Exhibit

EXHIBIT 10.2

LEGACY YARDS TENANT LP,

Landlord

TO

COACH, INC.,

Tenant

Lease

Dated as of August 1, 2016

TABLE OF CONTENTS

|

| | | | |

| | Page |

|

ARTICLE 1 PREMISES; TERM; USE | 1 |

|

1.01 |

| DEMISE | 1 |

|

1.02 |

| TERM | 1 |

|

1.03 |

| POSSESSION | 1 |

|

1.04 |

| INTENTIONALLY OMITTED | 2 |

|

1.05 |

| USE | 2 |

|

ARTICLE 2 RENT | 6 |

|

2.01 |

| RENT | 6 |

|

2.02 |

| FIXED RENT | 6 |

|

2.03 |

| ADDITIONAL CHARGES | 8 |

|

2.04 |

| PILOT PAYMENTS | 8 |

|

2.05 |

| IMPOSITIONS | 12 |

|

2.06 |

| TAX PAYMENTS | 15 |

|

2.07 |

| OPERATING PAYMENTS | 17 |

|

2.08 |

| PILOT, IMPOSITIONS, TAX AND OPERATING PROVISIONS | 30 |

|

2.09 |

| ELECTRIC CHARGES | 30 |

|

2.10 |

| MANNER OF PAYMENT | 32 |

|

ARTICLE 3 LANDLORD COVENANTS | 32 |

|

3.01 |

| LANDLORD SERVICES | 32 |

|

3.02 |

| GENERAL SERVICE PROVISIONS | 45 |

|

ARTICLE 4 LEASEHOLD IMPROVEMENTS; TENANT COVENANTS | 47 |

|

4.01 |

| TENANT'S WORK | 47 |

|

4.02 |

| ALTERATIONS | 48 |

|

4.03 |

| LANDLORD'S AND TENANT'S PROPERTY | 52 |

|

4.04 |

| ACCESS AND CHANGES TO BUILDING | 54 |

|

4.05 |

| REPAIRS | 55 |

|

4.06 |

| COMPLANCE WITH LAWS; HAZARDOUS MATERIALS | 56 |

|

4.07 |

| TENANT ADVERTISING | 58 |

|

4.08 |

| RIGHT TO PERFORM TENANT COVENANTS | 58 |

|

4.09 |

| RIGHT TO PERFORM LANDLORD COVENANTS | 59 |

|

4.10 |

| TELECOMMUNICATIONS; SHAFT SPACE | 60 |

|

4.11 |

| VIOLATIONS | 61 |

|

ARTICLE 5 ASSIGNMENT AND SUBLETTING | 62 |

|

5.01 |

| ASSIGNMENT; ETC | 62 |

|

5.02 |

| LANDLORD'S RIGHT OF FIRST OFFER | 63 |

|

5.03 |

| ASSIGNMENT AND SUBLETTING PROCEDURES | 65 |

|

-i-

|

| | | | |

5.04 |

| GENERAL PROVISIONS | 67 |

|

5.05 |

| ASSIGNMENT AND SUBLEASE PROFITS | 69 |

|

5.06 |

| ELIGIBLE SUBTENANT; NON-DISTURBANCE | 71 |

|

5.07 |

| TENANT AS SUBTENANT OR ASSIGNEE | 72 |

|

ARTICLE 6 SUBORDINATION; DEFAULT; INDEMNITY | 72 |

|

6.01 |

| SUBORDINATION | 72 |

|

6.02 |

| ESTOPPEL CERTIFICATE | 74 |

|

6.03 |

| DEFAULT | 75 |

|

6.04 |

| RE-ENTRY BY LANDLORD | 75 |

|

6.05 |

| DAMAGES | 76 |

|

6.06 |

| OTHER REMEDIES | 76 |

|

6.07 |

| RIGHT TO INJUNCTION | 77 |

|

6.08 |

| CERTAIN WAIVERS | 77 |

|

6.09 |

| NO WAIVER | 77 |

|

6.10 |

| HOLDING OVER | 77 |

|

6.11 |

| ATTORNEYS' FEES | 78 |

|

6.12 |

| NONLIABILITY AND INDEMNIFICATION | 78 |

|

ARTICLE 7 INSURANCE; CASUALTY; CONDEMNATION | 79 |

|

7.01 |

| COMPLIANCE WITH INSURANCE STANDARDS | 79 |

|

7.02 |

| TENANT'S INSURANCE | 80 |

|

7.03 |

| SUBROGATION WAIVER | 81 |

|

7.04 |

| CONDEMNATION | 81 |

|

7.05 |

| CASUALTY | 82 |

|

7.06 |

| LANDLORD'S INSURANCE | 85 |

|

ARTICLE 8 MISCELLANEOUS PROVISIONS | 85 |

|

8.01 |

| NOTICE | 85 |

|

8.02 |

| RULES AND REGULATIONS | 87 |

|

8.03 |

| SEVERABILITY | 88 |

|

8.04 |

| CERTAIN DEFINITIONS | 88 |

|

8.05 |

| QUIET ENJOYMENT | 89 |

|

8.06 |

| LIMITATION OF LIABILITY | 89 |

|

8.07 |

| COUNTERCLAIMS | 89 |

|

8.08 |

| SURVIVAL | 89 |

|

8.09 |

| CERTAIN REMEDIES; ARBITRATION | 90 |

|

8.10 |

| NO OFFER; COUNTERPARTS | 92 |

|

8.11 |

| CAPTIONS; CONSTRUCTION | 92 |

|

8.12 |

| AMENDMENTS | 92 |

|

8.13 |

| BROKER | 92 |

|

8.14 |

| MERGER | 92 |

|

8.15 |

| SUCCESSORS | 92 |

|

8.16 |

| APPLICABLE LAW | 93 |

|

8.17 |

| NO DEVELOPMENT RIGHTS | 93 |

|

8.18 |

| CONDOMINIUM | 93 |

|

-ii-

|

| | | | |

8.19 |

| EMBARGOED PERSON | 94 |

|

8.20 |

| DINING FACILITY; WET INSTALLATIONS | 94 |

|

8.21 |

| BUILDING AMENITIES | 98 |

|

8.22 |

| PARKING | 98 |

|

8.23 |

| GOVERNMENTAL INCENTIVES | 99 |

|

8.24 |

| CONFIDENTIALITY; PUBLICITY | 100 |

|

8.25 |

| RETAIL STANDARD | 100 |

|

8.26 |

| TENANT CREDITWORTHINESS | 100 |

|

8.27 |

| EVENTS | 101 |

|

8.28 |

| MEMORANDUM OF LEASE | 102 |

|

8.29 |

| REIT/UBTI COMPLIANCE | 102 |

|

ARTICLE 9 RENEWAL RIGHT | 103 |

|

9.01 |

| RENEWAL RIGHT | 103 |

|

9.02 |

| RENEWAL RENT AND OTHER TERMS | 105 |

|

ARTICAL 10 EXPANSION OPTIONS | 107 |

|

10.01 |

| FIRST EXPANSION OPTION | 107 |

|

10.02 |

| SECOND EXPANSION OPTION | 111 |

|

ARTICLE 11 RIGHT OF FIRST OFFER | 114 |

|

11.01 |

| OFFER SPACE OPTION | 114 |

|

ARTICLE 12 ROOF RIGHTS | 117 |

|

12.01 |

| ROOF RIGHTS | 117 |

|

ARTICLE 13 SIGNAGE; NAMING; LEASING TO COMPETITORS | 120 |

|

13.01 |

| SIGNAGE | 120 |

|

13.02 |

| NAMING | 121 |

|

13.03 |

| ELEVATOR LOBBY AND PREMISES DOOR SIGNAGE | 121 |

|

13.04 |

| SIGNAGE REMOVAL | 122 |

|

13.05 |

| LEASING TO COMPETITORS OF TENANT | 122 |

|

13.06 |

| BUILDING EXTERIOR LIGHTING SYSTEM | 123 |

|

13.07 |

| COACH NAME | 123 |

|

ARTICLE 14 LOBBY | 123 |

|

14.01 |

| COACH LOBBY | 123 |

|

ARTICLE 15 TERRACE SPACE | 125 |

|

15.01 |

| TERRACE SPACE | 125 |

|

|

| | |

EXHIBITS | |

A | Legal Description | |

-iii-

|

| | |

B-1 | Floor Plans | |

B-2 | Rentable Square Footage of Premises and Building | |

C | Rules and Regulations | |

D-1 | Standard Cleaning Specifications | |

D-2 | Green Cleaning Policy | |

E | Tenant's Initial Work Plans | |

F | HVAC Specifications | |

G | Elevator Specifications | |

H | Charges for Landlord Services and Personnel | |

I-1 | Tenant Design Standards | |

I-2 | Construction Rules | |

J | Intentionally Omitted | |

K | Approved Contractors | |

L | Telecommunications Plan | |

M-1 | Form of Superior Mortgagee SNDA | |

M-2 | Form of Superior Lessor RNDA | |

M-3 | Form of PILOT SNDA/RNDA | |

M-4 | Form of Condo SNDA | |

N | Form of Confidentiality Agreement | |

O | Location for Roof Equipment | |

P-1 | Signage | |

P-2 | Plaza Signage Prohibition Area | |

Q | Hoist Impact Area | |

R | Building Lobby and Coach Lobby | |

S | Design and Aesthetics of Food Hall | |

T | Security Specifications | |

U | Specifications for Building Exterior Lighting System | |

V | Insurance Minimum Coverage and Limits | |

W | Curb Space Location | |

X | 25th Floor Fan Space | |

Y | Form of Landlord's Non-Disturbance Agreement | |

Z | LEED Certification Requirements | |

AA | Terra Firma Podium | |

BB | Existing Superior Rights | |

CC-1 | Office Competitor of Tenant | |

CC-2 | Retail Competitor of Tenant | |

