UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number |

811-09913 | |

| AIM Counselor Series Trust (Invesco Counselor Series Trust) | ||

| (Exact name of registrant as specified in charter) | ||

| 11 Greenway Plaza, Suite 1000 Houston, Texas 77046 | ||

| (Address of principal executive offices) (Zip code) | ||

| Sheri Morris 11 Greenway Plaza, Suite 1000 Houston, Texas 77046 | ||

| (Name and address of agent for service) | ||

Registrant’s telephone number, including area code: (713) 626-1919

Date of fiscal year end: 08/31

Date of reporting period: 08/31/19

Item 1. Reports to Stockholders.

Andrew Schlossberg

|

| 2 | Invesco American Franchise Fund |

Bruce Crockett

|

| ■ | Ensuring that Invesco offers a diverse lineup of mutual funds that your financial adviser can use to strive to meet your financial needs as your investment goals change over time. |

| ■ | Monitoring how the portfolio management teams of the Invesco funds are performing in light of changing economic and market conditions. |

| ■ | Assessing each portfolio management team’s investment performance within the context of the investment strategy described in the fund’s prospectus. |

| ■ | Monitoring for potential conflicts of interests that may impact the nature of the services that your funds receive. |

| 3 | Invesco American Franchise Fund |

| The Fund’s holdings are subject to change, and there is no assurance that the Fund will continue to hold any particular security. |

| *Excluding money market fund holdings. |

| Data presented here are as of August 31, 2019. |

| 4 | Invesco American Franchise Fund |

| 5 | Invesco American Franchise Fund |

| 1 | Source: RIMES Technologies Corp. |

| 2 | Source: Lipper Inc. |

| 6 | Invesco American Franchise Fund |

| 7 | Invesco American Franchise Fund |

| ■ | Unless otherwise stated, information presented in this report is as of August 31, 2019, and is based on total net assets. |

| ■ | Unless otherwise noted, all data provided by Invesco. |

| ■ | To access your Fund’s reports/prospectus, visit invesco.com/fundreports. |

| 8 | Invesco American Franchise Fund |

| and as such, the NAVs for shareholder transactions and the returns based on those NAVs may differ from the NAVs and returns reported in the Financial Highlights. |

| ■ | Industry classifications used in this report are generally according to the Global Industry Classification Standard, which was developed by and is the exclusive property and a service mark of MSCI Inc. and Standard & Poor’s. |

| 9 | Invesco American Franchise Fund |

| 10 | Invesco American Franchise Fund |

| ADR | – American Depositary Receipt |

| 11 | Invesco American Franchise Fund |

| (a) | Industry and/or sector classifications used in this report are generally according to the Global Industry Classification Standard, which was developed by and is the exclusive property and a service mark of MSCI Inc. and Standard & Poor’s. |

| (b) | Non-income producing security. |

| (c) | All or a portion of this security was out on loan at August 31, 2019. |

| (d) | The money market fund and the Fund are affiliated by having the same investment adviser. The rate shown is the 7-day SEC standardized yield as of August 31, 2019. |

| (e) | The security has been segregated to satisfy the commitment to return the cash collateral received in securities lending transactions upon the borrower’s return of the securities loaned. See Note 1I. |

| 12 | Invesco American Franchise Fund |

| 13 | Invesco American Franchise Fund |

| Investment income: | |

| Dividends (net of foreign withholding taxes of $1,507,120) | $ 99,696,956 |

| Dividends from affiliated money market funds (includes securities lending income of $922,189) | 2,267,956 |

| Total investment income | 101,964,912 |

| Expenses: | |

| Advisory fees | 61,422,878 |

| Administrative services fees | 1,253,952 |

| Custodian fees | 107,847 |

| Distribution fees: | |

| Class A | 24,287,665 |

| Class C | 2,317,137 |

| Class R | 167,406 |

| Transfer agent fees — A, C, R and Y | 15,685,243 |

| Transfer agent fees — R5 | 80,019 |

| Transfer agent fees — R6 | 11,302 |

| Trustees’ and officers’ fees and benefits | 174,503 |

| Registration and filing fees | 200,525 |

| Reports to shareholders | 642,625 |

| Professional services fees | 140,442 |

| Other | 130,109 |

| Total expenses | 106,621,653 |

| Less: Fees waived and/or expense offset arrangement(s) | (215,799) |

| Net expenses | 106,405,854 |

| Net investment income (loss) | (4,440,942) |

| Realized and unrealized gain (loss) from: | |

| Net realized gain (loss) from: | |

| Investment securities (includes net gains (losses) from securities sold to affiliates of $(152,328)) | 710,483,736 |

| Foreign currencies | (209,972) |

| 710,273,764 | |

| Change in net unrealized appreciation (depreciation) of: | |

| Investment securities | (629,501,847) |

| Foreign currencies | (6,409) |

| (629,508,256) | |

| Net realized and unrealized gain | 80,765,508 |

| Net increase (decrease) in net assets resulting from operations | $ 76,324,566 |

| 14 | Invesco American Franchise Fund |

| 2019 | 2018 | |

| Operations: | ||

| Net investment income (loss) | $ (4,440,942) | $ (19,723,687) |

| Net realized gain | 710,273,764 | 958,613,075 |

| Change in net unrealized appreciation (depreciation) | (629,508,256) | 1,056,071,409 |

| Net increase in net assets resulting from operations | 76,324,566 | 1,994,960,797 |

| Distributions to shareholders from distributable earnings(1): | ||

| Class A | (804,913,487) | (478,520,623) |

| Class B | — | (2,479,794) |

| Class C | (33,225,403) | (20,255,914) |

| Class R | (3,005,915) | (1,865,721) |

| Class Y | (27,603,239) | (13,953,873) |

| Class R5 | (6,608,373) | (3,494,510) |

| Class R6 | (10,724,224) | (6,684,184) |

| Total distributions from distributable earnings | (886,080,641) | (527,254,619) |

| Share transactions–net: | ||

| Class A | 297,930,110 | (145,332,102) |

| Class B | — | (62,310,041) |

| Class C | (200,992,890) | (16,924,402) |

| Class R | (1,216,256) | (888,078) |

| Class Y | 6,407,551 | 60,767,520 |

| Class R5 | (5,226,299) | 7,510,265 |

| Class R6 | (1,969,306) | (10,728,006) |

| Net increase (decrease) in net assets resulting from share transactions | 94,932,910 | (167,904,844) |

| Net increase (decrease) in net assets | (714,823,165) | 1,299,801,334 |

| Net assets: | ||

| Beginning of year | 11,560,041,148 | 10,260,239,814 |

| End of year | $10,845,217,983 | $11,560,041,148 |

| (1) | The Securities and Exchange Commission eliminated the requirement to disclose distribution components separately, except for tax return of capital. For the year ended August 31, 2018, distributions to shareholders from distributable earnings consisted of distributions from net realized gains. |

| 15 | Invesco American Franchise Fund |

| Net

asset value, beginning of period |

Net

investment income (loss)(a) |

Net

gains (losses) on securities (both realized and unrealized) |

Total

from investment operations |

Distributions

from net realized gains |

Net

asset value, end of period |

Total

return (b) |

Net

assets, end of period (000’s omitted) |

Ratio

of expenses to average net assets with fee waivers and/or expenses absorbed |

Ratio

of expenses to average net assets without fee waivers and/or expenses absorbed |

Ratio

of net investment income (loss) to average net assets |

Portfolio

turnover (c) | |

| Class A | ||||||||||||

| Year ended 08/31/19 | $ 23.12 | $(0.01) | $(0.04) | $(0.05) | $ (1.80) | $ 21.27 | 1.21% | $10,115,813 | 1.01% (d) | 1.01% (d) | (0.04)% (d) | 43% |

| Year ended 08/31/18 | 20.25 | (0.04) | 3.97 | 3.93 | (1.06) | 23.12 | 20.30 | 10,524,889 | 1.01 | 1.01 | (0.17) | 44 |

| Year ended 08/31/17 | 16.96 | (0.03) | 3.99 | 3.96 | (0.67) | 20.25 | 24.19 | 9,333,084 | 1.06 | 1.06 | (0.15) | 48 |

| Year ended 08/31/16 | 16.49 | (0.01) | 1.30 | 1.29 | (0.82) | 16.96 | 7.99 | 8,253,739 | 1.08 | 1.08 | (0.04) | 59 |

| Year ended 08/31/15 | 18.07 | (0.05) | 0.08 | 0.03 | (1.61) | 16.49 | 0.27 | 8,320,796 | 1.05 | 1.05 | (0.28) | 74 |

| Class C | ||||||||||||

| Year ended 08/31/19 | 21.23 | (0.15) | (0.07) | (0.22) | (1.80) | 19.21 | 0.46 | 139,839 | 1.76 (d) | 1.76 (d) | (0.79) (d) | 43 |

| Year ended 08/31/18 | 18.81 | (0.18) | 3.66 | 3.48 | (1.06) | 21.23 | 19.43 | 401,863 | 1.76 | 1.76 | (0.92) | 44 |

| Year ended 08/31/17 | 15.92 | (0.15) | 3.71 | 3.56 | (0.67) | 18.81 | 23.23 | 370,960 | 1.81 | 1.81 | (0.90) | 48 |

| Year ended 08/31/16 | 15.64 | (0.12) | 1.22 | 1.10 | (0.82) | 15.92 | 7.18 | 367,233 | 1.83 | 1.83 | (0.79) | 59 |

| Year ended 08/31/15 | 17.34 | (0.17) | 0.08 | (0.09) | (1.61) | 15.64 | (0.46) | 381,264 | 1.80 | 1.80 | (1.03) | 74 |

| Class R | ||||||||||||

| Year ended 08/31/19 | 22.65 | (0.06) | (0.04) | (0.10) | (1.80) | 20.75 | 0.99 | 34,114 | 1.26 (d) | 1.26 (d) | (0.29) (d) | 43 |

