ANNUAL INFORMATION FORM

FOR HYDRO ONE INC.

FOR THE YEAR ENDED DECEMBER 31, 2021

February 25, 2022

TABLE OF CONTENTS

i

ii

GLOSSARY

When used in this annual information form, the following terms have the meanings set forth below unless expressly indicated otherwise:

“$” or “dollar” means Canadian Dollars, unless otherwise indicated.

“2017 Long-Term Energy Plan” has the meaning given to it under “The Electricity Industry in Ontario – Issues Affecting the Electricity Industry Generally – Ontario 2017 Long-Term Energy Plan”.

“2018 MTN Shelf Prospectus” has the meaning given to it under “General Development of the Business – Chronological Development of the Business –2020 MTN Shelf Prospectus and Related Offerings”.

“2020 MTN Shelf Prospectus” has the meaning given to it under “General Development of the Business – Chronological Development of the Business –2020 MTN Shelf Prospectus and Related Offerings”.

“2020 Ontario Budget” has the meaning given to it under “The Electricity Industry in Ontario – Issues Affecting the Electricity Industry Generally – 2020 Ontario Budget”.

“ACI” has the meaning given to it under “The Electricity Industry in Ontario – Regulation of Transmission and Distribution – Ontario Energy Board”.

“Annual MD&A” means the management’s discussion and analysis for Hydro One Inc. for the years ended December 31, 2021 and 2020 filed on SEDAR under Hydro One Inc.’s profile at www.sedar.com.

“Approved Banks” has the meaning given to it under “Description of Capital Structure – Class B Preference Shares”.

“Auditor General Act” means the Auditor General Act, RSO 1990, c A-35.

“Board” means the Board of Directors of Hydro One Inc.

“Building Broadband Faster Act” means the Building Broadband Faster Act, 2021, S.O. 2021, c. 2, Schedule 1.

“Canadian Energy Regulator Act” means the Canadian Energy Regulator Act, SC 2019, c 28, s 10.

“CCAA” means the Companies’ Creditors Arrangement Act, RSC 1985, c C-36.

“CDM” means conservation and demand management.

“CDOR Rate” has the meaning given to it under “Description of Capital Structure – Class B Preference Shares”.

“CEO” means Chief Executive Officer.

“CFO” means Chief Financial Officer.

“Class A Preference Shares” means the Class A Preference Shares in the capital of Hydro One Inc.

“Class A Redemption Date” has the meaning given to it under “Description of Capital Structure – Class A Preference Shares”.

1

“Class B Dividend Payment Date” has the meaning given to it under “Description of Capital Structure –Class B Preference Shares”.

“Class B Preference Shares” means the Class B Preference Shares in the capital of Hydro One Inc.

“Class B Redemption Date” has the meaning given to it under “Description of Capital Structure – Class B Preference Shares”.

“common shares” means the common shares in the capital of Hydro One Inc.

“CSO” has the meaning given to it under “Business of Hydro One – Employees”.

“Custom IR Method” has the meaning given to it under “Business of Hydro One – Transmission Business Segment – Regulation – Transmission Rate Setting”.

“CUSW” has the meaning given to it under “Business of Hydro One – Employees”.

“DBRS” has the meaning given to it under “Credit Ratings”.

“Dealer Agreement” has the meaning given to it under “Material Contracts”.

“Dealers” has the meaning given to it under “Material Contracts”.

“DERs” has the meaning given to it under “The Electricity Industry in Ontario – Regulation of Transmission and Distribution – Ontario Energy Board”.

“DMS” has the meaning given to it under “Business of Hydro One – Distribution Business Segment –Capital Expenditures”.

“Electricity Act” means the Electricity Act, 1998, SO 1998, c 15, Schedule A.

“Energy Statute Law Amendment Act” means the Energy Statute Law Amendment Act, 2016, SO 2016, c 10.

“Environmental Assessment Act” means the Environmental Assessment Act, RSO 1990, c E-18.

“EPSCA” has the meaning given to it under “Business of Hydro One – Employees”.

“ESG” means environmental, social and governance.

“Executive Compensation Exemptive Relief” has the meaning given to it under “General Development of Business – Chronological Development of Business – Exemptive Relief – Executive Compensation Disclosure”.

“FEI” has the meaning given to it under “The Electricity Industry in Ontario – Regulation of Transmission and Distribution – Ontario Energy Board”.

“Financial Administration Act” means the Financial Administration Act, RSO 1990, c F-12.

“Floating Quarterly Dividend Rate” has the meaning given to it under “Description of Capital Structure – Class B Preference Shares”.

“Floating Rate Calculation Date” means November 20, 2017 and each Class B Dividend Payment Date

2

thereafter.

“Golf Town” has the meaning given to it under “Directors and Officers – Corporate Cease Trade Orders and Bankruptcies”.

“Governance Agreement” means the governance agreement dated November 5, 2015 between Hydro One Limited and the Province.

“Great Lakes Power” means Great Lakes Power Transmission LP.

“HCCC” has the meaning given to it under “General Development of the Business – Chronological Developments of the Business – Niagara Reinforcement Limited Partnership – 2019”.

“HOSSM” means Hydro One Sault Ste. Marie LP.

“Hydro One” or the “Company” have the meanings given to such terms set out under “Presentation of Information”.

“Hydro One Accountability Act” means the Hydro One Accountability Act, 2018, SO 2018, c 10, Schedule 1.

“Hydro One Inc.” has the meaning given to it under “Presentation of Information”.

“Hydro One Limited” has the meaning given to it under “Presentation of Information”.

“Hydro One Networks” means Hydro One Networks Inc.

“Hydro One Remote Communities” means Hydro One Remote Communities Inc.

“Hydro One Telecom” means Hydro One Telecom Inc., now Acronym Solutions Inc.

“ICD.D” means the “Institute of Corporate Directors, Director” designation.

“IESO” means the Independent Electricity System Operator.

“Income Tax Act” means the Income Tax Act, RSC 1985, c 1 (5th Supp).

“Indian Act” means the Indian Act, RSC 1985, c I-5.

“kV” means kilovolt.

“kW” means kilowatt.

“Letter Agreement” means the agreement dated July 11, 2018 between Hydro One Limited and the Province.

“MAAD application” means an OEB Mergers, Acquisitions, Amalgamations and Divestitures application.

“management” has the meaning given to it under “Presentation of Information”.

“Market Rules” means the rules made under section 32 of the Electricity Act that are administered by the IESO.

3

“Minister of Energy” means the Minister of Energy, Northern Development and Mines for the Province or the Minister of Energy for the Province, as applicable at the relevant time.

“Moody’s” has the meaning given to it under “Credit Ratings”.

“National Energy Board Act” means the National Energy Board Act, RSC 1985, c N-7.

“NERC” means the North American Electric Reliability Corporation.

“Niagara Line” has the meaning given to it under “General Development of the Business – Chronological Development of the Business – Niagara Reinforcement Limited Partnership – 2019”.

“NPCC” means the Northeast Power Coordinating Council, Inc.

“NRLP” has the meaning given to it under “General Development of the Business – Chronological Development of the Business – Niagara Reinforcement Limited Partnership – 2019”.

“NYSE” means the New York Stock Exchange.

“OBCA” means the Business Corporations Act, RSO 1990, c B-16.

“OEB” means the Ontario Energy Board.

“OEFC” means Ontario Electricity Financial Corporation.

“Ontario” or the “province” has the meaning given to it under “Presentation of Information”.

“Ontario Energy Board Act” means the Ontario Energy Board Act, 1998, SO 1998, c 15, Schedule B.

“Orillia Power” means Orillia Power Distribution Corporation.

“PCBs” means polychlorinated biphenyls.

“PDI” means Peterborough Distribution Inc.

“Price Cap IR” has the meaning given to it under “Business of Hydro One – Distribution Business Segment – Regulation – Distribution Rates”.

“Province” has the meaning given to it under “Presentation of Information”.

“PWU” has the meaning given to it under “Business of Hydro One – Employees”.

“Quarterly Floating Rate Period” has the meaning given to it under “Description of Capital Structure – Class B Preference Shares”.

“rate base” has the meaning given to it under “Presentation of Information”.

“rate-regulated” has the meaning given to it under “Rate-Regulated Utilities – Rate Applications in Ontario – Framework”.

“Reliability Standards” has the meaning given to it under “Business of Hydro One – Transmission Business Segment – Regulation – Reliability Standards and Regulations for Transmission”.

4

“Reserve” means a “reserve” as that term is defined in the Indian Act.

“Retraction Date” has the meaning given to it under “Description of Capital Structure – Class B Preference Shares”.

