QuickLinks -- Click here to rapidly navigate through this document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy

Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant ý | ||

Filed by a Party other than the Registrant o |

||

Check the appropriate box: |

||

o |

Preliminary Proxy Statement |

|

o |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

ý |

Definitive Proxy Statement |

|

o |

Definitive Additional Materials |

|

o |

Soliciting Material under §240.14a-12 |

|

| CARDIONET, INC. | ||||

|

(Name of Registrant as Specified In Its Charter) |

||||

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

||||

Payment of Filing Fee (Check the appropriate box): |

||||

ý |

No fee required. |

|||

o |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|||

| (1) | Title of each class of securities to which transaction applies: |

|||

| (2) | Aggregate number of securities to which transaction applies: |

|||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|||

| (4) | Proposed maximum aggregate value of transaction: |

|||

| (5) | Total fee paid: |

|||

o |

Fee paid previously with preliminary materials. |

|||

o |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|||

(1) |

Amount Previously Paid: |

|||

| (2) | Form, Schedule or Registration Statement No.: |

|||

| (3) | Filing Party: |

|||

| (4) | Date Filed: |

|||

CARDIONET, INC.

227 Washington Street #210

Conshohocken, Pennsylvania 19428

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 4, 2012

Dear Stockholder:

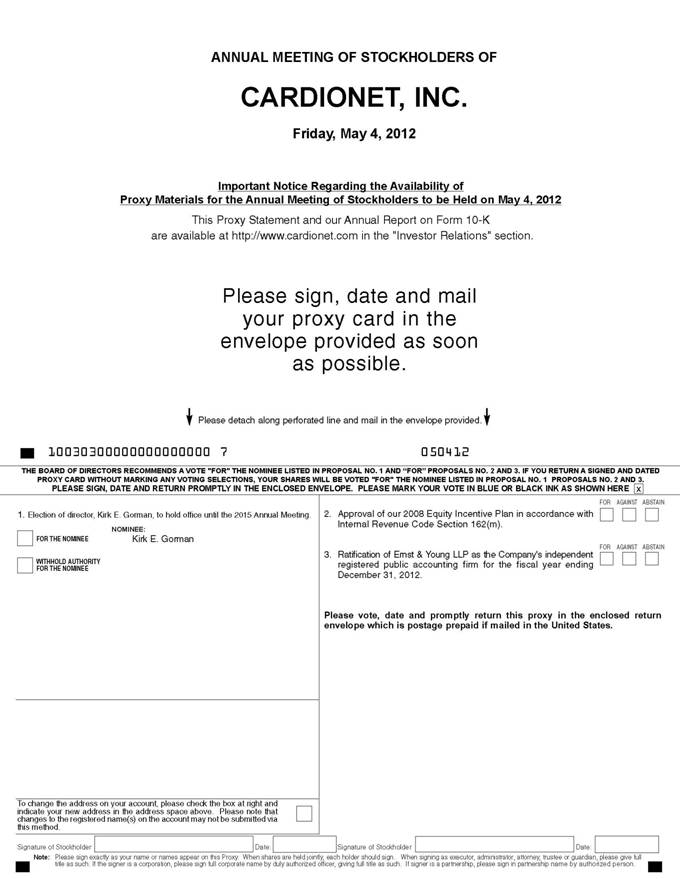

You are cordially invited to attend the Annual Meeting of Stockholders of CARDIONET, INC., a Delaware corporation (the "Company"). The meeting will be held on Friday, May 4, 2012 at 8:30 a.m. local time at the Philadelphia Marriott West located at 111 Crawford Avenue, West Conshohocken, Pennsylvania, 19428 for the following purposes:

1. To elect Kirk E. Gorman, who has been recommended by the Board of Directors as a Class II director, to hold office until the 2015 Annual Meeting of Stockholders.

2. To approve the CardioNet, Inc. 2008 Equity Incentive Plan in accordance with Internal Revenue Code Section 162(m).

3. To ratify the selection by the Audit Committee of the Company's Board of Directors of Ernst & Young LLP as the Company's independent registered public accounting firm for its fiscal year ending December 31, 2012.

4. To conduct any other business properly brought before the meeting.

These items of business are more fully described in the Proxy Statement accompanying this Notice.

The record date for the Annual Meeting is March 12, 2012. Only stockholders of record at the close of business on that date may vote at the meeting or any adjournment thereof.

| By Order of the Board of Directors | ||

Peter Ferola Secretary |

Date:

March 28, 2012

Conshohocken, Pennsylvania

You are cordially invited to attend the meeting in person. Whether or not you expect to attend the meeting, please complete, date, sign and return the enclosed proxy as promptly as possible in order to ensure your representation at the meeting. A return envelope (which is postage prepaid if mailed in the United States) is enclosed for your convenience. Even if you have voted by proxy and are a record holder of your shares, you may still vote in person if you attend the meeting. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the meeting, you must obtain a proxy issued in your name from that record holder.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING TO BE HELD ON MAY 4, 2012: The proxy statement and 2011 annual report on form 10-K are available at http://www.cardionet.com in the "Investor Relations" section.

CARDIONET, INC.

227 Washington Street #210

Conshohocken, Pennsylvania 19428

PROXY STATEMENT

FOR THE 2011 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 4, 2012

QUESTIONS AND ANSWERS ABOUT THIS PROXY MATERIAL AND VOTING

Why am I receiving these materials?

We have sent you this proxy statement and the enclosed proxy card because the Board of Directors of CARDIONET, INC. (sometimes referred to as the "Company" or "CardioNet") is soliciting your proxy to vote at the 2012 Annual Meeting of Stockholders, including at any adjournments or postponements of the meeting. You are invited to attend the annual meeting to vote on the proposals described in this proxy statement. However, you do not need to attend the meeting to vote your shares. Instead, you may simply complete, sign and return the enclosed proxy card.

The Company intends to mail this proxy statement and accompanying proxy card on or about March 28, 2012 to all stockholders of record entitled to vote at the annual meeting.

Who can vote at the annual meeting?

Only stockholders of record at the close of business on March 12, 2012, will be entitled to vote at the annual meeting. On this record date, there were 24,339,485 shares of common stock of the Company ("Common Stock") outstanding and entitled to vote.

Stockholder of Record: Shares Registered in Your Name

If on March 12, 2012, your shares were registered directly in your name with the Company's transfer agent, American Stock Transfer & Trust Company, then you are a stockholder of record. As a stockholder of record, you may vote in person at the meeting or vote by proxy. Whether or not you plan to attend the meeting, we urge you to fill out and return the enclosed proxy card to ensure your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank

If on March 12, 2012, your shares were held, not in your name, but rather in an account at a brokerage firm, bank, dealer, or other similar organization, then you are the beneficial owner of shares held in "street name" and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the annual meeting. As a beneficial owner, you have the right to direct your broker or other agent regarding how to vote the shares in your account. You are also invited to attend the annual meeting. However, since you are not the stockholder of record, you may not vote your shares in person at the meeting unless you request and obtain a valid proxy from your broker or other agent.

What am I voting on?

The following matters will be voted on at the Annual Meeting:

- •

- To elect Kirk E. Gorman, who has been recommended by the Board of Directors as a Class II director, to hold office

until the 2015 Annual Meeting of Stockholders;

- •

- To approve the CardioNet, Inc. 2008 Equity Incentive Plan in accordance with Internal Revenue Code Section 162(m);

1

- •

- To ratify of the selection by the Audit Committee of our Board of Directors of Ernst & Young LLP as the

Company's independent registered public accounting firm for its fiscal year ending December 31, 2012; and

- •

- Such other business as may properly come before the Annual Meeting or any adjournment or postponement of the Annual Meeting.

How do I vote?

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote in person at the annual meeting or vote by proxy using the enclosed proxy card. Whether or not you plan to attend the meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the meeting and vote in person even if you have already voted by proxy.

- •

- To vote in person, come to the annual meeting and we will give you a ballot when you arrive.

