Exhibit

T. ROWE PRICE GROUP, INC. 2012 LONG-TERM INCENTIVE PLAN

STATEMENT OF ADDITIONAL TERMS REGARDING AWARDS OF RESTRICTED STOCK UNITS

(version 3A)

This Statement of Additional Terms Regarding Awards of Restricted Stock Units made on or after December 6, 2017 (the “Terms”) and all of the provisions of the T. Rowe Price Group, Inc. 2012 Long-Term Incentive Plan (the “Plan”) are incorporated into your stock units award, the specifics of which are described on the “Notice of Grant of Restricted Stock Units Award” (the “Notice”) that you received. Once you have accepted the Notice in accordance with the instructions set forth thereon, the Terms (including its Appendix), the Plan and the Notice, together, constitute a binding and enforceable contract respecting your restricted stock units award. That contract is referred to in this document as the “Agreement.”

1.Terminology. Capitalized words and phrases used in these Terms are defined in the Glossary at the end of this document or the first place such word or phrase appears in this document.

(a)Vested Status upon Grant Date. All of the Stock Units are nonvested and forfeitable as of the Grant Date. Your Stock Units will become vested for purposes of this Agreement only on the applicable vesting dates under the vesting schedule set forth on the correlating Notice or on the dates specified in Section 2(d), Section 2(e), or Section 9, as applicable, notwithstanding the fact that, prior to any such date, subsequent vesting ceases to be conditioned upon your continued employment with the Company or any other substantial risk of forfeiture ceases to exist. A vested Stock Unit remains subject to the terms, conditions and forfeiture provisions provided for in the Plan and in this Agreement.

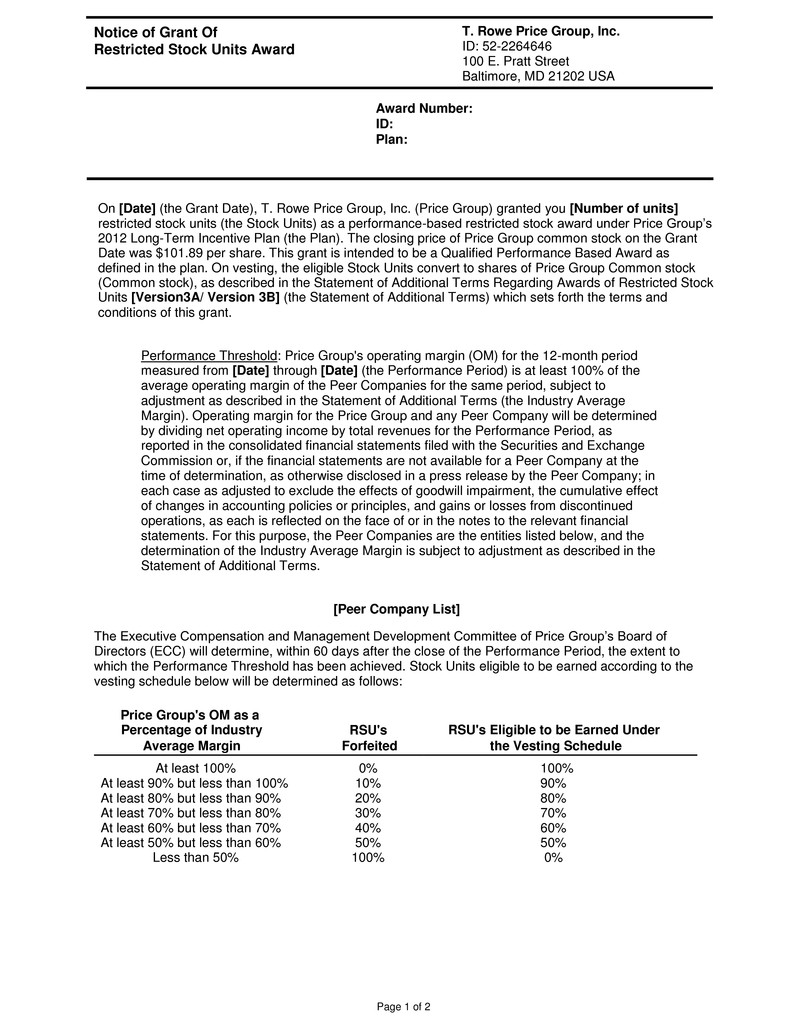

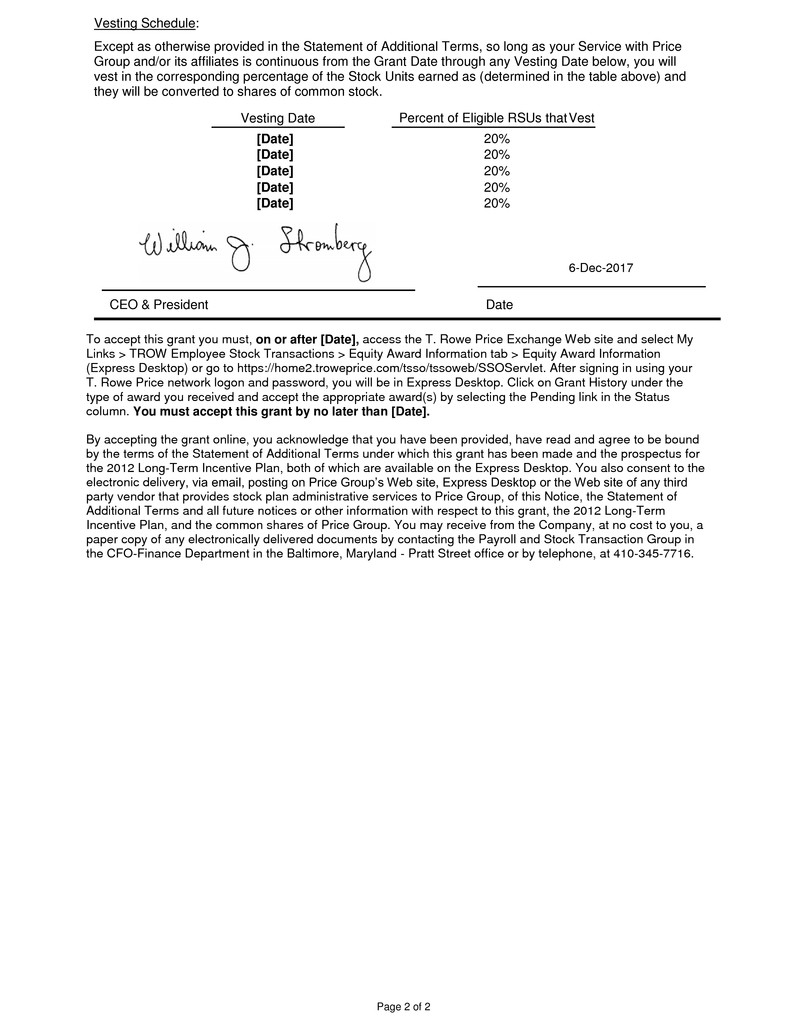

(b)Vesting Schedule. So long as your Service is continuous from the Grant Date through the applicable date upon which vesting is scheduled to occur and all other conditions for earning the Stock Units as set forth in the Notice have been satisfied, the Stock Units will become vested and nonforfeitable on the vesting dates set forth in the correlating Notice. If the Notice indicates that your restricted stock units award is a Qualified Performance- Based Award, then in no event will vesting under this Section 2(b) occur before the Executive Compensation Committee has certified in writing the extent to which the applicable Performance Threshold has been satisfied. If the Notice reflects that your restricted stock award is subject to satisfaction of a Performance Threshold then, to the extent that satisfaction of the Performance Threshold is determined based on information reported by a Peer Company in financial statements filed with the Securities and Exchange Commission or information otherwise disclosed by a Peer Company in a press release, such a determination shall be final and conclusive and no adjustment thereafter shall be made to the number of Stock Units eligible to vest in the event that a Peer Company thereafter files or discloses restated or updated financial information. To the extent that satisfaction of the Performance Threshold is to be determined based on information reported by Peer Companies, any Peer Company that has not filed

financial statements with the Securities and Exchange Commission or otherwise disclosed in a press release the relevant financial information for the Performance Period within 45 days after the end of the Performance Period in question, will not be considered a Peer Company for purposes of the determination. To the extent that satisfaction of the Performance Threshold is to be determined based on financial information reported for a specified period ending on the close of a calendar quarter and a Peer Company reports its relevant financial information over a fiscal period that does not end on the close of a calendar quarter, the Committee shall use the financial information reported by such Peer Company that most closely correlates to the duration of the Performance Period as reported before the close of the Performance Period.

