|

|

PRICING SUPPLEMENT Dated July 18, 2024 Filed Pursuant to Rule 424(b)(2) (To Prospectus dated May 27, 2022, Index Supplement dated May 27, 2022 and Product Supplement dated May 27, 2022) |

|

UBS AG $1,741,000 Capped Market-Linked Notes

Linked to an Equally Weighted Basket of Equity Indices due January 23, 2026

Investment Description

UBS AG Capped Market-Linked Notes (the “Notes”) are unsubordinated, unsecured debt obligations issued by UBS AG (“UBS” or the “issuer”) linked to an equally weighted basket (the “underlying basket”) consisting of 2 selected equity indices (each, a “basket asset”, together the “basket assets”) , as specified herein under “Final Terms — Underlying Basket”. The amount you receive at maturity will be based on the direction and percentage change in the level of the underlying basket from the initial basket level to the final basket level (the “basket return”). If the basket return is positive, at maturity, UBS will pay you a cash payment per Note equal to the principal amount plus a percentage return equal to the lesser of (a) the basket return and (b) the maximum gain. If the basket return is zero or negative, at maturity, UBS will pay you a cash payment per Note equal to the principal amount. Repayment of principal applies only if the Notes are held to maturity. Investing in the Notes involves significant risks. The Notes do not pay interest and your potential return on the Notes is limited to the maximum gain. The payment at maturity will be greater than the principal amount only if the basket return is positive Any payment on the Notes, including any repayment of principal, is subject to the creditworthiness of UBS. If UBS were to default on its obligations you may not receive any amounts owed to you under the Notes and you could lose all of your initial investment.

Features

Exposure to Positive Basket Return up to the Maximum Gain: At maturity, the Notes provide exposure to any positive basket return, up to the maximum gain.

Repayment of Principal Amount at Maturity: If the basket return is zero or negative, at maturity, UBS will pay you a cash payment per Note equal to the principal amount. Any payment on the Notes, including any repayment of principal, applies only if the Notes are held to maturity and is subject to the creditworthiness of UBS.

Key Dates

|

Strike Date |

July 17, 2024 |

|

Trade Date* |

July 18, 2024 |

|

Settlement Date* |

July 23, 2024 |

|

Final Valuation Date** |

January 20, 2026 |

|

Maturity Date** |

January 23, 2026 |

* We expect to deliver the Notes against payment on the third business day following the trade date. Under Rule 15c6-1 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), trades in the secondary market generally are required to settle in one business day (T+1), unless the parties to a trade expressly agree otherwise. Accordingly, purchasers who wish to trade the Notes in the secondary market on any date prior to one business day before delivery of the Notes will be required, by virtue of the fact that each Note initially will settle in three business days (T+3), to specify alternative settlement arrangements to prevent a failed settlement of the secondary market trade.

** Subject to postponement in the event of a market disruption event, as described in the accompanying product supplement.

Notice to investors: the Notes are significantly riskier than conventional debt instruments. The payment at maturity will be greater than the principal amount only if the basket return is positive. Additionally, investors are subject to the credit risk inherent in purchasing a debt obligation of UBS. You should not purchase the Notes if you do not understand or are not comfortable with the significant risks involved in investing in the Notes.

You should carefully consider the risks described under “Key Risks” beginning on page 4 and under “Risk Factors” beginning on page PS-9 of the accompanying product supplement. Events relating to any of those risks, or other risks and uncertainties, could adversely affect the market value of, and return on, your Notes. The Notes will not be listed or displayed on any securities exchange or any electronic communications network.

Note Offering

Information about the underlying basket and the basket assets is specified under “Final Terms — Underlying Basket” herein and described in more detail under “Information About the Underlying Basket and the Basket Assets” herein. The initial basket level was set to 100 on the strike date and the initial asset levels were also set on the strike date and not on the trade date, and the remaining terms of the Notes were also set on the strike date.

|

Underlying Basket |

Basket Weighting |

Maximum Gain |

Maximum Payment at Maturity per Note |

Initial Basket Level |

CUSIP |

ISIN |

|

An Equally Weighted Basket of 2 Equity Indices (see page 2 for further details) |

Equally Weighted (see page 2 for further details) |

13.35% |

$1,133.50 |

100.00 |

90307D5U2 |

US90307D5U20 |

The estimated initial value of the Notes as of the trade date is $995.00. The estimated initial value of the Notes was determined as of the close of the relevant markets on the date hereof by reference to UBS’ internal pricing models, inclusive of the internal funding rate. For more information about secondary market offers and the estimated initial value of the Notes, see “Key Risks — Estimated Value Considerations” and “— Risks Relating to Liquidity and Secondary Market Price Considerations” beginning on page 5 herein.

See “Additional Information About UBS and the Notes” on page ii. The Notes will have the terms set forth in the accompanying product supplement relating to the Notes, dated May 27, 2022, the accompanying prospectus dated May 27, 2022 and this document.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these Notes or passed upon the adequacy or accuracy of this document, the accompanying product supplement, the index supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

The Notes are not bank deposits and are not insured by the Federal Deposit Insurance Corporation or any other governmental agency.

|

Offering of Notes |

Issue Price to Public(1) |

Underwriting Discount (1)(2) |

Proceeds to UBS AG(2) |

|||||

|

|

Total |

Per Note |

Total |

Per Note |

Total |

Per Note |

||

|

Notes linked to an Equally Weighted Basket of Equity Indices |

$1,741,000.00 |

$1,000.00 |

$5,223.00 |

$3.00 |

$1,735,777.00 |

$997.00 |

||

(1) Notwithstanding the underwriting discount received by one or more third-party dealers from UBS Securities LLC described below, certain registered investment advisers or fee-based advisory accounts unaffiliated from UBS may have agreed to purchase Notes from a third-party dealer at a purchase price of at least $997.00 per Note, and such third-party dealer, with respect to such sales, may have agreed to forgo some or all of the underwriting discount.

(2) Our affiliate, UBS Securities LLC, will receive an underwriting discount of $3.00 per Note sold in this offering. UBS Securities LLC has agreed to re-allow the full amount of this discount to one or more third-party dealers. Certain of such third-party dealers may resell the Notes to other securities dealers at the issue price to the public less an underwriting discount of up to the underwriting discount received.

|

UBS Securities LLC |

UBS Investment Bank |

Additional Information About UBS and the Notes

UBS has filed a registration statement (including a prospectus, as supplemented by a product supplement and an index supplement), with the Securities and Exchange Commission (the “SEC”), for the Notes to which this document relates. You should read these documents and any other documents relating to the Notes that UBS has filed with the SEC for more complete information about UBS and this offering. You may obtain these documents without cost by visiting EDGAR on the SEC website at www.sec.gov. Our Central Index Key, or CIK, on the SEC website is 0001114446.

You may access these documents on the SEC website at www.sec.gov as follows:

♦Market-Linked Securities product supplement dated May 27, 2022:

http://www.sec.gov/Archives/edgar/data/1114446/000183988222011628/ubs2000004208_424b2-04373.htm

♦Index supplement dated May 27, 2022:

http://www.sec.gov/Archives/edgar/data/1114446/000183988222011632/ubs_index-supplement.htm

♦Prospectus dated May 27, 2022:

http://www.sec.gov/Archives/edgar/data/1114446/000119312522162430/d632731d424b3.htm

References to “UBS”, “we”, “our” and “us” refer only to UBS AG and not to its consolidated subsidiaries and references to “Notes” refer to the Capped Market-Linked Notes that are offered hereby, unless the context otherwise requires. Also, references to the “accompanying product supplement” mean the UBS product supplement, dated May 27, 2022, references to the “index supplement” mean the UBS index supplement, dated May 27, 2022 and references to the “accompanying prospectus” mean the UBS prospectus titled “Debt Securities and Warrants”, dated May 27, 2022.

