UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 10-K

(Mark One)

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: September 30, 2012

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________to _____________

Commission File No. 001-32898

CHINA BAK BATTERY,

INC.

(Exact Name of Registrant as Specified in Its

Charter)

| Nevada | 88-0442833 |

| (State or Other Jurisdiction of Incorporation or | (I.R.S. Employer Identification No.) |

| Organization) |

BAK Industrial Park

No. 1

BAK Street

Kuichong Town, Longgang District

Shenzhen 518119

People’s Republic of China

(Address of Principal Executive

Offices)

(86-755) 61886818-6957

(Registrant’s telephone

number, including area code)

Securities registered pursuant to Section 12(b) of the

Act:

| Title of each class |

Name of each exchange on which registered |

| Common Stock, par value $0.001 per share |

The NASDAQ Stock Market LLC (The NASDAQ Global Market) |

Securities registered pursuant to Section 12(g) of the Exchange Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes [ ] No [x]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes [ ] No [x]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer [ ] | Accelerated Filer [ ] |

| Non-Accelerated Filer [ ] | Smaller reporting company [X] |

| (Do not check if a smaller reporting company) |

Indicate by check mark whether registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes [ ] No [X]

As of March 31, 2012 (the last business day of the registrant’s most recently completed second fiscal quarter), the aggregate market value of the shares of the registrant’s common stock held by non-affiliates (based upon the closing sale price of such shares as reported on The NASDAQ Global Market) was approximately $45.6 million. Shares of the registrant’s common stock held by each executive officer and director and by each person who owns 10% or more of the outstanding common stock have been excluded from the calculation in that such persons may be deemed to be affiliates of the registrant. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

There were a total of 12,763,863 shares of the registrant’s common stock outstanding as of December 28, 2012.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s Proxy Statement relating to its 2013 Annual Meeting of Stockholders to be filed with the Commission within 120 days after the close of the registrant’s fiscal year are incorporated by reference into Part III of this Annual Report on Form 10-K.

| CHINA BAK BATTERY, INC. |

| Annual Report on Form 10-K |

TABLE OF CONTENTS

i

INTRODUCTORY NOTE

Use of Terms

Except as otherwise indicated by the context, references in this report to:

- “Company,” “we,” “us” and “our” are to the combined business of China BAK Battery, Inc., a Nevada corporation, and its consolidated subsidiaries;

- “BAK International” are to our Hong Kong subsidiary, BAK International Limited;

- “BAK Europe” are to our German subsidiary, BAK Europe GmbH;

- “BAK Canada” are to our Canadian subsidiary, BAK Battery Canada Ltd.;

- “BAK India” are to our Indian subsidiary, BAK Telecom India Private Limited;

- “Shenzhen BAK” are to our PRC subsidiary, Shenzhen BAK Battery Co., Ltd.;

- “BAK Tianjin” are to our PRC subsidiary, BAK International (Tianjin) Ltd.;

- “BAK Electronics” are to our PRC subsidiary, BAK Electronics (Shenzhen) Co., Ltd.;

- “Tianjin Meicai” are to our PRC subsidiary, Tianjin Meicai New Material Technology Co., Ltd.;

- “China” and “PRC” are to People’s Republic of China;

- “RMB” are to Renminbi, the legal currency of China;

- “U.S. dollar,” “$” and “US$” are to the legal currency of the United States.

- “SEC” are to the United States Securities and Exchange Commission;

- “Securities Act” are to the Securities Act of 1933, as amended; and

- “Exchange Act” are to the Securities Exchange Act of 1934, as amended.

Special Note Regarding Forward Looking Statements

Statements contained in this report include “forward-looking statements” within the meaning of such term in Section 27A of the Securities Act and Section 21E of the Exchange Act. Forward-looking statements involve known and unknown risks, uncertainties and other factors which could cause actual financial or operating results, performances or achievements expressed or implied by such forward-looking statements not to occur or be realized. Forward-looking statements made in this report generally are based on our best estimates of future results, performances or achievements, predicated upon current conditions and the most recent results of the companies involved and their respective industries. Forward-looking statements may be identified by the use of forward-looking terminology such as “may,” “will,” “could,” “should,” “project,” “expect,” “believe,” “estimate,” “anticipate,” “intend,” “continue,” “potential,” “opportunity” or similar terms, variations of those terms or the negative of those terms or other variations of those terms or comparable words or expressions. Potential risks and uncertainties include, among other things, such factors as:

- our ability to continue as a going concern;

- our ability to remain listed on a national securities exchange;

- our anticipated growth strategies and our ability to manage the expansion of our business operations effectively;

- our future business development, results of operations and financial condition;

- our ability to fund our operations and manage our substantial short-term indebtedness;

- our ability to maintain or increase our market share in the competitive markets in which we do business;

- our ability to keep up with rapidly changing technologies and evolving industry standards, including our ability to achieve technological advances;

- our ability to diversify our product offerings and capture new market opportunities;

- our ability to obtain original equipment manufacturer, or OEM, qualifications from brand names;

- our ability to source our needs for skilled labor, machinery and raw materials economically;

- uncertainties with respect to the PRC legal and regulatory environment;

- other risks identified in this report and in our other reports filed with the SEC, including those identified in “Item 1A. Risk Factors” below.

Readers are urged to carefully review and consider the various disclosures made by us in this report and our other filings with the SEC. These reports attempt to advise interested parties of the risks and factors that may affect our business, financial condition and results of operations and prospects. The forward-looking statements made in this report speak only as of the date hereof and we disclaim any obligation to provide updates, revisions or amendments to any forward-looking statements to reflect changes in our expectations or future events.

1

We completed a reverse stock split on October 26, 2012, pursuant to which every five shares of our common stock were combined into one share of common stock. All references in this report to share and per share data have been adjusted, including historical data which have been retroactively adjusted, to give effect to the reverse stock split unless specified otherwise.

PART I

ITEM 1. BUSINESS.

Overview of Our Business

We are a leading global manufacturer of lithium-based battery cells. We produce battery cells for OEM customers and replacement battery manufacturers that are the principal component of rechargeable batteries commonly used to power the following applications:

- cellular phones and smartphones;

- notebook computers, tablet computers and e-book readers;

- portable consumer electronics, such as digital cameras, portable media players, portable gaming devices, personal digital assistants, or PDAs, camcorders, digital cameras and Bluetooth headsets; and

- electric bicycles and other light electric vehicles, hybrid electric vehicles and other electric vehicles; cordless power tools; and uninterruptible power supplies, or UPS.

We conduct all of our manufacturing operations in China, in close proximity to China’s electronics manufacturing base and its rapidly growing market. Historically, we have primarily manufactured prismatic lithium-ion cells for the cellular phone replacement battery market and the OEM market. Our products are packed into batteries by third-party battery pack manufacturers in accordance with the specifications of manufacturers of portable electronic applications. At the request of our customers that order prismatic battery packs, we assemble our prismatic cells into battery packs at our Shenzhen facility or engage battery pack manufacturers to assemble our cells into batteries for a fee, and then sell battery packs to these customers both for the replacement and OEM markets.

In fiscal year 2012, we continued the implementation of our business plan to expand our lithium-ion polymer and high-power lithium battery production capacity in response to evolving market demands. In particular, we developed and supplied cylindrical cell packs for use in high-capacity public-use electric vehicles as part of a strategic cooperation program for electric vehicle development with a major Taiwan-based automobile manufacturer. We also expanded our prismatic cells production capacity for the smartphone market. As a result, we have derived and expect to continue to derive an increasing portion of our revenues from these other products.

