UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a‑6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to §240.14a‑12

(Name of Registrant as Specified In Its Charter)

Payment of Filing Fee (Check all boxes that apply):

☒ No fee required.

☐ Fee previously paid with preliminary materials.

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

IMPINJ, INC.

400 Fairview Avenue North, Suite 1200

Seattle, WA 98109

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held at 9:00 a.m. Pacific Time on June 6, 2024

TO THE HOLDERS OF COMMON STOCK OF IMPINJ, INC.:

Impinj, Inc., a Delaware corporation, will hold its annual meeting of stockholders virtually on June 6, 2024, 9:00 a.m. Pacific Time via live webcast. You can attend the annual meeting at https://web.lumiconnect.com/253024847. Because we are holding the meeting via the Internet, stockholders will only be able to attend the meeting virtually. We are holding the annual meeting for the following purposes, which are more fully described in the accompanying proxy statement:

1. To elect as directors the seven (7) nominees named in this proxy statement to serve until the 2025 annual meeting of stockholders or until their successors are duly elected and qualified;

2. To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2024;

3. To approve, on an advisory basis, the compensation of our named executive officers;

4. To approve an amendment to our amended and restated certificate of incorporation to limit the liability of certain officers as permitted by Delaware law; and

5. To transact such other business as may properly come before the meeting or any adjournments or postponements thereof.

The board of directors of Impinj, Inc. has fixed the close of business on April 17, 2024 as the record date for the annual meeting. Only stockholders of record of our common stock on April 17, 2024 are entitled to notice of, and to vote at, the meeting. Our proxy statement contains further information regarding voting rights and the matters to be voted upon.

We are mailing to our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access both the proxy statement and our annual report to stockholders. The Notice will also contain instructions on how to vote online or by telephone and how to receive a paper copy of the proxy materials by mail. Our proxy statement and our 2023 annual report to stockholders will be available at the following Internet address: http://www.astproxyportal.com/ast/20867.

YOUR VOTE IS IMPORTANT. Whether or not you plan to attend the annual meeting of stockholders, we urge you to submit your vote via the Internet, telephone or mail.

We appreciate your continued support of Impinj, Inc. and look forward to you joining our virtual meeting or receiving your proxy.

By order of the board of directors,

Chris Diorio, Ph.D.

Chief Executive Officer

Seattle, Washington

April 24, 2024

-2-

IMPINJ, INC.

400 Fairview Avenue North, Suite 1200

Seattle, WA 98109

PROXY STATEMENT

FOR 2024 ANNUAL MEETING OF STOCKHOLDERS

To Be Held at 9:00 a.m. Pacific Time on June 6, 2024

We are furnishing this proxy statement and the enclosed form of proxy in connection with a solicitation of proxies by our board of directors for use at our annual meeting of stockholders to be held on June 6, 2024, and any postponements, adjournments or continuations thereof (the “Annual Meeting”). We will hold the Annual Meeting virtually via live webcast on the Internet at https://web.lumiconnect.com/253024847 on June 6, 2024 at 9:00 a.m. Pacific Time.

We have elected to provide access to our proxy materials on the Internet. Accordingly, we are mailing a Notice of Internet Availability of Proxy Materials (the “Notice”) to our stockholders of record as of April 17, 2024, containing instructions on how to access both the proxy materials for our Annual Meeting and our annual report to stockholders. All stockholders will have the ability to access the proxy materials on the website referred to in the Notice, or to request a printed set of the proxy materials. You can find instructions on how to request a printed copy by mail in the below section entitled “The Proxy Process and Stockholder Voting Questions and Answers About This Proxy Material and Voting.” This information is largely about voting procedure. You should read this entire proxy statement carefully for additional information about proposals on which we encourage you to vote. On or about April 24, 2024, we will begin mailing the Notice to all stockholders entitled to vote at the Annual Meeting. Stockholders will be able to access our proxy materials over the Internet beginning on or about the same date. We intend to mail this proxy statement, together with the form of proxy, to those stockholders entitled to vote at the Annual Meeting who have properly requested copies of such materials by mail.

Information contained on, or that can be accessed through, our website is not intended to be incorporated by reference into this proxy statement and references to our website address in this proxy statement are inactive textual references only.

-1-

THE PROXY PROCESS AND STOCKHOLDER VOTING QUESTIONS AND ANSWERS

ABOUT THIS PROXY MATERIAL AND VOTING

What matters am I voting on?

You will be voting on:

How does the board of directors recommend I vote on these proposals?

The board of directors recommends a vote:

Who is entitled to vote?

Holders of our common stock as of the close of business on April 17, 2024, the record date, may vote at the Annual Meeting. As of the record date, we had 27,717,098 shares of common stock outstanding. In deciding all matters at the Annual Meeting, each stockholder will be entitled to one vote for each share of common stock held on the record date. We do not have cumulative voting rights for the election of directors.

Registered Stockholders. If your shares are registered directly in your name with our transfer agent, you are considered the stockholder of record with respect to those shares, and we provided the Notice to you directly. As the stockholder of record, you have the right to grant your voting proxy directly to the individuals listed on the proxy card or to vote in person at the Annual Meeting.

Street Name Stockholders. If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares held in street name, and the Notice was forwarded to you by your broker or nominee, who is considered the stockholder of record with respect to those shares.

-2-

As the beneficial owner, you have the right to direct your broker or nominee how to vote your shares. Beneficial owners are also invited to attend the Annual Meeting. However, since a beneficial owner is not the stockholder of record, you may not vote your shares directly at the Annual Meeting unless you follow your broker’s procedures for obtaining a legal proxy. If you request a printed copy of the proxy materials by mail, your broker or nominee will provide a voting instruction card for you to use.

After obtaining a valid legal proxy from your broker, bank or other agent, to then register to attend the Annual Meeting, you must submit proof of your legal proxy reflecting the number of your shares along with your name and email address to Equiniti Trust Company, LLC (“Equiniti”). Requests for registration should be directed to proxy@astfinancial.com. Written requests can be mailed to:

Equiniti Trust Company, LLC

55 Challenger Road, 2nd Floor

Ridgefield Park, New Jersey 07660

Requests for registration must be labeled as “Legal Proxy” and be received no later than 5:00 p.m., Eastern Time, on May 30, 2024.

You will receive a confirmation of your registration and 11-digit voter control number by email issued by Equiniti after we receive your registration materials. You may attend the Annual Meeting and vote your shares at https://web.lumiconnect.com/253024847 during the meeting. The passcode for the meeting is impinj2024. Follow the instructions provided to vote. We encourage you to access the meeting prior to the start time so that you have sufficient time to check in.

How do I vote?

You may vote by following the instructions set forth in the Notice or on your proxy card or, if you are a beneficial owner, by following the procedures provided by your broker or other nominee. You may access the Notice, our proxy materials and our 2023 annual report to stockholders at www.voteproxy.com.

Can I change my vote?

Yes. You can change your vote or revoke your proxy any time before the Annual Meeting by:

Attending the Annual Meeting will not cause your previously granted proxy to be revoked unless you specifically so request.

What is the effect of giving a proxy?

Proxies are solicited by and on behalf of our board of directors. Our board of directors has designated Chris Diorio and Yukio Morikubo as proxy holders. When you properly date, execute and return your proxy card, or properly register your votes online or by phone, the proxy holders will cast votes for your shares at the Annual Meeting as you instruct. If you do not give specific instructions, the proxy holders will vote your

-3-

shares in accordance with the recommendations of our board of directors, as described above. If any matters not described in this proxy statement are properly presented at the Annual Meeting, the proxy holders will use their own judgment to determine how to vote your shares. If the Annual Meeting is adjourned, the proxy holders can vote your shares on the new meeting date as well, unless you properly revoke your proxy instructions. See the section entitled “Can I change my vote?” above.

Why did I receive a notice regarding the availability of proxy materials on the Internet instead of a full set of proxy materials?

