CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities Offered | Maximum Aggregate Offering Price | Amount of Registration Fee(1) |

| Medium-Term Notes, Series B | $5,050,000.00 | $550.96 |

(1) Calculated in accordance with Rule 457(r) of the Securities Act of 1933, as amended.

Filed Pursuant to Rule 424(b)(2)

Registration Statement No. 333-253432

|

UBS AG | |

| $5,050,000 | ||

| Bloomberg Commodity IndexSM-Linked Medium-Term Notes due April 12, 2023 |

The notes do not bear interest. The amount that you will be paid on your notes on the stated maturity date (April 12, 2023) is based on the performance of the Bloomberg Commodity IndexSM as measured from the trade date (April 7, 2021) to and including the determination date (April 10, 2023).

To determine your payment at maturity, we will calculate the underlier return, which is the percentage increase or decrease in the final underlier level on the determination date from the initial underlier level of 83.7649. On the stated maturity date, for each $1,000 face amount of your notes, you will receive an amount in cash equal to the sum of (i) $1,000 plus (ii) the product of (a) the underlier return times (b) $1,000. If the final underlier level is less than the initial underlier level, you will receive less than the $1,000 face amount of your notes and you may lose your entire investment in the notes. In addition, the payment at maturity will be calculated based on the $1,000 face amount of your notes, which is less than the original issue price you pay for your notes. As a result, you will lose some or all of your investment in the notes if the underlier return is less than the percentage by which the original issue price you pay for your notes exceeds the $1,000 face amount of the notes.

Your investment in the notes involves certain risks, including, among other things, our credit risk. See “Additional Risk Factors Specific To Your Notes” beginning on page 8 herein. You should read the additional disclosure herein so that you may better understand the terms and risks of your investment.

The estimated initial value of the notes as of the trade date is $992.50 per $1,000 face amount. The estimated initial value of the notes was determined as of the close of the relevant markets on the date hereof by reference to UBS’ internal pricing models, inclusive of the internal funding rate. For more information about secondary market offers and the estimated initial value of the notes, see “Additional Risk Factors Specific To Your Notes — Estimated Value Considerations” and “— Risks Relating to Liquidity and Secondary Market Price Considerations” beginning on page 12 herein.

| Original issue date: | April 14, 2021 | Original issue price*: |

102.25% of the face amount | |||

| Underwriting discount*: | 2.00% of the face amount | Net proceeds to the issuer: | 100.25% of the face amount |

| * | For additional information, see “Supplemental plan of distribution (conflicts of interest); secondary markets (if any)” herein. |

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these notes or passed upon the accuracy or adequacy of this document, the accompanying product supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense. The notes are not bank deposits and are not insured by the Federal Deposit Insurance Corporation or any other governmental agency.

UBS Securities LLC

Pricing Supplement dated April 7, 2021

The issue price, underwriting discount and net proceeds listed above relate to the notes we sell initially. We may decide to sell additional notes after the date of this pricing supplement, at issue prices and with underwriting discounts and net proceeds that differ from the amounts set forth above. The return (whether positive or negative) on your investment in the notes will depend in part on the issue price you pay for such notes.

UBS Securities LLC, our affiliate, will purchase the notes from UBS for distribution to one or more registered broker dealers (“dealers”). UBS Securities LLC, the dealers or any of their respective affiliates may use this document in market-making transactions in notes after their initial sale. Unless UBS, UBS Securities LLC, the dealers or any of their respective affiliates selling such notes to you informs you otherwise in the confirmation of sale, this pricing supplement is being used in a market-making transaction. See “Supplemental plan of distribution (conflicts of interest); secondary markets (if any)” herein and “Supplemental Plan of Distribution (Conflicts of Interest)” in the accompanying product supplement.

SUMMARY INFORMATION

| UBS has filed a registration statement (including a prospectus, as supplemented by a product supplement for various securities we may offer, including the notes), with the Securities and Exchange Commission, or SEC, for the offering to which this document relates. You should read these documents and any other documents relating to this offering that UBS has filed with the SEC for more complete information about UBS and this offering. You may obtain these documents without cost by visiting EDGAR on the SEC website at www.sec.gov. Our Central Index Key, or CIK, on the SEC website is 0001114446. | |

| You may access these documents on the SEC website at www.sec.gov as follows: | |

| ¨ |

Underlier-Linked Notes product supplement dated February 25, 2021: http://www.sec.gov/Archives/edgar/data/1114446/000091412121001116/ub55690070-424b2.htm |

| ¨ |

Prospectus dated February 24, 2021: http://www.sec.gov/Archives/edgar/data/1114446/000119312521054082/d138688d424b3.htm |

| References to ‘‘UBS,’’ ‘‘we,’’ ‘‘our’’ and ‘‘us’’ refer only to UBS AG and not to its consolidated subsidiaries. In this document, ‘‘notes’’ refer to the Bloomberg Commodity IndexSM-Linked Medium-Term Notes, that are offered hereby, unless the context otherwise requires. Also, references to the “accompanying product supplement’’ mean the UBS Underlier-Linked Notes product supplement, dated February 25, 2021 and references to the ‘‘accompanying prospectus’’ mean the UBS prospectus titled ‘‘Debt Securities and Warrants,’’ dated February 24, 2021. | |

| This document, together with the documents listed above, contains the terms of the notes and supersedes all other prior or contemporaneous oral statements as well as any other written materials including preliminary or indicative pricing terms, correspondence, trade ideas, structures for implementation, sample structures, brochures or other educational materials of ours. You should carefully consider, among other things, the matters set forth in “Additional Risk Factors Specific To Your Notes” herein and in “Risk Factors” in the accompanying product supplement, as the notes involve risks not associated with conventional debt securities. We urge you to consult your investment, legal, tax and other advisors concerning an investment in the notes. | |

|

UBS reserves the right to change the terms of, or reject any offer to purchase, the notes prior to their issuance. In the event of any changes to the terms of the notes, UBS will notify you and you will be asked to accept such changes in connection with your purchase. You may also choose to reject such changes in which case UBS may reject your offer to purchase. | |

| ii |

INVESTOR SUITABILITY

The notes may be suitable for you if:

| ¨ | You fully understand the risks inherent in an investment in the notes, including the risk of loss of your entire initial investment. |

| ¨ | You can tolerate a loss of all or a substantial portion of your investment and are willing to make an investment that has the same downside market risk as that of an investment in the underlier or the futures contracts on physical commodities comprising the underlier (each, an “underlying commodity” and collectively, the “underlier commodities”). |

| ¨ | You understand and accept that the original issue price you pay for your notes is greater than the face amount and that you will not receive a positive return on your initial investment unless the underlier return is greater than the percentage by which the original issue price you pay for your notes exceeds the face amount. |

| ¨ | You believe that the level of the underlier will appreciate over the term of the notes and that the underlier return will be greater than the percentage by which the original issue price you pay for your notes exceeds the face amount of the notes. |

| ¨ | You can tolerate fluctuations in the price of the notes throughout their term that may be similar to or exceed the downside fluctuations in the level of the underlier or the price of the underlier commodities. |

| ¨ | You do not seek guaranteed current income from your investment. |

| ¨ | You are willing to hold the notes to maturity, a term of approximately 24 months, and accept that there may be little or no secondary market for the notes. |

| ¨ | You are willing to assume the credit risk of UBS for all payments under the notes, and understand that if UBS defaults on its obligations you may not receive any amounts due to you including any repayment of principal. |

| ¨ | You understand that the estimated initial value of the notes determined by our internal pricing models is lower than the issue price and that should UBS Securities LLC or any affiliate make secondary markets for the notes, the price (not including their customary bid-ask spreads) will temporarily exceed the internal pricing model price. |

