UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10−Q

(Mark One)

[X] QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended: June 30, 2014

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________ to _____________

Commission File Number: 001-32898

CHINA BAK BATTERY, INC.

(Exact Name of Registrant as Specified in Its Charter)

| Nevada | 88-0442833 |

| (State or other jurisdiction of | (I.R.S. Employer Identification No.) |

| incorporation or organization) |

BAK Industrial Park

Meigui Street,

Huayuankou

Economic Zone

Dalian 116422

People’s Republic of China

(Address

of principal executive offices, Zip Code)

(86-411) 6251-0619

(Registrant’s telephone number,

including area code)

__________________________________________________________________

(Former

name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes [X] No [_]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes [X] No [_]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [_] | Accelerated filer [_] | |

| Non-accelerated filer [_] (Do not check if a smaller reporting company) | Smaller reporting company [X] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes [_] No [X]

The number of shares outstanding of each of the issuer’s classes of common stock, as of August 18, 2014 is as follows:

| Class of Securities | Shares Outstanding | |

| Common Stock, $0.001 par value | 12,619,597 |

|

| CHINA BAK BATTERY, INC. |

| TABLE OF CONTENTS |

| PART I FINANCIAL INFORMATION | ||

| Item 1. |

Financial Statements. |

1 |

| Item 2. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations. |

1 |

| Item 3. |

Quantitative and Qualitative Disclosures About Market Risk. |

13 |

| Item 4. |

Controls and Procedures. |

13 |

| PART II OTHER INFORMATION | ||

| Item 1. |

Legal Proceedings. |

15 |

| Item 1A. |

Risk Factors. |

15 |

| Item 2. |

Unregistered Sales of Equity Securities and Use of Proceeds. |

16 |

| Item 3. |

Defaults Upon Senior Securities. |

16 |

| Item 4. |

Mine Safety Disclosures. |

16 |

| Item 5. |

Other Information. |

16 |

| Item 6. |

Exhibits. |

16 |

PART I

FINANCIAL INFORMATION

Item 1. Financial Statements.

| CHINA BAK BATTERY, INC. AND SUBSIDIARIES |

| CONDENSED CONSOLIDATED FINANCIAL STATEMENTS |

| FOR THE NINE MONTHS ENDED JUNE 30, 2014 AND 2013 |

|

Contents |

Page(s) |

|

Condensed Consolidated Balance Sheets as of September 30, 2013 and June 30, 2014 (unaudited) |

F-2 |

|

Condensed Consolidated Statements of Operations and Comprehensive Loss for the three and nine months ended June 30, 2014 and 2013 (unaudited) |

F-3 |

|

Condensed Consolidated Statements of Changes in Shareholders’ Equity for the nine months ended June 30, 2014 and 2013 (unaudited) |

F-4 |

|

Condensed Consolidated Statements of Cash Flows for the nine months ended June 30, 2014 and 2013(unaudited) |

F-5 |

|

Notes to the Condensed Consolidated Financial Statements (unaudited) |

F-6-F-29 |

F-1

| China BAK Battery, Inc. and subsidiaries |

| Condensed consolidated balance sheets |

| As of September 30, 2013 and June 30, 2014 |

| (In US$) |

|

|

September 30, | June 30, | |||||

|

|

Note | 2013 | 2014 | ||||

|

|

(Unaudited) | ||||||

|

Assets |

|||||||

|

Current assets |

|||||||

|

Cash and cash equivalents |

$ | 13,998,626 | $ | 272,115 | |||

|

Pledged deposits |

2 | 8,137,687 | - | ||||

|

Trade accounts receivable, net |

3 | 49,875,701 | 176,439 | ||||

|

Inventories |

4 | 57,275,187 | 806,699 | ||||

|

Prepayments and other receivables |

5(i) | 17,728,605 | 194,004 | ||||

|

Receivable from a former subsidiary |

5(ii) | - | 438,809 | ||||

|

Prepaid land use right, current portion |

7 | 707,810 | - | ||||

|

Assets of discontinued operations |

1 | 65,763 | - | ||||

|

|

|||||||

|

Total current assets |

147,789,379 | 1,888,066 | |||||

|

|

|||||||

|

Property, plant and equipment, net |

6 | 128,237,434 | 12,078,861 | ||||

|

Prepaid land use right- non current |

7 | 20,732,482 | - | ||||

|

Intangible assets, net |

8 | 730,884 | - | ||||

|

Noncurrent assets of discontinued operations |

1 | 43,115,001 | - | ||||

|

|

|||||||

|

Total assets |

$ | 340,605,180 | $ | 13,966,927 | |||

|

Liabilities |

|||||||

|

Current liabilities |

|||||||

|

Short-term bank loans |

9 | $ | 151,404,677 | $ | - | ||

|

Accounts and bills payable |

124,507,846 | 81,946 | |||||

|

Other short-term loans |

10(i) | 28,282,322 | - | ||||

|

Accrued expenses and other payables |

10(ii) | 23,155,435 | 9,230,115 | ||||

|

Deferred government grants, current |

12 | 24,525,004 | 24,176,781 | ||||

|

|

|||||||

|

Total current liabilities |

351,875,284 | 33,488,842 | |||||

|

|

|||||||

|

Deferred revenue - non current |

11 | 7,560,386 | - | ||||

|

Deferred government grants, noncurrent |

12 | 22,946,463 | - | ||||

|

Noncurrent liabilities of discontinued operations |

1 | 715,398 | - | ||||

|

Deferred tax liabilities |

13(b) | 779,814 | - | ||||

|

|

|||||||

|

Total liabilities |

383,877,345 | 33,488,842 | |||||

|

|

|||||||

|

Commitments and contingencies |

17 | ||||||

|

|

|||||||

|

Shareholders’ equity |

|||||||

|

Common stock $0.001 par value;20,000,000 authorized; 12,763,803 issued as of September 30, 2013 and June 30, 2014, respectively; 12,619,597 outstanding as of September 30, 2013 and June 30, 2014, respectively |

12,763 | 12,763 | |||||

|

Donated shares |

14,101,689 | 14,101,689 | |||||

|

Additional paid-in capital |

127,349,617 | 127,437,223 | |||||

|

Statutory reserves |

7,786,157 | - | |||||

|

Accumulated deficit |

(226,366,718 | ) | (157,012,118 | ) | |||

|

Accumulated other comprehensive income |

37,910,937 | 5,138 | |||||

|

|

(39,205,555 | ) | (15,455,305 | ) | |||

|

Less: Treasury shares |

(4,066,610 | ) | (4,066,610 | ) | |||

|

|

|||||||

|

Total shareholders’ equity |

(43,272,165 | ) | (19,521,915 | ) | |||

|

|

|||||||

|

Total liabilities and shareholders’ equity |

$ | 340,605,180 | $ | 13,966,927 |

F-2

See accompanying notes to the condensed consolidated financial statements.

