EXHIBIT 3

[FORM OF UBS AG EXCHANGE TRADED ACCESS SECURITIES (E-TRACS) LINKED TO THE ALERIAN NATURAL GAS MLP INDEX DUE JULY 9, 2040]

(Face of Security)

THIS SECURITY IS A GLOBAL SECURITY WITHIN THE MEANING OF THE INDENTURE HEREINAFTER REFERRED TO AND IS REGISTERED IN THE NAME OF A DEPOSITARY OR A NOMINEE THEREOF. THIS SECURITY MAY NOT BE EXCHANGED IN WHOLE OR IN PART FOR A SECURITY REGISTERED, AND NO TRANSFER OF THIS SECURITY IN WHOLE OR IN PART MAY BE REGISTERED, IN THE NAME OF ANY PERSON OTHER THAN SUCH DEPOSITARY OR A NOMINEE THEREOF, EXCEPT IN THE LIMITED CIRCUMSTANCES DESCRIBED IN THE INDENTURE.

UNLESS THIS CERTIFICATE IS PRESENTED BY AN AUTHORIZED REPRESENTATIVE OF THE DEPOSITORY TRUST COMPANY, A NEW YORK CORPORATION (“DTC”), TO UBS AG, OR ITS AGENT FOR REGISTRATION OF TRANSFER, EXCHANGE OR PAYMENT, AND ANY CERTIFICATE ISSUED IS REGISTERED IN THE NAME OF CEDE & CO. OR IN SUCH OTHER NAME AS IS REQUESTED BY AN AUTHORIZED REPRESENTATIVE OF DTC (AND ANY PAYMENT IS MADE TO CEDE & CO. OR TO SUCH OTHER ENTITY AS IS REQUESTED BY AN AUTHORIZED REPRESENTATIVE OF DTC), ANY TRANSFER, PLEDGE OR OTHER USE HEREOF FOR VALUE OR OTHERWISE BY OR TO ANY PERSON IS WRONGFUL INASMUCH AS THE REGISTERED OWNER HEREOF, CEDE & CO., HAS AN INTEREST HEREIN.

BY PURCHASING THIS SECURITY, THE HOLDER AGREES TO CHARACTERIZE THIS SECURITY FOR ALL U.S. FEDERAL INCOME TAX PURPOSES AS PROVIDED IN SECTION 8 ON THE FACE OF THIS SECURITY.

CUSIP No. 902641620

ISIN: US9026416209

UBS AG

MEDIUM-TERM NOTES, SERIES A

$— UBS AG Exchange Traded Access Securities (E-TRACS) linked to the Alerian

Natural Gas MLP Index due July 9, 2040

The following terms apply to this Security. Capitalized terms that are not defined the first time they are used in this Security shall have the meanings indicated elsewhere in this Security.

(Face of Security continued on next page)

–2–

(Face of Security continued on next page)

–3–

OTHER TERMS:

All terms used in this Security that are not defined in this Security but are defined in the Indenture referred to on the reverse of this Security shall have the meanings assigned to them in the Indenture. Section headings on the face of this Security are for convenience only and shall not affect the construction of this Security.

“Annual Tracking Fee” means, as of any date of determination, an amount per Security equal to the product of (i) 0.85% and (ii) the applicable Current Indicative Value as of the immediately preceding Index Business Day.

“Accrued Tracking Fee” means:

(1) With respect to the first Coupon Valuation Date, an amount equal to the product of (a) the Annual Tracking Fee as of the first Coupon Valuation Date and (b) a fraction, the numerator of which is the total number of calendar days from and excluding the Initial Trade Date to and including the first Coupon Valuation Date, and the denominator of which is 365.

(2) With respect to any Coupon Valuation Date other than the first Coupon Valuation Date, an amount equal to (a) the product of (i) the Annual Tracking Fee as of such Coupon Valuation Date and (ii) a fraction, the numerator of which is the total number of calendar days from and excluding the immediately preceding Coupon Valuation Date to and including such Coupon Valuation Date, and the denominator of which is 365, plus (b) the Tracking Fee Shortfall as of the immediately preceding Coupon Valuation Date, if any.

(3) As of the last Index Business Day in the Final Measurement Period, an amount equal to (a) the product of (i) the Annual Tracking Fee calculated as of the last Index Business Day in the Final Measurement Period and (ii) a fraction, the numerator of which is the total number of calendar days from and excluding the Calculation Date to and including the last Index Business Day in the Final Measurement Period, and the denominator of which is 365, plus (b) the Tracking Fee Shortfall as of the last Coupon Valuation Date, if any.

(4) As of the last Index Business Day in the Call Measurement Period, an amount equal to (a) a product of (i) the Annual Tracking Fee calculated as of the last Index Business Day in the Call Measurement Period and (ii) a fraction, the numerator of which is the total number of calendar days from and excluding the Call Valuation Date to and including the last Index Business Day in the Call Measurement Period, and the denominator of which is 365, plus (b) the adjusted Tracking Fee Shortfall, if any.

“Adjusted Coupon Amount” means:

(1) With respect to any Redemption Valuation Date, an amount in cash equal to the difference between the Adjusted Reference Distribution Amount, calculated as of such Redemption Valuation Date, and the Adjusted Tracking Fee, calculated as of such Redemption Valuation Date, to the extent that the Adjusted Reference Distribution Amount, calculated as of such Redemption Valuation Date, is greater than or equal to the Adjusted Tracking Fee, calculated as of the Redemption Valuation Date.

(Face of Security continued on next page)

–4–

(2) With respect to the Call Valuation Date, an amount in cash equal to the difference between the Adjusted Reference Distribution Amount, calculated as of the Call Valuation Date, and the Adjusted Tracking Fee, calculated as of the Call Valuation Date, to the extent that the Adjusted Reference Distribution Amount, calculated as of the Call Valuation Date, is greater than or equal to the Adjusted Tracking Fee, calculated as of the Call Valuation Date.