- •

- To vote using the proxy card, simply complete, sign and date the enclosed proxy card and return it promptly in the envelope provided. If you return your signed proxy card to us before the annual meeting, we will vote your shares as you direct.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If you are a beneficial owner of shares registered in the name of your broker, bank, or other agent, you should have received a proxy card and voting instructions with these proxy materials from that organization rather than from CardioNet. Simply complete and mail the proxy card to ensure that your vote is submitted to your broker or bank. Alternatively, you may vote as instructed by your broker or bank. To vote in person at the annual meeting, you must obtain a valid proxy from your broker, bank, or other agent. Follow the instructions from your broker or bank included with these proxy materials, or contact your broker or bank to request a proxy form.

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of Common Stock you own as of March 12, 2012.

What if I return a proxy card but do not make specific choices?

If you return a signed and dated proxy card without marking any voting selections, your shares will be voted "For" the election of the nominee listed in Proposal No. 1 for director (Proposal No. 1), "For" the approval of our 2008 Equity Incentive Plan in accordance with Internal Revenue Code Section 162(m) (Proposal No. 2); and "For" the ratification of the selection of Ernst & Young LLP, as the Company's independent public accounting firm for the fiscal year ending December 31, 2012 (Proposal No. 3). If any other matter is properly presented at the meeting, your proxyholder (one of the individuals named on your proxy card) will vote your shares using his or her best judgment.

Who is paying for this proxy solicitation?

The Company will pay for the entire cost of soliciting proxies. In addition to these mailed proxy materials, our directors and employees may also solicit proxies in person, by telephone, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

2

What does it mean if I receive more than one proxy card?

If you receive more than one proxy card, your shares are registered in more than one name or are registered in different accounts. Please complete, sign and return each proxy card to ensure that all of your shares are voted.

Are proxy materials available on the internet?

This proxy statement and our 2011 annual report to stockholders are available at http://www.cardionet.com in the "Investor Relations" section.

Can I change my vote after submitting my proxy?

Yes. You can revoke your proxy at any time before the final vote at the meeting. If you are the record holder of your shares, you may revoke your proxy in any one of three ways:

- •

- You may submit another properly completed proxy card with a later date.

- •

- You may send a timely written notice that you are revoking your proxy to CardioNet's Secretary at 227 Washington Street

#210, Conshohocken, Pennsylvania 19428.

- •

- You may attend the annual meeting and vote in person. Simply attending the meeting will not, by itself, revoke your proxy.

If your shares are held by your broker or bank as a nominee or agent, you should follow the instructions provided by your broker or bank.

When are stockholder proposals due for next year's annual meeting?

Stockholders who wish to include proposals in the proxy statement for the 2013 Annual Meeting must submit such proposals in accordance with regulations adopted by the Securities and Exchange Commission. To be considered for inclusion in the proxy statement for the 2013 Annual Meeting, such stockholder proposals must be submitted in writing by November 25, 2012. In addition, stockholders may wish to have a proposal presented at the 2013 Annual Meeting but not to have such proposal included in the proxy statement for the 2013 Annual Meeting. Pursuant to our bylaws, notice of any such proposal must be received by us between January 4, 2013 and February 3, 2013. If it is not received during this period, such proposal shall be deemed "untimely" for purposes of Rule 14a-4(c) under the Securities Exchange Act of 1934, as amended (the "1934 Act"), and, therefore, the proxies will have the right to exercise discretionary voting authority with respect to such proposal. Any stockholder proposals must be submitted to CardioNet's Secretary at 227 Washington Street #210, Conshohocken, Pennsylvania 19428. You should submit any proposal by a method that permits you to prove the date of delivery to us.

Your notice to the Secretary shall set forth: (A) your name and address, and the class and number of shares of the Company's Common Stock, which you beneficially own; (B) whether you intend to deliver a proxy statement and form of proxy to the holders of at least the number of shares of the Company necessary to carry the proposal, or in the case of a nomination for director, a sufficient number of shares of the Company necessary to elect such nominee; (C) as to each person whom you propose to nominate for election or reelection as a director all information relating to such person that is required to be disclosed in solicitations of proxies for election of directors in an election contest, or is otherwise required, in each case pursuant to Regulation 14A under the 1934 Act and Rule 14a-4(d) thereunder (including such person's written consent to being named in the proxy statement as a nominee and to serving as a director if elected); and (D) as to any other business that you propose to bring before the meeting, a brief description of the business desired to be brought before the meeting,

3

the reasons for conducting such business at the meeting and any material interest you have in such business.

For more information, please refer to the Company's Bylaws filed as Exhibit 3.2 to the Company's Registration Statement on Form S-1 (File No. 33-145547) originally filed with the United States Securities and Exchange Commission on August 17, 2007.

How are votes counted?

Votes will be counted by the inspector of election appointed for the meeting, who will separately count "For" and "Withhold" and, with respect to proposals other than the election of directors, "Against" votes, abstentions and broker non-votes. Abstentions will be counted towards the vote total for each proposal, and will have the same effect as "Against" votes. Broker non-votes have no effect and will not be counted towards the vote total for any proposal.

What are "broker non-votes"?

Broker non-votes occur when a beneficial owner of shares held in "street name" does not give instructions to the broker or nominee holding the shares as to how to vote on matters deemed "non-routine." Generally, if shares are held in street name, the beneficial owner of the shares is entitled to give voting instructions to the broker or nominee holding the shares. If the beneficial owner does not provide voting instructions, the broker or nominee can still vote the shares with respect to matters that are considered to be "routine," but not with respect to "non-routine" matters. Under the rules and interpretations of the New York Stock Exchange, "non-routine" matters include the election of directors and generally those matters involving a contest or a matter that may substantially affect the rights or privileges of shareholders, such as mergers or stockholder proposals.

How many votes are needed to approve each proposal?

- •

- Proposal No. 1, the election of one Class II nominee who is elected by a plurality, the nominee receiving

the most "For" votes (from the holders of votes of shares present in person or represented by proxy and entitled to vote on the election of directors) will be elected. Only votes "For" or "Withheld"

will affect the outcome. Brokers may no longer vote your shares on the election of directors in the absence of your specific instructions as to how to vote. We encourage you to provide instructions to

your broker regarding the voting of your shares.

- •

- Proposal No. 2, the approval of the CardioNet, Inc. 2008 Equity Incentive Plan in accordance with Internal

Revenue Service Code Section 162(m) must receive a "For" vote from the majority of shares present and entitled to vote either in person or by proxy. If you "Abstain" from voting, it will have

the same effect as an "Against" vote. Broker non-votes will have no effect.

- •

- Proposal No. 3, ratification of the selection of Ernst & Young LLP, Independent Registered Public Accounting Firm, as the Company's independent public accounting firm for the fiscal year ending December 31, 2012, must receive a "For" vote from the majority of shares present and entitled to vote either in person or by proxy. If you "Abstain" from voting, it will have the same effect as an "Against" vote. Broker non-votes will have no effect.

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if stockholders holding at least a majority of the outstanding shares are present at the meeting in person or represented by proxy. On the record date, there were 24,339,485 shares outstanding and entitled to vote. Thus, the holders of 12,169,743 shares must be present in person or represented by proxy at the meeting or by proxy to have a quorum.

4

Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote in person at the meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, the holders of a majority of shares present at the meeting in person or represented by proxy or the chairman of the meeting may adjourn the meeting to another date.

How can I find out the results of the voting at the annual meeting?

Preliminary voting results will be announced at the annual meeting. Final voting results will be reported by the Company on Form 8-K within four business days after the annual meeting.

PROPOSAL ONE:

ELECTION OF DIRECTORS

Our Board of Directors currently consists of six members and is divided into three classes, each of which has a three year term. Class I consists of two directors, Class II consists of one director and Class III consists of three directors. Vacancies on the Board of Directors may be filled only by persons elected by a majority of the remaining directors. A director elected by the Board of Directors to fill a vacancy in a class, including vacancies created by an increase in the number of directors, shall serve for the remainder of the full term of that class and until the director's successor is elected and qualified.