This document, together with the documents listed above, contains the terms of the Notes and supersedes all other prior or contemporaneous oral statements as well as any other written materials including all other prior pricing terms, correspondence, trade ideas, structures for implementation, sample structures, brochures or other educational materials of ours. You should carefully consider, among other things, the matters set forth in “Key Risks” herein and in “Risk Factors” in the accompanying product supplement, as the Notes involve risks not associated with conventional debt securities. We urge you to consult your investment, legal, tax, accounting and other advisors with respect to an investment in the Notes.

If there is any inconsistency between the terms of the Notes described in the accompanying prospectus, the accompanying product supplement, the index supplement and this document, the following hierarchy will govern: first, this document; second, the accompanying product supplement; third, the index supplement; and last, the accompanying prospectus.

UBS reserves the right to change the terms of, or reject any offer to purchase, the Notes prior to their issuance. In the event of any changes to the terms of the Notes, UBS will notify you and you will be asked to accept such changes in connection with your purchase. You may also choose to reject such changes in which case UBS may reject your offer to purchase.

ii

Investor Suitability

The Notes may be suitable for you if:

♦You fully understand the risks inherent in an investment in the Notes.

♦You are willing to make an investment that may not provide a positive return.

♦You believe that the level of the underlying basket will appreciate over the term of the Notes and that the percentage of appreciation is unlikely to exceed the maximum gain specified on the cover hereof.

♦You understand and accept that your potential return is limited to the maximum gain indicated on the cover hereof.

♦You can tolerate fluctuations in the price of the Notes prior to maturity that may be similar to or exceed the downside fluctuations in the level(s) of the underlying basket and basket assets.

♦You do not seek current income from your investment and are willing to forgo any dividends paid on the stocks comprising the basket assets (the “underlying constituents”).

♦You are willing to hold the Notes to maturity and accept that there may be little or no secondary market for the Notes.

♦You understand and are willing to accept the risks associated with the underlying basket and the basket assets.

♦You are willing to assume the credit risk of UBS for all payments under the Notes, and understand that if UBS defaults on its obligations you may not receive any amounts due to you including any repayment of principal.

♦You understand that the estimated initial value of the Notes determined by our internal pricing models is lower than the issue price and that should UBS Securities LLC or any affiliate make secondary markets for the Notes, the price (not including their customary bid-ask spreads) will temporarily exceed the internal pricing model price.

The Notes may not be suitable for you if:

♦You do not fully understand the risks inherent in an investment in the Notes.

♦You are not willing to make an investment that may not provide a positive return.

♦You believe that the level of the underlying basket will remain flat or decline during the term of the Notes, or you believe that the level of the basket will appreciate over the term of the Notes and that the percentage of appreciation is likely to exceed the maximum gain indicated on the cover hereof.

♦You seek an investment that has unlimited return potential without a cap on appreciation, or you are not willing to invest in the Notes based on the maximum gain indicated on the cover hereof.

♦You cannot tolerate fluctuations in the price of the Notes prior to maturity that may be similar to or exceed the downside fluctuations in the level(s) of the underlying basket or basket assets.

♦You seek current income from your investment or prefer to receive any dividends paid on the underlying constituents.

♦You are unable or unwilling to hold the Notes to maturity or you seek an investment for which there will be an active secondary market.

♦You do not understand or are unwilling to accept the risks associated with the underlying basket or the basket assets.

♦You are not willing to assume the credit risk of UBS for all payments under the Notes, including any repayment of principal.

The investor suitability considerations identified above are not exhaustive. Whether or not the Notes are a suitable investment for you will depend on your individual circumstances. You are urged to consult your investment, legal, tax, accounting and other advisors and carefully consider the suitability of an investment in the Notes in light of your particular circumstances. You should review “Information About the Underlying Basket and the Basket Assets” herein for more information on the underlying basket and the basket assets. You should also review carefully the “Key Risks” section herein for risks related to an investment in the Notes.

1

Final Terms

|

Issuer |

UBS AG London Branch |

|||

|

Principal Amount |

$1,000.00 per Note |

|||

|

Term |

Approximately 18 months. |

|||

|

Underlying Basket |

The following table lists the basket assets and their corresponding Bloomberg tickers, basket weightings and initial asset levels. |

|||

|

Basket Asset |

Bloomberg Ticker |

Basket Weighting |

Initial Asset Level(1)(2) |

|

|

Nasdaq-100 Index® |

NDX |

50.00% |

19,799.14 |

|

|

S&P 500® Index |

SPX |

50.00% |

5,588.27 |

|

|

Maximum Gain |

13.35% |

|||

|

Maximum Payment at Maturity per Note |

$1,133.50 |

|||

|

Payment at Maturity |

If the basket return is positive, UBS will pay you a cash payment equal to: $1,000 × (1 + the lesser of (a) Basket Return and (b) Maximum Gain) In this scenario, your potential return on the Notes is limited to the maximum gain and your payment at maturity will in no event exceed the maximum payment at maturity per Notes. If the basket return is zero or negative, UBS will pay you a cash payment equal to: $1,000 In this scenario, you will not receive a positive return on the Notes. The payment at maturity will be greater than the principal amount only if the basket return is positive. Any payment on the Notes, including any repayment of principal, is subject to the creditworthiness of UBS |

|||

|

Basket Return |

The quotient, expressed as a percentage, of the following formula: Final Basket Level – Initial Basket Level |

|

|

Initial Basket Level |

100.00 |

|

|

Final Basket Level |

The basket closing level on the final valuation date, as determined by the calculation agent |

|

|

Basket Closing Level |

The basket closing level will be calculated as follows: 100 × [1 + (the sum of each basket asset return multiplied by its basket weighting)] |

|

|

Basket Asset Return |

With respect to each basket asset, the quotient, expressed as a percentage, of the following formula: Final Asset Level – Initial Asset Level |

|

|

Final Asset Level(2) |

With respect to each basket asset, the closing level for such basket asset on the final valuation date. |

|

|

(1) With respect to each basket asset, the closing level for such basket asset on the strike date as determined by the calculation agent. (2) As determined by the calculation agent and as may be adjusted as described under “General Terms of the Securities — Discontinuance of, Adjustments to, or Benchmark Event or Change in Law Affecting, an Underlying Index; Alteration of Method of Calculation” in the accompanying product supplement. |

||

2

Investment Timeline

|

Strike Date |

|

The initial asset level of each basket asset is observed and the initial basket level and the final terms of the Notes are set. |

|

|

|

|

|

Maturity Date |

|

The final asset level for each basket asset is observed on the final valuation date and each basket asset return, the final basket level and the basket return are calculated. If the basket return is positive, UBS will pay you a cash payment per Note equal to: $1,000 × (1 + the lesser of (a) Basket Return and (b) Maximum Gain) In this scenario, your potential return on the Notes is limited to the maximum gain and your payment at maturity will in no event exceed the maximum payment at maturity per Notes. If the basket return is zero or negative, UBS will pay you a cash payment per Note equal to: $1,000 In this scenario, you will not receive a positive return on the Notes. The payment at maturity will be greater than the principal amount only if the basket return is positive. Any payment on the Notes, including any repayment of principal, is subject to the creditworthiness of UBS |

Investing in the Notes involves significant risks. Repayment of the principal amount applies only if the Notes are held to maturity. The payment at maturity will be greater than the principal amount only if the basket return is positive and your potential return on the Notes is limited to the maximum gain. Any payment on the Notes, including any repayment of principal, is subject to the creditworthiness of UBS. If UBS were to default on its obligations, you may not receive any amounts owed to you under the Notes and you could lose all of your initial investment.