The notes may not be suitable for you if:

| ¨ | You do not fully understand the risks inherent in an investment in the notes, including the risk of loss of your entire initial investment. |

| ¨ | You require an investment designed to guarantee a full return of principal at maturity. |

| ¨ | You cannot tolerate a loss of all or a substantial portion of your investment or are not willing to make an investment that has the same downside market risk as that of an investment in the underlier or the underlier commodities. |

| ¨ | You do not fully understand or are unwilling to accept that the original issue price of the notes is greater than the face amount and that you will receive a positive return on your initial investment only if the underlier return is greater than the percentage by which the original issue price you pay for your notes exceeds the face amount. |

| ¨ | You believe that the level of the underlier will decline during the term of the notes, or you believe that the level of the underlier will increase over the term of the notes and that the underlier return is likely to be less than the percentage by which the original issue price you pay for your notes exceeds the face amount of the notes. |

| ¨ | You cannot tolerate fluctuations in the price of the notes throughout their term that may be similar to or exceed the downside fluctuations in the level of the underlier or the price of the underlier commodities. |

| ¨ | You seek guaranteed current income from this investment. |

| ¨ | You are unable or unwilling to hold the notes to maturity, a term of approximately 24 months, or you seek an investment for which there will be an active secondary market. |

| ¨ | You are not willing to assume the credit risk of UBS for all payments under the notes. |

The investor suitability considerations identified above are not exhaustive. Whether or not the notes are a suitable investment for you will depend on your individual circumstances. You are urged to consult your investment, legal, tax, accounting and other advisors have carefully considered the suitability of an investment in the notes in light of your particular circumstances. You should also review “Additional Risk Factors Specific To Your Notes” herein and the more detailed “Risk Factors” in the accompanying product supplement for risks related to an investment in the notes.

| 1 |

KEY TERMS

Issuer: UBS AG London Branch

Underlier: Bloomberg Commodity IndexSM (Bloomberg symbol, “BCOM” <Index>), as maintained by Bloomberg Index Services Limited (“BISL” and collectively with its affiliates, “Bloomberg” or the “underlier sponsor”)

Specified currency: U.S. dollars (“$”)

Terms to be specified in accordance with the accompanying product supplement:

| ¨ | type of notes: notes linked to a single underlier |

| ¨ | averaging dates: not applicable |

| ¨ | cap level: not applicable |

| ¨ | buffer level: not applicable |

| ¨ | interest: not applicable |

Face amount: Each note will have a face amount of $1,000; $5,050,000 in the aggregate for all the offered notes; the aggregate face amount of the offered notes may be increased if the issuer, at its sole option, decides to sell an additional aggregate face amount of the notes subsequent to the date of this pricing supplement. The issue price, underwriting discount, and net proceeds of the notes in the subsequent sale may differ substantially (higher or lower) from the original issue price you paid as provided on the cover of this pricing supplement. The return (whether positive or negative) on your investment in the notes will depend in part on the issue price you pay for such notes.

Purchase at amount other than face amount: The amount we will pay you at the stated maturity date for your notes will not be adjusted based on the issue price you pay for your notes, so if you acquire notes at a premium (or discount) to face amount and hold them to the stated maturity date, it could affect your investment in a number of ways. The return on your investment in such notes will be lower (or higher) than it would have been had you purchased the notes at face amount. The original issue price represents a premium to the face amount. See “Additional Risk Factors Specific To Your Notes — Risks Relating to Return Characteristics — Because the Notes are Offered at a Premium to Face Amount, the Return on Your Investment Will Be Lower Than the Return on Notes Purchased at Face Amount and the Impact of Certain Key Terms of the Notes Will be Negatively Affected” herein.

Supplemental discussion of U.S. federal income tax consequences: You will be obligated pursuant to the terms of the notes — in the absence of a statutory or regulatory change or an administrative determination or a judicial ruling to the contrary — to characterize each note for all tax purposes as a prepaid derivative contract in respect of the underlier, as described under “Material U.S. Federal Income Tax Consequences” in the accompanying product supplement. Pursuant to this approach, based on certain factual representations received from us, our special U.S. tax counsel, Cadwalader, Wickersham & Taft LLP, is of the opinion that upon the taxable disposition of your notes, it would be reasonable for you to recognize capital gain or loss equal to the difference, if any, between the amount of cash you receive at such time and your tax basis in your notes. The U.S. Internal Revenue Service (the “IRS”) might not agree with this treatment, however, in which case, the timing and character of income or loss on your note could be materially and adversely affected.

The IRS, for example, might assert that Section 1256 of the U.S. Internal Revenue Code of 1986, as amended (the “Code”) should apply to the notes. If Section 1256 of the Code were to apply to the notes, gain or loss recognized with respect to the notes (or a portion of the notes) would be treated as 60% long-term capital gain or loss and 40% short-term capital gain or loss, without regard to your holding period in the notes. You would also be required to mark the notes (or a portion of the notes) to market at the end of each year (i.e., recognize income as if the notes or the relevant portion of the notes had been sold for fair market value). The IRS might also assert that the notes should be recharacterized for U.S. federal income tax purposes as instruments giving rise to current ordinary income (even before receipt of any cash), or that you should be required to recognize taxable gain on any rebalancing of the underlier or rollover of, or change to, the underlier commodities.

Treasury Regulations Requiring Disclosure of Reportable Transactions. Treasury regulations require U.S. taxpayers to report certain transactions (“Reportable Transactions”) on IRS Form 8886. An investment in the notes or a sale of the notes should generally not be treated as a Reportable Transaction under current law, but it is possible that future legislation, regulations or administrative rulings could cause your investment in the notes or a sale of the notes to be treated as a Reportable Transaction. You should consult with your tax advisor regarding any tax filing and reporting obligations that may apply in connection with acquiring, owning and disposing of the notes.

Notices 2015-73 and 2015-74. In 2015, IRS issued Notices 2015-73 and 2015-74 (the “Notices”), which require participants in certain “basket option contracts” and “basket contracts” or transactions substantially similar thereto, to disclose their participation in such transactions pursuant to Treasury Regulations section 1.6011-4. It is not entirely clear whether the Notices would apply to securities such as the notes. Accordingly, any participant in the notes may need to make an independent determination (which may differ from other participants’ determinations) regarding the applicability of the Notices to the notes. Purchasers of notes should contact their tax advisors regarding the potential applicability of the Notices to the notes and if applicable, the associated filing requirements.

| 2 |

Pursuant to final and temporary Treasury regulations and other IRS guidance, the withholding and reporting requirements under the Foreign Account Tax Compliance Act (“FATCA”) generally apply to certain “withholdable payments” and will generally not apply to gross proceeds on a sale or disposition and will generally apply to certain foreign passthru payments only to the extent that such payments are made after the date that is two years after final regulations defining the term “foreign passthru payment” are published. We will not pay additional amounts with respect to such withholding taxes discussed above. Foreign financial institutions and non-financial foreign entities located in jurisdictions that have an intergovernmental agreement with the U.S. governing FATCA may be subject to different rules.

Subject to the paragraph above, you should read the discussion under “Material U.S. Federal Income Tax Consequences— Foreign Account Tax Compliance Act” in the accompanying product supplement and consult your tax advisor concerning the potential application of FATCA.

For more information about the tax consequences of an investment in the notes, you should review carefully the section of the accompanying product supplement entitled “Material U.S. Federal Income Tax Consequences”.