The Board of Directors currently has six members and there is currently one director serving as Class II director. The term of office of the Class II directors expires in 2012. We are nominating Kirk E. Gorman. Mr. Gorman was appointed by the Board of Directors in August 2008. If elected at the annual meeting, this nominee would serve until the 2015 annual meeting and until his successor is elected and has qualified, or, if sooner, until the director's death, resignation or removal. It is the Company's policy to invite directors and nominees for director to attend the annual meeting.

There is one vacancy in Class I and two vacancies in Class II directors. We are seeking to identify individuals to fill these vacancies. All of our directors attended our 2011 Annual Meeting of Stockholders.

Directors are elected by a plurality of the votes of the holders of shares present in person or represented by proxy and entitled to vote on the election of directors. The two nominees receiving the most "For" votes (among votes properly cast in person or by proxy) will be elected. If no contrary indication is made, shares represented by executed proxies will be voted "For" the election of the two nominees named above or, if either nominee becomes unavailable for election as a result of an unexpected occurrence, "For" the election of a substitute nominee designated by our Board of Directors. Each nominee has agreed to serve as a director if elected, and we have no reason to believe that any nominee will be unable to serve.

5

The Board of Directors Recommends

A Vote In Favor of Our Named Nominee.

The following is a brief biography for our nominee for Class II director and each person whose term of office as a Class III or Class I director will continue after the annual meeting.

Name

|

Age | Position | |||

|---|---|---|---|---|---|

Directors: |

|||||

Class II Directors: |

|||||

Kirk E. Gorman(1) |

61 | Director and Chairman | |||

Class III Directors: |

|||||

Eric N. Prystowsky, M.D.(2)(3) |

64 | Director | |||

Rebecca W. Rimel(2) |

60 | Director | |||

Robert J. Rubin, M.D. (1)(3) |

66 | Director | |||

Class I Directors: |

|||||

Ronald A. Ahrens(1)(2)(3) |

72 | Director | |||

Joseph H. Capper |

48 | Director, President and Chief Executive Officer | |||

- (1)

- Member

of the Audit Committee.

- (2)

- Member

of the Compensation Committee.

- (3)

- Member of the Nominating and Corporate Governance Committee.

NOMINEES FOR ELECTION FOR A THREE-YEAR TERM EXPIRING AT THE 2015 ANNUAL MEETING

Kirk E. Gorman. Mr. Gorman has been a member of our Board of Directors since August 2008 and our Chairman since October 2011. Mr. Gorman has served as the Executive Vice President, Chief Financial Officer of Jefferson Health System, a hospital system in Philadelphia, Pennsylvania since September 2003. Mr. Gorman has also been a member of the Board of Directors and Audit Committee of IASIS Healthcare LLC since February 2004. From April 1987 to March 2003, Mr. Gorman served as the Senior Vice President, Chief Financial Officer of Universal Health Services, Inc, a hospital management company and President, Chief Financial Officer and a member of the Board of Trustees of Universal Health Realty Income Trust, a real estate investment trust specializing in healthcare and human service related facilities. From June 2007 to October 2009, he also served on the board of Care Investment Trust, a real estate investment trust. From November 2001 to December 2003 and February 2005 until its acquisition by Cardinal Health, Inc. in July 2007, Mr. Gorman served as a member of the Board of Directors of VIASYS Healthcare, Inc. a healthcare technology company. Mr. Gorman received an undergraduate degree from Dartmouth College and an M.B.A. from the Amos Tuck School of Business. Mr. Gorman brings extensive financial knowledge and experience as the Chief Financial Officer of numerous healthcare related companies, including Jefferson Health System, the largest hospital system in Philadelphia. His specific and ongoing healthcare related financial experience with reimbursement, tax, accounting, and financial and strategic planning is especially valuable to the Company. Mr. Gorman also brings significant public company board of director and audit committee experience.

THE BOARD OF DIRECTORS RECOMMENDS

A VOTE IN FAVOR OF THE NOMINEE NAMED ABOVE.

6

DIRECTORS CONTINUING IN OFFICE UNTIL THE 2013 ANNUAL MEETING

Eric N. Prystowsky, M.D. Dr. Prystowsky has been a member of our Board of Directors since March 2001. Since 1988, Dr. Prystowsky has served as the Director, Clinical Electrophysiology Laboratory at St. Vincent Hospital, Indianapolis Indiana. Since 1988, Dr. Prystowsky has served as Consulting Professor of Medicine at Duke University. Since 2004, he has served as the associate editor of Hurst Textbook of Cardiology and, since January 2004, he has served as editor-in-chief of the Journal of Cardiovascular Electrophysiology. From 1992 to 1994, he served as the Chairman of the American Heart Association's Committee on Electrocardiography and Electrophysiology and, from May 2001 to May 2002, as President of the Heart Rhythm Society. Dr. Prystowsky also served as the Chairman of the ABIM test writing committee for the Electrophysiology Boards until July 2008. Dr. Prystowsky currently serves on the Board of Directors of Stereotaxis, Inc., a biotechnology company. Dr. Prystowsky received an undergraduate degree from the Pennsylvania State University and an M.D. from the Mount Sinai School of Medicine. Dr. Prystowsky brings relevant real-time clinical and academic experience as a published and renowned electrophysiologist with St. Vincent Hospital and Consulting Professor at Duke University. Dr. Prystowsky's knowledge of and experience with cardiac medicine is vast and includes leading positions within the American Heart Association as well as the Heart Rhythm Society. Dr. Prystowsky also brings to the Board of Directors specific experience in serving as a board member of another company.

Rebecca W. Rimel. Ms. Rimel has been a member of our Board of Directors since May 2009. She joined The Pew Charitable Trusts in 1983 as Health Program Manager and has led the organization for 20 years as Executive Director from 1988 through 1994 and in her current position as President and CEO since 1994. From 1981 through 1983, Ms. Rimel served as Assistant Professor in the Department of Neurosurgery at the University of Virginia Hospital. Along with additional teaching and practitioner positions at the University of Virginia Hospital, she also held the title of Head Nurse of the medical center's emergency department. Ms. Rimel serves as a member of the Board of The Pew Charitable Trusts, and on the Boards of DWS Mutual Funds and Washington College. Ms. Rimel brings to the Company a superior reputation for leadership and experience in the clinical, academic and business sectors of the healthcare industry. She has had, and continues to build, an exemplary career in public policy, non-profit administration, advocacy and innovation related to the healthcare field. Ms. Rimel received her Bachelor of Science from the University of Virginia School of Nursing, and earned a Master of Business Administration from James Madison University. Ms. Rimel's education and professional experience serves as a basis for her contributions, past and present, as a member of the board of directors for various public and private companies.

Robert J. Rubin, M.D. Dr. Rubin has been a member of our Board of Directors since July 2007. He has been a clinical professor of medicine at Georgetown University since 1995. From 1987 to 2001, he was president of the Lewin Group (purchased by Quintiles Transnational Corp. in 1996), a national health policy and management consulting firm. From 1994 to 1996, Dr. Rubin served as Medical Director of ValueRx, a pharmaceutical benefits company. From 1992 to 1996, he served as President of Lewin-VHI, a health care consulting company. From 1987 to 1992, he served as President of Lewin-ICF, a health care consulting company. From 1984 to 1987, Dr. Rubin served as a principal for ICF, Inc., a health care consulting company. From 1981 to 1984, he served as the Assistant Secretary for Planning and Evaluation at the Department of Health and Human Services and as an Assistant Surgeon General in the United States Public Health Service. Dr. Rubin serves as a member of the Board of Directors of Soligenix, Inc. He is a board certified nephrologist and internist. He received an undergraduate degree in Political Science from Williams College and an M.D. from Cornell University. Dr. Rubin brings over 30 years of specific experience as a professor, policy maker, clinician and business professional dedicated to the medical profession. His specific experience with the United States Department of Health and Human Services and Assistant Surgeon General is a unique and invaluable qualification lending insight into governmental practice, policy making and regulation.