“Retraction Demand” has the meaning given to it under “Description of Capital Structure – Class B Preference Shares”.

“return on equity” has the meaning given to it under “Presentation of Information”.

“revenue cap escalator factor” has the meaning given to it under “Business of Hydro One – Transmission Business Segment – Regulation – Recent Transmission Rate Applications – HOSSM”.

“Revenue Cap Index” has the meaning given to it under “Business of Hydro One – Transmission Business Segment – Regulation – Transmission Rate Setting”.

“ROE” has the meaning given to it under “Rate-Regulated Utilities – Rate Applications in Ontario – Framework”.

“RPPAG” has the meaning given to it under “Business of Hydro One – Transmission Business Segment – Regulation – Regional Planning”.

“RRF” means the performance-based model set out in the OEB’s Renewed Regulatory Framework for Electricity Distributors.

“S&P” has the meaning given to it under “Credit Ratings”.

“Society” has the meaning given to it under “Business of Hydro One – Employees”.

“Taxation Act” means the Taxation Act, 2007, SO 2007, c 11, Schedule A.

“trust assets” has the meaning given to it under “Interest of Management and Others in Material Transactions – Relationships with the Province and Other Parties – Transfer Orders”.

“Trust Indenture” has the meaning given to it under “Material Contracts”.

“TS” means transmission station.

“TWh” means terawatt-hours.

“U.S.” means the United States of America.

“U.S. GAAP” means United States Generally Accepted Accounting Principles.

“uniform transmission rates” has the meaning given to it under “Business of Hydro One – Transmission Business Segment – Regulation – Transmission Rate Setting”.

5

PRESENTATION OF INFORMATION

Unless otherwise specified, all information in this annual information form is presented as at December 31, 2021.

Capitalized terms used in this annual information form are defined under “Glossary”. Words importing the singular number include the plural, and vice versa, and words importing any gender include all genders. The Annual MD&A and the audited consolidated financial statements of Hydro One Inc. as at and for the years ended December 31, 2021 and 2020, are specifically incorporated by reference into and form an integral part of this annual information form. Copies of these documents have been filed with the Canadian securities regulatory authorities and are available on SEDAR under Hydro One Inc.’s profile at www.sedar.com.

Unless otherwise noted or the context otherwise requires, references to “Hydro One” or the “Company” refer to Hydro One Inc. and its subsidiaries taken together as a whole. References to “Hydro One Limited” refer only to Hydro One Limited and references to “Hydro One Inc.” refer only to Hydro One Inc.

In addition, “Province” refers to the Province of Ontario as a provincial government entity, and “Ontario” or the “province” in lower case type refers to the Province of Ontario as a geographical area. References to “management” in this annual information form mean the persons who are identified as executive officers of Hydro One Inc. and its subsidiaries, as applicable, in this annual information form. Any statements made by or on behalf of management are made in such persons’ respective capacities as executive officers of Hydro One Inc. and its subsidiaries, as applicable, and not in their personal capacities. See “Directors and Officers” for more information.

This annual information form refers to certain terms commonly used in the electricity industry, such as “rate-regulated”, “rate base” and “return on equity”. Rate base is an amount that a utility is required to calculate for regulatory purposes, and refers to the net book value of the utility’s assets for regulatory purposes. Return on equity is a percentage that is set or approved by a utility’s regulator and represents the rate of return that a regulator allows the utility to earn on the equity component of the utility’s rate base. See also “Rate-Regulated Utilities”.

In this annual information form, all dollar amounts are expressed in Canadian dollars unless otherwise indicated. Hydro One Limited and Hydro One Inc. prepare and present their financial statements in accordance with U.S. GAAP.

6

FORWARD-LOOKING INFORMATION

Certain information in this annual information form contains “forward-looking information” within the meaning of applicable Canadian securities laws. Forward-looking information in this annual information form is based on current expectations, estimates, forecasts and projections about Hydro One’s business and the industry, and the regulatory and economic environments, in which Hydro One operates and includes beliefs of and assumptions made by management. Such statements include, but are not limited to, statements related to: the Company’s transmission and distribution rate applications, and resulting decisions, rates and impacts; expected impacts and timing of changes to the electricity industry; the potential impact of COVID-19, including its variants, on the Company’s business and operations; the Company’s maturing debt and standby credit facilities; expectations regarding the Company’s financing activities; expectations regarding the use of proceeds under Hydro One Inc.’s commercial paper program; credit ratings; ongoing and planned projects and/or initiatives; expected future capital investments and expenditures, the nature and timing of these investments and expenditures, including the Company’s plans for sustaining and development capital expenditures for its distribution and transmission systems; expectations regarding allowed return on equity; expectations regarding the ability of the Company to recover expenditures in future rates; expectations relating to the recoverability of incremental costs and lost revenues from ratepayers in connection with the COVID-19 pandemic; expectations regarding the ability to negotiate collective agreements consistent with rate orders; expectations related to work force demographics; expectations regarding taxes; expectations regarding load growth; the regional planning process; expectations related to Hydro One’s CDM requirements and targets; new legislation and regulatory initiatives relating to the electricity industry and the expected impacts of such, including the impacts of legislative changes resulting from the introduction of Bill 257; expectations regarding the Company’s DMS; expectations regarding the Company’s plans to build and operationalize a new Ontario grid control centre by 2022; the Company’s customer focus and related initiatives; statements related to the Company’s relationships with Indigenous communities; statements related to environmental matters, and the Company’s expected future environmental and remediation expenditures; statements related to the Company’s commitment to releasing an annual sustainability report and to increase the transparency of ESG disclosures; expectations related to the effect of interest rates; the Company’s reputation; cyber and data security; Hydro One Limited’s relationship with the Province; acquisitions and consolidation opportunities and other strategic initiatives; expectations regarding the Governance Agreement and other agreements with the Province; the status of litigation; expectations regarding the manner in which Hydro One will operate and the Company’s strategy; potential conflicts of interest; and legal proceedings in which Hydro One is currently involved.

Words such as “aim”, “could”, “would”, “expect”, “anticipate”, “intend”, “attempt”, “may”, “plan”, “will”, “believe”, “seek”, “estimate”, “goal”, “target”, and variations of such words and similar expressions are intended to identify such forward-looking information. These statements are not guarantees of future performance and involve assumptions and risks and uncertainties that are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed, implied or forecasted in such forward-looking information. Hydro One does not intend, and it disclaims any obligation to update any forward-looking information, except as required by law.

7

The forward-looking information in this annual information form is based on a variety of factors and assumptions including, but not limited to: the scope of the COVID-19 pandemic and duration thereof as well as the effect and severity of corporate and other mitigation measures on the Company’s operations, supply chain or employees; no unforeseen changes in the legislative and operating framework for Ontario’s electricity market; favourable decisions from the OEB and other regulatory bodies concerning outstanding and future rate and other applications; no unexpected delays in obtaining required regulatory approvals; no unforeseen changes in rate orders or rate setting methodologies for Hydro One’s distribution and transmission businesses; no unfavourable changes in environmental regulation; continued use of U.S. GAAP; a stable regulatory environment; no significant changes to the Company’s current credit ratings; no unforeseen impacts of new accounting pronouncements; no changes to expectations regarding electricity consumption; no unforeseen changes to economic and market conditions; recoverability of costs and expenses related to the COVID-19 pandemic, including the costs of customer defaults resulting from the pandemic; completion of operating and capital projects that have been deferred; and no significant event occurring outside the ordinary course of business. These assumptions are based on information currently available to Hydro One, including information obtained from third-party sources. Actual results may differ materially from those predicted by such forward-looking information. While Hydro One does not know what impact any of these differences may have, Hydro One’s business, results of operations, financial condition and credit stability may be materially adversely affected if any such differences occur. Factors that could cause actual results or outcomes to differ materially from the results expressed or implied by forward-looking information include, among other things:

•a significant expansion in length or severity of the COVID-19 pandemic, including the spread of its variants, restricting or prohibiting the Company’s operations or significantly impacting the Company’s supply chain or workforce;

•severity of mitigation measures relating to the COVID-19 pandemic and delays in completion of and increases in costs of operating and capital projects;

•the regulatory and accounting treatment of incremental costs and lost revenues of the Company related to the COVID-19 pandemic;

•regulatory risks and risks relating to Hydro One’s revenues, including risks relating to rate orders and the rate-setting models for transmission and distribution, actual performance against forecasts and capital expenditures, competition with other transmitters and other applications to the OEB, the regulatory treatment of the deferred tax asset, the recoverability of total compensation costs or denials of applications;