| Year ended 08/31/18 | 19.91 | (0.09) | 3.89 | 3.80 | (1.06) | 22.65 | 19.99 | 38,537 | 1.26 | 1.26 | (0.42) | 44 |

| Year ended 08/31/17 | 16.72 | (0.07) | 3.93 | 3.86 | (0.67) | 19.91 | 23.93 | 34,479 | 1.31 | 1.31 | (0.40) | 48 |

| Year ended 08/31/16 | 16.31 | (0.05) | 1.28 | 1.23 | (0.82) | 16.72 | 7.70 | 28,686 | 1.33 | 1.33 | (0.29) | 59 |

| Year ended 08/31/15 | 17.93 | (0.09) | 0.08 | (0.01) | (1.61) | 16.31 | 0.03 | 30,716 | 1.30 | 1.30 | (0.53) | 74 |

| Class Y | ||||||||||||

| Year ended 08/31/19 | 23.63 | 0.04 | (0.02) | 0.02 | (1.80) | 21.85 | 1.50 | 350,473 | 0.76 (d) | 0.76 (d) | 0.21 (d) | 43 |

| Year ended 08/31/18 | 20.62 | 0.02 | 4.05 | 4.07 | (1.06) | 23.63 | 20.63 | 368,991 | 0.76 | 0.76 | 0.08 | 44 |

| Year ended 08/31/17 | 17.22 | 0.02 | 4.05 | 4.07 | (0.67) | 20.62 | 24.47 | 264,309 | 0.81 | 0.81 | 0.10 | 48 |

| Year ended 08/31/16 | 16.69 | 0.04 | 1.31 | 1.35 | (0.82) | 17.22 | 8.26 | 147,246 | 0.83 | 0.83 | 0.21 | 59 |

| Year ended 08/31/15 | 18.22 | (0.01) | 0.09 | 0.08 | (1.61) | 16.69 | 0.56 | 152,179 | 0.80 | 0.80 | (0.03) | 74 |

| Class R5 | ||||||||||||

| Year ended 08/31/19 | 23.68 | 0.05 | (0.02) | 0.03 | (1.80) | 21.91 | 1.54 | 75,149 | 0.71 (d) | 0.71 (d) | 0.26 (d) | 43 |

| Year ended 08/31/18 | 20.66 | 0.03 | 4.05 | 4.08 | (1.06) | 23.68 | 20.64 | 86,177 | 0.71 | 0.71 | 0.13 | 44 |

| Year ended 08/31/17 | 17.23 | 0.03 | 4.07 | 4.10 | (0.67) | 20.66 | 24.63 | 67,740 | 0.72 | 0.72 | 0.19 | 48 |

| Year ended 08/31/16 | 16.68 | 0.05 | 1.32 | 1.37 | (0.82) | 17.23 | 8.39 | 53,789 | 0.71 | 0.71 | 0.33 | 59 |

| Year ended 08/31/15 | 18.20 | 0.01 | 0.08 | 0.09 | (1.61) | 16.68 | 0.62 | 50,052 | 0.71 | 0.71 | 0.06 | 74 |

| Class R6 | ||||||||||||

| Year ended 08/31/19 | 23.81 | 0.07 | (0.01) | 0.06 | (1.80) | 22.07 | 1.66 | 129,831 | 0.62 (d) | 0.62 (d) | 0.35 (d) | 43 |

| Year ended 08/31/18 | 20.75 | 0.05 | 4.07 | 4.12 | (1.06) | 23.81 | 20.75 | 139,584 | 0.62 | 0.62 | 0.22 | 44 |

| Year ended 08/31/17 | 17.29 | 0.05 | 4.08 | 4.13 | (0.67) | 20.75 | 24.72 | 130,807 | 0.64 | 0.64 | 0.27 | 48 |

| Year ended 08/31/16 | 16.72 | 0.07 | 1.32 | 1.39 | (0.82) | 17.29 | 8.49 | 120,754 | 0.63 | 0.63 | 0.42 | 59 |

| Year ended 08/31/15 | 18.22 | 0.03 | 0.08 | 0.11 | (1.61) | 16.72 | 0.73 | 86,444 | 0.62 | 0.62 | 0.15 | 74 |

| (a) | Calculated using average shares outstanding. |

| (b) | Includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset value and returns for shareholder transactions. Does not include sales charges and is not annualized for periods less than one year, if applicable. |

| (c) | Portfolio turnover is calculated at the fund level and is not annualized for periods less than one year, if applicable. |

| (d) | Ratios are based on average daily net assets (000’s omitted) of $9,715,066, $231,714, $33,481, $335,710, $79,981 and $130,563 for Class A, Class C, Class R, Class Y, Class R5 and Class R6 shares, respectively. |

| 16 | Invesco American Franchise Fund |

| A. | Security Valuations — Securities, including restricted securities, are valued according to the following policy. |

| 17 | Invesco American Franchise Fund |

| B. | Securities Transactions and Investment Income — Securities transactions are accounted for on a trade date basis. Realized gains or losses on sales are computed on the basis of specific identification of the securities sold. Interest income (net of withholding tax, if any) is recorded on the accrual basis from settlement date. Dividend income (net of withholding tax, if any) is recorded on the ex-dividend date. |

| C. | Country Determination — For the purposes of making investment selection decisions and presentation in the Schedule of Investments, the investment adviser may determine the country in which an issuer is located and/or credit risk exposure based on various factors. These factors include the laws of the country under which the issuer is organized, where the issuer maintains a principal office, the country in which the issuer derives 50% or more of its total revenues and the country that has the primary market for the issuer’s securities, as well as other criteria. Among the other criteria that may be evaluated for making this determination are the country in which the issuer maintains 50% or more of its assets, the type of security, financial guarantees and enhancements, the nature of the collateral and the sponsor organization. Country of issuer and/or credit risk exposure has been determined to be the United States of America, unless otherwise noted. |

| D. | Distributions – Distributions from net investment income and net realized capital gain, if any, are generally declared and paid annually and recorded on the ex-dividend date. The Fund may elect to treat a portion of the proceeds from redemptions as distributions for federal income tax purposes. |

| E. | Federal Income Taxes – The Fund intends to comply with the requirements of Subchapter M of the Internal Revenue Code of 1986, as amended (the “Internal Revenue Code”), necessary to qualify as a regulated investment company and to distribute substantially all of the Fund’s taxable earnings to shareholders. As such, the Fund will not be subject to federal income taxes on otherwise taxable income (including net realized capital gain) that is distributed to shareholders. Therefore, no provision for federal income taxes is recorded in the financial statements. |

| F. | Expenses – Fees provided for under the Rule 12b-1 plan of a particular class of the Fund are charged to the operations of such class. Transfer agency fees and expenses and other shareholder recordkeeping fees and expenses attributable to Class R5 and Class R6 are allocated to each share class based on relative net assets. Sub-accounting fees attributable to Class R5 are charged to the operations of the class. Transfer agency fees and expenses and other shareholder recordkeeping fees and expenses relating to all other classes are allocated among those classes based on relative net assets. All other expenses are allocated among the classes based on relative net assets. |

| G. | Accounting Estimates – The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America (“GAAP”) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period including estimates and assumptions related to taxation. Actual results could differ from those estimates by a significant amount. In addition, the Fund monitors for material events or transactions that may occur or become known after the period-end date and before the date the financial statements are released to print. |

| H. | Indemnifications – Under the Trust’s organizational documents, each Trustee, officer, employee or other agent of the Trust is indemnified against certain liabilities that may arise out of the performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts, including the Fund’s servicing agreements, that contain a variety of indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. The risk of material loss as a result of such indemnification claims is considered remote. |

| I. | Securities Lending – The Fund may lend portfolio securities having a market value up to one-third of the Fund’s total assets. Such loans are secured by collateral equal to no less than the market value of the loaned securities determined daily by the securities lending provider. Such collateral will be cash or debt securities issued or guaranteed by the U.S. Government or any of its sponsored agencies. Cash collateral received in connection with these loans is invested in short-term money market instruments or affiliated money market funds and is shown as such on the Schedule of Investments. The Fund bears the risk of loss with respect to the investment of collateral. It is the Fund’s policy to obtain additional collateral from or return excess collateral to the borrower by the end of the next business day, following the valuation date of the securities loaned. Therefore, the value of the collateral held may be temporarily less than the value of the securities on loan. When loaning securities, the Fund retains certain benefits of owning the securities, including the economic equivalent of dividends or interest generated by the security. Lending securities entails a risk of loss to the Fund if, and to the extent that, the market value of the securities loaned were to increase and the |

| 18 | Invesco American Franchise Fund |

| borrower did not increase the collateral accordingly, and the borrower failed to return the securities. The securities loaned are subject to termination at the option of the borrower or the Fund. Upon termination, the borrower will return to the Fund the securities loaned and the Fund will return the collateral. Upon the failure of the borrower to return the securities, collateral may be liquidated and the securities may be purchased on the open market to replace the loaned securities. The Fund could experience delays and costs in gaining access to the collateral and the securities may lose value during the delay which could result in potential losses to the Fund. Some of these losses may be indemnified by the lending agent. The Fund bears the risk of any deficiency in the amount of the collateral available for return to the borrower due to any loss on the collateral invested. Dividends received on cash collateral investments for securities lending transactions, which are net of compensation to counterparties, are included in Dividends from affiliated money market funds on the Statement of Operations. The aggregate value of securities out on loan, if any, is shown as a footnote on the Statement of Assets and Liabilities. |

| J. | Foreign Currency Translations — Foreign currency is valued at the close of the NYSE based on quotations posted by banks and major currency dealers. Portfolio securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollar amounts at the date of valuation. Purchases and sales of portfolio securities (net of foreign taxes withheld on disposition) and income items denominated in foreign currencies are translated into U.S. dollar amounts on the respective dates of such transactions. The Fund does not separately account for the portion of the results of operations resulting from changes in foreign exchange rates on investments and the fluctuations arising from changes in market prices of securities held. The combined results of changes in foreign exchange rates and the fluctuation of market prices on investments (net of estimated foreign tax withholding) are included with the net realized and unrealized gain or loss from investments in the Statement of Operations. Reported net realized foreign currency gains or losses arise from (1) sales of foreign currencies, (2) currency gains or losses realized between the trade and settlement dates on securities transactions, and (3) the difference between the amounts of dividends, interest, and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign currency gains and losses arise from changes in the fair values of assets and liabilities, other than investments in securities at fiscal period end, resulting from changes in exchange rates. |

