UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

For the fiscal year ended

or

For the transition period from to

Commission File No.

(Exact name of registrant as specified in its charter)

|

|

|

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

|

|

|

|

||

(Address of principal executive offices) |

|

(Zip Code) |

(Registrant’s telephone number, including area code): (

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class |

Trading Symbol |

Name of Each Exchange on Which Registered |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files).

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

☒ |

|

Accelerated filer |

☐ |

|

Non-accelerated filer |

☐ |

|

Smaller reporting company |

|

|

|

|

Emerging Growth Company |

If an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the Registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C.7262(b)) by the registered public accounting firm that prepared or issued its audit report.

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No

State the aggregate market value of the voting and non-voting common equity held by nonaffiliates, computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the Registrant’s most recently completed second fiscal quarter (June 30, 2021): $

Indicate the number of shares outstanding of each of the Registrant’s classes of common stock, as of February 25, 2022:

Documents Incorporated by Reference:

Part III of this Annual Report on Form 10-K will be incorporated by reference from certain portions of the Registrant's definitive Proxy Statement for its 2022 Annual Meeting of Shareholders, or will be included in an amendment hereto, to be filed not later than 120 days after the close of the fiscal year ended December 31, 2021. Except with respect to information specifically incorporated by reference in the Annual Report on From 10-K, the Proxy Statement is not deemed to be filed as part hereof.

Table of Contents

|

|

Page

|

ITEM 1. |

1 |

|

|

|

|

ITEM 1A. |

19 |

|

|

|

|

ITEM 1B. |

48 |

|

|

|

|

ITEM 2. |

48 |

|

|

|

|

ITEM 3. |

48 |

|

|

|

|

ITEM 4. |

48 |

|

|

||

|

||

ITEM 5. |

49 |

|

|

|

|

ITEM 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

51 |

|

|

|

ITEM 7A. |

60 |

|

|

|

|

ITEM 8. |

60 |

|

|

|

|

ITEM 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

60 |

|

|

|

ITEM 9A. |

61 |

|

|

|

|

ITEM 9B. |

62 |

|

|

||

|

||

ITEM 10. |

63 |

|

|

|

|

ITEM 11. |

63 |

|

|

|

|

ITEM 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

63 |

|

|

|

ITEM 13. |

Certain Relationships and Related Transactions, and Director Independence |

63 |

|

|

|

ITEM 14. |

63 |

|

|

||

|

||

ITEM 15. |

64 |

|

|

|

|

ITEM 16. |

66 |

|

|

67 |

|

Use of Names

References in this Annual Report to "OraSure" mean OraSure Technologies, Inc. References in this Annual Report to "we," "us," "our," or the "Company" mean OraSure and its consolidated subsidiaries, unless otherwise indicated.

Disclosure Regarding Forward Looking Statements

This Annual Report on Form 10-K for the fiscal year ended December 31, 2021 (the "Annual Report") contains certain “forward-looking statements,” within the meaning of the Federal securities laws. These may include statements about our expected revenues, earnings/losses per share, net income (loss), expenses, cash flow or other financial performance, or developments, clinical trial or development activities, expected regulatory filings and approvals, planned business transactions, views of future industry, competitive or market conditions, and other factors that could affect our future operations, results of operations or financial position. These statements often include words, such as “believes,” “expects,” “anticipates,” “intends,” “plans,” “estimates,” “may,” “will,” “should,” “could,” or similar expressions.

Forward-looking statements are not guarantees of future performance or results. Known and unknown factors that could cause actual performance or results to be materially different from those expressed or implied in these statements include, but are not limited to:

These and other factors that could affect our results are discussed more fully under Item 1A, entitled “Risk Factors,” and elsewhere in this Annual Report. Although forward-looking statements help to provide information about future prospects, readers should keep in mind that forward-looking statements may not be reliable. Readers are cautioned not to place undue reliance on the forward-looking statements. The forward-looking statements and Risk Factors are made as of the date of this Annual Report and we undertake no duty to update these statements, unless we are required to do so by law. If we do update one or more forward-looking statements, no inference should be drawn that we will make updates with respect to other forward-looking statements or that we will make any further updates to those forward-looking statements at any future time.

Investors should also be aware that while we do, from time to time, communicate with securities analysts, it is against our policy to disclose any material non-public information or other confidential commercial information. Accordingly, stockholders should not assume that we agree with any statement or report issued by any analyst irrespective of the content of the statement or report. Furthermore, we have a policy against issuing or confirming financial forecasts or projections issued by others. Thus, to the extent that reports issued by securities analysts contain any projections, forecasts or opinions, such reports are not the responsibility of OraSure.

Trademarks, Trade Names and Service Marks

This Annual Report contains certain trademarks, which are protected under applicable intellectual property laws and are the Company's property. Solely for convenience, the Company's trademarks and trade names referred to in this Annual Report may appear without the ® or TM symbol, but such references are not intended to indicate, in any way, that the Company will not assert, to the fullest extent under applicable law, its rights to these trademarks and trade names. We own rights to trademarks and service marks that we believe are necessary to conduct our business as currently operated. In the United States, we own a number of trademarks, including the OraSure®, Intercept®, Intercept i2® he, OraQuick®, OraQuick ADVANCE®, OraSure Quick Flu®, Q.E.D.®, InteliSwab®, Oragene®, DNA Genotek®, OMNImetTM, ORAcollect®, OMNIgene®, goDNATM, Diversigen®, CoreBiome®, Boostershot®, MetaGeneTM, BenchmarkTM, Novosanis®, Colli-Pee®, UCM®, UASTM, AUTO-LYTE®, prepIT® and Hemagene® trademarks. We also own many of these marks and others in several foreign countries and we are pursuing registration of several other trademarks.

PART I

ITEM 1. Business.

The overall goal of OraSure Technologies, Inc. (“OraSure” or “the Company”) is to empower the global community to improve health and wellness by providing access to accurate essential information through effortless tests, collection kits and services. Our business consists of two segments: our “Diagnostics” segment, and our “Molecular Solutions” segment.

Diagnostics

Our Diagnostics business primarily consists of the development, manufacture, marketing and sale of simple, easy to use diagnostic products and specimen collection devices using our proprietary technologies, as well as other diagnostic products including immunoassays and other in vitro diagnostic tests that are used on other specimen types. The Diagnostics business includes tests for diseases including COVID-19, HIV and Hepatitis C that are performed on a rapid basis at the point of care, and tests for drugs of abuse that are processed in a laboratory. These products are sold in the United States and internationally to various clinical laboratories, hospitals, clinics, community-based organizations, and other public health organizations, distributors, government agencies, physicians’ offices, and commercial and industrial entities. Our COVID-19 and HIV products are also sold in a consumer-friendly format in the over-the-counter (“OTC”) market in the U.S. and, in the case of the HIV product, as a self-test to individuals in a number of other countries. Through our Diagnostics business we are also developing and commercializing products that measure adherence to HIV medications including pre-exposure prophylaxis or PrEP, the daily medication to prevent HIV, and anti-retroviral medications to suppress HIV. These products include laboratory-based tests that can measure levels of the medications in a patient’s urine or blood, as well as point-of-care products currently in development.

Molecular Solutions

Our Molecular Solutions business is operated by our wholly-owned subsidiaries, DNA Genotek, Inc. ("DNAG"), Diversigen, Inc. ('Diversigen"), and Novosanis NV ("Novosanis"). Our Molecular Solutions business sells its products and services directly to its customers, primarily through its internal sales force in the U.S. domestic market, and in many international markets, also through distributors. Our products primarily consist of collection kits and services used by clinical laboratories, direct-to-consumer laboratories, researchers, pharmaceutical companies, and animal health service and product providers. Most of our Molecular Solutions revenues are derived from product sales to commercial customers and sales into the academic and research markets. A significant portion of our total sales is from repeat customers in both markets. Molecular Solutions customers span the disease risk management, diagnostics, pharmaceutical, biotech, companion animal and environmental markets.

