Exhibit 99.1

______________________________________________________________________________________________________

ANNUAL AND SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON MAY 8, 2018

NOTICE OF ANNUAL AND SPECIAL MEETING OF SHAREHOLDERS

and

MANAGEMENT PROXY CIRCULAR

________________________________________________________

This Notice and Management Proxy Circular,

along with accompanying materials, require your immediate attention.

If you have any questions regarding the information described in this Notice and Management Proxy Circular or require assistance with voting your shares, please contact Laurel Hill Advisory Group at 1-877-452-7184 (416-304-0211 collect) or by email at assistance@laurelhill.com |

THE BOARD OF DIRECTORS RECOMMENDS A VOTE IN FAVOR OF ALL PROPOSED RESOLUTIONS.

YOUR VOTE IS IMPORTANT. PLEASE VOTE TODAY.

April 2, 2018

NOTICE OF ANNUAL AND SPECIAL MEETING OF SHAREHOLDERS

NOTICE IS HEREBY GIVEN that the annual and special meeting of shareholders of Aeterna Zentaris Inc. (the “Corporation” or “Aeterna Zentaris”) will be held at the offices of Stikeman Elliott LLP, located on the 41st floor at 1155 René-Lévesque Blvd. West, Montreal, Quebec, Canada, H3B 3V2 on Tuesday, May 8, 2018, at 10:00 a.m. (Eastern time) for the following purposes:

1. | to receive the audited consolidated financial statements of the Corporation as at and for the year ended December 31, 2017, together with the auditors' report thereon; |

2. | to elect directors; |

3. | to appoint auditors and to authorize the directors to determine their compensation; |

4. | to consider an ordinary resolution to approve the long-term incentive plan of the Corporation (the “Long-Term Incentive Plan Resolution”), the full text of the long-term incentive plan is set out in Schedule A to this Circular; and |

5. | to transact such other business as may properly come before the meeting. |

The record date for the determination of shareholders of Aeterna Zentaris entitled to receive notice of and to vote at the meeting is March 20, 2018.

As shareholders of Aeterna Zentaris, it is very important that you read these materials carefully and vote your shares, either by proxy or in person, at the meeting.

The following pages tell you more about how to exercise your right to vote your shares and provide additional information relating to the matters to be dealt with at the meeting.

By order of the Board of Directors,

/s/ Carolyn S. Egbert

Chair of the Board

Charleston, South Carolina

April 2, 2018

Shareholders unable to attend the meeting are requested to complete and sign the enclosed form of proxy and to return it in the prepaid envelope enclosed. To be valid, proxies must reach the office of Computershare Trust Company of Canada, Share Ownership Management, 100 University Avenue, 8th Floor, Toronto, Ontario M5J 2Y1, no later than 48 hours (excluding Saturdays, Sundays and holidays) prior to the close of business on the date of the meeting or any adjournment or postponement thereof. The time limit for the deposit of proxies may be waived by the Chair of the Meeting without notice.

If you are a non-registered shareholder of Aeterna Zentaris Shares and have received these materials through your broker, custodian, nominee or other intermediary, please complete and return the voting instruction form provided to you by your broker, custodian, nominee or other intermediary in accordance with the instructions provided therein.

