|

KINETICS MUTUAL FUNDS, INC.

|

|

Table of Contents

|

|

December 31, 2014

|

|

Page

|

|

|

Shareholders’ Letter

|

2

|

|

Year 2014 Annual Investment Commentary

|

5

|

|

KINETICS MUTUAL FUNDS, INC. — FEEDER FUNDS

|

|

|

Growth of $10,000 Investment

|

9

|

|

Expense Example

|

20

|

|

Statements of Assets & Liabilities

|

26

|

|

Statements of Operations

|

30

|

|

Statements of Changes in Net Assets

|

34

|

|

Notes to Financial Statements

|

45

|

|

Financial Highlights

|

60

|

|

Report of Independent Registered Public Accounting Firm

|

89

|

|

KINETICS PORTFOLIOS TRUST — MASTER INVESTMENT PORTFOLIOS

|

|

|

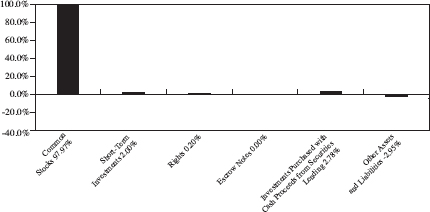

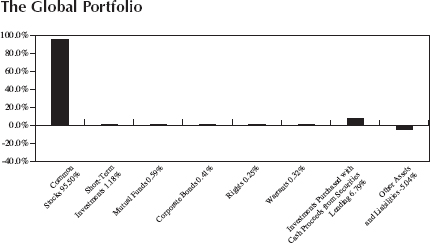

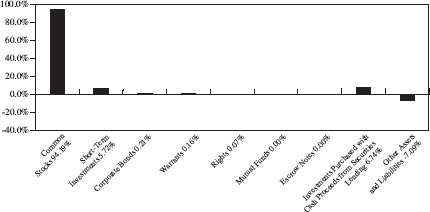

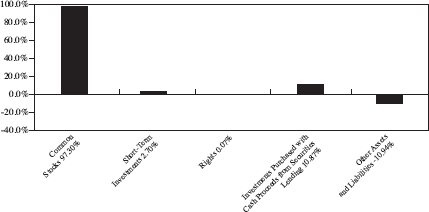

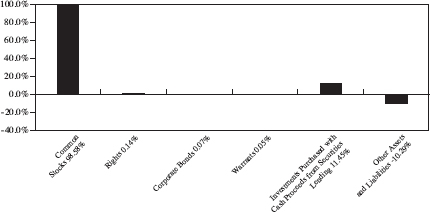

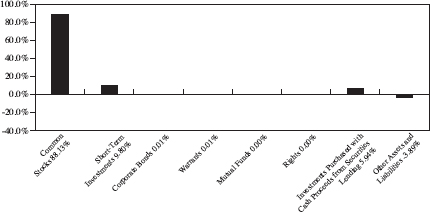

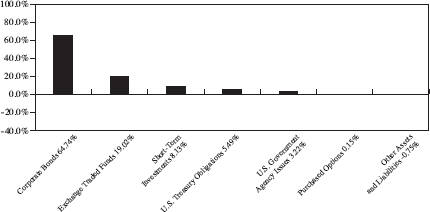

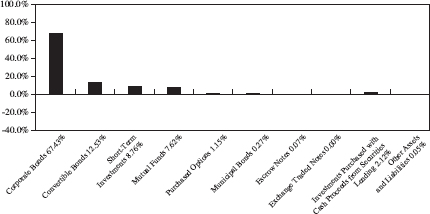

Allocation of Portfolio Assets

|

90

|

|

Portfolio of Investments — The Internet Portfolio

|

98

|

|

Portfolio of Investments — The Global Portfolio

|

103

|

|

Portfolio of Investments — The Paradigm Portfolio

|

108

|

|

Portfolio of Investments — The Medical Portfolio

|

115

|

|

Portfolio of Investments — The Small Cap Opportunities Portfolio

|

118

|

|

Portfolio of Investments — The Market Opportunities Portfolio

|

123

|

|

Portfolio of Investments — The Alternative Income Portfolio

|

128

|

|

Portfolio of Investments — The Multi-Disciplinary Income Portfolio

|

139

|

|

Portfolio of Options Written — The Alternative Income Portfolio

|

150

|

|

Portfolio of Options Written — The Multi-Disciplinary Income Portfolio

|

184

|

|

Statements of Assets & Liabilities

|

194

|

|

Statements of Operations

|

198

|

|

Statements of Changes in Net Assets

|

202

|

|

Notes to Financial Statements

|

206

|

|

Report of Independent Registered Public Accounting Firm

|

234

|

|

Management of the Funds and the Portfolios

|

235

|

|

Privacy Policy

|

243

|

|

KINETICS MUTUAL FUNDS, INC.

|

|

Shareholders’ Letter

|

|

KINETICS MUTUAL FUNDS, INC.

|

|

Investment Commentary

|

|

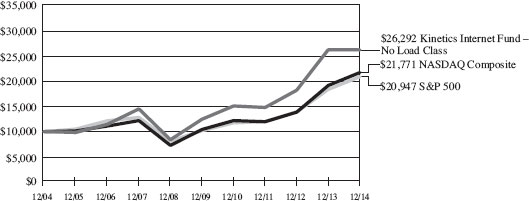

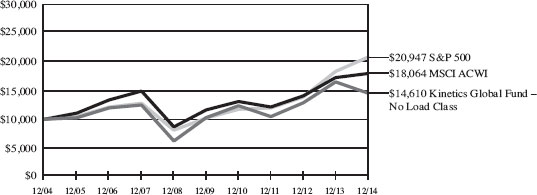

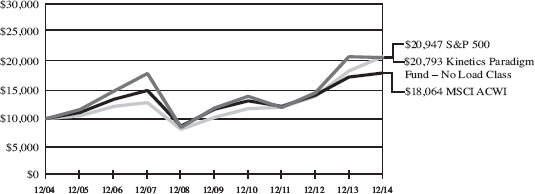

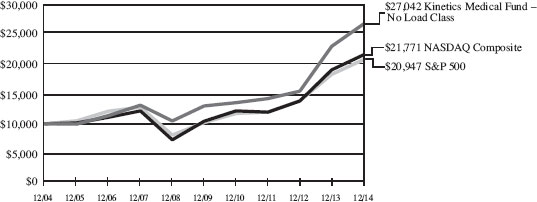

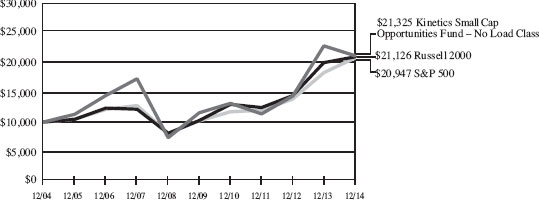

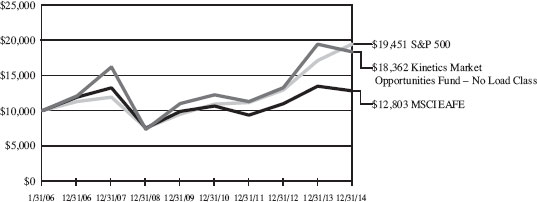

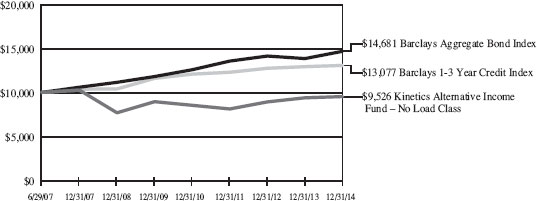

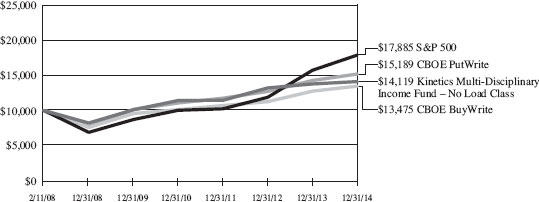

How a $10,000 Investment Has Grown:

|

|

|

The charts show the growth of a $10,000 investment in the Feeder Funds as compared to the performance of two or more representative market indices. The tables below the charts show the average annual total returns on an investment over various periods. Returns for periods greater than one year are average annual total returns. The annual returns assume the reinvestment of all dividends and distributions, however, the graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Past performance is not predictive of future performance. Current performance may be lower or higher than the returns quoted below. The performance data reflects voluntary fee waivers and expense reimbursements made by the Adviser and the returns would have been lower if these waivers and expense reimbursements were not in effect. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than their original costs.

|

|

|

The S&P 500 Index — is a capital-weighted index, representing the aggregate market value of the common equity of 500 stocks primarily traded on the New York Stock Exchange. The S&P 500 is unmanaged and includes the reinvestment of dividends and does not reflect the payments of transaction costs and advisory fees associated with an investment in the Funds. The securities that comprise the S&P 500 may differ substantially from the securities in the Funds’ portfolios. It is not possible to directly invest in an index.

|

|

|

The NASDAQ Composite Index — is a broad-based capitalization-weighted index of all NASDAQ stocks. The NASDAQ is unmanaged and does not include the reinvestment of dividends and does not reflect the payment of transaction costs or advisory fees associated with an investment in the Funds. The securities that comprise the NASDAQ Composite may differ substantially from the securities in the Funds’ portfolios. It is not possible to directly invest in an index.

|

|

|

The MSCI ACWI (All Country World Index) Index — is a free float- adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. As of June 2, 2014, the MSCI ACWI consists of 46 country indices comprising 23 developed and 23 emerging market country indices. The developed market country indices included are: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom and the United States. The

|

|

|

emerging market country indices included are: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Peru, Philippines, Poland, Qatar, Russia, South Africa, Taiwan, Thailand, Turkey, and United Arab Emirates. The securities that compromise the MSCI ACWI may differ substantially from the securities in the Funds’ portfolios. It is not possible to directly invest in an index.