3

Key Risks

An investment in the Notes involves significant risks. Investing in the Notes is not equivalent to a hypothetical investment in the underlying basket or in any of the basket assets. Some of the key risks that apply to the Notes are summarized below, but we urge you to read the more detailed explanation of risks relating to the Notes in the “Risk Factors” section of the accompanying product supplement. We also urge you to consult your investment, legal, tax, accounting and other advisors concerning an investment in the Notes.

Risks Relating to Return Characteristics

♦You may not receive a positive return on the Notes — If the basket return is zero or negative, the amount that you receive at maturity will be limited to the principal amount of your Notes and you will not earn a positive return on your investment in the Notes. The return of your principal amount at maturity will not compensate you for any loss in value due to inflation and other factors relating to the value of money over time.

♦The stated payout from the issuer applies only if you hold your Notes to maturity — You should be willing to hold your Notes to maturity. The stated payout by the issuer is available only if you hold your Notes to maturity. If you are able to sell your Notes prior to maturity in the secondary market, you may have to sell them at a loss relative to your initial investment even regardless of the then-current level of the underlying basket. Any payment on the Notes, including any repayment of principal, is subject to the creditworthiness of UBS.

♦The participation in any positive basket return, subject to the maximum gain, applies only at maturity — You should be willing to hold your Notes to maturity. If you are able to sell your Notes prior to maturity in the secondary market, the price you receive will likely not reflect the full economic value of the participation in any positive basket return, subject to the maximum gain, and the percentage return you realize may be less than the then-current basket return, even if such return is positive and does not exceed the maximum gain. You can receive the full benefit of the participation in any positive basket return, subject to the maximum gain, only if you hold your Notes to maturity.

♦Your potential return on the Notes is limited to the maximum gain — The return potential of the Note is limited to the maximum gain. Therefore, you will not benefit from any positive basket return in excess of an amount that exceeds the maximum gain and your return on the Notes may be less than it would be in a hypothetical direct investment in the basket or the basket assets.

♦No interest payments — UBS will not pay any interest with respect to the Notes.

♦Owning the Notes is not the same as owning the underlying constituents — The return on your Notes may not reflect the return you would realize if you actually owned the underlying constituents. For instance, you will not benefit from any positive basket return in excess of an amount that exceeds the maximum gain. Furthermore, as an owner of the Notes, you will not receive or be entitled to receive any dividend payments or other distributions on the underlying constituents during the term of the Notes, and any such dividends or distributions will not be factored into the calculation of the payment at maturity on your Notes. Similarly, you will not have voting rights or any other rights of a holder of the underlying constituents.

Risks Relating to Characteristics of the Underlying Basket and Basket Assets

♦Market risk — The return on the Notes is directly linked to the performance of the underlying basket (and, therefore, the basket assets) and indirectly linked to the performance of the underlying constituents and their issuers (the “underlying constituent issuers”). The level of the basket assets (and, therefore, the level of the underlying basket) can rise or fall sharply due to factors specific to the such basket assets and their underlying constituents, such as stock or commodity price volatility, earnings, financial conditions, corporate, industry and regulatory developments, management changes and decisions and other events, as well as general market factors, such as general stock and commodity market volatility and levels, interest rates and economic, political and other conditions. You, as an investor in the Notes, should conduct your own investigation into the basket assets and underlying constituents.

♦There can be no assurance that the investment view implicit in the Notes will be successful — It is impossible to predict whether and the extent to which the level of the underlying basket will rise or fall and there can be no assurance that the final basket level will be equal to or greater than the initial basket level. The final asset levels, and therefore, the final basket level will be influenced by complex and interrelated political, economic, financial and other factors that affect the basket assets and their underlying constituents. You should be willing to accept the risks associated with the underlying basket or the basket assets, and the risk of not receiving a positive return on the Notes at maturity.

♦Correlation (or lack of correlation) among the basket assets may adversely affect your return on the Notes — “Correlation” is a measure of the degree to which the returns of a pair of assets are similar to each other over a given period in terms of timing and direction. Movements in the levels of the basket assets may not correlate with each other. At a time when the level of a basket asset increases, the level of another basket asset may not increase as much, or may even decline. Therefore, in calculating the underlying basket’s performance on the final valuation date, an increase in the level of one basket asset may be mitigated, wholly offset or reversed by a lesser increase, or by a decline, in the level of another basket asset. Further, high correlation of movements in the levels of the basket assets could adversely affect your return on the Notes during periods of negative performance of the basket assets. Changes in the correlation of the basket assets may adversely affect the market value of, and return on, your Notes.

4

♦Changes affecting a basket asset, including regulatory changes, could have an adverse effect on the market value of, and return on, your Notes — The policies of any index sponsor as specified under “Information About the Underlying Basket and the Basket Assets” (each, an “index sponsor”), concerning additions, deletions and substitutions of the underlying constituents and the manner in which such index sponsor takes account of certain changes affecting those underlying constituents may adversely affect the level of the applicable basket asset. The policies of an index sponsor with respect to the calculation of the applicable basket asset could also adversely affect the level of such basket asset. An index sponsor may discontinue or suspend calculation or dissemination of the applicable basket asset. Further, indices like each basket asset have been, and continue to be, the subject of regulatory guidance and proposal for reform, including the European Union’s Regulation (EU) 2016/1011. The occurrence of a benchmark event (as defined in the accompanying product supplement under “General Terms of the Securities — Discontinuance of, Adjustments to, or Benchmark Event or Change in Law Affecting, an Underlying Index; Alteration of Method of Calculation”), such as the failure of a benchmark (the applicable basket asset) or the administrator (its index sponsor) or user of a benchmark (such as UBS), to comply with the authorization, equivalence or other requirements of the benchmarks regulation, may result in the discontinuation of the relevant benchmark or a prohibition on its use. If these or other events occur, then the calculation agent may select a successor index, reference a replacement basket or use an alternative method of calculation, in each case, in a manner it considers appropriate, or, if it determines that no successor index, replacement basket or alternative method of calculation would be comparable to the original basket asset, it may deem the closing level of the original basket asset on the trading day immediately prior to the date of such event to be its closing level on each applicable date. Such events and the potential adjustments are described further in the accompanying product supplement under “— Discontinuance of, Adjustments to, or Benchmark Event or Change in Law Affecting, an Underlying Index; Alteration of Method of Calculation”. Notwithstanding the ability of the calculation agent to make any of the foregoing adjustments, any such change or event could adversely affect the market value of, and return on, the Notes.

♦We cannot control actions by the index sponsors or any underlying constituent issuer and none of the index sponsors or any other underlying constituent issuer have any obligation to consider your interests — Neither UBS nor our affiliates are affiliated with the index sponsors or have any ability to control or predict their actions, including any errors in or discontinuation of public disclosure regarding methods or policies relating to the calculation of the basket assets. In addition, neither we nor our affiliates are affiliated with any other underlying constituent issuer or have any ability to control or predict their actions or their public disclosure of information, whether contained in SEC filings or otherwise. None of the index sponsors or any other underlying constituent issuer is involved in the Notes offering in any way and none have any obligation to consider your interest as an owner of the Notes in taking any actions that might affect the market value of, and return on, your Notes.

♦The basket assets reflect price return, not total return — The return on your Notes is based on the performance of the underlying basket and, therefore, the basket assets, which reflect the change in the market prices of their underlying constituents. None of the basket assets are a “total return” index or strategy, which, in addition to reflecting those price returns, would also reflect any dividends paid on the underlying constituents. Accordingly, the return on your Notes will not include such a total return feature or dividend component.