Aeterna Zentaris Inc.,

c/o Stikeman Elliott LLP

1155 René-Lévesque Blvd. West, 41st Floor

Montreal, Québec

H3B 3V2

MANAGEMENT PROXY CIRCULAR

TABLE OF CONTENTS

SECTION 1. INTRODUCTION | |

SECTION 2 INFORMATION CONCERNING VOTING AT THE MEETING | |

2.1 Your Vote is Important | |

2.2 Voting | |

2.3 How to Vote — Registered Shareholders | |

2.4 How to Vote — Non-Registered Shareholders | |

2.5 Completing the Form of Proxy and the Exercise of Discretion of Proxies | |

2.6 Revocation of Proxies | |

SECTION 3 VOTING SHARES, QUORUM AND PRINCIPAL SHAREHOLDERS | |

3.1 Voting Shares and Quorum | |

3.2 Principal Shareholders | |

SECTION 4 PRESENTATION OF THE FINANCIAL STATEMENTS | |

SECTION 5 ELECTION OF DIRECTORS | |

5.1 Board of Directors | |

SECTION 6 DISCLOSURE OF COMPENSATION | |

6.1 Remuneration of Directors | |

6.2 Compensation of Executive Officers | |

6.3 Compensation Discussion & Analysis | |

6.4 Incentive Plan Awards — Value Vested or Earned During the Year | |

6.5 Securities Authorized for Issuance under Equity Compensation Plans | |

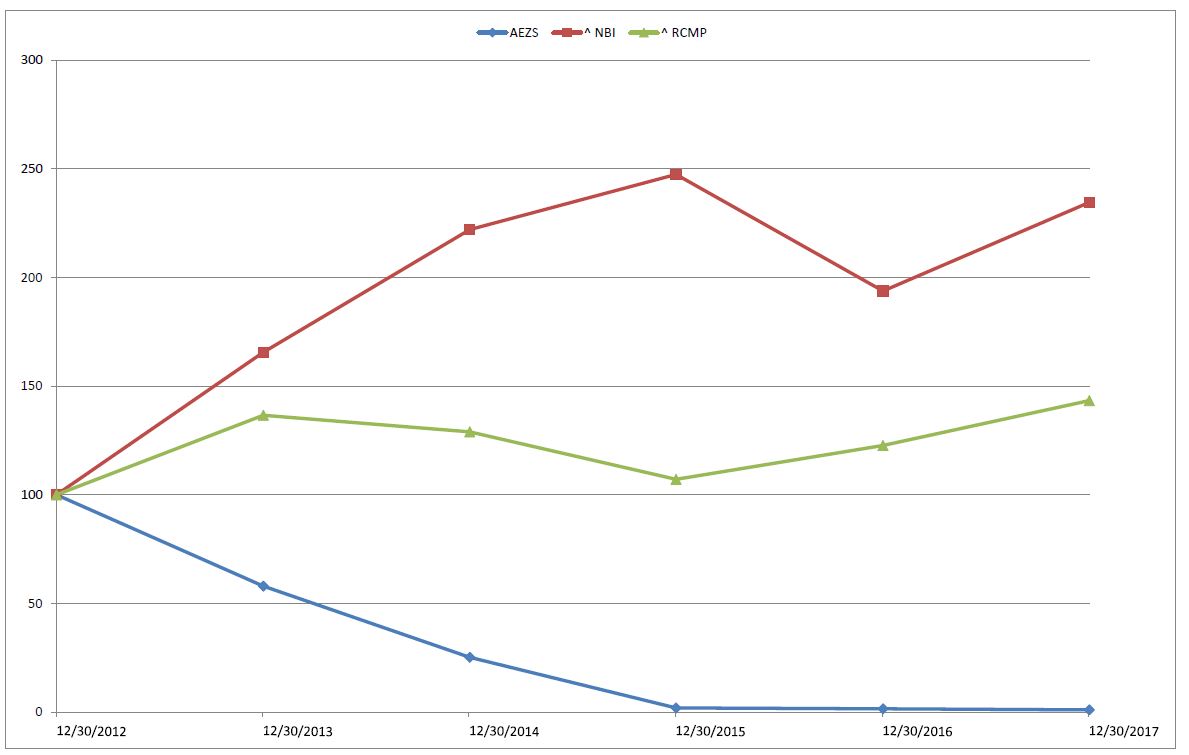

6.6 Performance Graph | |

6.7 Summary | |

SECTION 7 EMPLOYMENT AND CHANGE OF CONTROL AGREEMENTS | |

7.1 Employment and Change of Control Agreements | |

SECTION 8 APPOINTMENT OF AUDITORS AND AUDIT COMMITTEE DISCLOSURE | |

8.1 Appointment of Auditors | |

8.2 Audit Committee Disclosure | |

8.3 Composition of the Audit Committee | |

8.4 Education and Relevant Experience | |

8.5 Pre-Approval Policies and Procedures | |

8.6 External Auditor Service Fees | |

SECTION 9 APPROVAL OF THE CORPORATION'S LONG-TERM INCENTIVE PLAN | |

9.1 Background | |

9.2 The Share Pool | |

9.3 Key Features Designed to Protect Shareholders' Interests | |

9.4 Summary of Long-Term Incentive Plan | |

9.5 Recommendation of the Board and Management | |

SECTION 10 STATEMENT OF CORPORATE GOVERNANCE PRACTICES | |

SECTION 11 INDEBTEDNESS OF DIRECTORS AND OFFICERS | |

SECTION 12 INTEREST OF INFORMED PERSONS IN MATERIAL TRANSACTIONS | |

SECTION 13 SHAREHOLDER PROPOSALS FOR NEXT ANNUAL MEETING OF SHAREHOLDERS | |

SECTION 14 ADDITIONAL INFORMATION | |

SECTION 15 MAIL SERVICE INTERRUPTION | |

SECTION 16 DIRECTORS APPROVAL | |

ADDENDA | |

Schedule A: Long-Term Incentive Plan | |

Schedule B: Statement of Corporate Governance Practices | |

Schedule C: Mandate of the Board of Directors | |

Schedule D: Audit Committee Charter | |

Schedule E: Mandate of the Nominating, Governance and Compensation Committee | |

MANAGEMENT INFORMATION CIRCULAR

SECTION 1. | INTRODUCTION |

This management proxy circular (this “Circular”) is being furnished in connection with the solicitation of proxies by and on behalf of the management of Aeterna Zentaris Inc. (the “Corporation”, “Aeterna Zentaris”, “we” or “our”) for use at the annual and special meeting of our shareholders (the “Meeting”) and any adjournment(s) or postponement(s) thereof. No person has been authorized to give any information or to make any representation in connection with any matters to be considered at the Meeting other than those contained in this Circular and, if given or made, any such information or representation must not be relied upon as having been authorized.

In addition to solicitation by mail, our employees or our agents, we may solicit proxies by telephone or by other means. We will bear the entire cost of any such solicitation. We may also reimburse brokers and other persons holding our common shares (the “Common Shares”) in their names, or in the names of nominees, for their costs incurred in sending proxy materials to beneficial or non-registered owners and obtaining their proxies or voting instructions. We have appointed The Laurel Hill Advisory Group Company (“Laurel Hill”) as our soliciting agent. For this service, and other advisory services, we will pay Laurel Hill CAN $25,000 plus out-of-pocket expenses.

Information contained in this Circular is given as of April 2, 2018 unless otherwise specifically stated. Our directors and executive officers are generally paid in their home country currency. Unless otherwise indicated, all compensation information included in this Circular is presented in U.S. dollars and, to the extent a director or officer has been paid in a currency other than U.S. dollars, the amounts have been converted from such person's home country currency to U.S. dollars based on the following annual average exchange rates: for the financial year ended December 31, 2017: €1.000 = U.S.$1.198 and CAN$1.000 = U.S.$0.797; for the financial year ended December 31, 2016: €1.000 = U.S.$1.110 and CAN$1.000 = U.S.$0.754; and for the financial year ended December 31, 2015: €1.000 = U.S.$1.110 and CAN$1.000 = U.S.$0.783.

All references to “shareholders” in this Circular are to registered shareholders unless specifically stated otherwise.

SECTION 2 | INFORMATION CONCERNING VOTING AT THE MEETING |

2.1 | Your Vote is Important |

As a shareholder, it is very important that you read the following information on how to vote your Common Shares, either by proxy or in person at the Meeting. These materials are being sent to both our registered and non-registered shareholders. Please return your proxy as specified in this Circular and in the form of proxy.

2.2 | Voting |

You can attend the Meeting or you can appoint someone else to vote for you as your proxyholder. A shareholder entitled to vote at the Meeting may, by means of a proxy, appoint a proxyholder or one or more alternate proxyholders, who are not required to be shareholders, to attend and act at the Meeting in the manner and to the extent authorized by the proxy and with the authority conferred by the proxy. Voting by proxy means that you are giving the person named on your form of proxy the authority to vote your Common Shares for you at the Meeting and at any adjournment or postponement thereof.

You can choose from among four different ways to vote your Common Shares by proxy:

1. | by telephone; |

2. | by fax; |

3. | on the internet; or |

4. | by mail. |

The persons who are named on the form of proxy are our officers and will vote your shares for you. You have the right to appoint someone else to be your proxyholder. If you appoint someone else, he or she must attend the Meeting to vote your Common Shares.

2.3 | How to Vote — Registered Shareholders |

You are a registered shareholder if your name appears on your share certificate or on the register of shareholders maintained by our registrar and transfer agent. If you are not sure whether you are a registered shareholder, please contact Computershare Trust Company of Canada (“Computershare”) by telephone toll-free at 1-800-564-6253 or by e-mail at service@computershare.com.

By Telephone

Voting by proxy using the telephone is only available to shareholders located in Canada and the United States. Call 1-866-732-VOTE (8683) toll-free in Canada and 1-312-588-4290 toll-free in the United States from a touchtone telephone and follow the instructions provided. Your voting instructions are then conveyed by using touchtone selections over the telephone. You will need your Control Number located on your form of proxy or in the e-mail addressed to you, if you have chosen to receive this Circular electronically. If you choose the telephone, you cannot appoint any person other than the officers named on your form of proxy as your proxyholder.

The cut-off time for voting by telephone is 5:00 p.m. (Eastern Time) on May 4, 2018.

By Fax

Complete, date and sign your form of proxy and fax it to Computershare Trust Company of Canada, Attention: Proxy Department at 1-866-249-7775 (toll free in North America) or 416-263-9524 (international). If you return your proxy by fax, you can appoint a person other than the officers named in the form of proxy as your proxyholder. This person does not have to be a shareholder. Fill in the name of the person you are appointing in the blank space provided on the form of proxy. Complete your voting instruction on the form of proxy, and date and sign the form. Make sure that the person you appoint is aware that he or she has been appointed and attends the Meeting.

The cut-off time for voting by fax is 5:00 p.m. (Eastern Time) on May 4, 2018.

Via the Internet

Go to the website www.investorvote.com and follow the instructions on the screen. Your voting instructions are then conveyed electronically over the internet. You will need your Control Number located on your form of proxy or in the e-mail addressed to you, if you have chosen to receive this Circular electronically. If you return your proxy via the internet, you can appoint a person other than the officers named in the form of proxy as your proxyholder. This person does not have to be a shareholder. Indicate the name of the person you are appointing by following the instructions online.

The cut-off time for voting over the internet is 5:00 p.m. (Eastern Time) on May 4, 2018.

By Mail

Complete, date and sign your form of proxy and return it in the envelope provided to you or deliver it to 100 University Avenue, 8th Floor, Toronto, Ontario M5J 2Y1 for receipt before 5:00 p.m. (Eastern time) on May 4, 2018 or with the Secretary of the Meeting prior to commencement of the Meeting on the day of the Meeting or on the day of any adjournment or postponement thereof. If you return your proxy by mail, you can appoint a person other than the officers named in the form of proxy as your proxyholder. This person does not have to be a shareholder. Fill in the name of the person you are appointing in the blank space provided on the form of proxy. Complete your voting instruction on the form of proxy, and date and sign the form. Make sure that the person you appoint is aware that he or she has been appointed and attends the Meeting.

See the section titled “Completing the Form of Proxy” for more information.

In Person at the Meeting

You do not need to complete or return your form of proxy. You will be required to register your attendance for the Meeting with the scrutineer at the registration desk.

2.4 | How to Vote — Non-Registered Shareholders |

The information set forth in this section should be reviewed carefully by our non-registered shareholders. Shareholders who do not hold their shares in their own names should note that only proxies deposited by shareholders who appear on the records maintained by our registrar and transfer agent as registered holders of shares will be recognized and acted upon at the Meeting.

2

You are a non-registered shareholder (a “Beneficial Shareholder”), if your bank, trust company, securities broker or dealer or other financial institution or intermediary (“your nominee”) holds your Common Shares for you. If you are not sure whether you are a non-registered shareholder, please contact Computershare by telephone at 1-514-982-7555 or toll-free at 1-800-564-6253 or by e-mail at service@computershare.com.

Beneficial Shareholders will receive from their nominee either voting instruction forms or, less frequently, forms of proxy. The purpose of these forms is to permit Beneficial Shareholders to direct the voting of the Common Shares they beneficially own. Beneficial Shareholders should follow the procedures set out on the voting instruction form or form of proxy they receive. Every nominee has its own mailing procedures and provides its own return instructions to clients. The majority of nominees now delegate responsibility for obtaining voting instructions from clients to Broadridge Financial Solutions, Inc. in Canada and its counterpart in the United States (“Broadridge”).