“Adjusted Reference Distribution Amount” means:

(1) As of any Redemption Valuation Date, an amount equal to the gross cash distributions that a Reference Holder would have been entitled to receive in respect of the Index constituents held by such Reference Holder on the “record date” with respect to any Index constituent for those cash distributions whose “ex-dividend date” occurs during the period from and excluding the immediately preceding Coupon Valuation Date (or if the Redemption Valuation Date occurs prior to the first Coupon Valuation Date, the period from and excluding the Initial Trade Date) to and including such Redemption Valuation Date.

(2) As of the Call Valuation Date, an amount equal to the gross cash distributions that a Reference Holder would have been entitled to receive in respect of the Index constituents held by such Reference Holder on the “record date” with respect to any Index constituent for those cash distributions whose “ex-dividend date” occurs during the period from and excluding the immediately preceding Coupon Valuation Date to and including the Call Valuation Date.

“Adjusted Tracking Fee” means:

(1) As of any Redemption Valuation Date, an amount equal to (a) the Tracking Fee Shortfall as of the immediately preceding Coupon Valuation Date plus (b) the product of (i) the Annual Tracking Fee as of such Redemption Valuation Date and (ii) a fraction, the numerator of which is the total number of calendar days from and excluding the immediately preceding Coupon Valuation Date (or if the Redemption Valuation Date occurs prior to the first Coupon Valuation Date, the period from and excluding the Initial Trade Date) to and including such Redemption Valuation Date and the denominator of which is 365.

(2) As of the Call Valuation Date, an amount equal to (a) the Tracking Fee Shortfall as of the immediately preceding Coupon Valuation Date plus (b) the product of (i) the Annual Tracking Fee as of the Call Valuation Date, and (ii) a fraction, the numerator of which is the total number of calendar days from and excluding the immediately preceding Coupon Valuation Date to and including the Call Valuation Date and the denominator of which is 365.

“Adjusted Tracking Fee Shortfall” means:

(1) As of any Redemption Valuation Date, the difference between the Adjusted Tracking Fee and the Adjusted Reference Distribution Amount, to the extent that the Adjusted Reference Distribution Amount, calculated as of such Redemption Valuation Date, is less than the Adjusted Tracking Fee, calculated as of such Redemption Valuation Date.

(Face of Security continued on next page)

–5–

(2) As of the Call Valuation Date, the difference between the Adjusted Tracking Fee and the Adjusted Reference Distribution Amount, to the extent that the Adjusted Reference Distribution Amount, calculated as of the Call Valuation Date, is less than the Adjusted Tracking Fee, calculated as of the Call Valuation Date.

“Averaging Date” means each of the Index Business Days during the Final Measurement Period or Call Measurement Period, as applicable, each of which periods are subject to adjustments as provided under Section 3 hereof.

“Business Day” means any day that is not a Saturday, a Sunday or a day on which banking institutions in The City of New York, generally, are authorized or obligated by law, regulation or executive order to close.

“Calculation Date” means June 28, 2040, unless such day is not an Index Business Day, in which case the Calculation Date will be the next Index Business Day, subject to adjustments as provided under Section 3 hereof.

“Call Measurement Period” means the five Index Business Days from and including the Call Valuation Date, subject to adjustments as provided under Section 3 hereof.

“Call Settlement Date” means, with respect to the exercise by the Company of its Call Right, any Business Day specified by the Company on or after July 18, 2011 through and including the Maturity Date, which is also the third Business Day following the last Index Business Day in the Call Measurement Period, subject to adjustments as provided under Section 3 hereof.

“Call Valuation Date” means, if the Company issues a call notice on any calendar day, the last Business Day of the week following the week in which the call notice is issued, generally Friday.

“Coupon Ex-Date” means, with respect to a Coupon Amount, the first Exchange Business Day on which the Securities trade without the right to receive such Coupon Amount.

“Coupon Record Date” means the ninth Index Business Day following each Coupon Valuation Date.

“Coupon Valuation Date” means the 30th of March, June, September and December of each calendar year during the term of the Securities, commencing September 30, 2010, or if such date is not an Index Business Day, then the first Index Business Day following such date, provided that the final Coupon Valuation Date will be the Calculation Date, subject to adjustment as provided under Section 3 hereof.

“Current Indicative Value”, as determined by the Security Calculation Agent as of any date of determination, means an amount per Security, equal to the product of (i) the Principal Amount and (ii) a fraction, the numerator of which is equal to the VWAP Level as of such date and the denominator of which is equal to the Initial VWAP Level.

“Default Amount” means, on any day, an amount in U.S. dollars, as determined by the Security Calculation Agent in its sole discretion, equal to the cost of

(Face of Security continued on next page)

–6–

having a Qualified Financial Institution (selected as provided below) expressly assume the due and punctual payment of the principal of this Security, and the performance or observance of every covenant hereof and of the Indenture on the part of the Company to be performed or observed with respect to this Security (or to undertake other obligations providing substantially equivalent economic value to the Holder of this Security as the Company’s obligations hereunder). Such cost will equal (i) the lowest amount that a Qualified Financial Institution would charge to effect such assumption (or undertaking), plus (ii) the reasonable expenses (including reasonable attorneys’ fees) incurred by the Holder of this Security in preparing any documentation necessary for such assumption (or undertaking). During the Default Quotation Period, each Holder of this Security and the Company may request a Qualified Financial Institution to provide a quotation of the amount it would charge to effect such assumption (or undertaking) and notify the other in writing of such quotation. If the Company or any Holder obtains a quotation, it must notify the other party in writing of the quotation. The amount referred to in clause (i) of this paragraph will equal the lowest (or, if there is only one, the only) quotation so obtained, and as to which notice is so given, during the Default Quotation Period; provided that, with respect to any quotation, the party not obtaining such quotation may object, on reasonable and significant grounds, to the effectuation of such assumption (or undertaking) by the Qualified Financial Institution providing such quotation and notify the other party in writing of such grounds within two Business Days after the last day of the Default Quotation Period, in which case such quotation will be disregarded in determining the Default Amount. The “Default Quotation Period” shall be the period beginning on the day the Default Amount first becomes due and payable and ending on the third Business Day after such due date, unless no such quotation is obtained, or unless every such quotation so obtained is objected to within five Business Days after such due date as provided above, in which case the Default Quotation Period will continue until the third Business Day after the first Business Day on which prompt notice of a quotation is given as provided above, unless such quotation is objected to as provided above within five Business Days after such first Business Day, in which case, the Default Quotation Period will continue as provided in this sentence. Notwithstanding the foregoing, if the Default Quotation Period (and the subsequent two Business Day objection period) has not ended prior to the Calculation Date, then the Default Amount will equal the Principal Amount.