We have expanded the market focus of our Molecular Solutions business by selling existing collection products for use with COVID-19 tests. We have also developed new collection devices for the emerging microbiome market, which focuses on studying microbes and their effect on human health. Our primary product offering in the microbiome market, OMNIgene® • GUT, is focused on the human gut microbiome (microbes living in human stool). In 2021, the OMNIgene® • GUT collection device (OMD-200) was granted “FDA De Novo classification for the preservation and stabilization of the relative abundance of microbial nucleic acids in clinical samples.” We leverage our existing sales force and global research connections to engage microbiome customers worldwide to establish ourselves among the leaders in ease-of-collection, stabilization, and transport of this challenging sample type.

Our Molecular Solutions segment includes the Colli-Pee® device, developed and sold by our Novosanis subsidiary, for the volumetric collection of first void urine. This product is in its early stages, and initial sales are occurring primarily through distributors and collaborations in the liquid biopsy and sexually transmitted disease markets. Our Molecular Solutions business also offers laboratory and analytical services for both genomics and microbiome customers to more fully meet their needs. These services are primarily provided to pharmaceutical, biotech companies, and research institutions.

Business Update Related to InteliSwab® Covid-19 Rapid Tests

In June 2021, we received three Emergency Use Authorizations ("EUA") from the U.S. Food and Drug Administration ("FDA") for our InteliSwab® COVID-19 Rapid Tests (“InteliSwab®”) for non-prescription OTC, professional point-of-care use and prescription home use. We began recording revenues on the sales of our InteliSwab® tests during the third quarter of 2021. In September 2021, the Defense Logistics Agency awarded the Company a procurement contract for the InteliSwab® for OTC use, which the Defense Logistics Agency estimated to have a value of $205 million and which will provide InteliSwab® tests to up to 20,000 sites throughout the United States from October 2021 through September 2022. Also in September 2021, we entered into an agreement with the Biomedical Advanced Research Development Authority (“BARDA”), which is part of the office of the Assistant Secretary for Preparedness and Response at the U.S. Department of Health and Human Services (“HHS”), pursuant to which BARDA would provide the Company with up to $13.6

1

million in funding to obtain 510(k) clearance and Clinical Laboratory Improvement Amendments (“CLIA”) waiver of the InteliSwab® tests.

In the latter part of 2021, we have focused our efforts on scaling up our operations to meet the increasing demand for the InteliSwab® tests. In September 2021, we receive $109 million in funding from the U.S. Department of Defense (the “DOD”), in coordination with the HHS, to build additional manufacturing capacity in the United States for our InteliSwab® test as part of the nation’s pandemic preparedness plan. This funding will be used to expand the Company’s production capacity by 100 million tests annually and will be paid based on achievement of milestones through March 2024 for the design, acquisition, installation, qualification and acceptance of the manufacturing equipment.

We have obtained WHO pre-qualification for our OraQuick® HIV-1/Antibody Test, OraQuick® HIV Self-Test and OraQuick® HCV Test.

Exploration of Strategic Alternatives

The COVID-19 pandemic has provided us an opportunity to fundamentally transform into a higher growth, more innovative and efficient organization with broader customer reach, both within and outside the United States. We believe we are well positioned to address current public health challenges and capitalize on diagnostic trends in the market and enhance its operational and competitive profile. Against this backdrop, our Board of Directors is exploring and evaluating a broad range of strategic alternatives with the goal of maximizing value for stockholders There can be no assurance that the exploration of strategic alternatives will result in any agreements or transactions, or that, if completed, any agreements or transactions will be successful or on attractive terms.

Diagnostics Segment Products

The following is a summary of our principal products for the infectious disease and risk management markets, which comprise the Diagnostics segment of our business:

InteliSwab®COVID-19 Rapid Test

InteliSwab® is our rapid immunoassay platform designed to test nasal samples for the presence of antigen from SARS-CoV-2. The device uses an integrated swab to collect a specimen from the lower nostril. After collection, the integrated swab is inserted into a vial containing a pre-measured amount of developer solution and allowed to develop. The specimen and developer solution flow through the test device and test results are observable in 30 minutes. The InteliSwab® test has received emergency use authorization (“EUA”) from the U.S. Food and Drug Administration (“FDA”) for non-prescription, over-the-counter home use in individuals aged 2 years or older, with and without symptoms of COVID-19.

InteliSwab®COVID-19 Rapid Test Pro

The InteliSwab® COVID-19 Rapid Test Pro is a version of InteliSwab® intended for use by healthcare providers at the point of care. The test is performed in the same manner as the over-the-counter version, except that the test is run and interpreted by a healthcare provider. This test has received EUA from the U.S. FDA for use by laboratories located in the United States certified under CLIA. We have also received a CLIA waiver for use of the test enabling the test to be used by numerous additional sites in the United States not certified under CLIA to perform high and moderately complex tests, such as outreach clinics, community-based organizations and physicians’ offices. This test is also indicated for individuals aged two years and older, with and without symptoms of COVID-19.

InteliSwab®COVID-19 Rapid Test Rx

The InteliSwab® COVID-19 Rapid Test Rx is the version of InteliSwab® that has received EUA from the U.S. FDA for prescription home use with individuals aged 2 years or older who are suspected of COVID-19 infection by their healthcare provider within the first seven days of symptom onset.

OraQuick® Rapid HIV Test

OraQuick® is our rapid point-of-care test platform designed to test oral fluid, whole blood (i.e., both finger-stick and venous), plasma and serum samples for the presence of various antibodies or analytes. The device uses a porous flat pad to collect an oral fluid specimen. After collection, the pad is inserted into a vial containing a pre-measured amount of developer solution and allowed to develop. When blood, plasma or serum is to be tested, a loop collection device is used to collect a drop of the specimen and mix it in the developer solution, after which the collection pad is inserted into the solution and allowed to develop. In all cases, the specimen and developer solution then flow through the testing device where test results are observable in approximately 20 minutes. The OraQuick® device is a

2

screening test and requires a confirmation test where an initial positive result is obtained. This product is sold under the OraQuick ADVANCE® name in North America, Europe and certain other countries and under the OraQuick® name in other developing countries. The test has received pre-market approval (“PMA”) from the U.S. Food and Drug Administration (“FDA”) for the detection of antibodies to both HIV-1 and HIV-2 in oral fluid, finger-stick whole blood, venous whole blood and plasma. This test is available for use by laboratories located in the United States certified under the Clinical Laboratory Improvements Amendment of 1988 (“CLIA”), to perform moderately complex tests. We have also received a CLIA waiver for use of the test with oral fluid and finger-stick and venous whole blood. As a result, the test can be used by numerous additional sites in the United States not certified under CLIA to perform moderately complex tests, such as outreach clinics, community-based organizations and physicians’ offices.

On the international front, we have obtained a CE mark for our OraQuick ADVANCE® test so that we can sell this product in Europe and other countries accepting the CE mark for commercialization and this product is registered for sale in other countries. We have distributors in place for several countries and are seeking to increase awareness and expand our distribution network for this product throughout the world. We have also received World Health Organization (“WHO”) pre-qualification for our export-only version of this product.

OraQuick® In-Home HIV Test

The OraQuick® In-Home HIV test is an OTC oral-fluid only version of our OraQuick ADVANCE®HIV 1/2 Antibody Test. We received PMA approval to sell this test in the U.S. OTC market. The In-Home test is performed in the same manner as the OraQuick ADVANCE® test, except that it has product labeling and instructions designed for consumers. In addition, we have established toll-free, 24/7, 365-day per year customer telephone support to provide additional information and referral services for consumers that use this product.