If you receive a voting instruction form from Broadridge, the voting instruction form must be completed and returned to Broadridge, in accordance with Broadridge’s instructions, well in advance of the Meeting in order to: (a) have your Common Shares voted, as per your instructions, at the Meeting or (b) arrange to have an alternate representative duly appointed by you to attend the Meeting and to vote your Common Shares at the Meeting.

A voting instruction form allows you to provide your voting instructions via the internet, by telephone or by mail. You will need your Control Number found on your voting instruction form, if you choose to vote via the internet or by telephone. Alternatively, Beneficial Shareholders may complete the voting instruction form and return it by mail, as directed in the voting instruction form.

Should a Beneficial Shareholder who receives one of the above forms wish to attend and vote at the Meeting in person, the Beneficial Shareholder should strike out the names of the management designees and insert the Beneficial Shareholder’s name in the blank space provided for this purpose. In either case, Beneficial Shareholders should carefully follow the instructions of their nominee, including those regarding when and where the proxy or voting instruction form is to be delivered.

There are two kinds of Beneficial Shareholders: (i) those who object to their name being made known to the issuers of securities that they own, known as objecting beneficial owners or “OBOs” and (ii) those who do not object to their name being made known to the issuers of securities that they own, known as non-objecting beneficial owners or “NOBOs”.

We may utilize the Broadridge Quickvote™ service to assist NOBOs with voting their Common Shares. NOBOs may be contacted by Laurel Hill to conveniently obtain a vote directly over the telephone.

We intend to pay for proximate intermediaries to send the proxy-related materials to OBOs.

2.5 | Completing the Form of Proxy and the Exercise of Discretion of Proxies |

You can choose to vote “FOR” or “WITHHOLD” with respect to the election of directors and the appointment of auditors and “FOR” or “AGAINST” with respect to all other matters to be voted upon. If you are a Beneficial Shareholder voting your Common Shares, please follow the instructions provided in the voting instruction form that you should have received together with this Circular.

When you sign the form of proxy without appointing an alternate proxyholder, you authorize Michael V. Ward, the President and Chief Executive Officer of the Corporation and James Clavijo, Corporate Secretary to vote your Common Shares for you at the Meeting in accordance with your instructions. Where no choice is specified, the form of proxy will confer discretionary authority and will be voted FOR all matters proposed by management at the Meeting. The enclosed form of proxy also confers discretionary authority upon the persons named therein to vote with respect to any amendments or variations to the matters identified in the Notice of Meeting and with respect to any other matters that may properly come before the Meeting in such manner as the proxyholder in his judgment may determine.

Management is not aware of any other matters that will be presented for action at the Meeting. If, however, other matters properly come before the Meeting, the persons designated in the enclosed form of proxy will vote in accordance with their judgment, pursuant to the discretionary authority conferred by the proxy with respect to such matters.

You have the right to appoint a person or company of your choice who need not be a shareholder to represent you at the Meeting other than the persons designated in the enclosed proxy form. If you are appointing someone else to vote your Common Shares for you at the Meeting, fill in the name of the person voting for you in the blank space provided on the form of proxy.

If you are an individual shareholder, you or your authorized attorney must sign the form of proxy. If you are a corporation, partnership, trust or other legal entity, an authorized officer, representative or attorney must sign the form of proxy.

3

2.6 | Revocation of Proxies |

In addition to any other manner permitted by law, a proxy may be revoked before it is exercised by a written instrument executed in the same manner as a proxy deposited either at the Montreal office of our registrar and transfer agent, Computershare, located at 1500 Robert-Bourassa Boulevard, 7th Floor, Montreal, Quebec, Canada, H3A 3S8, or at our registered office, located at 1155 René-Lévesque Blvd. West, 41st Floor, Montréal, Québec, Canada H3B 3V2, c/o Stikeman Elliott LLP, at any time up to and including the last business day preceding the day of the Meeting, or any adjournment or postponement thereof, at which the proxy is to be used, or with the Chair of the Meeting on the day of the Meeting, or any adjournment or postponement thereof.

SECTION 3 | VOTING SHARES, QUORUM AND PRINCIPAL SHAREHOLDERS |

3.1 | Voting Shares and Quorum |

Shareholders of record on March 20, 2018 are entitled to receive notice of and to vote at the Meeting. As of March 20, 2018, there were 16,440,760 issued and outstanding Common Shares. The list of shareholders entitled to vote at the Meeting will be available for inspection on and after March 20, 2018 during usual business hours at the Montreal office of our registrar and transfer agent, Computershare, located at 1500 Robert-Bourassa Boulevard, 7th Floor, Montreal, Quebec, H3A 3S8, as well as at the Meeting. The holders of the Common Shares are entitled to one vote for each Common Share held by them at all meetings of shareholders.

Our By-Law One provides that a quorum is present at the Meeting if the holder(s) of 10% or more of the issued and outstanding Common Shares are present in person or represented by proxy, irrespective of the number of shareholders actually in attendance at the Meeting.

3.2 | Principal Shareholders |

As of April 2, 2018, to the knowledge of our officers and directors based on shareholders' public filings, there are no persons or entities that beneficially owned, or exercised control or direction over, directly or indirectly, 10% or more of the votes attached to the Common Shares.

SECTION 4 | PRESENTATION OF THE FINANCIAL STATEMENTS |

Our audited consolidated financial statements as at December 31, 2017 and December 31, 2016 and for the years ended December 31, 2017, 2016 and 2015 and the auditors' report thereon will be submitted at the Meeting.

4

SECTION 5 | ELECTION OF DIRECTORS |

5.1 | Board of Directors |

Our Articles provide that our Board of Directors (the “Board”) shall be composed of a minimum of five and a maximum of 15 directors. Our Board currently consists of five members. Directors are elected annually by our shareholders, but the directors may from time to time appoint one or more directors, provided that the total number of directors so appointed does not exceed one-third of the number of directors elected at the last annual meeting of shareholders. Management proposes the seven persons named in the table below (and in the form of proxy or voting instruction form enclosed together with this Circular) as candidates for election as directors. Each elected director will remain in office until termination of the next annual meeting of shareholders or until his or her successor is duly elected or appointed, unless his or her post is vacated earlier. Each of the candidates proposed by management is currently a director. As you will note from the enclosed form of proxy or voting instruction form, shareholders may vote for each director individually, and thus there is no slate vote.

In accordance with a majority voting policy adopted by our Board, in an uncontested election of directors, a nominee for election as a director who receives a greater number of votes “withheld” than votes “for” his or her nomination shall promptly tender his or her resignation to the Board following the meeting of shareholders at which the director is elected. The Nominating, Governance and Compensation Committee (the “NGCC”) will consider such resignation and make a recommendation to the Board as to whether to accept such resignation. The Board will accept the resignation except in situations where exceptional circumstances would warrant the director continuing to serve on the Board. The Board will make its final decision and announce it in a press release within 90 days following the meeting of shareholders. The director who tenders his or her resignation pursuant to this policy will not participate in any committee or Board deliberations and decisions pertaining to the resignation offer.

Unless instructions are given to abstain from voting with regard to the election of directors, the persons whose names appear on the enclosed form of proxy will vote in favor of the election of the seven nominees whose names are set out in the table below. Management does not foresee that any of the nominees listed below will be unable or, for any reason, unwilling to perform his or her duties as a director. In the event that the foregoing occurs for any reason, prior to the election, the persons indicated on the enclosed form of proxy reserve the right to vote for another candidate of their choice unless otherwise instructed by the shareholder in the form of proxy to abstain from voting on the election of directors.

Name and Place of Residence | Principal Occupation | Director since | Number of Common Shares Held(1) | |||

Cardiff, Michael(2)(3) Ontario, Canada | Chief Executive Officer of Accelerents (consulting firm) | 2016 | — | |||

Egbert, Carolyn(3) Texas, USA | Chair of the Board of Directors of the Corporation Corporate Director | 2012 | 1,920 | |||

Ernst, Juergen(2)(3) Koeln-Rodenkirchen, Germany | Corporate Director Former General Manager Pharmaceutical Sector of Solvay S.A. (international chemical and pharmaceutical group) | 2005 | 1,348 | |||

Limoges, Gérard (2) Quebec, Canada | Corporate Director Former Deputy Chairman of Ernst & Young LLP Canada (accounting firm) | 2004 | 1,200 | |||

Norton, Brent Ontario, Canada | Corporate Director Founder of PreMD Inc. (predictive medicine company) | — | — | |||

Pollack, Jonathan Ontario, Canada | President of the JMP Group (investment and consulting firm) | — | — | |||

Smith Hoke, Robin Ohio, USA | President and Chief Executive Officer of Leiter's Enterprises, Inc. (outsourcing provider of ophthalmology and hospital-based services) | — | — | |||

_________________________

(1) | We do not have any direct information concerning the number of Common Shares beneficially owned by the nominees or concerning our Common Shares over which such persons exercise control or direction. This information was provided to us by the nominees individually. |

(2) | Member of the Audit Committee. |

5

(3) | Member of the NGCC. |

Dr. Norton, Mr. Pollack and Ms. Smith Hoke are the only candidates for election as director who were not elected as directors at the Corporation’s 2017 annual meeting of shareholders. Their biographical information is set forth below.