| K. | Forward Foreign Currency Contracts — The Fund may engage in foreign currency transactions either on a spot (i.e. for prompt delivery and settlement) basis, or through forward foreign currency contracts, to manage or minimize currency or exchange rate risk. |

| Average Daily Net Assets | Rate |

| First $250 million | 0.695% |

| Next $250 million | 0.67% |

| Next $500 million | 0.645% |

| Next $550 million | 0.62% |

| Next $3.45 billion | 0.60% |

| Next $250 million | 0.595% |

| Next $2.25 billion | 0.57% |

| Next $2.5 billion | 0.545% |

| Over $10 billion | 0.52% |

| 19 | Invesco American Franchise Fund |

| 20 | Invesco American Franchise Fund |

| Level 1 | Level 2 | Level 3 | Total | |

| Investments in Securities | ||||

| Common Stocks & Other Equity Interests | $10,090,817,073 | $693,812,724 | $— | $ 10,784,629,797 |

| Money Market Funds | 93,468,312 | — | — | 93,468,312 |

| Total Investments | $10,184,285,385 | $693,812,724 | $— | $10,878,098,109 |

| Tax Character of Distributions to Shareholders Paid During the Fiscal Years Ended August 31, 2019 and August 31, 2018 | ||

| 2019 | 2018 | |

| Ordinary income | $ — | $ 33,773,211 |

| Long-term capital gain | 886,080,641 | 493,481,408 |

| Total distributions | $886,080,641 | $ 527,254,619 |

| Tax Components of Net Assets at Period-End: | |

| 2019 | |

| Undistributed long-term capital gain | $ 645,140,495 |

| Net unrealized appreciation — investments | 4,672,376,739 |

| Net unrealized appreciation (depreciation) - foreign currencies | (8,131) |

| Temporary book/tax differences | (2,336,319) |

| Late-Year ordinary loss deferral | (2,957,016) |

| Shares of beneficial interest | 5,533,002,215 |

| Total net assets | $10,845,217,983 |

| 21 | Invesco American Franchise Fund |

| Unrealized Appreciation (Depreciation) of Investments on a Tax Basis | |

| Aggregate unrealized appreciation of investments | $4,767,731,793 |

| Aggregate unrealized (depreciation) of investments | (95,355,054) |

| Net unrealized appreciation of investments | $ 4,672,376,739 |

| Summary of Share Activity | |||||

| Years ended August 31, | |||||

| 2019 (a) | 2018 | ||||

| Shares | Amount | Shares | Amount | ||

| Sold: | |||||

| Class A | 14,898,952 | $ 303,695,759 | 15,878,174 | $ 336,279,096 | |

| Class B(b) | - | - | 11,213 | 222,192 | |

| Class C | 1,254,642 | 23,546,144 | 1,956,690 | 38,381,580 | |

| Class R | 313,575 | 6,189,319 | 385,858 | 7,948,431 | |

| Class Y | 3,812,120 | 79,347,751 | 5,667,513 | 123,150,034 | |

| Class R5 | 927,059 | 19,376,762 | 953,465 | 20,609,344 | |

| Class R6 | 899,657 | 18,597,376 | 1,100,474 | 23,450,394 | |

| Issued as reinvestment of dividends: | |||||

| Class A | 42,328,565 | 759,797,658 | 23,082,251 | 454,951,201 | |

| Class B(b) | - | - | 127,537 | 2,441,051 | |

| Class C | 1,927,229 | 31,413,829 | 1,060,110 | 19,294,012 | |

| Class R | 171,298 | 3,004,573 | 96,419 | 1,865,721 | |

| Class Y | 1,242,260 | 22,857,584 | 576,480 | 11,593,017 | |

| Class R5 | 358,107 | 6,607,064 | 173,387 | 3,493,738 | |

| Class R6 | 572,179 | 10,625,365 | 327,912 | 6,636,942 | |

| Conversion of Class B shares to Class A shares:(c) | |||||

| Class A | - | - | 2,428,444 | 52,988,647 | |

| Class B | - | - | (2,523,779) | (52,988,647) | |

| Automatic conversion of Class C shares to Class A shares: | |||||

| Class A | 10,853,607 | 203,583,098 | - | - | |

| Class C | (11,963,414) | (203,583,098) | - | - | |

| 22 | Invesco American Franchise Fund |

| Summary of Share Activity | |||||

| Years ended August 31, | |||||

| 2019 (a) | 2018 | ||||

| Shares | Amount | Shares | Amount | ||

| Reacquired: | |||||

| Class A | (47,849,882) | $ (969,146,405) | (47,013,118) | $(989,551,046) | |

| Class B(b) | - | - | (603,399) | (11,984,637) | |

| Class C | (2,869,385) | (52,369,765) | (3,804,108) | (74,599,994) | |

| Class R | (542,053) | (10,410,148) | (512,785) | (10,702,230) | |

| Class Y | (4,629,269) | (95,797,784) | (3,442,724) | (73,975,531) | |

| Class R5 | (1,494,658) | (31,210,125) | (767,131) | (16,592,817) | |

| Class R6 | (1,450,009) | (31,192,047) | (1,871,050) | (40,815,342) | |

| Net increase (decrease) in share activity | 8,760,580 | $ 94,932,910 | (6,712,167) | $ (167,904,844) | |

| (a) | There are entities that are record owners of more than 5% of the outstanding shares of the Fund and in the aggregate own 27% of the outstanding shares of the Fund. IDI has an agreement with these entities to sell Fund shares. The Fund, Invesco and/or Invesco affiliates may make payments to these entities, which are considered to be related to the Fund, for providing services to the Fund, Invesco and/or Invesco affiliates including but not limited to services such as securities brokerage, distribution, third party record keeping and account servicing. The Fund has no knowledge as to whether all or any portion of the shares owned of record by these entities are also owned beneficially. |

| (b) | Class B shares activity for the period September 1, 2017 through January 26, 2018 (date of conversion). |

| (c) | Effective as of the close of business January 26, 2018, all outstanding Class B shares were converted to Class A shares. |

| 23 | Invesco American Franchise Fund |

| 24 | Invesco American Franchise Fund |

| Beginning

Account Value (03/01/19) |

ACTUAL | HYPOTHETICAL

(5% annual return before expenses) |

Annualized

Expense Ratio | |||

| Ending

Account Value (08/31/19)1 |

Expenses

Paid During Period2 |

Ending

Account Value (08/31/19) |

Expenses

Paid During Period2 | |||

| Class A | $1,000.00 | $1,088.50 | $5.37 | $1,020.06 | $ 5.19 | 1.02% |

| Class C | 1,000.00 | 1,084.10 | 9.30 | 1,016.28 | 9.00 | 1.77 |

| Class R | 1,000.00 | 1,086.90 | 6.68 | 1,018.80 | 6.46 | 1.27 |

| Class Y | 1,000.00 | 1,089.80 | 4.06 | 1,021.32 | 3.92 | 0.77 |

| Class R5 | 1,000.00 | 1,090.00 | 3.74 | 1,021.63 | 3.62 | 0.71 |

| Class R6 | 1,000.00 | 1,091.00 | 3.32 | 1,022.03 | 3.21 | 0.63 |

| 1 | The actual ending account value is based on the actual total return of the Fund for the period March 1, 2019 through August 31, 2019, after actual expenses and will differ from the hypothetical ending account value which is based on the Fund’s expense ratio and a hypothetical annual return of 5% before expenses. |

| 2 | Expenses are equal to the Fund’s annualized expense ratio as indicated above multiplied by the average account value over the period, multiplied by 184/365 to reflect the most recent fiscal half year. |

| 25 | Invesco American Franchise Fund |

Approval of Investment Advisory and Sub-Advisory Contracts

26 Invesco American Franchise Fund

27 Invesco American Franchise Fund

| Federal and State Income Tax | |

| Long-Term Capital Gain Distributions | $886,080,641 |

| Qualified Dividend Income* | 0% |

| Corporate Dividends Received Deduction* | 0% |

| U.S. Treasury Obligations* | 0% |

| Tax-Exempt Interest Dividends* | 0% |

| * | The above percentages are based on ordinary income dividends paid to shareholders during the Fund’s fiscal year. |

| 28 | Invesco American Franchise Fund |

Trustees and Officers

The address of each trustee and officer is AIM Counselor Series Trust (Invesco Counselor Series Trust) (the “Trust”), 11 Greenway Plaza, Suite 1000, Houston, Texas 77046-1173. The trustees serve for the life of the Trust, subject to their earlier death, incapacitation, resignation, retirement or removal as more specifically provided in the Trust’s organizational documents. Each officer serves for a one year term or until their successors are elected and qualified. Column two below includes length of time served with predecessor entities, if any.

| Name, Year of Birth and Position(s) Held with the Trust |

Trustee and/ or Officer Since |

Principal Occupation(s) During Past 5 Years |

Number of Funds in Fund |

Other Directorship(s) Held by Trustee During Past 5 Years | ||||

| Interested Persons | ||||||||

| Martin L. Flanagan1 — 1960 Trustee and Vice Chair |

2007 | Executive Director, Chief Executive Officer and President, Invesco Ltd. (ultimate parent of Invesco and a global investment management firm); Trustee and Vice Chair, The Invesco Funds; Vice Chair, Investment Company Institute; and Member of Executive Board, SMU Cox School of Business