Cash settlement amount (on the stated maturity date): For each $1,000 face amount of your notes, we will pay you on the stated maturity date an amount in cash equal to the sum of (1) $1,000 plus (2) the product of (i) $1,000 times (ii) the underlier return. The cash settlement amount will be calculated based on the face amount of your notes, which is less than the original issue price you pay for your notes. As a result, you will lose some or all of your investment in the notes if the underlier return is less than the percentage by which the original issue price you pay for your notes exceeds the $1,000 face amount of the notes.

Initial underlier level: 83.7649

Final underlier level: the closing level of the underlier on the determination date, except in the limited circumstances described under “Market Disruption Events” herein and “General Terms of the Notes — Discontinuance of, Adjustments to or Benchmark Event Affecting an Index Underlier or an Index Basket Underlier; Alteration of Method of Calculation” in the accompanying product supplement.

Underlier return: the quotient of (1) the final underlier level minus the initial underlier level divided by (2) the initial underlier level, expressed as a percentage

Trade date: April 7, 2021

Original issue date (settlement date): April 14, 2021

Determination date: April 10, 2023, subject to adjustment as described under “Market Disruption Events” herein.

Stated maturity date: April 12, 2023, subject to adjustment as described under “Market Disruption Events” herein, provided, however, that if the determination date is postponed as provided under “Determination date” above, the stated maturity date will be postponed by the same number of business day(s) from but excluding the originally scheduled determination date to and including the actual determination date.

Early termination following a change in law: The calculation agent may determine an early termination payment following an early termination of the notes upon a change in law event as described under “Early Termination following a Change in Law” herein.

No interest: The offered notes do not bear interest.

No redemption: The offered notes will not be subject to a redemption right or price dependent redemption right.

No listing: The offered notes will not be listed on any securities exchange or interdealer quotation system.

Closing level: as described under “General Terms of the Notes — Closing Level” in the accompanying product supplement

Business day: as described under “General Terms of the Notes — Business Day” in the accompanying product supplement

Trading day: as described under “General Terms of the Notes — Trading Day” in the accompanying product supplement

Use of proceeds and hedging: as described under “Use of Proceeds and Hedging” in the accompanying product supplement

ERISA: as described under “ERISA Considerations” in the accompanying product supplement

Supplemental plan of distribution (conflicts of interest); secondary markets (if any): UBS has agreed to sell to UBS Securities LLC, and UBS Securities LLC has agreed to purchase from UBS, the aggregate face amount of the notes specified on the front cover of this pricing supplement. UBS Securities LLC initially offered the notes to certain unaffiliated securities dealers at the original issue price set forth on the cover page of this document. We or one of our affiliates will also pay a fee to SIMON Markets LLC, a broker-dealer affiliated with Goldman Sachs & Co. LLC, who is acting as a dealer in connection with the distribution of the notes.

| 3 |

We expect to deliver the notes against payment therefor in New York, New York on April 14, 2021, which is the fifth business day following the date of this pricing supplement and of the pricing of the notes. Under Rule 15c6-1 of the Securities Exchange Act of 1934, as amended, trades in the secondary market generally are required to settle in two business days (T + 2), unless the parties to any such trade expressly agree otherwise. Accordingly, purchasers who wish to trade notes on any date prior to two business days before delivery will be required, by virtue of the fact that the notes are initially expected to settle in five business days (T + 5), to specify alternative settlement arrangements to prevent a failed settlement.

Conflicts of interest: UBS Securities LLC is an affiliate of UBS and, as such, has a “conflict of interest” in the offering within the meaning of the Financial Industry Regulatory Authority, Inc. (“FINRA”) Rule 5121. In addition, UBS will receive the net proceeds from the initial public offering of the notes, thus creating an additional conflict of interest within the meaning of FINRA Rule 5121. Consequently, the offering is being conducted in compliance with the provisions of FINRA Rule 5121.

UBS Securities LLC and its affiliates may offer to buy or sell the notes in the secondary market (if any) at prices greater than UBS’ internal valuation: The value of the notes at any time will vary based on many factors that cannot be predicted. However, the price (not including UBS Securities LLC’s or any affiliate’s customary bid-ask spreads) at which UBS Securities LLC or any affiliate would offer to buy or sell the notes immediately after the trade date in the secondary market is expected to exceed the estimated initial value of the notes as determined by reference to our internal pricing models. The amount of the excess will decline to zero on a straight line basis over a period ending no later than 3 months after the trade date, provided that UBS Securities LLC may shorten the period based on various factors, including the magnitude of purchases and other requests from and negotiated arrangements with selling agents. Notwithstanding the foregoing, UBS Securities LLC and its affiliates are not required to make a market for the notes and may stop making a market at any time. For more information about secondary market offers and the estimated initial value of the notes, see “Additional Risk Factors Specific To Your Notes — Estimated Value Considerations” and “— Risks Relating to Liquidity and Secondary Market Price Considerations” herein.

Prohibition of Sales to EEA & UK Retail Investors. The notes are not intended to be offered, sold or otherwise made available to and should not be offered, sold or otherwise made available to any retail investor in the European Economic Area (“EEA”). For these purposes, a retail investor means a person who is one (or more) of: (i) a retail client as defined in point (11) of Article 4(1) of Directive 2014/65/EU, as amended (“MiFID II”); (ii) a customer within the meaning of Directive 2002/92/EC, as amended, where that customer would not qualify as a professional client as defined in point (10) of Article 4(1) of MiFID II; or (iii) not a qualified investor as defined in Directive 2003/71/EC, as amended. Consequently, no key information document required by Regulation (EU) No 1286/2014 (as amended, the “EU PRIIPs Regulation”) for offering or selling the notes or otherwise making them available to retail investors in the EEA has been prepared and therefore offering or selling the notes or otherwise making them available to any retail investor in the EEA may be unlawful under the EU PRIIPs Regulation.

The notes are not intended to be offered, sold or otherwise made available to and should not be offered, sold or otherwise made available to any retail investor in the United Kingdom (the “UK”). For these purposes, a retail investor in the UK means a person who is one (or more) of: (i) a retail client as defined in point (8) of Article 2 of Regulation (EU) No 2017/565 as it forms part of domestic law by virtue of the European Union (Withdrawal) Act 2018, subject to amendments made by the Markets in Financial Instruments (Amendment) (EU Exit) Regulations 2018 (SI 2018/1403), as may be amended or superseded from time to time (the “EUWA”); (ii) a customer within the meaning of the provisions of the Financial Services and Markets Act 2000 (the “FSMA”) and any rules or regulations made under the FSMA to implement Directive (EU) 2016/97, where that customer would not qualify as a professional client, as defined in point (8) of Article 2(1) of Regulation (EU) No 600/2014 as it forms part of UK domestic law by virtue of the EUWA; or (iii) not a qualified investor as defined in Article 2 of the Prospectus Regulation as it forms part of domestic law by virtue of the EUWA (“UK Prospectus Regulation”). Consequently, no key information document required by the PRIIPs Regulation as it forms part of UK domestic law by virtue of the EUWA (the “UK PRIIPs Regulation”) for offering or selling the notes or otherwise making them available to retail investors in the UK has been prepared and therefore offering or selling the notes or otherwise making them available to any retail investor in the UK may be unlawful under the UK PRIIPs Regulation.