In November 2011, we were recognized by the PRC’s National Development and Reform Commission as a National-certified Enterprise Technology Center. We were previously recognized as a provincial-level Shenzhen Enterprise Technology Center in 2005. The criteria for recognition as a National-certified Enterprise Technology Center include technological innovation and industry leadership. As so certified, we will receive certain tax preferences, and will be reevaluated biennially to maintain this status. The award affirmed our view that we have been successfully demonstrating our capabilities on a national scale.

We have experienced net losses during the past two fiscal years. We generated revenues of $218.9 million and $205.7 million in the years ended September 30, 2011 and 2012, respectively, and net loss of $24.5 million and $65.8 million during the same periods, respectively. However, we believe that our accomplishments to date, as well as our business plan, will yield long-term growth of revenues and positive net income.

Our Corporate History and Structure

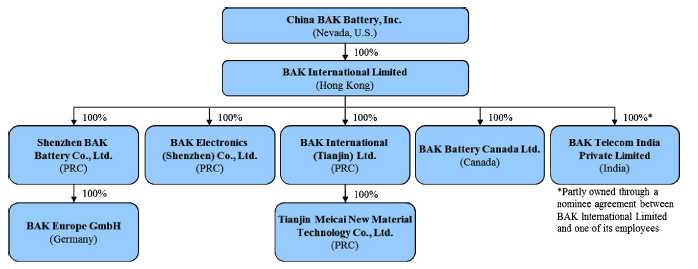

We conduct our current business through the following three wholly-owned operating subsidiaries in China that we own through BAK International:

- Shenzhen BAK, located in Shenzhen, China, incorporated in August 2001, which focuses on the development and manufacture of prismatic cells and cylindrical cells;

2

-

BAK Electronics located in Shenzhen, China, incorporated in August 2005, which focuses on the development and manufacture of lithium polymer cells; and

-

BAK Tianjin, located in Tianjin, China, incorporated in December 2006, which focuses on the development and manufacture of high-power lithium cells.

In addition, BAK Canada, a wholly-owned subsidiary of BAK International, was incorporated in Canada in December 2006 to advance our R&D of lithium-ion batteries. In November 2007, BAK Europe, a wholly-owned subsidiary of Shenzhen BAK, was established in Germany, which focuses on the sales and after-sales services of lithium-ion battery cells. In August 2008, BAK India, a wholly-owned subsidiary of BAK International, was incorporated in India to advance the sales and after-sales services of lithium-ion battery cells. BAK International beneficially owns 100% of BAK India partly through a nominee agreement with one of its employees. In February 2011, Tianjin Meicai, a wholly-owned subsidiary of BAK Tianjin, was established in Tianjin for the purpose of technical development of cathode materials for lithium-ion battery cells.

All of our business operations are conducted through our subsidiaries. The chart below presents our corporate structure as of September 30, 2012:

Our Products

We develop and manufacture various types of lithium-based rechargeable battery cells, which are the key component of lithium-based batteries used in a wide range of portable electronic applications. Since lithium-based batteries were first commercialized in the early 1990s, they have become the battery of choice for portable electronic devices because of their unique and favorable characteristics. The following table provides a summary of our battery cell offerings and their corresponding end applications:

| Battery Cell Type | End applications* | |

| Prismatic | Cellular phone [1] | |

| Camcorder [2] | ||

| MP3/MP4 player [1-2] | ||

| Digital camera [1] | ||

| Digital video camera [2-4] | ||

| PDA [1-2] | ||

| Smartphone [1] | ||

| Cylindrical | Notebook computer [6-8] | |

| Digital camera [1] | ||

| Portable DVD player [4] | ||

| Camcorder [2] | ||

| Portable gaming device [1-6] | ||

| Electric vehicle [500-10,000] | ||

| Power Bank [1-6] |

3

| Battery Cell Type | End applications* | |

| Lithium polymer | Cellular phone [1] | |

| Tablet Computer [1-3] | ||

| E-book reader [1-2] | ||

| MP3/MP4 player [1] | ||

| Digital camera [2] | ||

| Bluetooth headset [1] | ||

| High-power lithium battery | Cordless power tool [4-8] | |

| Light electric vehicle [10-150] | ||

| Hybrid electric vehicle [500] | ||

| Electric bicycles [10-65] | ||

| Electric car [1,500-2,000] | ||

| Electric bus [20,000-30,000] | ||

| Uninterruptible power supply [3-34] |

________________________

* Bracketed numbers

denote number of cells per particular battery.

Prismatic Cells

Prismatic cells contribute to a major portion of our revenue. Our prismatic cells are contained in metal casing made of aluminum. Aluminum-case cells generally are suited for use in batteries included in OEM cellular phones as well as many other small applications. At the request of customers that order prismatic battery packs, we assemble our prismatic cells into battery packs in our Shenzhen facility or engage battery pack manufacturers to assemble our cells into batteries for a fee, and then sell battery packs to these customers for the replacement market. OEMs with whom we have no contractual relationship may also purchase our battery cells from battery pack manufacturers. Our A grade prismatic cells deliver above average gross margins.

Cylindrical Cells

Cylindrical cells are generally used for notebook computers, portable DVD players, digital cameras, camcorders and power storage devices. One notebook computer battery typically contains at least a group of six cylindrical cells working together in a coordinated manner, so the failure of only one cell will affect the performance of the entire battery. Accordingly, cylindrical cells for notebook computers require a higher uniformity than prismatic cells. We are an approved vendor for major international OEM notebook computer manufacturers, and we are also a qualified supplier for domestic tier-one OEM notebook computer manufacturers.

In fiscal year 2012, the Company received a $1.9 million subsidy for its battery module project from the National Development and Reform Commission (NDRC) and Ministry of Industry and Information Technology (MIIT). In 2012, we continued our co-operative relations with Hua-chuang Automobile Information Technical Center Co., Ltd., or HAITEC, a subsidiary of Yulon Group, Taiwan’s largest automaker, for electric vehicle (EV) development. Also, the Company has received an EV sample order from FAW-Volkswagen Automotive Co., Ltd., a major passenger sedan joint-venture of FAW Group Corporation and Volkswagen AG. We believe this sector will be a new contributor to our revenues in the future.

Our cylindrical cells sold in the EV market sector deliver above average gross margins. We expect our cylindrical batteries for electric vehicles to continue to grow as a result of growing market recognition of our high quality products and technical capability.

Lithium Polymer Cells

In September 2005, we began producing and shipping lithium polymer battery cells. Our lithium polymer cells do not have a hard metal casing but rather a flexible, pouch-like container, thereby enabling flexible designs and customizations. Lithium polymer cells have expanded our reach to high-end cellular phones, Bluetooth headsets and PDAs, and will also allow us to capture the growth opportunities presented by new electronic applications. During the past fiscal year, we have been actively expanding applications of lithium polymer cells to smartphone, tablet computer and e-book reader batteries. During fiscal year 2012, we supplied lithium polymer cells to major Chinese smartphone brands such as Coolpad and major Chinese notebook computer manufacturers for use in tablet computers including Aigo Digital Technology Co. Ltd, or Aigo, and Hanvon Technology Co., Ltd., or Hanvon. We believe that through these and similar developments we will generate additional revenue and increase market share as the demand for smartphones, e-book readers and tablet computers has been increasing. Lithium polymer cells currently deliver below average gross margins. However, this product is in its growth stage and presents attractive growth potential for the reasons noted above.

