Exhibit

99.2

Management’s

Discussion and Analysis of Financial Condition and Results of Operations

Introduction

This

Management’s Discussion and Analysis (“MD&A”) provides a review of the results of operations, financial condition

and cash flows of Aeterna Zentaris Inc. for the three and nine-months ended September 30, 2022. In this MD&A, “Aeterna Zentaris”,

“Aeterna” the “Company”, “we”, “us” and “our” mean Aeterna Zentaris Inc.

and its subsidiaries. This discussion should be read in conjunction with the information contained in the Company’s unaudited condensed

consolidated financial statements and the accompanying notes thereto as at September 30, 2022 and for the three and nine-months ended

September 30, 2022 and 2021 and our audited consolidated financial statements and MD&A as of and for the year ended December 31,

2021. The unaudited condensed interim consolidated financial statements as at September 30, 2022 and for the three and nine-months ended

September 30, 2022 and 2021 were prepared in accordance with International Financial Reporting Standards as issued by the International

Accounting Standards Board (“IFRS”) applicable to the preparation of interim financial statements, including IAS 34 interim

financial reporting. The Company’s common shares are listed on both The Nasdaq Capital Market (“Nasdaq”) and on

the Toronto Stock Exchange (“TSX”) under the symbol “AEZS”.

All

amounts in this MD&A are presented in United States (“U.S.”) dollars, except as otherwise noted.

This

MD&A was approved by the Company’s Board of Directors on November 2, 2022. This MD&A is dated November 2, 2022.

Company

Overview

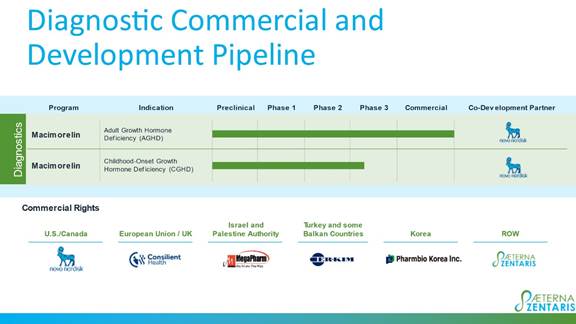

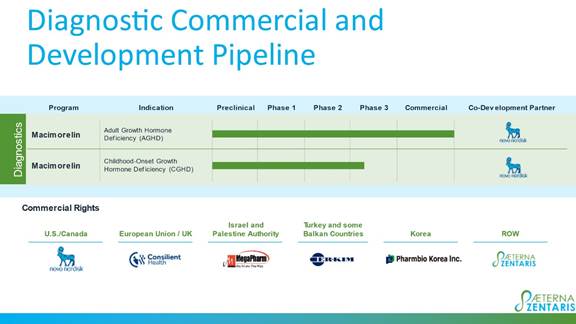

Aeterna

Zentaris is a specialty biopharmaceutical company commercializing and developing therapeutics and diagnostic tests. The Company’s

lead product, Macrilen™ (macimorelin), is the first and only U.S. Food and Drug Administration and European Medicines Agency (“EMA”)

approved oral test indicated for the diagnosis of patients with adult growth hormone deficiency (“AGHD”). Macimorelin is

currently marketed in the U.S. under the trade name Macrilen™ through the license agreement and the amended license agreement (collectively

the “Novo Amendment”) with Novo Nordisk Healthcare AG (“Novo Nordisk” or “Novo”), who was granted

an exclusive license for the development, manufacturing, registration and commercialization of Macrilen™ (macimorelin) for the

diagnosis of adult and pediatric growth hormone deficiency in the U.S. and Canada. On August 26, 2022, the Company announced that Novo

had exercised its right to terminate the Novo Amendment. Following a 270-day notice period, Aeterna will regain full rights to Macrilen™

in the U.S. and Canada.

According

to a commercialization and supply agreement, MegaPharm Ltd. is seeking regulatory approval and plans to subsequently commercialize macimorelin

in Israel and the Palestinian Authority. Additionally, upon receipt of pricing and reimbursement approvals, Aeterna Zentaris has started

marketing macimorelin in Europe and the United Kingdom through license and supply agreements with Consilient Health Ltd. (“Consilient

Health” or “CH”) under which Aeterna Zentaris is entitled to receive: regulatory milestone payments related to agreed-upon

pricing and reimbursement parameters; net sales milestone payments; and royalties, ranging from 10%-20% of net sales, subject to reduction

in certain cases, or sublicense income recorded by Consilient Health. Commercialization in European countries started at the end of May

2022. The Company is also leveraging the clinical success and compelling safety profile of macimorelin to develop it for the diagnosis

of childhood-onset growth hormone deficiency (“CGHD”), an area of significant unmet need. The Company is actively pursuing

business development opportunities for the commercialization of macimorelin in Asia and the rest of the world. We entered into license

and supply agreements with NK Meditech Ltd. (“NK”), a subsidiary of PharmBio Korea, effective November 30, 2021, and a distribution

and commercialization agreement with ER Kim Pharmaceuticals Bulgaria Food (“ER-Kim”), effective February 1, 2022. The agreements

with NK are related to the development and commercialization of macimorelin for the diagnosis of AGHD and CGHD in the Republic of Korea,

while the agreement with ER-Kim is related to the commercialization of macimorelin for the diagnosis of growth hormone deficiency in

children and adults in Turkey and some non-European Union Balkan countries.

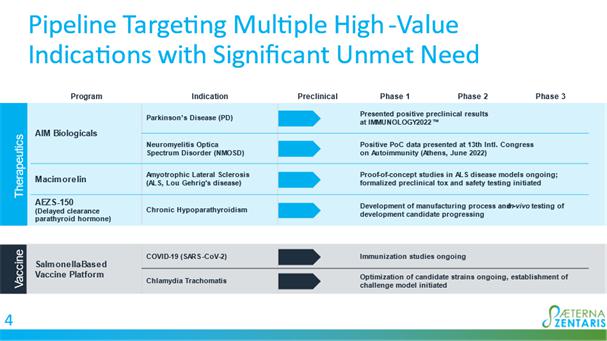

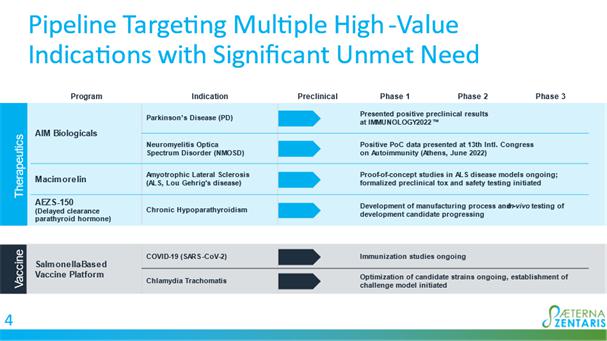

The

Company is also dedicated to the development of therapeutic assets and has taken steps to establish a pre-clinical pipeline to potentially

address unmet medical needs across a number of indications with a focus on rare or orphan indications. To date, we have signed agreements

to establish this growing pipeline across a number of indications, including neuromyelitis optica spectrum disorder (“NMOSD”),

Parkinson’s disease, primary hypoparathyroidism and amyotrophic lateral sclerosis (“ALS”, also known as Lou Gehrig’s

disease). Additionally, the Company is developing oral prophylactic bacterial vaccines against each of SARS-CoV-2, the virus that causes

COVID-19, and chlamydia trachomatis.

About

Forward-Looking Statements

This

document contains statements that may constitute forward-looking statements within the meaning of U.S. and Canadian securities legislation

and regulations, and such statements are made pursuant to the safe-harbor provision of the U.S. Private Securities Litigation Reform

Act of 1995. In some cases, these forward-looking statements can be identified by words or phrases such as “forecast”, “may”,

“will”, “expect”, “anticipate”, “estimate”, “intend”, “plan”,

“indicate”, “believe”, “direct”, or “likely”, or the negative of these terms, or other

similar expressions intended to identify forward-looking statements. In addition, any statements that refer to expectations, intentions,

projections and other characterizations of future events or circumstances contain forward-looking information.