7

Dr. Rubin's extensive and diverse background in education, government and business allows him to serve as a resource on a broad spectrum of matters.

DIRECTORS CONTINUING IN OFFICE UNTIL THE 2014 ANNUAL MEETING

Ronald A. Ahrens. Mr. Ahrens has been a member of our Board of Directors since August 2008 and Chairman of our Compensation Committee since December, 2009. From 2004 to the present, Mr. Ahrens has served as the Vice Chairman of the Board of Directors and as a member of the Compensation Committee of Temptime Corporation, a healthcare technology company. Previously he served as a member of the Board of Directors and Chairman of the Compensation Committee of VIASYS Healthcare Inc., a global medical technology company, from November 2001 until its acquisition in July 2007 for $1.5 billion by Cardinal Health. Mr. Ahrens' past experience includes serving as Chairman of the Board of Directors of Closure Medical Corporation, a medical devices corporation, from 1999 through June 2004, St. Ives Laboratories, Inc., a hair and skin care company from 1995 to 1997 and from 1990 to 1993 as a member of the Board of Directors of Alcide Corporation, an animal healthcare technology company. Earlier in his career, Mr. Ahrens held various positions with Merck & Co, Inc. a global pharmaceuticals products company, including President of Merck Consumer Healthcare Group Worldwide and Executive Vice President of Merck Consumer Healthcare Group International. Mr. Ahrens received an undergraduate degree in English from Concordia College and a Masters in Sacred Theology from Concordia Seminary. Mr. Ahrens is a veteran of the healthcare industry and brings to the Board over forty years of senior executive and management experience with both public and private pharmaceutical and device companies. He has also established a strong track record of serving and consulting for significant public and private company board of directors. Mr. Ahrens' breadth of knowledge and hands-on business experience provides him with the necessary skill to serve as the Chairman of the Compensation Committee for our Board of Directors and to easily relate to and liaison between other members and executives within the Company.

Joseph H. Capper. Mr. Capper has been our President and Chief Executive Officer and a member of our Board of Directors since June 2010. Mr. Capper has served as President, Chief Executive Officer and member of the Board of Directors of Home Diagnostics, Inc., a leading developer, manufacturer and marketer of diabetes management products. Mr. Capper joined Home Diagnostics in 2009. Home Diagnostics was listed on the NASDAQ stock market until its strategic merger. Prior to Home Diagnostics, from 2002 to 2009, Mr. Capper was President and Chief Executive Officer of CCS Medical Inc., a private company that is a leading provider of medical supplies in diabetes, wound care, respiratory and other therapeutic categories. Earlier in his career, Mr. Capper spent nine years with Bayer Corporation, ultimately becoming National Sales Director of the Diabetic Products Division. Mr. Capper also served in the U.S. Navy as a combat aviator and subsequently as a Congressional Liaison. Mr. Capper received an undergraduate degree in Accounting from West Chester University and an MBA in International Finance from George Washington University. Mr. Capper brings an extensive amount leadership and diverse experience in public and private companies.

INFORMATION REGARDING THE BOARD OF DIRECTORS AND

CORPORATE GOVERNANCE

8

INDEPENDENCE OF THE BOARD OF DIRECTORS

As required under the NASDAQ Stock Market ("NASDAQ") listing standards, a majority of the members of a listed company's Board of Directors must qualify as "independent," as affirmatively determined by the Board of Directors. The Board of Directors consults with the Company's counsel to ensure that the Board of Directors' determinations are consistent with relevant securities and other laws and regulations regarding the definition of "independent," including those set forth in pertinent listing standards of the NASDAQ, as in effect from time to time.

Consistent with these considerations, after review of all relevant transactions or relationships between each director, or any of his or her family members, and the Company, its senior management and its independent registered public accounting firm, the Board of Directors has affirmatively determined that the following directors are independent directors within the meaning of the applicable NASDAQ listing standards: Messrs. Ahrens, Gorman, Ms. Rimel and Drs. Prystowsky and Rubin. In making this determination, the Board of Directors found that none of these directors or nominees for director had a material or other disqualifying relationship with the Company. Mr. Capper, the Company's President and Chief Executive Officer is not an independent director by virtue of his employment with the Company.

BOARD LEADERSHIP STRUCTURE AND ROLE IN OVERSIGHT OF RISK

Our Board leadership structure is currently composed of an independent Chairman of the Board of Directors, an independent Audit Committee Chairman, an independent Nominating and Corporate Governance Committee Chairman, and an independent Compensation Committee Chairman. Kirk E. Gorman has served as a member of our Board of Directors since August of 2008 and the Chairman of our Board of Directors since October, 2011. In December 2009, the Board of Directors designated Ronald A. Ahrens as the lead independent director (the "Lead Director"). In October 2011, Mr. Thurman resigned from his position as the Chairman, and as a member of the Board of Directors. His resignation marked the end of a transition plan, which commenced in June 2010, and was designed to ensure a successful transition for the Company's Chief Executive Officer, Joseph H. Capper. Subsequent to Mr. Thurman's departure, the Company appointed Mr. Gorman to serve as Chairman of our Board of Directors. With the appointment of Mr. Gorman as an independent Chairman of the Board of Directors, the Company no longer required the role of Lead Director, and dissolved the position.

Our Board of Directors recognizes the importance of effective risk oversight in running a successful business, and in fulfilling its fiduciary responsibilities to CardioNet and its stockholders. While the Chief Executive Officer, the General Counsel and other members of our senior leadership team are responsible for the day-to-day management of risk, our Board of Directors is responsible for ensuring that an appropriate culture of risk management exists within the Company and for setting the right "tone at the top," overseeing our aggregate risk profile, and assisting management in addressing specific risks, such as strategic and competitive risks, financial risks, brand and reputation risks, legal risks, regulatory risks, and operational risks.

The Board believes that its current leadership structure best facilitates its oversight of risk by combining independent leadership, through the independent chairman, independent board committees, and majority independent board composition. The Chairman, independent committee chairs, and other directors also are experienced professionals or executives who can and do raise issues for board consideration and review, and are not hesitant to challenge management. The Board believes there is a well-functioning and effective balance between the independent Chairman and non-executive board members, which enhances risk oversight.

9

MEETINGS OF THE BOARD OF DIRECTORS

The Board of Directors met twenty six (26) times during the fiscal year ended December 31, 2011. All directors attended at least 75% of the aggregate of the meetings of the Board of Directors and of the committees on which they served, held during the period for which they were directors or committee members.

INFORMATION REGARDING COMMITTEES OF THE BOARD OF DIRECTORS

During the fiscal year ended December 31, 2011, the Board of Directors of CardioNet maintained three committees; the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee. The following table provides membership information for each of the committees of the Board of Directors as of March 12, 2012:

Name

|

Audit | Compensation | Nominating and Corporate Governance |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|

Ronald A. Ahrens |

X | X | * | X | ||||||

Robert J. Rubin, M.D. |

X | X | * | |||||||

Eric N. Prystowsky, M.D. |

X | X | ||||||||

Kirk E. Gorman |

X | * | ||||||||

Rebecca W. Rimel |

X | |||||||||

- *

- Committee Chairperson

Below is a description of each committee of the Board of Directors as such committees have been constituted during the fiscal year ended December 31, 2011 and are presently constituted. The Board of Directors has determined that each current member of each committee meets the applicable SEC and NASDAQ rules and regulations regarding "independence" and that each member is free of any relationship that would impair his or her individual exercise of independent judgment with regard to the Company.