•risks associated with the Province’s share ownership of Hydro One Limited and other relationships with the Province, including potential conflicts of interest that may arise between Hydro One, the Province and related parties, risks associated with the Province’s exercise of further legislative and regulatory powers in the implementation of the Hydro One Accountability Act, risks relating to the ability of the Company to attract and retain

8

qualified executive talent or the risk of a credit rating downgrade for the Company and its impact on the Company’s funding and liquidity;

•risks relating to the location of the Company’s assets on Reserve lands and the risk that Hydro One may incur significant costs associated with transferring assets located on Reserves;

•the risk that the Company may be unable to comply with regulatory and legislative requirements or that the Company may incur additional costs for compliance that are not recoverable through rates;

•the risk of exposure of the Company’s facilities to the effects of severe weather conditions, natural disasters, man-made events or other unexpected occurrences for which the Company is uninsured or for which the Company could be subject to claims for damage;

•the risk of non-compliance with environmental regulations and inability to recover environmental expenditures in rate applications and the risk that assumptions that form the basis of the Company’s recorded environmental liabilities and related regulatory assets may change;

•risks associated with information system security and maintaining complex information technology and operational technology system infrastructure, including system failures or risks of cyber-attacks or unauthorized access to corporate information technology and operational technology systems;

•the risk of labour disputes and inability to negotiate or renew appropriate collective agreements on acceptable terms consistent with the Company’s rate decisions;

•risks related to the Company’s work force demographic and its potential inability to attract and retain qualified personnel;

•the risk that the Company is not able to arrange sufficient cost-effective financing to repay maturing debt and to fund capital expenditures or the risk of a downgrade in the Company’s credit ratings;

•risks associated with fluctuations in interest rates and failure to manage exposure to credit and financial instrument risk;

•risks associated with economic uncertainty and financial market volatility;

•the risk that the Company may not be able to execute plans for capital projects necessary to maintain the performance of the Company’s assets or to carry out projects in a timely

9

manner or the risk of increased competition for the development of large transmission projects or legislative changes affecting the selection of transmitters;

•risks associated with asset condition, capital projects and innovation, including public opposition to or delays or denials of the requisite approvals and accommodations for the Company’s planned projects;

•the risk of failure to mitigate significant health and safety risks;

•the risk of not being able to recover the Company’s pension expenditures in future rates and uncertainty regarding the future regulatory treatment of pension, other post-employment benefits and post-retirement benefits costs;

•the impact of the ownership by the Province of lands underlying the Company’s transmission system;

•the risk associated with legal proceedings that could be costly, time-consuming or divert the attention of management and key personnel from the Company’s business operations;

•the impact if the Company does not have valid occupational rights on third-party owned or controlled lands and the risks associated with occupational rights of the Company that may be subject to expiry;

•risks relating to adverse reputational events or political actions;

•the potential that Hydro One may incur significant expenses to replace functions currently outsourced if agreements are terminated or expire before a new service provider is selected;

•risks relating to acquisitions, including the failure to realize the anticipated benefits of such transactions at all, or within the time periods anticipated, and unexpected costs incurred in relation thereto;

•the inability to continue to prepare financial statements using U.S. GAAP; and

•the risk related to the impact of any new accounting pronouncements.

Hydro One cautions the reader that the above list of factors is not exhaustive. Some of these and other factors are discussed in more detail under the heading “Risk Management and Risk Factors” in the Annual MD&A. You should review such section in detail, including the matters referenced therein.

In addition, Hydro One cautions the reader that information provided in this annual information form regarding Hydro One’s outlook on certain matters, including potential future expenditures, is provided in

10

order to give context to the nature of some of Hydro One’s future plans and may not be appropriate for other purposes.

ELECTRICITY INDUSTRY OVERVIEW

General Overview

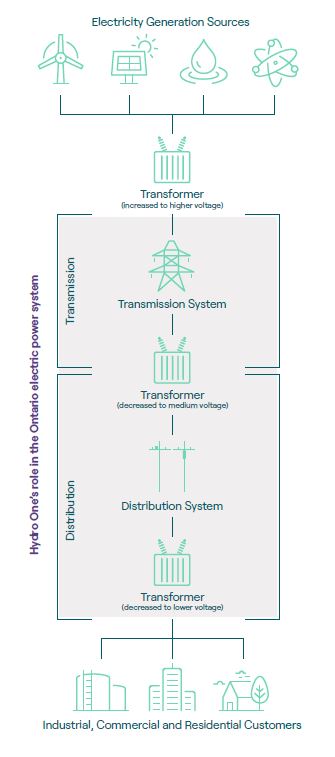

The electricity industry is made up of businesses that generate, transmit, distribute and sell electricity. While traditionally a mature and stable industry, the electricity industry is facing rapid and dramatic technological change and increasing innovation. Hydro One’s business is focused on the transmission and distribution of electricity.

•Transmission refers to the delivery of electricity over high voltage lines, typically over long distances, from generating stations to local areas and large industrial customers.

•Distribution refers to the delivery of electricity over low voltage lines to end users such as homes, businesses and institutions.

11

Overview of an Electricity System

The basic configuration of a typical electricity system, showing electricity generation, transmission and distribution, is illustrated in the following diagram:

Note:

The above image shows a typical electricity system with transmission-connected generation.

Transmission and distribution networks are sometimes referred to as the “electricity grid” or simply “the grid”.

12

THE ELECTRICITY INDUSTRY IN ONTARIO

Regulation of Transmission and Distribution

General

The Electricity Act and the Ontario Energy Board Act establish the general legislative framework for Ontario’s electricity market. The activities of transmitters and distributors in Ontario are overseen by three main regulatory authorities: (i) the OEB, (ii) the IESO, and (iii) the Canadian Energy Regulator. The Minister of Energy is responsible for developing long-term energy plans and has the power to issue directives to the IESO and the OEB regarding implementation of such plans.

Ontario Energy Board

The OEB is an independent regulatory agency. The Ontario Energy Board Act provides the OEB with the authority to regulate Ontario’s electricity market, including the activities of transmitters and distributors.

The OEB has the following legislated objectives in relation to the electricity industry:

•to inform consumers and protect their interests with respect to prices and the adequacy, reliability and quality of electricity service,

•to promote economic efficiency and cost effectiveness in the generation, transmission, distribution, sale and demand management of electricity and to facilitate the maintenance of a financially viable electricity industry,

•to promote electricity conservation and demand management in a manner consistent with the policies of the Province, including having regard to the consumer’s economic circumstances, and

•to facilitate innovation in the electricity sector.

The OEB is responsible for, among other things, approving transmission and distribution rates in Ontario. It also approves the construction, expansion, or reinforcement of transmission lines greater than two kilometres in length, as well as mergers, acquisitions, amalgamations and divestitures involving distributors, transmitters and other entities which it licenses. The activities of transmitters and distributors are subject to the conditions of their licences and a number of industry codes issued by the OEB. These codes and other requirements prescribe minimum standards of conduct and service for licensed participants in the electricity market.

In December 2017, the OEB posted its Strategic Blueprint: Keeping Pace with the Evolving Energy Sector, setting out the OEB’s commitment to modernize its approach to regulation over the next five years and established the Advisory Committee on Innovation (“ACI”). The ACI was tasked with identifying steps to develop a modern regulatory framework in response to technological changes occurring in the energy sector. In response to recommendations made by the ACI, in 2019, the OEB

13

initiated two consultation processes, Utility Remuneration and Responding to Distributed Energy Resources (“DERs”). In March 2021, the OEB issued a letter which renamed and consolidated these two consultations into a single consultation named Framework for Energy Innovation: Distributed Resources and Utility Incentives (“FEI”). The FEI consultation focuses on: (i) investigating and supporting utilities’ use of DERs they do not own as alternatives to traditional wires solutions to meet distribution needs; and (ii) ensuring that utilities’ planning is appropriately informed by DER penetration and forecasts. The FEI consultation is ongoing.

IESO

The IESO delivers key services across the electricity sector, including managing the power system in real time, planning for Ontario’s future energy needs, enabling conservation and designing a more efficient electricity marketplace to support sector evolution. Transmitters and other wholesale market participants must comply with the Market Rules issued by the IESO. The Market Rules require transmitters to comply with mandatory North American reliability standards for transmission issued by the NERC and the NPCC. The IESO enforces these reliability standards and coordinates with system operators and reliability agencies in other jurisdictions to ensure energy adequacy and security across the interconnected bulk electricity system in North America.

Canadian Energy Regulator

In August 2019, the Canadian Energy Regulator Act came into force, replacing the National Energy Board Act. As a result of the new statute, the National Energy Board became the Canadian Energy Regulator. Any decision or order made by the National Energy Board is considered to have been made under the Canadian Energy Regulator Act and may be enforced as such.