“Disrupted Day” with respect to any Index constituent is any Index Business Day on which the Primary Exchange or any Related Exchange fails to open for trading during its regular trading session or on which a Market Disruption Event has occurred and is continuing, and, in both cases, the occurrence of which is determined by the Security Calculation Agent to have a material effect on the VWAP Level.

“ex-dividend date” means, with respect to a distribution on an Index constituent, the first Business Day on which transactions in such Index constituent trade on the Primary Exchange without the right to receive such distribution.

“Exchange Business Day” means any day on which the Primary Exchange or market for trading of the Securities is scheduled to be open for trading.

“Final Measurement Period” means the five Index Business Days from and including the Calculation Date, subject to adjustments as provided under Section 3 hereof.

(Face of Security continued on next page)

–7–

“Final VWAP Level”, as determined by the VWAP Calculation Agent, will be the arithmetic mean of the VWAP Levels measured on each Index Business Day during the Final Measurement Period or Call Measurement Period, or the VWAP Level on any applicable Redemption Valuation Date, as applicable.

“Index Business Day” means any day on which the Primary Exchange and each Related Exchange are scheduled to be open for trading.

“Index Calculation Agent” means the entity that calculates and publishes the level of the Index, which is currently S&P.

“Index constituent” means the Master Limited Partnerships (MLP) included in the Index.

“Index Divisor” as of any date of determination, means the Divisor used by the Index Calculation Agent to calculate the level of the Index.

“Index Performance Ratio”, on any Index Business Day is calculated as follows:

Final VWAP Level

Initial VWAP Level

“Index Sponsor” means GKD Index Partners, LLC.

“Market Disruption Event”, with respect to an Index constituent, means:

(a) the occurrence or existence of a condition specified below:

(i) any suspension, absence or limitation of trading on the Primary Exchange for trading in the Index constituent, whether by reason of movements in price exceeding limits permitted by the Primary Exchange or otherwise;

(ii) any suspension, absence or limitation of trading on the Related Exchange for trading in futures or options contracts related to the Index constituent, whether by reason of movements in price exceeding limits permitted by such Related Exchange or otherwise, or

(iii) any event (other than an event described in (b) below) that disrupts or impairs (as determined by the Security Calculation Agent) the ability of market participants in general (A) to effect transactions in, or obtain market values for, the relevant Index constituent or (B) to effect transactions in, or obtain market values for, futures or options contracts relating to the relevant Index constituent; or

(b) the closure on any Index Business Day of the Primary Exchange or any Related Exchange prior to its Scheduled Closing Time unless such earlier closing time is announced by the Primary Exchange or such Related Exchange at least one hour prior to the earlier of (i) the actual closing time for the regular trading session on the Primary Exchange or such Related Exchange on such Index Business Day and (ii) the submission deadline for orders to be entered into the Primary Exchange or such Related Exchange system for execution at the close of trading on such Index Business Day;

(Face of Security continued on next page)

–8–

in each case determined by the Security Calculation Agent in its sole discretion; and

(c) a determination by the Security Calculation Agent in its sole discretion that the event described above materially interfered with the Company’s ability or the ability of any of the Company’s affiliates to adjust or unwind all or a material portion of any hedge with respect to the Securities.

For purposes of the above definition:

(a) a limitation on the hours or number of days of trading will not constitute a Market Disruption Event if it results from an announced change in the regular business hours of the Primary Exchange or Related Exchange, and

(b) for purposes of clause (a) above, limitations pursuant to the rules of any Primary Exchange or Related Exchange similar to NYSE Rule 80B or Nasdaq Rule 4120 (or any applicable rule or regulation enacted or promulgated by any other self-regulatory organization or any government agency of scope similar to NYSE Rule 80B or Nasdaq Rule 4120 as determined by the Security Calculation Agent) on trading during significant market fluctuations will constitute a suspension, absence or material limitation of trading.

“Maturity Date” means July 9, 2040, which is the third Business Day following the last Index Business Day in the Final Measurement Period, subject to adjustments as provided under Section 3 hereof.

“Primary Exchange” means, with respect to each Index constituent or each constituent underlying a Successor Index, the primary exchange or market of trading such Index constituent or such constituent underlying a Successor Index.

“Qualified Financial Institution” means, at any time, a financial institution organized under the laws of any jurisdiction in the United States of America, Europe or Japan, which at that time has outstanding debt obligations with a stated maturity of one year or less from the date of issue and rated either: (i) A-1 or higher by S&P or any successor, or any other comparable rating then used by that rating agency, or (ii) P-1 or higher by Moody’s Investors Service or any successor, or any other comparable rating then used by that rating agency.

“record date” means, with respect to a distribution on an Index constituent, the date on which a holder of the Index constituent must be registered as a unitholder of such Index constituent in order to be entitled to receive such distribution.

“Redemption Date” means the third Business Day following the Redemption Valuation Date, commencing on July 26, 2010.

“Redemption Fee Amount” As of any date of determination, an amount per Security equal to the product of (i) 0.125% and (ii) the Current Indicative Value as of the immediately preceding Index Business Day.