Audit Committee

The Audit Committee of the Board of Directors was established by the Board of Directors in accordance with Section 3(a)(58)(A) of the 1934 Act to oversee the Company's corporate accounting and financial reporting processes and audits of its financial statements. The Board of Directors has adopted an Audit Committee Charter which is available on our website at http://investors.cardionet.com. The functions of this committee include, among other things:

- •

- evaluating the performance of our independent registered public accounting firm and determining whether to retain their

services for the ensuing year;

- •

- reviewing and pre-approving the engagement of our independent registered public accounting firm to perform

audit services;

- •

- reviewing and proposing to the full Board of Directors for approval any permissible non-audit services;

- •

- reviewing our annual financial statements and reports and discussing the statements and reports with our independent

registered public accounting firm and management;

- •

- reviewing with our independent registered public accounting firm and management significant issues that arise regarding accounting principles and financial statement presentation, and matters concerning the effectiveness of internal auditing and financial reporting controls; and

10

- •

- establishing procedures for the receipt, retention and treatment of complaints received by the Company regarding accounting, internal accounting controls or auditing matters.

Both our independent registered public accounting firm and management periodically meet privately with our Audit Committee.

Our Audit Committee currently consists of Messrs. Gorman, Ahrens and Dr. Rubin, each of whom is a non-employee director of our Board of Directors. Mr. Gorman is currently the Chairman of our Audit Committee. Mr. Ahrens joined the Committee in April to fill the vacancy created by the departure of Fred Middleton in April, 2011. The Audit Committee met five (5) times in 2011. The Board of Directors reviews the NASDAQ listing standards definition of independence for Audit Committee members on an annual basis and has determined that all current members of the Company's Audit Committee are independent (as independence is currently defined in Rule 4350(d)(2)(A)(i) and (ii) of the NASDAQ listing standards). The Board of Directors has determined that Kirk Gorman is a financial expert.

In light of Mr. Gorman's appointment as Chairman of the Board, the Nominating and Governance Committee of the Board of Directors is in the process of identifying candidates to replace Mr. Gorman in his role as Chairman of the Audit Committee. Mr. Gorman remains serving in both roles until the Board is able to identify and add such a candidate as a member of the Company's Board of Directors.

Report of the Audit Committee of the Board of Directors

During fiscal year 2011, the Audit Committee met five (5) times. In the exercise of the Audit Committee's duties and responsibilities, the Audit Committee has reviewed and discussed the audited financial statements for the fiscal year ended December 31, 2011 with the Company's management. The Audit Committee has discussed with the independent registered public accounting firm the matters required to be discussed by the Statement on Auditing Standards No. 61, as amended (AICPA, Professional Standards, Vol. 1. AU section 380), as adopted by the Public Company Accounting Oversight Board ("PCAOB") in Rule 3200T. The Audit Committee has also received the written disclosures and the letter from the independent registered public accounting firm required by the Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), as adopted by the PCAOB in Rule 3600T and has discussed with the independent registered public accounting firm the independent registered public accounting firm's independence. Based on its review and discussions and subject to the limitations on the role and responsibilities of the Audit Committee in its charter, the Audit Committee recommended to the Board that the audited financial statements for fiscal year 2011 be included in the Company's Annual Report to shareholders on Form 10-K filed with the Securities and Exchange Commission.

Kirk

E. Gorman, Chair

Ronald A. Ahrens

Robert J. Rubin, M.D.

This Report of the Audit Committee is not "soliciting material" and shall not be deemed incorporated by reference by any general statement incorporating by reference this Proxy Statement into any filing under the Securities Act of 1933 or under the Securities Exchange Act of 1934, as amended, except to the extent the Company specifically incorporates this report by reference, and shall not otherwise be deemed filed under such Acts.

Compensation Committee

The Compensation Committee currently consists of three directors, Mr. Ahrens, the Chairman of the Compensation Committee, Dr. Prystowsky and Ms. Rimel. All members of the Company's Compensation Committee are independent (as independence is currently defined in Rule 4200(a)(15)

11

of the NASDAQ listing standards and section 162(m) of the Internal Revenue Code of 1986, as amended. In fiscal year 2011, the Compensation Committee met four (4) times.

The Board of Directors has adopted a Compensation Committee Charter which was revised as of January 22, 2009 and is available on our website at http://investors.cardionet.com.

The Compensation Committee of the Board of Directors acts on behalf of the Board of Directors to review, recommend for adoption, and oversee the Company's compensation strategy, policies, plans and programs, including:

- •

- reviewing and recommending to the Board of Directors the compensation and other terms of employment of our Chief Executive

Officer;

- •

- reviewing and approving the compensation and other terms of employment of our executive officers (other than the Chief

Executive Officer);

- •

- reviewing and recommending to the Board of Directors performance goals and objectives relevant to the compensation of our

Chief Executive Officer and assessing his or her performance against these goals and objectives;

- •

- interpreting, administering, and granting, or with respect to the Chief Executive Officer recommending for approval by the

Board of Directors, awards under the equity incentive plans, compensation plans and similar programs advisable for us, as well as modification or termination of existing plans and programs;

- •

- reviewing and periodically accessing the adequacy of compensation to be paid or awarded to members of the Board of

Directors;

- •

- establishing policies with respect to equity compensation arrangements;

- •

- reviewing the competitiveness of our executive compensation programs and evaluating the effectiveness of our compensation

policy and strategy in achieving expected benefits to us;

- •

- reviewing and recommending to the Board of Directors the terms of any employment agreements, severance arrangements,

change in control protections and any other compensatory arrangements for our executive officers;

- •

- reviewing incentive compensation arrangements to ensure that such compensation arrangements do not encourage unnecessary

risk taking; and

- •

- reviewing with management our disclosures under the caption "Compensation Discussion and Analysis" and recommending to the full Board of Directors its inclusion in our periodic reports to be filed with the Securities and Exchange Commission.

Typically, the Compensation Committee meets quarterly and with greater frequency if necessary. The agenda for each meeting is usually developed by the Chair of the Compensation Committee. The Compensation Committee meets regularly in executive session. However, from time to time, various members of management and other employees as well as outside advisors or consultants may be invited by the Compensation Committee to make presentations, provide financial or other background information or advice or otherwise participate in Compensation Committee meetings. The Chief Executive Officer may not participate in or be present during any deliberations of the Compensation Committee regarding his compensation. The charter of the Compensation Committee grants the Compensation Committee full access to all books, records, facilities and personnel of the Company, as well as authority to obtain, at the expense of the Company, advice and assistance from internal and external legal, accounting or other advisors and consultants and other external resources that the Compensation Committee considers necessary or appropriate in the performance of its duties.

12

Our Compensation Committee retains the services of third party executive compensation specialists and consultants from time to time, as it sees fit, in connection with the establishment of cash and equity compensation and related policies.

The specific recommendations of the Compensation Committee with respect to executive compensation for the fiscal year ended December 31, 2011 are described in greater detail in the Compensation Discussion and Analysis section of this proxy statement.

Compensation Committee Interlocks and Insider Participation

As indicated above, Mr. Ahrens, Ms. Rimel and Dr. Prystowsky currently serve, and previously served during fiscal year 2011, as members of the Compensation Committee. No member of the Compensation Committee has ever been an executive officer or employee of the Company. None of our officers currently serves, or has served during the last completed year, on the Compensation Committee or the Board of Directors of any other entity that has one or more officers serving as a member of the Board of Directors or the Compensation Committee.

Nominating and Corporate Governance Committee

During fiscal year 2011, the Nominating and Corporate Governance Committee met one (1) time. The Board of Directors has adopted a Nominating and Corporate Governance Committee Charter which is available on our website at http://investors.cardionet.com. All members of the Nominating and Corporate Governance Committee are independent (as independence is currently defined in Rule 4200(a)(15) of the NASDAQ listing standards).