DD | Arbiters | |

EE | Form of Memorandum of Lease | |

FF | BCG Competitors | |

GG | Public Plaza | |

HH | Replacement Landlord's Right of First Offer Provisions | |

-iv-

INDEX OF DEFINED TERMS

|

| |

Definition | Where Defined |

| |

25th Floor Fan Space | Section 3.01 |

25th Floor Vayner Lease | Section 2.07 |

A&R POA | Section 2.07 |

AAA | Section 2.07 |

Acceptance Notice | Section 14.01 |

Additional Charges | Section 2.03 |

Additional Insureds | Exhibit V |

Additional POA Amount | Section 2.08 |

Additional Tax Amount | Section 2.04 |

Additional Tax Payment | Section 2.04 |

Affected Related Portion | Section 4.11 |

Affiliate | Section 5.01 |

Alterations | Section 4.02 |

Amenity Floors | Section 5.06 |

Ancillary Office Uses | Section 1.05 |

Anticipated ES Inclusion Date | Section 10.01 |

Applicable Percentage | Section 6.10 |

Arbiter | Section 8.09 |

Assignment Consideration | Section 5.05 |

Available | Section 14.01 |

Base Cleaning Cost | Section 3.01 |

Base Impositions Amount | Section 2.05 |

Base Operating Amount | Section 2.07 |

Base Operating Year | Section 2.07 |

Base PILOT Amount | Section 2.04 |

Base PILOT Year | Section 2.04 |

Base POA Amount | Section 2.08 |

Base Rate | Section 4.08 |

BCG Competitor | Section 5.03 |

Broker | Section 8.13 |

Building | Recitals |

Building Exterior Lighting System | Section 13.06 |

Building Lobby | Section 17.01 |

Building Standby Power System | Section 3.01 |

Business Days | Section 3.02 |

Business Hours | Section 3.02 |

Casualty | Section 7.05 |

CCP PILOT | Section 2.04 |

Coach Lobby | Section 14.01 |

Coach Lobby Signage | Section 13.01 |

Coach Tenant | Section 4.02 |

-1-

|

| |

Commencement Date | Section 1.02 |

Condominium | Section 8.18 |

Condominium Declaration | Section 8.18 |

Construction Period | Section 2.04 |

Contiguous Stairs | Section 3.01 |

Control | Section 5.01 |

CPI | Section 8.04 |

Curb Space | Section 3.01 |

Curing Party | Section 4.08 |

Curing Party Notice | Section 4.08 |

Decorative Alterations | Section 4.02 |

Desk Space User | Section 5.01 |

Development Agreement | Section 1.03 |

Dining Facility | Section 1.05 |

Dispute | Section 8.09 |

Dispute Notice | Section 8.09 |

Disputing Party | Section 8.09 |

East Hoist | Section 2.02 |

Effective Period | Section 2.04 |

Electricity Provider | Section 2.09 |

Elevator Bank Signage | Section 16.01 |

Eligible Sublease | Section 5.06 |

Eligible Subtenant | Section 5.06 |

Embargoed Person | Section 8.19 |

ERY Buildings | Section 2.07 |

First ES Fair Market Rent | Section 10.01 |

First ES Delivery Period | Section 10.01 |

First ES Inclusion Date | Section 10.01 |

First ES Response Notice | Section 10.01 |

Excess Cleaners | Section 3.01 |

Excluded Items | Section 2.05 |

Exhaust Systems | Section 8.20 |

Expiration Date | Section 1.02 |

Exterior Signage | Section 16.01 |

Extra Cleaning | Section 3.01 |

Fair Market Rent | Section 9.02 |

Fair Offer Rent | Section 14.01 |

First Class Office Building | Section 1.05 |

First Expansion Notice | Section 10.01 |

First Expansion Option | Section 10.01 |

First Expansion Space | Section 10.01 |

First Expansion Space Work Allowance | Section 10.01 |

First Five Year Renewal Term | Section 9.01 |

First Renewal Notice | Section 9.01 |

First Renewal Option | Section 9.01 |

First Ten Year Renewal Term | Section 9.01 |

-2-

|

| |

Fixed Cleaning Credit | Section 3.01 |

Fixed Rent | Section 2.02 |

Fixtures | Section 4.03 |

Force Majeure Events | Section 1.04 |

Functional Occupancy Standby Power | Section 3.01 |

Functional Occupancy Standby Power System | Section 3.01 |

GAAP | Section 2.07 |

Garage | Section 8.21 |

Green Cleaning Policy | Section 3.01 |

Hazardous Materials | Section 4.06 |

Holidays | Section 3.02 |

Hoist Impact Area | Section 2.02 |

Hoist Rate | Section 2.02 |

Hoist Use Credit | Section 2.02 |

Hoist Use Period | Section 2.02 |

Hoist Removal Date | Section 2.02 |

Tenant's Work | Section 4.01 |

IDA | Section 2.04 |

IDA Information Request | Section 2.04 |

Impositions | Section 2.05 |

Impositions Payment | Section 2.05 |

Increased Taxes Period | Section 2.06 |

Initial Meeting | Section 9.02 |

Interest Rate | Section 4.08 |

Internal Stairs | Section 3.01 |

Landlord | Introduction |

Landlord Indemnified Party | Section 6.12 |

Landlord Services | Section 3.01 |

Landlord's Determination | Section 9.02 |

Landlord's Non-Disturbance Agreement | Section 5.06 |

Landlord's Rate | Section 2.09 |

Landlord's Statement | Section 2.07 |

Laws | Section 4.06 |

Lease Payments | Section 8.29 |

Lobby Signage | Section 16.01 |

Low-Rise Elevators | Section 3.01 |

Marketing Center Lease | Section 10.01 |

Marketing Center Renewal Option | Section 10.01 |

Marketing Center Space | Section 10.01 |

Marketing Center Space Vacancy Date | Section 10.01 |

Marketing Center Tenant | Section 10.01 |

Messenger Center | Section 3.01 |

Messenger Center Services | Section 3.01 |

Monthly Rate | Section 8.22 |

Net Effective Rental | Section 5.02 |

New Operating Expense Item | Section 5.02 |

-3-

|

| |

Non-Material Alteration | Section 4.02 |

Non-Material Alterations Cap | Section 4.02 |

Notice | Section 8.01 |

Offer Notice | Section 14.01 |

Offer Period | Section 14.01 |

Offer Space | Section 14.01 |

Offer Space Inclusion Date | Section 14.01 |

Offer Space Option | Section 14.01 |

Office Competitor of Tenant | Section 13.05 |

Office Premises | Section 1.01 |

Operating Expenses | Section 2.07 |

Operating Payment | Section 2.07 |

Operating Year | Section 2.07 |

OpEx Arbiter | Section 2.07 |

Other Disputing Party | Section 8.09 |

Other Sublease Considerations | Section 5.05 |

Outside Condenser Water Election date | Section 3.01 |

Permitted Uses | Section 1.05 |

Permitted Users | Section 1.05 |

PILOT | Section 2.04 |

PILOT Agreement | Section 2.04 |

PILOT Cessation Date | Section 2.04 |

PILOT Payment | Section 2.04 |

POA Amendment | Section 2.07 |

POA Base Year | Section 2.07 |

POA Charges | Section 2.07 |

POA Documents | Section 2.07 |

Premises | Section 1.01 |

Project | Recitals |