Estimated Value Considerations

♦The issue price you pay for the Notes exceeds their estimated initial value — The issue price you pay for the Notes exceeds their estimated initial value as of the trade date due to the inclusion in the issue price of the underwriting discount, hedging costs, issuance and other costs and projected profits. As of the close of the relevant markets on the trade date, we have determined the estimated initial value of the Notes by reference to our internal pricing models and it is set forth in this pricing supplement. The pricing models used to determine the estimated initial value of the Notes incorporate certain variables, including the levels and volatility of the basket assets and underlying constituents, any expected dividends on the underlying constituents, the correlation among the basket assets, prevailing interest rates, the term of the Notes and our internal funding rate. Our internal funding rate is typically lower than the rate we would pay to issue conventional fixed or floating rate debt securities of a similar term. The underwriting discount, hedging costs, issuance and other costs, projected profits and the difference in rates will reduce the economic value of the Notes to you. Due to these factors, the estimated initial value of the Notes as of the trade date is less than the issue price you pay for the Notes.

♦The estimated initial value is a theoretical price; the actual price at which you may be able to sell your Notes in any secondary market (if any) at any time after the trade date may differ from the estimated initial value — The value of your Notes at any time will vary based on many factors, including the factors described above and in “— Risks Relating to Characteristics of the Underlying Basket and Basket Assets — Market risk” above and is impossible to predict. Furthermore, the pricing models that we use are proprietary and rely in part on certain assumptions about future events, which may prove to be incorrect. As a result, after the trade date, if you attempt to sell the Notes in the secondary market, the actual value you would receive may differ, perhaps materially, from the estimated initial value of the Notes determined by reference to our internal pricing models. The estimated initial value of the Notes does not represent a minimum or maximum price at which we or any of our affiliates would be willing to purchase your Notes in any secondary market at any time.

♦Our actual profits may be greater or less than the differential between the estimated initial value and the issue price of the Notes as of the trade date — We may determine the economic terms of the Notes, as well as hedge our obligations, at least in part, prior to the trade date. In addition, there may be ongoing costs to us to maintain and/or adjust any hedges and such hedges are often imperfect. Therefore, our actual profits (or potentially, losses) in issuing the Notes cannot be determined as of the trade date and any such differential between the estimated initial value and the issue price of the Notes as of the trade date does not reflect our actual profits. Ultimately, our actual profits will be known only at the maturity of the Notes.

5

Risks Relating to Liquidity and Secondary Market Price Considerations

♦There may be little or no secondary market for the Notes — The Notes will not be listed or displayed on any securities exchange or any electronic communications network. There can be no assurance that a secondary market for the Notes will develop. UBS Securities LLC and its affiliates intend, but are not required, to make a market in the Notes and may stop making a market at any time. If you are able to sell your Notes prior to maturity, you may have to sell them at a substantial loss. The estimated initial value of the Notes does not represent a minimum or maximum price at which we or any of our affiliates would be willing to purchase your Notes in any secondary market at any time.

♦The price at which UBS Securities LLC and its affiliates may offer to buy the Notes in the secondary market (if any) may be greater than UBS’ valuation of the Notes at that time, greater than any other secondary market prices provided by unaffiliated dealers (if any) and, depending on your broker, greater than the valuation provided on your customer account statements — For a limited period of time following the issuance of the Notes, UBS Securities LLC or its affiliates may offer to buy or sell such Notes at a price that exceeds (i) our valuation of the Notes at that time based on our internal pricing models, (ii) any secondary market prices provided by unaffiliated dealers (if any) and (iii) depending on your broker, the valuation provided on customer account statements. The price that UBS Securities LLC may initially offer to buy such Notes following issuance will exceed the valuations indicated by our internal pricing models due to the inclusion for a limited period of time of the aggregate value of the underwriting discount, hedging costs, issuance and other costs and theoretical projected trading profit. The portion of such amounts included in our price will decline to zero on a straight line basis over a period ending no later than the date specified under “Supplemental Plan of Distribution (Conflicts of Interest); Secondary Markets (if any).” Thereafter, if UBS Securities LLC or an affiliate makes secondary markets in the Notes, it will do so at prices that reflect our estimated value determined by reference to our internal pricing models at that time. The temporary positive differential relative to our internal pricing models arises from requests from and arrangements made by UBS Securities LLC with the selling agents of structured debt securities such as the Notes. As described above, UBS Securities LLC and its affiliates intend, but are not required, to make a market for the Notes and may stop making a market at any time. The price at which UBS Securities LLC or an affiliate may make secondary markets at any time (if at all) will also reflect its then current bid-ask spread for similar sized trades of structured debt securities. UBS Securities LLC reflects this temporary positive differential on its customer statements. Investors should inquire as to the valuation provided on customer account statements provided by unaffiliated dealers.

♦Economic and market factors affecting the terms and market price of Notes prior to maturity — Because structured notes, including the Notes, can be thought of as having a debt component and a derivative component, factors that influence the values of debt instruments and options and other derivatives will also affect the terms and features of the Notes at issuance and the market price of the Notes prior to maturity. These factors include the level of the basket assets and the underlying constituents; the volatility of the basket assets and the underlying constituents; any expected dividends on the underlying constituents; the correlation among the basket assets; the time remaining to the maturity of the Notes; interest rates in the markets; geopolitical conditions and economic, financial, political, force majeure and regulatory or judicial events; the creditworthiness of UBS; the then current bid-ask spread for the Notes and the factors discussed under “—Risks Relating to Hedging Activities and Conflicts of Interest — Potential conflicts of interest” below. These and other factors are unpredictable and interrelated and may offset or magnify each other.

♦Impact of fees and the use of internal funding rates rather than secondary market credit spreads on secondary market prices — All other things being equal, the use of the internal funding rates described above under “— Estimated Value Considerations” as well as the inclusion in the issue price of the underwriting discount, hedging costs, issuance and other costs and any projected profits are, subject to the temporary mitigating effect of UBS Securities LLC’s and its affiliates’ market making premium, expected to reduce the price at which you may be able to sell the Notes in any secondary market.

Risks Relating to Hedging Activities and Conflicts of Interest

♦Potential UBS impact on price — Trading or transactions by UBS or its affiliates in any basket asset or any underlying constituent, as applicable, listed and/or over-the-counter options, futures, exchange-traded funds or other instruments with returns linked to the performance of any basket asset or underlying constituent, as applicable, may adversely affect the performance of the basket assets and therefore the level of the underlying basket and market value of, and return on, the Notes.

♦Potential conflicts of interest — UBS and its affiliates may engage in business with any underlying constituent issuer, which may present a conflict between the interests of UBS and you, as a holder of the Notes. There are also potential conflicts of interest between you and the calculation agent, which will be an affiliate of UBS. The calculation agent will determine the payment at maturity of the Notes based on observed levels of the basket assets on the final valuation date. The calculation agent can postpone the determination of the terms of the Notes if a market disruption event occurs or is continuing on the strike date or the final valuation date. As UBS determines the economic terms of the Notes, including the maximum gain, and such terms include the underwriting discount, hedging costs, issuance and other costs and projected profits, the Notes represent a package of economic terms. There are other potential conflicts of interest insofar as an investor could potentially get better economic terms if that investor entered into exchange-traded and/or OTC derivatives or other instruments with third parties, assuming that such instruments were available and the investor had the ability to assemble and enter into such instruments. Additionally, UBS and its affiliates act in various capacities with respect to the Notes, including as a principal, agent or dealer in connection with the sale of the Notes. Such affiliates, and any other third-party dealers, will derive compensation from the distribution of the Notes and such compensation may serve as an incentive to sell these Notes instead of other investments. Furthermore, given that UBS Securities LLC and its affiliates temporarily maintain a market making premium, it may have the effect of discouraging UBS Securities LLC and its affiliates from recommending sale of your Notes in the secondary market.