Forward-looking

statements are based on the opinions and estimates of the Company as of the date of this MD&A, and they are subject to known and

unknown risks, uncertainties, assumptions and other factors that may cause the actual results, level of activity, performance or achievements

to be materially different from those expressed or implied by such forward-looking statements, including but not limited to the factors

described under “Risk Factors” in our most recent Annual Report on Form 20-F and those relating to: Aeterna’s expectations

with respect to the DETECT-trial (as further defined below) (including regarding the enrollment of subjects in the DETECT-trial, the

application of the Macimorelin growth hormone stimulation tests and the completion of the DETECT-trial); Aeterna’s expectations

regarding conducting pre-clinical research to identify and characterize an AIM Biologicals-based development candidate for the treatment

of NMOSD as well as Parkinson’s disease (as further defined below), and developing a manufacturing process for selected candidates;

Aeterna’s expectations regarding conducting assessments in relevant Parkinson’s disease models; The University of Queensland’s

undertaking a subsequent investigator initiated clinical trial evaluating macimorelin as a potential therapeutic for the treatment of

ALS and Aeterna’s formulating a pre-clinical development plan for same; the commencement of Aeterna’s formal pre-clinical

development of AEZS-150 in preparation for a potential investigational new drug (“IND”) filing for conducting the first in-human

clinical study of AEZS-150; Aeterna’s plans to perform challenge experiments, select a development candidate, start clinical development

and establish a manufacturing process for the orally active COVID-19 (SARS-CoV-2) and Chlamydia live-attenuated bacterial vaccine; and

the termination of the license agreement with Novo.

Forward-looking

statements involve known and unknown risks and uncertainties and other factors which may cause the actual results, performance or achievements

stated herein to be materially different from any future results, performance or achievements expressed or implied by the forward-looking

information. Such risks and uncertainties include, among others: our reliance on the success of the pediatric clinical trial in the European

Union and U.S. for Macrilen™ (macimorelin); the commencement of the DETECT-trial may be delayed or we may not obtain regulatory

approval to initiate that study; we may be unable to enroll the expected number of subjects in the DETECT-trial and the result of the

DETECT-trial may not support receipt of regulatory approval in CGHD; the coronavirus vaccine platform technology (and any vaccine candidates

using that technology) licensed from the University of Wuerzburg has never been tested in humans, and as such, further pre-clinical or

clinical studies of that technology and any vaccine developed using that technology may not be effective as a vaccine against COVID-19

(SARS-CoV-2) or against any other coronavirus disease; the timeline to develop a vaccine may be longer than expected; such technology

or vaccines may not be capable of being used orally or may not have the same characteristics as vaccines previously approved using the

Salmonella Typhi Ty21a carrier strain; results from ongoing or planned pre-clinical studies of macimorelin by the University of Queensland

or for our other products under development may not be successful or may not support advancing the product to human clinical trials;

our ability to raise capital and obtain financing to continue our currently planned operations; our dependence on the success of Macrilen™

(macimorelin) and related out-licensing arrangements and the continued availability of funds and resources to successfully commercialize

the product, including the Company exploring all options for Macrilen™ following the termination notice received from Novo;

global instability due to the global pandemic of COVID-19 and COVID-19’s impact on our operations, which, as discussed below,

has resulted in and is expected to result in delays and higher-than-expected costs associated with our clinical development initiatives

related to Macrilen™ in the pediatric indication; interruptions due to the Russian invasion of Ukraine, which has also resulted

and is expected to result in delays and higher-than-expected costs associated with our clinical development initiatives related to Macrilen™

in the pediatric indication, as discussed below; our ability to enter into out-licensing, development, manufacturing, marketing and distribution

agreements with other pharmaceutical companies and to keep such agreements in effect; and our ability to continue to list our common

shares on the Nasdaq or the TSX. These risk factors are not intended to represent a complete list of the risk factors that could affect

the Company. These factors and assumptions, however, should be considered carefully. More detailed information about these and other

factors is included under “Risk Factors” in our most recent Annual Report on Form 20-F. Although the Company has attempted

to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements,

there may be other factors that cause results not to be as anticipated, estimated or intended. Many of these factors are beyond our control.

There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially

from those anticipated in such statements, particularly in light of the ongoing and developing COVID-19 pandemic and its impact on the

global economy and its uncertain impact on the Company’s business. Accordingly, readers should not place undue reliance on forward-looking

statements. The Company does not undertake to update any forward-looking statements contained herein, except as required by applicable

securities laws. New factors emerge from time to time, and it is not possible for the Company to predict all of these factors, or to

assess in advance the impact of each such factor on the Company’s business or the extent to which any factor, or combination of

factors, may cause actual results to differ materially from those contained in any forward-looking statement.

Certain

forward-looking statements contained herein about prospective results of operations, financial position or cash flows may constitute

a financial outlook. Such statements are based on assumptions about future events, are given as of the date hereof and are based on economic

conditions, proposed courses of action and management’s assessment of the relevant information currently available. Management

of the Company has approved the financial outlook as of the date hereof. Readers are cautioned that such financial outlook information

contained herein should not be used for purposes other than for which it is disclosed herein.

About

Material Information

This

MD&A includes information that we believe to be material to investors after considering all circumstances. We consider information

and disclosures to be material if they result in, or would reasonably be expected to result in, a significant change in the market price

or value of our securities, or where it is likely that a reasonable investor would consider the information and disclosures to be important

in making an investment decision.

We

are a reporting issuer under the securities legislation of all of the provinces of Canada, and our securities are registered with the

SEC. We are therefore required to file or furnish continuous disclosure information, such as interim and annual financial statements,

management’s discussion and analysis, proxy or information circulars, Form 20-F, material change reports and press releases with

the appropriate securities regulatory authorities. Additional information about the Company and copies of these documents may be obtained

free of charge upon request from our Corporate Secretary or online at: www.zentaris.com, www.sedar.com and www.sec.gov.

Diagnostic

Commercial and Development Pipeline

Macimorelin

Clinical Program

On

January 28, 2020, we announced the successful completion of patient recruitment for the first pediatric study of macimorelin as a growth

hormone stimulation test for the evaluation of growth hormone deficiency (“GHD”) in children. This study, AEZS-130-P01 (“Study

P01”), was the first of two studies as agreed with the EMA in our pediatric investigation plan for macimorelin as a GHD diagnostic.

Macimorelin, a ghrelin agonist, is an orally active small molecule that stimulates the secretion of growth hormone from the pituitary

gland into the circulatory system. The goal of Study P01 was to establish a dose that can both be safely administered to pediatric patients

and cause a clear rise in growth hormone concentration in subjects ultimately diagnosed as not having GHD. The recommended dose derived

from Study P01 is being evaluated in the pivotal second study, DETECT-trial, on diagnostic efficacy and safety.

In

late 2020, Aeterna entered into the start-up phase for the clinical safety and efficacy study, AEZS-130-P02 (“DETECT-trial”),

evaluating macimorelin for the diagnosis of CGHD. The DETECT-trial is an open-label, single dose, multicenter and multinational study

expected to enroll approximately 100 subjects worldwide, with at least 40 pre-pubertal and 40 pubertal subjects, and a minimum of 25

subjects expected to be enrolled in the U.S. The study design is expected to be suitable to support a claim for potential stand-alone

testing, if successful. In addition, under the Novo Amendment, Novo and Aeterna agreed that Novo will fund DETECT-trial costs up to $8.6

million (€9 million), which includes reimbursement of Aeterna’s relevant budgeted internal labor costs. Any additional external

jointly approved DETECT-trial costs incurred over $8.6 million (€9 million) will be shared equally between Novo and Aeterna. On

April 22, 2021, the U.S. FDA Investigational New Drug Application associated with this clinical trial became active, see: https://clinicaltrials.gov/ct2/show/NCT04786873,

and on May 13, 2021, we announced the opening of the first clinical site in the U.S.

On

January 26, 2022, the Company announced that it had experienced unavoidable delays in site initiation and patient enrollment due to the

rise of the Omicron variant in the COVID-19 pandemic. Our team is diligently working to get more clinical sites up and running with the

goal of building momentum and bringing this study across the finish line while navigating as best as possible through this challenge.

We have engaged a contract research organization (“CRO”) to conduct the DETECT-trial in the United States and in various

European countries, including Russia and Ukraine, where, in February 2022, due to the war between those nations, the clinical trial activities

were halted. Consequently, no patients have been enrolled in either of these countries’ clinical sites to date. Russia’s

invasion of Ukraine has impacted our ability to conduct our trials in the region. This could delay or hinder the completion of our clinical

trials and/or analyses of clinical results, which could materially harm our business.

