UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One) | ||||

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2017

OR | |

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 001-16017

BELMOND LTD.

(Exact name of registrant as specified in its charter)

Bermuda | 98-0223493 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

22 Victoria Street,

Hamilton HM 12, Bermuda

(Address of principal executive offices)

Registrant’s telephone number, including area code: (441) 295-2244

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

Title of each class | Name of each exchange on which registered | |

Class A Common Shares, $0.01 par value each | New York Stock Exchange | |

Preferred Share Purchase Rights | New York Stock Exchange | |

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. (Not applicable. See third paragraph under Item 1—Business.)

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company” and "emerging growth company" in Rule 12b-2 of the Act. (Check one):

Large Accelerated Filer x | Accelerated Filer o | |

Non-Accelerated Filer o | Smaller reporting company o | |

(Do not check if a smaller reporting company) | Emerging growth company o | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

The aggregate market value of the class A common shares held by non-affiliates of the registrant computed by reference to the closing price on June 30, 2017 (the last business day of the registrant’s second fiscal quarter in 2017) was approximately $1,335,000,000.

As of February 15, 2018, 102,394,570 class A common shares and 18,044,478 class B common shares of the registrant were outstanding. All of the class B shares are owned by a subsidiary of the registrant (see Note 18(c) to the Financial Statements (Item 8)).

Table of Contents

Page | |||

1

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains statements that constitute "Forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are any statements other than of historical fact, including statements regarding the intent, belief or current expectations of Belmond Ltd. and/or any of its directors or officers with respect to the matters discussed in this Annual Report. In some cases, forward-looking statements can be identified by the use of words such as “may,” “potential,” “anticipate,” “target,” “expect,” “estimate,” “intend,” “should,” “plan,” “goal,” “believe,” or other words of similar meaning. Such forward-looking statements appear in several places in this Annual Report, including but not limited to Item 1—Business, Item 7—Management's Discussion and Analysis of Financial Condition and Results of Operations, and Item 7A—Quantitative and Qualitative Disclosures about Market Risk.

All forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those discussed in, or implied by, the forward-looking statements.

Actual results could differ materially from those anticipated in the forward-looking statements due to a number of factors, including but not limited to those described in Item 1A—Risk Factors.

Investors are cautioned not to place undue reliance on any forward-looking statements made in this Annual Report which are based on currently available operational, financial, and competitive information and as such, are not guarantees of future performance. Instead, these forward-looking statements reflect management's opinion, expectation or belief only as of the date on which they are made. Except as otherwise required by law, Belmond Ltd. undertakes no obligation to update or revise publicly any forward-looking statement, whether as a result of new information, future events or otherwise.

2

3

PART I

ITEM 1. Business

Belmond Ltd. is incorporated in the Islands of Bermuda and is a “foreign private issuer” as defined in Rule 3b-4 promulgated by the U.S. Securities and Exchange Commission (“SEC”) under the U.S. Securities Exchange Act of 1934 (the “1934 Act”) and in Rule 405 under the U.S. Securities Act of 1933. As a result, it is eligible to file its annual reports pursuant to Section 13 of the 1934 Act on Form 20-F (in lieu of Form 10-K) and to file its interim reports on Form 6-K (in lieu of Forms 10-Q and 8-K). However, the Company has elected to file its annual and interim reports on Forms 10-K, 10-Q and 8-K, including any instructions therein that relate specifically to foreign private issuers. The class A common shares of the Company are listed on the New York Stock Exchange (“NYSE”).

The terms "Belmond" and the "Company" are used in this report to refer to Belmond Ltd. and Belmond Ltd. and its subsidiaries, unless otherwise stated.

These reports and amendments to them are available free of charge on the Internet website of the Company as soon as reasonably practicable after they are filed electronically with the SEC. The Company's principal Internet website address is belmond.com. Unless specifically noted, information on the Belmond website is not incorporated by reference into this Form 10-K annual report.

Pursuant to Rule 3a12-3 under the 1934 Act regarding foreign private issuers, the proxy solicitations of the Company are not subject to the disclosure and procedural requirements of Regulation 14A under the 1934 Act, and transactions in the Company’s equity securities by its officers, directors and significant shareholders are exempt from the reporting and liability provisions of Section 16 of the 1934 Act.

Introduction

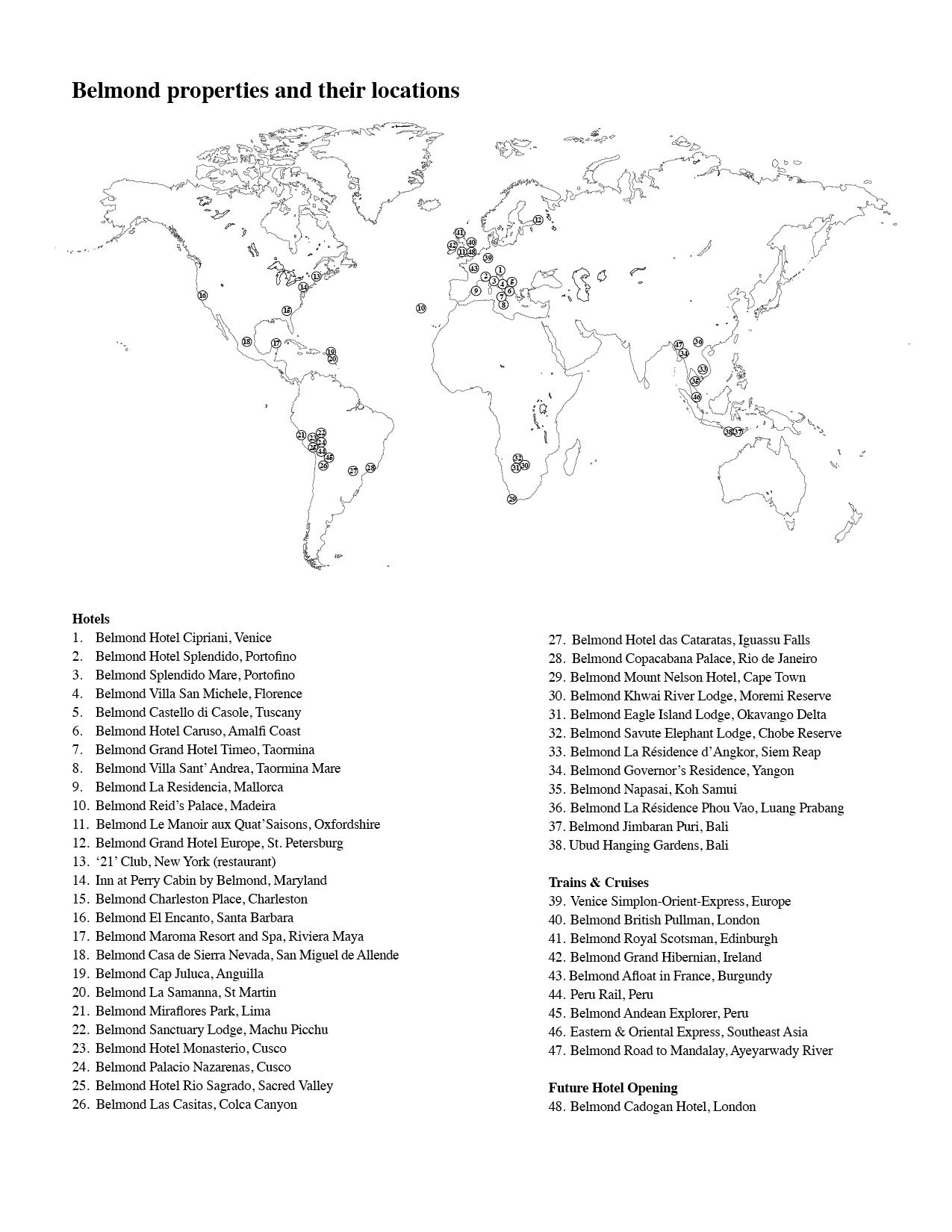

Belmond is a leading luxury hotel company and sophisticated adventure travel operator with exposure to both mature and emerging national economies. The Company’s predecessor began acquiring hotels in 1976 and organized the Company in 1994. Belmond currently owns, partially-owns and/or operates 46 properties (excluding one additional business scheduled for a future opening, the Belmond Cadogan Hotel in London, England), consisting of 36 highly individual deluxe hotels, one stand-alone restaurant, seven tourist trains and two river/canal cruise businesses. This portfolio includes one long-term leased hotel in Bali, Indonesia where the owner dispossessed Belmond from operation of the hotel in November 2013 (see Item 3—Legal Proceedings). The locations of Belmond's 46 properties operating in 24 countries are shown in the map on the preceding page. Belmond acquires, leases or manages only distinctive properties in areas of outstanding cultural, historic or recreational interest in order to provide luxury lifestyle experiences for the discerning traveler.