Formerly: Advisor to the Board, Invesco Advisers, Inc. (formerly known as Invesco Institutional (N.A.), Inc.); Chairman and Chief Executive Officer, Invesco Advisers, Inc. (registered investment adviser); Director, Chairman, Chief Executive Officer and President, Invesco Holding Company (US), Inc. (formerly IVZ Inc.) (holding company), Invesco Group Services, Inc. (service provider) and Invesco North American Holdings, Inc. (holding company); Director, Chief Executive Officer and President, Invesco Holding Company Limited (parent of Invesco and a global investment management firm); Director, Invesco Ltd.; Chairman, Investment Company Institute and President, Co-Chief Executive Officer, Co-President, Chief Operating Officer and Chief Financial Officer, Franklin Resources, Inc. (global investment management organization) |

229 | None | ||||

| Philip A. Taylor2 — 1954 Trustee |

2006 | Vice Chair, Invesco Ltd.; Trustee, The Invesco Funds

Formerly: Director, Invesco Canada Ltd. (formerly known as Invesco Trimark Ltd./Invesco Trimark Ltèe) (registered investment adviser and registered transfer agent); Head of the Americas and Senior Managing Director, Invesco Ltd.; Director, Invesco Advisers, Inc. (formerly known as Invesco Institutional (N.A.), Inc.) (registered investment adviser); Director and Chairman, Invesco Investment Services, Inc. (formerly known as Invesco AIM Investment Services, Inc.) (registered transfer agent); Chief Executive Officer, Invesco Corporate Class Inc. (corporate mutual fund company); Chairman and Chief Executive Officer, Invesco Canada Ltd. (formerly known as Invesco Trimark Ltd./Invesco Trimark Ltèe) (registered investment adviser and registered transfer agent); Senior Vice President, The Invesco Funds; Director, Invesco Investment Advisers LLC (formerly known as Van Kampen Asset Management); Director, Chairman, Chief Executive Officer and President, Invesco Management Group, Inc. (formerly known as Invesco AIM Management Group, Inc.) (financial services holding company); Co-Chairman, Co-President and Co-Chief Executive Officer, Invesco Advisers, Inc. (formerly known as Invesco Institutional (N.A.), Inc.) (registered investment adviser); Director, Chief Executive Officer and President, Van Kampen Exchange Corp; President and Principal Executive Officer, The Invesco Funds (other than AIM Treasurer’s Series Trust (Invesco Treasurer’s Series Trust), Short-Term Investments Trust and Invesco Management Trust); Executive Vice President, The Invesco Funds (AIM Treasurer’s Series Trust (Invesco Treasurer’s Series Trust), Short-Term Investments Trust and Invesco Management Trust only); Director and President, INVESCO Funds Group, Inc. (registered investment adviser and registered transfer agent); Director and Chairman, IVZ Distributors, Inc. (formerly known as INVESCO Distributors, Inc.) (registered broker dealer); Director, President and Chairman, Invesco Inc. (holding company), Invesco Canada Holdings Inc. (holding company), Trimark Investments Ltd./Placements Trimark Ltèe and Invesco Financial Services Ltd/Services Financiers Invesco Ltèe; Chief Executive Officer, Invesco Canada Fund Inc. (corporate mutual fund company); Director and Chairman, Van Kampen Investor Services Inc.; Director, Chief Executive Officer and President, 1371 Preferred Inc. (holding company) and Van Kampen Investments Inc.; Director and President, AIM GP Canada Inc. (general partner for limited partnerships) and Van Kampen Advisors, Inc.; Director and Chief Executive Officer, Invesco Trimark Dealer Inc. (registered broker dealer); Director, Invesco Distributors, Inc. (formerly known as Invesco AIM Distributors, Inc.) (registered broker dealer); Manager, Invesco Capital Management LLC; Director, Chief Executive Officer and President, Invesco Advisers, Inc.; Director, Chairman, Chief Executive Officer and President, Invesco AIM Capital Management, Inc.; President, Invesco Trimark Dealer Inc. and Invesco Trimark Ltd./Invesco Trimark Ltèe; Director and President, AIM Trimark Corporate Class Inc. and AIM Trimark Canada Fund Inc.; Senior Managing Director, Invesco Holding Company Limited; Director and Chairman, Fund Management Company (former registered broker dealer); President and Principal Executive Officer, The Invesco Funds (AIM Treasurer’s Series Trust (Invesco Treasurer’s Series Trust), and Short-Term Investments Trust only); President, AIM Trimark Global Fund Inc. and AIM Trimark Canada Fund Inc. |

229 | None |

| 1 | Mr. Flanagan is considered an interested person (within the meaning of Section 2(a)(19) of the 1940 Act) of the Trust because he is an officer of the Adviser to the Trust, and an officer and a director of Invesco Ltd., ultimate parent of the Adviser. |

| 2 | Mr. Taylor is considered an interested person (within the meaning of Section 2(a)(19) of the 1940 Act) of the Trust because he is an officer of Invesco Ltd., ultimate parent of the Adviser. |

T-1 Invesco American Franchise Fund

Trustees and Officers—(continued)

| Name, Year of Birth and Position(s) Held with the Trust |

Trustee and/ or Officer Since |

Principal Occupation(s) During Past 5 Years |

Number of Funds in Fund Complex Overseen by Trustee |

Other Directorship(s) Held by Trustee During | ||||

| Independent Trustees | ||||||||

| Bruce L. Crockett — 1944 Trustee and Chair |

2003 | Chairman, Crockett Technologies Associates (technology consulting company)

Formerly: Director, Captaris (unified messaging provider); Director, President and Chief Executive Officer, COMSAT Corporation; Chairman, Board of Governors of INTELSAT (international communications company); ACE Limited (insurance company); Independent Directors Council and Investment Company Institute: Member of the Audit Committee, Investment Company Institute; Member of the Executive Committee and Chair of the Governance Committee, Independent Directors Council |

229 | Director and Chairman of the Audit Committee, ALPS (Attorneys Liability Protection Society) (insurance company); Director and Member of the Audit Committee and Compensation Committee, Ferroglobe PLC (metallurgical company) | ||||

| David C. Arch — 1945 Trustee |

2010 | Chairman of Blistex Inc. (consumer health care products manufacturer); Member, World Presidents’ Organization | 229 | Board member of the Illinois Manufacturers’ Association | ||||

| Beth Ann Brown — 1968 Trustee |

2019 | Independent Consultant

Formerly: Head of Intermediary Distribution, Managing Director, Strategic Relations, Managing Director, Head of National Accounts, Senior Vice President, National Account Manager and Senior Vice President, Key Account Manager, Columbia Management Investment Advisers LLC; Vice President, Key Account Manager, Liberty Funds Distributor, Inc.; and Trustee of certain Oppenheimer Funds |

229 | Director, Board of Directors of Caron Engineering Inc.; Advisor, Board of Advisors of Caron Engineering Inc.; President and Director, Acton Shapleigh Youth Conservation Corps (non -profit); and Vice President and Director of Grahamtastic Connection (non-profit) | ||||

| Jack M. Fields — 1952 Trustee |

2003 | Chief Executive Officer, Twenty First Century Group, Inc. (government affairs company); and Chairman, Discovery Learning Alliance (non-profit)

Formerly: Owner and Chief Executive Officer, Dos Angeles Ranch L.P. (cattle, hunting, corporate entertainment); Director, Insperity, Inc. (formerly known as Administaff) (human resources provider); Chief Executive Officer, Texana Timber LP (sustainable forestry company); Director of Cross Timbers Quail Research Ranch (non-profit); and member of the U.S. House of Representatives |

229 | None | ||||

| Cynthia Hostetler — 1962 Trustee |

2017 | Non-Executive Director and Trustee of a number of public and private business corporations

Formerly: Director, Aberdeen Investment Funds (4 portfolios); Head of Investment Funds and Private Equity, Overseas Private Investment Corporation; President, First Manhattan Bancorporation, Inc.; Attorney, Simpson Thacher & Bartlett LLP |

229 | Vulcan Materials Company (construction materials company); Trilinc Global Impact Fund; Genesee & Wyoming, Inc. (railroads); Artio Global Investment LLC (mutual fund complex); Edgen Group, Inc. (specialized energy and infrastructure products distributor); Investment Company Institute (professional organization); Independent Directors Council (professional organization) | ||||

| Eli Jones — 1961 Trustee |

2016 | Professor and Dean, Mays Business School — Texas A&M University

Formerly: Professor and Dean, Walton College of Business, University of Arkansas and E.J. Ourso College of Business, Louisiana State University; Director, Arvest Bank |

229 | Insperity, Inc. (formerly known as Administaff) (human resources provider) | ||||

| Elizabeth Krentzman — 1959 Trustee |

2019 | Formerly: Principal and Chief Regulatory Advisor for Asset Management Services and U.S. Mutual Fund Leader of Deloitte & Touche LLP; General Counsel of the Investment Company Institute (trade association); National Director of the Investment Management Regulatory Consulting Practice, Principal, Director and Senior Manager of Deloitte & Touche LLP; Assistant Director of the Division of Investment Management — Office of Disclosure and Investment Adviser Regulation of the U.S. Securities and Exchange Commission and various positions with the Division of Investment Management — Office of Regulatory Policy of the U.S. Securities and Exchange Commission; Associate at Ropes & Gray LLP; Advisory Board Member of the Securities and Exchange Commission Historical Society; and Trustee of certain Oppenheimer Funds | 229 | Trustee of the University of Florida National Board Foundation and Audit Committee Member; Member of the Cartica Funds Board of Directors (private investment funds); Member of the University of Florida Law Center Association, Inc. Board of Trustees and Audit Committee Member | ||||

| Anthony J. LaCava, Jr. — 1956 Trustee |

2019 | Formerly: Director and Member of the Audit Committee, Blue Hills Bank (publicly traded financial institution) and Managing Partner, KPMG LLP | 229 | Blue Hills Bank; Chairman, Bentley University; Member, Business School Advisory Council; and Nominating Committee, KPMG LLP |