(Face of Security continued on next page)

–9–

“Redemption Valuation Date” means, for any applicable redemption request, the last Business Day of each week (generally Friday) that is also the first Index Business Day following the date that the relevant redemption notice and redemption confirmation are delivered, subject to adjustments as provided under Section 5 hereof.

“Reference Distribution Amount” means (i) as of the first Coupon Valuation Date, an amount equal to the gross cash distributions that a Reference Holder would have been entitled to receive in respect of the Index constituents held by such Reference Holder on the “record date” with respect to any Index constituent for those cash distributions whose “ex-dividend date” occurs during the period from and excluding the Initial Trade Date to and including the first Coupon Valuation Date; and (ii) as of any other Coupon Valuation Date, an amount equal to the gross cash distributions that a Reference Holder would have been entitled to receive in respect of the Index constituents held by such Reference Holder on the “record date” with respect to any Index constituent for those cash distributions whose “ex-dividend date” occurs during the period from and excluding the immediately preceding Coupon Valuation Date to and including such Coupon Valuation Date. Notwithstanding the foregoing, with respect to cash distributions for an Index constituent which is scheduled to be paid prior to the applicable Coupon Ex-Date, if, and only if, the issuer of such Index constituent fails to pay the distribution to holders of such Index constituent by the scheduled payment date for such distribution, such distribution will be assumed to be zero for the purposes of calculating the applicable Reference Distribution Amount.

“Reference Holder” means, as of any date of determination, a hypothetical holder of a number of units of each Index constituent equal to (i) the published unit weighting of that Index constituent as of that date, divided by (ii) the product of (a) the Index Divisor as of that date, and (b) the Initial VWAP Level divided by 15.

“Related Exchange” means, with respect to each Index constituent or each constituent underlying a Successor Index, each exchange or quotation system where trading has a material effect (as determined by the Security Calculation Agent) on the overall market for futures or options contracts relating to such Index constituent or such constituent underlying a Successor Index.

“S&P” means Standard & Poor’s Financial Services LLC, a subsidiary of The McGraw-Hill Companies, Inc.

“Scheduled Closing Time” means, with respect to the Primary Exchange or the Related Exchange, on any Index Business Day, the scheduled weekday closing time of the Primary Exchange or such Related Exchange on such Index Business Day, without regard to after hours or any other trading outside of the regular trading session hours.

“Stub Reference Distribution Amount” means:

(1) As of the last Index Business Day in the Final Measurement Period, an amount equal to the gross cash distributions that a Reference Holder would have been entitled to receive in respect of the Index constituents held by such Reference Holder on the “record date” with respect to any Index constituent, for those cash distributions whose “ex-dividend date” occurs during the period from and excluding the first Index Business Day in the Final Measurement Period to and including the last Index Business Day in the Final Measurement

(Face of Security continued on next page)

–10–

Period, provided, that for the purpose of calculating the Stub Reference Distribution Amount, the Reference Holder will be deemed to hold four-fifths, three-fifths, two-fifths and one-fifth of the shares of each Index constituent it would otherwise hold on the second, third, fourth and fifth Index Business Day, respectively, in the Final Measurement Period.

(2) As of the last Index Business Day in the Call Measurement Period, an amount equal to the gross cash distributions that a Reference Holder would have been entitled to receive in respect of the Index constituents held by such Reference Holder on the “record date” with respect to any Index constituent, for those cash distributions whose “ex-dividend date” occurs during the period from and excluding the first Index Business Day in the Call Measurement Period to and including the last Index Business Day in the Call Measurement Period, provided, that for the purpose of calculating the Stub Reference Distribution Amount, the Reference Holder will be deemed to hold four-fifths, three-fifths, two-fifths and one-fifth of the shares of each Index constituent it would otherwise hold on the second, third, fourth and fifth Index Business Day, respectively, in the Call Measurement Period.

“Successor Index” means any substitute index approved by the Security Calculation Agent as a Successor Index pursuant to Section 3 hereof.

“VWAP” means, with respect to each Index constituent, as of any date of determination, the volume-weighted average price of one unit of such Index constituent as determined by the VWAP Calculation Agent based on the Primary Exchange for each Index constituent.

“VWAP Calculation Agent” is initially the NYSE.

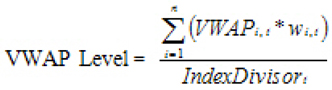

“VWAP Level”, as determined by the VWAP Calculation Agent as of any Index Business Day, is equal to (1) the sum of the products of (i) the VWAP of each Index constituent as of such date and (ii) the published share weighting of that Index constituent as of such date divided by (2) the Index Divisor as of such date, or expressed as a formula, as follows:

where:

n is the number of Index constituents;

VWAPi,t is the VWAP of Index constituent i as of Index Business Day t;

wi,t is the published share weighting of Index Component i as of Index Business Day t; and

Index Divisort is the Index Divisor as of Index Business Day t.

(Face of Security continued on next page)

–11–

1. Promise to Pay at Maturity, Upon Early Redemption or Upon Exercise of Call Right

UBS AG, a corporation duly organized and existing under the laws of Switzerland (herein called the “Company,” which term includes any successor Person under the Indenture hereinafter referred to), for value received, hereby promises to pay (or cause to be paid) to Cede & Co., as nominee for The Depository Trust Company, or registered assigns, the principal sum, calculated as provided under (i) “Early Redemption” and elsewhere on the face of this Security on the applicable Redemption Date, in the case of any Securities in respect of which a Holder exercises such Holder’s right to require the Company to redeem such Holder’s Securities prior to the Maturity Date, (ii) “Call Right” and elsewhere on the face of this Security on the Call Settlement Date, in the case of Securities subject to the Company’s exercise of its Call Right, or (iii) “Payment at Maturity” and elsewhere on the face of this Security on the Maturity Date, in the case of all other Securities. The Company promises to pay the Coupon Amount, if any, as provided for herein, on each Coupon Payment Date, to Holders in whose names the Security is registered on the applicable Coupon Record Date.