Dr. Brent Norton - Dr. Norton is a business leader in the life science industry with operational and director experience across several successful enterprises which have achieved significant product sales and returns for investors. He uses his cross functional knowledge to develop strategy, raise capital and build important relationships in the academic and business community. Dr. Norton founded PreMD, completing IPO’s and listings on both the Toronto Stock Exchange and the American Stock Exchange. Operationally, he has research and development and commercial operations, led transactions with AstraZeneca, Eli Lilly, L’Oreal, Parke Davis/Pfizer, etc., and taken products through the FDA to global out-licensing with Johnson & Johnson. He is a founding Director of Novadaq Technologies (TSX:NDQ, NASDAQ:NVDQ) and was recently sold to Stryker Corporation. Dr. Norton has been an active member of several boards in Canada and the United States. He is a Venture Partner at Lumira Capital, Executive Chairman & CEO of Ortho RTI, a member of the Research Committee for CAMH, an Advisory BOD member for the Ivey International Centre for Health Innovation, a Director of Alpine Ontario and Past-President and Director of the Osler Bluff Ski Club.

Jonathan Pollack - Jonathan Pollack is the President of The JMP Group, a private investment and consulting firm. He is also a director of several public and private companies including CECO Environmental Corp. (NASDAQ:CECE). Mr. Pollack also served as a director of API Technologies Corp. (NASDAQ: ATNY), Pinetree Capital Ltd. (TSX:PNP), Hanfeng Evergreen Inc. (TSX:HF) and Lifebank Corp. (TSX-V:LBK). Previously, he served as Executive Vice President of API Technologies Corp. (NASDAQ:ATNY), a leading provider of RF/microwave, microelectronics and security technologies for critical and high-reliability applications from 2009 and as a director from 2007 until January 2011 when it was sold. From March 2005 through its sale in 2009, he served as the Chief Financial Officer and Corporate Secretary of Kaboose Inc. Prior thereto, he worked in investment banking in New York. Mr. Pollack received a Master of Science in Finance from the London School of Economics and a Bachelor of Commerce from McGill University. He sits on the boards of several philanthropic organizations including the Mt. Sinai Hospital Foundation, the Crescent School Foundation, and the Sterling Hall School Foundation.

Robin Smith Hoke - Robin Smith Hoke is a business and legal executive with over 25 years of healthcare and pharmaceutical experience in various legal and business roles where she focused on operations, strategy, business development, acquisitions, strategic relationships, and commercialization. Ms. Hoke currently serves as President & CEO of Leiters, a 503B FDA registered outsourcing service provider with manufacturing facilities in Denver, Colorado and San Jose, California. She also serves as a member of the Board of Directors of Camargo Pharmaceutical Services, LLC., a privately held 505(b)(2) global drug development and regulatory services company in Cincinnati, Ohio. She previously served as a member of the board of Oncobiologics, Inc., a publically held clinical stage biopharmaceutical company focused on identifying, developing, manufacturing and commercializing complex biosimilar therapeutics. She previously served as chair of the Board of Directors and interim chief executive officer at Ricerca Biosciences, LLC, a pre-clinical CRO. Prior to Ricerca, Ms. Hoke served as the president of GeneraMedix, Inc., a specialty generic injectable company and held senior legal and business roles at Cardinal Health, Inc. She also spent time with Abbott Laboratories, Inc., and served as a partner in the business law firm of Kegler, Brown, Hill & Ritter, Co., L.P.A.

To the knowledge of our directors and officers, no proposed director, except as described below:

a) | is, as at the date of this Circular or has been, within ten years before the date of this Circular, a director, chief executive officer or chief financial officer of any company (including us) that, |

i) was subject to a cease trade or similar order or an order that denied the relevant company access to any exemption under securities legislation, that was in effect for a period of more than 30 consecutive days, that was issued while the proposed director was acting in the capacity as director, chief executive officer or chief financial officer; or

ii) | was subject to a cease trade or similar order or an order that denied the relevant company access to any exemption under securities legislation, that was in effect for a period of more than 30 consecutive days, that was issued after the proposed director ceased to be a director, chief executive officer or chief financial officer and which resulted from an event that occurred while that person was acting in the capacity as director, chief executive officer or chief financial officer; or |

b) | is, as at the date of this Circular, or has been within ten years before the date of this Circular, a director or executive officer of any company (including us) that, while that person was acting in that capacity, or within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or |

6

was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets; or

c) | has, within the ten years before the date of this Circular, become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold the assets of the proposed director: |

• | Mr. Gérard Limoges served from 1999 to 2013 as a director of Supratek Pharma Inc., a company that was placed under Court protection under the Companies’ Creditors Arrangement Act (Canada) (the “CCAA”) in January 2009 and made a proposal that was accepted and homologated by the Court on October 30, 2009. In addition, Mr. Limoges was a director of Hart Stores Inc. when it sought protection under the CCAA on August 30, 2011. On February 27, 2012, the Quebec Superior Court sanctioned and approved the plan of compromise and arrangement filed by Hart Stores Inc. under the CCAA. Hart Stores Inc. was subject to a cease trade order issued by the Canadian securities regulatory authorities for failure to file annual and interim financial statements as well as the related management’s discussion and analysis and Chief Executive Officer and Chief Financial Officer certifications within the prescribed periods. |

• | Dr. Brent Norton was a director and officer of PreMD Inc. in April 2009 when PreMD Inc. voluntarily delisted from the Toronto Stock Exchange. Later in April 2009, a general cease trade order by the Ontario Securities Commission was issued against PreMD Inc. for failure to file financial statements. These financial statements were not filed due to cost reasons and this remains so to date. |

• | On February 24, 2014, Mr. Jonathan Pollack was appointed as a director of Hanfeng Evergreen Inc., which was a reporting issuer in all provinces and territories of Canada, and was listed on the Toronto Stock Exchange. Prior to his appointment as a director, the trading of the shares on the Toronto Stock Exchange of Hanfeng Evergreen Inc. had been previously suspended and a cease trade order for failure of to file financial statements had been previously issued by the British Columbia Securities Commission. Similar cease trade orders were subsequently issued by the Ontario Securities Commission (on March 3, 2014), the Autorité des marchés financiers (on March 7, 2014), the Manitoba Securities Commission (on April 16, 2014) and the Alberta Securities Commission (on April 16, 2014). The shares of Hanfeng Evergreen Inc. were delisted from the Toronto Stock Exchange on June 9, 2014. On August 20, 2014, Ernst & Young Inc. was appointed as a receiver and manager over all of the assets of Hanfeng Evergreen Inc. |

7

SECTION 6 | DISCLOSURE OF COMPENSATION |

6.1 | Remuneration of Directors |

The compensation paid to members of our Board who are not our employees (our "Outside Directors") is designed to (i) attract and retain the most qualified people to serve on the Board and its committees, (ii) align the interests of the Outside Directors with those of our shareholders, and (iii) provide appropriate compensation for the risks and responsibilities related to being an effective Outside Director. This compensation is recommended to the Board by the NGCC. The NGCC is composed of three Outside Directors, each of whom is independent, namely Ms. Carolyn Egbert (Chair), Mr. Juergen Ernst and Mr. Michael Cardiff.

The Board has adopted a formal mandate for the NGCC, which is attached as Schedule E to this Circular and is also available on our website at www.aezsinc.com. The mandate of the NGCC provides that it is responsible for, among other matters, assisting the Board in developing our approach to corporate governance issues, proposing new Board nominees, overseeing the assessment of the effectiveness of the Board and its committees, their respective chairs and individual directors, making recommendations to the Board with respect to directors' compensation and generally serving in a leadership role for our corporate governance practices.