Revenue, earnings and identifiable assets of Belmond in 2017, 2016 and 2015 for Belmond's business segments and geographic areas are presented in Note 24 to the Financial Statements (Item 8). Belmond's operating segments are aggregated into six reportable segments, namely owned hotels in each of Europe, North America and Rest of World, owned trains and cruises, part-owned/managed hotels, and part-owned/managed trains.

Belmond revised the order of the presentation of these segments in the year ended December 31, 2016 and included a new sub-total to show management fees earned by the Company. In addition, Belmond reclassified certain expenses associated with the Company’s development team from the Part-owned/managed hotels segment to central costs. Prior periods have been re-presented to reflect the current period presentation. There has not been a material impact on the consolidated financial statements.

Hotels represent the largest part of Belmond’s business, contributing 86% of revenue in 2017, 87% of revenue in 2016 and 87% in 2015. Trains and cruises accounted for 13% of revenue in 2017, 13% of revenue in 2016 and 13% in 2015. Approximately 80% of Belmond’s customer revenue in 2017 was from leisure travelers, with approximately 44% originating from North America, 41% from Europe and the remaining 15% from elsewhere in the world.

Belmond’s worldwide portfolio of hotels currently in operation consists of 3,203 individual guest rooms and multiple-room suites, each known as a “key”. Hotels owned by Belmond in 2017 achieved an average daily room rate (“ADR”) of $510 (2016 - $490; 2015 - $481) and a revenue per available room (“RevPAR”) of $309 (2016 - $298; 2015 - $295).

In recent years, Belmond has sold to third parties a number of properties not considered key to Belmond’s portfolio of unique, high-valued properties. In March 2014, Belmond sold Inn at Perry Cabin by Belmond on the eastern shore of Maryland, with Belmond continuing to manage the hotel under a ten-year management agreement (that permits termination on the fifth anniversary

4

of the agreement) with the new owner. In May 2015, Belmond, together with its joint venture partner, each sold its 50% ownership interest in the entity which owned the Hotel Ritz by Belmond in Madrid, Spain and Belmond ended its agreement to manage the hotel. See Note 7 to the Financial Statements. On November 6, 2017, the entity that leased Belmond Orcaella provided notice of termination to the owner in respect of its charter agreement and on November 2, 2017, Belmond sold its interest in the entity which wholly owned Belmond Northern Belle. See Note 5 to the Financial Statements.

On February 23, 2014, the Company (formerly known as Orient-Express Hotels Ltd.) announced that its board of directors had approved a proposal to operate the Company's portfolio of luxury hotels and travel experiences under a new brand name—"Belmond"—from March 10, 2014, and to change its principal Internet website address to belmond.com. Belmond has retained its long-term license agreement with SNCF, the French transportation company that owns the "Orient-Express" trademark, for the Venice Simplon-Orient-Express train. With the decision to introduce the "Belmond" brand, Belmond also entered into an agreement with SNCF to terminate (with effect from December 31, 2014) the "Orient-Express" license for hotel use, without any cost or penalty. At the 2014 Annual General Meeting of Shareholders, shareholders approved a change in Belmond's corporate name from Orient-Express Hotels Ltd. to Belmond Ltd. in order to align Belmond's corporate identity with that of its primary luxury brand. On July 28, 2014, Belmond changed the ticker symbol of its class A common shares listed on the New York Stock Exchange from OEH to BEL.

On March 21, 2014, Belmond entered into a $657,000,000 senior secured credit facility, consisting of a $552,000,000 seven-year term loan and a $105,000,000 five-year, dual-currency revolving credit facility. The term loan comprised a $345,000,000 U.S. dollar-denominated tranche and a €150,000,000 euro-denominated tranche ($207,000,000 as of the completion date). Belmond used the proceeds from the term loan to refinance substantially all of the funded debt of Belmond (other than the debt of Belmond Charleston Place, a consolidated variable interest entity with separate non-recourse financing). On June 2, 2015, Belmond entered into an amendment to its senior secured credit facility to reduce the interest rate on the euro-denominated tranche to EURIBOR plus a 3.00% margin from EURIBOR plus a 3.00% margin. The Company amended and restated its senior secured credit facility on July 3, 2017 to increase the term loan, extend the maturity dates on the revolving credit facility and the term loan to July 3, 2022 and July 3, 2024, respectively, and decrease the interest rates imposed on borrowings. The amended and restated credit agreement consists of a $603,434,000 seven-year term loan and a $100,000,000 five-year, multi-currency revolving credit facility. The term loan consists of a $400,000,000 U.S. dollar-denominated tranche and a €179,000,000 million euro-denominated tranche ($203,434,000 as of the completion date). See Note 11 to the Financial Statements.

In August 2014, Charleston Center LLC entered into an $86,000,000 loan secured on its real and personal property. This loan had no amortization and is non-recourse to Belmond. This loan had an August 2019 maturity and an interest rate of LIBOR plus 2.12% per annum. In June 2016, Charleston Center LLC refinanced this loan with a $112,000,000 new loan with the same August 2019 maturity. The interest rate on the new loan is LIBOR plus 2.35% per annum, has no amortization and is non-recourse to Belmond. The additional proceeds were used to repay a 1984 development loan from a municipal agency in the principal amount of $10,000,000 and accrued interest of $16,819,000. In connection with the early repayment of the loan, Belmond negotiated a discount that resulted in a net gain, reported in the statements of consolidated operations during the year ended December 31, 2016, of $1,200,000 upon the extinguishment of the debt, including the payment of a tax indemnity to our partners in respect of their allocation of income from the discount arising on the cancellation of indebtedness. See Note 11 to the Financial Statements.

On July 8, 2014, Belmond announced the execution of a management agreement with Cadogan Hotel Partners Limited to operate Belmond Cadogan Hotel, a 64-key hotel in the Knightsbridge area of London, England. The 127-year old hotel closed at the end of July 2014 to undergo a $48,000,000 investment project. The fully renovated and re-conceptualized Belmond Cadogan Hotel is expected to open at the end of 2018 with refurbished public areas and the reconfiguration reduced to 54 keys in order to accommodate demand from luxury travelers for larger junior suites and suites.

On August 30, 2016, the Company commenced operations of Belmond Grand Hibernian, the first overnight luxury rail experience of its kind in Ireland. The luxury sleeper train accommodates up to 40 guests in 20 en-suite cabins. Belmond Grand Hibernian builds on the Company's expertise in operating a stable of the world's most famous trains, including Belmond Royal Scotsman, currently the U.K.'s only luxury touring sleeper train, and the legendary Venice Simplon-Orient-Express and Hiram Bingham in Peru.

On April 7, 2017, the Company and its joint venture partner acquired Las Casitas, a 20-key resort located in Colca Canyon in southern Peru. It is located on a 24 hectare site with 20 luxury individual bungalows. A soft goods renovation was completed in 2017, during which time the property remained open.

On May 4, 2017, PeruRail commenced operations of Belmond Andean Explorer, a luxury sleeper train running through the Peruvian Highlands from Cusco to Lake Titicaca and Arequipa, accommodating up to 68 passengers. It consists of 21 carriages, which

5

Belmond owned and operated in Australia through 2003 and sold to PeruRail in 2016. The train was shipped from Australia to Peru and underwent renovations to its interiors to a luxury standard.

On May 26, 2017, the Company acquired Cap Juluca, a 96-key luxury resort on the Caribbean Island of Anguilla, British West Indies. At the same time, the Company also entered into a 125-year ground lease with the Government of Anguilla for property that comprises approximately 167 acres, including approximately 250,000 square feet of additional developable beachfront land. See Note 4 to the Financial Statements. The resort is currently undergoing reconstruction and renovations following its acquisition and the impact of Hurricanes Irma and Jose in September 2017. See Note 8 to the Financial Statements.