2. Payment of Interest

The principal of this Security shall not bear interest.

3. Discontinuance or Modification of the Index; Market Disruption Event

If S&P discontinues publication of or otherwise fails to publish the Index, or S&P does not make the Index constituents, their share weighting and/or the Index Divisor available to the VWAP Calculation Agent, and the Index Sponsor, S&P or another entity publishes a successor or substitute index that the Security Calculation Agent determines to be comparable to the discontinued Index and for which the Index constituents, their share weighting, and/or the Index Divisor are available to the VWAP Calculation Agent (such index being referred to herein as a “Successor Index”), then the VWAP Level for such Successor Index will be determined by the VWAP Calculation Agent by reference to the sum of the products of the VWAPs of the constituents underlying such Successor Index on the Primary Exchanges and each such constituent’s respective weighting within the Successor Index (which sum will be adjusted by any index divisor used by such Successor Index) on the dates and at the times as of which the VWAP Levels for such Successor Index are to be determined.

Upon any selection by the Security Calculation Agent of a Successor Index, the Security Calculation Agent will cause written notice thereof to be furnished to the trustee, to the Company and to the holders of the Securities.

If S&P discontinues publication of the Index or does not make the Index constituents, their unit weightings and/or Index Divisor available to the VWAP Calculation Agent prior to, and such discontinuation or unavailability is continuing on the Calculation Date or any Index Business Day during the Final Measurement Period or Call Measurement Period, or on the Redemption Valuation Date, as applicable, or any other relevant date on which the VWAP Level is to be determined and the Security Calculation Agent determines

(Face of Security continued on next page)

–12–

that no Successor Index is available at such time, or the Security Calculation Agent has previously selected a Successor Index and publication of such Successor Index is discontinued prior to, and such discontinuation is continuing on the Calculation Date or any Index Business Day during the Final Measurement Period or Call Measurement Period, or on the Redemption Valuation Date, as applicable, or any other relevant date on which the VWAP Level is to be determined, then the VWAP Calculation Agent will determine the relevant VWAP Levels using the VWAP and published share weighting of each Index constituent included in the Index or Successor Index, as applicable, immediately prior to such discontinuation or unavailability, as adjusted for certain corporate actions. In such event, the Security Calculation Agent will cause notice thereof to be furnished to the trustee, to the Company and to the holders of the Securities.

If at any time the method of calculating the Index or a Successor Index, or the value thereof, is changed in a material respect, or if the Index or a Successor Index is in any other way modified so that the VWAP Level of the Index or such Successor Index does not, in the opinion of the Security Calculation Agent, fairly represent the VWAP Level of the Index or such Successor Index had such changes or modifications not been made, then the Security Calculation Agent will make such calculations and adjustments as, in the good faith judgment of the Security Calculation Agent, may be necessary in order to arrive at a VWAP level of an index comparable to the Index or such Successor Index, as the case may be, as if such changes or modifications had not been made, and the Security Calculation Agent will calculate the VWAP Levels for the Index or such Successor Index with reference to the Index or such Successor Index, as adjusted. The Security Calculation Agent will accordingly calculate the Final VWAP Level, the Index Performance Ratio, the Coupon Amount, the Adjusted Coupon Amount, if any, the Reference Distribution Amount, the Stub Reference Distribution Amount, if any, the Adjusted Reference Distribution Amount, the Accrued Tracking Fee (including the Annual Tracking Fee, any Tracking Fee Shortfall and any Adjusted Tracking Fee Shortfall), the Adjusted Tracking Fee, the Redemption Fee Amount, if any, the Cash Settlement Amount, if any, that the Company will pay at maturity, the Redemption Amount, if any, upon early redemption, if applicable, and the Call Settlement Amount, if any, that the Company will pay in the event the Company calls the Securities, based on the relevant VWAP Levels calculated by the VWAP Calculation Agent, as adjusted. Accordingly, if the method of calculating the Index or a Successor Index is modified so that the level of the Index or such Successor Index is a fraction of what it would have been if there had been no such modification (e.g., due to a split in the Index), which, in turn, causes the VWAP Level of the Index or such Successor Index to be a fraction of what it would have been if there had been no such modification, then the Security Calculation Agent will make such calculations and adjustments in order to arrive at a VWAP Level for the Index or such Successor Index as if it had not been modified (e.g., as if such split had not occurred).

To the extent a Disrupted Day exists with respect to an Index constituent on an Averaging Date or on a Redemption Valuation Date, the VWAP and published share weighting with respect to such Index constituent (and only with respect to such Index constituent) for such Averaging Date or Redemption Valuation Date will be determined by the Security Calculation Agent or one of its affiliates on the first succeeding Index Business Day that is not a Disrupted Day (the “Deferred Averaging Date”) with respect to such Index constituent irrespective of whether pursuant to such determination, the Deferred Averaging Date would fall on a date originally scheduled to be an Averaging Date. If the postponement described in the preceding sentence results in the VWAP of a particular Index constituent

(Face of Security continued on next page)

–13–

being calculated on a day originally scheduled to be an Averaging Date, for purposes of determining the VWAP Levels on the Index Business Days during the Final Measurement Period or Call Measurement Period, or on the Redemption Valuation Date, as applicable, the Security Calculation Agent or one of its affiliates, as the case may be, will apply the VWAP and the published share weighting with respect to such Index constituent for such Deferred Averaging Date to the calculation of the VWAP Level (i) on the date(s) of the original disruption with respect to such Index constituent and (ii) such Averaging Date.

