must attract, train and retain a sizable workforce comprising highly skilled employees and other key personnel. Since our industry is characterized by high demand and intense competition for talent, we may have to pay higher salaries and wages and provide greater benefits in order to attract and retain highly skilled employees or other key personnel that we will need to achieve our strategic objectives. As we are still a relatively young company and our business has grown rapidly, our ability to train and integrate new employees into our operations may not meet the requirements of our growing business. Our failure to attract, train or retain highly skilled employees and other key personnel in numbers that are sufficient to satisfy our needs would materially and adversely affect our business.

We may be exposed to infringement or misappropriation claims by third parties, which, if determined adversely to us, could cause our loss of significant rights and inability to continue providing our existing product offerings.

Our success also depends largely on our ability to use and develop our technology and know-how without infringing the intellectual property rights of third parties. The validity and scope of claims relating to lithium-ion battery technology patents involve complex scientific, legal and factual questions and analysis and, therefore, may be highly expensive and time-consuming. If there is a successful claim of infringement against us, we may be required to pay substantial damages to the party claiming infringement, develop non-infringing technologies or enter into royalty or license agreements that may not be available on acceptable terms, if at all. Our failure to develop non-infringing technologies or license the proprietary rights on a timely basis would harm our business. Protracted litigation could result in our customers, or potential customers, deferring or limiting their purchase or use of our products until resolution of such litigation. Parties making the infringement claim may also obtain an injunction that can prevent us from selling our products or using technology that contains the allegedly infringing contents. Any intellectual property litigation could have a material adverse effect on our business, results of operation and financial condition.

16

We can make no assurance that we will continue to get authorization from Shenzhen BAK to use its intellectual property rights when the current intellectual property rights use agreement with Shenzhen BAK expires, nor can we make assurance that we can get the authorization at a favorable price, which could harm our business and competitive position.

We lack intellectual property rights for the business we operate. As of September 30, 2016, Dalian BAK Power only owns 20 patents including 18 utility model patents and 2 patents for invention in the PRC. During fiscal year 2016, Dalian BAK Power obtained 3 patents. On August 25, 2014, we entered into an intellectual property rights use agreement with Shenzhen BAK under which we are authorized to use Shenzhen BAK’s registered logo, trademarks and patents for a period of 5 years for free from June 30, 2014. As of June 30, 2014, Shenzhen BAK owned 462 registered patents in PRC and 60 registered patents in other countries, 80 registered trademarks in PRC and 49 registered trademarks in the United States, European Union, Korea, Russia, Taiwan, Canada, India and Hong Kong that cover various categories of goods and services. We cannot provide assurance that we will continue to get authorization from Shenzhen BAK to use its intellectual property rights when the current intellectual property rights use agreement with Shenzhen BAK expires, nor can we make assurance that we can get the authorization at a favorable price, which could harm our business and competitive position.

We do not hold the property ownership rights for facilities located in the PRC. Our manufacturing activities could be adversely affected if we lose the facilities that we do not have property ownership rights.

We have obtained land use rights for our Dalian manufacture facilities, but have not yet obtained the property ownership of the Dalian manufacture facilities including its plants, office building, warehouse, and related supporting facilities. We expect that we will obtain the property ownership rights by March 2017. If we lose our Dalian facility due to the lack of the property ownership, our manufacturing activities will be adversely impacted.