The functions of the Nominating and Corporate Governance Committee include, among other things:

- •

- identifying, reviewing and evaluating candidates to serve on our Board of Directors consistent with criteria approved by

our Board of Directors;

- •

- determining the minimum qualifications for service on our Board of Directors;

- •

- evaluating director performance on the Board of Directors and applicable committees of the Board of Directors and

determining whether continued service on our Board of Directors is appropriate;

- •

- reviewing, evaluating and recommending individuals for membership on our Board of Directors;

- •

- evaluating nominations by stockholders of candidates for election to our Board of Directors;

- •

- considering and assessing the independence of members of our Board of Directors;

- •

- developing, as appropriate, a set of corporate governance policies and principles, including a code of business conduct

and ethics and reviewing and recommending to our Board of Directors any changes to such policies and principles;

- •

- periodically reviewing with our CEO the succession plans for the office of CEO and for other key executive officers, and

making recommendations to our Board of Directors of appropriate individuals to succeed to these positions;

- •

- considering questions of possible conflicts of interest of directors as such questions arise;

- •

- reviewing the adequacy of our Nominating and Corporate Governance Committee charter on a periodic basis; and

- •

- reviewing and evaluating, at least annually, the performance of the Nominating and Corporate Governance Committee.

13

The Nominating and Corporate Governance Committee believes that candidates for director should have certain minimum qualifications, including the ability to read and understand basic financial statements, being over 21 years of age and having the highest personal integrity and ethics. The Nominating and Corporate Governance Committee also intends to consider such factors as possessing relevant expertise upon which to be able to offer advice and guidance to management, having sufficient time to devote to the affairs of the Company, demonstrated excellence in his or her field, having the ability to exercise sound business judgment and having the commitment to rigorously represent the long-term interests of the Company's stockholders. However, the Nominating and Corporate Governance Committee retains the right to modify these qualifications from time to time. Candidates for director nominees are reviewed in the context of the current composition of the Board of Directors, the operating requirements of the Company and the long-term interests of stockholders. In conducting this assessment, the Nominating and Corporate Governance Committee considers diversity, age, skills, and such other factors as it deems appropriate given the current needs of the Board of Directors and the Company, to maintain a balance of knowledge, experience and capability.

The Nominating and Corporate Governance Committee places a high priority on identifying individuals with diverse skill sets and types of experience including identification of individuals from among the medical professional and medical device communities. In the case of incumbent directors whose terms of office are set to expire, the Nominating and Corporate Governance Committee reviews these directors' overall service to the Company during their terms, including the number of meetings attended, level of participation, quality of performance, and any other relationships and transactions that might impair the directors' independence. In the case of new director candidates, the Nominating and Corporate Governance Committee also determines whether the nominee is independent for NASDAQ purposes, which determination is based upon applicable NASDAQ listing standards, applicable SEC rules and regulations and the advice of counsel, if necessary. The Nominating and Corporate Governance Committee then uses its network of contacts to compile a list of potential candidates, but may also engage, if it deems appropriate, a professional search firm. The Nominating and Corporate Governance Committee conducts any appropriate and necessary inquiries into the backgrounds and qualifications of possible candidates after considering the function and needs of the Board of Directors. The Nominating and Corporate Governance Committee meets to discuss and consider the candidates' qualifications and then selects a nominee by majority vote.

The Nominating and Corporate Governance Committee will consider director candidates recommended by stockholders. The Nominating and Corporate Governance Committee does not intend to alter the manner in which it evaluates candidates, including the minimum criteria set forth above, based on whether or not the candidate was recommended by a stockholder. Stockholders who wish to recommend individuals for consideration by the Nominating and Corporate Governance Committee to become nominees for election to the Board of Directors for the 2013 Annual Meeting of Stockholders may do so by delivering a written recommendation to the Nominating and Corporate Governance Committee on or before December 31, 2012 at the following address: 227 Washington Street #210, Conshohocken, Pennsylvania 19428, Attn: Secretary. Submissions must include the full name of the proposed nominee, a description of the proposed nominee's business experience for at least the previous five years, complete biographical information, a description of the proposed nominee's qualifications as a director and the name of the nominating stockholder, a representation that the nominating stockholder is a beneficial or record holder of the Company's stock and has been a holder for at least one year. Any such submission must be accompanied by the written consent of the proposed nominee to be named as a nominee and to serve as a director if elected.

14

STOCKHOLDER COMMUNICATIONS WITH THE BOARD OF DIRECTORS

The Company's Board of Directors has adopted a formal process by which stockholders may communicate with the Board of Directors or any of its directors. This information is available on the Company's website at http://investors.cardionet.com.

CODE OF ETHICS

The Company has adopted the CardioNet, Inc. Code of Business Conduct and Ethics that applies to all officers, directors and employees, which was amended and updated to reflect current business practice and industry regulation on January 22, 2009. We intend to maintain the highest standards of ethical business practices and compliance with all laws and regulations applicable to our business. The Code of Business Conduct and Ethics is available on our website at http://investors.cardionet.com. If the Company makes any substantive amendments to the Code of Business Conduct and Ethics or grants any waiver from a provision of the Code to any executive officer or director, the Company will promptly disclose the nature of the amendment or waiver on its website at http://investors.cardionet.com.

EXECUTIVE OFFICERS

The following table sets forth information regarding our executive officers as of March 12, 2012:

Name

|

Age | Position | |||

|---|---|---|---|---|---|

Executive Officers: |

|||||

Joseph H. Capper |

48 | Director, Chairman, President and Chief Executive Officer | |||

Heather C. Getz, CPA |

37 | Senior Vice President and Chief Financial Officer | |||

Peter Ferola |

43 | Senior Vice President, Corporate Development and General Counsel | |||

Anna McNamara, RN |

64 | Senior Vice President, Clinical Operations | |||

Jareer Kasrawi |

40 | Senior Vice President, Strategic Contracting | |||

Daniel Wisniewski |

48 | Senior Vice President, Business Operations | |||

George Hrenko |

49 | Senior Vice President, Human Resources and Organizational Excellence | |||

Charles Gropper |

54 | Senior Vice President, Research and Development | |||

Anthony Schuler |

40 | Senior Vice President, Sales | |||

Biographical Information for Executive Officers

Joseph H. Capper. Mr. Capper was appointed President and Chief Executive Officer and a member of the Board of Directors of CardioNet in June 2010. Prior to CardioNet, Mr. Capper served as President, Chief Executive Officer and member of the Board of Directors of Home Diagnostics, Inc., a leading developer, manufacturer and marketer of diabetes management products. Mr. Capper joined Home Diagnostics in 2009 and positioned the Company for a strategic merger in a transaction that created substantial value to its stockholders. Home Diagnostics was listed on the NASDAQ stock market until its strategic merger. Prior to Home Diagnostics, from 2002 to 2009, Mr. Capper was President and Chief Executive Officer of CCS Medical Inc., a private company that is a leading provider of medical supplies in diabetes, wound care, respiratory and other therapeutic categories. Earlier in his career, Mr. Capper spent nine years with Bayer Corporation, ultimately becoming National Sales Director of the Diabetic Products Division. Mr. Capper also has a distinguished service record having served in the U.S. Navy as a combat aviator and subsequently as a Congressional Liaison. Mr. Capper received an undergraduate degree in Accounting from West Chester University and an MBA in International Finance from George Washington University.

15

Heather C. Getz, CPA. Ms. Getz was appointed Senior Vice President and Chief Financial Officer in January 2010. Ms. Getz joined CardioNet in May 2009 as Vice President of Finance. From April 2008 to May 2009, Ms. Getz was Vice President of Finance at Alita Pharmaceuticals, Inc., a privately held specialty pharmaceutical company, responsible for all areas of finance, accounting and information systems. Prior to Alita Pharmaceuticals, Inc., from March 2002 to April 2008, Ms. Getz held various financial leadership positions at VIASYS Healthcare Inc., a healthcare technology company, including directing the company's global financial planning, budgeting and analysis, and external reporting functions. From June, 1997 to February 2002, Ms. Getz began her career at Sunoco, Inc., where she held various positions of increasing responsibility. Ms. Getz is a certified public accountant, and received her undergraduate degree in Accountancy and an MBA from Villanova University.