Management’s

current estimated impacts of delays and higher-than-expected costs related to Macrilen’s ™ pediatric clinical development

due to both COVID-19 and the Russia/Ukraine war are discussed further below.

On

August 26, 2022, the Company announced it will regain full rights to Macrilen™ for the U.S. and Canada territories, following Novo’s

termination of the development and commercialization license agreement, which triggered a 270-day notice period. Novo will continue

to fund DETECT-trial costs up to $8.6 million (€9 million), which includes reimbursement of Aeterna’s relevant budgeted internal

labor costs. Any additional DETECT-trial costs incurred over $8.6 million (€9 million) up to $9.2 million (€9.8 million) will

be shared equally between Novo and Aeterna. The Company plans to engage in efforts to explore all options for Macrilen™.

Macimorelin

Commercialization Program

On

November 16, 2020, the Company announced that it had entered into the Novo Amendment related to the development and commercialization

of macimorelin. Novo is currently marketing macimorelin in the U.S. under the trade name Macrilen™ for the diagnosis of AGHD. Aeterna,

in collaboration with Novo, is currently developing the expanded use of macimorelin for the diagnosis of CGHD, an area of significant

unmet medical need. Following the termination of the Novo Amendment, pursuant to the terms of the Novo Amendment, Novo is required to

continue to fulfil its obligations during the 270-day notice period.

On

December 7, 2020, the Company entered into an exclusive licensing agreement with Consilient Health Limited (“CH” or “Consilient”)

for the commercialization of macimorelin in the European Economic Area and the United Kingdom. In December 2021, the Department of Health

and Social Care in the United Kingdom approved a list price which triggered a $226 (€0.2 million) pricing milestone payment from

CH to the Company. In Germany, a list price was approved on June 15, 2022 which triggered a second $226 (€0.2 million) pricing milestone

payment from CH to the Company. We shipped initial batches of macimorelin (Ghryvelin®) to Consilient in the first quarter of 2022.

Consilient launched the product meanwhile in the United Kingdom, Sweden, Denmark, Finland, Germany and Austria. More

EU countries will follow pending re-imbursement negotiations.

We

entered into license and supply agreements with NK Meditech Ltd. (“NK”), a subsidiary of PharmBio Korea, effective November

30, 2021, and a distribution and commercialization agreement with ER Kim Pharmaceuticals Bulgaria Food (“ER-Kim”), effective

February 1, 2022. The agreements with NK are related to the development and commercialization of macimorelin for the diagnosis of AGHD

and CGHD in the Republic of Korea, while the agreement with ER-Kim is related to the commercialization of macimorelin for the diagnosis

of growth hormone deficiency in children and adults in Turkey and some non-European Union Balkan countries.

On

April 19, 2022, we announced that European Patent Office had issued a patent providing intellectual property protection of macimorelin

in 27 countries within the European Union as well as additional European non-EU countries, such as the UK and Turkey, for macimorelin

(Ghryvelin®; Macrilen™) for use to diagnose GHD in adults.

Pipeline

Expansion Opportunities

Bacterial

Vaccine Platform: Orally active, live-attenuated bacterial vaccine platform with potential application against viruses and bacteria,

such as coronaviruses and chlamydia bacteria

On

February 2, 2021, the Company announced that it had entered into an exclusive option agreement (the “University License Agreement”)

to evaluate a preclinical potential COVID-19 vaccine developed at the University of Wuerzburg (the “University”). On March

14, 2021, the Company exercised the option to enter into a license agreement with the University. Pursuant to the terms of the University

License Agreement, the Company has been granted an exclusive, world-wide, license to certain patent applications and know-how owned by

the University to research and develop, manufacture, and sell a potential COVID-19 vaccine using the University’s bacterial vaccine

platform technology. The Company has paid an up-front payment under the University License Agreement and will conduct milestones payments

upon achievement of certain development, regulatory, and sales milestones, as well as a percentage of any sub-licensing revenue received

by the Company as well as royalty payments on net sales of the licensed vaccine products (including for by the Company or its sub-licensees).

Pursuant to the University License Agreement, the University granted the Company an exclusive option for the exclusive use of the licensed

rights in an undisclosed field. In September 2021, the Company exercised this option and disclosed the field to be Chlamydia trachomatis.

Additionally, the Company has entered into a research agreement under which the Company has engaged the University on a fee-for-service

basis to conduct supplementary research activities and preclinical development studies on the potential vaccines.

The

vaccine technology developed at the University is based on the active live-attenuated bacterial typhoid fever vaccine Salmonella Typhi

Ty21a with an excellent safety profile, as a carrier strain. Our vaccines have the potential to be administered orally (topically), induce

mucosal immunity, believed to be critical to suppress infection, induce a response to more than one antigen (similar to the spike protein),

and be stored and distributed at 2°C to 8°C. We believe that, if there is sufficient data to advance into human clinical trials,

the development program for these vaccines is expected to be abbreviated, as clinical safety data and manufacturing technology is already

available for the underlying vaccine strain.

The

Coronavirus outbreak began in the end of 2019 and in 2022 continues to infect worldwide populations with vaccinated people getting infected

and with booster vaccinations being needed. The competition is large with 11 vaccines currently being in clinical studies only in Europe.

Our COVID-19 vaccine candidate is unique in stimulating the mucosal immune system giving the potential to eliminate the virus when it

enters the body, before an infection can occur, and drastically reducing the risk of vaccinated people getting infected and spreading

the virus. In addition, the oral application and its expected storage stability should greatly facilitate distribution and administration.

Our next development steps include evaluating the administration route, dose and immunization scheme; initiating in-vivo immunology experiments

with antigen variant candidates in relevant mice models; conducting virus challenge experiments in immunized transgenic animals; starting

the manufacturing process assessment / development; and conducting pre-clinical safety and toxicology assessments.

Chlamydia

trachomatis is a sexually transmitted bacterium infecting over 130 million subjects annually. In US, the prevalence 2.4 million per year,

the incidence is 4 million per year, and the associated yearly health cost $691 million. The disease can spread to the reproductive tract

eventually inducing infertility, miscarriage, or ectopic pregnancy, which is a life-threatening condition. Additionally, ocular infections

can lead to inclusion conjunctivitis or trachoma, which is the primary source of visual impairment or infectious blindness. While diagnosed

infections can be treated with antibiotics, three quarters of all infections are asymptomatic and currently no vaccine exists to protect

against chlamydia. The potential strengths of our chlamydia vaccine candidate are the mucosal immunity, oral administration, good stability,

and inexpensive production. Our next development steps include designing and preparing candidate vaccine strains; evaluating administration

route, dose and immunization scheme; and initiating in-vivo immunology experiments with candidate strains in relevant mouse models.

On

March 10, 2022, the Company announced the expansion of its research program with the University of Wuerzburg to include the development

of human 3D intestinal tissue models to study infection biology in the gut, the site of Salmonella primary action.

Delayed

Clearance Parathyroid Hormone (“DC-PTH”) Fusion Polypeptides: Potential treatment for chronic hypoparathyroidism

On

March 11, 2021, the Company entered into an exclusive license agreement with The University of Sheffield, United Kingdom, for the intellectual

property relating to parathyroid hormone (“PTH”) fusion polypeptides covering the field of human use, which is being initially

studied by Aeterna for the potential therapeutic treatment of chronic hypoparathyroidism (“HypoPT”). Under the terms of the

exclusive patent and know-how license agreement entered into with the University of Sheffield, Aeterna obtained worldwide rights to develop,

manufacture and commercialize PTH fusion polypeptides covered by the licensed patent applications for all human uses for an up-front

cash payment, and milestone payments to be paid upon the achievement of certain development, regulatory and sales milestones, as well

as low single digit royalty payments on net sales of those products and certain fees payable in connection with sublicensing. Aeterna

will be responsible for the further development, manufacturing, approval, and commercialization of the licensed products. Aeterna has

also engaged the University of Sheffield under a research contract to conduct certain research activities to be funded by Aeterna, the

results of which will be included within the scope of the license granted to Aeterna.