On February 8, 2018, the Company acquired Castello di Casole resort and estate, which comprise the 39-key Castello di Casole hotel, together with high-quality vineyards and olive groves, extensive wooded Tuscan countryside, and 48 residential plots, of which 16 remain for sale, with three subject to non-binding reservation letters of intent to purchase and two expected to be converted into new villas as part of the hotel inventory. See Note 26 to the Financial Statements.

Owned Hotels—Europe

Italy

Belmond Hotel Cipriani—96 keys—in Venice was built for the most part in the 1950s and is located on about five acres (part on long-term lease) on Giudecca Island across from the Piazza San Marco which is accessible by a free private boat service. Most of the rooms have views overlooking the Venetian lagoon. Features include fine cuisine in three indoor and outdoor restaurants -- one of which gained a Michelin star, the Oro Restaurant -- gardens and terraces encompassing an Olympic-sized swimming pool, a tennis court, a spa and fitness center, and a large banquet and meeting facility situated in an historic refurbished warehouse. In 2016, 15 rooms in the Palazzo Vendramin and Palazzetto were refurbished. In 2017, the library was refurbished and converted into a new junior suite, along with the refurbishment of three existing keys, the addition of four cabanas in the pool area, and the creation of a casual trattoria restaurant, the Giudecca 10 within the existing breakfast room. During the 2017/2018 closure, the Cip's Club restaurant will be renovated and the Oro Restaurant Terrace refurbished.

Belmond Hotel Splendido and Belmond Splendido Mare—83 keys—overlook picturesque Portofino harbor on the Italian Riviera. Set on four acres, the main hotel was built in 1901 and is surrounded by gardens and terraces which include a swimming pool, spa and tennis court. There are two restaurants each with open-air dining as well as banquet/meeting rooms, and a shuttle service linking the main hotel with the smaller Belmond Splendido Mare on the harbor below. In 2016, ten suites and guest rooms were refurbished at Belmond Hotel Splendido and a further ten guest rooms were refurbished in 2017. Also in 2017, the facade of Belmond Hotel Splendido was restored and balconies added to 12 guest rooms. During the 2017/2018 closure, ten guest rooms will be refurbished and the Ginepro meeting room will be converted into two suites and one junior suite.

Belmond Villa San Michele—45 keys—is located in Fiesole, a short distance from Florence. Originally built as a monastery in the 15th century with a façade attributed to Michelangelo, it has stunning views over historic Florence and the Arno River Valley. Belmond has remodeled and expanded the guest accommodation to luxury standards in recent years including the addition of a swimming pool. A shuttle service is provided into the UNESCO World Heritage listed center of Florence. The property occupies ten acres. In 2016, the property created a new function facility to cater to the popular wedding and celebrations market. In 2017, four keys were refurbished, one key was added by converting the Kid's Club into a guestroom, a new outdoor bar within the Italian garden was added, and the ground floor public areas were refurbished.

Belmond Hotel Caruso—50 keys—in Ravello is located on three hill-top acres overlooking the Amalfi coast near Naples and ancient Roman and Greek archeological sites such as Pompeii and Paestum. The Amalfi coast, the city of Naples and the archeological sites have been designated UNESCO World Heritage sites. Once a nobleman’s palace, parts of the building date to the 11th century. Operated as a hotel for many years, Belmond rebuilt the property after acquiring it and reopened it in 2005. Amenities include two restaurants, a swimming pool, spa and extensive gardens. In 2017, 15 keys were refurbished and one junior suite was added in an underused public area. During the 2017/2018 closure, a junior suite will be added, along with a new hair salon. In addition, a staff dining room will be relocated to allow for the addition of a new spa and fitness center will be added. The adjacent Villa Margarita was purchased in 2017 and will be converted into a guest house with two bedrooms.

Belmond Grand Hotel Timeo—70 keys—in Taormina, Sicily was purchased in January 2010 and renovated during winter closure periods since then. With panoramic views of Mount Etna (a UNESCO World Heritage site) and the Gulf of Naxos from its main terrace, this hotel is widely considered the most luxurious hotel in Taormina and is situated in the city center next to the second century Greek Theater. Built in 1873 on a total site of about ten acres, the hotel features a restaurant serving regional specialties, a spa and fitness center, swimming pool, and separate banqueting and conference facilities, all surrounded by six acres of parkland. In 2017, 25 keys were renovated in the main hotel building and the public areas of Villa Flora were renovated.

6

Belmond Villa Sant’Andrea—69 keys—was purchased and renovated at the same time as Belmond Grand Hotel Timeo. Built in 1830 on Taormina's Bay of Mazzarò with its own beach, the hotel has the atmosphere of a private villa set in lush gardens, a total site of about two acres, with many of the guest rooms and the hotel’s seafood restaurant and swimming pool looking onto the Calabrian coast. Belmond completed construction in May 2014 of six poolside suites. During the 2015/16 winter closure, four new units were built (three junior suites and one double room) in a prime location on the pool side of the property with stunning views of the Bay. In 2017, 26 keys were refurbished and improvements were made to the outdoor restaurant and bar. During the 2017/2018 closure, the existing banquet room will be converted into three junior suites with the added flexibility to use one of the suites as a meeting room, an additional 26 keys will be refurbished, and a new outdoor lightweight structure will be added for banqueting. Belmond Grand Hotel Timeo and Belmond Villa Sant'Andrea are linked by a shuttle service so that guests may enjoy the facilities at both hotels.

Castello di Casole—39 keys—is located within easy access of both Florence and Sienna. A historic castle dating from the 10th century, the resort and estate span 1,500 hectares and comprise the Castello di Casole hotel, together with high-quality vineyards and olive groves, extensive wooded Tuscan countryside, and 48 residential plots, of which 16 remain for sale, with three subject to non-binding reservation letters of intent to purchase. Starting in 2018, the Company expects to invest $9.0 million in a phased refurbishment of the hotel over four years, including the addition of two new villas on two residential plots that will be retained, bringing the resort's total key count to 41. The resort and estate will be rebranded upon the Company assuming management of the property.

All of these Italian properties operate seasonally, closing for varying periods during the winter.

Spain

Belmond La Residencia—74 keys including a separate villa—is located in the charming village of Deià on the rugged northwest coast of the island of Mallorca with panoramic views of the Tramuntana Mountains, a UNESCO World Heritage site. The core of Belmond La Residencia was originally created from two adjoining 16th and 17th century country houses set on an owned hillside site of 30 acres. The hotel features two restaurants, including the gastronomic El Olivo, meeting rooms for up to 100 guests, two large swimming pools, tennis courts and a spa and fitness center with an indoor pool. In 2015, the property refurbished 12 junior suites and created a new bar. During the 2015/16 winter closure, the property commenced the first phase of the construction of six new suites and the units were added to the hotel inventory in the spring of 2017. During the 2017/2018 closure, 15 rooms will be renovated to create 12 guest rooms and one designer suite.

Portugal

Belmond Reid’s Palace—158 keys—is a famous hotel on the island of Madeira, situated on ten acres of semitropical gardens on a cliff top above the sea and the bay of Funchal, the main port city. Opened in 1891, the hotel has five seasonal restaurants and banquet/meeting facilities. Leisure and sports amenities include fresh and sea water swimming pools, a third tide-filled pool, tennis courts, ocean water sports, a spa and fitness center and access to two championship golf courses. It has year-round appeal, serving both winter escapes to the sun and regular summer holidays. In 2017, renovations were completed in the main building with the relocation of the reception and main entrance, the breakfast room was converted into meeting rooms, and the Pool Restaurant and Bar were renovated.

United Kingdom

Belmond Le Manoir aux Quat’Saisons—32 keys—is located in a picturesque village in Oxfordshire, England about an hour’s drive west of London. The main part of the hotel is a 16th century manor house set in 27 acres of gardens. Each suite has an entirely individual design. The property was developed by Raymond Blanc, one of Britain’s most famous chef-patrons, and the hotel’s restaurant has two stars in the Michelin Guide. Mr. Blanc has a four-year commitment that commenced January 2015 to remain the chef-patron at the hotel. The hotel recently expanded its event and meeting space to increase its appeal to social and corporate groups. In 2016, the La Bourgogne private dining room was renovated.