4

High-power Lithium Battery Cells

The use of new materials have enabled the configuration of high-power lithium battery cells to contain much higher energy density and higher voltage and have a longer life cycle and shorter charge time than other types of lithium-based batteries. These special attributes, coupled with intrinsic safety features, are suitable for batteries used for high-power applications. Our Tianjin facility is capable of producing high-power lithium battery cells for electric bicycles, electric cars, electric buses, hybrid electric vehicles, light electric vehicles, UPS, cordless power tools, and other applications. This facility has received positive market feedback to samples of its high-power lithium battery cells. In that connection, during the past fiscal year, we received orders to provide high-power lithium battery cells made at our Tianjin facility from major electric bicycle manufacturers including Geoby Electric Vehicle Co., Ltd., or Geoby, XDS Shenzhen Xidesheng Bicycle Co., Ltd., or XDS Shenzhen, and Suzhou Noah Electric Bicycle Co., Ltd, or Suzhou Noah, and automobile manufacturers such as Chery Automobile Co. Ltd., or Chery, and First Automobile Group Co., Ltd., or Faw. In fiscal 2012, we received an EV sample order from Brilliance Auto Group, one of the largest state-owned automobile manufacturers in China. In addition, Chery placed an order for more than 1,000 lithium-ion high-power battery units to power its Ruilin M1 electric cars. We believe that we will increase our revenue and market share as we gradually increase our high-power cells production as the demand for these cells has been increasing.

The nexus for our research, development, and production of our high-power lithium battery cells is our facility in Tianjin, China. The primary reasons for our continuing investments in the facilities in Tianjin are to realize the benefits of our prior investment in these facilities, to position the Company to capitalize on our knowledge of and experience with established markets for lithium technology, such as electric bicycles and cordless power tools, and to penetrate emerging consuming markets for this technology, such as electric cars, electric buses, light electric vehicles, and hybrid electric vehicles. Further, we expect interest in electric cars, electric buses, light electric vehicles, and hybrid electric vehicles to substantially increase demand for our rechargeable lithium-based batteries. We have therefore been engaged in the research and development of lithium cells specifically for use in light electric vehicles and hybrid electric vehicles. High-power lithium battery cells currently deliver below average gross margins. However, this product is in its growth stage and presents attractive growth potential for the reasons noted above.

Revenue by Product

Historically, we have derived most of our revenues from prismatic cells. As we expand our production capacity and add new product lines in response to evolving market demands, we have derived and will continue to derive an increasing portion of our revenues from our other product lines. The following table sets forth the breakdown of our net revenues by each battery cell type that contributed to at least 10% of our revenues during any of the last two fiscal years.

| Fiscal Year Ended September 30, | ||||||||||||

| 2012 | 2011 | |||||||||||

| % of Net | % of Net | |||||||||||

| Amount | Revenues | Amount | Revenues | |||||||||

| (in thousands of U.S. dollars, except percentages) | ||||||||||||

| Prismatic cells | ||||||||||||

| Aluminum-case cells | $ | 76,217 | 37.1% | $ | 94,380 | 43.1% | ||||||

| Battery packs | 55,320 | 26.9% | 55,131 | 25.2% | ||||||||

| Cylindrical cells | 45,336 | 22.0% | 53,162 | 24.3% | ||||||||

| High-power lithium | ||||||||||||

| battery cells | 10,472 | 5.1% | 6,113 | 2.8% | ||||||||

| Lithium polymer cells | 18,326 | 8.9% | 10,167 | 4.6% | ||||||||

| Total | $ | 205,671 | 100.0% | $ | 218,953 | 100.0% | ||||||

5

Key Rechargeable Battery Applications

End-product applications that are driving the demand for rechargeable lithium-based batteries include cellular phones, notebook computers, portable consumer electronics, cordless power tools, UPS, and electric bicycles. We also expect interest in electric cars, electric buses, light electric vehicles, and hybrid electric vehicles to substantially increase demand for rechargeable lithium-based batteries.

Cellular Phones

Cellular phone battery cells currently use lithium-based batteries as they allow for a smaller and more flexible form and longer battery life.

Demand for batteries for cellular phones is driven by two factors. The first is the sale of new cellular phones. An OEM of cellular phones includes a battery with a new cellular phone. There is also a replacement market for cellular phone batteries. Demand in the replacement market is in turn driven by a number of factors. Often a consumer will purchase a second battery to carry as a spare. In addition, lithium-ion batteries have a finite life, so over time consumers will need to purchase a battery to replace the failed battery in their phone. As the number of active cellular phone subscribers increases, the number of replacement batteries sold increases. A market characteristic unique to the Chinese cellular phone market is that cell phones are often sold and resold during their useful life. Over time these cell phones require a replacement battery. Our customers for cellular phone battery cells fall into two categories:

-

OEM: The OEMs manufacture mobile phone handsets. They purchase batteries to support their production of new cellular phones. They also purchase batteries to serve the replacement market which they sell under their own brand name. OEMs either purchase these battery cells directly from us or they purchase them from battery pack manufacturers that have packaged them according to the OEMs’ specifications.

-

Independent Battery Manufacturers: These third-party manufacturers compete against the OEMs for a share of the replacement market. They typically sell their products under their own brand name or a private label.

Notebook Computers

Notebook computer sales are forecast to grow further in coming years due to increasingly mobile workforces and the improved power and functionality of notebook computers. Due to their substantial power requirements and larger size relative to other portable electronic devices, notebook computers have in the past typically utilized nickel metal hydride batteries. However, over the last ten years, lithium-based batteries have almost completely replaced nickel metal hydride batteries due to the increasing power of lithium-based batteries and demand for smaller lighter notebook computers. We believe that we are the largest notebook computer battery cell manufacturer in China and that there currently are no other significant Chinese manufacturers in the notebook computer battery market.

Power Tools

Power tools such as drills, saws and grinders are used for both commercial and personal use. Due to high power requirements, many power tools have historically used small combustion engines, used heavier nickel metal hydride batteries or relied on external power sources. Manufacturers of power tools, such as Milwaukee Electric Tool Corporation, Stanley Black & Decker, Inc., the Bosch Group, Metabowerke GmbH and Rigid Tool Company have begun to use lithium-ion technology. The market for portable high-powered power tools is rapidly growing and has prompted many users, both commercial and personal, to replace or upgrade their current power tools.

Portable Consumer Electronics

This category includes digital audio players (such as MP3/MP4 players), digital still cameras, digital video cameras, portable DVD players, PDAs, smartphones such as the Coolpad (a major Chinese brand), portable gaming systems, and Bluetooth devices. There is a trend to use lithium-based batteries in portable consumer electronics (both rechargeable and non-rechargeable) due to a desire for smaller, longer-lasting devices.

Electric Vehicles

An electric vehicle, sometimes referred to as an electric drive vehicle, uses one or more electric motors for propulsion. Electric vehicles include electric cars, electric buses, electric trains, electric lorries, electric airplanes, electric boats, electric motorcycles, scooters and other light electric vehicles, hybrid electric vehicles, and electric spacecraft. Electric cars and electric buses are propelled by one or more electric motors powered by rechargeable battery packs. Electric cars and buses have the potential to significantly reduce city pollution by having zero tail pipe emissions. Electric cars and buses are also expected to have less dependence on oil. World governments are pledging significant funds to fund the development of electric vehicles and their components due in part to these advantages. Due to these factors and a lithium battery’s relatively environmentally-friendly, light-weight and high-capacity features, the demand for lithium batteries in the field of electric cars and buses is increasing.