As permitted under the rules of the Securities and Exchange Commission (the “SEC”), we have elected to furnish our proxy materials, including this proxy statement and our annual report to stockholders, primarily via the Internet. On or about April 24, 2024, we will begin mailing to our stockholders the Notice that contains instructions on how to access our proxy materials on the Internet, how to vote at the meeting, and how to request printed copies of the proxy materials and annual report to stockholders. You may request to receive all future proxy materials in printed form by mail or electronically by e-mail by following the instructions contained in the Notice. We encourage you to take advantage of the proxy materials on the Internet to help reduce our costs and the environmental impact of our annual meetings.

Who will tabulate the votes?

The inspector of election appointed by our board of directors for the Annual Meeting is responsible for counting votes. The inspector of election will tabulate all votes as required by Delaware law, the state of our incorporation.

What is a quorum?

A quorum is the minimum number of shares required to be present at the Annual Meeting for the meeting to be properly held under our Amended and Restated Bylaws (the “Bylaws”) and Delaware law. The presence, in person or by proxy, of a majority of all issued and outstanding shares of common stock entitled to vote at the meeting will constitute a quorum at the meeting. The shares subject to a proxy that are not being voted on a particular proposal because of withholding, abstention or broker non-vote will count for purposes of determining the presence of a quorum.

How many votes are needed for approval of each matter?

-4-

How do we solicit proxies for the Annual Meeting?

The board of directors is soliciting proxies for use at the Annual Meeting. We will bear all expenses associated with this solicitation. We will reimburse brokers or other nominees for reasonable expenses that they incur in sending these proxy materials to you if a broker or other nominee holds your shares.

How may my brokerage firm or other intermediary vote my shares if I fail to provide timely directions?

If your broker holds your shares as your nominee (that is, in “street name”), you will need to follow the instructions your broker provides to instruct your broker on how to vote your shares. If you do not give instructions to your broker, your broker can vote your shares with respect to “routine” items, but not with respect to “non-routine” items. The ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2024 (Proposal No. 2) is considered routine under applicable rules. Since a broker or other nominee may generally vote on routine matters, no broker non-votes are expected to exist in connection with this proposal. All of our other proposals are considered non-routine under applicable rules. Absent direction from you, your broker will not have discretion to vote on non-routine matters and therefore there may be broker non-votes in connection with these proposals.

Is my vote confidential?

We handle proxy instructions, ballots, and voting tabulations that identify individual stockholders in a manner that protects your voting privacy. We will not disclose your vote either within Impinj, Inc. or to third parties, except as necessary to meet applicable legal requirements, to allow for the tabulation of votes and certification of such votes, or to facilitate a successful proxy solicitation.

Where can I find the voting results of the Annual Meeting?

We will announce preliminary voting results at the Annual Meeting. We will also disclose voting results on a Current Report on Form 8-K that we will file with the SEC within four business days after the Annual Meeting. If final voting results are not available to us in time to file a Current Report on Form 8-K, we will file a Current Report on Form 8-K to publish preliminary results and will provide the final results in an amendment to the Form 8-K as soon as they become available.

I share an address with another stockholder, and we received only one paper copy of the proxy materials. How may I obtain an additional copy of the proxy materials?

We have adopted a procedure called “householding,” which the SEC has approved. Under this procedure, we deliver a single copy of the Notice and, if applicable, the proxy materials to multiple stockholders who share the same address unless we received contrary instructions from one or more of the stockholders. This procedure reduces our printing costs, mailing costs and fees. Stockholders who participate

-5-

in householding will continue to be able to access and receive separate proxy cards. Upon written or oral request, we will deliver promptly a separate copy of the Notice and, if applicable, the proxy materials to any stockholder at a shared address to which we delivered a single copy of any of these documents. To receive a separate copy, or, if you are receiving multiple copies, to request that Impinj, Inc. only send a single copy, of the Notice and, if applicable, the proxy materials, you may contact us as follows:

Impinj, Inc.

Attention: Investor Relations

400 Fairview Avenue North, Suite 1200

Seattle, WA 98109

(206) 517-5300

Stockholders who hold shares in street name may contact their brokerage firm, bank, broker-dealer or other similar organization to request information about householding.

What is the deadline to propose actions for consideration at next year’s annual meeting of stockholders or to nominate individuals to serve as directors?

Stockholder Proposals

Stockholders may present proposals for inclusion in our proxy statement and for consideration at the next annual meeting of stockholders by submitting their proposals in writing to our corporate secretary in a timely manner.

For a stockholder proposal to be considered for inclusion in our proxy statement for our 2025 annual meeting of stockholders, our corporate secretary must receive the written proposal at our principal executive offices not later than December 25, 2024. In addition, stockholder proposals must comply with the requirements of Rule 14a-8 regarding the inclusion of stockholder proposals in company-sponsored proxy materials. Stockholders should address proposals to:

Impinj, Inc.

Attention: Corporate Secretary

400 Fairview Avenue North, Suite 1200

Seattle, WA 98109

(206) 517-5300

Our Bylaws also establish an advance notice procedure for stockholders who wish to present a proposal before an annual meeting but do not intend for the proposal to be included in our proxy statement. Our Bylaws provide that the only business that may be conducted at an annual meeting is business that is (1) specified in our proxy materials with respect to such meeting (or supplement thereto), (2) otherwise properly brought before the meeting by or at the direction of our board of directors, or any duly authorized committee of our board of directors, or (3) properly brought before the meeting by a stockholder of record entitled to vote at the annual meeting who has delivered timely written notice to our corporate secretary, which notice must contain the information specified in our Bylaws. To be timely for our 2025 annual meeting of stockholders, our corporate secretary must receive the written notice at our principal executive offices:

If we do not hold our Annual Meeting or if we hold our Annual Meeting more than 25 days from the one-year anniversary date of the 2023 annual meeting, we must receive a notice of a stockholder proposal that

-6-

is not intended to be included in our proxy statement no earlier than 5:00 p.m., Pacific time, on the 120th day before such annual meeting and no later than 5:00 p.m., Pacific time, on the later of the following two dates:

If, after complying with the provisions above, a stockholder, or such stockholder’s qualified representative, does not appear at the annual meeting to present the stockholder’s proposal, we are not required to present the proposal for a vote at the meeting.

Recommendation and Nomination of Director Candidates

Stockholders may recommend director candidates for consideration by our nominating and governance committee. Any such recommendations should include the nominee’s name and qualifications for membership on our board of directors and should be directed to the corporate secretary of Impinj, Inc. at the address set forth above. For additional information regarding stockholder recommendations of director candidates, see the section entitled “Board of Directors and Corporate Governance—Stockholder Recommendations for the Board of Directors.”

In addition, our Bylaws permit stockholders to nominate directors for election at an annual meeting of stockholders. To nominate a director, the stockholder must provide the information required by our Bylaws. In addition, the stockholder must give timely notice to our corporate secretary in accordance with our Bylaws, which, in general, require that our corporate secretary receive the notice within the time period described above under the section entitled “Stockholder Proposals” above for stockholder proposals that are not intended to be included in our proxy statement. Such notice must also comply with Rule 14a-19 under the Exchange Act. For the purposes of Rule 14a-19, the role of our board of directors is to ensure that a stockholder nominee is eligible to be included in our proxy card based on requirements specified in our Amended and Restated Certificate of Incorporation, our Bylaws and under applicable law, not to ensure such nominee’s suitability to serve on our board of directors.

Proxy Access

Under our Bylaws, a stockholder (or a group of not more than 20 stockholders) that has held at least 3% of our outstanding common stock continuously for at least three years may nominate and include in our proxy materials for our 2025 annual meeting (i) one director nominee if the number of directors to be elected at the annual meeting is seven or less, and (ii) if the number of directors to be elected at the annual meeting is greater than seven, director nominees constituting up to the greater of 20% of the board of directors or two directors, provided in each case that the requirements set forth in our Bylaws are satisfied. To use this “proxy

access” nomination process, among other things, the electing stockholder(s) and proposed nominee(s) must comply with the detailed requirements set forth in our Bylaws, including the provision of the proposing stockholder information, various other required information, representations, undertakings, agreements and other requirements as set forth in our Bylaws and as required by law. One such requirement is that the nomination(s) must be received in a timely manner between 120 days and 150 days prior to the first anniversary of the date our proxy statement was first sent to stockholders in connection with the last annual meeting, which for our proxy materials for the 2025 annual meeting would be no earlier than November 25, 2024 and no later than December 25, 2024.