| China BAK Battery, Inc. and subsidiaries |

| Condensed consolidated statements of operations and comprehensive loss |

| For the three and nine months ended June 30, 2013 and 2014 |

| (Unaudited) |

| (In US$ except for number of shares) |

|

|

Three months ended June 30, | Nine months ended June 30, | ||||||||||

|

|

2013 | 2014 | 2013 | 2014 | ||||||||

|

Net revenues |

$ | 45,598,726 | $ | 47,994,846 | $ | 153,397,578 | $ | 122,039,250 | ||||

|

Cost of revenues |

(46,986,217 | ) | (43,675,974 | ) | (162,576,588 | ) | (112,558,168 | ) | ||||

|

Gross (loss) profit |

(1,387,491 | ) | 4,318,872 | (9,179,010 | ) | 9,481,082 | ||||||

|

Operating expenses: |

||||||||||||

|

Research and development expenses |

(1,135,371 | ) | (1,469,263 | ) | (3,995,011 | ) | (3,981,130 | ) | ||||

|

Sales and marketing expenses |

(1,710,001 | ) | (1,807,268 | ) | (5,812,595 | ) | (4,504,284 | ) | ||||

|

General and administrative expenses |

(4,654,653 | ) | (3,920,264 | ) | (13,743,951 | ) | (11,912,505 | ) | ||||

|

Recovery of (provision for) doubtful accounts |

4,387,805 | (729,415 | ) | 5,087,650 | 639,390 | |||||||

|

Impairment charge on property, plant and equipment |

(3,207,649 | ) | - | (14,603,998 | ) | - | ||||||

|

Total operating expenses |

(6,319,869 | ) | (7,926,210 | ) | (33,067,905 | ) | (19,758,529 | ) | ||||

|

Operating loss |

(7,707,360 | ) | (3,607,338 | ) | (42,246,915 | ) | (10,277,447 | ) | ||||

|

Finance costs, net |

(3,454,229 | ) | (6,193,187 | ) | (7,893,537 | ) | (16,785,103 | ) | ||||

|

Recovery of loss (loss) arising from loan guarantees |

808,950 | - | (2,002,089 | ) | - | |||||||

|

Government grant income |

112,796 | 22,413 | 131,073 | 74,532 | ||||||||

|

Other income (expense) |

27,167 | (51,318 | ) | (29,063 | ) | 636,343 | ||||||

|

Loss before income tax and continuing operations |

(10,212,676 | ) | (9,829,430 | ) | (52,040,531 | ) | (26,351,675 | ) | ||||

|

Income tax expenses |

(58,005 | ) | - | (6,084,277 | ) | (16,474 | ) | |||||

|

Net loss from continuing operations, net of tax |

(10,270,681 | ) | (9,829,430 | ) | (58,124,808 | ) | (26,368,149 | ) | ||||

|

Income from discontinued operations, net of tax |

- | 46,936,251 | - | 48,928,143 | ||||||||

|

Net (loss) profit |

$ | (10,270,681 | ) | $ | 37,106,821 | $ | (58,124,808 | ) | $ | 22,559,994 | ||

|

|

||||||||||||

|

Other comprehensive income |

||||||||||||

|

Release of foreign currency translation adjustment upon disposal of subsidiaries |

- | (39,008,449 | ) | - | (39,008,449 | ) | ||||||

|

Foreign currency translation adjustment |

871,823 | (182,152 | ) | 2,235,990 | 1,102,650 | |||||||

|

|

871,823 | (39,190,601 | ) | 2,235,990 | (37,905,799 | ) | ||||||

|

Comprehensive loss |

$ | (9,398,858 | ) | $ | (2,083,780 | ) | $ | (55,888,818 | ) | $ | (15,345,805 | ) |

|

|

||||||||||||

|

(Loss) earnings per share – Basic and diluted |

||||||||||||

|

- From continuing operations |

$ | (0.81 | ) | $ | (0.78 | ) | $ | (4.61 | ) | $ | (2.09 | ) |

|

- From discontinued operations |

- | 3.72 | - | 3.88 | ||||||||

|

(Loss) earnings per share – Basic and diluted |

$ | (0.81 | ) | $ | 2.94 | $ | (4.61 | ) | $ | 1.79 | ||

|

|

||||||||||||

|

Weighted average number of shares of common stock: |

||||||||||||

|

- Basic |

12,619,597 | 12,619,597 | 12,619,597 | 12,619,597 | ||||||||

|

- Diluted |

12,619,597 | 12,619,597 | 12,619,597 | 12,619,597 | ||||||||

See accompanying notes to the condensed consolidated financial statements.

F-3

| China BAK Battery, Inc. and subsidiaries |

| Condensed consolidated statements of changes in shareholders’ equity |

| For the nine months ended June 30, 2013 and 2014 |

| (Unaudited) |

| (In US$ except for number of shares) |

|

|

Accumulated | |||||||||||||||||||||||||||||

|

|

Common stock | Additional | other | Treasury shares | Total | |||||||||||||||||||||||||

|

|

Number | Donated | paid-in | Statutory | Accumulated | comprehensive | Number | shareholders’ | ||||||||||||||||||||||

|

|

of shares | Amount | shares | capital | reserves | deficit | income | of shares | Amount | equity | ||||||||||||||||||||

|

Balance as of October 1, 2012 |

12,763,269 | $ | 12,763 | $ | 14,101,689 | $ | 126,990,611 | $ | 7,786,157 | $ | (110,358,489 | ) | $ | 37,329,450 | (144,206 | ) | $ | (4,066,610 | ) | $ | 71,795,571 | |||||||||

|

|

||||||||||||||||||||||||||||||

|

Net loss |

- | - | - | - | - | (58,124,808 | ) | - | - | - | (58,124,808 | ) | ||||||||||||||||||

|

|

||||||||||||||||||||||||||||||

|

Share-based compensation for employee stock awards |

- | - | - | 297,729 | - | - | - | - | - | 297,729 | ||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||

|

Rounding difference on reverse stock split |

534 | - | - | - | - | - | - | - | - | - | ||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||

|

Foreign currency translation adjustment |

- | - | - | - | - | - | 2,235,990 | - | - | 2,235,990 | ||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||

|

Balance as of June 30, 2013 |

12,763,803 | $ | 12,763 | $ | 14,101,689 | $ | 127,288,340 | $ | 7,786,157 | $ | (168,483,297 | ) | $ | 39,565,440 | (144,206 | ) | $ | (4,066,610 | ) | $ | 16,204,482 | |||||||||

|

|

||||||||||||||||||||||||||||||

|

Balance as of October 1, 2013 |

12,763,803 | $ | 12,763 | $ | 14,101,689 | $ | 127,349,617 | $ | 7,786,157 | $ | (226,366,718 | ) | $ | 37,910,937 | (144,206 | ) | $ | (4,066,610 | ) | $ | (43,272,165 | ) | ||||||||

|

|

||||||||||||||||||||||||||||||

|

Net profit |

- | - | - | - | - | 22,559,994 | - | - | - | 22,559,994 | ||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||

|

Disposal of subsidiaries |

- | - | - | - | (7,786,157 | ) | 46,794,606 | (39,008,449 | ) | - | ||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||

|

Share-based compensation for employee stock awards |

- | - | - | 87,606 | - | - | - | - | - | 87,606 | ||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||

|

Foreign currency translation adjustment |

- | - | - | - | - | - | 1,102,650 | - | - | 1,102,650 | ||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||

|

Balance as of June 30, 2014 |

12,763,803 | $ | 12,763 | $ | 14,101,689 | $ | 127,437,223 | $ | - | $ | (157,012,118 | ) | $ | 5,138 | (144,206 | ) | $ | (4,066,610 | ) | $ | (19,521,915 | ) | ||||||||

See accompanying notes to the condensed consolidated financial statements.

F-4

| China BAK Battery, Inc. and subsidiaries |

| Condensed consolidated statements of cash flows |

| For the nine months ended June 30, 2013 and 2014 |

| (Unaudited)(In US$) |

|

|

Nine months ended June 30, | |||||

|

|

2013 | 2014 | ||||

|

Cash flow from operating activities |

||||||

|

Net (loss) profit |

$ | (58,124,808 | ) | $ | 22,559,994 | |

|

Income from discontinued operations, net of tax |

- | (48,928,143 | ) | |||

|

Adjustments to reconcile net loss to net cash provided by operating activities: |