OraQuick® HIV Self-Test

The OraQuick® HIV Self-Test is sold for use by individuals in certain foreign countries to meet the needs of those markets. This product has received WHO pre-qualification and is eligible for procurement by purchasing entities entitled to access funding and other resources from the Global Fund, UNITAID and other agencies. The OraQuick® HIV Self-Test received CE Mark in 2021 and is being sold in certain European Countries.

OraQuick® HCV Rapid Antibody Test

Another test available on the OraQuick® platform is the OraQuick® HCV rapid antibody test. This product is a qualitative test that can detect antibodies to the hepatitis C virus (“HCV”), in a variety of sample types. The OraQuick® HCV test operates in substantially the same manner as the OraQuick ADVANCE® HIV test.

We have received FDA pre-market approval and CLIA waiver for use of the test in detecting HCV antibodies in venous whole blood and finger-stick whole blood specimens, making it the first and only rapid HCV test approved by the FDA for use in the United States. The OraQuick® HCV test has received a CE mark for use with oral fluid, venous whole blood, finger-stick whole blood, plasma and serum and is sold in Europe. This CE-marked product is also registered and sold in other foreign countries and has received WHO pre-qualification.

OraQuick® Ebola Rapid Antigen Test

We have received 510(k) clearance from the FDA for our rapid Ebola test, making it the first and only rapid Ebola test cleared for sale in the U.S. This product utilizes the OraQuick® technology platform for the detection of Ebola antigen and can be used with finger-stick and whole blood samples from live patients and oral fluid samples from recently deceased individuals. The uses for this test are limited to individuals that meet certain criteria indicating they may be infected with the Ebola virus, so the test is not available for general screening of individuals that do not meet this criteria.

OraSure® Collection Device

Our OraSure® oral fluid collection device is used in conjunction with screening and confirmatory tests for HIV-1 antibodies. The generic version of this product can be used for other analytes. This device consists of a small, treated cotton-fiber pad on a handle that is placed in a person’s mouth for two to five minutes. The device collects oral mucosal transudate (“OMT”), a serum-derived fluid that contains higher concentrations of certain antibodies and analytes than saliva. As a result, OMT testing is a highly accurate method for detecting HIV-1 infection and other analytes.

3

The OraSure® collection device is FDA approved for use in the detection of HIV-1 antibodies. The generic version is a Class I medical device for the detection of cocaine and cotinine in oral fluid specimens for risk assessment testing. HIV-1 antibody detection using the OraSure® collection device involves three steps:

A trained health care professional then conveys test results and provides appropriate counseling to the individual who was tested.

Intercept® Drug Testing System

A collection device that is substantially similar to the OraSure® collection device is sold under the name Intercept®, and is used to collect oral mucosal transudate "OMT" for oral fluid drug testing. We have received FDA 510(k) clearance to use the Intercept® collection device with laboratory-based EIAs to test for drugs-of-abuse commonly identified by the National Institute for Drug Abuse (“NIDA”) as the NIDA-5 (i.e., tetrahydrocannabinol (“THC” or marijuana), cocaine, opiates, amphetamines/methamphetamines and phencyclidine (“PCP”)), and for barbiturates, methadone and benzodiazepines. Each of these EIAs is also FDA 510(k) cleared for use with the Intercept® device. Our Intercept® device and oral fluid assays are sold in the U.S. primarily through laboratory distributors.

We believe that the Intercept® device has several advantages over competing urine and other drugs-of-abuse testing products, including its lower total testing cost, its non-invasive nature, mobility and accuracy, the ease of maintaining a chain-of-custody, the treatment of test subjects with greater dignity, no requirement for specially-prepared collection facilities and difficulty of sample adulteration. The availability of an oral fluid test is intended to allow our customers to test for drug impairment and eliminate scheduling costs and inconvenience, thereby streamlining the testing process.

We have also developed a next-generation collection device, which we are marketing under the tradename “Intercept i2® he”. This device offers several important advantages over our original Intercept® device, including a sample adequacy indicator that provides a visual prompt when the appropriate volume of oral fluid has been collected, the ability to collect a larger sample required by current laboratory testing protocols and a more optimized chemistry that results in improved recovery of the targeted drug analytes. The Intercept i2®he device is currently being sold as a forensic use only device within the criminal justice and drug treatment markets along with a NIDA-5 panel of fully-automated high-throughput oral fluid drug assays that we distribute under an agreement with Thermo Fisher Scientific.

Immunoassay Tests and Reagents

We develop and sell immunoassay tests in formats, known as MICRO-PLATE and AUTO-LYTE®, to meet the specific needs of our customers. We also sell fully-automated high-throughput oral fluid drug assays developed under our agreement with Thermo Fisher. Our MICRO-PLATE tests can be performed on commonly used instruments and can detect drugs in urine, serum and sweat specimens. MICRO-PLATE tests are also used as part of the Intercept® product line to detect drugs-of-abuse in oral fluid specimens and we are selling a NIDA-5 panel of microplate assays supplied by Thermo Fisher to the U.S. forensic market under the agreement described above. AUTO-LYTE® tests are sold in the form of bottles of liquid reagents, are run on commercially available laboratory-based automated analytical instruments, and are typically used in high volume, automated, commercial reference insurance laboratories to detect certain drugs or chemicals in urine.

Q.E.D.® Saliva Alcohol Test

Our Q.E.D.® saliva alcohol test is a point-of-care test device that is a cost-effective alternative to breath or blood alcohol testing. The test is a quantitative, saliva-based method for the detection of ethanol, has been cleared for sale by the FDA and has received a CLIA waiver. The U.S. Department of Transportation (“DOT”) has also approved the test.

Each Q.E.D.® test kit contains a collection stick that is used to collect a sample of saliva and a disposable detection device that displays results in a format similar to a thermometer. The Q.E.D.® device is easy to operate and instrumentation is not required to read the result. The product has a testing range of 0 to 0.145% blood alcohol and produces results in approximately two minutes.

Molecular Solutions Segment

Genomic Products

4

We sell many genomic products that provide all-in-one systems for the collection, stabilization, transportation, and storage of DNA, RNA, as well as both DNA and RNA together from human and animal biological samples. Our lead products are sold under the Oragene® and ORAcollect® brands and are used to collect genetic material from human saliva. These products are currently sold to thousands of academic research and commercial customers in many countries worldwide.

Our genomic products are available in several configurations and contain proprietary chemical solutions optimized for the specific application for which each product is designed. Product physical design is focused on ease-of-use and reliability for self or assisted collection of samples. For example, several of the Oragene® products require users to hold the product close to their mouth and spit into the collection device. When the container is closed, the reagents stored in the container’s lid are mixed with the captured saliva and immediately protect the nucleic acids in the sample. This non-invasive collection method yields nucleic acid that remains stable at ambient temperature for extended periods. The stabilizing technology ensures the preservation of high quality and high quantity nucleic acids that are required for most genetic testing and analysis methods.

We believe these products provide significant advantages over competing DNA and RNA collection methods such as blood collection or buccal swabs, particularly in human genetic applications.

Benefits include:

We also sell the Colli-Pee® collection device for the volumetric collection of first void urine samples. This product is used in liquid biopsy applications for the prostate and bladder cancer markets and in the sexually transmitted infection screening market.