6.1.1 | Compensation of Outside Directors |

Retainers

Our Outside Directors are paid an annual retainer, the amount of which depends on the position held on the Board. Our Outside Directors will not be paid fees for their attendance of meetings, unless some circumstance dictates that an unusual and burdensome number of meetings must be held. If such circumstance occurs, the Board of Directors may institute meeting payments. The annual retainers are paid in quarterly installments on or about the last day of each calendar quarter. All payments will be calculated in U.S. dollars. The amount of each payment will be converted to the Outside Director’s home currency based on the exchange rate prevailing on the date of payment, as determined by our finance department. Each Outside Director will be paid the equivalent value of the payment in his or her home currency, net of any withholdings or deductions required by applicable law. Members of the Strategic Review Committee (the "SRC") were granted a monthly retainer in the amount of U.S. $7,500 from July 2017 up to and including January 2018 (the "SRC Retainer"), Ms. Egbert and Mr. Ernst deferred payment of their respective SRC Retainers to 2018.

The amounts of the retainers are set forth in the following table:

Type of Compensation | Annual Retainer for the year 2017 (in US$) | Monthly Retainer for the year 2017 (in US$) | |

Chair of the Board Retainer | 80,000 | - | |

Board Member Retainer | 40,000 | - | |

Audit Committee Chair Retainer | 20,000 | - | |

Audit Committee Member Retainer | 5,000 | - | |

NGCC Chair Retainer | 15,000 | - | |

NGCC Member Retainer | 3,000 | - | |

SRC Chair Retainer | - | 7,500 | |

SRC Member Retainer | - | 7,500 | |

All Directors are reimbursed for travel and other out-of-pocket expenses incurred in attending Board or committee meetings.

The number of Board and committee meetings held during the year ended December 31, 2017 and the attendance records of Board and committee members are presented in Schedule B to this Circular.

8

6.1.2 | Outstanding Option-Based Awards and Share-Based Awards |

The following table shows all awards outstanding to each Outside Director as at December 31, 2017:

Option-based Awards | Share-based Awards | |||||||||||||||||||

Name | Issuance Date | Number of Securities Underlying Unexercised Options(1) | Option Exercise Price | Option Expiration Date | Value of Unexercised In-the-money Options(2) | Issuance Date | Number of Shares or Units of Shares that have Not Vested | Market or Payout Value of Share-based Awards that have Not Vested | ||||||||||||

(mm-dd-yyyy) | (#) | ($) | (mm-dd-yyyy) | ($) | (mm-dd-yyyy) | (#) | ($) | |||||||||||||

Cardiff, Michael | 05-10-2016 | 20,000 | 3.48 | 05-09-2023 | — | — | — | — | ||||||||||||

12-06-2016 | 7,850 | 3.45 | 12-06-2023 | — | — | — | — | |||||||||||||

08-15-2017 | 60,000 | 2.05 | 08-15-2024 | 18,600 | — | — | — | |||||||||||||

Egbert, Carolyn | 05-10-2016 | 10,000 | 3.48 | 05-09-2023 | — | — | — | — | ||||||||||||

12-06-2016 | 7,850 | 3.45 | 12-06-2023 | — | — | — | — | |||||||||||||

08-15-2017 | 60,000 | 2.05 | 08-15-2024 | 18,600 | — | — | — | |||||||||||||

Ernst, Juergen | 05-10-2016 | 10,000 | 3.48 | 05-09-2023 | — | — | — | — | ||||||||||||

12-06-2016 | 7,850 | 3.45 | 12-06-2023 | — | — | — | — | |||||||||||||

08-15-2017 | 60,000 | 2.05 | 08-15-2024 | 18,600 | — | — | — | |||||||||||||

Limoges, Gérard | 05-10-2016 | 10,000 | 3.48 | 05-09-2023 | — | — | — | — | ||||||||||||

12-06-2016 | 7,850 | 3.45 | 12-06-2023 | — | — | — | — | |||||||||||||

08-15-2017 | 60,000 | 2.05 | 08-15-2024 | 18,600 | — | — | — | |||||||||||||

_________________________

(1) | The number of securities underlying unexercised options represents all awards outstanding as at December 31, 2017. |

(2) | "Value of unexercised in-the-money options" at financial year-end is calculated based on the difference between the closing prices of the Common Shares on the NASDAQ on the last trading day of the fiscal year (December 29, 2017) of $2.36 and the exercise price of the options, multiplied by the number of unexercised options. |

See Section 6.3.6 of this Circular, “Long-Term Equity Compensation – Summary of the Stock Option Plan”, for details on the Stock Option Plan.

9

6.1.3 | Total Compensation of Outside Directors |

The table below summarizes the total compensation paid to our Outside Directors during the financial year ended December 31, 2017 (all amounts are in U.S. dollars). Our Outside Directors are paid in their home currency, Messrs. Cardiff and Limoges were paid in Canadian dollars. Ms. Egbert and Mr. Newport were paid in U.S. dollars and Mr. Ernst was paid in euros.

Name | Fees earned | Share-based Awards | Option-based Awards(1) | Non-Equity Incentive Plan Compensation | Pension Value | All Other Compensation | Total | |||||||

($) | ($) | ($) | ($) | ($) | ($) | ($) | ||||||||

Cardiff, Michael | 92,022 | — | 78,000 | — | — | — | 170,022 | |||||||

Egbert, Carolyn | 139,022 | — | 50,000 | — | — | — | 189,022 | |||||||

Ernst, Juergen | 77,524 | — | 50,000 | — | — | — | 127,524 | |||||||

Limoges, Gérard | 73,207 | — | 50,000 | — | — | — | 123,207 | |||||||

Newport, Kenneth(2) | 25,565 | — | — | — | — | — | 25,565 | |||||||

_________________________

(1) The value of option based awards represents the closing price of the Common Shares on the NASDAQ on the last trading day preceding the date of grant ($2.03) multiplied by the Black-Scholes factor as at such date (81%) and the number of stock options granted on such date.

(2) Mr. Newport ceased to be a director of the Corporation on July 12, 2017.

During the financial year ended December 31, 2017, we paid an aggregate amount of $363,940 to all of our Outside Directors for services rendered in their capacity as directors, excluding reimbursement of out-of-pocket expenses and the value of option- based awards granted in 2017.

6.2 | Compensation of Executive Officers |

For the 2017 year, our "Named Executive Officers" were as follows:

• | Mr. David A. Dodd, who served as our President and Chief Executive Officer up to and including July 20, 2017; |

• | Mr. Michael V. Ward, who served as our Interim President and Chief Executive Officer pursuant to a services contract and not as our employee, from July 20, 2017 up to and including October 1, 2017; and currently serves as President and Chief Executive Officer as an employee from October 1, 2017; |

• | Mr. Jeffrey Whitnell, who served as our Interim Chief Financial Officer from September 25, 2017 up to December 7, 2017; |

• | Ms. Genevieve Lemaire, who served as our Vice President, Finance and Chief Accounting Officer and as our interim principal financial officer pursuant to a services contract and not as our employee, up to and including September 30, 2017; and |

• | Mr. Philip A. Theodore, Senior Vice President, Chief Administrative Officer, General Counsel and Corporate Secretary up to and including July 28, 2017; and Mr. Jude Dinges, our Senior Vice President and Chief Commercial Officer up to and including November 3, 2017; and Dr. Richard Sachse, our Senior Vice President and Chief Scientific and Chief Medical Officer, who were our three most highly compensated executive officers (other than our Chief Executive Officer, our current and former Chief Accounting Officer and interim principal financial officer) during 2017. |

6.2.1 | Determining Compensation |

NGCC

The compensation of executive officers of the Corporation and its subsidiaries is recommended to the Board by the NGCC. The NGCC is responsible for, among other matters, (i) assisting the Board in developing our approach to corporate governance issues, (ii) proposing new Board nominees, (iii) overseeing the assessment of the effectiveness of the Board and its committees, their respective chairs and individual directors and (iv) making recommendations to the Board with respect to board member nominees and directors’ compensation, as well as serving in a leadership role for our corporate governance practices. It is also responsible

10

for taking all reasonable actions to ensure that appropriate human resources policies, procedures and systems, e.g., recruitment and retention policies, competency and performance metrics and measurements, training and development programs, and market-based, competitive compensation and benefits structures, are in place so that we can attract, motivate and retain the quality of personnel required to achieve our business objectives. The NGCC also assists the Board in discharging its responsibilities relating to the recruitment, retention, development, assessment, compensation and succession planning for our executive and senior management members.