Belmond Cadogan —54 keys—is a 127-year old hotel located in the heart of London on Sloane Street. When it opens, as currently expected by year-end 2018, the Belmond Cadogan will reflect a thorough renovation that will bring contemporary classic design to this historic collection of buildings. The scope of the renovation includes the complete refurbishment of all public areas and the reconfiguration of 64 keys to 54 to create larger junior suites and suites. Built in 1887 in the Queen Anne style, the hotel has played an integral role in the social history of the Kensington and Chelsea areas. Belmond will operate the hotel under a third-party hotel management agreement.

7

Russia

Belmond Grand Hotel Europe—266 keys—in St. Petersburg was originally built in 1875. The hotel occupies one side of an entire city block on the fashionable Nevsky Prospect in the UNESCO World heritage listed heart of the city near the Russian Museum, Philharmonic Society, Mikhailovsky Theater and other tourist and cultural attractions as well as the commercial center. There are three restaurants on the premises, as well as a grand ballroom, meeting facilities, a spa and fitness center, and several retail shops. Luxury historic suites reflect the rich history of the hotel and city, named after famous guests like Pavarotti, Stravinsky and the Romanov tsars. The City of St. Petersburg owns a 6.5% minority interest in the hotel building. Recent improvements include six ultra-luxury suites that opened in July 2014, a new concept restaurant by a top designer, and improved meeting and banqueting rooms. In 2016, the property commenced renovations to its famous Krysha ballroom, which were completed in 2017. In 2017, renovation work commenced on the replacement of seven elevators with a planned completion at the end of 2019, refurbishment of 114 guest rooms including upgrades to the heating, ventilation, and air conditioning systems, and renovations to the Mezzanine Café to be completed in mid-2018.

Owned Hotels—North America

United States

Belmond Charleston Place—434 keys—is located in the heart of historic Charleston, South Carolina, a popular destination for tourists and business meetings. Opened in 1986, the hotel has two restaurants, extensive banqueting and conference space including a grand ballroom, a spa, fitness center and rooftop swimming pool, and a shopping arcade of 22 retail outlets leased by third parties. The hotel also owns the adjacent historic Riviera Theater remodeled as additional conference space and retail shops. In December 2015, the property completed a three-year phased refurbishment of all of its guest rooms. In 2016, the property refurbished a retail outlet space, converting it into an upscale sports bar with direct access to Market Street, a busy main street in Charleston. Other upgrades in 2016 included the addition of an outdoor Roof Terrace & Bar, the renovation and expansion of the Thoroughbred Bar increasing capacity by 40%, and the completion of the renovation of the ballroom and conference facilities. In 2017, the reception and spa were renovated and in December 2017, the property commenced the renovation of the Charleston Grill, with an expected completion planned for early 2018.

While Belmond has a 19.9% equity interest in Belmond Charleston Place, Belmond manages the property under an exclusive long-term contract and has a number of outstanding loans to the hotel. On evaluating its various interests in the hotel, Belmond has concluded that it is the primary beneficiary of this variable interest entity and, accordingly, consolidates the assets and liabilities of the hotel in Belmond’s balance sheets and consolidates the hotel’s results in Belmond’s statements of operations, comprehensive income and cash flows. See Note 6 to the Financial Statements.

Belmond El Encanto—92 keys—in Santa Barbara, California is located in the hills above the city center, with views over the Pacific Ocean. Dating from 1913, it sits in seven-acre landscaped gardens with heritage features and mature trees. Guest rooms are in authentic, California Rivera-style bungalows spread throughout the grounds. Belmond reopened the resort in 2013 following extensive renovation and it now includes an acclaimed restaurant, infinity-edge swimming pool, a destination spa and fitness center. Belmond El Encanto is Santa Barbara's only Forbes Five Star hotel.

‘21’ Club is Belmond's stand-alone restaurant, a famous landmark at 21 West 52nd Street in midtown Manhattan near the Broadway theater district and many top tourist attractions. Originally a speakeasy during Prohibition in the 1920s, this restaurant is open to the public, occupies three brownstone buildings and features fine American cuisine. It serves à la carte meals in the original bar restaurant and a separate dining room upstairs, and also has ten banqueting rooms used for receptions and events, including the famous secret wine cellar. Belmond added Bar ‘21’ on the restaurant’s ground floor lobby and reconfigured and expanded two event spaces on the first floor for private receptions.

Caribbean

Belmond Cap Juluca—96 keys—is located on the island of Anguilla in the British West Indies. It is set amid 179 acres of stunning tropical landscape and inland waterways overlooking the nearby St. Maarten mountains. Belmond Cap Juluca is an exclusive luxury hotel built in Greco-Moorish style on a white sandy beach. The Company acquired the property in May 2017 and also entered into a 125-year ground lease for property that comprises approximately 167 acres, including approximately 250,000 square feet of additional developable land. The property is undergoing a full renovation following its acquisition and the impact of Hurricanes Irma and Jose in September 2017, the renovations to include the addition of 20 new keys and two new-build casitas, a new spa and fitness center, outdoor pool, beach bar, meeting space and the renovation of two existing restaurants and bar. The property is currently expected to reopen in November 2018. See Notes 4 and 8 to the financial statements.

8

Belmond La Samanna—91 keys including eight villas—is located on the island of St. Martin in the French West Indies. Built in 1973, the hotel consists of several buildings on 16 acres of owned land along a 4,000-foot beach. Amenities include two restaurants, two swimming pools, a spa, tennis courts, fitness and conference centers, boating and ocean water sports, and extensive gardens. The hotel is open most of the year, seasonally closing during the autumn months. In recent years, Belmond has renovated many of the guest rooms and the main restaurant, bar and lobby area. The eight luxury villas located on part of the 35 acres of owned vacant land adjoining Belmond La Samanna provide additional villa-suite room stock for the hotel. The remaining land is available for future expansion. The hotel suffered damage from Hurricanes Irma and Jose in September 2017 during the hotel's annual closure. The renovation of ten keys had commenced and remedial works were also underway for a cliff stabilization project. The cliff stabilization project has been completed and the Company is currently contemplating a substantial reconstruction and renovation program conditioned on a significant restructuring of the cost structure of the hotel. If the Company proceeds with the reconstruction and renovation program, the expected re-opening would be in December 2018. See Note 8 to the financial statements.

Mexico

Belmond Maroma Resort and Spa—63 keys—is on Mexico’s Riviera Maya on the Caribbean coast of the Yucatan Peninsula, about 30 miles south of Cancun. The resort opened in 1995 and is set in 25 owned acres of verdant jungle along a 1,000-foot beach. The Cozumel barrier reef is offshore where guests may fish, snorkel and scuba-dive. Important Mayan archeological sites are nearby. Rooms are arranged in low-rise villas and there are three restaurants, three swimming pools, tennis courts and spacious spa facilities. The hotel purchased a beach concession on an adjacent piece of land in 2016. Belmond also owns a 28-acre tract adjacent to Belmond Maroma Resort and Spa for hotel expansion or construction of other improvements. Phase 1 planning efforts commenced in 2017 in advance of a planned renovation in 2019 to include the addition of ten keys and two new event palapas, along with upgrades to infrastructure and landscaping.

Belmond Casa de Sierra Nevada—37 keys—is a luxury resort in the colonial town of San Miguel de Allende, a UNESCO World Heritage site. Opened in 1952, the hotel consists of nine owned Spanish colonial buildings built in the 16th and 18th centuries. Belmond has renovated the hotel, including its restaurant, and has built new suites as well as a swimming pool, spa and garden area. The total site is approximately two acres. Belmond also owns a nearby cooking school and retail shop operated in conjunction with the hotel. In 2017, a phased guestroom renovation of all 37 keys and public areas, along with the addition of a spa and fitness center, commenced while the hotel remained open with completion scheduled for early 2018.

Owned Hotels—Rest of World

South America

Belmond Copacabana Palace—239 keys—was built in the 1920s on a three-acre owned site facing Copacabana Beach near the central business district of Rio de Janeiro, Brazil. It is a famous hotel in South America and features two fine-dining restaurants, 13 function rooms hosting up to 1,300 guests, including the hotel’s refurbished former casino rooms, a 25 meter-long swimming pool, spa and fitness center, and a roof-top tennis court and a private roof-top plunge pool for the penthouses. In December 2012, Belmond completed a two-year phased refurbishment of the guest rooms in the main building including an expanded and restyled lobby and, in early 2014, converted one of the hotel's bars into a new pan-Asian restaurant. Upgrades in 2017 included the renovation of the Pergula Restaurant, which is the main three-meal restaurant for the hotel located on the ground level with seating overlooking the pool, upgrades to the pool area, and a new energy management system. Third parties own a less than 2% minority interest in the hotel.