COVID Collection Products

Since 2020, we have actively engaged with several laboratories and researchers to demonstrate the effectiveness of our existing collection products for use with COVID-19 molecular testing. The stabilization solution in our molecular collection products can accommodate a vast spectrum of microbiome activity, spanning bacteria to viruses. We have collected data on the usability of our kits for this purpose. We believe that oral samples collected using devices from our product lines for liquid saliva or oral swab samples are a suitable alternative to more commonly used samples collected with a nasopharyngeal or oropharyngeal swab. Our products are optimized for self-collection, unlike nasopharyngeal and oropharyngeal swabs, which cannot be self-administered easily. That means healthcare providers, retailers, and online vendors can ship our kits directly to an individual’s home, eliminating unnecessary trips to hospitals, doctors’ offices, and testing facilities. Self-collection also supports the social distancing guidelines in many communities, reduces the burden on testing sites and healthcare facilities, and provides wider access to testing. Moreover, the chemistry in our products stabilizes nucleic acids, including RNA, which is the nucleic acid used by most labs for COVID-19 testing. The chemistry is bacteriostatic and inactivates viral activity in the sample. These products' usability and form factors are conducive to use at home or in clinic settings. As a result, since 2020, we have sold our ORAcollect® • RNA and OMNIgene® • ORAL collection devices for use in connection with COVID-19 molecular testing. These products have become an increasingly important part of our business and accounted for 47% of 2020 revenue generated by our Molecular Solutions segment and 40% in 2021.

Microbiome Products

We also market several microbiome collection products designed to collect, stabilize, and transport the microbial profile from multiple sample types. Unlike genomic DNA, the microbiome of a sample can change over time, especially when exposed to temperature and environmental fluctuations. A reliable method captures and preserves ("snapshots") the microbiome after collection until an analysis is required to optimize and standardize sample results. We believe our products provide such a reliable method.

Our OMNIgene® • GUT product is an all-in-one system designed to enable an individual to easily self-collect high-quality microbial DNA from feces or stool samples for gut microbiome profiling for use in the clinical laboratory and research settings. Most current methodologies for gut microbiome profiling have distinct shortcomings due to the introduction of bias, leading to a lack of reproducibility in the field. We believe our product ensures that the microbial DNA in the fecal sample is fully stabilized immediately upon collection and maintains an accurate and reliable bacterial profile for weeks at room temperature. Recently, we have applied these principles of sample stabilization to other sample types, including oral, skin, and vaginal samples. In 2021, the Microbiome portfolio grew to support collecting and stabilizing metabolites found in fecal samples.

5

Laboratory and Data Analytical Services

Our Molecular Solutions business also offers our customers microbiome laboratory testing and analytical services. These services reflect the collective benefits of our Diversigen subsidiaries, which were combined under the Diversigen name during 2020. Our services focus on accelerating microbiome discovery for customers in the pharmaceutical, agriculture, and research communities. Our goal is to help customers unleash the translational potential of the microbiome and providing fast and information-rich characterizations of microbial diversity and function paired with expert analytics. We also offer comprehensive microbiome and metagenomics services to improve human, animal, and environmental health. Diversigen has extensive experience with highly diverse microbiome sample types and provides complete project life cycle consulting services, including pre-project consulting, study design, extraction, and sequencing to complete bioinformatics analysis. Diversigen is at the forefront of setting quality standards for this industry and has obtained the College of American Pathologists (“CAP”) accreditation at its laboratory facilities. We are also in the process of integrating the services offered through GenoFINDTM, under the Diversigen brand.

Products Under Development

Diagnostic Products

Our research and development efforts include programs targeted at expanding and enhancing our diagnostics business. These programs typically focus on products related to drug adherence and rapid tests for various diseases. In 2021, significant time and resources were dedicated to the development of our COVID-19 Rapid Antigen Self-Test (InteliSwab®). We introduced our antigen test to the market in 2021 for three different uses:

We completed the InteliSwab® product development and clinical studies in 2021 and received three EUA authorizations for this test in June 2021.

In the first and second quarter of 2021, the clinical studies were completed and the EUAs were submitted to the FDA. Throughout 2021, limit of detection studies were completed with live coronavirus in certified third party analytical laboratories, confirming that InteliSwab® is able to detect all the variants of concern thus far including Omicron. The company has transferred the technology for the making of the devices to manufacturing which is ramping up and optimizing operations.

In 2021, we also received a $13.6 million grant from BARDA, which provides the funding necessary to obtain a 510(k) for InteliSwab® for both professional use (CLIA waived) and OTC use.

Molecular Solutions

In order to intersect evolving customer needs within the academic and commercial markets, our molecular business product development pipeline is focused on extending offerings across different sample types and analytes within both the genomics and microbiome areas. Genomic customers are demonstrating an increasing demand for collection and stabilization of cell-free nucleic acids, exosomes, DNA and RNA. On the microbiome front, we continue to focus research and development work on collecting and stabilizing microbial DNA, RNA and metabolites from multiple sample types including gut, skin, vagina and saliva.

The field of microbiome services is fast paced with evolving biological understanding and development of new methodologies. Our development efforts are focused on remaining at the forefront of laboratory and informatics technologies, as well as providing new and relevant services to our customers. These include a focus on laboratory and informatics methods to integrate DNA, RNA and metabolites from microbial communities across different sample types.

Sales and Marketing

6

We attempt to reach our major target markets through a combination of direct sales, strategic arrangements and independent distributors. Our marketing strategy is to create or raise awareness through a full array of marketing activities, which include trade shows, print advertising, special programs, distributor promotions, telemarketing and the use of digital and social media in order to stimulate sales in each target market.

We market our products in the United States and internationally. Consolidated net revenues attributable to customers in the United States were $188.4 million, $130.8 million, and $107.3 million in 2021, 2020, and 2019, respectively. Consolidated net revenues attributable to international customers amounted to $45.3 million, $40.9 million, and $47.3 million or 19%, 24%, and 31% of our total revenues in 2021, 2020, and 2019 respectively. For more information about our revenues and long-lived assets attributable to U.S. and international customers, please see Notes 2 and 14 to our consolidated financial statements included elsewhere in this Annual Report.

Diagnostics - Professional

Our InteliSwab® COVID-19 Rapid Test Pro and Rx products are primarily sold through distributors to U.S. hospitals, physician offices and clinics. It is also marketed directly to customers in the public health market including clinics and laboratories of state, county and other governmental agencies.

We market the OraQuick ADVANCE®HIV-1/2 antibody test directly to customers in the public health market for HIV testing. This market consists of a broad range of clinics and laboratories and includes states, counties, and other governmental agencies, family planning clinics, colleges and universities, correctional facilities and the military. There are also a number of organizations in the public health market, such as AIDS service organizations and various community-based organizations, that are set up primarily for the purpose of encouraging and enabling HIV testing. We sell our OraQuick ADVANCE® test to hospitals and physician offices in the U.S. primarily through distributors. In addition, we distribute our OraQuick® HIV test in certain foreign countries through distributors.

Our OraQuick® HCV test is sold primarily to the same markets where our OraQuick® ADVANCE HIV test is sold, including public health organizations, hospitals, physicians and retail clinics. We also sell this test in other countries through distributors.

Diagnostics - OTC and Self-Test

We sell our InteliSwab® COVID-19 Rapid Test product in the U.S. retail and consumer markets. The OTC InteliSwab® test is also sold directly and through distributors into a broad range of business-to-business (B2B) markets including employer testing, colleges and universities, local, state and federal governmental agencies and the US military.

We sell our OraQuick® In-Home test in the U.S. retail or consumer market. The product is also available for purchase on-line through certain retailers and from our website, www.oraquick.com. The primary target population for our HIV-OTC test comprises young, sexually active adults, with greater purchase intent found in high-risk sub-groups, such as men who have sex with men, African Americans and Latino Americans. We also sell our OraQuick® HIV Self-Test in certain international markets. Under a Charitable Support Agreement with the Bill & Melinda Gates Foundation (“Gates Foundation”) we are able to offer our OraQuick® HIV Self-Test at an affordable price in 50 developing countries in Africa and Asia with funding from the Gates Foundation. The funding consists of support payments tied to the volume of product we sell and reimbursement of certain related costs. The agreement was entered into in 2017 and has a four-year term and enables non-governmental organizations in the eligible countries that receive funding from government or public sector agencies and donors to access our HIV Self-Test at reduced pricing. The agreement with the Gates Foundation provides for an aggregate funding amount not to exceed $20.0 million over the four-year term or $6.0 million each year of the agreement. The term of this agreement expired in June 2021.