-7-

Availability of Bylaws

You may obtain a copy of our Bylaws by accessing our filings on the SEC’s website at www.sec.gov. You may also contact our corporate secretary at our principal executive offices for a copy of the relevant bylaw provisions regarding the requirements for making stockholder proposals, nominating director candidates and obtaining proxy access.

Attending the Annual Meeting

The Annual Meeting will be held virtually on June 6, 2024 at 9:00 a.m. Pacific Time via live webcast on the Internet. You will be able to attend the Annual Meeting, vote and submit your questions during the meeting by visiting https://web.lumiconnect.com/253024847. In order to vote or submit a question during the Annual Meeting, you will need an 11-digit voter control number included on your Notice or proxy card with the passcode impinj2024. If you do not have an 11-digit voter control number issued by Equiniti, you will be able to listen to the meeting only by registering as a guest and you will not be able to vote or submit your questions during the meeting.

-8-

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Our board of directors currently comprises seven members. Five of our directors are independent within the meaning of the independent director guidelines of The Nasdaq Global Select Market (“Nasdaq”). Our amended and restated certificate of incorporation and Bylaws provide that the number of our directors shall be at least one and will be fixed by resolution of our board of directors. At the Annual Meeting, seven directors will be elected for a one-year term and until their respective successors are duly elected and qualified or until their earlier death, resignation or removal. There are no family relationships among any of our directors or executive officers.

The nominating and governance committee recommended all of the director nominees named in this proxy statement for election or reelection to our board of directors at the Annual Meeting. The following table sets forth the names and certain other information for each of the nominees for election as a director as of March 31, 2024.

|

Age |

Position |

Director Since |

Current Term Expires |

Expiration of Term For Which Nominated |

Nominees |

|

|

|

|

|

Daniel Gibson(2)(3) |

43 |

Director |

2018 |

2024 |

2025 |

Umesh Padval(1)(2) |

66 |

Director |

2020 |

2024 |

2025 |

Steve Sanghi(1)(3) |

68 |

Director and Chair |

2021 |

2024 |

2025 |

Cathal Phelan |

60 |

Director, Chief Innovation Officer |

2019 |

2024 |

2025 |

Meera Rao(1)(3) |

63 |

Director |

2022 |

2024 |

2025 |

Chris Diorio, Ph.D. |

62 |

Director, Chief Executive Officer and Vice Chair |

2000 |

2024 |

2025 |

Miron Washington(2) |

56 |

Director |

2023 |

2024 |

2025 |

——————————

(1) Member of the nominating and governance committee

(2) Member of the compensation committee

(3) Member of the audit and risk committee

Nominees for Director

Chris Diorio, Ph.D., one of our co-founders, has served as a member of our board of directors since April 2000, as chief executive officer since November 2014 and as vice chair since September 2013. Previously, he served as our chief strategy and technology officer from September 2013 to November 2014, chief technology officer from November 2006 to September 2013, chair from April 2000 to January 2013, vice president of engineering from 2004 to 2006 and as a consultant to us from April 2000 to June 2004. In addition, he is an affiliate professor of computer science and engineering at the University of Washington, a former director and chair of the RAIN Alliance, a director of the GS1 Innovation Board and EPCglobal Board of Governors and a former director of Bluegiga Technologies Ltd. Dr. Diorio received a B.A. in physics from Occidental College and an M.S. and Ph.D. in electrical engineering from the California Institute of Technology. We believe Dr. Diorio’s perspective, experience and institutional knowledge as our co-founder, vice chair and chief executive officer qualify him to serve as director.

Daniel Gibson is a founding partner of Sylebra Capital and has been a portfolio manager since June 2011 and chief investment officer since January 2018. Sylebra Capital is a California-based investment manager, with offices in Hong Kong and Cayman Islands, focused on the technology, media and telecom

-9-

industries globally. Prior to that, Mr. Gibson worked at Coatue Capital from 2008 to 2011 as a partner and analyst. From 2006 to 2008, he was an associate at Calera Capital, a private equity fund where he was based in Boston. He started his career with UBS Investment Bank in New York as a member of the media group. Mr. Gibson received his B.A. in economics from Amherst College. We believe Mr. Gibson’s financial and investment management expertise as well as extensive experience in the semiconductor and consumer industries qualify him to serve as a director.

Umesh Padval has served as a member of our board of directors since November 2020. Mr. Padval is a managing director at Thomvest Ventures, a venture capital firm with which he has been associated since February 2016. Prior to joining Thomvest, Mr. Padval was a partner at Bessemer Venture Partners. Mr. Padval serves as a board member for Bolster, Inc., Isovalent, Inc., Qwiet AI (f/k/a ShiftLeft, Inc.), and Avalanche Technology. Mr. Padval received a B.Tech. in engineering from Indian Institute of Technology, Bombay, a M.S. in engineering from Pennsylvania State University, and a M.S. in engineering from Stanford University. We believe Mr. Padval’s experience as a venture capital investor, including his service on the board of directors of multiple private and public companies, his past experience as chief executive officer of C-Cube Microsystems, as well as his extensive experience in technology and engineering, qualifies him to serve as a director.

Steve Sanghi has served as our chair since June 2022 and a member of our board of directors since March 2021. Mr. Sanghi has been executive chairman of Microchip Technology, Inc., or Microchip, a publicly listed semiconductor company, since March 2021. Mr. Sanghi has also served as Microchip’s chief executive officer and chairman from 1993 to March 2021 and as Microchip’s president and chief executive officer from 1991 to 1993. Prior to joining Microchip, Mr. Sanghi held management positions at Waferscale Integration, Inc. and Intel Corporation. He is also a former director of Mellanox Inc., Hittite Microwave, and Myomo Inc. Mr. Sanghi received a B.S. in Science, Electronics and Communication from Punjab University and a M.S. in Electrical and Computer Engineering at the University of Massachusetts. We believe Mr. Sanghi’s extensive management experience at a publicly listed semiconductor company qualifies him to serve as a director.

Cathal Phelan has served as a member of our board of directors since September 2019 and as our chief innovation officer since January 2023. Mr. Phelan previously had been the chief executive officer of RAPT Touch Inc., a privately held IP provider for optical multi-touch systems, from November 2014 until November 2019. Mr. Phelan founded his own consulting firm, Atticotti LLC, in April 2013, focusing on business strategies, IP management and systems/semiconductor design. From 2008 to 2013 he was the CTO at Cypress Semiconductor, responsible for architecture definitions, IP management and business strategies. From May 2006 to September 2008, he served as chief executive officer and president of Ubicom, Inc., a privately held provider of IP and CPUs for wireless network routers. Mr. Phelan previously held several positions at Cypress Semiconductor Corporation, or Cypress, from 1991 to 2006, including serving as Cypress’ executive vice president of the consumer and computations division; chief technical officer, executive vice president of data communications, and executive vice president of personal communications. Mr. Phelan started his career as a memory designer at Philips Research Laboratories in the Netherlands from 1985 to 1990. He is a former director of Touchstone Semiconductor, Inc., Virage Logic Corporation and AgigA Tech, Inc. Mr. Phelan graduated from the Engineering School of Trinity College at the University of Dublin in Ireland, where he received a B.A. in mathematics and a B.A.I. in electronic engineering in 1984 and subsequently a M.S.E.E. in micro-electronic engineering in 1985. We believe Mr. Phelan is qualified to serve as a director because of his technical expertise and extensive management and consulting experience.