Belmond Hotel das Cataratas—187 keys—is located beside the famous Iguassu Falls in Brazil on the border with Argentina, a UNESCO World Heritage site. Belmond was awarded in 2007 a 20-year lease of the hotel from the government. It is the only hotel in the national park on the Brazilian side of the falls. First opened in 1958 on about four acres, the hotel has two restaurants, two bars, conference facilities, a swimming pool, spa, fitness center and tennis court, and tropical gardens looking onto the falls. In 2017, the hotel completed the renovation of 23 keys. Belmond had applied in 2009 to the Brazilian Ministry of Planning, Budget and Management for an amendment of the lease, but the Secretary of the Ministry denied the application in September 2014. Belmond thereafter claimed against the Federal Government for breach of the lease and received interlocutory relief at the trial court in the form of a 25% lease reduction and an injunction on the Federal Government from taking any action inconsistent with the court's decision, which was affirmed twice on appeal. The Federal Court subsequently issued a preliminary decision in October 2017 denying in part the Company's claim for modification of the lease concession and ordering the Company to pay the stated rent in the lease. This ruling has also been affirmed on appeal. See "Item 3—Legal Proceedings."

Belmond Miraflores Park—89 keys—is located in the fashionable Miraflores residential district of Lima, Peru. This all-suite owned hotel, occupying about an acre of land, faces the Pacific Ocean and is conveniently located to the city's commercial and cultural centers. Following a five-month closure for a $7,500,000 renovation project, Belmond reopened the hotel in April 2014

9

with refreshed guest accommodations, conference facilities and public areas. The hotel features two restaurants, large banqueting and meeting rooms and an exclusive lounge for guests staying on the upper floors. Leisure facilities include a spa, gym and rooftop swimming pool with ocean views. During 2016, the property converted former office space on its third floor into eight executive guest rooms. In 2017, planning commenced for the renovation of the lobby and three garden suites, scheduled to be completed in 2018. See also "Item 3—Legal Proceedings."

Africa

Belmond Mount Nelson Hotel—198 keys—in Cape Town, South Africa is a famous historic property opened in 1899. With beautiful gardens and pools, it stands just below Table Mountain and is within walking distance of the main business, civic and cultural center of the city. The hotel has two restaurants, a ballroom, two swimming pools, tennis courts, a spa and fitness center, and a business center with meeting rooms, all situated on ten acres of owned grounds. In 2012, Belmond renovated 30 guest rooms and the restaurant overlooking the main swimming pool and gardens and, in 2013, refurbished an additional 36 guest rooms. In 2014, Belmond refurbished eight junior suites and 18 suites, including its eight garden cottages. In 2015, the hotel's original ballroom and three conference rooms were renovated and in 2016, 48 keys in the main building were upgraded and refurbished. In 2017, significant upgrades were made to the entry drive, porte cochere, reception lobby, and Tea Lounge and Bar. The hotel has expansion potential through conversion of adjacent owned residential properties.

Belmond Khwai River Lodge, Belmond Eagle Island Lodge and Belmond Savute Elephant Lodge—39 keys in total—comprise Belmond’s African safari experience in Botswana consisting of three separate game-viewing lodges. Established in 1971, Belmond holds leases to the lodge sites in the Okavango River delta and nearby game reserves, where African wildlife can be observed from open safari vehicles or boats. The leases expire between 2021 and 2041. Botswana's Okavango Delta was added to the UNESCO World Heritage list in June 2014. Each camp has 12 or 15 luxury one bedroom tents under thatched roofs, and guests travel between the camps by light aircraft. Boating, fishing, hiking and swimming are offered at the various sites. In 2015, Belmond closed Belmond Eagle Island Lodge to undertake a full refurbishment of the property and re-opened it in November 2015. Conde Nast Traveller included Belmond Eagle Island Lodge on its 2016 Hotlist and the property received an award from International Property & Travel in 2016. Belmond Savute Elephant Lodge closed in November 2017 for a full renovation and is expected to open in May 2018. The renovation includes upgrades to the infrastructure, enhancements to finishes, new food and beverage outlets including outdoor dining, a swimming pool, and the addition of a spa tent.

Asia

Belmond Napasai—68 keys including 14 private villas—is located on its own beach on the north side of Koh Samui island of Thailand in the Gulf of Siam. It originally opened in 2004 and features two restaurants, tennis courts, a swimming pool, a spa and water sports such as sailing, diving and snorkeling in the nearby coral reef. The guest rooms and garden cottages are arranged in sea view on a total site of about 40 owned acres, which includes vacant land for future expansion. The villas, most of which are owned by third parties, are available for rent by hotel guests.

Belmond Jimbaran Puri—64 keys including 22 villas—is on the island of Bali in Indonesia and occupies seven beachfront acres under long-term lease through 2050 on the south coast of the island. Guest rooms are situated in cottages, and there are two restaurants, a spa, swimming pool and ocean water sports. Each villa has its own private plunge pool.

Ubud Hanging Gardens—38 keys—also on Bali is located on terraces on about seven steep hillside acres above the Ayung River gorge in the rain forest interior of the island. This long-term leased hotel opened in 2005 and offers two restaurants, a swimming pool and spa, and a free shuttle bus to the nearby town of Ubud, a cultural and arts center. Each key has its own private plunge pool.

As previously reported, following an unannounced dispossession of Belmond from Ubud Hanging Gardens by the third-party owner in November 2013, Belmond was unable to continue operating the hotel. Belmond believed this action by the owner was unlawful and in breach of its long-term lease arrangement and constituted a wrongful dispossession. Accordingly, Belmond has taken appropriate legal steps to protect its interests and is currently seeking to enforce its Singapore arbitral award for $8.5 million against the owner in Indonesia. See Item 3—Legal Proceedings.

Belmond La Résidence d’Angkor—59 keys—opened in 2002 and is situated in walled gardens in Siem Reap, Cambodia. The hotel occupies a site of about two acres under long-term lease until 2066. The ancient Temples of Angkor Wat, a UNESCO World Heritage site and the principal tourist attraction in the area, are nearby. The hotel has two indoor/outdoor restaurants, swimming pool, and a spa and fitness center. The property completed a full renovation of its guest rooms and added a pool suite by combining two keys overlooking the pool in 2016.

10

Belmond Governor’s Residence—49 keys—was built in the 1920s in the embassy district of Yangon, Myanmar (Burma) originally as the official home of one of the Burmese state governors and near the great Shwedagon pagoda in the city. The building is a two-story teak mansion surrounded by verandas overlooking lotus gardens on a site of about two acres leased until 2067. Belmond Governor's Residence opened as a hotel in 1997. It includes two restaurants and swimming pool.

Belmond La Résidence Phou Vao—34 keys—is in Luang Prabang, the ancient capital of Laos and a UNESCO World Heritage site. Belmond owns a 69% interest in the entity which owns the property. The hotel opened in 2001 and occupies about eight hillside acres under long-term lease until 2028. Guest rooms are in four two-story buildings surrounded by lush gardens that include a restaurant, spa and swimming pool.

Part-Owned/Managed Hotels

United States

Inn at Perry Cabin by Belmond—78 keys—was built in 1812 as a country inn located in St. Michaels, Maryland on the eastern shore of Chesapeake Bay. Set on 25 waterfront acres, it is an attractive conference and vacation destination, particularly for guests from the Washington, D.C., Baltimore and Philadelphia areas. During its ownership, Belmond expanded the hotel by adding guest rooms, a conference facility, a swimming pool and spa.

As noted in the "Introduction" above, Belmond completed the sale of Inn at Perry Cabin in March 2014 for gross proceeds of $39,700,000 and at the same time, entered into a ten-year management agreement (that permits termination on the fifth anniversary of the agreement) with the owner under which Belmond operates the property as Inn at Perry Cabin by Belmond. As part of the management agreement, Belmond funded $3,000,000 of key money to be used for agreed capital enhancements.

Peru

Belmond has a 50%/50% joint venture with local investors in Peru which operates the following four hotels under Belmond’s exclusive management.