T-2 Invesco American Franchise Fund

Trustees and Officers—(continued)

| Name, Year of Birth and Position(s) Held with the Trust |

Trustee and/ or Officer Since |

Principal Occupation(s) During Past 5 Years |

Number of Funds in Fund Complex Overseen by Trustee |

Other Directorship(s) Held by Trustee During | ||||

| Independent Trustees—(continued) | ||||||||

| Prema Mathai-Davis — 1950 Trustee |

2003 | Retired

Co-Owner & Partner of Quantalytics Research, LLC, (a FinTech Investment Research Platform for the Self-Directed Investor) |

229 | None | ||||

| Joel W. Motley — 1952 Trustee |

2019 | Director of Office of Finance, Federal Home Loan Bank; Member of the Vestry of Trinity Wall Street; Managing Director of Carmona Motley Inc. (privately held financial advisor); Member of the Finance and Budget Committee of the Council on Foreign Relations, Member of the Investment Committee and Board of Human Rights Watch and Member of the Investment Committee and Board of Historic Hudson Valley (non-profit cultural organization)

Formerly: Managing Director of Public Capital Advisors, LLC (privately held financial advisor); Managing Director of Carmona Motley Hoffman, Inc. (privately held financial advisor); Trustee of certain Oppenheimer Funds; and Director of Columbia Equity Financial Corp. (privately held financial advisor) |

229 | Director of Greenwall Foundation (bioethics research foundation); Member of Board and Investment Committee of The Greenwall Foundation; Director of Southern Africa Legal Services Foundation; Board Member and Investment Committee Member of Pulitzer Center for Crisis Reporting (non-profit journalism) | ||||

| Teresa M. Ressel — 1962 Trustee |

2017 | Non-executive director and trustee of a number of public and private business corporations

Formerly: Chief Financial Officer, Olayan America, The Olayan Group (international investor/commercial/industrial); Chief Executive Officer, UBS Securities LLC; Group Chief Operating Officer, Americas, UBS AG; Assistant Secretary for Management & Budget and CFO, US Department of the Treasury |

229 | Atlantic Power Corporation (power generation company); ON Semiconductor Corp. (semiconductor supplier) | ||||

| Ann Barnett Stern — 1957 Trustee |

2017 | President and Chief Executive Officer, Houston Endowment Inc. (private philanthropic institution)

Formerly: Executive Vice President and General Counsel, Texas Children’s Hospital; Attorney, Beck, Redden and Secrest, LLP; Business Law Instructor, University of St. Thomas; Attorney, Andrews & Kurth LLP |

229 | Federal Reserve Bank of Dallas | ||||

| Raymond Stickel, Jr. — 1944 Trustee |

2005 | Retired

Formerly: Director, Mainstay VP Series Funds, Inc. (25 portfolios); Partner, Deloitte & Touche |

229 | None | ||||

| Robert C. Troccoli — 1949 Trustee |

2016 | Retired

Formerly: Adjunct Professor, University of Denver — Daniels College of Business; Senior Partner, KPMG LLP |

229 | None | ||||

| Daniel S. Vandivort — 1954 Trustee |

2019 | Treasurer, Chairman of the Audit and Finance Committee, and Trustee, Board of Trustees, Huntington Disease Foundation of America; and President, Flyway Advisory Services LLC (consulting and property management)

Formerly: Trustee and Governance Chair, of certain Oppenheimer Funds |

229 | Chairman and Lead Independent Director, Chairman of the Audit Committee, and Director, Board of Directors, Value Line Funds | ||||

| James D. Vaughn — 1945 Trustee |

2019 | Retired

Formerly: Managing Partner, Deloitte & Touche LLP; Trustee and Chairman of the Audit Committee, Schroder Funds; Board Member, Mile High United Way, Boys and Girls Clubs, Boy Scouts, Colorado Business Committee for the Arts, Economic Club of Colorado and Metro Denver Network (economic development corporation); and Trustee of certain Oppenheimer Funds |

229 | Board member and Chairman of Audit Committee of AMG National Trust Bank; Trustee and Investment Committee member, University of South Dakota Foundation; Board member, Audit Committee Member and past Board Chair, Junior Achievement (non-profit) | ||||

| Christopher L. Wilson — 1957 Trustee, Vice Chair and Chair Designate |

2017 | Retired

Formerly: Director, TD Asset Management USA Inc. (mutual fund complex) (22 portfolios); Managing Partner, CT2, LLC (investing and consulting firm); President/Chief Executive Officer, Columbia Funds, Bank of America Corporation; President/Chief Executive Officer, CDC IXIS Asset Management Services, Inc.; Principal & Director of Operations, Scudder Funds, Scudder, Stevens & Clark, Inc.; Assistant Vice President, Fidelity Investments |

229 | ISO New England, Inc. (non-profit organization managing regional electricity market) | ||||

T-3 Invesco American Franchise Fund

Trustees and Officers—(continued)

| Name, Year of Birth and Position(s) Held with the Trust |

Trustee and/ or Officer Since |

Principal Occupation(s) During Past 5 Years |

Number of Funds in Fund Complex Overseen by Trustee |

Other Directorship(s) Held by Trustee During | ||||

| Other Officers | ||||||||

| Sheri Morris — 1964 President, Principal Executive Officer and Treasurer |

2003 | President, Principal Executive Officer and Treasurer, The Invesco Funds; Vice President, Invesco Advisers, Inc. (formerly known as Invesco Institutional (N.A.), Inc.) (registered investment adviser); and Vice President, Invesco Exchange-Traded Fund Trust, Invesco Exchange-Traded Fund Trust II, Invesco India Exchange-Traded Fund Trust, Invesco Actively Managed Exchange-Traded Fund Trust, Invesco Actively Managed Exchange-Traded Commodity Fund Trust and Invesco Exchange-Traded Self-Indexed Fund Trust; and Vice President, OppenheimerFunds, Inc.

Formerly: Vice President and Principal Financial Officer, The Invesco Funds; Vice President, Invesco AIM Advisers, Inc., Invesco AIM Capital Management, Inc. and Invesco AIM Private Asset Management, Inc.; Assistant Vice President and Assistant Treasurer, The Invesco Funds and Assistant Vice President, Invesco Advisers, Inc., Invesco AIM Capital Management, Inc. and Invesco AIM Private Asset Management, Inc.; and Treasurer, Invesco Exchange-Traded Fund Trust, Invesco Exchange-Traded Fund Trust II, Invesco India Exchange-Traded Fund Trust and Invesco Actively Managed Exchange-Traded Fund Trust |

N/A | N/A | ||||

| Russell C. Burk — 1958 Senior Vice President and Senior Officer |

2005 | Senior Vice President and Senior Officer, The Invesco Funds | N/A | N/A | ||||

| Jeffrey H. Kupor — 1968 Senior Vice President, Chief Legal Officer and Secretary |

2018 | Head of Legal of the Americas, Invesco Ltd.; Senior Vice President and Secretary, Invesco Advisers, Inc. (formerly known as Invesco Institutional (N.A.), Inc.) (registered investment adviser); Senior Vice President and Secretary, Invesco Distributors, Inc. (formerly known as Invesco AIM Distributors, Inc.); Vice President and Secretary, Invesco Investment Services, Inc. (formerly known as Invesco AIM Investment Services, Inc.) Senior Vice President, Chief Legal Officer and Secretary, The Invesco Funds; Secretary and General Counsel, Invesco Investment Advisers LLC (formerly known as Van Kampen Asset Management); Secretary and General Counsel, Invesco Capital Markets, Inc. (formerly known as Van Kampen Funds Inc.) and Chief Legal Officer, Invesco Exchange-Traded Fund Trust, Invesco Exchange-Traded Fund Trust II, Invesco India Exchange-Traded Fund Trust, Invesco Actively Managed Exchange-Traded Fund Trust, Invesco Actively Managed Exchange-Traded Commodity Fund Trust and Invesco Exchange-Traded Self-Indexed Fund Trust; Secretary, Invesco Indexing LLC; Secretary, W.L. Ross & Co., LLC

Formerly: Secretary and Vice President, Jemstep, Inc.; Head of Legal, Worldwide Institutional, Invesco Ltd.; Secretary and General Counsel, INVESCO Private Capital Investments, Inc.; Senior Vice President, Secretary and General Counsel, Invesco Management Group, Inc. (formerly known as Invesco AIM Management Group, Inc.); Assistant Secretary, INVESCO Asset Management (Bermuda) Ltd.; Secretary and General Counsel, Invesco Private Capital, Inc.; Assistant Secretary and General Counsel, INVESCO Realty, Inc.; Secretary and General Counsel, Invesco Senior Secured Management, Inc.; and Secretary, Sovereign G./P. Holdings Inc. |

N/A | N/A | ||||

| Andrew R. Schlossberg — 1974 Senior Vice President |

2019 | Head of the Americas and Senior Managing Director, Invesco Ltd.; Director and Senior Vice President, Invesco Advisers, Inc. (formerly known as Invesco Institutional (N.A.), Inc.) (registered investment adviser); Director and Chairman, Invesco Investment Services, Inc. (formerly known as Invesco AIM Investment Services, Inc.) (registered transfer agent); Senior Vice President, The Invesco Funds; Director, Invesco Investment Advisers LLC (formerly known as Van Kampen Asset Management); Director, President and Chairman, Invesco Insurance Agency, Inc.