Thus, the NGCC recommends the appointment of senior officers, including the terms and conditions of their appointment and termination, and reviews the evaluation of the performance of our senior officers, including recommending their compensation and overseeing risk identification and management in relation to executive compensation policies and practices. The Board, which includes the members of the NGCC, reviews the Chief Executive Officer’s corporate strategy, goals and performance objectives and evaluates and measures his or her performance and compensation against the achievement of such goals and objectives.

The NGCC recognizes that the industry, regulatory and competitive environment in which we operate requires a balanced level of risk-taking to promote and achieve the performance expectations of executives of a specialty biopharmaceutical company that is also seeking to acquire or in-license new commercial products. The NGCC is of the view that our executive compensation program should not encourage senior executives to take inappropriate or unreasonable risk. In this regard, the NGCC recommends the implementation of compensation methods that appropriately connect a portion of senior executive compensation with our short-term and long-term performance, as well as that of each individual executive officer and that take into account the advantages and risks associated with such compensation methods. The NGCC is also responsible for establishing compensation policies that are intended to reward the creation of shareholder value while reflecting a balance between our short-term and long-term performance and that of each executive officers.

The Board believes that the members of the NGCC collectively have the knowledge, experience and background required to fulfill its mandate:

Michael Cardiff - Mr. Cardiff was appointed to our Board on January 29, 2016 and elected as a director by our shareholders at our 2016 annual meeting. He was most recently Global Senior Vice President for the Office of the CFO Business Unit at INFOR, a $3 billion revenue software company. His business unit included software for financials, payroll, human resources, performance management, business improvement, planning and forecasting, compliance and risk management. Prior to holding that position, Mr. Cardiff held numerous senior positions in a number of technology companies, including large multinationals such as EDS, SAP and IBM, as well as startup companies such as Fincentric, Convergent Technologies, Tandem, and Stratus Computer. Mr. Cardiff is currently a director of Hydrogenics Corporation (NASDAQ: HYGS; TSX: HYG), and Startech.Com. Mr. Cardiff has also served as a director of other publicly traded companies, including Husky Injection Molding, Descartes Systems Group, Visible Genetics and Burntsand Inc. He has also been a director of private companies, including Solcorp, Spectra Security Software and Visible Decisions and not-for-profit organizations such as The Toronto Film Festival, Roy Thomson Hall and Medic Alert Foundation. Mr. Cardiff is a member of, and holds the ICD.D designation from, the Institute of Corporate Directors.

Carolyn Egbert - Ms. Egbert has served as a director on our Board since August 2012 and as Chair of our Board since May 2016. After enjoying the private practice of law as a defense litigator in Michigan and Washington, D.C., she joined Solvay America, Inc. ("Solvay") (a chemical and pharmaceutical company) in Houston, Texas. Over the course of a twenty-year career with Solvay, she held the positions of Vice President, Human Resources, President of Solvay Management Services, Global Head of Human Resources and Senior Executive Vice President of Global Ethics and Compliance. During her tenure with Solvay, she served as a director on the Board of Directors of seven subsidiary companies and as Chair of one subsidiary board. After retiring in 2010, she established a consulting business providing expertise in corporate governance, ethics and compliance, organizational development, executive compensation and strategic human resources. She holds a Bachelor of Sciences degree in Biological Sciences from George Washington University, Washington D.C. and a Juris Doctor degree from Seattle University, Seattle, Washington. She also was a Ph.D. candidate in Pharmacology at both Georgetown University Medical School at Washington, D.C. and Northwestern University Medical School at Chicago, Illinois. She remains an active member of both the Michigan State Bar and the District of Columbia Bar, Washington, D.C.

Juergen Ernst - Mr. Ernst has served as a director on our Board since 2005. As the former General Manager of the Pharmaceutical Sector of Solvay S.A. (international chemical and pharmaceutical group), Mr. Ernst had extensive senior management experience, where, among other functions, he oversaw the human resources department. Mr. Ernst is also a member of the Board of Directors of Pharming Group N.V., a publicly traded biotechnology company based in the Netherlands.

11

6.3 | Compensation Discussion & Analysis |

6.3.1 | Compensation Philosophy and Objectives |

Our Board, through the NGCC, establishes our executive compensation program that is market-based and at a competitive percentile grouping for both total cash and total direct compensation. The NGCC has established a compensation program that is designed to attract, motivate and retain high-performing senior executives, encourage and reward superior performance and align the executives' interests with those of our shareholders by:

• | providing the opportunity for an executive to earn compensation that is competitive with the compensation received by executives serving in the same or measurably similar positions within comparable companies; |

• | providing the opportunity for executives to participate in equity-based incentive compensation plans; |

• | aligning executive compensation with our corporate objectives; and |

• | attracting and retaining highly qualified individuals in key positions. |

6.3.2 | Compensation Elements |

Our executive compensation is targeted at the 50th percentile for small cap biopharmaceutical companies within both the local and national markets and is comprised of both fixed and variable components. The variable components include equity and non-equity incentive plans. Each compensation component is intended to serve a different function, but all elements are intended to work in concert to maximize both corporate and individual performance by establishing specific, competitive operational and corporate goals and by providing financial incentives to employees based on their level of attainment of these goals.

Our current executive compensation program is comprised of the following four basic components: (i) base salary; (ii) an annual bonus linked to both individual and corporate performance; (iii) equity incentives, consisting solely of stock options granted under our second amended and restated stock option plan adopted by the Board on March 29, 2016 and ratified by the shareholders of Aeterna on May 10, 2016 (the "Stock Option Plan") established for the benefit of our directors, certain executive officers and other participants as may be designated from time to time by either the Board or the NGCC; and (iv) other elements of compensation, consisting of benefits, perquisites and retirement benefits.

Base Salary. Base salaries are intended to provide a steady income to our executive officers regardless of share price. In determining individual base salaries, the NGCC takes into consideration individual circumstances that may include the scope of an executive's position, the executive's relevant competencies or experience and retention risk. The NGCC also takes into consideration the fulfillment of our corporate objectives, as well as the individual performance of the executive.

Short-Term, Non-Equity Incentive Compensation. Our short-term, non-equity incentive compensation plan sets a target cash bonus for each executive officer, expressed as a percentage of the executive officer's base salary. The amount of cash bonus paid to an executive officer depends on the extent to which he or she contributed to the achievement of the annual performance objectives established by the Board for the year. The annual performance objectives are specific operational, clinical, regulatory, financial, commercial and corporate goals that are intended to advance our product pipeline, to promote the success of our commercial efforts and to enhance our financial position. The annual performance objectives are set at the end of each financial year as part of the annual review of corporate strategies. The performance objectives are not established for individual executive officers but rather by functional area(s), many of which are carried out by or fall within the responsibility of our President and Chief Executive Officer, Chief Financial Officer (or principal financial officer) and our other executive officers, including our Named Executive Officers. The award of a cash bonus requires the approval of both the NGCC and the Board and is based upon an assessment of each individual's performance, as well as our overall performance at a corporate level. The determination of individual performance does not involve quantitative measures using a mathematical calculation in which each individual performance objective is given a numerical weight. Instead, the NGCC's determination of individual performance is a subjective determination as to whether a particular executive officer substantially achieved the stated objectives or over-performed or under-performed with respect to corporate objectives that were deemed to be important to our success.

Long-Term Equity Compensation Plan of Executive Officers. The long-term component of the compensation of our executive officers is based exclusively on the Stock Option Plan, which permits the award of a number of options based on the contribution of the officers and their responsibilities. The Board adopted a policy regarding stock option grants in December 2014 (the "2014 Stock Option Policy"), which provides that each Named Executive Officer is eligible to receive options to acquire our Common Shares having a value, based on the Black-Scholes option pricing model, equal to a specified multiple of his or her salary. The specified multiple for the President and Chief Executive Officer is 1.5. The specified multiple for each other Named Executive Officer is 0.75. To encourage retention and focus management on developing and successfully implementing our continuing growth strategy, stock options vest over a period of three years, with the first third vesting on the first anniversary of the date of grant. Stock options are usually granted to executive officers in December of each year.

12

Other Forms of Compensation. Our executive employee benefits program also includes life, medical, dental and disability insurance to the same extent and in the same manner as all other employees. Several of our executive officers also receive a car allowance as a perquisite. These benefits and perquisites are designed to be competitive overall with equivalent positions in comparable North American organizations in the life sciences industry. We also contribute to our North American employees' retirement plans to the extent of 50% of the employee's contribution up to an annual maximum amount of $9,000 for employees in the United States, and up to a maximum of $12,000 for employees and executive officers over 50 years old in the United States. The contribution amounts for our United States employees are subject to limitations imposed by the United States Internal Revenue Service on contributions to our most highly compensated employees. Employees based in Frankfurt, Germany also benefit from certain employer contributions into the employees' pension funds. Our executive officers, including the Named Executive Officers, are eligible to participate in such employer-contribution plans to the same extent and in the same manner as all other employees.