Belmond Hotel Monasterio—122 keys—is located in the ancient Inca capital of Cusco, an important tourist destination in Peru and a UNESCO World Heritage site. The hotel was originally built as a Spanish monastery in the 16th century, converted to hotel use in 1965, and has been upgraded since then. The guest rooms and two restaurants are arranged around open-air cloisters. Many of the guest rooms are specially oxygenated due to Cusco's high altitude. In 2015, Belmond completed a three-year phased renovation of guest rooms and bathrooms. The site measures approximately three acres under long-term lease until 2037, with options to renew until 2067. In 2017, we commenced the first phase of planning for the soft goods renovation of the lobby bar and two restaurants, which is expected to be completed in 2018.

Belmond Palacio Nazarenas—55 keys—is located adjacent to Belmond Hotel Monasterio in Cusco and is a former palace and convent which the joint venture has rebuilt as a separate hotel and opened in June 2012. This is an all-suite hotel arranged around courtyards and features oxygenated guest rooms, an outdoor heated swimming pool, spa, and poolside restaurant and bar. During construction, archeologists discovered Incan artifacts and foundations which have been preserved and displayed in the hotel. The property is subject to a lease until 2042, with an option to renew until 2067. In 2017, the joint venture commenced the first phase of planning to upgrade the main restaurant, which is expected to be completed in 2018.

Belmond Sanctuary Lodge—31 keys—is the only hotel at the famous mountaintop Inca ruins at Machu Picchu, a UNESCO World Heritage site. All of the rooms have been refurbished to a high standard. In 2016, the joint venture completed a three-year phased renovation of all guest rooms and suites, as well as the hotel's reception and public areas. In 2017, the Tinkuy buffet restaurant was refurbished. The joint venture leases the hotel as well as seven acres for possible future expansion at the foot of the ruins, close to the town on the Urubamba River where tourists arrive by train. The lease has been extended to 2025. See Item 3 — Legal Proceedings.

Belmond Hotel Rio Sagrado—23 keys including two villas—is owned by Belmond's Peru hotel joint venture and is located in the Sacred Valley of the Incas between Cusco and Machu Picchu. Opened in 2009, this rustic hotel has a spa with indoor plunge pool and extensive gardens beside the Urubamba River on a site of about six acres set against an imposing mountain backdrop. The Sacred Valley is a popular part of holiday itineraries in Peru, and a station on Belmond’s PeruRail train service is a short distance from the hotel. During 2013, the joint venture refurbished the guest rooms, enlarged the spa and installed an outdoor heated swimming pool. In 2014, the property enhanced the main entry arrival with a new entry drive and landscape improvements and added a train platform/lounge to accommodate Hiram Bingham train guests stopping at the hotel. In 2015, the joint venture

11

acquired an adjacent parcel of land of approximately two and a half acres on which the joint venture is contemplating further development.

Belmond Las Casitas—20 keys—is located in Colca Canyon, a river canyon in southern Peru famed for being one of the world's deepest and a habitat for the giant Andean condor and having pre-Inca roots. It is located on a 24 hectare estate with 20 luxury individual bungalows, each with a private terrace, plunge pool, fireplace, indoor and outdoor shower, and hot tub. The resort includes a library, outdoor pool, spa, and restaurant and bar, with an on-property farm that provides organic produce for the restaurant. The Company acquired the property through its 50%/50% joint venture in Peruvian hotels in May 2017 and a soft goods renovation was completed in 2017.

Owned Trains and Cruises

Venice Simplon-Orient-Express comprises 18 historic railway cars, all of which have been refurbished in original 1920s/1930s décor and meet modern safety standards. It operates once or twice weekly principally between multiple cities and Venice from March to November each year via Paris, Zurich and Innsbruck on a scenic route through the Alps. The journey from London to Venice departs from London Victoria station on the Belmond British Pullman train; passengers then cross the English Channel by coach on the Eurotunnel shuttle train. Occasional trips are also made to Vienna, Prague, Berlin, Copenhagen, Stockholm, Budapest and Istanbul. During 2015, the bar was completely refurbished and in 2016 and 2017 respectively, air conditioning and Wi-Fi were added throughout the train. During the 2017/2018 winter closure, one carriage will be converted into three grand suites with en-suite showers. Venice-Simplon-Orient-Express is made up of three dining cars, one bar car and sleeper cars carrying up to 182 passengers in 85 double and 12 single cabins. Venice Simplon-Orient-Express is also available for charter by private groups.

Belmond British Pullman consists of 11 Pullman dining cars in Britain which operate all year originating out of London on short excursions to places of historic, scenic or sporting interest in southern England, including some weekend trips when passengers stay at local hotels. Full fine dining is offered on every departure.

Belmond Royal Scotsman is a luxury sleeper train owned by Belmond and comprises nine Edwardian-style cars, including five sleeping cars (each compartment with private bathroom), two dining cars and a bar/observation car, and accommodates up to 40 passengers. In 2017, the bar/observation car was renovated and a spa car with two treatment rooms was added. Operating from April to October, the train travels on itineraries of up to seven nights through the Scottish countryside affording passengers the opportunity to visit clan castles, historic battlegrounds, famous Scotch whiskey distilleries and other points of interest. A soft goods renovation of the public areas was completed in 2017.

Belmond Grand Hibernian is a luxury sleeper train owned by Belmond and comprises ten Georgian-styled railway cars, including five sleeping cars (each compartment with a private bathroom), two dining cars, a bar/observation car and accommodates up to 40 passengers. It operates from April to October and travels on three itineraries through the Irish countryside affording passengers the opportunity to visit castles, lakes, towns, whiskey distilleries and other places of interest. This train commenced service in August 2016 through mid-October 2016 and began its 2017 season in April.

Belmond Road to Mandalay is a luxury river cruise ship on the Ayeyarwady (Irrawaddy) River in central Myanmar. The ship was a Rhine River cruiser built in 1964 that Belmond bought and refurbished. It has 43 air conditioned cabins with private bathrooms, spacious restaurant and lounge areas, and a canopied sun deck with a swimming pool. The ship travels between Mandalay and Bagan up to eight times each month and carries up to 82 passengers who may enjoy sightseeing along the river and guided shore excursions to places of cultural interest. Three- to 11-night itineraries are offered. The ship does not operate in the summer months and occasionally when the water level of the river falls too low due to lack of rainfall. During 2015, the top deck barbeque and bar venues were refurbished.

Belmond Afloat in France consists of five luxury river and canal boats (called péniche-hôtels) owned by Belmond and operates in Burgundy, Provence and other rural regions of France. They accommodate between four and 12 passengers each in double berth compartments with private bathrooms, and some have small plunge pools on deck. They operate seasonally between April and October on three- to six-night itineraries with guests dining on board or in nearby restaurants. Shore excursions are organized each day. It is anticipated that during 2018, two additional canal boats accommodating eight passengers each will be added to the fleet, which are expected to operate in the Champagne, Alsace and other regions of France.

Belmond Northern Belle and Belmond Orcaella—As noted in the "Introduction" above and in Note 5 to the Financial Statements, on November 2, 2017, Belmond sold its interest in the entity that owned Belmond Northern Belle and on November 6, 2017, the entity that leased Belmond Orcaella provided notice of termination to the owner in respect of its charter agreement.

All Belmond trains and cruises are available for private charter.

12

Part-Owned/Managed Trains

PeruRail: Belmond and local Peruvian investors formed two 50%/50% joint venture companies (PeruRail S.A. ("PeruRail") and Ferrocarril Transandino S.A. ("FTSA")). FTSA was awarded in 1999 a 30-year concession to operate the track and other infrastructure of the state-owned railways in southern and southeastern Peru. The concession had an initial term of 30 years from 1999 with the option to apply for six 5-year extensions. In December 2017, FTSA received a denial of its third extension request. As a result, FTSA can no longer conclude that the remaining three extensions are probable and has therefore reduced its expectation of the total expected life of the concession to the contracted term of 35 years of which 17 years are remaining as of December 31, 2017. This triggered an impairment test of the assets within the joint venture and the shorter time period over which to recover the carrying value of the assets has led to an impairment charge being recorded in the year ended December 31, 2017. The life of the concession is now expected to expire in 2034. See Note 7 to the Financial Statements.