Promotional Events | Section 8.27 |

Qualifying Tenant | Section 14.01 |

Records | Section 2.07 |

Recurring Additional Charges | Section 2.03 |

REIT | Section 8.29 |

Renewal Option | Section 9.01 |

Renewal Premises | Section 9.01 |

Renewal Term | Section 9.01 |

Rent | Section 2.01 |

Rent Commencement Date | Section 2.02 |

Requesting Party | Section 8.26 |

Reserved Generator Capacity | Section 3.01 |

Reserved Parking Outside Date | Section 8.22 |

Reserved Tonnage | Section 3.01 |

Restoration Work | Section 4.03 |

Restricted Areas | Section 4.04(d) |

Retail Competitor of Tenant | Section 13.05 |

-4-

|

| |

RNDA | Section 6.01 |

Rules and Regulations | Section 8.02 |

Roof Equipment | Section 15.01 |

S/H Notice | Section 4.09 |

SAP Competitor | Section 5.03 |

Second ES Fair Market Rent | Section 10.02 |

Second ES Delivery Period | Section 10.02 |

Second ES Inclusion Date | Section 10.02 |

Second ES Response Notice | Section 10.02 |

Second Expansion Notice | Section 10.02 |

Second Expansion Option | Section 10.02 |

Second Expansion Space | Section 10.02 |

Second Expansion Space Work Allowance | Section 10.02 |

Second Five Year Renewal Notice | Section 9.01 |

Second Five Year Renewal Option | Section 9.01 |

Second Five Year Renewal Term | Section 9.01 |

Second Ten Year Renewal Notice | Section 9.01 |

Second Ten Year Renewal Option | Section 9.01 |

Second Ten Year Renewal Term | Section 9.01 |

Second S/H Notice | Section 4.09 |

Service Provider | Section 8.29 |

Signage Conditions | Section 16.01 |

SNDA | Section 6.01 |

Specialty Installations | Section 4.03 |

Storage Space | Section 1.01 |

Subject to CPI Increases | Section 8.04 |

Sublease Conditions | Section 5.03 |

Substantial Portion | Section 3.02 |

Successor Landlord | Section 6.01 |

Superior Lease | Section 6.01 |

Superior Lessor | Section 6.01 |

Superior Mortgage | Section 6.01 |

Superior Mortgagee | Section 6.01 |

Tax Payment | Section 2.06 |

Tax Year | Section 2.04 |

Taxes | Section 2.06 |

Ten Year Renewal Term | Section 9.01 |

Tenant | Introduction |

Tenant Delay | Section 2.02 |

Tenant Indemnified Party | Section 6.12 |

Tenant Requisition | Section 3.05 |

Tenant's Basic Cost | Section 5.05 |

Tenant's Concierge | Section 14.01 |

Tenant's Contractors | Exhibit V |

Tenant's Determination | Section 9.02 |

Tenant's Expansion Space Work | Section 5.05 |

-5-

|

| |

Tenant's Offer Notice | Section 5.02 |

Tenant's Operating Share | Section 2.07 |

Tenant's Parking Spaces | Section 8.22 |

Tenant's Property | Section 4.03 |

Tenant's Specialty Cleaning Contractors | Section 3.01 |

Tenant's Statement | Section 2.07 |

Tenant's Tax Share | Section 2.04 |

Tenant's Work | Section 4.02 |

Term | Section 1.02 |

Terrace Space | Section 18.01 |

Transfer Notice | Section 5.03 |

Unavoidable Delay | Section 8.04 |

Untenantable | Section 3.02 |

Vayner | Section 10.02 |

Vayner Lease | Section 10.02 |

Vayner Space | Section 10.02 |

Vayner Vacancy Date | Section 10.02 |

Vayner Vacancy Date Notice | Section 10.02 |

Violations | Section 4.11 |

-6-

LEASE, dated as of August 1, 2016 (the “Effective Date”), between LEGACY YARDS TENANT LP (“Landlord”), a Delaware limited partnership whose address is c/o Related Companies, 60 Columbus Circle, New York, New York 10023 and COACH, INC. (“Tenant”), a Delaware corporation whose address is 516 West 34th Street, New York, New York 10001.

W I T N E S S E T H:

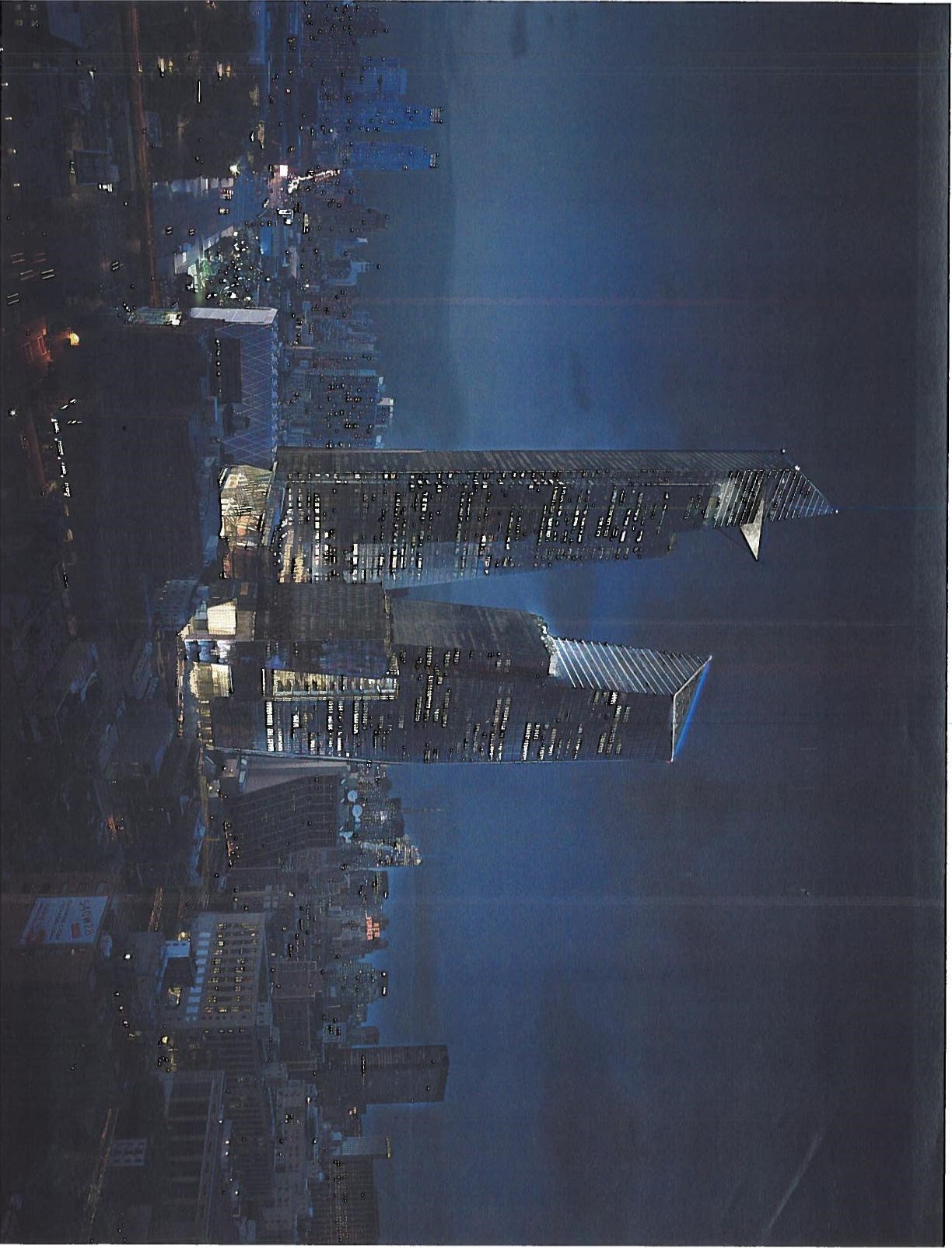

WHEREAS, Landlord is willing to lease to Tenant and Tenant is willing to hire from Landlord, on the terms hereinafter set forth, certain space in the building located on the land described on Exhibit A at the corner of 10th Avenue and 30th Street, New York, New York (together with all plazas, sidewalks and curbs adjacent thereto, the “Building”) as part of the Hudson Yards Development Project (the “Project”).

NOW, THEREFORE, Landlord and Tenant agree as follows:

ARTICLE 1

Premises; Term; Use

1.01 Demise. Landlord hereby leases to Tenant and Tenant hereby hires from Landlord, subject to the terms and conditions of this Lease, (i) the entire 9th through 23rd floors of the Building and (ii) a portion of the ground floor of the Building for storage space and a messenger center (collectively, the “Storage Space”) (collectively, the “Premises”; the Premises excluding the Storage Space and the Terrace Space is the “Office Premises”), in each case, as shown on the plans annexed as Exhibit B-1. Landlord and Tenant agree that the Office Premises is conclusively deemed to contain 693,938 rentable square feet, the Storage Space is conclusively deemed to contain 749 rentable square feet, and that the rentable square footage of each floor of the Office Premises and the Storage Space shall be as set forth on Exhibit B-2 annexed hereto.

1.02 Term. The term of this Lease (the “Term”) shall commence on the date hereof (the “Commencement Date”) and shall end, unless sooner terminated as herein provided, on the last day of the calendar month in which occurs the 20th anniversary of the day preceding the Rent Commencement Date (such date, as the same may be extended pursuant to Article 9, is called the “Expiration Date”).

1.03 Possession. As of the Commencement Date, Tenant is in possession of the Premises and Landlord shall be deemed to have delivered possession of the Premises to Tenant, and Tenant agrees to accept the same, “As Is” in its condition and state of repair existing as of the date hereof, and understands and agrees that Landlord shall not be required to perform any work, supply any materials or incur any expense to prepare the Premises for Tenant’s occupancy except as expressly set forth herein and in the Development Agreement. “Development Agreement” means that certain Development Agreement dated as of April 10, 2013 between ERY Developer LLC (the “Developer”) and Coach Legacy Yards LLC (the “Coach Member”), as amended to date. This Section 1.03 constitutes “an express provision to the contrary” within the meaning of said Section 223-a of the New York Real Property Law and any other law of like import now or hereafter in effect.