Calculation agent: UBS Securities LLC

CUSIP no.: 90276BWV1

ISIN no.: US90276BWV16

FDIC: The notes are not bank deposits and are not insured by the Federal Deposit Insurance Corporation or any other governmental agency.

| 4 |

HYPOTHETICAL EXAMPLES

The following examples are provided for purposes of illustration only. They should not be taken as an indication or prediction of future investment results and are intended merely to illustrate the impact that the various hypothetical final underlier levels on the determination date could have on the cash settlement amount at maturity assuming all other variables remain constant.

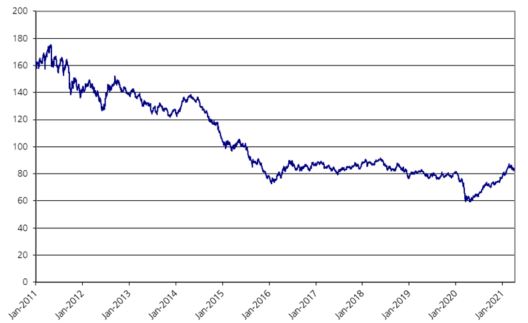

The examples below are based on a range of final underlier levels that are entirely hypothetical; no one can predict what the underlier level will be on any day throughout the term of your notes, and no one can predict what the final underlier level will be on the determination date. The underlier has been volatile in the past — meaning that the underlier level has changed considerably in relatively short periods — and its performance cannot be predicted for any future period.

The information in the following examples reflects hypothetical rates of return on the offered notes assuming that they are purchased on the original issue date and held to the stated maturity date. If you sell your notes in a secondary market prior to the stated maturity date, your return will depend upon the market value of your notes at the time of sale, which may be affected by a number of factors that are not reflected in the table below such as interest rates, the volatility of the underlier and our creditworthiness. In addition, the estimated value of your notes at the time the terms of your notes were set on the trade date (as determined by reference to our pricing models) is less than the original issue price of your notes. For more information on the estimated value of your notes, see “Additional Risk Factors Specific To Your Notes — Estimated Value Considerations — The Issue Price You Pay for the Notes Exceeds Their Estimated Initial Value” herein. The information in the table also reflects the key terms and assumptions in the box below.

|

Key Terms and Assumptions |

|

| Face amount | $1,000.00 |

| Original issue price | 102.25% |

|

Neither a market disruption event nor a non-trading day occurs on the originally scheduled determination date. | |

| No change in or affecting any of the underlier commodities or the method by which the underlier sponsor calculates the underlier. Notes are purchased on original issue date at the face amount and held to the stated maturity date. | |

The actual performance of the underlier over the term of your notes, as well as the return on the notes, if any, may bear little relation to the hypothetical examples shown below or to the historical underlier levels shown elsewhere herein. For information about the historical levels of the underlier during recent periods, see “The Underlier — Historical Closing Levels of the Underlier” herein.

Also, the hypothetical examples shown below do not take into account the effects of applicable taxes. Because of the U.S. tax treatment applicable to your notes, tax liabilities could affect the after-tax rate of return on your notes to a comparatively greater extent than the after-tax return on the underlier commodities.

| 5 |

The levels in the left column of the table below represent hypothetical final underlier levels and are expressed as percentages of the initial underlier level. The amounts in the middle column represent the hypothetical cash settlement amounts, based on the corresponding hypothetical final underlier level (expressed as a percentage of the initial underlier level), and are expressed as percentages of the face amount of a note (rounded to the nearest one-thousandth of a percent). The amounts in the right column represent the hypothetical cash settlement amounts expressed as percentages of the original issue price of $1,022.50 (102.250% of the face amount) of a note (rounded to the nearest one-thousandth of a percent). Thus, a hypothetical cash settlement amount of 100.000% means that the value of the cash payment that we would pay for each $1,000.00 of the outstanding face amount of the offered notes on the stated maturity date would equal 100.000% of the face amount of a note and approximately 97.800% of the original issue price, based on the corresponding hypothetical final underlier level (expressed as a percentage of the initial underlier level) and the assumptions noted above.

| Hypothetical Final Underlier Level (as Percentage of Initial Underlier Level) | Hypothetical Cash Settlement Amount (as Percentage of Face Amount) | Hypothetical Cash Settlement Amount (as Percentage of Original Issue Price) |

| 140.000% | 140.000% | 136.919% |

| 130.000% | 130.000% | 127.139% |

| 120.000% | 120.000% | 117.359% |

| 115.000% | 115.000% | 112.469% |

| 110.000% | 110.000% | 107.579% |

| 105.000% | 105.000% | 102.689% |

| 103.000% | 103.000% | 100.733% |

| 102.250% | 102.250% | 100.000% |

| 101.000% | 101.000% | 98.778% |

| 100.000% | 100.000% | 97.800% |

| 95.000% | 95.000% | 92.910% |

| 90.000% | 90.000% | 88.020% |

| 80.000% | 80.000% | 78.240% |

| 70.000% | 70.000% | 68.460% |

| 60.000% | 60.000% | 58.680% |

| 50.000% | 50.000% | 48.900% |

| 25.000% | 25.000% | 24.450% |

| 0.000% | 0.000% | 0.000% |

If, for example, the final underlier level were determined to be 25.000% of the initial underlier level, the cash settlement amount that we would pay on your notes at maturity would be 25.000% of the face amount of your notes, as shown in the table above. As a result, if you purchased your notes on the original issue date at the original issue price and held them to the stated maturity date, you would lose approximately 75.550% of your investment at the original issue price (since you purchased your notes at a premium to face amount you would lose a correspondingly higher percentage of your investment).

| 6 |

The cash settlement amounts shown above are entirely hypothetical; they are based on market prices for the underlier commodities that may not be achieved on the determination date and on assumptions that may prove to be erroneous. The actual market value of your notes on the stated maturity date or at any other time, including any time you may wish to sell your notes, may bear little relation to the hypothetical cash settlement amounts shown above, and these amounts should not be viewed as an indication of the financial return on an investment in the offered notes. The hypothetical cash settlement amounts on notes held to the stated maturity date in the examples above assume you purchased your notes at their face amount and have not been adjusted to reflect the actual issue price you pay for your notes. The return on your investment (whether positive or negative) in your notes will be affected by the amount you pay for your notes. The notes are being sold at an original issue price that represents a premium to the face amount, which will result in a lower return on investment than would have applied if the original issue price were equal to the face amount of the notes. If you purchase your notes for a price other than the original issue price reflected above, the return on your investment will differ from, and may be significantly lower than, the hypothetical returns suggested by the above examples. Please read “Additional Risk Factors Specific To Your Notes — Risks Relating to Characteristics of the Underlier — Market Risk” and “— Risks Relating to Return Characteristics — Because the Notes are Offered at a Premium to Face Amount, the Return on Your Investment Will Be Lower Than the Return on Notes Purchased at Face Amount and the Impact of Certain Key Terms of the Notes Will be Negatively Affected” herein.

| We cannot predict the actual final underlier level or what the market value of your notes will be on any particular trading day, nor can we predict the relationship between the underlier level and the market value of your notes at any time prior to the stated maturity date. The actual amount that you will receive, if any, at maturity and the rate of return on the offered notes will depend on the the actual final underlier level, which will be determined by the calculation agent as described above. Moreover, the assumptions on which the hypothetical returns are based may turn out to be inaccurate. Consequently, the amount of cash to be paid in respect of your notes, if any, on the stated maturity date may be very different from the information reflected in the table above. |

| 7 |

ADDITIONAL RISK FACTORS SPECIFIC TO YOUR NOTES

| An investment in your notes is subject to the risks described below, as well as the risks described under “Considerations Relating to Indexed Securities” in the accompanying prospectus, dated February 24, 2021, and “Risk Factors”, including the section “— Risks Related to Characteristics and Issues of Commodity Indices and ETFs with Commodities Constituents”, in the accompanying product supplement, dated February 25, 2021. You should carefully review these risks as well as the terms of the notes described herein and in the accompanying prospectus, dated February 24, 2021, as supplemented by the accompanying product supplement, dated February 25, 2021, of UBS. Your notes are a riskier investment than ordinary debt securities. Also, your notes are not equivalent to investing directly in the underlier commodities, i.e., the futures contracts on physical commodities comprising the underlier to which your notes are linked. You should carefully consider whether the offered notes are suited to your particular circumstances. |