Formerly: Director, Invesco UK Limited; Director and Chief Executive, Invesco Asset Management Limited and Invesco Fund Managers Limited; Assistant Vice President, The Invesco Funds; Senior Vice President, Invesco Advisers, Inc. (formerly known as Invesco Institutional (N.A.), Inc.) (registered investment adviser); Director and Chief Executive, Invesco Administration Services Limited and Invesco Global Investment Funds Limited; Director, Invesco Distributors, Inc.; Head of EMEA, Invesco Ltd.; President, Invesco Actively Managed Exchange-Traded Commodity Fund Trust, Invesco Actively Managed Exchange-Traded Fund Trust, Invesco Exchange-Traded Fund Trust, Invesco Exchange-Traded Fund Trust II and Invesco India Exchange-Traded Fund Trust; Managing Director and Principal Executive Officer, Invesco Capital Management LLC |

N/A | N/A |

T-4 Invesco American Franchise Fund

Trustees and Officers—(continued)

| Name, Year of Birth and Position(s) Held with the Trust |

Trustee and/ or Officer Since |

Principal Occupation(s) During Past 5 Years |

Number of Funds in Fund Complex Overseen by Trustee |

Other Directorship(s) Held by Trustee During | ||||

| Other Officers—(continued) | ||||||||

| John M. Zerr — 1962 Senior Vice President |

2006 | Chief Operating Officer of the Americas; Senior Vice President, Invesco Advisers, Inc. (formerly known as Invesco Institutional (N.A.), Inc.) (registered investment adviser); Senior Vice President, Invesco Distributors, Inc. (formerly known as Invesco AIM Distributors, Inc.); Director and Vice President, Invesco Investment Services, Inc. (formerly known as Invesco AIM Investment Services, Inc.) Senior Vice President, The Invesco Funds; Managing Director, Invesco Capital Management LLC; Director, Invesco Investment Advisers LLC (formerly known as Van Kampen Asset Management); Senior Vice President, Invesco Capital Markets, Inc. (formerly known as Van Kampen Funds Inc.); Manager, Invesco Indexing LLC; Manager, Invesco Specialized Products, LLC; Director and Senior Vice President, Invesco Insurance Agency, Inc.; Member, Invesco Canada Funds Advisory Board; Director, President and Chief Executive Officer, Invesco Corporate Class Inc. (corporate mutual fund company); and Director, Chairman, President and Chief Executive Officer, Invesco Canada Ltd. (formerly known as Invesco Trimark Ltd./Invesco Trimark Ltèe) (registered investment adviser and registered transfer agent)

Formerly: Director and Senior Vice President, Invesco Management Group, Inc. (formerly known as Invesco AIM Management Group, Inc.); Secretary and General Counsel, Invesco Management Group, Inc. (formerly known as Invesco AIM Management Group, Inc.); Secretary, Invesco Investment Services, Inc. (formerly known as Invesco AIM Investment Services, Inc.); Chief Legal Officer and Secretary, The Invesco Funds; Secretary and General Counsel, Invesco Investment Advisers LLC (formerly known as Van Kampen Asset Management); Secretary and General Counsel, Invesco Capital Markets, Inc. (formerly known as Van Kampen Funds Inc.); Chief Legal Officer, Invesco Exchange-Traded Fund Trust, Invesco Exchange-Traded Fund Trust II, Invesco India Exchange-Traded Fund Trust, Invesco Actively Managed Exchange-Traded Fund Trust, Invesco Actively Managed Exchange-Traded Commodity Fund Trust and Invesco Exchange-Traded Self-Indexed Fund Trust; Secretary, Invesco Indexing LLC; Director, Secretary, General Counsel and Senior Vice President, Van Kampen Exchange Corp.; Director, Vice President and Secretary, IVZ Distributors, Inc. (formerly known as INVESCO Distributors, Inc.); Director and Vice President, INVESCO Funds Group, Inc.; Director and Vice President, Van Kampen Advisors Inc.; Director, Vice President, Secretary and General Counsel, Van Kampen Investor Services Inc.; Director and Secretary, Invesco Distributors, Inc. (formerly known as Invesco AIM Distributors, Inc.); Director, Senior Vice President, General Counsel and Secretary, Invesco AIM Advisers, Inc. and Van Kampen Investments Inc.; Director, Vice President and Secretary, Fund Management Company; Director, Senior Vice President, Secretary, General Counsel and Vice President, Invesco AIM Capital Management, Inc.; Chief Operating Officer and General Counsel, Liberty Ridge Capital, Inc. (an investment adviser) |

N/A | N/A | ||||

| Gregory G. McGreevey — 1962 Senior Vice President |

2012 | Senior Managing Director, Invesco Ltd.; Director, Chairman, President, and Chief Executive Officer, Invesco Advisers, Inc. (formerly known as Invesco Institutional (N.A.), Inc.) (registered investment adviser); Director, Invesco Mortgage Capital, Inc. and Invesco Senior Secured Management, Inc.; and Senior Vice President, The Invesco Funds; and President, SNW Asset Management Corporation

Formerly: Senior Vice President, Invesco Management Group, Inc. and Invesco Advisers, Inc.; Assistant Vice President, The Invesco Funds |

N/A | N/A | ||||

| Kelli Gallegos — 1970 Vice President, Principal Financial Officer and Assistant Treasurer |

2008 | Assistant Treasurer, Invesco Specialized Products, LLC; Vice President, Principal Financial Officer and Assistant Treasurer, The Invesco Funds; Principal Financial and Accounting Officer — Pooled Investments, Invesco Capital Management LLC; Vice President and Treasurer, Invesco Exchange-Traded Fund Trust, Invesco Exchange-Traded Fund Trust II, Invesco India Exchange-Traded Fund Trust, Invesco Actively Managed Exchange-Traded Fund Trust, Invesco Actively Managed Exchange-Traded Commodity Fund Trust and Invesco Exchange-Traded Self-Indexed Fund Trust

Formerly: Assistant Treasurer, Invesco Exchange-Traded Fund Trust, Invesco Exchange-Traded Fund Trust II, Invesco India Exchange-Traded Fund Trust, Invesco Actively Managed Exchange-Traded Fund Trust, Invesco Actively Managed Exchange-Traded Commodity Fund Trust and Invesco Exchange-Traded Self-Indexed Fund Trust; Assistant Treasurer, Invesco Capital Management LLC; Assistant Vice President, The Invesco Funds |

N/A | N/A |

T-5 Invesco American Franchise Fund

Trustees and Officers—(continued)

| Name, Year of Birth and Position(s) Held with the Trust |

Trustee and/ or Officer Since |

Principal Occupation(s) During Past 5 Years |

Number of Funds in Fund Complex Overseen by Trustee |

Other Directorship(s) Held by Trustee During | ||||

| Other Officers—(continued) | ||||||||

| Crissie M. Wisdom — 1969 Anti-Money Laundering Compliance Officer |

2013 | Anti-Money Laundering Compliance Officer, Invesco Advisers, Inc. (formerly known as Invesco Institutional (N.A.), Inc.) (registered investment adviser), Invesco Capital Markets, Inc. (formerly known as Van Kampen Funds Inc.), Invesco Distributors, Inc., Invesco Investment Services, Inc., The Invesco Funds, and Invesco Exchange-Traded Fund Trust, Invesco Exchange-Traded Fund Trust II, Invesco India Exchange-Traded Fund Trust, Invesco Actively Managed Exchange-Traded Fund Trust, Invesco Actively Managed Exchange-Traded Commodity Fund Trust and Invesco Exchange-Traded Self-Indexed Fund Trust; Anti-Money Laundering Compliance Officer and Bank Secrecy Act Officer, INVESCO National Trust Company and Invesco Trust Company; and Fraud Prevention Manager and Controls and Risk Analysis Manager for Invesco Investment Services, Inc.

Formerly: Anti-Money Laundering Compliance Officer, Van Kampen Exchange Corp. and Invesco Management Group, Inc. |

N/A | N/A | ||||

| Robert R. Leveille — 1969 Chief Compliance Officer |

2016 | Chief Compliance Officer, Invesco Advisers, Inc. (registered investment adviser); and Chief Compliance Officer, The Invesco Funds

Formerly: Chief Compliance Officer, Putnam Investments and the Putnam Funds |

N/A | N/A |

The Statement of Additional Information of the Trust includes additional information about the Fund’s Trustees and is available upon request, without charge, by calling 1.800.959.4246. Please refer to the Fund’s Statement of Additional Information for information on the Fund’s sub-advisers.

| Office of the Fund 11 Greenway Plaza, Suite 1000 |

Investment Adviser Invesco Advisers, Inc. |

Distributor Invesco Distributors, Inc. |

Auditors PricewaterhouseCoopers LLP Houston, TX 77002-5021 | |||

| Counsel to the Fund Stradley Ronon Stevens & Young, LLP |

Counsel to the Independent Trustees Goodwin Procter LLP |

Transfer Agent Invesco Investment Services, Inc. |

Custodian State Street Bank and Trust Company | |||

T-6 Invesco American Franchise Fund

| • | Fund reports and prospectuses |

| • | Quarterly statements |

| • | Daily confirmations |

| • | Tax forms |

| SEC file numbers: 811-09913 and 333-36074 | Invesco Distributors, Inc. | VK-AMFR-AR-1 |

|

| ||||

|

Annual Report to Shareholders

|

August 31, 2019 | ||

|

| ||||

| Invesco California Tax-Free Income Fund

Nasdaq: A: CLFAX ∎ C: CLFCX ∎ Y: CLFDX ∎ R6: CLFSX | ||||

Letters to Shareholders

Dear Shareholders:

This annual report includes information about your Fund, including performance data and a complete list of its investments as of the close of the reporting period. Inside is a discussion of how your Fund was managed and the factors that affected its performance during the reporting period.

Throughout the reporting period, global equity markets remained volatile. Investor sentiment ranged from elation to fear. The reporting period began with several US equity indexes redefining new highs. The exuberance, however, ended in October 2018 as global equities, in particular US stocks, sold off, with the sharpest decline in December. The catalyst for the sell-off was a combination of ongoing trade concerns between the US and China, fears of a global economic slowdown and lower oil prices from a supply glut. Gains posted earlier in 2018 for global equities were erased, while US Treasury bonds, along with government and municipal bonds, rallied as investors fled to “safe haven” assets.

At the start of 2019, global equity markets rebounded strongly buoyed by more dovish central banks and optimism about a potential US-China trade deal. In May, US-China trade concerns and slowing global growth led to a global equity sell-off and rally in U.S. Treasuries. Despite the May sell-off, domestic equity markets rallied in June in anticipation of a U.S. Federal Reserve (the Fed) rate cut and closed the second quarter with modest gains. As the reporting period ended in August, market volatility once again increased as the US Treasury yield curve inverted several times magnifying concerns that the US economy could be headed into a recession.