Our OraQuick® HIV Self-Test is the only oral fluid HIV test prequalified by the WHO. WHO prequalification helps ensure that diagnostic tests for high burden diseases meet global standards of quality, safety, and efficacy in order to optimize use of health resources and improve health outcomes. WHO prequalification enables governmental organizations implementing HIV Self-Test pilots and programs to access international funding to purchase our test.

Substance Abuse Testing

Our substance abuse testing products are marketed to laboratories serving the workplace testing, forensic toxicology, criminal justice and drug rehabilitation markets in the U.S. and certain international markets.

We have entered into agreements for the distribution of our Intercept® collection device and associated MICRO-PLATE assays for drugs-of-abuse testing in the workplace testing market in the United States and Canada through several laboratory distributors and internationally for workplace, criminal justice and forensic toxicology testing through other distributors. We also market the Intercept® collection device on its own and as a kit in combination with laboratory testing services. To better serve our workplace customers, we

7

have contracted with commercial laboratories to provide prepackaged Intercept® test kits, with prepaid laboratory testing and specimen shipping costs included.

The criminal justice market in the United States for our substance abuse testing products consists of a wide variety of entities in the criminal justice system that require drug screening, such as pre-trial services, parole and probation offices, police forces, drug courts, prisons, drug treatment programs and community/family service programs. The forensic toxicology market consists of several hundred laboratories including federal, state and county crime laboratories, medical examiner laboratories and reference laboratories.

As discussed above, we also sell our next generation Intercept i2® he collection device with a NIDA-5 panel of fully-automated high-throughput oral fluid assays developed with Thermo Fisher for the detection of PCP, THC, opiates, cocaine, methamphetamines and amphetamines. These products are currently sold into the criminal justice and drug treatment markets.

We distribute our Q.E.D.® saliva alcohol test primarily through various distributors in the United States and internationally. The markets for alcohol testing are relatively small and fragmented with a broad range of legal and procedural barriers to entry. Markets range from law enforcement testing to workplace testing of employees in safety sensitive occupations. Typical usage situations include pre-employment, random, post-accident, reasonable-cause and return-to-duty testing.

Molecular Solutions

Our Molecular Solutions business sells its products directly to its customers, primarily through its own internal sales force in U.S. domestic markets. However, in many international markets, distributors are used.

Most of our Molecular Solutions revenues are derived from product sales to commercial customers and sales into the academic and research markets. Sales to commercial customers providing consumer genetics and clinical diagnostic services have been increasing and account for a majority these revenues. A significant portion of total sales are derived from repeat customers in both markets. Molecular Solutions also has customers in the livestock and companion animal markets.

We have expanded the market focus of our Molecular Solutions business by selling certain existing collection products for use in COVID-19 tests and by developing new collection devices for the emerging microbiome market, which is focused on the study of microbes and their effect on human health. Our primary product offering in the microbiome market, OMNIgene® • GUT, is focused on the human gut microbiome (microbes living in human stool). We are leveraging our existing sales force and global research connections to engage microbiome customers around the world and establish ourselves as among the leaders in ease-of-collection, stabilization and transport of this challenging sample type.

Our Molecular Solutions segment includes the Colli-Pee® device, a product developed and sold by our Novosanis subsidiary, for the volumetric collection of first void urine. This product is in its early stages and initial sales are occurring primarily through distributors and collaborations for use in the liquid biopsy and sexually transmitted disease markets.

This segment is offering laboratory and analytical services for both genomics and microbiome customers in order to more fully meet the needs of its customers. These services are primarily provided to pharmaceutical and biotech companies and research institutions. During 2019, we substantially expanded our ability to offer microbiome laboratory and bioinformatics services with the acquisition of CoreBiome and Diversigen. The laboratory operations of CoreBiome and Diversigen were combined during 2020 under the Diversigen brand.

Significant Products and Customers

Several different product lines have contributed significantly to our financial performance, accounting for 10% or more of our total revenues during the past three years. The table below shows a breakdown of those product lines (dollars in thousands).

|

|

For the years ended December 31, |

|

|||||||||

|

|

2021 |

|

|

2020 |

|

|

2019 |

|

|||

Genomics |

|

$ |

63,350 |

|

|

$ |

36,878 |

|

|

$ |

56,200 |

|

OraQuick® HIV |

|

|

42,373 |

|

|

|

44,224 |

|

|

|

43,092 |

|

COVID-19 collection kits |

|

|

54,167 |

|

|

|

50,927 |

|

|

|

— |

|

Inteliswab® |

|

|

22,405 |

|

|

|

— |

|

|

|

— |

|

One of our customers accounted for approximately 15% of our net consolidated revenues in 2019. We had no customers that accounted for more than 10% of our net consolidated revenues for the years ended December 31, 2021 and 2020.

8

Supply and Manufacturing

We manufacture all of our OraQuick ADVANCE® Rapid HIV test, OraQuick® In-Home HIV test, OraQuick® HCV test, OraQuick® Ebola test, OraSure®, Intercept® and Intercept i2® he collection devices, AUTOLYTE and MICRO-PLATE assays and Q.E.D.® saliva alcohol test in our Bethlehem, Pennsylvania facilities. We expect to continue to manufacture these products at this location for the foreseeable future.

We have contracted with a third party in Thailand for the assembly of the OraQuick® Rapid HIV test and the OraQuick® HIV In-Home Test in order to supply certain international markets. We believe that other firms would be able to assemble these OraQuick® tests on terms no less favorable than those set forth in the agreement if the Thailand contractor would be unable or unwilling to continue assembling this product. We have long-term agreements in place for the contract manufacturing in Thailand and one of our suppliers has been manufacturing for us for the past 20 years.

We can purchase the HIV antigens, the nitrocellulose and certain other critical components, and the HCV and Ebola antigens used in our OraQuick® product lines only from a limited number of sources. If for any reason these suppliers are unwilling or no longer able to supply our antigen or nitrocellulose needs, we believe that alternative supplies could be obtained at a competitive cost. However, a change in any of the antigens, the nitrocellulose or other critical components used in our products would require FDA approval and some additional development work. This in turn could require significant time to complete, increase our costs and disrupt our ability to manufacture and sell the affected products.