||||||

|

Depreciation and amortization |

15,059,133 | 8,251,510 | ||||

|

Reversal of doubtful debts |

(5,087,650 | ) | (639,390 | ) | ||

|

Write-down of inventories |

38,084,761 | 8,752,543 | ||||

|

Impairment charge |

14,603,998 | - | ||||

|

Loss arising from loan guarantee |

2,002,089 | - | ||||

|

Share-based compensation |

297,729 | 87,606 | ||||

|

Deferred income taxes |

5,755,399 | - | ||||

|

Exchange difference |

1,063,155 | 375,127 | ||||

|

Changes in operating assets and liabilities: |

||||||

|

Trade accounts receivable |

31,045,373 | (13,992,484 | ) | |||

|

Inventories |

(32,050,027 | ) | 7,163,543 | |||

|

Prepayments and other receivables |

1,257,546 | (8,768,517 | ) | |||

|

Accounts and bills payable |

(1,122,102 | ) | (22,626,190 | ) | ||

|

Accrued expenses and other payables |

30,622,819 | 24,964,173 | ||||

|

Deferred revenue |

(256,149 | ) | (245,887 | ) | ||

|

Net cash provided by (used in) continuing operations |

43,151,266 | (23,046,115 | ) | |||

|

Net cash provided by discontinued operations |

- | 3,615,638 | ||||

|

Net cash provided by (used in) operating activities |

43,151,266 | (19,430,477 | ) | |||

|

|

||||||

|

Cash flow from investing activities |

||||||

|

Disposal of subsidiaries, net of cash disposed of $4,163,555 |

- | (4,163,555 | ) | |||

|

Decrease (increase) in pledged deposits |

(7,592,656 | ) | 7,990,705 | |||

|

Payment of guaranteed loans |

(7,485,991 | ) | - | |||

|

Repayment of guaranteed loans |

5,483,903 | - | ||||

|

Purchases of property, plant and equipment |

(25,379,443 | ) | (8,456,929 | ) | ||

|

Purchases of intangible assets |

(370,066 | ) | (15,825 | ) | ||

|

Net cash (used in) provided by continuing operations |

(35,344,253 | ) | (4,645,604 | ) | ||

|

Net cash (used in) provided by discontinued operations |

(6,657,910 | ) | (3,296,571 | ) | ||

|

Net cash used in investing activities |

(42,002,163 | ) | (7,942,175 | ) | ||

|

|

||||||

|

Cash flow from financing activities |

||||||

|

Proceeds from borrowings |

148,398,191 | 91,614,488 | ||||

|

Repayment of borrowings |

(165,022,657 | ) | (178,695,284 | ) | ||

|

Borrowings from related parties |

8,546,133 | - | ||||

|

Repayment to related parties |

(8,747,771 | ) | - | |||

|

Borrowings from unrelated parties |

8,802,650 | 121,232,353 | ||||

|

Repayment of borrowings from unrelated parties |

- | (20,554,868 | ) | |||

|

Proceeds from long-term loans |

7,537,453 | - | ||||

|

Net cash (used in) provided by financing activities |

(486,001 | ) | 13,596,689 | |||

|

|

||||||

|

Effect of exchange rate changes on cash and cash equivalents |

467,153 | 49,452 | ||||

|

Net increase (decrease) in cash and cash equivalents |

1,130,255 | (13,726,511 | ) | |||

|

Cash and cash equivalents at the beginning of period |

9,271,633 | 13,998,626 | ||||

|

Cash and cash equivalents at the end of period |

$ | 10,401,888 | $ | 272,115 | ||

|

|

||||||

|

Supplemental disclosure of cash flow information: |

||||||

|

Cash received during the period for: |

||||||

|

Bills receivable discounted to banks |

$ | 38,072,936 | $ | 913,517 | ||

|

Cash paid during the period for: |

||||||

|

Income taxes |

$ | - | $ | - | ||

|

Interest, net of amounts capitalized |

$ | 7,527,458 | $ | 8,688,340 | ||

|

Non-cash transactions |

||||||

|

Disposal of subsidiaries (Note 1) |

||||||

See accompanying notes to the condensed consolidated financial statements.

F-5

| China BAK Battery, Inc. and subsidiaries |

| Notes to the condensed consolidated financial statements |

| For the three and nine months ended June 30, 2013 and 2014 |

| (In US$ except for number of shares) |

| (Unaudited) |

1. Principal Activities, Basis of Presentation and Organization

Principal Activities

China BAK Battery, Inc. (“China BAK”) is a corporation formed in the State of Nevada on October 4, 1999 as Medina Copy, Inc. The Company changed its name to Medina Coffee, Inc. on October 6, 1999 and subsequently changed its name to China BAK Battery, Inc. on February 14, 2005. China BAK and its subsidiaries (hereinafter, collectively referred to as the “Company”) are principally engaged in the manufacture, commercialization and distribution of high power lithium ion (known as "Li-ion" or "Li-ion cell") rechargeable batteries. Prior to the disposal of BAK International and its subsidiaries (see below), the batteries produced by the Company were for use in cellular telephones, as well as various other portable electronic applications, including high-power handset telephones, laptop computers, power tools, digital cameras, video camcorders, MP3 players, electric bicycle, hybrid/electric vehicles, and general industrial applications. After the disposal of BAK International and its subsidiaries, the Company will focus on the manufacture, commercialization and distribution of high power lithium ion rechargeable batteries for use in electric vehicles, light electric vehicles, electric tools, energy storage, UPS and other high power industrial applications. The shares of the Company traded in the over-the-counter market through the Over-the-Counter Bulletin Board from 2005 until May 31, 2006, when the Company obtained approval to list its common stock on The NASDAQ Global Market, and trading commenced that same date under the symbol "CBAK".

Basis of Presentation and Organization

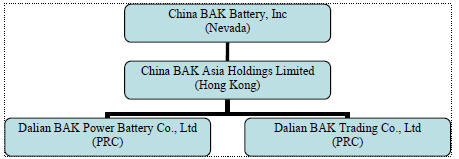

After the disposal of the BAK International and its subsidiaries effective on June 30, 2014, the Company’s subsidiaries consisted of: i) China BAK Asia Holdings Limited(“BAK Asia”), a wholly owned limited liability company incorporated in Hong Kong on July 9, 2013; ii) Dalian BAK Trading Co., Ltd. (“BAK Dalian”), a wholly owned limited company established on August 14, 2013 in the PRC; and iii) Dalian BAK Power Battery Co., Ltd. (“Dalian BAK Power”), a wholly owned limited liability company established on December 27, 2013 in the PRC.

Dalian BAK Power was established on December 27, 2013 as a wholly owned subsidiary of BAK Asia with a registered capital of $30,000,000 (Note 17(i)). Pursuant to Dalian BAK Power’s articles of association and relevant PRC regulations, BAK Asia was required to contribute $6,000,000 to Dalian BAK Power as capital (representing 20% of Dalian BAK Power’s registered capital) on or before December 27, 2015. Up to the date of this report, the Company has contributed $5,000,000 to Dalian BAK Power through an injection of a series of patents.

On November 6, 2004, BAK International, a non-operating holding company that had substantially the same shareholders as Shenzhen BAK, entered into a share swap transaction with the shareholders of Shenzhen BAK for the purpose of the subsequent reverse acquisition of the Company. The share swap transaction between BAK International and the shareholders of Shenzhen BAK was accounted for as a reverse acquisition of Shenzhen BAK with no adjustment to the historical basis of the assets and liabilities of Shenzhen BAK.

On January 20, 2005, the Company completed a share swap transaction with the shareholders of BAK International. The share swap transaction, also referred to as the “reverse acquisition” of the Company, was consummated under Nevada law pursuant to the terms of a Securities Exchange Agreement entered by and among China BAK, BAK International and the shareholders of BAK International on January 20, 2005.The share swap transaction has been accounted for as a capital-raising transaction of the Company whereby the historical financial statements and operations of Shenzhen BAK are consolidated using historical carrying amounts.

Also on January 20, 2005, immediately prior to consummating the share swap transaction, BAK International executed a private placement of its common stock with unrelated investors whereby it issued an aggregate of 1,720,087 shares of common stock for gross proceeds of $17,000,000. In conjunction with this financing, Mr. Xiangqian Li, the Chairman and Chief Executive Officer of the Company, agreed to place 435,910 shares of the Company’s common stock owned by him into an escrow account pursuant to an Escrow Agreement dated January 20, 2005 (the “Escrow Agreement”). Pursuant to the Escrow Agreement, 50% of the escrowed shares were to be released to the investors in the private placement if audited net income of the Company for the fiscal year ended September 30, 2005 was not at least $12,000,000, and the remaining 50% was to be released to investors in the private placement if audited net income of the Company for the fiscal year ended September 30, 2006 was not at least $27,000,000. If the audited net income of the Company for the fiscal years ended September 30, 2005 and 2006 reached the above-mentioned targets, the 435,910 shares would be released to Mr. Xiangqian Li in the amount of 50% upon reaching the 2005 target and the remaining 50% upon reaching the 2006 target.

F-6

| China BAK Battery, Inc. and subsidiaries |

| Notes to the condensed consolidated financial statements |

| For the three and nine months ended June 30, 2013 and 2014 (Continued) |

| (In US$ except for number of shares) |

| (Unaudited) |

1. Principal Activities, Basis of Presentation and Organization (Continued)

Basis of Presentation and Organization (Continued)

Under accounting principles generally accepted in the United States of America (“US GAAP”), escrow agreements such as the one established by Mr. Xiangqian Li generally constitute compensation if, following attainment of a performance threshold, shares are returned to a company officer. The Company determined that without consideration of the compensation charge, the performance thresholds for the year ended September 30, 2005 would be achieved. However, after consideration of a related compensation charge, the Company determined that such thresholds would not have been achieved. The Company also determined that, even without consideration of a compensation charge, the performance thresholds for the year ended September 30, 2006 would not be achieved.

While the 217,955 escrow shares relating to the 2005 performance threshold were previously released to Mr. Xiangqian Li, Mr. Xiangqian Li executed a further undertaking on August 21, 2006 to return those shares to the escrow agent for the distribution to the relevant investors. However, such shares were not returned to the escrow agent, but, pursuant to a Delivery of Make Good Shares, Settlement and Release Agreement between the Company, BAK International and Mr. Li entered into on October 22, 2007 (the “Li Settlement Agreement”), such shares were ultimately delivered to the Company as described below. Because the Company failed to satisfy the performance threshold for the fiscal year ended September 30, 2006, the remaining 217,955 escrow shares relating to the fiscal year 2006 performance threshold were released to the relevant investors. As Mr. Li has not retained any of the shares placed into escrow, and as the investors party to the Escrow Agreement are only shareholders of the Company and do not have and are not expected to have any other relationship to the Company, the Company has not recorded a compensation charge for the years ended September 30, 2005 and 2006.