6

Due to such recent trends as renewed concerns relating to the availability and price of oil, increased legal fuel-efficiency requirements and incentives, and heightened interest in environmentally-friendly or “green” technologies, light electric vehicles and hybrid electric vehicles are likely to continue to attract substantial interest from vehicle manufacturers and consumers. Light electric vehicles include bicycles, scooters, and motorcycles, with rechargeable electric motors. Due to their relatively small size and light design, approximately 10-150 high-power lithium cells can be used to power light electric vehicles. Hybrid electric vehicles include automobiles, trucks, buses, and other vehicles that combine a conventional propulsion system with a rechargeable energy storage system to achieve better fuel economy than conventional vehicles. As these vehicles tend to be large and heavy, their rechargeable energy storage system generally consists of a large quantity of rechargeable high-power lithium cells.

Uninterruptible Power Supplies

A UPS provides emergency power from a separate source when utility power is not available. The most common type of battery used in UPS is Sealed Lead-Acid, however, due to the lithium battery’s relatively small size, light design and environmentally-friendly features, the demand for lithium batteries in this industry is increasing.

Sales and Marketing

We have built an extensive sales and service network in China, highlighted by our strong presence in China’s economically prosperous coastal regions where we generate a significant portion of our sales. We have representative offices in Beijing, Shanghai, Fuzhou, and Taiwan, targeting our key customers. Our marketing department at headquarters is responsible for our marketing efforts in the PRC, and our sales staff in these representative offices conducts sales and provides post-sales services to brand owners and pack manufacturers in each designated area. We offer different price incentives to encourage large-volume and long-term customers. We have established subsidiaries in Germany and India, where our sales representatives market and sell our products and also provide after-sale services. In August 2008, we hired North America sales representatives based in Austin, Texas and Vancouver, British Columbia to better serve the North America market by bringing us into closer communications with our customers and prospects in the United States and Canada.

Our sales staff works closely with our customers to understand their needs and provide feedback to us so that we can better address their needs and improve the quality and features of our products.

We engage in marketing activities such as attending industry-specific conferences and exhibitions to promote our products and brand name. We believe these activities are conducive in promoting our products and brand name among key industry participants.

Suppliers

We have built a comprehensive supply chain of materials and equipment. The primary raw materials used in the manufacture of lithium-ion batteries include electrode materials, cases and caps, foils, electrolyte and separator. Cost of these raw materials is a key factor in pricing our products. We believe that there is an ample supply of most of the raw materials we need in China. We are seeking to identify alternative raw material suppliers to the extent there are viable alternatives and to expand our use of alternative raw materials. We have also restructured our operations in an effort to streamline corporate resources and improve internal efficiency, with a particular focus on manufacturing and sales. To ensure the quality of our suppliers, we use only those suppliers who have demonstrated quality control and reliability.

We aim to maintain multiple supply sources for each of our key raw materials to ensure that supply problems with any one supplier will not materially disrupt our operations. In addition, we strive to develop strategic relationships with new suppliers to secure a stable supply of materials and introduce competition in our supply chain, thereby increasing our ability to negotiate better pricing and reducing our exposure to possible price fluctuations.

Our economies of scale enable us to purchase materials in large volumes, offering us leverage to secure better pricing, and to a lesser degree, increasing the extent to which our suppliers rely on our purchase orders. We believe this relationship of mutual reliance will enable us to reduce our exposure to possible price fluctuations. For example, we have entered into a volume purchase agreement with some of our major suppliers, such as CITIC Guoan Information Industry Company Limited, from whom we purchase cathode material and lithium cobalt dioxide, one of the key materials for battery cells.

7

As of September 30, 2012, our key raw material suppliers were as follows:

| Materials | Main Suppliers | |

| Cases and caps | Shenzhen Tongli High-tech Co., Ltd. | |

| Shenzhen Dongri Technology Industry Co., Ltd. | ||

| Cathode materials | CITIC Guoan Information Industry Company Limited | |

| Hunan Reshine New Material Ltd. | ||

| Beijing Easpring Material Technology Co. Ltd | ||

| Anode materials | Shanghai / Ningbo Shanshan New Material Technology Co., Ltd. | |

| BTR New Energy Materials Inc. | ||

| Aluminum foil | Nannan Aluminum Corporation | |

| ShangHai HuXin Aluminum Foil Products Co., Ltd. | ||

| Copper foil | United Copper Foil (Huizhou) Co Ltd. | |

| FURUKAWA Circuit Foil Co., Ltd. | ||

| Electrolyte | Zhangjiagang Guotai-Huarong New Chemical Materials Co., Ltd. | |

| Tianjin Jinniu Electric Source Material Co., Ltd. | ||

| Separators | Ube Industries, Ltd. | |

|

|

|

Tonen Chemical Corporation |

We source our manufacturing equipment both locally and from overseas, based on consideration of their cost and function. As of September 30, 2012, we purchased our key equipment from the following suppliers:

| Instruments | Main Suppliers | |

| Coating machine | KOYO Trading Co., Ltd. | |

| Mixer | Inoue Mfg., Inc. | |

| Press machine | Innovative Machine Corporation | |

| Xingtai Naknor Electrode Rolling Equipment Co., Ltd. | ||

| Ultrasonic spot welding machine | Guang Dong New Power Ultrasonic Electronic Equipment Co., Ltd. | |

| Laser seam welder | Han's Laser Technology Co., Ltd. | |

| Wu Han Chu Tian Laser Co.,Ltd. | ||

| Vacuum oven | Jiangsu Wujiang Jiangling Instrument Co., Ltd. | |

| Winding machine | Kaido Manufacturing Co., Ltd. | |

| Shenzhen Yinghe Technology Co., Ltd. | ||

| Slitting machine | Nishimura Mfg. Co., Ltd. | |

| Guangzhou Lange Electric Equipment Co., Ltd. | ||

| Electrolyte filling machine | Guangzhou Lange Electric Equipment Co., Ltd. | |

| Kinlo Technology & System (Shenzhen) Co. Ltd. | ||

| Aging, Testing and sorting | Guangzhou Qingtian Industrial Co., Ltd. | |

| equipment | Hangzhou Hangke Optoelectronics Co., Ltd. | |

| Safety devices | Hangzhou Hangke Optoelectronics Co., Ltd. | |

| Guangzhou Qingtian Industrial Co., Ltd. |

Intellectual Property

We rely on a combination of patents, trade secrets, and employee non-disclosure and confidentiality agreements to protect our intellectual property rights. As of September 30, 2012, we have registered 73 trademarks in the PRC, including BAK in both English and in Chinese characters as well as our logo, and have registered 36 trademarks in the United States, European Union, Korea, Russia, Taiwan, India, Canada and Hong Kong. We have registered the following Internet and WAP domain name: www.bak.com.cn. As of September 30, 2012, we have registered 449 patents in the PRC and other countries relating to battery cell materials, design and manufacturing processes, and we had 712 pending patent applications filed in the PRC and 187 in other countries.

We also have unpatented proprietary technologies for our product offerings and key stages of the manufacturing process. Our management and key technical personnel have entered into agreements requiring them to keep confidential all information relating to our customers, methods, business and trade secrets during their terms of employment with us and thereafter and to assign to us their inventions, technologies and designs they develop during their term of employment with us.

8

We have institutionalized our efforts to safeguard our intellectual property rights by establishing an internal department that includes professionals such as attorneys, engineers, information managers and archives managers responsible for handling matters relating to our intellectual property rights. We have published internally a series of rules to protect our intellectual property rights.

Seasonality

Historically, our revenues were not materially impacted by seasonal variations. During the first several years of our operation, manufacturing capacities fell short of customer demands. As such, seasonality was minimal. Since we increased our manufacturing capacities, our revenues are now affected by seasonal variations in customer demand. We expect to experience seasonal lows in the demand for our products during the months of April to July, reflecting our customers’ decreased purchases. On the other hand, we will generally experience seasonal peaks during the months of September to March, primarily as a result of increased purchases from our customers. Also, at various times during the year, our inventories may be increased in anticipation of increased demand for consumer electronics. The months of October and February tend to be seasonally low sales months due to plant closures for national holidays and the Chinese New Year in the PRC.