In no event, however, will any postponement pursuant to the immediately preceding paragraph result in the final Averaging Date or the Redemption Valuation Date, as applicable, with respect to any Index constituent occurring more than three Index Business Days following the day originally scheduled to be such final Averaging Date or Redemption Valuation Date. If the third Index Business Day following the date originally scheduled to be the final Averaging Date, or the Redemption Valuation Date, as applicable, is not an Index Business Day or is a Disrupted Day with respect to such Index constituent, the Security Calculation Agent or one of its affiliates will determine the VWAP and share weighting with respect to any Index constituent required to be determined for the purpose of calculating the applicable VWAP Level based on its good faith estimate of the VWAP and share weighting of each such Index constituent that would have prevailed on the Primary Exchange on such third Index Business Day but for such suspension or limitation.

The Security Calculation Agent shall have the right to make all determinations and adjustments with respect to the Index in its sole discretion.

4. Payment at Maturity, Upon Early Redemption or on the Call Settlement Date

The payment of this Security that becomes due and payable on the Maturity Date, a Redemption Date or the Call Settlement Date, as the case may be, shall be the cash amount that must be paid to redeem this Security as provided herein under “Payment at Maturity”, “Early Redemption” and “Call Right,” respectively. The payment of this Security that becomes due and payable upon acceleration of the Maturity Date hereof after an Event of Default has occurred pursuant to the Indenture shall be (a) the Default Amount and (b) the Coupon Amount per Security, if any, with respect to the final Coupon Payment Date, as described herein, calculated as if the date of acceleration was the last Index Business Day in the Final Measurement Period and the four Index Business Days immediately preceding the date of acceleration were the corresponding Index Business Days in the accelerated Final Measurement Period, with the fourth Index Business Day immediately preceding the date of acceleration being the accelerated Calculation Date and the accelerated final Coupon Valuation Date, and the Index Business Day immediately preceding the date of acceleration being the relevant final Coupon Valuation Date. When the principal referred to in either of the two preceding sentences has been paid as provided herein (or such payment has been made available), the principal of this Security shall be deemed to have been paid in full, whether or not this Security shall have been surrendered for payment or cancellation. References to the payment at maturity or upon early redemption or call of this Security on any day shall be deemed to mean the payment of cash that is payable on such day as provided in this Security. This Security shall cease to be Outstanding as provided in the definition of such term in the Indenture when the principal of this Security shall be deemed to have been paid in full as provided above.

(Face of Security continued on next page)

–14–

5. Procedure for Early Redemption

Subject to the minimum redemption amount provided under “Early Redemption,” the Holder may require the Company to redeem the Holder’s Securities during the term of the Securities on any Redemption Date on or after July 26, 2010, provided that such Holder instructs its broker or other person through whom the Securities are held to (i) deliver a redemption notice to the Company via email no later than 12:00 noon (New York City time) on the Business Day immediately preceding the applicable Redemption Valuation Date; (ii) deliver the signed redemption confirmation to the Company via facsimile in the specified form by 5:00 p.m. (New York City time) on the same day; (iii) instruct the Holder’s DTC custodian to book a delivery versus payment trade with respect to the Holder’s Securities on the applicable Redemption Valuation Date at a price equal to the Redemption Amount; and (iv) cause the Holder’s DTC custodian to deliver the trade as booked for settlement via DTC prior to 10:00 a.m. (New York City time) on the applicable Redemption Date.

6. Call Right

The Securities are subject to redemption upon not less than eighteen (18) days’ prior notice on any Business Day on or after July 18, 2011 through and including the Maturity Date, as a whole and not in part, at the election of the Company. If the Company elects to redeem the Securities on the Call Settlement Date, the Holder will receive a cash payment equal to the Call Settlement Amount.

7. Role of Security Calculation Agent and VWAP Calculation Agent

The Security Calculation Agent will be solely responsible for all determinations and calculations regarding the value of the Securities, including at maturity or upon early redemption or call, Market Disruption Events, Business Days, Exchange Business Days, Index Business Days, the Index Performance Ratio, the Coupon Amount, the Adjusted Coupon Amount, if any, the Reference Distribution Amount, the Stub Reference Distribution Amount, if any, the Adjusted Reference Distribution Amount, the Accrued Tracking Fee (including the Annual Tracking Fee, any Tracking Fee Shortfall and any Adjusted Tracking Fee Shortfall), the Adjusted Tracking Fee, the Redemption Fee Amount, the Cash Settlement Amount, if any, that the Company will pay at maturity, the Coupon Ex-Dates, the Coupon Record Dates, the Redemption Amount, if any, that the Company will pay upon redemption, if applicable, the Call Amount, if any, that the Company will pay in the event that the Company calls the Securities and all such other matters as may be specified elsewhere herein as matters to be determined by the Security Calculation Agent. The Security Calculation Agent shall make all such determinations and calculations in its sole discretion, and absent manifest error, all determinations of the Security Calculation Agent shall be final and binding on the Company, the Holder and all other Persons having an interest in this Security, without liability on the part of the Security Calculation Agent. The Holder of this Security shall not be entitled to any compensation from the Company for any loss suffered as a result of any determinations or calculations made by the Security Calculation Agent.

The Company shall take such action as shall be necessary to ensure that there is, at all relevant times, a financial institution serving as the Security Calculation Agent hereunder.