PeruRail operates passenger and freight services in southern and southeastern Peru. The 70-mile Cusco-Machu Picchu line, carrying mainly tourists as well as local passenger traffic, is the principal means of access to the famous Inca ruins at Machu Picchu because there is no convenient road. Another carrier operates on this line in competition with PeruRail. A second rail line runs from Cusco to Matarani on the Pacific Ocean (via Arequipa) and to Puno on Lake Titicaca, and principally serves freight traffic under contract, an activity PeruRail has expanded by hauling the output of local copper mines in southern Peru to the Pacific port for export. See "Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations—Year ended December 31, 2017 compared to year ended December 31, 2016 and year ended December 31, 2016 compared to year ended December 31, 2015—Part-Owned/Managed trains, 2016 compared to 2015". PeruRail can continue to run trains on the track after the conclusion of FTSA's concession. PeruRail, along with other third-party operators, pays a track access fee to FTSA and FTSA pays the Peruvian government fees related to traffic levels and the use of rail infrastructure, locomotives and rolling stock.

The Cusco-Machu Picchu line connects four of Belmond’s Peruvian hotels, allowing inclusive tours served by the Belmond Hiram Bingham luxury daytime tourist train comprising two dining cars and a bar/observation car with capacity up to 84 passengers. PeruRail also operates a daytime tourist train that runs on the Cusco-Puno route through the High Andes mountains. In 2017, a new luxury sleeper train was launched under the name Belmond Andean Explorer, which runs through the Peruvian Highlands from Cusco to Lake Titicaca and Arequipa. This train consists of 21 carriages, which Belmond owned and operated in Australia until 2003 and sold to PeruRail in 2016. The train was shipped from Australia to Peru where it underwent a full renovation. It carries 68 passengers in 34 en-suite cabins, with two dining cars, a lounge car, and an observation car.

Eastern & Oriental Express: During its operating season from September to April, the Eastern & Oriental Express offers a round trip each week between Singapore, Kuala Lumpur and Bangkok. The journey includes two or three nights on board and side trips to Kuala Kangsar in Malaysia and the River Kwai in Thailand. Some overnight trips are also made from Bangkok to Chiang Mai and elsewhere in Thailand and to Vientiane, Laos. Longer itineraries, up to six nights on board, are offered to places of historic, scenic and cultural interest in the region. Originally built in 1970, the 24 cars were substantially refurbished in an elegant Asian décor and fitted with modern facilities such as air conditioning and private bathrooms. The train is made up of sleeping cars, three restaurant cars, a bar car and an open-air observation car and carries up to 82 passengers. The Eastern & Oriental Express is available for charter by private groups. Belmond manages the train and has a 25% shareholding in the owning company.

Management Strategies

As the foregoing indicates, Belmond has a global mix of luxury hotel and travel products that are geographically diverse and appeal to both high-end individual travelers as well as prominent meeting, incentive, and social groups. Individual travelers in 2017 made up approximately 72% of total hotel room nights, with meeting, social, and incentive groups accounting for the remaining 28%. Belmond’s properties are distinctive as well as luxurious and tend to attract guests prepared to pay higher rates for the travel experiences and high-quality service Belmond offers compared to its competitors.

Belmond benefits from long-term trends and developments favorably impacting the global hotel, travel and leisure markets, including growth trends in the luxury hotel market in many parts of the world, increased travel and leisure spending by consumers, favorable demographic trends in relevant age and income brackets of U.S., European and other populations, and increased online travel bookings.

Belmond’s aim is to continue to be the consummate luxury experiential travel company, providing guests with a window into authentic, 'one-of-a-kind' experiences in some of the most inspiring destinations in the world. In 2016, Belmond announced a strategic growth plan intended to grow its business by focusing on three key areas:

13

• | Driving top-line growth and bottom-line results at the Company's existing businesses -- Belmond plans to continue owning or part-owning and operating most of its existing properties, which allows Belmond to develop each product's distinctive local character and to benefit from current cash flow and potential future gains on sale. Belmond considers its combined owner/operator role as efficient and consistent with the long-term nature of its assets. Self-management or management with equity interest has enabled Belmond to capture the economic benefits otherwise shared with a third-party manager, to control the operations, quality and expansion of the hotels, and to use its experience with market adjustments, price changes, expansions and renovations to improve cash flow and enhance asset values. The Company continues to emphasize increasing revenue and earnings at its established and recently opened properties, with a particular focus on: |

◦ | maximizing RevPAR while controlling costs associated with incremental revenue; |

◦ | upgrading core systems to drive greater demand, improve customer relationships and increase website conversion ratios; |

◦ | investing in capital improvements at existing hotels and expanding where land or space is available, in both cases when potential investment returns are relatively high and operating costs are low; |

◦ | putting a greater emphasis on margin improvements; and |

◦ | increasing the utilization of its trains and cruises by adding departures and, for PeruRail, expanding its contracted freight business. |

• | Continuing the Company's efforts to build brand awareness -- Many of Belmond’s individual properties, such as Belmond Hotel Cipriani, Belmond Grand Hotel Europe, Belmond Copacabana Palace and Belmond Mount Nelson Hotel, have distinctive local character and strong brand identities. Prior to introducing the Belmond brand in 2014, the Company promoted its individual hotel properties and the Venice Simplon-Orient-Express train through the “Orient-Express" sub-brand. In 2014, the Company elected to migrate to more of a "hard-brand" strategy and now markets its collection under the Belmond brand. At the same time, the Company retained its long-term license agreement with SNCF, the French transportation company that owns the "Orient-Express" trademark for the Venice Simplon-Orient-Express train. With the decision to introduce the Belmond brand, the Company also entered into an agreement with SNCF to terminate (with effect from December 14, 2014) the "Orient-Express" license for hotel use, without any cost or penalty. |

The revised brand and marketing strategy is intended to increase consumer recognition of the broad scope of the Company's unique collection of luxury hotels and travel experiences, thereby increasing repeat and multi-property visits and enhancing revenue growth, and to heighten awareness of the entire portfolio of individual properties among existing and potential new guests. Management also expects this approach will make Belmond more attractive to third-party owners thereby facilitating the strategy of expanding into third-party management of properties that complement Belmond's existing portfolio.

The Company has made important progress on increasing consumer and industry awareness of the Belmond brand in the approximately four years since its launch. Management believes that there is additional scope for expanding awareness and is focused on building the brand and gaining more market share within the luxury leisure brand landscape. In particular, the Company is focused on making Belmond "the brand of choice" for its specific niche by expanding brand training for employees in order to bring the brand to life for guests while on property, identifying and introducing signature programming that differentiates the Company from its competitors, and utilizing public relations and media opportunities to introduce new experiences while at the same time reinforcing the Belmond brand. In 2017, the Company launched a new global brand campaign and fully re-designed consumer website to support and help centralize these collective brand objectives.

• | Expanding the Company's global footprint -- As part of the strategic plan that the Company unveiled in 2016, Belmond identified global footprint expansion as a meaningful driver of the Company's long-term growth and value. Footprint expansion includes growing the Company's international portfolio through any or all of the following: acquisitions, long-term leases, management agreements -- with or without a related investment, franchise agreements, and construction or acquisition of new train or cruise businesses. Factors in Belmond's evaluation of a potential acquisition, lease, management or franchise opportunity include the property's fit within the Belmond brand and the Company's target geographic markets, as well as an assessment against certain Company's defined financial criteria, with a focus on maintaining conservative debt and leverage levels. In keeping with this conservative approach, the Company intends to partially finance larger acquisitions through the sale of selected assets while generally seeking to retain long-term management of any disposed asset. |

As a sizeable part of its footprint expansion strategy, the Company plans to pursue long-term contracts to manage distinctive luxury hotels owned by others principally on a fee basis. These contractual arrangements may include cash, loan or other investment, including key money, by Belmond in connection with renovating or converting a property to meet Belmond's

14

standards and to align Belmond's interest as an operator with the owner. Management agreements are desirable to the Company in that they would typically be a less-capital-intensive manner of facilitating entry into new markets for Belmond. As owner of many unique and luxury properties that Belmond operates itself, Belmond believes it is well positioned to manage comparable hotels for others.

• | Other strategic considerations -- In recent years, management executed on a strategy to reduce Belmond’s long-term debt position. A number of assets not considered key to Belmond’s portfolio of unique, high-valued properties were identified and sold with proceeds being used to reduce debt, re-invest in other properties, and more recently to repurchase the Company's class A common shares. In the last four years, Belmond sold its 50% ownership in the entity which owned Hotel Ritz by Belmond, Madrid, Spain, the Inn at Perry Cabin by Belmond in Maryland, and Belmond Northern Belle in England for combined total proceeds of $87,489,000, and removed any debt or guarantees related to these properties from its consolidated balance sheets. See Note 5 to the Financial Statements. Management continues to review Belmond's portfolio to identify additional non-core assets and expects that any future asset sales would be encumbered by long-term management agreements for Belmond. See Item 7—Management’s Discussion and Analysis of Financial Condition and Results of Operations. |

Marketing, Sales and Public Relations

Belmond invested $3,000,000 in enhanced promotional and marketing initiatives in 2017.