During the reporting period, the Fed both raised and lowered the federal funds rate. Given signs of a strong economy, the Fed raised rates two times: in September and December 2018. In 2019, however, the Fed altered its outlook on further rate hikes leaving rates unchanged for the first half of the year. In July, the Fed lowered interest rates for the first time in 11 years. As 2019 unfolds, we’ll see how the interplay of interest rates, economic data, geopolitics and a host of other factors affect US and overseas equity and fixed income markets.

Investor uncertainty and market volatility, such as we witnessed during the reporting period, are unfortunate facts of life when it comes to investing. That’s why Invesco encourages investors to work with a professional financial adviser who can stress the importance of starting to save and invest early and the importance of adhering to a disciplined investment plan. A financial adviser who knows your unique financial situation, investment goals and risk tolerance can be an invaluable partner as you seek to achieve your financial goals. He or she can offer a long-term perspective when markets are volatile and time-tested advice and guidance when your financial situation or investment goals change.

Visit our website for more information on your investments

Our website, invesco.com/us, offers a wide range of market insights and investment perspectives. On the website, you’ll find detailed information about our funds, including performance, holdings and portfolio manager commentaries. You can access information about your account by completing a simple, secure online registration. To do so, select “Log In” on the right side of the homepage, and then select “Register for Individual Account Access.”

In addition to the resources accessible on our website and through our mobile app, you can obtain timely updates to help you stay informed about the markets and the economy by connecting with Invesco on Twitter, LinkedIn or Facebook. You can access our blog at blog.invesco.us.com. Our goal is to provide you the information you want, when and where you want it.

Finally, I’m pleased to share with you Invesco’s commitment to both the Principles for Responsible Investment and to considering environmental, social and governance issues in our robust investment process. I invite you to learn more at invesco.com/esg.

Have questions?

For questions about your account, contact an Invesco client services representative at 800 959 4246.

All of us at Invesco look forward to serving your investment management needs. Thank you for investing with us.

Sincerely,

Andrew Schlossberg

Head of the Americas,

Senior Managing Director, Invesco Ltd.

| 2 Invesco California Tax-Free Income Fund |

|

Dear Shareholders: Among the many important lessons I’ve learned in more than 40 years in a variety of business endeavors is the value of a trusted advocate. As independent chair of the Invesco Funds Board, I can assure you that the members of the Board are strong advocates for the interests of investors in Invesco’s mutual funds. We work hard to represent your interests through oversight of the quality of the investment management services your funds receive and other matters important to your investment, including but not limited to: ∎ Ensuring that Invesco offers a diverse lineup of mutual funds that your financial adviser can use to strive to meet your financial needs as your investment goals change over time. |

∎ Monitoring how the portfolio management teams of the Invesco funds are performing in light of changing economic and market conditions.

∎ Assessing each portfolio management team’s investment performance within the context of the investment strategy described in the fund’s prospectus.

∎ Monitoring for potential conflicts of interests that may impact the nature of the services that your funds receive.

We believe one of the most important services we provide our fund shareholders is the annual review of the funds’ advisory and sub-advisory contracts with Invesco Advisers and its affiliates. This review is required by the Investment Company Act of 1940 and focuses on the nature and quality of the services Invesco provides as the adviser to the Invesco funds and the reasonableness of the fees that it charges for those services. Each year, we spend months carefully reviewing information received from Invesco and a variety of independent sources, such as performance and fee data prepared by Lipper, Inc. (a subsidiary of Broadridge Financial Solutions, Inc.), an independent, third-party firm widely recognized as a leader in its field. We also meet with our independent legal counsel and other independent advisers to review and help us assess the information that we have received. Our goal is to assure that you receive quality investment management services for a reasonable fee.

I trust the measures outlined above provide assurance that you have a worthy advocate when it comes to choosing the Invesco Funds.

As always, please contact me at bruce@brucecrockett.com with any questions or concerns you may have. On behalf of the Board, we look forward to continuing to represent your interests and serving your needs.

Sincerely,

Bruce L. Crockett

Independent Chair

Invesco Funds Board of Trustees

| 3 Invesco California Tax-Free Income Fund |

Management’s Discussion of Fund Performance

| 4 Invesco California Tax-Free Income Fund |

| 5 Invesco California Tax-Free Income Fund |

| 6 Invesco California Tax-Free Income Fund |

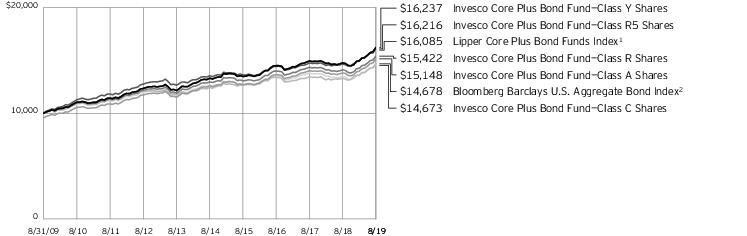

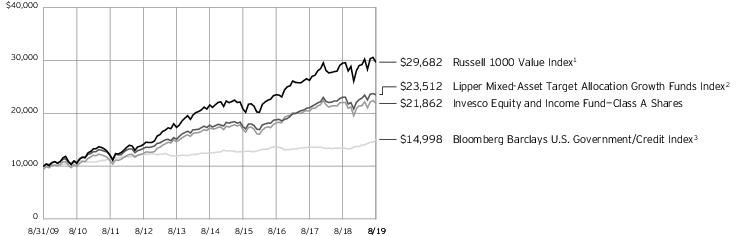

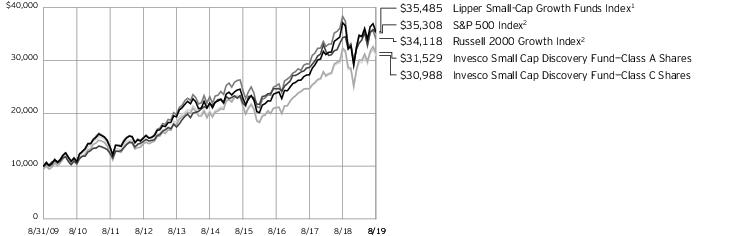

Your Fund’s Long-Term Performance

Results of a $10,000 Investment – Oldest Share Class(es)

Fund and index data from 8/31/09

1 Source: RIMES Technologies Corp.

2 Source: Lipper Inc.

| 7 Invesco California Tax-Free Income Fund |

| 8 Invesco California Tax-Free Income Fund |

Invesco California Tax-Free Income Fund’s investment objective is to provide a high level of current income exempt from federal and California income tax, consistent with the preservation of capital.

| ∎ | Unless otherwise stated, information presented in this report is as of August 31, 2019, and is based on total net assets. |

| ∎ | Unless otherwise noted, all data provided by Invesco. |

| ∎ | To access your Fund’s reports/prospectus, visit invesco.com/fundreports. |

| This report must be accompanied or preceded by a currently effective Fund prospectus, which contains more complete information, including sales charges and expenses. Investors should read it carefully before investing.

|

||

|

|

||

|

NOT FDIC INSURED | MAY LOSE VALUE | NO BANK GUARANTEE |

||

| 9 Invesco California Tax-Free Income Fund |

| 10 Invesco California Tax-Free Income Fund |

| 11 Invesco California Tax-Free Income Fund |

Schedule of Investments

August 31, 2019

| Interest Rate |

Maturity Date |

Principal Amount (000) |

Value | |||||||||||||

|

|

||||||||||||||||

| Municipal Obligations–107.22% |

||||||||||||||||

| California–104.22% | ||||||||||||||||

| ABAG Finance Authority for Non-profit Corps. (Sharp Healthcare); Series 2014 A, RB |

5.00% | 08/01/2043 | $ | 500 | $ | 562,905 | ||||||||||

|

|

||||||||||||||||

| Alhambra (City of), CA (Atherton Baptist Homes); Series 2010 A, RB (a)(b) |

7.62% | 01/01/2020 | 1,575 | 1,608,847 | ||||||||||||

|

|

||||||||||||||||

| Alhambra Elementary School District (Election of 1999); Series 1999 A, GO Bonds (INS -AGM)(c)(d) |

0.00% | 09/01/2020 | 1,925 | 1,905,865 | ||||||||||||

|

|

||||||||||||||||

| Anaheim (City of), CA Public Financing Authority (Electric System Distribution Facilities); Series 2011 A, RB (a)(b) |

5.38% | 04/01/2021 | 2,500 | 2,679,050 | ||||||||||||

|

|

||||||||||||||||

| Bay Area Toll Authority (San Francisco Bay Area); |

||||||||||||||||

| Series 2017 F-1, RB (e) |

5.00% | 04/01/2056 | 3,465 | 4,196,843 | ||||||||||||

|

|

||||||||||||||||

| Series 2017, Ref. RB |

4.00% | 04/01/2037 | 1,720 | 1,962,675 | ||||||||||||

|

|

||||||||||||||||

| Series 2017, Ref. RB |

4.00% | 04/01/2049 | 630 | 703,137 | ||||||||||||

|

|

||||||||||||||||

| Bay Area Water Supply & Conservation Agency; Series 2013 A, RB |

5.00% | 10/01/2034 | 1,950 | 2,204,494 | ||||||||||||

|

|

||||||||||||||||

| Beverly Hills Unified School District (Election of 2008); |

||||||||||||||||

| Series 2009, GO Bonds (d) |

0.00% | 08/01/2026 | 1,465 | 1,330,835 | ||||||||||||

|

|

||||||||||||||||

| Series 2009, GO Bonds (d) |

0.00% | 08/01/2032 | 3,045 | 2,357,104 | ||||||||||||

|

|

||||||||||||||||

| California (County of), CA Tobacco Securitization Agency (Alameda County Tobacco Asset Securitization Corp.); Series 2006 C, RB (d) |

0.00% | 06/01/2055 | 12,000 | 732,120 | ||||||||||||

|

|

||||||||||||||||

| California (County of), CA Tobacco Securitization Agency (Gold Country Settlement Funding Corp.); Series 2006, RB (d) |