(Face of Security continued on next page)

–15–

The Company may, in its sole discretion at any time and from time to time, upon written notice to the Trustee, but without notice to the Holder of this Security, terminate the appointment of any Person serving as the Security Calculation Agent and appoint another Person (including any Affiliate of the Company) to serve as the Security Calculation Agent. Insofar as this Security provides for the Security Calculation Agent to determine Market Disruption Events, Business Days, Index Business Days, Exchange Business Days, the Index Performance Ratio, the Coupon Amount, the Adjusted Coupon Amount, if any, the Reference Distribution Amount, the Stub Reference Distribution Amount, if any, the Adjusted Reference Distribution Amount, the Accrued Tracking Fee (including the Annual Tracking Fee, any Tracking Fee Shortfall and any Adjusted Tracking Fee Shortfall), the Adjusted Tracking Fee, the Redemption Fee Amount, the Cash Settlement Amount, if any, that the Company will pay at maturity, the Coupon Ex-Dates, the Coupon Record Dates, the Redemption Amount, if any, that the Company will pay upon redemption, if applicable, the Call Amount, if any, that the Company will pay in the event that the Company calls the Securities and all such other matters as may be specified elsewhere herein as matters to be determined by the Security Calculation Agent on any date or other information from any institution or other source, the Security Calculation Agent may do so from any source or sources of the kind contemplated or otherwise permitted hereby notwithstanding that any one or more of such sources are the Security Calculation Agent, affiliates of the Security Calculation Agent or affiliates of the Company.

NYSE will initially act as the VWAP Calculation Agent. The VWAP Calculation Agent will determine the Initial VWAP Level. The VWAP Calculation Agent will determine the VWAP of any Index constituent, the VWAP Level and the Final VWAP Level on any Index Business Day on which such VWAP, VWAP Level or the Final VWAP Level is to be determined during the term of the Securities, except as otherwise provided under Section 3 hereof. All determinations made by the VWAP Calculation Agent will be at the sole discretion of the VWAP Calculation Agent and will, in the absence of manifest error, be conclusive for all purposes and binding on the Holders and on the Issuer. The Company may, in its sole discretion at any time and from time to time, upon written notice to the Trustee, but without notice to the Holder of this Security, terminate the appointment of any Person serving as the VWAP Calculation Agent and appoint another Person (including any Affiliate of the Company) to serve as the VWAP Calculation Agent.

8. Tax Characterization

By its purchase of this Security, the Holder, on behalf of itself and any other Person having a beneficial interest in this Security, hereby agrees with the Company (in the absence of a statutory, regulatory, administrative or judicial ruling to the contrary) to treat this Security for all U.S. federal income tax purposes as a prepaid forward contract with respect to the Index and to treat the Coupon Amount (including amounts received upon the sale or maturity of the Securities in respect of accrued but unpaid Coupon Amounts) as an amount that should be included in ordinary income for tax purposes at the time such amounts accrue or are received, in accordance with the your regular method of tax accounting.

9. Payment

Payment of any amount payable on this Security will be made in such coin or currency of the United States of America as at the time of payment is legal tender for

(Face of Security continued on next page)

–16–

payment of public and private debts. Payment will be made to an account designated by the Holder (in writing to the Company and the Trustee on or before the Calculation Date, Call Valuation Date or applicable Redemption Valuation Date) and acceptable to the Company or, if no such account is designated and acceptable as aforesaid, at the office or agency of the Company maintained for that purpose in The City of New York, provided, however, that payment on the Maturity Date, Call Settlement Date or any Redemption Date shall be made only upon surrender of this Security at such office or agency (unless the Company waives surrender). Notwithstanding the foregoing, if this Security is a Global Security, any payment may be made pursuant to the Applicable Procedures of the Depositary as permitted in said Indenture.

All dollar amounts related to determination of the Coupon Amount, the Adjusted Coupon Amount, if any, the Reference Distribution Amount, the Stub Reference Distribution Amount, if any, the Adjusted Reference Distribution Amount, the Accrued Tracking Fee (including the Annual Tracking Fee, any Tracking Fee Shortfall and any Adjusted Tracking Fee Shortfall), the Adjusted Tracking Fee, the Redemption Amount and Redemption Fee Amount, if any, per Security, and the Cash Settlement Amount, if any, per Security, will be rounded to the nearest ten-thousandth, with five one hundred-thousandths rounded upward (e.g., .76545 would be rounded up to .7655); and all dollar amounts paid on the aggregate principal amount of Securities per Holder will be rounded to the nearest cent, with one-half cent rounded upward.

10. Reverse of this Security

Reference is hereby made to the further provisions of this Security set forth on the reverse hereof, which further provisions shall for all purposes have the same effect as if set forth at this place.

11. Certificate of Authentication

Unless the certificate of authentication hereon has been executed by the Trustee referred to on the reverse hereof by manual signature, this Security shall not be entitled to any benefit under the Indenture or be valid or obligatory for any purpose.

(Face of Security continued on next page)

–17–

IN WITNESS WHEREOF, the Company has caused this instrument to be duly executed.

| UBS AG | ||

| By: |

| |

| By: |

| |

This is one of the Securities of the series designated herein and referred to in the Indenture.

Dated: July 16, 2010

| U.S. BANK TRUST NATIONAL ASSOCIATION, AS TRUSTEE | ||

| By: |

| |

| Authorized Signatory | ||

(Reverse of Security on next page)

(Reverse of Security)

This Security is one of a duly authorized issue of securities of the Company (herein called the “Securities”) issued and to be issued in one or more series under the Indenture, dated as of November 21, 2000, as amended and supplemented by the First Supplemental Indenture, dated as of February 28, 2006 (herein called the “Indenture,” which term shall have the meaning assigned to it in such instrument), between the Company and U.S. Bank Trust National Association, as Trustee (herein called the “Trustee,” which term includes any successor trustee under the Indenture), and reference is hereby made to the Indenture for a statement of the respective rights, limitations of rights, duties and immunities thereunder of the Company, the Trustee, the Holders of the Securities and of the terms upon which the Securities are, and are to be, authenticated and delivered. Insofar as the provisions of the Indenture may conflict with the provisions set forth on the face of this Security, the latter shall control for purposes of this Security.

This Security is one of the series designated on the face hereof, limited to an aggregate initial offering price not to exceed $— (or the equivalent thereof in any other currency or currencies or currency units), which amount may be increased at the option of the Company if in the future it determines that it may wish to sell additional Securities of this series. References herein to “this series” mean the series designated on the face hereof.