1.04 Intentionally Omitted.

1.05 Use. (a) Subject to compliance with Laws (as the same may be contested by Tenant in accordance with Section 4.06 below), the Office Premises shall be used and occupied by Tenant (and any permitted subtenants and occupants) solely for executive, administrative and general office use (collectively, the “Primary Use”) and such ancillary uses in connection therewith as shall be required by Tenant in the operation of its business and, in each case, which are customarily permitted by landlords, and engaged in by similar tenants in, and are consistent with the standards and character of a first-class office buildings located in midtown Manhattan (which for purposes of this Lease shall be deemed to refer to the area of Manhattan from 33rd Street to 62nd Street which is situated between 3rd Avenue and 11th Avenue) of comparable, quality and character to the Building (each a “First Class Office Building” and, collectively, “First Class Office Buildings”), only, and for no other purpose. Such ancillary office uses (collectively, the “Ancillary Office Uses”) shall include, without limitation, the following ancillary uses; provided, that such Ancillary Office Uses are (x) ancillary to the Primary Use, (y) for the use of Tenant (and its permitted subtenants and occupants) and their employees, invitees, and other persons expressly entitled to use the Premises pursuant to the terms of this Lease, including, without limitation, invitees for Events in accordance with Section 8.27 (collectively, “Permitted Users”) and (z) permitted in accordance with all Laws (it being acknowledged that Landlord makes no representation that any of such ancillary uses are so permitted):

(i)training facilities and classrooms in connection with Tenant’s training programs for the exclusive use of Permitted Users;

(ii)subject to the provisions of Section 8.20 hereof, kitchens, cafeterias, dining facilities including, without limitation, executive dining rooms, test kitchens and private dining facilities for the preparation and sale of food and beverages (each, a “Dining Facility”), pantries for reheating by microwave or similar cooking equipment (which do not involve an open flame or require external ventilation), which may have dishwashers, refrigerators, vending machines and other customary and typical pantry items, in each case, for the exclusive use of Permitted Users;

(iii)an exercise facility for the exclusive use of Permitted Users (provided that (A) the entire floor on which any such exercise facility is located and the entire floor immediately below the floor on which such exercise facility is located shall be leased to Tenant and (B) Tenant shall cause such exercise facility to be constructed, operated and maintained so that no noise or vibration will emanate from the Premises to other portions of the Building not leased or occupied pursuant to this Lease (except to a de minimis extent));

(iv)duplicating, reproduction and/or offset or other printing facilities (provided that Tenant shall cause such facilities to be constructed, operated and maintained so that no noise or vibration will emanate from the Premises to any other portions of the Buildings (except to a de minimis extent));

(v)board rooms, conference rooms, meeting rooms, an auditorium and conference centers for the exclusive use of Permitted Users;

(vi)a day care center for the exclusive use of Permitted Users;

(vii)exhibition areas not open to the public;

(viii)storage and file rooms;

(ix)shipping and mail rooms;

(x)computer and data processing rooms;

(xi)a company store located in the Premises for the exclusive use of Permitted Users and, by invitation only, other invitees of Tenant, and which is not open for off-the-street retail sales to the general public (provided that (i) such company store shall have no exterior displays or exterior signage except for one identification sign on the door to such company store which shall be subject to Landlord’s approval if and to the extent such identification sign is visible from the exterior of the Premises and which approval, if required, shall not be unreasonably withheld, conditioned or delayed and (ii) all visitors to such company store must enter the Building through the Coach Lobby);

(xii)an infirmary and medical offices for the exclusive use of Permitted Users;

(xiii)a travel agency for the exclusive use of Permitted Users;

(xiv)audiovisual and closed circuit television facilities;

(xv)graphic design facilities;

(xvi)subject to the provisions of Section 4.06(c)(i), a product testing center operated by Tenant for the exclusive use of Permitted Users (provided that the entire floor immediately below the floor on which such product testing center is located shall be leased to Tenant or shall be a mechanical floor);

(xvii)facilities operated by Tenant (but not by any subtenant or occupant of Tenant unless such subtenant or occupant is an Affiliate of Tenant) for the assembly and manufacturing of sample products of Tenant or an Affiliate of Tenant, if permitted under the Zoning Resolution of the City of New York, effective December 15, 1961, as amended or restated from time to time, and all other applicable Laws, and subject to the insurance requirements set forth in Section 7.02 and Section 7.03;

(xviii)subject to Section 8.27, for Events; and

(xix)private showers and lavatory facilities for the exclusive use of Permitted Users.

For the purposes of this Lease the Primary Use and the Ancillary Office Uses are sometimes collectively referred to as the “Permitted Uses”.

(b)Subject to compliance with Laws, the Storage Space shall be used and occupied by Tenant (and any permitted subtenants or occupants) solely for storage purposes ancillary to Tenant’s (and any permitted subtenant’s or occupant’s ) use of the Office Premises and consistent with the standards and character of a First Class Office Building only, and for no other purpose.

(c)Notwithstanding anything to the contrary contained herein, except as set forth in Section 1.05(a)(xvii), in no event shall manufacturing be performed in or about any portion of the Premises.

(d)Except to the extent expressly permitted pursuant to Section 1.05(a), in no event shall the Premises be used for any of the following: (a) pornographic purpose or as a massage parlor, (b) adult bookstore, (c) peep show or adult entertainment facility, (d) a check cashing establishment, (e) the sale of drug paraphernalia or so-called “head shop, (f) a clinic for the treatment of alcoholism or drug addiction, (g) a so-called “sex shop”, or an establishment which permits or presents obscene, nude or semi-nude performances or modeling (it being agreed that main-stream industry type fashion shows and other similar events held in the ordinary course of Coach Tenant’s business and consistent with the standards and character of a First Class Office Building shall not be deemed to violate this clause (g)), (h) a gambling or gaming establishment (such as, without limitation, a sport gambling, casino gambling or similar establishment), or otherwise for gambling or the sale of gambling-related items (except as part of Tenant’s charitable activities), (i) a so-called “flea market”, dollar store or thrift store, (j) a billiards or pool hall, (k) an office, store, reading room, headquarters, center or other facility principally devoted or opposed to the promotion, advancement, representation, purpose or benefit of: (1) any political party, political movement or political candidate or (2) any religion, religious group or religious denomination, (l) a funeral parlor, (m) an arcade, (n) a pawn shop, (o) a banking, trust company, or safe deposit business, in each case open for business to the general public as distinguished from business invitees, (p) a savings bank, a savings and loan association, or a loan company, in each case open for business to the general public as distinguished from business invitees, (q) the sale of travelers’ checks and/or foreign exchange, in each case open for business to the general public as distinguished from business invitees, (r) a stock brokerage office whose business involves off-the-street retail sales to the general public as distinguished from business invitees, (s) a restaurant, bar or for the sale of food or beverages (except to the extent expressly permitted pursuant to Sections 1.05(a)(ii) and (xviii) ), (t) photographic reproductions and/or offset printing (other than such incidental printing as Tenant may perform in connection with the conduct of Tenant’s usual business operations (and as otherwise expressly permitted pursuant to Section 1.05(a)(iv)), (u) an employment or travel agency (except for an executive search firm or except as expressly permitted pursuant to Section 1.05(a)(xiii)), (v) a school or classroom (except to the extent expressly permitted pursuant to Section 1.05(a)(i)), (w) medical or psychiatric offices (except to the extent expressly permitted pursuant to Section 1.05(a)(xii)), (x) conduct of an auction (except in connection with a Permitted User’s business or as part of a Permitted User’s charitable activities), or (y) offices of an agency, department or bureau of the United States Government, any state or municipality within the United States or any foreign government, or any political subdivision of any of them. Tenant shall not use the Premises, and shall not permit the Premises to be used, for any purpose which would lower the character of the Building as a First Class Office Building or which would constitute a public or private nuisance, or which would impair the soundness and safety of the Building or interfere (other than to a de minimis extent) with the use and operation of the common areas of the Building, the Building systems or the premises of any other tenant or Landlord in the Building.

(e)Landlord shall or shall cause Developer to obtain a temporary certificate of occupancy for the Building pursuant to and in accordance with the terms of the Development Agreement, and shall thereafter exercise reasonable efforts to obtain and maintain a permanent base building certificate of occupancy for the Building, but shall maintain at a minimum the temporary certificate of occupancy for the Building required to be obtained by Developer in accordance with the terms of the Development Agreement throughout the Term. Subject to Tenant or the Coach Member’s completion of the Coach TCO Work (as defined in the Development Agreement), Landlord shall or shall cause Developer to obtain a temporary or permanent certificate of occupancy for the Premises pursuant to and in accordance with the terms of the Development Agreement and shall maintain the same throughout the Term.

(f)If Tenant requires an amendment to the certificate of occupancy of the Building to use the Premises for any of the uses permitted pursuant to this Section 1.05 that is not otherwise required to be obtained by Developer pursuant to the Development Agreement, Landlord shall file for and use commercially reasonable efforts to obtain such an amendment to the certificate of occupancy; provided, that neither this Lease nor any of Tenant’s obligations hereunder shall be conditioned upon Landlord obtaining the same, and, provided further that Tenant shall reimburse Landlord for Landlord’s actual out-of-pocket costs incurred in connection therewith within 30 days after receipt of an invoice therefor (accompanied by reasonable back-up documentation) as Additional Charges. If Tenant desires to obtain any special permits for use of the Premises, including a public assembly permit, Landlord shall reasonably cooperate with respect to the same to the extent such cooperation is reasonably necessary (including signing such certificates and applications as may be reasonably requested by Tenant, and performing such other reasonable ministerial and non-ministerial requirements as and to the extent required); provided, that obtaining any such permits shall be the sole responsibility of Tenant and provided further that Tenant shall reimburse Landlord for all actual out-of-pocket costs incurred by Landlord in connection therewith within 30 days after receipt of an invoice therefor (accompanied by reasonable back-up documentation) as Additional Charges.

(g)Tenant shall have, as appurtenant to the Premises, the non-exclusive right to use in common with others, for their intended uses and subject to the applicable provisions of this Lease, (i) the public areas of the Building, including, without limitation, the common lobbies, corridors, stairways, elevators and loading docks of the Building and (ii) if the Premises includes less than the entire rentable square footage of any floor, the common toilets, corridors and elevator lobby of such floor.