Customers

A small number of prismatic cell customers have historically accounted for a substantial portion of our revenue. In the year ended September 30, 2012, our top five and top ten customers in aggregate contributed to approximately 24.93% and 37.48% of our revenue, respectively. As we expand our product portfolio and target new market segments, our customer composition as well as the identity and concentration of our top customers are expected to change from period to period. Currently, we are actively investigating demand for, and pursuing opportunities in, other product lines, including UPS, electric vehicles (including electric bicycles, motorcycles), e-readers, smartphones, and tablet computers.

Prismatic Cells. Since the beginning of the last fiscal year, we have continued to primarily sell our prismatic cells to the OEM market and replacement market for cellular phones. We often sell our prismatic cells to battery pack manufacturers certified by cellular phone brand owners, which will pack our cells into branded batteries and sell them to the brand owner. Cellular phone brand owners and replacement market customers also sometimes directly place orders with us. For these orders, we assemble our prismatic cells into batteries by using our own packing lines or engage battery pack manufacturers to assemble our cells into batteries for a fee, and then arrange to deliver the batteries to the OEM brand owners and replacement market.

Our customers for prismatic cells used for cellular phones in the OEM market and replacement market include the following leading China-based battery pack manufacturers:

-

Jiangsu Huatiantong Technology Co., Ltd.

-

Beijing Benywave Technology Ltd.

-

Getac Technology Corporation

-

Yulong Computer Communications (Shenzhen) Co., Ltd.

-

Shenzhen Fuheqing Co., Ltd.

Cylindrical Cells. Since the beginning of the last fiscal year, we have continued to be a mass producer of cylindrical cells used for notebook computers and custom-ordered products used for electric vehicles. During the past fiscal year, we continued to supply our cylindrical cells to Taiwanese packing companies for use by major OEM notebook computer manufacturers after we were accepted into their approved vendor list. Due to pricing pressure from notebook battery competitors, we focused the expansion of applications of our cylindrical cells to electric vehicles. Our Shenzhen facility supplied cylindrical battery cells to HAITEC to power pure electric vehicles built by Dongfeng-Yulon, a joint venture between Taiwan’s largest automaker, Yulon Group, and major Chinese automaker Dongfeng Group, which were delivered to the public transportation authority of the city of Hangzhou, China. In September 2011, we entered into a strategic cooperation program for electric vehicle development with HAITEC, and have initiated shipment to HAITEC since October 2011 under this program.

High-power Lithium Battery Cells. We began commercial production of lithium battery cells in October 2005 for use in cordless power tools. In December 2006, our subsidiary BAK Tianjin was incorporated to focus on the R&D, manufacturing and distribution of high-power lithium battery cells. In October 2008, construction of its first high-power, lithium battery cells production line was completed and it commenced trial production. Our Tianjin facility is now capable of producing high-power lithium battery cells for electric bicycles, UPS, and other applications in addition to those mentioned above. This facility has received positive market feedback to samples of its high-power lithium battery cells. In that connection, during the past fiscal year, we received orders from major Chinese electric bicycle manufacturers such as Geoby, XDS Shenzhen and Suzhou Noah, and automobile manufacturers such as Chery and Faw to provide high-power lithium battery cells made at our Tianjin facility. We believe that we will increase our revenue and market share as we gradually increase our high-power cells production as the demand for these cells has been increasing.

9

Lithium Polymer. Since the beginning of the last fiscal year, we continued to sell our lithium polymer cells primarily to certain pack manufacturers that pack our cells and sell the final products. Most of our polymer cells have been sold to pack manufacturers for the OEM market. During the last fiscal year, we continued to actively expand applications of lithium polymer cells to the smartphone battery and tablet computer battery market. During fiscal year 2012, we received orders from smartphone OEM manufacturer Yulong Computer Telecommunication Scientific (Shenzhen) Co., Ltd., owner of the Coolpad brand, and from tablet computer manufacturers including Aigo and Hanvon. We believe that we will generate additional revenue and increase market share as the demand for these cells has been increasing.

Geography of Sales

We sell our products domestically and internationally. The following table sets forth certain information relating to our total revenues by location of our customers for the last two fiscal years.

| Year Ended September 30, | ||||||||||||

| 2012 | 2011 | |||||||||||

| (in thousands of U.S. dollars, except percentages) | ||||||||||||

| PRC Mainland | $ | 148,833 | 72.4% | $ | 152,703 | 69.8% | ||||||

| Taiwan | 24,102 | 11.7% | 39,004 | 17.8% | ||||||||

| Hong Kong, China | 11,719 | 5.7% | 8,331 | 3.8% | ||||||||

| India | 9,876 | 4.8% | 14,307 | 6.5% | ||||||||

| Others* | 11,142 | 5.4% | 4,608 | 2.1% | ||||||||

| Total | $ | 205,672 | 100.0% | $ | 218,953 | 100.0% | ||||||

* Includes the Middle East, Italy, Germany, Korea and Turkey.

For our international market, we sell our products directly to distributors, as well as pack manufacturers in these countries and territories. If we receive orders from distributors for batteries rather than cells, we engage pack manufacturers in China to assemble our cells into batteries for a fee or, for prismatic battery orders, assemble them into battery packs at our Shenzhen facility, and then arrange to deliver the batteries to fulfill the orders.

Competition

We face intense competition from battery cell makers in China, as well as in Korea and Japan for each of our product types. The following table sets forth our major competitors based on product type as of September 30, 2012:

| Product Type | Competitors | ||

| Prismatic | Japan: | Sony Corporation | |

| Panasonic Corporation | |||

| NEC Corporation | |||

| Hitachi, Ltd. | |||

| Korea: | LG Corp. | ||

| Samsung Electronics Co., Ltd. | |||

| China: | BYD Company Limited | ||

| Tianjin Lishen Battery Joint-Stock Co., Ltd. | |||

| Cylindrical | Japan: | Sony Corporation | |

| Panasonic Corporation | |||

| Korea: | LG Corp. | ||

| Samsung Electronics Co., Ltd. | |||

| High-power lithium battery | Japan: | Sony Corporation | |

10

| NEC Corporation | |||

| Hitachi, Ltd. | |||

| Panasonic Corporation | |||

| Korea: | LG Corp. | ||

| Samsung Electronics Co., Ltd. | |||

| China: | BYD Company Limited | ||

| Lithium polymer | Japan: | Amperex Technology Limited | |

| Panasonic Corporation | |||

| China: | BYD Company Limited | ||

| Tianjin Lishen Battery Joint- Stock Co., Ltd. | |||

| Harbin Coslight Power Co., Ltd. |

We believe that we are able to leverage our low-cost advantage to compete favorably with our competitors. Compared to Korean and Japanese cell makers, we are able to source our needs for skilled labor and raw materials locally and economically. Our substantially expanded production capacity has translated into greater purchasing power, thereby helping us negotiate lower purchase prices for materials. Furthermore, our strong proprietary technologies and use of a combination of manual labor and automation at the key stages of the manufacturing process enable us to enhance our production efficiency, resulting in further reduction in cost, while ensuring high uniformity and high-quality standards.

Research and Development

We have established an advanced R&D center. To enhance our product quality, reduce costs, and keep up with technological advances and evolving market trends, our R&D center focuses on advancement in technologies relating to new materials and new cells with prospects for use in new end application markets, such as electric cars, electric buses, hybrid electric vehicles, light electric vehicles, electric bicycles, and UPS.