The

researchers at the University of Sheffield have developed a method to increase the serum clearance time of peptides, which the Company

is applying to the development of a treatment for HypoPT, an orphan disease where the PTH level is abnormally low or absent. In consultation

with The University of Sheffield, Aeterna has selected AEZS-150 as the lead candidate in its DC-PTH program. AEZS-150 is being developed

to provide a weekly treatment option of chronic hypoparathyroidism in adults and our next steps include working with The University of

Sheffield to conduct in depth characterization of the development candidate (in-vitro and in-vivo). We have selected and engaged a contract

development and manufacturing company for developing the manufacturing process; and are preparing for the formal pre-clinical development

of AEZS-150 towards a potential IND filing for conducting the first in-human clinical study.

AIM

Biologicals: Targeted, highly specific autoimmunity modifying therapeutics for the potential treatment of neuromyelitis optica spectrum

disorder and Parkinson’s disease

In

January 2021, Aeterna entered into an exclusive patent license and research agreement with the University of Wuerzburg, Germany, for

worldwide rights to develop, manufacture, and commercialize AIM Biologicals for the potential treatment of NMOSD. Additionally, the Company

has engaged Dr. Joerg Wischhusen from the University Hospital in Wuerzburg as well as neuro-immunologist Dr. Michael Levy from the Massachusetts

General Hospital in Boston as consultants for scientific support and advice in the field of inflammatory CNS disorders, autoimmune diseases

of the nervous system, and NMOSD. In September 2021, the Company entered into an additional exclusive license with the University of

Wuerzburg for early pre-clinical development towards the potential treatment of Parkinson’s disease.

AIM

Biologicals is based on a feto-maternal-tolerance, natural process during pregnancy, which induces immunogenic tolerance of the maternal

immune system to the partially foreign fetal antigens. Fetal proteins are processed and presented on certain immunosuppressive major

histocompatibility complex class I molecules to induce this tolerance. In an autoimmune disease, the immune system is misdirected and

targets the body’s own protein. With AIM Biologicals, we aim to restore the tolerance against such proteins to selectively treat

autoimmune diseases.

NMOSD

is an autoimmune disease targeting the protein aquaporin 4, primarily found in optic nerves and the spinal cord, and is a disease which

leads to blindness and paralysis, more commonly in persons with Asian or African ancestors as compared to European ancestors, and more

prevalent among women. NMOSD progresses in often life-threatening relapses, which are aggressively treated with high-dose steroids and

plasmapheresis. Our pre-clinical plans include conducting in-vitro and in-vivo assessments to select an AIM Biologicals-based development

candidate; and manufacturing process development for the selected candidate. First pre-clinical in-vivo proof of concept results

were presented by our university collaborators at the 13th International Congress on Autoimmunity (June 2022; Athens; Greece).

Parkinson’s

disease is a neurological disease commonly associated with motoric problems with a slow and fast progression form. Dopaminergic medication

is the mainstay treatment of Parkinson disease symptoms, but currently there is no pharmacological therapy to prevent or delay disease

progression leading to alternate treatments, such as deep brain stimulation with short electric bursts, being investigated for the treatment

of symptoms. For the development of AIM Biologicals as potential PD therapeutics, Aeterna plans to utilize, among others, an innovative

animal model on neurodegeneration by α-synuclein-specific T cells in AAV-A53T-α-synuclein Parkinson’s disease mice,

which has recently been published by University of Wuerzburg researchers. Our next steps include designing and producing antigen-specific

AIM Biologics molecules for the potential treatment of Parkinson’s disease; and conducting in-vitro and in-vivo assessments in

relevant Parkinson’s disease models. Also for this indication, first pre-clinical in-vivo proof of concept results were

presented by our university collaborators at the IMMUNOLOGY2022™ conference in Portland (Oregon; USA).

Macimorelin

Therapeutic: Ghrelin agonist in development for the treatment of amyotrophic lateral sclerosis (Lou Gehrig’s disease)

In

January 2021, the Company entered into a material transfer agreement with the University of Queensland, Australia, to provide macimorelin

for the conduct of pre-clinical and subsequent clinical studies, evaluating macimorelin as a potential therapeutic for the treatment

of amyotrophic lateral sclerosis (“ALS”, or more commonly known as Lou Gehrig’s disease). ALS is a rare progressive

neurological disease primarily affecting the neurons controlling voluntary movement, leading to the disability to control movements such

as walking, talking, and chewing. Most people with ALS die from respiratory failure, usually between three to five years after diagnosis.

Currently there is no cure for ALS and no effective treatment to halt or reverse the progression of the disease. Ghrelin is a hormone

with wide-ranging biological actions, best known for stimulating growth hormone release, which is demonstrating emerging evidence as

therapeutic for ALS. As a ghrelin agonist, macimorelin has the potential as a treatment for ALS, which is evaluated in this research

collaboration. The University of Queensland researchers have filed for supportive grants to conduct such clinical studies. AEZS and the

UniQuest, the University of Queensland commercialization company, have signed a R&D and license option agreement effective July 1st,

2022. Our next steps include working with the University of Queensland to conduct proof-of-concept studies with macimorelin in disease-specific

animal models, but we also started conducting independent proof-of-concept studies with macimorelin in such animal models as well as

assessing alternative formulations and preparing to conduct the formal preclinical development with the required toxicology and safety

studies.

The

Company is evaluating alternative formulations for administration routes more suitable for ALS with the goal of ensuring sufficient bioavailability

and expects to provide updates on its progress as results become available.

Nasdaq

Letters and Share Consolidation

On

July 28, 2021, we received a letter from the Listing Qualifications Staff of the Nasdaq, notifying us that during the 30 consecutive

business days prior to the date of the letter, the closing bid price of our common shares was below US$1.00 per share and, therefore,

we did not meet the requirement for continued listing on Nasdaq as required by Nasdaq Listing Rule 5550(a)(2) (the “Bid Price Rule”).

In accordance with Nasdaq Listing Rule 5810(c)(3)(A), we were granted a grace period of 180 calendar days, through January 24, 2022.

On January 26, 2022, we announced that the Listing Qualifications Staff of the Nasdaq had notified the Company that it has been granted

an additional 180 calendar day period, through July 26, 2022, to comply with the US$1.00 minimum bid price requirement for continued

listing on the Nasdaq.

On

July 15, 2022, we announced that our shareholders had approved consolidation of our issued and outstanding common shares on a twenty-five

(25) to one (1) basis (the “Share Consolidation”), subject to approval of the Toronto Stock Exchange and the Nasdaq. On July

21, 2022 the Share Consolidation was effected and the Common Shares began trading on the TSX and Nasdaq on a post-Consolidation basis.

The Share Consolidation reduced the number of Common Shares issued and outstanding from 121,397,007 to 4,855,876 Common Shares. Accordingly,

all common shares, DSU and Warrants, stock options and per share amounts in the Company’s condensed interim consolidated

financial statements have been retroactively adjusted for all periods presented to give effect to the reverse stock split. Outstanding

stock options were proportionately reduced and the respective exercise prices, if applicable, were proportionately increased.

The

Company proceeded with the Share Consolidation in order to satisfy the Bid Price Rule. As the Company did not trade at or above the U.S.

$1.00 per Common Share for ten consecutive trading days by July 25, 2022, the current expiration date of its grace period, it received

a notice of delisting on July 28, 2022. On August 3, 2022, Company received formal notice from Nasdaq that the Company evidenced compliance

with the Bid Price Rule and all other applicable continued listing requirements and that the Nasdaq listing matter was closed.

Exposure

to Epidemic or Pandemic Outbreak

Coronavirus,

or COVID-19, a contagious disease that was characterized by the World Health Organization as a pandemic in early 2020, continues to affect

the global community. The significant spread of COVID-19 resulted in a widespread health crisis and has had adverse effects on national

economies generally, on the markets that we serve on our operations and on the market price of our common shares.

The

spread of COVID-19 may continue to impact our operations, including the potential interruption of our clinical trial activities and of

our supply chain. For example, the rise in the Omicron variant in the COVID-19 pandemic has caused delays in site initiation and patient

enrollment in our Phase 3 DETECT clinical trial for diagnostic use in childhood-onset growth hormone deficiency. Additionally, sales

activities for Macrilen™ in the U.S. may be impacted due to delays of diagnostic activities on AGHD in the U.S. Further, the COVID-19

pandemic may also cause some patients to be unwilling to enroll in our trials or be unable to comply with clinical trial protocols if

quarantines impede patient movement or interrupt healthcare services, which would delay our ability to conduct clinical trials or release

clinical trial results on a timely basis and could delay our ability to obtain regulatory approval and commercialize our product candidates.