ARTICLE 2

Rent

2.01 Rent. “Rent” shall consist of Fixed Rent and Additional Charges.

2.02 Fixed Rent. The fixed rent (“Fixed Rent”) shall be as follows:

(a)for the period commencing on the Rent Commencement Date and ending on the day immediately preceding the 5th anniversary of the Rent Commencement Date at the rate per annum of (i) $65.00 per rentable square foot of the Office Premises and (ii) $40.00 per rentable square foot of the Storage Space;

(b)for the period commencing on the 5th anniversary of the Rent Commencement Date and ending on the day immediately preceding the 10th anniversary of the Rent Commencement Date at the rate per annum of (i) $71.50 per rentable square foot of the Office Premises and (ii) $44.00 per rentable square foot of the Storage Space;

(c)for the period commencing on the 10th anniversary of the Rent Commencement Date and ending on the day immediately preceding the 15th anniversary of the Rent Commencement Date at the rate per annum of (i) $78.65 per rentable square foot of the Office Premises and (ii) $48.40 per rentable square foot of the Storage Space; and

(d)for the period commencing on the 15th anniversary of the Rent Commencement Date and ending upon the Expiration Date (or, if the Term is extended pursuant to Article 9, the date of expiration of the initial Term) at the rate per annum of (i) $86.50 per rentable square foot of the Office Premises and (ii) $53.24 per rentable square foot of the Storage Space.

For the purposes of this Lease, “Rentable Square Feet”, “Rentable Square Footage”, “rentable square feet” or “RSF” shall mean the rentable square feet of the Building (including, without limitation, the Premises) determined by using the Measurement Standard. “Measurement Standard” means calculating the “Usable Area” in accordance with the Real Estate Board of New York (“REBNY”) Recommended Method of Floor Measurement for Office Buildings, effective January 1, 1987 and as subsequently amended in 2003 and computing the rentable area utilizing a loss factor from rentable to usable for a full office floor of 27%. By way of example, if a full floor contained 10,000 usable square feet, such full floor would be deemed to contain 13,699 rentable square feet, obtained by dividing 10,000 by .73 (USF/[1-Loss Factor] = RSF). For a partial floor, the number of usable square feet contained within the common areas on such floor would be allocated on a proportional basis among the leasable areas on such floor before applying the loss factor.

(e)Fixed Rent shall be payable by Tenant in equal monthly installments in advance commencing on the Rent Commencement Date and on the first day of each calendar month thereafter (provided that if the Rent Commencement Date is not the first day of a month, then Fixed Rent for the month in which the Rent Commencement Date occurs shall be prorated (based on the number of days elapsed and the actual number of days in such month) and paid on the Rent Commencement Date). “Rent Commencement Date” means the Effective Date, as the Rent Commencement Date may be extended as expressly provided in this Lease. If, at any time after the Commencement Date but prior to the Rent Commencement Date, Tenant is expressly entitled under this Lease to an abatement of Fixed Rent and/or Additional Charges, then the amount of any such abatement (such amount to be equal to the Rent that would have been due and payable during the abatement period had the Rent Commencement Date occurred on the same date as the Commencement Date) shall be credited against the first Rents becoming due hereunder after the occurrence of the Rent Commencement Date.

(f)(A) Notwithstanding anything to the contrary contained herein, from and after the date hereof until the date that is 6 months following the date on which Tenant first occupies the Premises (or portion thereof) for the normal conduct of business in the ordinary course (the “Hoist Use Period”), Landlord may continue to maintain and use the construction hoist located on the 10th Avenue side of the Building (the “East Hoist”) on the following terms and conditions:

(i) For each month during the Hoist Use Period (and for each month or partial month thereafter to and including the Hoist Removal Date), as Tenant’s sole and exclusive remedy therefor, Tenant shall receive a credit against the Rent payable in an amount (the “Hoist Use Credit”) equal to the product of (x) the applicable Hoist Rate multiplied by (y) the Hoist Impact Area, which Hoist Use Credit shall be prorated for any partial month. The foregoing rent credit shall be applied from and after the Rent Commencement Date until fully credited.

(ii) At all times during the Hoist Use Period (and thereafter until the Hoist Removal Date, excepting any East Hoist brackets that may remain), the curtain wall enclosing the applicable portion of the Premises (or the façade surrounding the same) shall have been completed and finished in a water and weather-tight manner in compliance with all applicable Laws.

(iii) All temporary fire-rated walls required by applicable Law to demise the Hoist Impact Area from the balance of the Premises shall be installed and removed by Landlord at Landlord’s sole cost and expense (and not as an Operating Expense).

(v) Landlord shall use Best Efforts to cause the Hoist Removal Date to occur prior to the end of the Hoist Use Period (it being acknowledged and agreed, however, but without limiting Landlord’s liability under Section 2.02(f)(C), that Landlord’s liability for the failure of the Hoist Removal Date to occur on or prior to the expiration of the Hoist Use Period shall be limited to the Hoist Use Credit as provided herein). “Best Efforts” means the commercially reasonable efforts that a well-qualified and diligent development manager would use to fulfill its obligations, using its best professional skill and judgment and consistent with best practices in the industry.

(B) “Hoist Impact Area” means an amount of rentable square feet equal to two (2) times the rentable square feet of the Premises affected by the East Hoist as shown on Exhibit Q. “Hoist Rate” means a rate per annum equal to (x) $0 for the period commencing on the first day of the Hoist Use Period and continuing until the date that is six (6) months following the date on which Tenant first occupies the Premises (or portion thereof) for the normal conduct of business in the ordinary course, (y) $80.00 for the seventh month following the date on which Tenant first occupies the Premises (or portion thereof) for the normal conduct of business in the ordinary course, and (z) an additional $20.00 for each additional month thereafter until the occurrence of the Hoist Removal Date (i.e., $100 for the eighth month, $120 for the ninth month, and so on). “Hoist Removal Date” means the date on which Landlord removes the East Hoist and any brackets relating to the East Hoist, and patches any penetrations through the core of the Premises (or the façade surrounding the same) resulting from the East Hoist and completes and finishes the curtain wall enclosing the Premises (or the façade surrounding the same) in a water

and weather-tight manner, it being agreed that if Landlord is delayed in completing any of the foregoing as a result of any Tenant Delay, then the Hoist Removal Date shall be deemed to have occurred on the date Landlord would have completed the foregoing if there was no such Tenant Delay.

(C) Landlord shall indemnify, defend, reimburse, and hold harmless Tenant and each of the Tenant Indemnified Parties, from and against any and all claims arising out of or relating to the continued use of the East Hoist or presence of the East Hoist on the Building from and after the date hereof until the Hoist Removal Date, except to the extent such continued use or presence of the East Hoist results from any Tenant Delay or to the extent any such claims result from any negligence or willful misconduct of Tenant or persons claiming by, through or under Tenant.

(D) “Tenant Delay” means any delay that Landlord may encounter in commencing or performing any of Landlord’s obligations under this Lease to the extent due to any acts or omissions of Tenant, its agents, consultants, employees, contractors or subcontractors, including, without limitation, delays due to changes in or additions to Base Building Work (as defined in the Development Agreement) requested by Tenant, delays by Tenant in submission of information or giving authorizations or approvals or delays due to the postponement of any Base Building Work at the request of Tenant. Landlord shall notify Tenant, in writing, of any Tenant Delay arising from any such act or omission within 5 Business Days after Landlord actually becomes aware that such act or omission will result or has resulted in Tenant Delay (and such notice shall specify in reasonable detail the cause of the delay), failing which such delay shall constitute a Tenant Delay only from and after the date Landlord notifies Tenant thereof.

2.03 Additional Charges. “Additional Charges” means PILOT Payments, Additional Tax Payments, Impositions Payments, Tax Payments, Operating Payments, and all other sums of money, other than Fixed Rent, at any time payable by Tenant under this Lease, all of which Additional Charges shall be deemed to be Rent. “Recurring Additional Charges” means Additional Tax Payments, Impositions Payments, Operating Payments and either PILOT Payments or Tax Payments, as applicable.

2.04 PILOT Payments. (a) “Base PILOT Amount” means (i) the CCP PILOT payable by Landlord pursuant to the PILOT Agreement for the fourth (4th) Tax Year (the “Base PILOT Year”) following the Construction Period and (ii) the Annual Administration Fee payable by Landlord for the Building pursuant to the PILOT Agreement for the Base PILOT Year. “Construction Period” and “CCP PILOT” shall each have the meaning ascribed to such term in the PILOT Agreement.

(b)“PILOT Agreement” means that certain Amended and Restated Agency Lease Agreement effective as of the date hereof by and between the New York City Industrial Development Agency (the “IDA”) and Landlord, as the same may be modified from time to time.

(c)“PILOT” means, with respect to any Tax Year, (i) the CCP PILOT payable by Landlord for such Tax Year pursuant to the PILOT Agreement, (ii) any reasonable expenses incurred in contesting the assessed value of the Building, which expenses shall be

allocated to the Tax Year(s) (including the Base PILOT Year) to which such expenses relate and (iii) the “Annual Administrative Fee” (as defined in the PILOT Agreement). Notwithstanding the foregoing, “PILOT” shall not include any incremental or additional amount payable by Landlord under the PILOT Agreement due to (1) an “Event of Default” (as defined in the PILOT Agreement) thereunder which is not caused by a default by Tenant under this Lease or (2) “Other Improvement Taxes” (as defined in the PILOT Agreement), nor shall “PILOT” include any amounts included in the definition of “Taxes” or “Impositions” below or for which Tenant has otherwise reimbursed Landlord hereunder.