Risks Relating to Return Characteristics

You May Lose Your Entire Investment In The Notes

You can lose your entire investment in the notes. The cash payment on your notes, if any, on the stated maturity date will be based on the performance of the underlier as measured from the initial underlier level set on the trade date to the closing level on the determination date. If the final underlier level is less than the initial underlier level, you will have a loss for each $1,000 of the face amount of your notes equal to the product of (a) the underlier return times (b) $1,000. Thus, you may lose your entire investment in the notes, which would include any premium to face amount you paid when you purchased the notes. See “— Because the Notes are Offered at a Premium to Face Amount, the Return on Your Investment Will Be Lower Than the Return on Notes Purchased at Face Amount and the Impact of Certain Key Terms of the Notes Will be Negatively Affected” below.

Also, the market price of your notes prior to the stated maturity date may be significantly lower than the purchase price you pay for your notes. Consequently, if you sell your notes before the stated maturity date, you may receive far less than the amount of your investment in the notes.

Because the Notes are Offered at a Premium to Face Amount, the Return on Your Investment Will Be Lower Than the Return on Notes Purchased at Face Amount and the Impact of Certain Key Terms of the Notes Will be Negatively Affected

The notes are offered at a premium to the face amount. If you purchase the notes at the original issue price and hold them to the stated maturity date, the return on your investment in the notes will be lower than it would have been had you purchased the notes at face amount or a discount to face amount. The cash settlement amount will be calculated based on the face amount of the notes, which is lower than the original issue price, and will not be adjusted based on the original issue price you pay for the notes. As a result, you will lose some or all of your investment in the notes if the underlier return is less than the percentage by which the original issue price you pay for your notes exceeds the $1,000 face amount of the notes.

If you purchase notes at any other price that differs from the face amount of the notes, then the return on your investment in such notes held to the stated maturity date will differ from, and may be substantially less than, the return on notes purchased at face amount.

Your Notes Do Not Bear Interest

You will not receive any interest payments on your notes. As a result, even if the cash settlement amount payable for your notes on the stated maturity date exceeds the face amount of your notes, the overall return you earn on your notes may be less than you would have earned by investing in a conventional debt security of comparable maturity that bears interest at a prevailing market rate.

The Amount Payable on Your Notes Is Not Linked to the Level of the Underlier at Any Time Other than the Determination Date

The final underlier level will be based on the closing level of the underlier on the determination date, except in the limited circumstances described under “Market Disruption Events” herein and “General Terms of the Notes — Discontinuance of, Adjustments to or Benchmark Event Affecting an Index Underlier or an Index Basket Underlier; Alteration of Method of Calculation” in the accompanying product supplement. Therefore, if the closing level of the underlier dropped precipitously on the determination date, the cash settlement amount for your notes may be significantly less than it would have been had the cash settlement amount been linked to the closing level of the underlier prior to such drop in the level of the underlier. Although the actual level of the underlier on the stated maturity date or at other times during the term of your notes may be higher than the final underlier level, you will not benefit from the closing level of the underlier at any time other than on the determination date. Additionally, the calculation agent may determine an early termination payment following an early termination of the notes upon a change in law event, each as defined and described further under “Early Termination following a Change in Law” and “— The Notes May Be Terminated Early if the Calculation Agent Determines That a Change in Law Event has Occurred” herein.

| 8 |

You Have No Rights with Respect to Any Underlier Commodity or Rights to Receive Any Underlier Commodity

Investing in your notes will not make you a holder of any underlier commodity or in a collective investment vehicle that invests in the foregoing. Neither you nor any other holder or owner of your notes will have any rights with respect to such underlier commodities. Your notes will be paid in cash, and you will have no right to receive delivery of any commodities.

Your Notes Are Not Regulated by the Commodity Futures Trading Commission

The net proceeds to be received by us from the sale of the notes will not be used to purchase or sell any commodity futures contracts or options on commodity futures contracts for your benefit. An investment in the notes thus does not constitute either an investment in commodity futures contracts, options on commodity futures contracts or in a collective investment vehicle that trades in these contracts (i.e., the notes will not constitute a direct or indirect investment by you in the commodity futures contracts or options on futures), and you will not benefit from the regulatory protections of the Commodity Futures Trading Commission (the “CFTC”). You will not benefit from the CFTC’s or any other non-U.S. regulatory authority’s regulatory protections afforded to persons who trade in commodity futures contracts on a regulated futures exchange through a registered futures commission merchant. Unlike an investment in your notes, an investment in a collective investment vehicle that invests in commodity futures contracts on behalf of its participants may be subject to regulation as a commodity pool and its operator may be required to be registered with and regulated by the CFTC as a commodity pool operator, or qualify for an exemption from the registration requirement. In addition, the advisor to such vehicle may be required to register as a commodity trading advisor. Because the notes will not be interests in a commodity pool, the notes will not be regulated by the CFTC as a commodity pool, we will not be registered with the CFTC as a commodity pool operator or commodity trading advisor, and you will not benefit from the CFTC’s regulatory protections afforded to persons who invest in regulated commodity pools.

Risks Relating to Characteristics of the Underlier

Market Risk

The return on the notes is directly linked to the performance of the underlier and indirectly linked to the value of the underlier commodities, and the extent to which the underlier return is positive or negative. Trading in the underlier commodities is speculative and can be extremely volatile. Commodity prices are affected by a variety of factors, including weather, governmental programs and policies, national and international political, military, terrorist and economic events, changes in interest and exchange rates, and trading activities in commodities and related futures contracts. Different factors may cause the value of different commodities and the volatilities of their prices to move in inconsistent directions and at inconsistent rates. Additionally, the coronavirus infection has caused volatility in the global financial markets and a slowdown in the global economy. Coronavirus or any other communicable disease or infection may adversely affect the underlier commodities and, therefore, the underlier. You may lose some or all of your initial investment.

The Notes Do Not Offer Direct Exposure to Commodity Spot Prices

The underlier is comprised of commodity futures contracts, not physical commodities (or their spot prices). The price of a futures contract reflects the expected value of the commodity upon delivery in the future, whereas the spot price of a commodity reflects the immediate delivery value of the commodity. A variety of factors can lead to a disparity between the expected future price of a commodity and the spot price at a given point in time, such as the cost of storing the commodity for the term of the futures contract, interest charges incurred to finance the purchase of the commodity and expectations concerning supply and demand for the commodity. The price movements of a futures contract are typically correlated with the movements of the spot price of the referenced commodity, but the correlation is generally imperfect and price moves in the spot market may not be reflected in the futures market (and vice versa). Accordingly, the notes may underperform a similar investment that is linked to commodity spot prices.