♦Potentially inconsistent research, opinions or recommendations by UBS — UBS and its affiliates publish research from time to time on financial markets and other matters that may influence the market value of, and return on, the Notes, or express opinions or provide recommendations that are inconsistent with purchasing or holding the Notes. Any research, opinions or recommendations expressed by UBS or its affiliates may not be consistent with each other and may be modified from time to time without notice. Investors should make their own independent investigation of the merits of investing in the Notes and the underlying basket.

6

Risks Relating to General Credit Characteristics

♦Credit risk of UBS — The Notes are unsubordinated, unsecured debt obligations of UBS and are not, either directly or indirectly, an obligation of any third party. Any payment to be made on the Notes, including any repayment of principal, depends on the ability of UBS to satisfy its obligations as they come due. As a result, UBS’ actual and perceived creditworthiness may affect the market value of the Notes. If UBS were to default on its obligations, you may not receive any amounts owed to you under the terms of the Notes and you could lose all of your initial investment.

♦The Notes are not bank deposits — An investment in the Notes carries risks which are very different from the risk profile of a bank deposit placed with UBS or its affiliates. The Notes have different yield and/or return, liquidity and risk profiles and would not benefit from any protection provided to deposits.

♦If UBS experiences financial difficulties, FINMA has the power to open restructuring or liquidation proceedings in respect of, and/or impose protective measures in relation to, UBS, which proceedings or measures may have a material adverse effect on the terms and market value of the Notes and/or the ability of UBS to make payments thereunder — The Swiss Federal Act on Banks and Savings Banks of November 8, 1934, as amended (the “Swiss Banking Act”) grants the Swiss Financial Market Supervisory Authority (“FINMA”) broad powers to take measures and actions in relation to UBS if it concludes that there is justified concern that UBS is over-indebted or has serious liquidity problems or, after expiry of a deadline, UBS fails to fulfill the applicable capital adequacy requirements (whether on a standalone or consolidated basis). If one of these pre-requisites is met, FINMA is authorized to open restructuring proceedings or liquidation (bankruptcy) proceedings in respect of, and/or impose protective measures in relation to, UBS. The Swiss Banking Act grants significant discretion to FINMA in connection with the aforementioned proceedings and measures. In particular, a broad variety of protective measures may be imposed by FINMA, including a bank moratorium or a maturity postponement, which measures may be ordered by FINMA either on a stand-alone basis or in connection with restructuring or liquidation proceedings.

In restructuring proceedings, FINMA, as resolution authority, is competent to approve the restructuring plan. The restructuring plan may, among other things, provide for (a) the transfer of all or a portion of UBS’ assets, debts, other liabilities and contracts (which may or may not include the contractual relationship between UBS and the holders of Notes) to another entity, (b) a stay (for a maximum of two business days) on the termination of contracts to which UBS is a party, and/or the exercise of (w) rights to terminate, (x) netting rights, (y) rights to enforce or dispose of collateral or (z) rights to transfer claims, liabilities or collateral under contracts to which UBS is a party, (c) the partial or full conversion of UBS’ debt and/or other obligations, including its obligations under the Notes, into equity (a “debt-to-equity” swap), and/or (d) the partial or full write-off of obligations owed by UBS (a “write-off”), including its obligations under the Notes. Prior to any debt-to-equity swap or write-off with respect to any Notes, outstanding equity and debt instruments issued by UBS qualifying as additional tier 1 capital or tier 2 capital must be converted or written-down, as applicable, and cancelled. The Swiss Banking Act addresses the order in which a debt-to-equity swap or a write-off of debt instruments (other than debt instruments qualifying as additional tier 1 capital or tier 2 capital) should occur: first, all subordinated obligations not qualifying as regulatory capital; second, debt instruments for loss absorbency in the course of insolvency measures (Schuldinstrumente zur Verlusttragung im Falle von Insolvenzmassnahmen) under the Swiss Ordinance concerning Capital Adequacy and Risk Diversification for Banks and Securities Dealers of June 1, 2012, as amended; third, all other obligations not excluded by law from a debt-to-equity swap or write-off (other than deposits), such as the Notes; and fourth, deposits to the extent in excess of the amount privileged by law. However, given the broad discretion granted to FINMA, any restructuring plan approved by FINMA in connection with restructuring proceedings with respect to UBS could provide that the claims under or in connection with the Notes will be fully or partially converted into equity or written-off, while preserving other obligations of UBS that rank pari passu with UBS’ obligations under the Notes. Consequently, the exercise by FINMA of any of its statutory resolution powers or any suggestion of any such exercise could materially adversely affect the rights of holders of the Notes, the price or value of their investment in the Notes and/or the ability of UBS to satisfy its obligations under the Notes and could lead to holders losing some or all of their investment in the Notes.

Once FINMA has opened restructuring proceedings with respect to UBS, it may consider factors such as the results of operations, financial condition (in particular, the level of indebtedness, potential future losses and/or restructuring costs), liquidity profile and regulatory capital adequacy of UBS and its subsidiaries, or any other factors of its choosing, when determining whether to exercise any of its statutory resolution powers with respect to UBS, including, if it chooses to exercise such powers to order a debt-to- equity swap and/or a write-off, whether to do so in full or in part. The criteria that FINMA may consider in exercising any statutory resolution power provide it with considerable discretion. Therefore, holders of the Notes may not be able to refer to publicly available criteria in order to anticipate a potential exercise of any such power and, consequently, its potential effects on the Notes and/or UBS.

If UBS were to be subject to restructuring proceedings, the creditors whose claims are affected by the restructuring plan would not have a right to vote on, reject, or seek the suspension of the restructuring plan. In addition, if a restructuring plan with respect to UBS has been approved by FINMA, the rights of a creditor to challenge the restructuring plan or have the restructuring plan reviewed by a judicial or administrative process or otherwise (e.g., on the grounds that the plan would unduly prejudice the rights of holders of Notes or otherwise be in violation of the Swiss Banking Act) are very limited. Even if any of UBS’ creditors were to successfully challenge the restructuring plan in court, the court could only require the relevant creditors to be compensated ex post and there is currently no guidance as to on what basis such compensation would be calculated and how it would be funded. Any such challenge (even if successful) would not suspend, or result in the suspension of, the implementation of the restructuring plan.

Risks Relating to U.S. Federal Income Taxation

♦Uncertain tax treatment — Significant aspects of the tax treatment of the Notes are uncertain. You should consult your tax advisor about your tax situation. See “What Are the Tax Consequences of the Notes?” herein and “Material U.S. Federal Income Tax Consequences”, including the section “— Contingent Payment Debt Instruments”, in the accompanying product supplement.

7

Hypothetical Examples and Return Table of the Notes at Maturity

The below examples and table are based on hypothetical terms. The actual terms were set on the strike date and are indicated on the cover hereof.

The examples and table below illustrate the payment at maturity for a $1,000 Note on a hypothetical offering of the Notes, with the following assumptions (amounts may have been rounded for ease of reference):

|

Principal Amount: |

$1,000.00 |

|

Term: |

Approximately 18 months |

|

Initial Basket Level: |

100.00 |

|

Maximum Gain: |

13.35% |

|

Range of Basket Return: |

-100.00% to 40.00% |

Example 1: The Basket Return is 10.00%.

Because the basket return is positive and is less than the maximum gain, the payment at maturity per Note will be calculated as follows:

$1,000.00 × (1 + the lesser of (a) Basket Return and (b) Maximum Gain)

= $1,000.00 × (1 + the lesser of (a) 10.00% and (b) 13.35%)

= $1,000.00 × (1 + 10.00%)

= $1,100.00 per Security (10.00% total return).

Example 2 — The Basket Return is 40.00%.

Because the basket return is positive and is equal to or greater than the maximum gain, the payment at maturity per Note will be calculated as follows:

$1,000.00 × (1 + the lesser of (a) Basket Return and (b) Maximum Gain)

= $1,000.00 × (1 + the lesser of (a) 40.00% and (b) 13.35%)

= $1,000.00 × (1 + 13.35%)

= $1,133.50 per Note (13.35% total return).