For example, if the Performance Period is the 12-month period that ends December 31, 2012, and a Peer Company’s fiscal year ends on October 31, 2012, then for purposes of calculating the Performance Threshold

and the extent to which such Performance Threshold has been satisfied, the relevant financial information for the 12-month period that ends October 31, 2012 will be used for such Peer Company.

| |

(c) | Post-employment Vesting Continuation. |

(i)If, as of the date on which your Termination of Service occurs, you have attained age 60 and have at least ten years of Service credit with the Company (as determined by the Committee), including Service with any successor to the Company, then, except as otherwise provided in this Agreement, the then-unvested Stock Units with a Grant Date on or after December 6, 2017 that have not been previously forfeited and that are scheduled to vest during the period immediately following your Termination of Service will become vested and nonforfeitable, notwithstanding the fact that your Service has terminated, on their scheduled vesting dates set forth in the correlating Notice provided that all other conditions for earning the Stock Units as set forth in the Notice and these Terms are satisfied.

(ii)Notwithstanding the provisions of Section 2(c)(i) to the contrary, unless the Committee determines otherwise, your unvested Stock Units and all accrued dividend equivalents with respect to your unvested Stock Units will be immediately forfeited for no consideration, no further vesting will accrue and no shares of Common Stock will be delivered in respect thereof, if you breach any of the restrictive covenants set forth in Section 8.

(d)Vesting upon Death or Disability. All Stock Units that have not already vested or been previously forfeited will become vested and nonforfeitable upon your death or Termination of Service due to your Total and Permanent Disability.

(e)Double-trigger Vesting. If, coincident with or during the 18-month period following the effective date of a Change in Control, your Service is terminated either (i) by the Company or a successor to the Company, other than for Cause, Total and Permanent Disability or death or (ii) by you for Good Reason, then all Stock Units that have not already vested or been previously forfeited or terminated in connection with the Change in Control will become vested and nonforfeitable upon such Termination of Service.

| |

3. | Forfeitures Upon Termination of Service. |

(a)Termination before Attaining Age 60 with 10 Years of Service. If your Service ceases for any reason before you (i) have attained age 60, and (ii) have at least ten years of Service credit with the Company (as determined by the Committee), including any successor to the Company, all Stock Units that are not then vested and nonforfeitable, after giving effect to the applicable provisions of Section 2 above, will be immediately forfeited upon such cessation for no consideration.

(b)Forfeiture of Accrued Dividend Equivalents. Any accrued dividend equivalents attributable to forfeited Stock Units shall also be forfeited if and when the Stock Units are forfeited.

(c)Consequences of Forfeiture. You acknowledge and agree that upon the forfeiture of any unvested Stock Units, your right to receive dividend equivalents on, and all other rights, title or interest in, to or with respect to, the forfeited Stock Units and the shares into which they otherwise may have been converted shall automatically, without further act, terminate.

4.Restrictions on Transfer. Stock Units may not be assigned, transferred, pledged, hypothecated or disposed of in any way, whether by operation of law or otherwise, except by will or the laws of descent and distribution, and Stock Units may not be made subject to execution, attachment or similar process.

5.Dividend Equivalent Payments. On each dividend payment date for each regular cash dividend payable with respect to the Common Stock, the Company will pay to you in cash an amount equal to the product of (a) the per share cash dividend, multiplied by (b) the number of your Stock Units outstanding on the record date regardless of the vested or nonvested status of the Stock Units; provided, however, that if the Notice reflects that your Stock Units are subject to satisfaction of a Performance Threshold then any regular cash dividends that become payable with respect to unvested Stock Units before the Performance Threshold has been determined to have been satisfied will be accrued and held by the Company or an escrow agent appointed by the Committee until a determination has been made by the Executive Compensation Committee as to

whether and the extent to which the Performance Threshold has been satisfied. Any such accrued dividends will be paid to you, without interest, within 14 days after the date on which the Executive Compensation Committee determines that, and the extent to which, the Performance Threshold has been satisfied or will be forfeited to the Company if and when the Stock Units to which they relate are forfeited due to a failure to satisfy the Performance Threshold.

6.Settlement of Stock Units. Your Stock Units will be settled automatically, via the issuance of Common Stock as described herein, when or as soon as practicable, but in all events within 30 days, after they become vested and nonforfeitable in accordance with

Section 2 or Section 9, as applicable. You may not, directly or indirectly, designate the calendar

year in which such settlement will be made. You are not required to make any monetary payment (other than applicable tax withholding, if required) as a condition to settlement of the Stock Units. The Company will issue to you, in settlement of your Stock Units, the number of whole shares of Common Stock that equals the number of whole Stock Units that vested, and the vested Stock Units will cease to be outstanding upon the issuance of those shares. Unless you request the Company to deliver a share certificate to you, or deliver shares electronically or in certificate form to your designated broker, bank or nominee on your behalf, the Company will retain the shares in uncertificated book entry form.

(a)General Authority to Withhold. By accepting the Notice correlating with these Terms, you agree to make adequate provision for foreign (non-United States), federal, state and local taxes and social insurance contributions required by law to be withheld, if any, that arise in connection with the Stock Units. The Company shall have the right to deduct from any compensation or any other payment of any kind due you (including withholding the issuance or delivery of shares of Common Stock) the amount of any foreign (non-United States), federal, state or local taxes and social insurance contributions required by law to be withheld as a result of the vesting or settlement of the Stock Units, in whole or in part, or as otherwise may be required by applicable law; provided, however, that the value of the shares of Common Stock withheld may not exceed, by more than a fractional share, the statutory minimum withholding amount required by law. In lieu of such deduction, the Company may require you to make a cash payment to the Company equal to the amount required to be withheld. If you do not make such payment when requested, the Company may refuse to issue any Common Stock or deliver any stock certificate under this Agreement or otherwise release for transfer any such shares until arrangements satisfactory to the Company for such payment have been made.

(b)Withholding Taxes Satisfied with Shares of Common Stock. The Company may, in its sole discretion, permit or require you to satisfy, in whole or in part, any tax withholding or social insurance contribution obligation that may arise in connection with the Stock Units either by having the Company withhold from the shares to be issued upon vesting that number of shares, or by delivering to the Company already-owned shares, in either case having a fair market value equal to no more than the amount necessary to satisfy the statutory minimum withholding amount due.