|

|

|

The Russell 2000® Index — is a subset of the Russell 3000 Index® representing approximately 10% of the total market capitalization of that index. It includes approximately 2000 of the smallest securities based on a combination of their market cap and current index membership. The Russell 2000® Index is constructed to provide a comprehensive and unbiased small-cap barometer and is completely reconstituted annually to ensure larger stocks do not distort the performance and characteristics of the true small-cap opportunity set. The securities that compromise the Russell 2000 may differ substantially from the securities in the Funds’ portfolio. It is not possible to directly invest in an index.

|

|

|

The MSCI EAFE® Index (Europe, Australasia, Far East) — is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the United States and Canada. As of June 2, 2014, the MSCI EAFE® Index consisted of the following 21 developed market country indices: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, and the United Kingdom. The securities that compromise the MSCI EAFE® may differ substantially from the securities in the Funds’ portfolio. It is not possible to directly invest in an index.

|

|

|

The Barclays U.S. 1-3 Year Credit Index — measures the performance of investment grade corporate debt and sovereign, supranational, local authority and non-U.S. agency bonds that are U.S. dollar denominated and have a remaining maturity of greater than or equal to one year and less than three years. The securities that compromise the Barclays U.S. 1-3 Year Credit Index may differ substantially from the securities in the Funds’ portfolio. It is not possible to directly invest in an index.

|

|

|

The Barclays U.S. Aggregate Bond Index — covers the USD-denominated, investment-grade, fixed-rate, taxable bond market of SEC-registered securities. The Index includes multiple types of government and corporate-issued bonds, some of which are asset-backed. The securities that compromise the Barclays U.S. Aggregate Bond Index may differ substantially from the securities in the Funds’ portfolio. It is not possible to directly invest in an index.

|

|

|

CBOE S&P 500 BuyWrite Index (BXM) — is a benchmark index designed to track the performance of a hypothetical buy-write strategy on the S&P 500. The securities that comprise the CBOE S&P 500 BuyWrite Index may differ substantially from the securities in the Fund’s portfolio. It is not possible to directly invest in an index.

|

|

|

CBOE S&P 500 PutWrite Index (PUT) — is a benchmark index designed to track the performance of a passive program that sells near-term, at-the-money S&P 500 Index puts. The securities that comprise the CBOE S&P 500 PutWrite Index may differ substantially from the securities in the Fund’s portfolio. It is not possible to directly invest in an index.

|

|

|

Ended 12/31/2014

|

||||||||||||||||||||||||

|

Advisor

|

Advisor

|

|||||||||||||||||||||||

|

No Load

|

Class A

|

Class A

|

Advisor

|

NASDAQ

|

||||||||||||||||||||

|

Class

|

(No Load)

|

(Load Adjusted)(1)

|

Class C

|

S&P 500

|

Composite

|

|||||||||||||||||||

|

One Year

|

-0.16 | % | -0.41 | % | -6.14 | % | -0.86 | % | 13.69 | % | 13.40 | % | ||||||||||||

|

Five Years

|

16.09 | % | 15.81 | % | 14.45 | % | 15.24 | % | 15.45 | % | 15.85 | % | ||||||||||||

|

Ten Years

|

10.15 | % | 9.99 | % | 9.34 | % | N/A | 7.67 | % | 8.09 | % | |||||||||||||

|

Since Inception

|

||||||||||||||||||||||||

|

No Load Class

|

||||||||||||||||||||||||

|

(10/21/96)

|

15.40 | % | N/A | N/A | N/A | 8.00 | % | 7.66 | % | |||||||||||||||

|

Since Inception

|

||||||||||||||||||||||||

|

Advisor

|

||||||||||||||||||||||||

|

Class A

|

||||||||||||||||||||||||

|

(4/26/01)

|

N/A | 7.74 | % | 7.28 | % | N/A | 5.88 | % | 6.37 | % | ||||||||||||||

|

Since Inception

|

||||||||||||||||||||||||

|

Advisor

|

||||||||||||||||||||||||

|

Class C

|

||||||||||||||||||||||||

|

(2/16/07)

|

N/A | N/A | N/A | 10.12 | % | 6.78 | % | 8.48 | % | |||||||||||||||

|

Ended 12/31/2014

|

||||||||||||||||||||||||

|

Advisor

|

Advisor

|

|||||||||||||||||||||||

|

No Load

|

Class A

|

Class A

|

Advisor

|

|||||||||||||||||||||

|

Class

|

(No Load)

|

(Load Adjusted)(1)

|

Class C

|

S&P 500

|

MSCI ACWI

|

|||||||||||||||||||

|

One Year

|

-11.89 | % | -11.93 | % | -17.02 | % | -12.53 | % | 13.69 | % | 4.16 | % | ||||||||||||

|

Five Years

|

7.26 | % | 7.05 | % | 5.79 | % | 6.46 | % | 15.45 | % | 9.17 | % | ||||||||||||

|

Ten Years

|

3.86 | % | N/A | N/A | N/A | 7.67 | % | 6.09 | % | |||||||||||||||

|

Since Inception

|

||||||||||||||||||||||||

|

No Load Class

|

||||||||||||||||||||||||

|

(12/31/99)

|

-2.53 | % | N/A | N/A | N/A | 4.24 | % | 3.26 | % | |||||||||||||||

|

Since Inception

|

||||||||||||||||||||||||

|

Advisor

|

||||||||||||||||||||||||

|

Class A

|

||||||||||||||||||||||||

|

(5/19/08)

|

N/A | 3.33 | % | 2.41 | % | N/A | 8.04 | % | 2.96 | % | ||||||||||||||

|

Since Inception

|

||||||||||||||||||||||||

|

Advisor

|

||||||||||||||||||||||||

|

Class C

|

||||||||||||||||||||||||

|

(5/19/08)

|

N/A | N/A | N/A | 2.71 | % | 8.04 | % | 2.96 | % | |||||||||||||||

|

Ended 12/31/2014

|

||||||||||||||||||||||||||||

|

Advisor

|

Advisor

|

|||||||||||||||||||||||||||

|

No Load

|

Class A

|

Class A

|

Advisor

|

Institutional

|

||||||||||||||||||||||||

|

Class

|

(No Load)

|

(Load Adjusted)(1)

|

Class C

|

Class

|

S&P 500

|

MSCI ACWI

|

||||||||||||||||||||||

|

One Year

|

-0.79 | % | -1.04 | % | -6.73 | % | -1.54 | % | -0.61 | % | 13.69 | % | 4.16 | % | ||||||||||||||

|

Five Years

|

11.86 | % | 11.59 | % | 10.28 | % | 11.02 | % | 12.07 | % | 15.45 | % | 9.17 | % | ||||||||||||||

|

Ten Years

|

7.60 | % | 7.29 | % | 6.66 | % | 6.75 | % | N/A | 7.67 | % | 6.09 | % | |||||||||||||||

|

Since Inception

|

||||||||||||||||||||||||||||

|

No Load Class

|

||||||||||||||||||||||||||||

|

(12/31/99)

|

9.23 | % | N/A | N/A | N/A | N/A | 4.24 | % | 3.26 | % | ||||||||||||||||||

|

Since Inception

|

||||||||||||||||||||||||||||

|

Advisor Class A

|

||||||||||||||||||||||||||||

|

(4/26/01)

|

N/A | 9.53 | % | 9.06 | % | N/A | N/A | 5.88 | % | 5.30 | % | |||||||||||||||||

|

Since Inception

|

||||||||||||||||||||||||||||

|

Advisor Class C

|

||||||||||||||||||||||||||||

|

(6/28/02)

|

N/A | N/A | N/A | 9.74 | % | N/A | 8.20 | % | 7.44 | % | ||||||||||||||||||

|

Since Inception

|

||||||||||||||||||||||||||||

|

Institutional Class

|

||||||||||||||||||||||||||||

|

(5/27/05)

|

N/A | N/A | N/A | N/A | 7.74 | % | 8.05 | % | 6.44 | % | ||||||||||||||||||

|

Ended 12/31/2014

|

||||||||||||||||||||||||

|

Advisor

|

Advisor

|

|||||||||||||||||||||||

|

No Load

|

Class A

|

Class A

|

Advisor

|

NASDAQ

|

||||||||||||||||||||

|

Class

|

(No Load)

|

(Load Adjusted)(1)

|

Class C

|

S&P 500

|

Composite

|

|||||||||||||||||||

|

One Year

|

16.44 | % | 16.15 | % | 9.48 | % | 15.54 | % | 13.69 | % | 13.40 | % | ||||||||||||

|

Five Years

|

15.71 | % | 15.43 | % | 14.07 | % | 14.84 | % | 15.45 | % | 15.85 | % | ||||||||||||

|

Ten Years

|

10.46 | % | 10.21 | % | 9.55 | % | N/A | 7.67 | % | 8.09 | % | |||||||||||||

|

Since Inception

|

||||||||||||||||||||||||

|

No Load Class

|

||||||||||||||||||||||||

|

(9/30/99)

|

10.47 | % | N/A | N/A | N/A | 5.12 | % | 3.64 | % | |||||||||||||||

|

Since Inception

|

||||||||||||||||||||||||

|

Advisor Class A

|

||||||||||||||||||||||||

|

(4/26/01)

|

N/A | 6.63 | % | 6.18 | % | N/A | 5.88 | % | 6.37 | % | ||||||||||||||

|

Since Inception

|

||||||||||||||||||||||||

|

Advisor Class C

|

||||||||||||||||||||||||

|

(2/16/07)

|

N/A | N/A | N/A | 10.12 | % | 6.78 | % | 8.48 | % | |||||||||||||||

|

Ended 12/31/2014

|

||||||||||||||||||||||||||||

|

Advisor

|

Advisor

|

|||||||||||||||||||||||||||

|

No Load

|

Class A

|

Class A

|

Advisor

|

Institutional

|

||||||||||||||||||||||||

|

Class

|

(No Load)