Commodity Prices as Well as the Underlier Commodities May Change Unpredictably, Affecting the Value of Your Notes in Unforeseeable Ways

Commodity prices as well as the underlier commodities are affected by a variety of factors, including weather, governmental programs and policies, national and international political, military, terrorist and economic events, changes in interest and exchange rates and trading activities in commodities and related contracts. These factors may affect the levels of the underlier and the value of your notes in varying ways, and different factors may cause the value of different underlier commodities and the volatilities of their prices, to move in inconsistent directions and at inconsistent rates.

It Is Difficult to Predict What Effect Higher and Lower Future Prices of Commodities Included in the Underlier Relative to Their Current Prices May Have on Its Value

The underlier is composed of commodity futures contracts rather than physical commodities. Unlike equities, which typically entitle the holder to a continuing stake in a corporation, commodity futures contracts normally specify a certain date for delivery of the underlying physical commodity. As the exchange-traded futures contracts that comprise the underlier approach expiration, they are replaced by similar contracts that have a later expiration. Thus, for example, a futures contract purchased and held in August may specify an October expiration. As time passes, the contract expiring in October may be replaced by a contract for delivery in December. This process is referred to as “rolling”.

| 9 |

If the market for these contracts is in “backwardation,” which means that the prices are lower in the distant delivery months than in the nearer delivery months, the purchase of the December contract would take place at a price that is lower than the sale price of the October contract. Conversely, if the market for these contracts is in “contango,” which means that the prices are higher in the distant delivery months than in the nearer delivery months, the purchase of the December contract would take place at a price that is higher than the sale price of the October contract. The difference between the prices of the two contracts when they are rolled is sometimes referred to as a “roll yield”, and the change in price that contracts experience while they are components of the underlier is sometimes referred to as a “spot return”. An investor in the underlier cannot receive either the roll yield or the spot return separately. The presence of contango in the commodity markets could result in negative roll yields, which could adversely affect the value of the underlier.

Because of the potential effects of negative roll yields, it is possible for the value of the underlier to decrease significantly over time even when the near-term or spot prices of underlying commodities are stable or increasing. It is also possible, when near-term or spot prices of the underlying commodities are decreasing, for the value of the underlier to decrease significantly over time even when some or all of the underlier commodities are experiencing backwardation.

Certain underlying commodities included in the underlier, such as gold, have historically traded in contango markets and the underlier has experienced periods in which many of these commodities are in contango. Although certain of the commodity futures contracts included in the underlier have historically experienced periods of backwardation, it is possible that such backwardation will not be experienced in the future.

The Underlier Sponsor May Be Required to Replace a Designated Contract If the Existing Commodities Contract Is Terminated or Replaced

A commodity contract known as a “designated contract” has been selected as the reference contract for each of the physical commodities underlying the underlier. Data concerning this designated contract will be used to calculate the underlier. If a designated contract were to be terminated or replaced in accordance with the rules described under “The Underlier” in this pricing supplement, a comparable commodity contract may be selected by the underlier sponsor, if available, to replace that designated contract. The termination or replacement of any designated contract may have an adverse impact on the value of the underlier.

Data Sourcing and Calculation Risks Associated with the Underlier May Adversely Affect the Market Price of the Notes

Because the notes are linked to the underlier, which is composed of exchange-traded futures contracts only on commodities, it will be less diversified than other funds or investment portfolios investing in a broader range of products and, therefore, could experience greater volatility. Additionally, the annual composition of the underlier will be recalculated in reliance upon historic price, liquidity and production data that are subject to potential errors in data sources or other errors that may affect the weighting of the underlier commodities. Any discrepancies that require revision are not applied retroactively but will be reflected in the weighting calculations of the underlier for the following period. Additionally, BISL may not discover every discrepancy.

Furthermore, the weightings for the underlier are determined by BISL, which has a significant degree of discretion in exercising its supervisory duties with respect to the underlier. This discretion would permit, among other things, changes to the composition of the underlier or changes to the manner or timing of the publication of the values of such underlier, at any time during the year if BISL deemed the changes necessary in light of factors that include, but are not limited to (i) changes in liquidity of the underlier commodities that are included in the underlier or (ii) changes in legal, regulatory, sourcing or licensing matters relating to publication or replication of the underlier. In particular, without limitation, BISL’s access and rights to use data in connection with calculating, publishing and licensing the underlier remain subject to the ongoing consent of the sources of such data (including, without limitation, exchanges), which consent can be revoked at any time. Further, the sources of such data reserve the right to revise the terms and conditions of access and use of their data upon notice to BISL. BISL has reserved the right to modify the composition of the underlier on an as needed basis to minimize the impact of any loss of access to or revised terms of use with respect to such source data on the underlier.

The Return on Your Notes Is Based on an Underlier That Reflects Excess Return, Not Total Return

The return on your notes is based on the performance of the underlier, which reflects the returns that are potentially available through an unleveraged investment in the underlier commodities. It is not, however, linked to a “total return” index, which, in addition to reflecting those returns, would also reflect interest that could be earned on funds committed to the trading of the underlier commodities. The return on your notes will not include such a total return feature or interest component.

The Underlier May in the Future Include Contracts That Are Not Traded on Regulated Futures Exchanges

The underlier was originally based solely on futures contracts traded on regulated futures exchanges (referred to in the United States as “designated contract markets”). At present, the underlier is composed exclusively of regulated futures contracts. As described below, however, the underlier may in the future include over-the-counter contracts (such as swaps and forward contracts) traded on trading facilities that are subject to lesser degrees of regulation or, in some cases, no substantive regulation. As a result, trading in such contracts, and the manner in which prices and volumes are reported by the relevant trading facilities, may not be subject to the provisions of, and the protections afforded by, the U.S. Commodity Exchange Act, or other applicable statutes and related regulations, that govern trading on regulated U.S. futures exchanges, or similar statutes and regulations that govern trading on regulated U.K.

| 10 |

futures exchanges. In addition, many electronic trading facilities have only recently initiated trading and do not have significant trading histories. As a result, the trading of contracts on such facilities, and the inclusion of such contracts in the underlier, may be subject to certain risks not presented by U.S. or U.K. exchange-traded futures contracts, including risks related to the liquidity and price histories of the relevant contracts.

Legal and Regulatory Changes Could Adversely Affect the Return on and Value of Your Notes

The Dodd-Frank Wall Street Reform and Consumer Protection Act (“Dodd-Frank”), which effected substantial changes to the regulation of the futures and over-the-counter (“OTC”) derivatives markets, was enacted in July 2010. Dodd-Frank requires regulators, including the CFTC, to adopt regulations to implement many of the requirements of the legislation. While the CFTC has adopted many of the required regulations, a number of them have only recently become effective, and certain requirements remain to be finalized. The ultimate impact of the regulatory scheme, therefore, cannot yet be fully determined. Under Dodd-Frank, in October 2020 the CFTC adopted a rule to impose limits on the size of positions that can be held by market participants in futures and OTC derivatives on physical commodities. Required compliance with the new position limits rule begins on January 1, 2022 for physical commodity futures (and any associated referenced contracts other than economically equivalent swaps) and on January 1, 2023 for economically equivalent swaps. Related to the position limits rule, the CFTC has recently adopted final rules governing the aggregation of positions by market participants under common control and by trading managers. While the ultimate scope and impact of the proposed position limits rule, final aggregation rules and other CFTC rules cannot be conclusively determined at present, these new requirements could restrict the ability of certain market participants to participate in the commodities, futures and swap markets and markets for other OTC derivatives on physical commodities to the extent and at the levels that they have in the past. These factors may also have the effect of reducing liquidity and increasing costs in these markets as well as affecting the structure of the markets in other ways. In addition, these legislative and regulatory changes have increased, and will continue to increase, the level of regulation of markets and market participants, and therefore the costs of participating in the commodities, futures and OTC derivatives markets. Without limitation, these changes require many OTC derivatives transactions to be executed on regulated exchanges or trading platforms and cleared through regulated clearing houses. Swap dealers (as defined by the CFTC) are also required to be registered and are or will be subject to various regulatory requirements, including, but not limited to, proposed capital requirements, margin, recordkeeping and reporting requirements and various business conduct requirements. These legislative and regulatory changes, and the resulting increased costs and regulatory oversight requirements, could result in market participants being required to, or deciding to, limit their trading activities, which could cause reductions in market liquidity and increases in market volatility. In addition, transaction costs incurred by market participants are likely to be higher than in the past, reflecting the costs of compliance with the new regulations. These consequences could adversely affect the level of the underlier, or underlier commodities, which could in turn adversely affect the return on and value of your notes.