6.3.3 | Positioning |

The NGCC is authorized to engage its own independent consultant to advise it with respect to executive compensation matters. While the NGCC may rely on external information and advice, all of the decisions with respect to executive compensation are made by the Board upon the recommendation of the NGCC and may reflect factors and considerations other than, or that may differ from, the information and recommendations provided by any external compensation consultants that may be retained from time to time.

In 2013, the NGCC retained a compensation consultant to benchmark our executive compensation plan in an effort to determine whether we were achieving our objective of providing market competitive compensation opportunities. The compensation consultant gathered compensation data from companies that it concluded were of comparable size and/or stage of development as us and from other companies with which we compete for executive talent and advised the NGCC that our executive compensation should be generally aligned with the 50th percentile, or the mid-point, of the companies surveyed by the consultant. Furthermore, the consultant advised the NGCC that the total cash target payment (base salary and, if applicable or awarded in cash, annual bonus) for our executive officers in 2013 generally fell around the 50th percentile of the companies surveyed. The NGCC did not repeat or update the benchmarking process in 2014, 2015, 2016 or 2017 because it concluded that doing so would not provide additional meaningful data, considering the expense of the process. However, the NGCC, as a matter of good governance, will review and assess the current compensation program and make appropriate adjustments, if any, during 2018.

6.3.4 | Risk Assessment of Executive Compensation Program |

The Board, through the NGCC, oversees the implementation of compensation methods that tie a portion of executive compensation to our short-term and long-term performance and that of each executive officer and that take into account the advantages and risks associated with such compensation methods. In addition, the Board oversees the creation of compensation policies that are intended to reward the creation of shareholder value while reflecting a balance between our short-term and long-term performance and that of each executive officer. The NGCC has considered in general terms the concept of risk as it relates to our executive compensation program.

Base salaries are fixed in amount to provide a steady income to the executive officers regardless of share price and thus do not encourage or reward risk-taking to the detriment of other important business, operational, commercial or clinical metrics or milestones. The variable compensation elements (annual bonuses and stock options) are designed to reward each of short-term, mid-term and long-term performance. For short-term performance, a discretionary annual bonus may be awarded based on the timing and level of attainment of specific operational and corporate goals that the NGCC believes to be challenging, yet does not encourage unnecessary or excessive risk-taking. While our bonus payments are generally based on annual performance, a maximum bonus payment is pre-fixed for each senior executive officer and represents only a portion of each individual's overall total compensation opportunities. In exceptional circumstances, a particular executive officer may be awarded a bonus that exceeds his or her maximum pre-fixed or target bonus amount. Finally, a significant portion of executive compensation is provided in the form of stock options, which is intended to further align the interests of executives with those of shareholders. The NGCC believes that these awards do not encourage unnecessary or excessive risk-taking since the ultimate value of the awards is tied to our share price, and in the case of grants under the long-term incentive compensation plan, are generally subject to mid-term and long-term vesting schedules to help ensure that executives generally have significant value tied to long-term share price performance.

The NGCC believes that the variable compensation elements (annual bonuses and stock options) represent a percentage of overall compensation that is sufficient to motivate our executive officers to produce superior short-term, mid-term and long-term corporate results, while the fixed compensation element (base salary) is also sufficient to discourage executive officers from taking unnecessary or excessive risks. The NGCC and the Board also generally have the discretion to adjust annual bonuses and stock option grants based on individual performance and any other factors they may determine to be appropriate in the circumstances.

13

Such factors may include, where necessary or appropriate, the level of risk-taking a particular executive officer may have engaged in during the preceding year.

Based on the foregoing, the NGCC has not identified any specific risks associated with our executive compensation program that are reasonably likely to have a material adverse effect on us. The NGCC believes that our executive compensation program does not encourage or reward any unnecessary or excessive risk-taking behavior.

Our directors, executive officers and employees are prohibited from purchasing, selling or otherwise trading in derivative securities relating to our Common Shares. Derivative securities are securities whose value varies in relation to the price of our securities. Examples of derivative securities include warrants to purchase our Common Shares, and put or call options written on our Common Shares, as well as individually arranged derivative transactions, such as financial instruments, including, for greater certainty, pre-paid variable forward contracts, equity swaps, collars, or units of exchange funds, which are designed to hedge or offset a decrease in market value of our equity securities granted as executive compensation or directors' remuneration. Options to acquire Common Shares issued pursuant to our Stock Option Plan are not derivative securities for this purpose.

6.3.5 | 2017 Compensation |

Base Salary. The primary element of our compensation program is base salary. Our view is that a competitive base salary is a necessary element for retaining qualified executive officers. In determining individual base salaries, the NGCC takes into consideration individual circumstances that may include the scope of an executive's position, the executive's relevant competencies or experience and retention risk. The NGCC also takes into consideration the fulfillment of our corporate objectives, as well as the individual performance of the executive.

Short-Term, Non-Equity Incentive Compensation. The Board, based on the NGCC's recommendation, adopted the following performance objectives for 2017:

14

Goal | Result | |

Strengthen Financial Leadership | Hire new CFO (contingent on positive results for Macrilen™ and/or Zoptrex™) | On September 25, 2017, the Corporation announced the appointment of Jeffrey Whitnell to the position of Interim CFO. Mr. Whitnell resigned as CFO effective December 7, 2017. On March 5, 2018, the Corporation appointed James Clavijo as CFO, effective that date. |

Financing | Secure minimum of $15 Million (contingent on positive results for Macrilen™ and/or Zoptrex™), within parameters to be determined by the Board at the time of the financing | Not completed. The Corporation worked on securing the Strongbridge License Agreement |

Investment Banking Relationships | Identify 2-3 new improved-tier investment-banking relationships for presentation to and evaluation by the Board | Not completed. The Corporation continues to work to establish improved investment banking relationships |

Zoptrex™ | Report top-line results | Results were unsuccessful. |

If trial successful, submit regulatory dossier | In light of the results of the ZoptrexTM study, the Corporation shifted its focus to the commercialization of MacrilenTM (macimorelin) | |

Macrilen™ | Report top-line results | Results were released. FDA approval issued on December 20, 2017. |

If confirmatory trial successful, complete submission dossier | ||

Commercial Operations | Launch Macrilen™ field selling | Not completed. The Corporation worked on securing the Strongbridge License Agreement |

Achieve total revenues of $2.34 Million: Macrilen™: $1.0 M | The Company achieved revenues of $0.9 million in 2017. Reported Revenues of MacrilenTM (macimorelin) in 2018. | |

Apifiny®: $700,000 Saizen®: $343,000 | The Company achieved sales of $0.5 million in 2017. | |

Business Development | Out-license Zoptrex™ for Europe and other non-US territories | Not completed. Results were unsuccessful |

Out-license Macrilen™ for Europe and other non-US territories | Not completed. The Company continues to explore out-licensing opportunities | |

Present proposal for in-license of Lutrate Depot to Board | Not completed | |

Dr. Richard Sachse, our Senior Vice President, Chief Medical Officer and Chief Scientific Office was awarded a cash bonus with respect to 2017 in the amount of €100,000 (equivalent to $120,000), which represented 50% of his target bonus.

6.3.6 | Long-Term Equity Compensation |

The Board approved option awards to Mr. Ward on August 15, 2017 in accordance with the Stock Option Plan. Mr. Ward was awarded 150,000 stock options. The stock options have an exercise price of $2.05 and vest in three annual installments commencing on August 15, 2018.

Summary of the Stock Option Plan

We established the Stock Option Plan in order to attract and retain directors, officers, employees and suppliers of ongoing services, who will be motivated to work towards ensuring our success. The Board has full and complete authority to interpret the Stock Option Plan, to establish applicable rules and regulations and to make all other determinations it deems necessary or useful for the administration of the Stock Option Plan, provided that such interpretations, rules, regulations and determinations are consistent with the rules of all stock exchanges and quotation systems on which our securities are then traded and with all relevant securities legislation.