|

(Load Adjusted)(1)

|

Class C

|

Class

|

Russell 2000

|

S&P 500

|

||||||||||||||||||||||

|

One Year

|

-7.28 | % | -7.54 | % | -12.85 | % | -7.97 | % | -7.12 | % | 4.89 | % | 13.69 | % | ||||||||||||||

|

Five Years

|

12.99 | % | 12.71 | % | 11.38 | % | 12.15 | % | 13.21 | % | 15.55 | % | 15.45 | % | ||||||||||||||

|

Ten Years

|

7.87 | % | 7.59 | % | 6.95 | % | N/A | N/A | 7.77 | % | 7.67 | % | ||||||||||||||||

|

Since Inception

|

||||||||||||||||||||||||||||

|

No Load Class

|

||||||||||||||||||||||||||||

|

(3/20/00)

|

10.16 | % | N/A | N/A | N/A | N/A | 6.86 | % | 4.35 | % | ||||||||||||||||||

|

Since Inception

|

||||||||||||||||||||||||||||

|

Advisor Class A

|

||||||||||||||||||||||||||||

|

(12/31/01)

|

N/A | 8.22 | % | 7.73 | % | N/A | N/A | 8.61 | % | 6.72 | % | |||||||||||||||||

|

Since Inception

|

||||||||||||||||||||||||||||

|

Advisor Class C

|

||||||||||||||||||||||||||||

|

(2/16/07)

|

N/A | N/A | N/A | 3.30 | % | N/A | 6.50 | % | 6.78 | % | ||||||||||||||||||

|

Since Inception

|

||||||||||||||||||||||||||||

|

Institutional Class

|

||||||||||||||||||||||||||||

|

(8/12/05)

|

N/A | N/A | N/A | N/A | 7.54 | % | 8.07 | % | 7.89 | % | ||||||||||||||||||

|

Ended 12/31/2014

|

||||||||||||||||||||||||||||

|

Advisor

|

Advisor

|

|||||||||||||||||||||||||||

|

No Load

|

Class A

|

Class A

|

Advisor

|

Institutional

|

||||||||||||||||||||||||

|

Class

|

(No Load)

|

(Load Adjusted)(1)

|

Class C

|

Class

|

S&P 500

|

MSCI EAFE

|

||||||||||||||||||||||

|

One Year

|

-5.55 | % | -5.74 | % | -11.14 | % | -6.24 | % | -5.36 | % | 13.69 | % | -4.90 | % | ||||||||||||||

|

Five Years

|

10.81 | % | 10.56 | % | 9.26 | % | 10.01 | % | 11.05 | % | 15.45 | % | 5.33 | % | ||||||||||||||

|

Since Inception

|

||||||||||||||||||||||||||||

|

No Load Class

|

||||||||||||||||||||||||||||

|

(1/31/06)

|

7.05 | % | N/A | N/A | N/A | N/A | 7.75 | % | 2.81 | % | ||||||||||||||||||

|

Since Inception

|

||||||||||||||||||||||||||||

|

Advisor Class A

|

||||||||||||||||||||||||||||

|

(1/31/06)

|

N/A | 6.79 | % | 6.09 | % | N/A | N/A | 7.75 | % | 2.81 | % | |||||||||||||||||

|

Since Inception

|

||||||||||||||||||||||||||||

|

Advisor Class C

|

||||||||||||||||||||||||||||

|

(2/16/07)

|

N/A | N/A | N/A | 3.68 | % | N/A | 6.78 | % | 0.39 | % | ||||||||||||||||||

|

Since Inception

|

||||||||||||||||||||||||||||

|

Institutional Class

|

||||||||||||||||||||||||||||

|

(5/19/08)

|

N/A | N/A | N/A | N/A | 4.70 | % | 8.04 | % | -0.42 | % | ||||||||||||||||||

|

Ended 12/31/2014

|

||||||||||||||||||||||||||||

|

Barclays

|

||||||||||||||||||||||||||||

|

U.S. 1-3

|

Barclays

|

|||||||||||||||||||||||||||

|

Advisor

|

Advisor

|

Year

|

U.S.

|

|||||||||||||||||||||||||

|

No Load

|

Class A

|

Class A

|

Advisor

|

Institutional

|

Credit

|

Aggregate

|

||||||||||||||||||||||

|

Class

|

(No Load)

|

(Load Adjusted)(1)

|

Class C

|

Class

|

Index

|

Bond Index

|

||||||||||||||||||||||

|

One Year

|

1.50 | % | 1.24 | % | -4.57 | % | 0.74 | % | 1.72 | % | 1.12 | % | 5.97 | % | ||||||||||||||

|

Five Years

|

1.27 | % | 1.02 | % | -0.17 | % | 0.55 | % | 1.54 | % | 2.42 | % | 4.45 | % | ||||||||||||||

|

Since Inception

|

||||||||||||||||||||||||||||

|

No Load Class

|

||||||||||||||||||||||||||||

|

(6/29/07)

|

-0.64 | % | N/A | N/A | N/A | N/A | 3.64 | % | 5.25 | % | ||||||||||||||||||

|

Since Inception

|

||||||||||||||||||||||||||||

|

Advisor Class A

|

||||||||||||||||||||||||||||

|

(6/29/07)

|

N/A | -0.88 | % | -1.66 | % | N/A | N/A | 3.64 | % | 5.25 | % | |||||||||||||||||

|

Since Inception

|

||||||||||||||||||||||||||||

|

Advisor Class C

|

||||||||||||||||||||||||||||

|

(6/29/07)

|

N/A | N/A | N/A | -1.37 | % | N/A | 3.64 | % | 5.25 | % | ||||||||||||||||||

|

Since Inception

|

||||||||||||||||||||||||||||

|

Institutional Class

|

||||||||||||||||||||||||||||

|

(6/29/07)

|

N/A | N/A | N/A | N/A | -0.38 | % | 3.64 | % | 5.25 | % | ||||||||||||||||||

|

Ended 12/31/2014

|

||||||||||||||||||||||||||||||||

|

Advisor

|

||||||||||||||||||||||||||||||||

|

Advisor

|

Class A

|

|||||||||||||||||||||||||||||||

|

No Load

|

Class A

|

(Load

|

Advisor

|

Institutional

|

S&P

|

CBOE

|

CBOE

|

|||||||||||||||||||||||||

|

Class

|

(No Load)

|

Adjusted)(1)

|

Class C

|

Class

|

500 |

Buy

|

PUT

|

|||||||||||||||||||||||||

|

One Year

|

2.46 | % | 2.17 | % | -3.71 | % | 1.61 | % | 2.61 | % | 13.69 | % | 5.64 | % | 6.38 | % | ||||||||||||||||

|

Five Years

|

6.91 | % | 6.65 | % | 5.39 | % | 6.10 | % | 7.11 | % | 15.45 | % | 7.09 | % | 8.37 | % | ||||||||||||||||

|

Since Inception

|

||||||||||||||||||||||||||||||||

|

No Load Class

|

||||||||||||||||||||||||||||||||

|

(2/11/08)

|

5.14 | % | N/A | N/A | N/A | N/A | 8.81 | % | 4.42 | % | 6.26 | % | ||||||||||||||||||||

|

Since Inception

|

||||||||||||||||||||||||||||||||

|

Advisor Class A

|

||||||||||||||||||||||||||||||||

|

(2/11/08)

|

N/A | 4.88 | % | 3.99 | % | N/A | N/A | 8.81 | % | 4.42 | % | 6.26 | % | |||||||||||||||||||

|

Since Inception

|

||||||||||||||||||||||||||||||||

|

Advisor Class C

|

||||||||||||||||||||||||||||||||

|

(2/11/08)

|

N/A | N/A | N/A | 4.35 | % | N/A | 8.81 | % | 4.42 | % | 6.26 | % | ||||||||||||||||||||

|

Since Inception

|

||||||||||||||||||||||||||||||||

|

Institutional Class

|

||||||||||||||||||||||||||||||||

|

(2/11/08)

|

N/A | N/A | N/A | N/A | 5.34 | % | 8.81 | % | 4.42 | % | 6.26 | % | ||||||||||||||||||||

|

KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS

|

|

Expense Example

|

|

December 31, 2014

|

|

KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS

|

|

Expense Example — (Continued)

|

|

December 31, 2014

|

|

KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS

|

|

Expense Example — (Continued)

|

|

December 31, 2014

|

|

Expenses Paid

|

||||||||||||||||

|

Beginning

|

Ending

|

During

|

||||||||||||||

|

Account

|

Account

|

Annualized

|

Period*

|

|||||||||||||

|

Value

|

Value

|

Expense

|

(7/1/14 to

|

|||||||||||||

|

(7/1/14)

|

(12/31/14)

|

Ratio

|

12/31/14)

|

|||||||||||||

|

The Internet Fund

|

||||||||||||||||

|

No Load Class Actual

|

$ | 1,000.00 | $ | 1,022.70 | 1.79 | % | $ | 9.13 | ||||||||

|

No Load Class Hypothetical (5% return

|

||||||||||||||||

|

before expenses)

|

$ | 1,000.00 | $ | 1,016.18 | 1.79 | % | $ | 9.10 | ||||||||

|

Advisor Class A Actual

|

$ | 1,000.00 | $ | 1,021.30 | 2.04 | % | $ | 10.39 | ||||||||

|

Advisor Class A Hypothetical (5% return

|

||||||||||||||||

|

before expenses)