The Canadian Energy Regulator has jurisdiction over the construction and operation of international power lines, as well as interprovincial lines that are designated as being under federal jurisdiction (of which there are currently none). As Hydro One owns and operates 11 active international power lines connecting Ontario’s transmission system with transmission systems in Michigan, Minnesota and New York, Hydro One holds several certificates and permits with the Canadian Energy Regulator.

Transmission

Transmission companies own and operate transmission systems that deliver electricity over high voltage lines. Hydro One’s transmission system accounts for approximately 98% of Ontario’s electricity transmission capacity based on the revenues approved by the OEB. The Company’s transmission system is interconnected to systems in Manitoba, Michigan, Minnesota, New York and Quebec and is part of the North American electricity grid’s Eastern Interconnection. The Eastern Interconnection is a contiguous electricity transmission system that extends from Manitoba to Florida and from east of the Rocky Mountains to the North American east coast. Being part of the Eastern Interconnection provides benefits to Ontario, such as greater security and stability for Ontario’s transmission system, emergency support when there are generation constraints or shortages in Ontario, and the ability to exchange electricity with other jurisdictions.

14

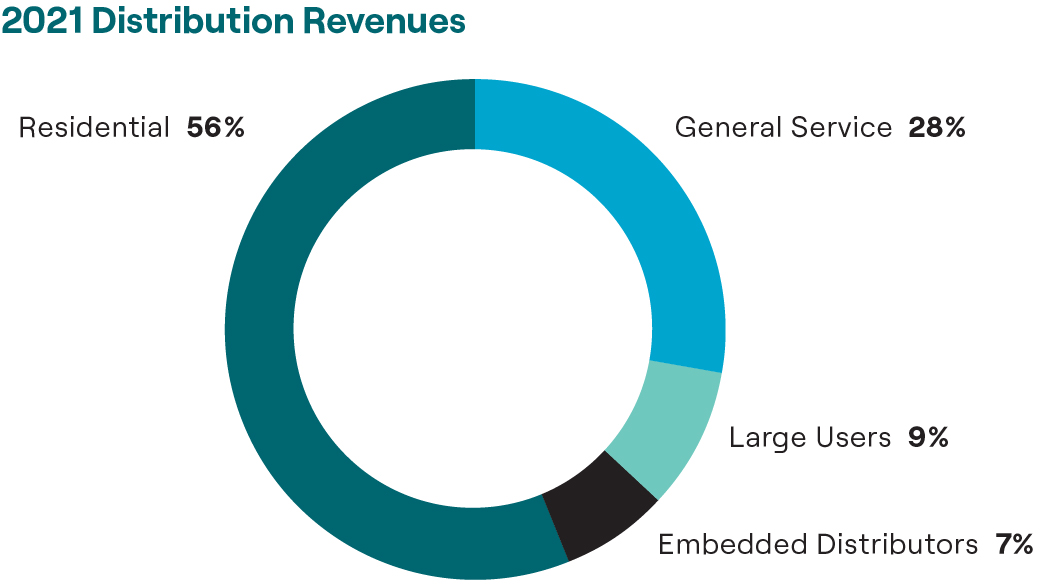

Distribution

Distributors own and operate distribution systems that deliver electricity over power lines at voltages of 50 kV or less to end users. A local distribution company is responsible for distributing electricity to customers in its OEB-licensed service territory, and in some cases to other distributors. A service territory may cover large portions or all of a particular municipality, or an otherwise-defined geographic area. Distribution customers include homes, commercial and industrial businesses and institutions such as governments, schools and hospitals.

In Ontario, as per the OEB’s 2020 Yearbook of Electricity Distributors, as at December 31, 2020, 59 local distribution companies provided electricity to over five million customers. The distribution industry in Ontario is fragmented, with the 10 largest local distribution companies accounting for approximately 80% of the province’s customers.

Hydro One owns the largest local distribution business in Ontario, which serves approximately 1.5 million predominantly rural customers, or approximately 28% of the total number of customers in Ontario.

Issues Affecting the Electricity Industry Generally

Tax Incentives

Tax incentives were included in the 2015 Ontario budget to promote consolidation in the electricity distribution sector. The 2015 Ontario budget announced a reduction in the tax rate for transfers of electricity assets from 33% to 22% and to nil for distributors with fewer than 30,000 customers. In addition, the budget introduced a capital gains exemption where capital gains arise as a result of exiting the payments in lieu of corporate taxes regime. These incentives are in place until December 31, 2022.

Ontario 2017 Long-Term Energy Plan

In October 2017, the Province released its 2017 Long-Term Energy Plan (the “2017 Long-Term Energy Plan”), which set out a number of initiatives for Ontario’s energy system, including: ensuring affordable and accessible energy, ensuring a flexible energy system, innovating to meet the future, improving value and performance for consumers, strengthening its commitment to energy conservation and efficiency, responding to the challenge of climate change, supporting First Nation and Métis capacity and leadership, and supporting regional solutions and infrastructure. The IESO and the OEB developed implementation plans in support of the objectives of the 2017 Long-Term Energy Plan, and each implementation plan was approved by the Minister of Energy in February 2018. The Province is currently consulting industry and stakeholders on a long-term system-planning process to replace the 2017 Long-Term Energy Plan.

2020 Ontario Budget

In November 2020, the Province released its 2020 Ontario Budget: Ontario’s Action Plan: Protect, Support, Recover (the “2020 Ontario Budget”), which included a rate mitigation plan to help certain

15

business and industrial customers. Starting on January 1, 2021, a portion of non-hydro renewable energy contracts (including wind, solar, bioenergy) is funded by the Province and not ratepayers. According to the 2020 Ontario Budget, this represents approximately 25% of the current cost of the “Global Adjustment”. The Global Adjustment is the difference between the guaranteed price and the money the generators earn in the wholesale marketplace. This reduction in the Global Adjustment does not benefit regulated price plan customers (households, farms, small businesses), who instead continue to be protected by means of the Ontario Electricity Rebate program.

OEB Actions on Electricity Pricing

Since March 2020, the Province has taken a number of actions related to the pricing of electricity to support regulated price plan customers in dealing with the impacts of the COVID-19 pandemic. These government mandated actions include providing different fixed electricity prices for various periods of time. All of these COVID-19 related pricing changes mandated by the Province have been implemented by the OEB and details are available on the OEB’s website.

In response to direction provided by the Province, in September 2020 the OEB announced that as of October 13, 2020, all utilities were required to give regulated price plan electricity customers the choice to opt out of time-of-use pricing and to elect instead to be charged on the basis of tiered (or fixed) electricity pricing.

On December 15, 2020, the OEB reset the regulated price plan prices effective January 1, 2021, to reflect a decrease in the regulated price plan supply cost as a result of the reduction in the Global Adjustment as set out in the 2020 Ontario Budget. These regulated price plan prices came into effect at the conclusion of the electricity price changes established to assist customers in dealing with the impacts of the COVID-19 pandemic. In April 2021, the OEB reset the regulated price plan prices effective May 1, 2021 for households and small businesses. In October 2021, the OEB announced that as of November 1, 2021, the electricity prices would not change under the regulated price plan. In January 2022, the OEB temporarily changed the regulated price plan prices for the period from January 18, 2022 to February 7, 2022, fixing the price for this period to the off-peak rate in order to provide temporary electricity rate relief as directed by the Province. It is anticipated that the OEB will review the regulated price plan prices in 2022 and will reset them if required in accordance with the OEB’s usual practice.

Supporting Broadband and Infrastructure Expansion Act, 2021

On March 4, 2021, the Province introduced Bill 257 (Supporting Broadband and Infrastructure Expansion Act, 2021) to create a new act entitled the Building Broadband Faster Act, 2021 that is aimed at supporting the timely deployment of broadband infrastructure within unserved and underserved rural Ontario communities. Bill 257 received Royal Assent on April 12, 2021. Bill 257 amends the Ontario Energy Board Act to provide the Province with regulation-making authority regarding the development of, access to, or use of electricity infrastructure for non-electricity purposes, including to reduce or fix the annual rental charge that telecommunications service providers must pay to attach their wireline broadband telecommunications attachments to utility poles, establish performance standards and timelines for how utilities must respond to attachment requests and require utilities to consider joint use of poles

16

during planning processes. The Building Broadband Faster Act Guideline (“BBFA Guideline”) and regulations informing the legislative changes were published on November 30, 2021. The Company continues to be engaged with the Province on implementing an appropriate regulatory framework to support the BBFA Guideline and regulations, including arrangements to sustain the Company’s revenues and recovery of reasonable associated costs. The Company will continue to assess the impact as more details become available.