The Stock Option Plan provides that the sole persons eligible to receive grants under the Stock Option Plan (each, a "Participant") shall be: (i) our most senior executive officers, including the persons occupying the positions of Chief Executive Officer, Chief Financial Officer, Chief Scientific Officer, Chief Commercial Officer, Chief Administrative Officer and Chief Compliance Officer; (ii) such other of our executive officers or executive officers of our subsidiaries that may, from time to time, report directly to the Chief Executive Officer; (iii) the non-employee, independent members of the Board; and (iv) such other of our officers or employees or the officers or employees of any of our subsidiaries, as the case may be, or suppliers of ongoing services, as may be expressly designated by resolution of the Board or the NGCC.

15

The maximum number of Common Shares issuable under the Stock Option Plan is fixed at 11.4% of the issued and outstanding Common Shares at any given time, which, as of April 2, 2018, represented 1.9 million Common Shares. There were 875,196 options outstanding under the Stock Option Plan representing approximately 5.3% of all issued and outstanding Common Shares on April 2, 2018. The proposed number of Common Shares issuable pursuant to the Long-Term Incentive Plan is fixed at 11.4% less the number of Common Shares issuable pursuant to stock options granted at such time under the Stock Option Plan. See Section 9 of this Circular, "Approval of the Corporation's Long-Term Incentive Plan" See Section 6.3.6 of this Circular, for complete description of the Long-Term Incentive Plan.

Under the Stock Option Plan, (i) the number of securities issuable to insiders, at any time, or issued within any one-year period, under all of our security-based compensation arrangements, cannot exceed 10% of our issued and outstanding securities and (ii) no single Participant may hold options to purchase, from time to time, more than 5% of our issued and outstanding Common Shares. In addition: (i) the aggregate fair value of options granted under all of our security-based compensation arrangements to any one of our Outside Directors entitled to receive a benefit under the Stock Option Plan, within any one-year period, cannot exceed $100,000 valued on a Black-Scholes basis and as determined by the NGCC; and (ii) the aggregate number of securities issuable to all of our Outside Directors entitled to receive a benefit under the Stock Option Plan, within any one-year period, under all of our security-based compensation arrangements, cannot exceed 1% of its issued and outstanding securities.

Options granted under the Stock Option Plan may be exercised at any time within a maximum period of seven or ten years following the date of their grant (the "Outside Expiry Date"), depending on the date of grant. The Board or the NGCC, as the case may be, designates, at its discretion, the specific Participants to whom stock options are granted under the Stock Option Plan and determines the number of Common Shares covered by each of such option grants, the grant date, the exercise price of each option, the Outside Expiry Date and any other matter relating thereto, in each case in accordance with the applicable rules and regulations of the regulatory authorities. The price at which the Common Shares may be purchased may not be lower than the greater of the closing prices of the Common Shares on the NASDAQ on the last trading day preceding the date of grant of the option. Options granted under the Stock Option Plan shall vest in equal tranches over a three-year period (one-third each year, starting on the first anniversary of the grant date) or as otherwise determined by the Board or the NGCC, as the case may be. Participants may not assign their options (nor any interest therein) other than by will or in accordance with the applicable laws of estates and succession.

Unless the Board or the NGCC decides otherwise, Participants cease to be entitled to exercise their options under the Stock Option Plan: (i) immediately, in the event a Participant who is an officer or employee resigns or voluntarily leaves his or her employment or his or her employment is terminated with cause and, in the case of a Participant who is a non-employee director of us or one of our subsidiaries, the date on which such Participant ceases to be a member of the relevant Board of Directors; (ii) six months following the date on which employment is terminated as a result of the death of a Participant who is an officer or employee and, in the case of a Participant who is an Outside Director, six months following the date on which such Participant ceases to be a member of the Board of Directors by reason of death; (iii) 90 days following the date on which a Participant's employment is terminated for a reason other than those mentioned in (i) or (ii) above including, without limitation, upon the disability, long-term illness, retirement or early retirement of the Participant; and (iv) where the Participant is a service supplier, 30 days following the date on which such Participant ceases to act as such, for any cause or reason (each, an "Early Expiry Date").

The Stock Option Plan also provides that, if the expiry date of one or more options (whether an Early Expiry Date or an Outside Expiry Date) occurs during a "blackout period" or within the seven business days immediately after a blackout period imposed by us, the expiry date will be automatically extended to the date that is seven business days after the last day of the blackout period. For the purposes of the foregoing, "blackout period" means the period during which trading in our securities is restricted in accordance with our corporate policies.

If (i) we accept an offer to amalgamate, merge or consolidate with any other entity (other than one of our wholly-owned subsidiaries) or to sell or license all or substantially all of our assets to any other entity (other than one of our wholly-owned subsidiaries); (ii) we sign a support agreement in customary form pursuant to which the Board agrees to support a takeover bid and recommends that our shareholders tender their Common Shares to such takeover bid; or (iii) holders of more than 50% of our then outstanding Common Shares tender all of their Common Shares to a takeover bid made to all of the holders of the Common Shares to purchase all of the then issued and outstanding Common Shares, then, in each case, all of the outstanding options shall, without any further action required to be taken by us, immediately vest. Each Participant shall thereafter be entitled to exercise all of such options at any time up to and including, but not after the close of business on that date which is ten days following the Closing Date (as defined below). Upon the expiration of such ten-day period, all rights of the Participant to such options or to the exercise of same (to the extent not already exercised) shall automatically terminate and have no further force or effect whatsoever. "Closing Date" is defined to mean (x) the closing date of the amalgamation, merger, consolidation, sale or license transaction in the case of clause (i) above; (y) the first expiry date of the takeover bid on which each of the offeror's conditions are either satisfied or waived in the case of clause (ii) above; or (z) the date on which it is publicly announced that holders of greater than 50% of our then outstanding Common Shares have tendered their Common Shares to a takeover bid in the case of clause (iii) above.

16

The Stock Option Plan provides that the following amendments may be made to the plan only upon approval of each of the Board and our shareholders as well as receipt of all required regulatory approvals:

• | any amendment to Section 3.2 of the Stock Option Plan (which sets forth the limit on the number of options that may be granted to insiders) that would have the effect of permitting, without having to obtain shareholder approval on a "disinterested vote" at a duly convened shareholders' meeting, the grant of any option(s) under the Stock Option Plan otherwise prohibited by Section 3.2; |

• | any amendment to the number of securities issuable under the Stock Option Plan (except for certain permitted adjustments, such as in the case of stock splits, consolidations or reclassifications); |

• | any amendment that would permit any option granted under the Stock Option Plan to be transferable or assignable other than by will or in accordance with the applicable laws of estates and succession; |

• | the addition of a cashless exercise feature, payable in cash or securities, which does not provide for a full deduction of the number of underlying securities from the Stock Option Plan reserve; |

• | the addition of a deferred or restricted share unit component or any other provision that results in employees receiving securities while no cash consideration is received by us; |

• | with respect to any Participant, whether or not such Participant is an "insider" and except in respect of certain permitted adjustments, such as in the case of stock splits, consolidations or reclassifications: |

• | any reduction in the exercise price of any option after the option has been granted, or |

• | any cancellation of an option and the re-grant of that option under different terms, or |

• | any extension to the term of an option beyond its Outside Expiry Date to a Participant who is an "insider" (except for extensions made in the context of a "blackout period"); |

• | any amendment to the method of determining the exercise price of an option granted pursuant to the Stock Option Plan; |

• | the addition of any form of financial assistance or any amendment to a financial assistance provision which is more favorable to employees; and |

• | any amendment to the foregoing amending provisions requiring Board, shareholder and regulatory approvals. |

The Stock Option Plan further provides that the following amendments may be made to the Stock Option Plan upon approval of the Board and upon receipt of all required regulatory approvals, but without shareholder approval:

• | amendments of a "housekeeping" or clerical nature or to clarify the provisions of the Stock Option Plan; |

• | amendments regarding any vesting period of an option; |

• | amendments regarding the extension of an option beyond an Early Expiry Date in respect of any Participant, or the extension of an option beyond the Outside Expiry Date in respect of any Participant who is a "non-insider"; |

• | adjustments to the number of issuable Common Shares underlying, or the exercise price of, outstanding options resulting from a split or a consolidation of the Common Shares, a reclassification, the payment of a stock dividend, the payment of a special cash or non-cash distribution to our shareholders on a pro rata basis provided such distribution is approved by our shareholders in accordance with applicable law, a recapitalization, a reorganization or any other event which necessitates an equitable adjustment to the outstanding options in proportion with corresponding adjustments made to all outstanding Common Shares; |

• | discontinuing or terminating the Stock Option Plan; and |