(a)Termination of Vesting. Notwithstanding anything in Section 2 or Section 3 to the contrary, unless the Committee determines otherwise, upon the occurrence of any Prohibited Action set forth in Section 8(b), the following shall occur with respect to your Stock Units: (i) no further Stock Units will become vested and (ii) Stock Units that are not then vested and nonforfeitable will be immediately forfeited for no consideration.

(b)Prohibited Actions. The following actions are considered Prohibited Actions and subject to the consequences set forth in Section 8(a) above, whether engaged in by you directly or indirectly, either as an employee, employer, consultant, or in any other capacity:

(i)engaging in any Competing Business. “Competing Business” shall be defined as the business of investment advisory services to individual and/or institutional investors, retirement

plan services, discount brokerage, trust services, and any other business that is competitive with the business activities of the Company;

(ii)soliciting, encouraging, or inducing any customers or clients of the Company who were current or prospective customers or clients as of the date on which your Termination of Service occurred, to terminate or reduce his, her or its relationship with the Company or not to proceed with, or enter into, any business relationship with the Company, or otherwise interfering with any such business relationship with the Company, including by encouraging or suggesting any investment management client of the Company (A) to withdraw any funds for which the Company provides investment management or advisory services, or (B) not to engage the Company to provide investment management or advisory services for any funds;

(iii)(A) soliciting, encouraging, or inducing any officer, director, employee, agent, partner, consultant or independent contractor of the Company to terminate, modify or reduce his or her relationship with the Company, (B) hiring, employing, supervising, managing or engaging any such individual, or (C) otherwise attempting to disrupt or interfere with the Company’s relationship with any such individual;

(iv)using, reproducing, or disclosing any Confidential Information of the Company. “Confidential Information” shall be defined as client and customer lists, information with respect to the name, address, contact persons or requirements of any customer or client, other information relating to clients and prospective clients from whom the Company has solicited business or plans to solicit business, information relating to business plans and business that is conducted or anticipated to be conducted, research, technology, computer software, processes, products, pricing, costs, business methods, business objectives or strategies, marketing plans and finances;

(v)pleading guilty or nolo contendere (or a similar plea) to, or being convicted of, (A) a felony (or its equivalent in a non-United States jurisdiction) or

(B) other conduct of a criminal nature that has or is likely to have a material adverse effect on the reputation or standing in the community of the Company, as determined by the Committee in its sole discretion, or that legally prohibits you from working for the Company;

(vi)breaching a regulatory rule that adversely affects your ability to perform your employment duties to the Company in any material respect; and

(vii)failing, in any material respect, to (A) perform your employment duties, (B) comply with the applicable policies of the Company, (C) follow reasonable directions received from the Company or (D) comply with covenants contained in any contract with the Company to which you are a party.

(c)Blue Pencil. If any of the provisions or terms of this Section 8 is construed by a court of competent jurisdiction to be invalid or unenforceable, it shall not affect the remainder of this Agreement, which shall be given full force and effect without regard to the invalid provision. Any invalid or unenforceable provision shall be reformed to the maximum

time, geographic and/or customer limitations permitted by the applicable laws, so as to be valid and enforceable.

(d)Notification To Company. For as long as you have outstanding unvested Stock Units, you covenant and agree that you will disclose to the Company the identity of any new employer within two business days of being employed or engaged by such new employer, and upon request of the Committee in advance of the settlement of any Stock Unit you will provide to the Company information sufficient to confirm that you have not engaged in any Prohibited Actions.

| |

9. | Adjustments for Corporate Transactions and Other Events. |

(a)Stock Dividend, Stock Split and Reverse Stock Split. Upon a stock dividend of, or stock split or reverse stock split affecting, the Common Stock, the number of outstanding Stock Units and the number

of Stock Units eligible to vest on each subsequent vesting date under the vesting schedule set forth on the Notice shall, without further action of the Committee, be adjusted to reflect such event; provided, however, that any fractional Stock Units resulting from any such adjustment shall be eliminated. Adjustments under this paragraph will be made by the Committee, whose determination regarding such adjustments will be final, binding and conclusive.

(b)Discretionary Adjustments. In the case of a merger, consolidation, stock rights offering, liquidation, statutory share exchange or similar event affecting Price Group, the Committee may make such other adjustments to outstanding Stock Units as it determines to be appropriate and desirable, which adjustments may include, without limitation, (i) the cancellation of outstanding Stock Units in exchange for payments of cash, securities or other property or a combination thereof having an aggregate value equal to the value of such Stock Units, as determined by the Committee in its sole discretion, (ii) the substitution of securities or other property (including, without limitation, cash or other securities of Price Group and securities of entities other than Price Group) for the shares of Common Stock subject to outstanding Stock Units, and (iii) the substitution of equivalent awards, as determined in the sole discretion of the Committee, of the surviving or successor entity or a parent thereof; provided, however, that all adjustments shall be made in compliance with the requirements of Section 409A of the Code and provided further that the Committee shall not have the authority to make adjustments pursuant to this paragraph to the extent that the existence of such authority would cause the Stock Units to fail to comply with Section 409A of the Code.

(c)Dissolution or Liquidation. Unless the Committee determines otherwise, all of the Stock Units shall terminate upon the dissolution or liquidation of Price Group.

(d)Change in Control. Notwithstanding anything in this Agreement or the Plan to the contrary, in the event that a Change in Control occurs, outstanding Stock Units will terminate upon the effective time of such Change in Control unless provision is made in connection with the transaction for the continuation or assumption of such Stock Units by, or for the substitution of equivalent units, as determined in the sole discretion of the Committee, of, the surviving or successor entity or a parent thereof. In the event of such termination, (i) the outstanding Stock Units that will terminate upon the effective time of the Change in Control shall, immediately before the effective time of the Change in Control, become fully vested, and

(ii) the Committee may take any of the actions set forth in Section 9(b) with respect to any or all

of the Stock Units. Implementation of the provisions of the immediately foregoing sentence shall be conditioned upon consummation of the Change in Control.

10.Non-Guarantee of Employment. Nothing in the Plan or this Agreement shall alter your employment status with the Company, nor be construed as a contract of employment between the Company and you, or as a contractual right of you to continue in the employ of the Company for any period of time, or as a limitation of the right of the Company to discharge you at any time with or without cause or notice, subject to applicable law, and whether or not such discharge results in the forfeiture of any Stock Units or any other adverse effect on your interests under the Plan.

11.Rights as Stockholder. Except as otherwise provided in this Agreement with respect to dividend equivalent payments, neither you nor any other person claiming through you shall have any rights with respect to any shares of Common Stock subject to the Stock Units, including without limitation, any voting rights, unless and until such shares are duly issued and delivered to you.

12.The Company’s Rights. The existence of the Stock Units will not affect in any way the right or power of the Price Group or its stockholders to make or authorize any or all adjustments, recapitalizations, reorganizations or other changes in the Company’s capital structure or its business, or any merger or consolidation of the Company, or any issue of bonds, debentures, preferred or other stocks with preference ahead of or convertible into, or otherwise affecting the Common Stock or the rights thereof, or the dissolution or liquidation of the Company, or any sale or transfer of all or any part of the Company’s assets or business, or any other corporate act or proceeding, whether of a similar character or otherwise.