Legislative Provisions Specific to Hydro One

In addition to legislation in Ontario that impacts all transmitters and distributors, there is legislation that is specific to Hydro One. Specifically, the Electricity Act requires Hydro One’s head office and principal grid control centre to be maintained in Ontario, restricts the disposition of substantially all of its OEB-regulated transmission or distribution business, prohibits any change to its jurisdiction of incorporation and requires the Company to have an ombudsman.

Ombudsman

The Electricity Act requires the Company to have an ombudsman to act as a liaison with customers and to establish procedures for the ombudsman to inquire into and report to the board of directors of Hydro One Limited on matters raised with the ombudsman by or on behalf of customers. See “Business of Hydro One – Ombudsman” for more information.

Hydro One Accountability Act

In August 2018, the Province passed the Hydro One Accountability Act, requiring the board of directors of Hydro One Limited to establish a new compensation framework for the board, CEO and certain other executives, as defined in the legislation, in consultation with the Province and the other five largest shareholders of Hydro One Limited. In accordance with this legislation, the Province was required to approve the new executive compensation framework and is required to approve any amendments to it. In February 2019, pursuant to the Hydro One Accountability Act, the Province issued a directive to Hydro One Limited which set out certain compensation-related requirements for the CEO, other executives and the board of directors of Hydro One Limited that Hydro One Limited is required to follow when developing its board and executive compensation framework, and in March 2019, the Province approved a new compensation framework that Hydro One submitted in compliance with the directive. Key highlights of the new compensation framework include, among other things, a maximum total direct compensation for the CEO and other executives and a cap on annual board compensation. Also in accordance with the Hydro One Accountability Act, the Ontario Energy Board Act was amended to preclude the OEB from approving or fixing rates for Hydro One Limited or any of its subsidiaries that include any amount in respect of compensation paid to the CEO and certain other executives. The executive and director compensation framework requirements in the Hydro One Accountability Act expire on January 1, 2023.

The Hydro One Accountability Act also requires Hydro One Limited to annually provide public disclosure concerning compensation paid to certain executives. Hydro One’s current executive

17

compensation framework can be found on its website at www.hydroone.com. The information contained on Hydro One’s website is not incorporated by reference into this annual information form.

Elimination of Certain Legislation With Respect to Hydro One

In 2015 and 2016, Hydro One ceased to be subject to a number of Ontario statutes that apply to entities owned by the Province. Hydro One Limited is similarly not subject to those statutes. Notwithstanding the elimination of certain legislation with respect to Hydro One, the Company is required under the Financial Administration Act and the Auditor General Act to provide financial information to the Province for the Province’s public reporting purposes.

Cybersecurity

The Company is exposed to potential risks related to cyberattacks, supply chain compromises and unauthorized access to our systems. As the Company continues to make investments in and rely on additional, more complex and interconnected digital technology to enable efficient operations, the likelihood of a cyber-breach impacting our business increases. In addition, the critical nature of our business further increases the likelihood of a sophisticated cyber attacker taking advantage of our people, processes and technology. The Company takes a risk-aligned approach to cyber related investments to reduce the likelihood of an impactful cyber related breach. Despite having strong security measures in place, a breach could occur. A breach has the ability to corrupt our information technology systems, compromise our sensitive information, effect the integrity of our financial controls, disrupt operations or have impacts to the safety of our work environment. The Company manages these risks by establishing a common set of cybersecurity standards, periodic security testing, program maturity objectives, security partnerships and a unified security strategy built on a set of cybersecurity standards driven by the OEB. This Ontario specific set of standards is in alignment with the National Institute of Standards and Technology’s Cyber Security Framework. In addition to provincial regulatory requirements of the OEB, critical systems that support the North American Bulk Electric System are regulated by the North American Electric Reliability Critical Infrastructure Protection Standards. These two foundational frameworks establish strong security measures across all aspects of our operations.

RECENT DEVELOPMENTS AT HYDRO ONE

Sustainability-linked Loan Amendments to Hydro One Credit Facilities

In January 2022, Hydro One successfully amended its syndicated credit facilities to incorporate ESG targets. The facilities now include a pricing adjustment which can increase or decrease Hydro One’s cost of funding based on its performance on certain Sustainability Performance Measures, which are related to Hydro One's sustainability goals.

18

RATE-REGULATED UTILITIES

Rate Applications in Ontario

Framework

The term “rate-regulated” is used to refer to an electricity business whose rates for transmission, distribution and other services are subject to approval by a regulator. The rate base of a rate-regulated utility means the net book value of the regulated assets of the utility, plus an allowance for working capital. The OEB is the regulator that approves electricity transmission and distribution rates in Ontario. Transmission and distribution rates have historically been determined using either a cost-of-service model or a performance-based model, which typically includes a cost-of-service base year. These models are reviewed and modified by the OEB from time to time. The OEB is currently considering alternative approaches to utility remuneration and incentives.

In a cost-of-service model, a utility charges rates for its services that allow it to recover the costs of providing its services and earn an allowed return on equity. A utility’s return on equity, or “ROE”, is the rate of return that a regulator allows the utility to earn on the equity portion of the utility’s rate base. The utility’s costs of providing its services must be prudently incurred. Cost savings are typically passed on to customers in the form of lower rates reflected in future rate decisions.

Cost of Service ($) | + | Return on Equity ($) | = | Revenue Requirement ($) | ||||||||||

In a performance-based model, a utility also charges rates for its services that allow it to recover the costs of providing its services and earn an allowed return on equity. However, rates are adjusted formulaically in years subsequent to the initial rebasing of costs. The formulaic adjustments in a performance-based model consider inflation and expectations regarding productivity. They assume that the utility becomes increasingly efficient over time. If a utility achieves cost savings in excess of those established by the regulator, the utility may retain some or all of the benefits of those cost savings, which may permit the utility to earn more than its allowed return on equity. In Ontario, transmission and distribution rates, including those of Hydro One, are now generally determined using a performance-based model.

CORPORATE STRUCTURE

Incorporation and Office

Hydro One Inc. was incorporated as Ontario Hydro Services Company Inc. by articles of incorporation dated December 1, 1998, under the OBCA. On May 1, 2000, it changed its name to Hydro One Inc. Its registered office and head office is located at 483 Bay Street, 8th Floor, South Tower, Toronto, Ontario M5G 2P5. Hydro One Inc. is a wholly-owned subsidiary of Hydro One Limited.

On August 31, 2015, the articles of Hydro One Inc. were amended to provide for certain share ownership restrictions required under amendments to the Electricity Act that came into force that day. On October

19

30, 2015, the articles of Hydro One Inc. were amended to remove restrictions on the Company’s ability to issue additional shares in its subsidiaries without the prior approval of the Minister of Energy, Science and Technology (predecessor to the Minister of Energy).

On October 31, 2015, the Province revoked all existing unanimous shareholder agreements, shareholder resolutions and shareholder declarations that restricted the powers of the directors to manage or supervise the business and affairs of Hydro One Inc.

Thereafter, on October 31, 2015, Hydro One Inc. repurchased for cancellation all of the outstanding Series A preferred shares in its capital and all of the remaining issued and outstanding shares of Hydro One Inc. were subsequently acquired by Hydro One Limited from the Province in exchange for the issuance to the Province of common shares and Series 1 preferred shares of Hydro One Limited.

On November 2, 2015, the articles of Hydro One Inc. were amended to remove the share ownership restrictions, revise the authorized capital of Hydro One Inc. to be an unlimited number of common shares and an unlimited number of Class A Preference Shares and to modernize the transfer restrictions on its securities.

On November 16, 2017, the articles of Hydro One Inc. were amended to revise the authorized capital of Hydro One Inc. to be an unlimited number of common shares, an unlimited number of Class A Preference Shares and an unlimited number of Class B Preference Shares.