Meera Rao has served as a member of our board of directors since February 2022. Ms. Rao has held several senior executive positions, most recently from January 2011 to March 2016 as Chief Financial Officer at Monolithic Power Systems, a leading company in high-performance analog solutions, and as Vice President of Finance from January 2009 to December 2010. Prior to Monolithic Power Systems, Ms. Rao has

-10-

held various executive roles at leading technology companies, including Integration Associates Inc. from 2004 to 2006, Atrica from 2002 to 2003, Raza Foundries from 2000 to 2002, NVIDIA February 1998 to May 1999 and AMD from 1988 to 1998. Ms. Rao is also a director for Rambus, an industry-leading chip manufacturer, since August 2019 and currently serves as the chair of the Audit Committee and a member of the Cyber Risk Committee. Ms. Rao is a certified public accountant (inactive status) and holds a master’s degree in business administration from the University of Rochester in New York. We believe Ms. Rao is qualified to serve as a director because of her extensive executive and financial experience and her familiarity with the semiconductor industry.

Miron Washington has served as a member of our board of directors since March 2023. Mr. Washington has served as the Chief Digital Officer at Parts Town, a commercial OEM replacement parts manufacturing company, since November 2022. Prior to joining Parts Town, Mr. Washington served as Vice President, Customer Experience at Home Depot from May 2019 to November 2022. Prior to joining Home Depot, Mr. Washington served as a Senior Vice President, Digital Commerce/Product Management at Monotype Imaging, a digital typesetting and typeface design company, from September 2017 to May 2019. Mr. Washington has also held senior leadership positions at Amazon, Staples, and Hewlett-Packard. Mr. Washington has served on many non-profit boards and currently serves on two advisory boards. Mr. Washington holds a bachelor’s degree in Accounting from the Leavy School of Business at Santa Clara University and an MST from Oregon Health & Science University (OGI Campus). Mr. Washington has also completed the Black Corporate Board Readiness program at Santa Clara University. We believe Mr. Washington is qualified to serve as director because of his broad expertise in business digitization and transformation, retail and supply-chain operations.

Vote Required

Director nominees will be elected by the affirmative vote of the majority of the votes cast at the meeting, meaning that the number of shares voted “For” a nominee must exceed the number of shares voted “Against” such nominee. If any incumbent nominee receives a greater number of votes “Against” his or her election than votes “For” such election, our corporate governance guidelines require that such incumbent nominee promptly tender his or her resignation promptly following certification of the applicable stockholder vote; our board of directors, acting through certain qualified independent directors, will then decide whether to accept or reject the resignation, or whether other action should be taken, and we will publicly disclose the board’s decision within 90 days of the certification of the election results. Any shares not voted “For” or “Against” a particular nominee (whether as a result of an abstention or a broker non-vote) are not considered “votes cast” and therefore have no effect on the election of director nominees.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR”

EACH OF THE NOMINEES NAMED ABOVE.

-11-

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

Director Independence

Our common stock is listed on Nasdaq. Under the rules of Nasdaq (the “Nasdaq Rules”), independent directors must comprise a majority of a listed company’s board of directors. In addition, the Nasdaq Rules require that, subject to specified exceptions, each member of a listed company’s audit, compensation and nominating and governance committees must be independent. Audit committee members must also satisfy the independence criteria set forth in Rule 10A-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Under the Nasdaq Rules, a director will only qualify as an “independent director” if, in the opinion of that company’s board of directors, that person does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

To be considered independent for purposes of Rule 10A-3, a member of an audit committee of a listed company may not, other than in his or her capacity as a member of the audit committee, the board of directors or any other board committee: (1) accept, directly or indirectly, any consulting, advisory or other compensatory fee from the listed company or any of its subsidiaries or (2) be an affiliated person of the listed company or any of its subsidiaries.

Our board of directors has reviewed its composition, the composition of its committees and the independence of directors and considered whether any director has a material relationship with us that could compromise his or her ability to exercise independent judgment in carrying out his or her responsibilities. Based upon information requested from and provided by each director concerning his or her background, employment and affiliations, including family relationships, our board of directors has determined that, other than Dr. Diorio and Mr. Phelan, none of our current directors or director nominees, has any relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and that each of these directors is “independent” as that term is defined under the Nasdaq Rules.

Our board of directors has also determined that Messrs. Gibson and Sanghi and Ms. Rao, who comprise our audit and risk committee; Messrs. Washington, Padval and Gibson, who comprise our compensation committee; and Messrs. Sanghi and Padval and Ms. Rao, who comprise our nominating and governance committee, satisfy the independence standards for those committees established by applicable SEC rules and the Nasdaq Rules.

In making this determination, our board of directors considered the relationships that each non-employee director has with us and all other facts and circumstances it deemed relevant in determining their independence, including the beneficial ownership of our capital stock by each non-employee director.

Board Diversity Matrix as of March 31, 2024

Board size: |

|

Total number of directors |

7 |

Gender: |

Male |

Female |

Non-Binary |

Gender Undisclosed |

Number of directors based on gender identity |

6 |

1 |

- |

- |

Number of directors who identify in any of the categories below: |

||||

African American or Black |

1 |

- |

- |

- |

Alaskan Native of American Indian |

- |

- |

- |

- |

Asian |

2 |

1 |

- |

- |

Hispanic or Latino |

- |

- |

- |

- |

Native Hawaiian or Pacific Islander |

- |

- |

- |

- |

White |

3 |

- |

- |

- |

-12-

Gender: |

Male |

Female |

Non-Binary |

Gender Undisclosed |

Two or More Races or Ethnicities |

- |

- |

- |

- |

LGBTQ+ |

- |

|||

Undisclosed |

- |

|||

Board Leadership Structure

Mr. Sanghi serves as the chair of the board of directors and Dr. Diorio serves as our chief executive officer. The roles of chief executive officer and chair of the board of directors are currently separated in recognition of the differences between the two roles. We believe that it is in the best interests of our stockholders for the board of directors to determine whether to separate or combine these roles each time it elects a new chair or appoints a chief executive officer, based on the relevant facts and circumstances applicable at the time. Our board of directors has determined that its structure is appropriate to fulfill its duties effectively and efficiently, so that our chief executive officer can focus on leading our company, while the chair can focus on leading the board of directors in overseeing management.

Risk Management

The role of our board of directors, and its committees, in risk management is consistent with our leadership structure, with our chief executive officer and senior management assessing and managing our risk exposure and our board of directors and its committees providing oversight in connection with those efforts. We believe this division of responsibilities facilitates effective oversight and management of the key risks that we face.

Our board of directors exercises its oversight responsibilities both directly and through its committees, as described below:

Board Meetings and Committees

During the year ended December 31, 2023, the board of directors held six meetings (including regularly scheduled and special meetings) and no incumbent director attended fewer than 75% of the total number of meetings of the board of directors and the committees of which he or she was a member.

Although we do not have a formal policy regarding attendance by members of our board of directors at the annual meetings of stockholders, we encourage, but do not require, directors to attend. Mr. Padval, Dr. Diorio and Ms. Rao attended our 2023 annual meeting of the stockholders on behalf of our board of directors.

Our board of directors has an audit and risk committee, a compensation committee and a nominating and governance committee, each of which has the composition and the responsibilities described below.

-13-

Audit and Risk Committee

The members of our audit and risk committee are Meera Rao, Daniel Gibson and Steve Sanghi, each of whom is a non-employee member of our board of directors. Ms. Rao is the chair of our audit and risk committee. Each of Ms. Rao and Mr. Gibson qualify as an “audit committee financial expert,” as that term is defined under the SEC rules implementing Section 407 of the Sarbanes-Oxley Act of 2002, and possesses financial sophistication, as defined under the Nasdaq Rules.

Our audit and risk committee oversees our corporate accounting and financial reporting process and assists our board of directors in monitoring our financial systems. Our audit and risk committee also:

The audit and risk committee held six meetings in 2023. The audit and risk committee was established in accordance with Section 3(a)(58)(A) of the Exchange Act and operates under a written charter that satisfies the applicable standards of the SEC and Nasdaq. A copy of the audit and risk committee charter is available on our website at http://corporate-governance.impinj.com.