13.Notices. All notices and other communications made or given pursuant to this Agreement shall be in writing and shall be sufficiently made or given if hand delivered or mailed by certified mail, addressed to you

at the address contained in the records of the Company, or addressed to the Committee, care of the Company for the attention of its Payroll and Stock Transaction Group in the CFO-Finance Department at the Company’s principal executive office or, if the receiving party consents in advance, transmitted and received via telecopy or via such other electronic transmission mechanism as may be available to the parties.

| |

14. | Electronic Delivery of Documents. |

(a)Methods of Delivery. The Company may from time to time electronically deliver, via e-mail or posting on the Company’s website, these Terms, information with respect to the Plan or the Stock Units, any amendments to the Agreement, and any reports of the Company provided generally to the Company’s stockholders. You may receive from the Company, at no cost to you, a paper copy of any electronically delivered documents by contacting the Payroll and Stock Transaction Group in the CFO-Finance Department in the Baltimore, Maryland - Pratt Street office or by telephone, at 410-345-7716.

(b)Consent and Acknowledgment. By your accepting the Notice correlating to these Terms, you (i) consent to the electronic delivery of this Agreement, all information with respect to the Plan and the Stock Units and any reports of the Company provided generally to the Company’s stockholders; (ii) acknowledge that you may receive from the Company a paper copy of any documents delivered electronically at no cost to you by contacting the Company by telephone or in writing; (iii) further acknowledge that you may revoke your consent to the

electronic delivery of documents at any time by notifying the Company of such revoked consent by telephone, postal service or electronic mail; and (iv) further acknowledge that you understand that you are not required to consent to electronic delivery of documents.

15.Recoupment. The terms and conditions of the Company’s Policy for Recoupment of Incentive Compensation, adopted by the Board of Directors of the Company effective April 14, 2010, as amended from time to time or any successor thereto (the “Recoupment Policy”), are incorporated by reference into this Agreement and shall apply to your Stock Units if you on the Grant Date are or subsequently become an executive officer or other senior executive who is subject to the Recoupment Policy.

16.Entire Agreement. This Agreement, together with the correlating Notice and the Plan, contain the entire agreement between you and the Company with respect to the Stock Units awarded hereunder. Any oral or written agreements, representations, warranties, written inducements, or other communications made prior to the acceptance of the Notice correlating to these Terms with respect to the Stock Units awarded hereunder shall be void and ineffective for all purposes.

17.Amendment. Except as otherwise provided in the Plan, the Committee may unilaterally amend the terms of this Agreement, but no such amendment shall materially impair your rights with respect to your Stock Units without your consent, except such an amendment made to cause the Plan or the Agreement to comply with applicable law, applicable rule of any securities exchange on which the Common Stock is listed or admitted for trading, or to prevent adverse tax or accounting consequences for you or the Company or any of its Affiliates. The Company shall give written notice to you of any such alteration or amendment of this Agreement by the Committee as promptly as practical after the adoption thereof. The foregoing shall not restrict the ability of you and the Company by mutual consent to alter or amend this Agreement in any manner that is consistent with the Plan and approved by the Committee.

18.Conformity with Plan. These Terms are intended to conform with, and are subject to all applicable provisions of, the Plan. In the event of any ambiguity in these Terms or any matters as to which these Terms are silent, the Plan shall govern. A copy of the Plan is available at https://home2.troweprice.com/tsso/tssoweb/SSOServlet or in hard copy upon request to the Company’s Payroll and Stock Transaction Group in the CFO-Finance Department in the Baltimore, Maryland - Pratt Street office or by telephone, at 410-345-7716.

19.No Funding. This Agreement constitutes an unfunded and unsecured promise by the Company to make payments and issue shares of Common Stock in the future in accordance with its terms. You have the status of a general unsecured creditor of the Company as a result of receiving the award of Stock Units. Any cash payment due under this Agreement with respect to dividend equivalent payments under Section 5 hereof

will be paid from the general assets of the Company and nothing in this Agreement will be construed to give you or any other person rights to any specific assets of the Company.

20.Governing Law. The validity, construction and effect of this Agreement, and of any determinations or decisions made by the Committee relating to this Agreement, and the rights of any and all persons having or claiming to have any interest under this Agreement, shall be determined exclusively in accordance with the laws of the State of Maryland, without regard to its provisions concerning the applicability of laws of other jurisdictions. As a condition of this Agreement, you agree that you will not bring any action arising under, as a result of, pursuant to

or relating to, this Agreement in any court other than a federal or state court in the districts that include Baltimore, Maryland, and you hereby agree and submit to the personal jurisdiction of any federal court located in the district that includes Baltimore, Maryland or any state court in the district that includes Baltimore, Maryland. You further agree that you will not deny or attempt to defeat such personal jurisdiction or object to venue by motion or other request for leave from any such court.

21.Resolution of Disputes. Any dispute or disagreement that shall arise under, or as a result of, or pursuant to or relating to, this Agreement shall be determined by the Committee in good faith in its absolute and uncontrolled discretion, and any such determination or any other determination by the Committee under or pursuant to this Agreement and any interpretation by the Committee of the terms of this Agreement, will be final, binding and conclusive on all persons affected thereby. You agree that before you may bring any legal action arising under, as a result of, pursuant to or relating to, this Agreement you will first exhaust your administrative remedies before the Committee. You further agree that in the event that the Committee does not resolve any dispute or disagreement arising under, as a result of, pursuant to or relating to, this Agreement to your satisfaction, no legal action may be commenced or maintained relating to this Agreement more than 24 months after the Committee’s decision.

22.Preemption of Applicable Laws or Regulations. Anything in this Agreement to the contrary notwithstanding, if, at any time specified herein for the issue of shares to you, any law, regulation or requirements of any governmental authority having jurisdiction in the premises shall require either the Company or you to take any action in connection with the shares then to be issued, the issue of such shares will be deferred until such action shall have been taken.

23.409A Savings Clause. This Agreement and the Stock Units awarded hereunder are intended to comply with, or otherwise be exempt from, Section 409A of the Code. This Agreement and the Stock Units shall be administered, interpreted and construed in a manner consistent with this intent. Should any provision of this Agreement or the Stock Units be found not to comply with, or otherwise be exempt from, the provisions of Section 409A of the Code, it shall be modified and given effect, in the sole discretion of the Committee and without requiring your consent, in such manner as the Committee determines to be necessary or appropriate to comply with, or to effectuate an exemption from, Section 409A of the Code. The preceding provisions shall not be construed as a guarantee or warranty by the Company of any particular tax effect of the Stock Units.

24.Service and Employment Acknowledgments. By accepting the Notice, you acknowledge and agree that: (i) the Plan is established voluntarily by the Company, is discretionary in nature and may be modified, amended, suspended or terminated by the Company at any time, unless otherwise provided in the Plan or this Agreement; (ii) you are voluntarily participating in the Plan; (iii) the award of Stock Units is a one-time benefit that does not create any contractual or other right to receive future awards of Stock Units, or compensation or benefits in lieu of Stock Units, even if Stock Units have been awarded repeatedly in the past; (iv) all determinations with respect to any such future awards, including, but not limited to, the times when Stock Units shall be awarded or shall become vested and the number of Stock Units subject to each award, will be at the sole discretion of the Committee;

(v) the value of the Stock Units is an extraordinary item of compensation that is outside the scope of your employment contract, if any; (vi) the value of the Stock Units is not part of normal or expected compensation or salary for any purpose, including, but not limited to, calculating

any termination, severance, resignation, redundancy, end of service payments or similar payments, or bonuses, long-service awards, pension, welfare or retirement benefits; (vii) the vesting of the Stock Units ceases upon termination of Service with the Company or transfer of employment from the Company, or other cessation of eligibility for any reason, except as may otherwise be explicitly provided in this Agreement; (viii) the value of the Stock Units and the underlying Shares cannot be predicted with certainty and will change over time and the Company does not guarantee any future value; (ix) if you are not an employee of the Company, the Stock Units grant will not be interpreted to form an employment contract or relationship with the Company; nothing in this Agreement shall confer upon you any right to continue in the service of the Company or interfere in any way with any right of the Company to terminate your service as a director, an employee or consultant, as the case may be, at any time, subject to applicable law; the Company is not providing any tax, legal or financial advice, nor is the Company making any recommendations regarding your participation in the Plan or your acquisition or sale of the Shares underlying the Stock Units; and (x) no claim or entitlement to compensation or damages arises if the value of the Stock Units or the underlying Shares decreases and in consideration for the grant of the Stock Units you irrevocably release the Company from any claim or entitlement to compensation or damages that does arise in connection with the Stock Units.