20

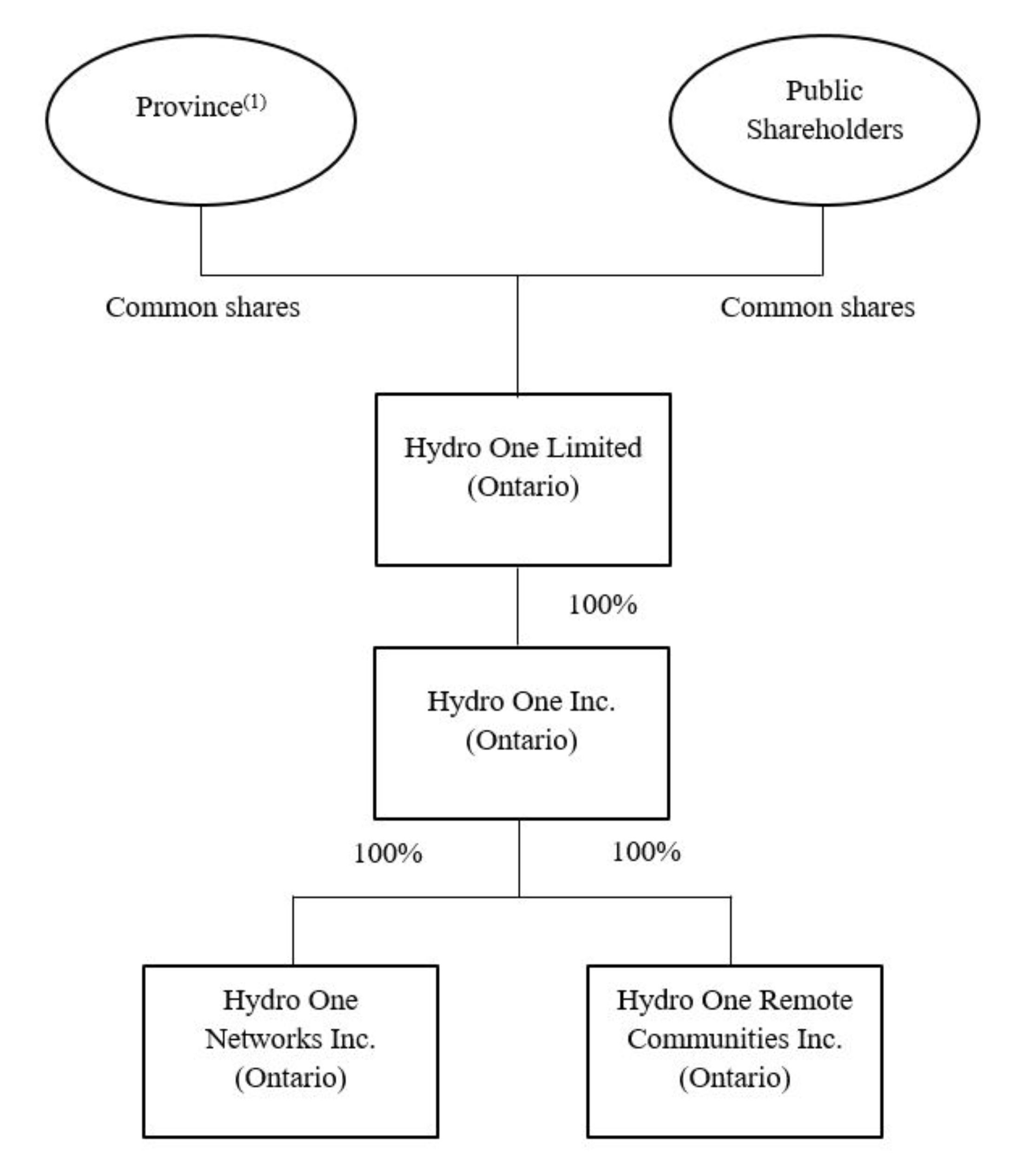

Corporate Structure and Subsidiaries

The following is a simplified chart showing the organizational structure of Hydro One and the name and jurisdiction of incorporation of certain of its subsidiaries. This chart does not include all legal entities within Hydro One’s organizational structure. Hydro One Inc. owns, directly or indirectly, 100% of the voting securities of all of the subsidiaries listed below.

Notes:

(1)As of December 31, 2021, the Province directly owned approximately 47.2% of Hydro One Limited’s outstanding common shares.

Certain of Hydro One’s subsidiaries are described below:

•Hydro One Networks – the principal operating subsidiary that carries on Hydro One’s rate-regulated transmission and distribution businesses.

•Hydro One Remote Communities – generates and supplies electricity to remote communities in northern Ontario.

21

GENERAL DEVELOPMENT OF THE BUSINESS

Chronological Development of the Business

Background

In August 2015, Hydro One Limited was incorporated by the Province as its sole shareholder. In 2015, prior to the closing of the initial public offering of Hydro One Limited, all of the issued and outstanding common shares of Hydro One Inc. were acquired by Hydro One Limited.

The following key events occurred from 2019 to 2021 in respect of Hydro One, beginning in 2019.

Directors and Executive Officers – 2019

In April 2019, Greg Kiraly, Chief Operating Officer, and Jamie Scarlett, Executive Vice President and Chief Legal Officer, left the Company following a period of planned leadership transition.

Effective May 1, 2019, Darlene Bradley was appointed as Acting Chief Operating Officer of Hydro One Networks and effective October 1, 2019, Ms. Bradley was appointed Chief Safety Officer of Hydro One Networks.

Effective May 9, 2019, Chris Lopez was appointed as CFO of Hydro One Limited and Hydro One Inc.

Effective May 10, 2019, Mark Poweska was appointed as President and CEO and a director of Hydro One Limited and Hydro One Inc.

Effective July 10, 2019, Saylor Millitz-Lee was appointed as Chief Human Resources Officer of Hydro One Networks.

On July 31, 2019, Tom Woods stepped down as Chair of the boards of directors of Hydro One Limited and Hydro One Inc.

Effective August 1, 2019, Tim Hodgson was appointed as Chair of the boards of directors of Hydro One Limited and Hydro One Inc.

Effective September 9, 2019, Paul Harricks was appointed as Chief Legal Officer of Hydro One Limited and Hydro One Inc.

Niagara Reinforcement Limited Partnership – 2019

In September 2018, the Niagara Reinforcement Limited Partnership (“NRLP”) was formed for the purpose of owning a new 230 kV transmission line in the Niagara region (the “Niagara Line”) to enable generators in the Niagara area to connect to load centres of the Greater Toronto and Hamilton areas.

22

In September 2018, Hydro One Networks filed a transmission licence application with the OEB for NRLP. In October 2018, Hydro One Networks filed two other applications with the OEB relating to NRLP requesting approval for Hydro One Networks to sell the Niagara Line to NRLP, and approval of interim rates to include in the 2019 uniform transmission rates. On December 20, 2018, the OEB issued a decision finding that the request for approval for an interim revenue requirement effective January 1, 2019 was premature but indicated that there would be an opportunity to adjudicate the matter at a later date.

In January 2019, construction on the Niagara Line was halted due to a land dispute with the Haudenosaunee Confederacy Chiefs Council (“HCCC”). In March 2019, Hydro One Networks filed a letter with the OEB requesting that the three previously-filed applications be heard together once the land dispute was resolved. Also in March 2019, the OEB put the NRLP applications in abeyance per Hydro One Networks’ request. Hydro One Networks filed a Statement of Claim with the Ontario Superior Court of Justice for injunctive relief against members of the HCCC, among others. In July 2019, Hydro One Networks was granted the injunction and resumed construction of the Niagara Line shortly thereafter. The construction of the Niagara Line was completed at the end of August 2019.

In August 2019, Hydro One Networks filed an update to the three previously-filed OEB applications and asked that the OEB resume adjudication of the applications. In September 2019, the OEB granted NRLP a transmission licence and also granted Hydro One Networks leave to sell the Niagara Line to NRLP.

In September 2019, the Niagara Line was transferred from Hydro One Networks to NRLP for $119 million and operation of the Niagara Line was contracted to Hydro One Networks. Subsequently, on the same date, Hydro One Networks sold to the Six Nations of the Grand River Development Corporation and, through a trust, to the Mississaugas of the Credit First Nation a 25.0% and 0.1%, respectively, equity interest in NRLP for total consideration of approximately $12 million, representing the fair value of the equity interest acquired. At the time of this sale, the Mississaugas of the Credit First Nation received an option to purchase an additional 19.9% equity interest in NRLP from Hydro One Networks at a price based on the value of the Niagara Line on the date of closing. The Mississaugas of the Credit First Nation exercised this option in December 2019, for a total cash consideration of approximately $9 million. This purchase transaction closed in January 2020. Following this transaction, Hydro One’s interest in NRLP was reduced from 75% to 55% with the Six Nations of the Grand River Development Corporation and, through a trust, the Mississaugas of the Credit First Nation owning 25% and 20%, respectively, of the equity interest in NRLP. See “Business of Hydro One – Transmission Business Segment – Regulation – Recent Transmission Rate Applications – Niagara Reinforcement Limited Partnership” for more information.

Executive Compensation

On March 8, 2019, Hydro One Limited released a revised executive compensation framework for the Board, the CEO and other executives that was approved by the Management Board of Cabinet of the Province.