Compensation Committee

The members of our compensation committee are Umesh Padval, Daniel Gibson and Miron Washington. Mr. Padval is the chair of our compensation committee. Each member of the compensation committee is also a non-employee director, as defined pursuant to Rule 16b-3 promulgated under the Exchange Act.

Our compensation committee oversees our compensation policies, plans and benefits programs. Our compensation committee also:

-14-

The compensation committee met three times in 2023. The compensation committee operates under a written charter that satisfies the applicable standards of the SEC and Nasdaq. A copy of the compensation committee charter is available on our website at http://corporate-governance.impinj.com. Pursuant to its charter, the compensation committee may form subcommittees and delegate to such subcommittees any power and authority the compensation committee deems appropriate, except for any power or authority required by law, regulation or listing standard to be exercised by the compensation committee as a whole.

Nominating and Governance Committee

The members of our nominating and governance committee are Steve Sanghi, Umesh Padval and Meera Rao. Mr. Sanghi is the chair of our nominating and governance committee.

Our nominating and governance committee oversees and assists our board of directors in reviewing and recommending nominees for election as directors. Our nominating and governance committee also:

The nominating and governance committee met two times in 2023. The nominating and governance committee operates under a written charter that satisfies the applicable standards of the SEC and Nasdaq. A copy of the nominating and governance committee charter is available on our website at http://corporate-governance.impinj.com.

-15-

Our board of directors may from time to time establish other committees.

Considerations in Evaluating Director Nominees

The nominating and governance committee considers various factors in identifying and evaluating candidates for director roles. The nominating and governance committee considers the current size and composition of the board of directors and the board’s and its committees’ needs. Some of the qualifications that the nominating and governance committee considers include, without limitation, a candidate’s character, integrity, judgment, diversity, age, independence, skills, education, expertise, business experience and acumen, length of service, understanding of our business, and their other commitments. There are no stated minimum criteria for director nominees.

The board of directors also believes that the board should be a diverse body. In evaluating candidates for director nominations, the nominating and governance committee considers all aspects of each candidate’s qualifications and competencies in light of our needs, with a view towards creating a board of directors with diverse experiences and perspectives, including diversity with respect to race, gender, geography and areas of expertise. As stated in our corporate governance guidelines, the nominating and governance committee includes, and has any search firm that it engages include, highly qualified women and minority candidates in the pool from which director nominees are selected.

Stockholder Recommendations for the Board of Directors

Our nominating and governance committee will evaluate stockholder recommendations for director roles in accordance with its charter, our Bylaws and under applicable law. Eligible stockholders wishing to recommend a candidate for nomination should contact our corporate secretary in writing. Such recommendations must include information about the candidate, a statement of support by the recommending stockholder, evidence of the recommending stockholder’s ownership of our stock, and a signed letter from the candidate confirming willingness to serve on our board of directors.

Stockholder Communications with the Board of Directors

Stockholders wishing to communicate with a non-management member of the board of directors may do so by writing to such director, and mailing the correspondence to:

Impinj, Inc.

Attention: Corporate Secretary

400 Fairview Avenue North, Suite 1200

Seattle, WA 98109

All such stockholder communications will be forwarded to the appropriate board committee, or if none is specified, to the chairperson of the board of directors.

Corporate Governance Guidelines and Code of Business Conduct and Ethics

Our board of directors has adopted corporate governance guidelines. These guidelines address, among other items, the responsibilities of our directors, the structure and composition of our board of directors and corporate governance policies and standards applicable to us in general. In addition, our board of directors has adopted a code of business conduct and ethics that applies to all of our employees, officers and directors, including our chief executive officer, chief financial officer and other executive and senior financial officers. The full text of our corporate governance guidelines and code of business conduct and ethics is posted on the Corporate Governance portion of our website at http://corporate-governance.impinj.com. We will disclose within four business days any substantive changes in or waivers of

-16-

the Code of Conduct granted to our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, by posting such information on our website rather than by filing a Form 8-K.

Compensation Committee Interlocks and Insider Participation

During 2023, Umesh Padval, Daniel Gibson, Miron Washington (beginning June 2023) and Gregory Sessler (until June 2023) served on our compensation committee. Dr. Diorio participated in compensation committee deliberations concerning executive officer compensation other than his own. No compensation committee member was or is a company officer or employee. No executive officer currently serves, or in the past year has served, as a member of the board of directors or compensation committee (or other board committee performing equivalent functions or, if no such committee exists, the entire board of directors) of any entity that has one or more executive officers serving on our board of directors or compensation committee.

Director Compensation

The following table sets forth information concerning compensation paid or accrued for services rendered to us by board members for the year ended December 31, 2023. The table excludes Dr. Diorio, our co-founder, vice-chair, chief executive officer and director, and Mr. Phelan, our chief innovation officer and director. Neither Dr. Diorio nor Mr. Phelan received any compensation in their role as a director for the year ended December 31, 2023.

2023 Director Compensation Table

Name |

Fees Earned or Paid in Cash ($)(1) |

Stock Awards ($)(2) |

Total ($) |

Gregory Sessler(3) |

31,363 |

- |

31,363 |

Daniel Gibson(4) |

66,401 |

184,640 |

251,041 |

Umesh Padval(5) |

71,875 |

184,640 |

256,515 |

Steve Sanghi(6) |

92,000 |

207,707 |

299,707 |

Meera Rao(7) |

74,630 |

184,640 |

259,270 |

Miron Washington(8) |

43,104 |

230,988 |

274,092 |

(1) Includes an annual retainer fee and a committee fee or chairperson fee, as applicable, earned quarterly.

(2) Represents the aggregate grant-date fair value of stock awards granted in 2023. We have computed these amounts in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”), Topic 718. For a discussion of valuation assumptions, see note 8 to our consolidated financial statements included in our annual report on Form 10-K for the year ended December 31, 2023.

(3) Mr. Sessler ceased to be a member of our board of directors effective June 8, 2023. As of December 31, 2023, Mr. Sessler held no outstanding equity awards.

(4) As of December 31, 2023, Mr. Gibson held restricted stock units for the settlement of 1,729 shares of common stock, of which no shares were vested as of such date.

(5) As of December 31, 2023, Mr. Padval held restricted stock units for the settlement of 1,729 shares of common stock, of which no shares were vested as of such date.

(6) As of December 31, 2023, Mr. Sanghi held restricted stock units for the settlement of 1,945 shares of common stock, of which no shares were vested as of such date.

(7) As of December 31, 2023, Ms. Rao held restricted stock units for the settlement of 1,729 shares of common stock, of which no shares were vested as of such date.

(8) As of December 31, 2023, Mr. Washington held restricted stock units for the settlement of 2,071 shares of common stock, of which no shares were vested as of such date.

-17-

Outside Director Compensation Policy

Our outside director compensation policy is administered by our board of directors, with recommendations provided by its compensation committee. We offer cash and stock-based compensation to attract and retain qualified outside candidates to serve on our board of directors.

Our board of directors, in conjunction with its compensation committee, periodically reviews the type and form of compensation paid to our outside directors to assess the competitiveness of our outside director compensation program is competitive and provides compensation that is appropriate for retaining and attracting qualified directors. Our board of directors also engages Compensia, a national executive compensation consulting firm, as an external advisor to review and recommend changes to the compensation paid to our outside directors. Any changes in compensation are ratified by the board of directors.