25.Data Privacy Consent. For purposes of the implementation, administration and management of the Stock Units and the Plan or the effectuation of any acquisition, equity or debt financing, joint venture, merger, reorganization, consolidation, recapitalization, business combination, liquidation, dissolution, share exchange, sale of stock, sale of material assets or other similar corporate transaction involving the Company (a “Corporate Transaction”), you explicitly and unambiguously consent, by accepting the Notice, to the collection, receipt, use, retention and transfer, in electronic or other form, of your personal data by and among the Company, its Affiliates and its third party vendors or any potential party to a potential Corporate Transaction. You understand that personal data (including but not limited to, name, home address, telephone number, employee number, employment status, social insurance number, tax identification number, date of birth, nationality, job title or duties, salary and payroll location, data for tax withholding purposes and Stock Units awarded, cancelled, vested and unvested) is held by the Company or its Affiliates and may be transferred to any broker designated by the Committee or third parties assisting in the implementation, administration and management of the Stock Units or the Plan or the effectuation of a Corporate Transaction and you expressly authorize such transfer as well as the retention, use, and the subsequent transfer of the data, in electronic or other form, by the recipient(s) for these purposes. You understand that these recipients may be located in your country or elsewhere, and that the recipient’s country may have different data privacy laws and protections than your country, including those that the European Commission or your jurisdiction does not consider to be equivalent to the protections in your country. You understand that personal data will be held only as long as is necessary to implement, administer and manage the Stock Units or Plan or effect a Corporate Transaction. You understand that, to the extent required by applicable law, you may, at any time, request a list with the names and addresses of any potential recipients of the personal data, view data, request additional information about the storage and processing of data, require any necessary amendments to data or refuse or withdraw the consents herein, in any case without cost, by contacting in writing the Company’s Payroll and Stock Transaction Group in the CFO-Finance Department in the Baltimore, Maryland - Pratt Street office. If you do not consent, or if you later seek to

revoke your consent, your Service and career with your employer will not be adversely affected; the only adverse consequence of refusing or withdrawing your consent is that the Company would not be able to grant you Stock Units or other equity awards or administer or maintain such awards. Therefore, you understand that refusing or withdrawing your consent may affect your ability to participate in the Plan. You also understand that you have the right to discontinue the collection, processing, or use of your data, or supplement, correct, or request deletion of any of your data. Further, you understand that you are providing the consents herein on a purely voluntary basis. You understand that your consent will be sought and obtained for any processing or transfer of your data for any purpose other than as described in the Agreement and any other Plan materials.

26.Headings. The headings in this Agreement are for reference purposes only and shall not affect the meaning or interpretation of this Agreement.

27.Country-Specific Terms and Conditions and Notices. Notwithstanding any provisions in this

Agreement, the grant of Stock Units shall be subject to any special terms and conditions for your country set forth in any appendix to this Agreement (the “Appendix”). Moreover, if you relocate to one of the countries included in the Appendix, the special terms and conditions for such country will apply to you, to the extent the Company determines that the application of such terms and conditions is necessary or advisable for legal or administrative reasons. The Appendix constitutes part of this Agreement.

{Glossary begins on next page}

GLOSSARY

(a)“Affiliate” means any entity, whether previously, now or hereafter existing, in which the Company, directly or indirectly, at the relevant time has a proprietary interest by reason of stock ownership or otherwise (including, but not limited to, joint ventures, limited liability companies, and partnerships) or any entity that provides services to the Company or a subsidiary or affiliated entity of the Company.

(b)“Agreement” means the contract consisting of the Notice, the Terms and

the Plan.

(c)“Cause” means: (i) your plea of guilty or nolo contendere (or a similar plea) to, or conviction of, (A) a felony (or its equivalent in a non-United States jurisdiction) or

(B) other conduct of a criminal nature that has or is likely to have a material adverse effect on the reputation or standing in the community of the Company, as determined by the Committee in its sole discretion, or that legally prohibits you from working for the Company; (ii) your breach of a regulatory rule that adversely affects your ability to perform your employment duties to the Company in any material respect; or (iii) your failure, in any material respect, to (A) perform your employment duties, (B) comply with the applicable policies of the Company, (C) follow reasonable directions received from the Company or (D) comply with covenants contained in any contract with the Company to which you are a party; provided, however, that you shall be provided a written notice describing in reasonable detail the facts that are considered to give rise to a breach described in this clause (iii) and you shall have 30 days following receipt of such written notice during which you may remedy the condition and, if so remedied, no Cause for Termination of Service shall exist.

(d)“Change in Control” has the meaning ascribed to such term in the Plan.

(e)“Code” means the Internal Revenue Code of 1986, as amended from time to time, and any successor thereto, the Treasury Regulations thereunder and other relevant interpretive guidance issued by the Internal Revenue Service or the Treasury Department. Reference to any specific section of the Code shall be deemed to include such regulations and guidance, as well as any successor section, regulations and guidance.

(f)“Committee” means the Executive Compensation Committee, or such other committee(s) or officer(s) duly appointed by the Board or the Executive Compensation Committee to administer the Plan or delegated limited authority to perform administrative actions under the Plan, and having such powers as shall be specified by the Board or the Executive Compensation Committee; provided, however, that at any time the Board may serve as the Committee in lieu of or in addition to the Executive Compensation Committee or such other committee(s) or officer(s) to whom administrative authority has been delegated.

(g)“Common Stock” means shares of common stock of T. Rowe Price Group, Inc., par value twenty cents ($0.20) per share and any capital securities into which they are converted.

(h)“Company” means T. Rowe Price Group, Inc. and its Affiliates and successors, except where the context otherwise requires. For purposes of determining whether a Change in Control has occurred, Company shall mean only T. Rowe Price Group, Inc.

(i)“Corporate Transaction” means the consummation of a reorganization, merger, tender offer, share exchange, consolidation or other business combination, acquisition of Price Group equity securities, or sale or other disposition of all or substantially all of the assets of Price Group or the acquisition of assets of another entity.

(j)“Executive Compensation Committee” means the Executive Compensation Committee of the Board of Directors of T. Rowe Price Group, Inc.

(k)“Good Reason” means, during the 18-month period following a Change in Control, actions taken by the Company or any successor corporation or other entity in a Corporate Transaction resulting in a material negative change in your employment relationship in one or more of the following ways:

(i)the assignment to you of duties materially inconsistent with your position (including offices, titles and reporting requirements), authority, duties or responsibilities, or a material diminution in such position, authority, duties or responsibilities, in each case from those in effect immediately prior to the Change in Control;

(ii)a material reduction of your aggregate annual compensation, including, without limitation, base salary and annual bonus and incentive compensation opportunity, from that in effect immediately prior to the Change in Control; or

(iii)a change in your principal place of employment that increases your commute by 75 or more miles as compared to your commute immediately prior to the Change in Control.