The spread of an infectious disease, including COVID-19, may also result in the inability of our suppliers to deliver components or raw

materials on a timely basis or at all. In addition, hospitals may reduce staffing and reduce or postpone certain treatments in response

to the spread of an infectious disease. Such events may result in a period of business disruption and, in reduced operations, doctors

or medical providers may be unwilling to participate in our clinical trials, any of which could materially affect our business, financial

condition or results of operations.

Given

this rapidly evolving situation, the duration, scope and impact on our business operations, clinical studies and financial results have

been and are expected to continue to be impacted by the pandemic, as discussed further below. Aeterna Zentaris has developed protocols

and procedures should they be required to deal with any potential epidemics and pandemics and has implemented these protocols and procedures

to address the current COVID-19 pandemic. Despite appropriate steps being taken to mitigate such risks, there can be no assurance that

existing policies and procedures will ensure that the Company’s operations will not be adversely affected. The COVID-19 pandemic

has resulted in a widespread health crisis that has adversely affected the economies and financial markets of many regions and countries.

There can be no assurance that a disruption in financial markets, regional economies and the world economy would not negatively affect

Aeterna Zentaris’ access to capital or its financial performance.

Uncertain

factors, including the duration of the outbreak, the severity of the disease and the actions to contain or treat its impact, could impair

our operations including, among other things, employee mobility and productivity, availability of our facilities, conduct of our clinical

trials and the availability and the productivity of third-party product and service suppliers. Please see the risk factor section titled

“The economic effects of a pandemic, epidemic or outbreak of an infectious disease could adversely affect our operations or the

market price of our Common Shares” in our most recent Form 20-F.

Russia/Ukraine

Conflict

Conducting

clinical trials in foreign countries, as in our ongoing DETECT-trial, presents additional risks that may delay completion of our clinical

trials. These risks include the failure of enrolled patients in foreign countries to adhere to clinical protocol as a result of differences

in healthcare services or cultural customs, managing additional administrative burdens associated with foreign regulatory schemes, as

well as political and economic risks, including war, relevant to such foreign countries. For example, we have engaged a CRO to conduct

the DETECT-trial outside the United States, including in Russia and Ukraine, and clinical trial activities in those countries are being

halted due to the war in Ukraine (which represents approximately 25 patients). To date, no patients have been enrolled in these clinical

trials.

Furthermore,

the United States and its European allies have imposed significant new sanctions against Russia, including regional embargoes, full blocking

sanctions, and other restrictions targeting major Russian financial institutions. Our ability to conduct clinical trials in Russia, parts

of Ukraine and elsewhere in the region have become restricted under applicable sanctions laws, which require us to identify alternative

trial sites, thereby increasing our development costs and delaying the clinical development of our product candidates.

Condensed

Interim Consolidated Statements of Comprehensive Income (Loss) Data

(in

thousands, except share and per share data)

| | |

Three months ended | | |

Nine months ended | |

| | |

September 30, | | |

September 30, | |

| | |

2022 | | |

2021 | | |

2022 | | |

2021 | |

| | |

| | |

(As restated) (1) | | |

| | |

(As restated) (1) | |

| | |

$ | | |

$ | | |

$ | | |

$ | |

| Revenues | |

| | | |

| | | |

| | | |

| | |

| License fees | |

| 605 | | |

| 293 | | |

| 831 | | |

| 1,309 | |

| Development services | |

| 1,202 | | |

| 684 | | |

| 2,091 | | |

| 2,809 | |

| Product sales | |

| — | | |

| — | | |

| 57 | | |

| — | |

| Royalties | |

| 14 | | |

| 20 | | |

| 57 | | |

| 47 | |

| Supply chain | |

| 39 | | |

| 55 | | |

| 119 | | |

| 139 | |

| Total revenues | |

| 1,860 | | |

| 1,052 | | |

| 3,155 | | |

| 4,304 | |

| Operating expenses | |

| | | |

| | | |

| | | |

| | |

| Cost of sales | |

| 14 | | |

| 31 | | |

| 106 | | |

| 72 | |

| Research and development expenses | |

| 3,293 | | |

| 1,485 | | |

| 8,081 | | |

| 4,711 | |

| General and administrative expenses | |

| 2,057 | | |

| 1,228 | | |

| 5,396 | | |

| 4,137 | |

| Selling expenses | |

| 217 | | |

| 360 | | |

| 822 | | |

| 924 | |

| Total operating expenses | |

| 5,581 | | |

| 3,104 | | |

| 14,405 | | |

| 9,844 | |

| Loss from operations | |

| (3,721 | ) | |

| (2,052 | ) | |

| (11,250 | ) | |

| (5,540 | ) |

| Gain (loss) due to changes in foreign currency exchange rates | |

| 301 | | |

| 124 | | |

| 977 | | |

| (42 | ) |

| Other finance costs | |

| — | | |

| (4 | ) | |

| (3 | ) | |

| (21 | ) |

| Net finance income (costs) | |

| 301 | | |

| 120 | | |

| 974 | | |

| (63 | ) |

| Loss before income taxes | |

| (3,420 | ) | |

| (1,932 | ) | |

| (10,276 | ) | |

| (5,603 | ) |

| Income tax recovery | |

| — | | |

| — | | |

| — | | |

| 129 | |

| Net loss | |

| (3,420 | ) | |

| (1.932 | ) | |

| (10,276 | ) | |

| (5,474 | ) |

| Other comprehensive income (loss): | |

| | | |

| | | |

| | | |

| | |

| Items that may be reclassified subsequently to profit or loss: | |

| | | |

| | | |

| | | |

| | |

| Foreign currency translation adjustments | |

| (105 | ) | |

| 39 | | |

| (26 | ) | |

| 460 | |

| Items that will not be reclassified to profit or loss: | |

| | | |

| | | |

| | | |

| | |

| Actuarial gain (loss) on defined benefit plans and remeasurement of the net defined benefit liability | |

| (1,794 | ) | |

| 219 | | |

| 6,231 | | |

| 133 | |

| Comprehensive loss | |

| (5,319 | ) | |

| (1,674 | ) | |

| (4,071 | ) | |

| (4,881 | ) |

| Net loss per share [basic and diluted] | |

| (0.70 | ) | |

| (0.40 | ) | |

| (2.12 | ) | |

| (1.21 | ) |

| Weighted average number of shares outstanding: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 4,855,876 | | |

| 4,851,880 | | |

| 4,855,876 | | |

| 4,509,731 | |

| Diluted | |

| 4,855,876 | | |

| 4,851,880 | | |

| 4,855,876 | | |

| 4,509,731 | |

| (1) |

This restatement is discussed below in the “Results of

operations” section, subsection “Restatement of Comparative Period Figures”. The interim financial statements for the

period ended September 30, 2021 have not been refiled, but the comparatives are corrected in the interim financial statements for the

periods ended September 30, 2022 filed with this MD&A. |

Condensed

Interim Consolidated Statements of Financial Position Data

(in

thousands)

| | |

As

at September 30,

2022 | | |

As

at December 31,

2021 | |

| | |

$ | | |

$ | |

| Cash and cash equivalents | |

| 53,816 | | |

| 65,300 | |

| Trade and other receivables and other current assets | |

| 4,556 | | |

| 5,447 | |

| Inventory | |

| 238 | | |

| 73 | |

| Restricted cash equivalents | |

| 300 | | |

| 335 | |

| Property, plant and equipment | |

| 40 | | |

| 42 | |

| Right of use assets | |

| 85 | | |

| 150 | |

| Other non-current assets | |

| 7,571 | | |

| 8,755 | |

| Total assets | |

| 66,606 | | |

| 80,102 | |

| Payables and accrued liabilities and income taxes payable | |

| 2,386 | | |

| 2,787 | |

| Current portion of provisions | |

| 25 | | |

| 34 | |

| Current portion of deferred revenues | |

| 3,484 | | |

| 4,815 | |

| Lease liabilities | |

| 89 | | |

| 161 | |

| Non-financial non-current

liabilities (1) | |

| 11,204 | | |

| 19,319 | |

| Total liabilities | |

| 17,188 | | |

| 27,116 | |

| Shareholders’ equity | |

| 49,418 | | |

| 52,986 | |

| Total liabilities and shareholders’ equity | |

| 66,606 | | |

| 80,102 | |

Critical

Accounting Policies, Estimates and Judgments

The

preparation of condensed interim consolidated financial statements in accordance with IFRS requires management to make judgments, estimates

and assumptions that affect the reported amounts of the Company’s assets, liabilities, revenues, expenses and related disclosures.