Belmond’s sales and marketing function is primarily based upon direct sales to consumers of travel (prioritizing strategic third-party travel agents, sales representatives and tour operators, and electronic channels such as the Internet and digital marketing), cross-selling to existing customers, and public relations. Belmond has its own global sales force located in 18 cities in the U.S., Brazil, Mexico, various European countries, Australia and Japan, and has appointed third-party sales representatives in ten additional cities in Asia and the Middle East. Belmond also has local sales staff responsible for the properties where they are based.

Belmond’s sales staff identify and train preferred travel industry and distribution partners, engage with group and corporate account representatives, and conduct marketing initiatives such as direct mailings, e-commerce, trade show participation and event sponsorship. Revenue is managed using sophisticated room rate and inventory tools. Belmond participates in a number of luxury travel partner programs, such as the “Fine Hotels & Resorts" and "Centurion Hotel Program", both operated by American Express, and the “Virtuoso” travel agent consortium. Belmond offers its top travel agents and other industry partners "by invitation only" participation in Belmond’s “Bellini Club” providing training courses, special commissions and sales support for all Belmond products worldwide.

Consumer advertising, websites and digital marketing are important direct sales and marketing tools for Belmond. Through its principal website (belmond.com), Belmond provides extensive descriptions and images of the products and guest activities in English and five other languages, in addition to bookings and brand wide promotions. The belmond.com website was fully rebuilt and re-branded in 2017, in anticipation of the launch of a global brand campaign and to support the business objective to increase bookings and revenues through online commerce. Belmond operates other Internet special interest travel portals that direct customers to Belmond’s properties, and works with other selected electronic distribution channels. Social media such as Facebook, Twitter, YouTube, Instagram and Pinterest are increasingly significant marketing tools, particularly as the brand looks to reach new markets and to target new customer demographics, including millennials.

Because repeat customers appreciate the consistent quality of Belmond’s hotels, trains and cruises, an important part of Belmond’s strategy is to promote Belmond properties through various cross-selling efforts to engage with Belmond's loyal customer base. These include gifts cards, customer relationship management systems and other customer recognition programs, worldwide preferred travel agent programs, and direct communications with customers. In 2018, the Company will continue to invest in business intelligence systems to further enhance the effectiveness of its marketing and communication strategy to ensure content is tailored, targeted and personalized in accordance with individual customer preferences.

Belmond’s marketing strategy also focuses on public relations, which management believes is a highly cost-effective marketing tool for luxury properties. Because of the unique nature of Belmond’s portfolio, guests often hear about Belmond’s hotels and other travel products through word-of-mouth or published articles. Belmond has an in-house public relations office in London and representatives in 11 countries worldwide, including third-party public relations firms under contract, to promote its properties through targeted newspapers, general interest and travel magazines, and broadcast, online and other media.

15

Corporate Social Responsibility

Belmond is committed to the implementation of responsible business practices furthering the sustainability of tourism and seeks to ensure that its properties and corporate offices engage with their local communities and environments in a positive manner through their ongoing activities. Examples of these are as follows:

• | Belmond has continued its association with the Sustainable Restaurant Association. The food and beverage operations of all of Belmond's properties will be assessed in 2018 to measure and benchmark their sustainability credentials. Belmond is the first global luxury hospitality brand to have undertaken this third party testing. This testing will continue to inform Belmond's minimum food sustainability, environmental responsibility and ethical sourcing standards during the coming year. |

• | In London, Belmond received a Certificate of Recognition from Mayor Sadiq Khan for its "exemplary contribution to volunteering" in the city's Team London awards. Activities in 2017 included volunteering with a local learning disabilities team, introducing a reading and math mentoring program for disadvantaged children, and taking part in several local community initiatives that contributed to the London corporate office's neighborhood being awarded a Britain in Bloom award. |

• | In the U.K., Belmond Manoir aux Quat'Saisons supports local community organizations, schools and an animal sanctuary. It is an active member of the Sustainable Restaurant Association and is committed to sourcing local food wherever possible, nuturing and expanding its organic gardens, composting waste, and caring for the environment by, among other things, collecting waste kitchen oils and fats and delivering them to a recyling plant to be converted into biofuel. |

• | In Myanmar, the ship doctor of Belmond Road to Mandalay has run community activities along the Ayeyarwady River in a program dating back to 1995. These include a free clinic that treats an average of 2,000 people per month, with plans to open a new operating theater to be staffed by a volunteer surgeon. Among other community activities are the construction and long-term support of 25 schools, and irrigation and solar power projects in remote villages. |

• | Our many diverse activities in southeast Asia include supporting a turtle conservation foundation, beach cleaning, and water purification and recycling programs in Bali, supporting an orphanage in Laos, and supporting a water conservation project involving dam construction in Koh Samui, Thailand. |

• | In Russia, Belmond Grand Hotel Europe works with local orphanages and youth organizations to support those in need. The hotel supports a house in the SOS children's village outside of St. Petersburg for young people without families, where five children aged between 12 and 15 years old are currently being cared for. The hotel has also introduced a greenhouse program to educate children in growing, and the importance of. fresh organic vegetables. |

• | In the U.S., Belmond Charleston Place created and coordinates the Charleston Chefs’ “Feed the Need” Program in which local hotels, restaurants and caterers provide weekly meals in food shelters for up to 500 persons. The hotel also introduced a "Teach the Need" program, teaching hospitality skills to at-risk high school students and helping them find employment. A new program, "Ben's Friends," helps those in the hospitality industry overcome drug- and alcohol-related problems. In addition, every Christmas, the hotel organizes a luncheon for 2,000 disadvantage local people, along with providing gifts such as winter coats. |

• | Also in the U.S., Belmond El Encanto is pursuing a number of community initiatives such as donating clothing, toys and other items to low-income families and local shelters. In addition, staff participate in charity races and volunteer as stewards. The hotel has sponsored disadvantaged children to travel to an island national park to learn about its ecosystem. The hotel's Sustainability Committee spearheads long-term environmental initiatives, which include water conservation through faucet aerators, laundry reduction, eco cleaning products and the introduction of moisture-resistant plants to its famous gardens. |

• | In Brazil, Belmond Copacabana Palace has continued to develop the sustainability and community programs it initiated in 2009 and the long-standing community programs it formalized in 2012. It now recycles more than 50% of its waste, uses 100% renewable energy, recycles 100% of its plastic bottles, donates retired linen and clothing to local charities, works with sustainable food and flower suppliers, and supports Solar Meninos de Luz, a local children's philanthropic organization. |

• | Also in Brazil, Belmond Hotel das Cataratas is committed to environmental conservation programs including Projeto Carnivoros do Iguaçu, which has overseen a substantial rise in numbers of endangered animals such as pumas and jaguars |

16

within the surrounding national park. The hotel also sponsors a local young people's training program offering youth apprenticeships and work placements for disadvantaged young people. The hotel is committed to environmental conservation and ecological operating programs and was the first South American hotel to be certified for ISO14001– Sustainability and SA8000–Social Responsibility.

• | Our Peru hotels and trains undertake a wide range of community and sustainability initiatives. These include support of local artisans and farmers who receive help to create products and grow crops that our Peru hotels and trains purchase at fair trade prices. Belmond Palacio Nazarenas has developed an edible herb garden, Belmond Hotel Rio Sagrado a small orchard, and Belmond Sanctuary Lodge a small greenhouse – all of which supply their kitchens. PeruRail supports community alpaca breeding and wool weaving projects and donates blankets to local communities. Additional community programs range from planting thousands of trees to clearing waste from riverbanks and beaches. Cultural initiatives include the provision of free train travel for disadvantaged children to Machu Picchu, community initiatives to improve safety along the train tracks, and a film-making program that records local people sharing local traditions and memories. One particular program, Cconamuro, helps train villagers in hospitality skills, enabling them to welcome our guests on cultural day visits that include lunch and the chance to discover aspects of local life. |