Peter Ferola. Mr. Ferola joined CardioNet in February 2011 with over 19 years of progressive leadership experience in business management, legal affairs and corporate governance. From 2009 to 2011, Mr. Ferola served as Vice President, General Counsel and Secretary of Nipro Diagnostics, Inc. (formerly Home Diagnostics, Inc., NASDAQ: HDIX). Prior to joining Home Diagnostics, Mr. Ferola worked as a corporate and securities attorney with Greenberg Traurig LLP and with Dilworth Paxson, LLP in Washington, D.C. focusing on mergers, acquisitions, public securities offerings and corporate governance matters. From 1989 to 2002, Mr. Ferola worked in executive management roles for an American Stock Exchange-listed company, most recently serving as Vice President—Administration and Corporate Secretary, overseeing the Company's administrative functions, legal matters and investor relations. Mr. Ferola earned a Bachelor of Science and Juris Doctor degree from Nova Southeastern University and a Master of Laws in Securities and Financial Regulation from Georgetown University Law Center. Mr. Ferola has authored numerous articles on corporate and securities laws, with a particular focus on audit committees and regulations implemented in the wake of the Sarbanes-Oxley Act of 2002.

Anna McNamara, RN. Ms. McNamara joined CardioNet in 2002 serving in various Clinical Operations roles. She currently serves as our Senior Vice President, Clinical Operations. From February 2001 to September 2002, Ms. McNamara served as Executive Vice President of Clinical Operations for LifeWatch Corp., a health care services company. From July 1998 to February 2001, Ms. McNamara served as Vice President of Clinical Operations for Quality Diagnostic Services at Matria Healthcare, Inc., a health care company. From January 1997 to July 1998, Ms. McNamara served as Vice President of Clinical Operations for WebMD Health Corp., a web-based health information provider. Ms. McNamara received an undergraduate degree from Marymount College and an RN at Mercy Hospital in Scranton, PA.

Jareer Kasrawi. Mr. Kasrawi joined CardioNet in 2008 as part of the sales leadership team. He was named Senior Vice President, Strategic Contracting in May 2011. Mr. Kasrawi brings 16 years of medical/pharmaceutical sales and sales leadership experience in the cardiovascular, anesthesia, spinal cord injury, and auto-immune market places. Most recently, Mr. Kasrawi served as Area Vice President for CardioNet from 2008-2011. Prior to CardioNet, Mr. Kasrawi held various sales and sales leadership positions at Reliant Pharmaceuticals and Jones Medical Industries. Mr. Kasrawi received an undergraduate degree in Speech Communication from Oregon State University.

16

Daniel Wisniewski. Mr. Wisniewski joined CardioNet in December 2010 with over 20 years of experience in executive leadership, information systems, and operations. Most recently, from 2000 to 2010, Mr. Wisniewski served as Chief Information Officer with CCS Medical, Inc. As the Chief Information Officer, Mr. Wisniewski was responsible for developing a highly scalable patient centric operational infrastructure focused on compliance, growth and expense control within the healthcare industry. Prior to CCS Medical, Inc., Mr. Wisniewski held various roles within the nuclear and banking industries with increasing responsibilities in information systems and general management. Mr. Wisniewski began his career as an U.S. Navy Nuclear Trained Naval Officer. Mr. Wisniewski received his undergraduate degree in Electrical Engineering from Virginia Military Institute.

George Hrenko. Mr. Hrenko joined CardioNet in 2008 as its VP of Human Resources and was named Senior Vice President, Human Resources and Organizational Excellence in May 2010. Most recently, Mr. Hrenko served as a Director of Human Resources for Target Corporation from February 2002 to March 2007. From December 1998 to February 2002, Mr. Hrenko held several positions with Bank One Corporation, including First Vice President, Human Resources Generalist, Vice President, Compensation, and Vice President, Corporate Staffing. From 1996 to 1998 he served as Managing Director, Human Resources for Continental Airlines. Prior to Continental Airlines, Mr. Hrenko served as Human Resources Manager at Pepsi-Cola Co, Pepsico, Inc., from 1987 to 1996. Mr. Hrenko received an undergraduate degree in English and Psychology from Penn State University.

Charles Gropper. Mr. Gropper joined CardioNet in January 2008 as our Vice President of Research and Development. Mr. Gropper was named our Senior Vice President of Research and Development in May, 2010. Mr. Gropper brings nearly 30 years of experience in the design and development of medical devices. Prior to CardioNet, Mr. Gropper most recently served as Vice President, Engineering at HepaHope, Inc., working on the design of an artificial liver system from 2005 to 2008. Prior to his experience with HepaHope, Mr. Gropper has held several senior engineering management positions with such companies as Cameron Health, Inc., Cardiac Science, Inc. Datascope Corp., and Bear Medical Systems. Mr. Gropper received his undergraduate degree in Biomedical Engineering from Rensselaer Polytechnic Institute and an MBA from California State University, Fullerton.

Anthony Schuler. Mr. Schuler joined CardioNet in 2007 as a Regional Sales director through the acquisition of PDS Heart, Inc. Most recently, Mr. Schuler served as Area Vice President for CardioNet from May 2009 to June 2011. From September 2003 to March 2007, Mr. Schuler held various positions with PDS Heart, including Account Executive and Regional Sales Director. From 1994 through 2001, Mr. Schuler was a school teacher and high school football coach. Mr. Schuler received an undergraduate degree in Education and Child Psychology from Moravian College.

17

SECURITY OWNERSHIP OF

CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding the ownership of the Company's Common Stock as of March 12, 2012 by: (i) each director and nominee for director; (ii) each of the executive officers named in the Summary Compensation Table; (iii) all executive officers and directors of the Company as a group; and (iv) all those known by the Company to be beneficial owners of more than five percent of its Common Stock.

| |

Beneficial Ownership(1) | ||||||

|---|---|---|---|---|---|---|---|

Beneficial Owner

|

Number of Shares |

Percent of Total |

|||||

Robert J. Rubin, M.D.(2) |

100,194 | * | |||||

Eric N. Prystowsky, M.D.(3) |

84,562 | * | |||||

Ronald A. Ahrens(4) |

99,676 | * | |||||

Kirk E. Gorman(5) |

74,229 | * | |||||

Rebecca W. Rimel(6) |

45,594 | * | |||||

Joseph H. Capper(7) |

138,558 | — | |||||

Heather C. Getz, CPA(8) |

61,885 | * | |||||

Peter Ferola(9) |

18,750 | — | |||||

Anna McNamara(10) |

50,311 | * | |||||

Jareer Kasrawi(11) |

30,893 | * | |||||

BlackRock, Inc.(12) |

1,529,460 | 6.3 | % | ||||

Camber Capital Management LLC(13) |

2,366,412 | 9.7 | % | ||||

Trigran Investments Inc.(14). |

1,957,193 | 8.0 | % | ||||

All directors and executive officers as a group (14 persons)(15) |

886,429 | 3.6 | % | ||||

- *

- Less

than one percent.

- (1)

- This

table is based upon information supplied by officers, directors and principal stockholders and Schedules 13D and 13G if any filed with the

Securities and Exchange Commission (the "SEC"). Unless otherwise indicated in the footnotes to this table and subject to community property laws where applicable, the Company believes that each of the

stockholders named in this table has sole voting and investment power with respect to the shares indicated as beneficially owned. Applicable percentages are based on 24,339,485 shares outstanding on

March 12, 2012, adjusted as required by rules promulgated by the SEC.

- (2)

- Includes

options to purchase 28,489 shares of Common Stock, which were exercisable as of, or will be exercisable within sixty (60) days after

March 12, 2012.

- (3)

- Includes

options to purchase 42,687 shares of Common Stock, which were exercisable as of, or will be exercisable within sixty (60) days after

March 12, 2012.

- (4)

- Includes

options to purchase 34,786 shares of Common Stock, which were exercisable as of, or will be exercisable within sixty (60) days after

March 12, 2012.