Judgments, estimates and assumptions are based on historical experience, expectations, current trends and other factors that management

believes to be relevant at the time at which the Company’s condensed interim consolidated financial statements are prepared.

Management

reviews, on a regular basis, the Company’s accounting policies, assumptions, estimates and judgments in order to ensure that the

consolidated financial statements are presented fairly and in accordance with IFRS applicable to interim financial statements. Revisions

to accounting estimates are recognized in the period in which the estimates are revised and in any future periods affected.

Critical

accounting estimates and assumptions, as well as critical judgments used in applying accounting policies in the preparation of the Company’s

condensed interim consolidated financial statements, were the same as those applied to the Company’s annual consolidated financial

statements for the year ended December 31, 2021.

| (1) | Comprised mainly of employee future benefits, provisions and non-current

portion of deferred revenues. |

The

rise in COVID-19 variants has caused delays in site initiation and patient enrollment in our DETECT-trial and may be impacting sales

activities for Macrilen™ in the US. Further, the continuation of the COVID-19 pandemic and the Russia/Ukraine conflict may also

cause some patients to be unwilling to enroll in our trials or be unable to comply with clinical trial protocols if such events impede

patient movement or interrupt healthcare services, both of which would delay our ability to conduct clinical trials or release clinical

trial results on a timely basis and could delay our ability to obtain regulatory approval and commercialize our product candidates. For

the period ended September 30, 2022, the Company assessed the impact of the uncertainties around the COVID-19 pandemic and the Russia/Ukraine

conflict on its judgments, estimates, accounting policies and amounts recognized in these unaudited condensed interim consolidated financial

statements and determined that no adjustments were required to the carrying value of assets and liabilities. During the quarter ended

June 30, 2022, management determined that the recruitment for the DETECT-trial and the remaining development services under the Novo

Amendment may now continue until later into 2023 compared to the end of the 2022 year as anticipated at the end of the previous fiscal

year. It is expected that the delays associated with COVID-19 and the Russia/Ukraine conflict will result in additional costs to the

program. As such, this change in estimate resulted in reversal of revenue in both the license fees and development services for the quarter

ended June 30, 2022. During the quarter ended September 30, 2022, Novo provided the Company with a notice of termination of the Novo

Amendment. The Company will continue to monitor the impact of the development

of the COVID-19 pandemic and Russia/Ukraine conflict in further reporting periods. Actual results could differ from these estimates,

and such differences may be material. Additional impacts are discussed below (see revenues under results of operations for the three-month

period end September 30, 2022).

Financial

Risk Factors and Other Financial Instruments

The

nature and extent of our exposure to risks arising from financial instruments, including credit risk, liquidity risk and market risk

and how we manage those risks are described in note 24 to the Company’s audited consolidated financial statements for the year

ended December 31, 2021. There were no significant changes in the three and nine month periods of 2022 as compared to the December 31,

2021 disclosures.

Results

of operations for the three and nine-month periods ended September 30, 2022

Restatement

of comparative period figures

In

the fourth quarter of 2021, the Company restated its previously reported condensed consolidated interim financial statements for the

three-month period ended March 31, 2021 and the three-month and six-month periods ended June 30, 2021 and three-month and nine-month

periods ended September 30, 2021 with respect to the recognition of revenue for the Novo Amendment, signed in November 2020. During the

fourth quarter of 2021, management reassessed the classification of the development activities associated with the DETECT-trial and concluded

that subsequent to the Novo Amendment the parties no longer shared joint control of these activities and, as such, these development

activities no longer met the definition of a joint operation, as defined in IFRS 11, Joint Arrangements. Therefore, pursuant to

the guidance in IFRS 15, Revenue from Contracts with Customers, the Company reclassified the charges to Novo, from research and

development expenses to development services revenue, in the related periods. In addition, the license fees related to the pediatric

indication were adjusted to reflect the revised pattern of recognition as the performance obligation for the development services has

now been combined with the pediatric license. In addition, the accounting for prepaid expenses and other assets and deferred revenues

related the DETECT-trial expenses incurred was restated.

Below

is the impact of the fourth quarter 2021 restatement on the September 30, 2021 financials (amounts in thousands, except for basic and

diluted loss per share):

| | |

Previously | | |

Effect of | | |

| |

| | |

reported | | |

restatement | | |

Amended | |

| | |

$ | | |

$ | | |

$ | |

| | |

| | |

| | |

| |

| Consolidated interim statement of loss and comprehensive loss for the three-month period ended September 30, 2021 | |

| | | |

| | | |

| | |

| License fees | |

| 527 | | |

| (234 | ) | |

| 293 | |

| Development service revenues | |

| — | | |

| 684 | | |

| 684 | |

| Research and development expenses | |

| 801 | | |

| 684 | | |

| 1,485 | |

| Net loss | |

| (1,698 | ) | |

| (234 | ) | |

| (1,932 | ) |

| Total comprehensive loss | |

| (1,440 | ) | |

| (234 | ) | |

| (1,674 | ) |

| Basic and diluted loss per share | |

| (0.35 | ) | |

| (0.05 | ) | |

| (0.40 | ) |

| | |

| | | |

| | | |

| | |

| Consolidated interim statement of loss and comprehensive loss for the nine-month period ended September 30, 2021 | |

| | | |

| | | |

| | |

| License fees | |

| 1,601 | | |

| (292 | ) | |

| 1,309 | |

| Development service revenues | |

| — | | |

| 2,809 | | |

| 2,809 | |

| Research and development expenses | |

| 1,902 | | |

| 2,809 | | |

| 4,711 | |

| Net loss | |

| (5,182 | ) | |

| (292 | ) | |

| (5,474 | ) |

| Total comprehensive loss | |

| (4,589 | ) | |

| (292 | ) | |

| (4,881 | ) |

| Basic and diluted loss per share | |

| (1.07 | ) | |

| (0.06 | ) | |

| (1.21 | ) |

| | |

| | | |

| | | |

| | |

| Consolidated interim statement of financial position as of September 30, 2021 | |

| | | |

| | | |

| | |

| Prepaid expenses and other current assets | |

| 3,431 | | |

| 600 | | |

| 4,031 | |

| Current portion of deferred revenues | |

| 2,075 | | |

| 943 | | |

| 3,018 | |

| Deficit | |

| (327,708 | ) | |

| (292 | ) | |

| (328,000 | ) |

These

restatements did not impact the Company’s cash and cash equivalent amounts and reported amounts of operating, investing and financing

activities within the consolidated interim statements of cash flows for the three and nine-month periods ended September 30, 2021.

Results

of operations for the three-month period ended September 30, 2022

For

the three-month period ended September 30, 2022 we reported a consolidated net loss of $3.4 million, or $0.70 loss per common share (basic),

as compared with a consolidated net loss of $1.9 million, or $0.40 loss per common share (basic) for the three-month period ended September

30, 2021. The $1.5 million increase in net loss is primarily from $0.8 million higher revenues, offset partially by an increase

in Operating expenses of $2.5 million and a increase of $0.2 million in Net Finance income.

Revenues

Our

total revenue for the three-month period ended September 30, 2022 was $1.9 million as compared to $1.1 million for the same period in

2021, representing an increase of $0.8 million. The increase arose primarily from an increase in license fees of $0.3 million and development

services revenue of $0.5 million due to the increase in DETECT-trial expenses from the previous year.

Operating

expenses

Our

total operating expenses for the three-month period ended September 30, 2022 was $5.6 million as compared with $3.1 million for the same

period in 2021, representing an increase of $2.5 million. This increase arose primarily from a $1.8 million increase in research and

development costs, $0.9 million increase in general and administrative expenses, as further discussed below, offset by a $0.2 million

decrease in selling expenses.