In order to invoke a Termination of Service for Good Reason, you must provide written notice to the Company or any successor corporation or other entity in a Corporate Transaction with respect to which you are employed or providing services (as applicable, the “Service Recipient”) of the existence of one or more of the conditions constituting Good Reason within 90 days following your knowledge of the initial existence of such condition or conditions, specifying in reasonable detail the conditions constituting Good Reason, and the Service Recipient shall have 30 days following receipt of such written notice (the “Cure Period”) during which it may remedy the condition. In the event that the Service Recipient fails to remedy the condition constituting Good Reason during the applicable Cure Period, your Termination of Service must occur, if at all, within 90 days following the expiration of such Cure Period in order for such termination as a result of such condition to constitute a Termination of Service for Good Reason.

(l)“Grant Date” means the date set forth on the Notice indicating when the grant of Stock Units was approved by the Committee.

(m)“Notice” means the Notice of Grant of Restricted Stock Units Award that correlates with these Terms and sets forth the specifics of the applicable award of Stock Units.

(n)“Peer Company” or collectively “Peer Companies” means each of the entities listed on the correlating Notice and each Peer Company’s successor; so long as each

Peer Company has a class of common securities listed for public trade on a national securities exchange or market from the beginning through the end of the Performance Period or otherwise files financial statements with the Securities and Exchange Commission, as defined on the correlating Notice. The Peer Companies shall be changed as follows:

(i)In the event that, at any time during the Performance Period, a Peer Company is no longer included in the same Standard & Poor’s Global Industry Classification Standard (“GICS”) Sub-Industry as Price Group, such company shall no longer be a Peer Company.

(ii)In the event of a merger, acquisition or business combination transaction of a Peer Company with or by another Peer Company, the surviving entity shall remain a Peer Company, provided that the surviving entity is still in the same GICS Sub-Industry as Price Group.

(iii)In the event of a merger of a Peer Company with or by an entity that is not a Peer Company, or the acquisition or business combination transaction of a Peer Company with an entity that is not a Peer Company, in each case, where the Peer Company is the surviving entity, the surviving entity shall remain a Peer Company, provided that the surviving entity is still in the same GICS Sub-Industry as Price Group.

(iv)In the event of a merger or acquisition or business combination transaction of a Peer Company with or by an entity that is not a Peer Company, other form of “going private” transaction relating to any Peer Company or the liquidation of any Peer Company, where such Peer Company is not the surviving entity or is otherwise no longer publicly traded, the company shall no longer be a Peer Company.

(v)In the event of a bankruptcy of a Peer Company, such company shall remain a Peer Company.

(o)“Performance Threshold” means the performance objective(s) set forth on the Notice, if any, which must be satisfied in order for any Stock Units to become vested, except as otherwise provided in this Agreement.

(p)“Plan” means the T. Rowe Price Group, Inc. 2012 Long-Term Incentive

Plan.

(q)“Price Group” means T. Rowe Price Group, Inc.

(r)“Qualified Performance-Based Award” means a grant that is intended by the Executive Compensation Committee to qualify for the exemption from the limitation on deductibility imposed by Section 162(m)(4)(C) of the Code.

(s)“Service” means your employment with the Company, inclusive of any period of credited service that may be allocated to you by the Company in writing for periods during which you were not employed with the Company. Your Service will be considered to have ceased with the Company if, immediately after a sale, merger or other corporate transaction, the trade, business or entity with which you are employed is not T. Rowe Price Group, Inc. or its successor or an Affiliate of T. Rowe Price Group, Inc. or its successor.

(t)“Stock Unit” means a bookkeeping entry used by the Company to record and account for the grant of a restricted stock unit until such time as such restricted stock unit is settled, forfeited or terminated, as the case may be. Each Stock Unit represents a contractual obligation of the Company to deliver one share of Common Stock to the holder upon vesting of the Stock Unit.

(u)“Termination of Service” means the termination of your employment with the Company. Temporary absences from employment because of illness, vacation or leave of absence and transfers among entities that comprise the Company, including all Affiliates, shall not be considered Terminations of Service; provided, however, that the Committee has discretion to determine that a Termination of Service has occurred if, for six continuous months, you are absent or otherwise unable for any reason to perform substantially all the essential duties of your position, as determined by the Committee. The Committee has discretion to determine the date upon which you incur a Termination of Service.

(v)“Terms” mean this Statement of Additional Terms Regarding Awards of Restricted Stock Units.

(w)“Total and Permanent Disability” means that you are (i) unable to engage in any substantial gainful activity by reason of any medically determinable physical or mental impairment that can be expected to last until your death or result in death, or

(ii) determined to be totally disabled by the Social Security Administration or other governmental or quasi-governmental body that administers a comparable social insurance program outside of the United States in which you participate and that conditions the right to receive benefits under such program on your being

unable to engage in any substantial gainful activity by reason of any medically determinable physical or mental impairment which can be expected to last until your death or result in death. The Committee may require such medical or other evidence as it deems necessary to judge the nature and permanency of your condition.

(x) “You”; “Your”. You, whether or not capitalized, means the recipient of the Stock Units as reflected in the Notice. Whenever the word “you” or “your” is used in any provision of this Agreement under circumstances where the provision should logically be construed, as determined by the Committee, to apply to the estate, personal representative, or beneficiary to whom the Stock Units may be transferred by will or by the laws of descent and distribution, the words “you” and “your” shall be deemed to include such person.

{Appendix begins on next page}

APPENDIX

APPENDIX TO THE STATEMENT OF ADDITIONAL TERMS

REGARDING AWARDS OF STOCK UNITS (VERSION 2A)

UNDER THE

T.ROWE PRICE GROUP, INC. 2012 LONG-TERM INCENTIVE PLAN

Terms and Conditions

This Appendix includes additional terms and conditions that govern the Stock Units granted to you under the Plan if you reside in one of the countries listed below. Certain capitalized terms used but not defined in this Appendix have the meanings set forth in the Plan and/or the main body of the Agreement.

Notifications

This Appendix also includes information regarding exchange controls and certain other issues of which you should be aware with respect to your participation in the Plan. The information is based on the securities, exchange control and other laws in effect in the respective countries as of January 2015. Such laws are often complex and change frequently. As a result, the Company strongly recommends that you not rely on the information in this Appendix as the only source of information relating to the consequences of your participation in the Plan because the information may be out of date at the time your Stock Units vest or you sell the shares of Common Stock acquired under the Plan.

In addition, the information contained herein is general in nature and may not apply to your particular situation, and the Company is not in a position to assure you of any particular result. Accordingly, you are advised to seek appropriate professional advice as to how the relevant laws of your country may apply to your situation.

Finally, if you are a citizen or resident of a country other than the one in which you are currently working or transfer to another country after the grant of the Stock Units, or you are considered a resident of another country for local law purposes, the information contained herein may not be applicable to you in the same manner. In addition, the Company shall, in its discretion, determine to what extent the terms and conditions contained herein shall apply to you under these circumstances.

AUSTRALIA

Notifications

Securities Law Information. The offering and resale of shares of Common Stock acquired under the Plan to a person or entity resident in Australia may be subject to disclosure requirements under Australian law. You are encouraged to obtain

legal advice regarding any applicable disclosure requirements prior to making any such offer.

DENMARK

Terms and Conditions

Exchange Control/Tax Reporting Information. You understand and acknowledge that if you establish an account holding shares or an account holding cash outside Denmark, you may need to report such account to the Danish Tax Administration. You understand that you are encouraged to consult your personal tax and legal advisors on these and any other matters related to your participation in the Plan.