- (5)

- Includes

options to purchase 27,286 shares of Common Stock, which were exercisable as of, or will be exercisable within sixty (60) days after

March 12, 2012.

- (6)

- Includes options to purchase 9,338 shares of Common Stock, which were exercisable as of, or will be exercisable within sixty (60) days after March 12, 2012.

18

- (7)

- Includes

options to purchase 138,558 shares of Common Stock, which were exercisable as of, or will be exercisable within sixty (60) days after

March 12, 2012, and does not include unvested Restricted Stock Units.

- (8)

- Includes

options to purchase 61,885 shares of Common Stock, which were exercisable as of, or will be exercisable within sixty (60) days after

March 12, 2012, and does not include unvested Restricted Stock Units.

- (9)

- Includes

options to purchase 18,750 shares of Common Stock, which were exercisable as of, or will be exercisable within sixty (60) days after

March 12, 2012, and does not include unvested Restricted Stock Units.

- (10)

- Includes

options to purchase 16,411 shares of Common Stock, which were exercisable as of, or will be exercisable within sixty (60) days after

March 12, 2012, and does not include unvested Restricted Stock Units.

- (11)

- Includes

options to purchase 29,904 shares of Common Stock, which were exercisable as of, or will be exercisable within sixty (60) days after

March 12, 2012, and does not include unvested Restricted Stock Units.

- (12)

- The

address of BlackRock, Inc. is 40 East 52nd Street, New York, NY 10022.

- (13)

- Camber

Capital Management LLC ("Camber") is a Massachusetts limited liability company primarily engaged in the business of investing in securities.

Stephen DuBois is the Managing Member of Camber and is a United States citizen. The address of the principal business and office of Camber Capital Management LLC is 101 Huntington Avenue,

25th Floor, Boston, MA 02199.

- (14)

- Trigran

Investments Inc. is an Illinois company primarily engaged in the business of investing in securities. Douglas Granat, Lawrence A. Oberman

and Steven G. Simon are United States Citizens and the controlling shareholders and sole directors of Trigran Investments, Inc. The address of the principal business and office of Trigran

Investments, Inc. is 630 Dundee Road, Suite 230, Northbrook, IL 60062.

- (15)

- Includes options to purchase 556,982 shares of Common Stock, which were exercisable as of, or will be exercisable within sixty (60) days after March 12, 2012.

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the 1934 Act requires the Company's directors and executive officers, and persons who own more than ten percent of a registered class of the Company's equity securities, to file with the SEC initial reports of ownership and reports of changes in ownership of Common Stock and other equity securities of the Company. Officers, directors and greater than ten percent stockholders are required by SEC regulation to furnish the Company with copies of all Section 16(a) forms they file.

As of March 12, 2012, based solely on a review of the copies of such reports furnished to us and representatives of these persons, all reports required to be filed have been filed for the year ended December 31, 2011.

19

EQUITY COMPENSATION PLAN INFORMATION

The following table presents the equity compensation plan information as of December 31, 2011:

| |

Equity Compensation Plan Information | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

Number of securities to be issued upon exercise of outstanding options, warrants, and rights |

Weighted-average exercise price of outstanding options, warrants and rights |

Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) |

|||||||

| |

(a) |

(b) |

(c) |

|||||||

Equity compensation plans approved by security holders: |

||||||||||

Employee and non-employee director stock option plans |

2,468,991 | $ | 9.43 | 2,369,802 | ||||||

Employee stock purchase plan |

51,544 | $ | 2.54 | 408,127 | ||||||

Total |

2,520,535 | $ | 11.97 | 2,777,929 | ||||||

DIRECTOR AND EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

Executive Summary

In this Compensation Discussion and Analysis, we address the compensation provided to our named executive officers listed below under "Our Named Executive Officers" and in the Summary Compensation Table that follows this discussion, the goals that we seek to achieve through our executive compensation program and other important factors underlying our compensation practices and policies.

2011 has been a challenging year for us with mixed results. Our loss before income taxes increased to $61.0 million from $16.9 million in 2010, primarily as a result of our write down of goodwill, a circumstance primarily outside of our control. Accordingly, we also experienced shortfalls to our operating results and earnings. However, despite this write down, we achieved, and in some cases exceeded, certain pre-established incentive plan goals. This presented a challenge to the Compensation Committee, which was tasked with balancing the need to provide compensation sufficient to attract and retain key members of our senior management team through this challenging period, on one hand, with the goal of aligning compensation with stockholder value, on the other hand. In an effort to strike an appropriate balance between these purposes, the Compensation Committee made downward adjustments to the compensation paid to certain executive officers (as described in more detail below) as compared to what they would have received based on a strict application of the pre-established performance metrics, while at the same time ensuring that overall incentive payments reflected the mixed results of 2011. This was accomplished mainly through a significant reduction in cash incentive payouts to our senior executives. The net effect of these decisions was an aggregate payout of cash incentive for 2011 performance at 50% of full target. Executives did, however, receive target equity compensation awards, since the ultimate value of these awards will be linked to the performance of the Company and is thus aligned with stockholders interests. In addition, the Compensation Committee periodically reviews the Company's executive pay practices, its appropriate peer group, and the utilization of shares in its equity plans, with a view toward ensuring that the Company's overall compensation practices are consistent with the market and effective in generating long-term shareholder value.

20

Our compensation program is generally designed to provide performance-oriented incentives that fairly compensate our executive officers and enable us to attract, retain and motivate executives with outstanding ability and potential. Our compensation program consists of both short-term and long-term components, including cash and equity-based compensation, and is intended to reward consistent performance that meets or exceeds formally established performance goals and objectives. Our Compensation Committee and senior management is focused on providing an appropriate mix of short-term and long-term incentives, and we are mindful not to rely on highly leveraged incentives that would result in risky short-term behavior. Our compensation program provides long-term incentives to ensure that our executives continue in employment with us and directly tie executive compensation to generation of shareholder value. For 2012, we have revised our Management Incentive Plan to include corporate goals and objectives relating to volume, revenue, and EBITDA growth, and we overlay management by objective (MBO) goals that are intended to encourage our executives to build and maintain an infrastructure that supports our growth and increases revenues.

Our Named Executive Officers

Our named executive officers for 2011 are Messrs. Capper, Ferola, and Kasrawi, and Ms. Getz and Ms. McNamara.

Compensation Philosophy and Components of Executive Compensation

Our Compensation Committee is composed entirely of independent directors. Our Compensation Committee administers our executive compensation program.

The general duties of the Compensation Committee include:

- •

- Administration of the Company's annual incentive, equity compensation and long term incentive plans;

- •

- Review and recommendation of major compensation plans for approval by the Board;

- •

- Recommendation of compensation for the President and Chief Executive Officer for approval by the independent members of

our Board; and

- •

- Approval of compensation decisions relating to all executive officers.

Our Compensation Committee believes that our executive compensation program should include both short-term and long-term components, including cash and equity-based compensation, and should reward consistent performance that meets or exceeds expectations. In general, we tie compensation to the achievement of specific corporate and individual goals. Determinations about corporate performance are based on achievement of specific, pre-determined objectives. Individual performance against goals are more subjective and are based on the judgments made at the discretion of our Compensation Committee and our Board of Directors, with input from our Chief Executive Officer, except as it relates to his own compensation. For our executive officers other than himself, our Chief Executive Officer evaluates the performance of the executive officers on an annual basis and makes recommendations to our Compensation Committee with respect to annual salary adjustments, bonuses and annual equity awards. These recommendations are reviewed by our Compensation Committee on an aggregated basis so that our Compensation Committee can evaluate the compensation paid to our executives on a total compensation basis. While our Compensation Committee reviews the recommendations of our Chief Executive Officer with respect to executive officers other than himself, our Compensation Committee exercises its own discretion in approving salary adjustments and discretionary cash and equity awards for all executives and communicates its final approval to our Board of Directors.

21