In this scenario, your potential return on the Notes is limited to the maximum gain and your payment at maturity will in no event exceed the maximum payment at maturity per Notes.

Example 3: The Basket Return is 0.00%.

Because the basket return is zero or negative, the payment at maturity per Note will be equal to the principal amount of $1,000.00 (0.00% total return).

In this scenario, you will not receive a positive return on your investment in the Notes. Any payment on the Notes, including any repayment of principal, is subject to the creditworthiness of UBS. If UBS were to default on its obligations, you may not receive any amount owed to you under the Notes and you could lose all of your initial investment.

Example 4: The Basket Return is -60.00%.

Because the basket return is zero or negative, the payment at maturity per Note will be equal to the principal amount of $1,000.00 (0.00% total return).

In this scenario, you will not receive a positive return on your investment in the Notes. Any payment on the Notes, including any repayment of principal, is subject to the creditworthiness of UBS. If UBS were to default on its obligations, you may not receive any amount owed to you under the Notes and you could lose all of your initial investment.

8

|

Underlying Basket |

Payment and Return at Maturity |

||

|

Final Basket Level |

Basket Return |

Payment at Maturity |

Note Total Return at Maturity |

|

140.00 |

40.00% |

$1,133.50 |

13.35% |

|

130.00 |

30.00% |

$1,133.50 |

13.35% |

|

120.00 |

20.00% |

$1,133.50 |

13.35% |

|

113.35 |

13.35% |

$1,133.50 |

13.35% |

|

110.00 |

10.00% |

$1,100.00 |

10.00% |

|

107.50 |

7.50% |

$1,075.00 |

7.50% |

|

105.00 |

5.00% |

$1,050.00 |

5.00% |

|

100.00 |

0.00% |

$1,000.00 |

0.00% |

|

90.00 |

0.00% |

$1,000.00 |

0.00% |

|

80.00 |

0.00% |

$1,000.00 |

0.00% |

|

70.00 |

0.00% |

$1,000.00 |

0.00% |

|

60.00 |

0.00% |

$1,000.00 |

0.00% |

|

50.00 |

0.00% |

$1,000.00 |

0.00% |

|

25.00 |

0.00% |

$1,000.00 |

0.00% |

|

0.00 |

0.00% |

$1,000.00 |

0.00% |

Investing in the Notes involves significant risks. Repayment of the principal amount applies only if the Notes are held to maturity. The payment at maturity will be greater than the principal amount only if the basket return is positive and your potential return on the Notes is limited to the maximum gain. Any payment on the Notes, including any repayment of principal, is subject to the creditworthiness of UBS. If UBS were to default on its obligations, you may not receive any amount owed to you under the Notes and you could lose all of your initial investment.

9

Information About the Underlying Basket and the Basket Assets

All disclosures contained in this document regarding the underlying basket and basket assets is derived from publicly available information. UBS has not conducted any independent review or due diligence of any publicly available information with respect to the underlying basket and basket assets. You should make your own investigation into the underlying basket and basket assets.

Included on the following pages is a brief description of the underlying basket and basket assets. This information has been obtained from publicly available sources. Set forth below are graphs that illustrate the past performance for each of the basket assets and a hypothetical underlying basket. We obtained the past performance information set forth below from Bloomberg Professional® service (“Bloomberg”) without independent verification. You should not take the historical levels of the basket assets as an indication of future performance.

The Underlying Basket

Because the underlying basket is a newly created basket and its level began to be calculated on the trade date, there is no actual historical information about the basket closing levels as of the date hereof. Therefore, the hypothetical basket closing levels of the underlying basket below are calculated based on publicly available information for each basket asset as reported by Bloomberg without independent verification. UBS has not conducted any independent review or due diligence of publicly available information obtained from Bloomberg. The hypothetical basket closing level has fluctuated in the past and may, in the future, experience significant fluctuations. The actual initial basket level was set to 100.00 on the strike date and not on the trade date. Any hypothetical historical upward or downward trend in the basket closing level during any period shown below is not an indication that the underlying basket is more or less likely to increase or decrease at any time during the term of the Notes.

Hypothetical Historical Basket Levels

The graph below illustrates the hypothetical performance of the underlying basket from January 1, 2019 through July 17, 2024, based on the daily closing levels of the basket assets, assuming the basket closing level was 100 on January 1, 2019. Past hypothetical performance of the underlying basket is not indicative of the future performance of the underlying basket.

Basket Closing Level

10

Nasdaq-100 Index®

We have derived all information regarding the Nasdaq-100 Index® (“NDX”) contained in this document, including, without limitation, its make-up, method of calculation and changes in its components, from publicly available information. Such information reflects the policies of, and is subject to change by The Nasdaq OMX Group, Inc. and its affiliates (collectively, “Nasdaq OMX”) (its “index sponsor” or “Nasdaq OMX”).

NDX is published by Nasdaq OMX, but Nasdaq OMX has no obligation to continue to publish NDX, and may discontinue publication of NDX at any time. NDX is determined, comprised and calculated by Nasdaq OMX without regard to this instrument.

As discussed more fully in the index supplement under the heading “Underlying Indices and Underlying Index Publishers – Nasdaq-100 Index®”, NDX includes 100 of the largest domestic and international non-financial securities listed on the Nasdaq Stock Market® (“Nasdaq”) based on market capitalization. NDX includes companies across major industry groups including computer hardware and software, telecommunications, retail and wholesale trade, and biotechnology, but does not contain securities of financial companies, including investment companies.

NDX is calculated under a modified capitalization-weighted methodology. The methodology is expected to retain in general the economic attributes of capitalization-weighting while providing enhanced diversification. To accomplish this, Nasdaq OMX will review the composition of NDX on a quarterly basis and adjust the weightings of Index components using a proprietary algorithm, if certain pre-established weight distribution requirements are not met.

Information from outside sources is not incorporated by reference in, and should not be considered part of, this document or any document incorporated herein by reference. UBS has not conducted any independent review or due diligence of any publicly available information with respect to the basket asset.

Historical Information

The graph below illustrates the performance of NDX from January 1, 2014 through July 17, 2024, based on the daily closing levels as reported by Bloomberg, without independent verification. UBS has not conducted any independent review or due diligence of any information obtained from Bloomberg. The closing level of NDX on July 17, 2024 was 19,799.14. Past performance of NDX is not indicative of the future performance of NDX during the term of the Notes.

11

S&P 500® Index

We have derived all information regarding the S&P 500® Index (“SPX”) contained in this document, including, without limitation, its make-up, method of calculation and changes in its components, from publicly available information. Such information reflects the policies of, and is subject to change by S&P Dow Jones Indices LLC (its “index sponsor” or “S&P Dow Jones”).

SPX is published by S&P Dow Jones, but S&P Dow Jones has no obligation to continue to publish SPX, and may discontinue publication of SPX at any time. SPX is determined, comprised and calculated by S&P Dow Jones without regard to this instrument.

As discussed more fully in the index supplement under the heading “Underlying Indices and Underlying Index Publishers — S&P 500® Index”, SPX is intended to provide an indication of the pattern of common stock price movement. The calculation of the value of SPX is based on the relative value of the aggregate market value of the common stock of 500 companies as of a particular time compared to the aggregate average market value of the common stocks of 500 similar companies during the base period of the years 1941 through 1943. Select information regarding top constituents and industry and/or sector weightings may be made available by the index sponsor on its website.

Information from outside sources is not incorporated by reference in, and should not be considered part of, this document or any document incorporated herein by reference. UBS has not conducted any independent review or due diligence of any publicly available information with respect to the basket asset.