Statement under Section 3(1) of the Act on Stock Options. You understand that pursuant to Section 3(1) of the Act on Stock Options in employment relations (the "Stock Option Act"), you are entitled to receive information regarding the Plan in a separate written statement. The full statement containing the information about your rights under the Plan and the Stock Option Act is attached as a separate written statement provided at the same time as this Agreement.

Notifications

Securities Disclaimer. The grant of Stock Units under the Plan is exempt from the requirement to publish a prospectus under the EU Prospectus Directive as implemented in Denmark.

CANADA

Terms and Conditions

Language Consent. The parties acknowledge that it is their express wish that this Agreement, as well as all documents, notices and legal proceedings entered into, given or instituted pursuant hereto or relating directly or indirectly hereto, be drawn up in English.

Les parties reconnaissent avoir expressement souhaité que la convention [“Agreement”], ainsi que tous les documents, avis et procédures judiciaries, éxecutés, donnés ou intentés en vertu de, ou lié, directement ou indirectement à la présente convention, soient rédigés en langue anglaise.

GERMANY

Notifications

Exchange Control Information. If you remit proceeds in excess of €12,500 out of or into Germany, such cross-border payment must be reported monthly to the State Central Bank. In the event that you make or receive a payment in excess of this amount, you are responsible for obtaining the appropriate form from a German bank and complying with applicable reporting requirements. In addition, you must also report on an annual basis in the unlikely event that you hold shares of Common Stock exceeding 10% of the total voting capital of the Company.

Securities Disclaimer. The participation in the Plan is exempt or excluded from the requirement to publish a prospectus under the EU Prospectus Directive as implemented in Germany.

HONG KONG

Notification

Securities Law Notice. Neither the Stock Units nor the shares of Common Stock issued upon vesting of the

Stock Units constitute a public offering of securities under Hong Kong law and are available only to employees of the Company. The Agreement, including this Appendix, the Plan and other incidental communication materials have not been prepared in accordance with and are not intended to constitute a “prospectus” for a public offering of securities under the applicable securities legislation in Hong Kong, nor have the documents been reviewed by any regulatory authority in Hong Kong. The Stock Units are intended only for the personal use of each eligible employee of the Company or its subsidiaries and may not be distributed to any other person. If you are in any doubt about any of the contents of the Agreement, including this Appendix, or the Plan, you should obtain independent professional advice.

ITALY

Terms and Conditions

Authorization to Release and Transfer Necessary Personal Information. This provision replaces in its entirety Section 25 of the Terms:

You understand that your employer (the "Employer") and/or the Company may hold certain personal information about you, including, but not limited to, your name, home address and telephone number, date of birth, social security number (or any other social or national identification number), salary, nationality, job title, number of shares held and the details of all Stock Units granted or any other entitlement to shares awarded, cancelled, vested, unvested or outstanding (the "Data") for the purpose of implementing, administering and managing your participation in the Plan. You are aware that providing the Company with your Data is necessary for the performance of this Agreement and that your refusal to provide such Data would make it impossible for the Company to perform its contractual obligations and may affect your ability to participate in the Plan.

The data Controller, the Milan Branch of T. Rowe Price International, Limited, with offices at Torino 2, 20123 Milan, Italy, and pursuant to D.lgs 196/2003 appoints both T. Rowe Price Group, Inc. and T. Rowe Price Associates, Inc. as the Co-Controllers and Processors of the personal data for the purposes described herein. You understand that the Data may be transferred to the Company or any of its subsidiaries or affiliates, or to any third parties assisting in the implementation, administration and management of the Plan, including any transfer required to a broker or other third party with whom shares acquired pursuant to the vesting or exercise of the Options or cash from the sale of such shares may be deposited. Furthermore, the recipients that may receive, possess, use, retain and transfer such Data for the above mentioned purposes may be located in Italy or elsewhere, including outside of the European Union and that the recipients' country (e.g., the United States) may have different data privacy laws and protections than your country. The processing activity, including the transfer of your personal data abroad, outside of the European Union, as herein specified and pursuant to applicable laws and regulations, does not require your consent thereto as the processing is necessary for the performance of contractual obligations related to the implementation, administration and management of the Plan. You understand that Data processing relating to the purposes above specified shall take place under automated or

non-automated conditions, anonymously when possible, that comply with the purposes for which Data are collected and with confidentiality and security provisions as set forth by applicable laws and regulations, with specific reference to D.lgs. 196/2003.

You understand that Data will be held only as long as is required by law or as necessary to implement, administer and manage your participation in the Plan. You understand that pursuant to art. 7 of D.Igs 196/2003, you have the right, including but not limited to, access, delete, update, request the rectification of your Data and cease, for legitimate reasons, the Data processing. Furthermore, you are aware that your Data will not be used for direct marketing purposes. In addition, the Data provided can be reviewed and questions or complaints can be addressed by contacting a local representative available at the following address: 100 E. Pratt Street, Baltimore, Maryland 21202.

Plan Document Acknowledgment. In accepting the Stock Units, you acknowledge that you have received a copy of the Plan and the Agreement and have reviewed the Plan and the Agreement, including this Appendix, in their entirety and fully understand and accept all provisions of the Plan and the Agreement, including this Appendix.

Notifications

Exchange Control Information. You are required to report in your annual tax return: (a) any transfers of cash or shares to or from Italy exceeding €10,000 or the equivalent amount in U.S. dollars; and (b) any foreign investments or investments (including proceeds from the sale of shares of Common Stock acquired under the Plan) held outside of Italy exceeding €10,000 or the equivalent amount in U.S. dollars, if the investment may give rise to income in Italy. You are exempt from the formalities in (a) if the investments are made through an authorized broker resident in Italy, as the broker will comply with the reporting obligation on your behalf.

Securities Disclaimer. The grant of the Stock Units is exempt or excluded from the requirement to publish a prospectus under the EU Prospectus Directive as implemented in Italy.

JAPAN

Notifications

Offshore Assets Reporting. You are required to report details of any assets held outside of Japan as of December 31st (including but not limited to any shares of Common Stock acquired under the Plan), to the extent such assets have a total net fair market value exceeding

¥50,000,000. Such report is due by March 15th each year. You should consult with your personal tax advisor as to whether the reporting obligation applies to you and whether you will be required to report details of any outstanding Stock Units or shares of Common Stock held by you in the report.

LUXEMBOURG

No country-specific terms or conditions.

NETHERLANDS

Notifications

You should be aware of the Dutch insider trading rules, which may affect the sale of shares of Common Stock acquired under the Plan. In particular, you may be prohibited from effecting certain share transactions if you have insider information regarding the Company. Below is a discussion of the applicable restrictions. You are advised to read the discussion carefully to determine whether the insider rules could apply to you. If it is uncertain whether the insider rules apply, the Company recommends that you consult with a legal advisor. The Company cannot be held liable if you violate the Dutch insider trading rules. You are responsible for ensuring your compliance with these rules.

Prohibition Against Insider Trading

Dutch securities laws prohibit insider trading. The regulations are based upon the European Market Abuse Directive and are stated in section 5:56 of the Dutch Financial Supervision Act (Wet op het financieel toezicht or Wft) and in section 2 of the Market Abuse Decree (Besluit marktmisbruik Wft). For further information, you are referred to the website of the Authority for the Financial Markets (AFM); http://www.afm.nl/~/media/Files/brochures/2012/insider- dealing.ashx.