0.00% | 06/01/2033 | 1,345 | 615,674 | ||||||||||||

|

|

||||||||||||||||

| California (County of), CA Tobacco Securitization Agency (Los Angeles County Securitization Corp.); Series 2006, RB (f) |

5.70% | 06/01/2046 | 1,030 | 1,036,221 | ||||||||||||

|

|

||||||||||||||||

| California (State of); |

||||||||||||||||

| Series 2004 A9, Ref. VRD GO Bonds (LOC-State Street Bank & Trust Co.)(g)(h) |

1.05% | 09/12/2019 | 3,275 | 3,275,000 | ||||||||||||

|

|

||||||||||||||||

| Series 2009, GO Bonds |

6.00% | 11/01/2035 | 1,750 | 1,764,000 | ||||||||||||

|

|

||||||||||||||||

| Series 2010, GO Bonds |

5.25% | 11/01/2040 | 3,000 | 3,139,950 | ||||||||||||

|

|

||||||||||||||||

| Series 2011, GO Bonds |

5.00% | 09/01/2032 | 2,450 | 2,637,645 | ||||||||||||

|

|

||||||||||||||||

| Series 2011, GO Bonds |

5.00% | 10/01/2041 | 2,500 | 2,694,525 | ||||||||||||

|

|

||||||||||||||||

| Series 2012, Ref. GO Bonds |

5.25% | 02/01/2030 | 1,000 | 1,098,250 | ||||||||||||

|

|

||||||||||||||||

| Series 2015, GO Bonds |

5.00% | 08/01/2045 | 1,000 | 1,185,790 | ||||||||||||

|

|

||||||||||||||||

| Series 2016, GO Bonds (e) |

5.00% | 09/01/2045 | 3,400 | 4,128,076 | ||||||||||||

|

|

||||||||||||||||

| Series 2017, Ref. GO Bonds |

5.00% | 08/01/2035 | 1,370 | 1,692,799 | ||||||||||||

|

|

||||||||||||||||

| California (State of) (Green Bonds); Series 2014, GO Bonds |

5.00% | 10/01/2037 | 1,745 | 2,045,541 | ||||||||||||

|

|

||||||||||||||||

| California (State of) Community College Financing Authority (Orange Coast Properties LLC- Orange Coast College); Series 2018, RB |

5.25% | 05/01/2048 | 665 | 794,934 | ||||||||||||

|

|

||||||||||||||||

| California (State of) Community Housing Agency (Annadel Apartments); |

5.00% | 04/01/2049 | 2,055 | 2,310,991 | ||||||||||||

|

|

||||||||||||||||

| California (State of) Educational Facilities Authority (Loma Linda University); |

||||||||||||||||

| Series 2017 A, Ref. RB |

5.00% | 04/01/2042 | 1,715 | 2,048,704 | ||||||||||||

|

|

||||||||||||||||

| Series 2017 A, Ref. RB |

5.00% | 04/01/2047 | 1,000 | 1,184,040 | ||||||||||||

|

|

||||||||||||||||

| California (State of) Educational Facilities Authority (Pitzer College); Series 2009, RB (a)(b) |

6.00% | 04/01/2020 | 2,000 | 2,058,580 | ||||||||||||

|

|

||||||||||||||||

| California (State of) Educational Facilities Authority (Stanford University); Series 2010, RB (e) |

5.25% | 04/01/2040 | 4,520 | 6,980,236 | ||||||||||||

|

|

||||||||||||||||

| California (State of) Health Facilities Financing Authority; Series 2019, RB |

5.00% | 11/15/2049 | 1,690 | 2,023,302 | ||||||||||||

|

|

||||||||||||||||

| California (State of) Health Facilities Financing Authority (Adventist Health System West); Series 2009 A, RB (a)(b) |

5.75% | 09/01/2019 | 500 | 500,000 | ||||||||||||

|

|

||||||||||||||||

| California (State of) Health Facilities Financing Authority (Catholic Healthcare West); Series 2011 A, RB |

5.25% | 03/01/2041 | 2,500 | 2,633,375 | ||||||||||||

|

|

||||||||||||||||

| California (State of) Health Facilities Financing Authority (Cedars-Sinai Medical Center); |

||||||||||||||||

| Series 2015, Ref. RB |

5.00% | 11/15/2031 | 1,300 | 1,591,759 | ||||||||||||

|

|

||||||||||||||||

| Series 2015, Ref. RB |

5.00% | 11/15/2032 | 1,250 | 1,535,112 | ||||||||||||

|

|

||||||||||||||||

| Series 2015, Ref. RB |

5.00% | 11/15/2033 | 1,000 | 1,220,500 | ||||||||||||

|

|

||||||||||||||||

| California (State of) Health Facilities Financing Authority (Children’s Hospital Los Angeles); |

||||||||||||||||

| Series 2010, RB (a)(b) |

5.25% | 07/01/2020 | 2,950 | 3,054,459 | ||||||||||||

|

|

||||||||||||||||

| Series 2017 A, Ref. RB |

5.00% | 08/15/2047 | 1,715 | 2,053,627 | ||||||||||||

|

|

||||||||||||||||

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

| 12 Invesco California Tax-Free Income Fund |

| Interest Rate |

Maturity Date |

Principal Amount (000) |

Value | |||||||||||||

| California–(continued) | ||||||||||||||||

| California (State of) Health Facilities Financing Authority (Lucile Salter Packard Children’s Hospital at Stanford); Series 2017, RB |

4.00% | 11/15/2047 | $ | 560 | $ | 619,931 | ||||||||||

| California (State of) Health Facilities Financing Authority (Scripps

Health); |

5.00% | 11/15/2036 | 4,000 | 4,031,520 | ||||||||||||

| California (State of) Health Facilities Financing Authority (St. Joseph Health System); Series 2013 A, RB |

5.00% | 07/01/2037 | 1,000 | 1,130,360 | ||||||||||||

| California (State of) Health Facilities Financing Authority (Stanford Hospital); |

||||||||||||||||

| Series 2008 A-2, Ref. RB (a)(b) |

5.25% | 11/15/2021 | 2,000 | 2,189,300 | ||||||||||||

| California (State of) Health Facilities Financing Authority (Sutter Health); |

||||||||||||||||

| Series 2011 B, RB (a)(b) |

5.50% | 08/15/2020 | 1,000 | 1,042,990 | ||||||||||||

| Series 2018 A, RB |

5.00% | 11/15/2048 | 3,000 | 3,676,470 | ||||||||||||

| California (State of) Housing Finance Agency; Series 2019 A-1, RB |

4.25% | 01/15/2035 | 1,695 | 2,030,135 | ||||||||||||

| California (State of) Housing Finance Agency (Verdant at Green Valley); Series 2019 A, RB (i) |

5.00% | 08/01/2049 | 1,360 | 1,544,158 | ||||||||||||

| California (State of) Municipal Finance Authority (American Heritage

Education Foundation); |

5.00% | 06/01/2036 | 1,000 | 1,167,050 | ||||||||||||

| Series 2016 A, Ref. RB |

5.00% | 06/01/2046 | 1,640 | 1,888,378 | ||||||||||||

| California (State of) Municipal Finance Authority (Bella Mente Montessori Academy); |

||||||||||||||||

| Series 2018 A, RB (i) |

5.00% | 06/01/2038 | 280 | 330,792 | ||||||||||||

| Series 2018 A, RB (i) |

5.00% | 06/01/2048 | 380 | 441,370 | ||||||||||||

| California (State of) Municipal Finance Authority (California Baptist University); Series 2016 A, RB (i) |

5.00% | 11/01/2046 | 1,000 | 1,146,660 | ||||||||||||

| California (State of) Municipal Finance Authority (Caritas Affordable

Housing, Inc.); |

5.25% | 08/15/2039 | 1,200 | 1,367,040 | ||||||||||||

| Series 2014 A, RB |

5.25% | 08/15/2049 | 1,420 | 1,597,827 | ||||||||||||

| California (State of) Municipal Finance Authority (Caritas Projects); |

||||||||||||||||

| Series 2012 A, RB |

5.50% | 08/15/2047 | 1,500 | 1,617,780 | ||||||||||||

| Series 2017 A, Ref. RB |

4.00% | 08/15/2037 | 1,055 | 1,136,056 | ||||||||||||

| California (State of) Municipal Finance Authority (CHF-Davis I, LLC - West Village Student Housing Project); Series 2018, RB |

5.00% | 05/15/2043 | 1,650 | 1,998,414 | ||||||||||||

| California (State of) Municipal Finance Authority (Community Medical

Centers); |

5.00% | 02/01/2042 | 625 | 746,213 | ||||||||||||

| Series 2017 A, Ref. RB |

5.00% | 02/01/2047 | 1,380 | 1,637,356 | ||||||||||||

| California (State of) Municipal Finance Authority (Eisenhower Medical Center); |

||||||||||||||||

| Series 2010 A, RB (a)(b) |

5.50% | 07/01/2020 | 1,000 | 1,037,030 | ||||||||||||

| Series 2010 A, RB (a)(b) |

5.75% | 07/01/2020 | 1,500 | 1,558,620 | ||||||||||||

| Series 2017 A, Ref. RB |

5.00% | 07/01/2047 | 1,000 | 1,172,880 | ||||||||||||

| California (State of) Municipal Finance Authority (Emerson

College); |

5.75% | 01/01/2022 | 1,315 | 1,462,043 | ||||||||||||

| California (State of) Municipal Finance Authority (Humangood Obligation Group); Series 2019 A, Ref. RB |

5.00% | 10/01/2044 | 1,695 | 2,010,626 | ||||||||||||

| California (State of) Municipal Finance Authority (Linxs APM); Series 2018 A, RB (j) |

5.00% | 12/31/2038 | 2,005 | 2,453,418 | ||||||||||||

| California (State of) Municipal Finance Authority (Mt. San Antonio Gardens); Series 2019, Ref. RB |

5.00% | 11/15/2049 | 2,750 | 3,255,230 | ||||||||||||