At the time the escrow shares relating to the 2006 performance threshold were transferred to the investors in fiscal year 2007, the Company should have recognized a credit to donated shares and a debit to additional paid-in capital, both of which are elements of shareholders’ equity. This entry is not material because total ordinary shares issued and outstanding, total shareholders’ equity and total assets do not change; nor is there any impact on income or earnings per share. Therefore, previously filed consolidated financial statements for the fiscal year ended September 30, 2007 will not be restated. This share transfer has been reflected in these financial statements by reclassifying the balances of certain items as of October 1, 2007. The balances of donated shares and additional paid-in capital as of October 1, 2007 were credited and debited by $7,955,358 respectively, as set out in the consolidated statements of changes in shareholders’ equity.

In November 2007, Mr. Xiangqian Li delivered the 217,955 shares related to the 2005 performance threshold to BAK International pursuant to the Li Settlement Agreement; BAK International in turn delivered the shares to the Company. Such shares (other than those issued to investors pursuant to the 2008 Settlement Agreements, as described below) are now held by the Company. Upon receipt of these shares, the Company and BAK International released all claims and causes of action against Mr. Xiangqian Li regarding the shares, and Mr. Xiangqian Li released all claims and causes of action against the Company and BAK International regarding the shares. Under the terms of the Li Settlement Agreement, the Company commenced negotiations with the investors who participated in the Company’s January 2005 private placement in order to achieve a complete settlement of BAK International’s obligations (and the Company’s obligations to the extent it has any) under the applicable agreements with such investors.

Beginning on March 13, 2008, the Company has entered into settlement agreements (the “2008 Settlement Agreements”) with certain investors in the January 2005 private placement. Since the other investors have never submitted any claims regarding this matter, the Company did not reach any settlement with them.

Pursuant to the 2008 Settlement Agreements, the Company and the settling investors have agreed, without any admission of liability, to a settlement and mutual release from all claims relating to the January 2005 private placement, including all claims relating to the escrow shares related to the 2005 performance threshold that had been placed into escrow by Mr. Xiangqian Li, as well as all claims, including claims for liquidated damages relating to registration rights granted in connection with the January 2005 private placement. Under the 2008 Settlement Agreement, the Company has made settlement payments to each of the settling investors of the number of shares of the Company’s common stock equivalent to 50% of the number of the escrow shares related to the 2005 performance threshold these investors had claimed; aggregate settlement payments as of March 31, 2013 amounted to 73,749 shares. Share payments to date have been made in reliance upon the exemptions from registration provided by Section 4(2) and/or other applicable provisions of the Securities Act of 1933, as amended. In accordance with the 2008 Settlement Agreements, the Company filed a registration statement covering the resale of such shares which was declared effective by the SEC on June 26, 2008.

F-7

| China BAK Battery, Inc. and subsidiaries |

| Notes to the condensed consolidated financial statements |

| For the three and nine months ended June 30, 2013 and 2014 (Continued) |

| (In US$ except for number of shares) |

| (Unaudited) |

1. Principal Activities, Basis of Presentation and Organization (Continued)

Basis of Presentation and Organization (Continued)

Pursuant to the Li Settlement Agreement, the 2008 Settlement Agreements and upon the release of the 217,955 escrow shares relating to the fiscal year 2006 performance threshold to the relevant investors, neither Mr. Li or the Company have any obligations to the investors who participated in the Company’s January 2005 private placement relating to the escrow shares.

As of June 30, 2014, the Company has not received any claim from the other investors who have not been covered by the “2008 Settlement Agreements” in the January 2005 private placement.

As the Company has transferred the 217,955 shares related to the 2006 performance threshold to the relevant investors in fiscal year 2007 and the Company also has transferred 73,749 shares relating to the 2005 performance threshold to the investors who had entered the “2008 Settlement Agreements” with us in fiscal year 2008, pursuant to “Li Settlement Agreement” and “2008 Settlement Agreements”, neither Mr. Li nor the Company has not had any remaining obligations to those related investors who participated in the Company’s January 2005 private placement relating to the escrow shares.

On October 26, 2012, the Company effected a 1-for-5 reverse stock split of its issued and outstanding shares of common stock and a proportional reduction of its authorized shares of common stock. All common share and per share amounts, and exercise prices of common stock options disclosed herein and in the accompanying unaudited condensed consolidated unaudited financial statements have been retroactively restated to reflect the reverse stock split.

The Company’s condensed consolidated financial statements have been prepared under accounting principles generally accepted in the United States of America (“US GAAP”).

These condensed consolidated financial statements are unaudited. In the opinion of management, all adjustments and disclosures necessary for a fair presentation of these condensed consolidated financial statements, which are of a normal and recurring nature, have been included. The results reported in the condensed consolidated financial statements for any interim periods are not necessarily indicative of the results that may be reported for the entire year. The following (a) condensed consolidated balance sheet as of September 30, 2013, which was derived from the Company’s audited financial statements, and (b) the unaudited condensed consolidated financial statements have been prepared pursuant to the rules and regulations of the Securities and Exchange Commission. Certain information and note disclosures normally included in annual financial statements prepared in accordance with accounting principles generally accepted in the United States have been condensed or omitted pursuant to those rules and regulations, though the Company believes that the disclosures made are adequate to make the information not misleading. These unaudited condensed consolidated financial statements should be read in conjunction with the audited consolidated financial statements and accompanying footnotes of the Company for the year ended September 30, 2013.

The preparation of financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting periods. Actual results could differ from those estimates. This basis of accounting differs in certain material respects from that used for the preparation of the books of account of the Company’s principal subsidiaries, which are prepared in accordance with the accounting principles and the relevant financial regulations applicable to enterprises with limited liabilities established in the PRC, Hong Kong, India, Canada or Germany, the accounting standards used in the places of their domicile. The accompanying condensed consolidated financial statements reflect necessary adjustments not recorded in the books of account of the Company’s subsidiaries to present them in conformity with US GAAP.

The Company had net liabilities, a working capital deficiency, accumulated deficit from recurring net losses incurred for the current and prior years and significant short-term debt obligations maturing in less than one year as of June 30, 2014. The Company has been suffering severe cash flow deficiencies.

F-8

| China BAK Battery, Inc. and subsidiaries |

| Notes to the condensed consolidated financial statements |

| For the three and nine months ended June 30, 2013 and 2014 (Continued) |

| (In US$ except for number of shares) |

| (Unaudited) |

1. Principal Activities, Basis of Presentation and Organization (Continued)

Basis of Presentation and Organization (Continued)

In order to repay the Company’s overdue bank loans, Shenzhen BAK Battery Co., Ltd (“Shenzhen BAK”), a former wholly-owned subsidiary of the Company, borrowed from Mr. Jinghui Wang (“Mr. Wang”), an unrelated third party, in December 2013 and January 2014, an aggregate of $83.8 million (RMB520 million) bearing interest at 20% per annum and repayable by March 31, 2014 (“the “Loans”). The Loans were secured by the Company’s 100% equity interest in BAK International (the “Shares”), guaranteed by BAK International and the Company (collectively the “Collateral”).

The Company failed to repay the loans to Mr. Wang on March 31, 2014. On April 24, 2014, the Company received a default notice from Mr. Wang. On June 30, 2014, the Company received a further notice from Mr. Wang that due to Shenzhen BAK’s default under the Loans, he had foreclosed his security interest in BAK International and sold and transferred to a third party the Shares for a purchase price of $83.8 million (RMB520 million). Pursuant to a debt waiver agreement also dated June 30, 2014, Mr. Wang agreed to waive his entitlement to the interest on the Loans accruing to $8.3 million (RMB51.3 million)as of June 30, 2014.Following the disposal and pursuant to a deed of waiver and release signed on July 4, 2014, the Company and BAK International were both released and discharged from their obligations under the corporate guarantees that they executed in favor of Mr. Wang, and the Company, Shenzhen BAK, BAK International and Mr. Wang shall have no claim whatsoever against each other.

As a result of the foreclosure, the equity interest of BAK International and its wholly owned subsidiaries, namely Shenzhen BAK, BAK Battery (Shenzhen) Co., Ltd., BAK International (Tianjin) Ltd., Tianjin Chenhao Technological Development Limited (a subsidiary of BAK Tianjin established on May 8, 2014,“Tianjin Chenhao”), BAK Battery Canada Ltd., BAK Europe GmbH and BAK Telecom India Private Limited (collectively the “Disposal Group”) was disposed of effective on June 30, 2014. The condensed consolidated financial statements were consolidated up to the date of disposal. The Company recorded a gain on disposal of subsidiaries of $45.8 million, which was mainly related to the market value appreciation of the Company’s Research and Development Centre in Shenzhen.