Research

and development expenses

The

following table summarizes our research and development expenses incurred during the periods indicated (amounts in thousands, except

percentages):

| | |

QUARTER ENDED | | |

NINE MONTHS ENDED | |

| | |

SEPTEMBER 30, | | |

SEPTEMBER 30, | |

| | |

2022 | | |

2021 | | |

$ CHANGE | | |

% CHANGE | | |

2022 | | |

2021 | | |

$ CHANGE | | |

% CHANGE | |

| | |

$ | | |

$ | | |

$ | | |

| | |

$ | | |

$ | | |

$ | | |

| |

| Macrilen™ (macimorelin) pediatric trial (DETECT-trial) direct research and development expenses | |

| 974 | | |

| 654 | | |

| 320 | | |

| 49 | % | |

| 2,521 | | |

| 2,684 | | |

| (163 | ) | |

| -6 | % |

| AEZS-130 direct research and development expenses | |

| 757 | | |

| 52 | | |

| 705 | | |

| 1,356 | % | |

| 1,453 | | |

| 86 | | |

| 1,367 | | |

| 1,590 | % |

| DC-PTH direct research and development expenses | |

| 587 | | |

| 43 | | |

| 544 | | |

| 1,265 | % | |

| 1,302 | | |

| 91 | | |

| 1,211 | | |

| 1,331 | % |

| Parkinson’s direct research and development expenses | |

| 152 | | |

| — | | |

| 152 | | |

| 100 | % | |

| 502 | | |

| — | | |

| 502 | | |

| 100 | % |

| Covid-19 direct research and development expenses | |

| 111 | | |

| 274 | | |

| (163 | ) | |

| -60 | % | |

| 305 | | |

| 575 | | |

| (270 | ) | |

| -47 | % |

| NMOSD direct research and development expenses | |

| 113 | | |

| 117 | | |

| (4 | ) | |

| -3 | % | |

| 317 | | |

| 347 | | |

| (30 | ) | |

| -9 | % |

| Chlamydia direct research and development expenses | |

| 103 | | |

| 37 | | |

| 66 | | |

| 178 | % | |

| 328 | | |

| 37 | | |

| 291 | | |

| 787 | % |

| Additional programs’ direct research and development expenses | |

| 145 | | |

| 90 | | |

| 55 | | |

| 61 | % | |

| 292 | | |

| 274 | | |

| 18 | | |

| 7 | % |

| Total direct research and development expenses | |

| 2,942 | | |

| 1,267 | | |

| 1,675 | | |

| 132 | % | |

| 7,020 | | |

| 4,094 | | |

| 2,926 | | |

| 72 | % |

| Employee-related expenses | |

| 270 | | |

| 180 | | |

| 90 | | |

| 50 | % | |

| 888 | | |

| 503 | | |

| 385 | | |

| 77 | % |

| Facilities, depreciation, and other expenses | |

| 81 | | |

| 38 | | |

| 43 | | |

| 113 | % | |

| 173 | | |

| 114 | | |

| 59 | | |

| 52 | % |

| Total | |

| 3,293 | | |

| 1,485 | | |

| 1,808 | | |

| 122 | % | |

| 8,081 | | |

| 4,711 | | |

| 3,370 | | |

| 72 | % |

Research

and development expenses increased $1.8 million for the quarter ended September 30, 2022 compared to the quarter ended September 30,

2021 primarily due to $1.4 million increase in direct research and development expenses, which was primarily due to a $1.3 million increase

in the pre-clinical projects with universities and a $0.3 million increase in costs for the DETECT-trial. The Company had its six pre-clinical

projects fully initiated in the quarter ended September 30, 2022 as compared to having started only five such projects in the same period

in 2021.

Employee-related

expenses have increased in 2022 by $0.1 million for the quarter ended September 30, 2022 as compared to the quarter ended September 30,

2021 primarily from the addition of two employees in the R&D team.

General

and administrative expenses

General

and administrative expenses increased by $0.9 million for the quarter ended September 30, 2022 compared to the quarter ended September

30, 2021, primarily due to an increase in share based compensation expense of $0.4 million pertaining to the DSUs issued during the quarter,

other employment expense $0.1 million, insurance expense of $0.2 million and professional fees $0.1 million. The increase in Insurance

expense was due to additional policies that started in the third quarter of 2021 and which continue into 2022.

Net

finance income

Our

net finance income for the three-month period ended September 30, 2022 was $0.3 million as compared with net finance income of $0.1 million

for the same period in 2021, representing an increase in net finance income of $0.2 million. This is primarily due to a $0.2 million

increase in gain from favorable changes in foreign currency exchange rates on the U.S. denominated cash held by the Company’s German

subsidiaries.

Results

of operations for the nine-month period ended September 30, 2022

For

the nine-month period ended September 30, 2022 we reported a consolidated net loss of $10.3 million, or $2.12 loss per common share (basic),

as compared with a consolidated net loss of $5.5 million, or $1.21 loss per common share (basic) for the nine-month period ended September

30, 2021. The $4.8 million increase in net loss is primarily from $1.1 million lower revenues, an increase in Operating expenses of $4.6

million offset by a net $1.0 million gain in Net Finance income and Income Tax recovery.

Revenues

Our

total revenue for the nine-month period ended September 30, 2022 was $3.2 million as compared to $4.3 million for the same period in

2021, representing a decrease of $1.1 million. During the quarter ended June 30, 2022, management determined that the recruitment for

the DETECT-trial and the remaining development services under the Novo Amendment may now continue until later into 2023 compared to the

end of the 2022 year as anticipated at the end of the previous fiscal year. It is expected that the delays associated with COVID-19 and

the Russia/Ukraine conflict will result in additional costs to the program. As such, this change in estimate resulted in reversal of

license fees revenues of $0.4 million and $0.8 million in development services revenue in Q2, 2022.

During

the first quarter of 2022, the Company shipped an initial batch of macimorelin (Ghryvelin®) to Consilient as they prepare to launch

in the United Kingdom.

Operating

expenses

Our

total operating expenses for the nine-month period ended September 30, 2022 was $14.4 million as compared with $9.8 million for the same

period in 2021, representing an increase of $4.6 million. This increase arose primarily from a $3.4 million increase in research and

development costs, $1.3 million in general and administrative expenses, offset by $0.1 million decrease in selling expenses, as further

discussed below.

Research

and development expenses

Research

and development expenses increased by $3.4 million for the nine-months ended September 30, 2022 compared to the nine-months ended September

30, 2021 primarily due to $3.1 million increase in direct research and development expenses, which was primarily due to an increase in

the initiation of our new pre-clinical projects with universities, which saw an increase in activity in these projects in 2022. In addition,

there was a $0.4 million increase in employee and facilities related expenses, offset by a $0.2 million decrease in costs for the DETECT-trial

caused by the delays that were previously mentioned (please refer to the table above under Research and development expenses for

the three month period ended September 30, 2022).

General

and administrative expenses

General

and administrative expenses increased by $1.3 million for the nine-months ended September 30, 2022 compared to the quarter ended September

30, 2021, primarily due to increases in share based compensation expense of $0.4 million pertaining to the DSUs issued during the quarter,

employment costs of $0.1 million, insurance costs of $0.6 million and legal fees of $0.2 million. The increase in insurance costs was

due to additional policies that started in the third quarter of 2021 and continue into 2022.

Net

finance income

Our

net finance income for the nine-month period ended September 30, 2022 was $1.0 million as compared with net finance expense of $0.1 million

for the same period in 2021, representing an increase in net finance income of $1.1 million. This is primarily due to a $1.0 million

increase in gain from favorable changes in foreign currency exchange rates on the U.S. denominated cash held by the Company’s German

subsidiaries.