In addition, other regulatory bodies have passed or proposed, or may propose in the future, legislation similar to that proposed by Dodd-Frank or other legislation containing other restrictions that could adversely impact the liquidity of and increase costs of participating in the commodities markets. For example, the EU MiFID II Directive (2014/65/EU), which has applied since January 3, 2018, introduces a new regime for EU Member States to establish and apply position limits on the net position which a person can hold at any time in commodity derivatives traded on trading venues and in economically equivalent OTC contracts. These position limits are set (and periodically revised) according to a methodology determined at the EU level, but applied by EU Member State authorities.

By way of further example, the European Market Infrastructure Regulation (Regulation (EU) No 648/2012) (“EMIR”) currently requires reporting of derivatives and various risk mitigation techniques such as timely confirmation, mandatory margin exchange and portfolio reconciliation to be applied to OTC derivatives. Mandatory clearing is in the process of being implemented by class of counterparty and derivative asset class.

Changes to be implemented under both EMIR and MiFID II will impact a broad range of counterparties, both outside and within the EU, and are expected to increase the cost of transacting derivatives.

Commodities-Related Litigation and Regulatory Investigations Could Affect Prices for Futures Contracts, Which Could Adversely Affect Your Notes

The underlier is comprised of 23 commodity futures contracts, including three metals contracts that trade on the London Metal Exchange (aluminum, nickel and zinc) and three metals contracts that trade on COMEX (copper, gold and silver). An increased focus on price setting and trading prices by regulators and exchanges recently has resulted in a number of changes to the ways in which prices are determined, including prices for commodities and futures contracts. This increased focus also resulted in the publication of standards for benchmark setting by the International Organization of Securities Commissions. Regulators have investigated possible manipulation of the trading prices of certain underlier commodities by a number of firms and may in the future raise similar questions. In addition, private litigation alleging manipulation of the trading prices of certain underlier commodities is ongoing against a number of firms.

Any industry investigations and litigation may result in further review by exchanges and regulators of the methods by which commodities prices and futures contract prices are determined and the manner in which they are traded and changes to those methods. In addition, changes to other commodity-related activities, such as storage facilities and delivery methods, may also occur. If

| 11 |

any of these changes occur, the prices of the futures contracts in the underlier may be affected, which may thereby adversely affect the level of the underlier and your notes.

In addition, if alleged trading price manipulation or other alleged conduct that may have artificially affected prices has occurred or is continuing, certain published commodity prices and futures contract prices (including historical prices) may have been, or may be in the future, artificially lower (or higher) than they would otherwise have been. Any such artificially lower (or higher) prices could have an adverse impact on the underlier and any payments on, and the value of, your notes and the trading market for your notes.

Changes Affecting the Composition and Valuation of the Underlier or Discontinuation or Modification of the Underlier and Including Regulatory Changes, Could Have An Adverse Effect On the Value of the Notes and the Amount You Will Receive at Maturity of Your Notes

The composition of the underlier may change over time, as additional commodity contracts satisfy the eligibility criteria of the underlier or commodity contracts currently included in the underlier fail to satisfy such criteria and those changes could impact the composition of the underlier. A number of modifications to the methodology for determining the contracts to be included in the underlier, and for valuing the underlier, have been made in the past several years and further modifications may be made in the future. Such changes could adversely affect the value of your notes.

In addition, indices like the underlier have been, and continue to be, the subject of regulatory guidance and proposal for reform. including the European Union’s Regulation (EU) 2016/1011. The occurrence of a benchmark event (as defined in the accompanying product supplement under “General Terms of the Notes — Discontinuance of, Adjustments to or Benchmark Event Affecting an Index Underlier or an Index Basket Underlier; Alteration of Method of Calculation”), such as the failure of a benchmark (the underlier) or the administrator (the underlier sponsor) or user of a benchmark (such as UBS) to comply with the authorization, equivalence or other requirements of the benchmarks regulation, may result in the discontinuation of the relevant benchmark or a prohibition on its use.

If events such as these occur, or if the final underlier level is not available because of a market disruption event, non-trading day or for any other reason, and no successor underlier is selected, the calculation agent — which initially will be UBS Securities LLC, an affiliate of UBS — may determine the final underlier level — and thus any amount payable at maturity —in a manner it considers appropriate as described further in the accompanying product supplement under “— Discontinuance of, Adjustments to or Benchmark Event Affecting an Index Underlier or an Index Basket Underlier; Alteration of Method of Calculation”.

Information on the Underlier or Underlier Commodities May Not Be Readily Available

There is no systematic reporting of last-sale information for many commodities and commodity indices. Reasonable current bid and offer information may be available in certain brokers’ offices, in bank trading offices, and to others who wish to subscribe for this information, but this information will not necessarily reflect the applicable level relevant for determining the value of your notes. The absence of last-sale information and the limited availability of quotations to individual investors make it difficult for you and other investors to obtain timely, accurate data about the state of the commodity markets.

Estimated Value Considerations

The Issue Price You Pay for the Notes Exceeds Their Estimated Initial Value

The issue price you pay for the notes exceeds their estimated initial value as of the trade date due to the inclusion in the issue price of the underwriting discount, hedging costs, issuance and other costs and projected profits. As of the close of the relevant markets on the trade date, we have determined the estimated initial value of the notes by reference to our internal pricing models and it is set forth in this pricing supplement. The pricing models used to determine the estimated initial value of the notes incorporate certain variables, including the level of the underlier, the volatility of the underlier, the volatility of the underlier commodities, prevailing interest rates, the term of the notes and our internal funding rate. Our internal funding rate is typically lower than the rate we would pay to issue conventional fixed or floating rate debt securities of a similar term. The underwriting discount, hedging costs, issuance and other costs, projected profits and the difference in rates will reduce the economic value of the notes to you. Due to these factors, the estimated initial value of the notes as of the trade date is less than the issue price you pay for the notes.

The Estimated Initial Value Is a Theoretical Price; the Actual Price that You May Be Able to Sell Your Notes in Any Secondary Market (if Any) at Any Time After the Trade Date May Differ From the Estimated Initial Value

The value of your notes at any time will vary based on many factors, including the factors described above and in “— Risks Relating to Characteristics of the Underlier — Market Risk” above and is impossible to predict. Furthermore, the pricing models that we use are proprietary and rely in part on certain assumptions about future events, which may prove to be incorrect. As a result, after the trade date, if you attempt to sell the notes in the secondary market, the actual value you would receive may differ, perhaps materially, from the estimated initial value of the notes determined by reference to our internal pricing models. The estimated initial value of the notes does not represent a minimum or maximum price at which we or any of our affiliates would be willing to purchase your notes in any secondary market at any time.

| 12 |

Our Actual Profits May Be Greater or Less than the Differential Between the Estimated Initial Value and the Issue Price of the Notes as of the Trade Date

We may determine the economic terms of the notes, as well as hedge our obligations, at least in part, prior to the trade date. In addition, there may be ongoing costs to us to maintain and/or adjust any hedges and such hedges are often imperfect. Therefore, our actual profits (or potentially, losses) in issuing the notes cannot be determined as of the trade date and any such differential between the estimated initial value and the issue price of the notes as of the trade date does not reflect our actual profits. Ultimately, our actual profits will be known only at the maturity of the notes.