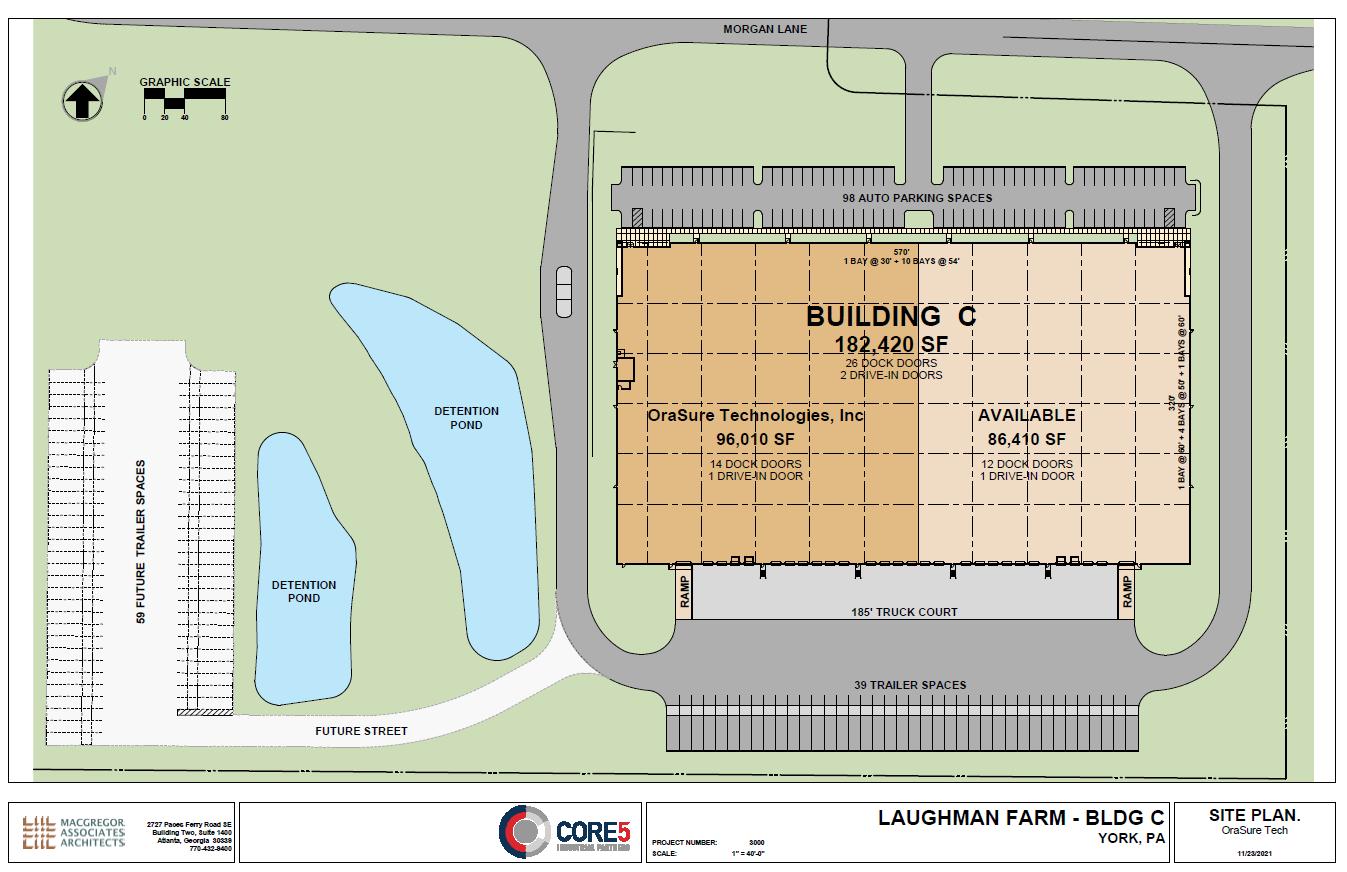

We manufacture all of the proprietary chemistry and assay cards for our InteliSwab® COVID-19 Rapid Tests in our Bethlehem, Pennsylvania facilities. We made significant capital investments during 2021 in order to scale this manufacturing. On September 30, 2021, we entered into an agreement for $109 million in capital funding from the US Department of Defense, in coordination with the Department of Health and Human Services, to build additional manufacturing capacity in the United States for our InteliSwab® COVID-19 Rapid Tests as part of the nation’s pandemic preparedness plan. Under the Agreement, the funding will be used to expand our production capacity by 100 million tests annually. Funding will be paid to us based on achievement of milestones through March 2024 for the design, acquisition, installation, qualification and acceptance of the manufacturing equipment. An existing Company location in Bethlehem, PA is being retrofitted to accommodate increased manufacturing and an additional new facility will be added in another U.S. location to be determined.

Our MICROPLATE and AUTO-LYTE assays require the production of highly specific and sensitive antibodies corresponding to the antigen of interest. Substantially all our antibody requirements are provided by contract suppliers. We believe that we have adequate reserves of antibody supplies and that we have access to sufficient raw materials for these products.

The fully-automated high-throughput oral fluid drug assays sold with our new Intercept i2® he collection device are manufactured and supplied under a long-term agreement with Thermo Fisher. There is no other supply source for these products.

Our wholly-owned subsidiary, DNA Genotek, Inc. ("DNAG") has three long-term contract manufacturing relationships to supply virtually all of its products, including the Oragene® product line. Many of the raw materials and components used in these products are also purchased from third parties, some of which are purchased from a single source supplier. We are actively seeking to qualify other suppliers that can manufacture and supply the raw materials and components for the DNAG products. All DNAG products in our Molecular Solutions segment are produced in Canada. We have increased the capacity for our molecular collection kits to meet demand for COVID molecular testing to 60 million kits per year (including non-COVID kits) with another 20 million kits per year to be qualified by end of 2022.

Our Colli-Pee® device is currently manufactured at our Belgian assembly facility with components supplied by third party vendors.

Our GenoFINDTM genomics laboratory services are provided to our customers by a third party laboratory. We believe there are other laboratories that can also provide these services. Our microbiome laboratory testing and analytical services are provided by our subsidiary, Diversigen.

Human Capital Resources

In order to achieve the goals and expectations of our Company, it is crucial that we continue to attract and retain top talent. To facilitate talent attraction and retention, we strive to make OraSure a safe and rewarding workplace with opportunities for our employees to grow and develop in their careers.

9

As of December 31, 2021, we had 785 full-time employees, which compares to 570 employees as of December 31, 2020. The increase in employees during 2021 was primarily the result of the need to add manufacturing capacity for our InteliSwab® COVID-19 Rapid Test and molecular collection devices used in COVID-19 molecular testing. Our employees are not currently represented by a U.S. collective bargaining agreement.

We believe our employees are among our most important resources and are critical to our continued success. We focus significant attention to attracting and retaining talented and experienced individuals to manage and support our operations, and our management team routinely reviews employee turnover rates at various levels of the organization. Management also reviews employee engagement and satisfaction surveys to monitor employee morale and receive feedback on a variety of issues.

The health and safety of our workforce is fundamental to the success of our business. We safeguard our people, projects and reputation by striving for zero employee injuries and illnesses, while operating and delivering our work responsibly and sustainably. We provide our employees upfront and ongoing safety training to ensure that safety policies and procedures are effectively communicated and implemented. Personal protective equipment is provided to those employees where needed for the employee to safely perform their job function.

During 2021, in response to the changing impact of the COVID-19 pandemic, we continued to implement safety protocols and new procedures to protect our employees, our subcontractors and our customers. These protocols include complying with social distancing and other health and safety standards as required by federal, state and local government agencies, taking into consideration guidelines of the Centers for Disease Control and Prevention and other public health authorities. In addition, we continued to modify the way we conduct many aspects of our business to reduce the number of in-person interactions.

As part of our compensation philosophy, we believe that we must offer and maintain market competitive compensation and benefits programs for our employees in order to attract and retain superior talent. In addition to healthy base wages, additional programs include annual bonus opportunities, a Company matched 401(k) Plan or other savings plan, healthcare and insurance benefits, health savings and flexible spending accounts, paid time off, family leave, flexible work schedules, and employee assistance programs.

The OraSure family of companies is committed to creating and fostering a diverse, equitable, and inclusive workplace that reflects and contributes to the global communities in which we do business and the customers and partners we serve. This includes all communities impacted by our corporate presence. Our management teams and all of our employees are expected to exhibit and promote honest, ethical and respectful conduct in the workplace. All of our employees must adhere to a Code of Conduct that sets standards for appropriate behavior and includes required annual training on preventing, identifying, reporting and stopping any type of unlawful discrimination. We strive to recruit the best people for the job regardless of gender, ethnicity or other protected trait and it is our policy to fully comply with all laws (domestic and foreign) applicable to discrimination in the workplace. We have an active Diversity, Equity and Inclusion Council that strives to drive diversity, equity and inclusion within the workplace. At OraSure, we believe a variety of perspectives are critical to achieving success, and that diversity, equity and inclusion are key drivers to growth-based innovation and profitability. We aim to create a culture where all people feel valued, supported, and inspired to be themselves fearlessly, without judgement. We believe that when all voices are heard, we honor and exemplify our core values and best serve our communities.