|

$ | 1,000.00 | $ | 1,014.92 | 2.04 | % | $ | 10.36 | ||||||||

|

Advisor Class C Actual — after

|

||||||||||||||||

|

expense reimbursement

|

$ | 1,000.00 | $ | 1,019.40 | 2.54 | % | $ | 12.93 | ||||||||

|

Advisor Class C Hypothetical (5% return

|

||||||||||||||||

|

before expenses) — after

|

||||||||||||||||

|

expense reimbursement

|

$ | 1,000.00 | $ | 1,012.40 | 2.54 | % | $ | 12.88 | ||||||||

|

The Global Fund

|

||||||||||||||||

|

No Load Class Actual — after

|

||||||||||||||||

|

expense reimbursement

|

$ | 1,000.00 | $ | 857.00 | 1.39 | % | $ | 6.51 | ||||||||

|

No Load Class Hypothetical (5% return

|

||||||||||||||||

|

before expenses) — after

|

||||||||||||||||

|

expense reimbursement

|

$ | 1,000.00 | $ | 1,018.19 | 1.39 | % | $ | 7.07 | ||||||||

|

Advisor Class A Actual — after

|

||||||||||||||||

|

expense reimbursement

|

$ | 1,000.00 | $ | 856.50 | 1.64 | % | $ | 7.67 | ||||||||

|

Advisor Class A Hypothetical (5% return

|

||||||||||||||||

|

before expenses) — after

|

||||||||||||||||

|

expense reimbursement

|

$ | 1,000.00 | $ | 1,016.93 | 1.64 | % | $ | 8.34 | ||||||||

|

Advisor Class C Actual — after

|

||||||||||||||||

|

expense reimbursement

|

$ | 1,000.00 | $ | 854.40 | 2.14 | % | $ | 10.00 | ||||||||

|

Advisor Class C Hypothetical (5% return

|

||||||||||||||||

|

before expenses) — after

|

||||||||||||||||

|

expense reimbursement

|

$ | 1,000.00 | $ | 1,014.41 | 2.14 | % | $ | 10.87 | ||||||||

|

KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS

|

|

Expense Example — (Continued)

|

|

December 31, 2014

|

|

Expenses Paid

|

||||||||||||||||

|

Beginning

|

Ending

|

During

|

||||||||||||||

|

Account

|

Account

|

Annualized

|

Period*

|

|||||||||||||

|

Value

|

Value

|

Expense

|

(7/1/14 to

|

|||||||||||||

|

(7/1/14)

|

(12/31/14)

|

Ratio

|

12/31/14)

|

|||||||||||||

|

The Paradigm Fund

|

||||||||||||||||

|

No Load Class Actual — after

|

||||||||||||||||

|

expense reimbursement

|

$ | 1,000.00 | $ | 948.00 | 1.64 | % | $ | 8.05 | ||||||||

|

No Load Class Hypothetical (5% return

|

||||||||||||||||

|

before expenses) — after

|

||||||||||||||||

|

expense reimbursement

|

$ | 1,000.00 | $ | 1,016.93 | 1.64 | % | $ | 8.34 | ||||||||

|

Advisor Class A Actual — after

|

||||||||||||||||

|

expense reimbursement

|

$ | 1,000.00 | $ | 946.70 | 1.89 | % | $ | 9.27 | ||||||||

|

Advisor Class A Hypothetical (5% return

|

||||||||||||||||

|

before expenses) — after

|

||||||||||||||||

|

expense reimbursement

|

$ | 1,000.00 | $ | 1,015.67 | 1.89 | % | $ | 9.60 | ||||||||

|

Advisor Class C Actual — after

|

||||||||||||||||

|

expense reimbursement

|

$ | 1,000.00 | $ | 944.00 | 2.39 | % | $ | 11.71 | ||||||||

|

Advisor Class C Hypothetical (5% return

|

||||||||||||||||

|

before expenses) — after

|

||||||||||||||||

|

expense reimbursement

|

$ | 1,000.00 | $ | 1,013.15 | 2.39 | % | $ | 12.13 | ||||||||

|

Institutional Class Actual — after

|

||||||||||||||||

|

expense reimbursement

|

$ | 1,000.00 | $ | 948.80 | 1.44 | % | $ | 7.07 | ||||||||

|

Institutional Class Hypothetical (5% return

|

||||||||||||||||

|

before expenses) — after

|

||||||||||||||||

|

expense reimbursement

|

$ | 1,000.00 | $ | 1,017.94 | 1.44 | % | $ | 7.32 | ||||||||

|

The Medical Fund

|

||||||||||||||||

|

No Load Class Actual — after

|

||||||||||||||||

|

expense reimbursement

|

$ | 1,000.00 | $ | 1,061.80 | 1.39 | % | $ | 7.22 | ||||||||

|

No Load Class Hypothetical (5% return

|

||||||||||||||||

|

before expenses) — after

|

||||||||||||||||

|

expense reimbursement

|

$ | 1,000.00 | $ | 1,018.19 | 1.39 | % | $ | 7.07 | ||||||||

|

Advisor Class A Actual — after

|

||||||||||||||||

|

expense reimbursement

|

$ | 1,000.00 | $ | 1,060.50 | 1.64 | % | $ | 8.52 | ||||||||

|

Advisor Class A Hypothetical (5% return

|

||||||||||||||||

|

before expenses) — after

|

||||||||||||||||

|

expense reimbursement

|

$ | 1,000.00 | $ | 1,016.93 | 1.64 | % | $ | 8.34 | ||||||||

|

Advisor Class C Actual — after

|

||||||||||||||||

|

expense reimbursement

|

$ | 1,000.00 | $ | 1,057.90 | 2.14 | % | $ | 11.10 | ||||||||

|

Advisor Class C Hypothetical (5% return

|

||||||||||||||||

|

before expenses) — after

|

||||||||||||||||

|

expense reimbursement

|

$ | 1,000.00 | $ | 1,014.41 | 2.14 | % | $ | 10.87 | ||||||||

|

KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS

|

|

Expense Example — (Continued)

|

|

December 31, 2014

|

|

Expenses Paid

|

||||||||||||||||

|

Beginning

|

Ending

|

During

|

||||||||||||||

|

Account

|

Account

|

Annualized

|

Period*

|

|||||||||||||

|

Value

|

Value

|

Expense

|

(7/1/14 to

|

|||||||||||||

|

(7/1/14)

|

(12/31/14)

|

Ratio

|

12/31/14)

|

|||||||||||||

|

The Small Cap Opportunities Fund

|

||||||||||||||||

|

No Load Class Actual — after

|

||||||||||||||||

|

expense reimbursement

|

$ | 1,000.00 | $ | 893.20 | 1.64 | % | $ | 7.83 | ||||||||

|

No Load Class Hypothetical (5% return

|

||||||||||||||||

|

before expenses) — after

|

||||||||||||||||

|

expense reimbursement

|

$ | 1,000.00 | $ | 1,016.93 | 1.64 | % | $ | 8.34 | ||||||||

|

Advisor Class A Actual — after

|

||||||||||||||||

|

expense reimbursement

|

$ | 1,000.00 | $ | 892.00 | 1.89 | % | $ | 9.01 | ||||||||

|

Advisor Class A Hypothetical (5% return

|

||||||||||||||||

|

before expenses) — after

|

||||||||||||||||

|

expense reimbursement

|

$ | 1,000.00 | $ | 1,015.67 | 1.89 | % | $ | 9.60 | ||||||||

|

Advisor Class C Actual — after

|

||||||||||||||||

|

expense reimbursement

|

$ | 1,000.00 | $ | 889.60 | 2.39 | % | $ | 11.38 | ||||||||

|

Advisor Class C Hypothetical (5% return

|

||||||||||||||||

|

before expenses) — after

|

||||||||||||||||

|

expense reimbursement

|

$ | 1,000.00 | $ | 1,013.15 | 2.39 | % | $ | 12.13 | ||||||||

|

Institutional Class Actual — after

|

||||||||||||||||

|

expense reimbursement

|

$ | 1,000.00 | $ | 894.10 | 1.44 | % | $ | 6.87 | ||||||||

|

Institutional Class Hypothetical (5% return

|

||||||||||||||||

|

before expenses) — after

|

||||||||||||||||

|

expense reimbursement

|

$ | 1,000.00 | $ | 1,017.94 | 1.44 | % | $ | 7.32 | ||||||||

|

The Market Opportunities Fund

|

||||||||||||||||

|

No Load Class Actual — after

|

||||||||||||||||

|

expense reimbursement

|

$ | 1,000.00 | $ | 939.70 | 1.64 | % | $ | 8.02 | ||||||||

|

No Load Class Hypothetical (5% return

|

||||||||||||||||

|

before expenses) — after

|

||||||||||||||||

|

expense reimbursement

|

$ | 1,000.00 | $ | 1,016.93 | 1.64 | % | $ | 8.34 | ||||||||

|

Advisor Class A Actual — after

|

||||||||||||||||

|

expense reimbursement

|

$ | 1,000.00 | $ | 938.90 | 1.89 | % | $ | 9.24 | ||||||||

|

Advisor Class A Hypothetical (5% return

|

||||||||||||||||

|

before expenses) — after

|

||||||||||||||||

|

expense reimbursement

|

$ | 1,000.00 | $ | 1,015.67 | 1.89 | % | $ | 9.60 | ||||||||

|

Advisor Class C Actual — after

|

||||||||||||||||

|

expense reimbursement

|

$ | 1,000.00 | $ | 936.60 | 2.39 | % | $ | 11.67 | ||||||||

|

Advisor Class C Hypothetical (5% return

|

||||||||||||||||

|

before expenses) — after

|

||||||||||||||||

|

expense reimbursement

|

$ | 1,000.00 | $ | 1,013.15 | 2.39 | % | $ | 12.13 | ||||||||

|

Institutional Class Actual — after

|

||||||||||||||||

|

expense reimbursement

|

$ | 1,000.00 | $ | 940.60 | 1.44 | % | $ | 7.04 | ||||||||

|

Institutional Class Hypothetical (5% return

|

||||||||||||||||

|

before expenses) — after

|

||||||||||||||||

|

expense reimbursement

|

$ | 1,000.00 | $ | 1,017.94 | 1.44 | % | $ | 7.32 | ||||||||

|

KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS

|

|

Expense Example — (Continued)