Our in-house R&D team consists of 160 researchers and scientists, led by Dr. Huanyu Mao, our chief technology officer, who pioneered core technologies in lithium-ion batteries since their introduction in 1992 and was the inventor under seven U.S. patents related to lithium-ion technology. In December 2006, we also established a wholly-owned subsidiary, BAK Canada, to focus on the research and development of lithium-ion batteries. It comprises a group of experts led by Mr. Kenneth G. Broom, our chief operating officer, who brings over 25 years of li-ion battery industry working experience. Our strong R&D capabilities have enabled us to obtain various government-sponsored R&D grants. We are accredited as a “new and high-technology company” in Shenzhen, entitling us to enjoy preferential tax treatment and other government incentive grants and subsidies. Furthermore, we collaborate with a number of reputable research institutes and science and technology universities in China, allowing us to capitalize on their R&D results economically.

In December 2006, BAK Tianjin was incorporated to focus on research and development, manufacturing and distribution of high-power lithium battery cells. In October 2008, our Tianjin facility completed construction of its first high-power lithium cells production line, and initiated trial production of high-power lithium cells. Our Tianjin facility is now capable of producing high-power lithium cells for electric bicycles, UPS, and other applications in addition to those mentioned above. This facility has received positive market feedback to samples of its high-power lithium cells. Moreover, this facility’s “Electric Vehicles Lithium-phosphate Power Battery Industrialization Project” was accepted into the PRC’s National High Technology Research and Development Program, or “National 863 Program,” by the PRC’s Ministry of Science and Technology. In that connection, we sent battery cell samples made at our Tianjin facility for light electric vehicles to customers and to manufacturing partners in the National 863 program. We received positive market feedback to these samples. We believe that we will generate additional revenue and increase market share as we gradually increase our high-power cells production as the demand for these cells has been increasing.

From December 2009 to June 2011, our BAK Canada facility researched and developed cylindrical battery cells for electric vehicles for use by HAITEC under our strategic cooperation program for electric vehicles to power Dongfeng-Yulon’s pure electric vehicles that were delivered to the public transportation authority of the city of Hangzhou, China. The batteries were produced and supplied by our Shenzhen facility. In addition, in late September 2011, we launched our first single battery and first battery module; both products were developed internally. Both products have a capacity of 100Ah. The single battery consists of one large cell and the battery module consists of a number of 18650-type cells. These products are for use in electric vehicles.

During the fiscal years ended September 30, 2012 and 2011, our expenditures for research and development activities consisted of $5.8 million and $7.3 million, respectively, or 2.8% and 3.3% of net revenues.

11

Environmental Compliance

As we conduct our manufacturing activities in China, we are subject to the requirements of PRC environmental laws and regulations on air emission, waste water discharge, solid waste and noise. The major environmental regulations applicable to us include the PRC Environmental Protection Law, the PRC Law on the Prevention and Control of Water Pollution and its Implementation Rules, the PRC Law on the Prevention and Control of Air Pollution and its Implementation Rules, the PRC Law on the Prevention and Control of Solid Waste Pollution, and the PRC Law on the Prevention and Control of Noise Pollution. We aim to comply with environmental laws and regulations and have passed ISO14001 certification for environmental practices. We have built environmental treatment facilities concurrently with construction of our manufacturing facilities, where waste air, waste water and waste solids we generate can be treated in accordance with the relevant requirements. We also outsource disposal of solid waste we generate to a third party contractor. Certain key materials used in manufacturing, such as cobalt dioxide, electrolyte and separators, have proven innocuous to worker’s health and safety as well as the environment. We are not subject to any admonitions, penalties, investigations or inquiries imposed by the environmental regulators, nor are we subject to any claims or legal proceedings to which we are named as defendant for violation of any environmental law or regulation. We do not have any reasonable basis to believe that there is any threatened claim, action or legal proceedings against us that would have a material adverse effect on our business, financial condition or results of operations.

Employees

We had a total of approximately 5,100 employees as of September 30, 2012.

Executive Officers

Our current executive officers are as follows:

| Name | Age | Positions | ||

| Xiangqian Li | 44 | Chairman, President, Chief Executive Officer and Interim Chief Financial Officer | ||

| Huanyu Mao | 61 | Chief Technology Officer and Director | ||

| Kenneth G. Broom | 57 | Chief Operating Officer |

Xiangqian Li. Mr. Li has served as the Chairman of our Board, our President and Chief Executive Officer since January 20, 2005. He has been a director of BAK International Limited, our Hong Kong incorporated subsidiary, since November 2004. Mr. Li is also serving as our Interim Chief Financial Officer until a permanent Chief Financial Officer of the Company is duly appointed. Mr. Li is the founder and has served as the Chairman of the Board of Shenzhen BAK, our wholly owned subsidiary, since its inception in August 2001, and served as Shenzhen BAK’s General Manager since December 2003. From June 2001 to June 2003, Mr. Li was the chairman of Huaran Technology Co., Ltd., a PRC-incorporated company engaged in the car audio business. Mr. Li received a bachelor’s degree in thermal energy and power engineering from the Lanzhou Railway Institute, China and a doctorate degree in quantitative economics from Jilin University in China.

Huanyu Mao. Dr. Mao has served as a director of the Company since May 12, 2006. He has also served as our Chief Technology Officer since January 20, 2005 and as our Chief Operating Officer from June 30, 2005 to February 24, 2009. Dr. Mao has served as the General Manager of BAK Tianjin since January 4, 2009. Dr. Mao has been the chief scientist of Shenzhen BAK since September 2004. Prior to joining us, between 1997 and September 2004, Dr. Mao was the chief technology officer of Tianjin Lishen, a leading battery manufacturer in China. Dr. Mao pioneered core technologies on lithium-ion battery before its commercialization in 1992 and was the inventor under seven U.S. patents relating to lithium-ion technology. Dr. Mao received a doctorate degree in electrochemistry from Memorial University of Newfoundland, Canada where he focused on conductive polymers.

Kenneth G. Broom. Mr. Broom has served as our Chief Operating Officer since February 24, 2009. Prior to that, he served as vice president of international OEM Business from October 1, 2007 to February 24, 2009. From January 2007 to September 2007, he worked as Executive Vice President for BAK Canada. Prior to joining us, Mr. Broom served as executive vice president of E-One Moli Energy (Canada) Limited (“E-One”), the only high volume manufacturer of cylindrical lithium-ion rechargeable cells in North America, from 2003 to 2007. He was also General Manager of Operations of E-One from 1992 to 2003; while in this role, he managed equipment and product design. He is a member of the Association of Professional Engineers and Geoscientists of B.C. Mr. Broom received a bachelor’s degree in chemical engineering from the University of Waterloo.

12

Available Information

Our internet website is at http://www.bak.com.cn. Our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, including exhibits, and amendments to those reports filed or furnished pursuant to Sections 13(a) or 15(d) of the Exchange Act, and other public filings with the SEC, are available free of charge on our website as soon as reasonably practicable after such filings are electronically filed with, or furnished to, the SEC. Copies of these filings may also be obtained free of charge by sending written requests to our Secretary, BAK Industrial Park, No. 1 BAK Street, Kuichong Town, Longgang District, Shenzhen, People’s Republic of China, attention Corporate Secretary. The information posted on our website is not part of this or any other report we file with or furnish with the SEC. Investors can also read any materials filed by us at the SEC’s internet website: www.sec.gov.

ITEM 1A. RISK FACTORS.

RISKS RELATED TO OUR BUSINESS

Our independent registered auditors have expressed substantial doubt about our ability to continue as a going concern.