The following table represents the net assets of the Disposal Group as of June 30, 2014 (date of disposal):

|

|

Carrying amount | ||

|

Cash and cash equivalents |

$ | 4,163,555 | |

|

Pledged deposits |

119,382 | ||

|

Bill and trade accounts receivable, net |

63,539,165 | ||

|

Inventories |

39,941,073 | ||

|

Prepayments and other receivables |

25,975,982 | ||

|

Property, plant and equipment, net |

165,242,359 | ||

|

Prepaid land use rights, net |

21,950,651 | ||

|

Intangible assets, net |

583,662 | ||

|

Short-term bank loans |

(63,181,988 | ) | |

|

Accounts and bills payable |

(100,364,485 | ) | |

|

Accrued expenses and other payables |

(39,278,719 | ) | |

|

Other short term loans |

(38,906,793 | ) | |

|

Payable to the Company (Note) |

(11,511,694 | ) | |

|

Deferred revenue |

(7,215,622 | ) | |

|

Other long-term payables |

(23,834,320 | ) | |

|

Rental deposits |

(1,144,121 | ) | |

|

Deferred tax liabilities |

(769,357 | ) | |

|

Net assets of BAK International and subsidiaries upon disposal |

35,308,730 | ||

|

Consideration received in the form of : |

|||

|

Offset against loans from Mr. Wang |

(83,812,839 | ) | |

|

Waiver of interest accruing up to June 30, 2014 |

(8,262,566 | ) | |

|

Net of stamp duty |

(84,677 | ) | |

|

|

(56,851,352 | ) | |

|

Impairment on receivable from the Disposal Group (note) |

11,072,885 | ||

|

Gain on disposal of subsidiaries |

$ | (45,778,467 | ) |

|

Note: |

The Disposal Group owed the Company a sum of $11,511,694 upon disposal. Management of the Company evaluated the collectability of this amount and determined that $11,072,885 should be impaired (Note 5(ii)). |

F-9

| China BAK Battery, Inc. and subsidiaries |

| Notes to the condensed consolidated financial statements |

| For the three and nine months ended June 30, 2013 and 2014 (Continued) |

| (In US$ except for number of shares) |

| (Unaudited) |

1. Principal Activities, Basis of Presentation and Organization (Continued)

Basis of Presentation and Organization (Continued)

DISCONTINUED OPERATIONS

The Company had also been engaged in property leasing and management of its Research and Development Centre in Shenzhen since its completion in July 2013. Following the disposal of BAK International and its subsidiaries on June 30, 2014, this business is now accounted for as discontinued operations in the accompanying condensed consolidated financial statements for all periods presented. Accordingly, assets and liabilities, revenues and expenses, and cash flows related to the property leasing and management business have been appropriately reclassified in the accompanying condensed consolidated financial statements as discontinued operations for all periods presented.

The following table presents the major classes of assets and liabilities of discontinued operations of the property leasing and management business reported in the condensed consolidated balance sheets:

|

|

September 30, 2013 | ||

|

|

|||

|

Prepayments and other receivables |

$ | 37,239 | |

|

Prepaid land use right, current portion |

28,524 | ||

|

Current assets of discontinued operations |

$ | 65,763 | |

|

Noncurrent assets |

|||

|

Property, plant and equipment, net |

$ | 41,914,724 | |

|

Prepaid land use right, non current |

1,200,277 | ||

|

Noncurrent assets of discontinued operations |

$ | 43,115,001 | |

|

|

|||

|

Noncurrent liabilities of discontinued operations - Rental deposits from tenants |

$ | (715,398 | ) |

The following table presents the components of discontinued operations in relation to the property leasing and management business reported in the condensed consolidated statements of operations and comprehensive loss:

|

|

Three months ended | Nine months ended | ||||

|

|

June 30, 2014 | June 30, 2014 | ||||

|

Net revenues |

$ | 1,459,719 | $ | 4,069,146 | ||

|

Cost of revenues |

(301,935 | ) | (919,470 | ) | ||

|

|

1,157,784 | 3,149,676 | ||||

|

Gain on disposal of subsidiaries |

45,778,467 | 45,778,467 | ||||

|

Income from discontinued operations |

$ | 46,936,251 | $ | 48,928,143 |

As a result of the above foreclosure, the Company currently owns a Hong Kong subsidiary, BAK Asia, which in turn wholly owns two Chinese subsidiaries, Dalian BAK and Dalian BAK Power. China BAK will continue to be a US listing company with a low level of liabilities. The Company has outsourced its manufacturing operations to BAK Tianjin before the completion of construction and operation of facility in Dalian. BAK Tianjin is now a supplier of the Company and the Company does not have any significant benefits or liability from the operating results of BAK Tianjin except the normal risk with any major supplier.

It is the Company’s understanding that the Dalian government will grant certain government subsidies to the Company, including but not limited to land use rights at a favorable price. As of June 30, 2014, the Company had advances from the Management Committee of Dalian Economic Zone of $24,176,781 to finance its removal of our production facilities to Dalian. The Company expects that the removal will be completed by the end of 2014 and these advances will be recognized as income or offset against related expenditures when there are no present or future obligations for the subsidized projects. The Company obtained a short term bank loan of $4.8 million (RMB30 million) from Bank of Dandong for the period from August 19, 2014 to August 18, 2015. The short term loan is bearing fixed interest at 7.8% per annum and was guaranteed by Shenzhen BAK and Mr. Xiangqian Li, the Company’s CEO. The Company plans to raise further financing from local banks to meet its daily cash demands. However, there can be no assurance that the Company will be successful in obtaining this financing.

F-10

| China BAK Battery, Inc. and subsidiaries |

| Notes to the condensed consolidated financial statements |

| For the three and nine months ended June 30, 2013 and 2014 (Continued) |

| (In US$ except for number of shares) |

| (Unaudited) |

1. Principal Activities, Basis of Presentation and Organization (Continued)

Basis of Presentation and Organization (Continued)

The accompanying condensed consolidated financial statements have been prepared assuming the Company will continue to operate as a going concern, which contemplates the realization of assets and the settlement of liabilities in the normal course of business. The condensed consolidated financial statements do not include any adjustments to reflect the possible future effects on the recoverability and classification of assets or the amounts and classification of liabilities that may result from the outcome of this uncertainty related to the Company’s ability to continue as a going concern.

Recently issued accounting pronouncements

In April 2014, the FASB issued ASU 2014-08 “Presentation of Financial Statements (Topic 205)and Property, Plant, and Equipment (Topic 360) - Reporting Discontinued Operations and Disclosures of Disposals of Components of an Entity”, which changes the threshold for reporting discontinued operations and adds new disclosures. The new guidance defines a discontinued operation as a disposal that “represents a strategic shift that has (or will have) a major effect on an entity’s operations and financial results.” The standard is required to be adopted by public business entities in annual periods beginning on or after December 15, 2014, and interim periods within those annual periods. Entities may “early adopt” the guidance for new disposals. The Company does not expect that the adoption will have a material impact on its consolidated financial statements.

In May 2014, the FASB issued ASU 2014-09, "Revenue from Contracts with Customers (Topic 606)" which clarifies and improves the principles for recognizing revenue and develops a common revenue standard for United States generally accepted accounting principles (U.S. GAAP) and International Financial Reporting Standards (IFRS) that among other things, improves comparability of revenue recognition practices and provides more useful information to users of financial statements through improved disclosure requirements. The amendments in ASU 2014-09 are effective for annual reporting periods beginning after December 15, 2016, including interim periods within that reporting period. Early application is not permitted. The Company is currently reviewing the effect of ASU 2014-09 on its revenue recognition.

In June 2014, the FASB issued ASU 2014-12, "Compensation - Stock Compensation (Topic 718)" which provides explicit guidance on the treatment of awards with performance targets that could be achieved after the requisite service period. The amendments in ASU 2014-12 are effective for annual periods and interim periods within those annual periods beginning after December 15, 2015. The Company does not expect that the adoption will have a material impact on its consolidated financial statements.

Other accounting standards that have been issued or proposed by the FASB or other standards-setting bodies that do not require adoption until a future date are not expected to have a material impact on the Company’s consolidated financial statements upon adoption.