|

|

December 31, 2014

|

|

Expenses Paid

|

||||||||||||||||

|

Beginning

|

Ending |

During

|

||||||||||||||

|

Account

|

Account |

Annualized

|

Period*

|

|||||||||||||

|

Value

|

Value |

Expense

|

(7/1/14 to

|

|||||||||||||

|

(7/1/14)

|

(12/31/14)

|

Ratio

|

12/31/14)

|

|||||||||||||

|

The Alternative Income Fund

|

||||||||||||||||

|

No Load Class Actual — after

|

||||||||||||||||

|

expense reimbursement

|

$ | 1,000.00 | $ | 988.70 | 0.95 | % | $ | 4.76 | ||||||||

|

No Load Class Hypothetical (5% return

|

||||||||||||||||

|

before expenses) — after

|

||||||||||||||||

|

expense reimbursement

|

$ | 1,000.00 | $ | 1,020.41 | 0.95 | % | $ | 4.84 | ||||||||

|

Advisor Class A Actual — after

|

||||||||||||||||

|

expense reimbursement

|

$ | 1,000.00 | $ | 987.30 | 1.20 | % | $ | 6.01 | ||||||||

|

Advisor Class A Hypothetical (5% return

|

||||||||||||||||

|

before expenses) — after

|

||||||||||||||||

|

expense reimbursement

|

$ | 1,000.00 | $ | 1,019.15 | 1.20 | % | $ | 6.11 | ||||||||

|

Advisor Class C Actual — after

|

||||||||||||||||

|

expense reimbursement

|

$ | 1,000.00 | $ | 985.00 | 1.70 | % | $ | 8.51 | ||||||||

|

Advisor Class C Hypothetical (5% return

|

||||||||||||||||

|

before expenses) — after

|

||||||||||||||||

|

expense reimbursement

|

$ | 1,000.00 | $ | 1,016.63 | 1.70 | % | $ | 8.64 | ||||||||

|

Institutional Class Actual — after

|

||||||||||||||||

|

expense reimbursement

|

$ | 1,000.00 | $ | 989.80 | 0.75 | % | $ | 3.76 | ||||||||

|

Institutional Class Hypothetical (5% return

|

||||||||||||||||

|

before expenses) — after

|

||||||||||||||||

|

expense reimbursement

|

$ | 1,000.00 | $ | 1,021.42 | 0.75 | % | $ | 3.82 | ||||||||

|

The Multi-Disciplinary Income Fund

|

||||||||||||||||

|

No Load Class Actual — after

|

||||||||||||||||

|

expense reimbursement

|

$ | 1,000.00 | $ | 976.80 | 1.49 | % | $ | 7.42 | ||||||||

|

No Load Class Hypothetical (5% return

|

||||||||||||||||

|

before expenses) — after

|

||||||||||||||||

|

expense reimbursement

|

$ | 1,000.00 | $ | 1,017.69 | 1.49 | % | $ | 7.58 | ||||||||

|

Advisor Class A Actual — after

|

||||||||||||||||

|

expense reimbursement

|

$ | 1,000.00 | $ | 975.30 | 1.74 | % | $ | 8.66 | ||||||||

|

Advisor Class A Hypothetical (5% return

|

||||||||||||||||

|

before expenses) — after

|

||||||||||||||||

|

expense reimbursement

|

$ | 1,000.00 | $ | 1,016.43 | 1.74 | % | $ | 8.84 | ||||||||

|

Advisor Class C Actual — after

|

||||||||||||||||

|

expense reimbursement

|

$ | 1,000.00 | $ | 972.90 | 2.24 | % | $ | 11.14 | ||||||||

|

Advisor Class C Hypothetical (5% return

|

||||||||||||||||

|

before expenses) — after

|

||||||||||||||||

|

expense reimbursement

|

$ | 1,000.00 | $ | 1,013.91 | 2.24 | % | $ | 11.37 | ||||||||

|

Institutional Class Actual — after

|

||||||||||||||||

|

expense reimbursement

|

$ | 1,000.00 | $ | 977.40 | 1.29 | % | $ | 6.43 | ||||||||

|

Institutional Class Hypothetical (5% return

|

||||||||||||||||

|

before expenses) — after

|

||||||||||||||||

|

expense reimbursement

|

$ | 1,000.00 | $ | 1,018.70 | 1.29 | % | $ | 6.56 | ||||||||

|

Note:

|

Each Feeder Fund records its proportionate share of the respective Master Portfolio’s expenses on a daily basis. Any expense reductions include Feeder Fund-specific expenses as well as the expenses allocated for the Master Portfolio. | |

|

*

|

Expenses are equal to the Feeder Fund’s annualized expense ratio before expense reimbursement and after expense reimbursement multiplied by the average account value over the period, multiplied by 184/365. | |

|

KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS

|

|

Statements of Assets & Liabilities

|

|

December 31, 2014

|

|

The Internet

|

The Global

|

|||||||

|

Fund

|

Fund

|

|||||||

|

ASSETS:

|

||||||||

|

Investments in the Master Portfolio, at value*

|

$ | 157,526,615 | $ | 8,872,053 | ||||

|

Receivable from Adviser

|

— | 7,861 | ||||||

|

Receivable for Master Portfolio interest sold

|

215,488 | — | ||||||

|

Receivable for Fund shares sold

|

24,774 | 37 | ||||||

|

Prepaid expenses and other assets

|

20,535 | 15,070 | ||||||

|

Total Assets

|

157,787,412 | 8,895,021 | ||||||

|

LIABILITIES:

|

||||||||

|

Payable for Master Portfolio interest purchased

|

— | 36 | ||||||

|

Payable to Directors

|

2,560 | 165 | ||||||

|

Payable to Chief Compliance Officer

|

192 | 14 | ||||||

|

Payable for Fund shares repurchased

|

240,262 | — | ||||||

|

Payable for shareholder servicing fees

|

33,586 | 1,895 | ||||||

|

Payable for distribution fees

|

3,654 | 2,715 | ||||||

|

Accrued expenses and other liabilities

|

59,049 | 13,532 | ||||||

|

Total Liabilities

|

339,303 | 18,357 | ||||||

|

Net Assets

|

$ | 157,448,109 | $ | 8,876,664 | ||||

|

NET ASSETS CONSIST OF:

|

||||||||

|

Paid in capital

|

$ | 72,348,653 | $ | 7,617,222 | ||||

|

Accumulated net investment income

|

153,826 | 15,403 | ||||||

|

Accumulated net realized gain (loss) on investments and foreign currency

|

3,563,235 | (75,822 | ) | |||||

|

Net unrealized appreciation on:

|

||||||||

|

Investments and foreign currency

|

81,382,395 | 1,319,861 | ||||||

|

Net Assets

|

$ | 157,448,109 | $ | 8,876,664 | ||||

|

CALCULATION OF NET ASSET VALUE PER SHARE — NO LOAD CLASS:

|

||||||||

|

Net Assets

|

$ | 151,199,801 | $ | 6,770,943 | ||||

|

Shares outstanding

|

2,696,030 | 1,271,135 | ||||||

|

Net asset value per share (offering price and redemption price)

|

$ | 56.08 | $ | 5.33 | ||||

|

CALCULATION OF NET ASSET VALUE PER SHARE — ADVISOR CLASS A:

|

||||||||

|

Net Assets

|

$ | 5,142,847 | $ | 497,376 | ||||

|

Shares outstanding

|

94,340 | 93,650 | ||||||

|

Net asset value per share (redemption price)

|

$ | 54.51 | $ | 5.31 | ||||

|

Offering price per share ($54.51 divided by .9425 and $5.31 divided by .9425)

|

$ | 57.84 | $ | 5.63 | ||||

|

CALCULATION OF NET ASSET VALUE PER SHARE — ADVISOR CLASS C:

|

||||||||

|

Net Assets

|

$ | 1,105,461 | $ | 1,608,345 | ||||

|

Shares outstanding

|

21,338 | 311,813 | ||||||

|

Net asset value per share (offering price and redemption price)

|

$ | 51.81 | $ | 5.16 | ||||

|

*

|

Each Feeder Fund invests all or generally all its assets directly in the corresponding Master Portfolio. The financial statements for the Master Portfolios, along with the portfolio of investments in securities, are contained elsewhere in this report and should be read in conjunction with the Feeder Funds’ financial statements.