Competition

Diagnostics Segment

The diagnostic industry is a multi-billion dollar international industry and is intensely competitive. Many of our competitors are substantially larger than we are, and have greater financial, research, manufacturing and marketing resources than we do. We have many rapid tests with proprietary features enabling them to compete effectively in select market segments. Broadly, we differentiate based on our tests’ ease of use, which has enabled us to expand our self-testing offering.

The primary competitive factors for our products include price, quality, performance, ease of use, customer service and reputation. Industry competition is based on these and the following additional factors:

10

A few large corporations produce a wide variety of diagnostic tests and other medical devices and equipment. A larger number of mid-size companies generally compete only in the diagnostic industry and a significant number of small companies produce only a few diagnostic products. As a result, the diagnostic test industry is highly fragmented and segmented. This enables us to serve specific segments where the products provide a unique benefit.

The future market for diagnostic products is expected to be characterized by greater cost consciousness, the development of new technologies, tighter reimbursement policies and consolidation. The purchasers of diagnostic products are expected to place increased emphasis on lowering costs, reducing inventory levels, obtaining better performing products, automation, service and volume discounts.

We expect competition to intensify as technological advances are made and become more widely known, and as new products reach the market. Furthermore, new testing methodologies could be developed in the future that render our products impractical, uneconomical or obsolete. There can be no assurance that our competitors will not succeed in developing or marketing technologies and products that are more effective than those we develop or that would render our technologies and products obsolete or otherwise commercially unattractive. In addition, there can be no assurance that our competitors will not succeed in obtaining regulatory approval for these products, or introduce or commercialize them, before we can do so. These developments could have a material adverse effect on our business, financial condition and results of operations.

Competition in the U.S. market for infectious disease testing in medical settings is intense and is expected to increase. Our principal competition for HIV testing in the professional market comes from existing and new professional point-of-care rapid blood tests and automated laboratory-based blood tests. Our OraQuick ADVANCE HIV rapid test is the only oral fluid test for HIV in the United States, and as such, enables outreach testing outside of clinics. Our OraQuick® rapid HCV test competes against laboratory-based blood tests in the U.S., as there currently are no other rapid HCV testing products approved by the FDA.

Our OraQuick® In-Home HIV oral fluid test is the only rapid HIV test approved by the FDA for sale in the US OTC market.

Outside the U.S., our rapid HIV and HCV tests compete against other rapid and laboratory-based tests, which require blood as a sample. The majority of these blood-based tests are priced at or below our HIV and HCV rapid oral fluid tests. There are no other oral fluid tests for HCV outside the US with WHO Prequalification status and the CE mark. The majority of our sales outside the US are in Africa due to the greater incidence of HIV in that region. In 2021, we obtained the CE mark for our OraQuick® HIV Self-Test which will enable us to enter the European over-the-counter market for HIV. In addition, in 2021, we received registration of our OraQuick® HIV Self-Test, and the Thai Free Sales Certificate which enables us to obtain registrations in Asia and Latin America.

The United States COVID-19 rapid testing market consists of tests used by medical professionals at the point-of-care as well as over-the-counter tests purchased and used by consumers. Currently, there are 45 professional point-of-care EUA authorizations by the US FDA. There are also 13 OTC Antigen rapid tests and 3 OTC rapid molecular tests authorized under EUA by the FDA. Our InteliSwab® test competes in both the professional point-of-care and OTC segments with these products.

In the substance abuse testing market, our Intercept® drug testing system competes with laboratory-based drug testing products using sample matrices such as urine, hair, sweat and oral fluid. We expect competition for our products to intensify, particularly from other domestic and international companies that have developed, or may develop, competing oral fluid drug testing products.

Our MICRO-PLATE oral fluid drug assays, which are sold for use with the original Intercept® collector and our OraSure® collection device, also continue to come under increasing competitive pressure from “home-brew” assays developed internally by our laboratory customers. Our oral fluid MICRO-PLATE assays also compete with urine-based homogeneous assays that are run on fully-automated, random access analyzers.

Our MICRO-PLATE drugs-of-abuse reagents sold in the forensic toxicology market are targeted to forensic testing laboratories where sensitivity, automation and “system solutions” are important. We compete with both homogeneous and heterogeneous tests manufactured by many companies.

11

Q.E.D.® competes against other semi-quantitative saliva-based alcohol tests that have received U.S. Department of Transportation approval as well as breath alcohol tests. Although there are lower priced tests on the market that use oral fluid or breath as a test medium, we believe that these tests are qualitative tests that we believe are lower in quality and provide fewer benefits than our Q.E.D.® test.

Molecular Solutions Segment

Our Oragene® and ORAcollect® collection systems compete against other types of collection devices used for molecular testing, such as blood collection devices and buccal swabs, which often are sold for prices lower than the prices charged for the Oragene® and ORAcollect® products. Although we believe the Oragene® and ORAcollect® devices offer a number of advantages over these other products, the availability of lower price competitive devices can result in lost sales and degradation in pricing and profit margin. Our Oragene® and ORAcollect® products are also facing increasing competition from similarly designed collection systems which are beginning to enter the market. With the receipt of authorizations for use in connection with COVID-19 molecular tests, our Oragene® and ORAcollect® products now compete against COVID-19 testing systems and the collection methods used in those systems.

OMNIgene®• GUT is being sold in the emerging microbiome market and competes with a variety of non-standard in-house solutions developed by various researchers, including simply freezing the sample after collection. The microbiome market is expected to require standardization in the methods used for collection and stabilization in order to derive more accurate and repeatable results. To date, we are one of the few vendors to offer a solution that fully meets these requirements.

Our genomic and microbiome laboratory service offerings primarily compete against a number of commercial reference laboratories, specialty laboratories and hospital laboratories in the U.S.

Patents and Proprietary Information

We seek patents and other intellectual property rights to protect and preserve our proprietary technology and our right to capitalize on the results of our research and development activities. We also rely on trade secrets, know-how, continuing technological innovations and licensing opportunities to provide competitive advantages for our products in our markets and to accelerate new product introductions. We regularly search for third-party patents in fields related to our business to shape our own patent and product commercialization strategies as effectively as possible and to identify licensing opportunities. United States patents generally have a maximum term of 20 years from the date an application is filed.

We have two United States patents and numerous foreign patents for the OraSure® and Intercept® collection devices and technology relating to oral fluid collection, containers for oral fluids, methods to test oral fluid, formulations for the manufacture of synthetic oral fluid, and methods to control the volume of oral fluid collected and dispersed. The U.S. patents expire from June 2022 to December 2026. We have also applied for additional patents, in both the United States and certain foreign countries, on such products and technology.

We have one United States patent for our OraQuick® platform expiring in 2028, as well as corresponding related international patents. We also have patent applications pending internationally. We have five pending patent applications in the United States for our InteliSwab® COVID-19 Rapid Test, and we have filed and expect to file additional patent applications for this product in certain international markets.

We hold, through our subsidiary, DNAG, twenty-four granted United States patents and numerous foreign patents issued for compositions, methods and apparatuses for the collection, stabilization, transportation and storage of nucleic acids (DNA and RNA) from oral fluid and other bodily fluids and tissues. These patents expire from February 2022 through April 2035.

We hold through our subsidiary, Novosanis, one granted United States patent and numerous foreign patents covering a medical device for capturing a predetermined volume of first void urine. This patent expires in September 2033.

Our subsidiary, Diversigen, has licensed one United States patent and several foreign patent applications from the University of Minnesota for analytical standards to detect and/or measure sampling, processing, and/or amplification errors in a biological samples containing polynucleotide molecules. This license also covers certain software and know-how related to laboratory and bioinformatics procedures and processes. Diversigen has also licensed certain know-how and database assets from the Baylor College of Medicine related to laboratory processes for microbiome and metagenomics services.