Given the broad scope of the definition of inside information, certain employees of the Company working at its Dutch affiliate may have inside information and thus are prohibited from making a transaction in securities in the Netherlands at a time when they have such inside information. By entering into this Agreement and participating in the Plan, you acknowledge having read and understood the notification above and acknowledge that it is your responsibility to comply with the Dutch insider trading rules, as discussed herein.

Securities Disclaimer. The grant of the Stock Units is exempt or excluded from the requirement to publish a prospectus under the EU Prospectus Directive as implemented in the Netherlands.

SINGAPORE

Notifications

Securities Law Information. The grant of the Stock Units is being made pursuant to the “Qualifying Person” exemption under section 273(1)(f) of the Singapore Securities and Futures Act (Chapter 289, 2006 Ed.) (“SFA”). The Plan has not been lodged or registered as a prospectus with the Monetary Authority of Singapore. You should note that the Stock Units are subject to section 257 of the SFA and you will not be able to make any subsequent sale in Singapore of the shares of Common Stock acquired through the vesting of the Stock Units or any offer of such sale in Singapore unless such sale or offer is made pursuant to the exemptions under Part XIII Division (1) Subdivision (4) (other than section 280) of the SFA.

Director Notification Obligation. If you are a director, associate director or shadow director of a Singapore subsidiary, you are subject to certain notification requirements under the Singapore Companies Act. Among these requirements is an obligation to notify the Singapore subsidiary in writing when you receive an interest (e.g., Stock Units or shares of Common Stock) in the

Company or any subsidiary. In addition, you must notify the Singapore subsidiary when you sell shares of Common Stock of the Company or any subsidiary (including when you sell shares of Common Stock acquired through the vesting of Stock Units). These notifications must be made within two business days of acquiring or disposing of any interest in the Company or any subsidiary. In addition, a notification must be made of your interests in the Company or any subsidiary within two business days of becoming a director.

SPAIN

Terms and Conditions

Nature of Grant. This provision supplements Section 24 of the Terms:

In accepting the Stock Units, you consent to participate in the Plan and acknowledge that you have received a copy of the Plan.

You understand that the Company has unilaterally, gratuitously, and in its sole discretion decided to grant Stock Units under the Plan to individuals who may be employees of the Company or one of its Affiliates throughout the world. The decision is a limited decision that is entered into upon the express assumption and condition that any grant will not bind the Company or any Affiliate, other than to the extent set forth in the Agreement and its Terms.

Consequently, you understand that the grant of Stock Units is made on the assumption and condition that the Stock Units and any shares acquired under the Plan are not part of any employment contract (either with the Company or any Affiliate), and shall not be considered a mandatory benefit, salary for any purposes (including severance compensation) or any other right whatsoever. Further, you understand that the grant of the Stock Units would not be made but for the assumptions and conditions referred to above; thus, you acknowledge and freely accept that, should any or all of the assumptions be mistaken or should any of the conditions not be met for any reason, then any grant of or right to the Stock Units shall be null and void.

Notifications

Tax Reporting Obligation for Assets Held Abroad. Individuals in Spain are required to report assets and rights located outside of Spain (which would include shares or any funds held in a

U.S. brokerage account) on Form 720 by March 31st after each calendar year. A report is not required if the value of assets held outside of Spain is EUR 50,000 or less or if the assets held outside of Spain have not increased by more than EUR 20,000 compared to the previous year (assuming that a prior report has been filed reporting these assets). You should consult your personal tax advisor for more information on how to complete the report and the specific information on what types of assets are required to be reported.

Exchange Control Information. You must declare the acquisition of stock in a foreign company (including Shares acquired under the Plan) to the Dirección General de Política Comercial e Inversiones Exteriores

(“DGPCIE”) of the Ministerio de Economia for statistical purposes. You must also declare ownership of any stock in a foreign company (including shares acquired under the Plan) with the Directorate of Foreign Transactions each January while the stock is owned. In addition, if you wish to import the share certificates into Spain, you must declare the importation of such securities to the DGPCIE.

When receiving foreign currency payments derived from the ownership of the shares

(i.e., dividends or sale proceeds), you must inform the financial institution receiving the payment of the basis upon which such payment is made. You will need to provide the following information: (i) your name, address, and fiscal identification number; (ii) the name and corporate domicile of the Company; (iii) the amount of the payment and the currency used; (iv) the country of origin; (v) the reasons for the payment; and (vi) any further information that may be required.

Securities Disclaimer. The grant of the Stock Units is exempt or excluded from the requirement to publish a prospectus under the EU Prospectus Directive as implemented in Spain.

SWEDEN

Notifications

Securities Disclosure. Your participation in the Plan and the grant of the Stock Units are exempt from the requirement to publish a prospectus under the EU Prospectus Directive as implemented in Sweden.

Exchange Control. You understand and agree that foreign and local banks or financial institutions (including brokers) engaged in cross-border transactions generally may be required to report any payments to or from a foreign country exceeding a certain amount to The National Tax Board, which receives the information on behalf of the Swedish Central Bank (Sw.Riksbanken). This requirement may apply even if you have a brokerage account with a foreign broker.

SWITZERLAND

Notifications

Securities Disclosure. The grant of Stock Units is considered a private offering in Switzerland; therefore, it is not subject to registration in Switzerland.

UNITED KINGDOM

Terms and Conditions

Tax Reporting and Payment Liability. The following provision supplements Section 7 of the Terms:

You agree that the Company or your U.K. employer may calculate the any taxes or National Insurance Contributions required to be withheld and accounted for in connection with the Stock Units by reference to the maximum applicable rates, without prejudice to any right you may have to recover any overpayment from relevant U.K. tax authorities. If payment or withholding of any income tax liability arising in connection with your participation in the Plan is not made by you to the U.K. employer within ninety (90) days of the event giving rise to such income tax liability or such other period specified in Section 222(1)(c) of the U.K. Income Tax (Earnings and Pensions) Act 2003 (the “Due Date”), you understand and agree that the amount of any uncollected income tax will constitute a loan owed by you to the U.K. employer, effective on the Due Date. You understand and agree that the loan will bear interest at the then-current official rate of Her Majesty’s Revenue and Customs, it will be immediately due and repayable by you,

and the Company and/or your employer may recover it at any time thereafter by any of the means referred to in the Plan and/or this Agreement. Notwithstanding the foregoing, you understand and agree that if you are a

director or an executive officer of the Company (within the meaning of such terms for purposes of Section 13(k) of the Exchange Act), you will not be eligible for such a loan to cover the income tax liability. In the event that you are a director or executive officer and the income tax is not collected from or paid by you by the Due Date, you understand that the amount of any uncollected income tax will constitute an additional benefit to you on which additional income tax and National Insurance Contributions will be payable. You understand and agree that you will be responsible for reporting and paying any income tax due on this additional benefit directly to Her Majesty’s Revenue and Customs under the self- assessment regime and for reimbursing the Company or the U.K. employer (as appropriate) for the value of any primary national insurance contributions due on this additional benefit that the Company or the U.K. employer may recover from you by any of the means referred to in the Plan and/or this Agreement.

Notification

Securities Disclaimer. Neither this Agreement nor this Appendix is an approved prospectus for the purposes of section 85(1) of the Financial Services and Markets Act 2000 (“FSMA”) and no offer of transferable securities to the public (for the purposes of section 102B of FSMA) is being made in connection with the Plan. The Plan and the Stock Units are exclusively available in the

U.K. to bona fide employees and former employees of the Company and any other U.K. subsidiary.

End of the Appendix

{end of document}