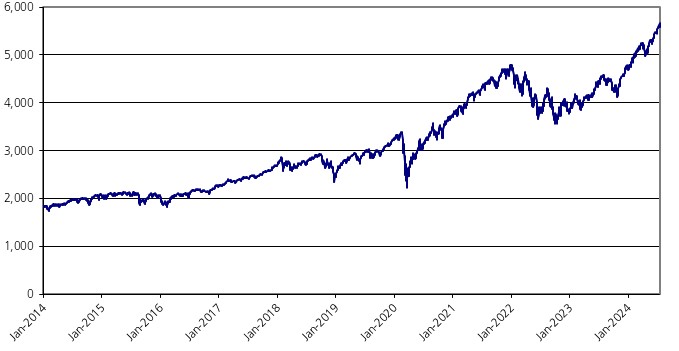

Historical Information

The graph below illustrates the performance of SPX from January 1, 2014 through July 17, 2024, based on the daily closing levels as reported by Bloomberg, without independent verification. UBS has not conducted any independent review or due diligence of any information obtained from Bloomberg. The closing level of SPX on July 17, 2024 was 5,588.27. Past performance of the basket asset is not indicative of the future performance of the basket asset during the term of the Notes.

12

What Are the Tax Consequences of the Notes?

The U.S. federal income tax consequences of your investment in the Notes are uncertain. There are no statutory provisions, regulations, published rulings or judicial decisions addressing the characterization for U.S. federal income tax purposes of securities with terms that are substantially the same as the Notes. Some of these tax consequences are summarized below, but we urge you to read the more detailed discussion in “Material U.S. Federal Income Tax Consequences”, including the section “— Contingent Payment Debt Instruments”, in the accompanying product supplement and to discuss the tax consequences of your particular situation with your tax advisor. This discussion is based upon the U.S. Internal Revenue Code of 1986, as amended (the “Code”), final, temporary and proposed U.S. Department of the Treasury (the “Treasury”) regulations, rulings and decisions, in each case, as available and in effect as of the date hereof, all of which are subject to change, possibly with retroactive effect. Tax consequences under state, local and non-U.S. laws are not addressed herein. No ruling from the U.S. Internal Revenue Service (the “IRS”) has been sought as to the U.S. federal income tax consequences of your investment in the Notes, and the following discussion is not binding on the IRS.

Additionally, the discussion herein does not address the consequences to taxpayers subject to special tax accounting rules under Section 451(b) of the Code.

U.S. Tax Treatment. Your Notes should be treated as contingent payment debt instruments (“CPDI”) subject to taxation under the “noncontingent bond method”. If your Notes are so treated, you should generally, for each accrual period, accrue original issue discount (“OID”) equal to the product of (i) the “comparable yield” (adjusted for the length of the accrual period) and (ii) the “adjusted issue price” of the Notes at the beginning of the accrual period. This amount is ratably allocated to each day in the accrual period and is includible as ordinary interest income by a U.S. holder for each day in the accrual period on which the U.S. holder holds the CPDI, whether or not the amount of any payment is fixed or determinable in the taxable year. Thus, the noncontingent bond method will result in recognition of income prior to the receipt of cash.

In general, the comparable yield of a CPDI is equal to the yield at which we would issue a fixed rate debt instrument with terms and conditions similar to those of the CPDI, including the level of subordination, term, timing of payments, and general market conditions. In general, because similar fixed rate debt instruments issued by us are traded at a price that reflects a spread above a benchmark rate, the comparable yield is the sum of the benchmark rate on the settlement date and the spread.

As the Notes have only a single contingent payment at maturity, the adjusted issue price of each Note at the beginning of each accrual period is equal to the issue price of the Note plus the amount of OID previously includible in the gross income of the U.S. holder in respect of prior accrual periods.

In addition to the determination of a comparable yield, the noncontingent bond method requires the construction of a projected payment schedule. The projected payment schedule includes the projected amounts for each contingent payment to be made under the CPDI that are adjusted to produce the comparable yield. We have determined that the comparable yield for the Notes is equal to 5.23% per annum, compounded semi-annually, with a projected payment at maturity of $1,080.60 based on an investment of $1,000.

Based on this comparable yield, if you are an initial holder that holds a Note until maturity and you calculate your taxes on a calendar year basis, we have determined that you would be required to report the following amounts as ordinary interest income from the Note, not taking into account any positive or negative adjustments you may be required to take into account based on actual payments on such Note:

|

Accrual Period |

Interest Deemed to Accrue During Accrual Period (per $1,000 Note) |

Total Interest Deemed to Have Accrued From Settlement Date (per $1,000 Note) as of End of Accrual Period |

|

Settlement Date through January 1, 2025 |

$22.95 |

$22.95 |

|

January 1, 2025 through July 1, 2025 |

$26.75 |

$49.70 |

|

July 1, 2025 through January 1, 2026 |

$27.45 |

$77.15 |

|

January 1, 2026 through Maturity Date |

$3.44 |

$80.60 |

A U.S. holder of the Notes is required to use our projected payment schedule to determine its interest accruals and adjustments, unless such holder determines that our projected payment schedule is unreasonable, in which case such holder must disclose its own projected payment schedule in connection with its U.S. federal income tax return and the reason(s) why it is not using our projected payment schedule. Neither the comparable yield nor the projected payment schedule constitutes a representation by us regarding the actual contingent amount, if any, that we will pay on a Note.

13

If the actual amounts of contingent payments are different from the amounts reflected in the projected payment schedule, a U.S. holder is required to make adjustments in its OID accruals under the noncontingent bond method described above when those amounts are paid. Accordingly, an adjustment arising from the contingent payment made at maturity that is greater than the assumed amount of such payment is referred to as a “positive adjustment”; such adjustment arising from the contingent payment at maturity that is less than the assumed amount of such payment is referred to as a “negative adjustment”. Any positive adjustment for a taxable year is treated as additional OID income of the U.S. holder. Any net negative adjustment reduces any OID on the Note for the taxable year that would otherwise accrue. Any excess is then treated as a current-year ordinary loss to the U.S. holder to the extent of OID accrued in prior years.

In general, a U.S. holder’s basis in a CPDI is increased by the projected contingent payments accrued by such holder under the projected payment schedule (as determined without regard to adjustments made to reflect differences between actual and projected payments) and the projected amount of any contingent payments previously made. Gain on the taxable disposition of a CPDI generally is treated as ordinary income. Loss, on the other hand, is treated as ordinary loss only to the extent of the U.S. holder’s prior net OID inclusions (i.e., reduced by the total net negative adjustments previously allowed to the U.S. holder as an ordinary loss) and capital loss to the extent in excess thereof. However, the deductibility of a capital loss realized on the taxable disposition of a Note is subject to limitations. Under the rules governing CPDI, special rules would apply to a person who purchases Notes at a price other than the adjusted issue price as determined for tax purposes.

A U.S. holder that purchases a Note for an amount other than the public offering price of the Note will be required to adjust its OID inclusions to account for the difference. These adjustments will affect the U.S. holder’s basis in the Note. Reports to U.S. holders may not include these adjustments. U.S. holders that purchase Notes at other than the issue price to public should consult their tax advisors regarding these adjustments.

You are urged to consult your tax advisor with respect to the application of the CPDI provisions to the Notes.

Based on certain factual representations received from us, our special U.S. tax counsel, Cadwalader, Wickersham & Taft LLP, is of the opinion that it would be reasonable to treat your Notes in the manner described above.

Alternative Characterizations. However, because there is no authority that specifically addresses the tax treatment of the Notes, it is possible that your Notes could alternatively be treated pursuant to some other characterization, such that the timing and character of your income from the Notes could differ materially and adversely from the treatment described above. In particular, the IRS might assert that the Notes should be treated as deemed to be redeemed and reissued on any rebalancing of the underlying basket or rollover of, or change to, the underlying constituents, or that OID accruals should be calculated using a different maturity date including due to certain early redemptions.