Payments under the Securities will be made without withholding or deduction for or on account of any present or future tax, duty, assessment or governmental charge (“Taxes”) imposed upon or as a result of such payments by Switzerland or any jurisdiction in which a branch of the Company through which the Securities are issued is located (or any political subdivision or taxing authority thereof or therein) (a “Relevant Jurisdiction”), unless required by law. To the extent any such Taxes are so levied or imposed, the Company will, subject to the exceptions and limitations set forth in Section 1007 of the Indenture, pay such additional amounts (“Additional Amounts”) to the Holder of any Security who is not a resident of the Relevant Jurisdiction as may be necessary in order that every net payment of the principal of such Security and any other amounts payable on such Security, after withholding for or on account of such Taxes imposed upon or as a result of such payment, will not be less than the amount provided for in such Security to be then due and payable. The Company will withhold, and not pay any Additional Amounts with respect to such withholding, at the rate of 30% on payments of Coupon Amounts that are made to Holders who are not U.S. persons, subject to possible applicable treaty exemption or reduction, unless such Holder provides properly executed IRS Form W-8ECI certifying that such Coupon Amounts is income effectively connected with such Holder’s conduct of a trade or business in the United States.

In addition to its ability to redeem this Security pursuant to the foregoing, if at any time as a result of any change in or amendment to the laws or regulations of a Relevant Jurisdiction affecting taxation, or a change in any

(Reverse of Security continued on next page)

application or interpretation of such laws or regulations (including the decision of any court or tribunal) either generally or in relation to any particular Securities, which change, amendment, application or interpretation becomes effective on or after the Initial Trade Date in making any payment of, or in respect of, the principal amount of the Securities, the Company would be required to pay any Additional Amounts with respect thereto, then the Securities will be redeemable upon not less than ten nor more than sixty days’ notice by mail, at any time thereafter, in whole but not in part, at the election of the Company as provided in the Indenture at a redemption price determined by the Security Calculation Agent in a manner reasonably calculated to preserve the relative economic position of the Company and the Holders of Outstanding Securities.

The Indenture permits, with certain exceptions as therein provided, the amendment thereof and the modification of the rights and obligations of the Company and the rights of the Holders of the Securities of each series to be affected under the Indenture at any time by the Company and the Trustee with the consent of the Holders of a majority in principal amount of the Securities at the time Outstanding of all series to be affected (considered together as one class for this purpose). The Indenture also contains provisions (i) permitting the Holders of a majority in principal amount of the Securities at the time Outstanding of all series to be affected under the Indenture (considered together as one class for this purpose), on behalf of the Holders of all Securities of such series, to waive compliance by the Company with certain provisions of the Indenture and (ii) permitting the Holders of a majority in principal amount of the Securities at the time Outstanding of any series to be affected under the Indenture (with each such series considered separately for this purpose), on behalf of the Holders of all Securities of such series, to waive certain past defaults under the Indenture and their consequences. Any such consent or waiver by the Holder of this Security shall be conclusive and binding upon such Holder and upon all future Holders of this Security and of any Security issued upon the registration of transfer hereof or in exchange herefor or in lieu hereof, whether or not notation of such consent or waiver is made upon this Security.

As provided in and subject to the provisions of the Indenture, the Holder of this Security shall not have the right to institute any proceeding with respect to the Indenture or for the appointment of a receiver or trustee or for any other remedy thereunder, unless such Holder shall have previously given the Trustee written notice of a continuing Event of Default with respect to the Securities of this series, the Holders of not less than 25% in principal amount of the Securities of this series at the time Outstanding shall have made written request to the Trustee to institute proceedings in respect of such Event of Default as Trustee and offered the Trustee indemnity reasonably satisfactory to it, and the Trustee shall not have received from the Holders of a majority in principal amount of Securities of this series at the time Outstanding a direction inconsistent with such request, and shall have failed to institute any such proceeding, for sixty days after receipt of such notice, request and offer of indemnity. The foregoing shall not apply to any suit instituted by the Holder of this Security for the enforcement of any payment of principal hereof on or after the respective due dates expressed herein.

(Reverse of Security continued on next page)

No reference herein to the Indenture and no provision of this Security or of the Indenture shall alter or impair the obligation of the Company, which is absolute and unconditional, to pay the principal of this Security as herein provided.

As provided in the Indenture and subject to certain limitations therein set forth, the transfer of this Security is registrable in the Security Register, upon surrender of this Security for registration of transfer at the office or agency of the Company in any place where the principal of this Security is payable, duly endorsed by, or accompanied by a written instrument of transfer in form satisfactory to the Company and the Security Registrar duly executed by, the Holder hereof or his attorney duly authorized in writing. Thereupon one or more new Securities of this series and of like tenor, of authorized denominations and for the same aggregate Principal Amount, will be issued to the designated transferee or transferees.

This Security, and any other Securities of this series and of like tenor, are issuable only in registered form without coupons in denominations of any multiple of $25.00. As provided in the Indenture and subject to certain limitations therein set forth, Securities of this series are exchangeable for a like aggregate principal amount of Securities of this series and of like tenor of a different authorized denomination, as requested by the Holder surrendering the same.

No service charge shall be made for any such registration of transfer or exchange, but the Company may require payment of a sum sufficient to cover any tax or other governmental charge payable in connection therewith.

Prior to due presentment of this Security for registration of transfer, the Company, the Trustee and any agent of the Company or the Trustee may treat the Person in whose name this Security is registered as the owner hereof for all purposes, whether or not this Security be overdue, and neither the Company, the Trustee nor any such agent shall be affected by notice to the contrary.

This Security is a Global Security and is subject to the provisions of the Indenture relating to Global Securities, including the limitations in Section 305 thereof on transfers and exchanges of Global Securities.

This Security and the Indenture shall be governed by and construed in accordance with the laws of the State of New York.

All terms used in this Security which are defined in the Indenture shall have the meanings assigned to them in the Indenture.

(Reverse of Security continued on next page)