(d)“Tax Year” means each period of 12 months, commencing on the first day of July of each such period, in which occurs any part of the Term, or such other period of 12 months occurring during the Term as hereafter may be adopted as the fiscal year for real estate tax purposes of the City of New York.

(e)“Tenant’s Tax Share” means 38.41%, which is calculated by dividing (i) the then total rentable square footage of the Premises by (ii) the then total rentable square footage of the Building. The initial rentable square footage of each office floor in the Building shall be as set forth on Exhibit B-2 annexed hereto and Tenant’s Tax Share shall not be increased or decreased during the Term, other than to reflect the incorporation of additional space into the Premises or the Building, or the removal of any space from the Premises or the Building, pursuant to any exercise of any of Landlord’s or Tenant’s rights expressly provided herein.

(f)(i) If PILOT for any Tax Year from and after July 1 of the Tax Year immediately following the Base PILOT Year until the “Cessation Date” (as defined in the PILOT Agreement; such date shall hereinafter be referred to in this Lease as the “PILOT Cessation Date”), shall exceed the Base PILOT Amount, Tenant shall pay to Landlord (each, a “PILOT Payment”) Tenant’s Tax Share of the amount by which PILOT for such Tax Year is greater than the Base PILOT Amount. The PILOT Payment for each Tax Year shall be due and payable by Tenant in installments in the same manner that PILOT for such Tax Year is due and payable by Landlord, whether as directed under the PILOT Agreement or to a Superior Lessor or Superior Mortgagee (provided that, notwithstanding that a Superior Lessor or Mortgagee may require installments of PILOT to be paid more frequently than would be required under the PILOT Agreement, in no event shall the aggregate PILOT Payment with respect to any Tax Year be increased, nor shall installments of PILOT Payments be payable hereunder less frequently than twice per calendar year, because Landlord is required to pay PILOT to a Superior Lessor or Superior Mortgagee). Tenant shall pay the PILOT Payment (or any installment thereof) within 30 days after the rendering of a statement therefor by Landlord to Tenant, which statement may be rendered so as to require the PILOT Payment (or installment thereof) to be paid by Tenant 5 Business Days prior to the date such PILOT Payment (or installment thereof) first becomes due and payable by Landlord. The statement to be rendered by Landlord shall set forth in reasonable detail the computation of Tenant’s Tax Share of the particular installment(s) of PILOT being billed. If there shall be any increase in the PILOT for any Tax Year, whether during or after such Tax Year, or if there shall be any decrease in the PILOT for any Tax Year, the PILOT Payment for such Tax Year shall be appropriately adjusted and paid or refunded, as the case may be (in accordance with Sections 2.04(g) and 2.08(a), to the extent applicable). In no event, however, shall PILOT be reduced below the Base PILOT Amount.

(ii)In addition to the PILOT Payments set forth above, and the Impositions Payment and Tax Payment set forth below, Tenant shall pay, as Additional Charges on account of real property taxes, for each calendar year (or portion thereof) throughout the Term of this Lease from and after January 1 of the first Tax Year following the Construction Period, an amount equal to the product of (A) the applicable Additional Tax Amount, multiplied by (B) the number of rentable square feet contained in the Premises (the “Additional Tax Payment”); provided, that if the rentable square footage of the Premises varies during any calendar year, such variation shall be taken into account for purposes of the calculation of the Additional Tax Payment for such calendar year. The Additional Tax Payment shall be due and payable in equal installments on the dates on which PILOT Payments (or installments thereof) are due and payable by Tenant. Tenant shall pay each such installment within 30 days after the rendering of a statement therefor by Landlord to Tenant, which statement may be rendered so as to require such installments to be paid by Tenant on the same dates on which Tenant is required to pay PILOT Payments (or installments thereof). The “Additional Tax Amount” shall be (I) $0.50 for the calendar year beginning on January 1 of the first Tax Year following the Construction Period, (II) $1.00 for the calendar year beginning on January 1 of the second Tax Year following the Construction Period, (III) $1.60 for the calendar year beginning on January 1 of the third Tax Year following the Construction Period and (iv) $1.90 for each calendar year thereafter for the full remaining Term of this Lease. By way of example, if the Premises contains 700,000 rentable square feet during the calendar year beginning on January 1 of the second Tax Year following the Construction Period, the Additional Tax Payment for the calendar year beginning on such January 1 shall be $700,000.00 (i.e., $1.00 x 700,000 = $700,000.00).

(g)If Landlord shall receive a refund of PILOT allocable to any Tax Year in which PILOT exceeded the Base PILOT Amount (or a credit in lieu of such a refund), Landlord shall promptly notify Tenant of such refund and shall pay to Tenant Tenant’s Tax Share of the net refund or credit (after deducting from such refund or credit the costs and expenses of obtaining the same, including, without limitation, appraisal, accounting and legal fees, to the extent that such costs and expenses were not included in the PILOT for such Tax Year) within 30 days after receipt of such refund; provided, that such payment to Tenant shall in no event exceed (i) if such refund is allocable to one Tax Year, Tenant’s PILOT Payment paid for such Tax Year or (ii) if such refund is allocable to more than one Tax Year, the aggregate Tenant’s PILOT Payments for such Tax Years.

(h)If the PILOT comprising the Base PILOT Amount is reduced as a result of an appropriate proceeding or otherwise, the PILOT as so reduced shall for all purposes be deemed to be the Base PILOT Amount and Landlord shall notify Tenant of the amount by which the PILOT Payments previously made were less than the PILOT Payments required to be made under this Section 2.04, and Tenant shall pay the deficiency within 30 days after demand therefor. Additionally, if Landlord actually receives a discount for early payment or prepayment of PILOT, Tenant shall be entitled to Tenant’s Tax Share of the benefit of any such discount for any early payment or prepayment of PILOT (but only if and to the extent Tenant shall have made an early payment or prepayment for Tenant’s Tax Share of such PILOT).

(i)Landlord shall, with respect to each Tax Year, initiate and pursue in good faith an application or proceeding seeking a reduction in the assessed valuation of the Building, except that Landlord shall not be required to initiate or pursue any such application or proceeding for any such Tax Year if Landlord (1) obtains with respect to such Tax Year a letter from a well known and reputable certiorari attorney that in such person’s opinion, considering only the Building (and not any other real estate owned by Landlord or any of its Affiliates), it would not be advisable or productive to bring such application or proceeding for the Tax Year in question and (2) provides a verbal explanation of the reason(s) for such opinion. Tenant, for itself and its immediate and remote subtenants and successors in interest hereunder, hereby waives, to the extent permitted by law, any right Tenant may now or in the future have to protest or contest any PILOT or Taxes or to bring any application or proceeding seeking a reduction in PILOT, Taxes or assessed valuation or otherwise challenging the determination thereof.

(j)(i) Promptly following Tenant’s receipt of written request (“IDA Information Request”) from Landlord, Tenant shall cooperate with Landlord in complying with the disclosure and reporting requirements relating to subtenant information required under the PILOT Agreement, including, without limitation, by furnishing such information and/or completing such questionnaires and reports as may be required to assist Landlord in satisfying the requirements of Section 8.7 (Employment Matters), Section 8.8 (Non-Discrimination), Section 8.14 (Automatically Deliverable Documents), Section 8.15 (Requested Documents) and Section 8.16 (Periodic Reporting Information for the Agency) of the PILOT Agreement, which IDA Information request shall specifically set forth the information and/or questionainnaires Landlord is requesting from Tenant and reference any specific sections of the PILOT Agreement requiring the same. Tenant shall furnish any such information and deliver any such completed questionnaires and reports to Landlord within 10 Business Days of Tenant’s receipt of the applicable IDA Information Request.

(ii)Tenant represents that Tenant’s occupancy at the Project will not result in the removal of a plant or facility of such Tenant located outside of the City of New York, but within the State of New York, to the Project or in the abandonment of one or more such plants or facilities of Tenant located outside of the City of New York but within the State of New York.

(iii)Tenant represents that neither Tenant nor any Principal of Tenant (A) is in default or in breach, beyond any applicable grace period, of its obligations under any written agreement with the Agency or the City, unless such default or breach has been waived in writing by the Agency or the City, as the case may be, (B) has been convicted of a misdemeanor related to truthfulness and/or business conduct in the past 5 years, (C) has been convicted of a felony in the past 10 years, (D) has received formal written notice from a federal, state or local governmental agency or body that such Person is currently under investigation for a felony criminal offense, or (E) has received written notice of default in the payment to the City of any taxes, sewer rents or water charges, which have not been paid, unless such default is currently being contested with due diligence in proceedings in court or other appropriate forum. For purposes of this paragraph (iii) only, all capitalized terms used in this paragraph (iii) (other than the term “Tenant”) shall have the meanings ascribed to them in the PILOT Agreement.

(iv)Tenant covenants that at all times from and after the Commencement Date through the expiration or earlier termination of this Lease (the “Effective Period”), Tenant shall ensure that employees and applicants for employment with the Tenant are treated without regard to their race, color, creed, age, sex or national origin. As used in this paragraph (iv) only, the term “treated” shall mean and include the following: recruited, whether by advertising or other means; compensated, whether in the form of rates of pay or other forms of compensation; selected for training, including apprenticeship; promoted; upgraded; downgraded; demoted; transferred; laid off; and terminated.