Our audited consolidated financial statements included in this report include an explanatory paragraph that indicates that they were prepared assuming that we would continue as a going concern. As discussed in Note 1 to the consolidated financial statements included with this report, we had a working capital deficiency, accumulated deficit from recurring net losses incurred for the current and prior years as of September 30, 2012 and significant short-term debt obligations maturing in less than one year. These conditions raise substantial doubt about our ability to continue as a going concern. Management’s plans regarding these matters also are described in Note 1 to the consolidated financial statements included with this report and under Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Overview”. The consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty.

We face risks related to general domestic and global economic conditions and to the recent credit crisis.

We currently generate sufficient operating cash flows, which combined with access to the credit markets, provides us with significant discretionary funding capacity. However, the current uncertainty arising out of domestic and global economic conditions, including the recent disruption in credit markets, poses a risk to the economies in which we operate that has impacted demand for our products and services, and may impact our ability to manage normal relationships with our customers, suppliers and creditors. If the current situation deteriorates significantly, our business could be materially negatively impacted, including such areas as reduced demand for our products and services from a slow-down in the general economy, or supplier or customer disruptions resulting from tighter credit markets. In addition, terrorist activities may cause unpredictable or unfavorable economic conditions and could have a material adverse impact on the Company’s operating results and financial condition.

We have significant short-term debt obligations, which mature in less than one year. Failure to extend those maturities of, or to refinance, that debt could result in defaults, and in certain instances, foreclosures on our assets. Moreover, we may be unable to obtain financing to fund ongoing operations and future growth.

At September 30, 2012, we had short-term bank loans of $151.4 million, long-term bank loans of $23.7 million maturing over one year, and bills payable of $75.4 million, a substantial portion of which is secured by certain of our assets that amounted to $159.3 million. Our inventory, machinery and equipment worth approximately $112.6 million secured the short-term bank loans, assets with a book value of $138.9 million secured the long-term bank loans, and our deposits worth $5.5 million secured certain bills payable, construction payable and short-term bank loans. Failure to obtain extensions of the maturity dates of, or to refinance, these obligations or to obtain additional equity financing to meet these debt obligations would result in an event of default with respect to such obligations and could result in the foreclosure on the collateral. The sale of such collateral at foreclosure would significantly disrupt our ability to produce products for our customers in the quantities required by customer orders or deliver products in a timely fashion, which could significantly lower our revenues and profitability. We may be able to refinance or obtain extensions of the maturities of all or some of such debt only on terms that significantly restrict our ability to operate, including terms that place additional limitations on our ability to incur other indebtedness, to pay dividends, to use our assets as collateral for other financing, to sell assets or to make acquisitions or enter into other transactions. Such restrictions may adversely affect our ability to finance our future operations or to engage in other business activities. If we finance the repayment of our outstanding indebtedness by issuing additional equity or convertible debt securities, such issuances could result in substantial dilution to our stockholders.

13

While we believe that our revenue growth projections and our ongoing cost controls will allow us to generate cash and achieve profitability in the foreseeable future, there is no assurance as to when or if we will be able to achieve our projections. Our future cash flows from operations, combined with our accessibility to cash and credit, may not be sufficient to allow us to finance ongoing operations or to make required investments for future growth. We may need to seek additional credit or access capital markets for additional funds. There is no assurance that we would be successful in this regard.

We are primarily dependent on sales of lithium-ion battery cells for the cellular phone battery replacement market. A reduction in the demand for lithium-ion battery cells that we sell for this market would cause our overall revenue to decline.

We have derived a major portion of revenues to date from sales of our lithium-ion battery cells for the cellular phone battery replacement market. While we have diversified our revenue sources by expanding to the global cellular phone OEM market, portable electronic device markets, notebook computers and high-power electrical appliance markets, we expect that sales of battery cells used for the cellular phone battery replacement market will continue to comprise a significant portion of our revenues in the near future. Accordingly, any decrease in the demand for our battery cells in the replacement market resulting from success of competing products, slower than expected growth of sales in the replacement market or other adverse developments relating to the replacement market may materially and adversely affect our business and cause our overall revenue to decline. During the fiscal year ended September 30, 2012, net revenues from our prismatic cells sold for the cellular phone battery replacement market were $76.2 million, or $18.2 million lower than net revenues from prismatic cells sold for the cellular phone battery replacement market for the fiscal year ended September 30, 2011 of $94.4 million. The decline of demand for replacement batteries was one of the primary reasons for the decline in revenue. In addition, our expansion to the global cellular phone battery OEM market and other markets may not increase our revenue to a level that would enable us to materially reduce our dependence on sales of battery cells for the cellular phone replacement market.

Our business depends on the growth in demand for portable electronic devices.

As the market demand for portable electronic devices is directly related to the demand for our products, a fast growing portable electronic device market will be critical to the success of our business. In anticipation of an expected increase in demand for portable electronic devices such as cellular phones, notebook computers and electric vehicles in the next few years, we have expanded our manufacturing capacity. However, the markets we have targeted, including those of the PRC, may not achieve the level of growth we expect. If this market fails to achieve our expected level of growth, we will have excess production capacity and may not be able to generate enough revenue to maintain our profitability.

If we cannot continue to develop new products in a timely manner, and at favorable margins, we may not be able to compete effectively.

The battery industry has been notable for the pace of innovations in product life, product design and applied technology. We and our competitors have made, and continue to make, investments in research and development with the goal of further innovation. The successful development and introduction of new products and line extensions face the uncertainty of customer acceptance and reaction from competitors, as well as the possibility of cannibalization of sales of our existing products. In addition, our ability to create new products and line extensions and to sustain existing products is affected by whether we can:

-

develop and fund research and technological innovations,

-

receive and maintain necessary intellectual property protections,

-

obtain governmental approvals and registrations,

-

comply with governmental regulations, and

-

anticipate customer needs and preferences successfully.

The failure to develop and launch successful new products could hinder the growth of our business and any delay in the development or launch of a new product could also compromise our competitive position. If competitors introduce new or enhanced products that significantly outperform ours, or if they develop or apply manufacturing technology which permits them to manufacture at a significantly lower cost relative to ours, we may be unable to compete successfully in the market segments affected by these changes.

14

Our efforts to develop products for new commercial applications could fail.

Although we are involved with developing certain products for new commercial applications, we cannot provide assurance that acceptance of our products will occur due to the highly competitive nature of the business. There are many new product and technology entrants into the marketplace, and we must continually reassess the market segments in which our products can be successful and seek to engage customers in these segments that will adopt our products for use in their products. In addition, these companies must be successful with their products in their markets for us to gain increased business. Increased competition, failure to gain customer acceptance of products, the introduction of competitive technologies or failure of our customers in their markets could have a further adverse effect on our business. In particular, we have made significant investments to develop high-power lithium battery cells suitable for emerging technologies such as hybrid electric vehicles and light electric vehicles that have not yet resulted, and may never result, in significantly increasing our earnings.

Our future success depends on the success of manufacturers of the end applications that use our products.

As we expand to the battery markets for global OEM cellular phones, notebook computers, electric vehicles and other portable electronic devices, our future success depends on whether end-application manufacturers are willing to use batteries that incorporate our products. To secure acceptance of our products, we must constantly develop and introduce more reliable and cost-effective battery cells with enhanced functionality to meet evolving industry standards. Our failure to gain acceptance of our products from these manufacturers could materially and adversely affect our future success.