Effective April 2, 2023, we previously amended our outside director compensation policy to update the cash compensation payable to our outside directors. We further amended our outside director compensation policy to update the cash compensation payable to our outside directors, effective March 31, 2024. The table below summarizes the cash amounts payable to our directors, on an annualized basis, under our outside director compensation policy, both before and after the effectiveness of such amendments:

|

|

Prior to April 2, 2023 |

|

From April 2, 2023 and prior to March 31, 2024 |

|

From and after March 31, 2024 |

|

|

|

|

Amount ($) |

|

|

Board of Directors: |

|

|

|

|

|

|

Member |

|

40,000 |

|

50,000 |

|

50,000 |

Chair |

|

17,500 |

|

25,000 |

|

25,000 |

Audit and Risk Committee: |

|

|

|

|

|

|

Member |

|

8,000 |

|

12,500 |

|

12,500 |

Chair |

|

16,000 |

|

25,000 |

|

25,000 |

Compensation Committee: |

|

|

|

|

|

|

Member |

|

5,000 |

|

10,000 |

|

10,000 |

Chair |

|

10,000 |

|

17,500 |

|

17,500 |

Nominating and Governance Committee: |

|

|

|

|

|

|

Member |

|

5,000 |

|

10,000 |

|

10,000 |

Chair |

|

10,000 |

|

10,000 |

|

15,000 |

All cash payments to outside directors are paid quarterly in arrears on a pro-rated basis.

Our outside director compensation policy also provides for the following equity compensation to our outside directors, subject to any limits in our 2016 Equity Incentive Plan (the “2016 Plan”):

-18-

Our outside director compensation policy was amended effective April 2, 2023 and March 31, 2024 to update the value of the equity compensation payable to out directors. The table below summarizes the value of the equity awards issuable under our outside director compensation policy, both before and after the effectiveness of such amendments:

|

|

Prior to April 2, 2023 |

|

From April 2, 2023 and prior to March 31, 2024 |

|

From and after March 31, 2024 |

|

|

Amount ($) |

||||

Initial award value |

|

175,000 |

|

200,000 |

|

250,000 |

Annual award value |

|

175,000 |

|

200,000 |

|

250,000 |

Annual chair award value |

|

17,500 |

|

25,000 |

|

25,000 |

Each initial, annual or board chair annual award described above, referred to in this proxy statement as an outside director award, vests upon the earlier of (i) the one-year anniversary of the date such award was granted and (ii) the date of the next annual meeting following the grant date, in each case, subject to the director’s continuing to be a service provider; however, in the event of a Change in Control (as defined in the 2016 Plan), all outside director awards shall vest in full.

As used above, “per share value” generally means the average trading price for a share of our common stock over the period beginning on the date that is 10 trading days prior to our announcement of quarterly earnings for the fiscal quarter immediately prior to the grant date of an award, and ending on the date that is 9 trading days after the earnings announcement.

Outside directors may be permitted to defer the settlement of an outside director award subject to the terms of our outside director compensation policy.

The 2016 Plan provides that in any given year, an outside director may not receive awards having a grant date fair value greater than $500,000, as determined under GAAP. This maximum limit does not reflect the intended size of any potential grants or a commitment to make grants in the future.

Outside directors may not sell, pledge, assign, hypothecate, transfer or dispose of in any manner other than by will or by the laws of descent or distribution, shares of our common stock received in an outside director award while the outside director continues to serve as a director, other than in order to pay for any tax obligations arising from the vesting and/or settlement of such award.

We also reimburse our outside directors for reasonable, customary and documented travel expenses incurred in connection with attending board of directors and committee meetings.

-19-

Non-Employee Director Stock Ownership Guidelines

Non-employee directors are subject to our stock ownership guidelines, which are intended to align their interests with those of our stockholders. Under the guidelines, our non-employee directors must maintain ownership of our common stock expressed as a lesser of (i) a multiple of five times the annual cash board retainer or (ii) 2,000 shares of our common stock. There is no required time period within which a non-employee director must attain the applicable stock ownership level. However, until the stock ownership level is achieved, our non-employee directors must retain 100% of the net profit shares by the later of February 16, 2028 and the fifth anniversary of the director’s initial appointment to the board of directors. Shares owned directly or jointly with a spouse, shares equal to the number of vested deferred stock units, shares credited to a 401(k) plan account, and shares held in trust are counted toward the guidelines. Pledged shares and unvested and unearned shares of restricted stock, restricted stock units, performance shares and shares subject to stock options (whether or not vested) do not count towards the stock ownership level.

-20-

PROPOSAL NO. 2

RATIFICATION OF APPOINTMENT OF INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM

The audit and risk committee of the board of directors has appointed Ernst & Young LLP (“EY”) as our independent registered public accounting firm to perform the audit of our financial statements for the year ending December 31, 2024. EY began serving as our independent registered public accounting firm for the audit of our financial statements for the year ended December 31, 2020.

Notwithstanding EY’s selection as our independent registered public accounting firm for the year ending December 31, 2024, our audit and risk committee, in its discretion, may appoint another independent registered public accounting firm at any time during the year if the audit and risk committee believes that such a change would be in the best interests of Impinj, Inc. and its stockholders. At the Annual Meeting, the stockholders are being asked to ratify the appointment of EY as our independent registered public accounting firm for the year ending December 31, 2024. Our audit and risk committee is submitting the selection of EY to our stockholders because we value our stockholders’ views on our independent registered public accounting firm and as a matter of good corporate governance. Representatives of EY will be present at the Annual Meeting, and they will have an opportunity to make statements and will be available to respond to appropriate questions from stockholders.

If the stockholders do not ratify the appointment of EY, the board of directors may reconsider the appointment.

Fees Paid to our Independent Registered Public Accounting Firm

The following table summarizes the fees billed by our independent registered public accounting firms for the fiscal years ended December 31, 2023 and 2022, inclusive of out-of-pocket expenses. All fees described below were pre-approved by the audit and risk committee.

|

Year Ended December 31, |

|

Fee Category |

2023 |

2022 |

Audit fees(1) |

$1,653,436 |

$1,145,943 |

Audit-related fees(2) |

- |

- |

Tax fees(3) |

- |

- |

All other fees(4) |

$1,803 |

$1,803 |

Total fees |

$1,655,239 |

$1,147,746 |

(1) Audit fees consist of fees for professional services provided in connection with the audit of our annual consolidated financial statements, review of our quarterly consolidated financial statements and audit services provided in connection with other statutory and regulatory filings.

(2) Audit-related fees consist of fees for professional services for assurance and related services that are reasonably related to the performance of the audit or review of our consolidated financial statements and are not reported under “Audit fees.” We did not incur any audit-related fees during 2023 or 2022.

(3) Tax fees consist of fees for professional services for tax compliance, tax advice and tax planning.

(4) All other fees include any fees billed that are not audit or audit related. In 2023 and 2022, these fees consisted of fees for an accounting and financial reporting research tool.

Auditor Independence

In 2023, there were no other professional services provided by EY that would have required the audit and risk committee to consider their compatibility with maintaining the independence of EY.

-21-

Policy on Audit and Risk Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Registered Public Accounting Firm

Pursuant to its charter, the audit and risk committee must review and approve, in advance, the scope and plans for the audits and the audit fees and approve in advance (or, where permitted under the rules and regulations of the SEC, subsequently) all non-audit services to be performed by the independent auditor that are not otherwise prohibited by law and any associated fees. The audit and risk committee may delegate to one or more members of the committee the authority to pre-approve audit and permissible non-audit services, as long as this pre-approval is presented to the full committee at scheduled meetings. In accordance with the foregoing, the committee has delegated to the chair of the audit and risk committee the authority to pre-approve services to be performed by our independent registered public accounting firm and associated fees, provided that the chair is required to report any decision to pre-approve such audit-related or non-audit services and fees to the full audit and risk committee for ratification at its next regular meeting.

Vote Required

The ratification of the appointment of EY must receive the affirmative vote of a majority of the shares present in person or by proxy at the Annual Meeting and entitled to vote thereon. Abstentions are considered votes cast and thus have the same effect as a vote “Against” the proposal. Broker non-votes, if any, will have no impact on this proposal.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR”

THE RATIFICATION OF THE APPOINTMENT OF ERNST & YOUNG LLP.

-22-

PROPOSAL NO. 3

ADVISORY VOTE ON COMPENSATION OF NAMED

EXECUTIVE OFFICERS (“SAY-ON-PAY”)

At our 2022 annual meeting of stockholders, our board of directors recommended, and our stockholders approved, holding an advisory vote on the compensation of our named executive officers every year. Accordingly, pursuant to Section 14A of the Exchange Act and in accordance with SEC rules, we are providing our stockholders with the opportunity to vote at the Annual Meeting on this advisory or non-binding proposal regarding the compensation of our named executive officers (commonly referred to as “say-on-pay”).