(v)Tenant shall indemnify and hold Landlord harmless from and against any and all loss, cost, liability, damage or expense (including, without limitation, reasonable attorneys’ fees, disbursements and court costs) actually incurred by Landlord (or any of its affiliates) arising from any failure of Tenant to comply in all respects with Sections 2.04(j)(i) or 2.04(j)(iv) or any misrepresentation by Tenant contained in Sections 2.04(j)(ii) or 2.04(j)(iii). If any amount payable by Landlord under the PILOT Agreement is greater than it would otherwise be, or if any additional amount is payable by Landlord under the PILOT Agreement, in either case, due to any failure of Tenant to comply in all respects with Sections 2.04(j)(i) or 2.04(j)(iv) or any misrepresentation by Tenant contained in Sections 2.04(j)(ii) or 2.04(j)(iii), Tenant shall pay to Landlord 100% of the amount by which such amount payable is so greater than it would otherwise be or 100% of the additional amount payable, as the case may be, within 10 days after Landlord’s demand therefor. If any amount payable by Landlord under the PILOT Agreement is greater than it would otherwise be, or if any additional amount is payable by Landlord under the PILOT Agreement, in either case, due to any “Event of Default” (as defined in the PILOT Agreement) under the PILOT Agreement which is not caused by any act or omission of, or breach of any representation or warranty by, Tenant, Tenant shall have no liability to pay for any of such incremental amount by which Landlord’s payment obligation is so greater or such additional amount.

2.05 Impositions.

(a)“Base Impositions Amount” means the sum of (i) one-half of the Impositions (excluding any amounts described in Section 2.05(b)(ii)) for the Tax Year during which the Construction Period ends and (ii) one-half of the Impositions (excluding any amounts described in Section 2.05(b)(ii)) for the first Tax Year that commences following the end of the Construction Period.

(b)“Impositions” means (i) subject to clause (B) of the last sentence of this Section 2.05(b), any and all real estate taxes, vault taxes, assessments and special assessments, levied, assessed or imposed upon or with respect to the Building by any federal, state, municipal or other government or governmental body or authority, including, without limitation, any taxes, assessments or charges imposed upon or against the Building or Landlord solely with respect to any business improvement district in which the Building is located or that is otherwise applicable to the Building and (ii) any market customary out-of-pocket actual expenses incurred by Landlord in contesting such taxes, assessments or charges, which expenses shall be allocated to the Tax Year (including the Base PILOT Year but without duplication of any such expenses included in the

definition of “PILOT” or “Taxes” herein or for which Tenant has otherwise reimbursed Landlord for) to which such expenses relate. If at any time the method of taxation shall be altered so that in lieu of or as an addition to or as a substitute for (as evidenced by either the terms of the legislation imposing such tax or assessment, the legislative history thereof or other documents or evidence which reasonably demonstrates that such tax or assessment was intended to serve as a real estate tax or fulfill substantially the same function as existing real estate taxes), the whole or any part of such taxes now imposed on real estate (other than real estate taxes levied by the City of New York) there shall be levied, assessed or imposed (x) a tax, assessment, levy, imposition, fee or charge wholly or partially as a capital levy or otherwise on the rents received therefrom, or (y) any other such substitute tax, assessment, levy, imposition, fee or charge, including without limitation, business improvement district in which the Building and/or Project is located and transportation taxes, fees and assessments, then, provided that Landlord can reasonably establish a legislative or other relevant authoritative basis for such addition or substitution, all such taxes, assessments, levies, impositions, fees or charges or the part thereof so measured or based shall be included in “Impositions” (provided that the same shall be computed as if Landlord’s sole asset were the Building). If the owner, or lessee under a Superior Lease, of all or any part of the Building is an entity exempt from the payment of taxes, assessments or charges described in clause (i), there shall be included in “Impositions” the taxes, assessments or charges described in clause (i) which would be so levied, assessed or imposed if such owner or lessee were not so exempt and such taxes, assessments or charges shall be deemed to have been paid by Landlord on the dates on which such taxes, assessments or charges otherwise would have been payable if such owner or lessee were not so exempt but only to the extent Landlord is actually obligated to and does pay such taxes, assessments or charges. “Impositions” shall not include (A) any capital stock or transfer tax, (B) any real property taxes levied by the City of New York, (C) any taxes, assessments or charges which would otherwise constitute Impositions to the extent included in Operating Expenses pursuant to Section 2.07, (D) any taxes on Landlord’s, a Superior Lessor’s or a Superior Mortgagee’s income (except to the extent expressly set forth in this Section 2.05(b) with respect to taxes on rents), (E) any corporation, unincorporated business or franchise taxes, (F) any estate, gift, succession or inheritance taxes, (G) any taxes or assessments directly imposed on any sign attached to or located on the Building or Project, (H) any occupancy taxes required to be paid by Landlord or its Affiliates by reason of Landlord’s or its Affiliates’ tenancy or occupancy in the Building, (I) any late payments, charges, interest or penalties assessed against Landlord, except to the extent with respect to a payment of Impositions, that part or all of which was the responsibility of Tenant hereunder, and which Tenant did not make in a timely manner or did not make at all and (J) any Agency Project Fee, HYIC Project Fee, Per Diem Fees, or PILOMRT Amount (as each such terms are defined in the PILOT Agreement) (the items set forth in clauses (A)-(J), collectively, the “Excluded Items”).

(c)For each Tax Year from and after January 1 of the first Tax Year following the Construction Period, if Impositions for any Tax Year shall exceed the Base Impositions Amount, Tenant shall pay to Landlord (each, an “Impositions Payment”) Tenant’s Tax Share of the amount by which Impositions for such Tax Year are greater than the Base Impositions Amount (provided that the Impositions Payment attributable to the 6-month period from January 1 of the first Tax Year following the Construction Period through June 30 of said first Tax Year following the Construction Period shall be 50% of Tenant’s Tax Share of the amount by which Impositions

for the first Tax Year following the Construction Period exceed the Base Impositions Amount). The Impositions Payment for each Tax Year shall be due and payable in

installments in the same manner that Impositions for such Tax Year are due and payable by Landlord, whether to the applicable taxing authority or to a Superior Lessor or Superior Mortgagee (provided that, notwithstanding that a Superior Lessor or Mortgagee may require installments of Impositions to be paid more frequently than would be required by the applicable taxing authority, in no event shall the aggregate Impositions Payment with respect to any Tax Year be increased because Landlord is required to pay Impositions to a Superior Lessor or Superior Mortgagee). If by Law any assessment included in Impositions may be paid in multiple installments without the imposition of any interest, fee or other charge, provided that no Superior Lessor or Superior Mortgagee requires Landlord to pay such assessment on a different schedule (but no less frequently than semi-annually), such assessment shall be payable hereunder in the maximum number of installments so permitted by Law without imposition of any interest, fee or other charge. Tenant shall pay Tenant’s Tax Share of each such installment within 30 days after the rendering of a statement therefor by Landlord to Tenant, which statement may be rendered so as to require Tenant’s Tax Share of Impositions to be paid by Tenant 5 Business Days prior to the date such Impositions first become due and payable by Landlord. The statement to be rendered by Landlord shall set forth in reasonable detail the computation of Tenant’s Tax Share of the particular installment(s) being billed (and, upon written request from Tenant, Landlord shall provide Tenant with a copy of the tax bill from the taxing authorities relevant to the computation of Tenant’s Tax Share of the particular installment(s) being billed). If there shall be any increase in the Impositions for any Tax Year, whether during or after such Tax Year, or if there shall be any decrease in the Impositions for any Tax Year, the Impositions Payment for such Tax Year shall be appropriately adjusted and paid or refunded, as the case may be (in accordance with Sections 2.05(c) and 2.08(a), to the extent applicable). In no event, however, shall Impositions be reduced below the Base Impositions Amount.

(d)If Landlord shall receive a refund (or credit in lieu of refund) of Impositions allocable to any Tax Year in which Impositions exceeded the Base Impositions Amount, Landlord shall promptly notify Tenant of such refund and shall pay to Tenant Tenant’s Tax Share of the net refund (after deducting from such refund the costs and expenses of obtaining the same, including, without limitation, appraisal, accounting and legal fees, to the extent that such costs and expenses were not included in the Impositions for such Tax Year) within 30 days after receipt of such refund; provided, that such payment to Tenant shall in no event exceed (i) if such refund is allocable to one Tax Year, Tenant’s Impositions Payment paid for such Tax Year or (ii) if such refund is allocable to more than one Tax Year, the aggregate Tenant’s Imposition Payments for such Tax Years.

(e)If Landlord receives a discount for early payment or prepayment of Impositions, Tenant shall be entitled to Tenant’s Tax Share of the benefit of any such discount for any early payment or prepayment of Impositions (but only if and to the extent Tenant shall have made an early payment or prepayment for Tenant’s Tax Share of such Impositions).

(f)If the Base Impositions Amount is reduced as a result of an appropriate proceeding or otherwise, Landlord shall notify Tenant of the amount by which any Impositions Payments previously made were less than the Impositions Payments required to be made under this Section 2.05, and Tenant shall pay the deficiency within 30 days after demand therefor.