F-11

| China BAK Battery, Inc. and subsidiaries |

| Notes to the condensed consolidated financial statements |

| For the three and nine months ended June 30, 2013 and 2014 (Continued) |

| (In US$ except for number of shares) |

| (Unaudited) |

2. Pledged Deposits

Pledged deposits as of September 30, 2013 and June 30, 2014 consisted of the following:

|

|

September 30, 2013 | June 30, 2014 | ||||

|

Pledged deposits with banks for: |

||||||

|

Advances from an unrelated third party (Note 10(b)) |

$ | 2,450,540 | $ | - | ||

|

Bills payable |

5,687,147 | - | ||||

|

|

$ | 8,137,687 | $ | - |

3. Trade Accounts Receivable, net

Trade accounts receivable as of September 30, 2013 and June 30, 2014 consisted of the following:

|

|

September 30, 2013 | June 30, 2014 | ||||

|

Trade accounts receivable |

$ | 61,706,474 | $ | 176,439 | ||

|

Less: Allowance for doubtful accounts |

(17,734,802 | ) | - | |||

|

|

43,971,672 | 176,439 | ||||

|

Bills receivable |

5,904,029 | - | ||||

|

|

$ | 49,875,701 | $ | 176,439 |

4. Inventories

Inventories as of September 30, 2013 and June 30, 2014 consisted of the following:

|

|

September 30, 2013 | June 30, 2014 | ||||

|

Raw materials |

$ | 9,732,211 | $ | - | ||

|

Work-in-progress |

9,220,019 | - | ||||

|

Finished goods |

38,322,957 | 806,699 | ||||

|

|

$ | 57,275,187 | $ | 806,699 |

During the three months ended June 30, 2013 and 2014, obsolete inventory write-downs to lower of cost or market of $12,288,997 and $3,105,534, respectively, were charged to cost of revenues.

During the nine months ended June 30, 2013 and 2014, obsolete inventory write-downs to lower of cost or market of $38,084,761 and $8,752,543, respectively, were charged to cost of revenues.

F-12

| China BAK Battery, Inc. and subsidiaries |

| Notes to the condensed consolidated financial statements |

| For the three and nine months ended June 30, 2013 and 2014 (Continued) |

| (In US$ except for number of shares) |

| (Unaudited) |

5. Prepayments and Other Receivables and Receivable from former subsidiaries

(i) Prepayments and other receivables were disposed as of September 30, 2013 and June 30, 2014 consisted of the following:

|

|

Note | September 30, 2013 | June 30, 2014 | ||||||

|

Prepayments for raw materials and others |

$ | 3,466,177 | $ | - | |||||

|

Staff advances |

701,923 | 17,776 | |||||||

|

Prepaid operating expenses |

292,049 | 1,934 | |||||||

|

Advance to an unrelated third party |

(a) (e) | 1,169,798 | - | ||||||

|

Advance to a related party |

(b) (e) | 885,052 | - | ||||||

|

Consideration receivable |

(c) (e) | 6,483,507 | - | ||||||

|

Net assets of BAK Canada held by trustee |

(d) (e) | 1,043,833 | - | ||||||

|

Value added tax recoverable |

4,295,390 | 165,250 | |||||||

|

Others |

1,371,790 | 9,044 | |||||||

|

|

19,709,519 | 194,004 | |||||||

|

Less: Allowance for doubtful accounts |

(1,980,914 | ) | - | ||||||

|

|

$ | 17,728,605 | $ | 194,004 |

| (a) |

Advance to an unrelated third party was interest-free, unsecured and repayable on demand. |

| (b) |

As of September 30, the Company advanced to Tianjin BAK New Energy Research Institute Co., Ltd (“Tianjin New Energy”), a related party under the common control of Mr. Xiangqian Li (“Mr. Li”), the Company’s CEO, an amount of $885,052 which was interest-free, unsecured and repayable on demand. |

| (c) |

On August 27, 2013, the Company completed the equity transfer of Tianjin Meicai to Tianjin Zhantuo International Trading Co., Ltd. (“Tianjin Zhantuo”), an unrelated third party. As of September 30, 2013, the remaining consideration receivable was $6,483,507. The amount was interest-free, repayable on September 26, 2013 (30 days upon completion) and pledged for advance from Tianjin Zhantuo. |

| (d) |

BAK Canada filed for bankruptcy on March 28, 2013. As of September 30, 2013, its net assets were held under the custody of its trustee. |

| (e) | These receivables were disposed as of June 30, 2014. (Note 1). |

(ii) Receivable from a former subsidiary

| June 30, 2014 | |||

| Receivable from a former subsidiary (Note 1) | $ | 11,511,694 | |

| Less: Allowance for doubtful accounts (Note 1) | 11,072,885 | ||

| $ | 438,809 |

As of June 30, 2014, the amount due from Shenzhen BAK was interest free, unsecured and repayable on demand. An amount of $438,809 was repaid in August 2014.

F-13

| China BAK Battery, Inc. and subsidiaries |

| Notes to the condensed consolidated financial statements |

| For the three and nine months ended June 30, 2013 and 2014 (Continued) |

| (In US$ except for number of shares) |

| (Unaudited) |

6. Property, Plant and Equipment, net

Property, plant and equipment as of September 30, 2013 and June 30, 2014 consisted of the following:

|

|

September 30, 2013 | June 30, 2014 | ||||

|

Buildings |

$ | 110,214,027 | $ | - | ||

|

Machinery and equipment |

125,617,004 | 7,816 | ||||

|

Office equipment |

2,520,480 | 2,396 | ||||

|

Motor vehicles |

1,722,492 | 116,842 | ||||

|

|

240,074,003 | 127,054 | ||||

|

Accumulated depreciation |

(123,715,978 | ) | (8,292 | ) | ||

|

Construction in progress |

11,321,396 | 11,960,099 | ||||

|

Prepayment for acquisition of property, plant and equipment |

558,013 | - | ||||

|

Carrying amount |

$ | 128,237,434 | $ | 12,078,861 |

| (i) |

Depreciation expense for the continuing operations is included in the condensed consolidated statements of operations and comprehensive loss as follows: |

|

|

Three months ended June 30, | Nine months ended June 30, | ||||||||||

|

|

2013 | 2014 | 2013 | 2014 | ||||||||

|

Cost of revenues |

$ | 3,634,835 | $ | 1,415,904 | $ | 11,029,359 | $ | 4,706,625 | ||||

|

Research and development expenses |

92,751 | 149,372 | 373,167 | 396,926 | ||||||||

|

Sales and marketing expenses |

34,820 | 27,357 | 101,673 | 84,194 | ||||||||

|

General and administrative expenses |

873,827 | 800,203 | 2,490,275 | 2,490,383 | ||||||||

|

|

$ | 4,636,233 | $ | 2,392,836 | $ | 13,994,474 | $ | 7,678,128 | ||||

| (ii) |

Construction in Progress |

|

Construction in progress as of September 30, 2013 mainly comprised of capital expenditures for the automation production line of BAK Tianjin. Construction in progress as of June 30, 2014 was mainly comprised of capital expenditures for the site of Dalian BAK Power. | |

|

For the three months ended June 30, 2013 and 2014, the Company capitalized interest of $605,648 and $26,943, respectively, to the cost of construction in progress. | |

|

For the nine months ended June 30, 2013 and 2014, the Company capitalized interest of $1,975,311 and $345,443, respectively, to the cost of construction in progress. | |

| (iii) |

Impairment charge |

|

During the course of the Company’s strategic review of its operations, the Company assessed the recoverability of the carrying value of the Company’s property, plant and equipment.. The Company charged impairment losses of $3.2 million and $14.6 million for the three and nine months ended June 30, 2013, respectively. The impairment charge represented the excess of carrying amounts of the Company’s property, plant and equipment over the estimated discounted cash flows expected to be generated by the Company’s production facilities in Shenzhen primarily for the production of aluminum-case cells. The Company believes that there was no further impairment for the three and nine months ended June 30, 2014. |

F-14

| China BAK Battery, Inc. and subsidiaries |

| Notes to the condensed consolidated financial statements |

| For the three and nine months ended June 30, 2013 and 2014 (Continued) |

| (In US$ except for number of shares) |

| (Unaudited) |

7. Prepaid Land Use Rights, net

Prepaid land use rights as of September 30, 2013 and June 30, 2014 consisted of the followings:

|

|

September 30, 2013 | June 30, 2014 | ||||

|

Prepaid land use rights |

$ | 25,104,833 | $ | - | ||

|

Accumulated amortization |

(3,664,541 | ) | - | |||

|

|

$ | 21,440,292 | $ | - | ||

|

Less: Classified as current assets |

(707,810 | ) | - | |||

|

|

$ | 20,732,482 | $ | - |

Amortization expenses for the continuing operations were $150,712 and $418,720 for the three and nine months ended June 30, 2014, respectively.