Section 1297. We will not attempt to ascertain whether any underlying constituent issuer would be treated as a “passive foreign investment company” (a “PFIC”) within the meaning of Section 1297 of the Code. If any such entity were so treated, certain adverse U.S. federal income tax consequences might apply to U.S. holders upon the taxable disposition of a Note. U.S. holders should refer to information filed with the SEC or the equivalent governmental authority by any such entity and consult their tax advisors regarding the possible consequences to them in the event that any such entity is or becomes a PFIC.

Notice 2008-2. In 2007, the IRS released a notice that may affect the taxation of holders of the Notes. According to Notice 2008-2, the IRS and the Treasury are actively considering whether the holder of an instrument similar to the Notes should be required to accrue ordinary income on a current basis. It is not possible to determine what guidance they will ultimately issue, if any. It is possible, however, that under such guidance, holders of the Notes will ultimately be required to accrue income currently and this could be applied on a retroactive basis. The IRS and the Treasury are also considering other relevant issues, including whether additional gain or loss from such instruments should be treated as ordinary or capital, whether non-U.S. holders of such instruments should be subject to withholding tax on any deemed income accruals, and whether the special “constructive ownership rules” of Section 1260 of the Code should be applied to such instruments. Both U.S. and non-U.S. holders are urged to consult their tax advisors concerning the significance, and potential impact, of the above considerations.

Medicare Tax on Net Investment Income. U.S. holders that are individuals, estates or certain trusts are subject to an additional 3.8% tax on all or a portion of their “net investment income”, which may include any income or gain realized with respect to the Notes, to the extent of their net investment income that when added to their other modified adjusted gross income, exceeds $200,000 for an unmarried individual, $250,000 for a married taxpayer filing a joint return (or a surviving spouse), $125,000 for a married individual filing a separate return or the dollar amount at which the highest tax bracket begins for an estate or trust. The 3.8% Medicare tax is determined in a different manner than the income tax. U.S. holders should consult their tax advisors as to the consequences of the 3.8% Medicare tax.

Specified Foreign Financial Assets. Certain U.S. holders that own “specified foreign financial assets” in excess of an applicable threshold may be subject to reporting obligations with respect to such assets with their tax returns, especially if such assets are held outside the custody of a U.S. financial institution. U.S. holders are urged to consult their tax advisors as to the application of this legislation to their ownership of the Notes.

Non-U.S. Holders. Subject to Section 871(m) of the Code and “FATCA”, discussed below, if you are a non-U.S. holder you should generally not be subject to U.S. withholding tax with respect to payments on your Notes or to generally applicable information reporting and backup withholding requirements with respect to payments on your Notes if you comply with certain certification and identification requirements as to your non-U.S. status (by providing us (and/or the applicable withholding agent) with a fully completed and duly executed applicable IRS Form W-8). Subject to Section 871(m) of the Code, discussed below, gain realized from the taxable disposition of a Note generally should not be subject to U.S. tax unless (i) such gain is effectively connected with a trade or business conducted by the non-U.S. holder in the U.S., (ii) the non-U.S. holder is a non-resident alien individual and is present in the U.S. for 183 days or more during the taxable year of such taxable disposition and certain other conditions are satisfied or (iii) the non-U.S. holder has certain other present or former connections with the U.S.

14

Section 871(m). A 30% withholding tax (which may be reduced by an applicable income tax treaty) is imposed under Section 871(m) of the Code on certain “dividend equivalents” paid or deemed paid to a non-U.S. holder with respect to a “specified equity-linked instrument” that references one or more dividend-paying U.S. equity securities or indices containing U.S. equity securities. The withholding tax can apply even if the instrument does not provide for payments that reference dividends. Treasury regulations provide that the withholding tax applies to all dividend equivalents paid or deemed paid on specified equity-linked instruments that have a delta of one (“delta-one specified equity-linked instruments”) issued after 2016 and to all dividend equivalents paid or deemed paid on all other specified equity-linked instruments issued after 2017. However, the IRS has issued guidance that states that the Treasury and the IRS intend to amend the effective dates of the Treasury regulations to provide that withholding on dividend equivalents paid or deemed paid will not apply to specified equity-linked instruments that are not delta-one specified equity-linked instruments and are issued before January 1, 2027.

Based on our determination that the Notes are not “delta-one” with respect to the underlying basket, any basket assets or any underlying constituents, our special U.S. tax counsel is of the opinion that the Notes should not be delta-one specified equity-linked instruments and thus should not be subject to withholding on dividend equivalents. Our determination is not binding on the IRS, and the IRS may disagree with this determination. Furthermore, the application of Section 871(m) of the Code will depend on our determinations on the date the terms of the Notes are set. If withholding is required, we will not make payments of any additional amounts.

Nevertheless, after the date the terms are set, it is possible that your Notes could be deemed to be reissued for tax purposes upon the occurrence of certain events affecting the underlying basket, the basket assets, the underlying constituents or your Notes, and following such occurrence your Notes could be treated as delta-one specified equity-linked instruments that are subject to withholding on dividend equivalents. It is also possible that withholding tax or other tax under Section 871(m) of the Code could apply to the Notes under these rules if you enter, or have entered, into certain other transactions in respect of the underlying basket, the basket assets, any underlying constituents or the Notes. If you enter, or have entered, into other transactions in respect of the underlying basket, the basket assets, any underlying constituents or the Notes, you should consult your tax advisor regarding the application of Section 871(m) of the Code to your Notes in the context of your other transactions.

Because of the uncertainty regarding the application of the 30% withholding tax on dividend equivalents to the Notes, you are urged to consult your tax advisor regarding the potential application of Section 871(m) of the Code and the 30% withholding tax to an investment in the Notes.

Foreign Account Tax Compliance Act. The Foreign Account Tax Compliance Act (“FATCA”) was enacted on March 18, 2010, and imposes a 30% U.S. withholding tax on “withholdable payments” (i.e., certain U.S. -source payments, including interest (and original issue discount), dividends, other fixed or determinable annual or periodical gain, profits, and income, and on the gross proceeds from a disposition of property of a type which can produce U.S. -source interest or dividends) and “passthru payments” (i.e., certain payments attributable to withholdable payments) made to certain foreign financial institutions (and certain of their affiliates) unless the payee foreign financial institution agrees (or is required), among other things, to disclose the identity of any U.S. individual with an account of the institution (or the relevant affiliate) and to annually report certain information about such account. FATCA also requires withholding agents making withholdable payments to certain foreign entities that do not disclose the name, address, and taxpayer identification number of any substantial U.S. owners (or do not certify that they do not have any substantial U.S. owners) to withhold tax at a rate of 30%. Under certain circumstances, a holder may be eligible for refunds or credits of such taxes.

Pursuant to final and temporary Treasury regulations and other IRS guidance, the withholding and reporting requirements under FATCA will generally apply to certain “withholdable payments”, will not apply to gross proceeds on a sale or disposition, and will apply to certain foreign passthru payments only to the extent that such payments are made after the date that is two years after final regulations defining the term “foreign passthru payment” are published. If withholding is required, we (or the applicable paying agent) will not be required to pay additional amounts with respect to the amounts so withheld. Foreign financial institutions and non-financial foreign entities located in jurisdictions that have an intergovernmental agreement with the U.S. governing FATCA may be subject to different rules.

Investors should consult their tax advisors about the application of FATCA, in particular if they may be classified as financial institutions (or if they hold their Notes through a foreign entity) under the FATCA rules.

Proposed Legislation. In 2007, legislation was introduced in Congress that, if it had been enacted, would have required holders of Notes purchased after the bill was enacted to accrue interest income over the term of the Notes despite the fact that there will be no interest payments over the term of the Notes.