Risks Relating to Liquidity and Secondary Market Price Considerations

There May Be Little or No Secondary Market for the Notes

The notes will not be listed or displayed on any securities exchange or any electronic communications network. There can be no assurance that a secondary market for the notes will develop. UBS Securities LLC and its affiliates may make a market in the notes, although they are not required to do so and may stop making a market at any time. If you are able to sell your notes prior to maturity, you may have to sell them at a substantial loss. The estimated initial value of the notes does not represent a minimum or maximum price at which we or any of our affiliates would be willing to purchase your notes in any secondary market at any time.

The Price at which UBS Securities LLC and Its Affiliates May Offer to Buy the Notes in the Secondary Market (if Any) May Be Greater than UBS’ Valuation of the Notes at that Time, Greater than Any Other Secondary Market Prices Provided by Unaffiliated Dealers (if Any) and, Depending on Your Broker, Greater than the Valuation Provided on Your Customer Account Statements

For a limited period of time following the issuance of the notes, UBS Securities LLC or its affiliates may offer to buy or sell such notes at a price that exceeds (i) our valuation of the notes at that time based on our internal pricing models, (ii) any secondary market prices provided by unaffiliated dealers (if any) and (iii) depending on your broker, the valuation provided on customer account statements. The price that UBS Securities LLC may initially offer to buy such notes following issuance will exceed the valuations indicated by our internal pricing models due to the inclusion for a limited period of time of the aggregate value of the underwriting discount, hedging costs, issuance and other costs and theoretical projected trading profit. The portion of such amounts included in our price will decline to zero on a straight line basis over a period ending no later than the date specified under “Summary Information – Key Terms – Supplemental plan of distribution (conflicts of interest); secondary markets (if any)” herein. Thereafter, if UBS Securities LLC or an affiliate makes secondary markets in the notes, it will do so at prices that reflect our estimated value determined by reference to our internal pricing models at that time. The temporary positive differential relative to our internal pricing models arises from requests from and arrangements made by UBS Securities LLC with the selling agents of structured debt securities such as the notes. As described above, UBS Securities LLC and its affiliates are not required to make a market for the notes and may stop making a market at any time. The price at which UBS Securities LLC or an affiliate may make secondary markets at any time (if at all) will also reflect its then current bid-ask spread for similar sized trades of structured debt securities. UBS Securities LLC reflects this temporary positive differential on its customer statements. Investors should inquire as to the valuation provided on customer account statements provided by unaffiliated dealers.

Price of Notes Prior to Maturity

The market price of the notes will be influenced by many unpredictable and interrelated factors, including the level of the underlier; the volatility of the underlier; the volatility of the underlier commodities; the time remaining to the maturity of the notes; interest rates in the markets; geopolitical conditions and economic, financial, political, force majeure and regulatory or judicial events; the creditworthiness of UBS and the then current bid-ask spread for the notes.

Impact of Fees and the Use of Internal Funding Rates Rather than Secondary Market Credit Spreads on Secondary Market Prices

All other things being equal, the use of the internal funding rates described above under “— Estimated Value Considerations” as well as the inclusion in the original issue price of the underwriting discount, hedging costs, issuance and other costs and any projected profits are, subject to the temporary mitigating effect of UBS Securities LLC’s and its affiliates’ market making premium, expected to reduce the price at which you may be able to sell the notes in any secondary market.

If the Level of the Underlier Changes, the Market Value of Your Notes May Not Change in the Same Manner

Your notes may trade quite differently from the performance of the underlier. Changes in the level of the underlier may not result in a comparable change in the market value of your notes. This is because your cash settlement amount at maturity will be based on the final underlier level. If the underlier return is negative, you could lose all or a substantial portion of your investment in the notes. We discuss some of the reasons for this disparity under “Risk Factors — Risks Related to Liquidity and Secondary Market Issues — The market value of the notes may be influenced by unpredictable factors” in the accompanying product supplement.

| 13 |

The Notes are Considered “Hold To Maturity” Products

Generally, there is no liquid market for the notes.

Risks Relating to Hedging Activities and Conflicts of Interest

Potential Conflict of Interest

As described further under “the Underlier” herein, UBS and its affiliates may engage in business relating to the underlier commodities or related physical commodities, which may present a conflict between the obligations of UBS and you, as a holder of the notes. There are also potential conflicts of interest between you and the calculation agent, which will be an affiliate of UBS. The calculation agent will determine the underlier return and the cash settlement amount, if any, based on the closing level of the underlier on the determination date. As described herein, the calculation agent can postpone the determination of the final underlier level if a market disruption event occurs and is continuing on the determination date. As UBS determines the economic terms of the notes, including the original issue price, and such terms include the underwriting discount, hedging costs, issuance and other costs and projected profits, the notes represent a package of economic terms. There are other potential conflicts of interest insofar as an investor could potentially get better economic terms if that investor entered into exchange-traded and/or OTC derivatives or other instruments with third parties, assuming that such instruments were available and the investor had the ability to assemble and enter into such instruments.

Furthermore, given that UBS Securities LLC and its affiliates temporarily maintain a market making premium, it may have the effect of discouraging UBS Securities LLC and its affiliates from recommending the sale of your notes in the secondary market. UBS or its affiliates may earn additional profits (or potentially incur losses) as a result of payments pursuant to such hedging activities. In performing these duties, the economic interests of UBS, UBS Securities LLC, the dealers or their respective affiliates are potentially adverse to your interests as an investor in the notes. Additionally, hedging activities may adversely affect the market value of your notes and the amount we will pay on your notes.

Potentially Inconsistent Research, Opinions or Recommendations By UBS

UBS and its affiliates publish research from time to time on financial markets and other matters that may influence the value of the notes, or express opinions or provide recommendations that are inconsistent with purchasing or holding the notes. Any research, opinions or recommendations expressed by UBS or its affiliates may not be consistent with each other and may be modified from time to time without notice. Investors should make their own independent investigation of the merits of investing in the notes and the underlier to which the notes are linked.

The Calculation Agent Can Postpone the Determination of the Initial Underlier Level and the Final Underlier Level if a Market Disruption Event Occurs on the Trade Date or the Determination Date

If the calculation agent determines that a market disruption event has occurred or is continuing on the trade date or the determination date, the trade date or the determination date, as the case may be, may be postponed until the first trading day on which no market disruption event occurs or is continuing. If such a postponement occurs, then the calculation agent will determine the closing level of the underlier on the first trading day on which no market disruption event occurs or is continuing. In no event, however, will the trade date or the determination date for the notes be postponed by more than eight trading days. As a result, the original issue date or maturity date for the notes could also be postponed. If the trade date or the determination date is postponed to the last possible day, but a market disruption event occurs or is continuing on that day, that last day will nevertheless be the trade date or the determination date, as applicable, and the closing level of the underlier will be determined by the calculation agent in the manner described in “Market Disruption Events” herein.

The Notes May Be Terminated Early if the Calculation Agent Determines That a Change in Law Event has Occurred