Amortization expenses for the continuing operations were $254,386 and $831,840 for the three and nine months ended June 30, 2013, respectively.

8. Intangible Assets, net

Intangible assets as of September 30, 2013 and June 30, 2014 consist of the following:

|

|

September 30, 2013 | June 30, 2014 | ||||

|

Trademarks, computer software and technology |

$ | 1,430,756 | $ | - | ||

|

Less: Accumulated amortization |

(699,872 | ) | - | |||

|

|

$ | 730,884 | $ | - |

Intangible assets represented the trademarks, computer software and technology used for battery production and research.

Amortization expenses for the continuing operations were $146,002 and $59,601 for the three months ended June 30, 2013 and 2014 and $232,819 and $154,662 for the nine months ended June 30, 2013 and 2014, respectively.

9. Short-term Bank Loans

As of September 30, 2013 and June 30, 2014, the Company had several short-term bank loans with aggregate outstanding balances of $151,404,677 and nil. The loans were primarily obtained for general working capital, carried at interest rates ranging from 5.88% to 15.00% per annum, and had maturity dates ranging from 9 to 12 months. The loans are guaranteed by Mr. Li, the Company’s CEO, BAK International (TJ) Ltd and BAK International Ltd. These facilities were also secured by the Company’s assets with the following carrying values:

|

|

September 30, 2013 | June 30, 2014 | ||||

|

Inventories |

$ | 24,505,399 | $ | - | ||

|

Accounts receivable, net |

31,392,774 | - | ||||

|

Machinery and equipment, net |

12,211,038 | - | ||||

|

Land use rights, buildings and construction in progress of BAK Industrial Park |

87,763,440 | - | ||||

|

Land use rights and buildings of Research and Development Test Centre |

43,143,525 | - | ||||

|

Land use rights #1 and buildings of Tianjin Industrial Park Zone |

17,857,940 | - | ||||

|

|

$ | 216,874,116 | $ | - |

As of June 30, 2014, short-term bank loans were disposed (note 1).

During the three months ended June 30, 2013 and 2014, interest expenses of $3,786,211 and $1,101,889, respectively, were incurred on the Company’s short-term bank borrowings.

During the nine months ended June 30, 2013 and 2014, interest expenses of $9,502,769 and $5,693,738, respectively, were incurred on the Company’s short-term bank borrowings.

F-15

| China BAK Battery, Inc. and subsidiaries |

| Notes to the condensed consolidated financial statements |

| For the three and nine months ended June 30, 2013 and 2014 (Continued) |

| (In US$ except for number of shares) |

| (Unaudited) |

10. Other short-term loans, Accrued Expenses and Other Payables

(i) Other short-term loans were disposed as of September 30, 2013 and June 30, 2014 consisted of the following:

|

|

Note | September 30, 2013 | June 30, 2014 | ||||||

|

Advances from unrelated third parties |

|||||||||

|

– Shenzhen Huo Huang Import & Export Co., Ltd. |

(a) | $ | 24,160,595 | $ | - | ||||

|

– Gold State Securities Limited |

(b) | 2,450,540 | - | ||||||

|

– Shenzhen Wellgain Industrial Co., Ltd. |

(c) | 816,847 | - | ||||||

|

– Shenzhen De Dao Trading Co., Ltd. (former supplier of the Company) |

816,847 | - | |||||||

|

– Others |

37,493 | - | |||||||

|

|

$ | 28,282,322 | $ | - |

(ii) Accrued expenses and other payables as of September 30, 2013 and June 30, 2014 consisted of the following:

|

|

Note | September 30, 2013 | June 30, 2014 | ||||||

|

Construction costs payable |

$ | 5,894,919 | $ | 7,555,228 | |||||

|

Equipment purchase payable |

5,359,816 | - | |||||||

|

Customer deposits |

2,038,387 | 104,992 | |||||||

|

Other payables and accruals |

(d) | 5,400,459 | 1,569,895 | ||||||

|

Accrued loan interest |

246,027 | - | |||||||

|

Accrued staff costs |

3,869,318 | - | |||||||

|

Deferred revenue, current portion |

346,509 | - | |||||||

|

|

$ | 23,155,435 | $ | 9,230,115 |

As of September 30, 2013, the Company had advances from unrelated parties of $28,282,322, which were unsecured, non- interest bearing and repayable on demand except for:

| (a) |

A loan from Shenzhen Huo Huang Import & Export Co., Ltd. that bears interest at 18% per annum; |

| (b) |

A loan from Gold State Securities Limited that bears interest at 2.31% per annum, secured by fixed deposits of the same amount plus interest placed with a bank (Note 2) and guaranteed by Mr. Xiangqian Li; and |

| (c) |

A loan of $3,267,387 (RMB20 million) from Shenzhen Wellgain Industrial Co., Ltd. which was interest bearing at 0.5% per month and repayable by July 9, 2013, guaranteed by Mr. Xiangqian Li and Mr. Chunzhi Zhang. The Company repaid principal of $2,450,540 and default interest of $201,958 prior to September 30, 2013, and repaid the remaining balance of $816,847 on October 21, 2013; |

As of June 30, 2014, advances from related parties were either repaid or disposed.

F-16

| China BAK Battery, Inc. and subsidiaries |

| Notes to the condensed consolidated financial statements |

| For the three and nine months ended June 30, 2013 and 2014 (Continued) |

| (In US$ except for number of shares) |

| (Unaudited) |

10. Other short-term loans, Accrued Expenses and Other Payables (continued)

| (d) |

Other payables and accruals as of September 30, 2013 and June 30, 2014 included a payable for liquidated damages of approximately $1,210,000. |

|

On August 15, 2006, the SEC declared effective a post-effective amendment that the Company had filed on August 4, 2006, terminating the effectiveness of a resale registration statement on Form SB-2 that had been filed pursuant to a registration rights agreement with certain shareholders to register the resale of shares held by those shareholders. The Company subsequently filed Form S-1 for these shareholders. On December 8, 2006, the Company filed its Annual Report on Form 10-K for the year ended September 30, 2006 (the “2006 Form 10-K”). After the filing of the 2006 Form 10-K, the Company’s previously filed registration statement on Form S-1 was no longer available for resale by the selling shareholders whose shares were included in such Form S-1. Under the registration rights agreement, those selling shareholders became eligible for liquidated damages from the Company relating to the above two events totaling approximately $1,051,000. As of September 30, 2013 and June 30, 2014, no liquidated damages relating to both events have been paid. | |

|

On November 9, 2007, the Company completed a private placement for the gross proceeds to the Company of $13,650,000 by selling 3,500,000 shares of common stock at the price of $3.90 per share. Roth Capital Partners, LLC acted as the Company’s exclusive financial advisor and placement agent in connection with the private placement and received a cash fee of $819,000. The Company may have become liable for liquidated damages to certain shareholders whose shares were included in a resale registration statement on Form S-3 that the Company filed pursuant to a registration rights agreement that the Company entered into with such shareholders in November 2007. Under the registration rights agreement, among other things, if a registration statement filed pursuant thereto was not declared effective by the SEC by the 100th calendar day after the closing of the Company’s private placement on November 9, 2007, or the “Effectiveness Deadline”, then the Company would be liable to pay partial liquidated damages to each such investor of (a) 1.5% of the aggregate purchase price paid by such investor for the shares it purchased on the one month anniversary of the Effectiveness Deadline; (b) an additional 1.5% of the aggregate purchase price paid by such investor every thirtieth day thereafter (pro rated for periods totaling less than thirty days) until the earliest of the effectiveness of the registration statement, the ten-month anniversary of the Effectiveness Deadline and the time that the Company is no longer required to keep such resale registration statement effective because either such shareholders have sold all of their shares or such shareholders may sell their shares pursuant to Rule 144 without volume limitations; and (c) 0.5% of the aggregate purchase price paid by such investor for the shares it purchased in our November 2007 private placement on each of the following dates: the ten-month anniversary of the Effectiveness Deadline and every thirtieth day thereafter (pro rated for periods totaling less than thirty days), until the earlier of the effectiveness of the registration statement and the time that the Company no longer is required to keep such resale registration statement effective because either such shareholders have sold all of their shares or such shareholders may sell their shares pursuant to Rule 144 without volume limitations. Such liquidated damages would bear interest at the rate of 1% per month (prorated for partial months) until paid in full. | |

|

On December 21, 2007, pursuant to the registration rights agreement, the Company filed a registration statement on Form S-3, which was declared effective by the SEC on May 7, 2008. As a result, the Company estimated liquidated damages amounting to $561,174 for the November 2007 registration rights agreement. As of September 30, 2013 and June 30, 2014, the Company had settled the liquidated damages with all the investors and the remaining provision of approximately $159,000 was included in other payables and accruals. |

During the three months ended June 30, 2013 and 2014, interest expense of $16,077 and $5,149,806 (including loan interest of $4,203,266 accruing on the loans from Mr. Wang as described in Note 1), respectively, was incurred on the Company’s advances from unrelated third parties.