Selected

quarterly financial data

| | |

Three months ended | |

| (in thousands, except for per share data) | |

Sep 30, 2022 | | |

Jun 30, 2022 | | |

Mar 31, 2022 | | |

Dec 31, 2021 | |

| | |

$ | | |

$ | | |

$ | | |

$ | |

| Revenues | |

| 1,860 | | |

| (222 | ) | |

| 1,517 | | |

| 956 | |

| Net loss | |

| (3,420 | ) | |

| (4,216 | ) | |

| (2,640 | ) | |

| (2,894 | ) |

| Net loss per share (basic and diluted)(2) | |

| (0.70 | ) | |

| (0.87 | ) | |

| (0.54 | ) | |

| (0.60 | ) |

| | |

Three months ended | |

| (in thousands, except for per share data) | |

Sep 30, 2021(1) | | |

Jun 30, 2021(1) | | |

Mar

31, 2021(1) | | |

Dec 31, 2020 | |

| | |

$ | | |

$ | | |

$ | | |

$ | |

| Revenues | |

| 1,052 | | |

| 1,584 | | |

| 1,668 | | |

| 2,366 | |

| Net loss | |

| (1,932 | ) | |

| (2,084 | ) | |

| (1,458 | ) | |

| (1,311 | ) |

| Net loss per share (basic and diluted)(2) | |

| (0.40 | ) | |

| (0.43 | ) | |

| (0.38 | ) | |

| (0.80 | ) |

| (1) |

The

restatements are also discussed above under “Revenues” in the Results from operations section of this MD&A. The interim

financial statements for the periods ended March 31, 2021, June 30, 2021 and September 30, 2021 have not been refiled but the comparatives

will be corrected when the interim financial statements for the periods ended March 31, 2022, June 30, 2022 and September 30, 2022

are filed. These restatements did not have any impact on 2020 results. |

| |

|

| (2) |

Net

loss per share is based on the weighted average number of shares outstanding during each reporting period, which may differ on a

quarter-to-quarter basis. As such, the sum of the quarterly net loss per share amounts may not equal full-year net loss per share. |

Historical

quarterly results of operations and net loss cannot be taken as reflective of recurring revenue or expenditure patterns of predictable

trends, largely given the non-recurring nature of certain components of our historical revenues, the impact of costs associated with

launching a number of significant preclinical research and development programs in 2021, and of foreign exchange gains and losses. In

addition, we cannot predict what the revenues from royalties will be earned from licensing agreements.

Use

of cash and cash equivalents

We

began the year 2022 with $65.3 million in cash and cash equivalents. During the nine-month period ended September 30, 2022, our operating

activities consumed $10.3 million, our financing activities and our investing activities used $0.1 million and the impact of the foreign

exchange fluctuations was a gain of $1.1 million. As at September 30, 2022 we had $53.8 million of cash and cash equivalents.

Liquidity

and capital reserves

Our

operations and capital expenditures have generally been financed through certain transactions impacting our cash flows from operating

activities, public equity offerings, registered direct offerings and issuances. A portion of the Company’s cash is held in AEZS

Germany, which is the counterparty to various license, supply and distribution agreements for the Company’s only approved product

Macrilen™ (macimorelin).

Via

public and private financings between September 2019 and February 2021, the Company has received $55.9 million in total funding (net

of transaction costs) and, throughout 2021, holders exercised 1.4 million warrants resulting in proceeds to the Company of $20.1 million.

| | |

Three months ended September 30, | | |

Nine months ended September 30, | |

| (in thousands) | |

2022 | | |

2021 | | |

2022 | | |

2021 | |

| | |

| | |

| | |

| | |

| |

| Cash and cash equivalents - beginning of period | |

| 58,157 | | |

| 69,868 | | |

| 65,300 | | |

| 24,271 | |

| Cash used in operating activities | |

| (3,945 | ) | |

| (1,488 | ) | |

| (10,256 | ) | |

| (6,168 | ) |

| Cash flows (used in) provided by financing activities | |

| (33 | ) | |

| (31 | ) | |

| (101 | ) | |

| 50,926 | |

| Cash flows used in investing activities | |

| (5 | ) | |

| (25 | ) | |

| (53 | ) | |

| (534 | ) |

| Effect of exchange rate changes on cash and cash equivalents | |

| (358 | ) | |

| (322 | ) | |

| (1,074 | ) | |

| (493 | ) |

| Cash and cash equivalents - end of period | |

| 53,816 | | |

| 68,002 | | |

| 53,816 | | |

| 68,002 | |

Operating

Activities

Cash

used by operating activities totaled $3.9 million for the three-month and $10.3 million in the nine -month periods ended September 30,

2022, as compared to $1.5 million and $6.2 million in the same periods in 2021. This $2.4 million increase in the three-months and $3.9

million in the nine-months ended September 30, 2022 in use of cash in operating activities is attributed primarily to increased research

and development and general and administrative expenses.

Financing

Activities

Cash

used in financing activities totaled $0.03 million for the three-months and consumed $0.1 million in the nine-month periods ended September

30, 2022, as compared with cash used in financing activities of $0.03 million and cash provided by financing activities of $51 million

in the same periods in 2021. On February 21, 2021, the Company completed the February 2021 financing with net cash proceeds of $31.0

million and, throughout the first quarter of 2021, the warrant exercises contributed cash of approximately $20.0 million.

Investing

Activities

Cash

used by investing activities totaled $0.01 million for the three-months and $0.05 million in the nine-month periods ended September 30,

2022, as compared to cash used by investing activities of $0.03 and $0.5 million in the same periods in 2021. During the first nine months

of 2021, the Company executed various agreements including in-licensing and similar arrangements with development partners reflecting

the purchase of separately acquired intangible assets of $0.5 million.

Capital

stock

On

July 21, 2022, the Share Consolidation was effected and the Common Shares began trading on the TSX and Nasdaq on a post-Consolidation

basis. The Share Consolidation reduced the number of Common Shares issued and outstanding from 121,397,007 Common Shares to 4,855,876

Common Shares. Proportionate adjustments were be made to the Company’s outstanding warrants and stock options. The Share Consolidation

has been retrospectively reflected in our September 30, 2022 results, as 4,855,876 common shares issued and outstanding, as well as 43,455

stock options, 16,920 deferred share units and 457,649 warrants outstanding. Each stock option, deferred share unit and warrant is exercisable

for one common share.

Adequacy

of financial resources

Since

inception, the Company has incurred significant expenses in its efforts to develop and co-promote products. Our current business focus

is to: investigate further therapeutic uses of Macrilen™, expand pipeline development activities, further expand the commercialization

of macimorelin in available territories and fund the DETECT-trial costs in excess of total expected reimbursements from Novo of $8.9

million (€9.4 million).

Consequently,

the Company has incurred operating losses and has generated negative cash flow from operations historically and in each of the last several

years except for the year ended December 31, 2018 when the Company earned revenue from the sale of a license for the adult indication

of Macrilen™ (macimorelin) in the U.S. and Canada. The Company expects to incur significant expenses and operating losses for the

foreseeable future as it advances its product candidates through preclinical and clinical development, seeks regulatory approval and

pursues commercialization of any approved product candidates. We expect that our research and development costs will increase in connection

with our planned research and development activities.

As

of September 30, 2022, the Company had cash and cash equivalents of $53.8 million and an accumulated deficit of $338.7 million. The Company

also had a net loss of $3.4 million and negative cash flows from operations of $3.9 million for the three-months ended September 30,

2022. We believe that our existing cash on hand will be sufficient to fund our anticipated operating and capital expenditure requirements

through 2023. We have based this estimate on assumptions that may prove to be wrong, and we could exhaust our capital resources sooner

than we expect. We may also require additional capital to pursue in-licenses or acquisitions of other product candidates.

Contractual

obligations and commitments as at September 30, 2022

| (in thousands) | |

Service and manufacturing | | |

R&D contracts | | |

TOTAL | |

| | |

$ | | |

$ | | |

$ | |

| Less than 1 year | |

| 7,006 | | |

| 1,870 | | |

| 8,876 | |

| 1 - 3 years | |

| 2,089 | | |

| 629 | | |

| 2,718 | |

| 4 - 5 years | |

| 46 | | |

| — | | |

| 46 | |

| More than 5 years | |

| — | | |

| — | | |

| — | |

| Total | |

| 9,141 | | |

| 2,499 | | |

| 11,640 | |

During

2021, the Company executed various agreements including in-licensing and similar arrangements with development partners with $0.6 million

in additions of separately acquired intangible assets recognized in the condensed interim consolidated statements of financial position.

Such agreements may require the Company to make payments on achievement of stages of development, launch or revenue milestones, although

the Company generally has the right to terminate these agreements at no penalty. The Company recognizes research and development milestones

as an intangible asset once it is committed to the payment, which is generally when the Company reaches a set point in the development

cycle.

Based

on the closing exchange rates at September 30, 2022, the Company expects to pay $8,527 including $6,394 (€6.5 million), and $1,283

(£1.2 million) and $850 USD, in R&D milestone payments and up to $37,438, including $27,043 (€27.6 million); $1,395 (£1.3

million) and $9,000 USD, in revenue related milestone payments. The table below contains all potential R&D and revenue-related milestone

payments that the Company may be required to make under such agreements:

| (in thousands) | |