23

Exemptive Relief – Executive Compensation Disclosure

In March 2019, Hydro One Inc. was granted exemptive relief (the “Executive Compensation Exemptive Relief”) by securities regulatory authorities in each of the provinces of Canada, exempting Hydro One Inc. from the requirement to provide executive compensation disclosure required by securities laws in its annual information form, for so long as: (i) Hydro One Inc. files such executive compensation disclosure as a stand-alone document with the securities regulatory authorities in each of the provinces of Canada no later than 140 days after its most recently completed financial year and (ii) Hydro One Inc. includes in its annual information form in respect of a financial year a notice that its executive compensation disclosure in respect of that financial year, when filed, is deemed to be incorporated by reference in its annual information form.

Increase to Commercial Paper Program

On March 25, 2019, Hydro One Inc. increased the authorized aggregate principal amount issuable under its commercial paper program from $1.5 billion to $2.3 billion. The commercial paper program is supported by Hydro One Inc.’s committed revolving credit facilities totaling $2.3 billion. The short-term liquidity made available under this program is expected to be used by the Company for general corporate purposes.

Strategy

In November 2019, Hydro One released its updated corporate strategy which reaffirms the Company’s commitment to Ontario and the provision of safe, reliable and affordable electricity. The strategy focuses on five key aspirational priorities:

•Plan, Design And Build A Grid For The Future

We will plan, design and build a reliable grid taking into account changing technologies to prevent future outages. There will be increased focus on grid resilience in order to restore power after events. Climate change and sustainability factors will be taken into consideration in our planning processes to increase resilience and lower our environmental footprint. We will incorporate distributed energy resources to enable customer choice while delivering exceptional value to customers through best-in-class asset management practices.

•Be The Safest And Most Efficient Utility

We will transform and improve our safety culture through robust safety analytics as well as grass-roots engagement with our employees. Field operations will be more empowered to drive efficiency, productivity and reliability and provided with efficient corporate support. There will be a focus on efficient capital delivery to support an ongoing growing work program.

•Be A Trusted Partner

We will make concerted efforts to build and grow relationships with Indigenous peoples, government and industry partners. We will proactively address community concerns and establish

24

strong partnerships with our customers through local investment and economic development for the benefit of Ontarians.

•Advocate For Our Customers And Help Them Make Informed Decisions

We will make it easier to do business with Hydro One by strengthening the customer experience through innovative customer-centric practices. We will help our customers make informed decisions with deeper insights and leverage our position as energy experts. We will expand access to energy offerings to become the provider of choice to our customers.

•Innovate And Grow The Business

We will continue to invest responsibly in our core transmission and distribution business. In addition, we will pursue incremental regulated and unregulated business opportunities through innovation and our focused presence in Ontario.

Directors and Executive Officers – 2020

Effective January 1, 2020, Susan Wolburgh Jenah was appointed as a director of the boards of directors of Hydro One Limited and Hydro One Inc.

Effective January 2, 2020, David Lebeter was appointed Chief Operating Officer of Hydro One Networks.

Effective July 23, 2020, Stacey Mowbray was appointed as a director of the boards of directors of Hydro One Limited and Hydro One Inc.

Effective September 28, 2020, Megan Telford was appointed Chief Human Resources Officer of Hydro One Networks.

COVID-19 Pandemic and Related Developments

Throughout the COVID-19 pandemic, the Company’s decisions and actions have continuously been guided by two priorities: to protect Hydro One’s employees; and to maintain the safe and reliable supply of electricity to Hydro One’s customers. To date, Hydro One has been successful in achieving these priorities as the Company continues to operate-in-line with the evolving safety procedures and practices implemented since the start of the pandemic. The Company continues to monitor and adhere to guidance provided by the Province and public health experts in an effort to ensure employee, customer and public safety.

As an essential service, Hydro One's teams have continued to ensure the delivery of reliable power to energize life for all Ontarians since the start of the pandemic. The Company continues to take actions to protect its employees against the spread of COVID-19 in the workplace. Like most organizations, Hydro One experienced a modest increase in the number of employees who needed time off following the onset of the Omicron sub-variant in late 2021, however employee absenteeism has improved in the recent months and there has been no significant impact to any of its services or its work programs.

25

Notwithstanding this improvement, Hydro One has proactively prepared contingency plans in the event of significant labour reductions in any of its lines of business. Strategies implemented would depend on the severity and duration of a reduction in employees.

The rapidly spreading Omicron variant is causing global staffing shortages which has led to supply chain issues in many industries. Hydro One has not been immune to the growing global supply chain disruptions and pricing pressures that are being experienced across the utility industry. However, it has managed these disruptions by shifting projects and taking proactive measures to ensure it has the materials and equipment necessary to complete its capital work program. As a result, there has not been a material impact to the overall work program.

In keeping with the Company’s ongoing commitment to customers, and to assist those customers significantly impacted by the pandemic, the Company continues to offer a number of customer relief measures including the Pandemic Relief Fund, increased payment flexibility to residential and small business customers, and assistance in securing other financial assistance.

While Hydro One continues to take the necessary steps to mitigate the impact of COVID-19 on the Company’s operations, the development of new variants and constantly changing public health restrictions make it very difficult to determine or estimate the future impacts of COVID-19 on Hydro One’s operations. Potential impacts will be largely dependent on the duration of the pandemic, the attributes of the variants, and the severity of the measures that may be implemented to combat them.

Hydro One will continue to actively monitor the impacts of the COVID-19 pandemic, including guidance provided by the Province and public health experts, and may take further actions that it determines to be in the best interest of its operations, employees, customers, partners and stakeholders, or as required by federal or provincial authorities.

2020 MTN Shelf Prospectus and Related Offerings

On April 14, 2020, Hydro One Inc. filed a short form base shelf prospectus in each of the provinces of Canada qualifying for issuance of up to $4 billion of medium term notes of Hydro One Inc. from time to time during the 25-month period ending May 14, 2022 (the “2020 MTN Shelf Prospectus”). The 2020 MTN Shelf Prospectus replaced the short form base shelf prospectus of Hydro One Inc. that expired on April 9, 2020 (the “2018 MTN Shelf Prospectus”). To date, Hydro One Inc. has issued the following medium term notes pursuant to the 2020 MTN Shelf Prospectus on the dates indicated:

26

| MTN Series | Aggregate Principal Amount | Issuance Date | ||||||

| Series 47 Notes due 2050 | $200 million | October 9, 2020 | ||||||

| Series 48 Notes due 2023 | $600 million | October 9, 2020 | ||||||

| Series 49 Notes due 2031 | $400 million | October 9, 2020 | ||||||

| Series 50 Notes due 2031 | $450 million | September 17, 2021 | ||||||

| Series 51 Notes due 2051 | $450 million | September 17, 2021 | ||||||

On February 28, 2020, Hydro One Inc. issued $400 million aggregate principal amount of Series 45 Notes due 2025, $400 million aggregate principal amount of Series 46 Notes due 2030 and $300 million aggregate principal amount of Series 47 Notes due 2050 pursuant to the 2018 MTN Shelf Prospectus.

Acquisition of Orillia Power – 2020

In August 2016, Hydro One Inc. reached an agreement to acquire Orillia Power, an electricity distribution company located in Simcoe County, Ontario, from the Corporation of the City of Orillia, subject to the satisfaction of customary closing conditions as well as approval by the OEB. In April 2020, the OEB issued its decision approving Hydro One Inc.’s acquisition of Orillia Power from the City of Orillia. In September 2020, Hydro One Inc. completed the acquisition for a purchase price of approximately $28 million inclusive of closing adjustments. See “Business of Hydro One – Distribution Business Segment – Acquisitions – Acquisition of Orillia Power” for more information.

Acquisition of the Business and Distribution Assets of Peterborough Distribution Inc. – 2020

In July 2018, Hydro One Inc. reached an agreement to acquire the business and distribution assets of PDI, an electricity distribution company located in the County of Peterborough, from the Corporation of the City of Peterborough, subject to the satisfaction of customary closing conditions as well as approval by the OEB. In April 2020, the OEB issued its decision approving Hydro One Inc.’s acquisition of the business and distribution assets of PDI from the City of Peterborough. In August 2020, Hydro One Inc. completed the acquisition for a purchase price of approximately $104 million, including the assumption of agreed upon liabilities and final closing adjustments. See “Business of Hydro One – Distribution Business Segment – Acquisitions – Acquisition of the Business and Distribution Assets of Peterborough Distribution Inc.” for more information.

Integration of Orillia Power – 2021

In June 2021, Hydro One completed the integration of Orillia Power, which was acquired in September 2020. See “Business of Hydro One – Distribution Business Segment – Acquisitions – Acquisition of Orillia Power” for more information.