We require our employees, consultants, outside collaborators and other advisors to execute confidentiality agreements upon the commencement of employment or consulting relationships with us. These agreements provide that all confidential information developed by or made known to the individual during the course of the individual’s relationship with us is to be kept confidential and not disclosed to third parties except in specific circumstances. In the case of employees and certain consultants, the agreements also

12

provide that all inventions conceived by the individual during his or her tenure with us or the performance by the consultant of services for us will be our exclusive property.

We own rights to trademarks and service marks that we believe are necessary to conduct our business as currently operated. In the United States, we own a number of trademarks, including the OraSure®, Intercept®, Intercept i2®he, OraQuick®, OraQuick ADVANCE®, OraSure QuickFlu®, Q.E.D.®, Inteliswab®, Oragene®, DNA Genotek®, OMNImetTM, ORAcollect®, OMNIgene®, goDNATM, Diversigen®, CoreBiome®, Boostershot®, MetaGeneTM, BenchmarkTM, Novosanis®, Colli-Pee®, UCM®, UASTM, AUTO-LYTE®, prepIT® and Hemagene® trademarks. We also own many of these marks and others in several foreign countries and we are pursuing registration of several other trademarks.

Although important, the issuance of a patent or existence of trademark or trade secret protection does not in itself ensure the success of our business. Competitors may be able to produce products competing with our patented products without infringing our patent rights. Issuance of a patent in one country generally does not prevent manufacture or sale of the patented product in other countries. The issuance of a patent is not conclusive as to validity or as to the enforceable scope of the patent. The validity or enforceability of a patent or trademark can be challenged by litigation after its issuance or registration. If the outcome of such litigation is adverse to the owner of the patent, the owner’s rights could be diminished or withdrawn. Trade secret protection does not prevent independent discovery and exploitation of the secret product or technique.

Government Regulation

General

Most of our products are regulated by the FDA, along with other federal, state and local agencies and comparable regulatory bodies in other countries. This regulated environment governs almost all aspects of development, production and marketing, including product design and testing, authorizations to market, labeling, advertising and promotion, manufacturing, distribution, post-market surveillance and reporting, and recordkeeping. We believe that our products and procedures are in material compliance with all applicable regulations, but the regulations regarding the manufacture and sale of our products may be unclear and are subject to change. We cannot predict the effect, if any, that these changes might have on our business, financial condition or results of operations.

Many of our FDA-regulated products require some form of review and action by the FDA before they can be marketed in the United States. After approval or clearance by the FDA, we must continue to comply with other FDA requirements applicable to marketed products and are subject to periodic inspections by the FDA and other regulatory bodies. Both before and after approval or clearance, failure to comply with the FDA’s requirements can lead to significant penalties or could disrupt our ability to manufacture and sell these products. In addition, the FDA could refuse permission to obtain certificates needed to export our products if the agency determines that we are not in compliance.

Domestic Regulation

Most of our products are regulated in the United States as in vitro diagnostic and medical devices. In the United States, devices are classified into three groups based on risk: class I (lowest risk), class II (moderate risk), and class III (highest risk). The classification of a device determines the level of regulation applicable to the device: class I devices are subject only to the general controls that are applicable to all regulated devices; class II devices are subject to both general controls and special controls, which are specific to the type of device; and class III devices are subject to general controls and any other controls that are needed to provide reasonable assurance of the safety and effectiveness of the specific device.

The classification of the device also influences the type of premarket submission that is required before the device can be marketed. Some low risk devices (including many class I and some class II devices) may be placed on the market without any premarket submission. Such devices often are referred to as “exempt” or “510(k)-exempt.” Most devices, however, require some form of premarket submission prior to marketing. There are several mechanisms by which such devices can be placed on the market in the United States, including 510(k)-clearance, de novo classification, premarket approval, or emergency use authorization.

Many class II devices and some class I devices may qualify for clearance under Section 510(k) of the Federal Food, Drug and Cosmetic Act. To obtain this clearance from the FDA, the manufacturer must submit to the FDA a premarket notification that it intends to begin marketing the product, and show that the product is substantially equivalent to another legally marketed predicate device (i.e., a device that has been cleared through the 510(k) process; a device that was legally marketed prior to May 28, 1976; a device that has been reclassified by the FDA; or a device that the FDA previously has determined to be exempt from the 510(k) process). To be substantially equivalent, an applicant must show that when compared to a predicate, the new device has the same intended use and same technology, or if different technology, that the new device is as safe and effective as the predicate and does not raise different questions of safety

13

and effectiveness. In all cases, data from some form of performance testing is required and in some cases, the submission must include data from human clinical studies. An applicant must submit a 510(k) notification at least 90 days before commercial distribution of the product commences. Marketing may only commence when the FDA issues a clearance letter finding that the new device is substantially equivalent to the predicate device. The standards and data requirements necessary for the clearance of a new device may be unclear or may be subject to change. Although FDA clearance usually takes from four to twelve months, in some cases more than a year may be required before clearance is obtained, if at all.

If the device does not qualify for the 510(k) procedure, either because there is no existing predicate device, it is not substantially equivalent to a legally marketed predicate device or because it is classified by the FDA as a class III device, the FDA must approve either a request for de novo classification or a premarket approval application (“PMA”) before marketing can begin. A de novo classification is an alternate pathway to classify novel devices of low to moderate risk for which no substantially equivalent predicate device exists into class I or class II. The FDA’s goal is to decide a de novo request in 150 days from the time the request is received, although it can take longer.

PMAs generally are required for class III devices, i.e., high risk devices, and must demonstrate, among other matters, that the medical device provides a reasonable assurance of safety and effectiveness for the intended use(s) of the device. A PMA is typically a complex submission, supported by valid scientific evidence, including the results of preclinical and clinical studies, usability data, detailed information about the manufacturing process for the device, and other data and information. Preparing a PMA is a resource-intensive and time-consuming process. Once a PMA has been submitted, the FDA is required to review the submission within 180 days. However, the FDA’s review may be, and often is, much longer, in many cases requiring one to three years or more, and may include requests for additional data, review by an independent panel of experts, and facility inspections before approval is granted, if at all.

If the FDA approves the PMA, it may place restrictions on the device. If the FDA’s evaluation of the PMA or the manufacturing facility is not favorable, the FDA may deny approval of the PMA application or issue a “not approvable” letter. The FDA may also require additional clinical trials, which can delay the PMA approval process by several years or prevent a PMA approval from being obtained.

If the FDA discovers that an applicant has submitted false or misleading information in any application or notification, the FDA may take action against the applicant and its employees or refuse to review submissions until certain requirements are met pursuant to its Application Integrity Policy. Delays in receipt of or failure to receive such clearances or approvals, the loss of previously received clearances or approvals, or the failure to comply with existing or future regulatory requirements could have a material adverse effect on our business, financial condition and results of operations.

Another option for marketing a product in the U.S. is through an Emergency Use Authorization (“EUA”). FDA may grant an EUA for a product if the Secretary of Health and Human Services declares that circumstances exist justifying the authorization of emergency use of certain products. Such declaration may be made following a determination by the Secretary of Health and Human Services that there is a public health emergency, by the Secretary of Homeland Security that there is a domestic emergency, or by the Secretary of Defense that there is a military emergency, or the declaration may be made if a material threat is identified under a particular provision of the Public Health Service Act. Typically, a diagnostic device may receive EUA-authorization on the basis of analytical and clinical studies that do not satisfy the requirements for full clearance or approval. Devices also may be exempt from design controls and other quality requirements. An EUA for a device remains in effect until the Secretary of Health and Human Services, in consultation with the Secretary of Defense, determines that the circumstances justifying emergency use of the device no longer exist, or until the authorized device is approved or cleared.