|

|

KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS

|

|

Statements of Assets & Liabilities — (Continued)

|

|

December 31, 2014

|

|

The Paradigm

|

The Medical

|

|||||||

|

Fund

|

Fund

|

|||||||

|

ASSETS:

|

||||||||

|

Investments in the Master Portfolio, at value*

|

$ | 1,176,068,317 | $ | 27,084,066 | ||||

|

Receivable from Adviser

|

20,839 | 13,566 | ||||||

|

Receivable for Master Portfolio interest sold

|

3,382,941 | 12,495 | ||||||

|

Receivable for Fund shares sold

|

1,405,661 | 552 | ||||||

|

Prepaid expenses and other assets

|

41,796 | 14,189 | ||||||

|

Total Assets

|

1,180,919,554 | 27,124,868 | ||||||

|

LIABILITIES:

|

||||||||

|

Payable to Directors

|

19,797 | 401 | ||||||

|

Payable to Chief Compliance Officer

|

1,340 | 33 | ||||||

|

Payable for Fund shares repurchased

|

4,788,602 | 13,047 | ||||||

|

Payable for shareholder servicing fees

|

194,889 | 5,749 | ||||||

|

Payable for distribution fees

|

375,380 | 3,840 | ||||||

|

Accrued expenses and other liabilities

|

237,076 | 16,681 | ||||||

|

Total Liabilities

|

5,617,084 | 39,751 | ||||||

|

Net Assets

|

$ | 1,175,302,470 | $ | 27,085,117 | ||||

|

NET ASSETS CONSIST OF:

|

||||||||

|

Paid in capital

|

$ | 1,533,328,312 | $ | 16,189,992 | ||||

|

Accumulated net investment income (loss)

|

(7,237,393 | ) | 67,272 | |||||

|

Accumulated net realized gain (loss) on investments and foreign currency

|

(747,781,728 | ) | 272,190 | |||||

|

Net unrealized appreciation on:

|

||||||||

|

Investments and foreign currency

|

396,993,279 | 10,555,663 | ||||||

|

Net Assets

|

$ | 1,175,302,470 | $ | 27,085,117 | ||||

|

CALCULATION OF NET ASSET VALUE PER SHARE — NO LOAD CLASS:

|

||||||||

|

Net Assets

|

$ | 521,737,954 | $ | 21,876,078 | ||||

|

Shares outstanding

|

15,310,812 | 713,265 | ||||||

|

Net asset value per share (offering price and redemption price)

|

$ | 34.08 | $ | 30.67 | ||||

|

CALCULATION OF NET ASSET VALUE PER SHARE — ADVISOR CLASS A:

|

||||||||

|

Net Assets

|

$ | 171,958,387 | $ | 4,578,294 | ||||

|

Shares outstanding

|

5,150,425 | 154,099 | ||||||

|

Net asset value per share (redemption price)

|

$ | 33.39 | $ | 29.71 | ||||

|

Offering price per share ($33.39 divided by .9425 and $29.71 divided by .9425)

|

$ | 35.43 | $ | 31.52 | ||||

|

CALCULATION OF NET ASSET VALUE PER SHARE — ADVISOR CLASS C:

|

||||||||

|

Net Assets

|

$ | 135,332,700 | $ | 630,745 | ||||

|

Shares outstanding

|

4,244,622 | 21,637 | ||||||

|

Net asset value per share (offering price and redemption price)

|

$ | 31.88 | $ | 29.15 | ||||

|

CALCULATION OF NET ASSET VALUE PER SHARE — INSTITUTIONAL CLASS:

|

||||||||

|

Net Assets

|

$ | 346,273,429 | N/A | |||||

|

Shares outstanding

|

10,159,663 | N/A | ||||||

|

Net asset value per share (offering price and redemption price)

|

$ | 34.08 | N/A | |||||

|

*

|

Each Feeder Fund invests all or generally all its assets directly in the corresponding Master Portfolio. The financial statements for the Master Portfolios, along with the portfolio of investments in securities, are contained elsewhere in this report and should be read in conjunction with the Feeder Funds’ financial statements. | |

|

KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS

|

|

Statements of Assets & Liabilities — (Continued)

|

|

December 31, 2014

|

|

The Small Cap

|

The Market

|

|||||||

|

Opportunities

|

Opportunities

|

|||||||

|

Fund

|

Fund

|

|||||||

|

ASSETS:

|

||||||||

|

Investments in the Master Portfolio, at value*

|

$ | 353,117,149 | $ | 54,360,074 | ||||

|

Receivable from Adviser

|

32,303 | 12,667 | ||||||

|

Receivable for Master Portfolio interest sold

|

— | 91,206 | ||||||

|

Receivable for Fund shares sold

|

1,860,621 | 10,005 | ||||||

|

Prepaid expenses and other assets

|

49,719 | 27,295 | ||||||

|

Total Assets

|

355,059,792 | 54,501,247 | ||||||

|

LIABILITIES:

|

||||||||

|

Payable for Master Portfolio interest purchased

|

748,964 | — | ||||||

|

Payable to Directors

|

6,355 | 983 | ||||||

|

Payable to Chief Compliance Officer

|

445 | 62 | ||||||

|

Payable for Fund shares repurchased

|

1,111,657 | 101,211 | ||||||

|

Payable for shareholder servicing fees

|

65,981 | 11,254 | ||||||

|

Payable for distribution fees

|

27,013 | 15,005 | ||||||

|

Accrued expenses and other liabilities

|

78,890 | 21,122 | ||||||

|

Total Liabilities

|

2,039,305 | 149,637 | ||||||

|

Net Assets

|

$ | 353,020,487 | $ | 54,351,610 | ||||

|

NET ASSETS CONSIST OF:

|

||||||||

|

Paid in capital

|

$ | 455,787,003 | $ | 63,750,870 | ||||

|

Accumulated net investment loss

|

(1,564,310 | ) | (616,233 | ) | ||||

|

Accumulated net realized loss on investments and foreign currency

|

(137,851,807 | ) | (21,552,662 | ) | ||||

|

Net unrealized appreciation on:

|

||||||||

|

Investments and foreign currency

|

36,649,601 | 12,769,635 | ||||||

|

Net Assets

|

$ | 353,020,487 | $ | 54,351,610 | ||||

|

CALCULATION OF NET ASSET VALUE PER SHARE — NO LOAD CLASS:

|

||||||||

|

Net Assets

|

$ | 251,109,571 | $ | 37,317,873 | ||||

|

Shares outstanding

|

6,749,305 | 2,237,115 | ||||||

|

Net asset value per share (offering price and redemption price)

|

$ | 37.21 | $ | 16.68 | ||||

|

CALCULATION OF NET ASSET VALUE PER SHARE — ADVISOR CLASS A:

|

||||||||

|

Net Assets

|

$ | 25,591,125 | $ | 8,816,721 | ||||

|

Shares outstanding

|

702,431 | 531,386 | ||||||

|

Net asset value per share (redemption price)

|

$ | 36.43 | $ | 16.59 | ||||

|

Offering price per share ($36.43 divided by .9425 and $16.59 divided by .9425)

|

$ | 38.65 | $ | 17.60 | ||||

|

CALCULATION OF NET ASSET VALUE PER SHARE — ADVISOR CLASS C:

|

||||||||

|

Net Assets

|

$ | 12,928,160 | $ | 5,108,596 | ||||

|

Shares outstanding

|

364,493 | 314,646 | ||||||

|

Net asset value per share (offering price and redemption price)

|

$ | 35.47 | $ | 16.24 | ||||

|

CALCULATION OF NET ASSET VALUE PER SHARE — INSTITUTIONAL CLASS:

|

||||||||

|

Net Assets

|

$ | 63,391,631 | $ | 3,108,420 | ||||

|

Shares outstanding

|

1,687,279 | 185,079 | ||||||

|

Net asset value per share (offering price and redemption price)

|

$ | 37.57 | $ | 16.80 | ||||

|

*

|

Each Feeder Fund invests all or generally all its assets directly in the corresponding Master Portfolio. The financial statements for the Master Portfolios, along with the portfolio of investments in securities, are contained elsewhere in this report and should be read in conjunction with the Feeder Funds’ financial statements. | |

|

KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS

|

|

Statements of Assets & Liabilities — (Continued)

|

|

December 31, 2014

|

|

The Multi-

|

||||||||

|

The Alternative

|

Disciplinary

|

|||||||

|

Income

|

Income

|

|||||||

|

Fund

|

Fund

|

|||||||

|

ASSETS:

|

||||||||

|

Investments in the Master Portfolio, at value*

|

$ | 38,115,285 | $ | 135,378,346 | ||||

|

Receivable from Adviser

|

29,176 | 35,614 | ||||||

|

Receivable for Master Portfolio interest sold

|

— | 73,373 | ||||||

|

Receivable for Fund shares sold

|

147,652 | 258,269 | ||||||

|

Prepaid expenses and other assets

|

17,314 | 31,113 | ||||||

|

Total Assets

|

38,309,427 | 135,776,715 | ||||||

|

LIABILITIES:

|

||||||||

|

Payable for Master Portfolio interest purchased

|

80,473 | — | ||||||

|

Payable to Directors

|

536 | 1,924 | ||||||

|

Payable to Chief Compliance Officer

|

23 | 100 | ||||||

|

Payable for Fund shares repurchased

|

67,179 | 331,642 | ||||||

|

Payable for shareholder servicing fees

|

3,716 | 11,431 | ||||||

|

Payable for distribution fees

|

5,300 | 20,695 | ||||||

|

Accrued expenses and other liabilities

|

16,395 | 31,329 | ||||||

|

Total Liabilities

|

173,622 | 397,121 | ||||||

|

Net Assets

|

$ | 38,135,805 | $ | 135,379,594 | ||||

|

NET ASSETS CONSIST OF:

|

||||||||

|

Paid in capital

|

$ | 45,287,894 | $ | 138,223,503 | ||||

|

Accumulated net investment loss

|

— | (845,286 | ) | |||||

|

Accumulated net realized gain (loss) on investments and foreign currency

|

(7,588,529 | ) | 623,497 | |||||

|

Net unrealized appreciation (depreciation) on:

|

||||||||

|

Investments and foreign currency

|

(95,442 | ) | (3,625,646 | ) | ||||

|

Written option contracts

|

531,882 | 1,003,526 | ||||||

|

Net Assets

|

$ | 38,135,805 | $ | 135,379,594 | ||||

|

CALCULATION OF NET ASSET VALUE PER SHARE — NO LOAD CLASS:

|

||||||||

|

Net Assets

|

$ | 8,201,899 | $ | 10,105,374 | ||||

|

Shares outstanding

|

92,091 | 936,406 | ||||||

|

Net asset value per share (offering price and redemption price)

|

$ | 89.06 | $ | 10.79 | ||||

|

CALCULATION OF NET ASSET VALUE PER SHARE — ADVISOR CLASS A:

|

||||||||

|

Net Assets

|

$ | 1,554,083 | $ | 12,281,404 | ||||

|

Shares outstanding

|

17,523 | 1,142,852 | ||||||

|

Net asset value per share (redemption price)