This say-on-pay proposal gives our stockholders the opportunity to express their overall views on how we compensate our named executive officers. This vote is not intended to address any specific item of compensation or any specific named executive officer, but rather the overall compensation of our named executive officers and the philosophy, policies and practices described in this proxy statement. Because the vote on this proposal is advisory in nature, it will not affect any compensation already paid or awarded to our named executive officers and will not be binding on us, the board of directors or the compensation committee. The say-on-pay vote will, however, provide information to us regarding investor sentiment about our executive compensation philosophy, policies and practices, which the compensation committee will be able to consider when determining executive compensation for the remainder of the current fiscal year and beyond. Our board of directors and our compensation committee value the opinions of our stockholders. To the extent there is any significant vote against the compensation of our named executive officers as disclosed in this proxy statement, we will endeavor to better understand the concerns that influenced the vote, and our compensation committee will evaluate whether any actions are necessary to address those concerns.

For more information about our named executive officer compensation during the fiscal year ended December 31, 2023, please refer to the “Executive Compensation” section of this proxy statement. We believe that our executive compensation program was designed appropriately and is working to ensure management’s interests are aligned with our stockholders’ interests to support long-term stockholder value creation.

We ask our stockholders to approve, on an advisory basis, the compensation of our named executive officers as described in this proxy statement by voting in favor of the following resolution:

“RESOLVED, that the stockholders of Impinj, Inc. approve, on an advisory basis, the compensation of Impinj, Inc.’s named executive officers, as disclosed in the Impinj, Inc.’s proxy statement for the 2024 annual meeting of stockholders pursuant to the executive compensation disclosure rules of the Securities and Exchange Commission, including the Compensation Discussion and Analysis, the compensation tables, and related narrative disclosures.”

Vote Required

The approval, on an advisory or non-binding basis, of our named executive officer compensation must receive the affirmative vote of a majority of the shares present in person or by proxy at the Annual Meeting and entitled to vote thereon. Abstentions are considered votes cast and thus have the same effect as a vote “Against” the proposal. Broker non-votes, if any, will have no impact on this proposal.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR”

THE SAY-ON-PAY APPROVAL OF THE NAMED EXECUTIVE OFFICER COMPENSATION.

-23-

PROPOSAL NO. 4

AMENDMENT TO OUR AMENDED AND RESTATED CERTIFICATE OF INCORPORATION TO LIMIT THE LIABILITY OF CERTAIN OFFICERS AS PERMITTED BY DELAWARE LAW

On April 2, 2024, our board of directors voted to approve, and to recommend that our stockholders approve, an amendment to our certificate of incorporation to provide for the elimination of monetary liability of certain officers of the company in certain limited circumstances, as permitted by Delaware law. The proposed certificate of amendment to our amended and restated certificate of incorporation, which would implement this proposal, is attached to this proxy statement as Annex A.

Background and Rationale for Officer Exculpation

Pursuant to, and consistent with, Section 102(b)(7) of the General Corporation Law of the State of Delaware (the “DGCL”), our amended and restated certificate of incorporation already eliminates the monetary liability of directors for breach of fiduciary duty as a director to the fullest extent permitted by Delaware law. Effective August 1, 2022, Section 102(b)(7) of the DGCL was amended to permit Delaware corporations to exculpate certain officers for breaches of the fiduciary duty of care for direct claims. Like the corresponding provisions limiting the liability of directors, Section 102(b)(7) does not permit eliminating liability of officers for any breach of the duty of loyalty to the corporation or its stockholders, any acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of the law, or any transaction from which the officer derived an improper personal benefit. Section 102(b)(7) also does not permit limiting the liability of officers in any derivative action (brought by or in the right of the company).

Officer exculpation would mitigate the risk to our officers of personal financial ruin due to an unintentional misstep—which is important for attracting and retaining talent—while not negatively impacting stockholder rights. Taking into account the narrow class and type of claims for which officers’ liability would be exculpated, and the benefits the nominating and governance committee believes would provide to the company and its stockholders in the form of an enhanced ability to attract and retain talented officers, the nominating and governance committee recommended to our board of directors an amendment to the certificate of incorporation to provide such exculpation to the extent permitted by Delaware law. Based on this recommendation, the board of directors believes that it is in the best interests of the company and our stockholders to amend the certificate of incorporation as described here.

Proposed Amendment to Our Certificate of Incorporation

To implement these officer exculpation provisions, we must amend Article VIII of our certificate of incorporation. If the amendment is approved by our stockholders, we intend to file a certificate of amendment, in the form attached as Annex A to this proxy statement, with the Secretary of State of the State of Delaware as soon as practicable after the Annual Meeting, at which time the new amendment will become effective.

The foregoing description of the amendments to our amended and restated certificate of incorporation are qualified in their entirety by, and you should read them in conjunction with, the full text of the proposed certificate of amendment, which is attached to this proxy statement as Annex A.

Vote Required

The affirmative “FOR” vote of a majority of the voting power of the shares outstanding as of the record date for the Annual Meeting is required to approve this amendment to our certificate of incorporation. You may vote “FOR,” “AGAINST,” or “ABSTAIN” on this proposal. Abstentions and broker non-votes will have the same effect as a vote against the proposal.

-24-

Vote Recommendation

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR”

THE AMENDMENT OF OUR CERTIFICATE OF INCORPORATION TO LIMIT THE LIABILITY OF OFFICERS AS PERMITTED BY LAW

-25-

REPORT OF THE AUDIT AND RISK COMMITTEE

The board's audit and risk committee currently comprises three independent directors as required by the Nasdaq Rules and the SEC's rules and regulations. The audit and risk committee operates under a written charter adopted by the board of directors. This written charter is reviewed annually for any appropriate changes.

The audit and risk committee members are currently Meera Rao (chair), Daniel Gibson and Steve Sanghi. Each member of the audit and risk committee is an “independent director” as currently defined in Rules 5605(c)(2)(A)(i) and (ii) of the Nasdaq Rules and Rule 10A-3 of the Exchange Act. The board of directors has also determined that Ms. Rao and Mr. Gibson are each an “audit committee financial expert” as described in applicable SEC rules and regulations.

The audit and risk committee appoints an accounting firm as our independent registered public accounting firm. The independent registered public accounting firm is responsible for performing an independent audit of our financial statements in accordance with generally accepted auditing standards and issuing a report thereon. Management is responsible for our internal controls and the financial reporting process. The audit and risk committee is responsible for monitoring and overseeing these processes.

The audit and risk committee held six meetings during 2023. The meetings were designed to provide information to the audit and risk committee necessary for it to conduct its oversight function of the external financial reporting activities and audit process of our company, and to facilitate and encourage communication between the audit and risk committee, management and our independent registered public accounting firm for fiscal year 2023, Ernst & Young, LLP. Management represented to the audit and risk committee that our financial statements were prepared in accordance with generally accepted accounting principles. The audit and risk committee reviewed and discussed the audited financial statements for fiscal year 2023 with management and the independent registered public accounting firm. The audit and risk committee also instructed the independent registered public accounting firm that the audit and risk committee expects to be advised if there are any subjects that require special attention.

The audit and risk committee discussed with the independent registered public accounting firm the matters required to be discussed by the independent registered accounting firm with the audit and risk committee under the applicable requirements of the Public Company Accounting Oversight Board (“PCAOB”) and the SEC.

The audit and risk committee has also received the written disclosures and the letter from the independent registered public accounting firm, Ernst & Young, LLP, required by applicable requirements of the PCAOB regarding the independent registered public accounting firm’s communications with the audit and risk committee concerning independence, and has discussed with Ernst & Young, LLP that firm’s independence.

Based on its review of the audited financial statements and the various discussions noted above, the audit and risk committee recommended to the board of directors that the audited financial statements be included in our annual report on Form 10-K for the fiscal year ended December 31, 2023 for filing with the SEC.