During the nine months ended June 30, 2013 and 2014, interest expense of $16,077 and $11,687,780 (including loan interest of $8,347,735 accruing on the loans from Mr. Wang as described in Note 1), respectively, was incurred on the Company’s advances from unrelated third parties.

F-17

| China BAK Battery, Inc. and subsidiaries |

| Notes to the condensed consolidated financial statements |

| For the three and nine months ended June 30, 2013 and 2014 (Continued) |

| (In US$ except for number of shares) |

| (Unaudited) |

11. Deferred Revenue

Deferred revenue mainly represented a government grant subsidy of $9.0million (RMB56 million) for costs of land use rights relating to BAK Industrial Park, which is amortized on a straight-line basis over the estimated useful lives of the depreciable facilities constructed thereon of 35 years.

12. Deferred Government Grants

Other long-term payables as of September 30, 2013 and June 30, 2014 consist of the following:

|

|

September 30, 2013 | June 30, 2014 | ||||

|

Advances from the Management Committee of Dalian Economic Zone (the “Management Committee”)(note) |

$ | 24,505,399 | $ | 24,176,781 | ||

|

Government subsidies received for:- |

||||||

|

– Automated high-power lithium battery project from the National Development and Reform Commission and Ministry of Industry and Information Technology |

8,145,594 | - | ||||

|

– New energy innovation project from the Ministry of Finance |

340,217 | - | ||||

|

– Various lithium battery related projects from various government authorities |

14,448,005 | - | ||||

|

Others |

32,252 | - | ||||

|

|

$ | 47,471,467 | $ | 24,176,781 | ||

|

Less: Current portion |

(24,525,004 | ) | (24,176,781 | ) | ||

|

|

$ | 22,946,463 | $ | - |

|

Note: |

The Management Committee provided a subsidy of RMB150 million to finance the removal of the Company’s production facilities from Tianjin to Dalian. The Company expects that the removal will be completed before December 2014. |

The Company will recognize these grants as income or offset against related expenditures when there are no present or future obligations for the subsidized projects.

F-18

| China BAK Battery, Inc. and subsidiaries |

| Notes to the condensed consolidated financial statements |

| For the three and nine months ended June 30, 2013 and 2014 (Continued) |

| (In US$ except for number of shares) |

| (Unaudited) |

13. Income Taxes, Deferred Tax Assets and Deferred Tax Liabilities

(a) Income taxes in the condensed consolidated statements of comprehensive loss

The Company’s provision for income taxes consisted of:

| Three Months ended June 30, | Nine Months ended June 30, | |||||||||||

| 2013 | 2014 | 2013 | 2014 | |||||||||

| PRC income tax: | ||||||||||||

| Current | $ | 32,777 | $ | - | $ | 277,599 | $ | 16,474 | ||||

| Deferred | 25,228 | - | 5,806,678 | - | ||||||||

| $ | 58,005 | $ | - | $ | 6,084,277 | $ | 16,474 | |||||

United States Tax

China BAK is subject to

statutory tax rate of 35% under United States of America tax law. No provision

for income taxes in the United States or elsewhere has been made as China BAK

had no taxable income for the three months ended andnine months ended June 30,

2013 and 2014.

Canada States Tax

BAK Canada is subject to

statutory tax rate of 38% under Canada tax law. No provision for income taxes in

Canada has been made as BAK Canada had no taxable income for the three months

and nine months ended June 30, 2013 and 2014.

German States Tax

BAK Europe is subject to

25% statutory tax rate under Germany tax law for the three months and nine

months ended June 30, 2013 and 2014.

India Tax

BAK India is subject to 30%

statutory tax rate under India tax law. No provision for income taxes in India

has been made as BAK India had no taxable income for the three months and nine

months ended June 30, 2013 and 2014.

Hong Kong Tax

BAK International and China

Asia are subject to Hong Kong profits tax rate of 16.5% . There is no taxable

income for both companies for the three months and nine months ended June 30, 2013 and 2014, thus

both companies did not incur any Hong Kong profits tax during the periods

presented.

PRC Tax

Shenzhen BAK is entitled to a

preferential enterprise income tax rate of 15% for the three and nine months

ended June 30, 2013 and 2014.

All the other subsidiaries in China are subject to an income tax rate of 25%.

F-19

| China BAK Battery, Inc. and subsidiaries |

| Notes to the condensed consolidated financial statements |

| For the three and nine months ended June 30, 2013 and 2014 (Continued) |

| (In US$ except for number of shares) |

| (Unaudited) |

13. Income Taxes, Deferred Tax Assets and Deferred Tax Liabilities (Continued)

(a) Income taxes in the condensed consolidated statements of comprehensive loss (Continued)

A reconciliation of the provision for income taxes determined at the statutory income tax rate to the Company’s income tax expenses is as follows:

|

|

Three Months ended June 30, | Nine Months ended June 30, | ||||||||||

|

|

2013 | 2014 | 2013 | 2014 | ||||||||

|

(Loss) before income taxes-continuing operations |

$ | (10,212,676 | ) | $ | $ (9,829,430 | ) | $ | (52,040,531 | ) | $ | (26,351,675 | ) |

|

|

||||||||||||

|

United States federal corporate income tax rate |

35% | 35% | 35% | 35% | ||||||||

|

Income tax computed at United States statutory corporate income tax rate |

(3,574,437 | ) | (3,440,301 | ) | (18,214,186 | ) | (9,223,086 | ) | ||||

|

Reconciling items: |

||||||||||||

|

Rate differential for PRC earnings |

1,720,899 | 455,721 | 9,782,790 | 2,555,291 | ||||||||

|

Valuation allowance on deferred tax assets |

1,328,284 | 2,939,065 | 7,109,734 | 6,147,546 | ||||||||

|

Non-deductible expenses |

554,557 | 40,430 | 7,087,660 | 506,060 | ||||||||

|

Share based payment |

27,771 | 5,085 | 104,205 | 30,663 | ||||||||

|

Under-provision in prior year |

931 | - | 214,074 | - | ||||||||

|

Income tax expenses |

$ | 58,005 | $ | - | $ | 6,084,277 | $ | 16,474 | ||||

As of September 30, 2013 and June 30, 2014, the Company’s U.S. entity, had net operating loss carry forwards of $2,511,374 and $3,354,362, respectively, available to reduce future taxable income which will expire in various years through 2030 and the Company’s PRC subsidiaries had net operating loss carry forwards of $105,668,004 and $595,495 which will expire in various years through 2019. Management believes it is more likely than not that the Company will not realize these potential tax benefits as these operations will not generate any operating profits in the foreseeable future. As a result, the full amount of the valuation allowance was provided against the potential tax benefits.

F-20

| China BAK Battery, Inc. and subsidiaries |

| Notes to the condensed consolidated financial statements |

| For the three and nine months ended June 30, 2013 and 2014 (Continued) |

| (In US$ except for number of shares) |

| (Unaudited) |

13. Income Taxes, Deferred Tax Assets and Deferred Tax Liabilities (Continued)

(b) Deferred tax assets and deferred tax liabilities

The tax effects of temporary differences that give rise to significant portions of the deferred tax assets and liabilities as of September 30, 2013 and June 30, 2014 are presented below:

|

|

September 30,2013 | June 30, 2014 | ||||

|

Deferred tax assets |

||||||

|

Short-term |

||||||

|

Trade accounts receivable |

$ | 5,530,324 | $ | - | ||

|

Inventories |

5,365,802 | - | ||||

|

Accrued expenses and other payables |

865,002 | - | ||||

|

Valuation allowance |

(11,761,128 | ) | - | |||

|

Short-term deferred tax assets |

- | - | ||||

|

|

||||||

|

Long-term |

||||||

|

Property, plant and equipment |

17,826,415 | - | ||||

|

Net operating loss carried forward |

26,833,658 | 1,322,901 | ||||

|

Valuation allowance |

(44,660,073 | ) | (1,322,901 | ) | ||

|

Long-term deferred tax assets |

- | - | ||||

|

Total net deferred tax assets |

$ | - | $ | - | ||

|

Deferred tax liabilities: |

||||||

|

Long-term - Property, plant and equipment |

$ | (779,814 | ) | $ | - | |

|

Net deferred tax liabilities |

$ | (779,814 | ) | $ | - |