|

$ | 88.69 | $ | 10.75 | ||||

|

Offering price per share ($88.69 divided by .9425 and $10.75 divided by .9425)

|

$ | 94.10 | $ | 11.41 | ||||

|

CALCULATION OF NET ASSET VALUE PER SHARE — ADVISOR CLASS C:

|

||||||||

|

Net Assets

|

$ | 1,505,632 | $ | 10,402,692 | ||||

|

Shares outstanding

|

17,386 | 976,618 | ||||||

|

Net asset value per share (offering price and redemption price)

|

$ | 86.60 | $ | 10.65 | ||||

|

CALCULATION OF NET ASSET VALUE PER SHARE — INSTITUTIONAL CLASS:

|

||||||||

|

Net Assets

|

$ | 26,874,191 | $ | 102,590,124 | ||||

|

Shares outstanding

|

298,133 | 9,482,593 | ||||||

|

Net asset value per share (offering price and redemption price)

|

$ | 90.14 | $ | 10.82 | ||||

|

*

|

Each Feeder Fund invests all or generally all its assets directly in the corresponding Master Portfolio. The financial statements for the Master Portfolios, along with the portfolio of investments in securities, are contained elsewhere in this report and should be read in conjunction with the Feeder Funds’ financial statements. | |

|

KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS

|

|

Statements of Operations

|

|

For the Year Ended December 31, 2014

|

|

The Internet

|

The Global

|

|||||||

|

Fund

|

Fund

|

|||||||

|

INVESTMENT INCOME (LOSS) ALLOCATED FROM MASTER PORTFOLIOS:

|

||||||||

|

Dividends†

|

$ | 689,583 | $ | 74,932 | ||||

|

Interest

|

948 | 454 | ||||||

|

Income from securities lending

|

39,420 | 39,953 | ||||||

|

Expenses allocated from Master Portfolio

|

(2,211,086 | ) | (171,423 | ) | ||||

|

Net investment loss from Master Portfolio

|

(1,481,135 | ) | (56,084 | ) | ||||

|

EXPENSES:

|

||||||||

|

Distribution fees — Advisor Class A

|

12,828 | 3,180 | ||||||

|

Distribution fees — Advisor Class C

|

8,362 | 12,080 | ||||||

|

Shareholder servicing fees — Advisor Class A

|

12,828 | 3,180 | ||||||

|

Shareholder servicing fees — Advisor Class C

|

2,788 | 4,027 | ||||||

|

Shareholder servicing fees — No Load Class

|

397,634 | 19,604 | ||||||

|

Transfer agent fees and expenses

|

146,328 | 20,472 | ||||||

|

Reports to shareholders

|

32,820 | 2,806 | ||||||

|

Administration fees

|

54,438 | 5,210 | ||||||

|

Professional fees

|

17,177 | 8,545 | ||||||

|

Directors’ fees

|

7,099 | 558 | ||||||

|

Chief Compliance Officer fees

|

2,000 | 136 | ||||||

|

Registration fees

|

46,139 | 43,206 | ||||||

|

Fund accounting fees

|

8,272 | 578 | ||||||

|

Other expenses

|

7,898 | 467 | ||||||

|

Total expenses

|

756,611 | 124,049 | ||||||

|

Less, expense reimbursement

|

— | (131,153 | ) | |||||

|

Net expenses

|

756,611 | (7,104 | ) | |||||

|

Net investment loss

|

(2,237,746 | ) | (48,980 | ) | ||||

|

REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS ALLOCATED FROM MASTER PORTFOLIOS:

|

||||||||

|

Net realized gain on:

|

||||||||

|

Investments and foreign currency

|

10,595,537 | 318,071 | ||||||

|

Net change in unrealized depreciation of:

|

||||||||

|

Investments and foreign currency

|

(9,484,952 | ) | (1,488,285 | ) | ||||

|

Net gain (loss) on investments

|

1,110,585 | (1,170,214 | ) | |||||

|

Net decrease in net assets resulting from operations

|

$ | (1,127,161 | ) | $ | (1,219,194 | ) | ||

|

† Net of foreign taxes withheld of:

|

$ | 1,416 | $ | 11,796 | ||||

|

KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS

|

|

Statements of Operations — (Continued)

|

|

For the Year Ended December 31, 2014

|

|

The Paradigm

|

The Medical

|

|||||||

|

Fund

|

Fund

|

|||||||

|

INVESTMENT INCOME (LOSS) ALLOCATED FROM MASTER PORTFOLIOS:

|

||||||||

|

Dividends†

|

$ | 5,712,887 | $ | 443,645 | ||||

|

Interest

|

42,724 | 195 | ||||||

|

Income from securities lending

|

2,045,419 | 44,575 | ||||||

|

Expenses allocated from Master Portfolio

|

(16,826,951 | ) | (371,663 | ) | ||||

|

Net investment income (loss) from Master Portfolio

|

(9,025,921 | ) | 116,752 | |||||

|

EXPENSES:

|

||||||||

|

Distribution fees — Advisor Class A

|

499,393 | 11,364 | ||||||

|

Distribution fees — Advisor Class C

|

1,052,238 | 4,324 | ||||||

|

Shareholder servicing fees — Advisor Class A

|

499,393 | 11,364 | ||||||

|

Shareholder servicing fees — Advisor Class C

|

350,746 | 1,441 | ||||||

|

Shareholder servicing fees — No Load Class

|

1,449,572 | 53,095 | ||||||

|

Shareholder servicing fees — Institutional Class

|

682,664 | — | ||||||

|

Transfer agent fees and expenses

|

310,790 | 26,646 | ||||||

|

Reports to shareholders

|

176,724 | 4,683 | ||||||

|

Administration fees

|

416,215 | 8,618 | ||||||

|

Professional fees

|

81,996 | 9,429 | ||||||

|

Directors’ fees

|

61,109 | 1,219 | ||||||

|

Chief Compliance Officer fees

|

15,698 | 325 | ||||||

|

Registration fees

|

83,897 | 43,165 | ||||||

|

Fund accounting fees

|

64,756 | 1,339 | ||||||

|

Other expenses

|

52,960 | 1,105 | ||||||

|

Total expenses

|

5,798,151 | 178,117 | ||||||

|

Less, expense waiver for Institutional Class shareholder servicing fees

|

(511,998 | ) | — | |||||

|

Less, expense reimbursement

|

(560,155 | ) | (167,683 | ) | ||||

|

Net expenses

|

4,725,998 | 10,434 | ||||||

|

Net investment income (loss)

|

(13,751,919 | ) | 106,318 | |||||

|

REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS ALLOCATED FROM MASTER PORTFOLIOS:

|

||||||||

|

Net realized gain on:

|

||||||||

|

Investments and foreign currency

|

36,331,414 | 723,512 | ||||||

|

Net change in unrealized appreciation (depreciation) of:

|

||||||||

|

Investments and foreign currency

|

(31,558,560 | ) | 3,048,505 | |||||

|

Net gain on investments

|

4,772,854 | 3,772,017 | ||||||

|

Net increase (decrease) in net assets resulting from operations

|

$ | (8,979,065 | ) | $ | 3,878,335 | |||

|

† Net of foreign taxes withheld of:

|

$ | 211,076 | $ | 32,954 | ||||

|

KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS

|

|

Statements of Operations — (Continued)

|

|

For the Year Ended December 31, 2014

|

|

The Small Cap

|

The Market

|

|||||||

|

Opportunities

|

Opportunities

|

|||||||

|

Fund

|

Fund

|

|||||||

|

INVESTMENT INCOME (LOSS) ALLOCATED FROM MASTER PORTFOLIOS:

|

||||||||

|

Dividends†

|

$ | 2,161,951 | $ | 604,699 | ||||

|

Interest

|

5,315 | 1,044 | ||||||

|

Income from securities lending

|

874,397 | 82,356 | ||||||

|

Expenses allocated from Master Portfolio

|

(5,412,883 | ) | (876,989 | ) | ||||

|

Net investment loss from Master Portfolio

|

(2,371,220 | ) | (188,890 | ) | ||||

|

EXPENSES:

|

||||||||

|

Distribution fees — Advisor Class A

|

74,524 | 26,085 | ||||||

|

Distribution fees — Advisor Class C

|

91,411 | 41,972 | ||||||

|

Shareholder servicing fees — Advisor Class A

|

74,524 | 26,085 | ||||||

|

Shareholder servicing fees — Advisor Class C

|

30,470 | 13,991 | ||||||

|

Shareholder servicing fees — No Load Class

|

795,055 | 111,730 | ||||||

|

Shareholder servicing fees — Institutional Class

|

90,523 | 4,982 | ||||||

|

Transfer agent fees and expenses

|

94,681 | 27,886 | ||||||

|

Reports to shareholders

|

69,091 | 7,619 | ||||||

|

Administration fees

|

132,079 | 22,288 | ||||||

|

Professional fees

|

33,435 | 11,630 | ||||||

|

Directors’ fees

|

23,543 | 2,990 | ||||||

|

Chief Compliance Officer fees

|

5,367 | 760 | ||||||

|

Registration fees

|

108,700 | 59,800 | ||||||

|

Fund accounting fees

|

21,613 | 3,207 | ||||||

|

Other expenses

|

12,963 | 2,766 | ||||||

|

Total expenses

|

1,657,979 | 363,791 | ||||||

|

Less, expense waiver for Institutional Class shareholder servicing fees

|

(67,891 | ) | (3,737 | ) | ||||

|

Less, expense reimbursement

|

(280,908 | ) | (137,265 | ) | ||||

|

Net expenses

|

1,309,180 | 222,789 | ||||||

|

Net investment loss

|

(3,680,400 | ) | (411,679 | ) | ||||

|

REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS ALLOCATED FROM MASTER PORTFOLIOS:

|

||||||||

|

Net realized gain on:

|

||||||||

|

Investments and foreign currency

|

22,542,735 | 4,069,744 | ||||||

|

Net change in unrealized depreciation of:

|

||||||||

|

Investments and foreign currency

|

(47,300,796 | ) | (7,185,651 | ) | ||||

|

Net loss on investments

|

(24,758,061 | ) | (3,115,907 | ) | ||||

|

Net decrease in net assets resulting from operations

|

$ | (28,438,461 | ) | $ | (3,527,586 | ) | ||

|

† Net of foreign taxes withheld of:

|

$ | 22,574 | $ | 16,987 | ||||

|

KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS

|

|

Statements of Operations — (Continued)

|

|

For the Year Ended December 31, 2014

|

|

The Multi-

|

||||||||

|

The Alternative

|

Disciplinary

|

|||||||

|

Income

|

Income

|

|||||||

|

Fund

|

Fund

|

|||||||

|

INVESTMENT INCOME (LOSS) ALLOCATED FROM MASTER PORTFOLIOS:

|

||||||||

|

Dividends

|

$ | 67,123 | $ | 927,945 | ||||

|

Interest

|

181,096 | 4,106,230 | ||||||

|

Income from securities lending

|

5,066 | 30,997 | ||||||

|

Expenses allocated from Master Portfolio

|

(378,101 | ) | (1,566,194 | ) | ||||

|

Net investment income (loss) from Master Portfolio

|

(124,816 | ) | 3,498,978 | |||||

|

EXPENSES:

|

||||||||

|

Distribution fees — Advisor Class A

|

7,673 | 57,683 | ||||||

|

Distribution fees — Advisor Class C

|

11,679 | 84,928 | ||||||

|

Shareholder servicing fees — Advisor Class A

|

7,673 | 57,683 | ||||||

|

Shareholder servicing fees — Advisor Class C

|

3,893 | 28,309 | ||||||

|

Shareholder servicing fees — No Load Class

|

30,889 | 47,913 | ||||||

|

Shareholder servicing fees — Institutional Class

|

28,298 | 122,026 | ||||||

|

Transfer agent fees and expenses

|

23,722 | 33,566 | ||||||

|

Reports to shareholders

|

2,891 | 20,919 | ||||||

|

Administration fees

|

10,061 | 41,158 | ||||||

|

Professional fees

|

9,650 | 14,577 | ||||||

|

Directors’ fees

|

1,580 | 5,336 | ||||||

|

Chief Compliance Officer fees

|

373 | 1,347 | ||||||

|

Registration fees

|

53,413 | 67,696 | ||||||

|

Fund accounting fees

|

1,514 | 5,510 | ||||||

|

Other expenses

|

993 | 4,035 | ||||||

|

Total expenses

|

194,302 | 592,686 | ||||||

|

Less, expense waiver for Institutional Class shareholder servicing fees

|

(21,224 | ) | (91,519 | ) | ||||

|

Less, expense reimbursement

|

(264,378 | ) | (339,600 | ) | ||||

|

Net expenses

|

(91,300 | ) | 161,567 | |||||

|

Net investment income (loss)

|

(33,516 | ) | 3,337,411 | |||||

|

REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS ALLOCATED FROM MASTER PORTFOLIOS:

|

||||||||

|

Net realized gain (loss) on:

|

||||||||

|

Investments and foreign currency

|

(43,800 | ) | (849,503 | ) | ||||

|

Written option contracts expired or closed

|

510,712 | 2,702,004 | ||||||

|

Long term realized gain distributions received from other investment companies

|

3,924 | 68,030 | ||||||

|

Net change in unrealized depreciation of:

|

||||||||

|

Investments and foreign currency

|

(37,188 | ) | (905,124 | ) | ||||

|

Written option contracts

|

(71,739 | ) | (2,322,399 | ) | ||||

|

Net gain (loss) on investments

|

361,909 | (1,306,992 | ) | |||||

|

Net increase in net assets resulting from operations

|

$ | 328,393 | $ | 2,030,419 | ||||

|

KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS

|

|

Statements of Changes in Net Assets

|

|

The Internet Fund

|

The Global Fund

|

|||||||||||||||

|

For the

|

For the

|

For the

|

For the

|

|||||||||||||

|

Year Ended

|

Year Ended

|

Year Ended

|

Year Ended

|

|||||||||||||

|

December 31,

|

December 31,

|

December 31,

|

December 31,

|

|||||||||||||

|

2014

|

2013

|

2014

|

2013

|

|||||||||||||

|

OPERATIONS:

|

||||||||||||||||

|

Net investment income (loss)

|

$ | (2,237,746 | ) | $ | (2,263,838 | ) | $ | (48,980 | ) | $ | 8,809 | |||||

|

Net realized gain on sale of investments

|

||||||||||||||||

|

and foreign currency

|

10,595,537 | 11,540,964 | 318,071 | 66,904 | ||||||||||||

|

Net change in unrealized appreciation

|

||||||||||||||||

|

(depreciation) of investments and

|

||||||||||||||||

|

foreign currency

|

(9,484,952 | ) | 52,880,805 | (1,488,285 | ) | 2,169,965 | ||||||||||

|

Net increase (decrease) in net assets

|

||||||||||||||||

|

resulting from operations

|

(1,127,161 | ) | 62,157,931 | (1,219,194 | ) | 2,245,678 | ||||||||||

|

DISTRIBUTIONS TO SHAREHOLDERS —

|

||||||||||||||||

|

NO LOAD CLASS:

|

||||||||||||||||

|

Net investment income

|

— | — | — | (9,185 | ) | |||||||||||

|

Net realized gains

|

(8,004,471 | ) | (8,399,207 | ) | (712 | ) | — | |||||||||

|

Total distributions

|

(8,004,471 | ) | (8,399,207 | ) | (712 | ) | (9,185 | ) | ||||||||

|

DISTRIBUTIONS TO SHAREHOLDERS —

|

||||||||||||||||

|

ADVISOR CLASS A:

|

||||||||||||||||

|

Net investment income

|

— | — | — | (2,107 | ) | |||||||||||

|

Net realized gains

|

(281,407 | ) | (264,840 | ) | (52 | ) | — | |||||||||

|

Total distributions

|

(281,407 | ) | (264,840 | ) | (52 | ) | (2,107 | ) | ||||||||

|

DISTRIBUTIONS TO SHAREHOLDERS —

|

||||||||||||||||

|

ADVISOR CLASS C:

|

||||||||||||||||

|

Net investment income

|

— | — | — | (1,648 | ) | |||||||||||

|

Net realized gains

|

(63,160 | ) | (47,335 | ) | (175 | ) | — | |||||||||

|

Total distributions

|

(63,160 | ) | (47,335 | ) | (175 | ) | (1,648 | ) | ||||||||

|

CAPITAL SHARE TRANSACTIONS —

|

||||||||||||||||

|

NO LOAD CLASS:

|

||||||||||||||||

|

Proceeds from shares sold

|

13,300,316 | 26,409,652 | 1,083,377 | 3,089,656 | ||||||||||||

|

Redemption fees

|

14,113 | 4,961 | 77 | 68 | ||||||||||||

|

Proceeds from shares issued to holders

|

||||||||||||||||

|

in reinvestment of dividends

|

7,733,943 | 8,096,254 | 679 | 8,850 | ||||||||||||

|

Cost of shares redeemed

|

(33,117,579 | ) | (69,661,189 | ) | (2,073,922 | ) | (1,183,302 | ) | ||||||||

|

Net increase (decrease) in net assets

|

||||||||||||||||

|

resulting from capital share

|

||||||||||||||||

|

transactions

|

(12,069,207 | ) | (35,150,322 | ) | (989,789 | ) | 1,915,272 | |||||||||

|

CAPITAL SHARE TRANSACTIONS —

|

||||||||||||||||

|

ADVISOR CLASS A:

|

||||||||||||||||

|

Proceeds from shares sold

|

2,906,101 | 4,387,670 | 726,190 | 1,186,661 | ||||||||||||

|

Redemption fees

|

277 | 550 | 1,415 | 40 | ||||||||||||

|

Proceeds from shares issued to holders

|

||||||||||||||||

|

in reinvestment of dividends

|

149,179 | 221,753 | 30 | 1,866 | ||||||||||||

|

Cost of shares redeemed

|

(3,086,613 | ) | (1,362,298 | ) | (2,164,173 | ) | (576,135 | ) | ||||||||

|

Net increase (decrease) in net assets

|

||||||||||||||||

|

resulting from capital share

|

||||||||||||||||

|

transactions

|

(31,056 | ) | 3,247,675 | (1,436,538 | ) | 612,432 | ||||||||||

|

KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS

|

|

Statements of Changes in Net Assets — (Continued)

|

|

The Internet Fund

|

The Global Fund

|

|||||||||||||||

|

For the

|

For the

|

For the

|

For the

|

|||||||||||||

|

Year Ended

|

Year Ended

|

Year Ended

|

Year Ended

|

|||||||||||||

|

December 31,

|

December 31,

|

December 31,

|

December 31,

|

|||||||||||||

|

2014

|

2013

|

2014

|

2013

|

|||||||||||||

|

CAPITAL SHARE TRANSACTIONS —

|

||||||||||||||||

|

ADVISOR CLASS C:

|

||||||||||||||||

|

Proceeds from shares sold

|

$ | 588,707 | $ | 604,756 | $ | 384,348 | $ | 914,460 | ||||||||

|

Redemption fees

|

487 | — | 40 | — | ||||||||||||

|

Proceeds from shares issued to holders

|

||||||||||||||||

|

in reinvestment of dividends

|

54,872 | 35,987 | 168 | 1,580 | ||||||||||||

|

Cost of shares redeemed

|

(369,965 | ) | (34,603 | ) | (81,376 | ) | (2,000 | ) | ||||||||

|

Net increase in net assets resulting

|

||||||||||||||||

|