(g)Tenant shall pay any and all commercial rent occupancy tax and any other occupancy tax or rent tax relating to the Premises now in effect or hereafter enacted. If any occupancy tax or rent tax (including, without limitation, any commercial rent occupancy tax) now in effect or hereafter enacted shall be payable by Landlord in the first instance or hereafter is required to be paid by Landlord, then Tenant shall reimburse Landlord as Additional Charges for all such amounts paid within 30 days after demand therefor.

2.06 Tax Payments. (a) “Taxes” means (i) the real estate taxes levied, assessed or imposed upon or with respect to the Building by the City of New York and (ii) any market customary expenses incurred by Landlord in contesting such taxes or assessments and/or the assessed value of the Building, which expenses shall be allocated to the Tax Year (including the Base PILOT Year but without duplication of any such expenses included in the definition of “PILOT” or “Impositions” herein or for which Tenant has otherwise reimbursed Landlord) to which such expenses relate. If at any time the method of taxation shall be altered so that in lieu of or as an addition to or as a substitute for, the whole or any part of such real estate taxes now imposed there shall be levied, assessed or imposed (x) a tax, assessment, levy, imposition, fee or charge wholly or partially as a capital levy or otherwise on the rents received therefrom, or (y) any other such substitute tax, assessment, levy, imposition, fee or charge, including without limitation, business improvement district in which the Building is located or that is otherwise applicable to the Building and transportation taxes, fees and assessments, then, provided that Landlord can reasonably establish a legislative or other relevant authoritative basis for such addition or substitution, all such taxes, assessments, levies, impositions, fees or charges or the part thereof so measured or based shall be included in “Taxes” (provided that the same shall be computed as if Landlord’s sole asset were the Building). If the owner, or lessee under a Superior Lease, of all or any part of the Building is an entity exempt from the payment of taxes described in clause (i), there shall be included in “Taxes” the taxes described in clause (i) which would be so levied, assessed or imposed if such owner or lessee were not so exempt and such taxes shall be deemed to have been paid by Landlord on the dates on which such taxes otherwise would have been payable if such owner or lessee were not so exempt but only to the extent Landlord is actually obligated to and does pay such taxes, assessments or charges. “Taxes” shall not include any Excluded Items (except that the items set forth in clause (B) of “Excluded Items” shall not be an Excluded Items for purposes of “Taxes”) or taxes or assessments which would otherwise constitute Taxes to the extent included in Operating Expenses pursuant to Section 2.07.

(b)(i) From and after the PILOT Cessation Date, if Taxes for any Tax Year (including the Tax Year in which the PILOT Cessation Date occurs), shall exceed the Base PILOT Amount, Tenant shall pay to Landlord (each, a “Tax Payment”) Tenant’s Tax Share of the amount by which Taxes for such Tax Year (or portion thereof from and after the PILOT Cessation Date) are greater than the Base PILOT Amount. The Tax Payment for each Tax Year shall be due and payable in installments in the same manner that Taxes for such Tax Year are due and payable by Landlord, whether to the City of New York or to a Superior Lessor or Superior Mortgagee (provided that, notwithstanding that a Superior Lessor or Mortgagee may require installments of Taxes to be paid more frequently than would be required by the City of New York, in no event shall

the aggregate Tax Payment with respect to any Tax Year be increased because Landlord is required to pay Taxes to a Superior Lessor or Superior Mortgagee). If by Law Taxes may be paid in multiple installments without the imposition of any interest, fee or other charge, provided that no Superior Lessor or Superior Mortgagee requires Landlord to pay Taxes on a different schedule

(but no less frequently than semi-annually), Taxes shall be payable hereunder in the maximum number of installments so permitted by Law without imposition of any interest, fee or other charge. Tenant shall pay Tenant’s Tax Share of each such installment within 30 days after the rendering of a statement therefor by Landlord to Tenant, which statement may be rendered so as to require Tenant’s Tax Share of Taxes to be paid by Tenant 5 Business Days prior to the date such Taxes first become due and payable by Landlord. The statement to be rendered by Landlord shall set forth in reasonable detail the computation of Tenant’s Tax Share of the particular installment(s) being billed. If there shall be any increase in the Taxes for any Tax Year, whether during or after such Tax Year, or if there shall be any decrease in the Taxes for any Tax Year, the Tax Payment for such Tax Year shall be appropriately adjusted and paid or refunded, as the case may be (in accordance with Sections 2.06(d) and 2.08(a), to the extent applicable). In no event, however, shall Taxes be reduced below the Base PILOT Amount.

(ii)Notwithstanding anything to the contrary contained herein, if the PILOT Cessation Date occurs prior to the 20th year following the Construction Period (A) as a result of Tenant’s acts or omissions, then, during the period from the PILOT Cessation Date until the 20th year following the Construction Period (the “Increased Taxes Period”), Tenant shall pay the Tax Payment as hereinabove provided, (B) as a result of Landlord’s acts or omissions, then, during the Increased Taxes Period only, for purposes of calculating the amount of the Tax Payment hereunder, clause (i) of Section 2.06(a) shall be deemed deleted and replaced with “the amount that CCP PILOT would have been for the applicable Tax Year pursuant to the PILOT Agreement had the PILOT Cessation Date not occurred” or (C) for any other reason, then, during the Increased Taxes Period only, (1) for purposes of calculating the amount of the Tax Payment hereunder, clause (i) of Section 2.06(a) shall be deemed deleted and replaced with “the sum of (x) the amount that CCP PILOT would have been for the applicable Tax Year pursuant to the PILOT Agreement had the PILOT Cessation Date not occurred and (y) an amount equal to 50% of the difference between the amount of real estate taxes assessed with respect to the Building by the City of New York for the applicable Tax Year and the amount that CCP PILOT would have been for such Tax Year pursuant to the PILOT Agreement had the PILOT Cessation Date not occurred”.

(iii)Notwithstanding the occurrence of the PILOT Cessation Date, after the PILOT Cessation Date Tenant shall continue to pay Additional Tax Payments as set forth in Section 2.04(f)(ii), except that such Additional Tax Payments shall be due and payable in installments on the dates on which Tax Payments (or installments thereof) are due and payable by Tenant, and Tenant shall pay each such installment within 30 days after the rendering of a statement therefor by Landlord to Tenant, which statement may be rendered so as to require such installments to be paid by Tenant on the same dates on which Tenant is required to pay Tax Payments (or installments thereof).

(c)Landlord shall, with respect to each Tax Year, initiate and pursue in good faith an application or proceeding seeking a reduction in the assessed valuation of the Building, except that Landlord shall not be required to initiate or pursue any such application or proceeding for any such Tax Year if Landlord (1) obtains with respect to such Tax Year a letter from a well

known and reputable certiorari attorney that in such person’s opinion, considering only the Building (and not any other real estate owned by Landlord or any of its Affiliates), it would

not be advisable or productive to bring such application or proceeding for the Tax Year in question and (2) provides a verbal explanation of the reason(s) for such opinion. Tenant, for itself and its immediate and remote subtenants and successors in interest hereunder, hereby waives, to the extent permitted by law, any right Tenant may now or in the future have to protest or contest any Taxes or to bring any application or proceeding seeking a reduction in Taxes or assessed valuation or otherwise challenging the determination thereof.

(d)If Landlord shall receive a refund of Taxes allocable to any Tax Year in which Taxes exceeded the Base PILOT Amount (from and after the occurrence of the PILOT Cessation Date), Landlord shall promptly notify Tenant of such refund and shall pay to Tenant Tenant’s Tax Share of the net refund (after deducting from such refund the costs and expenses of obtaining the same, including, without limitation, appraisal, accounting and legal fees, to the extent that such costs and expenses were not included in the Taxes for such Tax Year) within 30 days after receipt of such refund; provided, that (i) such payment to Tenant shall in no event exceed Tenant’s Tax Payment paid for such Tax Year and (ii) if the PILOT Cessation Date occurs on a date other than July 1 of any Tax Year, any refund with respect to such Tax Year shall be prorated to correspond to the portion of such Tax Year with respect to which Tenant paid a Tax Payment.

(e)If the Base PILOT Amount is reduced as a result of an appropriate proceeding or otherwise after the PILOT Cessation Date, Landlord shall notify Tenant of the amount by which any Tax Payments previously made were less than the Tax Payments required to be made under this Section 2.06, and Tenant shall pay the deficiency within 30 days after demand therefor.

(f)If Landlord receives a discount for early payment or prepayment of Taxes, Tenant shall be entitled to Tenant’s Tax Share of the benefit of any such discount for any early payment or prepayment of Taxes (but only if and to the extent Tenant shall have made an early payment or prepayment for Tenant’s Tax Share of such Taxes).

2.07 Operating Payments. (a) “Base Operating Amount” means Operating Expenses for the Base Operating Year; provided, that, if, due to construction warranties in effect during the Base Operating Year, materially fewer expenses on account of repairs to the Building are paid or incurred by or on behalf of Landlord during such Base Operating Year than would typically be paid or incurred during a calendar year with respect to a new First Class Office Building comparable in size to the Building with no construction warranties in effect, then the Operating Expenses for the Base Operating Year shall be increased to reflect the Operating Expenses that would have been paid or incurred if such construction warranties had not been in effect during the Base Operating Year. For purposes of the foregoing sentence only, the term “construction warranties” shall be deemed to refer solely to warranties in effect for a newly constructed First Class Office Building that would not typically be in effect at any given time for a First Class Office Building on account of alterations, improvements, repairs and replacements.

(b)“Base Operating Year” means the calendar year 2017.