Even if a manufacturer decides to use batteries that incorporate our products, the manufacturer may not be able to market and sell its products successfully. The manufacturer’s inability to market and sell its products successfully, whether from lack of market acceptance or otherwise, could materially and adversely affect our business and prospects because this manufacturer may not order new products from us. If we cannot achieve the expected level of sales, we will not be able to make sufficient profits to offset the expenditures we have incurred to expand our production capacity, nor will we be able to grow our business. Accordingly, our business, financial condition, results of operations and future success would be materially and adversely affected.

Our failure to keep up with rapid technological changes and evolving industry standards may cause our products to become obsolete and less marketable, resulting in loss of market share to our competitors.

The lithium-based battery market is characterized by changing technologies and evolving industry standards, which are difficult to predict. This, coupled with frequent introduction of new products and models, has shortened product life cycles and may render our products obsolete or unmarketable. Our ability to adapt to evolving industry standards and anticipate future standards will be a significant factor in maintaining and improving our competitive position and our prospects for growth. To achieve this goal, we have invested and plan to continue investing significant financial resources in our R&D infrastructure. R&D activities, however, are inherently uncertain, and we might encounter practical difficulties in commercializing our research results. Accordingly, our significant investment in our R&D infrastructure may not bear fruit. On the other hand, our competitors may improve their technologies or even achieve technological breakthroughs that would render our products obsolete or less marketable. Therefore, our failure to effectively keep up with rapid technological changes and evolving industry standards by introducing new and enhanced products may cause us to lose our market share and to suffer a decrease in our revenue.

A change in our product mix may cause our results of operations to differ substantially from the anticipated results in any particular period.

Our overall profitability may not meet expectations if our products, customers or geographic mix are substantially different than anticipated. Our profit margins vary among products, customers and geographic markets. Consequently, if our mix of any of these is substantially different from what is anticipated in any particular period, our profitability could be lower than anticipated.

15

We have been and most likely will continue to be subject to rapidly declining average selling prices, which may harm our revenue and gross profits.

Portable consumer electronics such as cellular phones and notebook computers are subject to rapid declines in average selling prices due to rapidly evolving technologies, industry standards and consumer preferences. As a result, manufacturers of these electronic devices expect us as suppliers to cut our costs and lower the price of our products in order to mitigate the negative impact on their own margins. We have reduced the price of our products in the past in order to meet market demand and expect to continue to face market-driven downward pricing pressures in the future. Our revenue and profitability will suffer if we are unable to offset any declines in our average selling prices by developing new or enhanced products with higher selling prices or gross profit margins, increasing our sales volumes or reducing our costs on a timely basis.

We may face impairment charges if economic environments in which our businesses operate and key economic and business assumptions substantially change.

A property, plant and equipment impairment charge of $3.9 million and $6.5 million was recognized for each of the years ended September 30, 2012 and 2011, respectively. During the course of our strategic review of our operations during fiscal year 2012, we assessed the recoverability of the carrying value of certain property, plant and equipment as inflated by $3.9 million, which we wrote down in accordance with US GAAP. Assessment of the potential impairment of property, plant and equipment, goodwill and other identifiable intangible assets is an integral part of our normal ongoing review of operations. Testing for potential impairment of long-lived assets is dependent on numerous assumptions and reflects our best estimates at a particular point in time, which may vary from testing date to testing date. The economic environments in which our businesses operate and key economic and business assumptions with respect to projected product selling prices and materials costs, market growth and inflation rates, can significantly affect the outcome of impairment tests. Estimates based on these assumptions may differ significantly from actual results. Changes in factors and assumptions used in assessing potential impairments can have a significant impact on both the existence and magnitude of impairments, as well as the time at which such impairments are recognized. Future changes in the economic environment and the economic outlook for the assets being evaluated could also result in impairment charges. Any significant asset impairments would adversely impact our financial results.

We may not be able to manage our expansion of operations effectively.

We were established in August 2001 and have grown rapidly since. We are in the process of significantly expanding our business in order to meet the increasing demand for our products, as well as capture new market opportunities. As we continue to grow, we must continue to improve our operational and financial systems, procedures and controls, increase manufacturing capacity and output, and expand, train and manage our growing employee base. In order to fund our on-going operations and our future growth, we need to have sufficient internal sources of liquidity or access to additional financing from external sources. Furthermore, our management will be required to maintain and strengthen our relationships with our customers, suppliers and other third parties. As a result, our continued expansion has placed, and will continue to place, significant strains on our management personnel, systems and resources. We also will need to further strengthen our internal control and compliance functions to ensure that we will be able to comply with our legal and contractual obligations and minimize our operational and compliance risks. Our current and planned operations, personnel, systems, internal procedures and controls may not be adequate to support our future growth. If we are unable to manage our growth effectively, we may not be able to take advantage of market opportunities, execute our business strategies or respond to competitive pressures.

We experience fluctuations in quarterly and annual operating results.

Our quarterly and annual operating results have fluctuated in the past and likely will fluctuate in the future. The demand for our products is driven largely by demand for the end-product applications that are powered by our products. Accordingly, the rechargeable battery industry is affected by market conditions that are often outside our control. Our results of operations may fluctuate significantly from period to period due to a number of factors, including seasonal variations in consumer demand for batteries and their end applications, capacity ramp up by competitors, industry-wide technological changes, the loss of a key customer and the postponement, rescheduling or cancellation of large orders by a key customer. As a result of these factors and other risks discussed in this section, period-to-period comparisons should not be relied upon to predict our future performance.

We may not be able to substantially increase our manufacturing output in order to maintain our cost competitiveness.

We believe that our ability to provide cost-effective products is one of the most significant factors that contributed to our past success and will be essential for our future growth. We believe this is one of our competitive advantages over our Japanese and Korean competitors. In order to continue doing so, we will need to increase our manufacturing output to a level that will enable us to substantially reduce the cost of our products on a per unit basis through economies of scale. However, our ability to substantially increase our manufacturing output is subject to significant constraints and uncertainties, including:

16

-

the need to raise significant additional funds to purchase and prepay raw materials or to build additional manufacturing facilities, which we may be unable to obtain on reasonable terms or at all;

-

delays and cost overruns as a result of a number of factors, many of which may be beyond our control, such as increases in raw material prices and problems with equipment vendors;

-

delays or denial of required approvals by relevant government authorities;

-

diversion of significant management attention and other resources; and

-

failure to execute our expansion plan effectively.

If we are unable to increase our manufacturing output because of any of the risks described above, we may be unable to maintain our competitive position or achieve the growth we expect. Moreover, even if we expand our manufacturing output, we may not be able to generate sufficient customer demand for our products to support our increased production output.

Maintaining our manufacturing operations requires significant capital expenditures, and our inability or failure to maintain our operations would have a material adverse impact on our market share and ability to generate revenue.

We had capital expenditures of approximately $19.4 million and $31.5 million in fiscal years 2012 and 2011, respectively. We may incur significant additional capital expenditures as a result of unanticipated expenses, regulatory changes and other events that impact our business. If we are unable or fail to adequately maintain our manufacturing capacity or quality control processes, we could lose customers and there could be a material adverse impact on our market share and our ability to generate revenue.

We may incur significant costs because of the warranties we supply with our products and services.

With respect to our battery products, we typically offer warranties against any defects due to product malfunction or workmanship for a periods of six-to-twelve months from the date of purchase. We provide a reserve for these potential warranty expenses, which is based on an analysis of historical warranty issues. There is no assurance that future warranty claims will be consistent with past history, and in the event we experience a significant increase in warranty claims, there is no assurance that our reserves will be sufficient. This could have a material adverse effect on our business, financial condition and results of operations.

Defects in our products could result in a loss of customers and decrease in revenue, unexpected expenses and a loss of market share.