The audit and risk committee of the board of directors of Impinj, Inc.:

Meera Rao (Chair)

Daniel Gibson

Steve Sanghi

-26-

This audit and risk committee report shall not be deemed to be “soliciting material” or to be “filed” with the SEC or subject to Regulation 14A promulgated by the SEC or to the liabilities of Section 18 of the Exchange Act, and shall not be deemed incorporated by reference into any prior or subsequent filing by Impinj, Inc. under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except to the extent Impinj, Inc. specifically requests that the information be treated as “soliciting material” or specifically incorporates it by reference.

-27-

EXECUTIVE OFFICERS

The following table sets forth the names, ages and positions of our executive officers as of March 31, 2024. Officers are elected by the board of directors to hold office until their successors are elected and qualified.

Name |

Age |

Position |

Executive Officers |

|

|

Chris Diorio, Ph.D. |

62 |

Director, Chief Executive Officer and Vice Chair |

Cary Baker |

48 |

Chief Financial Officer |

Jeff Dossett |

63 |

Chief Revenue Officer |

Hussein Mecklai |

51 |

Chief Operating Officer |

Cathal Phelan |

60 |

Director and Chief Innovation Officer |

There are no family relationships among any of the directors or executive officers.

Executive Officers

Chris Diorio, Ph.D. See the section entitled “Election of Directors—Nominees for Director.”

Cary Baker has served as our chief financial officer since February 2020. Prior to joining us, Mr. Baker was senior vice president, chief financial officer and treasurer of RealNetworks, Inc. from May 2017 to February 2020. From February 2015 to April 2017, he served as chief financial officer of HEAT Software, Inc., and from March 2014 to October 2016, Mr. Baker also served as chief financial officer of NetMotion Software, an affiliate of HEAT Software, Inc. From May 2010 to November 2013, he also held key financial leadership roles at Clearwire Corporation, including most recently as vice president, finance. Mr. Baker’s earlier experience includes financial leadership roles at Boost Mobile and Sprint Corporation. Mr. Baker holds an M.B.A. from the Kelley School of Business at Indiana University and a B.S. in finance from the University of Idaho.

Jeff Dossett has served as our chief revenue officer since June 2020. Prior to his promotion to chief revenue officer, Mr. Dossett served as our executive vice president of sales and marketing from January 2018 to June 2020. Previously, he served as our senior vice president of marketing and business development from May 2017 to December 2017. Prior to joining us, Mr. Dossett was a strategic advisor for GOOD Worldwide Inc., a global media brand and social impact company, from January 2007 to July 2017 and served as chief executive officer of GOOD Worldwide Inc. from March 2016 to October 2016. From December 2013 to March 2015, he served in various roles at Porch, Inc., an online home services platform, including head of partnerships, corporate development and interim chief financial officer. From October 2010 to May 2013, he served as executive vice president responsible for partnerships and revenue, and from May 2013 to December 2013 as chief revenue officer of Leaf Group Inc. (formerly known as Demand Media Inc.), a publicly traded content company. Mr. Dossett received a B.A. in business management and general management from Ivey Business School at Western University.

Hussein Mecklai has served as our chief operating office since February 2022. Prior to his promotion to chief operating officer, Mr. Mecklai had served as our executive vice president, engineering since December 2018. Previously, Mr. Mecklai held various positions at Intel Corporation from 2013 to 2018, including vice president, platform engineering group and general manager, product architecture group from February 2016 until December 2018. Mr. Mecklai received a B.S. in electrical engineering from Lafayette College, and a M.S. in electrical engineering from Lehigh University.

Cathal Phelan. See the section entitled “Election of Directors—Nominees for Director.”

-28-

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

Our Business

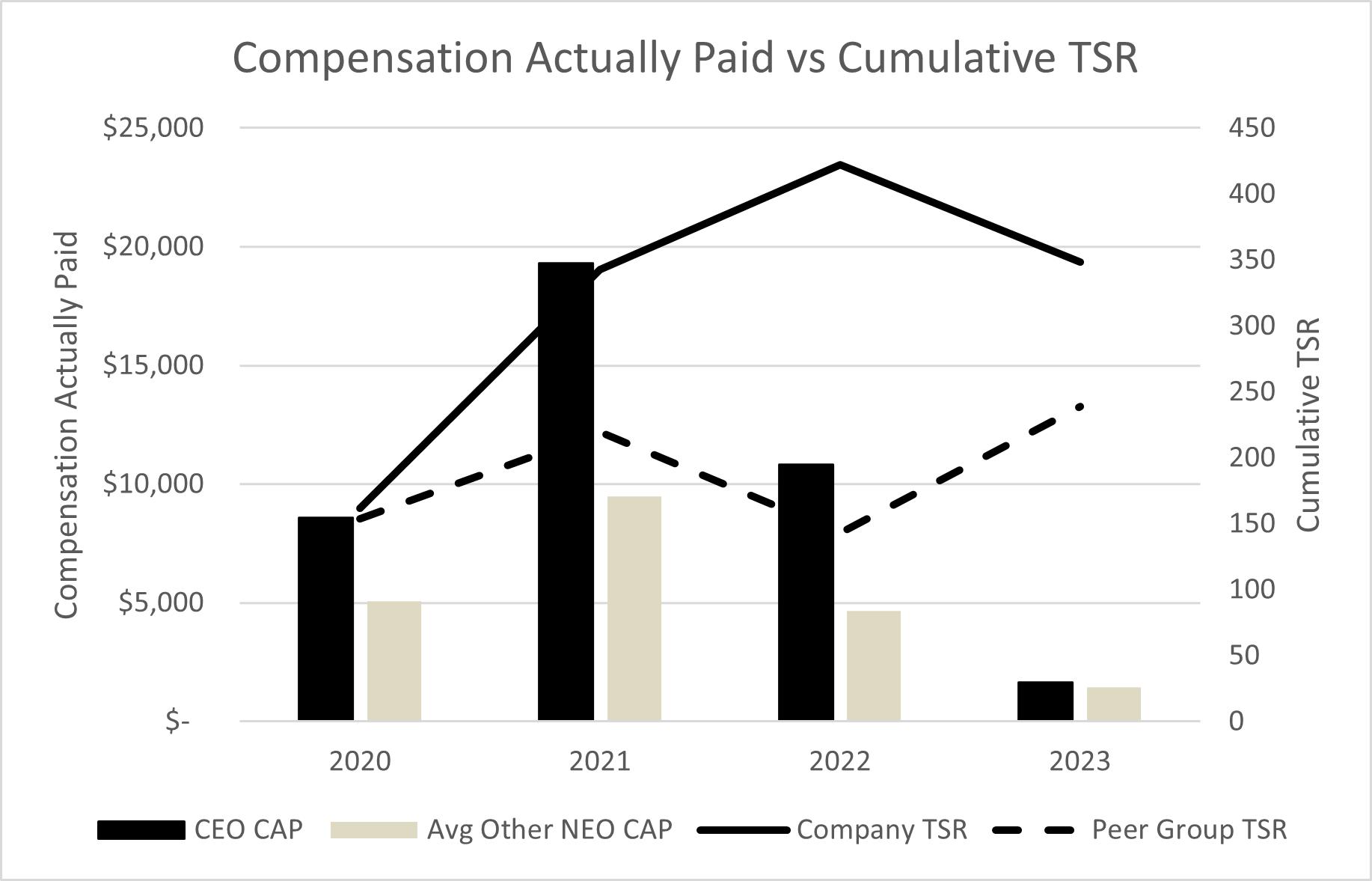

Our vision is a boundless Internet of Things, in which every physical item that businesses manufacture, transport and sell, and that people own, use and recycle, is wirelessly connected to a digital counterpart — a digital twin — in the cloud. Our mission is to connect every thing. We design and sell a platform that enables that wireless item-to-cloud connectivity and with which we and our partners innovate Internet of Things (“IoT”) solutions.