27

Integration of the Business and Distribution Assets of Peterborough Distribution Inc. – 2021

In June 2021, Hydro One completed the integration of the business and distribution assets of Peterborough Distribution, including the integration of employees, customer and billing information, business processes and operations. The business and distribution assets of Peterborough Distribution were acquired in August 2020. See “Business of Hydro One – Distribution Business Segment – Acquisitions – Acquisition of the Business and Distribution Assets of Peterborough Distribution Inc.” for more information.

General Development of the Business

In addition to the chronological development of the business, the following general developments in the business have occurred and continue to be relevant.

Customer Focus

Hydro One’s continued focus on customer service remains a critical aspect of its success as a company. Greater corporate accountability for performance outcomes, and company-wide improvements in productivity and efficiency, align with customers’ expectations of how Hydro One should operate. Hydro One intends to continue to offer affordable and reliable electricity, advocate for its customers and empower them to make informed decisions about their energy usage and respond to emerging customer needs.

Customer Service

Hydro One is committed to delivering value to its customers by becoming easier to do business with, being available when customers need assistance and always staying connected. This includes specific, measurable commitments that encompass all areas of service. Residential and small business customer satisfaction scores in 2021 were the highest in ten years at 89%, transmission customer satisfaction saw an increase from 2020 results from 83% to 92%, and commercial and industrial satisfaction has seen a decrease from 86% in 2020 to 80%. Overall, these results reflect our company-wide dedication to customer service.

Hydro One is on a multi-year journey to transform the customer experience by creating digital channels that introduce or enhance new services in order to meet customers’ expectations while reducing operational costs and increasing customer satisfaction. In 2021, Hydro One began to offer customers the option to report power outages by text.

As part of the Company’s continued commitment to customers, Hydro One again extended a number of the customer relief measures implemented at the onset of the COVID-19 pandemic. See “General Development of the Business – Chronological Development of the Business – COVID-19 Pandemic and Related Developments”.

Review of Operations

28

Hydro One is committed to providing value to its customers and shareholders by identifying and acting on opportunities to become the safest and most efficient utility. Hydro One has been focused on the identification of opportunities for improved corporate performance and the development of strategies to drive safer, more efficient and cost-effective operations. Hydro One conducts regular reviews of key corporate activities and programs, covering areas such as construction services and project management practices, asset deployment and controls, asset planning, information technology and cybersecurity, vegetation management practices, fleet services and utilization, supply chain management and business continuity planning. The Company has and continues to observe and implement operational and cost improvements across work planning and execution.

Sustainability Report

In August 2021, Hydro One Limited published its 2020 Sustainability Report, highlighting its progress in 2020 and its plans for future years. The 2020 Sustainability Report provides an account of our ESG performance. The Sustainability Report provides stakeholders, partners, our customers, and communities with a better understanding of how Hydro One manages the opportunities and challenges associated with our business. Hydro One is committed to releasing an annual sustainability report and to continuously increasing the transparency of our ESG disclosures. Our annual sustainability reporting is aligned with the Sustainability Accounting Standards Board and the Global Reporting Initiative Standards, and prepared broadly following the recommendations of the Task Force on Climate-related Financial Disclosures.

BUSINESS OF HYDRO ONE

Segments

Hydro One is Ontario’s largest electricity transmission and distribution utility with approximately $30 billion in assets and 2021 revenues of approximately $7.2 billion. Hydro One owns and operates substantially all of Ontario’s electricity transmission network and is the largest electricity distributor in Ontario by number of customers. Hydro One delivers electricity safely and reliably to approximately 1.5 million customers across the province of Ontario, and to large industrial customers and municipal utilities. Through its subsidiaries, Hydro One Inc. owns and operates approximately 30,000 circuit kilometres of high-voltage transmission lines and approximately 125,000 circuit kilometres of primary low-voltage distribution lines.

Hydro One has three segments: (i) transmission business; (ii) distribution business; and (iii) other. Each of the three segments is described below.

Hydro One’s transmission and distribution businesses are both operated primarily by Hydro One Networks. This allows both businesses to utilize common operating platforms, technology, work processes, equipment and field staff and thereby take advantage of operating efficiencies and synergies. For regulatory purposes, Hydro One Networks has historically filed separate rate applications with the OEB for each of its licensed transmission and distribution businesses. In 2021, a single application was filed for the Hydro One Networks transmission and distribution businesses for the period 2023 to 2027.

29

Transmission Business Segment

Overview

Hydro One’s transmission business consists of owning, operating and maintaining Hydro One’s transmission system, which accounts for approximately 98% of Ontario’s transmission capacity based on revenue approved by the OEB. All of the Company’s transmission business is carried out through its wholly-owned subsidiaries, Hydro One Networks and HOSSM (formerly Great Lakes Power), as well as through the Company’s approximately 66% interest in B2M Limited Partnership and approximately 55% interest in NRLP.

Hydro One’s transmission business represented approximately 60% of its total assets as at December 31, 2021, and accounted for approximately 51% of its total revenue, net of purchased power1 in 2021 and approximately 25% of its total revenue in 2021, and approximately 51% of its total revenue, net of purchased power in 2020 and approximately 24% of its total revenue in 2020.

The Company’s transmission business is a rate-regulated business that earns revenues mainly from transmission rates that are subject to approval by the OEB. Transmission rates are generally determined using a performance-based model, which typically includes a cost-of-service base year. Transmission rates are administered and collected by the IESO and are remitted by the IESO to Hydro One on a monthly basis, which means that Hydro One’s transmission business has no direct exposure to end-customer counterparty risk.

Transmission rates are based on monthly peak electricity demand across Ontario’s transmission network. This gives rise to seasonal variations in Hydro One’s transmission revenues, which are generally higher in the summer and winter due to increased demand, and lower during other periods of reduced demand. Hydro One’s transmission revenues also include revenues associated with exporting energy to markets outside of Ontario. Ancillary revenue includes revenues from providing maintenance services to generators and from third-party land use.

Business

The Company’s transmission system serves substantially all of Ontario and transported approximately 134 TWh of energy throughout the province in 2021. Hydro One’s transmission customers consist of 37 local distribution companies (including Hydro One’s own distribution business) and 85 large industrial customers connected directly to the transmission network, including automotive, manufacturing, chemical and natural resources businesses. Electricity delivered over the Company’s transmission network is

1 Revenues, net of purchased power is a non-GAAP financial measure. Non-GAAP financial measures do not have a standardized meaning under U.S. GAAP, which is used to prepare the Company’s financial statements, and accordingly, these measures may not be comparable to similar measures used by other companies. Additional disclosure for this non-GAAP financial measure is incorporated by reference herein and can be found in the section titled “Non-GAAP Measures” of the Annual MD&A available on SEDAR under Hydro One Limited’s profile at www.sedar.com.

30

supplied by 135 generators in Ontario and electricity imported into the province through interties. Interties are transmission interconnections between neighbouring electric systems that allow power to be imported and exported.

The high voltage power lines in Hydro One’s transmission network are categorized as either lines which form part of the “bulk electricity system” or “area supply lines”. Power lines which form part of the bulk electricity system typically connect major generation facilities with transmission stations and often cover long distances, while area supply lines serve a local region. Ontario’s transmission system is connected to the transmission systems of Manitoba, Michigan, Minnesota, New York and Quebec through the use of interties, allowing for the import and export of electricity to and from Ontario.

Hydro One’s transmission assets were approximately $18 billion as at December 31, 2021 and include transmission stations, transmission lines, a control centre and telecommunications facilities. Hydro One has approximately 306 in-service transmission stations and approximately 30,000 circuit kilometres of high voltage lines whose major components include cables, conductors and wood or steel support structures. All of these lines are overhead power lines except for approximately 270 circuit kilometres of underground cables located in primarily urban areas.

Hydro One’s transmission network is managed from a central location. This centre monitors and controls the Company’s entire transmission network and has the capability to remotely monitor and operate transmission equipment, respond to alarms and contingencies and restore and reroute interrupted power. There is also a backup facility which would be staffed in the event of an evacuation of the centre. In September 2019, Hydro One Inc. announced plans to build a new Ontario grid control centre, which is expected to become operational as Hydro One’s primary control centre in 2022.

Hydro One uses telecommunications systems for the protection and operation of its transmission and distribution networks. These systems are subject to very stringent reliability and security requirements, which help the Company meet its reliability obligations and facilitate the restoration of power following service interruptions.

B2M Limited Partnership is Hydro One’s partnership with the Saugeen Ojibway Nation with respect to the Bruce-to-Milton transmission line. B2M Limited Partnership owns the transmission line assets relating to two circuits between Bruce TS and Milton Switching Station. Hydro One Networks owns the stations where the lines terminate. Hydro One maintains and operates the Bruce-to-Milton line and has an approximately 66% economic interest in the partnership.